Form N-CSR JOHCM Funds Trust For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23615

JOHCM Funds Trust

(Exact name of registrant as specified in charter)

53 State Street, 13th Floor

Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Mary Lomasney

53 State Street, 13th Floor

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 933-0712

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

ANNUAL REPORT

SEPTEMBER 30, 2021

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for the distribution to prospective investors unless preceded or accompanied by an effective prospectus.

JOHCM FUNDS TRUST

September 30, 2021

| i | ||||

| iii | ||||

| 1 | ||||

| 37 | ||||

| 39 | ||||

| 41 | ||||

| 44 | ||||

| 60 | ||||

| 78 | ||||

| 80 | ||||

JOHCM FUNDS TRUST

September 30, 2021 (Unaudited)

DEAR SHAREHOLDER:

I am pleased to present the inaugural JOHCM Funds Trust Annual Report for the 12-months ended September 30, 2021. As you are aware, and thanks to your approval, the JOHCM Funds were reorganized into JOHCM Funds Trust in July. We believe the reorganizations were in the best interests of shareholders by providing each fund with oversight by a dedicated board of trustees with responsibility for a smaller number of funds. It also allowed us to directly engage with key third party service providers and negotiate lower fees for the services they perform. As part of our ongoing commitment to shareholders, JOHCM also agreed to lower the contractual expense limitations for each of the JOHCM Funds. We believe the reorganizations are a natural progression for the JOHCM Funds as assets have grown by 25% year over year to $14.6B and better position JOHCM to be able to capitalize on new opportunities to expand our product range to better serve our shareholders.

In light of the above and in line with our strategic priorities, JOHCM’s parent company, Pendal Group Limited, closed on the acquisition of Thompson, Siegel and Walmsley (“TSW”) on July 22nd. TSW is a Richmond, Virginia based value-oriented investment manager with over 50 years of operating history, and $23.9B in assets under management. TSW’s strategy range includes International and Domestic equity, as well as Multi-Asset and Fixed Income capabilities. This strategic acquisition significantly broadens the range of investment solutions that we can offer to clients across the U.S. market. As complementary businesses with almost no overlap of investment strategies, we will be better placed to take advantage of the growth opportunities we see in the U.S. market.

Since the TSW acquisition, we have been focused on bringing select TSW strategies to market under JOHCM Funds Trust. The first step in this product evolution was the launch of the TSW High Yield Bond Fund in late October. In addition, we expect to launch the TSW Emerging Markets Fund by year-end. We also expect, subject to shareholder approval, to reorganize the existing TS&W Equity Portfolio (Large Cap Value) into a newly established fund of JOHCM Funds Trust in December 2021. These new TSW branded funds, in conjunction with the August launch of our first fund under the Regnan brand - Regnan Global Equity Impact Solutions, which focuses on responsible investing solutions, will provide an enhanced product range to help clients meet the challenges of an ever-evolving investment landscape.

i

JOHCM FUNDS TRUST

SHAREHOLDER LETTER

September 30, 2021 (Unaudited)

Our success is ultimately determined by our ability to attract, develop and retain the very best talent. Many of our fund managers are regarded as thought leaders within our industry. We actively recruit investment talent with deep expertise and a strong sense of conviction, and we deliberately create an environment of independence and autonomy in which they can thrive. Our investment teams are supported by dedicated and highly experienced specialists across our business who share the same commitment to excellence and a “can do” mindset.

As we look to the future, we will be focused on the delivery of our core principles. We are a company that is talent-led, defined by conviction, and deeply connected with our clients. We have a spirit of entrepreneurialism that compels us to grow, build and to seek opportunity. Our commitment to delivering consistent performance and a superior experience for our clients has been, and will continue to be, our ongoing priority.

We thank you for the trust and confidence you place in us by choosing to invest in the JOHCM Funds.

| Respectfully submitted, |

||

|

|

||

| Nicholas Good |

||

| Chairman of the Board of Trustees |

||

ii

JOHCM FUNDS TRUST

September 30, 2021 (Unaudited)

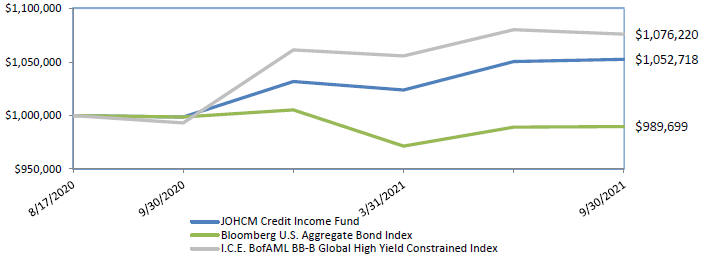

JOHCM Credit Income Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares from August 17, 2020 to September 30, 2021

Average Annual Total Returns as of September 30, 2021

| One Year Return |

Since Inception Return |

Gross Expense Ratio * |

Net Expense Ratio * | |||||

|

Institutional Shares |

5.42% | 5.27% | 1.99% | 0.58% | ||||

| Advisor Shares |

4.54% | 4.37% | 2.09% | 0.68% | ||||

| Bloomberg U.S. Aggregate Bond Index |

(0.90%) | (1.03%) | - | - | ||||

| I.C.E. BofAML BB-B Global High Yield Constrained Index | 8.37% | 7.62% | - | - |

Data as of September 30, 2021. The Fund’s performance reflects the performance of the predecessor JOHCM Credit Income Fund of the Advisers Investment Trust for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares and Advisor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares and Advisor Shares prior to their inception is based on performance of predecessor share classes of the JOHCM Credit Income Fund of the Advisers Investment Trust.

Historical performance for Advisor Shares prior to its inception is based on the performance of the Class I Shares predecessor share class. Class I Shares predecessor share class performance is based on performance of the Institutional Shares predecessor share class prior to the Class I Shares predecessor share class inception date. Performance of the Class I Shares predecessor share class was adjusted to reflect differences in expense.

* Expense ratios are per the most recent Fund Prospectus dated February 12, 2021, as revised July 19, 2021. The Adviser has entered into a contractual expense limitation agreement with respect to Fund until June 30, 2022.

iii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmarks for performance comparison purposes are the: Bloomberg US Aggregate Bond Index and the I.C.E. BofAML BB-B Global High Yield Constrained Index. The Bloomberg US Aggregate Bond Index is a broad-based benchmark that measures the investment grade U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. The I.C.E. BofAML BB-B Global High Yield Constrained Index contains all securities in The I.C.E. BofAML Global High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. The table reflects the theoretical reinvestment of dividends on securities in the indices. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the indices calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund aims to preserve capital and deliver returns through a combination of income and modest capital appreciation. The Fund invests, under normal circumstances, at least 80% of its net assets in fixed income securities across a wide range of maturities. The securities can include investment grade corporate debt, high yield securities, convertible bonds (including contingent convertible bonds), preferred stock, floating-rate debt, collateralized debt, municipal debt, foreign debt (including emerging markets), commercial paper, loans and loan participations. The Fund may also invest up to 10% of its net assets in dividend paying equities of companies of any size.

Performance

The Fund’s Institutional share class returned 5.42% for the 12-month period to September 30, 2021. Inflation fears and the Federal Reserve response function were the primary topic in markets for much of the year. Federal Reserve Bank Governors, CEOs, and investors alike have weighed in on the shades of meaning of the word “transitory”. One thing is certain, transitory inflation looks like persistent inflation until it wanes. With the tapering timeline now clearer, the open question is when the Federal Reserve will begin raising rates. We have seen increasing focus on the disfunction of our once tightly orchestrated logistics chain. The problems do not just stem from restarting a supply chain that was shut down during the pandemic – though there are clearly periodic areas globally where COVID causes delays as we have recently seen in Vietnam – but inbound containers at ports like Los Angeles and Long Beach are nearly 20% higher than during similar periods of 2019.

The top performers over the period were Innoviva convertible bonds, Kraft Heinz Food long dated bonds and Eagle Point. On the flip side, Fastly convertible bonds, Spotify and Twitter were the main laggards.

