Form N-CSR ETF Series Solutions For: Oct 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22668

ETF Series Solutions

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Paul R. Fearday

ETF Series Solutions

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(414) 765-5346

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Item 1. Reports to Stockholders.

Annual Report

October 31, 2018

AAM S&P 500 High Dividend Value ETF

Ticker: SPDV

AAM S&P Emerging Markets

High Dividend Value ETF

Ticker: EEMD

AAM ETFs

TABLE OF CONTENTS

|

Page

|

||

|

Management of Discussion of Fund Performance

|

1

|

|

|

Performance Summaries

|

3

|

|

|

Portfolio Allocations

|

5

|

|

|

Schedules of Investments

|

6

|

|

|

Statements of Assets and Liabilities

|

12

|

|

|

Statements of Operations

|

13

|

|

|

Statements of Changes in Net Assets

|

14

|

|

|

Financial Highlights

|

16

|

|

|

Notes to Financial Statements

|

18

|

|

|

Report of Independent Registered Public Accounting Firm

|

27

|

|

|

Trustees and Officers

|

28

|

|

|

Expense Examples

|

30

|

|

|

Federal Tax Information

|

32

|

|

|

Federal Tax Credit Pass Through

|

32

|

|

|

Information About Portfolio Holdings

|

33

|

|

|

Information About Proxy Voting

|

33

|

|

|

Frequency Distribution of Premiums and Discounts

|

33

|

AAM ETFs

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited)

The AAM S&P 500 High Dividend Value ETF

The AAM S&P 500 High Dividend Value ETF (“SPDV” or the “Fund”) seeks to track the total return performance, before fees and expenses, of its underlying index, the S&P 500 Dividend and Free Cash Flow Yield Index (the “Index”). Through the Index, SPDV, is passively managed using a rules-based, equal-weighted strategy that is designed to provide exposure to constituents of the S&P 500® Index that exhibit both high dividend yield and sustainable dividend distribution characteristics, while maintaining a diversified sector exposure.

For the period November 28, 2017 to October 31, 2018 (the annual “Period”), the U.S. equity market, represented by the S&P 500 index, gained 5.02%. Concerns of trade war with China, and the U.S. Federal Reserve (“Fed”) raising interest rates, created a challenging environment for equity markets for the Period. That said, SPDV generated a total return (NAV) of 5.98% and 6.15% (market price) over the same Period, while the underlying Index for SPDV generated a total return of 6.29%.

The top performing sectors contributing to SPDV’s return during the period were consumer discretionary, industrials and utilities. Worst performing sectors were financials, materials and health care.

Individual leaders contributing to SPDV’s return over the Period were Kohl’s (115 bps), WW Grainger (112 bps) and Macy’s (98 bps). The individual performance laggards over the Period were Western Digital (-109 bps), Principal Financial Group (-70 bps) and Cummins (-55 bps).

The AAM S&P Emerging Markets High Dividend Value ETF

The AAM S&P Emerging Markets High Dividend Value ETF (“EEMD” or the “Fund”) seeks to track the total return performance, before fees and expenses, of its underlying index, the S&P Emerging Markets Dividend and Free Cash Flow Yield Index (the “Index”). Through the Index, EEMD, is passively managed using a rules-based, equal-weighted strategy that is designed to provide exposure to constituents of the S&P Emerging Plus LargeMidCap® Index that exhibit both high dividend yield and sustainable dividend distribution characteristics, while maintaining a diversified sector exposure.

During the Period, emerging market equities continued their downward trend for the year. Historically, U.S. Federal Reserve (“Fed”) interest rate hikes often indicate a short-term decline in foreign currencies relative to the US dollar ($), all else being equal. Steady interest rate hikes throughout the Period helped contribute to international equites being out of favor relative to US equities.

EEMD generated a total return of -9.65% (NAV) and -9.19% (market price) over the Period. This compares to the -8.68% total return of the Index, and -14.34% total return of the benchmark index, the S&P Emerging Plus LargeMidCap® Index, for the same Period.

