Form N-CSR FIDELITY ADVISOR SERIES For: Oct 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

William C. Coffey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| Date of fiscal year end: | October 31 |

|

|

|

| Date of reporting period: | October 31, 2018 |

Item 1.

Reports to Stockholders

|

Fidelity Advisor® Diversified International Fund Class A, Class M, Class C, Class I and Class Z Annual Report October 31, 2018 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2018 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended October 31, 2018 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | (14.36)% | 1.57% | 6.35% |

| Class M (incl. 3.50% sales charge) | (12.57)% | 1.79% | 6.33% |

| Class C (incl. contingent deferred sales charge) | (10.75)% | 2.01% | 6.18% |

| Class I | (8.94)% | 3.07% | 7.29% |

| Class Z | (8.78)% | 3.23% | 7.38% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

The initial offering of Class Z shares took place on August 13, 2013. Returns prior to August 13, 2013, are those of Class I.

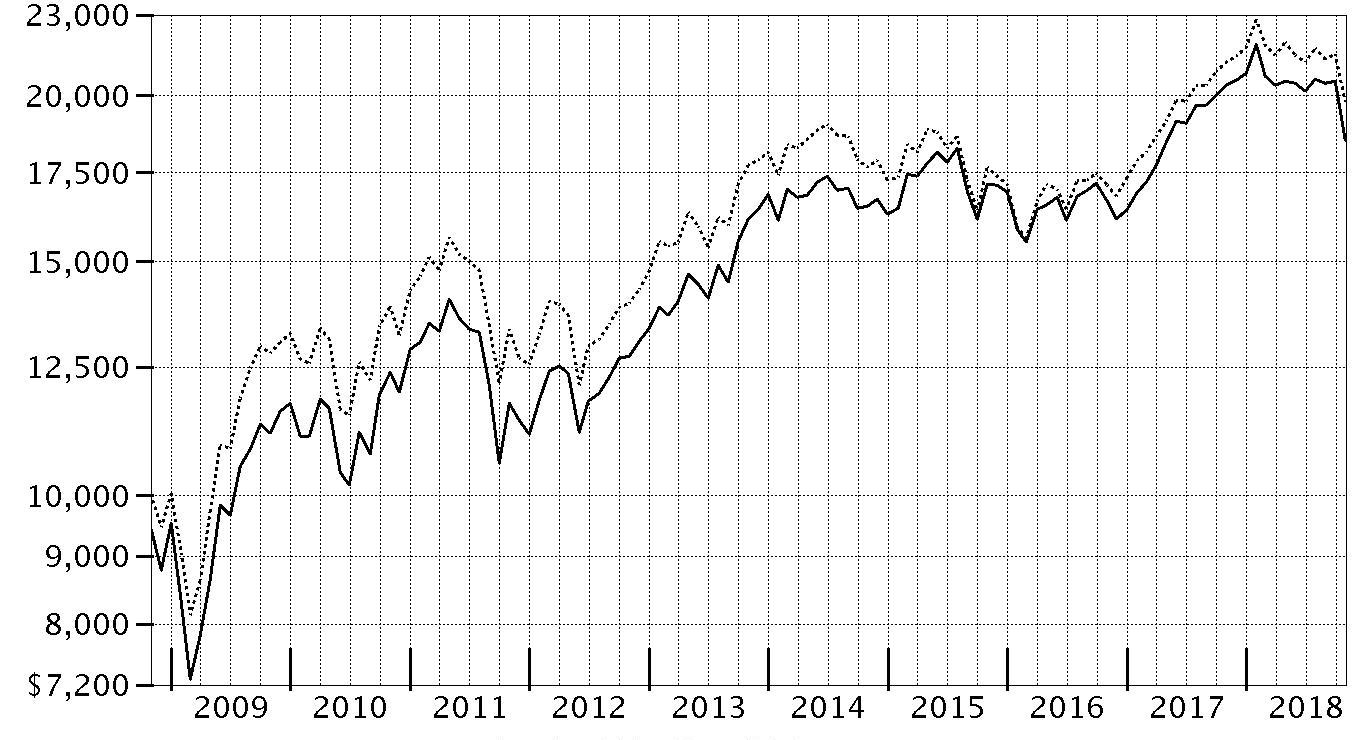

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Diversified International Fund - Class A on October 31, 2008, and the current 5.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the MSCI EAFE Index performed over the same period.

| Period Ending Values | ||

|

| $18,511 | Fidelity Advisor® Diversified International Fund - Class A |

|

| $19,780 | MSCI EAFE Index |

Management's Discussion of Fund Performance

Market Recap: International equities returned -8.08% for the 12 months ending October 31, 2018, according to the MSCI ACWI (All Country World Index) ex USA Index. A modestly positive first half of the period gave way to a confluence of overwhelmingly negative factors – including escalating trade tensions, a surging U.S. dollar, tepid economic growth in Europe, global central bank tightening, concerns about Italy’s budget stalemate with the EU, and weakness in China’s stock market – that yielded a -11% second-half return. The index lost 8% in October alone, its largest monthly drop in more than six years. Among sectors, new-media-infused communications services (-15%) was hit the hardest, while economically sensitive consumer discretionary (-13%), information technology (-12%), financials (-10%), industrials (-9%) and materials (-7%) stocks also fared poorly. Even the more defensive real estate (-9%), utilities (-6%) and consumer staples (-5%) sectors weren’t spared this period. Conversely, elevated crude-oil prices fueled a positive return for energy (+7%), the top-performing sector, followed by the relatively stable-growing health care segment (+2%). Regionally, emerging markets (-12%) fared the worst, hampered by the impact of foreign exchange and concerns about economic weakness in China, India and South Korea. Sluggish growth also pressured shares in continental Europe (-9%). Stocks in Japan (-3%) and the U.K. (-4%) held up better, followed by Canada (-5%) and Asia-Pacific ex Japan (-6%). Comments from Portfolio Manager William Bower: For the fiscal year, the fund’s share classes (excluding sales charges, if applicable) returned roughly between -9% to -10%, trailing the -6.65% return of the benchmark MSCI EAFE Index. Versus the benchmark, security selection, notably in the consumer staples and health care sectors, detracted from performance. Geographically, stock picks in the U.K. and Japan held back the fund's performance versus the index, though a non-index stake in the U.S. was helpful. Individual disappointments included U.K.- based software company Micro Focus International. Shares of the company returned -54% for the period, largely because a recent acquisition proved challenging, with revenue declining faster than anticipated amid heavy sales-force attrition. In Japan, an average overweighting in semiconductor manufacturer Renesas Electronics hurt, as excess industry capacity and weakening demand from end markets pressured the stock, which returned roughly -58%. Not owning index heavyweight Royal Dutch Shell was another notable detractor because shares of the Anglo-Dutch multinational oil and gas giant advanced about 8% on higher crude-oil prices and solid quarterly financial results. Conversely, security selection in information technology and materials added value. Top individual contributors included Norway-based exploration and production company Equinor (formerly Statoil), a top holding that benefited from higher crude-oil prices. Out-of-benchmark stakes in U.S.-based payment-processing firms Mastercard and Visa also worked out well, as the stocks gained about 34% and 26%, respectively. Litigation income received during the period also added to the fund’s return.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Five Stocks as of October 31, 2018