In terms of our outlook, our base case remains as follows, but we are vigilant for disconfirming evidence:

| • | The reflationary regime continues |

| • | Interest rates continue to normalize |

| • | The Fed will begin to taper its quantitative easing measures on schedule, but will continue to distance itself from the threat of rate increases |

| • | Supply chain-based shortages are likely to get worse before they get better, but a persistent consumer will find a way to fight through the disruption to spend strongly on the holidays. |

iv

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

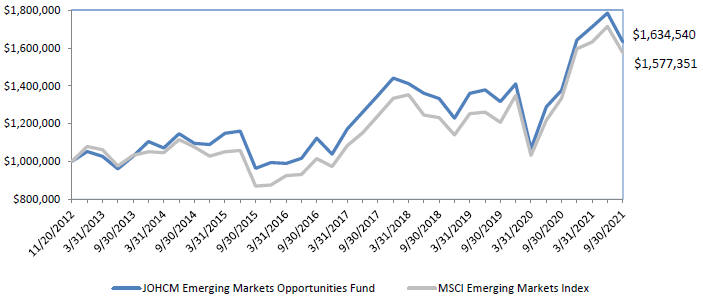

JOHCM Emerging Markets Opportunities Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares from November 20, 2012 to September 30, 2021

Average Annual Total Returns as of September 30, 2021

|

One Year Return |

Five Year Return |

Since Inception Return |

Gross Expense Ratio * |

Net Expense Ratio * | ||||||

| Institutional Shares |

18.70% | 7.80% | 5.70% | 1.04% | 1.04% | |||||

| Advisor Shares |

18.64% | 7.69% | 5.61% | 1.12% | 1.12% | |||||

| Investor Shares |

18.42% | 7.54% | 5.47% | 1.27% | 1.27% | |||||

| MSCI Emerging Markets Index |

18.20% | 9.23% | 5.28% | - | - |

Data as of September 30, 2021. The Fund’s performance reflects the performance of the predecessor JOHCM Emerging Markets Opportunities Fund of the Advisers Investment Trust and the predecessor JOHCM Emerging Markets Opportunities Fund of the Scotia Institutional Fund for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares, Advisor Shares, and Investor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares, Advisor Shares, and Investor Shares prior to their inception is based on performance of predecessor share classes of the predecessor JOHCM Emerging Markets Opportunities Fund of the Advisers Investment Trust and the predecessor JOHCM Emerging Markets Opportunities Fund of the Scotia Institutional Fund.

Historical performance for Investor Shares prior to its inception is based on the performance of the Class II Shares predecessor share class. Class II Shares predecessor share class performance is based on performance of the Class I Shares predecessor share class, the share class most similar to the Class II Shares predecessor share class, prior to the Class II Shares predecessor share class inception date. Performance of the Class II Shares predecessor share class was adjusted to reflect differences in expense.

* Expense ratios are per the most recent Fund Prospectus dated February 12, 2021, as revised July 19, 2021. The Adviser has entered into a contractual expense limitation agreement with respect to Fund until June 30, 2022.

v

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index. The Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks to outperform its benchmark through a combination of top-down (country level) and bottom-up (stock level) active positions. The fund managers believe in the importance of understanding the investment drivers and risks at the country level. They believe in only investing in companies that benefit from the top-down environment that they can foresee. The Fund buys quality growth stocks at attractive valuations leading to a focused portfolio of 40-60 emerging markets stocks.

Performance

The Fund’s Institutional share class returned 18.70% for the 12-month period to September 30, 2021 versus a return of 18.20% achieved by its benchmark, the MSCI Emerging Markets NR Index, for the same period.

The portfolio modestly outperformed over the year with our country allocation calls and stock selection both contributing positively. At the country level our underweight in China and overweight in India proved beneficial and stock selection in both countries was strong. We suffered from our underweight in Russia as rising oil prices benefited the market here. Not owning Alibaba proved beneficial given the regulatory clampdown in China. Our Indian financials were strong with State Bank of India and HDFC Bank among the top performers. Barrick Gold and Prosus were the main laggards.

With economies now largely recovering from the pandemic, policy focus is turning to ending quantitative easing and tightening policy, but this, in our opinion, is deliberately being done slowly. The sheer size of the stimulus will sit on government and central bank balance sheets for years to come, but the tapering is being done with an eye on allowing inflation to run at higher levels.

This tolerance of inflation should be a net positive for nominal GDP growth around the world, and also for commodity prices, which, in turn, should create a different, more positive, economic environment for more indebted and more commodity-intensive emerging economies.

Global growth remains strong, and emerging markets are still essentially cyclical assets. In 2005-8, price pressures from strong growth coincided with strong returns from emerging market equities. In addition, the US Federal Reserve’s policy tools have been expanded in recent years to reduce tail liquidity risks for emerging economies, for example, the swap lines and repo facilities available to some emerging market central banks.

Rising US yields and a stronger dollar are generally headwinds for some of our preferred markets, but we believe that country-level conditions remain the key driver, and these we see as positive enough to overcome these headwinds.

vi

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

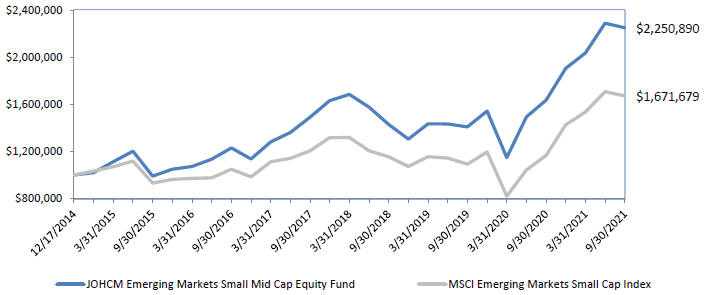

JOHCM Emerging Markets Small Mid Cap Equity Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares from December 17, 2014 to September 30, 2021

Average Annual Total Returns as of September 30, 2021

|

One Year Return |

Five Year Return |

Since Inception Return |

Gross Expense Ratio * |

Net Expense Ratio * | ||||||

| Institutional Shares |

37.60% | 12.85% | 12.70% | 1.88% | 1.49% | |||||

| Advisor Shares |

37.50% | 12.72% | 12.59% | 1.98% | 1.59% | |||||

| MSCI Emerging Markets Small Cap Index | 43.24% | 9.75% | 7.87% | - | - |

Data as of September 30, 2021. The Fund’s performance reflects the performance of the predecessor JOHCM Emerging Markets Small Mid Cap Equity Fund of the Advisers Investment Trust for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares and Advisor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares and Advisor Shares prior to their inception is based on performance of predecessor share classes of the JOHCM Emerging Markets Small Mid Cap Equity Fund of the Advisers Investment Trust.

Historical performance for Advisor Shares prior to its inception is based on the performance of the Class I Shares predecessor share class. Class I Shares predecessor share class performance is based on performance of the Institutional Shares predecessor share class prior to the Class I Shares predecessor share class inception date. Performance of the Class I Shares predecessor share class was adjusted to reflect differences in expense.

* Expense ratios are per the most recent Fund Prospectus dated February 12, 2021, as revised July 19, 2021. The Adviser has entered into a contractual expense limitation agreement with respect to Fund until June 30, 2022.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may

vii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Emerging Markets Small Cap Index. The Index includes small cap representation across 26 Emerging Markets countries and covers approximately 14% of the free float-adjusted market capitalization in each country. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The investment objective of the JOHCM Emerging Markets Small Mid Cap Equity Fund (the “Fund”) is to seek long-term capital appreciation. The Fund invests, under normal market conditions, at least 80% of its assets (net assets plus the amount of borrowings for investment purposes) in equity securities issued by small and medium capitalization companies that are listed in, or whose principal business activities are located in, emerging markets, including frontier markets.

Performance

The Fund’s Institutional share class returned 37.60% for the 12-month period to September 30, 2021 versus a return of 43.24% achieved by its benchmark, the MSCI Emerging Markets Small Cap NR Index, for the same period.

