Form N-CSR Manager Directed Portfol For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21897

Manager Directed Portfolios

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Douglas J. Neilson, President

Manager Directed Portfolios

c/o U.S. Bank Global Fund Services

811 East Wisconsin Avenue, 8th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(414) 287-3101

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2019

Date of reporting period: December 31, 2019

Item 1. Reports to Stockholders.

Spyglass Growth Fund

Annual Report

December 31, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail,

unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website, www.spyglassfunds.com, and you will be

notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications

from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 1-888-878-5680, sending an e-mail request to [email protected], or by enrolling at

www.spyglassfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of

your shareholder reports. If you invest directly with the Fund you can call 1-888-878-5680 or send an e-mail request to [email protected] to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your

election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Spyglass Growth Fund

Table of Contents

|

Letter to Shareholders

|

3

|

|

|

Investment Highlights

|

5

|

|

|

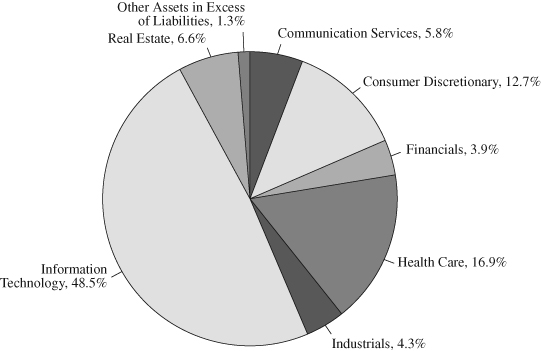

Sector Allocation of Portfolio Assets

|

6

|

|

|

Schedule of Investments

|

7

|

|

|

Statement of Assets and Liabilities

|

10

|

|

|

Statement of Operations

|

11

|

|

|

Statements of Changes in Net Assets

|

12

|

|

|

Financial Highlights

|

13

|

|

|

Notes to Financial Statements

|

14

|

|

|

Report of Independent Registered Public Accounting Firm

|

23

|

|

|

Expense Example

|

24

|

|

|

Notice to Shareholders

|

26

|

|

|

Trustees and Officers

|

27

|

|

|

Approval of the Spyglass Growth Fund Investment Advisory Agreement

|

30

|

|

|

Notice of Privacy Policy and Practices

|

34

|

Spyglass Growth Fund

Letter to Shareholders

Dear Shareholders,

For the fiscal year ended December 31, 2019, the Spyglass Growth Fund – Institutional Shares (the “Fund”) generated a return of 36.03%. This performance compared favorably to 35.47% for its benchmark, the Russell

MidCap Growth Index Total Return (which includes the impact of dividends), and compared to 31.49% for the S&P 500 Total Return Index (which includes the impact of dividends), as a comparison for the broader equity market performance. We believe

that our fundamentally driven stock selection based on our independent valuation process provided results that exceeded the benchmarks for 2019.

The Fund’s top five performers during 2019 were Chipotle Mexican Grill, Advanced Micro Devices, Dexcom, DocuSign, and Equinix. Each of these holdings remained in the portfolio at the end of 2019. Chipotle, a leader

in fast casual dining, was the top performing stock in the Fund as investors reacted positively to continued improvement in its business fundamentals after the company successfully resolved an apparent food safety issue in its restaurants. As

customers returned, revenues increased which led to improved profitability. Advanced Micro Devices, a leading semiconductor maker, posted consistently strong results throughout 2019, and investors rewarded the company. Dexcom, a leader in diabetes

care with its continuous glucose monitoring system, ended the year with results that significantly exceeded Wall Street expectations as demand for its products spiked. DocuSign, a leader in digital signature and document management, grew its

revenues at a rapid pace and made important progress toward its long-term profitability goals. Equinix, a leading data-center operator, had a strong year of stock performance. Equinix benefits from increased usage of the internet and as the demand

for bandwidth from its customers continues to grow, its fundamentals benefit.

In 2019, the Fund’s five biggest detractors were Zuora, Affiliated Managers Group, Alliance Data Systems, Vail Resorts, and Arista Networks. Each holding, with the exception of Alliance Data Systems, was still in the

portfolio at the end of 2019. Zuora, a leader in enterprise subscription billing and management software, faced some operational headwinds following an acquisition, but recent announcements by the company have given us increased confidence in future

results. Affiliated Managers Group, a global asset management company, struggled in 2019 as their investment management affiliates came under competitive pressure from lower cost ETF and passive strategies. Alliance Data Systems, a private label

credit card company, failed to achieve our expectations for business performance, and the Fund sold all of its shares after consecutive periods of disappointing results. Vail Resorts, a premier mountain resort company, was a new holding in the third

quarter of 2019 and while it was one of the biggest detractors for the Fund in 2019, its shares were essentially unchanged between the price the Fund paid and where shares ended the year. Arista Networks, a leading next generation information

technology networking company, struggled in 2019 as two of its three largest customers modified the timing and size of their orders for Arista products. After significant due diligence, the Fund believes that the longer-term prospects for Arista

remain bright.

3

Spyglass Growth Fund

The Fund invests in dynamic companies, operating in rapidly growing industries that are being led by results-oriented, entrepreneurial management teams. The Fund’s strategy remains consistent as it attempts to

identify companies that are benefiting from secular growth and are well positioned to compete in the industries in which they operate.

We believe that the global economy, and especially the U.S. economy, is entering a dynamic period of growth and persistent change. When we look out into the future, we see the transportation market being transformed

to an all-electric and fully autonomous future. We see vast productivity gains as people and goods can move more quickly and safely which will be a catalyst for increased economic activity. We can imagine artificial intelligence wringing enormous

inefficiencies out of corporate cost-structures by eliminating redundancies and helping companies and people anticipate needs before they arise. We see genomics, and the applied science around this revolution, ushering in an era of remarkable

diagnostics and targeted therapeutics which will not only improve the lives of countless thousands living with chronic conditions but also bring an end to many diseases. The Fund invests in companies that we believe are likely to benefit from these

changes.

