Form N-CSR Fidelity Rutland Square For: May 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21991

Fidelity Rutland Square Trust II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Christina H. Lee, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | May 31 |

Date of reporting period: | May 31, 2020 |

Item 1.

Reports to Stockholders

Strategic Advisers® Short Duration Fund

Offered exclusively to certain clients of Strategic Advisers LLC - not available for sale to the general public

May 31, 2020

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

|

Board Approval of Investment Advisory Contracts and Management Fees | |

To view a fund's proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2020 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended May 31, 2020 | Past 1 year | Past 5 years | Life of fundA |

| Strategic Advisers® Short Duration Fund | 2.51% | 1.80% | 1.51% |

A From December 20, 2011

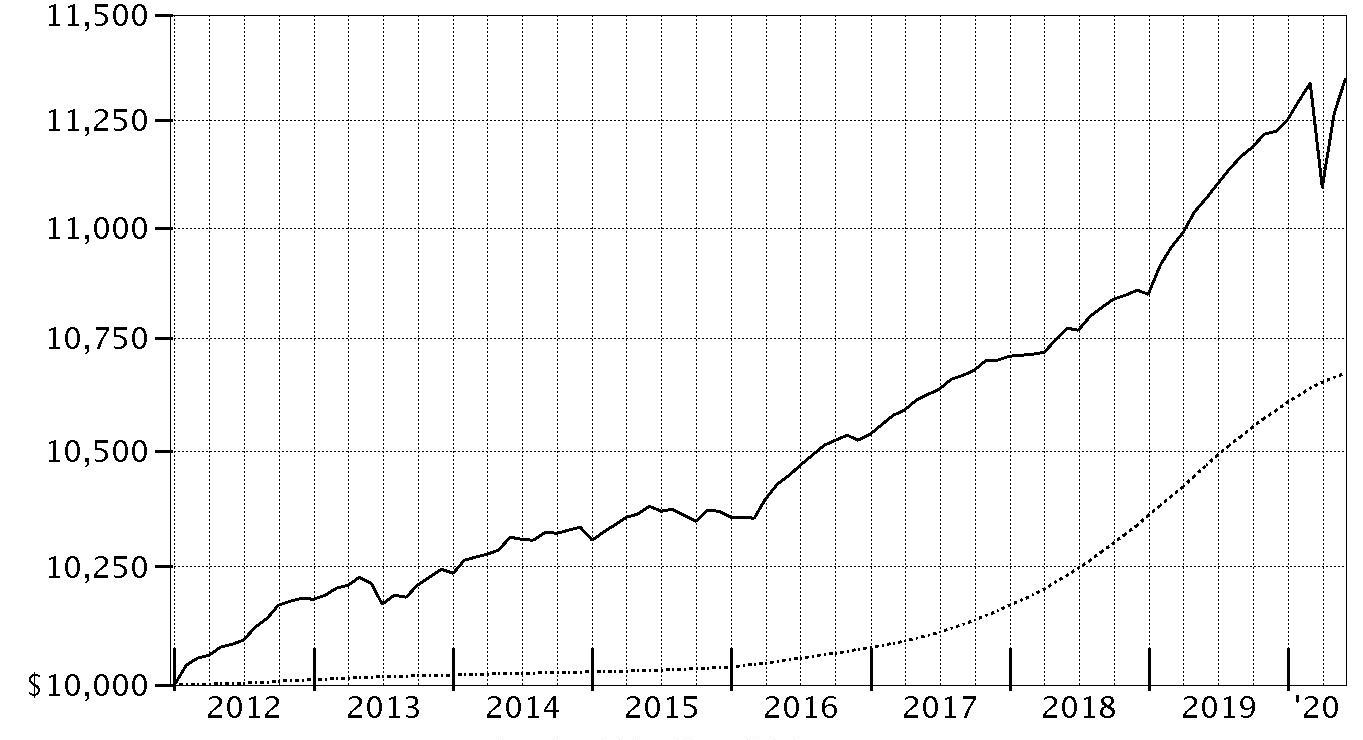

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Short Duration Fund on December 20, 2011, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the FTSE 6-Month U.S. Treasury Bill Index performed over the same period.

| Period Ending Values | ||

|

| $11,347 | Strategic Advisers® Short Duration Fund |

|

| $10,672 | FTSE 6-Month U.S. Treasury Bill Index |

Management's Discussion of Fund Performance

Market Recap: U.S. taxable investment-grade bonds posted robust gains for the year ending May 31, 2020, with the Bloomberg Barclays U.S. Aggregate Bond Index advancing 9.42%. From June through October, bonds broadly rode a wave of easing monetary policy, with the Federal Reserve lowering short-term interest rates 75 basis points (0.75%) by year-end. Most bonds came under some pressure in the fourth quarter of 2019, given comments from the Fed that seemingly set a high bar for additional rate cuts. U.S. bonds rebounded strongly in January on renewed demand for safe-haven assets, as the spread of coronavirus threatened to hamper global economic growth. In February and March, U.S. Treasuries continued to surge, while riskier segments—led by corporate debt—largely retreated as a recession took hold. A historically rapid and expansive monetary/fiscal-policy response provided a partial offset to the economic disruption. This was evident in April and May, when credit-sensitive segments of the market rebounded strongly on improving infection data, plans for reopening the economy and progress on potential treatments. Within the bellwether index, U.S. Treasuries (+11.36%) led the way for the period, while corporate bonds produced a similarly hearty 10.03% return. Meanwhile, securitized sectors lagged the market despite gaining ground: agency mortgage-backed securities (+6.53%); commercial mortgage-backed securities (+6.18%); and asset-backed securities (+4.01%). Outside the index, U.S. corporate high-yield bonds gained 1.32%, while Treasury Inflation-Protected Securities (TIPS) rose 8.00%, according to Bloomberg Barclays. Comments from Lead Portfolio Manager Jonathan Duggan: For the fiscal year, the Fund gained 2.51%, outpacing the 1.95% advance of the benchmark FTSE® 6-Month U.S. Treasury Bill Index. During the second half of 2019 and into 2020, we reduced risk in the portfolio by adding funds that invest in U.S. Treasuries, government-agency mortgage-backed securities and cash, while reducing the Fund's allocation to those with investment-grade corporate credit exposure. These moves dampened the portfolio's interest rate sensitivity and also provided dry powder to increase risk following the March downturn. During this time, we boosted the Fund's positions in short-term managers (those with an average duration of 1 to 3 years). As a result, the Fund rallied strongly in April and May. For the period, both sub-advisers within the portfolio – FIAM℠ (+2.5%) and T. Rowe Price (+3.6%) – outperformed the Fund's benchmark and added considerable value. Allocations to asset-backed securities and higher-quality, floating-rate corporate bonds fueled FIAM's performance. T. Rowe Price on the other hand, benefited from having a longer portfolio duration than the benchmark and from its corporate credit holdings. On the downside, PIMCO Short-Term Fund (+1.5%) was the biggest relative detractor. The manager of this fund expected the U.S. Federal Reserve to raise interest rates in 2019 and, as a result, did not have enough exposure to the parts of the short-term yield curve that declined the most during the period. Its performance was also hurt by an overweighting in corporate credit during the first quarter of 2020. Looking ahead, we are optimistic about a recovery in the U.S. economy during the second half of this year and into 2021. At the same time, we remain cognizant of key risk factors, including U.S. elections later this year.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

The information in the following tables is based on the direct investments of the Fund.Top Ten Holdings as of May 31, 2020

| (excluding cash equivalents) | % of fund's net assets |

| PIMCO Short-Term Fund - Administrator Class | 18.6 |

| Baird Ultra Short Bond Fund Institutional Class | 7.6 |

| iShares Lehman 1-3 Year Treasury Bond ETF | 6.8 |

| Fidelity Short-Term Bond Fund | 5.7 |

| PIMCO Enhanced Short Maturity Active ETF | 4.4 |

| Blackrock Low Duration Bond Portfolio Investor A Shares | 4.3 |

| U.S. Treasury Obligations | 3.6 |

| JPMorgan Ultra-Short Income ETF | 3.2 |

| iShares Short-Maturity Bond ETF | 3.2 |

| Metropolitan West Low Duration Bond Fund - Class M | 2.8 |

| 60.2 |

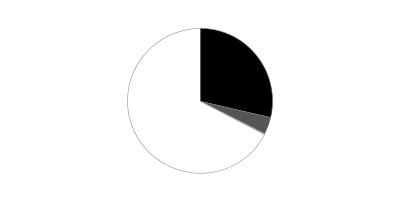

Asset Allocation (% of fund's net assets)

| As of May 31, 2020 | ||

| Corporate Bonds | 23.7% | |

| U.S. Government and U.S. Government Agency Obligations | 4.2% | |

| Asset-Backed Securities | 6.5% | |

| CMOs and Other Mortgage Related Securities | 1.8% | |

| Bank Loan Funds | 0.7% | |

| Other Investments | 0.7% | |

| Short-Term Funds | 58.8% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.6% | |

Asset allocations of funds in the pie chart reflect the categorizations of assets as defined by Morningstar as of the reporting date.

Schedule of Investments May 31, 2020

Showing Percentage of Net Assets

| Nonconvertible Bonds - 23.7% | |||

| Principal Amount | Value | ||

| COMMUNICATION SERVICES - 1.3% | |||

| Diversified Telecommunication Services - 0.3% | |||

| AT&T, Inc.: | |||

| 3 month U.S. LIBOR + 0.930% 2.3046% 6/30/20 (a)(b) | $7,845,000 | $7,849,534 | |

| 3.8% 3/15/22 | 980,000 | 1,029,592 | |

| SBA Tower Trust: | |||

| 3.156% 10/8/20 (c) | 265,000 | 265,445 | |

| 3.448% 3/15/48 (c) | 880,000 | 915,490 | |

| Verizon Communications, Inc.: | |||

| 3 month U.S. LIBOR + 1.000% 1.7405% 3/16/22 (a)(b) | 15,233,000 | 15,262,247 | |

| 5.15% 9/15/23 | 775,000 | 885,581 | |

| 26,207,889 | |||

| Entertainment - 0.4% | |||

| NBCUniversal Enterprise, Inc. 3 month U.S. LIBOR + 0.400% 1.8334% 4/1/21 (a)(b)(c) | 23,029,000 | 23,078,736 | |

| The Walt Disney Co.: | |||

| 3 month U.S. LIBOR + 0.250% 1.8304% 9/1/21 (a)(b) | 2,211,000 | 2,205,543 | |

| 1.65% 9/1/22 | 1,435,000 | 1,465,234 | |

| 3.35% 3/24/25 | 470,000 | 517,127 | |

| 27,266,640 | |||

| Interactive Media & Services - 0.0% | |||

| Baidu.com, Inc. 3.5% 11/28/22 | 780,000 | 811,444 | |

| Media - 0.6% | |||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp.: | |||

| 3.579% 7/23/20 | 5,662,000 | 5,662,289 | |

| 4.464% 7/23/22 | 3,590,000 | 3,823,197 | |

| 4.908% 7/23/25 | 2,145,000 | 2,455,344 | |

| Comcast Corp.: | |||

| 3 month U.S. LIBOR + 0.330% 1.7634% 10/1/20 (a)(b) | 7,282,000 | 7,287,175 | |

| 3 month U.S. LIBOR + 0.440% 1.8734% 10/1/21 (a)(b) | 8,940,000 | 8,966,230 | |

| 3.1% 4/1/25 | 355,000 | 387,984 | |

| 3.7% 4/15/24 | 1,075,000 | 1,188,742 | |

| COX Communications, Inc.: | |||

| 2.95% 6/30/23 (c) | 590,000 | 617,900 | |

| 3.15% 8/15/24 (c) | 585,000 | 620,695 | |

| Fox Corp.: | |||

| 3.05% 4/7/25 | 185,000 | 196,724 | |

| 3.666% 1/25/22 | 260,000 | 271,103 | |

| 4.03% 1/25/24 | 305,000 | 335,298 | |

| Interpublic Group of Companies, Inc. 3.5% 10/1/20 | 295,000 | 297,700 | |

| RELX Capital, Inc. 3.5% 3/16/23 | 575,000 | 608,594 | |

| Time Warner Cable, Inc. 4.125% 2/15/21 | 6,234,000 | 6,302,254 | |

| TWDC Enterprises 18 Corp.: | |||

| 3 month U.S. LIBOR + 0.190% 1.5043% 6/5/20 (a)(b) | 6,332,000 | 6,332,295 | |

| 3 month U.S. LIBOR + 0.390% 1.6438% 3/4/22 (a)(b) | 5,000,000 | 4,964,504 | |

| WPP Finance 2010 3.625% 9/7/22 | 310,000 | 323,213 | |

| 50,641,241 | |||

| Wireless Telecommunication Services - 0.0% | |||

| Axiata SPV2 Bhd 3.466% 11/19/20 (Reg. S) | 660,000 | 663,967 | |

| T-Mobile U.S.A., Inc. 3.5% 4/15/25 (c) | 1,005,000 | 1,076,224 | |

| Vodafone Group PLC 3.75% 1/16/24 | 650,000 | 706,833 | |

| 2,447,024 | |||

| TOTAL COMMUNICATION SERVICES | 107,374,238 | ||

| CONSUMER DISCRETIONARY - 1.2% | |||

| Automobiles - 0.8% | |||

| American Honda Finance Corp.: | |||

| 3 month U.S. LIBOR + 0.260% 1.0005% 6/16/20 (a)(b) | 5,000,000 | 4,999,930 | |

| 3 month U.S. LIBOR + 0.290% 1.186% 12/10/21 (a)(b) | 5,000,000 | 4,929,432 | |

| BMW U.S. Capital LLC: | |||

| 3 month U.S. LIBOR + 0.410% 1.7214% 4/12/21 (a)(b)(c) | 11,110,000 | 11,017,748 | |

