Form N-CSR TRUST FOR PROFESSIONAL For: Nov 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Adam W. Smith

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(414)-765-6115

Registrant's telephone number, including area code

Date of fiscal year end: November 30, 2018

Date of reporting period: November 30, 2018

Item 1. Reports to Stockholders.

Annual Report

November 30, 2018

Investment Advisor

Gerstein Fisher

565 Fifth Avenue, 27th Floor

New York, New York 10017

Phone: 800-473-1155

www.GersteinFisherFunds.com

Gerstein Fisher is a division of People’s United Advisors, Inc.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary or, if you are a direct investor, by calling the Funds at 1-800-473-1155.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Funds, you can call the Funds at 1-800-473-1155. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all Gerstein Fisher Funds you hold.

Table of Contents

|

LETTER TO SHAREHOLDERS

|

3

|

|

EXPENSE EXAMPLES

|

7

|

|

INVESTMENT HIGHLIGHTS

|

9

|

|

SCHEDULES OF INVESTMENTS

|

15

|

|

STATEMENTS OF ASSETS AND LIABILITIES

|

46

|

|

STATEMENTS OF OPERATIONS

|

48

|

|

STATEMENTS OF CHANGES IN NET ASSETS

|

50

|

|

FINANCIAL HIGHLIGHTS

|

54

|

|

NOTES TO FINANCIAL STATEMENTS

|

60

|

|

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

|

76

|

|

BASIS FOR TRUSTEES’ APPROVAL

OF INVESTMENT ADVISORY AGREEMENT

|

77

|

|

NOTICE OF PRIVACY POLICY & PRACTICES

|

81

|

|

ADDITIONAL INFORMATION

|

82

|

Dear Fellow Shareholders,

2018 has been a highly eventful and volatile year for the markets and investors, even as it draws to a close. It remains our privilege to recognize the trust in Gerstein Fisher you have shown and to continue to oversee our funds and strategies. It is a responsibility we take seriously and we look forward to continuing to earn this trust in the years to come.

Gerstein Fisher is focused on building and managing well-diversified, research-driven portfolios with the goal of offering investors consistent and efficient access to the performance of different markets and asset classes. With the future always an uncertain thing, we believe there is great value in a disciplined, thoughtfully structured investment approach such as ours that is grounded in fact and data and applied systematically.

We pride ourselves on our commitment to offering a quantitative alternative to managing investments through our Multi-Factor® strategies, and in always pushing our strategies and research forward in the best interest of our investors.

Sincerely,

Gregg. S. Fisher, CFA

Founder, Portfolio Manager and Head of Research

3

Review of Fund Performance

Gerstein Fisher Multi-Factor® Growth Equity Fund (GFMGX)

The twelve months ended November 30, 2018 were moderately positive for U.S. equities and for U.S. large-cap growth equities. The Gerstein Fisher Multi-Factor® Growth Equity Fund (the “Fund”) returned 5.81% for this period, compared to the Russell 1000® Growth Total Return Index, which returned 8.59% for the same twelve months.

As a result of the Fund’s diversified investment approach, with approximately 250 holdings and no individual holding constituting more than 5% of the total portfolio, performance was determined principally by broad trends in the U.S. equity market rather than the behavior of a limited number of stocks. The Fund’s performance relative to the Russell 1000® Growth Total Return Index was due largely to targeted exposures to certain strategic risk factors that are components of our Multi-Factor® strategy. Performance attribution during the twelve month period ended November 30, 2018 reveals that the Fund’s tilt to higher-profitability securities and higher price momentum (calculated over a 2-12 month trailing period) contributed positively to returns, while exposure to value-oriented securities and higher management quality securities lagged.

Since its inception in December 2009, the Fund has performed in line with our expectations. It is designed to be an all-cap U.S. growth equity portfolio with additional exposures to targeted, systematic risk factors that include profitability, value, and momentum, while seeking to avoid non-systematic risks such as industry or company overexposures. Because our process is based on a scientifically grounded approach, we believe that over time the Gerstein Fisher Multi-Factor® Growth Equity Fund should continue to be well positioned to deliver a positive investment experience in the U.S. growth equity space, as well as to provide exposure to often overlooked factors within the domestic growth universe.

Gerstein Fisher Multi-Factor® International Growth Equity Fund (GFIGX)

Developed-market equities were broadly negative in the twelve months ended November 30, 2018. The Gerstein Fisher Multi-Factor® International Growth Equity Fund (the “Fund”) returned -11.55% for this period, compared to the MSCI EAFE Growth Index, which returned -6.88% during the same twelve months.

The Fund maintains a diversified exposure to over 200 securities and approximately 25 countries, and no individual holding constitutes more than 5% of the total portfolio. Additionally, any single country’s exposure within the portfolio is limited to a maximum of approximately 15% of the Fund, providing a high degree of country-level diversification. The Fund’s performance relative to the MSCI EAFE Growth Index was due largely to targeted exposures to certain strategic risk factors that are components of our Multi-Factor® strategy. Performance attribution during the twelve month period ended November 30, 2018 reveals that the Fund’s tilt to stocks with higher momentum characteristics and those with lower valuations contributed positively to return when compared to the benchmark. The Fund’s exposure to stocks with smaller market capitalizations, as well as its under-exposure to some countries, such as Japan, had a negative impact on returns.

Since its inception in January 2012, the Fund has performed in line with our expectations. It is designed to be a large-cap, developed-market growth equity portfolio with additional exposures to targeted, systematic risk factors that include profitability, value, and momentum, while seeking to avoid non-systematic risks such as industry or company overexposures. Because our process is based on a scientifically grounded approach, we believe that the Gerstein Fisher Multi-Factor® International Growth Equity Fund should be

4

well positioned to deliver a positive investment experience in the international-developed growth equity space, as well as provide exposure to often overlooked factors within the international growth equity universe.

Gerstein Fisher Multi-Factor® Global Real Estate Securities Fund (GFMRX)

Global real estate as an asset class was relatively flat in terms of total returns in the twelve months ended November 30, 2018. The Gerstein Fisher Multi-Factor® Global Real Estate Securities Fund (the “Fund”) returned 0.19% for that period, while the FTSE EPRA/NAREIT Developed Index Net Total Return was up 1.21% for the same twelve months.

The Fund maintains a diversified exposure to over 200 securities and approximately 25 countries, and no individual holding constituted more than 5% of the total portfolio. The real estate exposure in the Fund is global in nature, with approximately 50% exposure to non-U.S. real estate securities. The Fund’s performance relative to the FTSE EPRA/NAREIT Developed Index Net Total Return was due in large part to higher exposure to certain risk factors targeted by our Multi-Factor® strategy. Performance attribution during the twelve month period ended November 30, 2018 reveals that the Fund’s tilt to real estate securities with high price momentum and lower valuations contributed positively to returns, while smaller capitalization securities contributed negatively to returns.