At Spyglass, we are optimistic about the future. We try to anticipate the effect of dynamic change in the industries in which we invest. We believe that change creates opportunity, and our research process is

dedicated to understanding the consequences. We will be vigilant about the prices we pay, and we will keep investing your capital, alongside ours.

Thank you for investing with us.

Sincerely,

Spyglass Capital Management LLC

The opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please see Schedule of Investments for a complete list of holdings.

Mutual fund investing involves risk. Principal loss is possible. The Fund is non-diversified, meaning it may focus its assets in fewer individual holdings than a diversified fund. Therefore, the

Fund is more exposed to individual stock volatility than a diversified fund. Medium-and small-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies.

The Russell Midcap® Growth Index measures the performance of those Russell Midcap companies with higher price/book ratios and higher

forecasted growth values. The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. The index measures the performance of the large-cap

segment of the market. Considered to be a proxy of the U.S. equity market, the index is composed of 500 constituent companies. An investment cannot be made directly in an index.

Must be preceded or accompanied by a prospectus.

The Spyglass Growth Fund is distributed by Quasar Distributors, LLC.

4

Spyglass Growth Fund

Investment Highlights (Unaudited)

Comparison of the Change in Value of a Hypothetical $100,000 Investment

in the Spyglass Growth Fund – Institutional Shares and

Russell Midcap® Growth Index

|

Annualized Total Return for Periods Ended

|

One

|

Three

|

Since Inception

|

|

December 31, 2019:

|

Year

|

Year

|

(10/1/2015)

|

|

Spyglass Growth Fund – Institutional Shares(1)(2)

|

36.03%

|

30.08%

|

17.05%

|

|

Russell Midcap® Growth Index

|

35.47%

|

17.36%

|

14.92%

|

Expense ratios*: Gross 1.78%, Net 1.00% (Institutional Shares)

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling

1-888-878-5680.

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund. Returns reflect the reinvestment of dividends and capital gain distributions. The performance data and expense ratios shown

reflect a contractual fee waiver made by the Adviser, currently, through January 1, 2021. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a shareholder may pay on

dividends, capital gain distributions, or redemption of Fund shares. This chart does not imply any future performance.

* The expense ratios presented are from the most recent prospectus.

|

(1)

|

Fund commenced operations on January 2, 2018.

|

|

(2)

|

The performance data quoted for periods prior to January 2, 2018 is that of the Spyglass Partners Fund Limited Partnership (the “Partnership”). The Partnership commenced operations on October 1, 2015. The

Partnership was not a registered mutual fund and was not subject to the same investments and tax restrictions as the Fund. If it had been, the Partnership’s performance might have been lower.

|

5

Spyglass Growth Fund

|

SECTOR ALLOCATION OF PORTFOLIO ASSETS

|

|

at December 31, 2019 (Unaudited)

|

Percentages represent market value as a percentage of net assets.

Note: For Presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the

Fund uses more specific industry classifications.

6

Spyglass Growth Fund

|

SCHEDULE OF INVESTMENTS

|

|

at December 31, 2019

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.7%

|

Shares

|

Value

|

||||||

|

COMMUNICATION SERVICES – 5.8%

|

||||||||

|

Entertainment – 1.7%

|

||||||||

|

IMAX Corp. (a)(b)

|

207,818

|

$

|

4,245,722

|

|||||

|

Interactive Media & Services – 4.1%

|

||||||||

|

Twitter, Inc. (a)

|

323,143

|

10,356,733

|

||||||

|

TOTAL COMMUNICATION SERVICES

|

14,602,455

|

|||||||

|

CONSUMER DISCRETIONARY – 12.7%

|

||||||||

|

Hotels, Restaurants & Leisure – 7.5%

|

||||||||

|

Chipotle Mexican Grill, Inc. (a)

|

13,253

|

11,094,219

|

||||||

|

Vail Resorts, Inc.

|

33,540

|

8,043,898

|

||||||

|

19,138,117

|

||||||||

|

Specialty Retail – 5.2%

|

||||||||

|

Ulta Beauty, Inc. (a)

|

51,706

|

13,088,857

|

||||||

|

TOTAL CONSUMER DISCRETIONARY

|

32,226,974

|

|||||||

|

FINANCIALS – 3.9%

|

||||||||

|

Capital Markets – 3.9%

|

||||||||

|

Affiliated Managers Group, Inc.

|

115,277

|

9,768,573

|

||||||

|

TOTAL FINANCIALS

|

9,768,573

|

|||||||

|

HEALTH CARE – 16.9%

|

||||||||

|

Biotechnology – 9.0%

|

||||||||

|

Ascendis Pharma A/S – ADR (a)(b)

|

80,534

|

11,203,890

|

||||||

|

Exact Sciences Corp. (a)

|

123,986

|

11,466,225

|

||||||

|

22,670,115

|

||||||||

|

Health Care Equipment & Supplies – 3.0%

|

||||||||

|

DexCom, Inc. (a)

|

35,245

|

7,709,491

|

||||||

|

Pharmaceuticals – 4.9%

|

||||||||

|

Pacira BioSciences, Inc. (a)

|

274,508

|

12,435,213

|

||||||

|

TOTAL HEALTH CARE

|

42,814,819

|

|||||||

The accompanying notes are an integral part of these financial statements.

7

Spyglass Growth Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at December 31, 2019

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.7% (Continued)

|

Shares

|

Value

|

||||||

|

INDUSTRIALS – 4.3%

|

||||||||

|

Construction & Engineering – 4.3%

|

||||||||

|

Quanta Services, Inc.