| 3 month U.S. LIBOR + 0.500% 0.9335% 8/13/21 (a)(b)(c) | 830,000 | 819,883 | |

| 2% 4/11/21 (c) | 1,500,000 | 1,506,293 | |

| Daimler Finance North America LLC: | |||

| 3 month U.S. LIBOR + 0.900% 1.2924% 2/15/22 (a)(b)(c) | 5,000,000 | 4,825,100 | |

| 1.75% 3/10/23 (c) | 1,800,000 | 1,772,900 | |

| 2.3% 2/12/21 (c) | 1,745,000 | 1,744,022 | |

| 3.75% 11/5/21 (c) | 325,000 | 332,171 | |

| General Motors Co.: | |||

| 4.875% 10/2/23 | 730,000 | 755,228 | |

| 5.4% 10/2/23 | 1,130,000 | 1,193,607 | |

| General Motors Financial Co., Inc.: | |||

| 3 month U.S. LIBOR + 0.850% 2.1699% 4/9/21 (a)(b) | 5,628,000 | 5,481,045 | |

| 2.9% 2/26/25 | 1,880,000 | 1,825,926 | |

| 3.2% 7/13/20 | 1,570,000 | 1,571,845 | |

| 3.2% 7/6/21 | 510,000 | 510,161 | |

| 4.2% 3/1/21 | 6,059,000 | 6,087,817 | |

| 4.2% 11/6/21 | 370,000 | 375,356 | |

| Harley-Davidson Financial Services, Inc.: | |||

| 3 month U.S. LIBOR + 0.940% 2.5204% 3/2/21 (a)(b)(c) | 995,000 | 980,421 | |

| 2.55% 6/9/22 (c) | 375,000 | 372,067 | |

| 4.05% 2/4/22 (c) | 1,210,000 | 1,227,929 | |

| Nissan Motor Acceptance Corp.: | |||

| 2.15% 9/28/20 (c) | 1,535,000 | 1,516,118 | |

| 3.65% 9/21/21 (c) | 580,000 | 564,156 | |

| Volkswagen Group of America Finance LLC: | |||

| 2.5% 9/24/21 (c) | 1,805,000 | 1,814,409 | |

| 2.7% 9/26/22 (c) | 650,000 | 661,141 | |

| 2.9% 5/13/22 (c) | 2,663,000 | 2,709,757 | |

| 3.125% 5/12/23 (c) | 355,000 | 364,547 | |

| 3.875% 11/13/20 (c) | 980,000 | 992,060 | |

| 60,951,069 | |||

| Hotels, Restaurants & Leisure - 0.0% | |||

| McDonald's Corp.: | |||

| 1.45% 9/1/25 | 600,000 | 611,692 | |

| 3.35% 4/1/23 | 645,000 | 693,813 | |

| Starbucks Corp.: | |||

| 1.3% 5/7/22 | 1,615,000 | 1,636,264 | |

| 2.7% 6/15/22 | 435,000 | 452,255 | |

| 3,394,024 | |||

| Household Durables - 0.0% | |||

| D.R. Horton, Inc. 2.55% 12/1/20 | 495,000 | 497,182 | |

| Panasonic Corp. 2.536% 7/19/22 (c) | 785,000 | 798,840 | |

| 1,296,022 | |||

| Internet & Direct Marketing Retail - 0.1% | |||

| eBay, Inc. 2.15% 6/5/20 | 805,000 | 805,104 | |

| Expedia, Inc. 5.95% 8/15/20 | 335,000 | 336,860 | |

| JD.com, Inc. 3.125% 4/29/21 | 2,645,000 | 2,666,491 | |

| QVC, Inc.: | |||

| 4.375% 3/15/23 | 660,000 | 643,500 | |

| 5.125% 7/2/22 | 1,330,000 | 1,328,338 | |

| The Booking Holdings, Inc. 4.1% 4/13/25 | 830,000 | 903,087 | |

| 6,683,380 | |||

| Leisure Products - 0.0% | |||

| Hasbro, Inc.: | |||

| 2.6% 11/19/22 | 885,000 | 906,670 | |

| 3% 11/19/24 | 1,190,000 | 1,213,071 | |

| 2,119,741 | |||

| Specialty Retail - 0.2% | |||

| AutoZone, Inc. 3.625% 4/15/25 | 485,000 | 532,638 | |

| O'Reilly Automotive, Inc. 3.8% 9/1/22 | 385,000 | 396,440 | |

| Ross Stores, Inc. 4.6% 4/15/25 | 2,310,000 | 2,576,991 | |

| The Home Depot, Inc. 3 month U.S. LIBOR + 0.310% 1.8904% 3/1/22 (a)(b) | 14,500,000 | 14,469,276 | |

| TJX Companies, Inc. 3.5% 4/15/25 | 770,000 | 860,280 | |

| 18,835,625 | |||

| Textiles, Apparel & Luxury Goods - 0.1% | |||

| VF Corp. 2.05% 4/23/22 | 6,772,000 | 6,917,758 | |

| TOTAL CONSUMER DISCRETIONARY | 100,197,619 | ||

| CONSUMER STAPLES - 1.0% | |||

| Beverages - 0.2% | |||

| Constellation Brands, Inc. 3 month U.S. LIBOR + 0.700% 1.0924% 11/15/21 (a)(b) | 5,000,000 | 4,967,809 | |

| Diageo Capital PLC 1.375% 9/29/25 | 680,000 | 687,169 | |

| Dr. Pepper Snapple Group, Inc. 3.551% 5/25/21 | 940,000 | 966,471 | |

| Molson Coors Beverage Co. 3.5% 5/1/22 | 3,209,000 | 3,322,781 | |

| Pernod Ricard SA 4.45% 1/15/22 (c) | 1,155,000 | 1,220,237 | |

| 11,164,467 | |||

| Food & Staples Retailing - 0.0% | |||

| Walgreen Co. 3.1% 9/15/22 | 435,000 | 454,408 | |

| Food Products - 0.2% | |||

| Archer Daniels Midland Co. 2.75% 3/27/25 | 285,000 | 307,194 | |

| Bunge Ltd. Finance Corp.: | |||

| 3% 9/25/22 | 2,775,000 | 2,836,950 | |

| 3.5% 11/24/20 | 4,365,000 | 4,415,036 | |

| 4.35% 3/15/24 | 130,000 | 139,917 | |

| Cargill, Inc. 1.375% 7/23/23 (c) | 630,000 | 640,711 | |

| General Mills, Inc. 3 month U.S. LIBOR + 0.540% 1.7161% 4/16/21 (a)(b) | 7,164,000 | 7,172,136 | |

| Mondelez International, Inc. 2.125% 4/13/23 | 2,351,000 | 2,428,420 | |

| Tyson Foods, Inc. 2.25% 8/23/21 | 600,000 | 609,701 | |

| 18,550,065 | |||

| Tobacco - 0.6% | |||

| Altria Group, Inc.: | |||

| 3.49% 2/14/22 | 2,867,000 | 2,989,521 | |

| 3.8% 2/14/24 | 1,300,000 | 1,413,094 | |

| 4.75% 5/5/21 | 4,386,000 | 4,552,445 | |

| BAT Capital Corp.: | |||

| 3 month U.S. LIBOR + 0.590% 1.014% 8/14/20 (a)(b) | 6,600,000 | 6,598,495 | |

| 2.764% 8/15/22 | 3,525,000 | 3,632,622 | |

| Imperial Tobacco Finance PLC: | |||

| 2.95% 7/21/20 (c) | 15,940,000 | 15,960,821 | |

| 3.75% 7/21/22 (c) | 1,800,000 | 1,843,964 | |

| Philip Morris International, Inc. 1.125% 5/1/23 | 9,481,000 | 9,592,876 | |

| Reynolds American, Inc. 3.25% 6/12/20 | 4,310,000 | 4,312,792 | |

| 50,896,630 | |||

| TOTAL CONSUMER STAPLES | 81,065,570 | ||

| ENERGY - 1.3% | |||

| Energy Equipment & Services - 0.1% | |||

| Schlumberger Finance Canada Ltd. 2.2% 11/20/20 (c) | 5,000,000 | 4,994,166 | |

| Schlumberger Holdings Corp. 3.75% 5/1/24 (c) | 620,000 | 650,799 | |

| 5,644,965 | |||

| Oil, Gas & Consumable Fuels - 1.2% | |||

| Aker Bp ASA 3% 1/15/25 (c) | 995,000 | 960,927 | |

| BP Capital Markets PLC 3 month U.S. LIBOR + 0.250% 0.6095% 11/24/20 (a)(b) | 10,000,000 | 9,996,673 | |

| Cenovus Energy, Inc. 3% 8/15/22 | 1,100,000 | 1,045,134 | |

| Chevron Corp.: | |||

| 3 month U.S. LIBOR + 0.480% 1.9428% 3/3/22 (a)(b) | 4,700,000 | 4,695,329 | |

| 1.141% 5/11/23 | 5,109,000 | 5,204,240 | |

| Columbia Pipeline Group, Inc. 3.3% 6/1/20 | 1,135,000 | 1,135,000 | |

| Diamondback Energy, Inc.: | |||

| 2.875% 12/1/24 | 2,720,000 | 2,644,132 | |

| 4.75% 5/31/25 | 1,080,000 | 1,130,529 | |

| Energy Transfer Partners LP: | |||

| 2.9% 5/15/25 | 255,000 | 252,311 | |

| 4.2% 9/15/23 | 280,000 | 291,092 | |

| 4.25% 3/15/23 | 615,000 | 637,752 | |

| 5.875% 1/15/24 | 2,375,000 | 2,592,973 | |

| Eni SpA 4% 9/12/23 (c) | 390,000 | 412,798 | |

| Enterprise Products Operating LP: | |||

| 2.8% 2/15/21 | 1,020,000 | 1,033,470 | |

| 2.85% 4/15/21 | 3,000,000 | 3,045,726 | |

| 3.5% 2/1/22 | 1,050,000 | 1,096,127 | |

| 5.2% 9/1/20 | 4,000,000 | 4,046,004 | |

| EOG Resources, Inc. 2.625% 3/15/23 | 291,000 | 303,042 | |

| EQT Corp.: | |||

| 3% 10/1/22 | 2,275,000 | 2,198,219 | |

| 4.875% 11/15/21 | 284,000 | 278,320 | |

| Exxon Mobil Corp.: | |||

| 3 month U.S. LIBOR + 0.330% 0.7156% 8/16/22 (a)(b) | 7,000,000 | 6,976,520 | |

| 1.571% 4/15/23 | 1,835,000 | 1,884,264 | |

| 2.992% 3/19/25 | 1,895,000 | 2,074,497 | |

| Kinder Morgan Energy Partners LP: | |||

| 3.5% 3/1/21 | 435,000 | 440,040 | |

| 3.95% 9/1/22 | 135,000 | 141,996 | |

| Kinder Morgan, Inc. 5% 2/15/21 (c) | 675,000 | 686,816 | |

| Marathon Oil Corp. 2.8% 11/1/22 | 1,925,000 | 1,865,694 | |

| MPLX LP: | |||

| 3 month U.S. LIBOR + 0.900% 1.8989% 9/9/21 (a)(b) | 275,000 | 266,137 | |

| 3 month U.S. LIBOR + 1.100% 2.0989% 9/9/22 (a)(b) | 1,683,000 | 1,589,098 | |

| Occidental Petroleum Corp.: | |||

| 3 month U.S. LIBOR + 0.950% 1.3976% 2/8/21 (a)(b) | 6,819,000 | 6,561,908 | |

| 3 month U.S. LIBOR + 1.250% 1.6835% 8/13/21 (a)(b) | 5,104,000 | 4,868,456 | |

| 3 month U.S. LIBOR + 1.450% 1.8424% 8/15/22 (a)(b) | 2,050,000 | 1,793,750 | |

| 2.6% 8/13/21 | 990,000 | 953,370 | |

| Phillips 66 Co. 3 month U.S. LIBOR + 0.600% 0.9595% 2/26/21 (a)(b) | 5,033,000 | 5,015,510 | |

| Plains All American Pipeline LP/PAA Finance Corp. 5% 2/1/21 | 455,000 | 457,454 | |

| Reliance Holding U.S.A., Inc. 5.4% 2/14/22 (Reg. S) | 1,700,000 | 1,782,344 | |