Since its inception in April 2013, the Fund has performed in line with our expectations. It is designed to be a global real estate portfolio with additional exposures to targeted, systematic risk factors that include size, value, and avoiding securities with a high degree of leverage, while seeking to avoid non-systematic risks such as company or single-security overexposures. Because our process is based on a scientifically grounded approach, we believe that the Gerstein Fisher Multi-Factor® Global Real Estate Securities Fund should be well positioned to deliver a positive investment experience in the global real estate space, as well as to provide exposure to often overlooked factors within that investable universe.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible.

These strategies and mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks as well as differences in accounting methods. These risks are greater for emerging markets. Small- and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Growth stocks typically are relatively more expensive than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. Options on securities may be subject to greater fluctuations in value than an investment in the underlying securities. The investment in options is not suitable for all investors. The risks of investments in derivatives include imperfect correlation between the value of these instruments and the underlying assets; risks of default by the other party to the derivative transactions; risks that the transactions may result in losses that partially or completely offset gains in portfolio positions; and risks that the derivative transactions may not be liquid. The Funds may engage in short sales of securities, which involves the risk that losses may exceed the original amount invested. A real estate investment trust’s (“REIT’s”) share price may decline because of adverse developments affecting the real estate industry, including changes in interest rates. The returns from REITs may trail returns from the overall market. Additionally, there is always a risk that a REIT will fail to qualify for favorable tax treatment. Unlike mutual funds, exchange-

5

traded funds (“ETFs”) do not necessarily trade at the net asset values of their underlying securities, which means an ETF could potentially trade above or below the value of the underlying portfolios. Additionally, because ETFs trade like stocks on exchanges, they are subject to trading and commission costs, unlike open-end investment companies.

Diversification does not assure a profit or protect against a loss in a declining market.

Index Definitions:

Russell 1000® Growth Total Return Index: The Russell 1000® Growth Total Return Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Growth Total Return Index is constructed to provide a comprehensive, unbiased, and stable barometer of the broad growth market. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

MSCI EAFE Growth Index: The MSCI EAFE Growth Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada, focusing on companies with higher price-to-book ratios and higher forecasted growth values. The index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

FTSE EPRA/NAREIT Developed Index Net Total Return: The Index is a global market capitalization weighted index composed of listed real estate securities from developed market countries in North America, Europe, and Asia.

An investment cannot be made directly in an index.

Must be preceded or accompanied by a prospectus.

The Gerstein Fisher Funds are distributed by Quasar Distributors, LLC.

6

Gerstein Fisher Funds

Expense Examples

(Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (6/1/18–11/30/18).

Actual Expenses

The first lines of the following tables provide information about actual account values and actual expenses. Although the Funds charge no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem your shares of a Fund within sixty days of purchase. Individual retirement accounts (“IRAs”) will be charged a $15.00 annual maintenance fee. To the extent a Fund invests in shares of exchange-traded funds or other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Example. The Example includes, but is not limited to, management fees, fund administration fees and accounting, custody and transfer agent fees. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second lines of the following tables provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

7

Gerstein Fisher Funds

Expense Examples (Continued)

(Unaudited)

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

June 1, 2018 -

|

|

|

June 1, 2018

|

November 30, 2018

|

November 30, 2018*

|

|

|

Actual

|

$1,000.00

|

$ 972.10

|

$4.89

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,020.10

|

$5.01

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 0.99%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

|

Gerstein Fisher Multi-Factor® International Growth Equity Fund

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

June 1, 2018 -

|

|

|

June 1, 2018

|

November 30, 2018

|

November 30, 2018*

|

|

|

Actual

|

$1,000.00

|

$ 871.30

|

$5.16

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,019.55

|

$5.57

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.10%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

|

Gerstein Fisher Multi-Factor® Global Real Estate Securities Fund

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

June 1, 2018 -

|

|

|

June 1, 2018

|

November 30, 2018

|

November 30, 2018*

|

|

|

Actual

|

$1,000.00

|

$ 995.30

|

$4.50

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,020.56

|

$4.56

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 0.90%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

|

8

Gerstein Fisher Multi-Factor® Growth Equity Fund

Investment Highlights

(Unaudited)

Under normal market conditions, at least 80% of the Fund’s net assets will be invested in equity securities. The Fund seeks to invest primarily in common stocks of domestic companies of any size. Equity securities may also include preferred stocks, ETFs that invest in equities, individual stock options and options on indices. At any one time, the combined value of options may be up to 5% of the Fund’s net assets. The Fund may invest up to 20% of its net assets in the securities of foreign issuers that are publicly traded in the United States or on foreign exchanges. Additionally, the Fund may sell shares of securities short for hedging purposes.

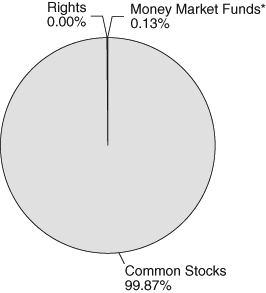

Allocation of Portfolio Holdings as of November 30, 2018

(% of Investments)

* Excludes securities lending collateral.

Average Annual Total Returns as of November 30, 2018

|

Gerstein Fisher

Multi-Factor®

Growth Equity

|

Russell 1000®

Growth Total

Return Index

|

|

|

One Year

|

5.81%

|

8.59%

|

|

Three Year

|

10.88%

|

13.97%

|

|

Five Year

|

10.24%

|

13.04%

|

|

Since Inception (1/15/10)(1)

|

13.00%

|

14.28%

|

|

(1)

|

While the Fund commenced operations on December 31, 2009, the Fund began investing consistent with its investment objective on January 15, 2010.

|

Continued

9

Gerstein Fisher Multi-Factor® Growth Equity Fund

Investment Highlights (Continued)

(Unaudited)

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 800-473-1155. The Fund imposes a 1.00% redemption fee of the net amount of the redemption on shares held for 60 days or less. Performance quoted does not reflect the redemption fee. If reflected, total returns would be reduced.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The Russell 1000® Growth Total Return Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Growth Total Return Index is constructed to provide a comprehensive, unbiased, and stable barometer of the broad growth market. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

One cannot invest directly in an index.

