Form N-CSR/A Investment Managers Seri For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Explanatory Note: The Registrant is filing this amendment to its Form N-CSR for the period ended September 30, 2020, originally filed with the Securities and Exchange Commission on December 9, 2020 (Accession Number 0001398344-20-024342), to provide a summation of Total Assets for the AXS Managed Futures Strategy Fund under Note 9 - Fair Value Measurements and Disclosure table of the Notes to Consolidated Financial Statements. Other than the aforementioned revision, this Form N-CSR/A does not reflect events occurring after the filing of the original Form N-CSR, or modify or update the disclosures therein in any way.

Item 1. Report to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

AXS Alternative Growth Fund

(Class A: EEHAX)

(Class I: EEHIX)

AXS Aspect Core Diversified Strategy Fund

(Class A: EQAAX)

(Class C: EQACX)

(Class I: EQAIX)

AXS Chesapeake Strategy Fund

(Class A: ECHAX)

(Class C: ECHCX)

(Class I: EQCHX)

AXS Managed Futures Strategy Fund

(Class A: MHFAX)

(Class C: MHFCX)

(Class I: MHFIX)

AXS Multi-Strategy Alternatives Fund

(Class I: KCMIX)

(Class R-1: KCMTX)

ANNUAL REPORT

September 30, 2020

|

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds, if you hold your shares directly with the Funds, or from your financial intermediary, such as a broker-dealer or bank, if you hold your shares through a financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you hold your shares directly with the Funds, you may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at (833) 297-2587 or, if you hold your shares through a financial intermediary, contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you hold your shares directly with the Fund, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports at (833) 297-2587 or, if you hold your shares through a financial intermediary, contacting your financial intermediary. Your election to receive reports in paper will apply to all of the Investment Managers Series Trust II’s Funds you hold directly or through your financial intermediary, as applicable. |

AXS Funds

Each a series of Investment Managers Series Trust II

Table of Contents

| Shareholder Letters | 1 |

| Fund Performance | 31 |

| Consolidated Schedule of Investments | 40 |

| Consolidated Statements of Assets and Liabilities | 72 |

| Consolidated Statements of Operations | 76 |

| Consolidated Statements of Changes in Net Assets | 79 |

| Consolidated Financial Highlights | 84 |

| Notes to Consolidated Financial Statements | 97 |

| Report of Independent Registered Public Accounting Firm | 129 |

| Supplemental Information | 132 |

| Expense Examples | 135 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the AXS Funds. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

www.axsinvestments.com

AXS Alternative Growth Fund

Letter to Shareholders for the quarter ending September 30, 2020

For the quarter ended September 30, 2020, the AXS Alternative Growth Fund (formerly, the Equinox Ampersand Strategy Fund) (the “Alternative Growth Fund” or the “Fund) Class I and Class A, respectively, were up 7.47% and 7.26% , underperforming the S&P 500 Total Return Index® (“S&P 500®”), which was up +8.93%.

| Return 3-Mo | Annualized Rate of Return (AROR) Since Inception (9/9/2013 to 9/30/2020) | Annualized Standard Deviation Since Inception (9/9/2013 to 9/30/2020) | |

| AXS Alternative Growth – Class I | 7.47% | 8.64% | 14.67% |

| AXS Alternative Growth – Class A | 7.26% | 8.35% | 14.62% |

| AXS Alternative Growth – Class A (w/ 5.75% max sales charge) | 1.09% | 7.45% | -- |

| S&P 500® | 8.93% | 12.68% | 13.65% |

Past performance does not guarantee future results. Investors cannot directly invest in an index.

Rationale

Over the years, we have observed that many investor portfolios are inadequately diversified because of the perceived opportunity cost of selling equities to gain exposure to diversifying alternative assets. We believe an overlay strategy offers the potential for superior and meaningful diversification without the need to reduce exposure to core holdings. This is the concept implemented in the Alternative Growth Fund. The Fund provides futures-based exposure to the broad US equity market, while simultaneously seeking to diversify equity factor risk through strategic and meaningful exposure to a futures-based portfolio of (i) uncorrelated diversifiers and (ii) negatively correlated dynamic equity-hedging strategies.

Analysis of Performance

The Fund’s long only equity strategy, which seeks to mirror approximately the performance of the S&P 500 Index, was up for the quarter (+9.77%). The hedge strategy had a negative quarter (−2.02%), which was not unexpected given the strong performance of equities, while the diversifier strategy had a slightly down quarter (−0.48%). The Fund’s fixed income holdings contributed positively (+0.20%).

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 1 |

Fund Contribution by Strategy:

| Strategy | Jul-20 | Aug-20 | Sep-20 | Q3 2020 |

| Long Only | 6.26% | 8.23% | -4.48% | 9.77% |

| Diversifier | 0.95% | -0.16% | -1.12% | -0.48% |

| Hedge | -0.20% | -1.15% | -0.65% | -2.02% |

| Fixed Income | 0.08% | 0.06% | 0.06% | 0.20% |

| Overall Fund Performance EEHIX | 7.09% | 6.98% | -6.19% | 7.47% |

Seven of our diversifying trading programs contributed positively. The best performer was an adaptive machine-learning program. Of the eight programs that contributed negatively, the worst performer was a short-term trading program.

There was one addition to the Fund’s portfolio of hedging programs. In July, we made an allocation to the Quadriga Smart Gold options and futures trading program. The Smart Gold Strategy is a liquid, absolute return strategy that aims to protect capital and generate negatively correlated returns (“crisis alpha”) during adverse and hostile equity markets, while seeking to earn neutral to positive returns during benign markets. Thus, the strategy seeks to earn, in the long run, higher risk-adjusted overall returns, particularly on the downside, through the combination of potentially higher compounded returns, lower realized volatility, and shallower drawdowns.

The Smart Gold strategy comprises three parts:

| · | A Core Precious Metals Strategy that seeks to maintain a long position in gold and other precious metals via futures contracts; |

| · | A Core U.S. Treasuries Strategy that seeks to maintain a long position in U.S. Treasury securities via futures contracts; and |

| · | A Long-Only Options Trading Program that primarily buys put options on various underlying “bubble” assets, such as equities, and call options on “anti-bubble” assets such as sovereign debt and precious metals. |

The Quadriga Smart Gold strategy performed negatively for the quarter, as did the Quest Hedging Strategy, while the QDRA strategy was virtually flat.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 2 |

Performance Attribution by CTAs:

| Commodity Trading Advisor | 31-Jul-20 | 31-Aug-20 | 30-Sep-20 | Q3 2020 |

| Diversifiers | ||||

| Arctic Blue Capital | 0.09% | 0.08% | -0.20% | -0.03% |

| Crabel Capital Management | -0.03% | -0.46% | -0.09% | -0.59% |

| Emil van Essen | 0.20% | 0.03% | 0.04% | 0.26% |

| FORT, L.P. | 0.06% | -0.12% | 0.08% | 0.02% |

| H20 Asset Management | -0.10% | 0.42% | -0.28% | 0.02% |

| IPM Informed Portfolio Mgmt. | 0.39% | 0.17% | -0.44% | 0.10% |

| JE Moody | -0.03% | -0.06% | 0.08% | -0.01% |

| KeyQuant | 0.32% | -0.05% | -0.04% | 0.24% |

| LCJ Investments | -0.14% | -0.02% | -0.01% | -0.18% |

| Mesirow Financial (Currency Management) | -0.07% | -0.03% | -0.11% | -0.22% |

| QMS Capital Management | -0.26% | -0.07% | 0.01% | -0.33% |

| Quantica Capital | 0.26% | 0.12% | -0.32% | 0.04% |

| Quantitative Investment Management | -0.37% | -0.17% | 0.24% | -0.33% |

| Quest Partners | 0.11% | -0.06% | -0.06% | -0.02% |

| SCT Capital Management | 0.52% | 0.06% | -0.02% | 0.55% |

| Total Diversifier | 0.95% | -0.16% | -1.12% | -0.48% |

| Hedges | ||||

| QDRA Pty. Ltd | -0.12% | -0.12% | 0.26% | 0.01% |

| Quadriga Asset Managers | -0.05% | -0.64% | -0.75% | -1.44% |

| Quest Partners | -0.03% | -0.39% | -0.16% | -0.59% |

| Total Hedge | -0.20% | -1.15% | -0.65% | -2.02% |

Performance attribution is estimated by Ampersand Investment Management and is net of fees. Past performance does not guarantee future results.

