Form N-CSR MUTUAL FUND SERIES TRUST For: Sep 30

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21872

Mutual Fund Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246

(Address of principal executive offices) (Zip code)

CT CORPORATION SYSTEM

1300 EAST NINTH STREET, CLEVELAND, OH 44114

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 9/30

Date of reporting period: 9/30/19

ITEM 1. REPORTS TO SHAREHOLDERS.

ANNUAL REPORT

Camelot Premium Return Fund

Camelot Excalibur Small Cap Income Fund

September 30, 2019

Camelot Funds, LLC

1700 Woodlands Dr.

Suite 100

Maumee, OH 43537

Beginning January 1, 2021, the Funds intend to meet their shareholder report delivery obligations by posting annual and semi-annual shareholder reports to the Funds’ website, www.camelotfunds.com rather than delivering paper copies. You will be notified by mail each time a report is posted and provided with the website link to access the report. You may elect to receive paper copies of a specific shareholder report or all future shareholder reports free of charge by contacting your financial intermediary (such as a broker-dealer or bank), or, if you are a direct investor, by following the instructions included with this annual report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to do anything.

Dear Fellow Shareholders,

Greetings - welcome to Camelot! We are honored to serve you and blessed to have your trust. We would not exist without you, so we strive to serve you with excellence and integrity.

The strategies of our two funds are very similar, so much of the commentary for the Camelot Premium Return Fund will apply to the Camelot Excalibur Small Cap Income Fund. The commentary for Camelot Excalibur Small Cap Income Fund will focus on the areas that are different from the Camelot Premium Return Fund.

Camelot – Premium Return Fund

We are disappointed with our results for fiscal 2019 as the Camelot Premium Return Fund delivered what we believe to be unattractive total returns for the fiscal year, but continued to deliver consistent cash flows. The strong declines in U.S. equity markets during Q4 2018 were more severe and persistent than we expected, so our opportunistic buying was too early and led to a very poor start to the fiscal year. We have recovered well over the last three quarters and believe the recovery is not yet complete.

According to Morningstar, our performance for Class I shares ranked in the 83rd percentile in our category for the 1 year period ending 9/30/2019 out of 141 funds. The A Shares were ranked in the 48th & 60th percentiles for the trailing 3 and 5 year periods respectively.

| Annualized Total Returns (%) | Inception | |||||||||||

| Q3 | YTD | 1 Year | 3 Year | 5 Year | (12/31/2010) | |||||||

| Camelot Premium Return Fund Class A – CPRFX - Load Waived | -1.89% | 22.32% | -2.99% | 4.94% | 3.31% | 6.23% | ||||||

| Camelot Premium Return Fund Class A – CPRFX - With Load | -7.54% | 15.27% | -8.56% | 2.90% | 2.10% | 5.52% | ||||||

| Camelot Premium Return Fund Class I – CPRIX | -1.79% | 22.49% | -2.78% | N/A | N/A | 4.25% | ||||||

| Options Based | 0.83% | 10.18% | 1.03% | 4.18% | 3.09% | 4.49% | ||||||

The maximum sales charge (load) for Class A is 5.75%. Dividends are not assured. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. For performance information current to the most recent month-end, please call toll-free 855-226-3863. (Data source from both Morningstar and Gemini 9.30.19)

While we are competitive by nature and desire to be at the top of our category each year, we know that is likely not always possible. Ultimately, our focus is on delivering consistent income and reinvestment of capital for the long-term. We believe investing, by nature, is a long-term process and requires at least five years to properly evaluate results. This will be our focus and the basis for our decision-making process. Our desire is to partner with you, the investor, to deliver on our specified objectives for many years to come, so you have a great investing experience, and consistent returns.

We believe investing is like growing an orchard. The true value is in the fruit that is produced each year. In the short term, the value of each tree and the whole orchard will fluctuate. But over time, the value of the orchard will reflect the consistent and growing yield coming from the trees each year. This is what we seek to do for our investors – create an orchard of investments that produce yield (cash flow) year after year.

While short-term returns can vary significantly, our focus is on cash flow – generation seeking investments that produce cash flow now and are likely to do so long into the future. As we have no control over short-term market fluctuations, we suggest only investing in our funds if you intend to hold them for at least 3-5 years. A decision to invest should be based on our long-term track record it would be foolish to sell based on a short-term (less than 3 years) result.

We consider each investor in our fund to be a partner. We are honored to meet many of you and know there are many more we will never meet. Even so, we value each one and are honored to serve you.

1

Objective 1 - High Rate of Gains / Cash Flow

While total return results are best gauged over a period of 5 years or more, cash flow can give investors something to hold on to in the shorter term. In this fund, cash flow is our primary focus. We want retirees and those close to retirement to feel confident in the stability of their cash flow – which is more important than total return to their daily lifestyle. At the same time, due to the currently low interest rates, many retirees must maintain exposure to equities to reduce the probability of outliving their savings. While the flat income streams from many retirement income vehicles may fail to keep up with inflation, this fund seeks to provide an income stream that will increase over time to keep up and/or outpace inflation.

Reinvesting this cash flow can be a great way for younger investors to build wealth as well.

We have delivered a quarterly target distribution for the past 34 quarters and have paid our target of $.14 on Class A shares over the past four quarters. We remain focused on our objective of maintaining and increasing this distribution in the future.

Objective 2 - Total Return

Nearly all investors hope to realize strong total returns and we have utilized this strategy for over a decade to do so. As mentioned above, this is a long-term objective, best evaluated over periods of at least five years. Our trailing 5 year annualized return is 3.31%, which puts us in the 60th percentile for our Morningstar category Option Writing. We will continue to evaluate rolling 5 year periods moving forward.

Objective 3 - Lower volatility than common stocks

One of the best ways to help investors stay invested during difficult times is to reduce the volatility they experience. This can often be a difficult proposition when trying to fulfill income and total return objectives as well. This fund seeks to do all three, but will give preference to the first two.

Achieving this objective has been elusive as the markets recently experienced a few bouts of extreme volatility after having experienced much lower than normal volatility over the previous 5-6 years. We believe this may be ushering in a multi-year period with above average market volatility. We believe our strategy will be able to demonstrate lower relative volatility in those conditions.

We don’t believe daily volatility (beta) is what concerns most investors. The primary concern, and therefore ours in this objective, is the size of a pullback in a down market. We seek to experience even less drawdown in such periods. This is a more difficult measure as we don’t know when or why pullbacks will occur, but we believe there are things we can do to increase the probability of success in this area while still keeping the priority of our first two objectives.

At the same time, we welcome volatility in the market as it typically provides for greater option premiums and long-term buying opportunities. While volatility can be painful in the short-run, especially when it is not expected, we must be willing to accept some of it to achieve attractive real returns over time.

Conclusion

We are not pleased with our performance this year and will work diligently to improve the results in the coming year. We believe there have been significant and material changes to certain market dynamics to which we much adapt, so we are actively working to do so.

Thank you for the opportunity to serve you. We don’t take it for granted. We will continue to work tirelessly to deliver solid results moving forward.

Market Review

The near relentless growth in the equity markets we mentioned last year came to an abrupt halt in the fourth quarter of 2018 as the Federal Reserve continued to raise interest rates in the face of slowing economic growth. After suggesting 2-3 more increases were in store for 2019, the Fed relented and has actually cut rates twice so far in 2019, leading the equity markets to recover from the 2018 decline and rally to new highs.

2

After peaking around 3.2% at the end of September, 2018, interest rates have dropped in half as the U.S. 10 year treasury fell from 3.2% to below 1.5% in August, 2019. This led to strongly positive returns for most parts of the bond market. This raises concerns about future duration risk although the inverted yield curve suggests a low likelihood of rising rates in the near future.

Oil prices reversed from their strong recovery, dropping from over $70 a barrel into the low $50s despite unrest in the Middle East. The energy sector continued its weak returns and has fallen to account for just 5% of the S&P 500 market capitalization, a near-record low. Last year, we conceded oil may stabilize higher than the $60 level we suggested the year before, but was likely near its highs. Now, $60 looks outright optimistic and would likely lead to a sizeable rally in energy stocks if it materialized.

The Federal Reserve ended the process of shrinking its’ balance sheet and has had to reverse course already as liquidity problems developed in the overnight lending repo markets. The Federal Funds rate target decreased to 2.0% in September 2019, with little consensus whether the next move will be higher or lower.

The market volatility we have been expecting showed up with a vengeance and quickly exceeded our expectations. We continue to believe it is likely volatility will be heightened for the next 4-5 years. This doesn’t necessarily mean the market will do poorly, but it will likely shake out skittish investors and create opportunities for us.

Camelot - Premium Return Fund Commentary

Returns – The return for the Fund for this fiscal year was -2.78% (Class I shares)1 versus 1.03% for the average fund in our Morningstar Category (Options-based).

Sector Weightings – we make no attempt to match our sector weightings to any particular benchmark or index.

Contributors – We had realized gains spread over dozens of positions, most of which were put and call options. We also had $1.4 million in net investment income (dividends and interest). Premiums received from option writing contributed over $4.2 million in realized gains. Our greatest contributors were Chipotle (CMG), TC Energy Corp (TRP), Vereit Inc. (VER), Under Armour Inc. (UAA), a variety of Puerto Rico Bonds, and a short position in VXX, several of which had been significant detractors in previous years and staged strong recoveries.

Detractors – Cemex (CX), Fluor Corp (FLR), GameStop Corp (GME), Office Properties Income Trust (OPI), & Tata Motors (TTM).

Our largest equity positions are Cemex (4.45%), Energy Transfer LP (4.29%) & Ford Motor Company (4.07%).

New Positions – As our option writing strategy naturally produces higher turnover, we initiated dozens of new positions, which will almost always be the case.

Eliminated Positions – Due to the nature of our option based strategy, we had dozens of positions throughout the fiscal year which we no longer hold.

Current Portfolio – As of fiscal year-end, our portfolio composition is in balance between equity holdings (dividend-paying stocks and/or stocks with covered calls) and put positions. We typically seek to have more than 50% of our portfolio in an option writing position (put or covered call). Even so, we are currently allocated more conservatively than normal as we believe there are currently elevated risks to the markets. However, the portfolios composition will fluctuate over time as markets fluctuate and different positions become more attractive.