|

265,696

|

$

|

10,816,484

|

|||||

|

TOTAL INDUSTRIALS

|

10,816,484

|

|||||||

|

INFORMATION TECHNOLOGY – 48.5%

|

||||||||

|

Communications Equipment – 4.8%

|

||||||||

|

Arista Networks, Inc. (a)

|

59,547

|

12,111,860

|

||||||

|

IT Services – 5.1%

|

||||||||

|

GoDaddy, Inc. (a)

|

190,461

|

12,936,111

|

||||||

|

Semiconductors & Semiconductor Equipment – 3.5%

|

||||||||

|

Advanced Micro Devices, Inc. (a)

|

193,787

|

8,887,072

|

||||||

|

Software – 35.1%

|

||||||||

|

DocuSign, Inc. (a)

|

135,555

|

10,045,981

|

||||||

|

Envestnet, Inc. (a)

|

76,474

|

5,324,885

|

||||||

|

Everbridge, Inc. (a)

|

108,450

|

8,467,776

|

||||||

|

Nutanix, Inc. (a)

|

385,981

|

12,065,766

|

||||||

|

Palo Alto Networks, Inc. (a)

|

58,394

|

13,503,612

|

||||||

|

Proofpoint, Inc. (a)

|

115,148

|

13,216,687

|

||||||

|

Splunk, Inc. (a)

|

74,948

|

11,224,962

|

||||||

|

SVMK, Inc. (a)

|

539,916

|

9,648,299

|

||||||

|

Zuora, Inc. (a)

|

366,947

|

5,258,351

|

||||||

|

88,756,319

|

||||||||

|

TOTAL INFORMATION TECHNOLOGY

|

122,691,362

|

|||||||

The accompanying notes are an integral part of these financial statements.

8

Spyglass Growth Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at December 31, 2019

|

|

Number of

|

||||||||

|

COMMON STOCKS – 98.7% (Continued)

|

Shares

|

Value

|

||||||

|

REAL ESTATE – 6.6%

|

||||||||

|

Equity Real Estate Investment Trusts (REITs) – 2.8%

|

||||||||

|

Equinix, Inc.

|

12,178

|

$

|

7,108,299

|

|||||

|

Real Estate Management & Development – 3.8%

|

||||||||

|

Redfin Corp. (a)

|

453,846

|

9,594,304

|

||||||

|

TOTAL REAL ESTATE

|

16,702,603

|

|||||||

|

TOTAL COMMON STOCKS

|

||||||||

|

(Cost $222,791,090)

|

249,623,270

|

|||||||

|

TOTAL INVESTMENTS

|

||||||||

|

(Cost $222,791,090) – 98.7%

|

249,623,270

|

|||||||

|

Other Assets in Excess of Liabilities – 1.3%

|

3,394,250

|

|||||||

|

TOTAL NET ASSETS – 100.0%

|

$

|

253,017,520

|

||||||

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

|

(a)

|

Non-income producing security.

|

|

(b)

|

U.S. traded security of a foreign issuer or corporation.

|

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard &

Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

9

Spyglass Growth Fund

|

STATEMENT OF ASSETS AND LIABILITIES

|

|

at December 31, 2019

|

|

Assets:

|

||||

|

Investments, at value (cost of $222,791,090)

|

$

|

249,623,270

|

||

|

Cash

|

3,109,281

|

|||

|

Receivables:

|

||||

|

Securities sold

|

6,304,300

|

|||

|

Fund shares sold

|

923,994

|

|||

|

Dividends and interest

|

62,646

|

|||

|

Prepaid expenses

|

24,793

|

|||

|

Total assets

|

260,048,284

|

|||

|

Liabilities:

|

||||

|

Payables:

|

||||

|

Securities purchased

|

6,798,010

|

|||

|

Investment advisory fees

|

167,940

|

|||

|

Administration and fund accounting fees

|

31,118

|

|||

|

Reports to shareholders

|

2,881

|

|||

|

Compliance expense

|

29

|

|||

|

Custody fees

|

4,220

|

|||

|

Trustee fees

|

301

|

|||

|

Transfer agent fees and expenses

|

9,227

|

|||

|

Other accrued expenses

|

17,038

|

|||

|

Total liabilities

|

7,030,764

|

|||

|

Net assets

|

$

|

253,017,520

|

||

|

Net assets consist of:

|

||||

|

Paid in capital

|

$

|

224,225,615

|

||

|

Total accumulated earnings

|

28,791,905

|

|||

|

Net assets

|

$

|

253,017,520

|

||

|

Institutional Shares:

|

||||

|

Net assets applicable to outstanding Institutional Shares

|

253,017,520

|

|||

|

Shares issued (Unlimited number of beneficial

|

||||

|

interest authorized, $0.01 par value)

|

17,957,213

|

|||

|

Net asset value, offering price and redemption price per share

|

$ |

14.09

|

||

The accompanying notes are an integral part of these financial statements.

10

Spyglass Growth Fund

|

STATEMENT OF OPERATIONS

|

|

For the Year Ended December 31, 2019

|

|

Investment income:

|

||||

|

Dividends

|

$

|

361,838

|

||

|

Total investment income

|

361,838

|

|||

|

Expenses:

|

||||

|

Investment advisory fees (Note 4)

|

1,506,377

|

|||

|

Administration and fund accounting fees (Note 4)

|

124,377

|

|||

|

Transfer agent fees and expenses (Note 4)

|

52,270

|

|||

|

Legal fees

|

29,999

|

|||

|

Federal and state registration fees

|

29,873

|

|||

|

Custody fees

|

23,482

|

|||

|

Audit fees

|

15,000

|

|||

|

Compliance expense

|

13,139

|

|||

|

Trustees’ fees and expenses

|

11,716

|

|||

|

Reports to shareholders

|

7,026

|

|||

|

Other

|

10,384

|

|||

|

Total expenses before reimbursement from advisor

|

1,823,643

|

|||

|

Expense reimbursement from advisor (Note 4)

|

(317,266

|

)

|

||

|

Net expenses

|

1,506,377

|

|||

|

Net investment loss

|

(1,144,539

|

)

|

||

|

Realized and unrealized gain:

|

||||

|

Net realized gain on investments

|

6,806,066

|

|||

|

Net change in unrealized appreciation on investments

|

26,069,543

|

|||

|

Net realized and unrealized gain

|

32,875,609

|

|||

|

Net increase in net assets resulting from operations

|

$

|

31,731,070

|

||

The accompanying notes are an integral part of these financial statements.