At the sector level, only equity indices had meaningful positive performance, while agricultural commodities added a smaller contribution. Fixed income was the biggest detractor, followed by metals, currencies and energy.

The overlay’s largest gross exposure as of quarter-end was to agricultural commodities (about 35%), followed by energy (21%), equity indices (about 15%), currencies (about 13%), fixed income (about 10%) and metals (about 6%). Together, the financial sectors represented about 38% of the Fund’s exposure. Net exposure to all sectors was long. At the end of the quarter, the dynamic hedging strategies had a negative beta of about −0.29 with respect to the S&P 500 Index. It is expected that this beta over time will be, on average, negative. Equity indices had the largest negative beta (−0.13), followed by currencies (−0.11), and fixed income (−0.08). Energy, agricultural commodities and metals had betas that were positive, but very close to zero.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 3 |

Gross Sector Exposure (As of 9/30/2020):

Source: Ampersand Investment Management and Bloomberg, LP. Reflects aggregate sector gross risk exposures

Futures Position Transparency (As of 9/30/2020):

Source: Ampersand Investment Management and Bloomberg, LP. Reflects broad sector net risk exposures. Sector exposures and positions held may vary depending on market conditions and may not be representative of the Fund’s current or future exposures. Portfolio positions are subject to change and should not be considered investment advice. Attribution numbers have been rounded for ease of use

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 4 |

Market Commentary

It was another good quarter for global equity markets. Equity market volatility as measured by the VIX® Index declined further during the quarter, staying in the 20% to 30% range, still higher than its long-term historical average.

JULY 2020

The Fund’s Class I shares were up during July (+7.09%), driven mainly by the long strategy (+6.26%). The diversifier strategy was also up (+0.95%), while the hedge strategy had slightly negative performance. (−0.20%).

The widespread havoc wreaked by the Coronavirus pandemic was reflected in record contractions in the second-quarter GDP readings of major global economies. Millions of lost jobs were, however, regained in June, although a continued rise in COVID-19 cases in the US raised concerns the recovery may be faltering, with newly imposed business closings and an increase in jobless claims. EU leaders agreed on a pandemic recovery package, partly funded in common debt, an unprecedented event for the bloc. Arrests in Hong Kong under the new security laws led to escalating tensions between Beijing and the US and Europe, adding to the stresses already created by the White House’s characterization of the Coronavirus as the “Wuhan/China virus.” US Treasury yields declined to near all-time lows as investors remained concerned about the pace of the economic recovery and Congress’s failure to agree on the next stimulus deal. Giant tech companies beat earnings estimates, leading to higher US equity markets, while European counterparts struggled amid surges in COVID-19 cases. Long fixed income positions yielded gains as yields fell on central bank easing, spurred by the potential second wave of Coronavirus infections. Global stock markets also rose on upbeat earnings from technology stocks, and the prospects of further stimulus deals. The US Dollar experienced its worst month in almost a decade amid weak economic data and political uncertainty. Demand revival and ongoing supply pressures boosted major agricultural markets. Coffee prices rose as data showed surges in home consumption. Oil prices rose on unprecedented cuts in North American output, while natural gas prices were more volatile, but climbed on forecasts of hotter weather. Precious metals also rose, as investors continued to clamor for insurance against the Coronavirus impact.

AUGUST 2020

The Fund performed positively in August (up +6.98%), driven entirely by the long strategy was again up (+8.23%). Both the hedge strategy (−1.15%) and the diversifier strategy (−0.16%) detracted from performance.

August saw the end of the S&P 500's sharpest bear market, which also turned out to be the shortest ever, as it took only 126 trading days to recoup pandemic-induced losses. Investor sentiment was somewhat bolstered by promising economic data and talk of a potential Coronavirus vaccine. Russia became the first country to approve a vaccine for civilian use, causing safe-haven assets to sell off. A new inflation goal (targeting an average inflation rate of 2%) from the Federal Reserve, designed to give the central bank further flexibility on monetary policy, also spurred a rally in risk assets. Government bond yields reversed their July decline, leading to losses in long positions. Global stock markets rallied, achieving new record highs, and leading to losses in short positions in some Asian and European stock indices. Some profits were generated from net short US Dollar positions, as the Federal Reserve's announcement drove the currency down against its major peers. Net short energy exposures generated losses. Notably, natural gas futures posted their biggest single-day gain in the last 18 months, as a hotter weather forecast along with increased export demand continued to send prices soaring. Energy prices were further affected by a major Atlantic hurricane, which disrupted production and forced plant closures. In agricultural commodities, short exposure led to losses, particularly in corn, whose price surged on concerns of worsening crop outlooks from the US to Europe and optimism over demand from China, where imports of corn climbed to a three-year high. Long metals exposure yielded some profits, with most precious and base metals rallying as the US Dollar weakened.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 5 |

SEPTEMBER 2020

September was a negative month for the Fund (−6.19%), as the long strategy (−4.48%), the diversifier strategy (−1.12%), and the hedge strategy (−0.65%) all performed negatively.

A rapid resurgence of Coronavirus cases in Europe and the associated tightening of restrictions contributed towards a general risk-off sentiment throughout the month. Payroll data and jobless claims painted an ambiguous picture of the state of the US recovery, while German PMI (Purchasing Managers’ Index) data at a 2-year high together with data showing the Eurozone in deflation territory raised similar doubts about the trajectory of the Eurozone economy. On the political scene, negotiations between the House and the Trump administration saw no agreement on another US virus relief package. The prospect of a hotly contested presidential election and the increased likelihood of a “no-deal outcome” on Brexit affected market sentiment. As the global economic recovery showed signs of stalling, further economic support was promised by several governments. As multiple equity markets declined for the first time in months, investors fled to bonds and the US Dollar. Currencies performed poorly, as the US Dollar reversed its prevailing bearish trend, leading to losses, particularly against the Euro and the Australian Dollar. Gains from short positions in energy were more than offset by losses in metals and agricultural commodities. Natural gas prices reversed and fell as inventories rose and the weather turned milder, whereas the

Conclusion

We believe that concerns about the global economy and geopolitics have been exacerbated by the coronavirus crisis. Historically, futures trading programs have tended to perform well in a variety of market conditions, perhaps particularly so during periods of market turbulence and volatility expansion. A period of a few weeks or months is far too short to judge the long-term potential of any strategy or asset class.

The Fund seeks to provide returns that, in the long run, are comparable to the S&P 500® Total Return Index with comparable volatility, while seeking to mitigate downside risk. We continue to believe that a significant and strategic allocation to the Fund as a substitute for core equity exposure in a portfolio may provide “smarter” equity exposure: equity exposure that is dynamically hedged, coupled with the potential for uncorrelated alpha in the long run.

Definition of Terms

Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund’s alpha.

Annualized rate of return (AROR) is the geometric average return for a period greater than or equal to one year, expressed on an annual basis or as a return per year.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. A beta of 1 indicates that the security's return will move with the market. A beta of less than 1 means that the security’s return will be less volatile than the market. A beta of greater than 1 indicates that the security's return will be more volatile than the market. For example, if a stock's beta is 1.2, it's return is theoretically 20% more volatile than the market’s return.

Brexit is an abbreviation of “British exit,” which refers to the June 23, 2016 referendum by British voters to exit the European Union. The referendum roiled global markets, including currencies, causing the British pound to fall to its lowest level in decades. Prime Minister David Cameron, who supported the UK remaining in the EU announced he would step down in October.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 6 |

Call options are financial contracts that give the option buyer the right, but not the obligation, to buy a stock, bond, commodity or other asset or instrument at a specified price within a specific time period.