| % of fund's net assets | |

| Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 1.4 |

| Prudential PLC (United Kingdom, Insurance) | 1.4 |

| ORIX Corp. (Japan, Diversified Financial Services) | 1.4 |

| British American Tobacco PLC sponsored ADR (United Kingdom, Tobacco) | 1.3 |

| SAP SE (Germany, Software) | 1.3 |

| 6.8 |

Top Five Market Sectors as of October 31, 2018

| % of fund's net assets | |

| Financials | 24.3 |

| Industrials | 14.8 |

| Health Care | 12.6 |

| Information Technology | 11.6 |

| Consumer Staples | 10.6 |

Top Five Countries as of October 31, 2018

| (excluding cash equivalents) | % of fund's net assets |

| Japan | 17.1 |

| United Kingdom | 16.5 |

| Germany | 8.3 |

| France | 7.3 |

| United States of America | 6.9 |

Asset Allocation (% of fund's net assets)

| As of October 31, 2018 | ||

| Stocks | 94.3% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.7% | |

Schedule of Investments October 31, 2018

Showing Percentage of Net Assets

| Common Stocks - 93.6% | |||

| Shares | Value (000s) | ||

| Australia - 0.8% | |||

| CSL Ltd. | 73,124 | $9,735 | |

| Magellan Financial Group Ltd. | 306,083 | 5,774 | |

| TOTAL AUSTRALIA | 15,509 | ||

| Bailiwick of Jersey - 1.8% | |||

| Ferguson PLC | 247,646 | 16,723 | |

| Glencore Xstrata PLC | 1,041,731 | 4,246 | |

| Shire PLC | 213,962 | 12,913 | |

| TOTAL BAILIWICK OF JERSEY | 33,882 | ||

| Belgium - 1.0% | |||

| KBC Groep NV | 238,380 | 16,443 | |

| Umicore SA | 64,800 | 3,053 | |

| TOTAL BELGIUM | 19,496 | ||

| Bermuda - 1.4% | |||

| Credicorp Ltd. (United States) | 40,805 | 9,210 | |

| Hiscox Ltd. | 477,000 | 9,926 | |

| IHS Markit Ltd. (a) | 147,788 | 7,763 | |

| TOTAL BERMUDA | 26,899 | ||

| Canada - 3.6% | |||

| Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | 453,600 | 21,663 | |

| CCL Industries, Inc. Class B | 43,900 | 1,847 | |

| Cenovus Energy, Inc. (Canada) | 1,010,600 | 8,552 | |

| Constellation Software, Inc. | 15,900 | 10,943 | |

| Fairfax India Holdings Corp. (a)(b) | 522,200 | 6,627 | |

| PrairieSky Royalty Ltd. | 10,369 | 158 | |

| Suncor Energy, Inc. | 537,600 | 18,034 | |

| TOTAL CANADA | 67,824 | ||

| Cayman Islands - 0.7% | |||

| Alibaba Group Holding Ltd. sponsored ADR (a) | 52,600 | 7,484 | |

| ENN Energy Holdings Ltd. | 380,000 | 3,230 | |

| Shenzhou International Group Holdings Ltd. | 90,000 | 994 | |

| Zai Lab Ltd. ADR (a) | 69,154 | 1,131 | |

| TOTAL CAYMAN ISLANDS | 12,839 | ||

| China - 0.8% | |||

| Kweichow Moutai Co. Ltd. (A Shares) | 60,476 | 4,759 | |

| Ping An Insurance (Group) Co. of China Ltd. (H Shares) | 494,500 | 4,657 | |

| Shanghai International Airport Co. Ltd. (A Shares) | 579,972 | 4,120 | |

| Tonghua Dongbao Pharmaceutical Co. Ltd. Class A | 680,280 | 1,305 | |

| TOTAL CHINA | 14,841 | ||

| Denmark - 0.6% | |||

| DONG Energy A/S (b) | 14,900 | 947 | |

| Netcompany Group A/S | 73,700 | 2,437 | |

| NNIT A/S (b) | 38,055 | 1,075 | |

| Novozymes A/S Series B | 129,300 | 6,390 | |

| SimCorp A/S | 3,300 | 254 | |

| TOTAL DENMARK | 11,103 | ||

| Finland - 0.9% | |||

| Nordea Bank ABP (a) | 965,300 | 8,395 | |

| Sampo Oyj (A Shares) | 165,800 | 7,636 | |

| TOTAL FINLAND | 16,031 | ||

| France - 7.3% | |||

| Aeroports de Paris | 28,000 | 5,864 | |

| Amundi SA (b) | 210,458 | 12,534 | |

| BNP Paribas SA | 297,400 | 15,539 | |

| Capgemini SA | 109,100 | 13,346 | |

| Danone SA | 39,700 | 2,811 | |

| Eiffage SA | 38,500 | 3,769 | |

| Elis SA | 298,800 | 6,034 | |

| Kering SA | 10,300 | 4,592 | |

| LVMH Moet Hennessy - Louis Vuitton SA | 56,343 | 17,095 | |

| Maisons du Monde SA (b) | 36,573 | 917 | |

| Sanofi SA | 249,255 | 22,274 | |

| Societe Generale Series A | 220,700 | 8,090 | |

| SR Teleperformance SA | 31,600 | 5,211 | |

| Thales SA | 50,300 | 6,438 | |

| VINCI SA (c) | 146,300 | 13,021 | |

| TOTAL FRANCE | 137,535 | ||

| Germany - 7.6% | |||

| adidas AG | 53,209 | 12,536 | |

| Allianz SE | 26,800 | 5,583 | |

| Aumann AG (b) | 34,088 | 1,683 | |

| Axel Springer Verlag AG | 9,397 | 625 | |

| Bayer AG | 192,926 | 14,788 | |

| Deutsche Borse AG | 40,000 | 5,055 | |

| Deutsche Post AG | 295,326 | 9,325 | |

| Fresenius SE & Co. KGaA | 220,700 | 14,027 | |

| Hannover Reuck SE | 56,000 | 7,554 | |