Dividend – We have continued to deliver our quarterly dividend since inception (35 quarters). We hope to maintain a steady quarterly dividend of $0.14 per share, but there is no guarantee this will happen as we must have realized gains in order to meet our target distribution.

Excalibur – Small Cap Income Fund

We are pleased with another positive year for Camelot Excalibur Small Cap Income Fund in relative terms despite having a negative year in absolute terms. As in the previous year, returns in the Small Cap Value space significantly lagged behind returns in the large cap and growth parts of the spectrum, making for a difficult environment. But our strategy and discipline paid off.

3

According to Morningstar, our performance for Class I shares ranked in the 17th percentile in our category for the 1 year period ending 9/30/2019 out of 417 funds.

| Annualized Total Returns (%) | Inception | |||||||||||

| Q3 | YTD | 1 Year | 3 Year | 5 Year | 12/31/2013 | |||||||

| Camelot Excalibur Small Cap Income Fund Class A – CEXAX – Load Waived | -3.74% | 16.64% | -4.68% | 5.24% | 2.74% | 1.53% | ||||||

| Camelot Excalibur Small Cap Income Fund Class A – CEXAX – With Load | -9.32% | 9.90% | -10.12% | 3.18% | 1.53% | 0.49% | ||||||

| Camelot Excalibur Small Cap Income Fund Class I – CEXIX | -3.58% | 16.99% | -4.33% | N/A | N/A | 3.53% | ||||||

| Russell 2000TR | -2.40% | 14.18% | -8.89% | 8.23% | 8.19% | 6.25% | ||||||

We delivered on our primary objective of delivering strong cash flow. We continued to maintain a $.10 quarterly distribution over the last four quarters, which we hope to maintain and increase over time. More than half of this distribution was attributed to Dividend Income.

Camelot Excalibur Small Cap Income Fund is designed to allow all investors to gain exposure to small caps and stay invested according to plan by generating consistent cash flow. We believe this fund is extremely unique in the small cap space and we believe it can be one of the most consistent & highest yielding funds in its category. Of course, there are no guarantees we will be able to achieve that.

Objective 1 – Consistent & Growing Income Stream

See notes under Objective 1 for the Camelot Fund.

We are pleased with the progress on this objective as we maintained a $.10 quarterly distribution, which is our target. We intend to maintain this as consistently as possible and increase it over time. Based on the 9/30/2019 NAV of $7.88 (CEXAX), this should equate to a very nice cash flow, especially for a small-cap fund.

Objective 2 – Total Return

The fund’s return was -4.33%, which was above the Russell 2000, which returned -8.89%, and above our category (Small Value) average of -9.37%, putting us in the 17th percentile.

Conclusion

We are pleased with our performance this year as we believe we delivered well on both objectives. We believe it shows the power of our strategy and our ability to capitalize on difficult market conditions. It is always fun to be near the top of our category, but we will not rest as our long term view continues to keep us disciplined.

Thank you for the opportunity to serve you. We don’t take it for granted. We will continue to work tirelessly to deliver solid results moving forward.

Market Review

Small caps (measured by the Russell 2000) under-performed larger companies (measured by the S&P 500) and Small Cap Value as measured by the Russell 2000 Value Index lagged the Russell 2000 Index. As this trend has persisted for quite some time, we believe the opportunities in small value are attractive and leave significant opportunities in the years ahead.

Excalibur – Small Cap Income Fund Commentary

Returns – The return for the Fund for this fiscal year was -4.33% (Class I shares)1 versus -8.89% for the Russell 2000 Total Return index and -9.37% for the average fund in our Morningstar Category (Small Value).

4

Sector Weightings – we make no attempt to match our sector weightings to any particular benchmark or index.

Contributors – We had realized gains spread over several dozen positions, most of which were put and call options, and over $400,000 in investment income (dividends & interest). The greatest contributors were Compass Diversified Holdings (CODI), Blackbaud Inc (BLKB), LGI Homes Inc (LGIH), a variety of Puerto Rico Bonds, and a short position in VXX.

Detractors – Our greatest detractors were Camping World Inc (CWH), Destination Maternity Corp (DEST), Fluor Corp (FLR), Tupperware Brands Corp (TUP), and Washington Prime Group Inc (WPG).

Our largest equity positions are Textainer Group Holdings Ltd (3.52%), Fluor Corp (3.38%), and Compass Minerals International Inc (3.01%).

New Positions – As our option writing strategy naturally produces higher turnover, we initiated dozens of new positions, which will almost always be the case.

Eliminated Positions – Due to the nature of our option based strategy, we had dozens of positions throughout the fiscal year which we no longer hold.

Current Portfolio – As of fiscal year-end, our portfolio composition is under 50% outright equity holdings and above 50% in put or covered call positions. This weighting is tilted more conservatively than normal as we believe there are currently elevated risks to the markets. However, the portfolios composition will fluctuate over time as markets fluctuate and different positions become more attractive.

Dividend – We maintained our quarterly dividend of $.10. We hope to maintain a steady quarterly dividend of $0.10 per share, increasing over time, but there is no guarantee this will happen as we must have investment income or realized gains in order to meet our target distribution.

Final Remarks

“Every trend goes on forever, until it ends.” -John Neff

“If you stay rational yourself, the stupidity of the world helps you.” -Charles Munger

The last several years have seemed like a broken record as the market returns have largely been driven by Large Caps, Growth, and Technology, something we saw in the late 1990’s. While we don’t believe there is a bubble of that size, we do believe this trend will eventually end. We believe Small Caps and Value will once again experience a period of outperformance and we plan to be ready when it happens.

Thank you to all our shareholders for the faith and trust you have placed in us. We are blessed and honored to be a part of your portfolio and take the responsibility seriously. Also, we thank all the advisors who utilize our funds for their clients. We know the risk you take every time you make a recommendation and will work hard to make sure your clients have a great investment experience.

May God bless you greatly in the coming year!

Kind Regards,

Darren T. Munn, CFA

Chief Investment Officer

© 2019 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

5

| (a) | Past performance is not indicative of future results. Specifically, there is no assurance that the Fund will achieve its investment objective or be profitable in the future. There can be no assurance that any investment discussed in this presentation will achieve results comparable to what is discussed herein, or avoid losses. |

| (b) | Unless otherwise specified, all performance results are as of September 30, 2019. |

| (c) | Certain portions of this presentation include information regarding the performance of various sectors, indices, or the economy in general. Such information is taken from various sources, and while believed to be reliable, is not necessarily independently verified by Camelot Portfolios LLC, and accordingly, such information should not be relied upon in making any investment decisions. |

| (d) | Russell 2000 Index is a market capitalization-weighted index designed to measure the performance of the small-cap segment of the U.S. equity market. S&P 500 Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. You cannot invest directly in an index. Accordingly, performance results for investment indexes do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. |

| (e) | Nothing in this communication should be in any way be interpreted as investment advice. Any person or entity considering an investment in a fund managed by Camelot Portfolios LLC should carefully review the prospectus relative to that fund, and consult with appropriate legal, tax and investment professionals. Any person in receipt of this communication should consult the same professionals before acting on any of the commentary presented herein, as this communication is not a substitute for personalized investment advice. |

| (f) | Certain statements in this presentation are based on information that is deemed valid as of the date of the presentation. Changes in circumstances, even minor ones, can materially alter the economic outlook, the outlook for a given investment or for an entire fund. |

| (g) | This communication presents specific information regarding specific investments made by one or more of the Camelot funds. These investments are presented for educational and demonstrative purposes only, and are not intended to represent the performance of any fund as a whole, or to be in any way indicative of the performance a Camelot fund should achieve in the future. There are many other investments made by each Camelot fund not presented here. For a full list of investments and returns related to any of the funds discussed herein, please contact Jennifer Rogers at [email protected]. |

7232-NLD-10/17/2019 CF083

6

| Camelot Premium Return Fund |

| PORTFOLIO REVIEW (Unaudited) |

| September 30, 2019 |

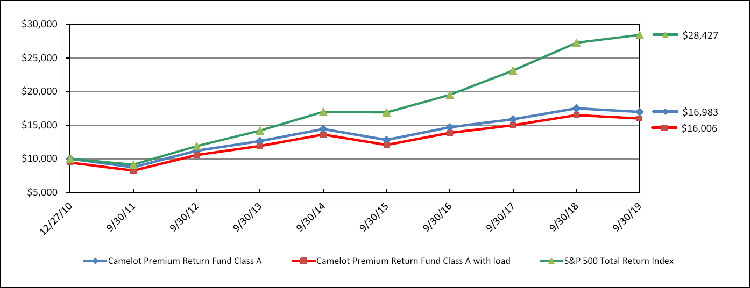

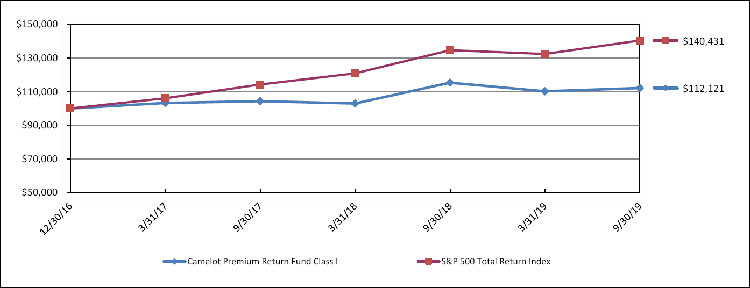

The Fund’s performance figures(1) for each of the periods ended September 30, 2019, compared to its benchmark:

| One Year Return | Three Year Return | Five Year Return | Since Inception(4) | Since Inception(5) | |

| Class A | (2.99)% | 4.94% | 3.31% | 6.23% | N/A |

| Class A with 5.75% load | (8.56)% | 2.90% | 2.10% | 5.52% | N/A |

| Class I | (2.78)% | N/A | N/A | N/A | 4.25% |

| S&P 500 Total Return Index(2) | 4.25% | 13.39% | 10.84% | 12.67% | 13.14% |

| CBOE S&P BuyWrite Index(3) | (1.11)% | 6.99% | 5.92% | 6.88% | 6.63% |

| (1) | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Manager and the Fund have entered into an Expense Limitation Agreement under which the Manager has contractually agreed to waive fees and/or reimburse expenses but only to the extent necessary to maintain total annual operating expenses (excluding brokerage costs; borrowing and liquidity costs such as interest and dividends on securities sold short; taxes; underlying/acquired fund expenses; and extraordinary expenses) at 1.75% and 1.50% for Class A and Class I, respectively, through January 31, 2020. Class A shares are subject to a maximum sales charge of 1.00%. Each waiver or reimbursement by the Manager is subject to repayment by the Fund within the three years following the fiscal year in which that particular expense is incurred, if the Fund is able to make the repayment without exceeding the expense limitation in effect at the time of the waiver or reimbursement or at the time of recoupment. Without these waivers, the Fund’s total annual operating expenses would have been 2.36% and 2.11% for the Fund’s Class A and Class I shares, respectively, including interest, dividend expenses, and acquired fund fees, per the most recent prospectus. Please review the Fund’s most recent prospectus for more detail on the expense waiver. For performance information current to the most recent month-end, please call toll-free 1-855-226-3863. |

