Form N-CSR Fidelity Rutland Square For: Feb 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21991

Fidelity Rutland Square Trust II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Christina H. Lee, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | February 29 |

Date of reporting period: | February 29, 2020 |

Item 1.

Reports to Stockholders

Strategic Advisers® Emerging Markets Fund

Offered exclusively to certain clients of Strategic Advisers LLC - not available for sale to the general public

February 29, 2020

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

|

Board Approval of Investment Advisory Contracts and Management Fees | |

To view a fund's proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2020 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following the end of this reporting period, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended February 29, 2020 | Past 1 year | Past 5 years | Life of fundA |

| Strategic Advisers® Emerging Markets Fund | 1.80% | 3.05% | 1.94% |

A From September 30, 2010

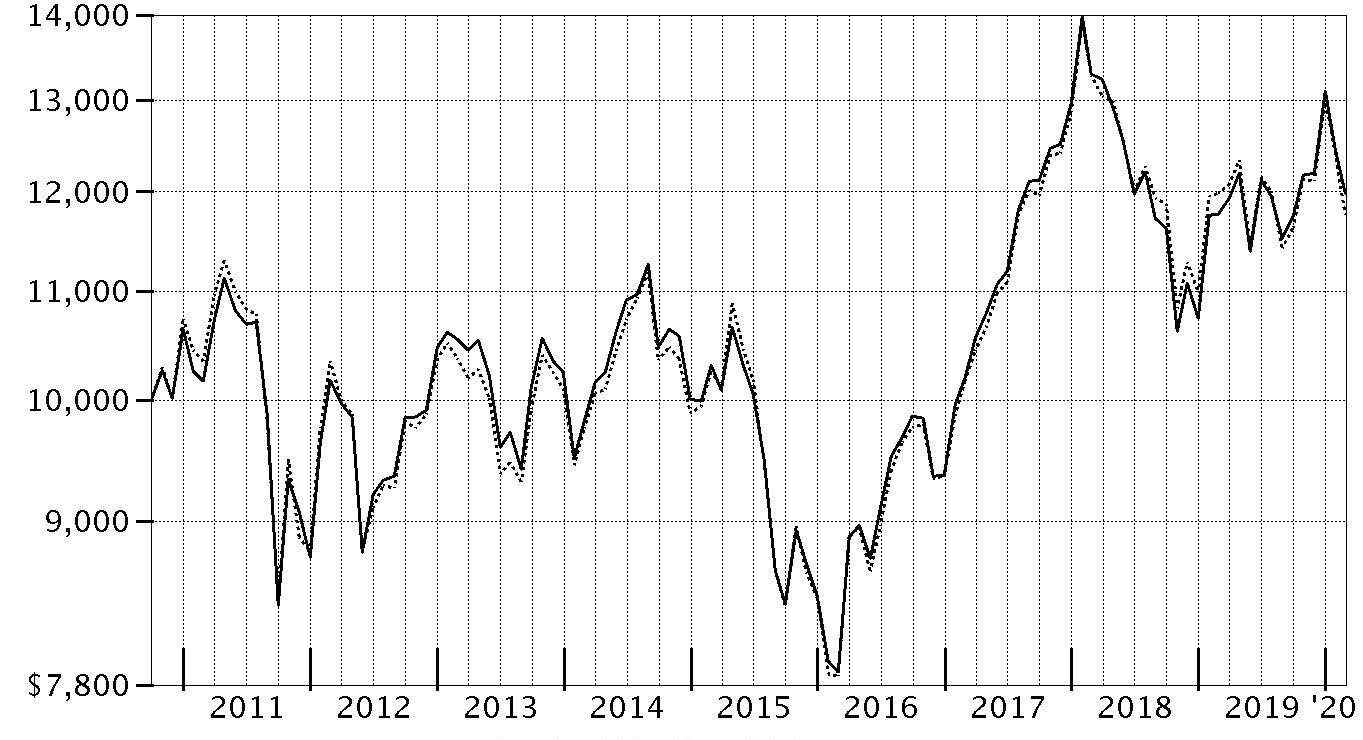

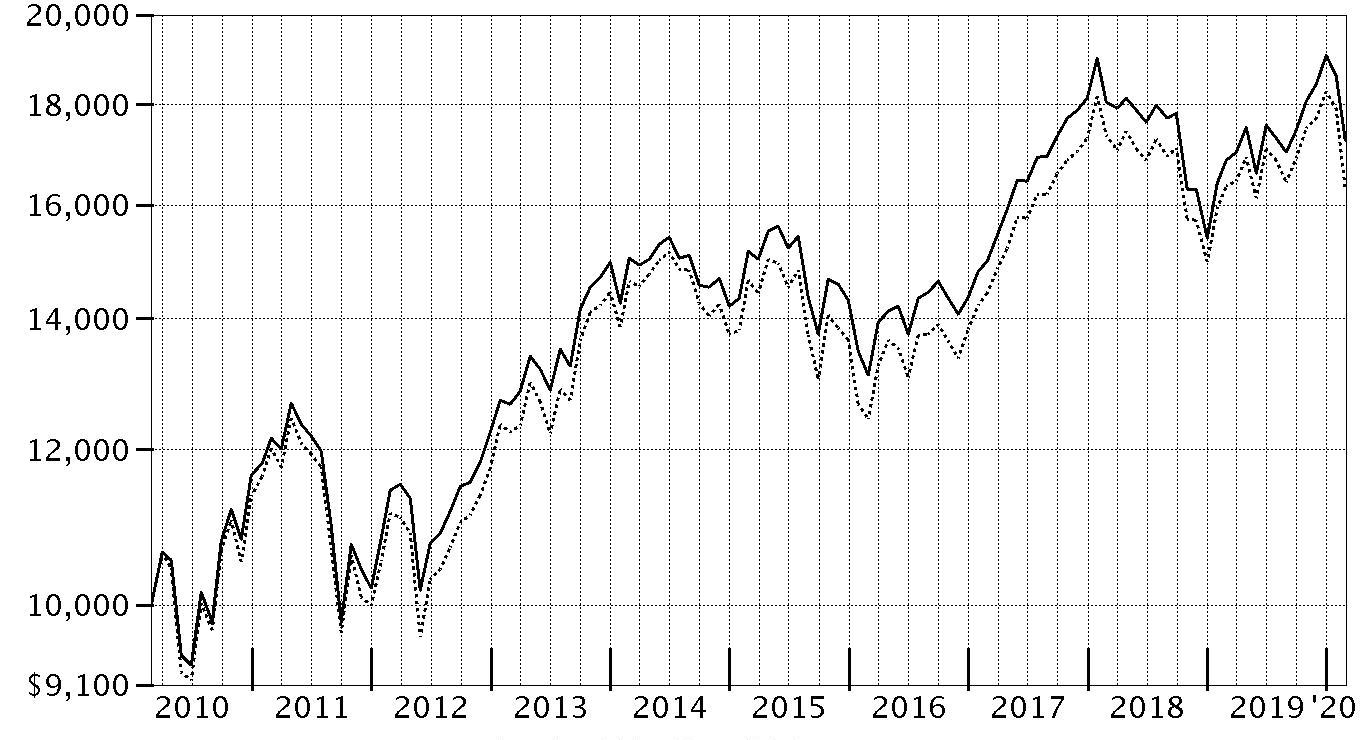

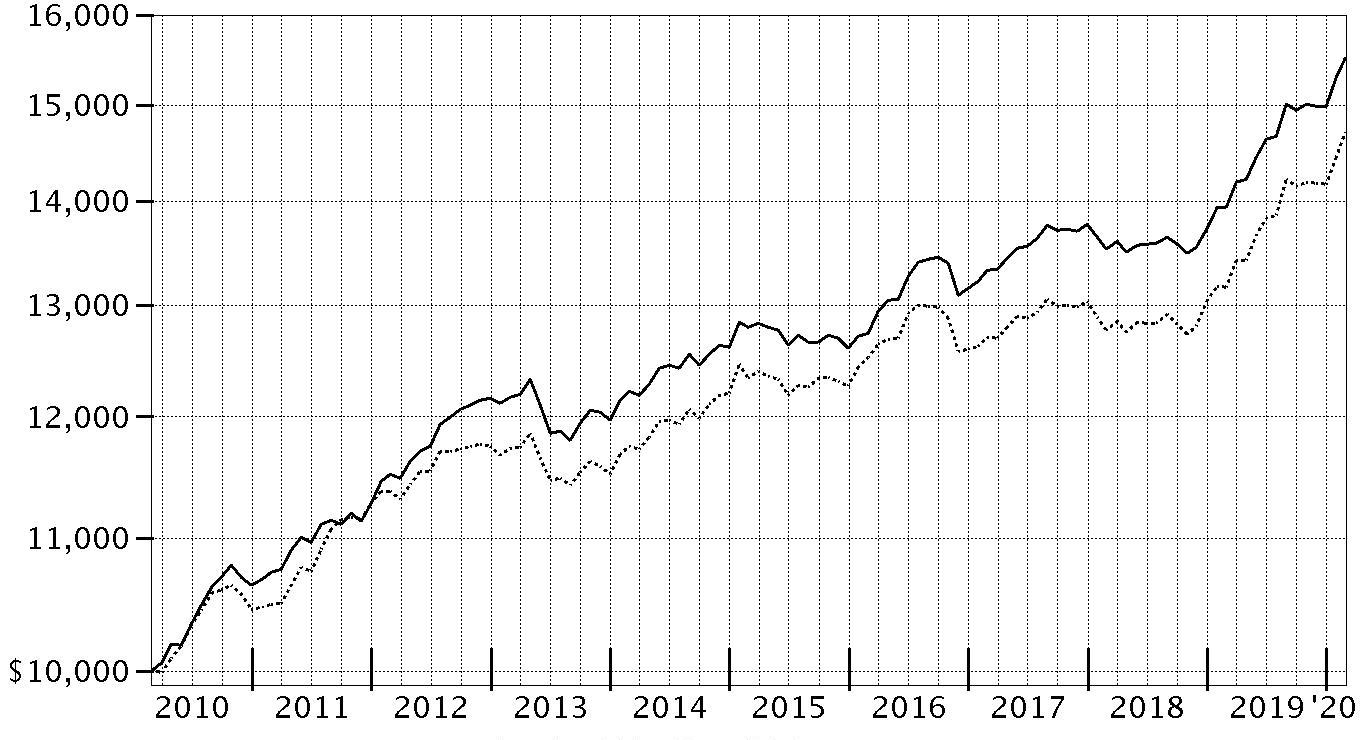

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Emerging Markets Fund on September 30, 2010, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the MSCI Emerging Markets Index performed over the same period.