11

Spyglass Growth Fund

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Year Ended

|

Period Ended

|

|||||||

|

December 31, 2019

|

December 31, 2018*

|

|||||||

|

Operations:

|

||||||||

|

Net investment loss

|

$

|

(1,144,539

|

)

|

$

|

(212,085

|

)

|

||

|

Net realized gain on investments

|

6,806,066

|

2,052,113

|

||||||

|

Net change in unrealized gain (loss) on investments

|

26,069,543

|

(1,298,120

|

)

|

|||||

|

Net increase in net assets

|

||||||||

|

resulting from operations

|

31,731,070

|

541,908

|

||||||

|

Distributions:

|

||||||||

|

Distributable earnings

|

(3,840,117

|

)

|

(1,701,713

|

)

|

||||

|

Total from distributable earnings

|

(3,840,117

|

)

|

(1,701,713

|

)

|

||||

|

Capital Share Transactions:

|

||||||||

|

Proceeds from transfer-in-kind

|

—

|

16,225,831

|

||||||

|

Proceeds from shares sold

|

192,635,756

|

28,181,425

|

||||||

|

Proceeds from shares issued to

|

||||||||

|

holders in reinvestment of dividends

|

2,369,158

|

1,389,575

|

||||||

|

Cost of shares redeemed

|

(11,407,986

|

)

|

(3,107,387

|

)

|

||||

|

Net increase in net assets from

|

||||||||

|

capital share transactions

|

183,596,928

|

42,689,444

|

||||||

|

Total increase in net assets

|

211,487,881

|

41,529,639

|

||||||

|

Net Assets:

|

||||||||

|

Beginning of period

|

41,529,639

|

—

|

||||||

|

End of period

|

$

|

253,017,520

|

$

|

41,529,639

|

||||

|

Changes in Shares Outstanding:

|

||||||||

|

Shares issued in connection with transfer-in-kind

|

—

|

1,622,583

|

||||||

|

Shares sold

|

14,718,603

|

2,460,689

|

||||||

|

Shares issued to holders

|

||||||||

|

in reinvestment of dividends

|

169,347

|

130,722

|

||||||

|

Shares redeemed

|

(877,437

|

)

|

(267,294

|

)

|

||||

|

Net increase in shares outstanding

|

14,010,513

|

3,946,700

|

||||||

|

*

|

The Spyglass Growth Fund commenced operations on January 2, 2018.

|

The accompanying notes are an integral part of these financial statements.

12

Spyglass Growth Fund

|

FINANCIAL HIGHLIGHTS

|

For a capital share outstanding throughout each period

|

Institutional Shares

|

||||||||

|

January 2, 2018*

|

||||||||

|

Year Ended

|

through

|

|||||||

|

December 31, 2019

|

December 31, 2018

|

|||||||

|

Net Asset Value – Beginning of Period

|

$

|

10.52

|

$

|

10.00

|

||||

|

Income from Investment Operations:

|

||||||||

|

Net investment loss1

|

(0.10

|

)

|

(0.10

|

)

|

||||

|

Net realized and unrealized gain on investments

|

3.89

|

1.14

|

||||||

|

Total from investment operations

|

3.79

|

1.04

|

||||||

|

Less Distributions:

|

||||||||

|

Dividends from net realized gains

|

(0.22

|

)

|

(0.52

|

)

|

||||

|

Total distributions

|

(0.22

|

)

|

(0.52

|

)

|

||||

|

Net Asset Value – End of Period

|

$

|

14.09

|

$

|

10.52

|

||||

|

Total Return

|

36.03

|

%

|

10.36%

|

^ | ||||

|

Ratios and Supplemental Data:

|

||||||||

|

Net assets, end of period (thousands)

|

$

|

253,018

|

$

|

41,530

|

||||

|

Ratio of operating expenses to average net assets:

|

||||||||

|

Before reimbursements

|

1.21

|

%

|

1.78

|

%+

|

||||

|

After reimbursements

|

1.00

|

%

|

1.00

|

%+

|

||||

|

Ratio of net investment loss to average net assets:

|

||||||||

|

Before reimbursements

|

(0.97

|

)%

|

(1.61

|

)%+

|

||||

|

After reimbursements

|

(0.76

|

)%

|

(0.83

|

)%+

|

||||

|

Portfolio turnover rate

|

39

|

%

|

66%

|

^ | ||||

|

*

|

Commencement of operations for Institutional Shares was January 2, 2018.

|

|

+

|

Annualized

|

|

^

|

Not Annualized

|

|

1

|

The net investment loss per share was calculated using the average shares outstanding method.

|

The accompanying notes are an integral part of these financial statements.

13

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS

|

|

at December 31, 2019

|

NOTE 1 – ORGANIZATION

The Spyglass Growth Fund (the “Fund”) is a series of Manager Directed Portfolios (the “Trust”). The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and

was organized as a Delaware statutory trust on April 4, 2006. The Fund is an open-end investment management company and is a non-diversified series of the Trust. The Fund acquired the assets of Spyglass Partners Fund, LP, a Delaware investment

limited partnership (the “Predecessor Private Fund”), in a tax-free conversion completed at the close of business on December 29, 2017. The Fund did not have any operations prior to December 29, 2017 other than those relating to organizational

matters and registration of its shares under applicable securities law. The Fund commenced operations on January 2, 2018, and currently only offers Institutional Shares. The Predecessor Private Fund had an investment objective and investment

policies that were, in all material respects, equivalent to those of the Fund. However, the Predecessor Private Fund was not registered as an investment company under the 1940 Act, and was not subject to certain investment limitations,

diversification requirements, liquidity requirements and other restrictions imposed by the 1940 Act and Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Upon completion of the conversion, the net assets of the Fund were

$16,225,831. The number of shares of the Fund issued in connection with the conversion was 1,622,583, and the amount of net unrealized gains on the portfolio securities transferred to the Fund was $2,060,757. Spyglass Capital Management LLC (the

“Advisor”) serves as the investment advisor to the Fund. As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic

946 Financial Services – Investment Companies. The investment objective of the Fund is to seek long term capital appreciation.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”).

|

A.

|

Security Valuation: All investments in securities are recorded at their estimated fair value, as described in Note 3.

|

|

|

B.

|

Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies

and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required.

|

|

|

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax

positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions to be taken or expected to be taken in the Fund’s 2018 and

|

14

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

|

2019 tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Delaware.