| (2) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. |

| (3) | The CBOE S&P BuyWrite Index is a benchmark index designed to show the hypothetical performance of a portfolio that engages in a buy-write strategy using S&P 500 index call options. |

| (4) | Class A inception date is December 27, 2010. |

| (5) | Class I inception date is December 30, 2016. |

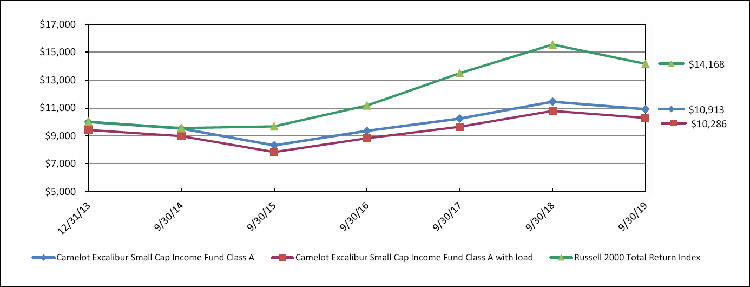

Comparison of the Change in Value of a $10,000 Investment

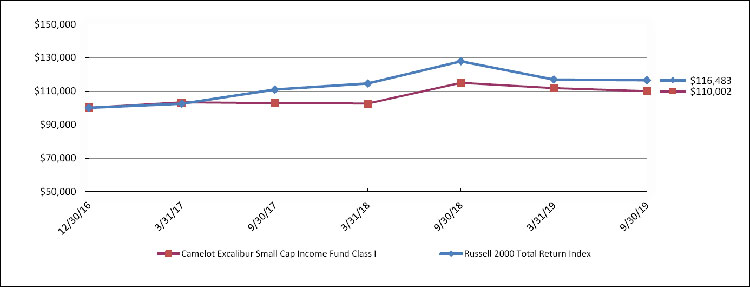

Comparison of the Change in Value of a $100,000 Investment

7

| Camelot Premium Return Fund |

| PORTFOLIO REVIEW (Unaudited) (Continued) |

| September 30, 2019 |

| Top 10 Allocations | % of Net Assets | |||

| Pipelines | 10.9 | % | ||

| Real Estate Investment Trusts | 9.5 | % | ||

| Municipal Bonds | 9.3 | % | ||

| Auto Manufacturers | 8.9 | % | ||

| Closed-End Funds | 8.0 | % | ||

| Retail | 5.4 | % | ||

| Building Materials | 5.2 | % | ||

| Banks | 5.1 | % | ||

| Telecommunications | 3.6 | % | ||

| Engineering & Construction | 2.8 | % | ||

| Other/Cash & Equivalents | 31.3 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this annual report for a detailed analysis of the Fund’s holdings.

8

| Camelot Excalibur Small Cap Income Fund |

| PORTFOLIO REVIEW (Unaudited) |

| September 30, 2019 |

The Fund’s performance figures(1) for each of the periods ended September 30, 2019, compared to its benchmark:

| One Year Return | Three Year Return | Five Year Return | Since Inception(3) | Since Inception(4) | |

| Class A | (4.68)% | 5.24% | 2.74% | 1.53% | N/A |

| Class A with 5.75% load | (10.12)% | 3.18% | 1.53% | 0.49% | N/A |

| Class I | (4.33)% | N/A | N/A | N/A | 3.53% |

| Russell 2000 Total Return Index(2) | (8.89)% | 8.23% | 8.19% | 6.25% | 5.70% |

| (1) | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Manager and the Fund have entered into an Expense Limitation Agreement under which the Manager has contractually agreed to waive fees and/or reimburse expenses but only to the extent necessary to maintain total annual operating expenses (excluding brokerage costs; borrowing and liquidity costs such as interest and dividends on securities sold short; taxes; underlying/acquired fund expenses; and extraordinary expenses) at 1.75% and 1.50% for Class A and Class I, respectively, through January 31, 2020. Class A shares are subject to a maximum sales charge of 1.00%. Each waiver or reimbursement by the Manager is subject to repayment by the Fund within the three years following the fiscal year in which that particular expense is incurred, if the Fund is able to make the repayment without exceeding the expense limitation in effect at the time of the waiver or reimbursement or at the time of recoupment. Without these waivers, the Fund’s total annual operating expenses would have been 3.00% and 2.75% for the Fund’s Class A and Class I shares, respectively, including interest, dividend expenses, and acquired fund fees, per the most recent prospectus. Please review the Fund’s most recent prospectus for more detail on the expense waiver. For performance information current to the most recent month-end, please call toll-free 1-855-226-3863. |

| (2) | The Russell 2000 Total Return Index measures the performance of the 2,000 smallest companies of the 3,000 largest U.S. companies based on total market capitalization. |

| (3) | Class A inception date is December 31, 2013. |

| (4) | Class I inception date is December 30, 2016. |

Comparison of the Change in Value of a $10,000 Investment

Comparison of the Change in Value of a $100,000 Investment

9

| Camelot Excalibur Small Cap Income Fund |

| PORTFOLIO REVIEW (Unaudited) (Continued) |

| September 30, 2019 |

| Top 10 Allocations | % of Net Assets | |||

| Real Estate Investment Trusts | 18.5 | % | ||

| Municipal Bonds | 12.9 | % | ||

| Retail | 12.2 | % | ||

| Closed-End Funds | 5.5 | % | ||

| Pipelines | 4.5 | % | ||

| Transportation | 4.2 | % | ||

| Commercial Services | 4.0 | % | ||

| Engineering & Construction | 3.9 | % | ||

| Insurance | 3.5 | % | ||

| Mining | 3.4 | % | ||

| Other/Cash & Equivalents | 27.4 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this annual report for a detailed analysis of the Fund’s holdings.

10

| Camelot Premium Return Fund |

| SCHEDULE OF INVESTMENTS |

| September 30, 2019 |

| Principal | Coupon Rate (%) | Maturity | Fair Value | |||||||||

| BONDS - 7.0% | ||||||||||||

| AGENCY COLLATERAL CMO - 1.4% | ||||||||||||

| $ | 1,988,450 | Fannie Mae REMICS | 3.0000 | 7/25/2042 | $ | 152,949 | ||||||

| 1,250,527 | Fannie Mae REMICS | 3.5000 | 3/25/2047 | 143,279 | ||||||||

| 746,810 | Fannie Mae REMICS | 3.5000 | 8/25/2049 | 116,766 | ||||||||

| 1,453,028 | Fannie Mae REMICS | 4.0000 | 7/25/2049 | 139,530 | ||||||||

| 552,524 | ||||||||||||

| RETAIL - 4.6% | ||||||||||||

| 500,000 | GameStop Corp. ^(a) | 6.7500 | 3/15/2021 | 491,250 | ||||||||

| 1,415,000 | Men’s Wearhouse, Inc. (a) | 7.0000 | 7/1/2022 | 1,393,775 | ||||||||

| 1,885,025 | ||||||||||||

| TELECOMMUNICATIONS - 1.0% | ||||||||||||

| 360,000 | Frontier Communications Corp. | 6.8750 | 1/15/2025 | 162,000 | ||||||||

| 500,000 | Frontier Communications Corp. | 10.5000 | 9/15/2022 | 233,125 | ||||||||

| 395,125 | ||||||||||||

| TOTAL BONDS (Cost $3,139,856) | 2,832,674 | |||||||||||

| MUNICIPAL BONDS - 9.3% | ||||||||||||

| PUERTO RICO - 8.5% | ||||||||||||

| 40,000 | Commonwealth of Puerto Rico # | 5.0000 | 7/1/2023 | 29,700 | ||||||||

| 225,000 | Commonwealth of Puerto Rico # | 5.0000 | 7/1/2024 | 167,625 | ||||||||

| 125,000 | Commonwealth of Puerto Rico # | 5.0000 | 7/1/2025 | 93,437 | ||||||||

| 100,000 | Commonwealth of Puerto Rico # | 5.0000 | 7/1/2029 | 74,750 | ||||||||

| 75,000 | Commonwealth of Puerto Rico # | 5.0000 | 7/1/2031 | 55,875 | ||||||||

| 140,000 | Commonwealth of Puerto Rico # | 5.0000 | 7/1/2034 | 104,650 | ||||||||

| 145,000 | Commonwealth of Puerto Rico # | 5.7500 | 7/1/2038 | 106,031 | ||||||||

| 50,000 | Puerto Rico Commonwealth Aqueduct & Sewer Authority | 4.9000 | 7/1/2020 | 49,975 | ||||||||

| 50,000 | Puerto Rico Commonwealth Aqueduct & Sewer Authority | 5.0000 | 7/1/2022 | 52,500 | ||||||||

| 200,000 | Puerto Rico Electric Power Authority # | 3.7500 | 7/1/2022 | 155,500 | ||||||||

| 70,000 | Puerto Rico Electric Power Authority # | 4.1000 | 10/24/2019 | 53,462 | ||||||||

| 100,000 | Puerto Rico Electric Power Authority # | 4.2500 | 7/1/2021 | 79,250 | ||||||||

| 110,000 | Puerto Rico Electric Power Authority # | 4.2500 | 7/1/2023 | 87,175 | ||||||||

| 130,000 | Puerto Rico Electric Power Authority # | 4.7500 | 7/1/2026 | 103,350 | ||||||||

| 220,000 | Puerto Rico Electric Power Authority # | 4.8000 | 7/1/2027 | 174,900 | ||||||||

| 40,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2020 | 32,000 | ||||||||

| 25,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2023 | 20,000 | ||||||||

| 20,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2024 | 16,000 | ||||||||

