Form N-CSR UNIFIED SERIES TRUST For: Mar 31

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-21237 |

| Unified Series Trust |

| (Exact name of registrant as specified in charter) |

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

Zachary P. Richmond

Ultimus Asset Services, LLC

225 Pictoria Drive. Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | 03/31 | |

| Date of reporting period: | 03/31/19 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

DEAN FUNDS

Dean Small Cap Value Fund

Dean Mid Cap Value Fund

Annual Report

March 31, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (888) 899-8343 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (888) 899-8343. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

DEAN SMALL CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited)

The Dean Small Cap Value Fund returned -0.08% net of fees for the twelve months ended March 31, 2019, compared with a 0.17% return for the benchmark Russell 2000 Value Index and a 2.05% return for the broader Russell 2000 Index.

Macro Factors Impacting Performance

For the second fiscal year in a row, growth stocks outperformed value stocks. This was a headwind for the portfolio as it is currently positioned with a greater bias toward value stocks relative to the benchmark. The portfolio underperformed its benchmark, the Russell 2000 Value Index, for the fiscal year due to this value bias and the stronger performance of high price momentum ( stocks with high valuations and high volatility) during the first half of the fiscal year.

In contrast, during the second half of the fiscal year the portfolio benefited from high price momentum stocks underperforming low price momentum stocks. All of the underperformance of momentum stocks originated from these last two quarters of the fiscal year when stock market volatility increased dramatically. Since we are price disciplined value investors, the small cap portfolio typically performs better when stocks with high price momentum begin to struggle, and this often coincides with periods of heightened stock market volatility. As this type of dynamic occurred during the last two quarters of the fiscal year, the portfolio outperformed its benchmark during this period.

Sector Performance (best/worst relative to benchmark)

The best performing sector relative to the benchmark for the twelve-month period was Materials. The outperformance versus the benchmark was due to strong stock selection. Most of the portfolio’s stocks in the Materials sector have more defensive end markets, where a slowing economy would not impact earnings as much as many of the benchmark’s more economically sensitive Materials stocks. For example, the portfolio has a heavy weighting in the Containers & Packaging industry, where the end markets are mostly Consumer Staples companies, and this gives the packaging stocks in the portfolio more of a Consumer Staples type of profile. This predictability of the portfolio’s companies’ end markets helped the portfolio’s Materials stocks hold up better than the benchmark’s Materials stocks as the stock market selloff took hold in the fiscal third quarter.

1

DEAN SMALL CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

The second best performing sector relative to the benchmark was Consumer Staples. The outperformance versus the benchmark was a result of the portfolio’s overweight stance as well as better than benchmark stock selection. Consumer Staples stocks were poor performers in the Fund’s fiscal second quarter. We took advantage of the relative weakness and added three new Consumer Staples holdings in that quarter. The opportunistic purchases we made benefited the portfolio in both the fiscal third and fiscal fourth quarters, as Consumer Staples held up better than the overall market. Nearly all of the portfolio’s weight in the sector was housed in the Food Products industry, which was the best performing industry within the Consumer Staples sector for the fiscal year.

The worst performing sector relative to the benchmark for the last twelve months was Consumer Discretionary. The underperformance versus the benchmark stemmed from both being underweight as well as from below benchmark stock selection. The portfolio was overweight the Auto Components and Automobiles industries at a time when stocks related to the auto cycle were some of the hardest hit stocks in the market, as global growth concerns intensified throughout the year. While valuations are extremely low in the auto space, investors are currently more focused on the potential for negative estimate revisions rather than low valuations. We tried to take advantage of the wholesale selloff in just about anything auto related by swapping out of existing portfolio positions into new holdings that we believe are higher quality companies, while continuing to maintain exposure to the attractively valued auto related space.

The second worst performing sector relative to the benchmark was Information Technology. The underperformance relative to the benchmark stemmed predominantly from worse than benchmark stock selection. Portfolio companies in the Electronic Equipment, Instruments, and Components industry missed earnings estimates during the year, leading to sharp stock price declines. While at the same time, the portfolio companies in the IT Services industry that are slow, but steady growers did not keep pace with the benchmark’s IT Services holdings this year. The combination of these two situations led to the below benchmark stock selection.

Individual Securities Performance (best/worst absolute contributors)

The largest contributing company in the fiscal year was NorthWestern Corp. (NWE). NWE provides electricity and natural gas services in the Upper Midwest and Northwest of the U.S. It serves customers in the states of Montana, South Dakota, and Nebraska. Utilities were the best performing sector in the fiscal year, and NWE benefited from the rising tide. Being somewhat more defensive in nature, NWE

2

DEAN SMALL CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

outperformed the benchmark Utilities stocks when stock market volatility increased in the last two fiscal quarters. The portfolio continues to hold a sizeable position in NWE.

The second largest contributing stock was Americold Realty Trust (COLD). COLD is a Real Estate Investment Trust (REIT) that is the world’s largest refrigerated warehousing and cold storage logistics provider, where it has an approximately 20% U.S. market share and an approximately 5% global market share. The industry fundamentals for cold storage are currently favorable, as demand is robust, while supply remains restrained. This backdrop helped COLD to report better than expected earnings as a result of better than expected pricing and margins. After a strong upward move in price, we exited the portfolio’s COLD position as a result of it reaching our estimate of private market value.

The largest detracting stock in the period was Deluxe Corp. (DLX). DLX is the largest check printer in the U.S. As written check volume is in secular decline, DLX has been attempting to use the strong cash flows from its checks business to transition itself into a provider of customer life-cycle management solutions to small businesses and financial institutions. Consequently, in addition to offering check and financial form printing services, it also offers logo and web design, hosting and web services, search engine optimization, marketing programs, and digital and physical printing services, amongst other products and services. In a period when small business optimism neared all-time highs and the economy was growing robustly, DLX continued to struggle to reach our estimate of normalized earnings power. It might be entering businesses where much more focused competition exits, and DLX is lacking any real competitive advantage in our opinion. We were increasingly losing confidence in our estimate of normalized earnings power for DLX, and as such, we exited the portfolio’s DLX position while harvesting a tax loss.

The second largest detracting stock was Tenneco, Inc. (TEN). TEN designs and manufactures emission control and ride control products and systems for the automotive original equipment market and aftermarket. Its products include shocks and struts, shock absorbers, mufflers, performance exhaust products, as well as noise, vibration, and harshness control components. TEN disappointed the market, as it reported slightly lower than expected earnings on lower than expected margins due to higher input costs. It also added a dose of uncertainty around its stock price by announcing the large acquisition of Federal-Mogul’s Motorparts and Powertrain businesses from Carl Icahn for $5.4 billion. TEN intends to combine Federal-Mogul’s Motorparts business with TEN’s Ride Performance business and Federal-Mogul’s

3

DEAN SMALL CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

Powertrain business with TEN’s Clean Air business, creating two independent publicly traded companies. We felt that the debt from this transaction combined with the execution risk, all during a worldwide auto sales slowdown, widened the range of outcomes for TEN beyond our comfort level. Thus, we exited the portfolio’s TEN position while harvesting a tax loss.

