Form N-CSR Trust for Advised Portfo For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-21422 | |||||||

|

| ||||||||

|

Trust for Advised Portfolios | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

615 East Michigan Street Milwaukee, Wisconsin |

|

53202 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Christopher E. Kashmerick Trust for Advised Portfolios 2020 East Financial Way, Suite 100 Glendora, CA 91741 | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

(626) 914-7385 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

December 31 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

December 31, 2018 |

| ||||||

Item 1. Reports to Stockholders.

Annual Report

December 31, 2018

1919 FINANCIAL SERVICES FUND

1919 MARYLAND TAX-FREE INCOME FUND

1919 SOCIALLY RESPONSIVE BALANCED FUND

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds' website, www.1919funds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, such as a broker-dealer or bank, or, if you are a direct investor, by calling the Fund toll-free at 1-844-828-1919.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call the Funds toll-free at 1-844-828-1919 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary.

Table of Contents

|

1919 Financial Services Fund |

|||||||

|

Letter to shareholders |

1 |

||||||

|

Fund performance |

4 |

||||||

|

Fund expenses |

6 |

||||||

|

Fund at a glance |

7 |

||||||

|

Schedule of investments |

8 |

||||||

|

Statement of assets and liabilities |

11 |

||||||

|

Statement of operations |

12 |

||||||

|

Statements of changes in net assets |

13 |

||||||

|

Financial highlights |

14 |

||||||

|

1919 Maryland Tax-Free Income Fund |

|||||||

|

Letter to shareholders |

17 |

||||||

|

Fund performance |

21 |

||||||

|

Fund expenses |

23 |

||||||

|

Fund at a glance |

24 |

||||||

|

Schedule of investments |

25 |

||||||

|

Statement of assets and liabilities |

28 |

||||||

|

Statement of operations |

29 |

||||||

|

Statements of changes in net assets |

30 |

||||||

|

Financial highlights |

31 |

||||||

|

1919 Socially Responsive Balanced Fund |

|||||||

|

Letter to shareholders |

34 |

||||||

|

Fund performance |

37 |

||||||

|

Fund expenses |

39 |

||||||

|

Fund at a glance |

40 |

||||||

|

Schedule of investments |

41 |

||||||

|

Statement of assets and liabilities |

47 |

||||||

|

Statement of operations |

48 |

||||||

|

Statements of changes in net assets |

49 |

||||||

|

Financial highlights |

50 |

||||||

|

Notes to financial statements |

54 |

||||||

|

Report of independent registered public accounting firm |

67 |

||||||

|

Other information |

69 |

||||||

|

Approval of investment advisory agreement |

71 | ||||||

|

Trustee and officer information |

74 | ||||||

|

Privacy notice |

77 | ||||||

|

Directory of funds' service providers |

Back Cover |

||||||

1919 Funds 2018 Annual Report

1919 Financial Services Fund

Letter to shareholders (unaudited)

Dear Shareholder,

2018 started out strong following the Tax Cut and Jobs Act of 2017 and was proceeded by accelerating GDP growth throughout the year. However, as the year progressed, investors became increasingly pessimistic about prospects for global growth amidst a backdrop of Federal Reserve interest rate increases and trade tensions. The declines were most prevalent in the fourth quarter, as the S&P 500 Index dropped 13.5%. Financials were not immune as the S&P 500 Financials Index were down 13%. Small-Cap financials were hit harder during the quarter, down 16.8% as measured by the Russell 2000 Index of Financial stocks.

Looking forward, aided by a healthy U.S. consumer and strong corporate balance sheets, we expect solid earnings growth for Financials as we move through 2019. For example, the earnings growth for the S&P Financial Index in 2019, per financial data research firm FactSet, is 9.1% compared with 6.5% for the S&P 500 at the date of this writing. We also believe valuations will be a growth catalyst for Financials in 2019. For example, again as of this writing, large-cap and mid-cap banks are trading at a significant discount to the historical 20-year averages, but in our view are better regulated, capitalized and managed than before the Great Recession.

For the twelve months ended December 31, 2018, the 1919 Financial Services Fund Class I returned -14.72%. The Fund's unmanaged benchmarks, the S&P 500 Index and S&P 500 Financials Index, returned -4.38% and -13.03% respectively. The Lipper Financial Services Fund Category average returned -15.41% over the same time frame.

How did we respond to these changing market conditions?

The changes to the Fund's investments were stock specific rather than reacting to the overall market conditions. We added to a number of small-cap and large-cap banks, Financial Technology, and Insurance stocks especially during periods of market weakness. We pared back or sold a few positions with weaker fundamentals or those that were viewed as more fully valued.

1919 Funds 2018 Annual Report

1

1919 Financial Services Fund

Letter to shareholders (unaudited) (cont'd)

What were the leading contributors to performance?

Our selection of Financial Technology and Property and Casualty Insurance contributed the most to performance. The top five performing stocks were i3 Verticals Inc., Visa, Inc., Verisk Analytics Inc., First Connecticut Bancorp, Inc., and CoBiz Financial Inc. The first three of these companies benefitted from reporting solid revenue and EPS growth while the last two appreciated following announcements they were being acquired by other banks.

What were the leading detractors to performance?

The five stocks that performed the worst were Affiliated Managers Group, Inc., Bank OZK, Texas Capital Bancshares, Inc., First Western Financial, Inc., and Cadence Bancorporation Class A. The smaller and mid cap regional banks underperformed primarily in the fourth quarter as recessionary fears surfaced.

Thank you for your investment in 1919 Financial Services Fund. As always we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund's investment goals.

Sincerely,

Christopher J. Perry, CFA

Portfolio Manager

1919 Investment Counsel, LLC

Lee Robertson, CFA

Portfolio Manager

1919 Investment Counsel, LLC

Charlie King, CFA

Portfolio Manager

1919 Investment Counsel, LLC

S&P 500 Index — The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

S&P 500 Financials Index — The S&P 500 Financials Index comprises those companies included in the S&P 500 that are classified as members of the Global Industry Classification Standard financials sector.

Lipper Financial Services Fund Category — Funds invest primarily in equity securities of companies engaged in providing financial services, including but not limited to banks, finance companies, insurance companies, and securities/brokerage firms.

Russell 2000 Index of Financial Stocks — Represents those financial companies who are included in the Russell 2000 index, which is an index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks.

1919 Funds 2018 Annual Report

2

Past performance is not a guarantee of future results.

Earnings growth is not representative of the Fund's future performance.

Opinions expressed herein are as of 12/31/18 and are subject to change at any time, are not a guaranteed and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please refer to the Schedule of Investments for a complete list of Fund holdings.

This report has been prepared for shareholders and may be distributed to other if preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. The Fund may invest in small and medium-capitalization companies which tend to have limited liquidity and greater price volatility than larger-capitalization companies. The Fund may invest in foreign and emerging market securities which will involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks are particularly significant for funds that invest in emerging markets. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested.