| 165,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2025 | 132,000 | ||||||||

| 25,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2026 | 25,022 | ||||||||

| 30,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2026 | 24,000 | ||||||||

| 105,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2027 | 84,000 | ||||||||

| 80,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2027 | 64,000 | ||||||||

| 50,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2028 | 40,000 | ||||||||

| 85,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2029 | 68,000 | ||||||||

| 25,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2037 | 20,000 | ||||||||

| 50,000 | Puerto Rico Electric Power Authority # | 5.0500 | 7/1/2042 | 40,000 | ||||||||

| 35,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2021 | 28,087 | ||||||||

| 50,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2024 | 40,125 | ||||||||

| 35,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2025 | 28,087 | ||||||||

| 65,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2027 | 52,162 | ||||||||

| 25,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2027 | 20,063 | ||||||||

| 55,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2028 | 44,137 | ||||||||

| 25,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2033 | 20,063 | ||||||||

| 50,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2035 | 40,125 | ||||||||

| 130,000 | Puerto Rico Electric Power Authority # | 5.2500 | 7/1/2040 | 104,325 | ||||||||

| 50,000 | Puerto Rico Electric Power Authority # | 5.4000 | 7/1/2028 | 39,438 | ||||||||

| 40,000 | Puerto Rico Electric Power Authority # | 5.5000 | 7/1/2021 | 32,150 | ||||||||

| 485,000 | Puerto Rico Highway & Transportation Authority | 0.0000 | 7/1/2027 | 336,183 | ||||||||

| 100,000 | Puerto Rico Public Buildings Authority # | 5.3750 | 7/1/2028 | 83,750 | ||||||||

| 585,000 | University of Puerto Rico | 5.0000 | 6/1/2021 | 586,463 | ||||||||

| 15,000 | University of Puerto Rico | 5.0000 | 6/1/2022 | 15,019 | ||||||||

| 10,000 | University of Puerto Rico | 5.0000 | 6/1/2022 | 10,013 | ||||||||

| 3,433,392 | ||||||||||||

| NEVADA - 0.8% | ||||||||||||

| 515,000 | State of Nevada Department of Business & Industry | 0.0000 | 1/1/2027 | 317,516 | ||||||||

| TOTAL MUNICIPAL BONDS (Cost $3,465,646) | 3,750,908 | |||||||||||

See accompanying notes to financial statements.

11

| Camelot Premium Return Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Shares | Fair Value | |||||||

| CLOSED-END FUNDS - 8.0% | ||||||||

| 20,000 | Aberdeen Asia-Pacific Income Fund, Inc. | $ | 83,800 | |||||

| 10,000 | Altaba, Inc. (b) | 194,800 | ||||||

| 17,134 | Ares Dynamic Credit Allocation Fund, Inc. | 255,297 | ||||||

| 20,000 | Eaton Vance Limited Duration Income Fund | 250,000 | ||||||

| 40,000 | Eaton Vance Senior Income Trust (b) | 244,800 | ||||||

| 27,463 | First Trust High Income Long/Short Fund | 416,339 | ||||||

| 35,000 | Invesco Dynamic Credit Opportunities Fund | 385,350 | ||||||

| 40,000 | Invesco Senior Income Trust | 168,000 | ||||||

| 27,125 | Nuveen Real Asset Income and Growth Fund (b) | 474,959 | ||||||

| 20,000 | PGIM Global High Yield Fund, Inc. (b) | 287,400 | ||||||

| 30,000 | PGIM High Yield Bond Fund, Inc. (b) | 448,500 | ||||||

| TOTAL CLOSED-END FUNDS (Cost $3,319,279) | 3,209,245 | |||||||

| COMMON STOCKS - 57.0% | ||||||||

| APPAREL - 2.0% | ||||||||

| 45,000 | Under Armour, Inc. - Cl. C * | 815,850 | ||||||

| AUTO MANUFACTURERS - 8.9% | ||||||||

| 14,818 | Fiat Chrysler Automobiles NV (a) | 191,893 | ||||||

| 210,400 | Ford Motor Co. (b)(c) | 1,927,264 | ||||||

| 30,000 | Renault SA | 342,600 | ||||||

| 136,000 | Tata Motors Ltd. *(a)(b) | 1,141,040 | ||||||

| 3,602,797 | ||||||||

| BANKS - 5.1% | ||||||||

| 40,000 | Barclays PLC - ADR (b)(c) | 293,600 | ||||||

| 167,500 | ING Groep NV - ADR (a)(b) | 1,750,375 | ||||||

| 2,043,975 | ||||||||

| BIOTECHNOLOGY - 1.7% | ||||||||

| 3,000 | Biogen, Inc. *(d) | 698,460 | ||||||

| BUILDING MATERIALS - 5.2% | ||||||||

| 537,636 | Cemex SAB de CV - ADR (a)(b)(c) | 2,107,533 | ||||||

| BUSINESS DEVELOPMENT COMPANIES - 1.2% | ||||||||

| 25,000 | Ares Capital Corp. (b)(c) | 465,875 | ||||||

| COMMERCIAL SERVICES - 2.1% | ||||||||

| 5,000 | Macquarie Infrastructure Corp. | 197,350 | ||||||

| 7,500 | ManpowerGroup, Inc. (b)(c) | 631,800 | ||||||

| 829,150 | ||||||||

| DISTRIBUTION/WHOLESALE - 0.4% | ||||||||

| 5,000 | Triton International Ltd. (b) | 169,200 | ||||||

| DIVERSIFIED FINANCIAL SERVICES - 1.5% | ||||||||

| 6,900 | Capital One Financial Corp. (b)(c)(d) | 627,762 | ||||||

| ELECTRONICS - 0.5% | ||||||||

| 20,000 | Flex Ltd. *(c) | 209,300 | ||||||

| ENGINEERING & CONSTRUCTION - 2.8% | ||||||||

| 60,000 | Fluor Corp. | 1,147,800 | ||||||

| FOOD - 0.1% | ||||||||

| 400 | Beyond Meat, Inc. *(c)(d) | 59,448 | ||||||

| HEALTHCARE - SERVICES - 2.8% | ||||||||

| 20,000 | DaVita, Inc. * | 1,141,400 | ||||||

| HOME BUILDERS - 1.4% | ||||||||

| 700 | PulteGroup, Inc. | 25,585 | ||||||

| 5,000 | Thor Industries, Inc. (a) | 283,200 | ||||||

| 6,000 | Toll Brothers, Inc. (a)(d) | 246,300 | ||||||

| 555,085 | ||||||||

| HOUSEWARES - 1.9% | ||||||||

| 40,100 | Newell Brands, Inc. | 750,672 | ||||||

See accompanying notes to financial statements.

12

| Camelot Premium Return Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Shares | Fair Value | |||||||

| COMMON STOCKS - 57.0% (Continued) | ||||||||

| INSURANCE - 2.8% | ||||||||

| 20,000 | American International Group, Inc. (a)(c)(d) | $ | 1,114,000 | |||||

| INTERNET - 2.7% | ||||||||

| 8,100 | Expedia Group, Inc. (b)(c)(d) | 1,088,721 | ||||||

| LEISURE TIME - 2.0% | ||||||||

| 9,100 | Polaris Industries, Inc. (b)(c)(d) | 800,891 | ||||||

| MACHINERY - CONSTRUCTION & MINING - 0.9% | ||||||||

| 5,000 | Oshkosh Corp. (b)(c) | 379,000 | ||||||

| OIL & GAS - 2.6% | ||||||||

| 11,428 | Obsidian Energy Ltd. * | 9,542 | ||||||

| 20,000 | TC Energy Corp. *(b) | 1,035,800 | ||||||

| 1,045,342 | ||||||||

| PHARMACEUTICALS - 0.8% | ||||||||

| 5,000 | CVS Health Corp. (d) | 315,350 | ||||||

| PIPELINES - 1.7% | ||||||||

| 20,000 | Enbridge, Inc. (b)(c) | 701,600 | ||||||

| REAL ESTATE - 1.7% | ||||||||

| 5,000 | Jones Lang LaSalle, Inc. (c) | 695,300 | ||||||

| RETAIL - 0.8% | ||||||||

| 60,000 | GameStop Corp. (b) | 331,200 | ||||||

| TELECOMMUNICATIONS - 2.6% | ||||||||

| 38,300 | America Movil SAB de CV (a)(c) | 569,138 | ||||||

| 10,000 | Millicom International Cellular SA (a) | 486,700 | ||||||

| 1,055,838 | ||||||||

| TEXTILES - 0.8% | ||||||||

| 2,500 | Mohawk Industries, Inc. * | 310,175 | ||||||

| TOTAL COMMON STOCKS (Cost $30,126,478) | 23,061,724 | |||||||

| REAL ESTATE INVESTMENT TRUSTS (REITs) - 8.4% | ||||||||

| 20,000 | AGNC Investment Corp. (b) | 321,800 | ||||||

| 29,775 | Office Properties Income Trust | 912,306 | ||||||

| 20,000 | Sabra Health Care REIT, Inc. (b)(d) | 459,200 | ||||||

| 47,136 | Two Harbors Investment Corp. (a)(b) | 618,896 | ||||||

| 40,000 | VEREIT, Inc. | 391,200 | ||||||

| 169,400 | Washington Prime Group, Inc. (a)(b) | 701,316 | ||||||

| TOTAL REAL ESTATE INVESTMENT TRUSTS (REITs) (Cost $5,264,725) | 3,404,718 | |||||||

| LIMITED PARTNERSHIPS - 7.9% | ||||||||

| PIPELINES - 7.2% | ||||||||

| 155,363 | Energy Transfer Equity LP (b)(d) | 2,032,148 | ||||||

| 30,000 | Enterprise Products Partners LP (b)(c) | 857,400 | ||||||

| 2,889,548 | ||||||||

| REAL ESTATE - 0.7% | ||||||||

| 15,000 | Brookfield Property Partners LP (c) | 304,500 | ||||||

| TOTAL LIMITED PARTNERSHIPS (Cost $4,569,284) | 3,194,048 | |||||||

See accompanying notes to financial statements.