| Period Ending Values | ||

|

| $11,980 | Strategic Advisers® Emerging Markets Fund |

|

| $11,755 | MSCI Emerging Markets Index |

Management's Discussion of Fund Performance

Market Recap: The MSCI ACWI (All Country World Index) ex USA Index returned -0.51% for the 12 months ending February 29, 2020, as the negative impact of the new coronavirus in early 2020 reversed a strong uptrend. For the first 10 months of the past year, international stocks gained ground as they benefited from accommodative monetary policies from central banks around the world, favorable economic growth and de-escalation of the U.S.–China trade conflict. However, in January, the outbreak and spread of the novel coronavirus in China became a growing concern for many investors, threatening global economic growth and corporate earnings. The index had a return of -2.68% for the month. The outbreak escalated globally in February, when the index returned -7.90% amid a surge of cases outside China and causing investors to generally favor safer asset classes. For the full 12 months, the energy (-17%) sector was hit hardest, as concerns about global growth and lack of demand for crude oil and natural gas pressured stocks. Materials (-8%) fared poorly, followed by financials (-5%). Conversely, the defensive health care (+10%) and utilities (+7%) sectors held up well, while information technology (+17%) led the way. Regionally, the U.K. (-7%) suffered from uncertainty tied to Brexit for most of the period, though Parliament approved a deal in January. Asia Pacific ex Japan (-3%) and emerging markets (-2%) lagged, whereas Europe ex U.K. (+3%), Canada (+2%) and Japan (+1) slightly outperformed. Comments from Portfolio Manager Wilfred Chilangwa: For the fiscal year, the Fund gained 1.80%, handily outpacing the -1.86% return the benchmark MSCI Emerging Markets Index. During a period in which growth stocks and strategies outperformed their value-oriented counterparts, growth-oriented underlying managers emphasizing momentum and/or company quality delivered the best results. Fidelity® Emerging Markets Fund (+12%) outpaced the MSCI EM Index by an outsized margin and was the portfolio’s top relative contributor. Its strategy of combining a GARP (growth at a reasonable price) and earnings momentum focus led to broadly positive stock selection the past 12 months. The Select Emerging Markets strategy managed by sub-adviser FIAM® (+4%) – a risk-managed GARP approach – also added considerable value. On the downside, Fidelity® SAI® Emerging Markets Low Volatility Index Fund (-7%) was the primary relative detractor. Adverse security selection among consumer discretionary and information technology stocks, along with an underweighted allocation in China, resulted in a disappointing outcome for this new portfolio addition. During the period, we added three new sub-advised strategies, one from FIAM (Concentrated Emerging Markets) and two from FIL (Global Emerging Markets and Greater China). Given my efforts to reduce sources of portfolio volatility during the past two years, I believe the Fund is well positioned for bouts of market turbulence.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

The information in the following tables is based on the direct investments of the Fund.Top Ten Holdings as of February 29, 2020

| (excluding cash equivalents) | % of fund's net assets |

| Fidelity Emerging Markets Fund | 8.3 |

| Fidelity SAI Emerging Markets Low Volatility Index Fund | 4.8 |

| Alibaba Group Holding Ltd. sponsored ADR | 3.7 |

| iShares MSCI China ETF | 3.7 |

| Tencent Holdings Ltd. | 3.6 |

| Samsung Electronics Co. Ltd. | 3.5 |

| Goldman Sachs Emerging Markets Equity Fund Institutional Shares | 3.3 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 3.3 |

| Invesco Oppenheimer Developing Markets Fund Class R6 | 2.6 |

| Aberdeen Emerging Markets Fund Institutional Service Class | 2.3 |

| 39.1 |

Top Five Market Sectors as of February 29, 2020

| (stocks only) | % of fund's net assets |

| Financials | 16.6 |

| Information Technology | 12.4 |

| Consumer Discretionary | 10.5 |

| Communication Services | 7.4 |

| Consumer Staples | 5.0 |

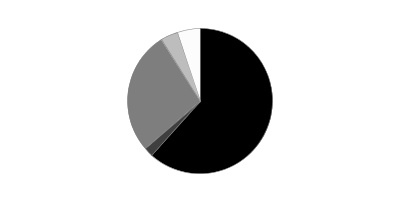

Geographic Diversification (% of fund's net assets)

| As of February 29, 2020 | ||

| United States of America* | 36.9% | |

| Cayman Islands | 13.0% | |

| China | 8.2% | |

| Korea (South) | 8.0% | |

| Taiwan | 6.4% | |

| India | 5.2% | |

| Brazil | 5.1% | |

| Russia | 3.0% | |

| Hong Kong | 2.5% | |

| Other | 11.7% | |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

Asset Allocation (% of fund's net assets)

| As of February 29, 2020 | ||

| Common Stocks | 61.5% | |

| Preferred Stocks | 2.1% | |

| Diversifed Emerging Markets Funds | 27.4% | |

| Other | 3.9% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.1% | |

Asset allocations of funds in the pie chart reflect the categorizations of assets as defined by Morningstar as of the reporting date.

Schedule of Investments February 29, 2020

Showing Percentage of Net Assets

| Common Stocks - 61.5% | |||

| Shares | Value | ||

| COMMUNICATION SERVICES - 7.3% | |||

| Diversified Telecommunication Services - 0.5% | |||

| China Telecom Corp. Ltd. (H Shares) | 13,872,000 | $5,214,235 | |

| China Tower Corp. Ltd. (H Shares) (a) | 11,608,000 | 2,814,512 | |

| China Unicom Ltd. | 3,906,000 | 3,138,734 | |

| Emirates Telecommunications Corp. | 35,503 | 152,728 | |

| HKBN Ltd. | 473,500 | 847,987 | |

| KT Corp. | 54,291 | 1,081,603 | |

| LG Telecom Ltd. | 400,125 | 4,398,223 | |

| Magyar Telekom PLC | 28,408 | 36,911 | |

| Ooredoo Qsc (b) | 62,110 | 107,871 | |

| PT Telekomunikasi Indonesia Tbk Series B | 11,122,900 | 2,712,040 | |

| Saudi Telecom Co. | 80,146 | 1,764,643 | |

| Telkom SA Ltd. | 405,832 | 690,387 | |

| Turk Telekomunikasyon A/S (b) | 1,007,763 | 1,217,904 | |

| 24,177,778 | |||

| Entertainment - 0.8% | |||

| Beijing Kunlun Tech Co. Ltd. (A Shares) (b) | 160,100 | 534,663 | |

| Bilibili, Inc. ADR (b)(c) | 34,498 | 885,909 | |

| CD Projekt RED SA | 59,735 | 4,286,035 | |

| Gravity Co. Ltd. ADR (b) | 498 | 13,695 | |

| HUYA, Inc. ADR (b) | 75,700 | 1,499,617 | |

| International Games Systems Co. Ltd. | 221,000 | 4,357,577 | |

| iQIYI, Inc. ADR (b) | 113,600 | 2,548,048 | |

| NetEase, Inc. ADR | 59,601 | 18,995,435 | |

| Nexon Co. Ltd. | 157,000 | 2,499,249 | |

| NHN Entertainment Corp. (b) | 2,843 | 165,013 | |

| Tencent Music Entertainment Group ADR (b) | 130,100 | 1,578,113 | |

| Wuhu Sanqi Interactive Entertainment Network Technology Group Co. Ltd. (A Shares) | 393,380 | 1,905,026 | |

| 39,268,380 | |||

| Interactive Media & Services - 4.9% | |||

| 58.com, Inc. ADR (b) | 30,362 | 1,675,072 | |

| Autohome, Inc. ADR Class A | 100,783 | 7,827,816 | |

| Baidu.com, Inc. sponsored ADR (b) | 122,721 | 14,724,066 | |

| Kakao Corp. | 19,564 | 2,802,165 | |

| Mail.Ru Group Ltd. GDR (Reg. S) (b) | 311,905 | 6,099,321 | |

| Momo, Inc. ADR | 130,100 | 3,658,412 | |

| NAVER Corp. | 52,858 | 7,658,921 | |

| Tencent Holdings Ltd. | 3,387,489 | 171,761,639 | |

| Weibo Corp. sponsored ADR (b) | 11,389 | 479,932 | |

| Yandex NV Series A (b)(c) | 477,740 | 19,401,021 | |

| 236,088,365 | |||

| Media - 0.0% | |||

| BlueFocus Intelligent Communications Group Co. Ltd. (A Shares) | 261,600 | 277,989 | |

| Cheil Worldwide, Inc. | 21,770 | 350,790 | |

| Hyundai HCN | 146,658 | 394,472 | |

| INNOCEAN Worldwide, Inc. | 3,518 | 198,332 | |

| 1,221,583 | |||

| Wireless Telecommunication Services - 1.1% | |||

| America Movil S.A.B. de CV Series L sponsored ADR | 159,370 | 2,530,796 | |

| Bharti Airtel Ltd. (b) | 1,139,936 | 8,226,699 | |

| China Mobile Ltd. | 2,312,000 | 18,400,317 | |

| China Mobile Ltd. sponsored ADR | 51,644 | 2,056,464 | |

| China United Network Communications Ltd. (A Shares) | 9,161,354 | 7,180,289 | |

| Etihad Etisalat Co. (b) | 96,454 | 589,805 | |

| Globe Telecom, Inc. | 1,795 | 62,577 | |

| Mobile Telecommunications Co. Saudi Arabia (b) | 1,131,224 | 3,051,576 | |

| Mobile TeleSystems OJSC sponsored ADR | 437,376 | 4,242,547 | |

| SK Telecom Co. Ltd. | 12,259 | 2,170,719 | |

| SK Telecom Co. Ltd. sponsored ADR | 19,876 | 381,818 | |

| Turkcell Iletisim Hizmet A/S | 584,447 | 1,298,198 | |

| VEON Ltd. sponsored ADR | 277,792 | 550,028 | |

| 50,741,833 | |||

| TOTAL COMMUNICATION SERVICES | 351,497,939 | ||

| CONSUMER DISCRETIONARY - 10.5% | |||

| Auto Components - 0.4% | |||

| Fuyao Glass Industries Group Co. Ltd. (A Shares) | 3,352,633 | 11,109,992 | |

| Huayu Automotive Systems Co. Ltd. (A Shares) | 584,831 | 2,354,564 | |

| Hyundai Mobis | 4,983 | 871,401 | |

| Motherson Sumi Systems Ltd. (b) | 1,258,401 | 1,798,112 | |

| Sailun Group Co. Ltd. A Shares | 642,920 | 417,460 | |

| Tianneng Power International Ltd. | 1,275,826 | 944,389 | |

| Yoo Sung Enterprise | 12,785 | 25,179 | |

| 17,521,097 | |||

| Automobiles - 0.8% | |||

| Bajaj Auto Ltd. | 225,034 | 8,965,498 | |

| Dongfeng Motor Group Co. Ltd. (H Shares) | 1,804,000 | 1,425,611 | |

| Guangzhou Automobile Group Co. Ltd. (H Shares) | 1,786,000 | 1,991,064 | |

| Hero Motocorp Ltd. | 241,697 | 6,836,348 | |

| Hyundai Motor Co. | 18,247 | 1,747,419 | |

| Kia Motors Corp. | 308,616 | 9,316,098 | |

| Mahindra & Mahindra Ltd. | 113,890 | 717,592 | |

| Maruti Suzuki India Ltd. | 22,078 | 1,912,327 | |

| PT Astra International Tbk | 10,474,100 | 4,033,414 | |

| 36,945,371 | |||

| Diversified Consumer Services - 0.5% | |||

| Estacio Participacoes SA | 738,009 | 8,563,538 | |

| New Oriental Education & Technology Group, Inc. sponsored ADR (b) | 93,574 | 11,967,179 | |