Current Positioning and Opportunities

The portfolio’s largest overweight sectors relative to the benchmark are currently in the Consumer Staples and Materials sectors. The largest underweight sectors relative to the benchmark are currently in the Real Estate and Information Technology sectors. Throughout the most recent quarter, we added the most weight to the Consumer Discretionary and Health Care sectors, while reducing the most weight in the Industrials and Information Technology sectors. As always, these relative weights are a residual of our bottom up opportunities and not based on a top down macro call on the market or economy.

We remain focused on the fundamentals of the companies we own and the price we are paying for those fundamentals. We are confident that a steadfast application of our proven and disciplined process should produce favorable results over time.

Thank you for your continued confidence in Dean.

4

DEAN SMALL CAP VALUE FUND

Performance Summary (Unaudited)

Average Annual Total Returns* (for the periods ended March 31, 2019) |

|||||

1 Year |

5 Year |

10 Year |

|||

Dean Small Cap Value Fund |

(0.08)% |

5.54% |

15.87% |

||

Russell 2000 Value Index** |

0.17% |

5.59% |

14.12% |

||

Russell 2000 Index** |

2.05% |

7.05% |

15.36% |

||

Total annual operating expenses, as disclosed in the Dean Small Cap Value Fund (the “Fund”) prospectus dated July 29, 2018, were 1.18% of the Fund’s average daily net assets. Additional information pertaining to the expense ratios as of March 31, 2019 can be found in the financial highlights. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-888-899-8343.

|

* |

Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

|

** |

The Russell 2000 and Russell 2000 Value Indices are unmanaged indices that assume reinvestment of all distributions and exclude the effect of taxes and fees. The indices are widely recognized unmanaged indices of equity prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. An individual cannot invest directly in an index or, the indicies. However, an individual may be able to invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. |

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling 1-888-899-8343.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

5

DEAN SMALL CAP VALUE FUND

Performance Summary (Unaudited) – (continued)

This graph shows the value of a hypothetical initial investment of $10,000 in the Fund, the Russell 2000 Index and the Russell 2000 Value Index on March 31, 2009 and held through March 31, 2019.

The Russell 2000 Index and the Russell 2000 Value Index are widely recognized unmanaged indices of common stock prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. Individuals cannot invest directly in the indices; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. Index returns do not include expenses, which have been deducted from the Fund’s return. These performance figures include the change in value of the stocks in the indices plus the reinvestment of dividends and are not annualized. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE OR PREDICT FUTURE RESULTS. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data

6

DEAN SMALL CAP VALUE FUND

Performance Summary (Unaudited) – (continued)

quoted. For more information on the Dean Small Cap Value Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-888-899-8343.

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling 1-888-899-8343.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

7

DEAN MID CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited)

The Dean Mid Cap Value Fund returned 3.10% net of fees for the twelve months ended March 31, 2019, compared with a 2.89% return for the benchmark Russell Midcap Value Index and a 6.47% return for the broader Russell Midcap Index.

Macro Factors Impacting Performance

Macro factors netted to a neutral impact for the fiscal year. On the positive side, quality factors such as lower earnings variability, higher profits and lower debt leverage outperformed relative to the benchmark. Stocks with quality attributes are core to our process. Offsetting the positive contribution from quality factors, the portfolio’s underweight to dividend yield and to stocks with high trading turnover generated a negative contribution.

Sector Performance (best/worst relative to benchmark)

The best performing sector relative to the benchmark for the year was Industrials. The outperformance versus the benchmark was due to strong stock selection. The portfolio’s holdings were positively impacted by being exposed to more favorable end markets and less impact from global sales, which were impacted by global trade concerns and slow international economies. For instance, Comfort Systems USA (FIX) sales are based in the United States and focused on systems for commercial office buildings, where demand remains favorable. With a strong backlog and lack of exposure to global trade concerns, the stock outperformed for the period held. Another example is Republic Services (RSG). The company provides non-hazardous solid waste collection and disposal services in the United States. The company’s earnings are generated in the United States and, due to the nature of its business, have a narrower range of outcomes, providing an attractive risk profile in times of uncertainty. Kansas City Southern (KSU) was another key driver of performance. The company is a railroad with a large portion of revenue generated on routes between Mexico and the United States. In the Fund’s fiscal second quarter, the stock benefited from a trade resolution between the United States, Canada and Mexico to replace NAFTA. As carload volumes continue to improve, the company has embarked on a cost cutting initiative to improve operating profit margins, which are below peers’.

Utilities was the portfolio’s second-best performing sector relative to the benchmark. Positive stock selection drove the outperformance for the year. All five of the portfolio’s regulated utility holdings outperformed the benchmark sector returns for the year. The portfolio also benefited from not owning PG&E (PCG), which is a sizeable weight in the benchmark. PCG was down over 50% as California wildfire

8

DEAN MID CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

liabilities may push the company into financial distress. Due to the sectors’ defensive characteristics and moderating interest rates late in the year, Utilities significantly outperformed the Russell Midcap Value Index. The portfolio’s modest underweight was a slight offset to performance for the period.

The worst performing sector relative to the benchmark for the last twelve months was REITs. The underperformance versus the benchmark was driven by the sector allocation. REITs are the portfolio’s largest underweight sector and REITs were the top performing sector for the year, up over 18%. Because of their higher than average dividend yield, REITs often trade similar to a bond, with stock prices rising as interest rates decline and vice versa. The dividend income characteristic also makes the sector attractive in periods of uncertainty. The large market declines in the fiscal third quarter and the Federal Reserve reducing the likelihood of interest rate increases in 2019 fueled significant outperformance of the sector.

Energy was the second-worst performing sector relative to the benchmark. The underperformance relative to the benchmark was a result of stock selection. The majority of the portfolio’s holdings are exploration and production companies operating in the Permian Basin in West Texas. While the basin’s economics are superior, the area has been plagued with infrastructure and asset issues over the past 12-24 months. While the Permian is one of the lowest cost, fastest growing basins in the continental U.S., the area is a victim of its own success. Due to a limited amount of take-away pipeline capacity for its gas & oil, price differentials relative to spot prices widened dramatically to cover more expensive transportation options. The companies realized prices were 20-25% below the spot price, an issue specific to this region. Most recently, concern has risen that drilling wells close together is damaging existing wells and reducing economic returns. Thus, the stocks have been re-rated lower as the prospective drilling potential is lower than originally believed. Portfolio holdings Concho Resources (CXO), Diamondback Energy (FANG) and Centennial Resource Development (CDEV) operate in the Permian Basin.

