Form N-CSR Investment Managers Seri For: Dec 31

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21719

INVESTMENT

MANAGERS SERIES TRUST

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee,

WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(414) 299-2295

Registrant's telephone number, including area code

Date of fiscal year end: December 31,

Date of reporting period: December 31, 2021

Item 1. Report to Stockholders.

| (a) | The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

Braddock Multi-Strategy Income Fund

(Class A: BDKAX)

(Class C: BDKCX)

(Institutional Class: BDKNX)

ANNUAL

REPORT

DECEMBER 31, 2021

Braddock Multi-Strategy Income Fund

A series of Investment Managers Series Trust

Table of Contents

| Shareholder Letter | 1 |

| Fund Performance | 7 |

| Schedule of Investments | 9 |

| Statement of Assets and Liabilities | 17 |

| Statement of Operations | 18 |

| Statements of Changes in Net Assets | 19 |

| Financial Highlights | 20 |

| Notes to Financial Statements | 23 |

| Report of Independent Registered Public Accounting Firm | 36 |

| Supplemental Information | 37 |

| Expense Example | 40 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Braddock Multi-Strategy Income Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

www.libertystreetfunds.com

2021 Braddock Multi-Strategy Income Fund

February 1, 2022

To Our Shareholders:

The Braddock Multi-Strategy Income Fund (the “Fund”), as measured by the Fund’s Institutional Share Class (BDKNX), returned 5.71% in 2021, outperforming both the Bloomberg Aggregate Bond Index’s (the “Aggregate Index”) return of -1.54% by 725 basis points and the ICE BofAML U.S. Cash Pay High Yield Index’s (the “High Yield Index”) return of 5.29% by 42 basis points. The Fund ended the year with $569 million of assets. The Aggregate Index along with traditional total return bond funds were negatively impacted by 2021’s rising interest rates and by widening of credit spreads from historically tight levels. The High Yield Index, and many funds in that sector, benefited from healthy corporate fundamentals and were less affected by rising rates due to their lower duration versus the Aggregate Index and total return bond funds.

The economic recovery from the Covid-19 pandemic continued in 2021 with the first half of the year driven by the positive effects of vaccine rollouts and strong corporate earnings. Unfortunately, the pace of recovery slowed in the second half of the year in response to the emergence of two Covid-19 variants and continued supply chain problems. These variants, along with the highest levels of inflation since the early 1980s, led to increased volatility in both the equity and fixed income markets.

The Fund was tactical in these evolving markets. In anticipation of the removal of Covid-19 related monetary accommodation, the Fund’s floating rate allocation was increased from 56% to 75% in 2021. By focusing on a strategy that emphasized Modern Residential Mortgage-Backed Securities (Credit sensitive RMBS issued in 2013 or later) and floating rate securities, the Fund was able to bring its interest rate duration to a multi-year low of 0.86 years and maintain a low credit duration of 3.35 years. As a result, the Fund experienced less price volatility in 2021 versus the benchmarks.

1

Housing and mortgage fundamentals were very positive in during the year. U.S. home prices increased close to 20% in 20211 and mortgage delinquencies trended down throughout the year2. In the post-pandemic economy, residential housing has provided personal well-being and added a home office aspect with the emergence of “work from home.”

Housing and Mortgage Fundamentals

Demographic factors have also been a major contributor to housing demand over the last two years and are forecasted to continue in the future. The Millennial generation is the largest generation since the Baby Boomers and approximately 24 million more Millennials will enter first time home buying age over the next five years3.

The U.S. housing market faces a shortage of four to seven million single-family housing units4 as a result of a decade of below normal construction levels. After the great recession, homebuilders reduced speculative home building and concentrated new construction on larger homes with higher gross margins. It wasn’t until 2016 that homebuilders began to reduce average home size to meet millennial demand5. In 2021, homebuilders faced significant challenges that limited their ability to add housing units. The majority of builders have reported labor shortages, zoning issues, and supply chain issues that resulted in higher costs and longer construction timelines. With these conditions, it will take several years to balance supply and demand in the U.S. housing market.

This supply and demand imbalance has reduced credit risk in RMBS sectors. Higher home prices have translated into higher levels of borrower equity which reduces the probability of mortgage defaults and lowers loss levels on those mortgages that do go to foreclosure. Troubled borrowers are more likely to simply sell their home and avoid negative consequences of the foreclosure process.

The average mortgage backing the Fund’s Modern RMBS reflects this lower risk with a Loan-To-Value below 65% and the average borrower FICO above 7506 as of December 31, 2021.

Market Conditions – Securities Markets

Total RMBS issuance of over $200 billion, the highest in over twelve years7 provided ample opportunity for the Fund to make attractive investments and structure the portfolio to demonstrate low volatility. The Fund was active across eight Modern RMBS sectors in 2021. Modern RMBS securities have benefited from the high-quality underwriting standards that have been standard in the housing finance industry since the housing crisis. Pre-Covid-19 RMBS positions experienced decreasing levels of delinquency and forbearance throughout 20218 which has been consistent across RMBS sectors of Credit Risk Transfer, Mortgage Insurance Linked Notes, Prime Jumbo A, and Non-qualified Mortgage sectors. Post-Covid-19 investments have benefited from strong credit performance as a result of the stricter, post-pandemic mortgage underwriting standards. The Fund’s RMBS allocation remained in the 69%-73% range in 2021 and contributed 3.88% to the 5.71% yearly return.

2

Consumer Asset Backed Securities (ABS) markets experienced significant credit spread tightening and elevated credit rating upgrades over the year, attributable to the ability of the consumer to meet their financial obligations and supportive technical factors. The Fund sold a portion of these outperforming fixed rate bonds during a strong ABS market. Overall, the Consumer ABS allocation was tactically lowered from 22% to 13% in 2021. The Fund sold these fixed rate bonds and rotated into floating rate and higher yielding structured credit opportunities. The Fund’s ABS positions added 1.18% to the year’s return.

The Fund re-entered the Collateralized Loan Obligations (CLO) market in 2021 and finished the year with a 9% investment grade allocation. The purchases added floating rate coupon exposure to the Fund and significant yield pick-up over traditional corporate credit. The levered loan market, the collateral within CLOs, experienced improved fundamentals with declining tail risks that translated into historically low default rates and monthly inflows to the loan market throughout the year. The strong credit performance and floating rate nature of the securities attracted new investors to the asset class. The depth of the investor base absorbed a record $421 billion of issuance of both new issue and refinancing transactions in 20219.

Multifamily Commercial Mortgage-Backed Securities (Multi-family) positions contributed 0.41% to the 2021 return. These Multifamily bonds added constructive diversification with low interest rate sensitivity. The Fund was tactical in the sector with an allocation ranging from 5% to 8%, participating in both Agency Multi-family bonds and Multi-family Commercial Real Estate-CLO bonds. High Demand for housing coupled with rental assistance programs and extended eviction moratoriums kept occupancy rates at high levels. Rent collections rates were high within the properties in the bond’s collateral pools.

Fund Outlook

Braddock believes the Fund’s Modern RMBS and floating rate bond strategy is advantageous in today’s economic environment. The supply-demand shortfall of single-family homes discussed above provides a strong underpinning to home values over the long term.

We believe the Fund’s high percentage allocation to floating rate securities helps mitigate against rising rates in a market where expectations of high economic growth and higher than desired inflation are influencing investor sentiment. Per the December Federal Reserve (the Fed) minutes, the Fed has met the inflation target for liftoff and is monitoring the employment target with an increasingly hawkish eye:

“Many participants judged that, if the current pace of improvement continued, labor markets would fast approach maximum employment. Several participants remarked that they viewed labor market conditions as already largely consistent with maximum employment.”

The Fed Dots signal eight hikes, a 2% increase in the Fed Funds rate, by the end of 2023. Floating rate bonds, which are indexed to short term LIBOR (London Interbank Offered Rate) or SOFR (Secured Overnight Financing Rate) rates should experience a similar increase in bond coupons as the Fed Funds rate rises. This dynamic, if it occurs, would increase the Fund’s floating rate bond coupons thereby increasing the amount of interest available for distribution to the Fund’s investors, and helping to maintain bond values.

3

With the combination of investment opportunities and the fundamental strength of the U.S. consumer and housing markets, we believe the Fund’s focus provides access to some of the strongest sectors of the economy. In light of general fixed income yields, we consider the securitized credit markets (Modern RMBS, Consumer ABS and CLOs) to provide compelling value. The Fund’s low effective duration of 0.86 years as of year end may provide less interest rate risk versus the Aggregate Index and is a complement to the Fund’s credit profile. Additionally, as a growing and nimble fund, the Fund seems well positioned to capitalize on the new and evolving opportunities in these sectors.

We thank you for your investment in the Braddock Multi-Strategy Income Fund.

Best regards,

Garrett Tripp, CFA Senior Portfolio Manager

Toby Giordano, CFA Portfolio Manager

IMPORTANT RISKS AND DISCLOSURES

The views expressed in this report reflect those of the Fund’s Sub-Advisor as of the date this is written and may not reflect its views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding the Fund’s investment methodology and do not constitute investment advice. This report may contain discussions about investments that may or may not be held by the Fund as of the date of this report. All current and future holdings are subject to risk and to change. To the extent this report contains forward looking statements, unforeseen circumstances may cause actual results to differ materially from the views expressed as of the date this is written.