| TAL Education Group ADR (b) | 82,174 | 4,469,444 | |

| Visang Education, Inc. | 8,025 | 57,471 | |

| 25,057,632 | |||

| Hotels, Restaurants & Leisure - 0.5% | |||

| Huazhu Group Ltd. ADR | 7,837 | 264,499 | |

| Jubilant Foodworks Ltd. | 101,321 | 2,453,932 | |

| Sands China Ltd. | 2,547,922 | 11,848,900 | |

| Yum China Holdings, Inc. | 221,698 | 9,708,155 | |

| 24,275,486 | |||

| Household Durables - 1.4% | |||

| Cyrela Brazil Realty SA | 55,900 | 372,883 | |

| Direcional Engenharia SA | 11,200 | 37,593 | |

| Even Construtora e Incorporadora SA (b) | 28,253 | 90,599 | |

| Gree Electric Appliances, Inc. of Zhuhai (A Shares) | 437,800 | 3,706,800 | |

| Haier Electronics Group Co. Ltd. | 2,030,349 | 5,808,439 | |

| Haier Smart Home Co. Ltd. (A Shares) | 1,606,322 | 3,910,154 | |

| LG Electronics, Inc. | 165,448 | 8,321,586 | |

| Midea Group Co. Ltd. (A Shares) | 4,546,790 | 34,497,845 | |

| MRV Engenharia e Participacoes SA | 218,981 | 954,391 | |

| Whirlpool of India Ltd. | 1,156 | 34,726 | |

| Zhejiang Supor Cookware Co. Ltd. | 881,095 | 9,255,848 | |

| 66,990,864 | |||

| Internet & Direct Marketing Retail - 5.6% | |||

| Alibaba Group Holding Ltd. sponsored ADR (b) | 859,474 | 178,770,592 | |

| B2W Companhia Global do Varejo (b) | 115,700 | 1,607,987 | |

| Ctrip.com International Ltd. ADR (b) | 134,584 | 4,085,970 | |

| Danawa Co. Ltd. | 1,879 | 34,424 | |

| JD.com, Inc. sponsored ADR (b) | 806,347 | 31,052,423 | |

| MakeMyTrip Ltd. (b) | 21,761 | 500,721 | |

| Meituan Dianping Class B (b) | 686,700 | 8,712,589 | |

| MercadoLibre, Inc. (b) | 11,971 | 7,374,495 | |

| Naspers Ltd. Class N | 182,852 | 28,590,031 | |

| Prosus NV (b) | 22,243 | 1,555,450 | |

| Tongcheng-Elong Holdings Ltd. (b) | 1,582,000 | 2,411,053 | |

| Vipshop Holdings Ltd. ADR (b) | 599,377 | 7,690,007 | |

| 272,385,742 | |||

| Multiline Retail - 0.3% | |||

| Lojas Renner SA | 1,175,312 | 14,008,392 | |

| Magazine Luiza SA | 87,187 | 984,970 | |

| 14,993,362 | |||

| Specialty Retail - 0.4% | |||

| Chow Tai Fook Jewellery Group Ltd. | 82,000 | 71,007 | |

| Lewis Group Ltd. | 11,913 | 20,985 | |

| Mr Price Group Ltd. | 608,009 | 5,971,751 | |

| Petrobras Distribuidora SA | 506,581 | 2,956,632 | |

| SSI Group, Inc. | 417,000 | 16,262 | |

| Via Varejo SA (b) | 299,560 | 925,093 | |

| Zhongsheng Group Holdings Ltd. Class H | 2,752,000 | 10,467,838 | |

| 20,429,568 | |||

| Textiles, Apparel & Luxury Goods - 0.6% | |||

| adidas AG | 3,767 | 1,060,592 | |

| Anta Sports Products Ltd. | 791,000 | 6,357,428 | |

| CECEP COSTIN New Materials Group Ltd. (b)(d) | 741,000 | 28,518 | |

| Fila Holdings Corp. | 46,374 | 1,482,905 | |

| Jinli Group Holdings Ltd. | 46,782 | 14,902 | |

| LG Fashion Corp. | 7,144 | 74,661 | |

| Li Ning Co. Ltd. | 2,369,000 | 6,230,212 | |

| LPP SA | 18 | 31,859 | |

| Mavi Jeans Class B (a)(b) | 311,998 | 2,678,954 | |

| Pou Chen Corp. | 189,000 | 211,002 | |

| Regina Miracle International Holdings Ltd. (a) | 351,000 | 195,876 | |

| Shenzhou International Group Holdings Ltd. | 799,200 | 9,816,985 | |

| Titan Co. Ltd. | 19,698 | 340,660 | |

| Weiqiao Textile Co. Ltd. (H Shares) | 426,500 | 110,523 | |

| 28,635,077 | |||

| TOTAL CONSUMER DISCRETIONARY | 507,234,199 | ||

| CONSUMER STAPLES - 4.9% | |||

| Beverages - 1.3% | |||

| Anheuser-Busch InBev SA NV | 64,353 | 3,718,383 | |

| China Resources Beer Holdings Co. Ltd. | 1,784,000 | 8,262,014 | |

| Coca-Cola Icecek Sanayi A/S | 1,563 | 11,313 | |

| Fomento Economico Mexicano S.A.B. de CV: | |||

| unit | 564,551 | 4,566,487 | |

| sponsored ADR | 158,222 | 12,877,689 | |

| Heineken NV (Bearer) | 61,411 | 6,118,500 | |

| Kweichow Moutai Co. Ltd. (A Shares) | 105,621 | 15,967,133 | |

| Shanghai Bairun Investment Holding Group Co. Ltd. (A Shares) | 1,297,300 | 5,638,620 | |

