Form N-CSRS ADVISORS SERIES TRUST For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jeffrey T. Rauman, President/Chief Executive Officer

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 5th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(626) 914-7363

Registrant's telephone number, including area code

Date of fiscal year end: March 31, 2022

Date of reporting period: September 30, 2021

Item 1. Reports to Stockholders.

Semi-Annual Report

September 30, 2021

AASGARD SMALL & MID-CAP FUND

EXPENSE EXAMPLE at September 30, 2021 (Unaudited)

Shareholders in mutual funds generally incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange

fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other fund expenses. The Aasgard Small & Mid-Cap Fund is a no-load mutual fund and has no shareholder transaction

expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of

$1,000 invested at the beginning of the period and held for the entire period (4/1/21 – 9/30/21).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire

transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. The Example below includes, but is not limited to, management fees, fund accounting, custody and transfer

agent fees. You may use the information in the first line of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value

divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses,

which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of

investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight

your ongoing costs only and will not help you determine the relative total costs of owning different funds, as they may charge transactional costs, such as sales charges (loads), redemption fees, or exchange fees.

3

AASGARD SMALL & MID-CAP FUND

EXPENSE EXAMPLE at September 30, 2021 (Unaudited), Continued

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Account Value

|

Account Value

|

During Period*

|

|

|

4/1/21

|

9/30/21

|

4/1/21 – 9/30/21

|

|

|

Actual

|

$1,000.00

|

$1,034.00

|

$5.10

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,020.05

|

$5.06

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 183 (days in most recent fiscal half-year)/365 days to reflect the

one-half year expense.

|

4

AASGARD SMALL & MID-CAP FUND

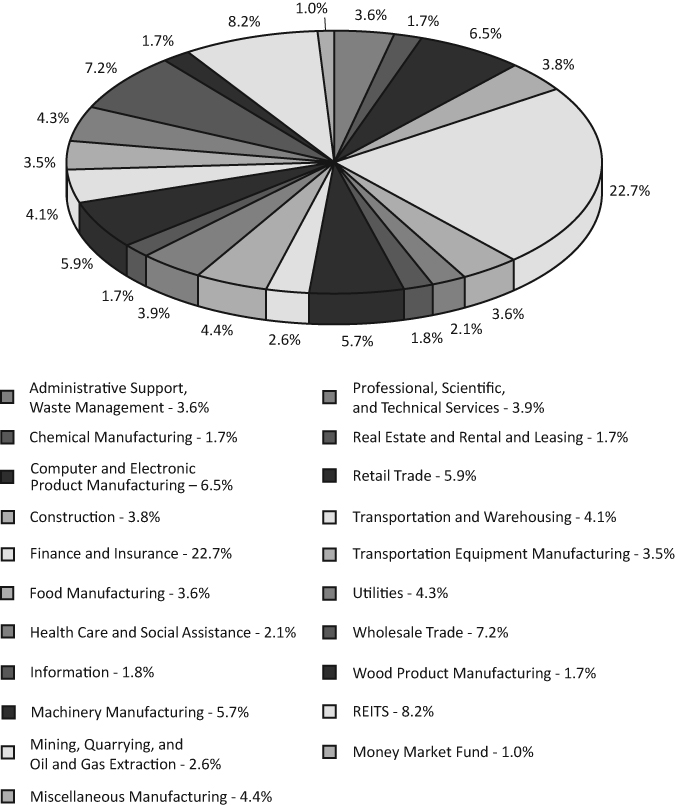

INDUSTRY ALLOCATION OF PORTFOLIO ASSETS at September 30, 2021 (Unaudited)

Percentages represent market value as a percentage of total investments.

5

AASGARD SMALL & MID-CAP FUND

SCHEDULE OF INVESTMENTS at September 30, 2021 (Unaudited)

|

Shares

|

COMMON STOCKS – 90.70%

|

Value

|

|||||

|

Administrative and Support Services – 3.64%

|

|||||||

|

10,045

|

Broadridge Financial Solutions, Inc.

|

$

|

1,673,899

|

||||

|

7,575

|

Scotts Miracle-Gro Co.

|

1,108,677

|

|||||

|

2,782,576

|

|||||||

|

Ambulatory Health Care Services – 2.05%

|

|||||||

|

10,760

|

Quest Diagnostics, Inc.

|

1,563,536

|

|||||

|

Chemical Manufacturing – 1.70%

|

|||||||

|

16,725

|

RPM International, Inc.

|

1,298,696

|

|||||

|

Computer and Electronic Product Manufacturing – 6.52%

|

|||||||

|

4,080

|

Monolithic Power Systems, Inc.

|

1,977,494

|

|||||

|

18,085

|

NetApp, Inc.

|

1,623,310

|

|||||

|

12,690

|

Teradyne, Inc.

|

1,385,367

|

|||||

|

4,986,171

|

|||||||

|

Construction of Buildings – 1.84%

|

|||||||

|

36,035

|

KB Home

|

1,402,482

|

|||||

|

Credit Intermediation and Related Activities – 12.15%

|

|||||||

|

37,085

|

Bank OZK

|

1,593,913

|

|||||

|

19,926

|

Commerce Bancshares, Inc.

|

1,388,444

|

|||||

|

68,195

|

Regions Financial Corp.

|

1,453,235

|

|||||

|

34,080

|

Synovus Financial Corp.

|

1,495,771

|

|||||

|

43,090

|

Washington Federal, Inc.

|

1,478,418

|

|||||

|

30,365

|

Zions Bancorp

|

1,879,290

|

|||||

|

9,289,071

|

|||||||

|

Food Manufacturing – 3.55%

|

|||||||

|

28,625

|

Campbell Soup Co.

|

1,196,811

|

|||||

|

64,310

|

Flowers Foods, Inc.

|

1,519,646

|

|||||

|

2,716,457

|

|||||||

|

Funds, Trusts, and Other Financial Vehicles – 1.94%

|

|||||||

|

9,555

|

Garmin Ltd. – ADR

|

1,485,420

|

|||||

|

Furniture and Home Furnishings Stores – 1.91%

|

|||||||

|

8,220

|

Williams-Sonoma, Inc.

|

1,457,653

|

|||||

|

Heavy and Civil Engineering Construction – 1.95%

|

|||||||

|

37,785

|

KBR, Inc.

|

1,488,729

|

|||||

The accompanying notes are an integral part of these financial statements.