Growth of $10,000 Investment

|

*

|

While the Fund commenced operations on December 31, 2009, the Fund began investing consistent with its investment objective on January 15, 2010.

|

10

Gerstein Fisher Multi-Factor® International Growth Equity Fund

Investment Highlights

(Unaudited)

Under normal market conditions, at least 80% of the Fund’s net assets will be invested in equity securities. The Fund seeks to invest primarily in common stocks of international companies of any size, including foreign securities and securities of U.S. companies. The Fund may invest in foreign securities, which may include securities of companies in emerging markets or less developed countries. Equity securities include common stocks, preferred stocks, ETFs that invest in equities, individual stock options and options on stock indices.

Allocation of Portfolio Holdings as of November 30, 2018

(% of Investments)

Average Annual Total Returns as of November 30, 2018

|

Gerstein Fisher

Multi-Factor®

International

Growth Equity

|

MSCI EAFE

Growth Index

|

|

|

One Year

|

-11.55%

|

-6.88%

|

|

Three Year

|

3.25%

|

4.32%

|

|

Five Year

|

2.41%

|

2.96%

|

|

Since Inception (1/27/12)

|

7.04%

|

6.48%

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Continued

11

Gerstein Fisher Multi-Factor® International Growth Equity Fund

Investment Highlights (Continued)

(Unaudited)

Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-473-1155. The Fund imposes a 1.00% redemption fee of the net amount of the redemption on shares held for 60 days or less. Performance quoted does not reflect the redemption fee. If reflected, total returns would be reduced.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The MSCI EAFE Growth Index consists of the growth portion (growth being a measure of price relative to book/value/cash flow) of the MSCI EAFE Index. One cannot invest directly in an index.

Growth of $10,000 Investment

* Inception Date

12

Gerstein Fisher Multi-Factor® Global Real Estate Securities Fund

Investment Highlights

(Unaudited)

Under normal market conditions, at least 80% of the Fund’s net assets will be invested in income-producing common stocks and other real estate securities, including REITs. The Fund may invest in equity securities (such as common, convertible and preferred stock) of real estate-related companies of any market capitalization. Equity securities may also include ETFs that invest in real estate-related equities, individual stock options and options on indices.

Allocation of Portfolio Holdings as of November 30, 2018

(% of Investments)

|

*

|

Excludes securities lending collateral.

|

Average Annual Total Returns as of November 30, 2018

|

Gerstein Fisher

Multi-Factor®

Global Real

Estate Securities

|

FTSE EPRA/

NAREIT

Developed Index

Net Total Return

|

|

|

One Year

|

0.19%

|

1.21%

|

|

Three Year

|

5.45%

|

4.98%

|

|

Five Year

|

7.13%

|

5.57%

|

|

Since Inception (4/30/13)

|

4.45%

|

3.21%

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted.

Continued

13

Gerstein Fisher Multi-Factor® Global Real Estate Securities Fund

Investment Highlights (Continued)

(Unaudited)

Performance data current to the most recent month-end may be obtained by calling 800-473-1155. The Fund imposes a 1.00% redemption fee of the net amount of the redemption on shares held for 60 days or less. Performance quoted does not reflect the redemption fee. If reflected, total returns would be reduced.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

FTSE EPRA/NAREIT Developed Index Net Total Return is a global market capitalization weighted index composed of listed real estate securities from developed market countries in North America, Europe, and Asia. By making the index constituents free-float adjusted, liquidity, size and revenue screened, the series is suitable for use as the basis for investment products, such as derivatives and ETFs. The index reflects the reinvestment of dividends and the application of the relevant withholding tax rates. One cannot invest directly in an index.

Growth of $10,000 Investment

* Inception Date

14

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS – 99.81%

|

||||||||

|

Accommodation – 0.45%

|

||||||||

|

Marriott International, Inc.

|

8,899

|

$

|

1,023,652

|

|||||

|

Wyndham Hotels & Resorts, Inc.

|

2,287

|

114,647

|

||||||

|

Wyndham Destinations, Inc.

|

2,287

|

94,842

|

||||||

|

1,233,141

|

||||||||

|

Administrative and Support Services – 3.77%

|

||||||||

|

AECOM (a)

|

700

|

22,512

|

||||||

|

Booking Holdings, Inc. (a)

|

1,077

|

2,037,555

|

||||||

|

Broadridge Financial Solutions, Inc.

|

987

|

104,493

|

||||||

|

MasterCard, Inc.

|

38,857

|

7,812,977

|

||||||

|

PayPal Holdings, Inc. (a)

|

3,190

|

273,734

|

||||||

|

Perspecta, Inc.

|

8,425

|

177,852

|

||||||

|

10,429,123

|

||||||||

|

Air Transportation – 2.23%

|

||||||||

|

American Airlines Group, Inc.

|

293

|

11,767

|

||||||

|

Delta Air Lines, Inc.

|

2,008

|

121,906

|

||||||

|

Southwest Airlines Co.

|

90,083

|

4,919,433

|

||||||

|

United Continental Holdings, Inc. (a)

|

11,495

|

1,111,566

|

||||||

|

6,164,672

|

||||||||

|

Ambulatory Health Care Services – 3.98%

|

||||||||

|

Amedisys, Inc. (a)

|

60,350

|

8,222,687

|

||||||

|

Chemed Corp.

|

7,375

|

2,336,252

|

||||||

|

Genomic Health, Inc. (a)

|

5,500

|

434,775

|

||||||

|

10,993,714

|

||||||||

|

Amusement, Gambling, and Recreation Industries – 0.03%

|

||||||||

|

Global Payments, Inc.

|

669

|

74,801

|

||||||

|

Apparel Manufacturing – 1.05%

|

||||||||

|

Columbia Sportswear Co.

|

2,293

|

209,420

|

||||||

|

Lululemon Athletica, Inc. (a)

|

1,000

|

132,550

|

||||||

|

Michael Kors Holdings Ltd. (a)(b)

|

25,676

|

1,123,325

|

||||||

|

VF Corp.

|

17,664

|

1,435,906

|

||||||

|

2,901,201

|

||||||||

|

Automobiles & Components – 0.00%

|

||||||||

|

Garrett Motion, Inc. (a)

|

49

|

563

|

||||||

|

Beverage and Tobacco Product Manufacturing – 1.67%

|

||||||||

|

Altria Group, Inc.

|

7,548

|

413,857

|

||||||

|

Boston Beer Co., Inc. (a)

|

848

|

232,810

|

||||||

|

Coca-Cola Co.

|

8,071

|

406,778

|

||||||

|

Coca-Cola European Partners PLC (b)

|

8,088

|

392,592

|

||||||

|

MGP Ingredients, Inc.

|

4,771

|

324,380

|

||||||

The accompanying notes are an integral part of these financial statements.