Commodity Trading Advisors (CTA) provide advice and services related to trading in futures contracts. They are responsible for the trading within managed futures accounts.

Correlation is a statistical measure of how two securities move in relation to each other.

Crisis alpha: Refers to profits or gains that can be made by exploiting certain market trends during times of market turmoil.

Hedge is making an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

Long position refers to buying a security such as a stock, commodity, or currency, with the expectation that the asset will rise in value.

Put option is a contract giving the owner the right, but not the obligation, to sell – or sell short – a specified amount of an underlying security at a pre-determined price within a specified time frame.

The Purchasing Managers' Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. The PMI is based on a monthly survey sent to senior executives at more than 400 companies in 19 primary industries, which are weighted by their contribution to U.S. GDP.

The S&P500 Total Return Index® is widely regarded as the best single gauge of the U.S. equities market. This world-renowned Index includes 500 leading companies in leading industries of the U.S. economy.

Short position is a position whereby an investor sells borrowed securities in anticipation of a price decline and is required to return an equal number of shares at some point in the future.

Standard Deviation (Volatility) is a measure of fluctuation in the value of an asset or investment. Lower volatility improves the stability and lowers the risk of an investment portfolio.

The VIX® Index (VIX) is a forward-looking measure of equity market volatility. Since its introduction, the VIX is considered by many to be the world’s premier barometer of investor sentiment and market volatility.

Yield is the income return on an investment. This refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value.

Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. The views in this letter were as of September 30, 2020 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 7 |

Annual Commentary - AXS Aspect Core Diversified Strategy Fund

| October 2019 – September 2020 | Private and Confidential |

October 2019 to September 2020

Poor US, UK and European economic data supported global slowdown worries at the start of Q4 2019. A double dose of relief pushed risk assets higher towards the end of the quarter as a preliminary trade deal between the US and China was announced and the Conservative Party won the UK election. Global stock markets ascended on the back of positive trade and economic headlines over the quarter benefitting the AXS Aspect Core Diversified Strategy Fund’s (“the Fund”) net long* stock index positions. Improvements in risk appetite shifted market participants out of safe-haven assets, lifting sovereign bond yields and resulting in losses for the Fund’s mostly long bond positions. The Fund’s short** positions in the New Zealand Dollar and Australian Dollar led to losses, as the currencies strengthened amid improved market sentiment.

At the start of 2020, risk appetite vacillated, as the threat of significant military conflict and the rapid de-escalation between the US and Iran interrupted an otherwise strong start for risk assets. The much-anticipated phase one trade deal between the US and China was signed, and upbeat US economic data helped brighten global sentiment. Towards the end January, the World Health Organisation declared the outbreak of a new coronavirus a global health emergency. There were early hopes that the respiratory disease could be contained, and after China’s central bank added a larger than expected liquidity injection, US equities reached all-time highs. During March, as the spread of coronavirus turned into one of the most significant pandemics in a century, growing fears of a global economic shutdown as a result of the socio-economic impact provided the spark for markets to experience one of the most rapid collapses in modern history. In the bond sector, a net long exposure throughout Q1 2020 created profits as globally governments enacted rate cuts and liquidity pumping pushing prices higher. After reaching record highs many stock indices reversed in record speed as there was a concerted flight to safety, causing losses for the Fund’s net long position early in Q1 2020. In energies, milder weather led natural gas prices lower rewarding the Fund’s short position.

Despite the backdrop in April of an overwhelmingly negative global economic outlook, the sheer size of the Fed's stimulus resulted in US equity markets recording their best month in 30 years. Lacklustre demand driven by COVID-19 disruption and the resulting storage capacity concerns, pushed WTI Crude oil into negative price territory for the first time in history. The remainder of Q2 2020 saw a continuation of positive sentiment across equity and commodity markets as some major economies eased lockdowns and economic activity began to tentatively resume. The reversal in sentiment from overwhelmingly bearish to bullish caused reversals in pro-cyclical assets such as stock indices, energies and industrial metals. The subsequent rallies in these markets detracted from performance. In currencies, the weakness in the world’s reserve currency, the US dollar was bolstered as investors looked towards a global recovery and this proved challenging for the currency sector.

At the start of Q3 2020, US Treasury yields declined to near all-time lows as investors remained worried about the pace of economic recovery and as the US Congress failed to agree on the next stimulus deal. August saw the end of the S&P 500’s shortest and sharpest bear market in its history, taking 126 trading days to recover pandemic-induced losses. During September, a rapid resurgence of coronavirus cases in Europe, the prospect of a hotly contested US presidential election and the increased likelihood of Brexit trade talks faltering marred market sentiment. The Fund gave back some earlier gains made in currencies during September as the US Dollar rallied against its prevailing bearish trend leading to losses particularly against the Pound. The Fund’s short lean hogs position dominated losses within the agriculturals sector as prices rose on increased demand expectations. Whereas, in energies, it was the short exposure in natural gas which mainly detracted from performance. The energy market posted its largest single-day gain in 18 months during August off the back of hotter weather forecasts and increased export demand.

|

October 2019 – September 2020 |

Private and Confidential |

| 8 |

Annual Commentary - AXS Aspect Core Diversified Strategy Fund

The views in this letter were as of September 30, 2020 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the Fund’s investment methodology and do not constitute investment advice

* A long position refers to getting economic exposure to a reference asset, and this position will increase in value if the reference asset’s price increases.

** A short position refers to getting economic exposure to a reference asset, and this position will increase in value if the reference asset’s price decreases.

|

October 2019 – September 2020 |

Private and Confidential |

| 9 |

OCTOBER 2019

October was a tough month in the markets for the fund. Nearly every sector was negative for the month, with the exception of metals. Metals led the commodity sector with gains for the fund. As is so often the case when the equity markets falter, investors fled to the safety of precious metals. Both gold and silver were up on the month. Palladium also continued its upward advance in October, rising to new highs as analysts are now projecting shortages in that metal because of the demands from the automobile industry. The Softs, Meats & Grains complexes all contributed negatively to monthly performance. Currencies continued their wild swings during the month as this sector had the largest negative impact on the Fund’s performance in October. Gains in emerging currencies including the Mexican Peso and Russian Ruble could not offset losses from G-7 currencies in particular, British Pound.

As with the currencies, equity markets continue to be volatile. Overall performance in equities was negative as most issues were down. Healthcare stocks were one subsector, which performed nicely as positions in Merck were positive. Our Nike position, which has been one of the best performing stocks in the Dow Jones this year, gave back some ground as investors locked in some gains. Another poor performer was McDonald’s whose stock declined sharply as they reported poor earnings, also hurting performance.

NOVEMBER 2019

The markets in November continued the malaise experienced in October. Commodities were particularly hard hit and continued to underperform and hurt our performance.

Metals, which rallied in October, were the worst performing sector as both gold and silver gave back the ground that was gained in the prior month. Losses were recorded in the base metals complex as nickel and lead were down on fears that a slowdown in the Chinese economy would lessen demand for metals. Palladium was a bright spot, as it continued its advance on strong demand from the automobile industry. Our positions in Softs, Meats & Grains were again down in November.

As with Metals, Currencies reversed course from being our biggest detractor October to becoming our biggest gainer in November. Our position in the Brazilian Real contributed to gains as that currency continued to slide and sit at near yearly lows. We were also bolstered by our long position in the Israeli Shekel, as that currency remains strong on the strength of the Israeli economy.

As in the prior month, the equity markets continue to be volatile and performance was only slightly positive. Despite rallying for most of the month, the complex gave back gains in the last week. Overall performance in equities was positive in November. Target reported very strong earnings in the third quarter, which benefited the portfolio. Gains were also recorded in both the French and Australian equity markets.