Individual Securities Performance (best/worst absolute contributors)

Keysight Technologies (KEYS) was the best contributing stock for the year. Keysight is an electronic measurement company, focusing on wireless, modular, and software solutions. The company delivers solutions in wireless communications, aerospace and defense and semiconductor markets. Keysight derives just over 60% of its revenue internationally, with the remaining portion from the Americas. The company beat and raised guidance several times throughout the year on continued strong order growth

9

DEAN MID CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

in automotive, energy and electrical end markets. Key drivers of future growth are 5G Broadband, connected cars and aerospace and defense spending. We sold shares on price strength but continue to hold a position in the stock.

Synopsys (SNPS) was the second largest contributing stock. Synopsys is a leading provider of electronic design automation (EDA) tools and services. These service and tools aid technology companies in designing, testing and manufacturing applications that speed the time to market and reduce costs. Synopsys continues to see strong end market demand, with electronics growth continuing to accelerate new semiconductor technologies being brought to market, such as artificial intelligence, auto integration and 5G. The company generates 80% of its revenue on annual technology license subscriptions, creating a relatively smooth and predictable revenue stream. The company continues to deliver consistent performance and growth on the back of the strength in the Semiconductor industry. We continue to hold our position in Synopsis.

The largest detractor to absolute performance was Conagra Brands (CAG). Conagra is a packaged foods manufacturer with its largest focus on frozen foods and snacks, with additional products in the refrigerated and center of the store categories. While the company has a large stable of brand names, some of the more popular brands include Birds Eye, Duncan Hines, Healthy Choice, Marie Callender’s and Slim Jim. Over the past 3 years, Conagra has gone through a significant portfolio transition, selling its private-label business to TreeHouse Foods, divesting its commercial business and spinning off Lamb Weston, its frozen potato food service unit. In October, Conagra closed on a transformational acquisition, buying Pinnacle Foods, another packaged food company with significant exposure to frozen foods. The strategy was to expand the product portfolio and extract significant cost savings with branded products that help offset industry pricing pressures. When the company reported earnings in December, they disclosed previously unknown issues within the Pinnacle brands business, including distribution losses in Birds Eye and accelerating losses in Duncan Hines and Wish Bone brands. The issues forced the company to lower expectations and the timeframe for synergies. We exited the stock and will revisit the thesis and company fundamentals in the future as there is additional clarity on the issues at hand.

Conduent (CNDT) was the second worst contributing stock. Conduent is a business process service company specializing in transaction intensive processing, analytics and automation. In the fiscal fourth quarter, the company lowered guidance based on several factors, including an increase in a Texas litigation reserve, slippage of deals into future quarters (increasing sales cycle) and a significant decline in new business bookings of approximately 20%. An attractive aspect of the company had been its

10

DEAN MID CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

historical 99% renewal rate with existing customers. In the fiscal fourth quarter, the renewal rate dropped to 91%, calling into question the company’s competitive position. Due to the increased uncertainty relative to our normal earnings power, the stock was exited.

Current Positioning and Opportunities

The portfolio’s largest overweight sectors relative to the benchmark are in the Industrials and Consumer Staples sectors. The largest underweight sectors relative to the benchmark are in the Real Estate and Utility sectors.

Currently, stocks with consistent earnings growth and/or defensive characteristics continue to be favored by the market. With the economy presumably in the late stages of a bull market and showing signs of slowing, stocks with a wider range of outcomes, either from cyclicality of their end markets or execution issues with their strategies, have underperformed. Using our valuations based on normal earnings power, many stocks with a wider range of outcomes appear a more favorable risk/reward. However, we do acknowledge, regardless of valuation, that cyclical areas of the market will likely underperform if the economy falls into a recession. Therefore, we are focusing on the highest quality companies in these markets and attempting to manage our risk through each individual stock’s percentage of the portfolio. If the central bank were to change the stance on interest rates from their current rate pause to monetary easing, this would be beneficial to many of the holdings recently added.

11

DEAN MID CAP VALUE FUND

Performance Summary (Unaudited)

Average Annual Total Returns* (for the periods ended March 31, 2019) |

|||||

1 Year |

5 Year |

10 Year |

|||

Dean Mid Cap Value Fund |

3.10% |

7.50% |

13.25% |

||

Russell Midcap Value Index** |

2.89% |

7.22% |

16.39% |

||

Russell Midcap Index** |

6.47% |

8.81% |

16.88% |

||

Effective March 31, 2011, the Fund changed its investment strategies from Large Cap Value to Mid Cap Value and also changed its benchmarks from the Russell 1000 Value Index to the Russell Midcap Value and Russell Midcap Indices. Performance prior to March 31, 2011 reflects the Fund’s Large Cap Value investment strategies and, as a result, the Fund’s 10-year return may vary substantially from those of the Midcap indices.

Total annual operating expenses, as disclosed in the Dean Mid Cap Value Fund (the “Fund”) prospectus dated July 29, 2018, were 1.53% of the Fund’s average daily net assets (1.10% after fee waivers/expense reimbursements by Dean Investment Associates, LLC (the “Adviser”)). The Adviser contractually has agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers) do not exceed 1.10% of the Fund’s average daily net assets through July 31, 2019. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of recoupment. This expense limitation agreement may not be terminated prior to July 31, 2019, except by the Board of Trustees. Additional information pertaining to the expense ratios as of March 31, 2019 can be found in the financial highlights. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-888-899-8343.

12

DEAN MID CAP VALUE FUND

Performance Summary (Unaudited) – (continued)

|

* |

Return figures reflect any change in price per share and assume the reinvestment of all distributions. Average annual total returns set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. |

|

** |

The Russell Midcap and Russell Midcap Value Indices are unmanaged indices that assume reinvestment of all distributions and exclude the effect of taxes and fees. The indices are widely recognized unmanaged indices of equity prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. An individual cannot invest directly in an index. However, an individual may be able to invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. |

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling 1-888-899-8343.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

13

DEAN MID CAP VALUE FUND

Performance Summary (Unaudited) – (continued)

This graph shows the value of a hypothetical initial investment of $10,000 in the Fund, the Russell Midcap Index and the Russell Midcap Value Index on March 31, 2009 and held through March 31, 2019.

The Russell Midcap Index and the Russell Midcap Value Index are widely recognized unmanaged indices of common stock prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. Individuals cannot invest directly in the indices; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. Index returns do not include expenses, which have been deducted from the Fund’s return. These performance figures include the change in value of the stocks in the indices plus the reinvestment of dividends and are not annualized. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE OR PREDICT FUTURE RESULTS. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data

14

DEAN MID CAP VALUE FUND

Performance Summary (Unaudited) – (continued)

quoted. For more information on the Dean Mid Cap Value Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-888-899-8343.