1

AAM ETFs

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) (Continued)

Top performing sectors contributing to EEMD’s return over the Period were materials, real estate and utilities. Worst performing sectors included consumer discretionary, information technology and health care.

Individual leaders contributing to EEMD’s return were CIA Energetica Minas (67 bps), China Vanke (54 bps) and Alrosa PJSC (47 bps). The individual performance laggards over the Period were Cheng UEI Precision Industry (-127 bps), Astro Malaysia (-104 bps) and BAIC Motor Corp (-89 bps).

Must be preceded or accompanied by a prospectus.

The AAM S&P 500 High Dividend Value ETF and AAM S&P Emerging Markets High Dividend Value ETF are distributed by Quasar Distributors, LLC.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV) and may trade at a discount or premium to NAV. Shares are not individually redeemable from the Funds and may be only be acquired or redeemed from the Funds in creation units. Brokerage commissions will reduce returns. Companies with high yield or payout ratio may underperform other securities in certain market conditions and reduce or discontinue paying dividends entirely while included in the index. The Funds return may not match or achieve a high degree of correlation with the return of the underlying Index. To the extent the Funds utilize a sampling approach, they may experience tracking error to a greater extent than if the Funds had sought to replicate the Index. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for emerging markets investments. Investments in mid-cap companies may involve less liquidity and greater volatility than larger companies. Diversification does not assure a profit or protect against a loss in a declining market.

S&P 500 Dividend and Free Cash Flow Yield index is a rules-based, equal-weighted index that is designed to provide exposure to the constituents of the S&P 500® Index that exhibit both high dividend yield and sustainable dividend distribution characteristics, while maintaining diversified sector exposure.

S&P 500® Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

S&P Emerging Markets Dividend and Free Cash Flow Yield Index is rules-based, equal-weighted index that is designed to provide exposure to the constituents of the S&P Emerging Plus LargeMidCap® Index that exhibit both high dividend yield and sustainable dividend distribution characteristics, while maintaining diversified sector exposure.

S&P Emerging Plus LargeMidCap® Index is designed to measure the performance of large- and mid-capitalization securities in emerging markets.

Basis Point (bps) refers to a unit of measurement for interest rates and other percentages. One basis point is equal to 1/100th of 1%, or 0.01%.

It is not possible to invest directly in an index.

For a complete list of Fund holdings please see the schedule of investments on page 7 of the report. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

2

AAM S&P 500 High Dividend Value ETF

PERFORMANCE SUMMARY

(Unaudited)

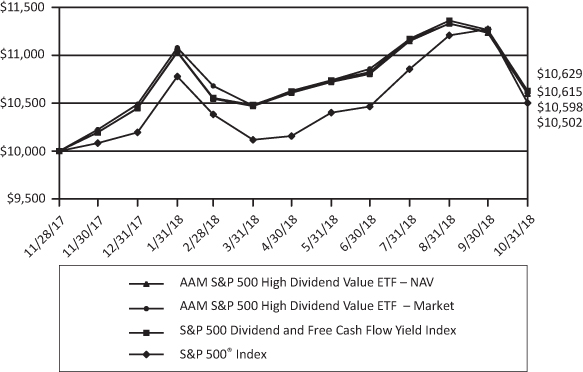

Growth of $10,000

|

Total Returns

|

Since Inception

|

|

Period Ending October 31, 2018

|

(11/28/2017)

|

|

AAM S&P 500 High Dividend Value ETF – NAV

|

5.98%

|

|

AAM S&P 500 High Dividend Value ETF – Market

|

6.15%

|

|

S&P 500 Dividend and Free Cash Flow Yield Index

|

6.29%

|

|

S&P 500® Index

|

5.02%

|

This chart illustrates the performance of a hypothetical $10,000 investment made on November 28, 2017 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains and dividends.