The Fund commenced investment operations on December 31, 2015, after the conversion of a limited partnership Account, Braddock Structured Opportunities Fund Series A, L.P., which commenced operations on 7/31/2009, (the “Predecessor Account”), into shares of the Fund’s Institutional Class. Performance information prior to December 31, 2015 discussed in this report is for the Predecessor Account. The Fund’s objectives, policies, guidelines and restrictions are in all material respects equivalent to those of the Predecessor Account. The Predecessor Account was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and therefore was not subject to certain restrictions imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986 on regulated investment companies. If the Predecessor Account had been registered under the 1940 Act, the Predecessor Account’s performance may have been adversely affected.

An investment in the Braddock Multi-Strategy Income Fund is subject to risk, including the possible loss of principal amount invested and including, but not limited to, the following risks: COVID-19 Related Market Events: The outbreak of COVID-19 has caused major disruptions to the worldwide economy, including the U.S. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund. Market Risk: the market price of a security may decline, sometimes rapidly or unpredictably, due to general market conditions that are not specifically related to a particular issuer, company, or asset class. Valuation: From time to time, the Fund will need to fair-value portfolio securities at prices that differ from third party pricing inputs. This may affect purchase price or redemption proceeds for investors who purchase or redeem Fund shares on days when the Fund is pricing or holding fair-valued securities. Such pricing differences can be significant and can occur quickly during times of market volatility. Fixed income/interest rate: Generally, fixed income securities decrease in value if interest rates rise, and increase in value if interest rates fall. Liquidity: the Fund may not be able to sell some or all of the invest-ments that it holds due to a lack of demand in the marketplace or it may only be able to sell those investments at a loss. Liquid investments may become illiquid or less liquid after purchase by the Fund, Illiquid investments may be harder to value, especially in changing markets. High Yield (“Junk”) bond: involve greater risk of default, downgrade, or price declines, can be more volatile and less liquid than investment-grade securities. Mortgage-backed and Asset-Backed securities: subject to prepayment risk, “extension risk” (repaid more slowly), credit risk, liquidity, and default risks. Management and Strategy: the evaluation and selection of the Fund’s investments depend on the judgment of the Fund’s Sub-Advisor about the quality, relative yield, value or market trends affecting a particular security, industry, sector or region, which may prove to be incorrect. Credit Risk: If an issuer or guarantor of a debt security held by the Fund or a counterparty to a financial contract with the Fund defaults or is downgraded or is perceived to be less creditworthy, the value of the Fund’s portfolio will typically decline. The Fund’s securities are generally not guaranteed by any governmental agency. Sector Focus: may present more risks than if broadly diversified. Real estate market: property values may fall due to various economic factors. Non-diversification: focus in the securities of fewer issuers, which exposes the Fund to greater market risk than if its assets were diversified among a greater number of issuers. Collateralized Loan Obligations: subject to interest rate, credit, asset manager, legal, regulatory, limited recourse, liquidity, redemption, and reinvestment risks. Repurchase agreement: may be subject to market and credit risk. Reverse repurchase agreement: risks of leverage and counterparty risk. Leverage: The use of leverage may magnify the Fund’s gains and losses and make the Fund more volatile. LIBOR: Many financial instruments use a floating rate based on the London Interbank Offered Rate (“LIBOR”), which is expected to expire by the end of 2021. Any effects of the transition away from LIBOR could result in losses. Derivatives: derivative instruments (e.g. short sells, options, futures) involve risks different from direct investment in the underlying assets, including possible losses in excess of amount invested or any gain in portfolio positions. ETF Risk: Investing in an ETF will provide the Fund with exposure to the securities comprising the index on which the ETF is based and will expose the Fund to risks similar to those of investing directly in those securities.

4

Basis points: one hundredth of one percent, used chiefly in expressing differences of interest rates. Dots: The Federal Reserve’s projections for interest rates that are published each quarter. Duration measures a portfolio’s sensitivity to changes in interest rates. Generally, the longer the effective duration, the greater the price change relative to interest rate movements. FICO Score: A measure of consumer credit quality that typically ranges from 300-850. Higher scores indicate more creditworthy borrowers. Investment grade is a rating that signifies a bond that presents a relatively low risk of default. Loan-to-Value ratio is an assessment of lending risk assessment that financial institutions and other lenders examine before approving a mortgage. Typically, assessments with high LTV ratios are higher risk. Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

5

Bloomberg Aggregate Bond Index measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. ICE Bank of America Merrill Lynch U.S. Cash Pay U.S. High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. One cannot invest directly in an index. Bloomberg Barclays US Mortgage Backed Securities Index tracks fixed-rate agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). The index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage. Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers. The index is limited to investment grade bonds. Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. STRIPS are excluded from the index. One cannot invest directly in an index.

| 1 | S&P Case-Shiller. As of 1/25/2022 |

| 2 | Fannie Mae, Freddie Mac. As of 1/25/2022 |

| 3 | U.S. Census Bureau, National Association of Realtors. As of 11/11/2021 |

| 4 | National Association of Realtors, Morgan Stanley, Realtor.com/Move Inc. As of 11/17/2021 |

| 5 | U.S. Census Bureau. As of 6/1/2021 |

| 6 | Fannie Mae, Freddie Mac, DV01, Moody’s Analytics. As of 1/25/2022 |

| 7 | Bank of America. As of 12/31/2021 |

| 8 | Black Knight. As of 1/4/2022 |

| 9 | JP Morgan. As of 12/31/2021 |

6

Braddock Multi-Strategy Income Fund

FUND PERFORMANCE at December 31, 2021 (Unaudited)

The Fund commenced investment operations on December 31, 2015, after the conversion of a limited partnership account, Braddock Structured Opportunities Fund Series A, L.P., which commenced operations on July 31, 2009, (the "Predecessor Account"), into Institutional Class shares of the Fund. The Fund’s objectives, policies, guidelines and restrictions are, in all material respects, equivalent to those of the Predecessor Account.

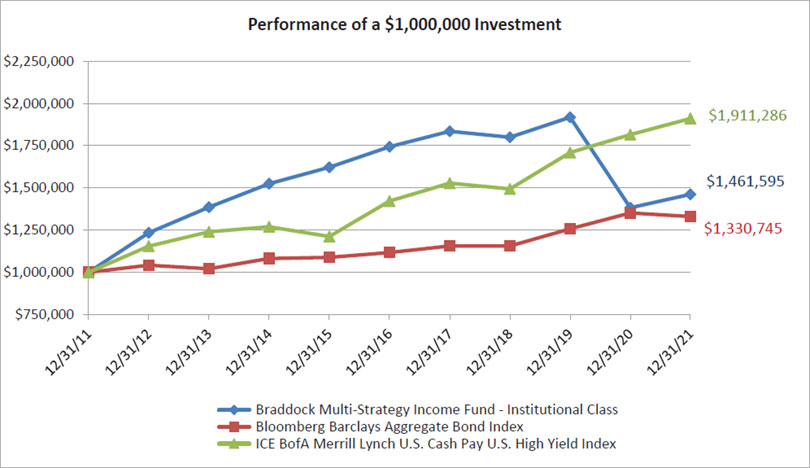

This graph compares a hypothetical $1,000,000 investment in the Fund’s Institutional Class during the periods shown with a similar investment in the Bloomberg Barclays Aggregate Bond Index and the ICE BofA Merrill Lynch U.S. Cash Pay U.S. High Yield Index. The performance graph above is shown for the Fund’s Institutional Class shares; Class A shares and Class C shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The Bloomberg Barclays Aggregate Bond Index measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The ICE BofA Merrill Lynch U.S. Cash Pay U.S. High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and it is not possible to invest in an index.

| Average Annual Total Return as of December 31, 2021 | 1 Year | 5 Years | 10 Years |

| Before deducting maximum sales charge | |||

| Class A1, * | 5.43% | -2.30% | 3.61% |

| Class C2, * | 4.64% | -3.03% | 2.84% |

| Institutional Class3 | 5.71% | -2.06% | 3.87% |

| After deducting maximum sales charge | |||

| Class A1, * | 0.93% | -3.15% | 3.00% |

| Class C2, * | 3.64% | -3.03% | 2.84% |

| Bloomberg Barclays Aggregate Bond Index | -1.54% | 3.57% | 2.90% |

| ICE BofA Merrill Lynch U.S. Cash Pay U.S. High Yield Index | 5.29% | 6.09% | 6.69% |

7

Braddock Multi-Strategy Income Fund

FUND PERFORMANCE at December 31, 2021 (Unaudited) - Continued

| * | The performance figures for Class A and Class C Shares include the performance for the Institutional Class for the period prior to December 31, 2015. Class A and Class C impose higher expenses than that of Institutional Class. |

| 1 | Maximum initial sales charge for Class A shares is 4.25%. No initial sales charge applies to purchase of $1 million or more, but a contingent deferred sales charge (“CDSC”) of 1.00% will be charged on certain Class A Share purchases of $1 million or more that are redeemed in whole or in part within 12 months of the date of purchase. |

| 2 | A CDSC of 1.00% will be charged on Class C share purchases that are redeemed in whole or in part within 12 months of purchase. |

| 3 | Institutional Class shares do not have any initial or contingent deferred sales charge. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (800) 207-7108.