6

AASGARD SMALL & MID-CAP FUND

SCHEDULE OF INVESTMENTS at September 30, 2021 (Unaudited), Continued

|

Shares

|

COMMON STOCKS – 90.70%, Continued

|

Value

|

|||||

|

Insurance Carriers and Related Activities – 6.18%

|

|||||||

|

11,320

|

Arthur J. Gallagher & Co.

|

$

|

1,682,718

|

||||

|

30,050

|

Brown & Brown, Inc.

|

1,666,273

|

|||||

|

13,735

|

RLI Corp.

|

1,377,208

|

|||||

|

4,726,199

|

|||||||

|

Machinery Manufacturing – 5.68%

|

|||||||

|

21,660

|

Graco, Inc.

|

1,515,550

|

|||||

|

6,980

|

IDEX Corp.

|

1,444,511

|

|||||

|

14,160

|

Toro Co.

|

1,379,326

|

|||||

|

4,339,387

|

|||||||

|

Merchant Wholesalers, Durable Goods – 5.66%

|

|||||||

|

17,925

|

MSC Industrial Direct Co., Inc. – Class A

|

1,437,406

|

|||||

|

3,470

|

Pool Corp.

|

1,507,403

|

|||||

|

5,230

|

Watsco, Inc.

|

1,383,962

|

|||||

|

4,328,771

|

|||||||

|

Merchant Wholesalers, Nondurable Goods – 1.53%

|

|||||||

|

23,670

|

Cardinal Health, Inc.

|

1,170,718

|

|||||

|

Miscellaneous Manufacturing – 4.38%

|

|||||||

|

12,000

|

Hill-Rom Holdings, Inc.

|

1,800,000

|

|||||

|

7,575

|

STERIS plc – ADR

|

1,547,421

|

|||||

|

3,347,421

|

|||||||

|

Miscellaneous Store Retailers – 2.25%

|

|||||||

|

8,500

|

Tractor Supply Co.

|

1,722,185

|

|||||

|

Oil and Gas Extraction – 2.62%

|

|||||||

|

22,995

|

Cimarex Energy Co.

|

2,005,164

|

|||||

|

Professional, Scientific, and Technical Services – 3.94%

|

|||||||

|

18,750

|

Booz Allen Hamilton Holding Corp.

|

1,487,812

|

|||||

|

18,260

|

MAXIMUS, Inc.

|

1,519,232

|

|||||

|

3,007,044

|

|||||||

|

Publishing Industries (Except Internet) – 1.76%

|

|||||||

|

19,405

|

SS&C Technologies Holdings, Inc.

|

1,346,707

|

|||||

|

Rental and Leasing Services – 1.73%

|

|||||||

|

18,390

|

McGrath RentCorp

|

1,323,161

|

|||||

|

Securities, Commodity Contracts, and Other Financial

|

|||||||

|

Investments and Related Activities – 2.44%

|

|||||||

|

9,655

|

Nasdaq, Inc.

|

1,863,608

|

|||||

The accompanying notes are an integral part of these financial statements.

7

AASGARD SMALL & MID-CAP FUND

SCHEDULE OF INVESTMENTS at September 30, 2021 (Unaudited), Continued

|

Shares

|

COMMON STOCKS – 90.70%, Continued

|

Value

|

|||||

|

Sporting Goods, Hobby, and

|

|||||||

|

Musical Instrument Stores – 1.70%

|

|||||||

|

33,400

|

Camping World Holdings, Inc. – Class A

|

$

|

1,298,258

|

||||

|

Support Activities for Transportation – 4.13%

|

|||||||

|

14,965

|

Expeditors International of Washington, Inc.

|

1,782,780

|

|||||

|

8,235

|

J.B. Hunt Transport Services, Inc.

|

1,377,057

|

|||||

|

3,159,837

|

|||||||

|

Transportation Equipment Manufacturing – 3.45%

|

|||||||

|

10,495

|

Polaris, Inc.

|

1,255,832

|

|||||

|

11,265

|

Thor Industries, Inc.

|

1,382,891

|

|||||

|

2,638,723

|

|||||||

|

Utilities – 4.28%

|

|||||||

|

28,060

|

Alliant Energy Corp.

|

1,570,799

|

|||||

|

29,275

|

ONEOK, Inc.

|

1,697,657

|

|||||

|

3,268,456

|

|||||||

|

Wood Product Manufacturing – 1.72%

|

|||||||

|

15,365

|

Owens Corning

|

1,313,708

|

|||||

|

TOTAL COMMON STOCKS (Cost $53,560,805)

|

69,330,138

|

||||||

|

REITS – 8.24%

|

|||||||

|

10,380

|

CoreSite Realty Corp.

|

1,438,045

|

|||||

|

32,740

|

CubeSmart

|

1,586,253

|

|||||

|

33,520

|

Duke Realty Corp.

|

1,604,602

|

|||||

|

42,455

|

STAG Industrial, Inc.

|

1,666,359

|

|||||

|

TOTAL REITS (Cost $4,904,323)

|

6,295,259

|

||||||

|

MONEY MARKET FUND – 1.05%

|

|||||||

|

801,363

|

Fidelity Investments Money Market Funds –

|

||||||

|

Government Portfolio – Class I, 0.01% (a)

|

801,363

|

||||||

|

TOTAL MONEY MARKET FUND (Cost $801,363)

|

801,363

|

||||||

|

TOTAL INVESTMENTS IN SECURITIES

|

|||||||

|

(Cost $59,266,491) – 99.99%

|

76,426,760

|

||||||

|

Other Assets in Excess of Liabilities – 0.01%

|

8,712

|

||||||

|

NET ASSETS – 100.00%

|

$

|

76,435,472

|

|||||

|

ADR –

|

American Depository Receipt

|

|

|

REIT –

|

Real Estate Investment Trust

|

|

|

(a)

|

Rate shown is the 7-day annualized yield as of September 30, 2021.

|

The accompanying notes are an integral part of these financial statements.