|

||

|

C.

|

Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities sold are

determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Withholding taxes on foreign dividends have been provided

for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

|

|

|

The Fund distributes substantially all of its net investment income, if any, and net realized capital gains, if any, annually. Distributions from net realized gains for book purposes may include short-term

capital gains. All short-term capital gains are included in ordinary income for tax purposes. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is determined in accordance

with federal income tax regulations, which may differ from GAAP. To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax treatment.

|

||

|

The Fund is charged for those expenses that are directly attributable to it, such as investment advisory, custody and transfer agent fees. Expenses that are not attributable to a Fund are typically allocated

among the funds in the Trust proportionately based on allocation methods approved by the Board of Trustees (the “Board”). Common expenses of the Trust are typically allocated among the funds in the Trust based on a fund’s respective net

assets, or by other equitable means.

|

||

|

D.

|

Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates.

|

|

|

E.

|

Reclassification of Capital Accounts: GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax

reporting. These reclassifications have no effect on net assets or net asset value per share.

|

|

|

F.

|

Events Subsequent to the Fiscal Year End: In preparing the financial statements as of December 31, 2019, management considered the impact of subsequent events for

potential recognition or disclosure in the financial statements. On November 25, 2019, U.S. Bancorp, the parent company of Quasar Distributors, LLC, the Fund’s distributor, announced that it had signed a purchase agreement to sell Quasar to

Foreside Financial Group, LLC such that Quasar will become a wholly-owned broker-dealer subsidiary of Foreside. The transaction is expected to close by the end of March 2020. Quasar will remain the Fund’s distributor at the close of the

transaction, subject to Board approval.

|

15

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

|

G.

|

Recent Accounting Pronouncements and Rule Issuances: In August 2018, FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the

Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The primary focus of ASU 2018-13 is to improve the effectiveness of the disclosure requirements for fair value measurements. The changes affect all companies that are

required to include fair value measurement disclosures. In general, the amendments in ASU 2018-13 are effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15, 2019. An entity is

permitted to early adopt the removed or modified disclosures upon the issuance of ASU 2018-13 and may delay adoption of the additional disclosures, which are required for public companies only, until their effective date. Management has

evaluated the impact of this change in guidance, and due to the permissibility of early adoption, modified the Fund’s fair value disclosures for the current reporting period.

|

NOTE 3 – SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards

require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period and expanded disclosure of valuation

levels for major security types. These inputs are summarized in the three broad levels listed below:

|

Level 1 –

|

Unadjusted, quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the date of measurement.

|

|

|

Level 2 –

|

Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments,

and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data).

|

|

|

Level 3 –

|

Significant unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would

use in valuing the asset or liability, and would be based on the best information available.

|

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Equity Securities: Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds, closed-end mutual

funds and real estate investment trusts (REITs), that are primarily traded on a national securities

16

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

exchange shall be valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and asked prices.

Securities primarily traded in the NASDAQ Global Market System for which market quotations are readily available shall be valued using the NASDAQ Official Closing Price (“NOCP”). If the NOCP is not available, such securities shall be valued at the

last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and asked prices. Over-the-counter securities that are not traded on a listed exchange are valued at the last sale price in the

over-the-counter market. Over-the-counter securities which are not traded in the NASDAQ Global Market System shall be valued at the mean between the bid and asked prices. To the extent these securities are actively traded and valuation adjustments

are not applied, they are categorized in Level 1 of the fair value hierarchy.

Registered Investment Companies: Investments in registered investment companies (e.g., mutual funds) are generally priced at the ending NAV provided by the

applicable registered investment company’s service agent and will be classified in Level 1 of the fair value hierarchy.

Short-Term Debt Securities: Debt securities, including short-term debt instruments having a maturity of less than 60 days, are valued at the evaluated mean

price supplied by an approved pricing service. Pricing services may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. In the absence of prices from

a pricing service, the securities will be priced in accordance with the procedures adopted by the Board. Short-term securities are generally classified in Level 1 or Level 2 of the fair market hierarchy depending on the inputs used and market

activity levels for specific securities.

The Board has delegated day-to-day valuation issues to a Valuation Committee of the Trust which, as of December 31, 2019, was comprised of officers of the Trust. The function of the Valuation

Committee is to value securities where current and reliable market quotations are not readily available, or the closing price does not represent fair value, by following procedures approved by the Board. These procedures consider many factors,

including the type of security, size of holding, trading volume and news events. All actions taken by the Valuation Committee are subsequently reviewed and ratified by the Board.

Depending on the relative significance of the valuation inputs, fair valued securities may be classified in either level 2 or level 3 of the fair value hierarchy.

17

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the fair valuation hierarchy of

the Fund’s securities as of December 31, 2019:

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Common Stocks

|

||||||||||||||||

|

Communication Services

|

$

|

14,602,455

|

$

|

—

|

$

|

—

|

$

|

14,602,455

|

||||||||

|

Consumer Discretionary

|

32,226,974

|

—

|

—

|

32,226,974

|

||||||||||||

|

Financials

|

9,768,573

|

—

|

—

|

9,768,573

|

||||||||||||

|

Health Care

|

42,814,819

|

—

|

—

|

42,814,819

|

||||||||||||

|

Industrials

|

10,816,484

|

—

|

—

|

10,816,484

|

||||||||||||

|

Information Technology

|

122,691,362

|

—

|

—

|

122,691,362

|

||||||||||||

|

Real Estate

|

16,702,603

|

—

|

—

|

16,702,603

|

||||||||||||

|

Total Common Stocks

|

249,623,270

|

—

|

—

|

249,623,270

|

||||||||||||

|

Total Investments in Securities

|

$

|

249,623,270

|

$

|

—

|

$

|

—

|

$

|

249,623,270

|

||||||||

NOTE 4 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

For the fiscal year ended December 31, 2019, the Advisor provided the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnishes all investment advice,

office space, and facilities, and provides most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee at an annual rate of 1.00% for the Spyglass Growth Fund based upon the average daily net

assets of the Fund. For the fiscal year ended December 31, 2019, the Fund incurred $1,506,377 in advisory fees.

