Form N-CSR Trust for Advised Portfo For: Jun 30

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

ZEVENBERGEN GROWTH FUND

INVESTOR CLASS (ZVNBX)

INSTITUTIONAL CLASS (ZVNIX)

ZEVENBERGEN GENEA FUND

INVESTOR CLASS (ZVGNX)

INSTITUTIONAL CLASS (ZVGIX)

|

|

ANNUAL REPORT TO SHAREHOLDERS

JUNE 30, 2021

TABLE OF CONTENTS

|

1 |

|

|

5 |

|

|

|

|

|

7 |

|

|

8 |

|

|

10 |

|

|

11 |

|

|

12 |

|

|

13 |

|

|

|

|

|

15 |

|

|

16 |

|

|

18 |

|

|

19 |

|

|

20 |

|

|

21 |

|

|

23 |

|

|

30 |

|

|

32 |

|

|

33 |

|

|

35 |

|

|

37 |

For the twelve months ending June 30, 2021 (Unaudited)

Dear Fellow Shareholders,

It’s not hyperbole to say that the world was changed in many ways by the events of 2020. Stepping back, one of the bigger epiphanies for the last year (and likely a lasting impact of the crisis) is the remarkable acceleration of the digital transformation. Equity returns in Q3 2020 saw shares of large cap technology companies surge, generating bubble comparisons, driving index gains and confounding many with the sheer velocity and strength of the rally. At the outset of Q4 2020, equities retreated, as global COVID-19 cases climbed, and lack of stimulus progress weakened investor enthusiasm. The brief pullback reversed on promising vaccine news, providing light at the end of the pandemic tunnel. After posting several false starts over recent years, value indices topped growth beginning in Q4 2020, as optimism increased regarding the “re-opening” and an economy potentially reclaiming strength. After rewarding high growth again to start the 2021 calendar year, equity markets swung aggressively toward cyclical and value-based strategies beginning in mid-February of 2021.

Continuing to invest in companies benefiting from the significant changes underway in how we live, work and play, the Zevenbergen Funds posted strong relative performance for the fiscal year. The Zevenbergen Growth Fund Investor Share Class (ZVNBX) returned 47.2% and the Zevenbergen Genea Fund Investor Share Class (ZVGNX) increased 69.3%, both exceeding the 43.0% gain of the Funds’ benchmark, the Russell 3000® Growth Index.

Zevenbergen Growth Fund:

Fund performance benefited from investments in consumer discretionary (electric transportation, advertising technology) and technology (graphics processors). Performance detractors included health care (biotechnology) and technology (insurance & analytics software).

Contributors:

Tesla, Inc. (TSLA):

Founder-led technology company helping accelerate the world’s transition efforts to sustainable energy. We believe the future of transportation is electric, and Tesla continues to demonstrate industry leading technology and demand. Strong fundamental results despite continued challenging industry supply chain dynamics supported price appreciation and led to S&P 500 inclusion late in 2020. Additional product expansions, progress on Gigafactories Shanghai, Berlin and Austin, battery investments, and full-self driving deployments point to a company committed to driving innovation in large addressable markets.

NVIDIA Corporation (NVDA):

Founder-led manufacturer of high-powered graphics processing chips. Demand for energy efficient, high-performance devices among gamers, remote workers, digital creators, and cryptocurrency miners continues to support growth. Laptop and desktop upgrades and deferred enterprise spending have been catalysts for Gaming segment wins, while data center processor sales have been propelled by hyperscale customers shifting workloads to the cloud and building artificial intelligence infrastructure. The company recently completed its acquisition of Mellanox Technologies, Ltd. (supplier of end-to-end high-speed networking equipment), expanding its ability to serve global enterprise customers with complex data science and storage needs.

The Trade Desk, Inc. (TTD):

Founder-led advertising technology platform company benefitting from the ongoing shift of advertising budgets from offline to online channels. Advertisers continue to be attracted to Trade Desk’s transparent, data-driven alternative to the dominant search and social media companies. The accelerating adoption of streaming video has definitively changed the advertising landscape and Trade Desk’s leadership in Connected TV and a redesigned software platform should enable the company to capitalize on the opportunity.

Detractors:

BioMarin Pharmaceutical Inc. (BMRN):

Leading biotech company with established products and a pipeline focused on discovering, researching, and commercializing first-to-market treatments for life-threatening rare diseases and medical conditions. Management and investors were surprised and disappointed by new guidance from the FDA which included a request for additional data on the company’s most meaningful pipeline product; potentially delaying approval and commercial launch by two years. The position was sold due to the increasingly binary nature of clinical trial outcomes and lack of transparency around the ultimate timeline for approval.

Alteryx, Inc. (AYX):

Founder-led analytics software provider cited elongated sales cycles, smaller than average deal sizes, and “less favorable” business trends as reasons for tepid Q3 2020 results and full year 2020 guidance. The company struggled to onboard new sales hires amid COVID-19 lockdowns and experienced sales and marketing productivity declines, as prospective customers focused on operational continuity projects, not data science initiatives. Given management’s belief that soft performance will likely continue until 2021, the position was sold for better growth alternatives.

EverQuote, Inc. (EVER):

Founder-led digital insurance marketplace positioned to capture share of growing insurance carrier sales and online spending. The announced acquisition of a direct-to-consumer health insurance agency overshadowed positive fundamental results and guidance in Q3 2020, as investors contemplated the business and financial model implications. The sudden and unfortunate passing of the company’s Co-Founder/CEO in late November 2020 led to further uncertainty and the position was sold for higher conviction holdings.

Zevenbergen Genea Fund:

Similar to the Growth Fund, the Genea Fund benefited from strong fundamental growth in innovative, technology-driven companies. Tesla, Inc. was also a top contributor for the period, in addition to investments in industrials (financial technology) and real estate. Alteryx, Inc. and EverQuote, Inc. were also detractors to performance as well as financials (cryptocurrency trading).

Contributors:

Please see Growth Fund commentary for discussion on Tesla, Inc.

Zillow Group, Inc. (ZG):

Founder-led real estate information and services provider, giving consumers transparency and tools to buy, rent, and sell homes. Extended work-from-home mandates led many individuals to re-evaluate their living situations. For large swaths of the American population, the home is no longer just a place to eat and sleep, but where one works, lives, learns, and plays. This shift in utility, along with favorable mortgage rates, contributed to record traffic on Zillow’s website and mobile app. After an operational pause early in 2020, Zillow resumed its Offers business (home buying program), which adds a fast-growing revenue source and allows it to participate in multiple areas of a real estate transaction.

Square, Inc. (SQ):

Founder-led commerce and consumer finance platform, empowering economic participation for entrepreneurs and individuals. In response to the difficult retail environment, Square supported its merchant customers through contactless functionality, such as curbside pickup and online shopping, while reinvigorated mainstream interest in Bitcoin led to strong engagement for Cash App. Longer term, additional investments in Cash App, omnichannel solutions and international markets could help Square become the preferred financial platform for individuals and sellers in the digital age.

Detractors:

Please see Growth Fund commentary for discussions on Alteryx, Inc., and EverQuote, Inc.

Coinbase Global, Inc. (COIN):

Founder-led financial technology company operating the largest U.S. platform for cryptocurrency trading and custody. Cryptocurrencies (or crypto, for short) are digital mediums of exchange and stores of value secured by complex cryptography (encoded data) offering security, anonymity and independence from central authorities to transaction participants. Earning transaction and subscription fees, Coinbase serves as a trusted digital asset service provider (zero reported security breaches since 2012 founding) and provides equity investors exposure to the rapidly evolving, yet relatively nascent, crypto industry. Following the company’s April 2021 direct public listing, shares reflected volatility in underlying crypto prices.