| Thai Beverage PCL | 9,711,300 | 5,438,161 | |

| 62,598,300 | |||

| Food & Staples Retailing - 1.6% | |||

| Avenue Supermarts Ltd. (a)(b) | 21,122 | 676,691 | |

| Bidcorp Ltd. | 92,032 | 1,665,283 | |

| Bim Birlesik Magazalar A/S JSC | 1,198,264 | 9,238,792 | |

| C.P. ALL PCL (For. Reg.) | 5,745,900 | 11,974,419 | |

| Clicks Group Ltd. | 121,082 | 1,830,946 | |

| Dairy Farm International Holdings Ltd. | 36,100 | 173,280 | |

| Drogasil SA | 466,922 | 12,519,052 | |

| President Chain Store Corp. | 501,000 | 4,917,736 | |

| PUREGOLD Price Club, Inc. | 2,790,500 | 2,023,290 | |

| Shoprite Holdings Ltd. | 478,893 | 3,488,221 | |

| Sun Art Retail Group Ltd. | 697,000 | 890,586 | |

| Wal-Mart de Mexico SA de CV Series V | 3,773,300 | 10,582,033 | |

| X5 Retail Group NV GDR (Reg. S) | 402,707 | 12,613,461 | |

| Yifeng Pharmacy Chain Co. Ltd. | 180,000 | 2,103,276 | |

| 74,697,066 | |||

| Food Products - 1.3% | |||

| Angel Yeast Co. Ltd. (A Shares) | 99,400 | 412,274 | |

| AVI Ltd. | 158,412 | 741,913 | |

| Charoen Pokphand Foods PCL (For. Reg.) | 2,396,600 | 2,031,983 | |

| China Mengniu Dairy Co. Ltd. | 9,962,496 | 35,721,843 | |

| Gruma S.A.B. de CV Series B | 177,965 | 1,709,397 | |

| Inner Mongoli Yili Industries Co. Ltd. (A Shares) | 567,100 | 2,344,820 | |

| JBS SA | 2,007,047 | 10,188,056 | |

| Minerva SA (b) | 315,049 | 818,638 | |

| Tiger Brands Ltd. | 41,567 | 408,808 | |

| Unified-President Enterprises Corp. | 2,767,000 | 6,659,204 | |

| Universal Robina Corp. | 1,081,830 | 2,995,543 | |

| 64,032,479 | |||

| Household Products - 0.2% | |||

| C&S Paper Co. Ltd. (A Shares) | 1,873,500 | 3,925,482 | |

| Hindustan Unilever Ltd. | 195,203 | 5,852,269 | |

| Kimberly-Clark de Mexico SA de CV: | |||

| Series A | 452,900 | 857,572 | |

| Series A sponsored ADR | 2,476 | 23,324 | |

| 10,658,647 | |||

| Personal Products - 0.5% | |||

| Hengan International Group Co. Ltd. | 379,000 | 2,812,720 | |

| LG Household & Health Care Ltd. | 13,778 | 14,009,075 | |

| Natura & Co. Holding SA | 584,900 | 5,952,458 | |

| Organic Tea Cosmetics Holdings Co. Ltd. | 4,513 | 4,190 | |

| 22,778,443 | |||

| TOTAL CONSUMER STAPLES | 234,764,935 | ||

| ENERGY - 2.9% | |||

| Energy Equipment & Services - 0.2% | |||

| China Oilfield Services Ltd. (H Shares) | 2,642,000 | 3,389,352 | |

| Ezion Holdings Ltd. warrants 4/16/23 (b)(d) | 5,020,014 | 5,658 | |

| Tenaris SA sponsored ADR | 157,200 | 2,861,040 | |

| Yantai Jereh Oilfield Services (A Shares) | 1,054,500 | 5,218,244 | |

| 11,474,294 | |||

| Oil, Gas & Consumable Fuels - 2.7% | |||

| China Petroleum & Chemical Corp. (H Shares) | 17,134,000 | 8,867,822 | |

| China Shenhua Energy Co. Ltd. (H Shares) | 395,000 | 685,106 | |

| CNOOC Ltd. | 15,172,099 | 21,106,091 | |

| CNOOC Ltd. sponsored ADR | 9,900 | 1,369,467 | |

| Compania de Petroleos de Chile SA (COPEC) | 280,010 | 2,173,595 | |

| Cosan Ltd. Class A (b) | 23,052 | 420,930 | |

| Ecopetrol SA ADR | 240,399 | 4,243,042 | |

| Exxaro Resources Ltd. | 126,121 | 913,697 | |

| Gazprom OAO sponsored ADR (Reg. S) | 1,621,628 | 9,925,649 | |

| Grupa Lotos SA | 4,822 | 73,684 | |

| Lukoil PJSC | 33,201 | 2,873,410 | |

| Lukoil PJSC sponsored ADR (c) | 277,091 | 23,901,437 | |

| MOL Hungarian Oil and Gas PLC Series A (For. Reg.) | 159,190 | 1,228,561 | |

| NOVATEK OAO GDR (Reg. S) | 88,363 | 12,892,727 | |

| PetroChina Co. Ltd. (H Shares) | 3,564,000 | 1,392,252 | |

| Petroleo Brasileiro SA - Petrobras (ON) | 190,300 | 1,155,358 | |

| Polski Koncern Naftowy Orlen SA | 265,061 | 4,004,033 | |

| PT Adaro Energy Tbk | 20,554,500 | 1,654,675 | |

| PTT Exploration and Production PCL NVDR | 1,024,773 | 3,442,977 | |

| QGEP Participacoes SA | 30,900 | 91,831 | |

| Reliance Industries Ltd. | 1,034,417 | 18,946,748 | |

| Rosneft Oil Co. OJSC | 354,531 | 2,174,094 | |

| SK Energy Co. Ltd. | 26,610 | 2,503,980 | |

| Susco Public Co. Ltd. unit | 267,500 | 20,179 | |

| Tatneft PAO sponsored ADR | 34,126 | 2,052,063 | |

| Tupras Turkiye Petrol Rafinerileri A/S | 74,801 | 1,216,120 | |

| 129,329,528 | |||

| TOTAL ENERGY | 140,803,822 | ||

| FINANCIALS - 15.4% | |||

| Banks - 10.2% | |||

| Absa Group Ltd. | 725,731 | 6,245,374 | |

| Abu Dhabi Commercial Bank PJSC | 685,646 | 1,331,025 | |

| Abu Dhabi Islamic Bank (b) | 39,990 | 59,775 | |

| Agricultural Bank of China Ltd. (H Shares) | 1,597,000 | 639,210 | |

| Akbank TAS (b) | 3,171,440 | 3,440,827 | |

| Al Rajhi Bank | 278,872 | 4,601,407 | |

| Alpha Bank AE (b) | 4,318,497 | 6,304,732 | |

| AMMB Holdings Bhd | 69,200 | 60,767 | |

| Arab National Bank | 151,132 | 1,019,230 | |

| Axis Bank Ltd. | 457,920 | 4,401,875 | |

| Banco de Chile sponsored ADR | 1,046 | 18,901 | |

| Banco do Brasil SA | 766,791 | 8,035,025 | |

| Banco Santander Chile sponsored ADR | 299,918 | 5,419,518 | |

| Banco Santander Mexico SA | 1,677,122 | 2,146,355 | |

| Bancolombia SA sponsored ADR | 65,589 | 3,114,166 | |

| Bank Al-Jazira | 65,767 | 244,029 | |

| Bank of China Ltd. (H Shares) | 44,106,000 | 17,427,387 | |

| Bank Polska Kasa Opieki SA | 112,122 | 2,537,193 | |

| Capitec Bank Holdings Ltd. | 64,531 | 5,462,220 | |

| China Construction Bank Corp. (H Shares) | 53,329,000 | 43,848,778 | |

| China Merchants Bank Co. Ltd.: | |||

| (A Shares) | 784,081 | 3,835,206 | |

| (H Shares) | 1,122,000 | 5,289,737 | |

| Chinatrust Financial Holding Co. Ltd. | 14,175,058 | 10,578,390 | |

| Chongqing Rural Commercial Bank Co. Ltd. (H Shares) | 34,000 | 15,353 | |

| Commercial International Bank SAE sponsored GDR | 903,499 | 4,449,281 | |

| Credicorp Ltd. (United States) | 73,473 | 13,318,451 | |

| Dubai Islamic Bank Pakistan Ltd. (b) | 139,333 | 204,854 | |

| E.SUN Financial Holdings Co. Ltd. | 6,564,128 | 6,293,162 | |

| EFG Eurobank Ergasias SA (b) | 3,690,736 | 2,351,686 | |

| Emirates NBD Bank PJSC (b) | 399,276 | 1,364,312 | |

| Grupo Aval Acciones y Valores SA ADR | 190,142 | 1,545,854 | |

| Grupo Financiero Banorte S.A.B. de CV Series O | 3,268,218 | 17,706,791 | |

| Grupo Financiero Inbursa S.A.B. de CV Series O | 320,573 | 343,977 | |

| Guaranty Trust Bank PLC GDR (Reg. S) | 53,450 | 208,423 | |

| Habib Bank Ltd. | 309,900 | 314,381 | |

| Hana Financial Group, Inc. | 320,325 | 8,375,835 | |

| HDFC Bank Ltd. | 792,846 | 12,947,027 | |

| HDFC Bank Ltd. sponsored ADR | 222,926 | 12,227,491 | |

| ICICI Bank Ltd. | 893,695 | 6,173,334 | |

| ICICI Bank Ltd. sponsored ADR | 2,258,563 | 31,326,269 | |

| Industrial & Commercial Bank of China Ltd. (H Shares) | 47,054,000 | 32,174,191 | |

| JB Financial Group Co. Ltd. | 5,224 | 21,795 | |

| JSC Halyk Bank of Kazakhstan GDR unit | 199,312 | 2,827,309 | |

| Kasikornbank PCL (For. Reg.) | 830,800 | 3,146,770 | |

| KB Financial Group, Inc. | 304,379 | 9,731,710 | |

| Kiatnakin Bank PCL (For. Reg.) | 485,800 | 958,512 | |

| Komercni Banka A/S | 60,829 | 1,866,106 | |

| Kotak Mahindra Bank Ltd. | 79,595 | 1,777,964 | |

| Krung Thai Bank PCL NVDR | 3,037,100 | 1,347,683 | |

| Malayan Banking Bhd | 1,072,125 | 2,142,469 | |

| Mega Financial Holding Co. Ltd. | 1,084,000 | 1,154,190 | |

| National Bank of Abu Dhabi PJSC | 3,551,234 | 13,845,834 | |

| National Bank of Kuwait | 1,217,016 | 4,028,880 | |

| National Commercial Bank | 166,158 | 1,962,095 | |

| Nova Ljubljanska banka d.d. unit | 227,428 | 2,901,732 | |

| OTP Bank PLC | 649,242 | 28,168,585 | |

| Powszechna Kasa Oszczednosci Bank SA | 16,134 | 129,181 | |

| PT Bank Bukopin Tbk (b) | 4,000 | 46 | |

| PT Bank Central Asia Tbk | 6,772,700 | 14,845,891 | |

| PT Bank Mandiri (Persero) Tbk | 2,167,000 | 1,098,792 | |

| PT Bank Negara Indonesia (Persero) Tbk | 7,216,300 | 3,533,334 | |

| PT Bank Rakyat Indonesia Tbk | 8,717,100 | 2,545,715 | |

| Qatar National Bank SAQ | 574,059 | 2,970,208 | |

| Riyad Bank | 94,706 | 553,367 | |

| Sberbank of Russia | 4,484,193 | 15,871,179 | |

| Sberbank of Russia sponsored ADR (c) | 3,249,650 | 46,368,150 | |

| Shinhan Financial Group Co. Ltd. | 82,930 | 2,243,117 | |

| Sinopac Holdings Co. | 414,000 | 176,162 | |

| Standard Bank Group Ltd. | 562,715 | 5,408,957 | |

| State Bank of India (b) | 1,216,886 | 5,083,010 | |

| TCS Group Holding PLC GDR unit | 113,599 | 2,485,355 | |

| Thanachart Capital PCL: | |||

| (For. Reg.) | 1,420,500 | 2,375,004 | |

| NVDR | 626,962 | 1,048,249 | |

| TISCO Financial Group PCL | 682,700 | 2,131,409 | |

| Turkiye Garanti Bankasi A/S (b) | 4,071,609 | 6,207,966 | |

| Turkiye Halk Bankasi A/S (b) | 289,353 | 277,708 | |

| Turkiye Is Bankasi A/S Series C (b) | 5,487,232 | 5,028,623 | |

| Turkiye Vakiflar Bankasi TAO (b) | 3,823,822 | 3,252,619 | |

| United Bank Ltd. | 2,898,095 | 3,113,265 | |

| Woori Financial Group, Inc. (b) | 132,508 | 1,060,408 | |

| Yapi ve Kredi Bankasi A/S (b) | 1,580,932 | 581,043 | |

| 491,672,191 | |||

| Capital Markets - 0.3% | |||

| BM&F BOVESPA SA | 937,962 | 10,067,796 | |

| CITIC Securities Co. Ltd. (H Shares) | 487,000 | 1,040,849 | |

| Hong Kong Exchanges and Clearing Ltd. | 9,400 | 308,470 | |

| Huatai Securities Co. Ltd. (H Shares) (a) | 644,400 | 1,119,330 | |

| Korea Investment Holdings Co. Ltd. | 4,137 | 216,348 | |

| Meritz Securities Co. Ltd. | 66,766 | 193,205 | |

| Moscow Exchange MICEX-RTS OAO (b) | 879,379 | 1,323,995 | |

| Noah Holdings Ltd. sponsored ADR (b)(c) | 14,820 | 420,592 | |

| Samsung Securities Co. Ltd. | 3,829 | 105,541 | |

| XP, Inc. Class A (b) | 19,572 | 678,170 | |

| 15,474,296 | |||

| Consumer Finance - 0.3% | |||

| Compartamos S.A.B. de CV | 284,714 | 273,243 | |

| Qudian, Inc. ADR (b)(c) | 27,998 | 73,355 | |

| Shriram Transport Finance Co. Ltd. | 813,138 | 13,410,124 | |

| 13,756,722 | |||

| Diversified Financial Services - 0.4% | |||

| Alexander Forbes Group Holdings Ltd. | 888 | 272 | |

| Aseer Trading Tourism & Manufacturing Co. (b) | 14,265 | 42,131 | |

| Chailease Holding Co. Ltd. | 451,000 | 1,687,581 | |

| FirstRand Ltd. | 1,936,110 | 6,912,542 | |

| Haci Omer Sabanci Holding A/S | 879,341 | 1,201,010 | |

| Power Finance Corp. Ltd. | 281,909 | 425,357 | |

| Rec Ltd. | 844,074 | 1,370,737 | |

| Yuanta Financial Holding Co. Ltd. | 14,674,000 | 9,224,600 | |

| 20,864,230 | |||

| Insurance - 3.6% | |||

| AIA Group Ltd. | 4,451,784 | 44,617,763 | |

| BB Seguridade Participacoes SA | 1,347,923 | 9,600,248 | |

| Cathay Financial Holding Co. Ltd. | 551,738 | 726,916 | |

| China Life Insurance Co. Ltd. (b) | 299,000 | 235,984 | |

| China Life Insurance Co. Ltd. (H Shares) | 2,880,000 | 6,959,267 | |

| China Pacific Insurance (Group) Co. Ltd. (H Shares) | 2,199,000 | 7,235,965 | |

| FPC Par Corretora de Seguros | 17,800 | 56,124 | |

| Fubon Financial Holding Co. Ltd. | 2,413,000 | 3,512,196 | |

| Hyundai Fire & Marine Insurance Co. Ltd. | 262,911 | 4,947,944 | |

| IRB Brasil Resseguros SA | 1,043,525 | 7,758,941 | |

| Liberty Holdings Ltd. | 494,964 | 3,018,162 | |

| MMI Holdings Ltd. | 1,647,333 | 1,852,032 | |

| Old Mutual Ltd. | 760,307 | 773,467 | |

| PICC Property & Casualty Co. Ltd. (H Shares) | 2,648,000 | 2,741,419 | |

| Ping An Insurance Group Co. of China Ltd.: | |||

| (A Shares) | 483,398 | 5,373,278 | |

| (H Shares) | 4,007,500 | 45,655,028 | |

| Porto Seguro SA | 489,321 | 6,672,509 | |

| Powszechny Zaklad Ubezpieczen SA | 420,867 | 3,752,963 | |

| Qualitas Controladora S.A.B. de CV | 96,305 | 412,316 | |

| Samsung Fire & Marine Insurance Co. Ltd. | 16,957 | 2,795,901 | |

| Sanlam Ltd. | 3,134,202 | 13,165,239 | |

| Sul America SA unit | 245,202 | 2,964,203 | |

| 174,827,865 | |||

| Thrifts & Mortgage Finance - 0.6% | |||

| Housing Development Finance Corp. Ltd. | 741,545 | 22,242,056 | |

| LIC Housing Finance Ltd. | 1,330,842 | 5,875,490 | |

| 28,117,546 | |||

| TOTAL FINANCIALS | 744,712,850 | ||

| HEALTH CARE - 0.9% | |||

| Biotechnology - 0.1% | |||

| Hualan Biological Engineer, Inc. (A Shares) | 247,300 | 1,467,824 | |

| Innovent Biolgics, Inc. (a)(b) | 373,000 | 1,703,502 | |

| Medy-Tox, Inc. | 20 | 4,888 | |

| 3,176,214 | |||

| Health Care Equipment & Supplies - 0.0% | |||

| Shenzhen Mindray Bio-Medical Electronics Co. Ltd. (A Shares) | 33,000 | 1,128,012 | |