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling 1-888-899-8343.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

15

DEAN SMALL CAP VALUE FUND HOLDINGS (Unaudited)

|

1 |

As a percent of total net assets. |

The investment objective of the Dean Small Cap Value Fund is long-term capital appreciation and, secondarily, dividend income. Portfolio holdings are subject to change.

16

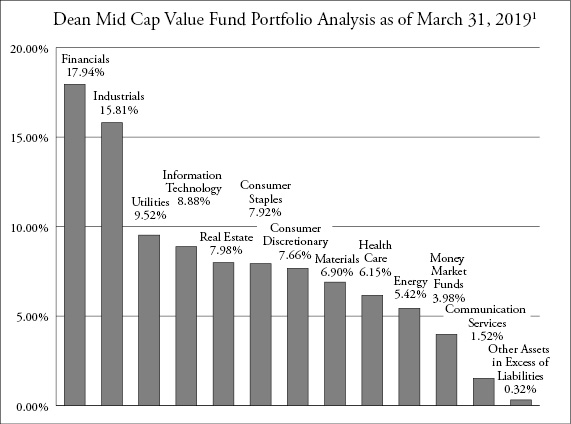

DEAN MID CAP VALUE FUND HOLDINGS (Unaudited)

|

1 |

As a percent of total net assets. |

The investment objective of the Dean Mid Cap Value Fund is long-term capital appreciation and, secondarily, dividend income. Portfolio holdings are subject to change.

Portfolio Holdings (Unaudited)

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year within sixty days after the end of the period. The Funds’ portfolio holdings are available at the SEC’s website at www.sec.gov.

17

DEAN SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS

March 31, 2019

COMMON STOCKS — 95.80% |

Shares |

Fair Value |

||||||

Consumer Discretionary — 9.00% |

||||||||

Big Lots, Inc. |

108,323 | $ | 4,118,440 | |||||

La-Z-Boy, Inc. |

46,000 | 1,517,540 | ||||||

Penske Automotive Group, Inc. |

131,695 | 5,880,182 | ||||||

Red Robin Gourmet Burgers, Inc.(a) |

147,720 | 4,255,813 | ||||||

Thor Industries, Inc. |

94,005 | 5,863,092 | ||||||

Tupperware Brands Corporation |

187,195 | 4,788,448 | ||||||

Visteon Corporation(a) |

36,665 | 2,469,388 | ||||||

| 28,892,903 | ||||||||

Consumer Staples — 10.31% |

||||||||

Andersons, Inc. (The) |

135,775 | 4,376,028 | ||||||

Cal-Maine Foods, Inc. |

112,330 | 5,013,288 | ||||||

Darling Ingredients, Inc.(a) |

183,480 | 3,972,342 | ||||||

Fresh Del Monte Produce, Inc. |

156,325 | 4,225,465 | ||||||

Hostess Brands, Inc.(a) |

424,004 | 5,300,050 | ||||||

John B. Sanfilippo & Son, Inc. |

34,647 | 2,490,080 | ||||||

Sanderson Farms, Inc. |

31,980 | 4,216,243 | ||||||

TreeHouse Foods, Inc.(a) |

54,535 | 3,520,234 | ||||||

| 33,113,730 | ||||||||

Energy — 3.93% |

||||||||

RPC, Inc. |

580,345 | 6,621,736 | ||||||

SRC Energy, Inc.(a) |

1,174,808 | 6,015,017 | ||||||

| 12,636,753 | ||||||||

Financials — 26.94% |

||||||||

Bank of Hawaii Corporation |

70,930 | 5,594,249 | ||||||

Bryn Mawr Bank Corporation |

129,752 | 4,687,940 | ||||||

Cadence Bancorporation |

306,570 | 5,686,874 | ||||||

CenterState Banks Corporation |

126,965 | 3,023,037 | ||||||

Chemical Financial Corporation |

161,445 | 6,645,076 | ||||||

First Financial Bancorp |

306,792 | 7,381,415 | ||||||

First Merchants Corporation |

101,737 | 3,749,008 | ||||||

Granite Point Mortgage Trust, Inc. |

169,165 | 3,141,394 | ||||||

Horace Mann Educators Corporation |

64,030 | 2,254,496 | ||||||

LegacyTexas Financial Group, Inc. |

61,805 | 2,310,889 | ||||||

MFA Financial, Inc. |

1,036,420 | 7,534,773 | ||||||

Northwest Bancshares, Inc. |

384,550 | 6,525,813 | ||||||

ProAssurance Corporation |

161,150 | 5,577,402 | ||||||

Renasant Corporation |

178,142 | 6,030,107 | ||||||

UMB Financial Corporation |

101,870 | 6,523,755 | ||||||

See accompanying notes which are an integral part of these financial statements.

18

DEAN SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS – (continued)

March 31, 2019

COMMON STOCKS — 95.80% - continued |

Shares |

Fair Value |

||||||

Financials — 26.94% - continued |

||||||||

Washington Federal, Inc. |

132,810 | $ | 3,836,881 | |||||

White Mountains Insurance Group Ltd. |

6,500 | 6,015,620 | ||||||

| 86,518,729 | ||||||||

Health Care — 3.97% |

||||||||

Magellan Health, Inc.(a) |

88,886 | 5,859,365 | ||||||

MEDNAX, Inc.(a) |

176,810 | 4,803,928 | ||||||

Select Medical Holdings Corporation(a) |

148,090 | 2,086,588 | ||||||

| 12,749,881 | ||||||||

Industrials — 16.21% |

||||||||

Argan, Inc. |

101,870 | 5,088,407 | ||||||

Astec Industries, Inc. |

110,550 | 4,174,368 | ||||||

Encore Wire Corporation |

40,445 | 2,314,263 | ||||||

EnPro Industries, Inc. |

56,460 | 3,638,847 | ||||||

Forward Air Corporation |

25,150 | 1,627,960 | ||||||

Greenbrier Companies, Inc. (The) |

159,815 | 5,150,837 | ||||||

Heartland Express, Inc. |

224,510 | 4,328,553 | ||||||

Knoll, Inc. |

287,800 | 5,442,298 | ||||||

Primoris Services Corporation |

283,941 | 5,871,900 | ||||||

Regal Beloit Corporation |

70,705 | 5,788,618 | ||||||

Valmont Industries, Inc. |

23,780 | 3,093,778 | ||||||

WESCO International, Inc.(a) |

104,615 | 5,545,641 | ||||||

| 52,065,470 | ||||||||

Information Technology — 6.10% |

||||||||

CSG Systems International, Inc. |

77,681 | 3,285,906 | ||||||

InterDigital, Inc. |

94,150 | 6,212,017 | ||||||

MTS Systems Corporation |

108,339 | 5,900,142 | ||||||

Plexus Corporation(a) |

42,665 | 2,600,432 | ||||||

Tech Data Corporation(a) |

15,580 | 1,595,548 | ||||||

| 19,594,045 | ||||||||

Materials — 9.84% |

||||||||

AdvanSix, Inc.(a) |

57,130 | 1,632,204 | ||||||

Alamos Gold, Inc., Class A |

854,169 | 4,339,179 | ||||||

Commercial Metals Company |

348,935 | 5,959,809 | ||||||

Graphic Packaging Holding Company |

380,985 | 4,811,841 | ||||||

Innospec, Inc. |

30,665 | 2,555,928 | ||||||

Silgan Holdings, Inc. |

252,335 | 7,476,686 | ||||||

Valvoline, Inc. |

259,975 | 4,825,136 | ||||||

| 31,600,783 | ||||||||

See accompanying notes which are an integral part of these financial statements.