1919 Funds are distributed by Quasar Distributors, LLC.

1919 Funds 2018 Annual Report

3

Fund performance (unaudited)

Value of $10,000 Investment

This chart illustrates the performance of a hypothetical $10,000 investment in the Fund's Class A shares over ten years. Assumes the deduction of the maximum initial sales charge of 5.75% at the time of investment and the reinvestment of dividends and capital gains, but does not reflect the effect of any other applicable sales charge or redemption fees. This chart does not imply any future performance. The performance of the Fund's other classes may be greater or less than the Class A shares' performance indicated on this chart, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes.

1919 Funds 2018 Annual Report

4

Total Returns* as of December 31, 2018

|

1 Year |

5 Year |

10 Year |

|||||||||||||

|

1919 Financial Services Fund Class A |

|||||||||||||||

|

With Sales Charges† |

|||||||||||||||

|

Class A |

-19.82 |

% |

5.61 |

% |

10.24 |

% |

|||||||||

|

Class C |

-16.40 |

6.13 |

10.12 |

||||||||||||

|

Without Sales Charges |

|||||||||||||||

|

Class A |

-14.93 |

6.87 |

10.90 |

||||||||||||

|

Class C |

-15.57 |

6.13 |

10.12 |

||||||||||||

|

Class I |

-14.72 |

7.23 |

11.23 |

||||||||||||

|

S&P 500 Index(i) |

-4.38 |

8.49 |

13.12 |

||||||||||||

|

S&P Financials Index(ii) |

-13.03 |

8.16 |

10.91 |

||||||||||||

* Returns over one year are annualized.

† Class A Shares have a maximum initial sales charge of 5.75% and Class C Shares have a contingent deferred sales charge (CDSC) of 1.00% for shares redeemed within one year of purchase.

As of the Fund's current prospectus dated April 30, 2018, the total annual operating expense ratios for Class A, Class C and Class I were 1.37%, 2.08% and 1.11%, respectively. The total net annual operating expense ratio for Class I was 1.10%(iii). Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease, and Fund expense ratios are more likely to increase when markets are volatile.

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Fund returns assume the reinvestment of all distributions, at net asset value and the deduction of all Fund expenses. Total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-844-828-1919.

As of November 7, 2014, the Fund assumed the performance, financial and other historic information of the Legg Mason Investment Counsel Financial Services Fund. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

(i) The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S.

(ii) The S&P 500 Financials Index is a capitalization-weighted index representing nine financial groups and fifty-three financial companies, calculated monthly with dividends reinvested at month-end.

(iii) The Advisor has contractually agreed to waive fees and reimburse operating expenses through April 30, 2020

The Indices are unmanaged and are not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index.

1919 Funds 2018 Annual Report

5

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on July 1, 2018 and held for the six months ended December 31, 2018. The hypothetical example is based on a six-month period ended December 31, 2018.

Actual expenses

The table below titled "Based on Actual Total Return" provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the

result by the number under the heading entitled "Expenses Paid During the Period".

Hypothetical example for comparison purposes

The table below titled "Based on Hypothetical Total Return" provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Based on actual total return1

|

Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

|||||||||||||||||||

|

Class A |

-17.22 |

% |

$ |

1,000.00 |

$ |

827.80 |

1.35 |

% |

$ |

6.22 |

|||||||||||||

|

Class C |

-17.54 |

1,000.00 |

824.60 |

2.06 |

9.47 |

||||||||||||||||||

|

Class I |

-17.13 |

1,000.00 |

828.70 |

1.05 |

4.84 |

||||||||||||||||||

Based on hypothetical total return1

|

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

|||||||||||||||||||

|

Class A |

5.00 |

% |

$ |

1,000.00 |

$ |

1,018.40 |

1.35 |

% |

$ |

6.87 |

|||||||||||||

|

Class C |

5.00 |

1000.00 |

1,014.82 |

2.06 |

10.46 |

||||||||||||||||||

|

Class I |

5.00 |

1000.00 |

1,019.91 |

1.05 |

5.35 |

||||||||||||||||||

1 For the six months ended December 31, 2018.

2 Assumes the reinvestment of all distributions at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge ("CDSC") with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

3 Expenses (net of fee waivers and/or expense reimbursements) are equal to each class' annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365.

1919 Funds 2018 Annual Report

6

Fund at a glance (unaudited)