13

| Camelot Premium Return Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Shares | Coupon Rate (%) | Maturity | Fair Value | |||||||||

| PREFERRED STOCKS - 5.7% | ||||||||||||

| ELECTRIC - 1.6% | ||||||||||||

| 5,000 | Pacific Gas & Electric Co. * | 4.3600 | Perpetual | $ | 101,250 | |||||||

| 6,000 | Pacific Gas & Electric Co. * | 4.5000 | Perpetual | 111,060 | ||||||||

| 2,000 | Pacific Gas & Electric Co. * | 4.8000 | Perpetual | 41,000 | ||||||||

| 16,000 | Pacific Gas & Electric Co. * | 5.0000 | Perpetual | 338,000 | ||||||||

| 3,000 | Pacific Gas & Electric Co. * | 5.5000 | Perpetual | 69,300 | ||||||||

| 660,610 | ||||||||||||

| PIPELINES - 2.0% | ||||||||||||

| 1,000 | DCP Midstream LP, Quarterly US LIBOR +4.88% **** | 7.9500 | Perpetual | 24,170 | ||||||||

| 5,000 | Enbridge, Inc., Canada Government 5 Year Bond +2.51% **** | 4.6890 | Perpetual | 60,159 | ||||||||

| 15,000 | Energy Transfer Partners LP, Quarterly US LIBOR +4.74% **** | 7.6250 | Perpetual | 370,500 | ||||||||

| 15,000 | NuStar Energy LP, Quarterly US LIBOR +6.88% **** | 9.0000 | Perpetual | 364,200 | ||||||||

| 819,029 | ||||||||||||

| REAL ESTATE INVESTMENT TRUSTS (REITs) - 1.1% | ||||||||||||

| 1,262 | Ashford Hospitality Trust, Inc. | 8.4500 | Perpetual | 30,930 | ||||||||

| 16,350 | Two Harbors Investment Corp. | 7.7500 | Perpetual | 413,819 | ||||||||

| 444,749 | ||||||||||||

| TRANSPORTATION - 1.0% | ||||||||||||

| 15,000 | Seaspan Corp. | 8.2500 | Perpetual | 382,800 | ||||||||

| TOTAL PREFERRED STOCKS (Cost $2,221,534) | 2,307,188 | |||||||||||

| Shares | ||||||||||||

| SHORT-TERM INVESTMENTS - 16.3% | ||||||||||||

| INVESTMENT PURCHASED AS SECURITIES LENDING COLLATERAL - 16.3% | ||||||||||||

| 6,607,316 | Mount Vernon Liquid Assets Portfolio, LLC, 2.13% **(e) | 6,607,316 | ||||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $6,607,316) | 6,607,316 | |||||||||||

| TOTAL INVESTMENTS IN LONG SECURITIES - 119.6% (Cost $58,714,118) | $ | 48,367,821 | ||||||||||

| TOTAL CALL OPTIONS WRITTEN - (3.8)% (Premiums Received $2,316,348) | (1,519,395 | ) | ||||||||||

| TOTAL PUT OPTIONS WRITTEN - (2.2)% (Premiums Received $1,119,616) | (899,563 | ) | ||||||||||

| TOTAL SECURITIES SOLD SHORT - (9.2)% (Proceeds $4,169,012) | (3,723,410 | ) | ||||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (4.4)% | (1,793,218 | ) | ||||||||||

| TOTAL NET ASSETS - 100.0% | $ | 40,432,235 | ||||||||||

| Notional Value at | ||||||||||||||

| September 30, | ||||||||||||||

| Contracts*** | Counterparty | 2019 | Fair Value | |||||||||||

| SCHEDULE OF CALL OPTIONS WRITTEN - (3.8)% * | ||||||||||||||

| 350 | America Movil SAB de CV | |||||||||||||

| Expiration February 2020, Exercise Price $15.00 | Interactive Brokers | $ | 525,000 | $ | 33,250 | |||||||||

| 200 | American International Group, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $55.00 | Interactive Brokers | 1,100,000 | 66,000 | |||||||||||

| 200 | American International Group, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $60.00 | Interactive Brokers | 1,200,000 | 24,600 | |||||||||||

| 250 | Ares Capital Corp. | |||||||||||||

| Expiration January 2020, Exercise Price $19.00 | Interactive Brokers | 475,000 | 9,500 | |||||||||||

| 400 | Barclays PLC | |||||||||||||

| Expiration January 2020, Exercise Price $7.00 | Interactive Brokers | 280,000 | 31,000 | |||||||||||

| 35 | Beyond Meat, Inc. | |||||||||||||

| Expiration November 2019, Exercise Price $145.00 | Interactive Brokers | 507,500 | 26,250 | |||||||||||

| 49 | Beyond Meat, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $140.00 | Interactive Brokers | 686,000 | 51,450 | |||||||||||

| 10 | Beyond Meat, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $135.00 | Interactive Brokers | 135,000 | 14,590 | |||||||||||

| 50 | Beyond Meat, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $145.00 | Interactive Brokers | 725,000 | 39,000 | |||||||||||

| 50 | Beyond Meat, Inc. | |||||||||||||

| Expiration January 2021, Exercise Price $140.00 | Interactive Brokers | 700,000 | 87,500 | |||||||||||

| 45 | Beyond Meat, Inc. | |||||||||||||

| Expiration January 2021, Exercise Price $170.00 | Interactive Brokers | 765,000 | 45,000 | |||||||||||

| 100 | Boston Scientific Corp. | |||||||||||||

| Expiration January 2020, Exercise Price $37.00 | Interactive Brokers | 370,000 | 51,000 | |||||||||||

See accompanying notes to financial statements.

14

| Camelot Premium Return Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Notional Value at | ||||||||||||||

| September 30, | ||||||||||||||

| Contracts*** | Counterparty | 2019 | Fair Value | |||||||||||

| SCHEDULE OF CALL OPTIONS WRITTEN - (3.8)% * (Continued) | ||||||||||||||

| 150 | Brookfield Property Partners LP | |||||||||||||

| Expiration January 2020, Exercise Price $20.00 | Interactive Brokers | $ | 300,000 | $ | 15,000 | |||||||||

| 69 | Capital One Financial Corp. | |||||||||||||

| Expiration January 2020, Exercise Price $92.50 | Interactive Brokers | 638,250 | 29,498 | |||||||||||

| 600 | Cemex SAB de CV - ADR | |||||||||||||

| Expiration January 2020, Exercise Price $4.00 | Interactive Brokers | 240,000 | 18,600 | |||||||||||

| 200 | Enbridge, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $35.00 | Interactive Brokers | 700,000 | 25,600 | |||||||||||

| 300 | Enterprise Products Partners LP | |||||||||||||

| Expiration January 2020, Exercise Price $29.00 | Interactive Brokers | 870,000 | 25,500 | |||||||||||

| 81 | Expedia Group, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $130.00 | Interactive Brokers | 1,053,000 | 85,050 | |||||||||||

| 200 | Flex Ltd. | |||||||||||||

| Expiration October 2019, Exercise Price $11.00 | Interactive Brokers | 220,000 | 2,600 | |||||||||||

| 600 | Ford Motor Co. | |||||||||||||

| Expiration January 2020, Exercise Price $9.00 | Interactive Brokers | 540,000 | 34,800 | |||||||||||

| 100 | Invesco QQQ Trust, Series 1 | |||||||||||||

| Expiration December 2019, Exercise Price $189.00 | Interactive Brokers | 1,890,000 | 71,500 | |||||||||||

| 400 | Invesco QQQ Trust, Series 1 | |||||||||||||

| Expiration January 2020, Exercise Price $188.00 | Interactive Brokers | 7,520,000 | 354,000 | |||||||||||

| 100 | Invesco QQQ Trust, Series 1 | |||||||||||||

| Expiration January 2020, Exercise Price $195.00 | Interactive Brokers | 1,950,000 | 49,600 | |||||||||||

| 300 | iShares Russell 2000 ETF | |||||||||||||

| Expiration January 2020, Exercise Price $150.00 | Interactive Brokers | 4,500,000 | 222,300 | |||||||||||

| 50 | Jones Lang LaSalle, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $160.00 | Interactive Brokers | 800,000 | 11,000 | |||||||||||

| 75 | ManpowerGroup, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $95.00 | Interactive Brokers | 712,500 | 7,312 | |||||||||||

| 50 | Oshkosh Corp. | |||||||||||||

| Expiration October 2019, Exercise Price $85.00 | Interactive Brokers | 425,000 | 750 | |||||||||||

| 50 | Polaris Industries, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $105.00 | Interactive Brokers | 525,000 | 10,000 | |||||||||||

| 15 | Tesla, Inc. | |||||||||||||

| Expiration October 2019, Exercise Price $250.00 | Interactive Brokers | 375,000 | 8,295 | |||||||||||

| 15 | Tesla, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $260.00 | Interactive Brokers | 390,000 | 21,300 | |||||||||||

| 15 | Tesla, Inc. | |||||||||||||

| Expiration January 2021, Exercise Price $300.00 | Interactive Brokers | 450,000 | 47,550 | |||||||||||

| TOTAL CALL OPTIONS WRITTEN - (Premiums Received $2,316,348) | $ | 1,519,395 | ||||||||||||

| SCHEDULE OF PUT OPTIONS WRITTEN - (2.2)% * | ||||||||||||||

| 100 | American International Group, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $50.00 | Interactive Brokers | $ | 500,000 | $ | 11,050 | |||||||||

| 50 | Beyond Meat, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $140.00 | Interactive Brokers | 700,000 | 252,500 | |||||||||||

| 30 | Biogen ,Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $230.00 | Interactive Brokers | 690,000 | 38,400 | |||||||||||

| 50 | Capital One Financial Corp. | |||||||||||||

| Expiration December 2019, Exercise Price $95.00 | Interactive Brokers | 475,000 | 32,150 | |||||||||||

| 50 | Capital One Financial Corp. | |||||||||||||

| Expiration December 2019, Exercise Price $97.50 | Interactive Brokers | 487,500 | 41,200 | |||||||||||

| 100 | Cardinal Health, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $42.50 | Interactive Brokers | 425,000 | 12,000 | |||||||||||

| 50 | Citigroup, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $72.50 | Interactive Brokers | 362,500 | 26,500 | |||||||||||

| 100 | CVS Health Corp. | |||||||||||||

| Expiration January 2020, Exercise Price $75.00 | Interactive Brokers | 750,000 | 123,700 | |||||||||||

| 10 | Energy Transfer LP | |||||||||||||

| Expiration October 2019 Exercise Price $16.00 | Interactive Brokers | 16,000 | 2,920 | |||||||||||

| 50 | Expedia Group, Inc. | |||||||||||||

| Expiration November 2019, Exercise Price $125.00 | Interactive Brokers | 625,000 | 11,750 | |||||||||||

| 25 | Intel Corp. | |||||||||||||

| Expiration January 2020, Exercise Price $50.00 | Interactive Brokers | 125,000 | 5,950 | |||||||||||

See accompanying notes to financial statements.