15

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Beverage and Tobacco Product Manufacturing – 1.67% (Continued)

|

||||||||

|

National Beverage Corp.

|

1,000

|

$

|

87,270

|

|||||

|

PepsiCo, Inc.

|

22,578

|

2,753,161

|

||||||

|

4,610,848

|

||||||||

|

Broadcasting (except Internet) – 1.05%

|

||||||||

|

CBS Corp.

|

3,848

|

208,485

|

||||||

|

Comcast Corp.

|

12,847

|

501,162

|

||||||

|

Discovery Communications, Inc. – Class A (a)

|

23,775

|

730,368

|

||||||

|

Discovery Communications, Inc. – Class C (a)

|

14,742

|

411,744

|

||||||

|

Walt Disney Co.

|

9,007

|

1,040,218

|

||||||

|

2,891,977

|

||||||||

|

Building Material and Garden Equipment and Supplies Dealers – 3.17%

|

||||||||

|

Home Depot, Inc.

|

42,020

|

7,577,046

|

||||||

|

Lowe’s Cos, Inc.

|

12,472

|

1,176,983

|

||||||

|

8,754,029

|

||||||||

|

Chemical Manufacturing – 7.12%

|

||||||||

|

Abbott Laboratories

|

6,000

|

444,300

|

||||||

|

AbbVie, Inc.

|

34,524

|

3,254,577

|

||||||

|

Allergan PLC (b)

|

80

|

12,528

|

||||||

|

Celgene Corp. (a)

|

10,506

|

758,743

|

||||||

|

Chemours Co.

|

34,487

|

982,190

|

||||||

|

Eli Lilly & Co.

|

471

|

55,879

|

||||||

|

Emergent BioSolutions, Inc. (a)

|

4,575

|

333,243

|

||||||

|

Gilead Sciences, Inc.

|

34,148

|

2,456,607

|

||||||

|

Innophos Holdings, Inc.

|

493

|

13,676

|

||||||

|

Innoviva, Inc. (a)

|

30,000

|

547,800

|

||||||

|

Johnson & Johnson

|

20,281

|

2,979,279

|

||||||

|

Kimberly-Clark Corp.

|

209

|

24,112

|

||||||

|

LyondellBasell Industries NV (b)

|

15,131

|

1,411,874

|

||||||

|

Medifast, Inc.

|

1,851

|

274,874

|

||||||

|

Myriad Genetics, Inc. (a)

|

5,275

|

170,066

|

||||||

|

OMNOVA Solutions, Inc. (a)

|

2,846

|

23,195

|

||||||

|

Supernus Pharmaceuticals, Inc. (a)

|

549

|

26,034

|

||||||

|

Trex Co, Inc. (a)

|

5,552

|

353,829

|

||||||

|

Trinseo SA (b)

|

85,000

|

4,295,050

|

||||||

|

Vertex Pharmaceuticals, Inc. (a)

|

6,985

|

1,262,818

|

||||||

|

19,680,674

|

||||||||

|

Clothing and Clothing Accessories Stores – 1.52%

|

||||||||

|

Children’s Place, Inc.

|

12,698

|

1,646,169

|

||||||

|

Ross Stores, Inc.

|

7,942

|

695,719

|

||||||

|

TJX Companies, Inc.

|

38,144

|

1,863,334

|

||||||

|

4,205,222

|

||||||||

The accompanying notes are an integral part of these financial statements.

16

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Computer and Electronic Product Manufacturing – 13.16%

|

||||||||

|

Alphabet, Inc. (a)

|

5,507

|

$

|

6,027,026

|

|||||

|

Apple, Inc.

|

75,665

|

13,512,256

|

||||||

|

Ciena Corp. (a)

|

971

|

31,674

|

||||||

|

Cirrus Logic, Inc. (a)

|

243

|

9,098

|

||||||

|

Dell Technologies, Inc. Class V (a)

|

2,630

|

277,412

|

||||||

|

Harris Corp.

|

6,496

|

928,603

|

||||||

|

Harvard Bioscience, Inc. (a)

|

6,087

|

24,044

|

||||||

|

Intel Corp.

|

62,048

|

3,059,587

|

||||||

|

KEMET Corp.

|

3,322

|

68,034

|

||||||

|

Lam Research Corp.

|

7,500

|

1,177,200

|

||||||

|

Medtronic PLC (b)

|

1,500

|

146,295

|

||||||

|

Micron Technology, Inc. (a)

|

133,978

|

5,166,192

|

||||||

|

National Instruments Corp.

|

7,130

|

349,085

|

||||||

|

NetApp, Inc.

|

3,369

|

225,285

|

||||||

|

NVIDIA Corp.

|

3,951

|

645,712

|

||||||

|

ON Semiconductor Corp. (a)

|

65,000

|

1,246,700

|

||||||

|

QUALCOMM, Inc.

|

14,594

|

850,246

|

||||||

|

Roper Technologies, Inc.

|

213

|

63,387

|

||||||

|

Rubicon Technology, Inc. (a)

|

610

|

5,246

|

||||||

|

Skyworks Solutions, Inc.

|

2,084

|

151,653

|

||||||

|

Square, Inc. (a)

|

26,862

|

1,876,042

|

||||||

|

Teradyne, Inc.

|

3,526

|

125,843

|

||||||

|

TTM Technologies, Inc. (a)

|

3,040

|

36,146

|

||||||

|

Western Digital Corp.

|

8,319

|

377,599

|

||||||

|

36,380,365

|

||||||||

|

Construction of Buildings – 0.46%

|

||||||||

|

KB Home

|

1,575

|

33,248

|

||||||

|

LGI Homes, Inc. (a)

|

765

|

35,313

|

||||||

|

MDC Holdings, Inc.

|

29,602

|

871,779

|

||||||

|

NVR, Inc. (a)

|

58

|

142,100

|

||||||

|

TRI Pointe Group, Inc. (a)

|

16,300

|

203,424

|

||||||

|

1,285,864

|

||||||||

|

Credit Intermediation and Related Activities – 1.39%

|

||||||||

|

Altisource Portfolio Solutions SA (a)(b)(c)

|

29,436

|

698,811

|

||||||

|

Ameriprise Financial, Inc.

|

9,150

|

1,187,212

|

||||||

|

LendingTree, Inc. (a)

|

155

|

40,353

|

||||||

|

Regional Management Corp. (a)

|

5,035

|

136,751

|

||||||

|

Santander Consumer USA Holdings, Inc.

|

25,368

|

493,408

|

||||||

|

USA Technologies, Inc. (a)

|

3,367

|

16,734

|

||||||

|

Wells Fargo & Co.

|

14,808

|

803,778

|

||||||

|

Western Union Co.

|

1,254

|

23,487

|

||||||

|

World Acceptance Corp. (a)

|

4,012

|

437,067

|

||||||

|

3,837,601

|

||||||||

The accompanying notes are an integral part of these financial statements.