DECEMBER 2019

The markets in December continued to be difficult to navigate. Commodities were mixed in December. Metals and agricultural markets were positive contributors to the portfolio. Palladium prices continued to move higher due to automobile industry demand. Bean oil positions also provided positives returns as strong demand for vegetable oils in China continued to rise, while the amount of oilseeds being planted remains steady. Positions in the soft and livestock complexes added to negative performance.

| Chesapeake Capital Corporation | [email protected] |

| 1721 Summit Avenue | tel 804.836.1617 |

| Richmond, VA 23230 | fax 804.836.1610 |

| 10 |

Currencies once again reversed course and contributed to the negative performance for the month. The British Pound weighed on the sector, declining during the election process that took place in December and renewed Brexit fears. Though volatile, our positions in the equity markets performed well in December and added positive performance for the month.

The interest rate sector, particularly global bonds markets, were negative attributes to the portfolio again in December.

JANUARY 2020

2020 was off to a nice start as the AXS Chesapeake Strategy Fund was positive in January. Gains in the currency complex and the fixed income sector were strong and they offset losses incurred in the equity and commodity sectors. The fixed income sector of the Fund performed well and was led by gains from positions in Italian, Australian and US Government bonds, as the uncertainty in the equity markets in the last half of the month caused these issues to rally.

The currencies complex provided positive returns for the month. Committee sensitive currencies like the Australian and New Zealand dollar as well as the Brazilian Real continued their decline, which helped our performance as we hold short positions against the US Dollar. The commodity complex had mixed results as gains on long positions in metals were not enough to overcome losses in other commodities. Metals were again a top mover in the commodity space and, palladium once again continued to lead the charge, rising sharply on the demand from foreign and domestic automakers. Losses were incurred in the softs, meats & grains led by losses in coffee, live cattle and soybean oil. Gains were recorded in cocoa and lean hogs.

Equity markets, which started off strong in January, tailed off in the second half of the month on global concerns about the coronavirus and economic growth.

FEBRUARY 2020

After an extremely strong first 20 days to the month, February ended up being a difficult market as a broad sell-off across sectors on COVID-19 fears led to losses for the Fund. Equity markets, up sharply for most of the month, collapsed in the last five trading days of February, causing the Fund substantial losses.

Fixed income markets were not spared either, as our positions gave back ground from their January gains. Italian Government bonds were off sharply as that country was suddenly struck with the coronavirus in the northern part of the country. The Fund was still able to post gains for the month in the fixed income complex but not enough to offset the equity rout. The US dollar was not immune to market volatility and currency positions suffered losses during the month as well.

In commodities, the Fund was able to post positive results for the month from the energy and soft commodity complexes. Short positions in heating oil led gainers for the month.

| Chesapeake Capital Corporation | [email protected] |

| 1721 Summit Avenue | tel 804.836.1617 |

| Richmond, VA 23230 | fax 804.836.1610 |

| 11 |

MARCH 2020

Equity markets continued to collapse in March. The Fund incurred losses in the equity and currency sectors and had gains in fixed income and commodities. The commodity sector was net positive, led by gains from energy and agricultural markets. Losses were incurred in the soft complex and metals, as palladium, which has been a positive long-term trade, finally gave back ground as the coronavirus very quickly dampened the market for Chinese automobiles.

The Fund profited from holding long positions in global bond markets. The long end of the US curve proved to be the strongest sub-sector in fixed income during the month. The volatility in the currency complex proved difficult and the Fund posted negative results in the complex. The strong US dollar helped the Fund’s positions in US dollar positions against emerging market and commodity currencies. Short dollar positions against safe haven currencies like the Japanese Yen and the Swiss Franc incurred losses and were closed out during the month.

APRIL 2020

The AXS Chesapeake Strategy Fund I share posted a gain in April. Gains in the interest rate and commodity sectors led the Fund in positive performance for the month, while losses were recorded in the equity and currency complexes. Interest rates were also positive as long positions in the US 10-year Note and the London Gilt contributed gains to the Fund for the month.

The commodity sector posted positive results for the month. Metals were positive led by long positions in the precious metals complex. The grain complex also produced gains. Losses from long positions in wheat were more than offset from gains on short positions in the corn, canola and soybean oil markets. Short positions in live cattle and live hogs also produced gains for the month. In the energy complex, short positions in heating oil led all gainers and was the best performing market for the month.

The equity sector produced losses for the month as short positions in Oracle and Verizon as well as short positions in the FTSE index contributed to the losses.

The currency sector also was negative for the month. Gains were recorded on long US Dollar positions against the South African Rand, Mexican Peso and Brazilian Real. Losses were incurred on long US Dollar positions vs. the Swedish Krona and Australian and Canadian Dollars.

MAY 2020

The Fund posted a loss in May. Losses in the currency and commodity sectors were the biggest drag on performance for the month. Gains were recorded in fixed income.

The currency sector was negative for the month. Losses were recorded on long US Dollar positions against the South African Rand, Mexican Peso and Brazilian Real as well as from long US Dollar positions vs. the Swedish Krona and Australian and Canadian Dollars.

The commodity sector posted negative results for the month. Energy positions led the losses for the month as all subsectors in the commodity complex incurred losses. In the metals complex, long positions in gold were positive, but short positions in industrial metals, aluminum and zinc offset these gains. The grain and meat complexes also produced losses for the month. Interest rates performance was positive as long positions in the US 10-year Note and the London Gilt contributed gains to the Fund for the month.

| Chesapeake Capital Corporation | [email protected] |

| 1721 Summit Avenue | tel 804.836.1617 |

| Richmond, VA 23230 | fax 804.836.1610 |

| 12 |

The equity sector was flat for the month.

JUNE 2020

The Fund posted a loss in June. Losses in the commodity sector contributed the largest impact of negative performance for the month. Gains were recorded in the equity and fixed income complexes.

The commodity sector posted negative results for the month. Energy positions led the losses for the month as well as the grain and industrial metal markets. In the metals complex, long positions in gold continued to provide positive results but short positions in industrial metals, copper, aluminum and zinc offset these gains. Long positions in wheat and short positions in the corn and soybean oil markets produced losses in the grain complex for the month. The meats and soft complexes produced small gains in June.

The currency sector also was negative for the month. Gains were recorded on long US Dollar positions against the Mexican Peso and Brazilian Real. Losses were incurred on long US Dollar positions vs. the Swedish Krona, the Russian Ruble and the Canadian Dollar.

The equity sector produced gains on long positions for the month. Performance for interest rates was positive as long positions in the US 5-year Note and US 10-year Note contributed gains to the Fund for the month.

JULY 2020

The AXS Chesapeake Strategy Fund posted a gain in July. Gains were recorded in all four sectors of the Fund: fixed income, equities, commodities and currencies. The commodity sector posted positive results for the month.

The metals markets were positive from long positions in the precious metals, gold and silver. The grain complex also produced gains. Losses from long positions in soybean oil were more than offset from gains on short positions in corn. In the energy and meat complex, short positions posted minor losses.

The fixed income sector was positive as long positions in the US and global rate markets all contributed positive results as interest rates declined. Gains were recorded across the curve led by the long end of the US rate market.

The equity sector produced positive results as long positions in the Nasdaq and S&P 500, coupled with gains on short positions in the London FTSE market all contributed gains for the month.

The currency sector was the best performing sector for the month. Gains were recorded on short US Dollar positions against the Euro Dollar, Swiss Franc, Swedish Krona and Australian dollar. Losses were incurred on long dollar positions versus the Brazilian Real.

| Chesapeake Capital Corporation | [email protected] |

| 1721 Summit Avenue | tel 804.836.1617 |

| Richmond, VA 23230 | fax 804.836.1610 |

| 13 |

AUGUST 2020

The Fund posted a gain in August. Gains were recorded in equities, currency and commodities, and losses were incurred in the fixed income sector.

As in July, the currency sector was the best performing sector for the month. Gains were recorded on short US Dollar positions with the biggest contributors to gains being the British Pound, Canadian Dollar and the Australian Dollar.