3

AAM S&P Emerging Markets High Dividend Value ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

|

Total Returns

|

Since Inception

|

|

Period Ending October 31, 2018

|

(11/28/2017)

|

|

AAM S&P Emerging Markets High Dividend Value ETF – NAV

|

-9.65%

|

|

AAM S&P Emerging Markets High Dividend Value ETF – Market

|

-9.19%

|

|

S&P Emerging Markets Dividend and Free Cash Flow Yield Index

|

-8.68%

|

|

S&P Emerging Plus LargeMidCap® Index

|

-14.34%

|

This chart illustrates the performance of a hypothetical $10,000 investment made on November 28, 2017 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains and dividends.

4

AAM ETFs

PORTFOLIO ALLOCATIONS

As of October 31, 2018 (Unaudited)

|

AAM S&P 500 High Dividend Value ETF

|

|

|

Percentage of

|

|

|

Sector

|

Net Assets

|

|

Utilities

|

10.2%

|

|

Consumer Staples

|

10.1

|

|

Real Estate

|

9.9

|

|

Consumer Discretionary

|

9.7

|

|

Industrials

|

9.7

|

|

Health Care

|

9.6

|

|

Energy

|

9.1

|

|

Financials

|

8.9

|

|

Materials

|

8.3

|

|

Information Technology

|

7.9

|

|

Communication Services

|

6.3

|

|

Other Assets in Excess of Liabilities

|

0.3

|

|

Short-Term Investments

|

0.0+

|

|

Total

|

100.0%

|

|

AAM S&P Emerging Markets High Dividend Value ETF

|

|

|

Percentage of

|

|

|

Sector

|

Net Assets

|

|

Communication Services

|

11.0%

|

|

Consumer Staples

|

10.4

|

|

Energy

|

9.7

|

|

Utilities

|

9.7

|

|

Information Technology

|

9.3

|

|

Materials

|

9.3

|

|

Real Estate

|

8.8

|

|

Financials

|

8.8

|

|

Industrials

|

8.7

|

|

Health Care

|

6.8

|

|

Consumer Discretionary

|

6.5

|

|

Other Assets in Excess of Liabilities

|

0.8

|

|

Short-Term Investments

|

0.2

|

|

Total

|

100.0%

|

|

+ Represents less than 0.05% of net assets.

|

The Global Industry Classification Standard (GICS®) was developed by and/or is exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bank Global Fund Services, LLC.

5

AAM S&P 500 High Dividend Value ETF

SCHEDULE OF INVESTMENTS

October 31, 2018

|

Shares

|

Security Description

|

Value

|

|||||

|

COMMON STOCKS – 99.7%

|

|||||||

|

Communication Services – 6.3%

|

|||||||

|

11,996

|

AT&T, Inc.

|

$

|

368,037

|

||||

|

20,476

|

CenturyLink, Inc.

|

422,625

|

|||||

|

7,377

|

Verizon Communications, Inc.

|

421,153

|

|||||

|

1,211,815

|

|||||||

|

Consumer Discretionary – 9.7%

|

|||||||

|

35,925

|

Ford Motor Company

|

343,084

|

|||||

|

15,179

|

H&R Block, Inc.

|

402,851

|

|||||

|

5,218

|

Kohl’s Corporation

|

395,159

|

|||||

|

9,655

|

Macy’s, Inc.

|

331,070

|

|||||

|

4,788

|

Target Corporation

|

400,420

|

|||||

|

1,872,584

|

|||||||

|

Consumer Staples – 10.1%

|

|||||||

|

9,481

|

Campbell Soup Company

|

354,684

|

|||||

|

8,819

|

General Mills, Inc.

|

386,272

|

|||||

|

3,529

|

J.M. Smucker Company

|

382,262

|

|||||

|

5,897

|

Molson Coors Brewing Company – Class B

|

377,408

|

|||||

|

5,805

|

Walgreens Boots Alliance, Inc.

