Form N-CSR TRUST FOR PROFESSIONAL For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(513) 629-8104

Registrant's telephone number, including area code

Date of fiscal year end: September 30, 2021

Date of reporting period: September 30, 2021

Item 1. Reports to Stockholders.

(a)

Annual Report

September 30, 2021

CrossingBridge Low Duration High Yield Fund

Institutional Class

(CBLDX)

CrossingBridge Responsible Credit Fund

Institutional Class

(CBRDX)

CrossingBridge Ultra-Short Duration Fund

Institutional Class

(CBUDX)

CrossingBridge Pre-Merger SPAC ETF

(SPC)

Investment Adviser

CrossingBridge Advisors, LLC

427 Bedford Road

Suite 230

Pleasantville, New York 10570

Phone: 1-888-898-2780

Table of Contents

|

MANAGEMENT’S DISCUSSION OF

|

|||

|

FUND PERFORMANCE AND ANALYSIS

|

3

|

||

|

EXPENSE EXAMPLE

|

14

|

||

|

INVESTMENT HIGHLIGHTS

|

16

|

||

|

SCHEDULES OF INVESTMENTS

|

24

|

||

|

STATEMENTS OF ASSETS AND LIABILITIES

|

47

|

||

|

STATEMENTS OF OPERATIONS

|

49

|

||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

51

|

||

|

FINANCIAL HIGHLIGHTS

|

54

|

||

|

NOTES TO FINANCIAL STATEMENTS

|

59

|

||

|

REPORT OF INDEPENDENT REGISTERED

|

|||

|

PUBLIC ACCOUNTING FIRM

|

78

|

||

|

BASIS FOR TRUSTEES’ APPROVAL OF

|

|||

|

INVESTMENT ADVISORY AGREEMENTS

|

80

|

||

|

REVIEW OF LIQUIDITY RISK MANAGEMENT PROGRAM

|

91

|

||

|

ADDITIONAL INFORMATION

|

92

|

||

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Low Duration High Yield Fund

(Unaudited)

The 2021 fiscal year for the CrossingBridge Low Duration High Yield Fund (CBLDX; the “Fund”) covers the twelve-month period of October 1, 2020 through September 30, 2021. During this period, the Fund gained 9.13% on

its Institutional Class shares while the ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index gained 10.85%, the ICE BofA 1-3 Year U.S. Corporate Bond Index gained 1.28% and the ICE BofA 0-3 Year U.S. Treasury Index gained 0.06%.

Monthly investment results for the fiscal year ranged from -0.42% in October 2020 to 1.69% in January 2021. The Fund generated positive returns for eleven out of the twelve months during the fiscal year. The median

monthly return for the period was 0.49% with an annualized standard deviation of 2.46%.

The Fund had positive contributions from interest income and had realized and unrealized gains during the period. 100% of the income was distributed for a 1-year dividend yield of 3.90%. The Fund’s subsidized 30 day

SEC yield was 2.23% and unsubsidized 30 day SEC yield was 2.24%. The total return for the period was higher as the NAV increased from $9.86 on September 30, 2020 to $10.36 on September 30, 2021.

We believe the opportunity set for the CrossingBridge Low Duration High Yield Fund was very attractive during the fiscal year:

|

•

|

The strong mergers and acquisitions environment led to various event-driven opportunities

|

|

•

|

Special purpose acquisition companies offered one of the most attractive risk/reward opportunities in today’s market and our exposure continues to grow

|

|

•

|

Core buy & hold and cushion bonds positions performed well

|

High Yield Spread Per Unit of Leverage (SPL) and

% of High Yield Bonds that are Trading to Call

High Yield Credit Chartbook, Bank of America, July 1, 2021 and 1Q21 High Yield and Loan Fundamentals, Morgan Stanley, July 6, 2021

3

The historically low interest rate policy (sometimes referred to as “the Fed put”) and the highly anticipated rebound in the economy have driven asset prices to new heights as investors fear missing out. As illustrated

above, the portion of the high yield market trading at a yield-to-call rate is at a 20+ year high as capital markets are wide open and any CFO who can refinance debt at a lower rate is taking advantage of the market. Concurrently, investors have

become more complacent in their required compensation for credit risk. As shown above, the high yield spread per unit of leverage has fallen to match the lows seen over the last 20 years. In such an environment, it is as important as ever to be a

“bottom up” credit-specific investor. The good news is that the universe of investment candidates is growing as turbocharged investment bankers feed the market with refinancings, mergers & acquisitions and market access for first-time debt

issuers. Moreover, the series of massive government stimulus packages and the policies of the Federal Reserve have permitted the U.S. economy to rebound rapidly, producing economic growth not seen since the 1950’s. Looking forward, we believe the

opportunity set remains very favorable for the Fund and we believe we are well-positioned to capitalize on it.

The Fund purchases below investment grade debt as part of its core strategy. Deemed speculative in nature by credit rating agencies because of elevated balance sheet leverage, the asset class has a greater potential

for defaults and credit losses than government and investment grade debt. However, we believe our “bottom-up” research approach significantly mitigates this risk.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Diversification does not assure a profit nor protect against risk in a declining market.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments for complete Fund holdings.

*Definitions: The ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index (HSNF) tracks the performance of short maturity U.S. dollar denominated below investment grade

rating (based on an average of Moody’s, S&P, and Fitch), at least 18 months to final maturity at the time of issuance, at least one month but less than three years remaining term to final maturity as of the rebalancing date, a fixed coupon

schedule and minimum amount outstanding of $250 million. The ICE BofA 1-3 Year U.S. Corporate Bond Index (C1A0) is a subset of the ICE BofA U.S. Corporate Bond Index including all securities with a remaining

term to final maturity less than three years. The ICE BofA 0-3 Year U.S. Treasury Index (G1QA) tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its

domestic market with maturities less than three years. Standard Deviation is a statistical measure that is used to quantify the amount of variation or dispersion of a set of data values. Duration is the weighted average of the present value of the cash flows and is used as a measure of a bond price’s response to changes in yield. Rising interest rates mean falling bond prices, while declining

interest rates mean rising bond prices. Dividend Yield expresses a percentage of a current share price. SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission

(SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the

fund’s expenses. It is also referred to as the “standardized yield.” Basis Point is one hundredth of one percent.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences

4

in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and

non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may invest

in exchange-traded funds (“ETFs”) and exchange-traded notes (“ETNs”), which are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s and ETN’s shares may trade at a discount

to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact the Fund’s ability to sell the shares. The value of ETNs may be

influenced by the level of supply and demand for the ETN, volatility and lack of liquidity. The Fund may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency

exchange rate. Derivatives can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in asset-backed, mortgage-backed, and

collateralized mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The

Fund invests in equity securities and warrants of special purpose acquisition companies (“SPACs”). Pre-combination SPACs have no operating history or ongoing business other than seeking a merger, share exchange, asset acquisition, share purchase

negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no guarantee that the

SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in U.S. government securities, money market

securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have

sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not support such a

Combination. Some SPACs may pursue Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada,

the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social,

and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign withholding taxes. Smaller

capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business

combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

5

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Responsible Credit Fund

(Unaudited)

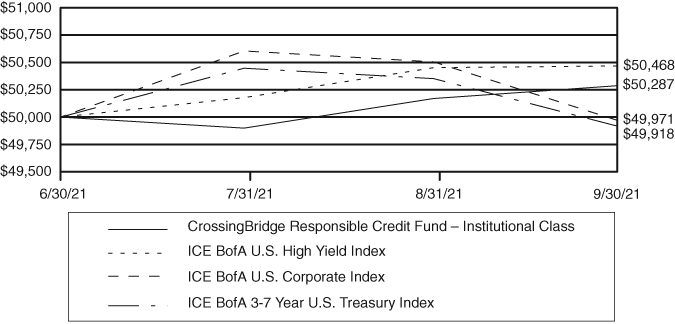

The 2021 fiscal period for the CrossingBridge Responsible Credit Fund (CBRDX; the “Fund”) covers the three-month period of June 30, 2021 (commencement of investment operations) through September 30, 2021. During this

period, the Fund gained 0.57% on its Institutional Class shares while the ICE BofA U.S. High Yield Index gained 0.94%, the ICE BofA U.S. Corporate Index lost 0.06% and the ICE BofA 3-7 Year U.S. Treasury Index lost 0.16%.

Monthly investment results for the fiscal period ranged from -0.20% in July 2021 to 0.54% in August 2021. The Fund generated positive returns for two out of the three months during the fiscal period. The median

monthly return for the period was 0.23%.

The Fund had positive contributions from interest income and had realized capital losses and unrealized gains during the period. The total return for the period was higher as the NAV increased from $10.00 on June 30,

2021 to $10.01 on September 30, 2021.

According to J.P. Morgan, European corporate debt issuers actively pursuing environmental, social and governance (ESG) principals are often rewarded with a lower cost of capital whereas the same phenomenon is not yet

prevalent in the U.S. This appears, to us, to be another market mis-pricing and future opportunity.

Industrial BBB Credit Spreads vs. ESG Scores

Oceans Apart – Assessing the ESG Cost of Debt in Global Credit, J.P. Morgan, June 9, 2021

The graph above illustrates the difference in the pricing of ESG-sensitive credit in Europe versus the U.S. credit spreads. BBB1 quality

European credits with higher ESG scores tend to have lower credit spreads. This sharply contrasts with the U.S. where the credit spreads of BBB credits do not appear to be correlated to the ESG score, and counterintuitively, the credits with the

best ESG scores in the U.S. yield 14 basis points more than those with lower scores. Although we respect the objectives of ESG-mindful companies and the discipline required to execute these elements, credit quality must also be taken into account

when determining the appropriate spread.

|

1

|

Ratings given by a rating agency such as S&P or Moody’s.

|

6

Many consider the Nordic financial markets as leaders in adopting ESG principles and standardization as well as a model to observe investor behavior. As one of the largest U.S. investors in the Nordic corporate credit

market, we have witnessed firsthand the tightening in credit spreads for ESG-friendly companies when investors emphasized adherence to ESG standards.

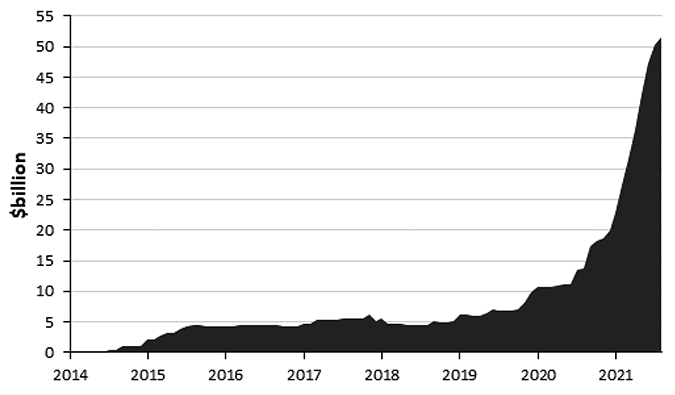

ESG Global HY Issuance

The Sustainable Finance Movement, Deutsche Bank, June 7, 2021

Globally, ESG equity funds have grown from $299 billion at the end of 2017 to approximately $1.6 trillion in August 2021, a cumulative annual growth rate of approximately 67%. However, the global fixed income market

has been slower to adopt ESG strategies with assets growing from approximately $350 billion in early 2018 to an estimated $500 billion in early 2021 for a cumulative average growth rate of less than 13%. As shown above, growth of global high yield

issuance of ESG bonds has been robust over the last two years, although the issuance amount has been quite small relative to the whole high yield market. Generally, the U.S. has lagged Europe in ESG adoption, and the ESG-friendly high yield debt

market is even further behind and in the early stages. We are hopeful that ESG standardization and independent scoring will encourage broader mindfulness among corporate issuers rather than simply be a catalyst for one-off “green” projects. Then, we

believe the market should boom.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

The Fund is non-diversified under the 1940 act, therefore allowing the Fund to be more concentrated than a diversified fund. Because the Fund is non-diversified it may invest a greater percentage of

its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, a decline in the value of an investment in a single issuer could cause the Fund’s overall value to decline to a greater

degree than if the Fund held a more diversified portfolio. Current fund statistics may not be indicative of future positioning.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments for complete Fund holdings.

7

Definitions: The ICE BofA U.S. High Yield Index (H0A0) tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S.

domestic market. The ICE BofA U.S. Corporate Index (C0A0) tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market. The ICE BofA 3-7 Year U.S. Treasury Index (G30C) is a subset of ICE BofA U.S. Treasury Index including all securities with a remaining term to final maturity greater than or equal to 3 years and less than 7 years.

Basis Point is one hundredth of one percent.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting

methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to

principal and interest than higher-rated securities. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund’s focus on sustainability considerations (ESG criteria) may limit

the number of investment opportunities available to the Fund, and as a result, at times, the Fund may underperform funds that are not subject to similar investment considerations. The Fund invests in equity securities of special purpose acquisition

companies (“SPACs”), which raise assets to seek potential business combination opportunities. Unless and until a business combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash.