The commodity sector posted positive results for the month. Gains on long positions in the precious metals complex, led by silver, were the best performing subsector. Losses were recorded in the grain complex on short corn positions.

The equity sector posted positive results for the month. Gains were led by long positions in the broad indices, the Nasdaq and S&P 500. Gains were also recorded in single names led by Target and Wal-Mart.

The fixed income sector posted losses for the month. As global interest rates rose, losses were experienced on long fixed income positions.

SEPTEMBER 2020

The Fund posted a loss in September. The month saw a reversal of trends from August as losses were recorded in equities, currency and commodities. Gains were incurred in the fixed income sector.

The commodity sector posted negative results for the month. The metals complex produced negative results on long positions in gold and silver. Gains were recorded in the grain complex led by long positions in soybeans and canola.

The equity sector produced losses on long positions for the month.

The currency sector also was negative for the month. Losses were recorded on short US Dollar positions against the Swiss Franc, Swedish Krona and Euro Dollar as well as the British Pound, Canadian Dollar and the Australian Dollar. Gains were recorded on long US Dollar positions against the Mexican Peso and short US Dollar positions against the Japanese Yen.

In fixed income, interest rate performance was positive for the month. Global bond markets contributed the most to the positive performance led by Italian, German and British interest rate positions.

The views in this letter were as of September 30, 2020 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the Fund’s investment methodology and do not constitute investment advice.

| Chesapeake Capital Corporation | [email protected] |

| 1721 Summit Avenue | tel 804.836.1617 |

| Richmond, VA 23230 | fax 804.836.1610 |

| 14 |

AXS Managed Futures Strategy Fund

Annual Letter to Shareholders for the year ended September 30, 2020

For the fiscal year, October 1, 2019 through September 30, 2020, the AXS Managed Futures Strategy Fund’s (formerly the Equinox MutualHedge Strategy Fund) Class A Shares (with No Load) returned -25.22%, Class A Shares (with Maximum Load) returned -29.49 %, Class C Shares returned -25.80%, and Class I Shares returned -25.01%. During the period, the Fund’s Class I Shares underperformed the Barclay BTOP50 Index® (the “Managed Futures Index”), which returned -3.67%, as well as US equities (as represented by S&P 500® Total Return Index, the “Equities Index”), which returned +15.15%.

The Fund has remained virtually uncorrelated to equities since inception, with a 0.12 correlation coefficient relative to the Equities Index. Like the managed futures asset class as a whole, to which it had a correlation of 0.80 since inception, the Fund offers the potential for diversification benefits when added to traditional investment portfolios that have equities as their core holding.

FUND STRATEGY

The Fund’s investment objective is to achieve capital appreciation in both rising and falling equity markets, with an annualized level of volatility that is generally lower than the historical level of volatility experienced by the Equities Index The sub-advisor seeks an annualized level of volatility that is generally lower than the historic level of volatility experienced by the S&P 500 Index. This is only a long-term target, and short-term volatility may fall outside this range. The Fund’s realized volatility since inception has been a little over 10%.

The Sub-Advisor pursues the Fund’s investment objectives mainly by investing in (i) fixed-income securities, and (ii) global derivatives markets, through the proprietary programs of one or more commodity trading advisors (“CTAs”), which are often labeled “managed futures” programs.

The Sub-Advisor draws on its experience in the managed futures space to select futures trading programs and, by analyzing the interrelationships among them, to combine them in a portfolio that seeks to offer performance potential with lower volatility than individual programs. The portfolio is designed to be diversified across (i) trading methodologies (e.g., trend-following, global macro trading, relative value trading); (ii) trading time horizons (short-term, medium-term, long-term); (iii) sectors (energy, metals, agricultural commodities, equity indices, interest rates, currencies); and (iv) geography. The Sub-Advisor seeks to manage the risk of the portfolio by monitoring key parameters such as returns, volatility, drawdowns, value at risk (VaR), and sector exposures. While the portfolio is actively managed, it does not express or incorporate tactical views on markets or trading programs; rather, the Sub-Advisor emphasizes strategic allocation and long-term risk-adjusted returns.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 15 |

PORTFOLIO

As of September 30, 2020, the Fund’s portfolio consisted of 19 futures trading programs. Three global macro programs (H2O, IPM and QMS) represented about 21% of the Fund’s portfolio, while four diversified intermediate-term to long-term trend-following programs (Winton, KeyQuant, Quantica, and Quest) represented approximately 19% of the Fund’s portfolio. Three relative-value/commodity trading programs (Arctic Blue, EVE, and J E Moody) represented approximately 15%, while four machine-learning/short-term trading programs (Crabel, Katonah, QIM and SCT) had a 21% allocation. Two currency trading programs (LCJ and Mesirow, formerly Cambridge) represented a 9% allocation. The remaining 15% was allocated to FORT Contrarian, QDRA and Quadriga. The Sub-Advisor believes that this diversification across trading styles and horizons has the potential, over time, to earn positive returns under varying market conditions while keeping the volatility of the Fund’s returns generally lower than the historic level of volatility experienced by the S&P 500 Index. It is worth mentioning that the above allocations are based on “notional trading,” whereas the Sub-Advisor employs a modified “risk-parity” allocation approach to determine allocations.

Table 1 displays the Fund’s quarter-by-quarter allocations to futures trading programs. This year, there were two additions.

In February 2020, we made an allocation to the Katonah Capital Partners machine-learning based futures trading program. The program seeks to derive trading/portfolio features by the amalgamation of information from proprietary flow models. These features are fed through a proprietary ‘machine learning framework,’ including a “states of the world” model, that systematically evolves with changes in financial markets. Over the long term, returns are expected to be uncorrelated to other futures trading strategies as well as to core asset classes.

In July 2020, we made an allocation to the Quadriga Smart Gold options and futures trading program. The Smart Gold Strategy is a liquid, absolute return strategy that aims to protect capital and generate negatively correlated returns (“crisis alpha”) during adverse and hostile equity markets, while seeking to earn neutral to positive returns during benign markets. Thus, the strategy seeks to earn, in the long run, higher risk-adjusted overall returns, particularly on the downside, through the combination of potentially higher compounded returns, lower realized volatility, and shallower drawdowns. The Smart Gold strategy comprises three parts:

• A Core Precious Metals Strategy that seeks to maintain a long position in gold and other precious metals via futures contracts

• A Core U.S. Treasuries Strategy that seeks to maintain a long position in U.S. Treasury securities via futures contracts; and

• A Long-Only Options Trading Program that primarily buys put options on various underlying “bubble” assets, such as equities, and calls on “anti-bubble” assets such as sovereign debt and precious metals.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 16 |