Manager Perspective:

Given the stellar gains in U.S. stocks over the twelve months ended June 30, 2021, investors with a cynical view have been trying in vain to predict when stock prices would start falling in earnest. While there is no perfect historical comparison that can be used as a road map for future market performance, we are reminded of a lesson learned from the pandemic: the world is rapidly changing. The continuous evolution and widespread adoption of technology are helping a multitude of industries, allowing users and enterprises to connect, create and achieve more than what was previously thought possible. We believe this is the key to future resilience and growth, and the bigger risk may be overestimating the significance of negatives and underestimating the magnitude of positives.

In health and prosperity.

Zevenbergen Capital Investments Portfolio Management Team

|

|

|

Brooke de Boutray, CFA, CIC |

|

|

|

|

Joe Dennison, CFA |

|

|

|

|

Leslie Tubbs, CFA, CIC |

|

|

|

|

Anthony Zackery, CFA |

|

|

|

|

Nancy Zevenbergen, CFA, CIC |

|

Past performance is no guarantee of future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of fund holdings.

Russell 3000® Growth Index: A market capitalization weighted index based on the Russell 3000® Index. The Russell 3000® Growth Index includes companies that display signs of above average growth. The Index is used to provide a gauge of the performance of growth stocks in the U.S. One cannot invest directly in an index.

Mutual fund investing involves risk, including the loss of principal. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Non-diversified funds may hold a significant percentage of their assets in the securities of fewer companies and therefore events affecting those companies have a greater impact on the funds than on a diversified fund. If the Funds invest in a few sectors they may have increased exposure to price movements of those sectors. Small and medium capitalization companies tend to have limited liquidity and greater price volatility than large capitalization companies.

Performance Summary

June 30, 2021 (Unaudited)

Comparison of a Hypothetical $50,000 Investment

in the Zevenbergen Growth Fund - Institutional Class

and Russell 3000® Growth Index

Investment Returns

For the Periods Ended June 30, 2021

|

|

One Year |

|

Three Year* |

|

Five Year* |

|

Since Inception* |

|

Zevenbergen Growth Fund ** |

|

|

|

|

|

|

|

|

Investor Class |

47.22% |

|

37.84% |

|

36.42% |

|

28.29% |

|

Institutional Class |

47.63%*** |

|

38.20% |

|

36.78% |

|

28.62% |

|

Russell 3000® Growth Index |

42.99% |

|

24.47% |

|

23.31% |

|

20.74% |

|

* |

Annualized. |

|

** |

Inception date on August 31, 2015. |

| *** | Returns are based on unadjusted net asset values and differ from returns shown in Financial Highlights which include adjustments in accordance with GAAP. |

Zevenbergen Genea Fund

Performance Summary

June 30, 2021 (Unaudited)

Comparison of a Hypothetical $50,000 Investment

in the Zevenbergen Genea Fund - Institutional Class

and Russell 3000® Growth Index

Investment Returns

For the Periods Ended June 30, 2021

|

|

One Year |

|

Three Year* |

|

Five Year* |

|

Since Inception* |

|

Zevenbergen Genea Fund ** |

|

|

|

|

|

|

|

|

Investor Class |

69.27%*** |

|

39.68% |

|

43.20% |

|

34.61% |

|

Institutional Class |

69.80%*** |

|

40.01% |

|

43.59% |

|

34.95% |

|

Russell 3000® Growth Index |

42.99% |

|

24.47% |

|

23.31% |

|

20.74% |

| |

* |

Annualized. |

| |

** |

Inception date on August 31, 2015. |

| *** | Returns are based on unadjusted net asset values and differ from returns shown in Financial Highlights which include adjustments in accordance with GAAP. |

Allocation of Portfolio Holdings

(Calculated as a percentage of Total Investments)

June 30, 2021 (Unaudited)

|

* |

Short-Term Investments consist of amounts held in money market funds. The Fund strategy does not seek to hold large cash balances (more than 5% of total investments), and any significant cash holdings are typically due to trade settlement timing. |

Zevenbergen Growth Fund

Schedule of Investments

As of June 30, 2021

|

Number of Shares |

|

|

|

|

Value |

|

||

|

|

|

|

COMMON STOCKS ― 98.7% |

|

|

|

|

|

|

|

|

|

CONSUMER DISCRETIONARY ― 35.6% |

|

|

|

|

|

|

16,675 |

|

|

Airbnb, Inc. (a) |

|

|

$ |

2,553,610 |

|

|

1,200 |

|

|

Amazon.com, Inc. (a) |

|

|

|

4,128,192 |

|

|

25,485 |

|

|

Chegg, Inc. (a) |

|

|

|

2,118,058 |

|

|

28,000 |

|

|

Chewy, Inc. (a) |

|

|

|

2,231,880 |

|

|

16,500 |

|

|

Coursera, Inc. (a) |

|

|

|

652,740 |

|

|

4,030 |

|

|

MercadoLibre, Inc. (a) |

|

|

|

6,277,894 |

|

|

5,500 |

|

|

Netflix, Inc. (a) |

|

|

|

2,905,155 |

|

|

24,700 |

|

|

Peloton Interactive, Inc. (a) |

|

|

|

3,063,294 |

|

|

13,200 |

|

|

Tesla, Inc. (a) |

|

|

|

8,972,040 |

|

|

91,000 |

|

|

The Trade Desk, Inc. (a) |

|

|

|

7,039,760 |

|

|

73,575 |

|

|

Uber Technologies, Inc. (a) |

|

|

|

3,687,579 |

|

|

|

|

|

|

|

|

|

43,630,202 |

|

|

|

|

|

FINANCIALS ― 3.8% |

|

|

|

|

|

|

3,950 |

|

|

Coinbase Global, Inc. (a) |

|

|

|

1,000,535 |

|

|

9,975 |

|

|

Goosehead Insurance, Inc. |

|

|

|

1,269,817 |

|

|

10,250 |

|

|

Lemonade, Inc. (a) |

|

|

|

1,121,453 |

|

|

11,500 |

|

|

Silvergate Capital Corporation (a) |

|

|

|

1,303,180 |

|

|

|

|

|

|

|

|

|

4,694,985 |

|

|

|

|

|

HEALTH CARE ― 13.4% |

|

|

|

|

|

|

23,350 |

|

|

Adaptive Biotechnologies Corporation (a) |

|

|

|

954,081 |

|

|

12,000 |

|

|

Castle Biosciences, Inc. (a) |

|

|

|

879,960 |

|

|

48,850 |

|

|

Exact Sciences Corporation (a) |

|

|

|

6,072,543 |

|

|

35,000 |

|

|

GoodRx Holdings, Inc. (a) |

|

|

|

1,260,350 |

|

|

7,225 |

|

|

Seagen Inc. (a) |

|

|

|

1,140,683 |

|

|

25,325 |

|

|

Teladoc Health, Inc. (a) |

|

|

|

4,211,294 |

|

|

6,050 |

|

|

Veeva Systems Inc. (a) |

|

|

|

1,881,248 |

|

|

|

|

|

|

|

|

|

16,400,159 |

|

|

|

|

|

INDUSTRIALS ― 7.6% |

|

|

|

|

|

|

22,600 |

|

|

Desktop Metal, Inc. (a) |

|

|

|

259,900 |

|

|

14,300 |

|

|

PayPal Holdings, Inc. (a) |

|

|

|

4,168,164 |

|

|

19,775 |

|

|

Square, Inc. (a) |

|

|

|

4,821,145 |

|

|

|

|

|

|

|

|

|

9,249,209 |

|

The accompanying notes are an integral part of these financial statements.