Investment breakdown (%) as a percent of total investments

1919 Funds 2018 Annual Report

7

Schedule of investments

December 31, 2018

1919 Financial Services Fund

|

Security |

Shares |

Value |

|||||||||

|

Common Stocks — 98.5% |

|||||||||||

|

Capital Markets — 2.8% |

|||||||||||

|

Affiliated Managers Group Inc. |

14,392 |

$ |

1,402,357 |

||||||||

|

Ameriprise Financial Inc. |

38,425 |

4,010,417 |

|||||||||

|

CME Group Inc. |

4,000 |

752,480 |

|||||||||

|

Total Capital Markets |

6,165,254 |

||||||||||

|

Commercial Banks — 54.0% |

|||||||||||

|

Bank of America Corp. |

278,000 |

6,849,920 |

|||||||||

|

Bank of the Ozarks Inc. |

65,698 |

1,499,885 |

|||||||||

|

Banner Corp. |

80,142 |

4,285,994 |

|||||||||

|

Berkshire Hills Bancorp Inc. |

104,500 |

2,818,365 |

|||||||||

|

BOK Financial Corp. |

36,314 |

2,662,906 |

|||||||||

|

Bryn Mawr Bank Corp. |

70,000 |

2,408,000 |

|||||||||

|

Cadence BanCorp |

160,000 |

2,684,800 |

|||||||||

|

Centerstate Banks Inc. |

221,300 |

4,656,152 |

|||||||||

|

Coastal Financial Corp/WA |

70,000 |

1,066,100 |

* |

||||||||

|

Columbia Banking System Inc. |

131,805 |

4,783,203 |

|||||||||

|

Comerica Inc. |

40,000 |

2,747,600 |

|||||||||

|

Farmers & Merchants Bank of Long Beach |

200 |

1,540,000 |

|||||||||

|

First Financial Bancorp |

57,000 |

1,352,040 |

|||||||||

|

First Foundation Inc. |

163,000 |

2,096,180 |

* |

||||||||

|

First Merchants Corp. |

28,000 |

959,560 |

|||||||||

|

First Western Financial Inc. |

110,000 |

1,288,100 |

* |

||||||||

|

Franklin Financial Network Inc. |

45,000 |

1,186,650 |

* |

||||||||

|

Heritage Financial Corp. |

133,000 |

3,952,760 |

|||||||||

|

JPMorgan Chase & Co. |

97,310 |

9,499,402 |

|||||||||

|

Level One Bancorp Inc. |

80,000 |

1,794,400 |

|||||||||

|

MB Financial Inc. |

94,000 |

3,725,220 |

|||||||||

|

National Commerce Corp. |

30,000 |

1,080,000 |

* |

||||||||

|

Northrim Bancorp Inc. |

39,100 |

1,285,217 |

|||||||||

|

Pacific City Financial Corp. |

115,000 |

1,799,750 |

|||||||||

|

Pacific Premier Bancorp Inc. |

65,263 |

1,665,512 |

* |

||||||||

|

People's Utah Bancorp |

102,000 |

3,075,300 |

|||||||||

|

PNC Financial Services Group Inc. |

29,000 |

3,390,390 |

|||||||||

|

QCR Holdings Inc. |

126,500 |

4,059,385 |

|||||||||

|

SmartFinancial Inc. |

50,000 |

913,500 |

* |

||||||||

|

Sterling Bancorp |

268,200 |

4,427,982 |

|||||||||

|

SunTrust Banks Inc. |

69,000 |

3,480,360 |

|||||||||

| SVB Financial Group |

26,000 |

4,937,920 |

* |

||||||||

|

TCF Financial Corp. |

110,000 |

2,143,900 |

|||||||||

1919 Funds 2018 Annual Report

8

1919 Financial Services Fund

|

Security |

Shares |

Value |

|||||||||

|

Commercial Banks — continued |

|||||||||||

|

Texas Capital Bancshares Inc. |

100,000 |

$ |

5,109,000 |

* |

|||||||

|

Towne Bank/Portsmouth VA |

48,812 |

1,169,058 |

|||||||||

|

U.S. Bancorp |

60,500 |

2,764,850 |

|||||||||

|

Univest Corp. of Pennsylvania |

55,126 |

1,189,068 |

|||||||||

|

Webster Financial Corp. |

93,895 |

4,628,085 |

|||||||||

|

Western Alliance Bancorp |

116,000 |

4,580,840 |

* |

||||||||

|

Wintrust Financial Corp. |

70,000 |

4,654,300 |

|||||||||

|

Total Commercial Banks |

120,211,654 |

||||||||||

|

Consumer Finance — 2.2% |

|||||||||||

|

Discover Financial Services |

84,000 |

4,954,320 |

|||||||||

|

Total Consumer Finance |

4,954,320 |

||||||||||

|

Diversified Financial Services — 6.3% |

|||||||||||

|

Charles Schwab Corp. |

96,000 |

3,986,880 |

|||||||||

|

Intercontinental Exchange Inc. |

90,500 |

6,817,365 |

|||||||||

|

Voya Financial Inc. |

78,000 |

3,130,920 |

|||||||||

|

Total Diversified Financial Services |

13,935,165 |

||||||||||

|

Insurance — 11.8% |

|||||||||||

|

American Financial Group Inc. |

44,650 |

4,042,164 |

|||||||||

|

Brown & Brown Inc. |

134,000 |

3,693,040 |

|||||||||

|

Chubb Limited |

52,500 |

6,781,950 |

|||||||||

|

Hanover Insurance Group Inc. |

40,000 |

4,670,800 |

|||||||||

|

Marsh & McLennan Cos Inc. |

68,000 |

5,423,000 |

|||||||||

|

RenaissanceRe Holdings Ltd |

13,000 |

1,738,100 |

|||||||||

|

Total Insurance |

26,349,054 |

||||||||||

|

IT Services — 11.8% |

|||||||||||

|

Black Knight Inc. |

67,000 |

3,019,020 |

* |

||||||||

|

Fidelity National Information Services Inc. |

27,000 |

2,768,850 |

|||||||||

|

Fiserv Inc. |

43,680 |

3,210,043 |

* |

||||||||

|

Global Payments Inc. |

45,699 |

4,712,938 |

|||||||||

|

I3 Verticals Inc. |

110,480 |

2,662,568 |

* |

||||||||

|

Visa Inc., Class A Shares |

54,400 |

7,177,536 |

|||||||||

|

Worldpay Inc. |

35,000 |

2,675,050 |

* |

||||||||

|

Total IT Services |

26,226,005 |

||||||||||

|

Professional Services — 0.8% |

|||||||||||

|

Verisk Analytics Inc., Class A Shares |

15,500 |

1,690,120 |

* |

||||||||

|

Total Professional Services |

1,690,120 |

||||||||||

|

Real Estate Investment Trust (REITs) — 4.1% |

|||||||||||

|

Crown Castle International Corp. |

49,000 |

5,322,870 |

|||||||||

|

Simon Property Group LP |

23,500 |

3,947,765 |

|||||||||

|

Total Real Estate Investment Trust (REITs) |

9,270,635 |

||||||||||

1919 Funds 2018 Annual Report

9

Schedule of investments (cont'd)

December 31, 2018

1919 Financial Services Fund

|

Security |

Shares |

Value |

|||||||||||||

|

Thrifts & Mortgage Finance — 4.7% |

|||||||||||||||

|

Bridgewater Bancshares Inc. |

165,000 |

$ |

1,740,750 |

* |

|||||||||||

|

FS Bancorp Inc. |

17,000 |

728,960 |

|||||||||||||

|

Merchants Bancorp/IN |

90,000 |

1,796,400 |

|||||||||||||

|

Riverview Bancorp Inc. |

125,000 |

910,000 |

|||||||||||||

|

Territorial Bancorp Inc. |

65,000 |

1,688,700 |

|||||||||||||

|

WSFS Financial Corp. |

92,803 |

3,518,162 |

|||||||||||||

|

Total Thrifts & Mortgage Finance |

10,382,972 |

||||||||||||||

|

Total Common Stocks (Cost — $172,993,465) |

219,185,179 |

||||||||||||||

|

Rate |

|||||||||||||||

|

Short-Term Investment — 1.8% |

|||||||||||||||

|

Fidelity Investments Money Market — Government Portfolio — Class I |

2.250 |

% |

4,082,804 |

4,082,804 |

(a) |

||||||||||

|

Total Short-Term Investment (Cost — $4,082,804) |

4,082,804 |

||||||||||||||

|

Total Investments — 100.3% (Cost — $177,076,269) |

223,267,983 |

||||||||||||||

|

Liabilities in Excess of Other Assets — (0.3)% |

(758,541 |

) |

|||||||||||||

|

Total Net Assets — 100.0% |

$ |

222,509,442 |

|||||||||||||

Notes:

* Non-income producing security

(a) The rate reported is the annualized seven-day yield at period end.

The Accompanying Notes are an Integral Part of these Financial Statements.

1919 Funds 2018 Annual Report

10

1919 Financial Services Fund

Statement of assets and liabilities

December 31, 2018

|

Assets: |

|||||||

|

Investments in securities at value (cost $177,076,269) |

$ |

223,267,983 |

|||||

|

Cash |

8,580 |

||||||

|

Foreign currency at value (cost $17,785) |

17,091 |

||||||

|

Receivable for Fund shares sold |

724,705 |

||||||

|

Dividends and interest receivable |

145,130 |

||||||

|

Prepaid expenses |

27,946 |

||||||

|

Total Assets |

224,191,435 |

||||||

|

Liabilities: |

|||||||

|

Payable for Fund shares repurchased |

975,448 |

||||||

|

Advisory fees payable |

161,539 |

||||||

|

Distribution fees payable |

375,796 |

||||||

|

Accrued other expenses |

169,210 |

||||||

|

Total Liabilities |

1,681,993 |

||||||

|

Net Assets |

$ |

222,509,442 |

|||||

|

Components of Net Assets: |

|||||||

|

Paid-in capital |

$ |

176,307,111 |

|||||

|

Total distributable earnings |

46,202,331 |

||||||

|

Net Assets |

$ |

222,509,442 |

|||||

|

Class A: |

|||||||

|

Net Assets |

$ |

71,081,807 |

|||||

|

Shares Issued and Outstanding |

3,122,122 |

||||||

|

Net Asset Value and Redemption Price |

$ |

22.77 |

|||||

|

Maximum Public Offering Price (based on maximum initial sales charge of 5.75%) |

$ |

24.16 |

|||||

|

Class C: |

|||||||

|

Net Assets |

$ |

46,763,494 |

|||||

|

Shares Issued and Outstanding |

2,239,176 |

||||||

|

Net Asset Value, Redemption Price* and Offering Price Per Share |

$ |

20.88 |

|||||

|

Class I: |

|||||||

|

Net Assets |

$ |

104,664,141 |

|||||

|

Shares Issued and Outstanding |

4,554,058 |

||||||

|

Net Asset Value, Redemption Price and Offering Price Per Share |

$ |

22.98 |

|||||

* Redemption price per share of Class C shares is NAV reduced by a 1.00% CDSC if shares are redeemed within one year of purchase. (See Note 3).