15

| Camelot Premium Return Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Notional Value at | ||||||||||||||

| September 30, | ||||||||||||||

| Contracts*** | Counterparty | 2019 | Fair Value | |||||||||||

| SCHEDULE OF PUT OPTIONS WRITTEN - (2.2)% * (Continued) | ||||||||||||||

| 150 | iPath Series B S&P 500 | |||||||||||||

| Expiration October 2019, Exercise Price $24.00 | Interactive Brokers | $ | 360,000 | $ | 26,850 | |||||||||

| 250 | iPath Series B S&P 500 | |||||||||||||

| Expiration November 2019, Exercise Price $23.00 | Interactive Brokers | 575,000 | 52,500 | |||||||||||

| 60 | iPath Series B S&P 500 | |||||||||||||

| Expiration December 2019, Exercise Price $23.00 | Interactive Brokers | 138,000 | 17,280 | |||||||||||

| 25 | Laboratory Corporation of America | |||||||||||||

| Expiration November 2019, Exercise Price $160.00 | Interactive Brokers | 400,000 | 6,938 | |||||||||||

| 100 | Marathon Petroleum Corp . | |||||||||||||

| Expiration January 2020, Exercise Price $65.00 | Interactive Brokers | 650,000 | 76,000 | |||||||||||

| 100 | Owens Corning | |||||||||||||

| Expiration November 2019, Exercise Price $52.50 | Interactive Brokers | 525,000 | 4,750 | |||||||||||

| 25 | Polaris Industries, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $100.00 | Interactive Brokers | 250,000 | 36,500 | |||||||||||

| 50 | Polaris Industries, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $105.00 | Interactive Brokers | 525,000 | 93,000 | |||||||||||

| 190 | Sabra Health Care REIT, Inc. | |||||||||||||

| Expiration October 2019, Exercise Price $20.00 | Interactive Brokers | 380,000 | 1,425 | |||||||||||

| 50 | salesforce.com, Inc. | |||||||||||||

| Expiration November 2019, Exercise Price $140.00 | Interactive Brokers | 700,000 | 12,700 | |||||||||||

| 150 | Toll Brothers, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $37.00 | Interactive Brokers | 555,000 | 13,500 | |||||||||||

| TOTAL PUT OPTIONS WRITTEN - (Premiums Received $1,119,616) | $ | 899,563 | ||||||||||||

| Shares | ||||||||||||||

| SECURITIES SOLD SHORT - (9.2)% | ||||||||||||||

| COMMON STOCKS - (4.4)% | ||||||||||||||

| 2,000 | Danaher Corp. | $ | 288,860 | |||||||||||

| 2,500 | Home Depot, Inc. | 580,050 | ||||||||||||

| 45,000 | Under Armour, Inc. * | 897,300 | ||||||||||||

| 1,766,210 | ||||||||||||||

| CLOSED-END FUND - (1.0)% | ||||||||||||||

| 30,000 | Stone Harbor Emerging Markets Income Fund | 393,300 | ||||||||||||

| EXCHANGE TRADED FUNDS - (2.7)% | ||||||||||||||

| 2,500 | SPDR Gold Shares * | 347,175 | ||||||||||||

| 2,500 | SPDR S&P 500 ETF Trust | 741,925 | ||||||||||||

| 1,089,100 | ||||||||||||||

| EXCHANGE TRADED NOTE - (1.1)% | ||||||||||||||

| 20,000 | iPATH S&P 500 VIX Short-Term Futures ETN * | 474,800 | ||||||||||||

| TOTAL SECURITIES SOLD SHORT (Proceeds $4,169,012) | $ | 3,723,410 | ||||||||||||

ADR - American Depositary Receipt

ETN - Exchange Traded Note

LLC - Limited Liability Company

LP - Limited Partnership

PLC - Public Limited Company

REIT - Real Estate Investment Trust

VIX - S&P 500 Volatility Index

| **** | Variable Rate as of September 30, 2019. |

| ^ | 144A Security - Security exempt from registration under Rule 144A of the Securities Act of 1933. The 144A securities represent 1.21% of total net assets. The securities may be resold in transactions exempt from registration typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. |

| # | Security in default. |

| * | Non-Income producing security. |

| ** | Interest rate reflects seven-day effective yield on September 30, 2019. |

| *** | One contract is equivalent to 100 shares of common stock. |

| (a) | All or a portion of the security is out on loan at September 30, 2019. Total loaned securities had a market value of $6,441,250 at September 30, 2019. |

| (b) | All or a portion of the security is segregated as collateral for call options written. |

| (c) | Subject to call options written. |

| (d) | Subject to put options written. |

| (e) | All or a portion of the security is segregated as collateral for securities on loan at September 30, 2019. Total collateral had a market value of $6,607,316 at September 30, 2019. |

See accompanying notes to financial statements.

16

| Camelot Excalibur Small Cap Income Fund |

| SCHEDULE OF INVESTMENTS |

| September 30, 2019 |

| Principal | Coupon Rate (%) | Maturity | Fair Value | |||||||||

| BONDS - 8.6% | ||||||||||||

| RETAIL - 7.2% | ||||||||||||

| $ | 200,000 | GameStop Corp. ^ | 6.7500 | 3/15/2021 | $ | 196,500 | ||||||

| 524,000 | Men’s Wearhouse, Inc. | 7.0000 | 7/1/2022 | 516,140 | ||||||||

| 712,640 | ||||||||||||

| TELECOMMUNICATIONS - 1.4% | ||||||||||||

| 300,000 | Frontier Communications Corp. | 10.5000 | 9/15/2022 | 139,875 | ||||||||

| TOTAL BONDS (Cost $903,510) | 852,515 | |||||||||||

| MUNICIPAL BONDS - 12.9% | ||||||||||||

| PUERTO RICO - 12.9% | ||||||||||||

| 320,000 | Commonwealth of Puerto Rico # | 4.7500 | 7/1/2020 | 225,600 | ||||||||

| 50,000 | Commonwealth of Puerto Rico # | 5.7500 | 7/1/2023 | 37,438 | ||||||||

| 150,000 | Commonwealth of Puerto Rico # | 5.0000 | 7/1/2035 | 112,125 | ||||||||

| 25,000 | Puerto Rico Electric Power Authority # | 5.0000 | 10/24/2019 | 19,469 | ||||||||

| 25,000 | Puerto Rico Electric Power Authority # | 4.2500 | 7/1/2020 | 19,812 | ||||||||

| 25,000 | Puerto Rico Electric Power Authority # | 4.5000 | 7/1/2023 | 19,875 | ||||||||

| 30,000 | Puerto Rico Electric Power Authority # | 4.5000 | 7/1/2023 | 23,850 | ||||||||

| 110,000 | Puerto Rico Electric Power Authority # | 4.7500 | 7/1/2026 | 87,450 | ||||||||

| 30,000 | Puerto Rico Electric Power Authority # | 4.8750 | 7/1/2027 | 23,850 | ||||||||

| 30,000 | Puerto Rico Electric Power Authority # | 5.0000 | 7/1/2027 | 24,000 | ||||||||

| 45,000 | Puerto Rico Electric Power Authority # | 4.8000 | 7/1/2029 | 35,662 | ||||||||

| 20,000 | Puerto Rico Electric Power Authority # | 4.6250 | 7/1/2030 | 15,850 | ||||||||

| 35,000 | Puerto Rico Electric Power Authority # | 5.0500 | 7/1/2042 | 28,000 | ||||||||

| 140,000 | Puerto Rico Public Buildings Authority # | 5.7500 | 7/1/2022 | 119,700 | ||||||||

| 85,000 | Puerto Rico Public Buildings Authority # | 5.5000 | 7/1/2023 | 71,613 | ||||||||

| 45,000 | Puerto Rico Public Buildings Authority # | 5.1250 | 7/1/2025 | 37,631 | ||||||||

| 115,000 | Puerto Rico Public Buildings Authority # | 5.1250 | 7/1/2026 | 96,169 | ||||||||

| 270,000 | University of Puerto Rico | 5.0000 | 6/1/2021 | 270,675 | ||||||||

| TOTAL MUNICIPAL BONDS (Cost $1,062,436) | 1,268,769 | |||||||||||

| Shares | ||||||||||||

| CLOSED-END FUNDS - 5.5% | ||||||||||||

| 15,000 | Ares Dynamic Credit Allocation Fund, Inc. (a) | 223,500 | ||||||||||

| 35,000 | Morgan Stanley Emerging Markets Debt Fund, Inc. | 321,650 | ||||||||||

| TOTAL CLOSED-END FUNDS (Cost $528,397) | 545,150 | |||||||||||

| COMMON STOCKS - 42.0% | ||||||||||||

| AGRICULTURE - 0.6% | ||||||||||||

| 2,500 | Andersons, Inc. | 56,075 | ||||||||||

| AIRLINES - 1.5% | ||||||||||||

| 1,000 | Allegiant Travel Co. (a)(b) | 149,660 | ||||||||||

| AUTO MANUFACTURERS - 1.0% | ||||||||||||

| 7,000 | Wabash National Corp. (b)(c) | 101,570 | ||||||||||

| AUTO PARTS & EQUIPMENT - 1.1% | ||||||||||||

| 12,600 | American Axle & Manufacturing Holdings, Inc. * | 103,572 | ||||||||||

| BUSINESS DEVELOPMENT COMPANIES - 1.9% | ||||||||||||

| 3,333 | Apollo Investment Corp. | 53,628 | ||||||||||

| 20,000 | Prospect Capital Corp. | 131,800 | ||||||||||

| 185,428 | ||||||||||||

| CHEMICALS - 1.9% | ||||||||||||

| 10,000 | Olin Corp. | 187,200 | ||||||||||

| COMMERCIAL SERVICES - 4.0% | ||||||||||||

| 40,000 | Textainer Group Holdings Ltd. *(a)(b) | 396,400 | ||||||||||

| COSMETICS/PERSONAL CARE - 0.3% | ||||||||||||

| 14,500 | Veru, Inc. * | 31,320 | ||||||||||

| DISTRIBUTION/WHOLESALE - 1.7% | ||||||||||||

| 5,000 | Triton International Ltd. (a)(b) | 169,200 | ||||||||||

See accompanying notes to financial statements.