The Fund is responsible for its own operating expenses. The Advisor has contractually agreed to waive its management fees and/or absorb expenses of the Fund to ensure that the total annual

operating expenses [excluding front-end or contingent deferred loads, Rule 12b-1 plan fees, shareholder servicing plan fees, taxes, leverage, interest, brokerage commissions and other transactional expenses, expenses in connection with a merger or

reorganization, dividends or interest on short positions, acquired fund fees and expenses or extraordinary expenses (collectively, “Excludable Expenses”)] do not exceed the following amounts of the average daily net assets for the Institutional

Shares:

|

Spyglass Growth Fund

|

|||

|

Institutional Shares

|

1.00%

|

||

For the fiscal year ended December 31, 2019, the Advisor reduced its fees and absorbed Fund expenses in the amount of $317,266 for the Fund. The waivers and reimbursements will remain in effect

through January 1, 2021 unless terminated sooner by, or with the consent of, the Board.

18

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

The Advisor may request recoupment of previously waived fees and paid expenses in any subsequent month in the three-year period from the date of the management fee reduction and expense payment if

the aggregate amount actually paid by the Fund toward the operating expenses for such fiscal year (taking into account the reimbursement) will not cause the Fund’s expenses to exceed the lesser of: (1) the expense limitation in place at the time of

the management fee reduction and expense payment; or (2) the expense limitation in place at the time of the reimbursement. Any such reimbursement is also contingent upon Board of Trustees review and approval at the time the reimbursement is made.

Such reimbursement may not be paid prior to the Fund’s payment of current ordinary operating expenses. Cumulative expenses subject to recapture pursuant to the aforementioned conditions expire as follows:

|

Amount

|

Expiration

|

||

|

$197,172

|

12/31/2021

|

||

|

$317,266

|

12/31/2022

|

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, LLC (“Fund Services” or the “Administrator”) acts as the Fund’s Administrator under an Administration Agreement.

The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian, transfer agent and accountants;

coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. Fund Services also serves as the fund accountant and transfer agent to the Fund. Vigilant Compliance, LLC serves as the Chief Compliance Officer

to the Fund. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. For the fiscal year ended December 31, 2019, the Fund incurred the following expenses for administration, fund accounting, transfer agency and custody fees:

|

Administration & fund accounting

|

$124,377

|

||

|

Custody

|

$23,482

|

||

|

Transfer agency(a)

|

$26,065

|

||

|

(a) Does not include out-of-pocket expenses.

|

At December 31, 2019, the Fund had payables due to Fund Services for administration, fund accounting and transfer agency fees and to U.S. Bank N.A. for custody fees in the following amounts:

|

Administration & fund accounting

|

$31,118

|

||

|

Custody

|

$4,220

|

||

|

Transfer agency(a)

|

$4,127

|

||

|

(a) Does not include out-of-pocket expenses.

|

Quasar Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of the Administrator. A

Trustee of the Trust is deemed to be an interested person of the Trust due to his former position with the Distributor.

19

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

Certain officers of the Fund are employees of the Administrator and are not paid any fees by the Fund for serving in such capacities.

NOTE 5 – SECURITIES TRANSACTIONS

For the fiscal year ended December 31, 2019, the cost of purchases and the proceeds from sales of securities, excluding short-term securities, were as follows:

|

Purchases

|

Sales

|

|||

|

Spyglass Growth Fund

|

$234,646,195

|

$57,569,473

|

There were no purchases or sales of long-term U.S. Government securities.

NOTE 6 – INCOME TAXES AND DISTRIBUTIONS TO SHAREHOLDERS

As of December 31, 2019, the components of accumulated earnings/(losses) on a tax basis were as follows:

|

Cost of investments(a)

|

$

|

224,384,449

|

|||

|

Gross unrealized appreciation

|

34,886,607

|

||||

|

Gross unrealized depreciation

|

(9,647,786

|

)

|

|||

|

Net unrealized appreciation

|

25,238,821

|

||||

|

Undistributed ordinary income

|

720,997

|

||||

|

Undistributed long-term capital gain

|

2,832,087

|

||||

|

Total distributable earnings

|

3,553,084

|

||||

|

Other accumulated losses

|

—

|

||||

|

Total accumulated earnings

|

$

|

28,791,905

|

|

(a)

|

The difference between the book basis and tax basis net unrealized depreciation and cost is attributable primarily to wash sales.

|

As of December 31, 2019, the Fund had no long-term or short-term tax basis capital losses to offset future capital gains.

The tax character of distributions paid during the fiscal year ended December 31, 2019 and fiscal period ended December 31, 2018 was as follows:

|

Fiscal Year Ended

|

Fiscal Period Ended

|

||||||||

|

December 31, 2019

|

December 31, 2018

|

||||||||

|

Ordinary income

|

$

|

253,725

|

$

|

1,366,355

|

|||||

|

Long-Term Capital Gains

|

3,586,392

|

335,358

|

|||||||

|

Total

|

$

|

3,840,117

|

$

|

1,701,713

|

|||||

20

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

NOTE 7 – PRINCIPAL RISKS

Below are summaries of some, but not all, of the principal risks of investing in the Fund, each of which could adversely affect the Fund’s NAV, market price, yield, and total return. Further

information about investment risks is available in the Fund’s prospectus and Statement of Additional Information.

Equity Market Risk: Equity securities are susceptible to general stock market fluctuations due to economic, market, political and issuer-specific

considerations and to potential volatile increases and decreases in value as market confidence in and perceptions of their issuers change.

Small-Cap and Mid-Cap Company Risk: Small-Cap and Mid-Cap companies often have less predictable earnings, more limited product lines, markets, distribution

channels or financial resources, and the management of such companies may be dependent upon one or few key people. The market movements of equity securities of these companies may be more abrupt and volatile than the market movements of equity

securities of larger, more established companies, or the stock market in general. Because of these movements, and because small-cap and mid-cap companies tend to be bought and sold less often and in smaller amounts, they are generally less liquid

than the equity securities of larger companies.