The Accompanying Notes are an Integral Part of these Financial Statements.

1919 Funds 2018 Annual Report

11

1919 Financial Services Fund

Statement of operations

For the Year Ended December 31, 2018

|

Investment Income: |

|||||||

|

Dividend income |

$ |

4,197,702 |

|||||

|

Investment interest income |

99,870 |

||||||

|

Total Investment Income |

4,297,572 |

||||||

|

Expenses: |

|||||||

|

Advisory fees (Note 3) |

2,238,471 |

||||||

|

Distribution fees (Note 6) |

854,403 |

||||||

|

Transfer agent fees and expenses (Note 3 & Note 6) |

393,119 |

||||||

|

Administration and fund accounting fees (Note 3) |

159,084 |

||||||

|

Shareholder reporting fees |

56,783 |

||||||

|

Registration fees |

53,374 |

||||||

|

Custody fees (Note 3) |

25,980 |

||||||

|

Audit fees |

15,000 |

||||||

|

Legal fees |

13,075 |

||||||

|

Trustees' fees (Note 3) |

11,796 |

||||||

|

Miscellaneous |

9,495 |

||||||

|

Compliance fees (Note 3) |

6,287 |

||||||

|

Insurance fees |

5,195 |

||||||

|

Total Expenses |

3,842,062 |

||||||

|

Net investment Income |

455,510 |

||||||

|

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency |

|||||||

|

Net realized gain on investments |

3,607,323 |

||||||

|

Net change in unrealized appreciation/depreciation on: |

|||||||

|

Investments |

(47,289,426 |

) |

|||||

|

Foreign currency |

(1,471 |

) |

|||||

|

Translation of assets and liabilities denominated in foreign currency |

(1,062 |

) |

|||||

|

Net Change in Unrealized Appreciation/Depreciation |

(47,291,959 |

) |

|||||

|

Net Realized and Unrealized Loss on Investments |

(43,684,636 |

) |

|||||

|

Net Decrease in Net Assets Resulting from Operations |

$ |

(43,229,126 |

) |

||||

The Accompanying Notes are an Integral Part of these Financial Statements.

1919 Funds 2018 Annual Report

12

1919 Financial Services Fund

Statements of changes in net assets

|

For the year ended December 31, |

2018 |

2017 |

|||||||||

|

Increase (Decrease) in Net Assets from: Operations: |

|||||||||||

|

Net investment income |

$ |

455,510 |

$ |

183,450 |

|||||||

|

Net realized gain (loss) |

3,607,323 |

(62,823 |

) |

||||||||

|

Net change in unrealized appreciation/depreciation |

(47,291,959 |

) |

29,421,001 |

||||||||

|

Net Increase (Decrease) in Net Assets Resulting From Operations |

(43,229,126 |

) |

29,541,628 |

||||||||

|

Distributions to Shareholders: |

|||||||||||

|

Class A |

(1,185,165 |

) |

— |

||||||||

|

Class C |

(822,722 |

) |

— |

||||||||

|

Class I |

(2,040,861 |

) |

(151,413 |

) |

|||||||

|

Total Distributions to Shareholders |

(4,048,748 |

) |

(151,413 |

)* |

|||||||

|

Capital Transactions: |

|||||||||||

|

Net proceeds from shares sold |

138,066,099 |

104,206,746 |

|||||||||

|

Reinvestment of distributions |

3,778,413 |

143,794 |

|||||||||

|

Cost of shares repurchased |

(125,012,334 |

) |

(53,007,703 |

) |

|||||||

|

Net Increase in Net Assets From Capital Transactions |

16,832,178 |

51,342,837 |

|||||||||

|

Total Increase (Decrease) in Net Assets |

(30,445,696 |

) |

80,733,052 |

||||||||

|

Net Assets: |

|||||||||||

|

Beginning of year |

252,955,138 |

172,222,086 |

|||||||||

|

End of year |

$ |

222,509,442 |

$ |

252,955,138 |

** |

||||||

* Distribution is from net investment income.

** Includes undistributed net investment income of $6,843.

The Accompanying Notes are an Integral Part of these Financial Statements.

1919 Funds 2018 Annual Report

13

1919 Financial Services Fund

Financial highlights

For a share of beneficial interest outstanding through each period ended December 31, unless otherwise noted:

|

Class A Shares |

2018 |

2017 |

2016 |

2015 |

20141 |

20142 |

|||||||||||||||||||||

|

Net asset value, beginning of period |

$ |

27.16 |

$ |

23.69 |

$ |

19.28 |

$ |

19.40 |

$ |

18.63 |

$ |

15.13 |

|||||||||||||||

|

Income from investment operations: |

|||||||||||||||||||||||||||

|

Net investment income3 |

0.05 |

0.04 |

0.08 |

0.11 |

0.06 |

0.05 |

|||||||||||||||||||||

|

Net realized and unrealized gain (loss) on investments |

(4.08 |

) |

3.43 |

5.02 |

1.17 |

1.21 |

3.47 |

||||||||||||||||||||

|

Total income (loss) from investment operations |

(4.03 |

) |

3.47 |

5.10 |

1.28 |

1.27 |

3.52 |

||||||||||||||||||||

|

Less distributions: |

|||||||||||||||||||||||||||

|

From net investment income |

(0.01 |

) |

— |

(0.06 |

) |

(0.09 |

) |

(0.07 |

) |

(0.02 |

) |

||||||||||||||||

|

From net realized gain on investments |

(0.35 |

) |

— |

(0.63 |

) |

(1.31 |

) |

(0.43 |

) |

— |

|||||||||||||||||

|

Total distributions |

(0.36 |

) |

0.00 |

(0.69 |

) |

(1.40 |

) |

(0.50 |

) |

(0.02 |

) |

||||||||||||||||

|

Net asset value, end of period |

$ |

22.77 |

$ |

27.16 |

$ |

23.69 |

$ |

19.28 |

$ |

19.40 |

$ |

18.63 |

|||||||||||||||

|

Total return4 |

-14.93 |

% |

14.65 |

% |

26.46 |

% |

6.53 |

% |

6.81 |

%5 |

23.26 |

% |

|||||||||||||||

|

Supplemental data and ratios: |

|||||||||||||||||||||||||||

|

Net assets, end of period (in thousands) |

$ |

71,082 |

$ |

118,310 |

$ |

92,948 |

$ |

70,630 |

$ |

64,795 |

$ |

77,220 |

|||||||||||||||

|

Ratios to average net assets Gross expenses |

1.33 |

% |

1.37 |

% |

1.46 |

% |

1.45 |

% |

1.44 |

%6 |

1.46 |

% |

|||||||||||||||

|

Net expenses8 |

1.33 |

1.37 |

1.469 |

1.45 |

1.446,7,9 |

1.467 |

|||||||||||||||||||||

|

Net investment income |

0.19 |

0.16 |

0.43 |

0.54 |

0.446 |

0.27 |

|||||||||||||||||||||

|

Portfolio turnover rate |

18 |

% |

4 |

% |

8 |

% |

20 |

% |

11 |

%5 |

14 |

% |

|||||||||||||||

1 For the period ended April 1, 2014 through December 31, 2014. See Note 1.

2 For the year ended March 31.

3 Per share amounts have been calculated using the average shares method.

4 Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

5 Not annualized.

6 Annualized.

7 The impact of compensating balance arrangements, if any, was less than 0.01%.

8 Effective April 30, 2017, the advisor agreed to limit the ratio of expenses, other than brokerage, interest, taxes, extraordinary expenses and acquired fund fees and expenses, to 1.50% of the average net assets of Class A shares. This expense limitation arrangement cannot be terminated prior to April 30, 2020 without the Board of Trustees' consent. Prior to April 30, 2017, this limitation was 1.46%. See Note 3.

9 Reflects fee waivers and/or expense reimbursements.

The Accompanying Notes are an Integral Part of these Financial Statements.

1919 Funds 2018 Annual Report

14

For a share of beneficial interest outstanding through each period ended December 31, unless otherwise noted:

|

Class C Shares |

2018 |

2017 |

2016 |

2015 |

20141 |

20142 |

|||||||||||||||||||||

|

Net asset value, beginning of period |

$ |

25.12 |

$ |

22.07 |

$ |

18.06 |

$ |

18.30 |

$ |

17.63 |

$ |

14.40 |

|||||||||||||||

|

Income from investment operations: |

|||||||||||||||||||||||||||

|

Net investment loss3 |

(0.13 |

) |

(0.13 |

) |

(0.04 |

) |

(0.03 |

) |

(0.03 |

) |

(0.06 |

) |

|||||||||||||||

|

Net realized and unrealized gain (loss) on investments |

(3.76 |

) |

3.18 |

4.68 |

1.10 |

1.14 |

3.29 |

||||||||||||||||||||

|

Total income (loss) from investment operations |

(3.89 |

) |

3.05 |

4.64 |

1.07 |

1.11 |

3.23 |

||||||||||||||||||||

|

Less distributions: |

|||||||||||||||||||||||||||

|

From net investment income |

— |

— |

— |

— |

(0.01 |

) |

— |

||||||||||||||||||||

|

From net realized gain on investments |

(0.35 |

) |

— |

(0.63 |

) |

(1.31 |

) |

(0.43 |

) |

— |

|||||||||||||||||

|

Total distributions |

(0.35 |

) |

0.00 |

(0.63 |

) |

(1.31 |

) |

(0.44 |

) |

0.00 |

|||||||||||||||||

|

Net asset value, end of period |

$ |

20.88 |

$ |

25.12 |

$ |

22.07 |

$ |

18.06 |

$ |

18.30 |

$ |

17.63 |

|||||||||||||||

|

Total return4 |

-15.57 |

% |

13.82 |

% |

25.67 |

% |

5.77 |

% |

6.28 |

%5 |

22.43 |

% |

|||||||||||||||

|

Supplemental data and ratios: |

|||||||||||||||||||||||||||

|

Net assets, end of period (in thousands) |

$ |

46,763 |

$ |

53,667 |

$ |

37,271 |

$ |

26,919 |

$ |

25,498 |

$ |

26,484 |

|||||||||||||||

|

Ratios to average net assets Gross expenses |

2.05 |

% |

2.08 |

% |

2.19 |

% |

2.22 |

% |

2.14 |

%8 |

2.13 |

% |

|||||||||||||||

|

Net expenses7 |

2.05 |

2.08 |

2.139 |

2.139 |

2.116,8,9 |

2.136 |

|||||||||||||||||||||

|

Net investment loss |

(0.52 |

) |

(0.55 |

) |

(0.24 |

) |

(0.15 |

) |

(0.20 |

)8 |

(0.40 |

) |

|||||||||||||||

|

Portfolio turnover rate |

18 |

% |

4 |

% |

8 |

% |

20 |

% |

11 |

%5 |

14 |

% |

|||||||||||||||

1 For the period ended April 1, 2014 through December 31, 2014. See Note 1.

2 For the year ended March 31.

3 Per share amounts have been calculated using the average shares method.

4 Performance figures, exclusive of CDSC, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

5 Not annualized.

6 The impact of compensating balance arrangements, if any, was less than 0.01%.

7 Effective April 30, 2017, the advisor agreed to limit the ratio of expenses, other than brokerage, interest, taxes, extraordinary expenses and acquired fund fees and expenses, to 2.25% of the average net assets of Class C shares. This expense limitation arrangement cannot be terminated prior to April 30, 2020 without the Board of Trustees' consent. Prior to April 30, 2017, this limitation was 2.13%. See Note 3.

8 Annualized.

9 Reflects fee waivers and/or expense reimbursements.

The Accompanying Notes are an Integral Part of these Financial Statements.

1919 Funds 2018 Annual Report

15

1919 Financial Services Fund

Financial highlights (cont'd)

For a share of beneficial interest outstanding through each period ended December 31, unless otherwise noted:

|

Class I Shares |

2018 |

2017 |

2016 |

2015 |

20141 |

20142 |

|||||||||||||||||||||

|

Net asset value, beginning of period |

$ |

27.41 |

$ |

23.90 |

$ |

19.42 |

$ |

19.50 |

$ |

18.71 |

$ |

15.17 |

|||||||||||||||

|

Income from investment operations: |

|||||||||||||||||||||||||||

|

Net investment income3 |

0.14 |

0.11 |

0.17 |

0.19 |

0.12 |

0.12 |

|||||||||||||||||||||

|

Net realized and unrealized gain (loss) on investments |

(4.14 |

) |

3.45 |

5.08 |

1.18 |

1.21 |

3.49 |

||||||||||||||||||||

|

Total income (loss) from investment operations |

(4.00 |

) |

3.56 |

5.25 |

1.37 |

1.33 |

3.61 |

||||||||||||||||||||

|

Less distributions: |

|||||||||||||||||||||||||||

|

From net investment income |

(0.08 |

) |

(0.05 |

) |

(0.14 |

) |

(0.14 |

) |

(0.11 |

) |

(0.07 |

) |

|||||||||||||||

|

From net realized gain on investments |

(0.35 |

) |

— |

(0.63 |

) |

(1.31 |

) |

(0.43 |

) |

— |

|||||||||||||||||

|

Total distributions |

(0.43 |

) |

(0.05 |

) |

(0.77 |

) |

(1.45 |

) |

(0.54 |

) |

(0.07 |

) |

|||||||||||||||

|

Net asset value, end of period |

$ |

22.98 |

$ |

27.41 |

$ |

23.90 |

$ |

19.42 |

$ |

19.50 |

$ |

18.71 |

|||||||||||||||

|

Total return4 |

-14.72 |

% |

14.95 |

%5 |

27.01 |

% |

6.93 |

% |

7.10 |

%6 |

23.75 |

% |

|||||||||||||||

|

Supplemental data and ratios: |

|||||||||||||||||||||||||||

|

Net assets, end of period (in thousands) |

$ |

104,664 |

$ |

80,979 |

$ |

42,003 |

$ |

24,432 |

$ |

24,873 |

$ |

25,360 |

|||||||||||||||

|

Ratios to average net assets Gross expenses |

1.06 |

% |

1.11 |

% |

1.18 |

% |

1.20 |

% |

1.10 |

%9 |

1.05 |

% |

|||||||||||||||

|

Net expenses8 |

1.06 |

1.1010 |

1.0510 |

1.0510 |

1.067,9,10 |

1.057 |

|||||||||||||||||||||

|

Net investment income |

0.49 |

0.44 |

0.84 |

0.93 |

0.849 |

0.68 |

|||||||||||||||||||||

|

Portfolio turnover rate |

18 |

% |

4 |

% |

8 |

% |

20 |

% |

11 |

%6 |

14 |

% |

|||||||||||||||

1 For the period ended April 1, 2014 through December 31, 2014. See Note 1.

2 For the year ended March 31.

3 Per share amounts have been calculated using the average shares method.

4 Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

5 Total return reflects adjustments to conform to generally accounting principles.

6 Not Annualized.

7 The impact of compensating balance arrangements, if any, was less than 0.01%.

8 Effective April 30, 2017, the advisor agreed to limit the ratio of expenses, other than brokerage, interest, taxes, extraordinary expenses and acquired fund fees and expenses, to 1.25% of the average net assets of Class I shares. See Note 3. This expense limitation arrangement cannot be terminated prior to April 30, 2020 without the Board of Trustees' consent. Prior to April 30, 2017, this limitation was 1.05%.

9 Annualized.

10 Reflects fee waivers and/or expense reimbursements.

The Accompanying Notes are an Integral Part of these Financial Statements.

1919 Funds 2018 Annual Report

16

1919 Maryland Tax-Free Income Fund

Letter to shareholders (unaudited)

Dear Shareholder,

Municipal bonds provided sanctuary from the late-year chaos within the financial markets, serving the role of safe-haven along with Treasury bonds for beleaguered investors. The Bloomberg Barclays Municipal Bond Index, the 1919 Maryland Tax-Free Fund's primary benchmark and a proxy for the entire municipal market, returned a sturdy 1.69% during the volatile fourth quarter. The flight-to-quality rally pushed the index into the black for the year, as calendar year returns were 1.28%. Performance for the 1919 Maryland Tax-Free Fund were competitive versus the broad benchmark's returns, as the I-shares posted a gain of 1.26% for the year ending December 31, 2018. In addition, our continued defensive posture and commitment to a short-duration portfolio served shareholders well versus other Maryland-specific funds. The 1919 Fund outperformed its Lipper peer group by 43 basis points over the past twelve months, finishing 7th out of 22 Maryland funds within its universe. As of 12/31/18, Class I shares had an Overall Morningstar Rating of 5 stars among 139 U.S. Municipal Single State Intermediate Funds based upon risk-adjusted returns derived from a weighted average of the performance figures associated with 3-, 5- and 10-year (if applicable) Morningstar Ratings metrics.

The path of Treasury yields usually sets the course for other investment grade fixed income securities, municipal bonds included. Therefore, it is not unexpected that municipal yields moved higher in 2018 despite the strong rally late in the year. The Federal Reserve, now chaired by Trump nominee Jerome Powell, maintained the strategy of previous Fed Chairman Janet Yellen by raising overnight interest rates once a quarter, which pressured short maturity yields higher. Concurrently, the Committee remained committed to reducing the amount of longer maturity Treasury bonds the Fed owned on its balance sheet. These bonds were bought during the credit crisis in an attempt to keep borrowing costs low and stimulate the economy. Not surprisingly, the Fed's reduced demand for these securities forced longer maturity yields higher as well.

However, within the backdrop of higher Treasury yields, municipal bonds actually benefitted from a healthy technical environment. Despite passage of a tax cut that on the surface should reduce the value of a tax-free income stream, demand for

1919 Funds 2018 Annual Report

17

1919 Maryland Tax-Free Income Fund

Letter to shareholders (unaudited) (cont'd)

tax-free income remained resilient for most of the year. We believe the limitation of the deductibility of state and local taxes (i.e. SALT) for high income residents played a role in this demand dynamic, creating the possibility of a higher tax bill despite lower marginal tax rates. Traditional and dependable tax havens such as municipal bonds were beneficiaries as wealthy tax payers await the result of this April's tax season before deciding how to navigate the current ambiguity of the law. We expect investors' worries will prove valid, particularly within wealthy, high-tax states such as Maryland, where the new $10,000 limit on SALT deductions in most cases will be reached quickly, resulting in a higher tax bill despite cosmetically lower marginal tax rates. Maryland tax-free bonds should benefit accordingly.

As demand remains firm, we are somewhat optimistic that the supply of newly issued bonds will rebound versus the pace seen in 2018. Nationally, according to The Bond Buyer, municipal issuance was down 24.4% versus the prior year, with Maryland showing an even steeper 48% drop in the volume of tax-free bonds sold. Much of the volume shortfall arose from municipalities being prohibited by the Tax Reform Act from selling new bonds to advance-refund outstanding, higher-yielding debt. This popular refunding technique made up nearly half of new issuance during the historically low interest rate environment of the past few years, so its absence skews the yearly comparison. In addition, the 2017 supply data was bloated as a record amount of bonds were sold in December of 2017 prior to the uncertainties of the new tax laws effective in 2018. However, looking deeper into the makeup of the 2018 supply picture, "new money"

issuance used for capital expenditures surprisingly was a touch higher. We expect that trend will continue, primarily because we are optimistic that a bipartisan infrastructure bill seems one of the few items likely to pass within the divided government following the mid-term elections.

As we head into what we believe is a more balanced technical backdrop with supply better aligned with demand, we will continue to extend maturities where appropriate to take advantage of the higher, more attractive interest rate environment. While it is possible that yields move higher from here, it seems the Federal Reserve's previous tightening moves successfully cooled the prospects for an overheating in the economy, and more importantly eased expectations for future inflation. The prevailing volatility within other risk-based assets, primarily equities, should likewise buoy the prospects of conservative, high-quality assets such as tax-free bonds. While we forecast the economy to slow from the sturdy pace of mid-2018, we do not forecast a recession this year, so credit trends within the municipal space should remain healthy. That being said, we will employ our credit resources to manage risk accordingly, particularly with regards to specific pension problems, as well as isolated pockets of weakness should property values and subsequent property tax revenues suffer as an unintended and unwelcomed consequence of the SALT deduction limitation.

Sincerely,

R. Scott Pierce, CFA

Portfolio Manager

1919 Investment Counsel, LLC

1919 Funds 2018 Annual Report

18

Basis point is a unit equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Bloomberg Barclays Municipal Bond Index is an unmanaged index that is considered representative of the broad market for investment grade, tax-exempt bonds with a maturity of at least one year. One cannot invest in an index.