| Sabine Pass Liquefaction LLC: | |||

| 5.625% 2/1/21 (a) | 3,725,000 | 3,799,093 | |

| 5.625% 4/15/23 (a) | 845,000 | 913,962 | |

| 6.25% 3/15/22 | 2,495,000 | 2,654,088 | |

| Saudi Arabian Oil Co. 2.75% 4/16/22 (c) | 1,815,000 | 1,854,703 | |

| Suncor Energy, Inc. 2.8% 5/15/23 | 505,000 | 517,375 | |

| Sunoco Logistics Partner Operations LP: | |||

| 3.45% 1/15/23 | 110,000 | 111,785 | |

| 4.4% 4/1/21 | 765,000 | 775,414 | |

| The Williams Companies, Inc. 3.7% 1/15/23 | 2,205,000 | 2,298,851 | |

| Valero Energy Corp. 2.7% 4/15/23 | 895,000 | 926,010 | |

| Western Gas Partners LP 4% 7/1/22 | 1,800,000 | 1,769,616 | |

| Williams Partners LP: | |||

| 3.35% 8/15/22 | 200,000 | 206,543 | |

| 4.3% 3/4/24 | 305,000 | 327,962 | |

| 96,513,054 | |||

| TOTAL ENERGY | 102,158,019 | ||

| FINANCIALS - 13.9% | |||

| Banks - 8.9% | |||

| Abbey National PLC: | |||

| 2.1% 1/13/23 | 1,255,000 | 1,289,663 | |

| 2.125% 11/3/20 | 570,000 | 573,831 | |

| ABN AMRO Bank NV: | |||

| 3 month U.S. LIBOR + 0.410% 1.5453% 1/19/21 (a)(b)(c) | 10,000,000 | 10,013,800 | |

| 3 month U.S. LIBOR + 0.570% 0.9393% 8/27/21 (a)(b)(c) | 12,413,000 | 12,418,636 | |

| Australia & New Zealand Banking Group Ltd. 3 month U.S. LIBOR + 0.500% 0.8805% 8/19/20 (a)(b)(c) | 7,000,000 | 7,006,396 | |

| Banco del Estado de Chile 2.704% 1/9/25 (c) | 665,000 | 668,533 | |

| Banco Santander Chile 2.5% 12/15/20 (c) | 1,745,000 | 1,751,544 | |

| Banco Santander Mexico SA 4.125% 11/9/22 (Reg. S) | 1,750,000 | 1,799,984 | |

| Banco Santander SA 3 month U.S. LIBOR + 1.120% 2.4314% 4/12/23 (a)(b) | 800,000 | 780,452 | |

| Bank of America Corp.: | |||

| 3 month U.S. LIBOR + 0.380% 1.423% 1/23/22 (a)(b) | 15,000,000 | 14,930,599 | |

| 3 month U.S. LIBOR + 0.650% 1.8656% 6/25/22 (a)(b) | 20,000,000 | 19,908,955 | |

| 3 month U.S. LIBOR + 0.650% 2.0834% 10/1/21 (a)(b) | 10,000,000 | 10,013,867 | |

| 2.328% 10/1/21 (a) | 3,000,000 | 3,008,891 | |

| 2.503% 10/21/22 | 1,475,000 | 1,509,191 | |

| 2.738% 1/23/22 (a) | 830,000 | 838,814 | |

| 3.124% 1/20/23 (a) | 5,000,000 | 5,166,683 | |

| 3.3% 1/11/23 | 1,445,000 | 1,529,324 | |

| Bank of Montreal: | |||

| 3 month U.S. LIBOR + 0.400% 1.296% 9/10/21 (a)(b) | 5,000,000 | 5,001,881 | |

| 3 month U.S. LIBOR + 0.440% 1.1805% 6/15/20 (a)(b) | 11,600,000 | 11,601,125 | |

| 3 month U.S. LIBOR + 0.460% 1.7714% 4/13/21 (a)(b) | 960,000 | 962,315 | |

| 3 month U.S. LIBOR + 0.570% 1.8024% 3/26/22 (a)(b) | 5,000,000 | 5,006,060 | |

| Bank of Nova Scotia 3 month U.S. LIBOR + 0.290% 1.6424% 1/8/21 (a)(b) | 10,000,000 | 10,004,187 | |

| Banque Federative du Credit Mutuel SA: | |||

| 3 month U.S. LIBOR + 0.490% 1.6253% 7/20/20 (a)(b)(c) | 15,000,000 | 15,026,805 | |

| 1.96% 7/21/21 (c) | 5,000,000 | 5,064,076 | |

| 2.125% 11/21/22 (c) | 1,415,000 | 1,437,541 | |

| 2.2% 7/20/20 (c) | 940,000 | 942,438 | |

| 2.5% 4/13/21 (c) | 5,000,000 | 5,085,932 | |

| Barclays Bank PLC: | |||

| 3 month U.S. LIBOR + 0.460% 1.7714% 1/11/21 (a)(b) | 11,000,000 | 11,000,932 | |

| 3 month U.S. LIBOR + 0.650% 1.124% 8/7/20 (a)(b) | 15,000,000 | 15,009,927 | |

| 1.7% 5/12/22 | 1,790,000 | 1,814,446 | |

| 2.65% 1/11/21 | 10,905,000 | 11,005,016 | |

| Barclays PLC: | |||

| 3 month U.S. LIBOR + 1.620% 2.9364% 1/10/23 (a)(b) | 645,000 | 638,760 | |

| 3 month U.S. LIBOR + 2.110% 2.5576% 8/10/21 (a)(b) | 14,003,000 | 14,141,042 | |

| BB&T Corp. 2.15% 2/1/21 | 1,160,000 | 1,171,348 | |

| BBVA U.S.A. 3 month U.S. LIBOR + 0.730% 1.4981% 6/11/21 (a)(b) | 11,700,000 | 11,596,543 | |

| BNP Paribas SA 3 month U.S. LIBOR + 0.390% 0.864% 8/7/21 (a)(b)(c) | 5,000,000 | 5,005,274 | |

| BPCE SA: | |||

| 3 month U.S. LIBOR + 0.300% 1.6114% 1/14/22 (a)(b)(c) | 5,000,000 | 4,956,091 | |

| 3 month U.S. LIBOR + 1.220% 1.578% 5/22/22 (a)(b)(c) | 1,605,000 | 1,601,630 | |

| 3.145% 7/31/20 (c) | 9,500,000 | 9,538,257 | |

| Capital One Bank NA 2.014% 1/27/23 (a) | 7,000,000 | 7,013,347 | |

| Capital One NA: | |||

| 2.15% 9/6/22 | 2,575,000 | 2,607,457 | |

| 2.25% 9/13/21 | 250,000 | 253,015 | |

| Citibank NA: | |||

| 3 month U.S. LIBOR + 0.300% 1.4353% 10/20/20 (a)(b) | 4,500,000 | 4,503,431 | |

| 3 month U.S. LIBOR + 0.600% 0.9766% 5/20/22 (a)(b) | 8,000,000 | 7,961,088 | |

| Citigroup, Inc.: | |||

| 3 month U.S. LIBOR + 1.190% 1.7461% 8/2/21 (a)(b) | 9,500,000 | 9,548,842 | |

| 3 month U.S. LIBOR + 1.380% 2.7546% 3/30/21 (a)(b) | 10,000,000 | 10,053,949 | |

| 2.312% 11/4/22 (a) | 16,290,000 | 16,510,080 | |

| 2.35% 8/2/21 | 5,000,000 | 5,088,581 | |

| 2.9% 12/8/21 | 1,495,000 | 1,535,821 | |

| Credit Agricole SA: | |||

| 3 month U.S. LIBOR + 0.970% 1.866% 6/10/20 (a)(b)(c) | 13,280,000 | 13,283,373 | |

| 3 month U.S. LIBOR + 1.020% 2.0403% 4/24/23 (a)(b)(c) | 675,000 | 662,714 | |

| Credit Suisse Group Funding Guernsey Ltd.: | |||

| 3 month U.S. LIBOR + 2.290% 3.4253% 4/16/21 (a)(b) | 4,250,000 | 4,308,125 | |

| 3.125% 12/10/20 | 5,000,000 | 5,055,122 | |

| 3.45% 4/16/21 | 5,000,000 | 5,115,949 | |

| Danske Bank A/S: | |||

| 3.001% 9/20/22 (a)(c) | 1,475,000 | 1,489,962 | |

| 5% 1/12/22 (c) | 1,050,000 | 1,100,113 | |

| Fifth Third Bancorp 1.625% 5/5/23 | 10,625,000 | 10,818,644 | |

| First Niagara Financial Group, Inc. 7.25% 12/15/21 | 515,000 | 552,394 | |

| HSBC Holdings PLC: | |||

| 3 month U.S. LIBOR + 0.650% 1.4341% 9/11/21 (a)(b) | 15,675,000 | 15,678,114 | |

| U.S. SOFR SEC OVRN FIN RATE INDX + 0.000% 2.099% 6/4/26 (a)(b) | 1,840,000 | 1,836,892 | |

| ING Groep NV 3 month U.S. LIBOR + 1.150% 2.5246% 3/29/22 (a)(b) | 735,000 | 734,817 | |

| JPMorgan Chase & Co.: | |||

| 3 month U.S. LIBOR + 0.680% 2.2604% 6/1/21 (a)(b) | 10,024,000 | 10,028,908 | |

| 3 month U.S. LIBOR + 1.100% 2.0989% 6/7/21 (a)(b) | 11,083,000 | 11,146,734 | |

| 2.083% 4/22/26 (a) | 1,870,000 | 1,913,662 | |

| 2.4% 6/7/21 | 5,993,000 | 6,099,595 | |

| 2.55% 10/29/20 | 10,000,000 | 10,069,943 | |

| 2.55% 3/1/21 | 18,053,000 | 18,304,479 | |

| KeyBank NA 3 month U.S. LIBOR + 0.660% 1.3466% 2/1/22 (a)(b) | 8,128,000 | 8,087,144 | |

| Lloyds Bank PLC: | |||

| 3 month U.S. LIBOR + 0.490% 0.964% 5/7/21 (a)(b) | 9,000,000 | 9,015,248 | |

| 3.3% 5/7/21 | 2,649,000 | 2,713,211 | |

| Manufacturers & Traders Trust Co. 3 month U.S. LIBOR + 0.270% 1.2614% 1/25/21 (a)(b) | 10,000,000 | 10,007,067 | |

| Mitsubishi UFJ Financial Group, Inc.: | |||

| 3 month U.S. LIBOR + 0.650% 1.6414% 7/26/21 (a)(b) | 6,926,000 | 6,913,703 | |

| 3 month U.S. LIBOR + 0.700% 1.6989% 3/7/22 (a)(b) | 10,000,000 | 9,928,603 | |

| 3 month U.S. LIBOR + 0.860% 1.8514% 7/26/23 (a)(b) | 665,000 | 656,187 | |

| 3 month U.S. LIBOR + 0.920% 1.278% 2/22/22 (a)(b) | 840,000 | 833,877 | |

| 2.998% 2/22/22 | 5,000,000 | 5,161,171 | |

| 3.218% 3/7/22 | 1,090,000 | 1,128,930 | |

| Mizuho Financial Group, Inc.: | |||

| 3 month U.S. LIBOR + 0.940% 1.3113% 2/28/22 (a)(b) | 5,000,000 | 4,982,271 | |

| 3 month U.S. LIBOR + 1.140% 1.9125% 9/13/21 (a)(b) | 17,000,000 | 17,033,369 | |

| Nordea Bank AB 4.875% 5/13/21 (c) | 710,000 | 733,172 | |

| PNC Bank NA: | |||

| 1.743% 2/24/23 (a) | 4,078,000 | 4,129,935 | |

| 2.028% 12/9/22 (a) | 7,000,000 | 7,116,277 | |

| Rabobank Nederland 3.95% 11/9/22 | 1,370,000 | 1,441,206 | |

| Rabobank Nederland New York Branch: | |||

| 3 month U.S. LIBOR + 0.430% 1.4214% 4/26/21 (a)(b) | 12,500,000 | 12,517,853 | |

| 3 month U.S. LIBOR + 0.830% 2.1414% 1/10/22 (a)(b) | 5,000,000 | 5,035,224 | |

| Regions Bank 3 month U.S. LIBOR + 0.500% 0.9335% 8/13/21 (a)(b) | 8,350,000 | 8,290,498 | |

| Royal Bank of Canada: | |||

| 3 month U.S. LIBOR + 0.300% 1.3976% 7/22/20 (a)(b) | 5,000,000 | 5,006,455 | |

| 3 month U.S. LIBOR + 0.390% 1.1501% 4/30/21 (a)(b) | 10,000,000 | 10,030,008 | |