The portfolio underperformed over the year with stock selection, chiefly within the materials sector, weighing on relative returns. There were positives, however, with strength among our healthcare, consumer discretionary and industrials holdings going some way to offset this weakness. Sector allocation effects were broadly neutral over the period.

Chinese sports shoe retailer Xtep was the top performer, benefiting from strong sales growth. This was partly due to the success of its new professional running shoes which are popular among professional marathon runners in China. Indian Energy exchange also did well on the back of increasing market share and the successful launch of new products.

Turning to the laggards, New Horizon Health, a Chinese developer of cancer screening technology, suffered on the back of fears over increasing regulations within the Chinese pharma sector.

We have been approaching our top-down framework from the point of view of rising inflation, and the need for central banks to take action. No doubt the can will be kicked further down the road but yields are rising again and another rotation towards cyclicals is beginning. From a country perspective, India has been a strong performer, benefiting from capital flows out of China. Today though, the market is somewhat extended, in our view, while the country currently faces the tough reality of a higher oil price. We are therefore becoming more selective whilst also looking at countries which are beneficiaries of the current oil and gas situation.

viii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

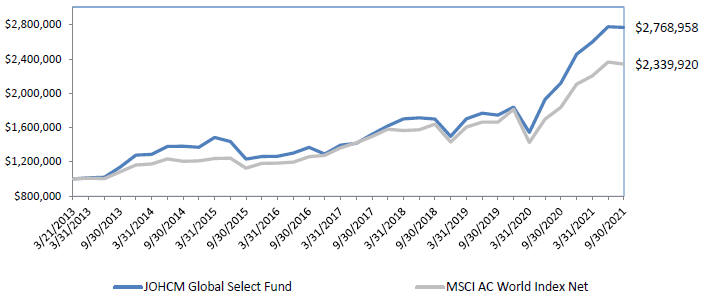

JOHCM Global Select Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares from March 21, 2013 to September 30, 2021

Average Annual Total Returns as of September 30, 2021

| One Year Return |

Five Year Return |

Since Inception Return |

Gross Expense Ratio * |

Net Expense Ratio * | ||||||

| Institutional Shares

|

30.71%

|

15.15%

|

12.68%

|

0.98%

|

0.98%

| |||||

| Advisor Shares

|

30.60%

|

15.04%

|

12.59%

|

1.08%

|

1.08%

| |||||

| MSCI ACWI

|

27.44%

|

13.20%

|

10.48%

|

-

|

-

|

Data as of September 30, 2021. The Fund’s performance reflects the performance of the predecessor JOHCM Global Equity Fund of the Advisers Investment Trust and the predecessor JOHCM Global Equity Fund of the Scotia Institutional Fund for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares and Advisor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares and Advisor Shares prior to their inception is based on performance of predecessor share classes of the predecessor JOHCM Global Equity Fund of the Advisers Investment Trust and the predecessor JOHCM Global Equity Fund of the Scotia Institutional Fund.

* Expense ratios are per the most recent Fund Prospectus dated February 12, 2021, as revised July 19, 2021. The Adviser has entered into a contractual expense limitation agreement with respect to Fund until June 30, 2022.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

ix

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) All Country World Index (ACWI). The Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

To seek to achieve its investment objective of long-term capital appreciation, the Fund employs a growth at a reasonable price (GARP) investment philosophy, which is sometimes described as a core focus with a growth bias. The Fund seeks to own stocks, sectors and countries with positive earnings surprise, sustainably high or increasing return on equity, and attractive valuations. The Fund managers believe they can increase the probability of finding an attractive stock by looking where traditional growth investors tend to ignore. While the Fund’s managers seek to own stocks with idiosyncratic return patterns, they also recognize that many stocks have varying degrees of beta or correlation to their sector or country, so they also maintain a top-down research focus when constructing the portfolio. The Fund’s management team offers the unique capability of blending both a bottom-up and a top-down investment research approach to the portfolio construction process.

Performance

The Fund’s Institutional share class returned 30.71% for the 12-month period to September 30, 2021 versus a return of 27.44% achieved by its benchmark, the MSCI AC World NR Index, for the same period. The Fund performed well over the year with stock selection, particularly within technology, healthcare and industrials, driving relative returns. These positives offset modest weakness among our financials and materials holdings. Sector allocation effects weighed on relative returns as our zero-weighting in energy provided a drag given surging prices towards the end of the period.

Looking at individual stock performers, technology holdings Atlassian, ASML and Keysight Technologies added value. Chart Industries was the top performer. On the negative side of the ledger The a2 Milk Company and Peptidream lagged.

Many investors seem dogmatically stuck on the ‘Value’ versus ‘Growth’ debate when the truth is pragmatically somewhere in the middle, depending on the business cycle. This is why we combine Growth, Value and Momentum factors over the cycle. Value usually performs best during the first year of an economic recovery, when earnings growth rates are accelerating. Growth then usually performs better after that, as earnings growth rates start to decelerate - which appears to be what is now starting to happen. Year to date, Value and Growth performance has been roughly equal, while the Momentum factor has significantly underperformed as it was whipsawed by several rotations between Value and Growth.

We were buyers of September’s dip, moving to 75% bullish and 25% bearish. The highest probability outcome is still “one of the biggest ever equity bull markets, followed by one of the biggest ever equity bear markets” but some early warning signs are flashing so we will keep an open mind in a fast changing world. We are positioned for a Q4 rally, and expect continued volatility and market rotations in 2022.

If policy makers recognise and react to slowing growth, we will probably move to 80% bullish, 20% bearish, if not, we will probably get more bearish.

x

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

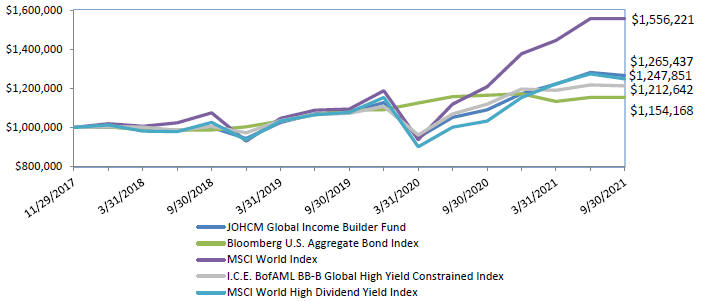

JOHCM Global Income Builder

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares from November 29, 2017 to September 30, 2021

Average Annual Total Returns as of September 30, 2021

| One Year Return |

Since Inception Return |

Gross Expense Ratio * |

Net Expense Ratio * | |||||

| Institutional Shares

|

16.12%

|

6.33%

|

0.89%

|

0.74%

| ||||

| Advisor Shares

|

16.01%

|

6.22%

|

0.99%

|

0.84%

| ||||

| Investor Shares

|

15.88%

|

6.09%

|

1.14%

|

0.99%

| ||||

| Bloomberg US Aggregate Bond Index

|

(0.90%)

|

3.81%

|

-

|

-

| ||||

| I.C.E. BofAML BB-B Global High Yield Constrained Index

|

8.37%

|

5.16%

|

-

|

- | ||||

| MSCI World Index

|

28.82%

|

12.22%

|

-

|

-

| ||||

| MSCI World High Dividend Yield Index

|

20.84%

|

5.94%

|

-

|

-

|

Data as of September 30, 2021. The Fund’s performance reflects the performance of the predecessor JOHCM Global Income Builder Fund of the Advisers Investment Trust for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares, Advisor Shares, and Investor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares, Advisor Shares, and Investor Shares prior to their inception is based on performance of predecessor share classes of the JOHCM Global Income Builder Fund of the Advisers Investment Trust.