Duration is a measure of the sensitivity of the price, the value of principal, of a fixed-income investment to a change in interest rates and is expressed as a number of years.

Investment grade is a rating that indicates that a municipal or corporate bond has a relatively low risk of default.

The Morningstar RatingTM for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history without adjustment for sales load. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar RatingTM for a managed product is derived from a weighted average of the performance figures

associated with its three-, five-, and 10-year (if applicable) Morningstar RatingTM metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Class I shares of the Fund were rated against 139, 137, and 116 U.S. Municipal Single State Intermediate Funds over the 3-, 5- and 10-year periods, respectively. With respect to these funds, Class I shares of the Fund received Morningstar Ratings of 4, 4, and 5 as of December 31, 2018. Ratings shown are for the highest and lowest rated share classes only, when available. Other share classes have different expense structures and performance characteristics. Classes have a common portfolio. ©2019 Morningstar Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Opinions expressed herein are as of 12/31/18 and are subject to change at any time, are not a guaranteed and should not be considered investment advice.

1919 Funds 2018 Annual Report

19

1919 Maryland Tax-Free Income Fund

Letter to shareholders (unaudited) (cont'd)

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Please refer to the Schedule of Investments for a complete list of Fund holdings.

This report has been prepared for shareholders and may be distributed to others if preceded or accompanied by a current prospectus.

Mutual fund investing involves risk; Principal loss is possible. Bonds are subject to a variety of risks, including interest rate, credit and inflation risks. As interest rates rise, bond prices fall, reducing the value of a fixed-income investment. Municipal securities purchased by the Fund may be adversely affected by changes in the financial condition of municipal issuers and insurers, regulatory and political developments, uncertainties and public perceptions, and other factors. The Fund is non-diversified, meaning it concentrates its assets in fewer individual holdings than a diversified fund, specifically in the State of Maryland issues. The Fund is susceptible to adverse economic, political, tax, or regulatory changes specific to Maryland, which may magnify other risks and make the Fund more volatile than a municipal bond fund that invests in more than one state. Income from tax-exempt funds may become subject to state and local taxes and a portion of income may be subject to the Federal Alternative minimum tax for certain investors. Please see the Fund's prospectus for a more complete discussion of these and other risks, and the Fund's investment strategies.

Nothing contained in this communication constitutes tax or investment advice.

Investors must consult their tax advisor for advice and information concerning their particular situation.

1919 Funds are distributed by Quasar Distributors, LLC.

1919 Funds 2018 Annual Report

20

Fund performance (unaudited)

Value of $10,000 Investment

This chart illustrates the performance of a hypothetical $10,000 investment in the Fund's Class A shares over ten years. Assumes the deduction of the maximum initial sales charge of 4.25% at the time of investment and the reinvestment of dividends and capital gains, but does not reflect the effect of any other applicable sales charge or redemption fees. This chart does not imply any future performance. The performance of the Fund's other classes may be greater or less than the Class A shares' performance indicated on this chart, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes.

1919 Funds 2018 Annual Report

21

Fund performance (unaudited) (cont'd)

Total Returns* as of December 31, 2018

|

1 Year |

5 Year |

10 Year |

Since Inception** |

||||||||||||||||

|

1919 Maryland Tax-Free Income Fund |

|||||||||||||||||||

|

With Sales Charges† |

|||||||||||||||||||

|

Class A |

-3.25 |

% |

1.49 |

% |

3.58 |

% |

N/A |

||||||||||||

|

Class C |

-0.49 |

1.81 |

N/A |

2.82 |

% |

||||||||||||||

|

Without Sales Charges |

|||||||||||||||||||

|

Class A |

1.04 |

2.37 |

4.03 |

N/A |

|||||||||||||||

|

Class C |

0.49 |

1.81 |

N/A |

2.82 |

|||||||||||||||

|

Class I |

1.26 |

2.52 |

N/A |

N/A |

|||||||||||||||

|

Bloomberg Barclays Municipal Bond Index(i) |

1.28 |

3.82 |

4.85 |

4.41 |

|||||||||||||||

* Returns over one year are annualized.

** The Inception date for Class C was February 5, 2009.

† Class A Shares have a maximum initial sales charge of 4.25% and Class C Shares have a contingent deferred sales charge (CDSC) of 1.00% for shares redeemed within one year of purchase.

As of the Fund's current prospectus dated April 30, 2018, the total gross annual operating expense ratios for Class A, Class C and Class I were 0.97%, 1.54% and 0.88%, respectively. The total net annual operating expense ratios for Class A, Class C and Class I were 0.75%(ii), 1.30%(ii) and 0.60%(ii), respectively. Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Fund returns assume the reinvestment of all distributions, at net asset value and the deduction of all Fund expenses. Total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-844-828-1919.

As of November 7, 2014, the Fund assumed the performance, financial and other historic information of the Legg Mason Investment Counsel Maryland Tax-Free Income Trust. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

(i) The Bloomberg Barclays Municipal Bond Index is a market value weighted index of investment grade municipal bonds with maturities of one year or more. The Index was previously named the Barclays Municipal Bond Index.

(ii) The Advisor has contractually agreed to waive fees and reimburse operating expenses through April 30, 2020.

The Indices are unmanaged and are not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index.

1919 Funds 2018 Annual Report

22

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on July 1, 2018 and held for the six months ended December 31, 2018. The hypothetical example is based on a six-month period ended December 31, 2018.

Actual expenses

The table below titled "Based on Actual Total Return" provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the

result by the number under the heading entitled "Expenses Paid During the Period".

Hypothetical example for comparison purposes

The table below titled "Based on Hypothetical Total Return" provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Based on actual total return1

|

Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

|||||||||||||||||||

|

Class A |

1.16 |

% |

$ |

1,000.00 |

$ |

1,011.60 |

0.75 |

% |

$ |

3.80 |

|||||||||||||

|

Class C |

0.88 |

1,000.00 |

1,008.80 |

1.30 |

6.58 |

||||||||||||||||||

|

Class I |

1.23 |

1,000.00 |

1,012.30 |

0.60 |

3.04 |

||||||||||||||||||

Based on hypothetical total return1

|

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

|||||||||||||||||||

|

Class A |

5.00 |

% |

$ |

1,000.00 |

$ |

1,021.42 |

0.75 |

% |

$ |

3.82 |

|||||||||||||

|

Class C |

5.00 |

1,000.00 |

1,018.65 |

1.30 |

6.61 |

||||||||||||||||||

|

Class I |

5.00 |

1,000.00 |

1,022.18 |

0.60 |

3.06 |

||||||||||||||||||

1 The six months ended December 31, 2018.

2 Assumes the reinvestment of all distributions at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge ("CDSC") with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

3 Expenses (net of fee waivers and/or expense reimbursements) are equal to each class' annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365.