| 3 month U.S. LIBOR + 0.400% 1.3914% 1/25/21 (a)(b) | 5,000,000 | 5,009,021 | |

| Royal Bank of Scotland Group PLC 3.875% 9/12/23 | 1,085,000 | 1,148,901 | |

| Royal Bank of Scotland PLC 2.375% 5/21/23 (c) | 1,525,000 | 1,538,080 | |

| Santander Holdings U.S.A., Inc. 4.45% 12/3/21 | 7,000,000 | 7,304,749 | |

| Santander UK Group Holdings PLC 2.875% 10/16/20 | 820,000 | 826,274 | |

| Standard Chartered PLC: | |||

| 3 month U.S. LIBOR + 1.150% 2.2853% 1/20/23 (a)(b)(c) | 910,000 | 896,932 | |

| 2.744% 9/10/22 (a)(c) | 860,000 | 864,774 | |

| Sumitomo Mitsui Banking Corp. 3 month U.S. LIBOR + 0.370% 1.5461% 10/16/20 (a)(b) | 5,000,000 | 5,007,100 | |

| Sumitomo Mitsui Financial Group, Inc.: | |||

| 3 month U.S. LIBOR + 1.140% 2.2753% 10/19/21 (a)(b) | 6,500,000 | 6,532,675 | |

| 3 month U.S. LIBOR + 1.680% 2.6789% 3/9/21 (a)(b) | 3,000,000 | 3,021,297 | |

| SunTrust Banks, Inc. 3 month U.S. LIBOR + 0.500% 1.4914% 10/26/21 (a)(b) | 5,000,000 | 4,988,845 | |

| Svenska Handelsbanken AB 3 month U.S. LIBOR + 0.470% 0.8295% 5/24/21 (a)(b) | 8,500,000 | 8,524,965 | |

| Swedbank AB 2.65% 3/10/21 (c) | 2,210,000 | 2,241,669 | |

| Synchrony Bank 3% 6/15/22 | 10,395,000 | 10,432,457 | |

| Synovus Bank 2.289% 2/10/23 (a) | 1,237,000 | 1,222,048 | |

| The Toronto-Dominion Bank: | |||

| 3 month U.S. LIBOR + 0.240% 1.2314% 1/25/21 (a)(b) | 11,565,000 | 11,569,831 | |

| 3 month U.S. LIBOR + 0.260% 1.1031% 9/17/20 (a)(b) | 5,000,000 | 5,005,041 | |

| 3 month U.S. LIBOR + 0.270% 1.1131% 3/17/21 (a)(b) | 10,000,000 | 10,011,645 | |

| U.S. SOFR SEC OVRN FIN RATE INDX + 0.480% 0.5321% 1/27/23 (a)(b) | 5,000,000 | 4,889,312 | |

| U.S. Bancorp 3% 3/15/22 | 1,530,000 | 1,596,351 | |

| U.S. Bank NA, Cincinnati: | |||

| 3 month U.S. LIBOR + 0.140% 1.183% 10/23/20 (a)(b) | 3,535,000 | 3,531,268 | |

| 3 month U.S. LIBOR + 0.250% 1.2703% 7/24/20 (a)(b) | 5,000,000 | 5,002,368 | |

| Wells Fargo & Co.: | |||

| 3 month U.S. LIBOR + 0.880% 1.9776% 7/22/20 (a)(b) | 14,900,000 | 14,931,660 | |

| 1.654% 6/2/24 (a) | 5,935,000 | 5,951,953 | |

| 2.188% 4/30/26 (a) | 840,000 | 851,121 | |

| 2.5% 3/4/21 | 7,010,000 | 7,113,127 | |

| 2.6% 7/22/20 | 5,000,000 | 5,014,400 | |

| 3.5% 3/8/22 | 735,000 | 769,918 | |

| 4.6% 4/1/21 | 10,000,000 | 10,329,131 | |

| Wells Fargo Bank NA: | |||

| 3 month U.S. LIBOR + 0.500% 1.543% 7/23/21 (a)(b) | 5,000,000 | 4,998,665 | |

| 2.082% 9/9/22 (a) | 1,105,000 | 1,118,161 | |

| 3.325% 7/23/21 (a) | 1,935,000 | 1,941,670 | |

| Zions Bancorp NA 3.5% 8/27/21 | 5,000,000 | 5,078,922 | |

| 714,121,680 | |||

| Capital Markets - 1.9% | |||

| Bank of New York, New York 3 month U.S. LIBOR + 0.280% 1.5338% 6/4/21 (a)(b) | 5,000,000 | 5,000,000 | |

| Charles Schwab Corp. 3 month U.S. LIBOR + 0.320% 0.6941% 5/21/21 (a)(b) | 990,000 | 990,317 | |

| Credit Suisse AG: | |||

| U.S. SOFR SEC OVRN FIN RATE INDX + 0.450% 0.5051% 2/4/22 (a)(b) | 5,310,000 | 5,245,003 | |

| 2.1% 11/12/21 | 4,591,000 | 4,683,596 | |

| 2.8% 4/8/22 | 3,625,000 | 3,756,050 | |

| Deutsche Bank AG New York Branch: | |||

| 3 month U.S. LIBOR + 0.810% 1.9126% 1/22/21 (a)(b) | 10,000,000 | 9,826,298 | |

| 3 month U.S. LIBOR + 1.290% 1.8461% 2/4/21 (a)(b) | 860,000 | 846,827 | |

| 2.7% 7/13/20 | 5,000,000 | 5,000,000 | |

| 2.95% 8/20/20 | 3,940,000 | 3,943,635 | |

| 3.15% 1/22/21 | 11,435,000 | 11,444,803 | |

| 3.375% 5/12/21 | 125,000 | 125,239 | |

| Goldman Sachs Group, Inc.: | |||

| 3 month U.S. LIBOR + 1.200% 1.9405% 9/15/20 (a)(b) | 4,670,000 | 4,678,640 | |

| 3 month U.S. LIBOR + 1.360% 2.3514% 4/23/21 (a)(b) | 10,000,000 | 10,060,682 | |

| 2.6% 12/27/20 | 1,752,000 | 1,754,262 | |

| 2.625% 4/25/21 | 5,000,000 | 5,081,598 | |

| 2.876% 10/31/22 (a) | 520,000 | 531,296 | |

| 2.905% 7/24/23 (a) | 10,000,000 | 10,275,261 | |

| 3% 4/26/22 | 1,505,000 | 1,531,206 | |

| 5.75% 1/24/22 | 1,800,000 | 1,937,977 | |

| Morgan Stanley: | |||

| 3 month U.S. LIBOR + 0.930% 2.0276% 7/22/22 (a)(b) | 4,040,000 | 4,031,435 | |

| U.S. SOFR SEC OVRN FIN RATE INDX + 0.700% 0.7506% 1/20/23 (a)(b) | 5,000,000 | 4,896,452 | |

| U.S. SOFR SEC OVRN FIN RATE INDX + 0.830% 0.944% 6/10/22 (a)(b) | 5,000,000 | 4,938,535 | |

| 2.5% 4/21/21 | 5,000,000 | 5,082,067 | |

| 2.625% 11/17/21 | 17,214,000 | 17,683,610 | |

| 2.75% 5/19/22 | 1,095,000 | 1,136,922 | |

| 5.5% 7/24/20 | 670,000 | 674,777 | |

| 5.75% 1/25/21 | 10,000,000 | 10,330,560 | |

| State Street Corp. 2.825% 3/30/23 (a)(c) | 603,000 | 623,535 | |

| TD Ameritrade Holding Corp. 3 month U.S. LIBOR + 0.430% 1.1166% 11/1/21 (a)(b) | 7,500,000 | 7,454,586 | |

| UBS AG London Branch 1.75% 4/21/22 (c) | 7,525,000 | 7,648,109 | |

| UBS Group AG 3% 4/15/21 (c) | 1,495,000 | 1,524,855 | |

| UBS Group Funding AG 3 month U.S. LIBOR + 1.220% 1.578% 5/23/23 (a)(b)(c) | 880,000 | 882,724 | |

| 153,620,857 | |||

| Consumer Finance - 1.7% | |||

| AerCap Ireland Capital Ltd./AerCap Global Aviation Trust: | |||

| 3.95% 2/1/22 | 1,070,000 | 1,008,303 | |

| 4.45% 12/16/21 | 1,395,000 | 1,324,046 | |

| 4.625% 10/30/20 | 635,000 | 632,461 | |

| American Express Co.: | |||

| 3 month U.S. LIBOR + 0.600% 1.1409% 11/5/21 (a)(b) | 6,750,000 | 6,744,058 | |

| 2.2% 10/30/20 | 3,000,000 | 3,017,461 | |

| 2.65% 12/2/22 | 9,500,000 | 9,927,223 | |

| 2.75% 5/20/22 | 5,000,000 | 5,190,925 | |

| 3% 2/22/21 | 5,000,000 | 5,078,589 | |

| 3.375% 5/17/21 | 1,500,000 | 1,536,837 | |

| Aviation Capital Group LLC: | |||

| 3 month U.S. LIBOR + 0.670% 1.4301% 7/30/21 (a)(b)(c) | 1,427,000 | 1,322,723 | |

| 3 month U.S. LIBOR + 0.950% 2.5304% 6/1/21 (a)(b)(c) | 4,307,000 | 3,963,332 | |

| Capital One Financial Corp.: | |||

| 2.4% 10/30/20 | 615,000 | 618,219 | |

| 3.2% 1/30/23 | 765,000 | 792,927 | |

| 3.5% 6/15/23 | 555,000 | 585,155 | |

| 3.9% 1/29/24 | 505,000 | 536,235 | |

| Ford Motor Credit Co. LLC: | |||

| 3 month U.S. LIBOR + 0.930% 2.1341% 9/24/20 (a)(b) | 1,855,000 | 1,836,450 | |

| 3.157% 8/4/20 | 8,910,000 | 8,902,872 | |

| 3.47% 4/5/21 | 415,000 | 404,625 | |

| 3.813% 10/12/21 | 495,000 | 481,388 | |

| 5.875% 8/2/21 | 290,000 | 290,725 | |

| GE Capital International Funding Co. 2.342% 11/15/20 | 19,564,000 | 19,693,405 | |

| Hyundai Capital America: | |||

| 2.375% 2/10/23 (c) | 1,925,000 | 1,900,366 | |

| 2.45% 6/15/21 (c) | 755,000 | 754,636 | |

| 2.85% 11/1/22 (c) | 511,000 | 510,808 | |

| 3% 6/20/22 (c) | 1,060,000 | 1,066,100 | |

| 3.95% 2/1/22 (c) | 1,315,000 | 1,336,553 | |

| John Deere Capital Corp.: | |||

| 3 month U.S. LIBOR + 0.160% 1.5124% 1/8/21 (a)(b) | 8,720,000 | 8,715,747 | |

| 3 month U.S. LIBOR + 0.170% 1.4899% 10/9/20 (a)(b) | 5,000,000 | 5,002,183 | |

| 3 month U.S. LIBOR + 0.240% 1.0241% 3/12/21 (a)(b) | 5,000,000 | 4,998,521 | |

| 3 month U.S. LIBOR + 0.260% 1.156% 9/10/21 (a)(b) | 5,000,000 | 4,986,962 | |

| 3 month U.S. LIBOR + 0.420% 1.7314% 7/10/20 (a)(b) | 5,000,000 | 5,006,700 | |

| Paccar Financial Corp. 3.1% 5/10/21 | 1,260,000 | 1,290,920 | |

| Synchrony Financial 2.85% 7/25/22 | 3,473,000 | 3,408,738 | |

| Toyota Motor Credit Corp.: | |||

| 3 month U.S. LIBOR + 0.120% 0.5585% 8/13/21 (a)(b) | 6,904,000 | 6,866,052 | |

| 3 month U.S. LIBOR + 0.170% 1.0594% 9/18/20 (a)(b) | 10,000,000 | 9,998,855 | |

| 1.15% 5/26/22 | 5,000,000 | 5,023,860 | |

| 134,754,960 | |||

| Diversified Financial Services - 0.2% | |||

| AIG Global Funding: | |||

| 3 month U.S. LIBOR + 0.460% 1.6756% 6/25/21 (a)(b)(c) | 4,293,000 | 4,282,480 | |

| 2.3% 7/1/22 (c) | 1,528,000 | 1,574,586 | |

| 3.35% 6/25/21 (c) | 770,000 | 791,881 | |

| BP Capital Markets America, Inc.: | |||

| 2.937% 4/6/23 | 700,000 | 739,362 | |

| 4.742% 3/11/21 | 5,000,000 | 5,152,143 | |

| Brixmor Operating Partnership LP 3.875% 8/15/22 | 170,000 | 173,194 | |

| CNH Industrial Capital LLC: | |||

| 3.875% 10/15/21 | 1,325,000 | 1,344,917 | |

| 4.375% 11/6/20 | 1,725,000 | 1,730,366 | |

| General Electric Capital Corp.: | |||

| 3.15% 9/7/22 | 555,000 | 568,394 | |

| 3.45% 5/15/24 | 530,000 | 543,362 | |

| Park Aerospace Holdings Ltd.: | |||

| 4.5% 3/15/23 (c) | 435,000 | 368,494 | |

| 5.25% 8/15/22 (c) | 880,000 | 776,505 | |

| 18,045,684 | |||

| Insurance - 1.2% | |||

| ACE INA Holdings, Inc. 2.3% 11/3/20 | 970,000 | 975,889 | |

| AIA Group Ltd. 3 month U.S. LIBOR + 0.520% 1.6358% 9/20/21 (a)(b)(c) | 6,046,000 | 5,964,263 | |