8

AASGARD SMALL & MID-CAP FUND

STATEMENT OF ASSETS AND LIABILITIES at September 30, 2021 (Unaudited)

|

ASSETS

|

||||

|

Investments in securities, at value

|

||||

|

(identified cost $59,266,491)

|

$

|

76,426,760

|

||

|

Receivables:

|

||||

|

Dividends and interest

|

76,937

|

|||

|

Dividend tax reclaim

|

341

|

|||

|

Prepaid expenses

|

14,180

|

|||

|

Total assets

|

76,518,218

|

|||

|

LIABILITIES

|

||||

|

Payables:

|

||||

|

Advisory fees

|

44,535

|

|||

|

Administration and fund accounting fees

|

15,779

|

|||

|

Audit fees

|

10,477

|

|||

|

Transfer agent fees and expenses

|

4,276

|

|||

|

Chief Compliance Officer fee

|

2,521

|

|||

|

Shareholder reporting

|

1,919

|

|||

|

Custody fees

|

165

|

|||

|

Legal fees

|

74

|

|||

|

Accrued other expenses

|

3,000

|

|||

|

Total liabilities

|

82,746

|

|||

|

NET ASSETS

|

$

|

76,435,472

|

||

|

CALCULATION OF NET ASSET VALUE PER SHARE

|

||||

|

Net assets applicable to shares outstanding

|

$

|

76,435,472

|

||

|

Shares issued and outstanding [unlimited

|

||||

|

number of shares (par value $0.01) authorized]

|

4,669,388

|

|||

|

Net asset value, offering and redemption price per share

|

$

|

16.37

|

||

|

COMPOSITION OF NET ASSETS

|

||||

|

Paid-in capital

|

$

|

53,666,207

|

||

|

Total distributable earnings

|

22,769,265

|

|||

|

Net assets

|

$

|

76,435,472

|

||

The accompanying notes are an integral part of these financial statements.

9

AASGARD SMALL & MID-CAP FUND

STATEMENT OF OPERATIONS For the Six Months Ended September 30, 2021 (Unaudited)

|

INVESTMENT INCOME

|

||||

|

Income

|

||||

|

Dividends (net of foreign tax withheld of $758)

|

$

|

691,281

|

||

|

Interest

|

32

|

|||

|

Total income

|

691,313

|

|||

|

Expenses

|

||||

|

Advisory fees (Note 4)

|

333,883

|

|||

|

Administration and fund accounting fees (Note 4)

|

50,898

|

|||

|

Transfer agent fees and expenses (Note 4)

|

14,485

|

|||

|

Registration fees

|

12,607

|

|||

|

Audit fees

|

10,477

|

|||

|

Trustee fees and expenses

|

7,568

|

|||

|

Chief Compliance Officer fee (Note 4)

|

7,520

|

|||

|

Reports to shareholders

|

4,269

|

|||

|

Legal fees

|

3,936

|

|||

|

Custody fees (Note 4)

|

3,454

|

|||

|

Miscellaneous expenses

|

2,490

|

|||

|

Insurance expense

|

1,518

|

|||

|

Interest expense (Note 6)

|

54

|

|||

|

Total expenses

|

453,159

|

|||

|

Less: advisory fee waiver (Note 4)

|

(60,356

|

)

|

||

|

Net expenses

|

392,803

|

|||

|

Net investment income

|

298,510

|

|||

|

REALIZED AND UNREALIZED GAIN ON INVESTMENTS

|

||||

|

Net realized gain on investments

|

4,984,796

|

|||

|

Net change in unrealized appreciation/(depreciation)

|

||||

|

on investments

|

(2,711,761

|

)

|

||

|

Net realized and unrealized gain on investments

|

2,273,035

|

|||

|

Net Increase in Net Asset

|

||||

|

Resulting from Operations

|

$

|

2,571,545

|

||

The accompanying notes are an integral part of these financial statements.

10

AASGARD SMALL & MID-CAP FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

Six Months Ended

|

||||||||

|

September 30, 2021

|

Year Ended

|

|||||||

|

(Unaudited)

|

March 31, 2021

|

|||||||

|

INCREASE/(DECREASE) IN NET ASSETS FROM:

|

||||||||

|

OPERATIONS

|

||||||||

|

Net investment income

|

$

|

298,510

|

$

|

502,127

|

||||

|

Net realized gain on investments

|

4,984,796

|

587,328

|

||||||

|

Net change in unrealized appreciation/

|

||||||||

|

(depreciation) on investments

|

(2,711,761

|

)

|

26,119,084

|

|||||

|

Net increase in net assets

|

||||||||

|

resulting from operations

|

2,571,545

|

27,208,539

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

Net dividends and distributions

|

||||||||

|

to shareholders

|

(284,683

|

)

|

(804,251

|

)

|

||||

|

Total distributions to shareholders

|

(284,683

|

)

|

(804,251

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Net increase/(decrease) in net assets

|

||||||||

|

derived from net change in

|

||||||||

|

outstanding shares (a)

|

(1,016,734

|

)

|

5,057,007

|

|||||

|

Total increase in net assets

|

1,270,128

|

31,461,295

|

||||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

75,165,344

|

43,704,049

|

||||||

|

End of period

|

$

|

76,435,472

|

$

|

75,165,344

|

||||

|

(a)

|

A summary of share transactions is as follows:

|

|

Six Months Ended

|

|||||||||||||||||

|

September 30, 2021

|

Year Ended

|

||||||||||||||||

|

(Unaudited)

|

March 31, 2021

|

||||||||||||||||

|

Shares sold

|

174,853

|

$

|

2,879,175

|

787,261

|

$

|

10,675,703

|

|||||||||||

|

Shares issued

|

|||||||||||||||||

|

on reinvestments

|

|||||||||||||||||

|

of distributions

|

17,492

|

284,683

|

60,839

|

804,251

|

|||||||||||||

|

Shares redeemed

|

(252,540

|

)

|

(4,180,592

|

)

|

(493,006

|

)

|

(6,422,947

|

)

|

|||||||||

|

Net increase/(decrease)

|

(60,195

|

)

|

$

|

(1,016,734

|

)

|

355,094

|

$

|

5,057,007

|

|||||||||

The accompanying notes are an integral part of these financial statements.