| Linde PLC | 99,638 | 16,347 | |

| Merck KGaA | 11,100 | 1,190 | |

| Morphosys AG (a) | 16,383 | 1,518 | |

| Morphosys AG sponsored ADR | 104,317 | 2,401 | |

| MTU Aero Engines Holdings AG | 9,400 | 1,999 | |

| Rational AG | 2,300 | 1,334 | |

| SAP SE | 233,873 | 25,042 | |

| Scout24 AG (b) | 95,000 | 3,945 | |

| Symrise AG | 108,700 | 9,131 | |

| Vonovia SE | 128,700 | 5,892 | |

| Wirecard AG | 19,500 | 3,653 | |

| TOTAL GERMANY | 143,628 | ||

| Hong Kong - 1.8% | |||

| AIA Group Ltd. | 2,892,800 | 21,893 | |

| BOC Hong Kong (Holdings) Ltd. | 1,244,500 | 4,650 | |

| Techtronic Industries Co. Ltd. | 1,420,500 | 6,648 | |

| TOTAL HONG KONG | 33,191 | ||

| India - 3.6% | |||

| Adani Ports & Special Economic Zone Ltd. | 717,591 | 3,094 | |

| Axis Bank Ltd. (a) | 546,458 | 4,303 | |

| Godrej Consumer Products Ltd. | 156,548 | 1,534 | |

| HDFC Bank Ltd. | 743,471 | 19,301 | |

| Housing Development Finance Corp. Ltd. | 793,387 | 18,979 | |

| Kotak Mahindra Bank Ltd. | 253,740 | 3,840 | |

| LIC Housing Finance Ltd. | 389,732 | 2,166 | |

| Reliance Industries Ltd. | 1,026,708 | 14,732 | |

| TOTAL INDIA | 67,949 | ||

| Indonesia - 0.9% | |||

| PT Bank Central Asia Tbk | 5,471,100 | 8,511 | |

| PT Bank Rakyat Indonesia Tbk | 38,917,000 | 8,064 | |

| TOTAL INDONESIA | 16,575 | ||

| Ireland - 2.4% | |||

| CRH PLC | 273,000 | 8,152 | |

| DCC PLC (United Kingdom) | 51,300 | 4,403 | |

| Kerry Group PLC Class A | 112,500 | 11,532 | |

| Kingspan Group PLC (Ireland) | 224,900 | 9,782 | |

| Ryanair Holdings PLC sponsored ADR (a) | 148,459 | 12,292 | |

| TOTAL IRELAND | 46,161 | ||

| Israel - 0.5% | |||

| Check Point Software Technologies Ltd. (a) | 79,500 | 8,825 | |

| Italy - 0.7% | |||

| FinecoBank SpA | 115,900 | 1,214 | |

| Intesa Sanpaolo SpA | 2,625,800 | 5,816 | |

| Prada SpA | 1,143,200 | 4,038 | |

| Recordati SpA | 73,300 | 2,484 | |

| TOTAL ITALY | 13,552 | ||

| Japan - 17.1% | |||

| Bandai Namco Holdings, Inc. | 85,600 | 3,046 | |

| Daikin Industries Ltd. | 122,800 | 14,234 | |

| GMO Internet, Inc. | 110,500 | 1,579 | |

| Hoya Corp. | 421,900 | 23,983 | |

| Iriso Electronics Co. Ltd. | 16,700 | 707 | |

| Itochu Corp. | 209,100 | 3,878 | |

| Kao Corp. | 151,600 | 10,085 | |

| Keyence Corp. | 49,800 | 24,407 | |

| Minebea Mitsumi, Inc. | 987,600 | 15,108 | |

| Misumi Group, Inc. | 191,300 | 3,842 | |

| Mitsubishi UFJ Financial Group, Inc. | 3,130,100 | 18,945 | |

| Morinaga & Co. Ltd. | 70,700 | 2,842 | |

| Nabtesco Corp. | 86,000 | 1,896 | |

| Nidec Corp. | 85,900 | 11,031 | |

| Nintendo Co. Ltd. | 5,300 | 1,655 | |

| Nissan Chemical Corp. | 51,300 | 2,419 | |

| Nitori Holdings Co. Ltd. | 103,400 | 13,503 | |

| NOF Corp. | 13,300 | 378 | |

| Olympus Corp. | 164,900 | 5,496 | |

| ORIX Corp. | 1,579,800 | 25,776 | |

| Outsourcing, Inc. | 171,400 | 2,172 | |

| PALTAC Corp. | 58,300 | 2,976 | |

| Panasonic Corp. | 173,300 | 1,860 | |

| Recruit Holdings Co. Ltd. | 617,200 | 16,565 | |

| Renesas Electronics Corp. (a) | 704,400 | 3,733 | |

| Seria Co. Ltd. | 23,900 | 806 | |

| Shin-Etsu Chemical Co. Ltd. | 77,200 | 6,451 | |

| Shiseido Co. Ltd. | 138,900 | 8,764 | |

| SMC Corp. | 27,800 | 8,907 | |

| SoftBank Corp. | 194,700 | 15,408 | |

| Sony Corp. | 382,900 | 20,721 | |

| Subaru Corp. | 106,600 | 2,876 | |

| Sundrug Co. Ltd. | 65,616 | 2,384 | |

| Suzuki Motor Corp. | 164,100 | 8,183 | |

| Temp Holdings Co., Ltd. | 135,600 | 2,581 | |

| Tsubaki Nakashima Co. Ltd. | 75,468 | 1,391 | |

| Tsuruha Holdings, Inc. | 134,300 | 13,997 | |

| Welcia Holdings Co. Ltd. | 197,806 | 10,098 | |

| Yahoo! Japan Corp. | 920,300 | 2,871 | |

| Zozo, Inc. | 232,600 | 5,605 | |

| TOTAL JAPAN | 323,159 | ||

| Korea (South) - 0.3% | |||

| Cafe24 Corp. (a) | 13,900 | 1,346 | |

| LG Chemical Ltd. | 14,233 | 4,329 | |

| TOTAL KOREA (SOUTH) | 5,675 | ||

| Luxembourg - 0.8% | |||

| B&M European Value Retail S.A. | 2,281,095 | 12,153 | |

| Samsonite International SA | 1,109,400 | 3,183 | |

| TOTAL LUXEMBOURG | 15,336 | ||

| Netherlands - 4.4% | |||

| Adyen BV (b) | 6,700 | 4,334 | |

| ASML Holding NV | 101,700 | 17,529 | |

| Heineken NV (Bearer) | 48,900 | 4,409 | |

| ING Groep NV (Certificaten Van Aandelen) | 468,800 | 5,546 | |

| Koninklijke Philips Electronics NV | 311,900 | 11,633 | |