17

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Data Processing, Hosting and Related Services – 1.97%

|

||||||||

|

Limelight Networks, Inc. (a)

|

37,471

|

$

|

123,280

|

|||||

|

Visa, Inc.

|

37,492

|

5,312,991

|

||||||

|

5,436,271

|

||||||||

|

Educational Services – 0.64%

|

||||||||

|

ITT Educational Services, Inc. (a)

|

3,750

|

0

|

||||||

|

Strategic Education, Inc.

|

13,029

|

1,778,328

|

||||||

|

1,778,328

|

||||||||

|

Electrical Equipment, Appliance, and Component Manufacturing – 0.02%

|

||||||||

|

AO Smith Corp.

|

914

|

43,305

|

||||||

|

Resideo Technologies, Inc. (a)

|

81

|

1,671

|

||||||

|

44,976

|

||||||||

|

Electronics and Appliance Stores – 0.17%

|

||||||||

|

Aaron’s, Inc.

|

9,884

|

462,571

|

||||||

|

Fabricated Metal Product Manufacturing – 0.01%

|

||||||||

|

General Finance Corp. (a)

|

1,408

|

19,219

|

||||||

|

Food and Beverage Stores – 0.02%

|

||||||||

|

GrubHub, Inc. (a)

|

683

|

53,472

|

||||||

|

Food Manufacturing – 0.17%

|

||||||||

|

Bunge Ltd. (b)

|

6,298

|

359,427

|

||||||

|

Farmer Brothers Co. (a)

|

4,694

|

114,299

|

||||||

|

473,726

|

||||||||

|

Food Services and Drinking Places – 1.03%

|

||||||||

|

Cracker Barrel Old Country Store, Inc.

|

3,709

|

670,624

|

||||||

|

Darden Restaurants, Inc.

|

16,380

|

1,810,645

|

||||||

|

McDonald’s Corp.

|

801

|

150,997

|

||||||

|

Wayfair, Inc. (a)

|

2,070

|

219,834

|

||||||

|

2,852,100

|

||||||||

|

Furniture and Related Product Manufacturing – 0.20%

|

||||||||

|

Herman Miller, Inc.

|

7,630

|

258,352

|

||||||

|

Kimball International, Inc.

|

15,659

|

238,956

|

||||||

|

Sleep Number Corp. (a)

|

1,476

|

56,590

|

||||||

|

553,898

|

||||||||

|

General Merchandise Stores – 4.69%

|

||||||||

|

Burlington Stores, Inc. (a)

|

50,547

|

8,378,671

|

||||||

|

Dollar General Corp.

|

26,783

|

2,972,645

|

||||||

|

WalMart, Inc.

|

16,460

|

1,607,319

|

||||||

|

12,958,635

|

||||||||

The accompanying notes are an integral part of these financial statements.

18

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Health and Personal Care Stores – 0.54%

|

||||||||

|

CVS Health Corp.

|

1,077

|

$

|

86,341

|

|||||

|

Express Scripts Holding Co. (a)

|

10,163

|

1,031,240

|

||||||

|

McKesson Corp.

|

3,000

|

373,500

|

||||||

|

1,491,081

|

||||||||

|

Heavy and Civil Engineering Construction – 0.03%

|

||||||||

|

Century Communities, Inc. (a)

|

3,829

|

78,763

|

||||||

|

Insurance Carriers and Related Activities – 5.87%

|

||||||||

|

Anthem, Inc.

|

29,812

|

8,647,567

|

||||||

|

Cigna Corp.

|

5,000

|

1,116,900

|

||||||

|

Hanover Insurance Group, Inc.

|

1,761

|

202,004

|

||||||

|

Humana, Inc.

|

6,190

|

2,039,419

|

||||||

|

Lincoln National Corp.

|

23,256

|

1,464,430

|

||||||

|

Prudential Financial, Inc.

|

7,525

|

705,544

|

||||||

|

Travelers Companies, Inc.

|

72

|

9,387

|

||||||

|

Universal Insurance Holdings, Inc.

|

39,649

|

1,740,195

|

||||||

|

Voya Financial, Inc.

|

6,967

|

313,167

|

||||||

|

16,238,613

|

||||||||

|

Leather and Allied Product Manufacturing – 0.34%

|

||||||||

|

Crocs, Inc. (a)

|

11,700

|

325,260

|

||||||

|

NIKE, Inc.

|

8,000

|

600,960

|

||||||

|

Tapestry, Inc.

|

208

|

8,097

|

||||||

|

934,317

|

||||||||

|

Machinery Manufacturing – 0.69%

|

||||||||

|

Applied Materials, Inc.

|

25,000

|

932,000

|

||||||

|

Caterpillar, Inc.

|

1,008

|

136,756

|

||||||

|

Cummins, Inc.

|

4,156

|

627,805

|

||||||

|

Deere & Co.

|

261

|

40,424

|

||||||

|

Ingersoll-Rand PLC (b)

|

1,641

|

169,876

|

||||||

|

1,906,861

|

||||||||

|

Management of Companies and Enterprises – 0.01%

|

||||||||

|

EchoStar Corp. (a)

|

470

|

19,665

|

||||||

|

Merchant Wholesalers, Durable Goods – 2.42%

|

||||||||

|

3M Co.

|

6,653

|

1,383,292

|

||||||

|

Arrow Electronics, Inc. (a)

|

17,635

|

1,357,366

|

||||||

|

Builders FirstSource, Inc. (a)

|

5,697

|

77,080

|

||||||

|

Honeywell International, Inc.

|

491

|

72,054

|

||||||

|

Huntington Ingalls Industries, Inc.

|

17,422

|

3,754,441

|

||||||

|

KLA-Tencor Corp.

|

391

|

38,537

|

||||||

|

6,682,770

|

||||||||

The accompanying notes are an integral part of these financial statements.