11

AASGARD SMALL & MID-CAP FUND

FINANCIAL HIGHLIGHTS For a share outstanding throughout each period

|

For the

|

||||||||||||||||||||||||

|

Six Months

|

||||||||||||||||||||||||

|

Ended

|

||||||||||||||||||||||||

|

September 30,

|

||||||||||||||||||||||||

|

2021

|

Year Ended March 31,

|

|||||||||||||||||||||||

|

(Unaudited)

|

2021

|

2020

|

2019

|

2018

|

2017

|

*

|

||||||||||||||||||

|

Net asset value,

|

||||||||||||||||||||||||

|

beginning of period

|

$

|

15.89

|

$

|

9.99

|

$

|

12.82

|

$

|

12.66

|

$

|

11.67

|

$

|

10.00

|

||||||||||||

|

Income from

|

||||||||||||||||||||||||

|

investment operations:

|

||||||||||||||||||||||||

|

Net investment income

|

0.06

|

0.11

|

0.13

|

0.12

|

0.14

|

0.20

|

||||||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||||||

|

gain/(loss) on investments

|

0.48

|

5.97

|

(2.82

|

)

|

0.44

|

1.32

|

1.66

|

|||||||||||||||||

|

Total from

|

||||||||||||||||||||||||

|

investment operations

|

0.54

|

6.08

|

(2.69

|

)

|

0.56

|

1.46

|

1.86

|

|||||||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

From net investment income

|

(0.06

|

)

|

(0.11

|

)

|

(0.13

|

)

|

(0.12

|

)

|

(0.14

|

)

|

(0.19

|

)

|

||||||||||||

|

From net realized

|

||||||||||||||||||||||||

|

gain on investments

|

—

|

(0.07

|

)

|

(0.01

|

)

|

(0.28

|

)

|

(0.33

|

)

|

—

|

||||||||||||||

|

Total distributions

|

(0.06

|

)

|

(0.18

|

)

|

(0.14

|

)

|

(0.40

|

)

|

(0.47

|

)

|

(0.19

|

)

|

||||||||||||

|

Net asset value, end of period

|

$

|

16.37

|

$

|

15.89

|

$

|

9.99

|

$

|

12.82

|

$

|

12.66

|

$

|

11.67

|

||||||||||||

|

Total return

|

3.40

|

%‡

|

61.23

|

%

|

-21.14

|

%

|

4.69

|

%

|

12.54

|

%

|

18.79

|

%

|

||||||||||||

|

Ratios/supplemental data:

|

||||||||||||||||||||||||

|

Net assets, end of

|

||||||||||||||||||||||||

|

period (thousands)

|

$

|

76,435

|

$

|

75,165

|

$

|

43,704

|

$

|

55,046

|

$

|

37,384

|

$

|

29,354

|

||||||||||||

|

Ratio of expenses to

|

||||||||||||||||||||||||

|

average net assets:

|

||||||||||||||||||||||||

|

Before advisory fee waiver and

|

||||||||||||||||||||||||

|

expense recoupment

|

1.15

|

%†

|

1.23

|

%

|

1.24

|

%

|

1.24

|

%

|

1.42

|

%

|

1.54

|

%

|

||||||||||||

|

After advisory fee waiver and

|

||||||||||||||||||||||||

|

expense recoupment

|

1.00

|

%†

|

1.00

|

%

|

1.08

|

%

|

1.25

|

%

|

1.25

|

%

|

1.25

|

%

|

||||||||||||

|

Ratio of net investment income

|

||||||||||||||||||||||||

|

to average net assets:

|

||||||||||||||||||||||||

|

Before advisory fee waiver and

|

||||||||||||||||||||||||

|

expense recoupment

|

0.61

|

%†

|

0.62

|

%

|

0.83

|

%

|

0.95

|

%

|

0.93

|

%

|

1.67

|

%

|

||||||||||||

|

After advisory fee waiver and

|

||||||||||||||||||||||||

|

expense recoupment

|

0.76

|

%†

|

0.85

|

%

|

0.99

|

%

|

0.94

|

%

|

1.10

|

%

|

1.96

|

%

|

||||||||||||

|

Portfolio turnover rate

|

21.61

|

%‡

|

70.47

|

%

|

46.85

|

%

|

63.38

|

%

|

53.19

|

%

|

41.73

|

%

|

||||||||||||

|

*

|

Commencement of operations on April 1, 2016.

|

|

†

|

Annualized.

|

|

‡

|

Not annualized.

|

The accompanying notes are an integral part of these financial statements.