Historical performance for Investor Shares prior to its inception is based on the performance of the Class II Shares predecessor share class. Class II Shares predecessor share class performance is based on performance of the Institutional Shares predecessor share class prior to the Class II Shares predecessor share class inception date. Performance of the Class II Shares predecessor share class was adjusted to reflect differences in expense.

xi

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

* Expense ratios are per the most recent Fund Prospectus dated February 12, 2021, as revised July 19, 2021. The Adviser has entered into a contractual expense limitation agreement with respect to Fund until June 30, 2022.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmarks for performance comparison purposes are the: Bloomberg US Aggregate Bond Index, I.C.E. BofAML BB-B Global High Yield Constrained Index, Morgan Stanley Capital International (“MSCI”) World Index and MSCI World High Dividend Yield Index. The Bloomberg US Aggregate Bond Index is a broad-based benchmark that measures the investment grade U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. The I.C.E. BofAML BB-B Global High Yield Constrained Index contains all securities in The I.C.E. BofAML Global High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed market countries. The MSCI World High Dividend Yield Index is based on the MSCI World Index, its parent index, and includes large and mid-cap stocks across 23 developed markets countries. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The table reflects the theoretical reinvestment of dividends on securities in the Indices. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Indices calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund aims to generate meaningful monthly income distributions and long-term capital appreciation by applying a global value investment philosophy to income-generative assets. The Fund invests in global equities and fixed income but may also hold cash and hedging assets e.g. commodity-linked investment instruments such as exchange traded funds that invest in gold and precious metals. The investment team has a long-term, absolute return-oriented investment philosophy and believes their highest priority is to protect the capital they manage from permanent impairment.

Performance

The Fund’s Institutional share class returned 16.12% for the 12-month period to September 30, 2021. Our top contributors among our equity holdings included several technology shares, namely Oracle, which benefited from its strong earnings and outlook. Microsoft and Alphabet also performed well. A commercial real estate REIT, Columbia Property Trust, also contributed positively, thanks to the announcement of a go-private transaction following a strategic review. Italian asset manager Azimut advanced with strong AUM development.

Our top detractor among our equity holdings was European utility Enel, which was negatively impacted by Spanish government actions against certain power generation businesses. Tencent Holdings was in the crosshairs of Chinese regulation seeking to prevent excessive youth involvement with video games. Elsewhere Samsung Electronics lost some ground amid concerns of supply-chain impacts.

While risk assets have generally performed extremely well from the depths of the pandemic market crisis of 2020, and in this later phase of post-vaccine recovery, we continue to see upside potential and reasonably attractive valuation in many areas. Strong demand paired with supply-side shortages may benefit a wide range of businesses, as we continue to identify a generally reflationary market regime. At the same time, we are cautious about the potential for rising interest rates, which could undermine the positive impact of earnings growth. We continue to have relatively more exposure to the opportunity set in equity markets, given the low interest rate and tight credit spread environment. However, we continue to see pockets of opportunity in credit, by taking advantage of equity optionality within certain convertible bonds, for example.

xii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

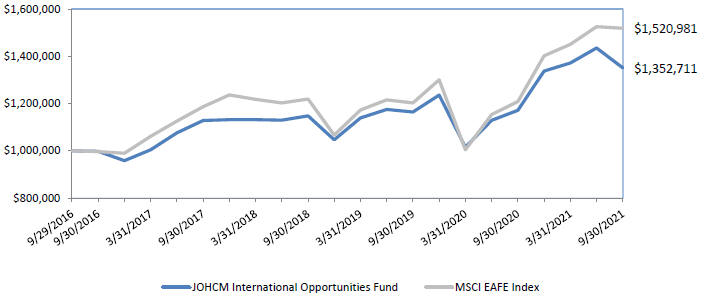

JOHCM International Opportunities Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares from September 29, 2016 to September 30, 2021

Average Annual Total Returns as of September 30, 2021

| One Year Return |

Five Year Return |

Since Inception Return |

Gross Expense Ratio * |

Net Expense Ratio * | ||||||

|

Institutional Shares |

15.39% | 6.27% | 6.22% | 3.17% | 0.88% | |||||

|

MSCI EAFE Index |

25.73% | 8.81% | 8.74% | - | - |

Data as of September 30, 2021. The Fund’s performance reflects the performance of the predecessor JOHCM International Opportunities Fund of the Advisers Investment Trust for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares prior to their inception is based on performance of the predecessor share class of the JOHCM International Opportunities Fund of the Advisers Investment Trust.

* Expense ratios are per the most recent Fund Prospectus dated February 12, 2021, as revised July 19, 2021. The Adviser has entered into a contractual expense limitation agreement with respect to Fund until June 30, 2022.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Europe, Australasia and Far East (“EAFE”) Index. The Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The table reflects the theoretical reinvestment of

xiii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The investment objective of the JOHCM International Opportunities Fund (the “Fund”) is to achieve long-term total return by investing in a focused portfolio of international equity securities. The Fund invests, under normal market conditions, primarily in equity securities of companies headquartered outside the US, including those in emerging markets. The Fund may invest in foreign companies of any size, including small- and mid-capitalisation companies, in order to achieve its objective. Equity securities include common and preferred stocks, rights and warrants. The Fund may also invest in equity related instruments, such as equity linked notes and participation notes, all of which derive their value from equities. The portfolio typically contains 25 to 40 stocks.

Performance

The Fund’s Institutional share class returned 15.39% for the 12-month period to September 30, 2021 versus a return of 25.73% achieved by its benchmark, the MSCI EAFE NR Index, for the same period. The portfolio underperformed over the year with our utilities the main source of weakness as Enel and Iberdrola lagging amidst surging gas and electricity prices. Enel also suffered on the back of negative regulatory developments in Spain.

Strong market leadership by market extremes tends to be a clear headwind for relative performance. Banks, energy and miners tend to be the most geared beneficiaries of an inflationary environment. On the other hand recent history provides plenty of examples of a narrowly tech/growth-led market which we have tended to underperform despite the solid growth profile of many of the companies in the portfolio. Clearly in absolute terms there is always risk from poor operational execution by any of our portfolio companies, although we mitigate this risk by focusing on diversified businesses with low operational and/or financial gearing. Finally, again in absolute terms, it is almost impossible to predict how we will perform in a disorderly market sell-off after a long period of complacency – although we would expect to perform well in relative terms, as we have done in previous periods.

The equity market has moved into “shoot first, ask questions later” mode. This reflects the combination of complacency and “no alternative” reluctance which had supported the unbroken rally from November to August. The major macro concern currently is stagflation, where inflation is driven by supply-side weakness, not demand-side strength. The difference is particularly important for cyclicals, which is why there are currently few hiding places. There are plenty of sector-specific issues emerging, which the market is having to digest - not least political and regulatory. The challenge is to work out which are genuine buying opportunities and which are value traps. As ever, diversification and balance sheet strength will be important differentiators.

The outlook for inflation and monetary policy is clearly going to be critical, as well as the ongoing post-Covid recovery. A calm ‘mid-cycle’ environment of gentle economic recovery likely allows for outperformance of quality names with idiosyncratic growth potential, as market leadership by either extreme growth or geared cyclicals becomes less dominant. There is plenty of potential for much greater volatility, especially if supply side tightness and disruption creates extreme commodity-led inflation and concerns about stagflation.

xiv

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

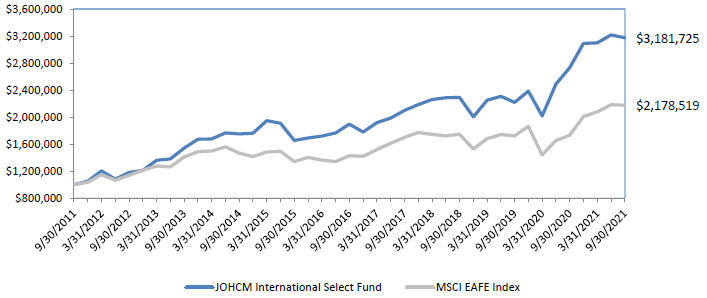

JOHCM International Select Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares from September 30, 2011 to September 30, 2021

Average Annual Total Returns as of September 30, 2021

| One Year Return |

Five Year Return |

Ten Year Return |

Gross Expense Ratio * |

Net Expense Ratio * | ||||||

|

Institutional Shares |

16.24% | 10.88% | 12.27% | 0.98% | 0.98% | |||||

|

Investor Shares |

15.94% | 10.60% | 11.99% | 1.21% | 1.21% | |||||

|

MSCI EAFE Index |

25.73% | 8.81% | 8.10% | - | - |

Data as of September 30, 2021. The Fund’s performance reflects the performance of the predecessor JOHCM International Select Fund of the Advisers Investment Trust and the predecessor JOHCM International Select Fund of the Scotia Institutional Fund for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares and Investor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares and Investor Shares prior to their inception is based on performance of predecessor share classes of the predecessor JOHCM International Select Fund of the Advisers Investment Trust and the predecessor JOHCM International Select Fund of the Scotia Institutional Fund.