Management Risk: The ability of the Fund to meet its investment objective is directly related to the Advisor’s management of the Fund. The value of your

investment in the Fund may vary with the effectiveness of the Advisor’s research, analysis and asset allocation among portfolio securities. If the investment strategies do not produce the expected results, the value of your investment could be

diminished or even lost entirely.

New Fund Risk: There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board may determine to

liquidate the Fund. Liquidation of the Fund can be initiated without shareholder approval by the Board if it determines that liquidation is in the best interest of shareholders. As a result, the timing of the Fund’s liquidation may not be favorable.

Non-Diversified Fund Risk: Because the Fund is “non-diversified,” it may invest a greater percentage of its assets in the securities of a single issuer. As

a result, a decline in the value of an investment in a single issuer could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio.

Sector Emphasis Risk: Although the Advisor selects stocks based on their individual merits, some economic sectors will represent a larger portion of the

Fund’s overall investment portfolio than other sectors. Potential negative market or economic developments affecting one of the larger sectors could have a greater impact on the Fund than on a fund with fewer holdings in that sector.

Information Technology Sector Risk: Technology companies face intense competition, which may have an adverse effect on profit margins. Technology companies

may have limited product lines, markets, financial resources or personnel. The products of

21

Spyglass Growth Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

at December 31, 2019

|

technology companies may face obsolescence due to rapid technological developments and frequent new product introduction, unpredictable changes in growth rates, and competition for the services of qualified personnel.

Information technology companies may be smaller and less experienced companies, with limited product lines, markets or financial resources and fewer experienced management or marketing personnel. Information technology companies may be subject to

additional risks, including loss of patent, copyright, and trademark protections, as well as evolving industry standards.

REIT Risk: A REIT’s share price may decline because of adverse developments affecting the real estate industry, including changes in interest rates. The

returns from REITs may trail returns from the overall market. The Fund’s investments in REITs may be subject to special tax rules, or a particular REIT may fail to qualify for the favorable federal income tax treatment applicable to REITs, the

effect of which may have adverse tax consequences for the Fund and shareholders.

Cash and Cash Equivalent Risk: At various times, the Fund may have cash balances that exceed federally insured limits. It is the opinion of management that

the solvency of the financial institutions are not of a particular concern at this time.

NOTE 8 – GUARANTEES AND INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure

under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

NOTE 9 – LINE OF CREDIT

The Fund has an uncommitted line of credit in the amount of the lesser of (i) $6,000,000, or (ii) 10% of gross market value of the Fund, or (iii) 33.33% of the market value of the Fund’s net

assets, intended to provide short-term financing, if necessary, subject to certain restrictions, in connection with shareholder redemptions. The credit facility is with the Funds’ custodian bank, U.S. Bank N.A. Borrowings under this arrangement bear

interest at the bank’s prime rate and are unsecured. During the year ended December 31, 2019, the Fund did not utilize the line of credit. As of December 31, 2019, the Fund did not have any borrowings outstanding under the line of credit.

22

Spyglass Growth Fund

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

To the Board of Trustees of Manager Directed Portfolios

and the Shareholders of Spyglass Growth Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Spyglass Growth Fund, a series of shares of beneficial interest in Manager Directed Portfolios (the “Fund”), including the schedule of investments, as of December 31, 2019, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for the year then

ended and for the period from January 2, 2018 (commencement of operations) through December 31, 2018, and the related notes (collectively referred to as the “financial statements”). In our

opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2019, and the results of its operations for the year then ended, and the changes in its net assets and its financial

highlights for the year then ended and for the period from January 2, 2018 through December 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm

registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal

securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of

material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of

internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures

included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019 by correspondence with the custodian and broker. Our

audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our

opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Manager Directed Portfolios since 2007.

Philadelphia, Pennsylvania

February 28, 2020

23

Spyglass Growth Fund

|

EXPENSE EXAMPLE

|

|

December 31, 2019 (Unaudited)

|

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs including sales charges (loads) and redemption fees, if applicable; and (2) ongoing costs, including management

fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period indicated and held for the entire period from July 1, 2019 to December 31, 2019 for the Institutional Shares.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns together with the amount

you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the row entitled “Expenses Paid

During Period” to estimate the expenses you paid on your account during this period. There are some account fees that are charged to certain types of accounts, such as Individual Retirement Accounts (generally, a $15 fee is charged to the account

annually) that would increase the amount of expenses paid on your account. The example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting

principles.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual

expense ratio and assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the

period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

As noted above, there are some account fees that are charged to certain types of accounts that would increase the amount of expense paid on your account.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange

fees. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these

transactional costs were included, your costs would have been higher.

24

Spyglass Growth Fund

|

EXPENSE EXAMPLE (Continued)

|

|

December 31, 2019 (Unaudited)

|

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Account Value

|

Account Value

|

During Period

|

|

|

7/1/2019

|

12/31/2019

|

7/1/2019 – 12/31/2019(1)

|

|

|

Actual

|

|||

|

Institutional Shares

|

$1,000.00

|

$1,084.90

|

$5.26

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

|||

|

Institutional Shares

|

$1,000.00

|

$1,020.16

|

$5.09

|

|

(1)

|

Expenses are equal to the Institutional Shares’ annualized expense ratio of 1.00% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the period).

|

25

Spyglass Growth Fund

|

NOTICE TO SHAREHOLDERS

|

|

at December 31, 2019 (Unaudited)

|

How to Obtain a Copy of the Fund’s Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling

1-888-878-5680 or on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

How to Obtain a Copy of the Fund’s Proxy Voting Records for the most recent 12-Month Period Ended June 30

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available no later than August 31 without charge, upon

request, by 1-888-878-5680. Furthermore, you can obtain the Fund’s proxy voting records on the SEC’s website at http://www.sec.gov.

Quarterly Filings on Form N-Q

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q or Part F of Form N-PORT (beginning with filings after March

31, 2020). The Fund’s Form N-Q or Part F of Form N-PORT (beginning with filings after March 31, 2020) is available on the SEC’s website at http://www.sec.gov. Information included in the Fund’s Form N-Q or Part F of Form N-PORT (beginning with

filings after March 31, 2020) is also available, upon request, by calling 1-888-878-5680.