19

DEAN SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS – (continued)

March 31, 2019

COMMON STOCKS — 95.80% - continued |

Shares |

Fair Value |

||||||

Real Estate — 6.51% |

||||||||

Columbia Property Trust, Inc. |

260,570 | $ | 5,865,431 | |||||

Corepoint Lodging, Inc. |

293,625 | 3,279,791 | ||||||

Equity Commonwealth |

223,250 | 7,298,042 | ||||||

Sabra Health Care REIT, Inc. |

229,555 | 4,469,436 | ||||||

| 20,912,700 | ||||||||

Utilities — 2.99% |

||||||||

NorthWestern Corporation |

79,980 | 5,631,392 | ||||||

Portland General Electric Company |

76,570 | 3,969,389 | ||||||

| 9,600,781 | ||||||||

Total Common Stocks (Cost $306,736,427) |

307,685,775 | |||||||

MONEY MARKET FUNDS — 4.92% |

||||||||

Fidelity Investments Money Market Government Portfolio, Institutional Class, 2.35%(b) |

15,806,810 | 15,806,810 | ||||||

Total Money Market Funds (Cost $15,806,810) |

15,806,810 | |||||||

Total Investments — 100.72% (Cost $322,543,237) |

323,492,585 | |||||||

Liabilities in Excess of Other Assets — (0.72)% |

(2,314,761 | ) | ||||||

NET ASSETS — 100.00% |

$ | 321,177,824 | ||||||

|

(a) |

Non-income producing security. |

|

(b) |

Rate disclosed is the seven day effective yield as of March 31, 2019. |

The sectors shown on the schedule of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

See accompanying notes which are an integral part of these financial statements.

20

DEAN MID CAP VALUE FUND

SCHEDULE OF INVESTMENTS

March 31, 2019

COMMON STOCKS — 95.70% |

Shares |

Fair Value |

||||||

Communication Services — 1.52% |

||||||||

Interpublic Group of Companies, Inc. (The) |

30,340 | $ | 637,443 | |||||

Consumer Discretionary — 7.66% |

||||||||

Aptiv plc |

8,180 | 650,228 | ||||||

Aramark |

19,781 | 584,529 | ||||||

Cracker Barrel Old Country Store, Inc. |

3,650 | 589,876 | ||||||

Genuine Parts Company |

6,518 | 730,212 | ||||||

Gildan Activewear, Inc. |

18,184 | 654,078 | ||||||

| 3,208,923 | ||||||||

Consumer Staples — 7.92% |

||||||||

Casey's General Stores, Inc. |

4,595 | 591,698 | ||||||

Clorox Company (The) |

3,911 | 627,559 | ||||||

Ingredion, Inc. |

6,681 | 632,624 | ||||||

J.M. Smucker Company (The) |

6,909 | 804,899 | ||||||

US Foods Holding Corporation(a) |

18,901 | 659,834 | ||||||

| 3,316,614 | ||||||||

Energy — 5.42% |

||||||||

Concho Resources, Inc. |

5,638 | 625,592 | ||||||

Diamondback Energy, Inc. |

6,756 | 685,937 | ||||||

Noble Energy, Inc. |

25,973 | 642,312 | ||||||

TechnipFMC plc |

13,492 | 317,332 | ||||||

| 2,271,173 | ||||||||

Financials — 17.94% |

||||||||

Ameriprise Financial, Inc. |

4,856 | 622,053 | ||||||

Blackstone Mortgage Trust, Inc., Class A |

18,967 | 655,500 | ||||||

Brown & Brown, Inc. |

20,857 | 615,490 | ||||||

Commerce Bancshares, Inc. |

11,040 | 640,982 | ||||||

Hanover Insurance Group, Inc. (The) |

5,247 | 599,050 | ||||||

M&T Bank Corporation |

3,943 | 619,130 | ||||||

Northern Trust Corporation |

6,550 | 592,186 | ||||||

Regions Financial Corporation |

45,266 | 640,514 | ||||||

Reinsurance Group of America, Inc. |

4,302 | 610,798 | ||||||

Torchmark Corporation |

8,250 | 676,088 | ||||||

UMB Financial Corporation |

8,994 | 575,976 | ||||||

W.R. Berkley Corporation |

7,886 | 668,102 | ||||||

| 7,515,869 | ||||||||

See accompanying notes which are an integral part of these financial statements.

21

DEAN MID CAP VALUE FUND

SCHEDULE OF INVESTMENTS – (continued)