Historical performance for Investor Shares prior to its inception is based on the performance of the Class II Shares predecessor share class. Class II Shares predecessor share class performance is based on performance of the Class I Shares predecessor share class prior to the Class II Shares predecessor share class inception date. Performance of the Class II Shares predecessor share class was adjusted to reflect differences in expense.

* Expense ratios are per the most recent Fund Prospectus dated February 12, 2021, as revised July 19, 2021. The Adviser has entered into a contractual expense limitation agreement with respect to Fund until June 30, 2022.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less

xv

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2021 (Unaudited)

than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Europe, Australasia and Far East (“EAFE”) Index. The Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

To seek to achieve its investment objective of long-term capital appreciation, the Fund employs a growth at a reasonable price (GARP) investment philosophy, which is sometimes described as a core focus with a growth bias. The Fund seeks to own stocks, sectors and countries with positive earnings surprise, sustainably high or increasing return on equity, and attractive valuations. The Fund managers believe they can increase the probability of finding an attractive stock by looking where traditional growth investors tend to ignore. While the Fund’s managers seek to own stocks with idiosyncratic return patterns, they also recognize that many stocks have varying degrees of beta or correlation to their sector or country, so they also maintain a top-down research focus when constructing the portfolio. The Fund’s management team offers the unique capability of blending both a bottom-up and a top-down investment research approach to the portfolio construction process.

Performance

The Fund’s Institutional share class returned 16.24% for the 12-month period to September 30, 2021 versus a return of 25.73% achieved by its benchmark, the MSCI EAFE NR Index, for the same period.

Underperformance over the year came largely from challenging stock selection with our financials and consumer discretionary holdings the main source of weakness, offsetting strength in our technology holdings. Sector allocation effects were also negative as our zero-weighting in energy weighed on relative returns after the rally towards the end of the period. Individual stocks of note include our technology names, Advantest and MediaTek while auto parts company Aptiv also added value. On the negative side The a2 Milk Company and Peptidream were the main laggards.

Many investors seem dogmatically stuck on the ‘Value’ versus ‘Growth’ debate when the truth is pragmatically somewhere in the middle, depending on the business cycle. This is why we combine Growth, Value and Momentum factors over the cycle. Value usually performs best during the first year of an economic recovery, when earnings growth rates are accelerating. Growth then usually performs better after that, as earnings growth rates start to decelerate - which appears to be what is now starting to happen. Year to date, Value and Growth performance has been roughly equal, while the Momentum factor has significantly underperformed as it was whipsawed by several rotations between Value and Growth.

We were buyers of September’s dip, moving to 75% bullish and 25% bearish. The highest probability outcome is still “one of the biggest ever equity bull markets, followed by one of the biggest ever equity bear markets” but some early warning signs are flashing so we will keep an open mind in a fast changing world. We are positioned for a Q4 rally, and expect continued volatility and market rotations in 2022.

If policy makers recognise and react to slowing growth, we will probably move to 80% bullish, 20% bearish, if not, we will probably get more bearish.

xvi

JOHCM FUNDS TRUST

JOHCM CREDIT INCOME FUND

September 30, 2021

| Percentage Assets |

Shares | Value | ||||||||||

| COMMON STOCKS |

0.2% | |||||||||||

| Holding Companies-Diversified |

0.2% | |||||||||||

| Alpha Capital Acquisition Co.(a) |

428 | $ | 4,263 | |||||||||

| Austerlitz Acquisition Corp. II(a) |

634 | 6,245 | ||||||||||

| CC Neuberger Principal Holdings III(a) |

104 | 1,035 | ||||||||||

| Northern Star Investment Corp. III(a) |

211 | 2,080 | ||||||||||

|

|

|

|||||||||||

| 13,623 | ||||||||||||

|

|

|

|||||||||||

| TOTAL COMMON STOCKS (Cost $13,785) |

13,623 | |||||||||||

|

|

|

|||||||||||

| Percentage of Net Assets |

Principal Amount | Value | ||||||||||

| CONVERTIBLE BONDS |

15.9% | |||||||||||

| Biotechnology |

2.3% | |||||||||||

| Innoviva, Inc. |

$ | 100,000 | 120,108 | |||||||||

|

|

|

|||||||||||

| Internet |

3.0% | |||||||||||

| Airbnb, Inc. |

50,000 | 49,125 | ||||||||||

| Spotify U.S.A., Inc. |

70,000 | 63,070 | ||||||||||

| Twitter, Inc. |

50,000 | 46,417 | ||||||||||

|

|

|

|||||||||||

| 158,612 | ||||||||||||

|

|

|

|||||||||||

| Media |

5.7% | |||||||||||

| Liberty Broadband Corp. |

100,000 | 105,564 | ||||||||||

| Liberty Latin America Ltd. |

190,000 | 192,850 | ||||||||||

|

|

|

|||||||||||

| 298,414 | ||||||||||||

|

|

|

|||||||||||

| Software |

4.9% | |||||||||||

| Alteryx, Inc. |

70,000 | 64,575 | ||||||||||

| Envestnet, Inc. |

100,000 | 101,175 | ||||||||||

| Fastly, Inc. |

110,000 | 92,538 | ||||||||||

|

|

|

|||||||||||

| 258,288 | ||||||||||||

|

|

|

|||||||||||

| TOTAL CONVERTIBLE BONDS (Cost $819,862) |

835,422 | |||||||||||

|

|

|

|||||||||||

| CORPORATE BONDS |

60.8% | |||||||||||

| Advertising |

4.0% | |||||||||||

| Advantage Sales & Marketing, Inc. |

200,000 | 208,448 | ||||||||||

|

|

|

|||||||||||

| Aerospace/Defense |

4.1% | |||||||||||

| Boeing (The) Co. |

80,000 | 106,637 | ||||||||||

| Hexcel Corp. |

100,000 | 109,242 | ||||||||||

|

|

|

|||||||||||

| 215,879 | ||||||||||||

|

|

|

|||||||||||

See Notes to Financial Statements.