|

463,065

|

|||||

|

1,963,691

|

|||||||

|

Energy – 9.1%

|

|||||||

|

4,577

|

Exxon Mobil Corporation

|

364,695

|

|||||

|

5,357

|

HollyFrontier Corporation

|

361,276

|

|||||

|

5,156

|

Marathon Petroleum Corporation

|

363,240

|

|||||

|

3,446

|

Phillips 66

|

354,318

|

|||||

|

3,542

|

Valero Energy Corporation

|

322,641

|

|||||

|

1,766,170

|

|||||||

|

Financials – 8.9%

|

|||||||

|

24,850

|

Huntington Bancshares, Inc.

|

356,100

|

|||||

|

8,461

|

MetLife, Inc.

|

348,509

|

|||||

|

20,613

|

People’s United Financial, Inc.

|

322,800

|

|||||

|

6,991

|

Principal Financial Group, Inc.

|

329,066

|

|||||

|

3,872

|

Prudential Financial, Inc.

|

363,116

|

|||||

|

1,719,591

|

|||||||

The accompanying notes are an integral part of these financial statements.

6

AAM S&P 500 High Dividend Value ETF

SCHEDULE OF INVESTMENTS

October 31, 2018 (Continued)

|

Shares

|

Security Description

|

Value

|

|||||

|

COMMON STOCKS (Continued)

|

|||||||

|

Health Care – 9.6%

|

|||||||

|

4,153

|

AbbVie, Inc.

|

$

|

323,311

|

||||

|

2,002

|

Amgen, Inc.

|

385,965

|

|||||

|

7,726

|

Cardinal Health, Inc.

|

390,936

|

|||||

|

4,893

|

Gilead Sciences, Inc.

|

333,605

|

|||||

|

10,084

|

Pfizer, Inc.

|

434,217

|

|||||

|

1,868,034

|

|||||||

|

Industrials – 9.7%

|

|||||||

|

2,824

|

Cummins, Inc.

|

386,012

|

|||||

|

7,354

|

Delta Air Lines, Inc.

|

402,484

|

|||||

|

4,906

|

Eaton Corporation plc

|

351,613

|

|||||

|

4,204

|

Ingersoll-Rand plc

|

403,332

|

|||||

|

12,867

|

Nielsen Holdings plc

|

334,285

|

|||||

|

1,877,726

|

|||||||

|

Information Technology – 7.9%

|

|||||||

|

16,526

|

HP, Inc.

|

398,938

|

|||||

|

2,596

|

International Business Machines Corporation

|

299,656

|

|||||

|

6,821

|

Seagate Technology plc

|

274,409

|

|||||

|

5,111

|

Western Digital Corporation

|

220,131

|

|||||

|

18,790

|

Western Union Company

|

338,971

|

|||||

|

1,532,105

|

|||||||

|

Materials – 8.3%

|

|||||||

|

8,733

|

CF Industries Holdings, Inc.

|

419,446

|

|||||

|

3,793

|

Eastman Chemical Company

|

297,181

|

|||||

|

3,508

|

LyondellBasell Industries NV – Class A

|

313,159

|

|||||

|

3,265

|

Packaging Corporation of America

|

299,760

|

|||||

|

6,614

|

WestRock Company

|

284,204

|

|||||

|

1,613,750

|

|||||||

|

Real Estate – 9.9%

|

|||||||

|

14,686

|

HCP, Inc.#

|

404,599

|

|||||

|

17,982

|

Host Hotels & Resorts, Inc.#

|

343,636

|

|||||

|

22,794

|

Kimco Realty Corporation#

|

366,756

|

|||||

|

2,239

|

Simon Property Group, Inc.#

|

410,901

|

|||||

|

6,585

|

Ventas, Inc.#

|

382,193

|

|||||

|

1,908,085

|

|||||||

The accompanying notes are an integral part of these financial statements.