Zevenbergen Growth Fund

Schedule of Investments (Continued)

As of June 30, 2021

|

Number of Shares |

|

|

|

|

Value |

|

||

|

|

|

|

REAL ESTATE ― 3.6% |

|

|

|

|

|

|

36,200 |

|

|

Zillow Group, Inc. Class C (a) |

|

|

$ |

4,424,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TECHNOLOGY ― 33.5% |

|

|

|

|

|

|

2,315 |

|

|

Coupa Software Incorporated (a) |

|

|

|

606,785 |

|

|

4,450 |

|

|

Fiverr International Ltd. ― ADR (a) |

|

|

|

1,079,081 |

|

|

13,900 |

|

|

Global-e Online Ltd. ― ADR (a) |

|

|

|

793,412 |

|

|

8,000 |

|

|

NVIDIA Corporation |

|

|

|

6,400,800 |

|

|

17,275 |

|

|

Okta, Inc. (a) |

|

|

|

4,226,847 |

|

|

4,200 |

|

|

Sea Limited ― ADR (a) |

|

|

|

1,153,320 |

|

|

5,300 |

|

|

ServiceNow, Inc. (a) |

|

|

|

2,912,615 |

|

|

5,650 |

|

|

Shopify Inc. ― ADR (a) |

|

|

|

8,254,537 |

|

|

57,625 |

|

|

Snap Inc. (a) |

|

|

|

3,926,567 |

|

|

8,500 |

|

|

Snowflake Inc. (a) |

|

|

|

2,055,300 |

|

|

22,150 |

|

|

Sprout Social, Inc. (a) |

|

|

|

1,980,653 |

|

|

3,350 |

|

|

Twilio Inc. (a) |

|

|

|

1,320,436 |

|

|

8,500 |

|

|

UiPath, Inc. (a) |

|

|

|

577,405 |

|

|

24,400 |

|

|

Unity Software Inc. (a) |

|

|

|

2,679,852 |

|

|

7,800 |

|

|

Zoom Video Communications, Inc. (a) |

|

|

|

3,018,834 |

|

|

|

|

|

|

|

|

|

40,986,444 |

|

|

|

|

|

TELECOMMUNICATIONS ― 1.2% |

|

|

|

|

|

|

46,050 |

|

|

fuboTV Inc. (a) |

|

|

|

1,478,665 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMMON STOCKS |

|

|

|

|

|

|

|

|

|

(Cost $71,455,954) |

|

|

$ |

120,864,028 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHORT-TERM INVESTMENTS ― 0.9% |

|

|

|

|

|

|

1,081,861 |

|

|

First American U.S. Treasury Money Market Fund, Class Z, 0.06%(b) |

|

|

|

1,081,861 |

|

|

|

|

|

TOTAL SHORT-TERM INVESTMENTS (Cost $1,081,861) |

|

|

$ |

1,081,861 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS ― 99.6% (Cost $72,537,815) |

|

|

|

121,945,889 |

|

|

|

|

|

Other Assets in Excess of Liabilities ― 0.4% |

|

|

|

478,778 |

|

|

|

|

|

TOTAL NET ASSETS ― 100.0% |

|

|

$ |

122,424,667 |

|

| ADR: | American Depository Receipt. |

| (a): | Non Income Producing. |

| (b): | Variable rate security. The rate disclosed is the annualized seven-day effective yield as of June 30, 2021. |

The accompanying notes are an integral part of these financial statements.

Zevenbergen Growth Fund

Statement of Assets and Liabilities

June 30, 2021

|

Assets |

|

|

|

|

|

Investments in securities, at value (cost $72,537,815) |

|

$ |

121,945,889 |

|

|

Dividend and interest receivable |

|

|

1,281 |

|

|

Receivable for Fund shares sold |

|

|

1,252,021 |

|

|

Receivable for investments sold |

|

|

1,407,052 |

|

|

Prepaid expenses |

|

|

22,777 |

|

|

Total Assets |

|

|

124,629,020 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

Payable for Fund shares redeemed |

|

|

10,572 |

|

|

Payable for securities purchased |

|

|

1,950,232 |

|

|

Payable to Adviser |

|

|

136,234 |

|

|

Shareholder Service Fees |

|

|

23,256 |

|

|

Distribution fees - Investor Class |

|

|

13,710 |

|

|

Accrued other expenses and other liabilities |

|

|

70,349 |

|

|

Total Liabilities |

|

|

2,204,353 |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

122,424,667 |

|

|

|

|

|

|

|

|

Components of Net Assets |

|

|

|

|

|

Paid-in capital |

|

$ |

71,722,395 |

|

|

Total distributable earnings |

|

|

50,702,272 |

|

|

Net Assets |

|

$ |

122,424,667 |

|

|

|

|

|

|

|

|

Investor Class: |

|

|

|

|

|

Net assets |

|

$ |

40,471,655 |

|

|

Shares outstanding (unlimited number of shares authorized, no par value) |

|

|

946,910 |

|

|

Net asset value, offering and redemption price per share * |

|

$ |

42.74 |

|

|

|

|

|

|

|

|

Institutional Class: |

|

|

|

|

|

Net assets |

|

$ |

81,953,012 |

|

|

Shares outstanding (unlimited number of shares authorized, no par value) |

|

|

1,888,696 |

|

|

Net asset value, offering and redemption price per share * |

|

$ |

43.39 |

|

* Shares redeemed or exchanged within 90 days of purchase are charged a 1.00% redemption fee (Note 9).

The accompanying notes are an integral part of these financial statements.

Zevenbergen Growth Fund

Statement of Operations

For the Year Ended June 30, 2021

|

Investment Income |

|

|

|

|

|

Dividends and interest income |

|

$ |

52,462 |

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

Advisory fees |

|

|

806,382 |

|

|

Administration fees (Note 3) |

|

|

124,117 |

|

|

Shareholder servicing fees (Note 6) |

|

|

119,656 |

|

|

Distribution fees - Investor Class |

|

|

94,289 |

|

|

Transfer agent fees and expenses (Note 3) |

|

|

55,450 |

|

|

Registration fees |

|

|

37,624 |

|

|

Legal fees |

|

|

29,310 |

|

|

Custody fees (Note 3) |

|

|

17,863 |

|

|

Trustees’ fees |

|

|

17,548 |

|

|

Audit fees |

|

|

15,695 |

|

|

Compliance fees (Note 3) |

|

|

12,680 |

|

|

Shareholder reporting fees |

|

|

5,205 |

|

|

Miscellaneous expenses |

|

|

4,758 |

|

|

Insurance fees |

|

|

2,919 |

|

|

Total expenses |

|

|

1,343,496 |

|

|

Expenses waived by the Adviser (Note 3) |

|

|

(222,372 |

) |

|

Net Expenses |

|

|

1,121,124 |

|

|

|

|

|

|

|

|

Net Investment Loss |

|

|

(1,068,662 |

) |

|

|

|

|

|

|

|

Realized and Unrealized Gain on Investments |

|

|

|

|

|

Net realized gain on investments |

|

|

2,557,399 |

|

|

Change in unrealized appreciation on investments |

|

|

26,632,067 |

|

|

Net Realized and Unrealized Gain on Investments |

|

|

29,189,466 |

|

|

|

|

|

|

|

|

Net Increase in Net Assets from Operations |

|

$ |

28,120,804 |

|

The accompanying notes are an integral part of these financial statements.