1

JOHCM FUNDS TRUST

JOHCM CREDIT INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

| Percentage Assets |

Principal Amount | Value | ||||||||||

| Banks |

4.1% | |||||||||||

| Bank of America Corp. |

||||||||||||

| (Variable, ICE LIBOR USD 3M + 2.66%) 4.30%, 01/28/25(c) |

$ | 105,000 | $ | 106,838 | ||||||||

| JPMorgan Chase & Co. |

||||||||||||

| (Variable, U.S. SOFR + 2.75%) 4.00%, 04/01/25(c) |

105,000 | 105,446 | ||||||||||

|

|

|

|||||||||||

| 212,284 | ||||||||||||

|

|

|

|||||||||||

| Commercial Services |

2.0% | |||||||||||

| Graham Holdings Co. |

100,000 | 104,430 | ||||||||||

|

|

|

|||||||||||

| Diversified Financial Services |

3.2% | |||||||||||

| Charles Schwab Corp. (The) |

||||||||||||

| (Variable, U.S. Treasury Yield Curve Rate CMT 5Y + 4.97%) 5.38%, 06/01/25(c) |

150,000 | 166,688 | ||||||||||

|

|

|

|||||||||||

| Electrical Component & Equipments |

2.1% | |||||||||||

| WESCO Distribution, Inc. |

100,000 | 110,750 | ||||||||||

|

|

|

|||||||||||

| Food |

3.3% | |||||||||||

| JBS U.S.A. LUX S.A./JBS U.S.A. Food Co./JBS U.S.A. Finance, Inc. |

100,000 | 111,750 | ||||||||||

| Post Holdings, Inc. |

60,000 | 62,354 | ||||||||||

|

|

|

|||||||||||

| 174,104 | ||||||||||||

|

|

|

|||||||||||

| Healthcare-Services |

4.0% | |||||||||||

| Encompass Health Corp. |

150,000 | 157,657 | ||||||||||

| IQVIA, Inc. |

50,000 | 51,244 | ||||||||||

|

|

|

|||||||||||

| 208,901 | ||||||||||||

|

|

|

|||||||||||

| Internet |

13.9% | |||||||||||

| Go Daddy Operating Co. LLC/GD Finance Co., Inc. |

120,000 | 125,100 | ||||||||||

| GrubHub Holdings, Inc. |

100,000 | 103,750 | ||||||||||

| Netflix, Inc. |

110,000 | 139,150 | ||||||||||

| TripAdvisor, Inc. |

190,000 | 201,400 | ||||||||||

| Uber Technologies, Inc. |

150,000 | 158,531 | ||||||||||

|

|

|

|||||||||||

| 727,931 | ||||||||||||

|

|

|

|||||||||||

| Machinery-Diversified |

1.0% | |||||||||||

| Flowserve Corp. |

50,000 | 52,209 | ||||||||||

|

|

|

|||||||||||

See Notes to Financial Statements.

2

JOHCM FUNDS TRUST

JOHCM CREDIT INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

| Percentage Assets |

Principal Amount | Value | ||||||||||

| Media |

6.4% | |||||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., |

||||||||||||

| 4.00%, 03/01/23(b) |

$ | 50,000 | $ | 50,234 | ||||||||

| 5.38%, 06/01/29(b) |

150,000 | 162,000 | ||||||||||

| ViacomCBS, Inc., |

||||||||||||

| (Variable, ICE LIBOR USD 3M + 3.90%) |

10,000 | 10,125 | ||||||||||

| (Variable, ICE LIBOR USD 3M + 3.90%) |

100,000 | 114,500 | ||||||||||

|

|

|

|||||||||||

| 336,859 | ||||||||||||

|

|

|

|||||||||||

| Packing & Containers |

2.0% | |||||||||||

| Berry Global, Inc. |

75,000 | 78,754 | ||||||||||

| Plastipak Holdings, Inc. |

25,000 | 25,453 | ||||||||||

|

|

|

|||||||||||

| 104,207 | ||||||||||||

|

|

|

|||||||||||

| Pipelines |

0.5% | |||||||||||

| DCP Midstream L.P. |

||||||||||||

| (Variable, ICE LIBOR USD 3M + 5.15%) 7.38%, 12/15/22(c) |

25,000 | 24,313 | ||||||||||

|

|

|

|||||||||||

| Real Estate |

2.1% | |||||||||||

| Realogy Group LLC/Realogy Co-Issuer Corp. |

100,000 | 109,875 | ||||||||||

|

|

|

|||||||||||

| Real Estate Investment Trusts |

4.1% | |||||||||||

| MGM Growth Properties Operating Partnership L.P./MGP Finance

Co-Issuer, Inc. |

160,000 | 184,000 | ||||||||||

| SBA Communications Corp. |

30,000 | 28,987 | ||||||||||

|

|

|

|||||||||||

| 212,987 | ||||||||||||

|

|

|

|||||||||||

| Software |

2.0% | |||||||||||

| SS&C Technologies, Inc. |

100,000 | 105,593 | ||||||||||

|

|

|

|||||||||||

| Transportation |

2.0% | |||||||||||

| XPO Logistics, Inc. |

100,000 | 105,548 | ||||||||||

|

|

|

|||||||||||

| TOTAL CORPORATE BONDS (Cost $3,172,925) |

3,181,006 | |||||||||||

|

|

|

|||||||||||

| FOREIGN ISSUER BONDS |

8.3% | |||||||||||

| Beverages |

2.2% | |||||||||||

| Bacardi Ltd. |

100,000 | 115,510 | ||||||||||

|

|

|

|||||||||||

| Oil & Gas |

2.0% | |||||||||||

| BP Capital Markets PLC |

||||||||||||

| (Variable, U.S. Treasury Yield Curve Rate CMT 5Y + 4.04%) 4.38%, 06/22/25(c) |

100,000 | 106,565 | ||||||||||

|

|

|

|||||||||||

| Packing & Containers |

1.7% | |||||||||||

| OI European Group B.V. |

85,000 | 86,700 | ||||||||||

|

|

|

|||||||||||

See Notes to Financial Statements.

3

JOHCM FUNDS TRUST

JOHCM CREDIT INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

| Percentage Assets |

Principal Amount | Value | ||||||||||

| Telecommunications |

2.4% | |||||||||||

| Altice France S.A. 8.13%, 02/01/27(b) |

$ | 115,000 | $ | 123,740 | ||||||||

|

|

|

|||||||||||

| TOTAL FOREIGN ISSUER BONDS (Cost $431,383) |

432,515 | |||||||||||

|

|

|

|||||||||||

| Percentage of Net Assets |

Shares | Value | ||||||||||

| PREFERRED STOCKS |

5.4% | |||||||||||

| Banks |

1.0% | |||||||||||

| Morgan Stanley (Variable, ICE LIBOR USD 3M + 3.49%) 5.85%(c) |

1,679 | 49,748 | ||||||||||

|

|

|

|||||||||||

| Real Estate Investment Trusts |

1.4% | |||||||||||

| Vornado Realty Trust 5.70% |

3,000 | 75,060 | ||||||||||

|

|

|

|||||||||||

| Telecommunications |

3.0% | |||||||||||

| 2020 Cash Mandatory Exchangeable Trust (a)(b) |

140 | 158,308 | ||||||||||

|

|

|

|||||||||||

| PREFERRED STOCKS (Cost $276,405) |

283,116 | |||||||||||

|

|

|

|||||||||||

| CLOSED-END FUNDS |

1.2% | |||||||||||

| Eagle Point Credit Co., Inc. |

4,474 | 60,936 | ||||||||||

|

|

|

|||||||||||

| TOTAL CLOSED-END FUNDS (Cost $46,682) |

60,936 | |||||||||||

|

|

|

|||||||||||

| SHORT-TERM INVESTMENTS |

7.4% | |||||||||||

| Northern Institutional Treasury Portfolio (Premier Class), 0.01%(d) |

384,500 | 384,500 | ||||||||||

|

|

|

|||||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $384,500) |

384,500 | |||||||||||

|

|

|

|||||||||||

| TOTAL INVESTMENTS |

99.2% | 5,191,118 | ||||||||||

| NET OTHER ASSETS (LIABILITIES) |

0.8% | 42,398 | ||||||||||

|

|

|

|||||||||||

| NET ASSETS |

100.0% | $ | 5,233,516 | |||||||||

|

|

|

|||||||||||

(a)Non-income producing security.

(b)Securities purchased in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. These securities may not be publicly traded without registration under the Securities Act of 1933. The value of these securities is determined by valuations supplied by a pricing service or brokers.

(c)Floating rate security. The rate presented is the rate in effect at September 30, 2021, and the related index and spread are shown parenthetically for each security.

(d)7-day current yield as of September 30, 2021 is disclosed.

See Notes to Financial Statements.

4

JOHCM FUNDS TRUST

JOHCM CREDIT INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

At September 30, 2021, the JOHCM Credit Income Fund’s investments were concentrated as follows:

| Country Allocation (Unaudited) | Percentage of Net Assets |

|||

| United States |

87.2 | % | ||

| Chile |

3.7 | |||

| France |

2.4 | |||

| Bermuda |

2.2 | |||

| United Kingdom |

2.0 | |||

| Netherlands |

1.7 | |||

| Total |

99.2 | % | ||

| 5 Largest Security Positions | ||||

| Issuer | % of Net Assets | |||

| Advantage Sales & Marketing, Inc. |

4.0 | % | ||

| TripAdvisor, Inc. |

3.9 | |||

| Liberty Latin America Ltd. |

3.7 | |||

| MGM Growth Properties Operating |

3.5 | |||

| Charles Schwab Corp. (The) |

3.2 | |||

| Total |

18.3 | % | ||

See Notes to Financial Statements.