The expense ratio for Class A shares was 1.78%, for Class C shares was 2.53%, and for Institutional Class shares was 1.53%, which were stated in the current prospectus dated May 1, 2021. For the Fund’s most current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses of short sales, acquired fund fees and expenses (as determined in accordance with Form N-1A), expenses incurred in connection with any merger or reorganization and extraordinary expenses such as litigation expenses) do not exceed 1.75%, 2.50%, and 1.50% of the average daily net assets of the Class A shares, Class C shares, and Institutional Class shares, respectively. This agreement is in effect until April 30, 2022, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

Braddock Multi-Strategy Income Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2021

| Principal Amount | Value | |||||||

| ASSET-BACKED SECURITIES — 80.6% | ||||||||

| ACC Auto Trust 2021-A | ||||||||

| $ | 6,000,000 | 6.100%, 6/15/20291,2 | $ | 5,940,690 | ||||

| Alternative Loan Trust 2005-62 | ||||||||

| 9,748,785 | 2.300%, 12/25/20352,3,4 | 515,676 | ||||||

| Aqua Finance Trust 2020-A | ||||||||

| 5,840,000 | 7.150%, 7/17/20461,2 | 6,074,020 | ||||||

| Arbor Realty Commercial Real Estate Notes 2021-FL1 Ltd. | ||||||||

| 3,570,000 | 3.510%, (1-Month USD Libor+340 basis points), 12/15/20351,2,5 | 3,565,021 | ||||||

| Arbor Realty Commercial Real Estate Notes 2021-FL4 Ltd. | ||||||||

| 4,000,000 | 3.490%, (1-Month USD Libor+340 basis points), 11/15/20361,2,5 | 3,996,680 | ||||||

| Atlas Senior Loan Fund XI Ltd. | ||||||||

| 5,000,000 | 3.175%, (3-Month USD Libor+305 basis points), 7/26/20311,2,5 | 4,766,643 | ||||||

| Avant Loans Funding Trust 2021-REV1 | ||||||||

| 3,931,000 | 6.410%, 7/15/20301,2 | 3,936,665 | ||||||

| Bellemeade Re 2019-1 Ltd. | ||||||||

| 3,731,000 | 4.102%, (1-Month USD Libor+400 basis points), 3/25/20291,2,5 | 3,749,684 | ||||||

| Bellemeade Re 2019-4 Ltd. | ||||||||

| 2,000,000 | 3.952%, (1-Month USD Libor+385 basis points), 10/25/20291,2,5 | 1,994,960 | ||||||

| Bellemeade Re 2020-2 Ltd. | ||||||||

| 7,880,000 | 6.101%, (1-Month USD Libor+600 basis points), 8/26/20301,2,5 | 8,273,823 | ||||||

| 8,066,000 | 8.601%, (1-Month USD Libor+850 basis points), 8/26/20301,2,5 | 8,860,302 | ||||||

| Bellemeade Re 2020-3 Ltd. | ||||||||

| 4,250,000 | 3.802%, (1-Month USD Libor+370 basis points), 10/25/20301,2,5 | 4,368,510 | ||||||

| 4,378,000 | 6.452%, (1-Month USD Libor+635 basis points), 10/25/20301,2,5 | 4,589,770 | ||||||

| Bellemeade Re 2020-4 Ltd. | ||||||||

| 2,269,000 | 5.102%, (1-Month USD Libor+500 basis points), 6/25/20301,2,5 | 2,296,542 | ||||||

| Bellemeade Re 2021-1 Ltd. | ||||||||

| 2,000,000 | 4.899%, (SOFR30A+485 basis points), 3/25/20311,2,5 | 2,123,548 | ||||||

| Bellemeade Re 2021-2 Ltd. | ||||||||

| 4,500,000 | 2.950%, (SOFR30A+290 basis points), 6/25/20311,2,5 | 4,365,402 | ||||||

| 3,000,000 | 4.200%, (SOFR30A+415 basis points), 6/25/20311,2,5 | 2,962,747 | ||||||

| Bellemeade RE 2021-3 Ltd. | ||||||||

| 3,000,000 | 3.200%, (SOFR30A+315 basis points), 9/25/20311,2,5 | 2,925,671 | ||||||

| Benefit Street Partners Clo XII Ltd. | ||||||||

| 3,919,000 | 3.174%, (3-Month USD Libor+305 basis points), 10/15/20301,2,5 | 3,879,976 | ||||||

| CAN Capital Funding LLC 2014-1A | ||||||||

| 535,925 | 4.257%, 4/15/20221,6 | – | ||||||

| Cathedral Lake V Ltd. | ||||||||

| 3,000,000 | 3.381%, (3-Month USD Libor+325 basis points), 10/21/20301,2,5 | 2,923,068 | ||||||

| Eagle RE 2019-1 Ltd. | ||||||||

| 5,910,000 | 4.602%, (1-Month USD Libor+450 basis points), 4/25/20291,2,5 | 5,976,875 | ||||||

| Eagle RE 2020-1 Ltd. | ||||||||

| 3,750,000 | 2.952%, (1-Month USD Libor+285 basis points), 1/25/20301,2,5 | 3,595,719 | ||||||

9

Braddock Multi-Strategy Income Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2021

| Principal Amount | Value | |||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| Eagle RE 2021-1 Ltd. | ||||||||

| $ | 2,000,000 | 4.500%, (SOFR30A+445 basis points), 10/25/20331,2,5 | $ | 2,019,063 | ||||

| Eagle RE 2021-2 Ltd. | ||||||||

| 4,750,000 | 4.300%, (SOFR30A+425 basis points), 4/25/20341,2,5 | 4,760,000 | ||||||

| Finance of America HECM Buyout 2021-HB1 | ||||||||

| 3,500,000 | 3.640%, 2/25/20311,2,4,6 | 3,503,500 | ||||||

| 1,500,000 | 6.414%, 2/25/20311,2,4,6 | 1,526,100 | ||||||

| 5,000,000 | 9.000%, 2/25/20311,2,4,6 | 4,996,500 | ||||||

| FMC GMSR Issuer Trust | ||||||||

| 7,000,000 | 4.450%, 1/25/20261,2,4 | 7,029,708 | ||||||

| 4,500,000 | 4.360%, 7/25/20261,4 | 4,464,940 | ||||||

| Freddie Mac STACR REMIC Trust 2020-DNA5 | ||||||||

| 2,800,000 | 4.850%, (SOFR30A+480 basis points), 10/25/20501,2,5 | 2,974,959 | ||||||

| Freddie Mac STACR REMIC Trust 2021-DNA5 | ||||||||

| 8,500,000 | 5.549%, (SOFR30A+550 basis points), 1/25/20341,2,5 | 8,833,268 | ||||||

| Freddie Mac STACR REMIC Trust 2021-DNA6 | ||||||||

| 4,000,000 | 3.450%, (SOFR30A+340 basis points), 10/25/20411,2,5 | 4,032,384 | ||||||

| 5,000,000 | 7.549%, (SOFR30A+750 basis points), 10/25/20411,2,5 | 5,213,035 | ||||||

| Freddie Mac STACR REMIC Trust 2021-HQA2 | ||||||||

| 5,550,000 | 5.499%, (SOFR30A+545 basis points), 12/25/20331,2,5 | 5,802,755 | ||||||

| Freddie Mac STACR REMIC Trust 2021-HQA3 | ||||||||

| 5,500,000 | 6.299%, (SOFR30A+625 basis points), 9/25/20411,2,5 | 5,417,910 | ||||||

| Freddie Mac Structured Agency Credit Risk Debt Notes | ||||||||

| 579,311 | 10.853%, (1-Month USD Libor+1,075 basis points), 3/25/20252,5 | 593,442 | ||||||

| 4,795,654 | 9.303%, (1-Month USD Libor+920 basis points), 10/25/20272,5 | 5,504,144 | ||||||

| 1,682,902 | 7.653%, (1-Month USD Libor+755 basis points), 12/25/20272,5 | 1,807,686 | ||||||

| 3,141,490 | 2.603%, (1-Month USD Libor+250 basis points), 12/25/20422,5 | 3,087,293 | ||||||

| 222,742 | 3.103%, (1-Month USD Libor+300 basis points), 12/25/20422,5 | 149,249 | ||||||

| 9,569,000 | 3.730%, 2/25/20481,2,4 | 9,279,608 | ||||||

| 10,820,544 | 3.807%, 5/25/20481,2,4 | 10,432,563 | ||||||

| 5,212,650 | 4.146%, 8/25/20481,2,4 | 5,159,539 | ||||||

| 1,884,477 | 4.502%, 11/25/20481,2,4 | 1,861,809 | ||||||

| 2,127,000 | 4.303%, (1-Month USD Libor+420 basis points), 2/25/20471,2,5 | 2,247,977 | ||||||

| 1,000,000 | 8.453%, (1-Month USD Libor+835 basis points), 1/25/20481,2,5 | 1,104,597 | ||||||

| 5,100,000 | 4.153%, (1-Month USD Libor+405 basis points), 2/25/20491,2,5 | 5,293,883 | ||||||

| 3,449,065 | 9.453%, (1-Month USD Libor+935 basis points), 4/25/20282,5,6 | 3,708,058 | ||||||

| 4,600,000 | 4.753%, (1-Month USD Libor+465 basis points), 1/25/20491,2,5 | 4,806,184 | ||||||

| 1,486,109 | 8.703%, (1-Month USD Libor+860 basis points), 3/25/20292,5 | 1,585,987 | ||||||

| 5,250,000 | 7.849%, (SOFR30A+780 basis points), 11/25/20411,2,5 | 5,546,646 | ||||||

| Generate CLO 2 Ltd. | ||||||||

| 3,100,000 | 2.728%, (3-Month USD Libor+260 basis points), 1/22/20311,2,5 | 3,067,390 | ||||||

| Home Re 2019-1 Ltd. | ||||||||

| 7,000,000 | 4.452%, (1-Month USD Libor+435 basis points), 5/25/20291,2,5 | 7,105,628 | ||||||