| Zevenbergen Growth Fund |

| Statements of Changes in Net Assets |

| Operations | For the Year Ended June 30, 2021 |

For the Year Ended June 30, 2020 |

||||||

| Net investment loss | $ | (1,068,662 | ) | $ | (272,739 | ) | ||

| Net realized gain (loss) on investments | 2,557,399 | (499,239 | ) | |||||

| Net change in unrealized appreciation on investments | 26,632,067 | 15,723,445 | ||||||

| Net Increase in Net Assets from Operations | 28,120,804 | 14,951,467 | ||||||

| Distributions to shareholders from | ||||||||

| Net realized gain on investments | ||||||||

| Investor Class | (28,529 | ) | — | |||||

| Institutional Class | (44,887 | ) | — | |||||

| Total distributions to shareholders | (73,416 | ) | — | |||||

| Capital Transactions | ||||||||

| Proceeds from shares sold | ||||||||

| Investor Class | 43,165,174 | 13,574,932 | ||||||

| Institutional Class | 52,153,468 | 15,697,643 | ||||||

| Proceeds from shares reinvested | ||||||||

| Investor Class | 28,457 | — | ||||||

| Institutional Class | 44,273 | — | ||||||

| Cost of shares redeemed | ||||||||

| Investor Class | (30,756,770 | ) | (3,969,298 | ) | ||||

| Institutional Class | (26,179,707 | ) | (3,633,206 | ) | ||||

| Redemption fees | ||||||||

| Investor Class | 49,185 | 7,748 | ||||||

| Institutional Class | 80,175 | 17,169 | ||||||

| Net Increase in Net Assets from Capital Share Transactions | 38,584,255 | 21,694,988 | ||||||

| Total Increase in Net Assets | 66,631,643 | 36,646,455 | ||||||

| Net Assets | ||||||||

| Beginning of year | 55,793,024 | 19,146,569 | ||||||

| End of year | $ | 122,424,667 | $ | 55,793,024 | ||||

| Capital Shares Transactions | ||||||||

| Investor Class | ||||||||

| Shares sold | 1,100,673 | 601,012 | ||||||

| Shares reinvested | 631 | — | ||||||

| Shares redeemed | (790,935 | ) | (199,182 | ) | ||||

| Net increase in shares outstanding | 310,369 | 401,830 | ||||||

| Institutional Class | ||||||||

| Shares sold | 1,321,445 | 672,998 | ||||||

| Shares reinvested | 968 | — | ||||||

| Shares redeemed | (702,266 | ) | (169,981 | ) | ||||

| Net increase in shares outstanding | 620,147 | 503,017 | ||||||

The accompanying notes are an integral part of these financial statements.

| Zevenbergen Growth Fund |

| Financial Highlights |

| Investor Class |

For a Capital Share Outstanding Throughout Each Year Presented:

| For the Year Ended June 30, 2021 |

For the Year Ended June 30, 2020 |

For the Year Ended June 30, 2019 |

For the Year Ended June 30, 2018 |

For the Year Ended June 30, 2017 |

||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 29.05 | $ | 19.00 | $ | 16.33 | $ | 12.27 | $ | 9.05 | ||||||||||

| Gain (Loss) from Investment Operations: | ||||||||||||||||||||

| Net investment loss (1) | (0.49 | ) | (0.27 | ) | (0.20 | ) | (0.17 | ) | (0.13 | ) | ||||||||||

| Net realized and unrealized gain on investments | 14.16 | 10.30 | 2.85 | 4.22 | 3.35 | |||||||||||||||

| Total Gain from Investment Operations | 13.67 | 10.03 | 2.65 | 4.05 | 3.22 | |||||||||||||||

| Less Distributions: | (0.03 | ) | — | — | — | — | ||||||||||||||

| Redemption Fee Proceeds (1) | 0.05 | 0.02 | 0.02 | 0.01 | — | |||||||||||||||

| Net Asset Value, End of Year | $ | 42.74 | $ | 29.05 | $ | 19.00 | $ | 16.33 | $ | 12.27 | ||||||||||

| Total Return | 47.22 | % | 52.89 | % | 16.35 | % | 33.09 | % | 35.58 | % | ||||||||||

| Supplemental Data and Ratios: | ||||||||||||||||||||

| Net assets, end of year (in thousands) | $ | 40,472 | $ | 18,492 | $ | 4,460 | $ | 1,292 | $ | 194 | ||||||||||

| Ratio of expenses to average net assets | ||||||||||||||||||||

| Before fees waived and reimbursed by the Adviser | 1.52 | % | 2.14 | % | 2.78 | % | 3.63 | % | 5.89 | % | ||||||||||

| After fees waived and reimbursed by the Adviser | 1.30 | % | 1.30 | % | 1.30 | % | 1.30 | % | 1.30 | % | ||||||||||

| Ratio of net investment loss to average net assets | ||||||||||||||||||||

| Before fees waived and reimbursed by the Adviser | -1.47 | % | -2.12 | % | -2.69 | % | -3.53 | % | -5.76 | % | ||||||||||

| After fees waived and reimbursed by the Adviser | -1.25 | % | -1.28 | % | -1.21 | % | -1.20 | % | -1.17 | % | ||||||||||

| Portfolio turnover rate (2) | 43.12 | % | 38.74 | % | 28.68 | % | 31.12 | % | 25.90 | % | ||||||||||

| (1) | Per share amounts have been calculated using the average shares method |

| (2) | Portfolio turnover rate is calculated for the Fund without distinguishing between classes. |

The accompanying notes are an integral part of these financial statements.

| Zevenbergen Growth Fund |

| Financial Highlights |

| Institutional Class |

For a Capital Share Outstanding Throughout Each Year Presented:

| For the Year Ended June 30, 2021 |

For the Year Ended June 30, 2020 |

For the Year Ended June 30, 2019 |

For the Year Ended June 30, 2018 |

For the Year Ended June 30, 2017 |

||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 29.40 | $ | 19.18 | $ | 16.45 | $ | 12.33 | $ | 9.07 | ||||||||||

| Gain (Loss) from Investment Operations: | ||||||||||||||||||||

| Net investment loss (1) | (0.37 | ) | (0.20 | ) | (0.15 | ) | (0.13 | ) | (0.09 | ) | ||||||||||

| Net realized and unrealized gain on investments | 14.34 | 10.40 | 2.87 | 4.24 | 3.35 | |||||||||||||||

| Total Gain from Investment Operations | 13.97 | 10.20 | 2.72 | 4.11 | 3.26 | |||||||||||||||

| Less Distributions: | (0.03 | ) | — | — | — | — | ||||||||||||||

| Redemption Fee Proceeds (1) | 0.05 | 0.02 | 0.01 | 0.01 | — | * |

||||||||||||||

| Net Asset Value, End of Year | $ | 43.39 | $ | 29.40 | $ | 19.18 | $ | 16.45 | $ | 12.33 | ||||||||||

| Total Return | 47.68 | % | 53.28 | % | 16.60 | % | 33.41 | % | 35.94 | % | ||||||||||

| Supplemental Data and Ratios: | ||||||||||||||||||||

| Net assets, end of year (in thousands) | $ | 81,953 | $ | 37,302 | $ | 14,686 | $ | 10,970 | $ | 6,427 | ||||||||||