12

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited)

NOTE 1 – ORGANIZATION

The Aasgard Small & Mid-Cap Fund (the “Fund”) is a diversified series of Advisors Series Trust (the “Trust”), which is registered under the Investment

Company Act of 1940, as amended, (the “1940 Act”) as an open-end management investment company. The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard

Codification Topic 946 “Financial Services – Investment Companies”. The investment objective of the Fund is to seek a combination of dividend income and capital appreciation, with a secondary focus on lower than market volatility. The Fund commenced

operations on April 1, 2016.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting

principles generally accepted in the United States of America.

|

A.

|

Security Valuation: All investments in securities are recorded at their estimated fair value, as described in note 3.

|

|

B.

|

Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies

and to distribute substantially all of its taxable income to its shareholders. Therefore, no Federal income or excise tax provision is required.

|

|

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The tax returns of the Fund’s prior

three fiscal years are open for examination. Management has reviewed all open tax years in major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax events relating

to uncertain income tax positions taken or expected to be taken on a tax return. The Fund identifies their major tax jurisdictions as U.S. Federal and the state of Wisconsin. The Fund is not aware of any tax positions for which it is

reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

|

|

|

C.

|

Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities sold are

determined on a first-in, first-out basis. Interest income is recorded on an accrual basis. Dividend income, income and capital gain distributions from underlying funds, and distributions to shareholders are recorded on the ex-dividend date.

|

13

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

|

The Fund is charged for those expenses that are directly attributable to the Fund, such as investment advisory, custody and transfer agent fees. Common expenses of the Trust are typically allocated among the

funds in the Trust based on a fund’s respective net assets, or by other equitable means.

|

|

|

The Fund distributes substantially all net investment income, if any, quarterly and net realized gains, if any, annually. Distributions from net realized gains for book purposes may include short-term capital

gains. All short-term capital gains are included in ordinary income for tax purposes.

|

|

|

The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is determined in accordance with Federal income tax regulations, which differs from accounting

principles generally accepted in the United States of America. To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their Federal tax treatment.

|

|

|

D.

|

Reclassification of Capital Accounts: Accounting principles generally accepted in the United States of America require that certain components of net assets relating to

permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

|

|

E.

|

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period.

Actual results could differ from those estimates.

|

|

F.

|

REITs: The Fund may invest in real estate investment trusts (“REITs”) which pay dividends to their shareholders based upon funds available from operations. It is quite

common for these dividends to exceed the REIT’s taxable earnings and profits resulting in the excess portion of such dividends being designated as a return of capital. The Fund intends to include the gross dividends from such REITs in its

annual distributions to its shareholders and, accordingly, a portion of the Fund’s distributions may also be designated as a return of capital.

|

|

G.

|

Events Subsequent to the Fiscal Period End: In preparing the financial statements as of September 30, 2021, management considered the impact of subsequent events for

potential recognition or disclosure in the financial statements. Refer to Note 10 for more information about subsequent events.

|

14

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

NOTE 3 – SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for

measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the

period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

|

|

|

Level 2 –

|

Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument

on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

|

|

|

Level 3 –

|

Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in

valuing the asset or liability, and would be based on the best information available.

|

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a

recurring basis.

The Fund determines the fair value of its investments and computes its net asset value per share as of the close of regular trading on the New York Stock

Exchange (4:00 pm EST).

Equity Securities: The Fund’s investments are carried at fair value. Equity securities, including common stocks,

real estate investment trusts, and closed-end funds, that are primarily traded on a national securities exchange shall be valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been

no sale on such day, at the mean between the bid and asked prices. Securities primarily traded in the NASDAQ Global Market System for which market quotations are readily available shall be valued using the NASDAQ Official Closing Price (“NOCP”). If

the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and asked prices. Over-the-counter securities which are not traded in

the NASDAQ Global Market System shall be valued at the most recent sales price.

15

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

Investment Companies: Investments in open-end mutual funds, including money market funds, are generally priced at

their net asset value per share provided by the service agent of the funds and will be classified in level 1 of the fair value hierarchy.

Short-Term Securities: Short-term debt securities, including those securities having a maturity of 60 days or

less, are valued at the evaluated mean between the bid and asked prices. To the extent the inputs are observable and timely, these securities would be classified in level 2 of the fair value hierarchy.

The Board of Trustees (“Board”) has delegated day-to-day valuation issues to a Valuation Committee of the Trust which is comprised of representatives from

the Fund’s administrator, U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”). The function of the Valuation Committee is to value securities where current and reliable market quotations are not readily

available or the closing price does not represent fair value by following procedures approved by the Board. These procedures consider many factors, including the type of security, size of holding, trading volume and news events. All actions taken by

the Valuation Committee are subsequently reviewed and ratified by the Board.

Depending on the relative significance of the valuation inputs, fair valued securities may be classified in either level 2 or level 3 of the fair value

hierarchy.

16

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a

summary of the inputs used to value the Fund’s securities as of September 30, 2021:

|

Common Stocks

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Administrative Support,

|

||||||||||||||||

|

Waste Management

|

$

|

2,782,576

|

$

|

—

|

$

|

—

|

$

|

2,782,576

|

||||||||

|

Construction

|

2,891,211

|

—

|

—

|

2,891,211

|

||||||||||||

|

Finance and Insurance

|

17,364,299

|

—

|

—

|

17,364,299

|

||||||||||||

|

Health Care and Social Assistance

|

1,563,536

|

—

|

—

|

1,563,536

|

||||||||||||

|

Information

|

1,346,707

|

—

|

—

|

1,346,707

|

||||||||||||

|

Manufacturing

|

20,640,562

|

—

|

—

|

20,640,562

|

||||||||||||

|

Mining, Quarrying, and

|

||||||||||||||||

|

Oil and Gas Extraction

|

2,005,164

|

—

|

—

|

2,005,164

|

||||||||||||

|

Professional, Scientific,

|

||||||||||||||||

|

and Technical Services

|

3,007,044

|

—

|

—

|

3,007,044

|

||||||||||||

|

Real Estate and Rental and Leasing

|

1,323,161

|

—

|

—

|

1,323,161

|

||||||||||||

|

Retail Trade

|

4,478,096

|

—

|

—

|

4,478,096

|

||||||||||||

|

Transportation and Warehousing

|

3,159,837

|

—

|

—

|

3,159,837

|

||||||||||||

|

Utilities

|

3,268,456

|

—

|

—

|

3,268,456

|

||||||||||||

|

Wholesale Trade

|

5,499,489

|

—

|

—

|

5,499,489

|

||||||||||||

|

Total Common Stocks

|

69,330,138

|

—

|

—

|

69,330,138

|

||||||||||||

|

REITs

|

6,295,259

|

—

|

—

|

6,295,259

|

||||||||||||

|

Money Market Fund

|

801,363

|

—

|

—

|

801,363

|

||||||||||||

|

Total Investments in Securities

|

$

|

76,426,760

|

$

|

—

|

$

|

—

|

$

|

76,426,760

|

||||||||

Refer to the Fund’s schedule of investments for a detailed break-out of securities by industry classification.