| American International Group, Inc.: | |||

| 2.5% 6/30/25 | 1,460,000 | 1,510,202 | |

| 4.875% 6/1/22 | 675,000 | 726,173 | |

| 6.4% 12/15/20 | 2,010,000 | 2,069,423 | |

| Aon Corp.: | |||

| 2.2% 11/15/22 | 1,592,000 | 1,638,141 | |

| 5% 9/30/20 | 4,135,000 | 4,194,025 | |

| Aon PLC 2.8% 3/15/21 | 1,320,000 | 1,335,874 | |

| Lincoln National Corp. 4% 9/1/23 | 270,000 | 292,202 | |

| Marsh & McLennan Companies, Inc.: | |||

| 3 month U.S. LIBOR + 1.200% 2.5746% 12/29/21 (a)(b) | 4,546,000 | 4,530,113 | |

| 3.5% 12/29/20 | 5,296,000 | 5,384,289 | |

| 3.875% 3/15/24 | 725,000 | 795,513 | |

| MassMutual Global Funding II: | |||

| 2.25% 7/1/22 (c) | 1,150,000 | 1,183,899 | |

| 2.5% 4/13/22 (c) | 3,780,000 | 3,892,486 | |

| Metropolitan Life Global Funding I: | |||

| 3 month U.S. LIBOR + 0.400% 1.1841% 6/12/20 (a)(b)(c) | 10,000,000 | 10,002,295 | |

| U.S. SOFR SEC OVRN FIN RATE INDX + 0.570% 0.6159% 1/13/23 (a)(b)(c) | 6,940,000 | 6,782,208 | |

| U.S. SOFR SEC OVRN FIN RATE INDX + 0.570% 0.63% 9/7/20 (a)(b)(c) | 5,000,000 | 4,997,500 | |

| 2.5% 12/3/20 (Reg. S) (c) | 3,000,000 | 3,031,661 | |

| Metropolitan Tower Global Funding U.S. SOFR SEC OVRN FIN RATE INDX + 0.550% 0.5989% 1/17/23 (a)(b)(c) | 5,000,000 | 4,863,460 | |

| New York Life Global Funding: | |||

| 3 month U.S. LIBOR + 0.280% 2.0141% 1/10/23 (a)(b)(c) | 6,945,000 | 6,808,382 | |

| 3 month U.S. LIBOR + 0.320% 0.8209% 8/6/21 (a)(b)(c) | 6,177,000 | 6,182,835 | |

| 1.1% 5/5/23 (c) | 725,000 | 733,530 | |

| 2.95% 1/28/21 (c) | 3,775,000 | 3,837,743 | |

| Pricoa Global Funding I 2.55% 11/24/20 (c) | 2,614,000 | 2,638,436 | |

| Protective Life Global Funding: | |||

| 3 month U.S. LIBOR + 0.370% 1.6814% 7/13/20 (a)(b)(c) | 7,000,000 | 7,005,855 | |

| 3 month U.S. LIBOR + 0.520% 1.8946% 6/28/21 (a)(b)(c) | 2,000,000 | 2,000,524 | |

| Reinsurance Group of America, Inc. 5% 6/1/21 | 125,000 | 129,473 | |

| Trinity Acquisition PLC 3.5% 9/15/21 | 650,000 | 662,023 | |

| 94,168,417 | |||

| Thrifts & Mortgage Finance - 0.0% | |||

| Crown Castle Towers LLC/Crown Atlantic Holdings Sub LLC/Crown Communication, Inc. 3.72% 7/15/43 (c) | 370,000 | 385,302 | |

| TOTAL FINANCIALS | 1,115,096,900 | ||

| HEALTH CARE - 2.0% | |||

| Biotechnology - 0.3% | |||

| AbbVie, Inc.: | |||

| 3 month U.S. LIBOR + 0.650% 1.0241% 11/21/22 (a)(b)(c) | 7,100,000 | 7,043,342 | |

| 2.15% 11/19/21 (c) | 11,244,000 | 11,454,074 | |

| 2.3% 5/14/21 | 850,000 | 862,335 | |

| 2.6% 11/21/24 (c) | 2,745,000 | 2,883,181 | |

| 2.9% 11/6/22 | 1,740,000 | 1,822,323 | |

| 3.2% 11/6/22 | 170,000 | 178,756 | |

| 3.25% 10/1/22 (c) | 185,000 | 193,493 | |

| 3.45% 3/15/22 (c) | 615,000 | 639,878 | |

| Baxalta, Inc. 3.6% 6/23/22 | 265,000 | 278,671 | |

| 25,356,053 | |||

| Health Care Equipment & Supplies - 0.2% | |||

| Baxter International, Inc. 3.75% 10/1/25 (c) | 910,000 | 1,027,017 | |

| Becton, Dickinson & Co.: | |||

| 3 month U.S. LIBOR + 0.870% 2.2496% 12/29/20 (a)(b) | 8,326,000 | 8,323,502 | |

| 2.404% 6/5/20 | 1,195,000 | 1,194,883 | |

| 2.894% 6/6/22 | 2,230,000 | 2,316,591 | |

| 3.125% 11/8/21 | 350,000 | 361,050 | |

| 3.363% 6/6/24 | 1,215,000 | 1,310,244 | |

| 3.734% 12/15/24 | 285,000 | 313,152 | |

| Zimmer Biomet Holdings, Inc. 3 month U.S. LIBOR + 0.750% 1.8019% 3/19/21 (a)(b) | 3,220,000 | 3,193,342 | |

| 18,039,781 | |||

| Health Care Providers & Services - 0.8% | |||

| AmerisourceBergen Corp. 3.5% 11/15/21 | 610,000 | 632,637 | |

| Anthem, Inc.: | |||

| 2.375% 1/15/25 | 410,000 | 430,915 | |

| 2.5% 11/21/20 | 1,095,000 | 1,105,051 | |

| Cardinal Health, Inc.: | |||

| 2.616% 6/15/22 | 115,000 | 118,036 | |

| 3.079% 6/15/24 | 695,000 | 733,491 | |

| 3.2% 3/15/23 | 875,000 | 917,911 | |

| 3.5% 11/15/24 | 1,180,000 | 1,264,789 | |

| Cigna Corp.: | |||

| 3 month U.S. LIBOR + 0.650% 1.4931% 9/17/21 (a)(b) | 5,165,000 | 5,137,434 | |

| 3% 7/15/23 (c) | 715,000 | 754,600 | |

| 3.4% 9/17/21 | 370,000 | 382,852 | |

| 3.75% 7/15/23 | 738,000 | 802,965 | |

| 3.9% 2/15/22 (c) | 585,000 | 614,268 | |

| 4.125% 9/15/20 (c) | 710,000 | 715,706 | |

| CVS Health Corp.: | |||

| 3 month U.S. LIBOR + 0.720% 1.7189% 3/9/21 (a)(b) | 8,025,000 | 8,037,468 | |

| 2.625% 8/15/24 | 335,000 | 353,767 | |

| 2.8% 7/20/20 | 11,000,000 | 11,011,330 | |

| 3.35% 3/9/21 | 6,556,000 | 6,689,032 | |

| 3.7% 3/9/23 | 2,710,000 | 2,903,079 | |

| Express Scripts Holding Co. 3 month U.S. LIBOR + 0.750% 1.1125% 11/30/20 (a)(b) | 14,665,000 | 14,610,079 | |

| Humana, Inc.: | |||

| 2.9% 12/15/22 | 160,000 | 167,639 | |

| 3.15% 12/1/22 | 315,000 | 330,089 | |

| 3.85% 10/1/24 | 490,000 | 535,511 | |

| 4.5% 4/1/25 | 1,205,000 | 1,364,334 | |

| McKesson Corp. 3.65% 11/30/20 | 1,380,000 | 1,398,443 | |

| 61,011,426 | |||

| Life Sciences Tools & Services - 0.0% | |||

| Thermo Fisher Scientific, Inc. 4.133% 3/25/25 | 385,000 | 437,646 | |

| Pharmaceuticals - 0.7% | |||

| AstraZeneca PLC 2.375% 11/16/20 | 5,000,000 | 5,042,159 | |

| Bayer U.S. Finance II LLC: | |||

| 3 month U.S. LIBOR + 0.630% 1.8456% 6/25/21 (a)(b)(c) | 17,180,000 | 17,087,695 | |

| 3.5% 6/25/21 (c) | 855,000 | 873,711 | |

| Bristol-Myers Squibb Co.: | |||

| 2.55% 5/14/21 (c) | 9,104,000 | 9,294,394 | |

| 2.6% 5/16/22 (c) | 635,000 | 661,375 | |

| 2.75% 2/15/23 (c) | 605,000 | 635,510 | |

| 2.875% 8/15/20 (c) | 1,203,000 | 1,209,159 | |

| 2.875% 2/19/21 (c) | 1,110,000 | 1,130,183 | |

| 2.9% 7/26/24 (c) | 840,000 | 906,824 | |

| 3.25% 2/20/23 (c) | 185,000 | 197,496 | |

| 3.55% 8/15/22 (c) | 600,000 | 636,811 | |

| 3.625% 5/15/24 (c) | 160,000 | 175,911 | |

| EMD Finance LLC 2.95% 3/19/22 (c) | 430,000 | 443,362 | |

| Perrigo Finance PLC: | |||

| 3.5% 3/15/21 | 605,000 | 605,729 | |

| 3.5% 12/15/21 | 631,000 | 629,185 | |

| 3.9% 12/15/24 | 1,780,000 | 1,853,898 | |

| Shire Acquisitions Investments Ireland DAC: | |||

| 2.4% 9/23/21 | 1,000,000 | 1,020,021 | |

| 2.875% 9/23/23 | 115,000 | 121,275 | |

| Takeda Pharmaceutical Co. Ltd. 4% 11/26/21 | 1,550,000 | 1,621,831 | |

| Zoetis, Inc. 3 month U.S. LIBOR + 0.440% 0.8166% 8/20/21 (a)(b) | 10,000,000 | 9,987,793 | |

| 54,134,322 | |||

| TOTAL HEALTH CARE | 158,979,228 | ||

| INDUSTRIALS - 1.1% | |||

| Aerospace & Defense - 0.1% | |||

| General Dynamics Corp. 3% 5/11/21 | 10,000,000 | 10,242,547 | |

| Northrop Grumman Corp. 2.55% 10/15/22 | 785,000 | 821,780 | |

| 11,064,327 | |||

| Air Freight & Logistics - 0.0% | |||

| FedEx Corp. 3.8% 5/15/25 | 570,000 | 626,265 | |

| Airlines - 0.0% | |||

| American Airlines 2017-2 Class B Pass Through Trust equipment trust certificate 3.7% 4/15/27 | 622,274 | 385,006 | |

| Delta Air Lines, Inc. 2.6% 12/4/20 | 290,000 | 282,847 | |

| United Airlines 2019-2 Class B Pass Through Trust equipment trust certificate 3.5% 11/1/29 | 410,000 | 254,172 | |

| 922,025 | |||

| Building Products - 0.0% | |||

| Carrier Global Corp. 2.242% 2/15/25 (c) | 1,860,000 | 1,862,855 | |

| Commercial Services & Supplies - 0.0% | |||

| Republic Services, Inc. 2.5% 8/15/24 | 880,000 | 931,308 | |

| Electrical Equipment - 0.0% | |||

| Shanghai Electric Group Global Investment Ltd. 2.65% 11/21/24 | 2,220,000 | 2,271,564 | |

| Industrial Conglomerates - 0.2% | |||

| Honeywell International, Inc.: | |||

| 3 month U.S. LIBOR + 0.370% 0.8176% 8/8/22 (a)(b) | 9,078,000 | 9,064,643 | |

| 1.35% 6/1/25 | 970,000 | 989,836 | |

| 2.3% 8/15/24 | 740,000 | 786,475 | |

| Roper Technologies, Inc.: | |||

| 2.35% 9/15/24 | 365,000 | 379,023 | |

| 3% 12/15/20 | 475,000 | 478,890 | |

| 3.125% 11/15/22 | 1,505,000 | 1,577,217 | |

| 3.65% 9/15/23 | 270,000 | 291,477 | |

| 13,567,561 | |||

| Machinery - 0.5% | |||

| Caterpillar Financial Services Corp.: | |||

| 3 month U.S. LIBOR + 0.200% 0.6346% 11/12/21 (a)(b) | 5,000,000 | 4,970,717 | |

| 3 month U.S. LIBOR + 0.230% 0.9705% 3/15/21 (a)(b) | 5,000,000 | 5,001,580 | |

| 3 month U.S. LIBOR + 0.250% 0.6095% 8/26/20 (a)(b) | 5,000,000 | 4,998,005 | |

| 3 month U.S. LIBOR + 0.280% 1.2789% 9/7/21 (a)(b) | 6,790,000 | 6,777,459 | |

| 3 month U.S. LIBOR + 0.300% 1.2989% 3/8/21 (a)(b) | 5,000,000 | 4,990,906 | |

| 2.95% 2/26/22 | 1,040,000 | 1,080,868 | |

| Otis Worldwide Corp.: | |||

| 3 month U.S. LIBOR + 0.450% 2.0876% 4/5/23 (a)(b)(c) | 3,299,000 | 3,254,941 | |