Because SPACs have no operating history or ongoing business other than seeking a business combination, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable business

combination. There is no guarantee that the SPACs in which the Fund invests will complete a business combination or that any business combination that is completed will be profitable. The Fund is non-diversified meaning it may concentrate its assets

in fewer individual holdings than a diversified fund. The Fund invests in equity securities and warrants of SPACs. Pre-combination SPACs have no operating history or ongoing business other than seeking a merger, share exchange, asset acquisition,

share purchase negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no

guarantee that the SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in U.S. government

securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with the management of

the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not

support such a Combination. Some SPACs may pursue Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not

limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating

to political, social, and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign withholding

taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to

consummate a business combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

8

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Ultra-Short Duration Fund

(Unaudited)

The 2021 fiscal period for the CrossingBridge Ultra-Short Duration Fund (CBUDX; the “Fund”) covers the three-month period of June 30, 2021 (commencement of investment operations) through September 30, 2021. During

this period, the Fund gained 0.07% on its Institutional Class shares while the ICE BofA 0-1 Year U.S. Corporate Index gained 0.09%, the ICE BofA 0-1 Year U.S. Treasury Index gained 0.03% and the ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed

Securities Index gained 0.12%.

Monthly investment results for the fiscal period ranged from -0.09% in August 2021 to 0.11% in September 2021. The Fund generated positive returns for two out of the three months during the fiscal period. The median

monthly return for the period was 0.05%.

The Fund had positive contributions from interest income and had realized and unrealized gains during the period. The total return for the period was higher as the NAV increased from $10.00 on June 30, 2021 to $10.01

on September 30, 2021.

We launched the CrossingBridge Ultra-Short Duration Fund on June 30, 2021 to offer a solution for investors seeking ultra-short term fixed income allocations at “rock bottom” interest rates, while stressing

preservation of capital. The Fund was designed to compete in the Morningstar Ultra-Short Bond category which requires a minimum of 65% of the Fund be in investment grade bonds.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Diversification does not assure a profit nor protect against risk in a declining market.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments for complete Fund holdings.

*Definitions: The ICE BofA 0-1 Year U.S. Corporate Index (H540) tracks the performance of short-maturity U.S. dollar denominated investment grade corporate debt publicly issued

in the U.S. domestic market. The ICE BofA 0-1 Year U.S. Treasury Index (G0QA) tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market with

maturities less than a year. The ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed Securities Index (R1A0) is a subset of ICE BofA U.S. Fixed Rate Asset Backed Securities Index including all securities with an

average life less than 3 years. Duration is the weighted average of the present value of the cash flows and is used as a measure of a bond price’s response to changes in yield. Rising interest rates mean

falling bond prices, while declining interest rates mean rising bond prices.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting

methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to

principal and interest than higher-rated securities. The fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund invests in equity securities and warrants of special purpose

acquisition companies (“SPACs”). Pre-combination

9

SPACs have no operating history or ongoing business other than seeking a merger, share exchange, asset acquisition, share purchase negotiation or similar business combination (a “Combination”), and

the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no guarantee that the SPACs in which the Fund invests will complete a Combination or that

any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded

a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a

transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not support such a Combination. Some SPACs may pursue Combinations only within certain

industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in

SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences between U.S. and

foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which

they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

10

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Pre-Merger SPAC ETF

(Unaudited)

The 2021 fiscal period for the CrossingBridge Pre-Merger SPAC ETF (SPC; the “Fund”) covers the ten-day period of September 20, 2021 (commencement of investment operations) through September 30, 2021. During this

period, the Fund had a NAV return of 0.03% and a market return of 0.20% while the ICE BofA 0-3 Year U.S. Treasury Index lost 0.06%. The Fund had realized gains and unrealized losses during the period. The total return for the period was higher as

the share price increased from $20.00 on September 20, 2021 to $20.04 on September 30, 2021 while the NAV increased from $20.00 to $20.01 for the period.

During the COVID-19 pandemic, Special Purpose Acquisition Companies (SPACs) have evolved from a backwater niche to a bona fide stand-alone asset class1. We contend that SPACs purchased below trust value with the intent to hold them to liquidation or redeem upon a business combination (whichever happens sooner) are an attractive alternative to short-term fixed income

allocations. Please see the end of the letter for a brief primer on SPACs.

According to SPACinformer.com2, there are 461 SPACS with $134 billion of trust value seeking merger partners and 120 SPACs with $35

billion of capital with pending transactions at quarter-end.

Special Purpose Acquisition Companies (SPACs) Trust Value ($millions) and Yield to Liquidation Date (%) – October 1, 20213

The subset of SPACS with a yield to liquidation greater than 2.0%, referenced in the chart above, is comprised of 229 companies with $53.6 billion of trust value. As a group these SPACS had a 2.4% yield to liquidation

and time to liquidation of 1.1 years, which represents a 227-basis point spread to a comparable-maturity U.S. Treasury bond.4

________________

|

1

|

The SPAC market has grown from 59 SPACs raising $14.0 billion in 2019 to a cumulative 670 SPACs raising over $200 billion in 2020 and 2021 (year-to-date).

|

|

2

|

SPACinformer.com is an affiliate of CrossingBridge Advisors, LLC.

|

|

3

|

Per SPACinformer.com, as of 10/1/2021.

|

|

4

|

Computation is based on weighted average capital in trust.

|

11

Should a SPAC consummate a transaction substantially sooner than its liquidation date, the realized return will be significantly greater for investors that exercise the redemption right. For example, if all SPACs

currently seeking targets closed transactions within the next six months, the yield to redemption date will be in excess of 4.0%. Additional upside may occur should the market become enthusiastic about an announced deal and drive the stock price

above the trust value, allowing an exit through the sale of shares instead of redemption.

SPAC Primer

A special purpose acquisition company (SPAC) is a company with no commercial operations that raises money from investors through an IPO for the sole purpose of acquiring an existing private operating business within a

specific period of time (generally up to two years). SPACs are sometimes called “blank check companies” because, at the time of the IPO, investors do not know the business in which the sponsor will choose to invest, although the sponsor’s track

record of investment in certain industries or stated areas of interest may provide an indication. IPO proceeds are placed in a trust account, typically invested in U.S. government securities, money markets, and cash. This trust account is held for

the benefit of the SPAC’s common shareholders until it is used to fund a successful business combination, or until it is returned to investors once the SPAC is liquidated because it failed to consummate a merger. A unique feature of SPACs is that

SPAC common shareholders have the option to redeem their shares for their pro rata interest in the trust should the investor choose not to participate in the newly formed company. In many cases, the SPAC sponsor may overcollateralize the trust at the

time of the IPO, meaning that there is more money in the trust than the IPO proceeds raised with the excess cash held for the benefit of SPAC common shareholders in the event of redemption or liquidation. If SPAC common shares are purchased at or

below trust value, we believe the opportunity exists to earn an attractive yield to liquidation with minimal principal risk. As a result of the shareholder-friendly redemption feature of SPACs, should a SPAC successfully pursue a business

combination, an investor’s realized rate of return will likely be higher due to the shortened maturity of the security. Furthermore, the market’s positive reaction to a SPAC’s announcement of a business combination may result in equity upside above

the trust value.