19

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Merchant Wholesalers, Nondurable Goods – 3.53%

|

||||||||

|

Central Garden & Pet Co. (a)

|

143,523

|

$

|

4,463,565

|

|||||

|

Herbalife Nutrition Ltd. (a)(b)

|

82,792

|

4,739,842

|

||||||

|

Nu Skin Enterprises, Inc.

|

7,389

|

487,452

|

||||||

|

Univar, Inc. (a)

|

2,178

|

47,176

|

||||||

|

US Foods Holding Corp. (a)

|

430

|

14,268

|

||||||

|

9,752,303

|

||||||||

|

Miscellaneous Manufacturing – 3.17%

|

||||||||

|

ABIOMED, Inc. (a)

|

12,426

|

4,133,882

|

||||||

|

Align Technology, Inc. (a)

|

199

|

45,748

|

||||||

|

Becton Dickinson & Co.

|

940

|

237,585

|

||||||

|

Brady Corp.

|

6,646

|

289,500

|

||||||

|

Estee Lauder Companies, Inc.

|

6,300

|

898,758

|

||||||

|

Intuitive Surgical, Inc. (a)

|

1,980

|

1,051,122

|

||||||

|

Stryker Corp.

|

4,800

|

842,208

|

||||||

|

Zimmer Biomet Holdings, Inc.

|

10,894

|

1,274,816

|

||||||

|

8,773,619

|

||||||||

|

Motion Picture and Sound Recording Industries – 0.97%

|

||||||||

|

NetFlix, Inc. (a)

|

9,360

|

2,678,177

|

||||||

|

Motor Vehicle and Parts Dealers – 0.04%

|

||||||||

|

Lithia Motors, Inc.

|

1,530

|

126,776

|

||||||

|

Nonstore Retailers – 3.31%

|

||||||||

|

Amazon.com, Inc. (a)

|

5,342

|

9,028,888

|

||||||

|

Nutrisystem, Inc.

|

371

|

13,798

|

||||||

|

Systemax, Inc.

|

4,232

|

118,030

|

||||||

|

9,160,716

|

||||||||

|

Oil and Gas Extraction – 0.44%

|

||||||||

|

Evolution Petroleum Corp.

|

82,073

|

714,856

|

||||||

|

Parsley Energy, Inc. (a)

|

3,717

|

74,823

|

||||||

|

Renewable Energy Group, Inc. (a)

|

16,134

|

434,811

|

||||||

|

1,224,490

|

||||||||

|

Other Information Services – 3.41%

|

||||||||

|

Brightcove, Inc. (a)

|

4,322

|

31,032

|

||||||

|

Chegg, Inc. (a)

|

71,560

|

2,000,102

|

||||||

|

Facebook, Inc. (a)

|

30,916

|

4,347,099

|

||||||

|

Travelzoo (a)

|

6,977

|

62,932

|

||||||

|

Twitter, Inc. (a)

|

25,000

|

786,250

|

||||||

|

Yelp, Inc. (a)

|

65,243

|

2,196,732

|

||||||

|

9,424,147

|

||||||||

The accompanying notes are an integral part of these financial statements.

20

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Paper Manufacturing – 0.17%

|

||||||||

|

International Paper Co.

|

5,915

|

$

|

273,214

|

|||||

|

Veritiv Corp. (a)

|

113

|

3,429

|

||||||

|

Verso Corp. (a)

|

7,490

|

188,898

|

||||||

|

465,541

|

||||||||

|

Performing Arts, Spectator Sports, and Related Industries – 1.54%

|

||||||||

|

Boyd Gaming Corp.

|

2,079

|

51,601

|

||||||

|

Electronic Arts, Inc. (a)

|

50,000

|

4,203,500

|

||||||

|

4,255,101

|

||||||||

|

Personal and Laundry Services – 0.05%

|

||||||||

|

Weight Watchers International, Inc. (a)

|

2,691

|

134,604

|

||||||

|

Primary Metal Manufacturing – 0.08%

|

||||||||

|

Global Brass & Copper Holdings, Inc.

|

1,779

|

57,586

|

||||||

|

Olympic Steel, Inc.

|

9,542

|

175,191

|

||||||

|

232,777

|

||||||||

|

Printing and Related Support Activities – 0.01%

|

||||||||

|

Deluxe Corp.

|

768

|

38,669

|

||||||

|

Professional, Scientific, and Technical Services – 7.59%

|

||||||||

|

Accenture PLC (b)

|

2,481

|

408,174

|

||||||

|

Amgen, Inc.

|

3,682

|

766,776

|

||||||

|

CACI International, Inc. (a)

|

4,293

|

707,959

|

||||||

|

Cognizant Technology Solutions Corp.

|

2,040

|

145,309

|

||||||

|

eBay, Inc. (a)

|

25,931

|

774,040

|

||||||

|

Ebix, Inc. (c)

|

38,604

|

1,822,881

|

||||||

|

Hackett Group, Inc.

|

33,659

|

594,081

|

||||||

|

Hamilton Lane, Inc.

|

13,435

|

508,112

|

||||||

|

Insperity, Inc.

|

29,758

|

2,976,990

|

||||||

|

Itron, Inc. (a)

|

363

|

19,660

|

||||||

|

LivePerson, Inc. (a)

|

33,937

|

640,391

|

||||||

|

Luminex Corp.

|

7,857

|

230,760

|

||||||

|

Okta, Inc. (a)

|

8,323

|

529,759

|

||||||

|

Quotient Technology, Inc. (a)

|

39,778

|

488,872

|

||||||

|

Salesforce.com, Inc. (a)

|

5,246

|

748,919

|

||||||

|

Trade Desk, Inc. (a)

|

224

|

31,909

|

||||||

|

VMware, Inc. (a)

|

57,208

|

9,573,187

|

||||||

|

20,967,779

|

||||||||

|

Publishing Industries (except Internet) – 9.14%

|

||||||||

|

Activision Blizzard, Inc.

|

25,994

|

1,296,580

|

||||||

|

Adobe Systems, Inc. (a)

|

11,597

|

2,909,571

|

||||||

|

Citrix Systems, Inc.

|

1,323

|

144,167

|

||||||

|

DXC Technology Co.

|

16,850

|

1,062,224

|

||||||

The accompanying notes are an integral part of these financial statements.