| LyondellBasell Industries NV Class A | 11,100 | 991 | |

| Unilever NV (Certificaten Van Aandelen) (Bearer) | 446,000 | 23,966 | |

| Wolters Kluwer NV | 245,300 | 13,936 | |

| TOTAL NETHERLANDS | 82,344 | ||

| New Zealand - 0.3% | |||

| Ryman Healthcare Group Ltd. | 651,045 | 5,141 | |

| Norway - 1.6% | |||

| Equinor ASA | 922,100 | 23,988 | |

| Schibsted ASA (A Shares) | 207,100 | 7,176 | |

| TOTAL NORWAY | 31,164 | ||

| South Africa - 0.1% | |||

| Capitec Bank Holdings Ltd. | 35,700 | 2,397 | |

| Spain - 1.9% | |||

| Aedas Homes SAU (b) | 13,529 | 350 | |

| Amadeus IT Holding SA Class A | 201,400 | 16,237 | |

| CaixaBank SA | 2,964,300 | 11,996 | |

| Masmovil Ibercom SA (a) | 24,090 | 3,127 | |

| Neinor Homes SLU (a)(b) | 34,733 | 559 | |

| Prosegur Cash SA (b) | 2,232,295 | 4,425 | |

| TOTAL SPAIN | 36,694 | ||

| Sweden - 1.7% | |||

| Alfa Laval AB | 176,000 | 4,495 | |

| ASSA ABLOY AB (B Shares) | 557,800 | 11,095 | |

| Coor Service Management Holding AB (b) | 445,200 | 3,138 | |

| HEXPOL AB (B Shares) | 469,100 | 4,342 | |

| Indutrade AB | 105,900 | 2,541 | |

| Swedbank AB (A Shares) | 207,200 | 4,667 | |

| Telefonaktiebolaget LM Ericsson (B Shares) | 255,000 | 2,220 | |

| TOTAL SWEDEN | 32,498 | ||

| Switzerland - 4.7% | |||

| Credit Suisse Group AG | 861,756 | 11,266 | |

| Julius Baer Group Ltd. | 166,500 | 7,593 | |

| Lonza Group AG | 29,786 | 9,366 | |

| Roche Holding AG (participation certificate) | 108,237 | 26,336 | |

| Sig Combibloc Group AG (a) | 182,700 | 2,026 | |

| Sika AG | 119,770 | 15,364 | |

| Swatch Group AG (Bearer) | 16,460 | 5,570 | |

| TE Connectivity Ltd. | 23,800 | 1,795 | |

| UBS Group AG | 686,113 | 9,599 | |

| TOTAL SWITZERLAND | 88,915 | ||

| Taiwan - 0.9% | |||

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 465,200 | 17,724 | |

| United Kingdom - 16.5% | |||

| Admiral Group PLC | 211,600 | 5,445 | |

| Aon PLC | 31,600 | 4,935 | |

| Ascential PLC | 1,037,977 | 4,999 | |

| Ashtead Group PLC | 1,600 | 40 | |

| AstraZeneca PLC (United Kingdom) | 302,779 | 23,159 | |

| Beazley PLC | 560,546 | 3,779 | |

| Big Yellow Group PLC | 125,100 | 1,379 | |

| BP PLC sponsored ADR | 295,700 | 12,825 | |

| British American Tobacco PLC sponsored ADR | 581,000 | 25,215 | |

| Bunzl PLC | 401,000 | 11,845 | |

| Coca-Cola European Partners PLC | 141,800 | 6,450 | |

| Compass Group PLC | 592,792 | 11,669 | |

| Conviviality PLC (d) | 775,686 | 0 | |

| Cranswick PLC | 171,000 | 6,317 | |

| DS Smith PLC | 401,881 | 2,018 | |

| Halma PLC | 231,300 | 3,926 | |

| Hastings Group Holdings PLC (b) | 1,715,495 | 4,059 | |

| Indivior PLC (a) | 1,064,300 | 2,562 | |

| Informa PLC | 374,068 | 3,412 | |

| InterContinental Hotel Group PLC | 70,800 | 3,719 | |

| ITV PLC | 1,659,700 | 3,160 | |

| John Wood Group PLC | 552,200 | 5,041 | |

| LivaNova PLC (a) | 22,100 | 2,475 | |

| Lloyds Banking Group PLC | 17,732,900 | 12,940 | |

| London Stock Exchange Group PLC | 244,700 | 13,496 | |

| Melrose Industries PLC | 2,893,571 | 6,238 | |

| Micro Focus International PLC | 423,752 | 6,569 | |

| Ocado Group PLC (a) | 31,200 | 341 | |

| Prudential PLC | 1,314,294 | 26,317 | |

| Reckitt Benckiser Group PLC | 244,613 | 19,780 | |

| RELX PLC | 662,447 | 13,108 | |

| Rentokil Initial PLC | 507,500 | 2,051 | |

| Smith & Nephew PLC | 401,100 | 6,520 | |

| Spectris PLC | 176,400 | 4,834 | |

| St. James's Place Capital PLC | 1,038,500 | 13,453 | |

| Standard Chartered PLC (United Kingdom) | 757,588 | 5,321 | |

| Standard Life PLC | 2,219,760 | 7,675 | |

| Tesco PLC | 4,800,972 | 13,075 | |

| The Weir Group PLC | 323,300 | 6,554 | |

| Volution Group PLC | 2,421,400 | 5,354 | |

| TOTAL UNITED KINGDOM | 312,055 | ||

| United States of America - 6.9% | |||

| Alphabet, Inc. Class C (a) | 13,249 | 14,266 | |

| Amgen, Inc. | 69,300 | 13,360 | |

| Becton, Dickinson & Co. | 27,600 | 6,362 | |

| Boston Scientific Corp. (a) | 284,000 | 10,264 | |

| Citigroup, Inc. | 160,500 | 10,506 | |

| Coty, Inc. Class A | 573,000 | 6,045 | |

| DowDuPont, Inc. | 48,500 | 2,615 | |

| FleetCor Technologies, Inc. (a) | 16,100 | 3,220 | |

| International Flavors & Fragrances, Inc. | 39,600 | 5,729 | |

| International Flavors & Fragrances, Inc. (Israel) | 19,123 | 2,761 | |