10

Braddock Multi-Strategy Income Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2021

| Principal Amount | Value | |||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| Home RE 2021-1 Ltd. | ||||||||

| $ | 4,000,000 | 2.952%, (1-Month USD Libor+285 basis points), 7/25/20331,2,5 | $ | 3,902,520 | ||||

| 4,000,000 | 3.752%, (1-Month USD Libor+365 basis points), 7/25/20331,2,5 | 3,847,245 | ||||||

| JP Morgan Wealth Management | ||||||||

| 1,249,154 | 2.800%, (SOFR30A+275 basis points), 3/25/20511,2,5 | 1,251,806 | ||||||

| 824,442 | 3.700%, (SOFR30A+365 basis points), 3/25/20511,2,5 | 835,300 | ||||||

| 1,576,000 | 6.949%, (SOFR30A+690 basis points), 3/25/20511,2,5 | 1,593,687 | ||||||

| JPMorgan Chase Bank N.A. - CACLN | ||||||||

| 3,850,000 | 8.482%, 12/26/20281,2 | 3,936,240 | ||||||

| 3,150,000 | 9.812%, 2/26/20291,2 | 3,109,595 | ||||||

| LL ABS Trust 2020-1 | ||||||||

| 2,200,000 | 6.540%, 1/17/20281,2 | 2,299,238 | ||||||

| LOANDEPOT GMSR Master Trust Seres 2018-GT1 | ||||||||

| 1,000,000 | 3.607%, (1-Month USD Libor+350 basis points), 10/16/20231,5 | 1,000,904 | ||||||

| Mosaic Solar Loan Trust 2018-2-GS | ||||||||

| 9,461,215 | 7.440%, 2/22/20441,2 | 8,770,188 | ||||||

| Mosaic Solar Loan Trust 2019-1 | ||||||||

| 681,414 | 0.000%, 12/21/20431,2 | 609,094 | ||||||

| Mosaic Solar Loan Trust 2019-2 | ||||||||

| 3,760,149 | 6.180%, 9/20/20401,2 | 3,607,271 | ||||||

| Multifamily Connecticut Avenue Securities Trust 2019-01 | ||||||||

| 6,412,000 | 3.352%, (1-Month USD Libor+325 basis points), 10/15/20491,2,5 | 6,328,703 | ||||||

| Multifamily Connecticut Avenue Securities Trust 2020-01 | ||||||||

| 5,000,000 | 3.852%, (1-Month USD Libor+375 basis points), 3/25/20501,2,5 | 5,085,740 | ||||||

| Oaktown Re IV Ltd. | ||||||||

| 5,651,000 | 11.602%, (1-Month USD Libor+1,150 basis points), 7/25/20301,2,5 | 5,744,718 | ||||||

| Oaktown Re V Ltd. | ||||||||

| 6,500,000 | 5.352%, (1-Month USD Libor+525 basis points), 10/25/20301,2,5 | 6,754,843 | ||||||

| 3,397,000 | 7.102%, (1-Month USD Libor+700 basis points), 10/25/20301,2,5 | 3,554,117 | ||||||

| Oaktown Re VI Ltd. | ||||||||

| 2,500,000 | 4.000%, (SOFR30A+395 basis points), 10/25/20331,2,5 | 2,508,991 | ||||||

| 1,500,000 | 5.549%, (SOFR30A+550 basis points), 10/25/20331,2,5 | 1,525,276 | ||||||

| Oaktown Re VII Ltd. | ||||||||

| 3,500,000 | 4.450%, (SOFR30A+440 basis points), 4/25/20341,2,5 | 3,468,641 | ||||||

| Oaktree CLO 2019-1 Ltd. | ||||||||

| 8,550,000 | 3.928%, (3-Month USD Libor+380 basis points), 4/22/20301,2,5 | 8,381,529 | ||||||

| Octane Receivables Trust 2019-1 | ||||||||

| 3,790,000 | 5.960%, 5/20/20271,2 | 3,833,630 | ||||||

| Octane Receivables Trust 2020-1 | ||||||||

| 4,717,000 | 5.450%, 3/20/20281,2 | 4,792,859 | ||||||

| Oportun Issuance Trust 2021-B | ||||||||

| 2,080,000 | 5.410%, 5/8/20311,2 | 2,083,349 | ||||||

| PNMAC FMSR Issuer Trust 2018-FT1 | ||||||||

| 2,800,000 | 2.452%, (1-Month USD Libor+235 basis points), 4/25/20231,2,5 | 2,800,536 | ||||||

11

Braddock Multi-Strategy Income Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2021

| Principal Amount | Value | |||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| PNMAC GMSR Issuer Trust 2018-GT1 | ||||||||

| $ | 4,092,000 | 2.952%, (1-Month USD Libor+285 basis points), 2/25/20231,5 | $ | 4,103,626 | ||||

| PNMAC GMSR Issuer Trust 2018-GT2 | ||||||||

| 7,000,000 | 2.752%, (1-Month USD Libor+265 basis points), 8/25/20251,2,5 | 7,023,038 | ||||||

| Radnor RE 2019-1 Ltd. | ||||||||

| 10,300,000 | 4.553%, (1-Month USD Libor+445 basis points), 2/25/20291,2,5 | 10,412,586 | ||||||

| 5,350,000 | 2.802%, (1-Month USD Libor+270 basis points), 6/25/20291,2,5 | 5,357,998 | ||||||

| Radnor RE 2020-1 Ltd. | ||||||||

| 2,350,000 | 3.102%, (1-Month USD Libor+300 basis points), 1/25/20301,2,5 | 2,264,066 | ||||||

| Radnor RE 2020-2 Ltd. | ||||||||

| 2,000,000 | 7.702%, (1-Month USD Libor+760 basis points), 10/25/20301,2,5 | 2,048,671 | ||||||

| Radnor RE 2021-1 Ltd. | ||||||||

| 4,750,000 | 4.050%, (SOFR30A+400 basis points), 12/27/20331,2,5 | 4,626,290 | ||||||

| Radnor RE 2021-2 Ltd. | ||||||||

| 4,000,000 | 5.049%, (SOFR30A+500 basis points), 11/25/20311,2,5 | 4,114,352 | ||||||

| 4,000,000 | 6.049%, (SOFR30A+600 basis points), 11/25/20311,2,5 | 4,126,712 | ||||||

| Ready Capital Mortgage Financing 2021-FL7 LLC | ||||||||

| 5,000,000 | 3.502%, (1-Month USD Libor+340 basis points), 11/25/20361,2,5 | 5,001,011 | ||||||

| RESI Finance LP 2003-CB1 | ||||||||

| 1,050,323 | 1.751%, (1-Month USD Libor+165 basis points), 6/10/20351,2,5 | 862,635 | ||||||

| RMF Buyout Issuance Trust 2021-HB1 | ||||||||

| 3,500,000 | 6.000%, 11/25/20311,2,4,6 | 3,476,550 | ||||||

| Santander Bank N.A. - SBCLN | ||||||||

| 4,250,000 | 6.171%, 12/15/20311,2 | 4,250,506 | ||||||

| SolarCity FTE Series 2 LLC | ||||||||

| 8,234,152 | 7.500%, 9/20/20491,2 | 8,305,445 | ||||||

| Sound Point CLO V-R Ltd. | ||||||||

| 5,220,000 | 3.222%, (3-Month USD Libor+310 basis points), 7/18/20311,2,5 | 5,046,176 | ||||||

| STAR 2021-SFR1 Trust | ||||||||

| 6,000,000 | 3.309%, (1-Month USD Libor+320 basis points), 4/17/20381,5 | 6,028,410 | ||||||

| 3,633,000 | 4.559%, (1-Month USD Libor+445 basis points), 4/17/20381,5 | 3,676,901 | ||||||

| Steele Creek Clo 2018-2 Ltd. | ||||||||

| 4,500,000 | 3.560%, (3-Month USD Libor+340 basis points), 8/18/20311,2,5 | 4,426,666 | ||||||

| Triangle Re 2019-1 Ltd. | ||||||||

| 6,000,000 | 4.252%, (1-Month USD Libor+415 basis points), 11/26/20291,2,5 | 5,991,691 | ||||||

| 2,895,489 | 3.002%, (1-Month USD Libor+290 basis points), 11/26/20291,2,5 | 2,894,810 | ||||||

| Triangle Re 2020-1 Ltd. | ||||||||

| 2,123,000 | 7.852%, (1-Month USD Libor+775 basis points), 10/25/20301,2,5 | 2,232,861 | ||||||

| Triangle Re 2021-1 Ltd. | ||||||||

| 10,000,000 | 4.602%, (1-Month USD Libor+450 basis points), 8/25/20331,2,5 | 9,968,710 | ||||||

| Triangle Re 2021-2 Ltd. | ||||||||

| 2,000,000 | 5.602%, (1-Month USD Libor+550 basis points), 10/25/20331,2,5 | 2,122,202 | ||||||

| 2,000,000 | 7.602%, (1-Month USD Libor+750 basis points), 10/25/20331,2,5 | 2,190,128 | ||||||