| Supermax Corp. Bhd | 64,476 | 24,331 | |

| 1,152,343 | |||

| Health Care Providers & Services - 0.2% | |||

| Aier Eye Hospital Group Co. Ltd. (A Shares) | 46,100 | 263,732 | |

| Hapvida Participacoes e Investimentos SA (a) | 62,200 | 767,781 | |

| Mediclinic International PLC (London) | 191,426 | 845,074 | |

| Qualicorp Consultoria E Corret | 229,832 | 1,760,269 | |

| Selcuk Ecza Deposu Tic A/S | 122,624 | 129,301 | |

| Shanghai Pharmaceuticals Holding Co. Ltd. (H Shares) | 705,300 | 1,290,260 | |

| Sinopharm Group Co. Ltd. (H Shares) | 779,700 | 2,405,617 | |

| 7,462,034 | |||

| Life Sciences Tools & Services - 0.1% | |||

| Hangzhou Tigermed Consulting Co. Ltd. (A Shares) | 13,796 | 150,944 | |

| Pharmaron Beijing Co. Ltd. (H Shares) (a)(b) | 86,500 | 588,133 | |

| WuXi AppTec Co. Ltd. | 21,637 | 328,023 | |

| WuXi AppTec Co. Ltd. (H Shares) (a) | 140,560 | 2,071,885 | |

| Wuxi Biologics (Cayman), Inc. (a)(b) | 264,500 | 3,868,249 | |

| 7,007,234 | |||

| Pharmaceuticals - 0.5% | |||

| Alembic Pharmaceuticals Ltd. (b) | 4,278 | 37,151 | |

| Aurobindo Pharma Ltd. | 171,185 | 1,192,931 | |

| CSPC Pharmaceutical Group Ltd. | 1,398,000 | 3,185,180 | |

| Dr. Reddy's Laboratories Ltd. | 54,473 | 2,203,225 | |

| Hansoh Pharmaceutical Group Co. Ltd. (a) | 1,200,000 | 4,164,208 | |

| J.B. Chemicals & Pharmaceuticals Ltd. | 5,061 | 37,585 | |

| Jiangsu Hengrui Medicine Co. Ltd. (A Shares) | 49,800 | 598,929 | |

| Lijun International Pharmaceutical Holding Ltd. | 814,000 | 681,901 | |

| Pfizer Ltd. | 2,143 | 123,905 | |

| PT Kalbe Farma Tbk | 35,808,056 | 3,044,839 | |

| Richter Gedeon PLC | 188,971 | 3,834,156 | |

| Sino Biopharmaceutical Ltd. | 359,000 | 519,502 | |

| Yunnan Baiyao Group Co. Ltd. (A Shares) | 253,500 | 2,852,983 | |

| 22,476,495 | |||

| TOTAL HEALTH CARE | 41,274,320 | ||

| INDUSTRIALS - 2.4% | |||

| Aerospace & Defense - 0.1% | |||

| Elbit Systems Ltd. (Israel) | 16,800 | 2,518,668 | |

| Garden Reach Shipbuilders & Engineers Ltd. (b) | 23,582 | 49,561 | |

| 2,568,229 | |||

| Air Freight & Logistics - 0.0% | |||

| Hyundai Glovis Co. Ltd. | 1,943 | 199,015 | |

| Airlines - 0.1% | |||

| Air Arabia PJSC (b) | 835,141 | 318,335 | |

| AirAsia Group BHD | 1,811,200 | 429,856 | |

| Azul SA sponsored ADR (b) | 32,566 | 960,697 | |

| Copa Holdings SA Class A | 24,058 | 2,000,182 | |

| Wizz Air Holdings PLC (a)(b) | 6,780 | 301,694 | |

| 4,010,764 | |||

| Commercial Services & Supplies - 0.0% | |||

| Country Garden Services Holdings Co. Ltd. | 319,502 | 1,246,037 | |

| Frontken Corp. BHD | 248,800 | 134,040 | |

| Indian Railway Catering & Tourism Corp. Ltd. | 14,408 | 346,361 | |

| 1,726,438 | |||

| Construction & Engineering - 0.4% | |||

| China Communications Construction Co. Ltd. (H Shares) | 2,213,000 | 1,649,459 | |

| China Communications Services Corp. Ltd. (H Shares) | 1,926,000 | 1,489,901 | |

| China National Chemical Engineering Co. Ltd. (A Shares) | 3,939,592 | 3,915,955 | |

| China Railway Construction Corp. Ltd. (H Shares) | 1,635,000 | 1,870,969 | |

| Daelim Industrial Co. | 23,895 | 1,442,622 | |

| Larsen & Toubro Ltd. | 346,238 | 5,668,329 | |

| Orascom Construction PLC | 1,460 | 8,219 | |

| Sinopec Engineering Group Co. Ltd. (H Shares) | 465,000 | 230,263 | |

| Tekfen Holding A/S | 773,855 | 1,844,360 | |

| 18,120,077 | |||

| Electrical Equipment - 0.1% | |||

| DONGYANG E&P, Inc. | 21,665 | 243,557 | |

| Polycab India Ltd. | 51,478 | 754,155 | |

| Weg SA | 252,529 | 2,436,688 | |

| Zhuzhou CRRC Times Electric Co. Ltd. (H Shares) | 486,700 | 1,701,421 | |

| 5,135,821 | |||

| Industrial Conglomerates - 0.3% | |||

| Astra Industrial Group (b) | 3,085 | 12,861 | |

| Fosun International Ltd. | 1,508,000 | 1,921,031 | |

| Hanwha Corp. | 50,367 | 840,946 | |

| Hong Leong Industries Bhd | 3,000 | 6,622 | |

| Industries Qatar QSC (b) | 243,150 | 600,321 | |

| Koc Holding A/S | 595,641 | 1,644,268 | |

| LG Corp. | 39,163 | 2,201,341 | |

| Mannai Corp. | 86,440 | 72,238 | |

| SK C&C Co. Ltd. | 4,071 | 650,894 | |

| SM Investments Corp. | 319,900 | 6,109,005 | |

| 14,059,527 | |||

| Machinery - 0.6% | |||

| Airtac International Group | 378,000 | 5,900,529 | |

| Estun Automation Co. Ltd. (A Shares) | 198,200 | 314,650 | |

| HIWIN Technologies Corp. | 524,270 | 5,116,752 | |

| Lonking Holdings Ltd. | 10,993,000 | 3,060,271 | |

| Sany Heavy Industry Co. Ltd. (A Shares) | 910,100 | 2,268,758 | |

| Shenzhen Inovance Technology Co. Ltd. (A Shares) | 1,032,300 | 4,179,723 | |

| Sinotruk Hong Kong Ltd. (c) | 1,614,983 | 3,087,010 | |

| Techtronic Industries Co. Ltd. | 136,000 | 1,100,038 | |

| Weichai Power Co. Ltd. (H Shares) | 1,951,000 | 3,839,428 | |

| XCMG Construction Machinery Co. Ltd. (A Shares) | 1,398,600 | 1,054,158 | |

| Zoomlion Heavy Industry Science and Technology Co. Ltd. (H Shares) | 327,800 | 271,660 | |

| 30,192,977 | |||

| Marine - 0.0% | |||

| Costamare, Inc. | 9,179 | 59,939 | |

| Qatar Navigation QPSC | 23,620 | 36,391 | |

| 96,330 | |||

| Professional Services - 0.1% | |||

| 51job, Inc. sponsored ADR (b) | 11,609 | 868,005 | |

| Centre Testing International Group Co. Ltd. (A Shares) | 1,458,652 | 3,396,314 | |

| Sporton International, Inc. | 169,000 | 1,169,154 | |

| 5,433,473 | |||

| Road & Rail - 0.2% | |||

| Globaltrans Investment PLC GDR (Reg. S) | 49,724 | 367,695 | |

| Localiza Rent A Car SA | 175,965 | 1,949,352 | |

| Rumo SA (b) | 1,060,178 | 5,007,035 | |

| United International Transportation Co. | 260,323 | 2,411,362 | |

| 9,735,444 | |||

| Trading Companies & Distributors - 0.0% | |||

| Al Hassan Ghazi Ibrahim Shaker Co. (b) | 13,536 | 43,875 | |

| CCS Supply Chain Management Co. Ltd. A Shares | 88,072 | 78,726 | |

| 122,601 | |||

| Transportation Infrastructure - 0.5% | |||

| Airports of Thailand PCL (For. Reg.) | 970,200 | 1,837,384 | |

| DP World Ltd. | 295,314 | 4,798,853 | |

| Grupo Aeroportuario del Pacifico S.A.B. de CV Series B | 200,019 | 2,171,217 | |

| Grupo Aeroportuario del Sureste S.A.B. de CV Series B sponsored ADR | 11,676 | 1,949,892 | |

| Grupo Aeroportuario Norte S.A.B. de CV | 510,888 | 3,355,306 | |

| Shanghai International Airport Co. Ltd. (A Shares) | 864,317 | 8,122,808 | |

| Zhejiang Expressway Co. Ltd. (H Shares) | 1,226,000 | 926,381 | |

| 23,161,841 | |||

| TOTAL INDUSTRIALS | 114,562,537 | ||

| INFORMATION TECHNOLOGY - 12.1% | |||

| Communications Equipment - 0.0% | |||

| Accton Technology Corp. | 380,000 | 2,015,806 | |

| Electronic Equipment & Components - 1.9% | |||

| AAC Technology Holdings, Inc. | 186,500 | 1,221,402 | |

| AVIC Jonhon OptronicTechnology Co. Ltd. | 217,329 | 1,221,241 | |

| Chaozhou Three-Circle Group Co. (A Shares) | 62,900 | 214,106 | |

| China Railway Signal & Communications Corp. (H Shares) (a) | 474,000 | 243,233 | |

| Coretronic Corp. | 87,400 | 105,919 | |

| Delta Electronics, Inc. | 671,000 | 3,058,847 | |

| FLEXium Interconnect, Inc. | 380,000 | 1,391,668 | |

| Foxconn Industrial Internet Co. Ltd. (A Shares) | 175,500 | 428,713 | |

| Foxconn Technology Co. Ltd. | 31,000 | 60,512 | |

| Hangzhou Hikvision Digital Technology Co. Ltd. (A Shares) | 679,203 | 3,399,925 | |