TABLE 1: QUARTER-END PORTFOLIO ALLOCATIONS

| Advisor | 9/30/2019 | 12/31/2019 | 3/31/2020 | 6/30/2020 | 9/30/2020 |

| Arctic Blue | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% |

| Crabel | 8.0% | 7.0% | 7.0% | 7.0% | 7.0% |

| Emil van Essen | 6.0% | 6.0% | 6.0% | 5.0% | 5.0% |

| Fort Contrarian | 6.0% | 6.0% | 5.0% | 5.0% | 5.0% |

| H2O Asset Management | 10.0% | 10.0% | 7.0% | 9.0% | 9.0% |

| IPM | 7.0% | 7.0% | 7.0% | 7.0% | 7.0% |

| JE Moody | 4.0% | 4.0% | 5.0% | 5.0% | 5.0% |

| Katonah | 4.0% | 4.0% | 4.0% | ||

| Key Trends | 5.0% | 6.0% | 5.0% | 5.0% | 5.0% |

| LCJ | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% |

| Mesirow Financial | 5.0% | 5.0% | 5.0% | 5.0% | 4.0% |

| QDRA | 7.0% | 7.0% | 8.0% | 7.0% | 6.0% |

| QIM | 7.0% | 7.0% | 7.0% | 7.0% | 6.0% |

| QMS | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% |

| Quadriga | 4.0% | ||||

| Quantica | 7.0% | 7.0% | 6.0% | 7.0% | 6.0% |

| Quest | 3.0% | 3.0% | 3.0% | 3.0% | 3.0% |

| SCT | 4.0% | 4.0% | 4.0% | 4.0% | 4.0% |

| Winton | 6.0% | 6.0% | 6.0% | 5.0% | 5.0% |

ANALYSIS OF FUND PERFORMANCE

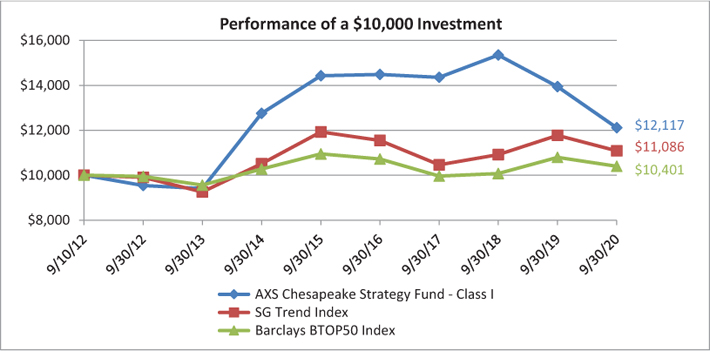

As shown in Table 2, the Fund underperformed both the Managed Futures Index and the Equities Index. The Fund’s volatility since inception is lower than that of the Equities Index.

TABLE 2: PERFORMANCE STATISTICS OF THE FUND

|

RETURN (Fiscal Year) |

VOLATILITY (5/24/2011-9/30/2020) |

CORRELATION (5/24/2011 – 9/30/2020) | |

| Fund (Class I shares) | -25.01% | 10.1% | 1.00 |

| Barclay BTOP50 Index® | -3.67% | 6.40% | 0.80 |

| S&P 500 Total Return Index® | 15.15% | 13.4% | 0.12 |

Past performance does not guarantee future results.

FUND PERFORMANCE ATTRIBUTION BY TRADING PROGRAM AND SECTOR

The fact that only three trading programs had a positive year, as shown in Table 3, is an indication that this was an unusual period. Generally, because of the diversified portfolio of trading allocations, even in a bad year, the number of positive and negative performers tends to be roughly balanced.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 17 |

TABLE 3: TRADING PROGRAM CONTRIBUTIONS TO PERFORMANCE (10/1/2019 to 9/30/2020)

| Trading Program | Contribution |

| Arctic Blue | 0.78% |

| Crabel | -0.18% |

| Emil van Essen | -2.60% |

| Fort Contrarian | -0.86% |

| H2O Asset Management | -6.93% |

| IPM | -1.44% |

| JE Moody | 2.75% |

| Katonah | -0.79% |

| Key Trends | -1.53% |

| LCJ | -2.24% |

| Mesirow Financial | -1.48% |

| QDRA | -1.08% |

| QIM | -0.78% |

| QMS | -1.70% |

| Quadriga | -2.23% |

| Quantica | -1.18% |

| Quest | 0.20% |

| SCT | -0.79% |

| Winton | -4.22% |

| Fixed Income Securities | 1.29% |

| TOTAL | -25.01% |

At the sector level, as shown in Table 4, except for Interest Rates, all other sectors contributed negatively, again an occurrence that is out of the ordinary.

TABLE 4: FUND PERFORMANCE ATTRIBUTION BY SECTOR (10/1/2019 to 9/30/2020)

| Sector | Contribution |

| Currencies | -10.46% |

| Equity Indices | -13.69% |

| Interest Rates | 2.47% |

| Agricultural Commodities | -0.18% |

| Energy | -2.56% |

| Metals | -1.88% |

| Fixed Income Securities | 1.29% |

| Total | -25.01% |

Performance contribution is estimated by Ampersand Investment Management and is net of fees. Past performance does not guarantee future results.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 18 |

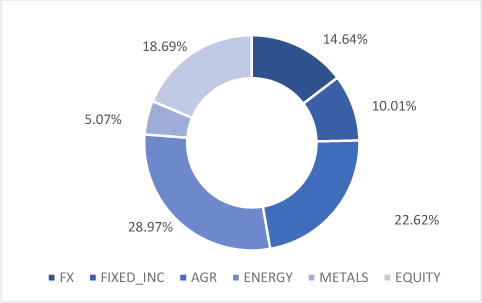

FUND SECTOR DIVERSIFICATION

RISK EXPOSURE AS OF 9/30/2019

RISK EXPOSURE AS OF 9/30/2020

Source: Ampersand Investment Management and Bloomberg, LP. Reflects aggregate sector gross risk exposures

The Fund’s largest gross exposure as of quarter-end was to the energy sector (about 29%), followed by agricultural commodities (about 23%), equity indices (about 19%), currencies (about 15%) and interest rates (about 10%), while exposure to metals was the smallest (about 5%). Combined, the financial sectors represent about 44% of the Fund’s exposure, significantly higher than the 28% exposure at the end of the prior period.

MARKET COMMENTARY

Q4 2019

The Fund’s Class I shares were down (−5.05%) for the quarter, but still ended the year up +9.32%.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 19 |

Equity market volatility as measured by the VIX® Index, was relatively high (17%-20%) during the first ten days of October, but subsided dramatically thereafter and stayed within a narrow range (about 12% to 16%), ending the quarter and the year at under 14%.

OCTOBER 2019

The Fund had a difficult October (−4.06%).

Poor US, UK and European economic data led to global slowdown worries early during the month. However, these concerns started to ease when the initial phase of a trade deal was outlined, which involved the US holding off on tariff increases in exchange for some Chinese concessions. Optimism over the trade relationship continued through the rest of the month. Meanwhile, UK Prime Minister Boris Johnson secured a draft Brexit deal with the European Union. He lost the vote, but ultimately the UK was granted an extension of the October 31 deadline, paving the way for a general election.

Stock indices mostly recovered their initial losses by the end of the month, with Asian and European markets leading the way. Quarterly earnings were positive on average, which also drove equity indices higher through the second half of the month. The S&P 500® reached another new high.

US and Eurozone government bond yields dropped in the first week amid concerns of a slowdown. However, later news of positive developments on the geopolitical front enticed market participants to sell safe-haven assets, boosting yields. The yield surge halted when the Fed announced its widely anticipated rate cut. The accompanying verbiage was, as always, open to interpretation. However, the market generally chose to focus on the resistance to future hikes, which led to a small recovery in global bond prices.

In the UK, a breakthrough in Brexit negotiations improved investor sentiment, with both the pound and Euro rallying through the month. Both the Australian and New Zealand Dollars also strengthened.

In energy markets, oil prices moved sideways initially as Russia said it would not cut production significantly, but the Saudis later affirmed that they would. Long positions in oils were profitable as prices rose amid trade optimism. Meanwhile, natural gas prices also rallied on expectations of higher demand.

Continued automotive demand for palladium benefitted long positions, as did the rally in prices of other precious metals, especially gold.

Choppy market conditions in agricultural commodities led to losses, from mainly short positions.

NOVEMBER 2019

Performance reversed and was positive for November (+2.23%).

Optimism increased in light of the ongoing trade talks and better economic data. The proposed US-China trade agreement appeared more holistic than initially anticipated, with the inclusion of Chinese intellectual property considerations. However, geopolitical uncertainty remained after President Trump signed a bill supportive of the Hong Kong demonstrators, which drew criticism from China. In Europe, Brexit continued to feature prominently as the UK Parliament was dissolved and campaigning began for the third general election in four years. Election polls predicted the Conservative Party would win with a firm majority.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 20 |

Global stock markets climbed higher on the back of positive trade and economic headlines. US equities hit further new highs as constructive developments around “Phase One” of the US-China trade agreement shaped headlines. European and Asian indices moved up albeit less, as Purchasing Managers' Index (PMI) survey results and earning reports both disappointed.