12

Braddock Multi-Strategy Income Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2021

| Principal Amount | Value | |||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| Triangle Re 2021-3 Ltd. | ||||||||

| $ | 5,104,000 | 4.999%, (SOFR30A+495 basis points), 2/25/20341,2,5 | $ | 5,003,472 | ||||

| Vibrant ClO VIII Ltd. | ||||||||

| 5,000,000 | 2.981%, (3-Month USD Libor+285 basis points), 1/20/20311,2,5 | 4,780,143 | ||||||

| Vivint Solar Financing VI LLC | ||||||||

| 9,012,924 | 4.871%, (3-Month USD Libor+475 basis points), 8/29/20231,2,5 | 8,938,589 | ||||||

| Voya CLO 2014-2 Ltd. | ||||||||

| 6,500,000 | 3.672%, (3-Month USD Libor+355 basis points), 4/17/20301,2,5 | 6,304,764 | ||||||

| Voya CLO 2014-4 Ltd. | ||||||||

| 7,000,000 | 3.477%, (3-Month USD Libor+335 basis points), 7/14/20311,2,5 | 6,697,781 | ||||||

| TOTAL ASSET-BACKED SECURITIES | ||||||||

| (Cost $447,486,711) | 458,500,607 | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS — 13.8% | ||||||||

| CFMT 2020-HB4 LLC | ||||||||

| 3,250,000 | 4.948%, 12/26/20301,2,4,6 | 3,250,325 | ||||||

| 1,810,193 | 6.000%, 12/26/20301,2,4,6 | 1,809,288 | ||||||

| CFMT 2021-HB5 LLC | ||||||||

| 2,314,525 | 5.682%, 2/25/20311,2,4,6 | 2,313,136 | ||||||

| Chase Mortgage Finance Corp. | ||||||||

| 2,158,000 | 6.550%, (SOFR30A+650 basis points), 2/25/20501,2,5 | 2,157,360 | ||||||

| CHL Mortgage Pass-Through Trust 2005-3 | ||||||||

| 10,098,664 | 2.136%, 4/25/20352,3,4 | 470,656 | ||||||

| Dominion Mortgage Trust 2021-RTL1 | ||||||||

| 3,500,000 | 5.731%, 7/25/20271,2,7 | 3,499,428 | ||||||

| Fannie Mae Connecticut Avenue Securities | ||||||||

| 2,240,000 | 3.853%, (1-Month USD Libor+375 basis points), 3/25/20312,5 | 2,303,191 | ||||||

| 4,100,000 | 9.353%, (1-Month USD Libor+925 basis points), 11/25/20391,2,5 | 4,318,557 | ||||||

| 2,260,621 | 9.353%, (1-Month USD Libor+925 basis points), 4/25/20292,5 | 2,446,508 | ||||||

| 3,000,000 | 4.452%, (1-Month USD Libor+435 basis points), 4/25/20311,2,5 | 3,095,493 | ||||||

| 5,993,596 | 5.353%, (1-Month USD Libor+525 basis points), 10/25/20232,5 | 6,237,519 | ||||||

| 3,809,496 | 5.003%, (1-Month USD Libor+490 basis points), 11/25/20242,5 | 3,954,562 | ||||||

| 4,107,458 | 4.503%, (1-Month USD Libor+440 basis points), 1/25/20242,5 | 4,256,464 | ||||||

| 7,850,000 | 6.050%, (SOFR30A+600 basis points), 10/25/20411,2,5 | 8,057,617 | ||||||

| 2,800,000 | 5.550%, (SOFR30A+550 basis points), 12/25/20411,2,5 | 2,819,922 | ||||||

| FARM Mortgage Trust 2021-1 | ||||||||

| 1,770,280 | 3.249%, 1/25/20511,2,4 | 1,569,818 | ||||||

| FREMF 2020-KI05 Mortgage Trust | ||||||||

| 1,734,557 | 2.394%, (1-Month USD Libor+230 basis points), 7/25/20241,2,5 | 1,740,883 | ||||||

| JP Morgan Mortgage Trust 2020-8 | ||||||||

| 830,112 | 3.538%, 3/25/20511,2,4 | 792,272 | ||||||

| 855,000 | 3.538%, 3/25/20511,2,4 | 642,856 | ||||||

| 1,882,850 | 3.377%, 3/25/20511,2,4 | 861,545 | ||||||

| JP Morgan Seasoned Mortgage Trust 2014-1 | ||||||||

| 2,451,507 | 0.828%, 5/25/20331,2,4 | 2,160,272 | ||||||

13

Braddock Multi-Strategy Income Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2021

| Principal Amount | Value | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS (Continued) | ||||||||

| JP Morgan Trust 2015-1 | ||||||||

| $ | 2,731,957 | 2.115%, 12/25/20441,2,4 | $ | 2,739,942 | ||||

| LHOME Mortgage Trust 2019-RTL3 | ||||||||

| 2,800,000 | 5.682%, 7/25/20241,2,7 | 2,797,388 | ||||||

| Morgan Stanley Residential Mortgage Loan Trust 2021-2 | ||||||||

| 1,727,205 | 2.907%, 5/25/20511,2,4 | 1,449,144 | ||||||

| 1,500,000 | 2.907%, 5/25/20511,2,4 | 912,574 | ||||||

| 1,251,254 | 2.907%, 5/25/20511,2,4 | 485,160 | ||||||

| Oceanview Mortgage Trust 2021-1 | ||||||||

| 1,543,000 | 2.734%, 5/25/20511,2,4 | 1,102,020 | ||||||

| 772,000 | 2.734%, 5/25/20511,2,4 | 455,516 | ||||||

| Oceanview Mortgage Trust 2021-3 | ||||||||

| 1,406,000 | 2.728%, 6/25/20511,2,4 | 1,021,844 | ||||||

| 527,000 | 2.728%, 6/25/20511,2,4 | 316,956 | ||||||

| Sequoia Mortgage Trust 2017-3 | ||||||||

| 3,648,881 | 3.754%, 4/25/20471,2,4 | 3,714,565 | ||||||

| Sequoia Mortgage Trust 2017-4 | ||||||||

| 3,730,011 | 3.931%, 7/25/20471,2,4 | 3,769,564 | ||||||

| Western Mortgage Reference Notes Series 2021-CL2 | ||||||||

| 1,000,000 | 6.550%, (SOFR30A+650 basis points), 7/25/20591,2,5 | 1,000,000 | ||||||

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | ||||||||

| (Cost $74,814,798) | 78,522,345 | |||||||

| CORPORATE BONDS — 0.0% | ||||||||

| FINANCIALS — 0.0% | ||||||||

| First Matrix RMOF Trust | ||||||||

| 750,000 | 0.000% 10/1/20294,6,8,* | — | ||||||

| TOTAL FINANCIALS | ||||||||

| (Cost $6,456) | — | |||||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $6,456) | — | |||||||

| Number of Shares | ||||||||

| SHORT-TERM INVESTMENTS — 5.8% | ||||||||

| 3,279,633 | Fidelity Institutional Government Portfolio, 0.010%9 | 3,279,633 | ||||||

| 29,826,515 | Morgan Stanley Institutional Liquidity Fund - Government Portfolio, 0.026%9 | 29,826,515 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $33,106,148) | 33,106,148 | |||||||

| TOTAL INVESTMENTS — 100.2% | ||||||||

| (Cost $555,414,113) | 570,129,100 | |||||||

| Liabilities in Excess of Other Assets — 0.2% | (1,377,996 | ) | ||||||

| TOTAL NET ASSETS — 100.0% | $ | 568,751,104 | ||||||

14

Braddock Multi-Strategy Income Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2021

REMIC – Real Estate Mortgage Investment Conduit

LLC – Limited Liability Company

LP – Limited Partnership

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities are restricted and may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities is $500,402,517, which represents 88.0% of total net assets of the Fund. |

| 2 | Callable. |

| 3 | Interest-only security. |

| 4 | Variable rate security. |

| 5 | Floating rate security. |

| 6 | Level 3 securities fair valued under procedures established by the Board of Trustees, represents 4.3% of Net Assets. The total value of these securities is $24,583,457. |

| 7 | Step rate security. |

| 8 | Security is in default. |

| 9 | The rate is the annualized seven-day yield at period end. |

| * | Non-income producing security. |

See accompanying Notes to Financial Statements.