In October 2020, the Securities and Exchange Commission (the “SEC”) adopted new regulations governing the use of derivatives by registered investment

companies (“Rule 18f-4”). Funds will be required to implement and comply with Rule 18f-4 by August 19, 2022. Once implemented, Rule 18f-4 will impose limits on the amount of derivatives a fund can enter into, eliminate the asset segregation

framework currently used by funds to comply with Section 18 of the 1940 Act, treat derivatives as senior securities and require funds whose use of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive

derivatives risk management program and appoint a derivatives risk manager. The Fund does not currently enter into derivatives transactions. Management is currently evaluating the potential impact of Rule 18f-4 on the Fund.

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for

17

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 will permit fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other

conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted related

recordkeeping requirements and is rescinding previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. The Fund will be required to comply with the rules

by September 8, 2022. Management is currently assessing the potential impact of the new rules on the Fund’s financial statements.

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The

ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Fund invests depends on

future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively

impact the Fund’s performance.

NOTE 4 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Fund has an investment advisory agreement with Coldstream Capital Management, Inc. (the “Advisor”) pursuant to which the Advisor is responsible for

providing investment management services to the Fund. The Advisor furnishes all investment advice, office space and facilities, and provides most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a

fee, computed daily and payable monthly. The Fund pays fees calculated at an annual rate of 0.85% based upon the average daily net assets of the Fund. For the six months ended September 30, 2021, the advisory fees incurred by the Fund are disclosed

in the statement of operations.

The Fund is responsible for its own operating expenses. The Advisor has contractually agreed to waive a portion or all of its management fees and pay Fund

expenses in order to ensure that the total annual operating expenses (excluding acquired fund fees and expenses, interest expense, taxes and extraordinary expenses) do not exceed 1.00% of the Fund’s average daily net assets. The Advisor may request

recoupment of previously waived fees and paid expenses in any subsequent month in the 36-month period from the date of the management fee reduction and expense payment if the aggregate amount actually paid by the Fund

18

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

toward the operating expenses for such fiscal year (taking into account the reimbursement) will not cause the Fund to exceed the lesser of: (1) the expense limitation in place at the time of the management fee

reduction and expense payment; or (2) the expense limitation in place at the time of the reimbursement. Any such reimbursement is also contingent upon Board of Trustees review and approval at the time the reimbursement is made. Such reimbursement

may not be paid prior to the Fund’s payment of current ordinary operating expenses. For the six months ended September 30, 2021, the Advisor reduced its fees and absorbed Fund expenses in the amount of $60,356. The expense limitation will remain in

effect through at least July 29, 2022 and may be terminated only by the Trust’s Board of Trustees. The Advisor may recapture portions of the amounts shown below no later than the corresponding dates:

|

Expiration

|

Amount

|

||||

|

March 2023

|

$

|

94,222

|

|||

|

March 2024

|

132,598

|

||||

|

September 2024

|

60,356

|

||||

|

$

|

287,176

|

||||

Fund Services serves as the Fund’s administrator, fund accountant and transfer agent. U.S. Bank N.A. serves as custodian (the “Custodian”) to the Fund. The

Custodian is an affiliate of Fund Services. Fund Services maintains the Fund’s books and records, calculates the Fund’s NAV, prepares various federal and state regulatory filings, coordinates the payment of fund expenses, reviews expense accruals and

prepares materials supplied to the Board of Trustees. The officers of the Trust, including the Chief Compliance Officer, are employees of Fund Services. Fees paid by the Fund for administration and accounting, transfer agency, custody and compliance

services for the six months ended September 30, 2021, are disclosed in the statement of operations.

Quasar Distributors, LLC (“Quasar”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. Quasar is a wholly-owned

broker-dealer subsidiary of Foreside Financial Group, LLC (“Foreside”). On July 7, 2021, Foreside announced that it had entered into a definitive purchase and sale agreement with Genstar Capital (“Genstar”) such that Genstar would acquire a majority

stake in Foreside. The Board approved continuing the distribution agreement with Quasar at the close of the transaction which occurred on September 30, 2021.

19

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

NOTE 5 – PURCHASES AND SALES OF SECURITIES

For the six months ended September 30, 2021, the cost of purchases and the proceeds from sales of securities (excluding short-term securities) were

$16,717,050 and $17,772,391, respectively. There were no purchases and sales of U.S. government securities during the six months ended September 30, 2021.

NOTE 6 – LINE OF CREDIT

The Fund has a secured line of credit in the amount of $3,000,000. This line of credit is intended to provide short-term financing, if necessary, subject

to certain restrictions, in connection with shareholder redemptions. The credit facility is with the Fund’s custodian, U.S. Bank N.A. During the six months ended September 30, 2021, the Fund drew on its line of credit. The Fund had an outstanding

average daily balance of $9,585, paid a weighted average interest rate of 3.25% and incurred interest expense of $54. The maximum borrowing by the Fund during the six months ended September 30, 2021 was $345,000, which occurred on September 1, 2021.

At September 30, 2021 the Fund had no outstanding loan amounts.