March 31, 2019

COMMON STOCKS — 95.70% - continued |

Shares |

Fair Value |

||||||

Health Care — 6.15% |

||||||||

Catalent, Inc.(a) |

9,809 | $ | 398,147 | |||||

Quest Diagnostics, Inc. |

6,746 | 606,600 | ||||||

Universal Health Services, Inc., Class B |

5,996 | 802,086 | ||||||

Zimmer Biomet Holdings, Inc. |

6,029 | 769,903 | ||||||

| 2,576,736 | ||||||||

Industrials — 15.81% |

||||||||

Curtiss-Wright Corporation |

5,019 | 568,853 | ||||||

Hubbell, Inc. |

6,518 | 768,994 | ||||||

ITT, Inc. |

11,764 | 682,313 | ||||||

Kansas City Southern |

6,192 | 718,148 | ||||||

KAR Auction Services, Inc. |

12,710 | 652,150 | ||||||

Masco Corporation |

17,467 | 686,628 | ||||||

Parker-Hannifin Corporation |

3,454 | 592,775 | ||||||

Republic Services, Inc. |

9,288 | 746,570 | ||||||

Snap-on, Inc. |

3,683 | 576,463 | ||||||

Xylem, Inc. |

7,984 | 631,055 | ||||||

| 6,623,949 | ||||||||

Information Technology — 8.88% |

||||||||

Amdocs Ltd. |

11,015 | 596,022 | ||||||

Keysight Technologies, Inc.(a) |

8,962 | 781,486 | ||||||

KLA-Tencor Corporation |

6,322 | 754,910 | ||||||

NetApp, Inc. |

7,658 | 531,006 | ||||||

Synopsys, Inc.(a) |

9,157 | 1,054,428 | ||||||

| 3,717,852 | ||||||||

Materials — 6.90% |

||||||||

Alcoa Corporation(a) |

7,104 | 200,049 | ||||||

Eastman Chemical Company |

8,147 | 618,194 | ||||||

International Flavors & Fragrances, Inc. |

5,149 | 663,140 | ||||||

Sealed Air Corporation |

16,066 | 739,999 | ||||||

Sonoco Products Company |

10,852 | 667,724 | ||||||

| 2,889,106 | ||||||||

Real Estate — 7.98% |

||||||||

Equity LifeStyle Properties, Inc. |

7,658 | 875,309 | ||||||

Essex Property Trust, Inc. |

3,096 | 895,487 | ||||||

Healthcare Trust of America, Inc., Class A |

27,179 | 777,048 | ||||||

Vornado Realty Trust |

11,764 | 793,364 | ||||||

| 3,341,208 | ||||||||

See accompanying notes which are an integral part of these financial statements.

22

DEAN MID CAP VALUE FUND

SCHEDULE OF INVESTMENTS – (continued)

March 31, 2019

COMMON STOCKS — 95.70% - continued |

Shares |

Fair Value |

||||||

Utilities — 9.52% |

||||||||

Ameren Corporation |

11,048 | $ | 812,580 | |||||

Atmos Energy Corporation |

7,332 | 754,683 | ||||||

CMS Energy Corporation |

14,632 | 812,661 | ||||||

Pinnacle West Capital Corporation |

8,734 | 834,796 | ||||||

Xcel Energy, Inc. |

13,752 | 773,000 | ||||||

| 3,987,720 | ||||||||

Total Common Stocks (Cost $33,893,789) |

40,086,593 | |||||||

MONEY MARKET FUNDS — 3.98% |

||||||||

Fidelity Investments Money Market Government Portfolio, Institutional Class, 2.35%(b) |

1,666,736 | 1,666,736 | ||||||

Total Money Market Funds (Cost $1,666,736) |

1,666,736 | |||||||

Total Investments — 99.68% (Cost $35,560,525) |

41,753,329 | |||||||

Other Assets in Excess of Liabilities — 0.32% |

135,641 | |||||||

NET ASSETS — 100.00% |

$ | 41,888,970 | ||||||

|

(a) |

Non-income producing security. |

|

(b) |

Rate disclosed is the seven day effective yield as of March 31, 2019. |

The sectors shown on the schedule of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

See accompanying notes which are an integral part of these financial statements.

23

DEAN FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

March 31, 2019

Dean Small Cap |

Dean Mid Cap |

|||||||

Assets |

||||||||

Investments in securities at value (cost $322,543,237 and $35,560,525) |

$ | 323,492,585 | $ | 41,753,329 | ||||

Cash |

7,208 | 3,916 | ||||||

Receivable for fund shares sold |

289,039 | 79,172 | ||||||

Dividends receivable |

640,095 | 79,402 | ||||||

Prepaid expenses |

37,850 | 20,128 | ||||||

Total Assets |

324,466,777 | 41,935,947 | ||||||

Liabilities |

||||||||

Payable for investments purchased |

2,774,886 | — | ||||||

Payable for fund shares redeemed |

165,862 | — | ||||||

Payable to Adviser |

245,792 | 21,945 | ||||||

Payable to Administrator |

32,455 | 2,868 | ||||||

Other accrued expenses |

69,958 | 22,164 | ||||||

Total Liabilities |

3,288,953 | 46,977 | ||||||

Net Assets |

$ | 321,177,824 | $ | 41,888,970 | ||||

Net Assets consist of: |

||||||||

Paid-in capital |

$ | 320,323,543 | $ | 35,121,781 | ||||

Accumulated earnings |

854,281 | 6,767,189 | ||||||

Net Assets |

$ | 321,177,824 | $ | 41,888,970 | ||||

Shares outstanding (unlimited number of shares authorized, no par value) |

22,628,946 | 2,112,435 | ||||||

Net asset value, offering and redemption price per share |

$ | 14.19 | $ | 19.83 | ||||

See accompanying notes which are an integral part of these financial statements.

24

DEAN FUNDS

STATEMENTS OF OPERATIONS

For the year ended March 31, 2019

Dean Small Cap |

Dean Mid Cap |

|||||||

Investment Income |

||||||||

Dividend income (net of foreign taxes withheld of $1,272 and $1,727) |

$ | 7,518,389 | $ | 848,578 | ||||

Total investment income |

7,518,389 | 848,578 | ||||||

Expenses |

||||||||

Adviser |

3,122,044 | 331,269 | ||||||

Administration |

163,967 | 22,170 | ||||||

Transfer agent |

125,101 | 12,000 | ||||||

Fund accounting |

104,713 | 20,069 | ||||||

Report printing |

60,000 | 3,780 | ||||||

Custodian |

48,238 | 9,343 | ||||||

Registration |

36,137 | 27,033 | ||||||

Legal |

18,089 | 18,089 | ||||||

Audit and tax |

17,200 | 17,200 | ||||||

Trustee |

12,563 | 12,563 | ||||||

Insurance |

9,572 | 4,260 | ||||||

Chief Compliance Officer |

8,512 | 8,563 | ||||||

Pricing |

1,964 | 1,765 | ||||||

Miscellaneous |

169,680 | 27,308 | ||||||

Total expenses |

3,897,780 | 515,412 | ||||||

Fees waived by Adviser |

— | (85,295 | ) | |||||

Fees reduced by Administrator |

— | (25,000 | ) | |||||

Net operating expenses |

3,897,780 | 405,117 | ||||||

Net investment income |

3,620,609 | 443,461 | ||||||

Net Realized and Change in Unrealized Gain (Loss) on Investments |

||||||||

Net realized gain (loss) on investment securities transactions |

(954,748 | ) | 372,179 | |||||

Net change in unrealized appreciation (depreciation) of investment securities |

(5,534,954 | ) | 449,340 | |||||

Net realized and change in unrealized gain (loss) on investments |

(6,489,702 | ) | 821,519 | |||||

Net increase (decrease) in net assets resulting from operations |

$ | (2,869,093 | ) | $ | 1,264,980 | |||

See accompanying notes which are an integral part of these financial statements.