7

AAM S&P 500 High Dividend Value ETF

SCHEDULE OF INVESTMENTS

October 31, 2018 (Continued)

|

Shares

|

Security Description

|

Value

|

|||||

|

COMMON STOCKS (Continued)

|

|||||||

|

Utilities – 10.2%

|

|||||||

|

29,224

|

AES Corporation

|

$

|

426,086

|

||||

|

13,603

|

CenterPoint Energy, Inc.

|

367,417

|

|||||

|

6,910

|

Evergy, Inc.

|

386,891

|

|||||

|

2,234

|

NextEra Energy, Inc.

|

385,365

|

|||||

|

5,897

|

WEC Energy Group, Inc.

|

403,355

|

|||||

|

1,969,114

|

|||||||

|

TOTAL COMMON STOCKS (Cost $20,136,748)

|

19,302,665

|

||||||

|

SHORT-TERM INVESTMENTS – 0.0%+

|

|||||||

|

9,626

|

Invesco Government & Agency Portfolio Short-Term

|

||||||

|

Investments Trust, Institutional Class – 2.08%*

|

9,626

|

||||||

|

TOTAL SHORT-TERM INVESTMENTS (Cost $9,626)

|

9,626

|

||||||

|

TOTAL INVESTMENTS – 99.7% (Cost $20,146,374)

|

19,312,291

|

||||||

|

Other Assets in Excess of Liabilities – 0.3%

|

57,261

|

||||||

|

NET ASSETS – 100.0%

|

$

|

19,369,552

|

|||||

Percentages are stated as a percent of net assets.

|

#

|

Real Estate Investment Trust (“REIT”)

|

|

|

*

|

Rate shown is the annualized seven-day yield as of October 31, 2018.

|

|

|

+

|

Represents less than 0.05% of net assets.

|

The Global Industry Classification Standard (GICS®) was developed by and/or is exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bank Global Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

8

AAM S&P Emerging Markets High Dividend Value ETF

SCHEDULE OF INVESTMENTS

October 31, 2018

|

Shares

|

Security Description

|

Value

|

|||||

|

COMMON STOCKS – 96.4%

|

|||||||

|

Brazil – 8.6%

|

|||||||

|

4,700

|

Banco Santander Brasil SA

|

$

|

53,434

|

||||

|

14,200

|

CCR SA

|

41,554

|

|||||

|

6,200

|

Cia de Saneamento Basico do Estado de Sao Paulo

|

46,235

|

|||||

|

5,679

|

Hypermarcas SA

|

45,209

|

|||||

|

186,432

|

|||||||

|

China – 21.7%

|

|||||||

|

88,000

|

Agricultural Bank of China, Ltd. – H Shares

|

38,615

|

|||||

|

49,500

|

BAIC Motor Corporation, Ltd. – H Shares

|

27,783

|

|||||

|

154,000

|

China Cinda Asset Management

|

||||||

|

Company, Ltd. – H Shares

|

37,717

|

||||||

|

173,000

|

China Huarong Asset Management

|

||||||

|

Compay, Ltd. – H Shares

|

31,337

|

||||||

|

46,000

|

China Petroleum & Chemical Corporation – H Shares

|

37,319

|

|||||

|

19,000

|

China Shenhua Energy Company, Ltd. – H Shares

|

43,044

|

|||||

|

13,000

|

China Vanke Company, Ltd. – H Shares

|

40,048

|

|||||

|

49,000

|

Chongqing Changan Automobile

|

||||||

|

Company, Ltd. – Class B

|

33,002

|

||||||

|

44,000

|

Dongfeng Motor Group

|

||||||

|

Company, Ltd. – H Shares

|

43,330

|

||||||

|

15,500

|

Longfor Group Holdings, Ltd.

|

37,646

|

|||||

|

15,000

|

Shimao Property Holdings, Ltd.