SPACs are commonly issued at $10 per unit with a unit consisting of one share and a warrant or fraction of a warrant. The warrant allows its holder to purchase a specified amount of common stock at a specified price

for a specified time; typically, the exercise price is $11.50 and the warrant has 5 years until expiration. On average, 55-60 days following the IPO, SPAC unit holders may elect to separate their units into shares and warrants that will trade as

standalone securities. Some investors may sell the warrants to reduce their initial cost, thereby enhancing the yield to liquidation or yield to redemption. Other investors may choose to sell their SPAC common shares while keeping the warrants, in

essence creating a portfolio of long-term, out-of-the-money options of future business combinations. Some investors may simply choose to keep the units, or the combination of SPAC common shares and warrants, to replicate the characteristics of a

convertible bond.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

12

Diversification does not assure a profit nor protect against risk in a declining market.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments for complete Fund holdings.

*Definitions: The ICE BofA 0-3 Year U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic

market with maturities less than three years. Yield to Liquidation is similar to a bond’s Yield to Maturity, SPACs have a Yield to Liquidation/Redemption, which can be calculated using the Gross Spread and

Time to Liquidation. Basis Point is one hundredth of one percent. Out-of-the-money is if the underlying option price is trading below the strike price of the call, or a

put options underlying’s price is above the put’s strike price.

It is not possible to invest directly in an index.

Investing involves risk; Principal loss is possible. The Fund invests in equity securities and warrants of SPACs. Pre-combination SPACs have no operating history or ongoing business other than seeking a merger, share

exchange, asset acquisition, share purchase negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity's management to identify and complete a profitable

Combination. There is no guarantee that the SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in

U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with

the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public

stockholders do not support such a Combination. Some SPACs may pursue Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S.,

including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such

as risks relating to political, social, and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign

withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC

to consummate a business combination. Because the Fund is non-diversified it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, a decline

in the value of an investment in a single issuer could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio.

Must be preceded or accompanied by a prospectus.

Distributor: Foreside Fund Services, LLC.

13

CROSSINGBRIDGE FUNDS

Expense Example

(Unaudited)

As a shareholder of the CrossingBridge Low Duration High Yield Fund, CrossingBridge Responsible Credit Fund and CrossingBridge Ultra-Short Duration Fund, you incur two types of costs: (1) transaction costs and

(2) ongoing costs, including management fees, shareholder servicing plan fees and other Fund expenses. As a shareholder of the CrossingBridge Pre-Merger SPAC ETF, you incur two types of costs: (1) transaction costs, including brokerage commissions

paid on purchases and sales of the Fund’s shares, and (2) ongoing costs, including management fees of the Fund. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with

the ongoing costs of investing in other funds. The Example is based on an investment of $1,000 invested at the beginning of the respective period disclosed in the following table and held for the entire respective period disclosed in the following

table.

Actual Expenses

The first line under each Fund in the following table provides information about actual account values and actual expenses for each Fund. You may use the information in this line, together with the amount you invested,

to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled

“Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the following table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per

year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the

ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are

meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not

help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

14

CROSSINGBRIDGE FUNDS

Expense Example (Continued)

(Unaudited)

|

Beginning

|

Ending

|

|||

|

Annualized

|

Account Value

|

Account Value

|

Expenses

|

|

|

Expense

|

April 1,

|

September 30,

|

Paid During

|

|

|

Ratio

|

2021

|

2021

|

Period(1)

|

|

|

CrossingBridge Low

|

||||

|

Duration High Yield Fund

|

||||

|

Based on actual return

|

0.86%

|

$1,000.00

|

$1,031.70

|

$4.38

|

|

Based on hypothetical return

|

||||

|

(5% return before expenses)

|

0.86%

|

1,000.00

|

1,020.76

|

4.36

|

|

(1)

|

Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period (183 days), divided by 365 days to

reflect the six month period ended September 30, 2021.

|

|

Beginning

|

Ending

|

|||

|

Annualized

|

Account Value

|

Account Value

|

Expenses

|

|

|

Expense

|

June 30,

|

September 30,

|

Paid During

|

|

|

Ratio

|

2021(1)

|

2021

|

Period(2)

|

|

|

CrossingBridge

|

||||

|

Responsible Credit Fund

|

||||

|

Based on actual return

|

0.91%

|

1,000.00

|

1,005.70

|

2.30

|

|

Based on hypothetical return

|

||||

|

(5% return before expenses)

|

0.91%

|

1,000.00

|

1,010.42

|

2.33

|

|

CrossingBridge

|

||||

|

Ultra-Short Duration Fund

|

||||

|

Based on actual return

|

0.90%

|

1,000.00

|

1,000.70

|

2.27

|

|

Based on hypothetical return

|

||||

|

(5% return before expenses)

|

0.90%

|

1,000.00

|

1,010.45

|

2.31

|

|

(1)

|

Commencement of operations.

|

|

(2)

|

Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period (93 days), divided by 365 days to

reflect the period of June 30, 2021 through September 30, 2021.

|

|

Beginning

|

Ending

|

|||

|

Annualized

|

Account Value

|

Account Value

|

Expenses

|

|

|

Expense

|

September 20,

|

September 30,

|

Paid During

|

|

|

Ratio

|

2021(1)

|

2021

|

Period(2)

|

|

|

CrossingBridge

|

||||

|

Pre-Merger SPAC ETF

|

||||

|

Based on actual return

|

0.80%

|

1,000.00

|

1,000.30

|

0.22

|

|

Based on hypothetical return

|

||||

|

(5% return before expenses)

|

0.80%

|

1,000.00

|

1,001.27

|

0.24

|

|

(1)

|

Commencement of operations.

|

|

(2)

|

Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period (11 days), divided by 365 days to

reflect the period of September 20, 2021 through September 30, 2021.

|

15

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

Investment Highlights

(Unaudited)

The Fund seeks high current income and capital appreciation consistent with the preservation of capital using a low duration mandate. The allocation of portfolio holdings as of September 30, 2021 is as follows:

Allocation of Portfolio Holdings

(% of Investments)

|

*

|

Less than 0.05%.

|

Average Annual Total Returns as of September 30, 2021

|

One

|

Three

|

Since

|

|

|

Year

|

Years

|

February 1, 20181

|

|

|

Institutional Class Shares

|

9.13%

|

4.52%

|

4.24%

|

|

ICE BofA 0-3 Year U.S. High Yield

|

|||

|

Excluding Financials Index

|

10.85%

|

4.58%

|

4.75%

|

|

ICE BofA 0-3 Year U.S. Treasury Index

|

0.06%

|

2.27%

|

2.07%

|

|

ICE BofA 1-3 Year U.S. Corporate Bond Index

|

1.28%

|

3.63%

|

3.24%

|

|

1

|

Commencement of investment operations.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when

redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-888-898-2780.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

16

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

Investment Highlights (Continued)

(Unaudited)

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates

performance of a hypothetical investment made in the Fund and the Fund’s primary benchmark index, the ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index, as well as other broad-based securities indices on the Fund’s inception date. The

graph does not reflect any future performance. ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index is a subset of ICE BofA 0-3 Year U.S. High Yield Index excluding sector level 2 Financial issuers. ICE BofA 0-3 Year U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market with maturities less than three years.

Qualifying securities must have at least 18 months to maturity at point of issuance, at least one month and less than three years remaining term to final maturity, a fixed coupon schedule and minimum amount outstanding of $1 billion. ICE BofA 1-3 Year U.S. Corporate Bond Index is a subset of ICE BofA U.S. Corporate Bond Index including all securities with a remaining term to final maturity less than 3 years. It is not possible to invest

directly in an index.

Growth of $50,000 Investment

|

*

|

Commencement of investment operations.

|

17

CROSSINGBRIDGE RESPONSIBLE CREDIT FUND

Investment Highlights

(Unaudited)

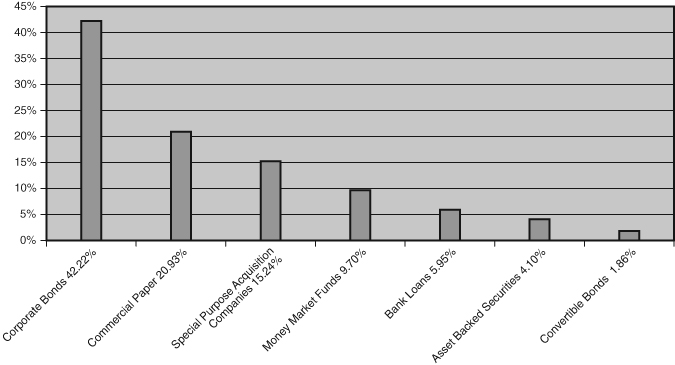

The Fund seeks high current income and capital appreciation consistent with the preservation of capital by investing in fixed income securities that meet the responsible investing criteria of the Fund’s investment

adviser. The allocation of portfolio holdings as of September 30, 2021 is as follows:

Allocation of Portfolio Holdings

(% of Investments)

Total Returns as of September 30, 2021

|

Since

|

|

|

June 30, 20211

|

|

|

Institutional Class Shares

|

0.57%

|

|

ICE BofA U.S. High Yield Index

|

0.94%

|

|

ICE BofA 3-7 Year U.S. Treasury Index

|

-0.16%

|

|

ICE BofA U.S. Corporate Index

|

-0.06%

|

|

1

|

Commencement of investment operations.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when

redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-898-2780.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

18

CROSSINGBRIDGE RESPONSIBLE CREDIT FUND

Investment Highlights (Continued)

(Unaudited)

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates

performance of a hypothetical investment made in the Fund and the Fund’s primary benchmark index, the ICE BofA U.S. High Yield Index, as well as other broad-based securities indices on the Fund’s inception date. ICE

BofA 3-7 Year U.S. Treasury Index measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than 3 years and less than or equal to 7 years. ICE BofA U.S.

Corporate Index is an unmanaged index comprised of U.S. dollar denominated investment grade, fixed rate corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity and at

least $250 million outstanding. ICE BofA U.S. High Yield Index is an unmanaged index that tracks the performance of U.S. dollar denominated, below investment-grade rated corporate debt publicly issued in the

U.S. domestic market. It is not possible to invest directly in an index.

Growth of $50,000 Investment

19

CROSSINGBRIDGE ULTRA-SHORT DURATION FUND

Investment Highlights

(Unaudited)

The Fund seeks to offer a higher yield than cash instruments while maintaining a low duration. The allocation of portfolio holdings as of September 30, 2021 is as follows:

Allocation of Portfolio Holdings

(% of Investments)

Total Returns as of September 30, 2021

|

Since

|

|

|

June 30, 20211

|

|

|

Institutional Class Shares

|

0.07%

|

|

ICE BofA 0-1 Year U.S. Corporate Index

|

0.09%

|

|

ICE BofA 0-1 Year U.S. Treasury Index

|

0.03%

|

|

ICE BofA 0-3 Year U.S. Fixed Rate

|

|

|

Asset Backed Securities Index

|

0.12%

|

|

1

|

Commencement of investment operations.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when

redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-898-2780.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

20

CROSSINGBRIDGE ULTRA-SHORT DURATION FUND

Investment Highlights (Continued)

(Unaudited)

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates

performance of a hypothetical investment made in the Fund and the Fund’s primary benchmark index, ICE BofA 0-1 Year U.S. Corporate Index, as well as other broad-based securities indices on the Fund’s inception date. ICE

BofA 0-1 Year U.S. Corporate Index is a subset of ICE BofA U.S. Corporate Bond Index including all securities with a remaining term to final maturity less than 1 year. ICE BofA 0-1 Year U.S. Treasury Index

tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market with maturities less than one year. ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed

Securities Index is a subset of ICE BofA U.S. Fixed Rate Asset Backed Securities Index including all securities with a remaining term to final maturity less than three years. It is not possible to invest directly in an index.