Householding

In an effort to decrease costs, the Fund intends to reduce the number of duplicate prospectuses and annual and semi-annual reports you receive by sending only one copy of each to those addresses

shared by two or more accounts and to shareholders the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at

1-888-878-5680 to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not apply

to account statements.

Other Tax Information (Unaudited)

For the fiscal year ended December 31, 2019, certain dividends paid by the Fund may be subject to a maximum tax rate of 15%, as provided by the Jobs and Growth Tax Relief Reconciliation Act of

2003. The percentage of dividends declared from ordinary income designated as qualified dividend income was as follows:

|

Spyglass Growth Fund

|

2.75%

|

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended December 31, 2019 was as follows:

|

Spyglass Growth Fund

|

1.79%

|

26

Spyglass Growth Fund

|

TRUSTEES AND OFFICERS

|

|

(Unaudited)

|

The business and affairs of the Trust are managed under the oversight of the Board, subject to the laws of the State of Delaware and the Trust’s Agreement and Declaration of Trust. The Board is

currently comprised of three trustees who are not interested persons of the Trust within the meaning of the 1940 Act (the “Independent Trustees”) and one interested person of the Trust (the “Interested Trustee”). The Trustees are responsible for

deciding matters of overall policy and overseeing the actions of the Trust’s service providers. The officers of the Trust conduct and supervise the Trust’s daily business operations.

|

Number of

|

||||

|

Funds

|

Other

|

|||

|

Position(s) Held

|

in Fund

|

Directorships

|

||

|

Name,

|

with the Trust

|

Complex

|

Held by Trustee

|

|

|

Year of Birth

|

and Length of

|

Principal Occupation(s)

|

Overseen by

|

During the Past

|

|

and Address(1)

|

Time Served(3)

|

During the Past Five Years

|

Trustee

|

Five Years

|

|

INTERESTED TRUSTEE

|

||||

|

James R.

|

Trustee and

|

Distribution Consultant; since

|

9

|

None

|

|

Schoenike(2)

|

Chairman since

|

2018, President and CEO,

|

||

|

(Born 1959)

|

July 2016

|

Board of Managers, Quasar

|

||

|

Distributors, LLC (2013 – 2018).

|

||||

|

INDEPENDENT TRUSTEES

|

||||

|

Gaylord B. Lyman

|

Trustee and Audit

|

Senior Portfolio Manager,

|

9

|

None

|

|

(Born 1962)

|

Committee

|

Affinity Investment Advisors,

|

||

|

Chairman, since

|

LLC, since 2017; Managing

|

|||

|

April 2015

|

Director of Kohala Capital

|

|||

|

Partners, LLC (2011 – 2016).

|

||||

|

Scott Craven Jones

|

Trustee since

|

Managing Director, Carne Global

|

9

|

Trustee, Madison

|

|

(Born 1962)

|

July 2016 and

|

Financial Services (US) LLC

|

Funds; since 2019

|

|

|

Lead Independent

|

(a provider of independent

|

(18 portfolios);

|

||

|

Trustee since

|

governance and distribution

|

Director,

|

||

|

May 2017

|

support for the asset management

|

Guestlogix Inc.

|

||

|

industry), since 2013.

|

(a provider of

|

|||

|

ancillary-focused

|

||||

|

technology to the

|

||||

|

travel industry)

|

||||

|

(2015 – 2016);

|

||||

|

Trustee, XAI

|

||||

|

Octagon Floating

|

||||

|

Rate & Alternative

|

||||

|

Income Term

|

||||

|

Trust, since 2017.

|

27

Spyglass Growth Fund

|

TRUSTEES AND OFFICERS (Continued)

|

|

(Unaudited)

|

|

Number of

|

||||

|

Funds

|

Other

|

|||

|

Position(s) Held

|

in Fund

|

Directorships

|

||

|

Name,

|

with the Trust

|

Complex

|

Held by Trustee

|

|

|

Year of Birth

|

and Length of

|

Principal Occupation(s)

|

Overseen by

|

During the Past

|

|

and Address(1)

|

Time Served(3)

|

During the Past Five Years

|

Trustee

|

Five Years

|

|

Lawrence T.

|

Trustee since

|

Senior Vice President and Chief

|

9

|

None

|

|

Greenberg

|

July 2016

|

Legal Officer, The Motley Fool

|

||

|

(Born 1963)

|

Holdings, Inc., since 1996;

|

|||

|

Venture Partner and General

|

||||

|

Counsel, Motley Fool Ventures

|

||||

|

LP, since 2018; Manager,

|

||||

|

Motley Fool Wealth Management,

|

||||

|

LLC, since 2013; Adjunct

|

||||

|

Professor, Washington College

|

||||

|

of Law, American University,

|

||||

|

since 2006; General Counsel

|

||||

|

Motley Fool Asset Management,

|

||||

|

LLC (2008 – 2019).

|

|

(1)

|

The address of each Trustee as it relates to the Trust’s business is c/o U.S. Bancorp Fund Services LLC, 615 East Michigan Street, Milwaukee, WI 53202.

|

|

(2)

|

Mr. Schoenike is an Interested Trustee by virtue of the fact that he was recently President of Quasar Distributors, LLC, the Fund’s distributor (the “Distributor”).

|

|

(3)

|

Each Trustee serves during the continued lifetime of the Trust until he dies, resigns, is declared bankrupt or incompetent by a court of competent jurisdiction, or is removed.

|

28

Spyglass Growth Fund

|

TRUSTEES AND OFFICERS (Continued)

|

|

(Unaudited)

|

As of the date of this report, no Independent Trustee nor any of his immediate family members (i.e., spouse or dependent children) serves as an officer or director or is an employee of the Advisor,

Sub-Advisor or Distributor, or any of their respective affiliates, nor is such person an officer, director or employee of any company controlled by or under common control with such entities.

|

Name

|

Position(s) Held with

|

|

|

(Year of Birth)

|

Trust and Length

|

|

|

and Address

|

of Time Served(3)

|