5

JOHCM FUNDS TRUST

JOHCM EMERGING MARKETS OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

| Percentage of Net Assets |

Shares | Value | ||||||||||

| COMMON STOCKS |

96.0% | |||||||||||

| Brazil |

7.7% | |||||||||||

| Ambev S.A. - ADR |

4,247,492 | $ | 11,723,078 | |||||||||

| B3 S.A. - Brasil Bolsa Balcao |

5,364,549 | 12,550,035 | ||||||||||

| Petroleo Brasileiro S.A. - ADR |

2,790,892 | 28,857,823 | ||||||||||

| Suzano S.A. - ADR(a) |

1,044,640 | 10,446,400 | ||||||||||

|

|

|

|||||||||||

| 63,577,336 | ||||||||||||

|

|

|

|||||||||||

| Canada |

2.3% | |||||||||||

| Barrick Gold Corp. |

1,051,451 | 18,978,691 | ||||||||||

|

|

|

|||||||||||

| China |

20.8% | |||||||||||

| Anhui Conch Cement Co. Ltd. - Class H |

3,278,109 | 17,632,643 | ||||||||||

| China Construction Bank Corp. - Class H |

11,205,502 | 7,948,605 | ||||||||||

| Country Garden Services Holdings Co. Ltd. |

1,470,000 | 11,536,092 | ||||||||||

| ENN Energy Holdings Ltd. |

1,770,016 | 28,985,490 | ||||||||||

| Jiangsu Expressway Co. Ltd. - Class H |

4,758,982 | 4,817,752 | ||||||||||

| Longfor Group Holdings Ltd.(b) |

5,373,372 | 24,693,746 | ||||||||||

| Proya Cosmetics Co. Ltd. - Class A |

421,792 | 11,325,893 | ||||||||||

| Proya Cosmetics Co. Ltd. - Class A (Shanghai Exchange) |

195,992 | 5,274,337 | ||||||||||

| TravelSky Technology Ltd. - Class H |

3,370,000 | 6,495,353 | ||||||||||

| Trip.com Group Ltd. - ADR(a) |

442,566 | 13,608,905 | ||||||||||

| Tsingtao Brewery Co. Ltd. - Class H |

991,536 | 7,737,203 | ||||||||||

| Xinyi Energy Holdings Ltd. |

1,654,948 | 965,248 | ||||||||||

| Xinyi Solar Holdings Ltd. |

10,723,440 | 21,834,036 | ||||||||||

| Zhejiang Expressway Co. Ltd. - Class H |

12,319,315 | 10,162,613 | ||||||||||

|

|

|

|||||||||||

| 173,017,916 | ||||||||||||

|

|

|

|||||||||||

| Hong Kong |

5.2% | |||||||||||

| China Resources Land Ltd. |

1,751,176 | 7,365,738 | ||||||||||

| Hong Kong Exchanges & Clearing Ltd. |

526,799 | 31,975,783 | ||||||||||

| Lee & Man Paper Manufacturing Ltd. |

5,748,000 | 4,221,659 | ||||||||||

|

|

|

|||||||||||

| 43,563,180 | ||||||||||||

|

|

|

|||||||||||

| India |

16.0% | |||||||||||

| Apollo Tyres Ltd. |

1,150,776 | 3,475,414 | ||||||||||

| Container Corp. of India Ltd. |

1,234,466 | 11,655,920 | ||||||||||

| HDFC Bank Ltd. - ADR |

303,582 | 22,188,808 | ||||||||||

| ICICI Bank Ltd. - ADR |

1,510,981 | 28,512,212 | ||||||||||

| Larsen & Toubro Ltd. |

848,782 | 19,371,990 | ||||||||||

| Mahindra & Mahindra Ltd. |

1,448,551 | 15,571,676 | ||||||||||

| State Bank of India |

5,202,967 | 31,780,824 | ||||||||||

|

|

|

|||||||||||

| 132,556,844 | ||||||||||||

|

|

|

|||||||||||

| Jersey |

0.6% | |||||||||||

| Centamin PLC |

4,193,722 | 5,404,577 | ||||||||||

|

|

|

|||||||||||

| Mexico |

5.8% | |||||||||||

| Bolsa Mexicana de Valores S.A.B. de C.V. |

2,708,622 | 5,212,144 | ||||||||||

| Cemex S.A.B. de C.V. - ADR(a) |

3,719,110 | 26,666,019 | ||||||||||

See Notes to Financial Statements.

6

JOHCM FUNDS TRUST

JOHCM EMERGING MARKETS OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

| Percentage of Net Assets |

Shares | Value | ||||||||||

| Megacable Holdings S.A.B. de C.V. - CPO |

1,414,168 | $ | 4,323,038 | |||||||||

| Wal-Mart de Mexico S.A.B. de C.V. |

3,428,580 | 11,648,684 | ||||||||||

|

|

|

|||||||||||

| 47,849,885 | ||||||||||||

|

|

|

|||||||||||

| Netherlands |

4.3% | |||||||||||

| Prosus N.V.(a) |

452,402 | 35,630,370 | ||||||||||

|

|

|

|||||||||||

| Russia |

0.8% | |||||||||||

| Globaltrans Investment PLC - REG - GDR |

833,616 | 6,643,257 | ||||||||||

|

|

|

|||||||||||

| South Africa |

5.9% | |||||||||||

| FirstRand Ltd. |

5,042,370 | 21,385,458 | ||||||||||

| Mr Price Group Ltd. |

1,173,295 | 15,673,346 | ||||||||||

| Naspers Ltd. - Class N |

73,048 | 12,037,430 | ||||||||||

|

|

|

|||||||||||

| 49,096,234 | ||||||||||||

|

|

|

|||||||||||

| South Korea |

17.8% | |||||||||||

| Cheil Worldwide, Inc. |

537,733 | 10,199,389 | ||||||||||

| NCSoft Corp. |

21,082 | 10,673,516 | ||||||||||

| Samsung Electronics Co. Ltd. |

1,079,665 | 67,197,060 | ||||||||||

| Samsung Electronics Co. Ltd. - REG - GDR |

1,125 | 1,748,733 | ||||||||||

| SK Hynix, Inc. |

288,552 | 24,881,979 | ||||||||||

| SK Telecom Co. Ltd. |

120,163 | 32,766,565 | ||||||||||

|

|

|

|||||||||||

| 147,467,242 | ||||||||||||

|

|

|

|||||||||||

| Taiwan |

6.0% | |||||||||||

| Primax Electronics Ltd. |

6,944,384 | 12,717,850 | ||||||||||

| Taiwan Cement Corp. |

4,577,000 | 8,366,247 | ||||||||||

| Tong Yang Industry Co. Ltd. |

6,827,643 | 8,292,945 | ||||||||||

| Win Semiconductors Corp. |

522,000 | 5,755,833 | ||||||||||

| Yuanta Financial Holding Co. Ltd. |

17,186,000 | 15,126,517 | ||||||||||

|

|

|

|||||||||||

| 50,259,392 | ||||||||||||

|

|

|

|||||||||||

| United Arab Emirates |

2.8% | |||||||||||

| Emaar Malls PJSC(a) |

24,272,136 | 13,198,560 | ||||||||||

| Emaar Properties PJSC |

8,777,172 | 9,738,041 | ||||||||||

|

|

|

|||||||||||

| 22,936,601 | ||||||||||||

|

|

|

|||||||||||

| TOTAL COMMON STOCKS (Cost $692,301,791) |

796,981,525 | |||||||||||

|

|

|

|||||||||||

| PREFERRED STOCKS |

0.9% | |||||||||||

| Brazil |

0.9% | |||||||||||

| Azul S.A. - ADR(a) |

357,264 | 7,166,716 | ||||||||||

|

|

|

|||||||||||

| TOTAL PREFERRED STOCKS (Cost $8,707,149) |

7,166,716 | |||||||||||

|

|

|

|||||||||||

| TOTAL INVESTMENTS |

96.9% | 804,148,241 | ||||||||||

| NET OTHER ASSETS (LIABILITIES) |

3.1% | 25,701,629 | ||||||||||

|

|

|

|||||||||||

| NET ASSETS |

100.0% | $ | 829,849,870 | |||||||||

|

|

|

|||||||||||

(a)Non-income producing security.