Growth of $50,000 Investment

21

CROSSINGBRIDGE PRE-MERGER SPAC ETF

Investment Highlights

(Unaudited)

The Fund seeks to provide total returns consistent with the preservation of capital. The allocation of portfolio holdings as of September 30, 2021 is as follows:

Allocation of Portfolio Holdings

(% of Investments)

Total Returns as of September 30, 2021

|

Since

|

|

|

September 20, 20211

|

|

|

Net Asset Value

|

0.03%

|

|

Market Value

|

0.20%

|

|

ICE BofA 0-3 Year U.S. Treasury Index

|

-0.06%

|

|

1

|

Commencement of investment operations.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when

redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-898-2780.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates

performance of a hypothetical investment made in the Fund and broad-based securities indices on the Fund’s inception date. The graph does not reflect any future performance. ICE BofA 0-3 Year U.S. Treasury Index tracks

the performance of U.S. dollar denominated sovereign debt publicly issued by the

22

CROSSINGBRIDGE PRE-MERGER SPAC ETF

Investment Highlights (Continued)

(Unaudited)

U.S. government in its domestic market with maturities less than three years. Qualifying securities must have at least 18 months to maturity at point of issuance, at least one month and less than three years remaining

term to final maturity, a fixed coupon schedule and minimum amount outstanding of $1 billion. It is not possible to invest directly in an index.

Growth of $10,000 Investment

23

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments

|

September 30, 2021

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

ASSET BACKED SECURITIES – 1.02%

|

||||||||

|

Finance and Insurance – 0.30%

|

||||||||

|

HTS Fund I LLC

|

||||||||

|

2021-1, 1.410%, 08/25/2036 (a)

|

1,000,000

|

$

|

999,961

|

|||||

|

Transportation and Warehousing – 0.72%

|

||||||||

|

Hawaiian Airlines 2013-1 Class B Pass Through Certificates

|

||||||||

|

2013-1, 4.950%, 07/15/2023

|

2,341,761

|

2,339,766

|

||||||

|

TOTAL ASSET BACKED SECURITIES (Cost $3,194,943)

|

3,339,727

|

|||||||

|

BANK LOANS – 20.95%

|

||||||||

|

Arts, Entertainment, and Recreation – 0.63%

|

||||||||

|

Golden Nugget

|

||||||||

|

13.000% (3 Month LIBOR + 12.000%), 10/04/2023 (b)

|

1,884,938

|

2,064,007

|

||||||

|

Construction – 0.25%

|

||||||||

|

Lealand Finance (McDermott)

|

||||||||

|

3.084% (1 Month Base Rate + 3.000%), 06/30/2024 (b)(d)

|

1,337,668

|

802,601

|

||||||

|

Finance and Insurance – 1.32%

|

||||||||

|

JZ Capital Partners Ltd.

|

||||||||

|

16.000% (3 Month LIBOR + 11.000% +

|

||||||||

|

4.000% PIK), 06/12/2022 (b)(d)(j)(k)

|

4,293,369

|

4,293,369

|

||||||

|

Health Care and Social Assistance – 0.77%

|

||||||||

|

Change Healthcare Holdings LLC

|

||||||||

|

3.500% (1 Month LIBOR + 2.500%), 03/01/2024 (b)

|

2,514,089

|

2,514,214

|

||||||

|

Information – 5.18%

|

||||||||

|

Gray Television, Inc.

|

||||||||

|

0.000%, 08/03/2022 (l)(m)

|

6,233,000

|

6,233,000

|

||||||

|

Intelsat Jackson Holdings SA

|

||||||||

|

8.000% (3 Month LIBOR + 3.750%), 11/27/2023 (b)(d)

|

825,000

|

837,375

|

||||||

|

8.625%, 01/02/2024 (d)

|

3,301,000

|

3,362,894

|

||||||

|

8.750% (3 Month LIBOR + 4.500%), 01/02/2024 (b)(d)

|

2,131,000

|

2,171,627

|

||||||

|

Meredith Corp.

|

||||||||

|

2.584% (1 Month LIBOR + 2.500%), 01/31/2025 (b)

|

4,318,000

|

4,313,056

|

||||||

|

16,917,952

|

||||||||

|

Manufacturing – 8.38%

|

||||||||

|

Forterra Finance LLC

|

||||||||

|

4.000% (1 Month LIBOR + 3.000%), 10/25/2023 (b)

|

4,185,492

|

4,188,108

|

||||||

The accompanying notes are an integral part of these financial statements.

24

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2021

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

BANK LOANS – 20.95% (CONTINUED)

|

||||||||

|

Manufacturing – 8.38% (Continued)

|

||||||||

|

K&N Parent, Inc.

|

||||||||

|

5.750% (3 Month LIBOR + 4.750%), 10/20/2023 (b)

|

4,401,072

|

$

|

4,228,704

|

|||||

|

LABL, Inc.

|

||||||||

|

4.084% (1 Month LIBOR + 4.000%), 07/02/2026 (b)

|

4,407,756

|

4,408,307

|

||||||

|

Mallinckrodt International

|

||||||||

|

4.382% (3 Month LIBOR + 2.250%), 02/28/2022 (b)

|

12,524,560

|

12,322,601

|

||||||

|

Pixelle Specialty Solutions

|

||||||||

|

7.500% (1 Month LIBOR + 6.500%), 10/31/2024 (b)

|

2,199,000

|

2,201,749

|

||||||

|

27,349,469

|

||||||||

|

Mining, Quarrying, and Oil and Gas Extraction – 1.36%

|

||||||||

|

Quarternorth Energy Holding, Inc.

|

||||||||

|

9.000% (Base Rate + 8.000%), 08/27/2026 (b)

|

4,419,985

|

4,447,610

|

||||||

|

Professional, Scientific, and Technical Services – 1.58%

|

||||||||

|

Parexel International Corp.

|

||||||||

|

2.834% (1 Month LIBOR + 2.750%), 09/27/2024 (b)

|

5,169,268

|

5,170,716

|

||||||

|

Transportation and Warehousing – 1.48%

|

||||||||

|

Syncreon Group BV

|

||||||||

|

7.000% (1 Month LIBOR + 6.000%), 04/01/2025 (b)(d)

|

4,824,000

|

4,878,270

|

||||||

|

TOTAL BANK LOANS (Cost $68,776,517)

|

68,438,208

|

|||||||

|

COMMERCIAL PAPER – 8.55%

|

||||||||

|

Manufacturing – 8.55%

|

||||||||

|

Conagra Brands, Inc.

|

||||||||

|

0.251%, 12/22/2021 (c)

|

5,418,000

|

5,414,153

|

||||||

|

Constellation Brands, Inc.

|

||||||||

|

0.170%, 10/08/2021 (c)

|

3,370,000

|

3,369,768

|

||||||

|

General Motors Financial Co, Inc.

|

||||||||

|

0.271%, 10/06/2021 (c)

|

4,136,000

|

4,135,825

|

||||||

|

0.320%, 11/22/2021 (c)

|

4,141,000

|

4,138,939

|

||||||

|

ITT, Inc.

|

||||||||

|

0.170%, 11/30/2021 (c)

|

2,096,000

|

2,094,629

|

||||||

|

Viatris, Inc.

|

||||||||

|

0.323%, 10/25/2021 (c)

|

3,870,000

|

3,869,038

|

||||||

|

0.365%, 11/19/2021 (c)

|

4,879,000

|

4,876,391

|

||||||

|

TOTAL COMMERCIAL PAPER (Cost $27,900,753)

|

27,898,743

|

|||||||

The accompanying notes are an integral part of these financial statements.