17

| Camelot Excalibur Small Cap Income Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Shares | Fair Value | |||||||

| COMMON STOCKS - 42.0% (Continued) | ||||||||

| DIVERSIFIED FINANCIAL SERVICES - 2.4% | ||||||||

| 5,000 | Ares Management Corp. (a)(b) | $ | 134,050 | |||||

| 2,000 | Deluxe Corp. (b) | 98,320 | ||||||

| 232,370 | ||||||||

| ELECTRONICS - 0.9% | ||||||||

| 12,500 | Celestica, Inc. * | 89,625 | ||||||

| ENERGY-ALTERNATE SOURCES - 0.8% | ||||||||

| 7,000 | FutureFuel Corp. | 83,580 | ||||||

| ENGINEERING & CONSTRUCTION - 3.9% | ||||||||

| 19,900 | Fluor Corp. (c) | 380,687 | ||||||

| HEALTHCARE-SERVICES - 0.8% | ||||||||

| 10,000 | Brookdale Senior Living, Inc. *(a)(b)(c) | 75,800 | ||||||

| HOUSEWARES - 1.6% | ||||||||

| 9,700 | Tupperware Brands Corp. (a) | 153,939 | ||||||

| LEISURE TIME - 0.5% | ||||||||

| 5,000 | Camping World Holdings, Inc. (a) | 44,500 | ||||||

| MEDIA - 0.4% | ||||||||

| 27,000 | Salem Media Group, Inc. | 41,310 | ||||||

| MINING - 3.4% | ||||||||

| 6,000 | Compass Minerals International, Inc. (a) | 338,940 | ||||||

| MISCELLANEOUS MANUFACTURING - 2.1% | ||||||||

| 5,000 | Sturm Ruger & Co., Inc. (a)(b) | 208,800 | ||||||

| OIL & GAS - 0.9% | ||||||||

| 1,950 | CVR Energy, Inc. (a)(b) | 85,858 | ||||||

| 1,429 | Obsidian Energy Ltd. * | 1,193 | ||||||

| 87,051 | ||||||||

| REAL ESTATE - 1.7% | ||||||||

| 39,900 | Xinyuan Real Estate Co. Ltd. - ADR (c) | 161,994 | ||||||

| RETAIL - 5.0% | ||||||||

| 5,000 | Big Lots, Inc. | 122,500 | ||||||

| 5,000 | Buckle, Inc. (b) | 103,000 | ||||||

| 3,000 | Cheesecake Factory, Inc. (a)(b)(c) | 125,040 | ||||||

| 100 | Cracker Barrel Old Country Store, Inc. | 16,265 | ||||||

| 10,000 | GameStop Corp. | 55,200 | ||||||

| 25,000 | Office Depot, Inc. | 43,875 | ||||||

| 10,000 | Tile Shop Holdings, Inc. | 31,900 | ||||||

| 497,780 | ||||||||

| SEMICONDUCTORS - 3.1% | ||||||||

| 10,000 | Rambus, Inc. *(b) | 131,250 | ||||||

| 5,000 | Silicon Motion Technology Corp. (a)(b) | 176,750 | ||||||

| 308,000 | ||||||||

| TRANSPORTATION - 0.5% | ||||||||

| 1,300 | Matson, Inc. | 48,763 | ||||||

| TOTAL COMMON STOCKS (Cost $5,622,852) | 4,133,564 | |||||||

| REAL ESTATE INVESTMENT TRUSTS (REITs) - 11.1% | ||||||||

| 10,000 | Ashford Hospitality Trust, Inc. | 33,100 | ||||||

| 12,500 | CoreCivic, Inc. (a) | 216,000 | ||||||

| 5,500 | Great Ajax Corp. | 85,250 | ||||||

| 6,250 | Office Properties Income Trust (a) | 191,500 | ||||||

| 24,360 | Two Harbors Investment Corp. (a) | 319,847 | ||||||

| 60,000 | Washington Prime Group, Inc. (a) | 248,400 | ||||||

| TOTAL REAL ESTATE INVESTMENT TRUSTS (REITs) (Cost $1,780,899) | 1,094,097 | |||||||

See accompanying notes to financial statements.

18

| Camelot Excalibur Small Cap Income Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Shares | Fair Value | |||||||||||

| LIMITED PARTNERSHIPS - 6.4% | ||||||||||||

| INVESTMENT COMPANIES - 2.5% | ||||||||||||

| 12,500 | Compass Diversified Holdings (a)(b) | $ | 246,375 | |||||||||

| OIL & GAS SERVICES - 0.5% | ||||||||||||

| 15,000 | CSI Compressco LP | 44,400 | ||||||||||

| PIPELINES - 2.4% | ||||||||||||

| 5,000 | Holly Energy Partners LP | 126,350 | ||||||||||

| 12,500 | Martin Midstream Partners LP (a) | 56,750 | ||||||||||

| 2,000 | NuStar Energy LP | 56,640 | ||||||||||

| 239,740 | ||||||||||||

| REAL ESTATE - 1.0% | ||||||||||||

| 5,000 | Brookfield Property Partners LP | 101,500 | ||||||||||

| TOTAL LIMITED PARTNERSHIPS (Cost $1,284,677) | 632,015 | |||||||||||

| Coupon Rate (%) | Maturity | |||||||||||

| PREFERRED STOCKS - 17.5% | ||||||||||||

| INSURANCE - 3.5% | ||||||||||||

| 5,000 | Maiden Holdings Ltd. | 6.6250 | 6/14/2046 | 89,250 | ||||||||

| 5,000 | Maiden Holdings Ltd. | 6.7000 | Perpetual | 34,600 | ||||||||

| 10,000 | Maiden Holdings Ltd. | 7.7500 | 12/1/2043 | 219,000 | ||||||||

| 342,850 | ||||||||||||

| INVESTMENT COMPANIES - 0.8% | ||||||||||||

| 3,000 | Prospect Capital Corp. (a) | 6.2500 | 6/15/2024 | 75,900 | ||||||||

| PIPELINES - 2.1% | ||||||||||||

| 10,000 | NuStar Energy LP, Quarterly US LIBOR +5.64% ** | 7.6250 | Perpetual | 211,000 | ||||||||

| REAL ESTATE INVESTMENT TRUSTS (REITs) - 7.4% | ||||||||||||

| 3,600 | Invesco Mortgage Capital, Inc. | 7.7500 | Perpetual | 94,392 | ||||||||

| 5,000 | Pennsylvania Real Estate Investment Trust | 7.2000 | Perpetual | 96,050 | ||||||||

| 3,573 | Pennsylvania Real Estate Investment Trust | 7.3750 | Perpetual | 73,961 | ||||||||

| 5,000 | Two Harbors Investment Corp. | 7.5000 | Perpetual | 127,650 | ||||||||

| 5,000 | Two Harbors Investment Corp. | 7.7500 | Perpetual | 126,550 | ||||||||

| 5,000 | Washington Prime Group, Inc. | 6.8750 | Perpetual | 101,750 | ||||||||

| 5,000 | Washington Prime Group, Inc. | 7.5000 | Perpetual | 109,900 | ||||||||

| 730,253 | ||||||||||||

| TRANSPORTATION - 3.7% | ||||||||||||

| 4,000 | Costamare, Inc. | 8.8750 | Perpetual | 103,801 | ||||||||

| 5,000 | Seaspan Corp. | 7.9500 | Perpetual | 127,600 | ||||||||

| 5,000 | Seaspan Corp. | 8.2500 | Perpetual | 127,600 | ||||||||

| 359,001 | ||||||||||||

| TOTAL PREFERRED STOCKS (Cost $1,716,680) | 1,719,004 | |||||||||||

| TOTAL INVESTMENTS IN LONG SECURITIES - 104.0% (Cost $12,899,451) | $ | 10,245,114 | ||||||||||

| TOTAL CALL OPTIONS WRITTEN - (5.2)% (Premiums Received $504,198) | (509,903 | ) | ||||||||||

| TOTAL PUT OPTIONS WRITTEN - (0.7)% (Premiums Received $117,302) | (74,800 | ) | ||||||||||

| TOTAL SECURITIES SOLD SHORT - (4.7)% (Proceeds $610,896) | (460,308 | ) | ||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES - 6.6% | 649,210 | |||||||||||

| TOTAL NET ASSETS - 100.0% | $ | 9,849,313 | ||||||||||

See accompanying notes to financial statements.

19

| Camelot Excalibur Small Cap Income Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Notional Value at | ||||||||||||||

| September 30, | ||||||||||||||

| Contracts*** | Counterparty | 2019 | Fair Value | |||||||||||

| SCHEDULE OF CALL OPTIONS WRITTEN - (5.2)% * | ||||||||||||||

| 10 | Allegiant Travel Co. | |||||||||||||

| Expiration January 2020, Exercise Price $140.00 | Interactive Brokers | $ | 140,000 | $ | 14,150 | |||||||||

| 3 | Ares Commercial Real Estate Co. | |||||||||||||

| Expiration November 2019, Exercise Price $15.00 | Interactive Brokers | 4,500 | 158 | |||||||||||

| 50 | Ares Management Corp. | |||||||||||||

| Expiration December 2019, Exercise Price $30.00 | Interactive Brokers | 150,000 | 2,700 | |||||||||||

| 100 | Brookdale Senior Living, Inc. | |||||||||||||

| Expiration October 2019, Exercise Price $9.00 | Interactive Brokers | 90,000 | 750 | |||||||||||

| 50 | Buckle, Inc. | |||||||||||||

| Expiration December 2019, Exercise Price $17.50 | Interactive Brokers | 87,500 | 16,000 | |||||||||||

| 30 | Cheesecake Factory, Inc. | |||||||||||||

| Expiration October 2019, Exercise Price $50.00 | Interactive Brokers | 150,000 | 150 | |||||||||||

| 125 | Compass Diversified Holdings | |||||||||||||

| Expiration November 2019, Exercise Price $20.00 | Interactive Brokers | 250,000 | 6,250 | |||||||||||

| 60 | Compass Minerals International | |||||||||||||

| Expiration December 2019, Exercise Price $55.00 | Interactive Brokers | 330,000 | 24,300 | |||||||||||