21

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Publishing Industries (except Internet) – 9.14% (Continued)

|

||||||||

|

EPAM Systems, Inc. (a)

|

1,225

|

$

|

159,556

|

|||||

|

ePlus, Inc. (a)

|

26,824

|

2,192,862

|

||||||

|

Fair Isaac Corp. (a)

|

1,000

|

198,630

|

||||||

|

InterActiveCorp (a)

|

22,322

|

3,972,423

|

||||||

|

Microsoft Corp.

|

104,806

|

11,621,938

|

||||||

|

Mitek Systems, Inc. (a)

|

15,548

|

148,795

|

||||||

|

News Corp.

|

10,508

|

136,394

|

||||||

|

Oracle Corp.

|

25,000

|

1,219,000

|

||||||

|

Twenty-First Century Fox, Inc.

|

3,908

|

191,609

|

||||||

|

25,253,749

|

||||||||

|

Rental and Leasing Services – 0.61%

|

||||||||

|

Air Lease Corp.

|

3,476

|

135,078

|

||||||

|

Aircastle Ltd. (b)

|

22,939

|

427,812

|

||||||

|

CAI International, Inc. (a)

|

3,000

|

73,530

|

||||||

|

Triton International Ltd. (b)

|

12,826

|

437,110

|

||||||

|

United Rentals, Inc. (a)

|

5,362

|

628,051

|

||||||

|

1,701,581

|

||||||||

|

Securities, Commodity Contracts, and Other

|

||||||||

|

Financial Investments and Related Activities – 1.08%

|

||||||||

|

BlackRock, Inc.

|

143

|

61,205

|

||||||

|

Morningstar, Inc.

|

4,569

|

539,782

|

||||||

|

S&P Global, Inc.

|

6,451

|

1,179,630

|

||||||

|

Yum China Holdings, Inc.

|

33,790

|

1,210,696

|

||||||

|

2,991,313

|

||||||||

|

Social Assistance – 0.19%

|

||||||||

|

Care.com, Inc. (a)

|

28,707

|

514,429

|

||||||

|

Specialty Trade Contractors – 0.59%

|

||||||||

|

Comfort Systems USA, Inc.

|

763

|

40,180

|

||||||

|

Quanta Services, Inc. (a)

|

45,241

|

1,587,959

|

||||||

|

1,628,139

|

||||||||

|

Support Activities for Mining – 0.22%

|

||||||||

|

Antero Resources Corp. (a)

|

45,763

|

600,868

|

||||||

|

Support Activities for Transportation – 0.08%

|

||||||||

|

Expeditors International of Washington, Inc.

|

2,650

|

201,638

|

||||||

|

Willis Lease Finance Corp. (a)

|

300

|

11,052

|

||||||

|

212,690

|

||||||||

|

Telecommunications – 0.21%

|

||||||||

|

ARC Group Worldwide, Inc. (a)

|

1,500

|

2,025

|

||||||

|

Argan, Inc.

|

706

|

30,690

|

||||||

The accompanying notes are an integral part of these financial statements.

22

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Telecommunications – 0.21% (Continued)

|

||||||||

|

AT&T, Inc.

|

8,113

|

$

|

253,450

|

|||||

|

Vonage Holdings Corp. (a)

|

27,701

|

293,354

|

||||||

|

579,519

|

||||||||

|

Transportation Equipment Manufacturing – 3.50%

|

||||||||

|

Boeing Co.

|

12,000

|

4,161,120

|

||||||

|

Commercial Vehicle Group, Inc. (a)

|

8,111

|

56,615

|

||||||

|

Lawson Products, Inc. (a)

|

3,160

|

97,328

|

||||||

|

Lear Corp.

|

36,745

|

5,006,506

|

||||||

|

Marine Products Corp.

|

11,215

|

243,814

|

||||||

|

MasterCraft Boat Holdings, Inc. (a)

|

2,059

|

53,349

|

||||||

|

Meritor, Inc. (a)

|

2,416

|

39,864

|

||||||

|

Spartan Motors, Inc.

|

3,035

|

24,432

|

||||||

|

9,683,028

|

||||||||

|

Utilities – 0.01%

|

||||||||

|

Ormat Technologies, Inc.

|

629

|

35,281

|

||||||

|

Total Common Stocks (Cost $151,326,917)

|

275,864,357

|

|||||||

|

RIGHTS – 0.00%

|

||||||||

|

Newstar Financial, Inc. CVR (a)(d)(e)

|

4,036

|

2,341

|

||||||

|

Total Rights (Cost $0)

|

2,341

|

|||||||

|

INVESTMENTS PURCHASED WITH PROCEEDS

|

||||||||

|

FROM SECURITIES LENDING – 0.26%

|

||||||||

|

Money Market Fund – 0.26%

|

||||||||

|

First American Government Obligations Fund – Class Y, 1.800% (f)

|

721,069

|

721,069

|

||||||

|

Total Investments Purchased with Proceeds

|

||||||||

|

from Securities Lending (Cost $721,069)

|

721,069

|

|||||||

The accompanying notes are an integral part of these financial statements.

23

Gerstein Fisher Multi-Factor® Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

SHORT-TERM INVESTMENTS – 0.13%

|

||||||||

|

Money Market Fund – 0.13%

|

||||||||

|

First American Treasury Obligations Fund – Class X, 2.144% (f)

|

357,100

|

$

|

357,100

|

|||||

|

Total Short-Term Investments (Cost $357,100)

|

357,100

|

|||||||

|

Total Investments (Cost $152,405,086) – 100.20%

|

276,944,867

|

|||||||

|

Liabilities in Excess of Other Assets – (0.20)%

|

(551,187

|

)

|

||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

276,393,680

|

||||||

Percentages are stated as a percent of net assets.

|

(a)

|

Non-income producing security.

|

|

(b)

|

Foreign issued security.

|

|

(c)

|

All or portion of this security is out on loan as of November 30, 2018. Total value of securities out on loan is $705,973.

|

|

(d)

|

Illiquid security. The total market value of these securities were $2,341, representing 0.00% of net assets.

|

|

(e)

|

Fair valued security. Value determined using significant unobservable inputs.

|

|

(f)

|

Seven day yield as of November 30, 2018.

|

Abbreviations:

|

Ltd.

|

Limited is a term indicating a company is incorporated and shareholder have limited liability.

|

|

NV

|

Naamloze Vennootschap is a Dutch term for publicly traded companies.

|

|

PLC

|

Public Limited Company is a publicly traded company which signifies that shareholders have limited liability.

|

|

SA

|

An abbreviation used by many countries to signify a stock company whereby shareholders have limited liability.

|

The accompanying notes are an integral part of these financial statements.