25

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2021

|

Number

|

||||||||

|

of Shares

|

Value

|

|||||||

|

COMMON STOCKS – 0.02%

|

||||||||

|

Mining, Quarrying, and Oil and Gas Extraction – 0.02%

|

||||||||

|

Superior Energy Services, Inc.

|

1,616

|

$

|

69,488

|

|||||

|

TOTAL COMMON STOCKS (Cost $2,117)

|

69,488

|

|||||||

|

Face

|

||||||||

|

Amount†

|

||||||||

|

CONVERTIBLE BONDS – 3.56%

|

||||||||

|

Information – 2.58%

|

||||||||

|

Buzzfeed, Inc.

|

||||||||

|

7.000%, 09/30/2026 (n)

|

4,900,000

|

—

|

||||||

|

DISH Network Corp.

|

||||||||

|

2.375%, 03/15/2024

|

5,229,000

|

5,114,616

|

||||||

|

UpHealth, Inc.

|

||||||||

|

6.250%, 06/15/2026 (a)

|

4,136,000

|

3,314,094

|

||||||

|

8,428,710

|

||||||||

|

Transportation and Warehousing – 0.98%

|

||||||||

|

Ship Finance International Ltd.

|

||||||||

|

5.750%, 10/15/2021 (d)

|

3,150,000

|

3,177,720

|

||||||

|

TOTAL CONVERTIBLE BONDS (Cost $12,352,483)

|

11,606,430

|

|||||||

|

CORPORATE BONDS – 43.91%

|

||||||||

|

Accommodation and Food Services – 0.56%

|

||||||||

|

Nathan’s Famous, Inc.

|

||||||||

|

6.625%, 11/01/2025 (a)

|

1,803,000

|

1,844,505

|

||||||

|

Administrative and Support and Waste

|

||||||||

|

Management and Remediation Services – 0.12%

|

||||||||

|

Lakers Holding AB

|

||||||||

|

5.960% (3 Month NIBOR + 5.500%), 06/09/2025 (b)(d)(e)

|

NOK 3,400,000

|

399,634

|

||||||

|

Arts, Entertainment, and Recreation – 0.13%

|

||||||||

|

Gaming Innovation Group PLC

|

||||||||

|

8.500% (3 Month STIBOR + 8.500%), 06/11/2024 (b)(d)(f)

|

SEK 3,500,000

|

411,184

|

||||||

|

Educational Services – 0.14%

|

||||||||

|

Hercules Achievement Inc / Varsity Brands Holding Co, Inc.

|

||||||||

|

9.000% (3 Month LIBOR + 8.000%), 12/22/2024 (a)(b)

|

473,000

|

473,816

|

||||||

The accompanying notes are an integral part of these financial statements.

26

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2021

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

CORPORATE BONDS – 43.91% (CONTINUED)

|

||||||||

|

Finance and Insurance – 3.53%

|

||||||||

|

Icahn Enterprises LP / Icahn Enterprises Finance Corp.

|

||||||||

|

6.750%, 02/01/2024

|

3,162,000

|

$

|

3,205,477

|

|||||

|

Nordic Capital Partners II AS

|

||||||||

|

6.800% (3 Month NIBOR + 6.250%), 06/30/2024 (b)(d)(e)

|

NOK 10,200,000

|

1,187,455

|

||||||

|

Stockwik Forvaltning AB

|

||||||||

|

7.000% (3 Month STIBOR + 7.000%), 09/03/2023 (b)(d)(f)

|

SEK 7,500,000

|

878,135

|

||||||

|

StoneX Group, Inc.

|

||||||||

|

8.625%, 06/15/2025 (a)

|

5,486,000

|

5,904,308

|

||||||

|

VNV Global Ltd.

|

||||||||

|

5.750%, 10/04/2022 (d)(f)

|

SEK 2,960,000

|

349,104

|

||||||

|

11,524,479

|

||||||||

|

Health Care and Social Assistance – 0.65%

|

||||||||

|

ADDvise Group AB

|

||||||||

|

7.250% (3 Month STIBOR + 7.250%), 05/21/2024 (b)(d)(f)

|

SEK 5,470,000

|

640,459

|

||||||

|

Surgery Center Holdings, Inc.

|

||||||||

|

6.750%, 07/01/2025 (a)

|

1,452,000

|

1,479,225

|

||||||

|

2,119,684

|

||||||||

|

Information – 16.91%

|

||||||||

|

Azerion Holding BV

|

||||||||

|

7.250%, 04/28/2024 (d)(g)

|

EUR 2,571,000

|

3,102,279

|

||||||

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

||||||||

|

4.000%, 03/01/2023 (a)

|

3,617,000

|

3,638,449

|

||||||

|

Cengage Learning, Inc.

|

||||||||

|

9.500%, 06/15/2024 (a)

|

4,959,000

|

5,082,479

|

||||||

|

CentralNic Group PLC

|

||||||||

|

7.000% (3 Month EURIBOR + 7.000%), 07/03/2023 (b)(d)(g)

|

EUR 943,000

|

1,133,282

|

||||||

|

Cogent Communications Group, Inc.

|

||||||||

|

5.375%, 03/01/2022 (a)

|

425,000

|

427,656

|

||||||

|

CSC Holdings LLC

|

||||||||

|

6.750%, 11/15/2021

|

11,540,000

|

11,583,275

|

||||||

|

INNOVATE Corp.

|

||||||||

|

8.500%, 02/01/2026 (a)

|

6,774,000

|

6,748,801

|

||||||

|

Linkem S.p.A.

|

||||||||

|

6.000% (3 Month EURIBOR + 6.000%), 08/09/2022 (a)(b)(d)(g)

|

EUR 5,917,000

|

6,853,933

|

||||||

|

Lumen Technologies, Inc.

|

||||||||

|

5.800%, 03/15/2022

|

6,076,000

|

6,199,039

|

||||||

|

Meredith Corp.

|

||||||||

|

6.500%, 07/01/2025

|

2,224,000

|

2,383,505

|

||||||

The accompanying notes are an integral part of these financial statements.