| 20 | CVR Energy, Inc. | |||||||||||||

| Expiration March 2020, Exercise Price $45.00 | Interactive Brokers | 90,000 | 7,000 | |||||||||||

| 20 | Deluxe Corp. | |||||||||||||

| Expiration January 2020, Exercise Price $45.00 | Interactive Brokers | 90,000 | 10,600 | |||||||||||

| 100 | Invesco QQQ Trust, Series 1 | |||||||||||||

| Expiration December 2020, Exercise Price $189.00 | Interactive Brokers | 1,890,000 | 71,500 | |||||||||||

| 70 | iShares Russell 2000 ETF | |||||||||||||

| Expiration December 2019, Exercise Price $150.00 | Interactive Brokers | 1,050,000 | 45,920 | |||||||||||

| 250 | iShares Russell 2000 ETF | |||||||||||||

| Expiration January 2020, Exercise Price $150.00 | Interactive Brokers | 3,750,000 | 185,250 | |||||||||||

| 25 | LGI Homes, Inc. | |||||||||||||

| Expiration November 2019, Exercise Price $70.00 | Interactive Brokers | 175,000 | 37,250 | |||||||||||

| 100 | Rambus, Inc. | |||||||||||||

| Expiration January 2020, Exercise Price $11.00 | Interactive Brokers | 110,000 | 24,800 | |||||||||||

| 50 | Silicon Motion Technology Corp. | |||||||||||||

| Expiration March 2020, Exercise Price $35.00 | Interactive Brokers | 175,000 | 19,500 | |||||||||||

| 50 | Sturm Ruger & Co., Inc. | |||||||||||||

| Expiration October 2019, Exercise Price $55.00 | Interactive Brokers | 275,000 | 125 | |||||||||||

| 200 | Textainer Group Holdings Ltd. | |||||||||||||

| Expiration February 2020, Exercise Price $10.00 | Interactive Brokers | 200,000 | 27,500 | |||||||||||

| 50 | Triton International Ltd. | |||||||||||||

| Expiration January 2020, Exercise Price $35.00 | Interactive Brokers | 175,000 | 8,650 | |||||||||||

| 70 | Wabash National Corp. | |||||||||||||

| Expiration January 2020, Exercise Price $15.00 | Interactive Brokers | 105,000 | 7,350 | |||||||||||

| TOTAL CALL OPTIONS WRITTEN - (Premiums Received $504,198) | $ | 509,903 | ||||||||||||

| SCHEDULE OF PUT OPTIONS WRITTEN - (0.7)% * | ||||||||||||||

| 100 | Brookdale Senior Living, Inc. | |||||||||||||

| Expiration October 2019, Exercise Price $7.00 | Interactive Brokers | 70,000 | 1,000 | |||||||||||

| 50 | Brookdale Senior Living, Inc. | |||||||||||||

| Expiration October 2019, Exercise Price $8.00 | Interactive Brokers | 40,000 | 2,625 | |||||||||||

| 30 | Cheesecake Factory, Inc. | |||||||||||||

| Expiration October 2019, Exercise Price $45.00 | Interactive Brokers | 135,000 | 10,200 | |||||||||||

| 1 | Fluor Corp. | |||||||||||||

| Expiration October 2019, Exercise Price $37.50 | Interactive Brokers | 3,750 | 1,925 | |||||||||||

| 100 | iPath Series B S&P 500 | |||||||||||||

| Expiration October 2019, Exercise Price $24.00 | Interactive Brokers | 240,000 | 17,900 | |||||||||||

| 100 | iPath Series B S&P 500 | |||||||||||||

| Expiration November 2019, Exercise Price $23.00 | Interactive Brokers | 230,000 | 21,000 | |||||||||||

| 50 | MEDNAX, Inc. | |||||||||||||

| Expiration November 2019, Exercise Price $22.50 | Interactive Brokers | 112,500 | 7,000 | |||||||||||

| 100 | Signet Jewelers Ltd. | |||||||||||||

| Expiration October 2019, Exercise Price $15.00 | Interactive Brokers | 150,000 | 3,500 | |||||||||||

See accompanying notes to financial statements.

20

| Camelot Excalibur Small Cap Income Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Notional Value at | ||||||||||||||

| September 30, | ||||||||||||||

| Contracts*** | Counterparty | 2019 | Fair Value | |||||||||||

| SCHEDULE OF PUT OPTIONS WRITTEN - (0.7)% (Continued) | ||||||||||||||

| 30 | Wabash National Corp. | |||||||||||||

| Expiration October 2019, Exercise Price $12.50 | Interactive Brokers | $ | 37,500 | $ | 150 | |||||||||

| 100 | Xinyuan Real Estate Co. Ltd. | |||||||||||||

| Expiration October 2019, Exercise Price $5.00 | Interactive Brokers | 50,000 | 9,500 | |||||||||||

| TOTAL PUT OPTIONS WRITTEN - (Premiums Received $117,302) | $ | 74,800 | ||||||||||||

| Shares | ||||||||||||||

| SECURITIES SOLD SHORT - (4.7)% | ||||||||||||||

| COMMON STOCK - (0.0)% | ||||||||||||||

| 100 | Ampco-Pittsburgh Corp. * | $ | 368 | |||||||||||

| CLOSED-END FUND - (2.0)% | ||||||||||||||

| 15,000 | Stone Harbor Emerging Markets Income Fund | 196,650 | ||||||||||||

| EXCHANGE TRADED NOTE - (2.4)% | ||||||||||||||

| 10,000 | iPATH S&P 500 VIX Short-Term Futures ETN * | 237,400 | ||||||||||||

| REAL ESTATE INVESTMENT TRUST (REIT) - (0.3)% | ||||||||||||||

| 1,700 | Ares Commercial Real Estate Corp. | 25,890 | ||||||||||||

| TOTAL SECURITIES SOLD SHORT (Proceeds $610,896) | $ | 460,308 | ||||||||||||

ADR - American Depositary Receipt

LP - Limited Partnership

ETN - Exchange Traded Note

REIT - Real Estate Investment Trust

VIX - S&P 500 Volatility Index

| ^ | 144A Security - Security exempt from registration under Rule 144A of the Securities Act of 1933. The 144A securities represent 2.00% of total net assets. The securities may be resold in transactions exempt from registration typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. |

| # | Security in default. |

| * | Non-Income producing security |

| ** | Variable Rate as of September 30, 2019. |

| *** | One contract is equivalent to 100 shares of common stock. |

| (a) | All or a portion of the security is segregated as collateral for call options written. |

| (b) | Subject to call options written. |

| (c) | Subject to put options written. |

See accompanying notes to financial statements.

21

| Camelot Funds |

| STATEMENTS OF ASSETS AND LIABILITIES |

| September 30, 2019 |

| Camelot Premium | Camelot Excalibur | |||||||

| Return Fund | Small Cap Income Fund | |||||||

| ASSETS | ||||||||

| Investment securities: | ||||||||

| At cost | $ | 58,714,118 | $ | 12,899,451 | ||||

| At value (including collateral for loaned securities) | $ | 48,367,821 | $ | 10,245,114 | ||||

| Cash and cash equivalents | 760,873 | 284,177 | ||||||

| Deposit with Brokers for options | 4,434,315 | 320,986 | ||||||

| Dividends and interest receivable | 131,020 | 54,927 | ||||||

| Receivable for Fund shares sold | 11,339 | 5,160 | ||||||

| Receivable for securities sold | 10,000 | — | ||||||

| Receivable due from Manager | — | 5 | ||||||

| Prepaid expenses and other assets | 16,307 | 16,107 | ||||||

| TOTAL ASSETS | 53,731,675 | 10,926,476 | ||||||

| LIABILITIES | ||||||||

| Options written, at value (Premiums received $3,435,964, $621,500) | 2,418,958 | 584,703 | ||||||

| Securities sold short (Proceeds $4,169,012, $610,896) | 3,723,410 | 460,308 | ||||||

| Investment management fees payable | 37,350 | — | ||||||

| Foreign currency overdraft | 58,586 | — | ||||||

| Payable upon return of securities loaned | 6,607,316 | — | ||||||

| Securities purchased payable | 237,644 | — | ||||||

| Distribution (12b-1) fees payable | 2,180 | 494 | ||||||

| Payable for Fund shares repurchased | 43,863 | 9,943 | ||||||

| Payable to related parties | 13,105 | 4,247 | ||||||

| Dividends on securities sold short payable | 3,799 | 561 | ||||||

| Broker fees for options | 148,604 | 13,235 | ||||||

| Accrued expenses and other liabilities | 4,625 | 3,672 | ||||||

| TOTAL LIABILITIES | 13,299,440 | 1,077,163 | ||||||

| NET ASSETS | $ | 40,432,235 | $ | 9,849,313 | ||||

| Composition of Net Assets: | ||||||||

| Paid in capital | $ | 48,475,684 | $ | 11,953,390 | ||||

| Accumulated losses | (8,043,449 | ) | (2,104,077 | ) | ||||

| NET ASSETS | $ | 40,432,235 | $ | 9,849,313 | ||||

| Net Asset Value Per Share: | ||||||||

| Class A Shares: | ||||||||

| Net Assets | $ | 1,994,590 | $ | 271,786 | ||||

| Shares of beneficial interest outstanding (a) | 217,303 | 34,483 | ||||||

| Net asset value (Net Assets ÷ Shares Outstanding) and redemption price per share (b) | $ | 9.18 | $ | 7.88 | ||||

| Maximum offering price per share (net asset value plus maximum sales charge of 5.75%) | $ | 9.74 | $ | 8.36 | ||||

| Class I Shares: | ||||||||

| Net Assets | $ | 38,437,645 | $ | 9,577,527 | ||||

| Shares of beneficial interest outstanding (a) | 4,186,638 | 1,223,896 | ||||||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | $ | 9.18 | $ | 7.83 | ||||

| (a) | Unlimited number of shares of beneficial interest authorized, no par value. |

| (b) | Investments in Class A shares made at or above the $1 million breakpoint are not subject to an initial sales charge and may be subject to a 1.00% contingent deferred sales charge (“CDSC”) on shares redeemed less than 18 months after the date of purchase (excluding shares purchased with reinvested dividends and/or distributions). |

See accompanying notes to financial statements.

22

| Camelot Funds |