24

Gerstein Fisher Multi-Factor® International Growth Equity Fund

|

Schedule of Investments

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS – 98.75%

|

||||||||

|

Australia – 9.61%

|

||||||||

|

AGL Energy Ltd.

|

17,405

|

$

|

240,132

|

|||||

|

Alumina Ltd.

|

11,746

|

19,245

|

||||||

|

BHP Billiton Ltd.

|

11,739

|

260,833

|

||||||

|

BlueScope Steel Ltd.

|

89,719

|

741,949

|

||||||

|

Caltex Australia Ltd.

|

9,679

|

195,312

|

||||||

|

CIMIC Group Ltd.

|

49,568

|

1,476,656

|

||||||

|

Coca-Cola Amatil Ltd.

|

397,943

|

2,513,401

|

||||||

|

Cochlear Ltd.

|

11,870

|

1,475,347

|

||||||

|

Coles Group Ltd. (a)

|

608

|

5,204

|

||||||

|

CSL Ltd.

|

9,077

|

1,183,333

|

||||||

|

Flight Centre Travel Group Ltd.

|

7,067

|

253,214

|

||||||

|

Insurance Australia Group Ltd.

|

195,200

|

1,041,913

|

||||||

|

Macquarie Group Ltd.

|

3,822

|

321,628

|

||||||

|

Medibank Private Ltd.

|

438,732

|

778,672

|

||||||

|

Qantas Airways Ltd.

|

303,654

|

1,327,412

|

||||||

|

Rio Tinto Ltd.

|

87,852

|

4,731,399

|

||||||

|

Sonic Healthcare Ltd.

|

6,174

|

103,238

|

||||||

|

South32 Ltd.

|

435,897

|

985,018

|

||||||

|

TPG Telecom Ltd.

|

110,717

|

583,416

|

||||||

|

Treasury Wine Estates Ltd.

|

215,000

|

2,231,718

|

||||||

|

Wesfarmers Ltd.

|

608

|

14,080

|

||||||

|

Woolworths Group Ltd.

|

390

|

8,268

|

||||||

|

20,491,388

|

||||||||

|

Austria – 0.05%

|

||||||||

|

ANDRITZ AG

|

2,165

|

104,550

|

||||||

|

Belgium – 3.03%

|

||||||||

|

Colruyt SA

|

55,000

|

3,513,915

|

||||||

|

KBC Group NV

|

4,675

|

336,275

|

||||||

|

UCB SA

|

23,264

|

1,960,565

|

||||||

|

Umicore SA

|

15,000

|

650,118

|

||||||

|

6,460,873

|

||||||||

|

Bermuda – 0.94%

|

||||||||

|

Jardine Strategic Holdings Ltd.

|

43,265

|

1,670,015

|

||||||

|

Shangri-La Asia Ltd.

|

235,186

|

335,253

|

||||||

|

2,005,268

|

||||||||

|

Cayman Islands – 0.31%

|

||||||||

|

CK Asset Holdings Ltd.

|

9,220

|

66,595

|

||||||

|

WH Group Ltd. (b)

|

802,245

|

585,730

|

||||||

|

652,325

|

||||||||

The accompanying notes are an integral part of these financial statements.

25

Gerstein Fisher Multi-Factor® International Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Denmark – 3.73%

|

||||||||

|

Coloplast A/S

|

10,733

|

$

|

1,024,735

|

|||||

|

DSV A/S

|

1,392

|

106,607

|

||||||

|

H Lundbeck A/S

|

18,000

|

739,864

|

||||||

|

Novo Nordisk A/S

|

119,073

|

5,538,258

|

||||||

|

Vestas Wind System A/S

|

185

|

13,829

|

||||||

|

William Demant Holding A/S (a)

|

18,000

|

526,292

|

||||||

|

7,949,585

|

||||||||

|

Finland – 1.43%

|

||||||||

|

Elisa OYJ

|

4,616

|

185,334

|

||||||

|

Metso OYJ

|

757

|

21,666

|

||||||

|

Neste OYJ

|

29,115

|

2,279,382

|

||||||

|

Stora Enso OYJ

|

2,458

|

31,422

|

||||||

|

UPM-Kymmene OYJ

|

7,850

|

209,670

|

||||||

|

Wartsila OYJ Abp

|

19,092

|

311,494

|

||||||

|

3,038,968

|

||||||||

|

France – 12.62%

|

||||||||

|

Aeroports de Paris

|

1,840

|

357,944

|

||||||

|

Alstom SA

|

142,467

|

6,255,297

|

||||||

|

Arkema SA

|

31,202

|

2,961,668

|

||||||

|

Atos SE

|

15,000

|

1,276,212

|

||||||

|

Bouygues SA

|

26,148

|

1,006,417

|

||||||

|

Capgemini SE

|

8,786

|

1,025,871

|

||||||

|

Credit Agricole SA

|

156,912

|

1,950,093

|

||||||

|

Dassault Systemes SE

|

8,374

|

1,006,856

|

||||||

|

Eiffage SA

|

8,399

|

799,937

|

||||||

|

EssilorLuxottica SA

|

1,617

|

204,447

|

||||||

|

Eurazeo SA

|

9,101

|

682,947

|

||||||

|

Hermes International

|

1,348

|

729,830

|

||||||

|

Ipsen SA

|

86

|

11,084

|

||||||

|

Kering SA

|

626

|

272,488

|

||||||

|

Legrand SA

|

1,384

|

84,897

|

||||||

|

L’Oreal SA

|

1,861

|

439,132

|

||||||

|

LVMH Moet Hennessy Louis Vuitton SE

|

6,226

|

1,782,120

|

||||||

|

Pernod Ricard SA

|

2,332

|

372,804

|

||||||

|

Peugeot SA

|

115,263

|

2,536,026

|

||||||

|

Remy Cointreau SA

|

9,168

|

1,061,786

|

||||||

|

Safran SA

|

3,830

|

479,398

|

||||||

|

Societe BIC SA

|

5,722

|

613,812

|

||||||

|

Thales SA

|

3,776

|

463,433

|

||||||

|

Ubisoft Entertainment SA (a)

|

6,218

|

507,089

|

||||||

|

Veolia Environnement SA

|

984

|

20,968

|

||||||

|

26,902,556

|

||||||||

The accompanying notes are an integral part of these financial statements.

26

Gerstein Fisher Multi-Factor® International Growth Equity Fund

|

Schedule of Investments (Continued)

|

November 30, 2018

|

Shares

|

Value

|

|||||||

|

Germany – 9.33%

|

||||||||

|

Adidas AG

|

8,604

|

$

|

1,905,513

|

|||||

|

Axel Springer SE

|

1,647

|

105,298

|

||||||

|

Bayer AG

|

23,647

|

1,735,242

|

||||||

|

Commerzbank AG (a)

|

68,274

|

591,518

|

||||||

|

Continental AG

|

1,338

|

202,186

|

||||||

|

Covestro AG (b)

|

31,769

|

1,840,164

|

||||||

|

Daimler AG

|

564

|

31,888

|

||||||

|

Deutsche Boerse AG

|

938

|

120,151

|

||||||

|

Deutsche Lufthansa AG

|

80,461

|

1,968,495

|

||||||

|