| Ratio of expenses to average net assets | ||||||||||||||||||||

| Before fees waived and reimbursed by the Adviser | 1.22 | % | 1.90 | % | 2.52 | % | 3.55 | % | 5.86 | % | ||||||||||

| After fees waived and reimbursed by the Adviser | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Ratio of net investment loss to average net assets | ||||||||||||||||||||

| Before fees waived and reimbursed by the Adviser | -1.17 | % | -1.88 | % | -2.43 | % | -3.45 | % | -5.72 | % | ||||||||||

| After fees waived and reimbursed by the Adviser | -0.95 | % | -0.98 | % | -0.91 | % | -0.90 | % | -0.87 | % | ||||||||||

| Portfolio turnover rate (2) | 43.12 | % | 38.74 | % | 28.68 | % | 31.12 | % | 25.90 | % | ||||||||||

| * | Less than $0.01 per share |

| (1) | Per share amounts have been calculated using the average shares method |

| (2) | Portfolio turnover rate is calculated for the Fund without distinguishing between classes. |

The accompanying notes are an integral part of these financial statements.

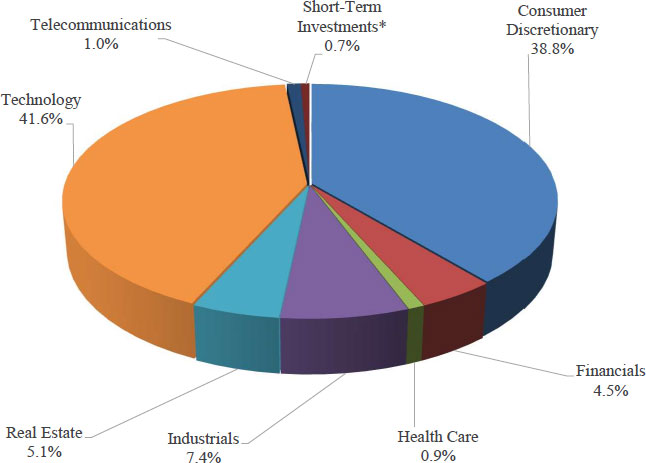

| Zevenbergen Genea Fund |

| Allocation of Portfolio Holdings |

| (Calculated as a percentage of Total Investments) |

| June 30, 2021 (Unaudited) |

| * | Short-Term Investments consist of amounts held in money market funds. The Fund strategy does not seek to hold large cash balances (more than 5% of total investments), and any significant cash holdings are typically due to trade settlement timing. |

| Zevenbergen Genea Fund |

| Schedule of Investments |

| As of June 30, 2021 |

| Number of | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS ― 99.3% | ||||||||

| CONSUMER DISCRETIONARY ― 38.8% | ||||||||

| 31,202 | Airbnb, Inc. (a) | $ | 4,778,274 | |||||

| 2,520 | Amazon.com, Inc. (a) | 8,669,203 | ||||||

| 65,850 | Chegg, Inc. (a) | 5,472,793 | ||||||

| 55,500 | Chewy, Inc. (a) | 4,423,905 | ||||||

| 37,100 | Coursera, Inc. (a) | 1,467,676 | ||||||

| 7,575 | MercadoLibre, Inc. (a) | 11,800,259 | ||||||

| 8,500 | Netflix, Inc. (a) | 4,489,785 | ||||||

| 57,250 | Peloton Interactive, Inc. (a) | 7,100,145 | ||||||

| 42,425 | Poshmark, Inc. (a) | 2,025,370 | ||||||

| 26,205 | Tesla, Inc. (a) | 17,811,539 | ||||||

| 176,400 | The Trade Desk, Inc. (a) | 13,646,304 | ||||||

| 139,400 | Uber Technologies, Inc. (a) | 6,986,728 | ||||||

| 88,671,981 | ||||||||

| FINANCIALS ― 4.5% | ||||||||

| 12,000 | Coinbase Global, Inc. (a) | 3,039,600 | ||||||

| 45,815 | Lemonade, Inc. (a) | 5,012,619 | ||||||

| 18,900 | Silvergate Capital Corporation (a) | 2,141,748 | ||||||

| 10,193,967 | ||||||||

| HEALTH CARE ― 0.9% | ||||||||

| 65,500 | Green Thumb Industries Inc. ― ADR (a) | 2,161,500 | ||||||

| INDUSTRIALS ― 7.4% | ||||||||

| 19,830 | Axon Enterprise, Inc. (a) | 3,505,944 | ||||||

| 21,600 | Bill.com Holdings, Inc. (a) | 3,956,688 | ||||||

| 38,300 | Square, Inc. (a) | 9,337,540 | ||||||

| 16,800,172 | ||||||||

| REAL ESTATE ― 5.1% | ||||||||

| 94,615 | Zillow Group, Inc. Class C (a) | 11,563,845 | ||||||

| TECHNOLOGY ― 41.6% | ||||||||

| 39,900 | Bumble Inc. (a) | 2,298,240 | ||||||

| 9,830 | Coupa Software Incorporated (a) | 2,576,541 | ||||||

| 10,860 | Datadog, Inc. (a) | 1,130,309 | ||||||

| 39,750 | Global-e Online Ltd. ― ADR (a) | 2,268,930 | ||||||

| 17,240 | MongoDB, Inc. (a) | 6,232,605 | ||||||

| 14,525 | NVIDIA Corporation | 11,621,452 | ||||||

| 24,575 | Okta, Inc. (a) | 6,013,011 | ||||||

| 47,591 | Olo Inc. (a) | 1,779,427 | ||||||

The accompanying notes are an integral part of these financial statements.

| Zevenbergen Genea Fund |

| Schedule of Investments (Continued) |

| As of June 30, 2021 |

| Number of | ||||||||

| Shares | Value | |||||||

| TECHNOLOGY ― 41.6% (Continued) | ||||||||

| 82,030 | Pinterest, Inc. (a) | $ | 6,476,269 | |||||

| 9,500 | Shopify Inc. (a) | 13,879,310 | ||||||

| 123,800 | Snap Inc. (a) | 8,435,732 | ||||||

| 23,800 | Snowflake Inc. (a) | 5,754,840 | ||||||

| 42,540 | Sprout Social, Inc. (a) | 3,803,927 | ||||||

| 19,350 | Twilio Inc. (a) | 7,626,996 | ||||||

| 24,300 | UiPath, Inc. (a) | 1,650,699 | ||||||

| 46,000 | Unity Software Inc. (a) | 5,052,180 | ||||||

| 21,000 | Zoom Video Communications, Inc. (a) | 8,127,630 | ||||||

| 94,728,098 | ||||||||

| TELECOMMUNICATIONS ― 1.0% | ||||||||

| 74,100 | fuboTV Inc. (a) | 2,379,352 | ||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $152,428,981) | $ | 226,498,915 | ||||||

| SHORT-TERM INVESTMENTS ― 0.7% | ||||||||

| 1,496,779 | First American U.S. Treasury Money Market Fund, Class Z, 0.06%(b) | 1,496,779 | ||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $1,496,779) | $ | 1,496,779 | ||||||

| TOTAL INVESTMENTS ― 100.0% (Cost $153,925,760) | 227,995,694 | |||||||

| Liabilities in Excess of Other Assets ― 0.0% | (98,064 | ) | ||||||

| TOTAL NET ASSETS ― 100.0% | $ | 227,897,630 | ||||||

| ADR: | American Depository Receipt. |

| (a): | Non Income Producing. |

| (b): | Variable rate security. The rate disclosed is the annualized seven-day effective yield as of June 30, 2021. |