| Marsh & McLennan Companies, Inc. | 19,400 | 1,644 | |

| MasterCard, Inc. Class A | 96,400 | 19,055 | |

| Microsoft Corp. | 17,900 | 1,912 | |

| Oceaneering International, Inc. (a) | 38,110 | 722 | |

| Quintiles Transnational Holdings, Inc. (a) | 47,800 | 5,876 | |

| S&P Global, Inc. | 42,600 | 7,767 | |

| Visa, Inc. Class A | 136,800 | 18,858 | |

| TOTAL UNITED STATES OF AMERICA | 130,962 | ||

| TOTAL COMMON STOCKS | |||

| (Cost $1,536,439) | 1,769,904 | ||

| Nonconvertible Preferred Stocks - 0.7% | |||

| Germany - 0.7% | |||

| Henkel AG & Co. KGaA | 83,700 | 9,156 | |

| Jungheinrich AG | 64,800 | 2,150 | |

| Sartorius AG (non-vtg.) | 18,000 | 2,610 | |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | |||

| (Cost $12,734) | 13,916 | ||

| Money Market Funds - 5.8% | |||

| Fidelity Cash Central Fund, 2.23% (e) | 96,105,882 | 96,125 | |

| Fidelity Securities Lending Cash Central Fund 2.23% (e)(f) | 13,217,428 | 13,219 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $109,344) | 109,344 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.1% | |||

| (Cost $1,658,517) | 1,893,164 | ||

| NET OTHER ASSETS (LIABILITIES) - (0.1)% | (1,037) | ||

| NET ASSETS - 100% | $1,892,127 |

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

(a) Non-income producing

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $44,593,000 or 2.4% of net assets.

(c) Security or a portion of the security is on loan at period end.

(d) Level 3 security

(e) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(f) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| (Amounts in thousands) | |

| Fidelity Cash Central Fund | $599 |

| Fidelity Securities Lending Cash Central Fund | 450 |

| Total | $1,049 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2018, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | ||||

| Investments in Securities: | ||||

| Equities: | ||||

| Communication Services | $56,699 | $36,765 | $19,934 | $-- |

| Consumer Discretionary | 151,074 | 100,339 | 50,735 | -- |

| Consumer Staples | 204,882 | 126,401 | 78,481 | 0 |

| Energy | 84,052 | 84,052 | -- | -- |

| Financials | 457,654 | 319,206 | 138,448 | -- |

| Health Care | 239,984 | 102,838 | 137,146 | -- |

| Industrials | 277,005 | 193,779 | 83,226 | -- |

| Information Technology | 218,430 | 184,599 | 33,831 | -- |

| Materials | 82,242 | 65,220 | 17,022 | -- |

| Real Estate | 7,621 | 7,621 | -- | -- |

| Utilities | 4,177 | 4,177 | -- | -- |

| Money Market Funds | 109,344 | 109,344 | -- | -- |

| Total Investments in Securities: | $1,893,164 | $1,334,341 | $558,823 | $0 |

The following is a summary of transfers between Level 1 and Level 2 for the period ended October 31, 2018. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements:

| Transfers | Total (000s) |

| Level 1 to Level 2 | $77,702 |

| Level 2 to Level 1 | $231,642 |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | October 31, 2018 | |

| Assets | ||

| Investment in securities, at value (including securities loaned of $12,602) — See accompanying schedule: Unaffiliated issuers (cost $1,549,173) | $1,783,820 | |

| Fidelity Central Funds (cost $109,344) | 109,344 | |

| Total Investment in Securities (cost $1,658,517) | $1,893,164 | |

| Foreign currency held at value (cost $394) | 386 | |

| Receivable for investments sold | 8,074 | |

| Receivable for fund shares sold | 8,179 | |

| Dividends receivable | 6,276 | |

| Distributions receivable from Fidelity Central Funds | 116 | |

| Prepaid expenses | 4 | |

| Other receivables | 145 | |

| Total assets | 1,916,344 | |

| Liabilities | ||

| Payable for investments purchased | $7,298 | |

| Payable for fund shares redeemed | 1,789 | |

| Accrued management fee | 1,079 | |

| Distribution and service plan fees payable | 307 | |

| Other affiliated payables | 381 | |

| Other payables and accrued expenses | 144 | |

| Collateral on securities loaned | 13,219 | |

| Total liabilities | 24,217 | |

| Net Assets | $1,892,127 | |

| Net Assets consist of: | ||

| Paid in capital | $1,591,351 | |

| Total distributable earnings (loss) | 300,776 | |

| Net Assets | $1,892,127 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($463,074 ÷ 21,972 shares) | $21.08 | |