1919 Funds 2018 Annual Report

23

Fund at a glance (unaudited)

Investment breakdown (%) as a percent of total investments

1919 Funds 2018 Annual Report

24

Schedule of investments

December 31, 2018

1919 Maryland Tax-Free Income Fund

|

Rate |

Maturity Date |

Face Amount |

Value |

||||||||||||||||

|

Municipal Bonds — 99.1% |

|||||||||||||||||||

|

Education — 16.6% |

|||||||||||||||||||

|

Maryland Stadium Authority |

5.000 |

% |

5/1/42 |

$ |

2,000,000 |

$ |

2,258,980 |

||||||||||||

|

Maryland State EDC, Student Housing Revenue Bonds: |

|||||||||||||||||||

|

Frostburg State University Project |

4.000 |

% |

10/1/19 |

500,000 |

505,925 |

||||||||||||||

|

Frostburg State University Project |

4.000 |

% |

10/1/20 |

500,000 |

512,625 |

||||||||||||||

|

Maryland Economic Development Corp. |

5.000 |

% |

7/1/36 |

250,000 |

271,795 |

||||||||||||||

|

Salisbury University Project |

5.000 |

% |

6/1/27 |

455,000 |

483,615 |

||||||||||||||

|

Senior Morgan State University Project |

5.000 |

% |

7/1/27 |

1,870,000 |

1,964,641 |

||||||||||||||

|

University of Maryland, College Park Projects |

5.000 |

% |

7/1/31 |

500,000 |

536,325 |

||||||||||||||

|

Maryland State Health & Higher EFA Revenue Bonds: |

|||||||||||||||||||

|

College of Notre Dame of Maryland |

4.000 |

% |

10/1/25 |

1,645,000 |

1,685,960 |

||||||||||||||

|

Good Samaritan Hospital of Maryland |

1.300 |

% |

4/1/35 |

3,400,000 |

3,400,000 |

(c) |

|||||||||||||

|

Johns Hopkins University |

5.000 |

% |

7/1/21 |

2,000,000 |

2,153,400 |

||||||||||||||

|

Maryland Institute College of Art |

4.000 |

% |

6/1/42 |

250,000 |

248,487 |

||||||||||||||

|

Total Education |

14,021,753 |

||||||||||||||||||

|

Health Care — 20.7% |

|||||||||||||||||||

|

County of Baltimore, MD, Oak Crest Village Inc. |

5.000 |

% |

1/1/30 |

495,000 |

555,717 |

||||||||||||||

|

County of Prince George's, MD, COPS |

3.000 |

% |

10/1/31 |

2,500,000 |

2,471,175 |

||||||||||||||

|

Maryland State Health & Higher EFA Revenue Bonds: |

|||||||||||||||||||

|

Adventist Rehabilitation Hospital |

5.500 |

% |

1/1/27 |

1,250,000 |

1,473,575 |

||||||||||||||

|

Anne Arundel Health System |

1.270 |

% |

7/1/43 |

600,000 |

600,000 |

(c) |

|||||||||||||

|

Carroll Hospital Center Inc. |

5.000 |

% |

7/1/21 |

1,005,000 |

1,081,058 |

||||||||||||||

|

Greater Baltimore Medical Center Inc. |

1.520 |

% |

7/1/25 |

800,000 |

800,000 |

(c) |

|||||||||||||

|

Helix Health Issue, AMBAC |

5.250 |

% |

8/15/38 |

3,000,000 |

3,557,220 |

||||||||||||||

|

James Lawrence Kernan Hospital |

5.000 |

% |

7/1/34 |

50,000 |

50,578 |

||||||||||||||

|

James Lawrence Kernan Hospital |

1.000 |

% |

7/1/41 |

600,000 |

600,000 |

(c) |

|||||||||||||

|

MedStar Health Obligated Group |

5.000 |

% |

5/15/42 |

2,000,000 |

2,194,580 |

||||||||||||||

|

Refunding, Mercy Ridge |

4.750 |

% |

7/1/34 |

3,200,000 |

3,203,296 |

||||||||||||||

|

The Johns Hopkins Hospital Issue |

7.000 |

% |

7/1/19 |

890,000 |

880,887 |

(a) |

|||||||||||||

|

Total Health Care |

17,468,086 |

||||||||||||||||||

|

Housing — 8.9% |

|||||||||||||||||||

|

Maryland Community Development Administration Local Government Infrastructure |

4.000 |

% |

6/1/47 |

1,000,000 |

1,017,960 |

||||||||||||||

|

Maryland State Community Development Administration, Department of Housing and Community Development: |

|||||||||||||||||||

|

Bolton North LP |

3.350 |

% |

9/15/34 |

1,000,000 |

981,960 |

||||||||||||||

|

Local Government Infrastructure, Senior Lien |

4.000 |

% |

6/1/30 |

4,485,000 |

4,527,204 |

||||||||||||||

|

Local Government Infrastructure, Subordinate Lien |

4.000 |

% |

6/1/30 |

1,000,000 |

1,015,080 |

||||||||||||||

|

Total Housing |

7,542,204 |

||||||||||||||||||

|

Industrial Revenue — 0.7% |

|||||||||||||||||||

|

Maryland EDC, EDR, Lutheran World Relief Inc. and Immigration and Refugee Service |

5.250 |

% |

4/1/29 |

565,000 |

566,435 |

||||||||||||||

|

Total Industrial Revenue |

566,435 |

||||||||||||||||||

1919 Funds 2018 Annual Report

25

Schedule of investments (cont'd)

December 31, 2018

1919 Maryland Tax-Free Income Fund

|

Rate |

Maturity Date |

Face Amount |

Value |

||||||||||||||||

|

Leasing — 1.3% |

|||||||||||||||||||

|

Montgomery County, MD, Lease Revenue, Metrorail Garage Project |

5.000 |

% |

6/1/24 |

$ |

1,000,000 |

$ |

1,071,230 |

||||||||||||

|

Total Leasing |

1,071,230 |

||||||||||||||||||

|

Local General Obligation — 14.3% |

|||||||||||||||||||

|

Anne Arundel County, Maryland, GO Bonds, Water & Sewer |

4.000 |

% |

4/1/27 |

1,150,000 |

1,230,040 |

||||||||||||||

|

Baltimore County, Maryland, GO Bonds |

4.000 |

% |

8/1/23 |

1,270,000 |

1,309,446 |

||||||||||||||

|

County of Baltimore, Maryland |

5.000 |

% |

3/1/30 |

1,000,000 |

1,188,370 |

||||||||||||||

|

County of Montgomery, Maryland |

0.980 |

% |

11/1/37 |

2,600,000 |

2,600,000 |

(c) |

|||||||||||||

|

Howard County, Maryland, GO Bonds, Consolidated Public Improvement Project and Refunding Bonds |

5.000 |

% |

8/15/19 |

1,000,000 |

1,019,950 |

||||||||||||||

|

Howard County, Maryland, GO Bonds, Consolidated Public Improvement Project and Refunding Bonds |

3.000 |

% |

2/15/29 |

3,000,000 |

3,020,790 |

||||||||||||||

|

State of Maryland |

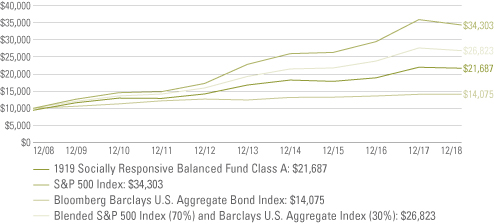

4.000 |