15

Braddock Multi-Strategy Income Fund

SUMMARY OF INVESTMENTS

As of December 31, 2021

| Security Type/Sector | Percent of Total Net Assets | |||

| Corporate Bonds | 0.0 | % | ||

| Financials | 0.0 | % | ||

| Total Corporate Bonds | 0.0 | % | ||

| Asset-Backed Securities | 80.6 | % | ||

| Collateralized Mortgage Obligations | 13.8 | % | ||

| Short-Term Investments | 5.8 | % | ||

| Total Investments | 100.2 | % | ||

| Liabilities in Excess of Other Assets | (0.2 | )% | ||

| Total Net Assets | 100.0 | % | ||

See accompanying Notes to Financial Statements.

16

Braddock Multi-Strategy Income Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2021

| Assets: | ||||

| Investments, at value (cost $555,414,113) | $ | 570,129,100 | ||

| Receivables: | ||||

| Fund shares sold | 627,556 | |||

| Dividends and interest | 1,291,004 | |||

| Prepaid expenses | 73 | |||

| Callable bond proceeds (Note 11) | 24,547 | |||

| Total assets | 572,072,280 | |||

| Liabilities: | ||||

| Payables: | ||||

| Due to broker | 1,407,094 | |||

| Fund shares redeemed | 1,022,228 | |||

| Advisory fees | 600,952 | |||

| Shareholder servicing fees (Note 7) | 57,711 | |||

| Distribution fees - Class A & Class C (Note 6) | 11,942 | |||

| Fund services fees | 143,893 | |||

| Auditing fees | 22,970 | |||

| Commitment fees payable (Note 12) | 13,494 | |||

| Trustees' deferred compensation (Note 3) | 9,462 | |||

| Chief Compliance Officer fees | 5,383 | |||

| Trustees' fees and expenses | 3,911 | |||

| Accrued other expenses | 22,136 | |||

| Total liabilities | 3,321,176 | |||

| Net Assets | $ | 568,751,104 | ||

| Components of Net Assets: | ||||

| Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | $ | 575,833,468 | ||

| Total accumulated deficit | (7,082,364 | ) | ||

| Net Assets | $ | 568,751,104 | ||

| Maximum Offering Price per Share: | ||||

| Class A Shares: | ||||

| Net assets applicable to shares outstanding | $ | 11,016,687 | ||

| Shares of beneficial interest issued and outstanding | 1,507,782 | |||

| Redemption price1 | $ | 7.31 | ||

| Maximum sales charge (4.25% of offering price)2 | 0.32 | |||

| Maximum offering price to public | $ | 7.63 | ||

| Class C Shares: | ||||

| Net assets applicable to shares outstanding | $ | 10,346,120 | ||

| Shares of beneficial interest issued and outstanding | 1,419,411 | |||

| Redemption price3 | $ | 7.29 | ||

| Institutional Class Shares: | ||||

| Net assets applicable to shares outstanding | $ | 547,388,297 | ||

| Shares of beneficial interest issued and outstanding | 74,850,685 | |||

| Redemption price | $ | 7.31 | ||

| 1 | A Contingent Deferred Sales Charge ("CDSC") of 1.00% may be imposed on certain purchases of $1 million or more that are redeemed in whole or in part within 12 months of purchase. |

| 2 | On sales of $50,000 or more, the sales charge will be reduced and no initial sales charge is applied to purchases of $1 million or more. |

| 3 | A Contingent Deferred Sales Charge ("CDSC") of 1.00% may be imposed on certain purchases that are redeemed in whole or in part within 12 months of purchase. |

See accompanying Notes to Financial Statements.

17

Braddock Multi-Strategy Income Fund

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2021

| Investment income: | ||||

| Interest | $ | 35,200,174 | ||

| Total investment income | 35,200,174 | |||

| Expenses: | ||||

| Advisory fees | 8,691,797 | |||

| Shareholder servicing fees (Note 7) | 514,516 | |||

| Distribution fees - Class A (Note 6) | 60,687 | |||

| Distribution fees - Class C (Note 6) | 129,636 | |||

| Fund services fees | 883,855 | |||

| Registration fees | 102,917 | |||

| Dividends and interest on securities sold short | 57,561 | |||

| Legal fees | 54,977 | |||

| Commitment fees (Note 12) | 24,444 | |||

| Auditing fees | 23,076 | |||

| Miscellaneous | 22,813 | |||

| Chief Compliance Officer fees | 18,114 | |||

| Trustees' fees and expenses | 17,507 | |||

| Shareholder reporting fees | 16,108 | |||

| Extraordinary Expense (Note 3) | 15,000 | |||

| Insurance fees | 3,604 | |||

| Total expenses | 10,636,612 | |||

| Advisory fees recovered | 65,672 | |||

| Net expenses | 10,702,284 | |||

| Net investment income | 24,497,890 | |||

| Realized and Unrealized Gain (Loss): | ||||

| Net realized gain (loss) on: | ||||

| Investments | 24,566,854 | |||

| Purchased options contracts | (365,166 | ) | ||

| Securities sold short | (389,472 | ) | ||

| Net realized gain | 23,812,216 | |||

| Net change in unrealized appreciation/depreciation on: | ||||

| Investments | (8,403,633 | ) | ||

| Purchased options contracts | 343,026 | |||

| Net change in unrealized appreciation/depreciation | (8,060,607 | ) | ||

| Net realized and unrealized gain | 15,751,609 | |||

| Net Increase in Net Assets from Operations | $ | 40,249,499 | ||

See accompanying Notes to Financial Statements.

18

Braddock Multi-Strategy Income Fund

STATEMENTS OF CHANGES IN NET ASSETS

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| December 31, 2021 | December 31, 2020 | |||||||

| Increase (Decrease) in Net Assets from: | ||||||||

| Operations: | ||||||||

| Net investment income | $ | 24,497,890 | $ | 33,021,163 | ||||

| Net realized gain (loss) on investments, purchased options contracts and securities sold short | 23,812,216 | (43,142,189 | ) | |||||

| Net change in unrealized appreciation/depreciation on investments, purchased options contracts and securities sold short | (8,060,607 | ) | 11,813,705 | |||||

| Net increase in net assets resulting from operations | 40,249,499 | 1,692,679 | ||||||

| Distributions to Shareholders: | ||||||||

| Distributions: | ||||||||

| Class A | (793,806 | ) | (1,402,211 | ) | ||||

| Class C | (333,010 | ) | (533,914 | ) | ||||

| Institutional Class | (23,667,630 | ) | (31,709,024 | ) | ||||

| Total distributions to shareholders | (24,794,446 | ) | (33,645,149 | ) | ||||

| Capital Transactions: | ||||||||

| Net proceeds from shares sold: | ||||||||

| Class A | 9,258,822 | 46,335,618 | ||||||

| Class C | 162,600 | 7,278,672 | ||||||

| Institutional Class | 101,319,586 | 775,705,232 | ||||||

| Reinvestment of distributions: | ||||||||

| Class A | 641,912 | 1,163,118 | ||||||

| Class C | 307,717 | 454,599 | ||||||

| Institutional Class | 15,983,011 | 24,780,455 | ||||||

| Cost of shares redeemed: | ||||||||

| Class A | (34,359,865 | ) | (45,344,229 | ) | ||||

| Class C | (5,100,512 | ) | (7,222,115 | ) | ||||

| Institutional Class | (339,195,057 | ) | (600,027,003 | ) | ||||

| Net increase (decrease) in net assets from capital transactions | (250,981,786 | ) | 203,124,347 | |||||

| Total increase (decrease) in net assets | (235,526,733 | ) | 171,171,877 | |||||

| Net Assets: | ||||||||

| Beginning of period | 804,277,837 | 633,105,960 | ||||||

| End of period | $ | 568,751,104 | $ | 804,277,837 | ||||

| Capital Share Transactions: | ||||||||

| Shares sold: | ||||||||

| Class A | 1,268,252 | 7,177,211 | ||||||

| Class C | 22,362 | 1,024,936 | ||||||

| Institutional Class | 13,867,054 | 133,872,143 | ||||||

| Shares reinvested: | ||||||||

| Class A | 87,796 | 167,002 | ||||||

| Class C | 42,208 | 65,633 | ||||||

| Institutional Class | 2,184,616 | 3,647,516 | ||||||

| Shares redeemed: | ||||||||

| Class A | (4,702,238 | ) | (6,371,871 | ) | ||||

| Class C | (698,511 | ) | (1,021,460 | ) | ||||

| Institutional Class | (46,443,671 | ) | (87,317,318 | ) | ||||

| Net increase (decrease) in capital share transactions | (34,372,132 | ) | 51,243,792 | |||||

See accompanying Notes to Financial Statements.

19

Braddock Multi-Strategy Income Fund

FINANCIAL HIGHLIGHTS

Class A

Per share operating performance.