25

DEAN FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

Dean Small Cap Value Fund |

Dean Mid Cap Value Fund |

|||||||||||||||

For the Year |

For the Year |

For the Year |

For the Year |

|||||||||||||

Increase (Decrease) in Net Assets due to: |

||||||||||||||||

Operations |

||||||||||||||||

Net investment income |

$ | 3,620,609 | $ | 3,089,757 | $ | 443,461 | $ | 148,184 | ||||||||

Net realized gain (loss) on investment securities transactions |

(954,748 | ) | 11,451,243 | 372,179 | 1,189,549 | |||||||||||

Net change in unrealized appreciation (depreciation) of investment securities |

(5,534,954 | ) | (11,522,605 | ) | 449,340 | 794,112 | ||||||||||

Net increase (decrease) in net assets resulting from operations |

(2,869,093 | ) | 3,018,395 | 1,264,980 | 2,131,845 | |||||||||||

Distributions to Shareholders From: |

||||||||||||||||

Earnings |

(9,984,457 | ) | (47,881,637 | ) | (1,171,674 | ) | (839,312 | ) | ||||||||

Total distributions |

(9,984,457 | ) | (47,881,637 | ) | (1,171,674 | ) | (839,312 | ) | ||||||||

Capital Transactions |

||||||||||||||||

Proceeds from shares sold |

128,051,056 | 191,223,325 | 8,892,396 | 7,875,636 | ||||||||||||

Reinvestment of distributions |

9,477,489 | 44,400,524 | 1,152,532 | 829,980 | ||||||||||||

Amount paid for shares redeemed |

(153,679,579 | ) | (125,141,608 | ) | (2,342,190 | ) | (2,037,300 | ) | ||||||||

Net increase (decrease) in net assets resulting from capital transactions |

(16,151,034 | ) | 110,482,241 | 7,702,738 | 6,668,316 | |||||||||||

Total Increase (Decrease) in Net Assets |

(29,004,584 | ) | 65,618,999 | 7,796,044 | 7,960,849 | |||||||||||

Net Assets |

||||||||||||||||

Beginning of year |

350,182,408 | 284,563,409 | 34,092,926 | 26,132,077 | ||||||||||||

End of year |

$ | 321,177,824 | $ | 350,182,408 | $ | 41,888,970 | $ | 34,092,926 | ||||||||

Share Transactions |

||||||||||||||||

Shares sold |

8,821,738 | 11,890,066 | 453,935 | 396,936 | ||||||||||||

Shares issued in reinvestment of distributions |

707,804 | 2,987,922 | 61,765 | 40,966 | ||||||||||||

Shares redeemed |

(10,839,550 | ) | (7,636,262 | ) | (118,970 | ) | (103,724 | ) | ||||||||

Net increase (decrease) in shares outstanding |

(1,310,008 | ) | 7,241,726 | 396,730 | 334,178 | |||||||||||

|

(a) |

For the year ended March 31, 2018, distributions from earnings consisted of $2,018,303 from net investment income and $45,863,334 from net realized gains. As of March 31, 2018, accumulated undistributed net investment income was $3,455,348. |

|

(b) |

For the year ended March 31, 2018, distributions from earnings consisted of $167,587 from net investment income and $671,725 from net realized gains. As of March 31, 2018, accumulated undistributed net investment income was $69,300. |

See accompanying notes which are an integral part of these financial statements.

26

DEAN SMALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

(For a share outstanding during each year)

For the Years ended |

||||||||||||||||||||

March 31, |

March 31, |

March 31, |

March 31, |

March 31, |

||||||||||||||||

Selected Per Share Data: |

||||||||||||||||||||

Net asset value, beginning of year |

$ | 14.63 | $ | 17.04 | $ | 14.32 | $ | 15.71 | $ | 15.96 | ||||||||||

Investment operations: |

||||||||||||||||||||

Net investment income |

0.15 | 0.12 | 0.19 | 0.11 | 0.07 | |||||||||||||||

Net realized and unrealized gain (loss) |

(0.18 | ) | 0.19 | (a) | 3.20 | (0.60 | ) | 1.00 | ||||||||||||

Total from investment operations |

(0.03 | ) | 0.31 | 3.39 | (0.49 | ) | 1.07 | |||||||||||||

Less distributions to shareholders from: |

||||||||||||||||||||

Net investment income |

(0.20 | ) | (0.11 | ) | (0.18 | ) | (0.03 | ) | (0.09 | ) | ||||||||||

Net realized gains |

(0.21 | ) | (2.61 | ) | (0.49 | ) | (0.87 | ) | (1.23 | ) | ||||||||||

Total distributions |

(0.41 | ) | (2.72 | ) | (0.67 | ) | (0.90 | ) | (1.32 | ) | ||||||||||

Net asset value, end of year |

$ | 14.19 | $ | 14.63 | $ | 17.04 | $ | 14.32 | $ | 15.71 | ||||||||||

Total Return(b) |

(0.08 | )% | 1.59 | % | 23.67 | % | (2.73 | )% | 7.25 | % | ||||||||||

Ratios and Supplemental Data: |

||||||||||||||||||||

Net assets, end of year (000 omitted) |

$ | 321,178 | $ | 350,182 | $ | 284,563 | $ | 198,450 | $ | 142,872 | ||||||||||

Ratio of net expenses to average net assets |

1.12 | % | 1.18 | % | 1.15 | % | 1.25 | % | 1.25 | % | ||||||||||

Ratio of expenses to average net assets before waiver or recoupment |

1.12 | % | 1.18 | % | 1.15 | % | 1.20 | % | 1.22 | % | ||||||||||

Ratio of net investment income to average net assets |

1.04 | % | 0.97 | % | 1.36 | % | 0.96 | % | 0.41 | % | ||||||||||

Portfolio turnover rate |

120 | % | 165 | % | 154 | % | 148 | % | 128 | % | ||||||||||

|

(a) |

The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

|

(b) |

Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

27

DEAN MID CAP VALUE FUND

FINANCIAL HIGHLIGHTS

(For a share outstanding during each year)