The accompanying notes are an integral part of these financial statements.

|

Zevenbergen Genea Fund |

|

June 30, 2021 |

|

Assets |

|

|

|

|

|

Investments in securities, at value (cost $153,925,760) |

|

$ |

227,995,694 |

|

|

Receivable for Fund shares sold |

|

|

671,952 |

|

|

Receivable for investments sold |

|

|

1,312,329 |

|

|

Dividends and Interest receivable |

|

|

2,277 |

|

|

Prepaid expenses |

|

|

35,214 |

|

|

Total Assets |

|

|

230,017,466 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

Payable for Fund shares redeemed |

|

|

89,639 |

|

|

Payable for securities purchased |

|

|

1,495,736 |

|

|

Payable to Adviser |

|

|

350,932 |

|

|

Shareholder Service Fees |

|

|

51,535 |

|

|

Distribution fees - Investor Class |

|

|

56,691 |

|

|

Accrued other expenses and other liabilities |

|

|

75,303 |

|

|

Total Liabilities |

|

|

2,119,836 |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

227,897,630 |

|

|

|

|

|

|

|

|

Components of Net Assets |

|

|

|

|

|

Paid-in capital |

|

$ |

158,434,120 |

|

|

Total distributable earnings |

|

|

69,463,510 |

|

|

Net Assets |

|

$ |

227,897,630 |

|

|

|

|

|

|

|

|

Investor Class: |

|

|

|

|

|

Net assets |

|

$ |

120,715,711 |

|

|

Shares outstanding (unlimited number of shares authorized, no par value) |

|

|

2,140,332 |

|

|

Net asset value, offering and redemption price per share * |

|

$ |

56.40 |

|

|

|

|

|

|

|

|

Institutional Class: |

|

|

|

|

|

Net assets |

|

$ |

107,181,919 |

|

|

Shares outstanding (unlimited number of shares authorized, no par value) |

|

|

1,872,478 |

|

|

Net asset value, offering and redemption price per share * |

|

$ |

57.24 |

|

* Shares redeemed or exchanged within 90 days of purchase are charged a 1.00% redemption fee (Note 9).

The accompanying notes are an integral part of these financial statements.

|

Zevenbergen Genea Fund |

|

For the Year Ended June 30, 2021 |

|

Investment Income |

|

|

|

|

|

Dividends and interest income |

|

$ |

8,832 |

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

Advisory fees |

|

|

1,359,261 |

|

|

Distribution fees - Investor Class |

|

|

218,645 |

|

|

Shareholder servicing fees (Note 6) |

|

|

200,677 |

|

|

Administration fees (Note 3) |

|

|

119,624 |

|

|

Transfer agent fees and expenses (Note 3) |

|

|

61,075 |

|

|

Registration fees |

|

|

42,620 |

|

|

Legal fees |

|

|

32,289 |

|

|

Trustees’ fees |

|

|

16,956 |

|

|

Custody fees (Note 3) |

|

|

16,176 |

|

|

Audit fees |

|

|

15,695 |

|

|

Compliance fees (Note 3) |

|

|

11,683 |

|

|

Shareholder reporting fees |

|

|

9,125 |

|

|

Miscellaneous expenses |

|

|

6,846 |

|

|

Insurance fees |

|

|

3,196 |

|

|

Total expenses |

|

|

2,113,868 |

|

|

Expenses waived by the Adviser (Note 3) |

|

|

(178,337 |

) |

|

|

|

|

||

|

Net Expenses |

|

|

1,935,531 |

|

|

|

|

|

|

|

|

Net Investment Loss |

|

|

(1,926,699 |

) |

|

|

|

|

|

|

|

Realized and Unrealized Gain on Investments |

|

|

|

|

|

Net realized gain on investments |

|

|

229,375 |

|

|

Change in unrealized appreciation on investments |

|

|

45,466,313 |

|

|

Net Realized and Unrealized Gain on Investments |

|

|

45,695,688 |

|

|

|

|

|

|

|

|

Net Increase in Net Assets from Operations |

|

$ |

43,768,989 |

|

The accompanying notes are an integral part of these financial statements.

|

Zevenbergen Genea Fund |

|

|

|

For the Year |

|

|

For the Year |

|

||

|

Operations |

|

June 30, 2021 |

|

|

June 30, 2020 |

|

||

|

Net investment loss |

|

$ |

(1,926,699 |

) |

|

$ |

(503,696 |

) |

|

Net realized gain (loss) on investments |

|

|

229,375 |

|

|

|

(2,559,382 |

) |

|

Net change in unrealized appreciation on investments |

|

|

45,466,313 |

|

|

|

17,999,600 |

|

|

Net Increase in Net Assets from Operations |

|

|

43,768,989 |

|

|

|

14,936,522 |

|

|

|

|

|

|

|

|

|

|

|

|

Capital Transactions |

|

|

|

|

|

|

|

|

|

Proceeds from shares sold |

|

|

|

|

|

|

|

|

|

Investor Class |

|

|

123,929,435 |

|

|

|

13,742,698 |

|

|

Institutional Class |

|

|

93,591,974 |

|

|

|

6,071,493 |

|

|

Cost of shares redeemed |

|

|

|

|

|

|

|

|

|

Investor Class |

|

|

(61,416,630 |

) |

|

|

(17,810,000 |

) |

|

Institutional Class |

|

|

(30,234,551 |

) |

|

|

(4,320,587 |

) |

|

Redemption fees |

|

|

|

|

|

|

|

|

|

Investor Class |

|

|

176,080 |

|

|

|

12,696 |

|

|

Institutional Class |

|

|

140,670 |

|

|

|

10,340 |

|

|

Net Increase/(Decrease) in Net Assets from Capital Share Transactions |

|

|

126,186,978 |

|

|

|

(2,293,360 |

) |

|

|

|

|

|

|

||||

|

Total Increase in Net Assets |

|

|

169,955,967 |

|

|

|

12,643,162 |

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets |

|

|

|

|

|

|

|

|

|

Beginning of year |

|

|

57,941,663 |

|

|

|

45,298,501 |

|

|

End of year |

|

$ |

227,897,630 |

|

|

$ |

57,941,663 |

|

|

|

|

|

|

|

|

|

|

|

|

Capital Shares Transactions |

|

|

|

|

|

|

|

|

|

Investor Class |

|

|

|

|

|

|

|

|

|

Shares sold |

|

|

2,373,277 |

|

|

|

544,623 |

|

|

Shares reinvested |

|

|

— |

|

|

|

— |

|

|

Shares redeemed |

|

|

(1,215,594 |

) |

|

|

(815,815 |

) |

|

Net increase/(decrease) in shares outstanding |

|

|

1,157,683 |

|

|

|

(271,192 |

) |

|

|

|

|

|

|

|

|

|

|

|

Institutional Class |

|

|

|

|

|

|

|

|

|

Shares sold |

|

|

1,715,120 |

|

|

|

248,310 |

|

|

Shares reinvested |

|

|

— |

|

|

|

— |

|

|

Shares redeemed |

|

|

(588,952 |

) |

|

|

(201,126 |

) |

|

Net increase in shares outstanding |

|

|

1,126,168 |

|

|

|

47,184 |

|

The accompanying notes are an integral part of these financial statements.