For a capital share outstanding throughout each period.

| For the Year Ended December 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Net asset value, beginning of period | $ | 7.17 | $ | 10.39 | $ | 10.15 | $ | 10.27 | $ | 10.05 | ||||||||||

| Income from Investment Operations: | ||||||||||||||||||||

| Net investment income1 | 0.24 | 0.29 | 0.39 | 0.41 | 0.41 | |||||||||||||||

| Net realized and unrealized gain (loss) | 0.15 | (3.22 | ) | 0.24 | (0.11 | ) | 0.29 | |||||||||||||

| Total from investment operations | 0.39 | (2.93 | ) | 0.63 | 0.30 | 0.70 | ||||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.25 | ) | (0.29 | ) | (0.39 | ) | (0.42 | ) | (0.48 | ) | ||||||||||

| Total distributions | (0.25 | ) | (0.29 | ) | (0.39 | ) | (0.42 | ) | (0.48 | ) | ||||||||||

| Net asset value, end of period | $ | 7.31 | $ | 7.17 | $ | 10.39 | $ | 10.15 | $ | 10.27 | ||||||||||

| Total return2 | 5.43 | % | (28.05 | )% | 6.34 | % | 2.99 | % | 7.13 | % | ||||||||||

| Ratios and Supplemental Data: | ||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 11,017 | $ | 34,785 | $ | 40,319 | $ | 19,620 | $ | 7,361 | ||||||||||

| Ratio of expenses to average net assets (including dividends and interest on securities sold short, extraordinary expenses and commitment fees): | ||||||||||||||||||||

| Before fees waived and expenses absorbed/recovered3 | 1.75 | % | 1.74 | % | 1.76 | % | 1.82 | % | 1.99 | % | ||||||||||

| After fees waived and expenses absorbed/recovered3 | 1.76 | % | 1.77 | % | 1.76 | % | 1.75 | % | 1.76 | % | ||||||||||

| Ratio of net investment income to average net assets (including dividends and interest on securities sold short, extraordinary expenses and commitment fees): | ||||||||||||||||||||

| Before fees waived and expenses absorbed/recovered | 3.31 | % | 4.07 | % | 3.78 | % | 3.87 | % | 3.78 | % | ||||||||||

| After fees waived and expenses absorbed/recovered | 3.30 | % | 4.04 | % | 3.78 | % | 3.94 | % | 4.01 | % | ||||||||||

| Portfolio turnover rate | 50 | % | 91 | % | 27 | % | 35 | % | 33 | % | ||||||||||

| 1 | Based on average shares outstanding for the period. |

| 2 | Total returns would have been higher/lower had expenses not been recovered/waived or absorbed by the Advisor. Returns shown include Rule 12b-1 fees of up to 0.25% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown do not include payment of sales load of 4.25% of offering price which is waived on sales of $1 million or more. Returns do not include payment of Contingent Deferred Sales Charge ("CDSC") of 1.00% on certain redemptions of Class A shares made within 12 months of purchase. If the sales charge was included, total returns would be lower. |

| 3 | If commitment fees, and dividends and interest on securities sold short had been excluded, the expense ratios would have been lowered by 0.01% for the year ended December 31, 2021. For the prior years ended December 31, 2020, 2019, 2018, and 2017, the ratios would have been lowered by 0.02%, 0.01%, 0.00% and 0.01%, respectively. |

See accompanying Notes to Financial Statements.

20

Braddock Multi-Strategy Income Fund

FINANCIAL HIGHLIGHTS

Class C

Per share operating performance.

For a capital share outstanding throughout each period.

| For the Year Ended December 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Net asset value, beginning of period | $ | 7.15 | $ | 10.36 | $ | 10.13 | $ | 10.25 | $ | 10.04 | ||||||||||

| Income from Investment Operations: | ||||||||||||||||||||

| Net investment income1 | 0.19 | 0.24 | 0.31 | 0.33 | 0.33 | |||||||||||||||

| Net realized and unrealized gain (loss) | 0.14 | (3.21 | ) | 0.24 | (0.10 | ) | 0.30 | |||||||||||||

| Total from investment operations | 0.33 | (2.97 | ) | 0.55 | 0.23 | 0.63 | ||||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.19 | ) | (0.24 | ) | (0.32 | ) | (0.35 | ) | (0.42 | ) | ||||||||||

| Total distributions | (0.19 | ) | (0.24 | ) | (0.32 | ) | (0.35 | ) | (0.42 | ) | ||||||||||

| Net asset value, end of period | $ | 7.29 | $ | 7.15 | $ | 10.36 | $ | 10.13 | $ | 10.25 | ||||||||||

| Total return2 | 4.64 | % | (28.59 | )% | 5.49 | % | 2.26 | % | 6.38 | % | ||||||||||

| Ratios and Supplemental Data: | ||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 10,346 | $ | 14,675 | $ | 20,552 | $ | 9,833 | $ | 3,510 | ||||||||||

| Ratio of expenses to average net assets (including dividends and interest on securities sold short, extraordinary expenses and commitment fees): | ||||||||||||||||||||

| Before fees waived and expenses absorbed/recovered3 | 2.50 | % | 2.49 | % | 2.51 | % | 2.57 | % | 2.74 | % | ||||||||||

| After fees waived and expenses absorbed/recovered3 | 2.51 | % | 2.52 | % | 2.51 | % | 2.50 | % | 2.51 | % | ||||||||||

| Ratio of net investment income to average net assets (including dividends and interest on securities sold short, extraordinary expenses and commitment fees): | ||||||||||||||||||||

| Before fees waived and expenses absorbed/recovered | 2.56 | % | 3.32 | % | 3.03 | % | 3.12 | % | 3.03 | % | ||||||||||

| After fees waived and expenses absorbed/recovered | 2.55 | % | 3.29 | % | 3.03 | % | 3.19 | % | 3.26 | % | ||||||||||

| Portfolio turnover rate | 50 | % | 91 | % | 27 | % | 35 | % | 33 | % | ||||||||||

| 1 | Based on average shares outstanding for the period. |

| 2 | Total returns would have been higher/lower had expenses not been recovered/waived or absorbed by the Advisor. Returns shown include Rule 12b-1 fees of up to 1.00% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns do not include payment of Contingent Deferred Sales Charge ("CDSC") of 1.00% on certain redemptions of Class C shares made within 12 months of purchase. If the sales charge was included, total returns would be lower. |

| 3 | If commitment fees, and dividends and interest on securities sold short had been excluded, the expense ratios would have been lowered by 0.01% for the year ended December 31, 2021. For the prior years ended December 31, 2020, 2019, 2018, and 2017, the ratios would have been lowered by 0.02%, 0.01%, 0.00% and 0.01%, respectively. |

See accompanying Notes to Financial Statements.

21

Braddock Multi-Strategy Income Fund

FINANCIAL HIGHLIGHTS

Institutional Class

Per share operating performance.

For a capital share outstanding throughout each period.

| For the Year Ended December 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Net asset value, beginning of period | $ | 7.17 | $ | 10.40 | $ | 10.16 | $ | 10.28 | $ | 10.05 | ||||||||||

| Income from Investment Operations: | ||||||||||||||||||||

| Net investment income1 | 0.26 | 0.30 | 0.42 | 0.43 | 0.44 | |||||||||||||||

| Net realized and unrealized gain (loss) | 0.15 | (3.22 | ) | 0.24 | (0.10 | ) | 0.30 | |||||||||||||

| Total from investment operations | 0.41 | (2.92 | ) | 0.66 | 0.33 | 0.74 | ||||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.27 | ) | (0.31 | ) | (0.42 | ) | (0.45 | ) | (0.51 | ) | ||||||||||

| Total distributions | (0.27 | ) | (0.31 | ) | (0.42 | ) | (0.45 | ) | (0.51 | ) | ||||||||||

| Net asset value, end of period | $ | 7.31 | $ | 7.17 | $ | 10.40 | $ | 10.16 | $ | 10.28 | ||||||||||

| Total return2 | 5.71 | % | (27.93 | )% | 6.60 | % | 3.24 | % | 7.50 | % | ||||||||||

| Ratios and Supplemental Data: | ||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 547,388 | $ | 754,817 | $ | 572,235 | $ | 306,520 | $ | 124,020 | ||||||||||

| Ratio of expenses to average net assets (including dividends and interest on securities sold short, extraordinary expenses and commitment fees): | ||||||||||||||||||||

| Before fees waived and expenses absorbed/recovered3 | 1.50 | % | 1.49 | % | 1.51 | % | 1.57 | % | 1.74 | % | ||||||||||

| After fees waived and expenses absorbed/recovered3 | 1.51 | % | 1.52 | % | 1.51 | % | 1.50 | % | 1.51 | % | ||||||||||

| Ratio of net investment income to average net assets (including dividends and interest on securities sold short, extraordinary expenses and commitment fees): | ||||||||||||||||||||

| Before fees waived and expenses absorbed/recovered | 3.56 | % | 4.32 | % | 4.03 | % | 4.12 | % | 4.03 | % | ||||||||||

| After fees waived and expenses absorbed/recovered | 3.55 | % | 4.29 | % | 4.03 | % | 4.19 | % | 4.26 | % | ||||||||||

| Portfolio turnover rate | 50 | % | 91 | % | 27 | % | 35 | % | 33 | % | ||||||||||

| 1 | Based on average shares outstanding for the period. |

| 2 | Total returns would have been higher/lower had expenses not been recovered/waived or absorbed by the Advisor. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| 3 | If commitment fees, and dividends and interest on securities sold short had been excluded, the expense ratios would have been lowered by 0.01% for the year ended December 31, 2021. For the prior years ended December 31, 2020, 2019, 2018, and 2017, the ratios would have been lowered by 0.02%, 0.01%, 0.00% and 0.01%, respectively. |

See accompanying Notes to Financial Statements.