For the Years ended |

||||||||||||||||||||

March 31, |

March 31, |

March 31, |

March 31, |

March 31, |

||||||||||||||||

Selected Per Share Data: |

||||||||||||||||||||

Net asset value, beginning of year |

$ | 19.87 | $ | 18.92 | $ | 16.15 | $ | 15.83 | $ | 14.82 | ||||||||||

Investment operations: |

||||||||||||||||||||

Net investment income |

0.22 | 0.08 | 0.12 | 0.03 | 0.11 | |||||||||||||||

Net realized and unrealized gain |

0.36 | 1.40 | 2.73 | 0.31 | 1.00 | |||||||||||||||

Total from investment operations |

0.58 | 1.48 | 2.85 | 0.34 | 1.11 | |||||||||||||||

Less distributions to shareholders from: |

||||||||||||||||||||

Net investment income |

(0.16 | ) | (0.10 | ) | (0.08 | ) | (0.02 | ) | (0.10 | ) | ||||||||||

Net realized gains |

(0.46 | ) | (0.43 | ) | — | — | — | |||||||||||||

Total distributions |

(0.62 | ) | (0.53 | ) | (0.08 | ) | (0.02 | ) | (0.10 | ) | ||||||||||

Net asset value, end of year |

$ | 19.83 | $ | 19.87 | $ | 18.92 | $ | 16.15 | $ | 15.83 | ||||||||||

Total Return(a) |

3.10 | % | 7.79 | % | 17.65 | % | 2.17 | % | 7.50 | % | ||||||||||

Ratios and Supplemental Data: |

||||||||||||||||||||

Net assets, end of year (000 omitted) |

$ | 41,889 | $ | 34,093 | $ | 26,132 | $ | 17,313 | $ | 16,437 | ||||||||||

Ratio of net expenses to average net assets |

1.10 | % | 1.10 | % | 1.10 | % | 1.50 | % | 1.50 | % | ||||||||||

Ratio of expenses to average net assets before waiver or recoupment |

1.40 | % | 1.53 | % | 1.76 | % | 1.91 | % | 1.88 | % | ||||||||||

Ratio of net investment income to average net assets |

1.20 | % | 0.49 | % | 0.75 | % | 0.23 | % | 0.66 | % | ||||||||||

Portfolio turnover rate |

46 | % | 52 | % | 57 | % | 39 | % | 52 | % | ||||||||||

|

(a) |

Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

28

DEAN FUNDS

NOTES TO THE FINANCIAL STATEMENTS

March 31, 2019

NOTE 1. ORGANIZATION

The Dean Small Cap Value Fund (the “Small Cap Fund”) and the Dean Mid Cap Value Fund (the “Mid Cap Fund”) (each a “Fund” and, collectively the “Funds”) were organized as diversified series of Unified Series Trust (the “Trust”) on November 13, 2006. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 17, 2002 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. The Funds are each a series of the Trust currently authorized by the Board. The investment adviser to each Fund is Dean Investment Associates, LLC (“Dean Investment Associates” or “Adviser”). In addition, the Adviser has retained Dean Capital Management, LLC (“DCM” or “Sub-Adviser”) to serve as sub-adviser to the Funds. DCM is an affiliate of the Adviser. The investment objective of each Fund is long-term capital appreciation and, secondarily, dividend income.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Funds make no provision for federal income or excise tax. The Funds have qualified and intend to qualify each year as regulated investment companies (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of their taxable income. The Funds also intend to distribute sufficient

29

DEAN FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

March 31, 2019

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

net investment income and net capital gains, if any, so that they will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income is not distributed, the Funds could incur a tax expense.

As of and during the fiscal year ended March 31, 2019, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the period, the Funds did not incur any interest or penalties. Management of the Funds has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each Fund’s relative net assets or other appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Funds follow industry practice and record security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Distributions received from investments in real estate investment trusts (“REITs”) that represent a return of capital or capital gain are recorded as a reduction of the cost of investment or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Funds’ investments in REITs are reported to the Funds after the end of the calendar year; accordingly, the Funds estimate these amounts for accounting purposes until the characterization of REIT distributions is reported. Estimates are based on the most recent REIT distributions information available. Withholding taxes on foreign dividends and related reclaims have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

30

DEAN FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

March 31, 2019

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

Dividends and Distributions – Each Fund intends to distribute substantially all of its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from the ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature; they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of the Funds.

For the fiscal year ended March 31, 2019, the Funds made the following reclassifications to increase (decrease) the components of net assets:

Paid-in Capital |

Accumulated |

|||||||

Small Cap Fund |

$ | (1 | ) | $ | 1 | |||

Mid Cap Fund |

14,064 | (14,064 | ) | |||||

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that each Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on

31

DEAN FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

March 31, 2019

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below.

|

● |

Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

|

● |

Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

|

● |

Level 3 – significant unobservable inputs (including each Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, each Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

32

DEAN FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

March 31, 2019

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

Investments in mutual funds, including money market mutual funds, are generally priced at the ending net asset value (“NAV”) provided by the service agent of the mutual funds. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser and/or Sub-Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable, as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by Adviser and/or Sub-Adviser would be the amount that the Funds might reasonably expect to receive for them upon their current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in the Adviser or Sub-Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser or Sub-Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used at March 31, 2019 in valuing the Funds’ investments:

Valuation Inputs |

||||||||||||||||

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||

Small Cap Fund |

||||||||||||||||

Assets |

||||||||||||||||

Common Stocks(a) |

$ | 307,685,775 | $ | — | $ | — | $ | 307,685,775 | ||||||||

Money Market Funds |

15,806,810 | — | — | 15,806,810 | ||||||||||||

Total |

$ | 323,492,585 | $ | — | $ | — | $ | 323,492,585 | ||||||||

33

DEAN FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

March 31, 2019

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

Valuation Inputs |

||||||||||||||||

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||

Mid Cap Fund |

||||||||||||||||

Assets |

||||||||||||||||

Common Stocks(a) |

$ | 40,086,593 | $ | — | $ | — | $ | 40,086,593 | ||||||||

Money Market Funds |

1,666,736 | — | — | 1,666,736 | ||||||||||||

Total |

$ | 41,753,329 | $ | — | $ | — | $ | 41,753,329 | ||||||||

|

(a) |

Refer to the schedule of investments for sector classifications. |

The Funds did not hold any assets at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Each Fund’s investments are managed by the Adviser pursuant to the terms of an advisory agreement with the Trust. The Adviser has hired the Sub-Adviser to manage the Funds’ assets on a day-to-day basis. The Sub-Adviser is paid by the Adviser. In accordance with the advisory agreement for each Fund, the Adviser is entitled to an investment advisory fee, computed and accrued daily and paid monthly, at an annual rate of 0.90% of the average daily net assets of each Fund. For the fiscal year ended March 31, 2019, the Adviser earned fees, before the waiver described below, of $3,122,044 and $331,269 from the Small Cap Fund and the Mid Cap Fund, respectively. At March 31, 2019, the Adviser was owed $245,792 from the Small Cap Fund and $21,945 from the Mid Cap Fund.

The Adviser contractually agreed to waive its management fee and/or to reimburse certain Fund operating expenses, but only to the extent necessary so that total annual operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; expenses incurred

34

DEAN FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

March 31, 2019

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES – continued

in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers, and other expenses that the Trustees agree have not been incurred in the ordinary course of the Funds’ business), do not exceed 1.25% of the Small Cap Fund’s average daily net assets and 1.10% of the Mid Cap Fund’s average daily net assets. The contractual agreement with respect to each Fund is in place through July 31, 2019. For the fiscal year ended March 31, 2019, the Adviser waived fees of $85,295 for the Mid Cap Fund.

Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of recoupment. As of March 31, 2019 the Adviser may seek repayment of investment advisory fees waived and expense reimbursements in the amount of $93,585, $93,991 and $85,295, pursuant to the aforementioned conditions, from the Mid Cap Fund no later than March 31, 2020, 2021 and 2022, respectively.