In reaction to optimistic signals on the trade war front, government bond yields increased across developed markets. Risk-on sentiment was further supported by stronger economic data from the US and comments from Fed Chairman Powell that “sustained expansion of economic activity is likely”.

Long US Dollar exposure vs the Euro and the Yen was profitable. Meanwhile, the Australian Dollar fell on monetary easing prospects and the Chilean Peso plummeted in response to civil unrest.

In volatile energy markets, crude oil prices experienced a modest rally on the back of the improved trade sentiment and expectations that OPEC would deepen production cuts. Natural gas dropped on predictions of warmer weather and increased output from shale basins.

In metals, nickel prices fell as Indonesia eased its metal export ban and Chinese steel production output appeared to weaken. Precious metals declined as investors reduced their exposure to safe-haven assets, and as the US dollar rallied.

In agricultural commodities, sugar futures rose on production concerns linked to frost-damaged crops in the US.

DECEMBER 2019

The Fund ended the year up despite a difficult December (−3.19%).

In December, risk assets rallied as a preliminary trade deal between the US and China was announced, staving off the December 15 hike in tariffs. Meanwhile, the Conservative Party won the UK elections handily. Recessionary fears temporarily eased as economic growth indicators showed that the economy maintained a moderate pace of expansion, supported by a strong labor market. Meanwhile, China experienced an unexpected rebound in manufacturing.

Stock indices experienced a shaky start as the US adopted a more aggressive trade stance by reinstating tariffs on Argentina and Brazil. However, improving geopolitics and upbeat economic data helped major stock indices end the month higher; the S&P 500® gained almost 31.5% for the year.

Bond yields generally rose as risk sentiment improved, to the detriment of long positions. Sweden ended its five-year spell of negative interest rates, prompting speculation among investors that other central banks could reassess the efficacy of sub-zero rates.

In currencies, rosier global growth prospects and improving relations between the US and China led to waning safe-haven demand for the US Dollar, which weakened against most major currencies as well as the Australian Dollar and some Latin American currencies. The election-driven rally in GBP was short-lived, however, as Mr. Johnson ruled out any extension to the transition period in which a trade deal with the EU must be negotiated.

Long agricultural positions, particularly the soy complex, struggled as markets rallied broadly on the news of a partial US-China trade deal. Beijing committed to buy $32 billion additional US agricultural products over the next two years. In energies, oil rallied after OPEC agreed on deeper than anticipated output cuts at the December meeting. The rally continued against a more buoyant demand outlook, driven by US-China trade optimism. In metals, palladium extended its 2019 rally, powered by a sustained global deficit.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 21 |

Q1 2020

In what turned out to be an extremely turbulent and volatile quarter, the Fund’s Class I shares were down −10.51%.

Equity market volatility as measured by the VIX® Index, kicked off the year in the 12%-14% range until the third week of January, but began to trend higher as fears about the pandemic caught hold. Still, until February 21, it stayed in the 14%-19% range. It spiked to 25% on February 24 and ended the month at 40%. It continued to rise during March, peaking at about 83% on March 16, before subsiding slightly to end the month and quarter at about 54%. During this explosively volatile period, equity markets whipsawed sharply almost every day, conditions that are generally not conducive to futures trading strategies in the short run.

JANUARY 2020

The Fund started off the year with a good month of January (+2.56%).

Spurred by a series of geopolitical and economic events, markets fluctuated between “risk on” and “risk off” during the month. The threat of significant military conflict between the US and Iran was one of the first risk-off catalysts. However, by mid-month, the long-awaited phase one trade deal between the US and China was signed, and positive US economic data releases restored global sentiment, and equity markets touched new highs. However, everything changed towards the end of the month, when the WHO declared the outbreak of the coronavirus a global health emergency. The US treasury curve inverted once again, reviving fears of a global growth slowdown.

Global stock indices were hit amid flaring tensions and fears about the economic consequences of coronavirus. The MSCI Emerging Markets and FTSE China A50 indices were among those most affected. In fixed income, long positions profited from the risk-off environment. In currencies, the US Dollar gained amid increasing safe-haven demand.

In agricultural commodities, long coffee positions gave up previous ground gained on supply concerns on signals of ample supply from Brazil, the world's top producer. In metals, palladium continued to hit new record highs amid the ongoing global supply shortage. Fears that the coronavirus could slow global transportation hurt energy markets, particularly from WTI Crude oil and natural gas. Other cyclically sensitive commodities like industrial metals also sold off. Gold played its role as a traditional safe-haven asset and gained.

FEBRUARY 2020

The Fund continued to perform well until February 20, when it was up more than 6% for the month. However, performance reversed sharply thereafter and was negative for the full month of February. (−3.38%).

COVID-19 continued to spread beyond China to many other parts of the globe. Early in the month, there were hopes that the respiratory virus could be contained, and after China's central bank injected greater liquidity than expected, US equities reached new highs. However, the fear of rapidly growing infections and supply chain disruptions grew, and gold and government bonds began to rally. Those fears were realized when coronavirus outbreak clusters were picked up in Italy, Iran and South Korea. As Italy locked down northern towns, Switzerland banned large gatherings and the US had its first community infection, the WHO issued its highest alert. Markets responded with a concerted flight to safety and major US and European indices entered correction territory. Industrial and agricultural commodities including energy also sold off sharply. The benchmark US 10Y yield hit historic lows, while German and Japanese yields fell further below zero. Gold continued its safe-haven rally.

Short positions in bonds and the US Dollar were decimated during the month, as were long equity index positions and long energy positions. In short, the same positions that had driven the Fund up nearly 9% for the year-to-date gave up all those gains and then some.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 22 |

MARCH 2020

In March, the Fund had one of its worst months ever (−9.70%).

Against one of the most significant global pandemics in a century, the fragility of the financial markets became evident. Rising fears of a global economic shutdown as a result of the socio-economic impact of COVID-19 provided the spark for markets to experience one of the most rapid collapses in modern history.

For several days during the month, equity markets fell by their largest single day drops on record, only to also rally by equally record setting moves.

Central banks and governments the world over provided unprecedented levels of stimulus as they sought to stabilize the markets and to support shuttered economies. The lasting effects of the pandemic on society as a whole and on nations, economies, and populations are yet to play out fully, and the aftershocks will be felt for a long time to come.

Amid the pandemonium, the world also saw the disintegration of the OPEC cartel and the ensuing record low oil prices. The massive twin supply and demand shocks saw crude oil collapse by 75% so far this year.

Q2 2020

In a quarter slightly less turbulent than Q1, the AXS Managed Futures Strategy Fund’s Class I shares were down −6.45%.

Equity market volatility as measured by the VIX Index declined during April from 57 to about 35 but continued to be high by recent historical standards. The average for May and June was about 31, with the index staying in a narrow range of 25 to 36, barring one outlier of 41.

APRIL 2020

The Fund started off the quarter with a positive month of April (+1.00%).

Against the backdrop of the negative global economic outlook caused by the pandemic and in the face of US jobless claims that rose above previous record highs, the Fed’s stimulus lifted US equity markets to their best month in 30 years. Elsewhere, data showed that China and the Eurozone both suffered a historic economic slump in the first quarter. With bonds and commodities signaling a prolonged period of low growth, the recent rally in equity markets appears almost irrational. Unprecedented price swings rocked global oil markets, as the end of the price war between Saudi Arabia and Russia and the prospect of production cuts sent oil prices soaring at the start of the month, only to see lackluster COVID-driven demand disruption and the resulting storage capacity shortage concerns push WTI Crude into negative territory for the first time in history.

Government bond prices rose across the globe on continuing historic levels of monetary stimulus. Volatility declined, while remaining high compared to its long-term average, leading global equity markets to recover by around 25% from their March lows. The US Dollar lost ground, notably against the Australian Dollar, as the Reserve Bank of Australia's unchanged monetary policy stimulated that currency, while safe-haven demand subsided somewhat.