| 2.056% 4/5/25 (c) | 1,080,000 | 1,114,343 | |

| Westinghouse Air Brake Co. 3 month U.S. LIBOR + 1.300% 2.0405% 9/15/21 (a)(b) | 5,428,000 | 5,160,699 | |

| 37,349,518 | |||

| Professional Services - 0.1% | |||

| Equifax, Inc.: | |||

| 3 month U.S. LIBOR + 0.870% 1.2624% 8/15/21 (a)(b) | 610,000 | 602,513 | |

| 2.3% 6/1/21 | 975,000 | 984,174 | |

| 3.6% 8/15/21 | 570,000 | 585,362 | |

| 3.95% 6/15/23 | 1,090,000 | 1,159,353 | |

| 3,331,402 | |||

| Road & Rail - 0.1% | |||

| Avolon Holdings Funding Ltd.: | |||

| 2.875% 2/15/25 (c) | 980,000 | 750,279 | |

| 3.625% 5/1/22 (c) | 1,560,000 | 1,388,086 | |

| 3.95% 7/1/24 (c) | 265,000 | 218,670 | |

| Eastern Creation II Investment Holdings Ltd. 2.75% 9/26/20 | 1,380,000 | 1,383,105 | |

| Penske Truck Leasing Co. LP: | |||

| 3.2% 7/15/20 (c) | 1,710,000 | 1,710,426 | |

| 3.3% 4/1/21 (c) | 1,160,000 | 1,175,390 | |

| 3.65% 7/29/21 (c) | 385,000 | 391,407 | |

| SMBC Aviation Capital Finance: | |||

| 3.55% 4/15/24 (c) | 325,000 | 325,354 | |

| 4.125% 7/15/23 (c) | 200,000 | 202,381 | |

| Union Pacific Corp. 3.2% 6/8/21 | 1,205,000 | 1,236,335 | |

| 8,781,433 | |||

| Trading Companies & Distributors - 0.1% | |||

| Air Lease Corp.: | |||

| 2.25% 1/15/23 | 810,000 | 755,487 | |

| 2.5% 3/1/21 | 275,000 | 265,426 | |

| 3.5% 1/15/22 | 5,560,000 | 5,321,482 | |

| GATX Corp. 3.9% 3/30/23 | 545,000 | 569,455 | |

| 6,911,850 | |||

| Transportation Infrastructure - 0.0% | |||

| HPHT Finance 17 Ltd. 2.75% 9/11/22 (Reg. S) | 1,235,000 | 1,245,484 | |

| TOTAL INDUSTRIALS | 88,865,592 | ||

| INFORMATION TECHNOLOGY - 0.5% | |||

| Electronic Equipment & Components - 0.1% | |||

| Amphenol Corp. 2.05% 3/1/25 | 910,000 | 928,157 | |

| Avnet, Inc. 3.75% 12/1/21 | 905,000 | 929,803 | |

| Jabil, Inc. 5.625% 12/15/20 | 485,000 | 495,965 | |

| Tyco Electronics Group SA 3 month U.S. LIBOR + 0.450% 1.7643% 6/5/20 (a)(b) | 5,261,000 | 5,260,692 | |

| 7,614,617 | |||

| IT Services - 0.1% | |||

| Fiserv, Inc. 2.75% 7/1/24 | 1,820,000 | 1,930,383 | |

| Global Payments, Inc. 2.65% 2/15/25 | 800,000 | 840,306 | |

| IBM Corp.: | |||

| 2.5% 1/27/22 | 460,000 | 476,161 | |

| 2.85% 5/13/22 | 725,000 | 757,707 | |

| 2.875% 11/9/22 | 125,000 | 132,273 | |

| PayPal Holdings, Inc. 1.35% 6/1/23 | 3,824,000 | 3,884,613 | |

| The Western Union Co.: | |||

| 2.85% 1/10/25 | 905,000 | 933,914 | |

| 3.6% 3/15/22 | 735,000 | 765,192 | |

| 9,720,549 | |||

| Semiconductors & Semiconductor Equipment - 0.2% | |||

| Analog Devices, Inc. 2.95% 4/1/25 | 295,000 | 314,288 | |

| Broadcom Corp./Broadcom Cayman LP 2.2% 1/15/21 | 225,000 | 226,145 | |

| Microchip Technology, Inc.: | |||

| 2.67% 9/1/23 (c) | 1,110,000 | 1,115,308 | |

| 3.922% 6/1/21 | 2,185,000 | 2,221,100 | |

| Micron Technology, Inc.: | |||

| 2.497% 4/24/23 | 2,585,000 | 2,646,596 | |

| 4.64% 2/6/24 | 340,000 | 373,621 | |

| NXP BV/NXP Funding LLC: | |||

| 2.7% 5/1/25 (c) | 205,000 | 211,418 | |

| 3.875% 9/1/22 (c) | 690,000 | 723,229 | |

| 4.125% 6/1/21 (c) | 795,000 | 818,035 | |

| 4.625% 6/1/23 (c) | 1,175,000 | 1,266,663 | |

| Texas Instruments, Inc.: | |||

| 1.375% 3/12/25 | 545,000 | 560,313 | |

| 1.85% 5/15/22 | 1,035,000 | 1,062,002 | |

| 11,538,718 | |||

| Software - 0.0% | |||

| Oracle Corp. 2.5% 4/1/25 | 1,300,000 | 1,381,766 | |

| Technology Hardware, Storage & Peripherals - 0.1% | |||

| Apple, Inc.: | |||

| 0.75% 5/11/23 | 6,265,000 | 6,331,558 | |

| 2.4% 5/3/23 | 1,025,000 | 1,083,395 | |

| 7,414,953 | |||

| TOTAL INFORMATION TECHNOLOGY | 37,670,603 | ||

| MATERIALS - 0.2% | |||

| Chemicals - 0.2% | |||

| CNAC HK Finbridge Co. Ltd.: | |||

| 3% 7/19/20 (Reg. S) | 825,000 | 826,031 | |

| 4.125% 3/14/21 (Reg. S) | 765,000 | 775,649 | |

| DuPont de Nemours, Inc. 3.766% 11/15/20 | 1,105,000 | 1,120,704 | |

| International Flavors & Fragrances, Inc. 3.4% 9/25/20 | 6,415,000 | 6,438,481 | |

| LyondellBasell Industries NV 6% 11/15/21 | 1,755,000 | 1,851,108 | |

| Syngenta Finance NV 3.933% 4/23/21 (c) | 735,000 | 736,626 | |

| 11,748,599 | |||

| Construction Materials - 0.0% | |||

| Boral Finance Pty Ltd. 3% 11/1/22 (c) | 135,000 | 134,512 | |

| Vulcan Materials Co.: | |||

| 3 month U.S. LIBOR + 0.600% 1.3405% 6/15/20 (a)(b) | 790,000 | 789,564 | |

| 3 month U.S. LIBOR + 0.650% 2.2304% 3/1/21 (a)(b) | 1,620,000 | 1,603,728 | |

| 2,527,804 | |||

| Metals & Mining - 0.0% | |||

| Anglo American Capital PLC: | |||

| 3.75% 4/10/22 (c) | 400,000 | 408,196 | |

| 4.125% 9/27/22 (c) | 624,000 | 636,080 | |

| Nucor Corp. 2% 6/1/25 | 350,000 | 356,276 | |

| POSCO 2.375% 1/17/23 (c) | 1,870,000 | 1,885,464 | |

| 3,286,016 | |||

| TOTAL MATERIALS | 17,562,419 | ||

| REAL ESTATE - 0.1% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.1% | |||

| American Campus Communities Operating Partnership LP 3.75% 4/15/23 | 910,000 | 913,486 | |

| Crown Castle International Corp.: | |||

| 2.25% 9/1/21 | 1,195,000 | 1,212,286 | |

| 3.4% 2/15/21 | 860,000 | 873,501 | |

| Highwoods/Forsyth LP 3.625% 1/15/23 | 1,620,000 | 1,667,469 | |

| Simon Property Group LP: | |||

| 2.625% 6/15/22 | 1,150,000 | 1,146,964 | |

| 3.375% 10/1/24 | 1,175,000 | 1,199,407 | |

| Ventas Realty LP 3.1% 1/15/23 | 180,000 | 178,526 | |

| 7,191,639 | |||

| Real Estate Management & Development - 0.0% | |||

| Essex Portfolio LP 3.625% 8/15/22 | 55,000 | 56,553 | |

| Ventas Realty LP/Ventas Capital Corp. 3.25% 8/15/22 | 345,000 | 348,021 | |

| WEA Finance LLC/Westfield UK & Europe Finance PLC 3.25% 10/5/20 (c) | 235,000 | 235,338 | |

| 639,912 | |||

| TOTAL REAL ESTATE | 7,831,551 | ||

| UTILITIES - 1.1% | |||

| Electric Utilities - 0.5% | |||

| American Electric Power Co., Inc. 3.65% 12/1/21 | 180,000 | 186,622 | |

| Duke Energy Corp.: | |||

| 3 month U.S. LIBOR + 0.500% 0.924% 5/14/21 (a)(b)(c) | 7,000,000 | 6,992,305 | |

| 3.55% 9/15/21 | 330,000 | 339,340 | |

| Edison International 3.125% 11/15/22 | 650,000 | 669,145 | |

| ENEL Finance International NV: | |||

| 2.875% 5/25/22 (c) | 1,660,000 | 1,703,797 | |

| 4.25% 9/14/23 (c) | 780,000 | 841,452 | |

| Exelon Corp. 2.85% 6/15/20 | 5,000,000 | 5,002,788 | |

| FirstEnergy Corp. 2.85% 7/15/22 | 885,000 | 913,107 | |

| Israel Electric Corp. Ltd. 5% 11/12/24 (Reg. S) (c) | 1,365,000 | 1,508,707 | |

| NextEra Energy Capital Holdings, Inc.: | |||

| 3 month U.S. LIBOR + 0.550% 0.9213% 8/28/21 (a)(b) | 1,285,000 | 1,285,079 | |

| 2.403% 9/1/21 | 11,475,000 | 11,740,493 | |

| NRG Energy, Inc. 3.75% 6/15/24 (c) | 535,000 | 554,750 | |

| PNM Resources, Inc. 3.25% 3/9/21 | 995,000 | 1,004,963 | |

| Sinosing Services Pte Ltd. 2.25% 2/20/25 (Reg. S) | 2,200,000 | 2,200,000 | |

| Southern Co. 2.35% 7/1/21 | 280,000 | 284,802 | |

| Vistra Operations Co. LLC 3.55% 7/15/24 (c) | 3,025,000 | 3,092,816 | |

| 38,320,166 | |||

| Gas Utilities - 0.0% | |||

| CenterPoint Energy Resources Corp. 4.5% 1/15/21 | 590,000 | 597,876 | |

| Independent Power and Renewable Electricity Producers - 0.0% | |||

| The AES Corp. 3.3% 7/15/25 (c) | 820,000 | 832,530 | |

| Multi-Utilities - 0.6% | |||

| CenterPoint Energy, Inc. 3.6% 11/1/21 | 455,000 | 471,825 | |

| Consolidated Edison Co. of New York, Inc. 3 month U.S. LIBOR + 0.400% 1.6156% 6/25/21 (a)(b) | 11,500,000 | 11,488,040 | |

| Dominion Energy, Inc.: | |||

| 3 month U.S. LIBOR + 0.400% 1.9804% 12/1/20 (a)(b)(c) | 10,000,000 | 9,972,740 | |

| 2.579% 7/1/20 (a) | 2,335,000 | 2,337,471 | |

| 2.715% 8/15/21 | 3,153,000 | 3,205,825 | |

| San Diego Gas & Electric Co. 1.914% 2/1/22 | 137,146 | 137,406 | |

| Sempra Energy: | |||

| 3 month U.S. LIBOR + 0.500% 1.7189% 1/15/21 (a)(b) | 17,575,000 | 17,493,893 | |