| Hollysys Automation Technologies Ltd. | 14,647 | 221,756 | |

| Hon Hai Precision Industry Co. Ltd. (Foxconn) | 9,336,626 | 24,498,255 | |

| INTOPS Co. Ltd. | 30,521 | 299,908 | |

| Largan Precision Co. Ltd. | 201,000 | 28,588,761 | |

| Lens Technology Co. Ltd. (A Shares) | 187,300 | 521,561 | |

| LG Display Co. Ltd. (b) | 111,198 | 1,278,745 | |

| LG Innotek Co. Ltd. | 31,609 | 3,421,856 | |

| Partron Co. Ltd. | 8,100 | 60,369 | |

| Pinnacle Technology Holdings Ltd. | 11,198 | 4,865 | |

| Redington India Ltd. | 26,941 | 40,835 | |

| Samsung SDI Co. Ltd. | 25,919 | 6,367,191 | |

| Sirtec International Co. Ltd. | 5,000 | 4,738 | |

| Sunny Optical Technology Group Co. Ltd. | 303,200 | 4,714,284 | |

| Synnex Technology International Corp. | 50,000 | 61,834 | |

| Unimicron Technology Corp. | 3,818,000 | 4,918,086 | |

| Yageo Corp. | 67,000 | 870,091 | |

| Zhen Ding Technology Holding Ltd. | 762,000 | 2,882,419 | |

| 90,101,120 | |||

| IT Services - 1.0% | |||

| HCL Technologies Ltd. | 648,892 | 4,779,986 | |

| Hexaware Technologies Ltd. | 465,190 | 2,305,461 | |

| Infosys Ltd. | 660,846 | 6,670,220 | |

| Infosys Ltd. sponsored ADR | 1,870,657 | 18,837,516 | |

| Mphasis BFL Ltd. | 69,476 | 834,748 | |

| Network International Holdings PLC (a) | 255,044 | 1,741,952 | |

| NIIT Ltd. (b) | 14,423 | 19,754 | |

| PagSeguro Digital Ltd. (b) | 100,561 | 3,154,599 | |

| QIWI PLC Class B sponsored ADR | 16,212 | 282,737 | |

| Samsung SDS Co. Ltd. | 1,984 | 275,083 | |

| Sonata Software Ltd. | 6,875 | 31,745 | |

| StoneCo Ltd. Class A (b) | 57,505 | 2,293,874 | |

| Tata Consultancy Services Ltd. | 238,669 | 6,580,926 | |

| Wipro Ltd. | 535,360 | 1,642,586 | |

| WNS Holdings Ltd. sponsored ADR (b) | 24,362 | 1,603,994 | |

| 51,055,181 | |||

| Semiconductors & Semiconductor Equipment - 5.3% | |||

| ASE Technology Holding Co. Ltd. | 1,937,000 | 4,516,557 | |

| Dongbu HiTek Co. Ltd. | 29,703 | 588,688 | |

| Everlight Electronics Co. Ltd. | 73,000 | 75,607 | |

| King Yuan Electronics Co. Ltd. | 1,125,000 | 1,196,019 | |

| Koh Young Technology, Inc. | 27,733 | 2,203,195 | |

| Malaysian Pacific Industries BHD | 12,286 | 31,841 | |

| MediaTek, Inc. | 805,000 | 9,410,144 | |

| Novatek Microelectronics Corp. | 12,000 | 75,938 | |

| Phison Electronics Corp. | 202,000 | 2,169,915 | |

| Powertech Technology, Inc. | 659,000 | 2,167,501 | |

| Radiant Opto-Electronics Corp. | 250,000 | 796,314 | |

| Realtek Semiconductor Corp. | 947,000 | 6,890,354 | |

| Semiconductor Manufacturing International Corp. (b)(c) | 231,500 | 457,528 | |

| Shenzhen Goodix Technology Co. Ltd. (A Shares) | 63,650 | 2,820,757 | |

| Sino-American Silicon Products, Inc. | 444,000 | 1,504,294 | |

| SK Hynix, Inc. | 763,070 | 55,854,848 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 11,627,000 | 120,534,834 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 668,427 | 35,988,110 | |

| Topco Scientific Co. Ltd. | 106,000 | 361,139 | |

| Unisem (M) Bhd | 103,259 | 49,258 | |

| United Microelectronics Corp. | 7,406,000 | 3,715,572 | |

| United Microelectronics Corp. sponsored ADR | 353,437 | 876,524 | |

| Win Semiconductors Corp. | 201,000 | 1,764,089 | |

| 254,049,026 | |||

| Software - 0.1% | |||

| Asseco Poland SA | 19,723 | 307,992 | |

| Globant SA (b) | 10,254 | 1,158,805 | |

| Kingsoft Corp. Ltd. (b) | 158,000 | 510,789 | |

| Mix Telematics Ltd. sponsored ADR | 5,794 | 76,886 | |

| Nucleus Software Exports Ltd. (b) | 31,536 | 127,815 | |

| Totvs SA | 204,300 | 3,244,112 | |

| 5,426,399 | |||

| Technology Hardware, Storage & Peripherals - 3.8% | |||

| ASUSTeK Computer, Inc. | 23,000 | 154,717 | |

| Catcher Technology Co. Ltd. | 445,000 | 3,356,879 | |

| Chicony Electronics Co. Ltd. | 92,000 | 250,665 | |

| Compal Electronics, Inc. | 51,000 | 30,918 | |

| Lenovo Group Ltd. | 6,860,000 | 4,233,047 | |

| Lite-On Technology Corp. | 1,514,000 | 2,167,382 | |

| Pegatron Corp. | 2,364,000 | 4,836,617 | |

| Samsung Electronics Co. Ltd. | 3,679,429 | 166,068,527 | |

| Xiaomi Corp. Class B (a)(b) | 150,600 | 242,660 | |

| 181,341,412 | |||

| TOTAL INFORMATION TECHNOLOGY | 583,988,944 | ||

| MATERIALS - 2.8% | |||

| Chemicals - 0.5% | |||

| China Sanjiang Fine Chemicals Ltd. | 424,000 | 81,591 | |

| LG Chemical Ltd. | 51,808 | 15,876,409 | |

| Sinofert Holdings Ltd. | 2,042,000 | 204,331 | |

| Sociedad Quimica y Minera de Chile SA (PN-B) sponsored ADR | 108,600 | 2,973,468 | |

| Solar Industries India Ltd. (b) | 88,400 | 1,411,202 | |

| Taekwang Industrial Co. Ltd. | 168 | 112,759 | |

| 20,659,760 | |||

| Construction Materials - 0.6% | |||

| Anhui Conch Cement Co. Ltd.: | |||

| (A Shares) | 92,300 | 724,201 | |

| (H Shares) | 2,088,500 | 15,312,094 | |

| Asia Cement (China) Holdings Corp. | 259,584 | 342,338 | |

| CEMEX S.A.B. de CV sponsored ADR | 434,800 | 1,426,144 | |

| China National Building Materials Co. Ltd. (H Shares) | 2,686,442 | 3,105,175 | |

| China Resources Cement Holdings Ltd. | 792,165 | 996,939 | |

| City Cement Co. | 59,139 | 268,620 | |

| Eastern Province Cement Co. | 23,628 | 218,550 | |

| Gansu Qilianshan Cement Group Co. Ltd. (A Shares) | 960,100 | 1,701,334 | |

| JK Cement Ltd. | 135,600 | 2,593,802 | |

| Shree Cement Ltd. | 6,493 | 2,029,287 | |

| West China Cement Ltd. | 346,000 | 55,928 | |

| 28,774,412 | |||

| Containers & Packaging - 0.0% | |||

| Anadolu Cam Sanayii A/S | 134,325 | 81,275 | |

| Bio Pappel S.A.B. de CV (b) | 24,738 | 25,576 | |

| Klabin SA unit | 267,675 | 1,152,249 | |

| 1,259,100 | |||

| Metals & Mining - 1.5% | |||

| Alrosa Co. Ltd. | 2,838,260 | 3,045,636 | |

| Aluminum Corp. of China Ltd. (H Shares) (b) | 594,000 | 157,740 | |

| Anglo American Platinum Ltd. | 37,024 | 2,492,037 | |

| AngloGold Ashanti Ltd. | 330,935 | 5,893,376 | |

| AngloGold Ashanti Ltd. sponsored ADR | 39,500 | 689,275 | |

| Ann Joo Resources Bhd | 500 | 125 | |

| CAP SA | 85,501 | 484,007 | |

| China Molybdenum Co. Ltd. (H Shares) | 453,000 | 169,112 | |

| Compania de Minas Buenaventura SA sponsored ADR | 86,500 | 964,475 | |

| Daehan Steel Co. Ltd. | 2,905 | 12,192 | |

| Eregli Demir ve Celik Fabrikalari T.A.S. | 426,808 | 565,127 | |

| Grupo Mexico SA de CV Series B | 1,513,100 | 3,568,465 | |

| Hindalco Industries Ltd. | 880,082 | 1,891,462 | |

| Impala Platinum Holdings Ltd. | 691,379 | 5,619,649 | |

| KGHM Polska Miedz SA (Bearer) (b) | 45,216 | 829,222 | |

| KISCO Corp. | 6,262 | 19,815 | |

| Korea Zinc Co. Ltd. | 13,629 | 4,704,312 | |

| Kumba Iron Ore Ltd. | 93,581 | 1,724,550 | |

| Magnitogorsk Iron & Steel Works PJSC sponsored GDR (Reg. S) | 37,183 | 282,617 | |

| MMC Norilsk Nickel PJSC sponsored ADR | 368,349 | 11,137,716 | |

| Nanjing Iron & Steel Co. Ltd. | 400,200 | 176,291 | |

| Novolipetsk Steel OJSC GDR (Reg. S) | 12,307 | 236,307 | |

| Polyus PJSC | 8,916 | 1,127,908 | |

| Polyus PJSC unit | 11,923 | 741,296 | |

| POSCO | 49,449 | 8,032,764 | |

| POSCO sponsored ADR | 36,270 | 1,461,318 | |

| Severstal PAO GDR (Reg. S) | 7,512 | 92,093 | |

| Shanxi Taigang Stainless Steel Co. Ltd. (A Shares) | 784,304 | 394,847 | |

| Sheng Yu Steel Co. Ltd. | 35,418 | 22,695 | |

| Southern Copper Corp. | 105,931 | 3,564,578 | |

| Ternium SA sponsored ADR | 178,441 | 3,158,406 | |

| Vale SA sponsored ADR (b) | 839,001 | 8,238,990 | |

| Zijin Mining Group Co. Ltd. (H Shares) | 642,000 | 288,262 | |

| 71,786,665 | |||

| Paper & Forest Products - 0.2% | |||

| Duratex SA | 280,847 | 1,092,137 | |

| Suzano Papel e Celulose SA | 1,111,100 | 9,476,364 | |

| 10,568,501 | |||

| TOTAL MATERIALS | 133,048,438 | ||

| REAL ESTATE - 1.4% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.0% | |||