NOTE 7 – INCOME TAXES AND DISTRIBUTIONS TO SHAREHOLDERS

The distributions paid by the Fund during the six months ended September 30, 2021 and the year ended March 31, 2021, were characterized as follows:

|

September 30, 2021

|

March 31, 2021

|

|||||||

|

Ordinary income

|

$

|

284,683

|

$

|

479,038

|

||||

|

Long-term capital gains

|

$

|

—

|

$

|

325,213

|

||||

As of March 31, 2021, the most recently completed fiscal year end, the components of accumulated earnings/(losses) on a tax basis were as follows:

|

Cost of investments (a)

|

$

|

55,156,123

|

||

|

Gross tax unrealized appreciation

|

20,259,306

|

|||

|

Gross tax unrealized depreciation

|

(387,276

|

)

|

||

|

Net tax unrealized appreciation (a)

|

19,872,030

|

|||

|

Undistributed ordinary income

|

23,089

|

|||

|

Undistributed long-term capital gain

|

587,284

|

|||

|

Total distributable earnings

|

610,373

|

|||

|

Other accumulated gains/(losses)

|

—

|

|||

|

Total accumulated earnings/(losses)

|

$

|

20,482,403

|

|

(a)

|

The book-basis and tax-basis net unrealized appreciation and cost are the same.

|

20

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

NOTE 8 – PRINCIPAL RISKS

Below is a summary of some, but not all, of the principal risks of investing in the Fund, each of which may adversely affect the Fund’s net asset value and

total return. The Fund’s most recent prospectus provides further descriptions of the Fund’s investment objective, principal investment strategies and principal risks.

|

•

|

Small- and Medium-Sized Companies Risk – Small- and medium-sized companies often have less predictable earnings, more limited product lines, markets, distribution

channels or financial resources and the management of such companies may be dependent upon one or few key people. The market movements of equity securities of small- and medium-sized companies may be more abrupt and volatile than the market

movements of equity securities of larger, more established companies or the stock market in general and small-sized companies in particular, are generally less liquid than the equity securities of larger companies.

|

|

•

|

Market and Regulatory Risk – Events in the financial markets and economy may cause volatility and uncertainty and adversely impact the Fund’s performance. Market events

may affect a single issuer, industry, sector, or the market as a whole. Traditionally liquid investments may experience periods of diminished liquidity. Governmental and regulatory actions, including tax law changes, may also impair portfolio

management and have unexpected or adverse consequences on particular markets, strategies, or investments. The Fund’s investments may decline in value due to factors affecting individual issuers (such as the results of supply and demand), or

sectors within the securities markets. The value of a security or other investment also may go up or down due to general market conditions that are not specifically related to a particular issuer, such as real or perceived adverse economic

conditions, changes in interest rates or exchange rates, or adverse investor sentiment generally. In addition, unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters;

financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in

general, in ways that cannot necessarily be foreseen.

|

|

•

|

Equity Securities Risk – The price of equity securities may rise or fall because of economic or political changes, or changes in a company’s financial condition,

sometimes rapidly or unpredictably. These price movements may result from factors affecting individual companies, sectors or industries selected for the Fund’s portfolio or the securities market as a whole, such as changes in economic or

political conditions.

|

21

AASGARD SMALL & MID-CAP FUND

NOTES TO FINANCIAL STATEMENTS at September 30, 2021 (Unaudited), Continued

|

•

|

Investment Style Risk – The Fund’s investments in dividend-paying common stocks may cause the Fund to underperform funds that do not limit their investments to

dividend-paying common stocks during periods when dividend-paying stocks underperform other types of stocks. In addition, if stocks held by the Fund reduce or stop paying dividends, the Fund’s ability to generate income may be affected.

|

|

•

|

Growth Stock Risk – Over time, a growth oriented investing style may go in and out of favor, which may cause the Fund to underperform other equity funds that use

different investing styles.

|

|

•

|

Management Risk – If the Advisor’s investment strategies do not produce the expected results, the value of the Fund may decrease.

|

|

•

|

Real Estate Investment Trust (REIT) Risk – Investments in REITs will be subject to the risks associated with the direct ownership of real estate. Risks commonly

associated with the direct ownership of real estate include fluctuations in the value of underlying properties, defaults by borrowers or tenants, changes in interest rates and risks related to general or local economic conditions. REITs have

their own expenses, and the Fund will bear a proportionate share of those expenses. In addition, the value of an individual REIT’s securities can decline if the REIT fails to continue qualifying for special tax treatment.

|

NOTE 9 – CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund,

under Section 2(a)(9) of the 1940 Act. As of September 30, 2021, National Financial Services LLC and Charles Schwab & Co., Inc., for the benefit of their customers, owned 48.33% and 37.26%, respectively, of the outstanding shares of the Fund.

NOTE 10 – SUBSEQUENT EVENTS

Coldstream Capital Management, Inc., the Advisor to the Fund, has recommended, and the Board of Trustees of Advisors Series Trust has approved, the

liquidation and termination of the Fund. The decision was made to exit the fund business and offer this strategy solely through separate accounts, which will reduce expenses for investors continuing in the strategy. The liquidation is expected to

occur after the close of business on January 14, 2022.

22

AASGARD SMALL & MID-CAP FUND

NOTICE TO SHAREHOLDERS at September 30, 2021 (Unaudited)

How to Obtain a Copy of the Fund’s Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without

charge upon request by calling (877) 476-1909 or on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

How to Obtain a Copy of the Fund’s Proxy Voting Records for the 12-Month Period Ended June 30

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without

charge, upon request, by calling (877) 476-1909. Furthermore, you can obtain the Fund’s proxy voting records on the SEC’s website at http://www.sec.gov.

Quarterly Filings on Form N-PORT

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form N-PORT. The

Fund’s Form N-PORT is available on the SEC’s website at http://www.sec.gov. Information included in the Fund’s Form N-PORT is also available by calling (877) 476-1909.

23

AASGARD SMALL & MID-CAP FUND

HOUSEHOLDING

In an effort to decrease costs, the Fund will reduce the number of duplicate prospectuses, supplements, and certain other shareholder documents that you

receive by sending only one copy of each to those addresses shown by two or more accounts. Please call the Fund's transfer agent toll free at (877) 476-1909 to request individual copies of these documents. The Fund will begin sending individual

copies 30 days after receiving your request. This policy does not apply to account statements.

24

PRIVACY NOTICE

The Fund collects non-public information about you from the following sources:

|

•

|

Information we receive about you on applications or other forms;

|

|

•

|

Information you give us orally; and/or

|

|

•

|

Information about your transactions with us or others.

|

We do not disclose any non-public personal information about our customers or former customers without the customer’s authorization, except as permitted by law or in response to inquiries from governmental authorities.