| 2.85% 11/15/20 | 1,830,000 | 1,839,918 | |

| 2.875% 10/1/22 | 535,000 | 552,198 | |

| 47,499,316 | |||

| TOTAL UTILITIES | 87,249,888 | ||

| TOTAL NONCONVERTIBLE BONDS | |||

| (Cost $1,899,324,954) | 1,904,051,627 | ||

| U.S. Treasury Obligations - 3.6% | |||

| U.S. Treasury Notes: | |||

| 0.125% 4/30/22 | $9,120,000 | $9,115,012 | |

| 0.125% 5/15/23 | 113,726,000 | 113,490,552 | |

| 0.375% 3/31/22 (d) | 109,000,000 | 109,408,750 | |

| 1.75% 6/15/22 | 810,000 | 836,135 | |

| 2.125% 5/15/22 | 14,690,000 | 15,248,909 | |

| 2.25% 4/15/22 (d) | 23,070,000 | 23,961,259 | |

| 2.375% 3/15/22 | 4,290,000 | 4,458,584 | |

| 2.375% 8/15/24 | 10,000,000 | 10,882,422 | |

| TOTAL U.S. TREASURY OBLIGATIONS | |||

| (Cost $285,541,234) | 287,401,623 | ||

| U.S. Government Agency - Mortgage Securities - 0.4% | |||

| Fannie Mae - 0.3% | |||

| 12 month U.S. LIBOR + 1.550% 3.692% 12/1/35 (a)(b) | 6,228 | 6,481 | |

| 12 month U.S. LIBOR + 1.620% 4.27% 7/1/35 (a)(b) | 5,659 | 5,870 | |

| 12 month U.S. LIBOR + 1.650% 4.319% 8/1/37 (a)(b) | 2,279 | 2,362 | |

| 12 month U.S. LIBOR + 1.690% 4.295% 5/1/38 (a)(b) | 22,993 | 23,962 | |

| 12 month U.S. LIBOR + 1.780% 3.698% 5/1/38 (a)(b) | 12,613 | 13,146 | |

| 12 month U.S. LIBOR + 1.830% 3.609% 4/1/38 (a)(b) | 18,150 | 18,993 | |

| 12 month U.S. LIBOR + 1.850% 4.522% 8/1/38 (a)(b) | 9,155 | 9,504 | |

| 12 month U.S. LIBOR + 1.860% 3.661% 5/1/38 (a)(b) | 17,513 | 18,302 | |

| 12 month U.S. LIBOR + 2.040% 4.119% 12/1/36 (a)(b) | 3,797 | 3,979 | |

| 6 month U.S. LIBOR + 1.360% 3.069% 10/1/33 (a)(b) | 35,198 | 36,261 | |

| 3% 9/1/28 to 2/1/35 | 2,749,041 | 2,938,411 | |

| 3.5% 11/1/26 to 2/1/48 | 548,251 | 580,593 | |

| 4% 1/1/47 to 1/1/50 | 2,389,797 | 2,555,569 | |

| 4.5% 11/1/20 to 1/1/50 | 6,383,221 | 6,938,765 | |

| 5% 12/1/20 to 7/1/45 | 1,687,499 | 1,916,175 | |

| 5.5% 3/1/21 to 5/1/40 | 2,138,442 | 2,466,905 | |

| 6% to 6% 1/1/22 to 2/1/49 | 1,989,711 | 2,350,149 | |

| 6.5% 7/1/32 to 12/1/32 | 91,191 | 105,190 | |

| TOTAL FANNIE MAE | 19,990,617 | ||

| Freddie Mac - 0.0% | |||

| 12 month U.S. LIBOR + 1.590% 3.841% 9/1/35 (a)(b) | 3,601 | 3,735 | |

| 12 month U.S. LIBOR + 1.620% 4.314% 7/1/38 (a)(b) | 23,619 | 24,378 | |

| 12 month U.S. LIBOR + 1.620% 4.5% 6/1/38 (a)(b) | 28,875 | 30,012 | |

| 12 month U.S. LIBOR + 1.720% 4.102% 5/1/38 (a)(b) | 9,131 | 9,507 | |

| 12 month U.S. LIBOR + 1.720% 4.48% 7/1/35 (a)(b) | 10,466 | 10,854 | |

| 12 month U.S. LIBOR + 1.730% 3.733% 2/1/37 (a)(b) | 4,894 | 5,136 | |

| 12 month U.S. LIBOR + 1.730% 4.411% 10/1/36 (a)(b) | 23,988 | 24,926 | |

| 12 month U.S. LIBOR + 1.740% 3.743% 2/1/37 (a)(b) | 6,184 | 6,494 | |

| 12 month U.S. LIBOR + 1.770% 4.65% 5/1/37 (a)(b) | 7,334 | 7,697 | |

| 12 month U.S. LIBOR + 2.020% 4.048% 11/1/36 (a)(b) | 2,994 | 3,135 | |

| 12 month U.S. LIBOR + 2.050% 4.118% 12/1/36 (a)(b) | 6,214 | 6,516 | |

| 12 month U.S. LIBOR + 2.080% 4.082% 2/1/38 (a)(b) | 18,071 | 19,022 | |

| 12 month U.S. LIBOR + 2.190% 4.19% 2/1/37 (a)(b) | 8,474 | 8,904 | |

| U.S. TREASURY 1 YEAR INDEX + 2.340% 4.097% 11/1/34 (a)(b) | 14,252 | 14,862 | |

| 3% 11/1/34 | 452,674 | 486,635 | |

| 3.5% 11/1/49 to 1/1/50 | 764,524 | 806,307 | |

| 4% 12/1/49 | 327,564 | 354,733 | |

| 4.5% 5/1/50 | 484,560 | 527,995 | |

| 5% 10/1/22 to 12/1/41 | 728,290 | 818,653 | |

| 5.5% 11/1/21 to 10/1/38 | 23,583 | 24,951 | |

| 6% 7/1/21 to 1/1/38 | 128,441 | 150,174 | |

| 7% 3/1/39 | 180,972 | 212,420 | |

| 7.5% 6/1/38 | 188,075 | 219,906 | |

| TOTAL FREDDIE MAC | 3,776,952 | ||

| Ginnie Mae - 0.1% | |||

| 6% 7/15/36 | 233,835 | 271,906 | |

| 4% 2/20/48 to 4/20/50 (e) | 1,152,238 | 1,252,836 | |

| 4.5% 9/20/40 to 3/20/50 | 1,829,382 | 1,975,470 | |

| 5% 12/20/34 to 5/20/48 | 2,299,863 | 2,549,789 | |

| 5.5% 9/15/45 to 2/20/49 | 2,196,206 | 2,434,165 | |

| TOTAL GINNIE MAE | 8,484,166 | ||

| TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES | |||

| (Cost $31,308,388) | 32,251,735 | ||

| Asset-Backed Securities - 6.5% | |||

| Allegro CLO Ltd. Series 2015-1A Class AR, 3 month U.S. LIBOR + 0.840% 1.8314% 7/25/27 (a)(b)(c) | $547,421 | $539,972 | |

| Ally Auto Receivables Trust: | |||

| Series 2017-2: | |||

| Class C, 2.46% 9/15/22 | 745,000 | 747,150 | |

| Class D, 2.93% 11/15/23 | 200,000 | 200,707 | |

| Series 2019-1 Class A2, 2.85% 3/15/22 | 2,260,316 | 2,268,250 | |

| Series 2019-2 Class A2, 2.34% 6/15/22 | 2,937,146 | 2,953,901 | |

| Series 2019-3 Class A4, 1.96% 12/16/24 | 600,000 | 610,773 | |

| Series 2019-4 Class A2, 1.93% 10/17/22 | 3,150,000 | 3,166,556 | |

| Ally Master Owner Trust: | |||

| Series 2018-1 Class A1: | |||

| 1 month U.S. LIBOR + 0.280% 0.4636% 1/17/23 (a)(b) | 8,383,000 | 8,363,952 | |

| 2.7% 1/17/23 | 1,905,000 | 1,920,902 | |

| Series 2018-2 Class A, 3.29% 5/15/23 | 2,060,000 | 2,099,932 | |

| Series 2018-3 Class A, 1 month U.S. LIBOR + 0.320% 0.5036% 7/15/22 (a)(b) | 5,000,000 | 4,992,810 | |

| American Credit Acceptance Receivables Trust Series 2019-3 Class A, 2.44% 12/12/22 (c) | 1,118,081 | 1,120,975 | |

| American Express Credit Account Master Trust: | |||

| Series 2019-1 Class A, 2.87% 10/15/24 | 1,749,000 | 1,825,202 | |

| Series 2019-3 Class B, 2.2% 4/15/25 | 740,000 | 762,740 | |

| AmeriCredit Automobile Receivables Trust: | |||

| Series 2016-1 Class C, 2.89% 1/10/22 | 110,702 | 110,713 | |

| Series 2016-3 Class D, 2.71% 9/8/22 | 810,000 | 818,622 | |

| Series 2016-4 Class D, 2.74% 12/8/22 | 2,320,000 | 2,351,080 | |

| Series 2017-1: | |||

| Class C, 2.71% 8/18/22 | 240,000 | 242,391 | |

| Class D, 3.13% 1/18/23 | 1,330,000 | 1,347,868 | |

| Series 2017-3: | |||

| Class B, 2.24% 6/19/23 | 395,000 | 396,818 | |

| Class C, 2.69% 6/19/23 | 420,000 | 426,539 | |

| Class D, 3.18% 7/18/23 | 1,355,000 | 1,370,744 | |

| Series 2018-1 Class D, 3.82% 3/18/24 | 1,645,000 | 1,688,848 | |

| Series 2018-3 Class A3, 3.38% 7/18/23 | 3,532,000 | 3,591,634 | |

| Series 2019-3: | |||

| Class A2A, 2.17% 1/18/23 | 2,655,990 | 2,667,781 | |

| Class B, 2.13% 7/18/25 | 985,000 | 989,537 | |

| Series 2020-1: | |||

| Class C, 1.59% 10/20/25 | 705,000 | 676,626 | |

| Class D, 1.8% 12/18/25 | 690,000 | 645,546 | |

| Applebee's/IHOP Funding LLC Series 2019-1A Class A2I, 4.194% 6/7/49 (c) | 1,360,000 | 1,109,529 | |

| ARI Fleet Lease Trust: | |||

| Series 2017-A Class A2, 1.91% 4/15/26 (c) | 10,098 | 10,099 | |

| Series 2018-A Class A2, 2.55% 10/15/26 (c) | 244,931 | 245,414 | |

| Series 2020-A Class B, 2.06% 11/15/28 (c) | 770,000 | 735,017 | |

| Ascentium Equipment Receivables LLC Series 2017-1A Class A3, 2.29% 6/10/21 (c) | 84,602 | 84,749 | |

| Avis Budget Rental Car Funding (AESOP) LLC: | |||

| Series 2015-2A Class A, 2.63% 12/20/21 (c) | 890,000 | 874,143 | |

| Series 2016-1A Class A, 2.99% 6/20/22 (c) | 610,000 | 603,180 | |

| Series 2017-1A Class B, 3.41% 9/20/23 (c) | 540,000 | 456,553 | |

| Series 2017-2A Class A, 2.97% 3/20/24 (c) | 905,000 | 899,356 | |

| Series 2018-2A Class C, 4.95% 3/20/25 (c) | 430,000 | 337,723 | |

| Series 2019-1A Class B, 3.7% 3/20/23 (c) | 245,000 | 209,352 | |

| Series 2019-2A Class A, 3.35% 9/22/25 (c) | 650,000 | 639,741 | |

| Series 2020-1A Class A, 2.33% 8/20/26 (c) | 540,000 | 504,082 | |

| Babson CLO Ltd. Series 2013-IA Class AR, 3 month U.S. LIBOR + 0.800% 1.9353% 1/20/28 (a)(b)(c) | 1,441,923 | 1,422,304 | |

| Bank of The West Auto Trust Series 2019-1 Class A2, 2.4% 10/17/22 (c) | 851,699 | 856,673 | |

| Bayview Opportunity Master Fund Trust: | |||

| Series 2017-RT3 Class A, 3.5% 1/28/58 (a)(c) | 1,059,106 | 1,067,626 | |

| Series 2017-SPL4 Class A, 3.5% 1/28/55 (c) | 314,613 | 318,645 | |

| Bayview Opportunity Master Funding Trust Series 2017-SPL5 Class A, 3.5% 6/28/57 (c) | 907,213 | 910,045 | |

| BlueMountain CLO Ltd. Series 2015-2A Class A1R, 3 month U.S. LIBOR + 0.930% 2.0653% 7/18/27 (a)(b)(c) | 1,584,694 | 1,549,621 | |

| BMW Floorplan Master Owner Trust Series 2018-1 Class A2, 1 month U.S. LIBOR + 0.320% 0.5036% 5/15/23 (a)(b)(c) | 6,174,000 | 6,111,552 | |

| BMW Vehicle Lease Trust Series 2019-1 Class A2, 2.79% 3/22/21 | 1,795,090 | 1,800,618 | |

| BRE Grand Islander Timeshare Issuer Series 2019-A Class A, 3.28% 9/26/33 (c) | 302,768 | 292,585 | |

| Canadian Pacer Auto Receivables Trust: | |||

| Series 2018-2A Class A2B, 1 month U.S. LIBOR + 0.180% 0.3524% 6/21/21 (a)(b)(c) | 543,214 | 543,032 | |

| Series 2019-1A Class A2, 2.78% 3/21/22 (c) | 2,100,299 | 2,111,442 | |

| Capital Auto Receivables Asset Trust: | |||

| Series 2017-1: | |||

| Class B, 2.43% 5/20/22 (c) | 145,000 | 145,594 | |

| Class C, 2.7% 9/20/22 (c) | 235,000 | 233,568 | |

| Series 2018-1 Class B, 3.09% 8/22/22 (c) | 760,000 | 776,156 | |

| Series 2018-2: | |||

| Class B, 3.48% 10/20/23 (c) | 370,000 | 375,740 | |

| Class C, 3.69% 12/20/23 (c) | 460,000 | 468,292 | |

| Capital One Multi-Asset Execution Trust Series 2016-16 Class A2, 1 month U.S. LIBOR + 0.630% 0.8136% 2/15/24 (a)(b) | 13,275,000 | 13,322,773 | |