| Concentradora Fibra Danhos SA de CV | 12,699 | 17,762 | |

| Fibra Uno Administracion SA de CV | 17,167 | 25,808 | |

| Link (REIT) | 107,500 | 995,702 | |

| Macquarie Mexican (REIT) (a) | 9,672 | 12,835 | |

| Musharaka Real Estate Income Fund | 13,897 | 34,006 | |

| Prologis Property Mexico SA | 60,798 | 128,435 | |

| Prologis Property Mexico SA rights (b) | 18,730 | 76 | |

| 1,214,624 | |||

| Real Estate Management & Development - 1.4% | |||

| Agile Property Holdings Ltd. | 3,329,238 | 4,672,465 | |

| Aldar Properties PJSC (b) | 1,478,311 | 853,294 | |

| Ayala Land, Inc. | 11,122,200 | 8,500,212 | |

| BR Malls Participacoes SA | 577,447 | 2,109,950 | |

| BR Properties SA (b) | 9,285 | 28,611 | |

| CapitaLand Ltd. | 587,800 | 1,489,650 | |

| Central China Real Estate Ltd. | 137,925 | 80,685 | |

| China Overseas Grand Oceans Group Ltd. | 656,000 | 448,554 | |

| China Overseas Land and Investment Ltd. | 1,792,000 | 6,011,648 | |

| China Resources Land Ltd. | 228,000 | 1,051,520 | |

| China South City Holdings Ltd. | 497,873 | 54,929 | |

| China Vanke Co. Ltd.: | |||

| (A Shares) | 228,097 | 965,309 | |

| (H Shares) | 135,300 | 520,718 | |

| Country Garden Holdings Co. Ltd. | 6,702,000 | 8,872,949 | |

| Dar Al Arkan Real Estate Development Co. (b) | 666,777 | 1,665,387 | |

| Emaar Properties PJSC | 3,967,374 | 3,780,663 | |

| Gemdale Corp. (A Shares) | 158,100 | 323,348 | |

| Gemdale Properties and Investment Corp. Ltd. | 628,000 | 111,179 | |

| Greenland Holdings Corp. Ltd. (A Shares) | 4,424,963 | 3,695,934 | |

| Greenland Hong Kong Holdings Ltd. | 133,366 | 51,841 | |

| Guangzhou R&F Properties Co. Ltd. (H Shares) | 551,200 | 854,201 | |

| Hang Lung Properties Ltd. | 579,000 | 1,264,218 | |

| Hopson Development Holdings Ltd. | 24,545 | 22,105 | |

| IOI Properties Group Bhd | 77,800 | 18,649 | |

| K Wah International Holdings Ltd. | 409,123 | 196,820 | |

| Kaisa Group Holdings Ltd. | 327,000 | 145,147 | |

| KSL Holdings Bhd (b) | 105,100 | 17,710 | |

| KWG Property Holding Ltd. | 980,500 | 1,436,473 | |

| Logan Property Holdings Co. Ltd. | 549,692 | 937,897 | |

| Longfor Properties Co. Ltd. (a) | 1,322,048 | 6,114,154 | |

| Poly Property Group Co. Ltd. | 1,135,686 | 426,884 | |

| Powerlong Real Estate Holding Ltd. | 378,417 | 235,934 | |

| PT Puradelta Lestari TBK | 5,453,700 | 89,707 | |

| Radium Life Tech Co. Ltd. | 330,676 | 109,773 | |

| Risesun Real Estate Development Co. Ltd. (A Shares) | 3,065,444 | 3,752,916 | |

| Road King Infrastructure Ltd. | 249,966 | 426,497 | |

| Sansiri PCL (For. Reg.) | 6,763,900 | 152,215 | |

| Shanghai Shimao Co. Ltd. (A Shares) | 1,476,815 | 846,978 | |

| Shimao Property Holdings Ltd. | 869,778 | 3,113,125 | |

| Shui On Land Ltd. | 360,500 | 71,684 | |

| Sun Hung Kai Properties Ltd. | 97,000 | 1,378,781 | |

| Sunac China Holdings Ltd. | 354,000 | 1,930,083 | |

| United Development Co. (b) | 229,244 | 76,116 | |

| 68,906,913 | |||

| TOTAL REAL ESTATE | 70,121,537 | ||

| UTILITIES - 0.9% | |||

| Electric Utilities - 0.5% | |||

| Cheung Kong Infrastructure Holdings Ltd. | 127,000 | 865,131 | |

| CPFL Energia SA | 183,800 | 1,460,322 | |

| EDP Energias do Brasil SA | 693,537 | 3,168,443 | |

| Enel Chile SA | 1,983,170 | 177,004 | |

| Enel Chile SA sponsored ADR | 176,677 | 775,612 | |

| Energa SA (b) | 19,990 | 35,989 | |

| Enersis SA | 14,466,654 | 2,423,196 | |

| Enersis SA sponsored ADR | 113,466 | 975,808 | |

| Equatorial Energia SA | 1,128,125 | 6,220,972 | |

| Korea Electric Power Corp. (b) | 140,742 | 2,490,744 | |

| Polska Grupa Energetyczna SA (b) | 195,906 | 225,222 | |

| Power Grid Corp. of India Ltd. | 660,912 | 1,653,669 | |

| Tenaga Nasional Bhd | 994,630 | 2,856,301 | |

| 23,328,413 | |||

| Gas Utilities - 0.4% | |||

| Beijing Enterprises Holdings Ltd. | 37,000 | 156,164 | |

| China Gas Holdings Ltd. | 1,894,200 | 6,925,555 | |

| China Resource Gas Group Ltd. | 150,000 | 748,557 | |

| Daesung Energy Co. Ltd. | 20,047 | 77,793 | |

| ENN Energy Holdings Ltd. | 101,300 | 1,122,162 | |

| Gujarat State Petronet Ltd. | 7,065 | 21,958 | |

| Indraprastha Gas Ltd. (b) | 1,130,824 | 6,896,656 | |

| Mahanagar Gas Ltd. | 34,288 | 475,189 | |

| PT Perusahaan Gas Negara Tbk Series B | 712,900 | 63,601 | |

| Samchully Co. Ltd. | 279 | 18,215 | |

| 16,505,850 | |||

| Independent Power and Renewable Electricity Producers - 0.0% | |||

| Benpres Holdings Corp. | 124,600 | 9,034 | |

| China Longyuan Power Grid Corp. Ltd. (H Shares) | 1,560,000 | 816,523 | |

| 825,557 | |||

| Water Utilities - 0.0% | |||

| Companhia de Saneamento Basico do Estado de Sao Paulo (SABESP) | 91,100 | 1,196,835 | |

| SIIC Environment Holdings Ltd. | 187,000 | 32,866 | |

| 1,229,701 | |||

| TOTAL UTILITIES | 41,889,521 | ||

| TOTAL COMMON STOCKS | |||

| (Cost $2,526,239,021) | 2,963,899,042 | ||

| Nonconvertible Preferred Stocks - 2.1% | |||

| COMMUNICATION SERVICES - 0.1% | |||

| Diversified Telecommunication Services - 0.1% | |||

| Telefonica Brasil SA | 47,240 | 563,893 | |

| Telefonica Brasil SA sponsored ADR | 190,100 | 2,267,893 | |

| 2,831,786 | |||

| CONSUMER STAPLES - 0.1% | |||

| Beverages - 0.0% | |||

| Ambev SA sponsored ADR | 455,222 | 1,461,263 | |

| Food & Staples Retailing - 0.1% | |||

| Companhia Brasileira de Distribuicao Grupo Pao de Acucar (PN) | 133,900 | 2,159,156 | |

| TOTAL CONSUMER STAPLES | 3,620,419 | ||

| ENERGY - 0.4% | |||

| Oil, Gas & Consumable Fuels - 0.4% | |||

| Petroleo Brasileiro SA - Petrobras: | |||

| (PN) sponsored ADR (non-vtg.) | 425,446 | 4,790,522 | |

| sponsored ADR | 1,088,563 | 13,171,612 | |

| 17,962,134 | |||

| FINANCIALS - 1.2% | |||

| Banks - 1.2% | |||

| Banco Bradesco SA (PN) | 1,628,984 | 11,121,197 | |

| Banco do Estado Rio Grande do Sul SA | 4,800 | 19,482 | |

| Itau Unibanco Holding SA | 4,098,536 | 29,328,284 | |

| Itau Unibanco Holding SA sponsored ADR | 837,485 | 5,921,019 | |

| Itausa-Investimentos Itau SA (PN) | 3,546,868 | 9,525,679 | |

| Sberbank of Russia | 109,335 | 358,504 | |

| 56,274,165 | |||

| INDUSTRIALS - 0.0% | |||

| Airlines - 0.0% | |||

| Azul SA (b) | 125,800 | 1,250,151 | |

| INFORMATION TECHNOLOGY - 0.3% | |||

| Technology Hardware, Storage & Peripherals - 0.3% | |||

| Samsung Electronics Co. Ltd. | 444,661 | 16,866,503 | |

| UTILITIES - 0.0% | |||

| Electric Utilities - 0.0% | |||

| Companhia Paranaense de Energia-Copel (PN-B) | 116,800 | 1,872,969 | |

| Water Utilities - 0.0% | |||

| Cia de Saneamento do Parana | 109,070 | 482,924 | |

| Companhia de Saneamento Basico do Estado de Sao Paulo (SABESP) sponsored ADR | 30,784 | 401,116 | |

| 884,040 | |||

| TOTAL UTILITIES | 2,757,009 | ||

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | |||

| (Cost $95,024,783) | 101,562,167 | ||

| Equity Funds - 31.3% | |||

| Diversified Emerging Markets Funds - 31.3% | |||

| Aberdeen Emerging Markets Fund Institutional Service Class | 7,414,699 | 108,254,604 | |

| Brandes Emerging Markets Value Fund Class A | 10,256,732 | 82,771,827 | |

| Fidelity Emerging Markets Fund (e) | 12,174,383 | 398,711,045 | |

| Fidelity SAI Emerging Markets Low Volatility Index Fund (e) | 25,266,069 | 232,700,499 | |

| GMO Emerging Markets Fund - Class III | 1,632,303 | 50,340,230 | |

| Goldman Sachs Emerging Markets Equity Fund Institutional Shares | 7,309,524 | 159,128,342 | |

| Invesco Oppenheimer Developing Markets Fund Class R6 | 3,026,106 | 125,916,270 | |

| Invesco Oppenheimer Emerging Markets Innovators Fund Class R6 (b) | 4,679,444 | 48,900,194 | |

| iShares MSCI China ETF (c) | 2,832,430 | 175,978,876 | |

| iShares MSCI EM ESG Optimized ETF (c) | 70,286 | 2,293,432 | |

| iShares MSCI South Korea Index ETF | 373,835 | 20,545,972 | |

| Lazard Emerging Markets Equity Portfolio Open Shares | 2,147,890 | 35,740,896 | |

| Matthews Korea Fund Investor Class | 6,983,487 | 27,235,601 | |

| Matthews Pacific Tiger Fund Investor Class | 128 | 3,404 | |

| Morgan Stanley Institutional Fund, Inc. Frontier Markets Portfolio Class I | 1,987,350 | 31,420,010 | |

| Xtrackers Harvest CSI 300 China ETF Class A (c) | 414,269 | 11,835,665 | |

| TOTAL EQUITY FUNDS | |||

| (Cost $1,352,849,991) | 1,511,776,867 | ||

| U.S. Treasury Obligations - 0.2% | |||

| U.S. Treasury Bills, yield at date of purchase 1.38% to 1.55% 3/5/20 to 5/28/20 (f) | |||

| (Cost $7,298,701) | 7,310,000 | 7,299,977 | |

| Money Market Funds - 9.1% | |||

| Fidelity Cash Central Fund 1.60% (g) | 758,777 | 758,929 | |

| Fidelity Securities Lending Cash Central Fund 1.60% (g)(h) | 205,035,861 | 205,056,364 | |

| State Street Institutional U.S. Government Money Market Fund Premier Class 1.53% (i) | 231,056,124 | 231,056,124 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $436,871,417) | 436,871,417 | ||

| TOTAL INVESTMENT IN SECURITIES - 104.2% | |||

| (Cost $4,418,283,913) | 5,021,409,470 | ||

| NET OTHER ASSETS (LIABILITIES) - (4.2)% | (203,164,772) | ||

| NET ASSETS - 100% | $4,818,244,698 |

| Futures Contracts | |||||

| Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| ICE E-mini MSCI Emerging Markets Index Contracts (United States) | 2,638 | March 2020 | $133,060,720 | $(10,452,627) | $(10,452,627) |

The notional amount of futures purchased as a percentage of Net Assets is 2.8%

For the period, the average monthly notional amount at value for futures contracts in the aggregate was $211,913,599.