In agricultural commodities, a sharp decline in ethanol production sent corn prices tumbling as demand fell. Natural gas prices rose on expectations of reduced supply given the collapse in crude oil prices. Industrial metals rallied on hopes that the easing of lockdowns and restarting of factories would revive demand.

MAY 2020

The Fund gave up ground in May (−3.97%).

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 23 |

Positive sentiment across equity and commodity markets continued to build as some major economies eased lockdowns and economic activity began to resume, albeit hesitantly. Hopes of earlier-than-anticipated treatments or vaccines for COVID-19 buoyed sentiment in risk assets, and this was reinforced by major stimulus packages in the EU and Japan. Bond markets, however, still appeared concerned about the precariousness of the recovery. Risk sentiment whipsawed in the last part of the month, as the US and China reignited and escalated their trade war.

In fixed income markets, yields continued to decline globally; however, increases were seen at the longer end of the US yield curve, as the US Treasury was forced to announce larger auctions to finance its stimulus packages. Stock indices broadly continued to rally. The US Dollar continued to decline as “risk-off” sentiment decreased. The Norwegian Krone strengthened as oil prices rallied.

The reopening of economies boosted the prices of industrial metals. Natural gas prices reversed their trend, as did WTI Crude, whose worst month on record was followed by its best, as global oil production cuts kicked in.

JUNE 2020

June was another negative month for the Fund (−3.55%).

Markets vacillated between risk-on and risk-off postures. Surprisingly positive US jobs figures sent some US stock indices to record highs; however, a subsequent resurgence in COVID-19 cases, gloomy economic forecasts, and concerns over global trade restrictions led to a sharp retreat. Meanwhile, increased stimulus from the Fed and the European Central Bank boosted positive sentiment.

Led by Germany, government bond yields dropped as governments and central banks reaffirmed their accommodative policies. Gains in Asian markets were offset by losses from short positions in emerging market indices, which gained partly due to a weaker US Dollar. This weakness was bolstered as investors looking towards a global recovery moved out of safe-haven assets.

Short positions in lean hogs and cocoa were profitable, as these commodities struggled amid oversupply and weakened demand, respectively. Volatile natural gas futures touched a 25-year low amid swelling stockpiles, before regaining ground due to warmer weather forecasts and the bankruptcy of a major supplier. Short exposure to oil was unprofitable, as it rallied on higher fuel demand. In metals, sliding Chinese inventories alongside better economic prospects led to losses for short positions in industrial metals such as aluminum.

Q3 2020

In a quarter slightly less turbulent than Q2, the Fund’s Class I shares were down −5.67%. Multiple sharp reversals in equity, fixed income, currency and energy markets amid the persistence of the pandemic were not conducive to performance.

Equity market volatility as measured by the VIX® Index declined further during the quarter, staying in the 20% to 30% range, still higher than its long-term historical average.

JULY 2020

The Fund started off the quarter with a positive month of July (+0.77%). The widespread havoc wreaked by the Coronavirus pandemic was reflected in record contractions in the second-quarter GDP readings of major global economies. Millions of lost jobs were, however, regained in June, although a continued rise in COVID-19 cases in the US raised concerns the recovery may be faltering, with newly imposed business closings and an increase in jobless claims. EU leaders agreed on a pandemic recovery package, partly funded in common debt, an unprecedented event for the bloc. Arrests in Hong Kong under the new security laws led to escalating tensions between Beijing and the US and Europe, adding to the stresses already created by the White House’s characterization of the Coronavirus as the “Wuhan/China virus.” US Treasury yields declined to near all-time lows as investors remained concerned about the pace of the economic recovery and Congress’s failure to agree on the next stimulus deal. Giant tech companies beat earnings estimates, leading to higher US equity markets, while European counterparts struggled amid surges in COVID-19 cases.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 24 |

Long fixed income positions yielded gains as yields fell on central bank easing, spurred by the potential second wave of Coronavirus infections. Global stock markets also rose on upbeat earnings from technology stocks, and the prospects of further stimulus deals. The US Dollar experienced its worst month in almost a decade amid weak economic data and political uncertainty. Demand revival and ongoing supply pressures boosted major agricultural markets. Coffee prices rose as data showed surges in home consumption. Oil prices rose on unprecedented cuts in North American output, while natural gas prices were more volatile, but climbed on forecasts of hotter weather. Precious metals also rose, as investors continued to clamor for insurance against the Coronavirus impact.

AUGUST 2020

The Fund gave up some ground in August (−1.67%). August saw the end of the S&P 500's sharpest bear market, which also turned out to be the shortest ever, as it took only 126 trading days to recoup pandemic-induced losses. Investor sentiment was somewhat bolstered by promising economic data and talk of a potential Coronavirus vaccine. Russia became the first country to approve a vaccine for civilian use, causing safe-haven assets to sell off. A new inflation goal (targeting an average inflation rate of 2%) from the Federal Reserve, designed to give the central bank further flexibility on monetary policy, also spurred a rally in risk assets. Government bond yields reversed their July decline, leading to losses in long positions. Global stock markets rallied, achieving new record highs, and leading to losses in short positions in some Asian and European stock indices. Some profits were generated from net short US Dollar positions, as the Federal Reserve's announcement drove the currency down against its major peers Net short energy exposures generated losses. Notably, natural gas futures posted their biggest single-day gain in the last 18 months, as hotter weather forecast along with increased export demand continued to send prices soaring. Energy prices were further affected by a major Atlantic hurricane, which disrupted production and forced plant closures. In agricultural commodities, short exposure led to losses, particularly in corn, whose price surged on concerns of worsening crop outlooks from the US to Europe and optimism over demand from China, where imports of corn climbed to a three-year high. Long metals exposure yielded some profits, with most precious and base metals rallying as the US Dollar weakened.

SEPTEMBER 2020

September was a disappointing month for the Fund (−4.79%). A rapid resurgence of Coronavirus cases in Europe and the associated tightening of restrictions contributed towards a general risk-off sentiment throughout the month. Payroll data and jobless claims painted an ambiguous picture of the state of the US recovery, while German PMI (Purchasing Managers’ Index) data at a 2-year high together with data showing the Eurozone in deflation territory raised similar doubts about the trajectory of the Eurozone economy. On the political scene, negotiations between the House and the Trump administration saw no agreement on another US virus relief package. The prospect of a hotly contested presidential election and the increased likelihood of a “no-deal outcome” on Brexit affected market sentiment. As the global economic recovery showed signs of stalling, further economic support was promised by several governments.

As multiple equity markets declined for the first time in months, investors fled to bonds and the US Dollar. Currencies performed poorly, as the US Dollar reversed its prevailing bearish trend, leading to losses, particularly against the Euro and the Australian Dollar. Gains from short positions in energy were more than offset by losses in metals and agricultural commodities. Natural gas prices reversed and fell as inventories rose and the weather turned milder, whereas the crude oil complex declined on slowing global demand. Long precious metals positions incurred losses as investors took profits on the extended rallies in gold and silver. Lean hog positions suffered as prices hit a four-month high on rising wholesale pork prices and increased demand expectations.

ampersandinvestments.com • 47 Hulfish St., Suite 510 Princeton, NJ 08542 • 609.454.5200

| 25 |

Conclusion

We believe that concerns about the global economy and geopolitics have been exacerbated by the coronavirus crisis. Historically, futures trading programs have tended to perform well in a variety of market conditions, perhaps particularly so during periods of market turbulence and volatility expansion. A period of a few weeks or months is far too short to judge the long-term potential of any strategy or asset class.

The Fund seeks to provide returns that, in the long run, are comparable to the S&P 500® Total Return Index with comparable volatility, while seeking to mitigate downside risk. We continue to believe that a significant and strategic allocation to the Fund as a substitute for core equity exposure in a portfolio may provide “smarter” equity exposure: equity exposure that is dynamically hedged, coupled with the potential for uncorrelated alpha in the long run.