For a Capital Share Outstanding Throughout Each Year Presented:

|

|

|

For the Year |

|

|

For the Year |

|

|

For the Year |

|

|

For the Year |

|

|

For the Year |

|

|||||

|

Net Asset Value, Beginning of Year |

|

$ |

33.34 |

|

|

$ |

23.12 |

|

|

$ |

20.77 |

|

|

$ |

14.20 |

|

|

$ |

9.40 |

|

|

Gain (Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment loss (1) |

|

|

(0.69 |

) |

|

|

(0.32 |

) |

|

|

(0.29 |

) |

|

|

(0.23 |

) |

|

|

(0.16 |

) |

|

Net realized and unrealized gain on investments |

|

|

23.65 |

|

|

|

10.53 |

|

|

|

2.68 |

|

|

|

6.79 |

|

|

|

4.96 |

|

|

Total Gain from Investment Operations |

|

|

22.96 |

|

|

|

10.21 |

|

|

|

2.39 |

|

|

|

6.56 |

|

|

|

4.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less Distributions: |

|

|

— |

|

|

|

— |

|

|

|

(0.06 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption Fee Proceeds (1) |

|

|

0.10 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

|

— |

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Asset Value, End of Year |

|

$ |

56.40 |

|

|

$ |

33.34 |

|

|

$ |

23.12 |

|

|

$ |

20.77 |

|

|

$ |

14.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return |

|

|

69.17 |

% |

|

|

44.20 |

% |

|

|

11.72 |

% |

|

|

46.27 |

% |

|

|

51.06 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Data and Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of year (in thousands) |

|

$ |

120,716 |

|

|

$ |

32,763 |

|

|

$ |

28,986 |

|

|

$ |

12,633 |

|

|

$ |

2,074 |

|

|

Ratio of expenses to average net assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before fees waived and reimbursed by the Adviser |

|

|

1.48 |

% |

|

|

1.98 |

% |

|

|

2.09 |

% |

|

|

3.35 |

% |

|

|

7.96 |

% |

|

After fees waived and reimbursed by the Adviser |

|

|

1.37 |

% |

|

|

1.40 |

% |

|

|

1.40 |

% |

|

|

1.40 |

% |

|

|

1.40 |

% |

|

Ratio of net investment loss to average net assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before fees waived and reimbursed by the Adviser |

|

|

-1.47 |

% |

|

|

-1.96 |

% |

|

|

-2.04 |

% |

|

|

-3.27 |

% |

|

|

-7.89 |

% |

|

After fees waived and reimbursed by the Adviser |

|

|

-1.36 |

% |

|

|

-1.38 |

% |

|

|

-1.35 |

% |

|

|

-1.32 |

% |

|

|

-1.33 |

% |

|

Portfolio turnover rate (2) |

|

|

32.40 |

% |

|

|

61.63 |

% |

|

|

35.25 |

% |

|

|

22.35 |

% |

|

|

67.59 |

% |

|

* |

Less than $0.01 per share |

|

(1) |

Per share amounts have been calculated using the average shares method |

|

(2) |

Portfolio turnover rate is calculated for the Fund without distinguishing between classes. |

The accompanying notes are an integral part of these financial statements.

|

Zevenbergen Genea Fund |

For a Capital Share Outstanding Throughout Each Year Presented:

|

|

|

For the Year |

|

|

For the Year |

|

|

For the Year |

|

|

For the Year |

|

|

For the Year |

|

|||||

|

Net Asset Value, Beginning of Year |

|

$ |

33.74 |

|

|

$ |

23.33 |

|

|

$ |

20.93 |

|

|

$ |

14.30 |

|

|

$ |

9.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain (Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment loss (1) |

|

|

(0.54 |

) |

|

|

(0.25 |

) |

|

|

(0.22 |

) |

|

|

(0.18 |

) |

|

|

(0.12 |

) |

|

Net realized and unrealized gain on investments |

|

|

23.94 |

|

|

|

10.65 |

|

|

|

2.66 |

|

|

|

6.80 |

|

|

|

4.99 |

|

|

Total Gain from Investment Operations |

|

|

23.40 |

|

|

|

10.40 |

|

|

|

2.44 |

|

|

|

6.62 |

|

|

|

4.87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less Distributions: |

|

|

— |

|

|

|

— |

|

|

|

(0.06 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption Fee Proceeds (1) |

|

|

0.10 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net Asset Value, End of Year |

|

$ |

57.24 |

|

|

$ |

33.74 |

|

|

$ |

23.33 |

|

|

$ |

20.93 |

|

|

$ |

14.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return |

|

|

69.65 |

% |

|

|

44.62 |

% |

|

|

11.87 |

% |

|

|

46.36 |

% |

|

|

51.97 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Data and Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of year (in thousands) |

|

$ |

107,182 |

|

|

$ |

25,179 |

|

|

$ |

16,312 |

|

|

$ |

9,073 |

|

|

$ |

3,669 |

|

|

Ratio of expenses to average net assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before fees waived and reimbursed by the Adviser |

|

|

1.18 |

% |

|

|

1.70 |

% |

|

|

1.80 |

% |

|

|

3.21 |

% |

|

|

8.08 |

% |

|

After fees waived and reimbursed by the Adviser |

|

|

1.07 |

% |

|

|

1.10 |

% |

|

|

1.10 |

% |

|

|

1.10 |

% |

|

|

1.10 |

% |

|

Ratio of net investment loss to average net assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before fees waived and reimbursed by the Adviser |

|

|

-1.17 |

% |

|

|

-1.68 |

% |

|

|

-1.75 |

% |

|

|

-3.14 |

% |

|

|

-8.02 |

% |

|

After fees waived and reimbursed by the Adviser |

|

|

-1.06 |

% |

|

|

-1.08 |

% |

|

|

-1.05 |

% |

|

|

-1.03 |

% |

|

|

-1.04 |

% |

|

Portfolio turnover rate (2) |

|

|

32.40 |

% |

|

|

61.63 |

% |

|

|

35.25 |

% |

|

|

22.35 |

% |

|

|

67.59 |

% |

|

(1) |

Per share amounts have been calculated using the average shares method |

|

(2) |

Portfolio turnover rate is calculated for the Fund without distinguishing between classes. |

The accompanying notes are an integral part of these financial statements.

Zevenbergen Funds

Notes to the Financial Statements

June 30, 2021

NOTE 1 – ORGANIZATION

Zevenbergen Growth Fund (the “Growth Fund”) and Zevenbergen Genea Fund (the “Genea Fund”; each a “Fund” collectively the “Funds”) are non-diversified series of Trust for Advised Portfolios (the “Trust”). The Trust, a Delaware Statutory Trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end management investment company. Zevenbergen Capital Investments LLC (the “Adviser”) serves as the investment manager to the Funds. The inception date of the Funds was August 31, 2015. The Funds’ investment objective is long-term capital appreciation.

Growth Fund and Genea Fund, each, currently offer two classes of shares, Institutional Class and Investor Class. Each share class represents an equal interest in the Fund, except the difference of class specific expenses, which reflects the difference in the range of services provided to each class. Income, expenses (other than class specific), and realized and unrealized gains and losses on investments are allocated daily to each class based on relative net assets.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds in preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for investment companies. Each Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The presentation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the period. Actual results may differ from those estimates.

A. Securities Valuation

The Funds follow a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Funds’ own market assumptions (unobservable inputs). The inputs or methodology used in determining the value of each Fund’s investments are not necessarily an indication of the risk associated with investing in those securities.

Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized into three broad categories as defined below:

Level 1 - Quoted prices in active markets for identical securities. An active market for a security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3 - Significant unobservable inputs, including the Funds’ own assumptions in determining fair value of investments.

Equity securities that are traded on a national securities exchange are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized as Level 1 of the fair value hierarchy.

Short-term investments classified as money market instruments are valued at NAV. These investments are categorized as Level 1 of the fair value hierarchy.

Zevenbergen Funds

Notes to the Financial Statements (Continued)

June 30, 2021

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (Continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the fair values of the Funds’ investments in each category investment type as of June 30, 2021:

Growth Fund

|

Description |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks |

|

$ |

120,864,028 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

120,864,028 |

|

|

Short-Term Investments |

|

|

1,081,861 |

|

|

|

— |

|

|

|

— |

|

|

|

1,081,861 |

|

|

Total Assets |

|

$ |

121,945,889 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

121,945,889 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Genea Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description |

|

|

Level 1 |

|

|

|

Level 2 |

|

|

|

Level 3 |

|

|

|

Total |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks |

$ |

226,498,915 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

226,498,915 |

|

|

|

Short-Term Investments |

|

|

1,496,779 |

|

|

|

— |

|

|

|

— |

|

|

|

1,496,779 |

|

|

Total Assets |

|

$ |

227,995,694 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

227,995,694 |

|

Please refer to the Schedule of Investments for further classification.

B. Security Transactions, Investment Income and Distributions

The Funds record security transactions based on trade date. Realized gains and losses on sales of securities are calculated by comparing the original cost of the specifically identified security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date, and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Trust’s understanding of the applicable country’s tax rules and rates.

C. Federal Income Taxes

The Funds have elected to be taxed as Regulated Investment Companies (“RIC”) under the U.S. Internal Revenue Code of 1986, as amended, and intend to maintain this qualification and to distribute substantially all of their net taxable income to their shareholders. Therefore, no provision is made for federal income taxes. Due to the timing of dividend distributions (if any) and the differences in accounting for income and realized gains and losses for financial statement and federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains and losses are recorded by the Funds.

Management of the Funds is required to analyze all open tax years, as defined by IRS statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of and during the period ended June 30, 2021, the Funds did not have a liability for any unrecognized tax benefits. Generally, tax authorities can examine tax returns filed for the preceding three years. The Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Zevenbergen Funds

Notes to the Financial Statements (Continued)

June 30, 2021

NOTE 3 – INVESTMENT MANAGEMENT AGREEMENT AND OTHER RELATED PARTY TRANSACTIONS

The Trust entered into an agreement for the Adviser to furnish investment advisory services to the Funds. Under the terms of this agreement, Growth Fund and Genea Fund will pay the Adviser a monthly fee based on each Fund’s average daily net assets at the annual rate of 0.80%.

Effective April 1, 2021, the advisory fee of the Zevenbergen Genea Fund decreased from 0.90% to 0.80%, and the limits on total annual fund operating expenses decreased from 1.25% to 1.15% for the Fund’s Investor Class and from 1.00% to 0.90% for the Fund’s Institutional Class shares as detailed in the following section.

The Adviser has contractually agreed to waive its management fee and/or reimburse each Fund’s operating expenses (excluding shareholder servicing fees, any front-end or contingent deferred loads, taxes, leverage interest, brokerage commissions, acquired fund fees and expenses, merger or reorganization-related expenses, portfolio transaction expenses, interest expense and dividends paid on short sales, and extraordinary expenses) to ensure they do not exceed, on an annual basis, the expense limitations, expressed as a percentage rate of the average daily net assets of each Fund, listed below. Waivers or reimbursements are calculated daily and settled monthly or quarterly in conjunction with each Fund’s payment of advisory fees.

|

Fund |

Investor Class |

Institutional Class |

|

Growth Fund |

1.15% |

0.90% |

|

Genea Fund |

1.15% |

0.90% |

See Note 6 – Shareholder Servicing Plan for shareholder servicing fees charged in addition to fees outlined in this table.

The Adviser is permitted to recapture amounts waived and/or reimbursed to a class within three years if the class’s total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. However, in no case will the Adviser recapture any amount that would result, on any particular business day of the Funds, in the class’s total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

At June 30, 2021, the expenses reimbursed and contractual fees waived by the Adviser and subject to potential recapture by period were as follows:

|

Fiscal Year waived/reimbursed |

|

Growth Fund |

|

|

Genea Fund |

|

|

Expiration |

|

|||

|

FYE June 30, 2019 |

|

$ |

227,826 |

|

|

$ |

224,757 |

|

|

|

June 30, 2022 |

|

|

FYE June 30, 2020 |

|

|

230,107 |

|

|

|

236,776 |

|

|

|

June 30, 2023 |

|

|

FYE June 30, 2021 |

|

|

222,372 |

|

|

|

178,337 |

|

|

|

June 30, 2024 |

|

|

|

|

$ |

680,305 |

|

|

$ |

639,870 |

|

|

|

|

|

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”), serves as the Funds’ administrator, fund accountant, and transfer agent. The officers of the Trust are employees of Fund Services. U.S. Bank serves as the Funds’ custodian and provides compliance services to the Funds. For the year ended June 30, 2021, the Funds incurred the following expenses for administration and fund accounting, custody, transfer agent and compliance fees:

|

|

|

Growth Fund |

|

|

Genea Fund |

|

||

|

Administration |

|

$ |

124,117 |

|

|

$ |

119,624 |

|

|

Custody |

|

|

17,863 |

|

|

|

16,176 |

|

|

Transfer Agency |

|

|

55,450 |

|

|

|

61,075 |

|

|

Chief Compliance Officer |

|

|

12,680 |

|

|

|

11,683 |

|

Zevenbergen Funds

Notes to the Financial Statements (Continued)

June 30, 2021

At June 30, 2021, the Funds had payables due to Fund Services and its affiliates for administration and fund accounting, custody, transfer agent and compliance fees in the following amounts:

|

|

|

Growth Fund |

|

|

Genea Fund |

|

||

|

Administration |

|

$ |

24,110 |

|

|

$ |

21,187 |

|

|

Custody |

|

|

5,521 |

|

|

|

2,878 |

|

|

Transfer Agency |

|

|

13,925 |

|

|

|

15,672 |

|

|

Chief Compliance Officer |

|

|

3,204 |

|

|

|

3,219 |

|

The above payable amounts are included in the Accrued other expenses and other liabilities line item in the Statement of Assets and Liabilities.

The Independent Trustees were paid $34,504 for their services to the Funds during the year ended June 30, 2021. No compensation is paid directly by the Funds to the Interested Trustee or officers of the Trust.

NOTE 4 – INVESTMENT TRANSACTIONS

Purchases and sales of investment securities (excluding short-term investments) for each Fund for the year ended June 30, 2021, were as follows:

|

Growth Fund |

|

|

|

|

|

Purchases |

|

$ |

79,037,774 |

|

|

Sales |

|

$ |

42,899,999 |

|

|

|

|

|

|

|

|

Genea Fund |

|

|

|

|

|

Purchases |

|

$ |

173,288,076 |

|

|

Sales |

|

$ |

50,112,496 |

|

NOTE 5 – FEDERAL INCOME TAX INFORMATION

At June 30, 2021, the components of distributable earnings for income tax purposes were as follows:

|

|

|

Growth Fund |

|

|

Genea Fund |

|

||

|

|

|

|