We may share information with affiliated and unaffiliated third parties with whom we have contracts for servicing the Fund. We will provide unaffiliated third parties with only the information necessary to carry out their assigned responsibilities.

We maintain physical, electronic and procedural safeguards to guard your non-public personal information and require third parties to treat your personal information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary would govern how

your non-public personal information would be shared by those entities with unaffiliated third parties.

25

(This Page Intentionally Left Blank.)

Investment Advisor

Coldstream Capital Management, Inc.

One – 100th Avenue NE, Suite 102

Bellevue, Washington 98004

Independent Registered Public Accounting Firm

Tait, Weller & Baker LLP

Two Liberty Place

50 South 16th Street Suite 2900

Philadelphia, Pennsylvania 19102

Legal Counsel

Sullivan & Worcester LLP

1633 Broadway, 32nd Floor

New York, New York 10019

Custodian

U.S. Bank N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, Wisconsin 53212

Transfer Agent, Fund Accountant and Fund Administrator

U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, Wisconsin 53202

(877) 476-1909

Distributor

Quasar Distributors, LLC

111 East Kilbourn Avenue, Suite 2200

Milwaukee, Wisconsin 53202

This report is intended for shareholders of the Fund and may not be used as sales literature unless preceded or accompanied by a current prospectus. For a current prospectus please call (877) 476-1909. Statements and

other information herein are dated and are subject to change.

(b) Not Applicable.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

|

(a)

|

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

|

|

(b)

|

Not Applicable.

|

Item 6. Investments.

|

(a)

|

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

|

|

(b)

|

Not Applicable.

|

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees.

Item 11. Controls and Procedures.

|

(a)

|

The Registrant’s President/Chief Executive Officer/Principal Executive Officer and Vice President/Treasurer/Principal Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c)

under the Investment Company Act of 1940, as amended, (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of

1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and

reported and made known to them by others within the Registrant and by the Registrant’s service provider.

|

|

(b)

|

There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably

likely to materially affect, the Registrant's internal control over financial reporting.

|

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Exhibits.

|

(a)

|

(1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an

exhibit. Not Applicable.

|

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the

registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by

this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

(Registrant) Advisors Series Trust

By (Signature and Title)* /s/ Jeffrey T. Rauman

Jeffrey T. Rauman, President/Chief Executive

Officer/Principal Executive Officer

Date 12/7/21

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and

in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Jeffrey T. Rauman

Jeffrey T. Rauman, President/Chief Executive

Officer/Principal Executive Officer

Date 12/7/21

By (Signature and Title)* /s/ Cheryl L. King

Cheryl L. King, Vice President/Treasurer/Principal

Financial Officer

Date 12/6/21

* Print the name and title of each signing officer under his or her signature.

CERTIFICATIONS

I, Jeffrey T. Rauman, certify that:

|

1.

|

I have reviewed this report on Form N-CSR of Advisors Series Trust;

|

|

2.

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not

misleading with respect to the period covered by this report;

|

|

3.

|

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if

the financial statements are required to include a statement of cash flows) of the registrant as of, and for, the periods presented in this report;

|

|

4.

|

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) and internal control over

financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the registrant and have:

|

|

(a)

|

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated

subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

|

|

(b)

|

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and

the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

|

|

(c)

|

Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the

filing date of this report based on such evaluation; and

|

|

(d)

|

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the

registrant’s internal control over financial reporting; and

|

|

5.

|

The registrant’s other certifying officer(s) and I have disclosed to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

|

|

(a)

|

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize, and

report financial information; and

|

|

(b)

|

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

|

Date: 12/7/21

|

/s/ Jeffrey T. Rauman

Jeffrey T. Rauman President/Chief Executive Officer/Principal Executive Officer

|

CERTIFICATIONS

I, Cheryl L. King, certify that:

|

1.

|

I have reviewed this report on Form N-CSR of Advisors Series Trust;

|

|

2.

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not

misleading with respect to the period covered by this report;

|

|

3.

|

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if

the financial statements are required to include a statement of cash flows) of the registrant as of, and for, the periods presented in this report;

|

|

4.

|

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) and internal control over

financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the registrant and have:

|

|

(a)

|

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated

subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

|

|

(b)

|

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and

the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

|

|

(c)

|

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the

filing date of this report based on such evaluation; and

|

|

(d)

|

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the

registrant’s internal control over financial reporting; and

|

|

5.

|

The registrant’s other certifying officer(s) and I have disclosed to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

|

|

(a)

|

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize, and

report financial information; and

|

|

(b)

|

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

|

Date: 12/6/21

|

/s/ Cheryl L. King

Cheryl L. King Vice President/Treasurer/Principal Financial Officer

|

Certification Pursuant to Section 906 of the Sarbanes-Oxley Act

Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, each of the undersigned officers of the Advisors Series Trust, does hereby certify, to such officer’s knowledge, that the report on Form N-CSR of the Advisors

Series Trust for the period ended September 30, 2021 fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as applicable, and that the information contained in the Form N-CSR fairly presents, in all

material respects, the financial condition and results of operations of the Advisors Series Trust for the stated period.

|

/s/ Jeffrey T. Rauman

Jeffrey T. Rauman

President/Chief Executive Officer/Principal Executive Officer

Advisors Series Trust

|

/s/ Cheryl L. King

Cheryl L. King

Vice President/Treasurer/Principal Financial Officer

Advisors Series Trust

|

|

Dated: 12/7/21

|

Dated: 12/6/21

|

This statement accompanies this report on Form N-CSR pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not be deemed as filed by Advisors Series Trust for purposes of Section 18 of the Securities Exchange Act of 1934.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- WidePoint Awarded $22.7 Million in Tech and Cyber Security Services Contracts During Q1 2024

- Sustainable Infrastructure Dividend ETF Distributions

- Wilbur-Ellis Nutrition and Bond Pet Foods Enter into Partnership to Develop Ingredients Through Precision Fermentation

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share