22

Braddock Multi-Strategy Income Fund

NOTES TO FINANCIAL STATEMENTS

December 31, 2021

Note 1 – Organization

The Braddock Multi-Strategy Income Fund (the ‘‘Fund’’) was organized as a non-diversified series of Investment Managers Series Trust, a Delaware statutory trust (the “Trust”) which is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund seeks total return with an emphasis on providing current income. The Fund currently offers four classes of shares: A shares, C shares, T shares, and Institutional shares. Class T shares are not currently available for purchase.

The Fund commenced investment operations on December 31, 2015, with Class A, Class C, and Institutional Class shares, prior to which its only activity was the receipt of a $10,000 investment from principals of the Fund’s advisor and a $49,561,285 transfer of shares of the Fund in exchange for the net assets of the Braddock Structured Opportunities Fund Series A, LP, a Delaware limited partnership (the “Company”). This exchange was nontaxable, whereby the Fund’s Institutional Class issued 4,933,206 shares for the net assets of the Company on December 31, 2015. Assets with a fair market value of $49,561,285 consisting of cash, interest receivable and securities of the Company with a fair value of $46,984,053 (identified costs of investments transferred were $44,433,272) and cash were the primary assets received by the Fund on January 1, 2016. For financial reporting purposes, assets received and shares issued by the Fund were recorded at fair value; however, the cost basis of the investments received from the Partnership was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amount distributable to shareholders for tax purposes.

The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, subject to the approval of the Trustees. Income, expenses (other than expenses attributable to a specific class) and realized and unrealized gains and losses on investments are allocated to each class of shares in proportion to their relative net assets. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification, Financial Services – Investment Companies”, Topic 946 (ASC 946).

Note 2 – Accounting Policies

The following is a summary of the significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

(a) Valuation of Investments

The Fund values equity securities at the last reported sale price on the principal exchange or in the principal over the counter (“OTC”) market in which such securities are traded, as of the close of regular trading on the NYSE on the day the securities are being valued or, if there are no sales, at the mean between the last available bid and asked prices on that day. Securities traded on the NASDAQ are valued at the NASDAQ Official Closing Price (“NOCP”). Investments in open-end investment companies are valued at the daily closing net asset value of the respective investment company. Debt securities are valued by utilizing a price supplied by independent pricing service providers. The independent pricing service providers may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. These models generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings and general market conditions. If a price is not readily available for a portfolio security, the security will be valued at fair value (the amount which the Fund might reasonably expect to receive for the security upon its current sale) as determined in good faith by the Fund’s sub-advisor, subject to review and approval by the Valuation Committee, pursuant to procedures adopted by the Board of Trustees. The actions of the Valuation Committee are subsequently reviewed by the Board at its next regularly scheduled board meeting. The Valuation Committee meets as needed. The Valuation Committee is comprised of all the Trustees, but action may be taken by any one of the Trustees.

23

Braddock Multi-Strategy Income Fund

NOTES TO FINANCIAL STATEMENTS – Continued

December 31, 2021

Trading in securities on many foreign securities exchanges and OTC markets is normally completed before the close of business on each U.S. business day. In addition, securities trading in a particular country or countries may not take place on all U.S. business days or may take place on days which are not U.S. business days. Changes in valuations on certain securities may occur at times or on days on which the Fund’s net asset values (“NAV”) are not calculated and on which the Fund does not affect sales and redemptions of its shares.

(b) Asset-Backed Securities

Asset-backed securities include pools of mortgages, loans, receivables or other assets. Payment of principal and interest may be largely dependent upon the cash flows generated by the assets backing the securities, and, in certain cases, supported by letters of credit, surety bonds, or other credit enhancements. The value of asset-backed securities may also be affected by the creditworthiness of the servicing agent for the pool, the originator of the loans or receivables, or the financial institution(s) providing the credit support. In addition, asset-backed securities are not backed by any governmental agency.

Collateralized Debt Obligations (“CDOs”) include Collateralized Bond Obligations (“CBOs”), Collateralized Loan Obligations (“CLOs”) and other similarly structured securities. CBOs and CLOs are types of asset backed securities. A CBO is a trust which is backed by a diversified pool of high risk, below investment grade fixed income securities. A CLO is a trust typically collateralized by a pool of loans, which may include, among others, domestic and foreign senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans. The risks of an investment in a CDO depend largely on the type of the collateral securities and the class of the CDO in which a Fund invests. CDOs carry additional risks including, but not limited to, (i) the possibility that distributions from collateral securities will not be adequate to make interest or other payments, (ii) the collateral may decline in value or default, (iii) a Fund may invest in CDOs that are subordinate to other classes, and (iv) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results.

(c) Short Sales

The Fund may sell securities short. Short sales are transactions under which the Fund sells a security it does not own in anticipation of a decline in the value of that security. To complete such a transaction, the Fund must borrow the security to make delivery to the buyer. The Fund then is obligated to replace the security borrowed by purchasing the security at market price at the time of replacement. The price at such time may be more or less than the price at which the security was sold by the Fund. When a security is sold short a decrease in the value of the security will be recognized as a gain and an increase in the value of the security will be recognized as a loss, which is potentially limitless. Until the security is replaced, the Fund is required to pay the lender amounts equal to dividend or interest that accrue during the period of the loan which is recorded as an expense. To borrow the security, the Fund also may be required to pay a premium or an interest fee, which are recorded as interest expense. Cash or securities are segregated for the broker to meet the necessary margin requirements. The Fund is subject to the risk that it may not always be able to close out a short position at a particular time or at an acceptable price.

24

Braddock Multi-Strategy Income Fund

NOTES TO FINANCIAL STATEMENTS – Continued

December 31, 2021

(d) Investment Transactions, Investment Income and Expenses

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends, if applicable, are paid (a portion of which may be reclaimable) or provided for in accordance with the applicable country’s tax rules and rates and are disclosed in the Statement of Operations. Withholding tax reclaims are filed in certain countries to recover a portion of the amounts previously withheld. The Fund records a reclaim receivable based on a number of factors, including a jurisdiction’s legal obligation to pay reclaims as well as payment history and market convention. Discounts on debt securities are accreted or amortized to interest income over the lives of the respective securities using the effective interest method. Premiums for callable debt securities are amortized to the earliest call date, if the call price was less than the purchase price. If the call price was not at par and the security was not called, the security is amortized to the next call price and date. Income and expenses of the Fund is allocated on a pro rata basis to each class of shares relative net assets, except for distribution and service fees which are unique to each class of shares. Expenses incurred by the Trust with respect to more than one fund are allocated in proportion to the net assets of each fund except where allocation of direct expenses to each fund or an alternative allocation method can be more appropriately made.

(e) Reverse Repurchase Agreements

The Fund may enter into “reverse” repurchase agreements to seek to enhance the portfolio’s return. Pursuant to a reverse repurchase agreement, the Fund will sell portfolio securities and agree to repurchase them from the buyer at a particular date and price. When the Fund enters into a reverse repurchase agreement, it will establish a segregated account in which it will maintain liquid assets in an amount at least equal to the repurchase price marked to market daily (including accrued interest), and will subsequently monitor the account to ensure that such equivalent value is maintained. The Fund pays interest on amounts obtained pursuant to reverse repurchase agreements. Reverse repurchase agreements are considered to be borrowings by the Fund. Similar to borrowing, reverse repurchase agreements provide the Fund with cash for investment purposes, which creates leverage and subjects the Fund to the risks of leverage. Reverse repurchase agreements also involve the risk that the other party may fail to return the securities in a timely manner or at all. The Fund could lose money if it is unable to recover the securities and the value of collateral held by the Fund, including the value of the investments made with cash collateral, is less than the value of securities. Reverse repurchase agreements also create Fund expenses and require that the Fund have sufficient cash available to purchase the debt obligations when required. Reverse repurchase agreements also involve the risk that the market value of the debt obligation that is the subject of the reverse repurchase agreement could decline significantly below the price at which the Fund is obligated to repurchase the security.

(f) Federal Income Taxes

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized gains to its shareholders. Therefore, no provision is made for federal income or excise taxes. Due to the timing of dividend distributions and the differences in accounting for income and realized gains and losses for financial statement and federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains and losses are recorded by the Fund.

FASB Accounting Standard Codification “Accounting for Uncertainty in Income Taxes”, Topic 740 (ASC 740) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing a Fund’s tax returns to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations.

25

Braddock Multi-Strategy Income Fund

NOTES TO FINANCIAL STATEMENTS – Continued

December 31, 2021

ASC 740 requires management of the Fund to analyze tax positions taken in the prior three open tax years, if any, and tax positions expected to be taken in the Fund’s current tax year, as defined by the IRS statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of and during the open tax periods ended December 31, 2018-2021, the Fund did not have a liability for any unrecognized tax benefits. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

(g) Distributions to Shareholders

The Fund will make dividend distributions of net investment income, if any, monthly and net capital gains distributions, if any, at least annually, typically in December. The Fund may make an additional payment of dividends or distributions if it deems it desirable at any other time during the year. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain (loss) items for financial statement and tax purposes.

(h) Illiquid Securities