|

29,352

|

|||||

|

70,000

|

Sinopec Shanghai Petrochemical

|

||||||

|

Company, Ltd. – H Shares

|

30,717

|

||||||

|

50,000

|

Zhejiang Expressway Company, Ltd. – H Shares

|

41,904

|

|||||

|

471,814

|

|||||||

|

Malaysia – 7.9%

|

|||||||

|

95,000

|

Astro Malaysia Holdings, Bhd.

|

30,649

|

|||||

|

5,100

|

British American Tobacco Malaysia, Bhd.

|

37,904

|

|||||

|

107,300

|

FGV Holdings, Bhd.

|

35,899

|

|||||

|

70,600

|

Sime Darby, Bhd.

|

37,118

|

|||||

|

136,900

|

YTL Power International, Bhd.

|

31,080

|

|||||

|

172,650

|

|||||||

|

Marshall Islands – 1.5%

|

|||||||

|

5,992

|

Costamare, Inc.

|

31,758

|

|||||

The accompanying notes are an integral part of these financial statements.

9

AAM S&P Emerging Markets High Dividend Value ETF

SCHEDULE OF INVESTMENTS

October 31, 2018 (Continued)

|

Shares

|

Security Description

|

Value

|

|||||

|

COMMON STOCKS (Continued)

|

|||||||

|

Mexico – 1.8%

|

|||||||

|

52,595

|

Nemak SAB de CV

|

$

|

38,100

|

||||

|

Pakistan – 2.0%

|

|||||||

|

10,320

|

Pakistan Oilfields, Ltd.

|

42,447

|

|||||

|

Qatar – 6.0%

|

|||||||

|

4,297

|

Barwa Real Estate Company

|

44,120

|

|||||

|

2,123

|

Ooredoo Q.P.S.C.

|

40,156

|

|||||

|

9,765

|

Qatar Gas Transport Company, Ltd.

|

46,793

|

|||||

|

131,069

|

|||||||

|

Republic of Korea – 3.8%

|

|||||||

|

3,176

|

KT Corporation – ADR

|

43,956

|

|||||

|

444

|

KT&G Corporation

|

39,547

|

|||||

|

83,503

|

|||||||

|

Russian Federation – 11.4%

|

|||||||

|

28,100

|

Alrosa PJSC

|

42,701

|

|||||

|

643,000

|

Inter RAO UES PJSC

|

38,948

|

|||||

|

60,100

|

Magnitogorsk Iron & Steel Works PJSC

|

43,832

|

|||||

|

4,905

|

Mobile TeleSystems PJSC – ADR

|

39,289

|

|||||

|

2,740

|

Severstal PJSC

|

42,930

|

|||||

|

14,026

|

VEON, Ltd. – ADR

|

39,413

|

|||||

|

247,113

|

|||||||

|

South Africa – 6.5%

|

|||||||

|

23,620

|

Life Healthcare Group Holdings, Ltd.

|

39,190

|

|||||

|

21,281

|

Netcare, Ltd.

|

35,784

|

|||||

|

3,085

|

SPAR Group, Ltd.

|

36,735

|

|||||

|

1,716

|

Tiger Brands, Ltd.

|

30,631

|

|||||

|

142,340

|

|||||||

|

Taiwan, Province of China – 14.3%

|

|||||||

|

107,000

|

AU Optronics Corporation

|

42,187

|

|||||

|

40,000

|

Cheng Uei Precision Industry Company, Ltd.

|

27,535

|

|||||

|

26,000

|

CTCI Corporation

|

36,677

|

|||||

|

152,000

|

HannStar Display Corporation

|

33,403

|

|||||

|

55,000

|

Inventec Corporation

|

44,348

|

|||||

|

21,000

|

Radiant Opto-Electronics Corporation

|

54,904

|

|||||

The accompanying notes are an integral part of these financial statements.