(b)Securities purchased in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. These securities may not be publicly traded without registration under the Securities Act of 1933. The value of these securities is determined by valuations supplied by a pricing service or brokers.

See Notes to Financial Statements.

7

JOHCM FUNDS TRUST

JOHCM EMERGING MARKETS OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

Abbreviations:

ADR – American Depositary Receipt

CPO – Certificados de Partcipatión Ordinario

GDR – Global Depositary Receipt

REG – Registered

At September 30, 2021 the industry sectors for the JOHCM Emerging Markets Opportunities Fund were:

| Sector Allocation (Unaudited) | % of Net Assets | |||

| Communication Services |

7.0 | % | ||

| Consumer Discretionary |

12.6 | |||

| Consumer Staples |

5.7 | |||

| Energy |

3.5 | |||

| Financials |

21.3 | |||

| Industrials |

7.2 | |||

| Information Technology |

16.9 | |||

| Materials |

11.1 | |||

| Real Estate |

8.0 | |||

| Utilities |

3.6 | |||

| Total |

96.9 | % | ||

See Notes to Financial Statements.

8

JOHCM FUNDS TRUST

JOHCM EMERGING MARKETS OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

At September 30, 2021, the JOHCM Emerging Markets Opportunities Fund’s investments were concentrated as follows:

| Market Exposure (Unaudited) | ||||

| Equity Securities | % of Net Assets | |||

| Banks |

13.5 | % | ||

| Semiconductors |

12.0 | |||

| Internet |

8.7 | |||

| Real Estate |

8.0 | |||

| Diversified Financial Services |

7.8 | |||

| Building Materials |

6.3 | |||

| Telecommunications |

4.5 | |||

| Gas |

3.5 | |||

| Oil & Gas |

3.5 | |||

| Retail |

3.3 | |||

| Mining |

2.9 | |||

| Energy-Alternate Sources |

2.8 | |||

| Commercial Services |

2.6 | |||

| Beverages |

2.3 | |||

| Engineering & Construction |

2.3 | |||

| Transportation |

2.2 | |||

| Cosmetics/Personal Care |

2.0 | |||

| Auto Manufacturers |

1.9 | |||

| Computers |

1.5 | |||

| Auto Parts & Equipment |

1.4 | |||

| Forest Products & Paper |

1.3 | |||

| Advertising |

1.2 | |||

| Airlines |

0.9 | |||

| Packing & Containers |

0.5 | |||

| Total |

96.9 | % | ||

| 5 Largest Security Positions | ||||

| Issuer | % of Net Assets | |||

| Samsung Electronics Co. Ltd. |

8.1 | % | ||

| Prosus N.V |

4.3 | |||

| SK Telecom Co. Ltd. |

4.0 | |||

| Hong Kong Exchanges & Clearing Ltd. |

3.9 | |||

| State Bank of India |

3.8 | |||

| Total |

24.1 | % | ||

See Notes to Financial Statements.

9

JOHCM FUNDS TRUST

JOHCM EMERGING MARKETS SMALL MID CAP EQUITY FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

| Percentage of Net Assets |

Shares | Value | ||||||||||

| COMMON STOCKS |

94.5% | |||||||||||

| Brazil |

4.9% | |||||||||||

| Aeris Industria E Comercio De Equipamentos Para Geracao De Energia S.A.(a) |

144,300 | $ | 211,717 | |||||||||

| Aliansce Sonae Shopping Centers S.A. |

52,400 | 218,616 | ||||||||||

| Cia Brasileira de Aluminio(a) |

90,000 | 231,043 | ||||||||||

| Empreendimentos Pague Menos S.A.(a) |

108,000 | 246,511 | ||||||||||

| Lojas Quero Quero S.A. |

116,982 | 349,072 | ||||||||||

| Petroreconcavo S.A. (a) |

63,400 | 234,006 | ||||||||||

| Santos Brasil Participacoes S.A.(a) |

303,000 | 441,223 | ||||||||||

| Sinqia S.A. (a) |

43,400 | 168,635 | ||||||||||

| Zenvia, Inc. - Class A(a) |

16,325 | 224,469 | ||||||||||

|

|

|

|||||||||||

| 2,325,292 | ||||||||||||

|

|

|

|||||||||||

| Canada |

3.6% | |||||||||||

| Capstone Mining Corp.(a) |

87,963 | 342,379 | ||||||||||

| Dundee Precious Metals, Inc. |

69,974 | 420,971 | ||||||||||

| ERO Copper Corp.(a) |

14,848 | 263,292 | ||||||||||

| Neo Performance Materials, Inc. |

14,831 | 205,850 | ||||||||||

| Parex Resources, Inc. |

25,999 | 472,933 | ||||||||||

|

|

|

|||||||||||

| 1,705,425 | ||||||||||||

|

|

|

|||||||||||

| Chile |

0.8% | |||||||||||

| Cia Cervecerias Unidas S.A. - ADR |

22,396 | 387,227 | ||||||||||

|

|

|

|||||||||||

| China |

5.4% | |||||||||||

| China Datang Corp. Renewable Power Co. Ltd. - Class H |

1,484,000 | 661,843 | ||||||||||

| China Yongda Automobiles Services Holdings Ltd. |

154,500 | 222,413 | ||||||||||

| New Horizon Health Ltd.(a)(b) |

42,000 | 183,231 | ||||||||||

| Sany Heavy Equipment International Holdings Co. Ltd. |

211,000 | 249,147 | ||||||||||

| Silergy Corp. |

3,313 | 486,523 | ||||||||||

| Sinopec Engineering Group Co. Ltd. - Class H |

551,500 | 279,945 | ||||||||||

| Sinotrans Ltd. - Class H |

805,000 | 314,744 | ||||||||||

| Xtep International Holdings Ltd. |

128,000 | 176,768 | ||||||||||

|

|

|

|||||||||||

| 2,574,614 | ||||||||||||

|

|

|

|||||||||||

| Colombia |

0.4% | |||||||||||

| Tecnoglass, Inc. |

9,545 | 207,413 | ||||||||||

|

|

|

|||||||||||

| France |

0.6% | |||||||||||

| Vicat S.A. |

5,874 | 260,342 | ||||||||||

|

|

|

|||||||||||

| Greece |

2.6% | |||||||||||

| Eurobank Ergasias Services and Holdings S.A.(a) |

463,959 | 434,439 | ||||||||||

| Motor Oil Hellas Corinth Refineries S.A.(a) |

17,414 | 265,690 | ||||||||||

| Mytilineos S.A. |

13,339 | 217,636 | ||||||||||

| Star Bulk Carriers Corp. |

12,570 | 302,183 | ||||||||||

|

|

|

|||||||||||

| 1,219,948 | ||||||||||||

|

|

|

|||||||||||

| Hong Kong |

5.9% | |||||||||||

| Bosideng International Holdings Ltd. |

342,000 | 241,432 | ||||||||||

| China Power International Development Ltd. |

1,124,000 | 594,805 | ||||||||||

| CIMC Enric Holdings Ltd. |

540,000 | 642,804 | ||||||||||

See Notes to Financial Statements.

10

JOHCM FUNDS TRUST

JOHCM EMERGING MARKETS SMALL MID CAP EQUITY FUND

SCHEDULE OF INVESTMENTS

September 30, 2021

| Percentage of Net Assets |

Shares | Value | ||||||||||

| Pacific Basin Shipping Ltd. |

557,000 | $ | 257,949 | |||||||||

| Pax Global Technology Ltd. |

373,000 | 467,612 | ||||||||||

| Towngas China Co. Ltd.(a) |