27

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2021

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

CORPORATE BONDS – 43.91% (CONTINUED)

|

||||||||

|

Information – 16.91% (Continued)

|

||||||||

|

Nielsen Co.

|

||||||||

|

5.000%, 02/01/2025 (a)(d)

|

3,796,000

|

$

|

3,890,900

|

|||||

|

NortonLifeLock, Inc.

|

||||||||

|

5.000%, 04/15/2025 (a)

|

391,000

|

397,721

|

||||||

|

Sprint Communications, Inc.

|

||||||||

|

11.500%, 11/15/2021

|

3,709,000

|

3,755,363

|

||||||

|

55,196,682

|

||||||||

|

Manufacturing – 9.64%

|

||||||||

|

Chobani LLC / Chobani Finance Corp, Inc.

|

||||||||

|

7.500%, 04/15/2025 (a)

|

5,194,000

|

5,410,849

|

||||||

|

Dell International LLC / EMC Corp.

|

||||||||

|

7.125%, 06/15/2024 (a)

|

9,013,000

|

9,229,312

|

||||||

|

EnPro Industries, Inc.

|

||||||||

|

5.750%, 10/15/2026

|

2,607,000

|

2,730,507

|

||||||

|

Fiven ASA

|

||||||||

|

6.850% (3 Month EURIBOR + 6.850%), 06/21/2024 (b)(d)(g)

|

EUR 3,160,000

|

3,784,606

|

||||||

|

Ford Motor Credit Co LLC

|

||||||||

|

0.999% (3 Month LIBOR + 0.880%), 10/12/2021 (b)

|

979,000

|

979,007

|

||||||

|

3.813%, 10/12/2021

|

6,653,000

|

6,664,643

|

||||||

|

LR Global Holding GmbH

|

||||||||

|

7.250% (3 Month EURIBOR + 7.250%), 02/03/2025 (b)(d)(g)

|

EUR 2,198,000

|

2,670,164

|

||||||

|

31,469,088

|

||||||||

|

Mining, Quarrying, and Oil and Gas Extraction – 1.51%

|

||||||||

|

Copper Mountain Mining Corp.

|

||||||||

|

8.000%, 04/09/2026 (d)

|

4,700,000

|

4,935,000

|

||||||

|

Professional, Scientific, and Technical Services – 3.90%

|

||||||||

|

C3 Nano, Inc.

|

||||||||

|

6.500%, 02/15/2024 (a)

|

630,000

|

636,407

|

||||||

|

Desenio Holding AB

|

||||||||

|

5.500% (3 Month STIBOR + 5.500%), 12/16/2024 (b)(d)(f)

|

SEK 2,500,000

|

292,139

|

||||||

|

Diebold Nixdorf, Inc.

|

||||||||

|

8.500%, 04/15/2024

|

3,448,000

|

3,527,252

|

||||||

|

Jaguar Holding Co II / PPD Development LP

|

||||||||

|

4.625%, 06/15/2025 (a)

|

7,969,000

|

8,287,760

|

||||||

|

12,743,558

|

||||||||

|

Retail Trade – 2.71%

|

||||||||

|

The Fresh Market, Inc.

|

||||||||

|

9.750%, 05/01/2023 (a)

|

8,579,000

|

8,847,094

|

||||||

The accompanying notes are an integral part of these financial statements.

28

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2021

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

CORPORATE BONDS – 43.91% (CONTINUED)

|

||||||||

|

Transportation and Warehousing – 3.27%

|

||||||||

|

Altera Shuttle Tankers LLC

|

||||||||

|

7.125%, 08/15/2022 (d)

|

1,600,000

|

$

|

1,610,000

|

|||||

|

PBF Logistics LP / PBF Logistics Finance Corp.

|

||||||||

|

6.875%, 05/15/2023

|

2,468,000

|

2,409,385

|

||||||

|

Rockpoint Gas Storage Canada Ltd.

|

||||||||

|

7.000%, 03/31/2023 (a)(d)

|

6,538,000

|

6,644,243

|

||||||

|

10,663,628

|

||||||||

|

Wholesale Trade – 0.84%

|

||||||||

|

Martin Midstream Partners LP / Martin Midstream Finance Corp.

|

||||||||

|

10.000%, 02/29/2024 (a)

|

2,656,079

|

2,740,689

|

||||||

|

TOTAL CORPORATE BONDS (Cost $142,614,867)

|

143,369,041

|

|||||||

|

MUNICIPAL BONDS – 0.73%

|

||||||||

|

Construction – 0.73%

|

||||||||

|

Puerto Rico Highway & Transportation Authority

|

||||||||

|

7.215%, 07/01/2022 (c)

|

1,055,000

|

991,787

|

||||||

|

7.312%, 07/01/2023 (c)

|

1,570,000

|

1,387,580

|

||||||

|

TOTAL MUNICIPAL BONDS (Cost $2,389,515)

|

2,379,367

|

|||||||

|

Number of

|

||||||||

|

Shares

|

||||||||

|

PREFERRED STOCKS – 0.51%

|

||||||||

|

Real Estate and Rental and Leasing – 0.51%

|

||||||||

|

Gladstone Land Corp. Series D

|

||||||||

|

Cumulative Term Preferred 5.000%, 01/31/2026

|

63,987

|

1,665,901

|

||||||

|

TOTAL PREFERRED STOCKS (Cost $1,599,675)

|

1,665,901

|

|||||||

|

SPECIAL PURPOSE ACQUISITION COMPANIES – 10.45%

|

||||||||

|

890 5th Avenue Partners, Inc. (h)

|

193,405

|

1,916,644

|

||||||

|

Adit EdTech Acquisition Corp. (h)

|

12,435

|

121,117

|

||||||

|

Alkuri Global Acquisition Corp. (h)

|

12,435

|

123,977

|

||||||

|

Argus Capital Corp. (h)

|

45,287

|

457,399

|

||||||

|

Aries I Acquisition Corp. (d)(h)

|

1,018

|

10,160

|

||||||

|

Athena Technology Acquisition Corp. (h)

|

30,481

|

302,536

|

||||||

|

Athlon Acquisition Corp. (h)

|

12,435

|

121,614

|

||||||

|

Atlantic Avenue Acquisition Corp. (h)

|

90,259

|

884,538

|

||||||

|

Authentic Equity Acquisition Corp. (d)(h)

|

12,435

|

120,619

|

||||||

|

AxonPrime Infrastructure

|

||||||||

|

Acquisition Corp. Founder Shares (h)(j)(k)

|

5,000

|

—

|

||||||

|

Alpha Partners Technology Merger Corp. Founder Shares (h)(j)(k)

|

9,341

|

—

|

||||||

The accompanying notes are an integral part of these financial statements.

29

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2021

|