| Capital One Prime Auto Receivables Trust Series 2019-1 Class A2, 2.58% 4/15/22 | 5,016,937 | 5,051,108 | |

| Carlyle Global Market Strategies Series 2015-3A Class A1R, 3 month U.S. LIBOR + 1.000% 1.8871% 7/28/28 (a)(b)(c) | 1,615,000 | 1,575,484 | |

| CarMax Auto Owner Trust: | |||

| Series 2017-4 Class C, 2.7% 10/16/23 | 205,000 | 206,217 | |

| Series 2018-3 Class A2A, 2.88% 10/15/21 | 221,043 | 221,239 | |

| Series 2018-4 Class A2B, 1 month U.S. LIBOR + 0.200% 0.3836% 2/15/22 (a)(b) | 1,253,990 | 1,253,990 | |

| Series 2019-1 Class A2A, 3.02% 7/15/22 | 1,810,028 | 1,821,381 | |

| Series 2019-2: | |||

| Class A2A, 2.69% 7/15/22 | 1,724,824 | 1,736,943 | |

| Class B, 3.01% 12/16/24 | 1,935,000 | 1,970,846 | |

| Series 2019-4 Class A2A, 2.01% 3/15/23 | 1,291,000 | 1,300,303 | |

| Series 2020-1 Class A2, 1.87% 4/17/23 | 3,542,000 | 3,577,540 | |

| Carvana Auto Receivables Trust Series 2019-4A Class A2, 2.2% 7/15/22 (c) | 449,000 | 450,156 | |

| Chesapeake Funding II LLC: | |||

| Series 2017-2A Class A2, 1 month U.S. LIBOR + 0.450% 0.6336% 5/15/29 (a)(b)(c) | 2,037,885 | 2,029,136 | |

| Series 2017-4A Class A2, 1 month U.S. LIBOR + 0.340% 0.5236% 11/15/29 (a)(b)(c) | 1,220,776 | 1,215,900 | |

| Series 2018-3A Class A2, 1 month U.S. LIBOR + 0.480% 0.6636% 1/15/31 (a)(b)(c) | 1,883,954 | 1,845,908 | |

| Series 2019-1A Class A1, 2.94% 4/15/31 (c) | 2,763,682 | 2,785,796 | |

| CNH Equipment Trust: | |||

| Series 2018-A Class B, 3.47% 10/15/25 | 380,000 | 388,264 | |

| Series 2019-A Class A2, 2.96% 5/16/22 | 1,613,404 | 1,621,928 | |

| Series 2019-B Class A2, 2.55% 9/15/22 | 2,897,847 | 2,916,553 | |

| Series 2019-C Class A2, 1.99% 3/15/23 | 1,322,000 | 1,329,243 | |

| Series 2020-A Class A4, 1.51% 4/15/27 | 590,000 | 591,215 | |

| Cole Park CLO Ltd. Series 2015-1A Class AR, 3 month U.S. LIBOR + 1.050% 2.1853% 10/20/28 (a)(b)(c) | 1,610,000 | 1,581,593 | |

| Daimler Trucks Retail Trust: | |||

| Series 2018-1 Class A4, 3.03% 11/15/24 (c) | 420,000 | 422,562 | |

| Series 2020-1 Class A4, 1.37% 6/15/27 | 1,820,000 | 1,802,473 | |

| Dell Equipment Finance Trust: | |||

| Series 2018-2 Class A2 3.16% 2/22/21 (c) | 912,969 | 915,301 | |

| Series 2019-1 Class A2, 2.78% 8/23/21 (c) | 2,476,304 | 2,489,175 | |

| Series 2019-2: | |||

| Class A2, 1.95% 12/22/21 (c) | 4,210,000 | 4,224,755 | |

| Class A3, 1.91% 10/22/24 (c) | 1,714,000 | 1,729,652 | |

| Discover Card Master Trust: | |||

| Series 2018-A5 Class A5, 3.32% 3/15/24 | 5,000,000 | 5,183,439 | |

| Series 2019-A2 Class A, 1 month U.S. LIBOR + 0.270% 0.4536% 12/15/23 (a)(b) | 10,000,000 | 10,011,702 | |

| DLL Securitization Trust: | |||

| Series 2019-MA2 Class A2, 2.27% 5/20/22 (c) | 2,683,194 | 2,687,801 | |

| Series 2019-MT3: | |||

| Class A2, 2.13% 1/20/22 (c) | 4,210,000 | 4,231,378 | |

| Class A3, 2.08% 2/21/23 (c) | 1,639,000 | 1,645,392 | |

| Drive Auto Receivables Trust Series 2019-4 Class A2A, 2.32% 6/15/22 | 1,220,623 | 1,223,448 | |

| DT Auto Owner Trust: | |||

| Series 2019-3A Class A, 2.55% 8/15/22 (c) | 1,544,133 | 1,549,779 | |

| Series 2019-4A Class A, 2.17% 5/15/23 (c) | 2,518,112 | 2,529,440 | |

| Elara HGV Timeshare Issuer LLC: | |||

| Series 2014-A Class A, 2.53% 2/25/27 (c) | 47,022 | 46,414 | |

| Series 2017-A Class A, 2.69% 3/25/30 (c) | 183,136 | 175,650 | |

| Ellington Financial Mortgage Trust Series 2019-2 Class A1, 2.739% 11/25/59 (c) | 603,637 | 594,699 | |

| Enterprise Fleet Financing LLC: | |||

| Series 2017-3 Class A2, 2.13% 5/22/23 (c) | 247,333 | 247,804 | |

| Series 2018-1 Class A2, 2.87% 10/20/23 (c) | 209,481 | 210,825 | |

| Series 2018-2 Class A2, 3.14% 2/20/24 (c) | 458,228 | 462,676 | |

| Series 2019-1 Class A2, 2.98% 10/20/24 (c) | 2,684,233 | 2,721,012 | |

| Series 2019-3 Class A2, 2.06% 5/20/25 (c) | 855,000 | 850,095 | |

| Series 2020-1 Class A2, 1.78% 12/22/25 (c) | 7,440,000 | 7,354,966 | |

| Fifth Third Auto Trust Series 2019-1 Class A2A, 2.66% 5/16/22 | 2,346,613 | 2,359,599 | |

| Ford Credit Auto Lease Trust: | |||

| Series 2019-B Class A2A, 2.28% 2/15/22 | 2,853,118 | 2,869,359 | |

| Series 2020-A Class A2, 1.8% 7/15/22 | 7,000,000 | 7,050,572 | |

| Ford Credit Floorplan Master Owner Trust Series 2017-2: | |||

| Class A2, 1 month U.S. LIBOR + 0.350% 0.5336% 9/15/22 (a)(b) | 10,000,000 | 9,971,919 | |

| Class B, 2.34% 9/15/22 | 1,345,000 | 1,329,090 | |

| GM Financial Automobile Leasing Trust: | |||

| Series 2017-3 Class C, 2.73% 9/20/21 | 32,105 | 32,137 | |

| Series 2018-2 Class C, 3.5% 4/20/22 | 470,000 | 473,576 | |

| Series 2019-1: | |||

| Class A2A, 2.91% 4/20/21 | 1,587,624 | 1,591,533 | |

| Class C, 3.56% 12/20/22 | 835,000 | 849,549 | |

| Series 2020-1 Class A2A, 1.67% 4/20/22 | 11,633,000 | 11,682,828 | |

| 3.11% 12/20/21 | 435,000 | 437,357 | |

| GM Financial Consumer Automobile Receivables Trust: | |||

| Series 2020-1 Class A2, 1.83% 1/17/23 | 4,419,000 | 4,454,562 | |

| Series 2020-2 Class A3, 1.49% 12/16/24 | 335,000 | 341,752 | |

| GM Financial Securitized Auto Receivables Trust Series 2017-3A Class C, 2.52% 3/16/23 (c) | 245,000 | 246,873 | |

| GM Financial Securitized Term Auto Receivables Trust: | |||

| Series 2018-4 Class A2, 2.93% 11/16/21 | 90,507 | 90,611 | |

| Series 2019-1 Class A2, 2.99% 3/16/22 | 469,044 | 469,940 | |

| GMF Floorplan Owner Revolving Trust: | |||

| Series 2017-2 Class A2, 1 month U.S. LIBOR + 0.430% 0.6136% 7/15/22 (a)(b)(c) | 10,000,000 | 9,994,465 | |

| Series 2019-1 Class A, 2.7% 4/15/24 (c) | 710,000 | 718,988 | |

| Golub Capital Partners CLO 39B LLC Series 2018-39A Class A1, 3 month U.S. LIBOR + 1.150% 2.2853% 10/20/28 (a)(b)(c) | 930,000 | 914,038 | |

| GreatAmerica Leasing Receivables Funding LLC 2.6% 6/15/21 (c) | 175,333 | 176,098 | |

| Halcyon Loan Advisors Funding LLC Series 2017-3A Class B1R, 3 month U.S. LIBOR + 1.700% 2.7976% 10/22/25 (a)(b)(c) | 745,000 | 731,293 | |

| Hardee's Funding LLC / Carl's Jr. Funding LLC Series 2018-1A Class AI, 4.25% 6/20/48 (c) | 928,994 | 910,888 | |

| Hilton Grand Vacations Trust: | |||

| Series 2014-AA Class A, 1.77% 11/25/26 (c) | 74,576 | 74,019 | |

| Series 2017-AA: | |||

| Class A, 2.66% 12/26/28 (c) | 94,394 | 91,130 | |

| Class B, 2.96% 12/26/28 (a)(c) | 64,780 | 59,489 | |

| Honda Auto Receivables Owner Trust Series 2019-2 Class A2, 2.57% 12/21/21 | 3,285,898 | 3,315,241 | |

| Honda Automobile Receivables Series 2020-1 Class A2, 1.63% 10/21/22 | 11,000,000 | 11,104,663 | |

| HPEFS Equipment Trust Series 2020-1A Class A2, 1.73% 2/20/30 (c) | 4,012,000 | 4,008,258 | |

| Hyundai Auto Lease Securitization Trust: | |||

| Series 2019-A Class A2, 2.92% 7/15/21 (c) | 3,482,674 | 3,500,742 | |

| Series 2020-A: | |||

| Class A2, 1.9% 5/16/22 (c) | 5,500,000 | 5,552,126 | |

| Class A3, 1.95% 7/17/23 (c) | 2,698,000 | 2,722,813 | |

| Hyundai Auto Receivables Trust: | |||

| Series 2017-A Class B, 2.38% 4/17/23 | 340,000 | 342,980 | |

| Series 2019-A: | |||

| Class A2, 2.67% 12/15/21 | 2,522,501 | 2,535,152 | |

| Class B, 2.94% 5/15/25 | 635,000 | 657,164 | |

| Series 2019-B: | |||

| Class A2, 1.93% 7/15/22 | 4,998,313 | 5,032,714 | |

| Class A3, 1.94% 2/15/24 | 3,090,000 | 3,155,307 | |

| Series 2020-A Class A3, 1.41% 11/15/24 | 735,000 | 749,384 | |

| John Deere Owner Trust: | |||

| Series 2019-A Class A2, 2.85% 12/15/21 | 1,886,119 | 1,894,278 | |

| Series 2019-B Class A2, 2.28% 5/16/22 | 2,942,885 | 2,956,746 | |

| Series 2020-A Class A2, 1.01% 1/17/23 | 2,740,000 | 2,747,066 | |

| KKR Finanical CLO Ltd. Series 13 Class A1R, 3 month U.S. LIBOR + 0.800% 1.9761% 1/16/28 (a)(b)(c) | 1,588,620 | 1,558,311 | |

| Kubota Credit Owner Trust: | |||

| Series 2019-1A Class A3, 2.46% 10/16/23 (c) | 2,870,000 | 2,916,797 | |

| Series 2020-1A Class A3, 1.96% 3/15/24 (c) | 380,000 | 384,250 | |

| Lanark Master Issuer PLC Series 2020-1A Class 1A, 2.277% 12/22/69 (a)(c) | 1,768,000 | 1,779,041 | |

| Madison Park Funding Ltd. Series 2015-18A Class A1R, 3 month U.S. LIBOR + 1.190% 2.299% 10/21/30 (a)(b)(c) | 1,165,000 | 1,140,653 | |

| Magnetite CLO Ltd. Series 2015-16A Class AR, 3 month U.S. LIBOR + 0.800% 1.9353% 1/18/28 (a)(b)(c) | 2,032,004 | 1,998,841 | |

| Mercedes-Benz Auto Lease Trust: | |||

| Series 2019-A: | |||

| Class A2, 3.01% 2/16/21 | 758,922 | 759,534 | |

| Class A3, 3.1% 11/15/21 | 2,592,000 | 2,619,065 | |

| Series 2019-B Class A3, 2% 10/17/22 | 2,416,000 | 2,435,583 | |

| Series 2020-A Class A2, 1.82% 3/15/22 | 7,000,000 | 7,035,022 | |