Security Type Abbreviations

ETF – Exchange-Traded Fund

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $29,305,649 or 0.6% of net assets.

(b) Non-income producing

(c) Security or a portion of the security is on loan at period end.

(d) Level 3 security

(e) Affiliated Fund

(f) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $7,256,892.

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(h) Investment made with cash collateral received from securities on loan.

(i) The rate quoted is the annualized seven-day yield of the fund at period end.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $34,749 |

| Fidelity Securities Lending Cash Central Fund | 479,665 |

| Total | $514,414 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Affiliated Underlying Funds

Fiscal year to date information regarding the Fund's investments in affiliated Underlying Funds, excluding any Money Market Central Funds, is presented below. Exchanges between classes of the same affiliated Underlying Funds may occur.

| Affiliate | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| Fidelity Emerging Markets Fund | $355,884,838 | $7,163,136 | $-- | $7,163,139 | $-- | $35,663,071 | $398,711,045 |

| Fidelity SAI Emerging Markets Low Volatility Index Fund | -- | 256,782,547 | -- | 4,782,547 | -- | (24,082,048) | 232,700,499 |

| Total | $355,884,838 | $263,945,683 | $-- | $11,945,686 | $-- | $11,581,023 | $631,411,544 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of February 29, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Equities: | ||||

| Communication Services | $354,329,725 | $139,631,353 | $214,698,372 | $-- |

| Consumer Discretionary | 507,234,199 | 469,749,109 | 37,456,572 | 28,518 |

| Consumer Staples | 238,385,354 | 196,222,899 | 42,162,455 | -- |

| Energy | 158,765,956 | 68,583,339 | 90,176,959 | 5,658 |

| Financials | 800,987,015 | 460,513,862 | 340,473,153 | -- |

| Health Care | 41,274,320 | 38,226,021 | 3,048,299 | -- |

| Industrials | 115,812,688 | 102,956,864 | 12,855,824 | -- |

| Information Technology | 600,855,447 | 354,319,168 | 246,536,279 | -- |

| Materials | 133,048,438 | 91,770,572 | 41,277,866 | -- |

| Real Estate | 70,121,537 | 70,011,688 | 109,849 | -- |

| Utilities | 44,646,530 | 41,894,575 | 2,751,955 | -- |

| Equity Funds | 1,511,776,867 | 1,511,776,867 | -- | -- |

| Other Short-Term Investments | 7,299,977 | -- | 7,299,977 | -- |

| Money Market Funds | 436,871,417 | 436,871,417 | -- | -- |

| Total Investments in Securities: | $5,021,409,470 | $3,982,527,734 | $1,038,847,560 | $34,176 |

| Derivative Instruments: | ||||

| Liabilities | ||||

| Futures Contracts | $(10,452,627) | $(10,452,627) | $-- | $-- |

| Total Liabilities | $(10,452,627) | $(10,452,627) | $-- | $-- |

| Total Derivative Instruments: | $(10,452,627) | $(10,452,627) | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of February 29, 2020. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value | |

| Asset | Liability | |

| Equity Risk | ||

| Futures Contracts(a) | $0 | $(10,452,627) |

| Total Equity Risk | 0 | (10,452,627) |

| Total Value of Derivatives | $0 | $(10,452,627) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

Other Information

Distribution of the direct investments by country of issue, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 36.9% |

| Cayman Islands | 13.0% |

| China | 8.2% |

| Korea (South) | 8.0% |

| Taiwan | 6.4% |

| India | 5.2% |

| Brazil | 5.1% |

| Russia | 3.0% |

| Hong Kong | 2.5% |

| South Africa | 2.0% |

| Mexico | 1.4% |

| Others (Individually Less Than 1%) | 8.3% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| February 29, 2020 | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $200,405,299) — See accompanying schedule: Unaffiliated issuers (cost $3,658,070,048) | $4,184,182,633 | |

| Fidelity Central Funds (cost $205,815,293) | 205,815,293 | |

| Other affiliated issuers (cost $554,398,572) | 631,411,544 | |

| Total Investment in Securities (cost $4,418,283,913) | $5,021,409,470 | |

| Cash | 6,299,116 | |

| Foreign currency held at value (cost $2,208,374) | 2,160,627 | |

| Receivable for investments sold | 10,001,835 | |

| Receivable for fund shares sold | 1,926,892 | |

| Dividends receivable | 7,599,069 | |

| Interest receivable | 287,978 | |

| Distributions receivable from Fidelity Central Funds | 80,768 | |

| Other receivables | 62,246 | |

| Total assets | 5,049,828,001 | |

| Liabilities | ||

| Payable for investments purchased | $18,053,742 | |

| Payable for fund shares redeemed | 5,871,701 | |

| Accrued management fee | 1,563,290 | |

| Payable for daily variation margin on futures contracts | 488,425 | |

| Other payables and accrued expenses | 580,774 | |

| Collateral on securities loaned | 205,025,371 | |

| Total liabilities | 231,583,303 | |

| Net Assets | $4,818,244,698 | |

| Net Assets consist of: | ||

| Paid in capital | $4,469,570,436 | |

| Total accumulated earnings (loss) | 348,674,262 | |

| Net Assets | $4,818,244,698 | |

| Net Asset Value, offering price and redemption price per share ($4,818,244,698 ÷ 472,299,126 shares) | $10.20 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended February 29, 2020 | ||

| Investment Income | ||

| Dividends: | ||

| Unaffiliated issuers | $101,902,773 | |

| Affiliated issuers | 11,945,686 | |

| Non-Cash dividends | 16,661,237 | |

| Interest | 5,916,161 | |

| Income from Fidelity Central Funds (including $479,665 from security lending) | 514,414 | |

| Income before foreign taxes withheld | 136,940,271 | |

| Less foreign taxes withheld | (9,508,908) | |

| Total income | 127,431,363 | |

| Expenses | ||

| Management fee | $29,751,832 | |

| Accounting and security lending fees | 521,164 | |

| Custodian fees and expenses | 851,461 | |

| Independent trustees' fees and expenses | 53,680 | |

| Registration fees | 57,251 | |

| Audit | 98,643 | |

| Legal | 17,549 | |

| Miscellaneous | 341,050 | |

| Total expenses before reductions | 31,692,630 | |

| Expense reductions | (12,387,865) | |

| Total expenses after reductions | 19,304,765 | |

| Net investment income (loss) | 108,126,598 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (30,107,368) | |

| Fidelity Central Funds | 9,267 | |

| Foreign currency transactions | (1,788,998) | |

| Futures contracts | 31,211,404 | |

| Capital gain distributions from underlying funds: | ||

| Unaffiliated issuers | 5,201,048 | |

| Total net realized gain (loss) | 4,525,353 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers (net of increase in deferred foreign taxes of $56,260) | 4,160,075 | |

| Affiliated issuers | 11,581,023 | |

| Assets and liabilities in foreign currencies | (286,860) | |

| Futures contracts | (22,927,293) | |

| Total change in net unrealized appreciation (depreciation) | (7,473,055) | |

| Net gain (loss) | (2,947,702) | |

| Net increase (decrease) in net assets resulting from operations | $105,178,896 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended February 29, 2020 | Year ended February 28, 2019 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $108,126,598 | $77,358,567 |

| Net realized gain (loss) | 4,525,353 | (86,864,085) |

| Change in net unrealized appreciation (depreciation) | (7,473,055) | (640,462,210) |

| Net increase (decrease) in net assets resulting from operations | 105,178,896 | (649,967,728) |

| Distributions to shareholders | (108,590,118) | (69,748,423) |

| Share transactions | ||

| Proceeds from sales of shares | 778,953,889 | 1,059,692,349 |

| Reinvestment of distributions | 107,714,914 | 69,510,261 |

| Cost of shares redeemed | (725,778,234) | (819,100,492) |

| Net increase (decrease) in net assets resulting from share transactions | 160,890,569 | 310,102,118 |

| Total increase (decrease) in net assets | 157,479,347 | (409,614,033) |

| Net Assets | ||

| Beginning of period | 4,660,765,351 | 5,070,379,384 |

| End of period | $4,818,244,698 | $4,660,765,351 |

| Other Information | ||

| Shares | ||

| Sold | 75,927,054 | 96,882,174 |

| Issued in reinvestment of distributions | 9,678,318 | 7,458,183 |

| Redeemed | (69,026,725) | (80,109,848) |

| Net increase (decrease) | 16,578,647 | 24,230,509 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Strategic Advisers Emerging Markets Fund

| Years ended February 28, | 2020 A | 2019 | 2018 | 2017 | 2016 A |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $10.23 | $11.75 | $9.14 | $7.15 | $9.47 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | .23C | .17 | .14 | .10 | .10 |

| Net realized and unrealized gain (loss) | (.03) | (1.53) | 2.62 | 1.99 | (2.32) |

| Total from investment operations | .20 | (1.36) | 2.76 | 2.09 | (2.22) |

| Distributions from net investment income | (.23) | (.16) | (.15) | (.10) | (.10) |

| Distributions from net realized gain | – | – | –D | (.01) | – |

| Total distributions | (.23) | (.16) | (.15) | (.10)E | (.10) |

| Net asset value, end of period | $10.20 | $10.23 | $11.75 | $9.14 | $7.15 |

| Total ReturnF | 1.80% | (11.48)% | 30.23% | 29.40% | (23.49)% |

| Ratios to Average Net AssetsG,H,I | |||||

| Expenses before reductions | .64% | .66% | .70% | .60% | .50% |

| Expenses net of fee waivers, if any | .39% | .41% | .45% | .35% | .25% |

| Expenses net of all reductions | .39% | .40% | .45% | .35% | .24% |

| Net investment income (loss) | 2.20%C | 1.60% | 1.36% | 1.23% | 1.25% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $4,818,245 | $4,660,765 | $5,070,379 | $4,599,443 | $4,265,092 |

| Portfolio turnover rateI | 39% | 57% | 31% | 23% | 41% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.87%.

D Amount represents less than $.005 per share.

E Total distributions of $.10 per share is comprised of distributions from net investment income of $.097 and distributions from net realized gain of $.005 per share.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.