| Maximum offering price per share (100/94.25 of $21.08) | $22.37 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($174,637 ÷ 8,353 shares) | $20.91 | |

| Maximum offering price per share (100/96.50 of $20.91) | $21.67 | |

| Class C: | ||

| Net Asset Value and offering price per share ($149,848 ÷ 7,451 shares)(a) | $20.11 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($806,537 ÷ 37,618 shares) | $21.44 | |

| Class Z: | ||

| Net Asset Value, offering price and redemption price per share ($298,031 ÷ 13,903 shares) | $21.44 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | Year ended October 31, 2018 | |

| Investment Income | ||

| Dividends | $48,317 | |

| Income from Fidelity Central Funds | 1,049 | |

| Income before foreign taxes withheld | 49,366 | |

| Less foreign taxes withheld | (4,266) | |

| Total income | 45,100 | |

| Expenses | ||

| Management fee | $14,536 | |

| Transfer agent fees | 3,943 | |

| Distribution and service plan fees | 4,320 | |

| Accounting and security lending fees | 963 | |

| Custodian fees and expenses | 286 | |

| Independent trustees' fees and expenses | 11 | |

| Registration fees | 97 | |

| Audit | 74 | |

| Legal | 8 | |

| Miscellaneous | 15 | |

| Total expenses before reductions | 24,253 | |

| Expense reductions | (364) | |

| Total expenses after reductions | 23,889 | |

| Net investment income (loss) | 21,211 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 66,421 | |

| Fidelity Central Funds | (1) | |

| Foreign currency transactions | (469) | |

| Total net realized gain (loss) | 65,951 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers (net of decrease in deferred foreign taxes of $503) | (274,281) | |

| Assets and liabilities in foreign currencies | (112) | |

| Total change in net unrealized appreciation (depreciation) | (274,393) | |

| Net gain (loss) | (208,442) | |

| Net increase (decrease) in net assets resulting from operations | $(187,231) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Year ended October 31, 2018 | Year ended October 31, 2017 |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $21,211 | $17,535 |

| Net realized gain (loss) | 65,951 | 145,317 |

| Change in net unrealized appreciation (depreciation) | (274,393) | 244,874 |

| Net increase (decrease) in net assets resulting from operations | (187,231) | 407,726 |

| Distributions to shareholders | (24,045) | – |

| Distributions to shareholders from net investment income | – | (18,146) |

| Distributions to shareholders from net realized gain | – | (4,351) |

| Total distributions | (24,045) | (22,497) |

| Share transactions - net increase (decrease) | (148,877) | 12,173 |

| Redemption fees | – | 8 |

| Total increase (decrease) in net assets | (360,153) | 397,410 |

| Net Assets | ||

| Beginning of period | 2,252,280 | 1,854,870 |

| End of period | $1,892,127 | $2,252,280 |

| Other Information | ||

| Undistributed net investment income end of period | $17,289 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Advisor Diversified International Fund Class A

| Years ended October 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $23.43 | $19.38 | $20.10 | $19.56 | $19.47 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .21 | .17 | .18 | .15 | .27B |

| Net realized and unrealized gain (loss) | (2.33)C | 4.11 | (.77) | .61 | .17 |

| Total from investment operations | (2.12) | 4.28 | (.59) | .76 | .44 |

| Distributions from net investment income | (.16) | (.19) | (.13) | (.20) | (.18) |

| Distributions from net realized gain | (.07) | (.05) | – | (.02) | (.17) |

| Total distributions | (.23) | (.23)D | (.13) | (.22) | (.35) |

| Redemption fees added to paid in capitalA | – | –E | –E | –E | –E |

| Net asset value, end of period | $21.08 | $23.43 | $19.38 | $20.10 | $19.56 |

| Total ReturnF,G | (9.14)%C | 22.39% | (2.97)% | 3.93% | 2.28% |

| Ratios to Average Net AssetsH,I | |||||

| Expenses before reductions | 1.19% | 1.21% | 1.23% | 1.22% | 1.26% |

| Expenses net of fee waivers, if any | 1.19% | 1.21% | 1.23% | 1.22% | 1.26% |

| Expenses net of all reductions | 1.17% | 1.20% | 1.22% | 1.21% | 1.26% |

| Net investment income (loss) | .89% | .82% | .92% | .75% | 1.34%B |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $463 | $579 | $574 | $662 | $693 |

| Portfolio turnover rateJ | 32% | 44% | 31% | 34% | 40% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .85%.

C Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (9.62)%.

D Total distributions of $.23 per share is comprised of distributions from net investment income of $.187 and distributions from net realized gain of $.046 per share.

E Amount represents less than $.005 per share.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Diversified International Fund Class M

| Years ended October 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $23.24 | $19.21 | $19.92 | $19.38 | $19.30 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .14 | .12 | .13 | .10 | .21B |

| Net realized and unrealized gain (loss) | (2.31)C | 4.08 | (.77) | .61 | .18 |

| Total from investment operations | (2.17) | 4.20 | (.64) | .71 | .39 |

| Distributions from net investment income | (.09) | (.13) | (.07) | (.15) | (.14) |

| Distributions from net realized gain | (.07) | (.05) | – | (.02) | (.17) |

| Total distributions | (.16) | (.17)D | (.07) | (.17) | (.31) |

| Redemption fees added to paid in capitalA | – | –E | –E | –E | –E |

| Net asset value, end of period | $20.91 | $23.24 | $19.21 | $19.92 | $19.38 |

| Total ReturnF,G | (9.40)%C | 22.10% | (3.22)% | 3.67% | 2.04% |

| Ratios to Average Net AssetsH,I | |||||

| Expenses before reductions | 1.46% | 1.48% | 1.49% | 1.48% | 1.51% |

| Expenses net of fee waivers, if any | 1.46% | 1.47% | 1.49% | 1.48% | 1.51% |

| Expenses net of all reductions | 1.44% | 1.47% | 1.48% | 1.47% | 1.51% |

| Net investment income (loss) | .62% | .56% | .66% | .49% | 1.09%B |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $175 | $224 | $224 | $271 | $284 |

| Portfolio turnover rateJ | 32% | 44% | 31% | 34% | 40% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .60%.

C Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (9.88)%.

D Total distributions of $.17 per share is comprised of distributions from net investment income of $.128 and distributions from net realized gain of $.046 per share.

E Amount represents less than $.005 per share.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Diversified International Fund Class C

| Years ended October 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $22.35 | $18.48 | $19.19 | $18.68 | $18.63 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .03 | .01 | .03 | –B | .11C |

| Net realized and unrealized gain (loss) | (2.23)D | 3.94 | (.74) | .59 | .18 |

| Total from investment operations | (2.20) | 3.95 | (.71) | .59 | .29 |

| Distributions from net investment income | – | (.03) | – | (.06) | (.07) |

| Distributions from net realized gain | (.04) | (.05) | – | (.02) | (.17) |

| Total distributions | (.04) | (.08) | – | (.08) | (.24) |

| Redemption fees added to paid in capitalA | – | –B | –B | –B | –B |

| Net asset value, end of period | $20.11 | $22.35 | $18.48 | $19.19 | $18.68 |

| Total ReturnE,F | (9.85)%D | 21.46% | (3.70)% | 3.15% | 1.58% |

| Ratios to Average Net AssetsG,H | |||||

| Expenses before reductions | 1.95% | 1.96% | 1.98% | 1.97% | 2.00% |

| Expenses net of fee waivers, if any | 1.95% | 1.96% | 1.98% | 1.97% | 2.00% |

| Expenses net of all reductions | 1.94% | 1.96% | 1.98% | 1.96% | 2.00% |

| Net investment income (loss) | .13% | .07% | .17% | - %I | .60%C |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $150 | $211 | $206 | $251 | $243 |

| Portfolio turnover rateJ | 32% | 44% | 31% | 34% | 40% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Net investment income per share reflects a large, non-recurring dividend which amounted to $.09 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .11%.

D Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (10.33)%.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the contingent deferred sales charge.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than .005%.

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Diversified International Fund Class I

| Years ended October 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $23.85 | $19.73 | $20.46 | $19.91 | $19.80 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .27 | .24 | .24 | .21 | .33B |

| Net realized and unrealized gain (loss) | (2.37)C | 4.18 | (.78) | .63 | .18 |

| Total from investment operations | (2.10) | 4.42 | (.54) | .84 | .51 |

| Distributions from net investment income | (.24) | (.25) | (.19) | (.26) | (.23) |

| Distributions from net realized gain | (.07) | (.05) | – | (.02) | (.17) |

| Total distributions | (.31) | (.30) | (.19) | (.29)D | (.40) |

| Redemption fees added to paid in capitalA | – | –E | –E | –E | –E |

| Net asset value, end of period | $21.44 | $23.85 | $19.73 | $20.46 | $19.91 |

| Total ReturnF | (8.94)%C | 22.75% | (2.69)% | 4.24% | 2.60% |

| Ratios to Average Net AssetsG,H | |||||

| Expenses before reductions | .92% | .93% | .94% | .94% | .97% |

| Expenses net of fee waivers, if any | .92% | .93% | .94% | .94% | .97% |

| Expenses net of all reductions | .91% | .92% | .94% | .94% | .97% |

| Net investment income (loss) | 1.16% | 1.10% | 1.21% | 1.03% | 1.63%B |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $807 | $953 | $757 | $747 | $648 |

| Portfolio turnover rateI | 32% | 44% | 31% | 34% | 40% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.14%.

C Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (9.42)%.

D Total distributions of $.29 per share is comprised of distributions from net investment income of $.263 and distributions from net realized gain of $.022 per share.

E Amount represents less than $.005 per share.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Diversified International Fund Class Z

| Years ended October 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $23.85 | $19.73 | $20.46 | $19.93 | $19.81 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .31 | .27 | .27 | .24 | .36B |

| Net realized and unrealized gain (loss) | (2.37)C | 4.18 | (.78) | .61 | .19 |

| Total from investment operations | (2.06) | 4.45 | (.51) | .85 | .55 |

| Distributions from net investment income | (.28) | (.28) | (.22) | (.30) | (.26) |

| Distributions from net realized gain | (.07) | (.05) | – | (.02) | (.17) |

| Total distributions | (.35) | (.33) | (.22) | (.32) | (.43) |

| Redemption fees added to paid in capitalA | – | –D | –D | –D | –D |

| Net asset value, end of period | $21.44 | $23.85 | $19.73 | $20.46 | $19.93 |

| Total ReturnE | (8.78)%C | 22.94% | (2.54)% | 4.34% | 2.81% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | .78% | .78% | .79% | .79% | .81% |

| Expenses net of fee waivers, if any | .78% | .78% | .79% | .79% | .81% |

| Expenses net of all reductions | .76% | .78% | .79% | .78% | .81% |

| Net investment income (loss) | 1.30% | 1.25% | 1.36% | 1.18% | 1.79%B |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $298 | $286 | $93 | $83 | $24 |

| Portfolio turnover rateH | 32% | 44% | 31% | 34% | 40% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.30%.

C Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (9.26)%.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended October 31, 2018

(Amounts in thousands except percentages)

1. Organization.

Fidelity Advisor Diversified International Fund (the Fund) is a fund of Fidelity Advisor Series VIII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3– unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of October 31, 2018, including information on transfers between Levels 1 and 2, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of October 31, 2018, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets and Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), deferred trustees compensation and losses deferred due to wash sales

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $355,585 |

| Gross unrealized depreciation | (135,957) |

| Net unrealized appreciation (depreciation) | $219,628 |

| Tax Cost | $1,673,536 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $16,882 |

| Undistributed long-term capital gain | $64,620 |

| Net unrealized appreciation (depreciation) on securities and other investments | $219,470 |

The tax character of distributions paid was as follows:

| October 31, 2018 | October 31, 2017 | |

| Ordinary Income | $24,045 | $ 22,497 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

New Rule Issuance. During August 2018, the U.S. Securities and Exchange Commission issued Final Rule Release No. 33-10532, Disclosure Update and Simplification. This Final Rule includes amendments specific to registered investment companies that are intended to eliminate overlap in disclosure requirements between Regulation S-X and GAAP. In accordance with these amendments, certain line-items in the Fund's financial statements have been combined or removed for the current period as outlined in the table below.

| Financial Statement | Current Line-Item Presentation | Prior Line-Item Presentation |

| Statement of Assets and Liabilities | Total distributable earnings (loss) | Undistributed/Distributions in excess of/Accumulated net investment income (loss) Accumulated/Undistributed net realized gain (loss) Net unrealized appreciation (depreciation) |

| Statement of Changes in Net Assets | N/A – removed | Undistributed/Distributions in excess of/Accumulated net investment income (loss) end of period |

| Statement of Changes in Net Assets | Distributions to shareholders | Distributions to shareholders from net investment income Distributions to shareholders from net realized gain |

| Distributions to Shareholders Note to Financial Statements | Distributions to shareholders | Distributions to shareholders from net investment income Distributions to shareholders from net realized gain |

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $683,001 and $893,862, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .424% of the Fund's average net assets and an annualized group fee rate that averaged .24% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .66% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | -% | .25% | $1,389 | $33 |

| Class M | .25% | .25% | 1,052 | 18 |

| Class C | .75% | .25% | 1,879 | 59 |

| $4,320 | $110 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges are 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| Retained by FDC | |

| Class A | $70 |

| Class M | 19 |

| Class C(a) | 6 |

| $95 |

(a) When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund, except for Class Z. FIIOC receives an asset-based fee of Class Z's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| Amount | % of Class-Level Average Net Assets | |

| Class A | $1,161 | .21 |

| Class M | 476 | .23 |

| Class C | 412 | .22 |

| Class I | 1,750 | .19 |

| Class Z | 144 | .05 |

| $3,943 |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions. For the period, the fees were equivalent to an annual rate of .04%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $4 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $6 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. At period end, there were no security loans outstanding with FCM. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $450, including less than five hundred dollars from securities loaned to FCM.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $341 for the period.

In addition, during the period the investment advisor reimbursed and/or waived a portion of fund-level operating expenses in the amount of $23.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Year ended October 31, 2018 | Year ended October 31, 2017 |

|

| Distributions to shareholders | ||

| Class A | $5,653 | $– |

| Class M | 1,520 | – |

| Class C | 401 | – |

| Class I | 12,234 | – |

| Class Z | 4,237 | – |

| Total | $24,045 | $– |

| From net investment income | ||

| Class A | $– | $5,441 |

| Class M | – | 1,459 |

| Class C | – | 337 |

| Class I | – | 9,585 |

| Class Z | – | 1,324 |

| Total | $– | $18,146 |

| From net realized gain | ||

| Class A | $– | $1,338 |

| Class M | – | 524 |

| Class C | – | 500 |

| Class I | – | 1,771 |

| Class Z | – | 218 |

| Total | $– | $4,351 |

10. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| Shares | Shares | Dollars | Dollars | |

| Year ended October 31, 2018 | Year ended October 31, 2017 | Year ended October 31, 2018 | Year ended October 31, 2017 | |

| Class A | ||||

| Shares sold | 2,464 | 3,317 | $58,230 | $69,149 |

| Reinvestment of distributions | 235 | 342 | 5,469 | 6,436 |

| Shares redeemed | (5,429) | (8,598) | (126,599) | (175,117) |

| Net increase (decrease) | (2,730) | (4,939) | $(62,900) | $(99,532) |

| Class M | ||||

| Shares sold | 557 | 809 | $13,025 | $16,845 |

| Reinvestment of distributions | 64 | 102 | 1,487 | 1,912 |

| Shares redeemed | (1,889) | (2,936) | (44,045) | (59,831) |

| Net increase (decrease) | (1,268) | (2,025) | $(29,533) | $(41,074) |

| Class C | ||||

| Shares sold | 462 | 706 | $10,419 | $14,348 |

| Reinvestment of distributions | 16 | 40 | 361 | 720 |

| Shares redeemed | (2,468) | (2,474) | (55,659) | (49,015) |

| Net increase (decrease) | (1,990) | (1,728) | $(44,879) | $(33,947) |

| Class I | ||||

| Shares sold | 6,999 | 13,526 | $164,832 | $282,118 |

| Reinvestment of distributions | 434 | 479 | 10,246 | 9,168 |

| Shares redeemed | (9,766) | (12,447) | (231,388) | (259,183) |

| Net increase (decrease) | (2,333) | 1,558 | $(56,310) | $32,103 |

| Class Z | ||||

| Shares sold | 5,480 | 9,293 | $130,793 | $197,380 |

| Reinvestment of distributions | 164 | 81 | 3,858 | 1,541 |

| Shares redeemed | (3,743) | (2,078) | (89,906) | (44,298) |

| Net increase (decrease) | 1,901 | 7,296 | $44,745 | $154,623 |

11. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Fidelity Advisor Series VIII and Shareholders of Fidelity Advisor Diversified International Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Fidelity Advisor Diversified International Fund (one of the funds constituting Fidelity Advisor Series VIII, referred to hereafter as the "Fund") as of October 31, 2018, the related statement of operations for the year ended October 31, 2018, the statement of changes in net assets for each of the two years in the period ended October 31, 2018, including the related notes, and the financial highlights for each of the five years in the period ended October 31, 2018 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October 31, 2018 and the financial highlights for each of the five years in the period ended October 31, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.