10

AAM S&P Emerging Markets High Dividend Value ETF

SCHEDULE OF INVESTMENTS

October 31, 2018 (Continued)

|

Shares

|

Security Description

|

Value

|

|||||

|

COMMON STOCKS (Continued)

|

|||||||

|

Taiwan, Province of China (Continued)

|

|||||||

|

2,000

|

St. Shine Optical Company, Ltd.

|

$

|

35,549

|

||||

|

14,000

|

TTY Biopharm Company, Ltd.

|

36,558

|

|||||

|

311,161

|

|||||||

|

Thailand – 7.5%

|

|||||||

|

15,400

|

Glow Energy pcl

|

38,906

|

|||||

|

17,700

|

PTT Global Chemical pcl

|

41,247

|

|||||

|

430,800

|

Quality Houses pcl

|

40,806

|

|||||

|

97,200

|

Star Petroleum Refining pcl

|

41,343

|

|||||

|

162,302

|

|||||||

|

Turkey – 1.4%

|

|||||||

|

43,903

|

Turkiye Is Bankasi AS – Class C

|

31,262

|

|||||

|

United Arab Emirates – 2.0%

|

|||||||

|

9,217

|

Emirates Telecommunications Group Company PJSC

|

43,662

|

|||||

|

TOTAL COMMON STOCKS (Cost $2,544,558)

|

2,095,613

|

||||||

|

PREFERRED STOCKS – 2.6%

|

|||||||

|

Brazil – 2.6%

|

|||||||

|

19,162

|

Cia Energetica de Minas Gerais

|

57,004

|

|||||

|

TOTAL PREFERRED STOCKS (Cost $43,453)

|

57,004

|

||||||

|

SHORT-TERM INVESTMENTS – 0.2%

|

|||||||

|

4,876

|

Invesco Government & Agency Portfolio Short-Term

|

||||||

|

Investments Trust, Institutional Class – 2.08%*

|

4,876

|

||||||

|

TOTAL SHORT-TERM INVESTMENTS (Cost $4,876)

|

4,876

|

||||||

|

TOTAL INVESTMENTS – 99.2% (Cost $2,592,887)

|

2,157,493

|

||||||

|

Other Assets in Excess of Liabilities – 0.8%

|

17,149

|

||||||

|

NET ASSETS – 100.0%

|

$

|

2,174,642

|

|||||

Percentages are stated as a percent of net assets.

|

ADR

|

American Depositary Receipt

|

|

|

*

|

Rate shown is the annualized seven-day yield as of October 31, 2018.

|

The accompanying notes are an integral part of these financial statements.

11

AAM ETFs

STATEMENTS OF ASSETS & LIABILITIES

October 31, 2018

|

AAM

|

AAM

|

|||||||

|

S&P 500

|

S&P Emerging

|

|||||||

|

High

|

Markets High

|

|||||||

|

Dividend

|

Dividend

|

|||||||

|

Value ETF

|

Value ETF

|

|||||||

|

ASSETS

|

||||||||

|

Investments in securities, at value*

|

$

|

19,312,291

|

$

|

2,157,493

|

||||

|

Foreign currency, at value*

|

—

|

1

|

||||||

|

Cash

|

—

|

1,021

|

||||||

|

Receivable for securities sold

|

34,071

|

4,887

|

||||||

|

Dividends and interest receivable

|

27,448

|

12,150

|

||||||

|

Total assets

|

19,373,810

|

2,175,552

|

||||||

|

LIABILITIES

|

||||||||

|

Management fees payable

|

4,258

|

910

|

||||||

|

Total liabilities

|

4,258

|

910

|

||||||

|

NET ASSETS

|

$

|

19,369,552

|

$

|

2,174,642

|

||||

|

Net assets consist of:

|

||||||||

|

Paid-in capital

|

$

|

20,266,444

|

$

|

2,704,897

|

||||

|

Total distributable earnings/(accumulated deficit)

|

(896,892

|

)

|

(530,255

|

)

|

||||

|

Net assets

|

$

|

19,369,552

|

$

|

2,174,642

|

||||

|

Net asset value:

|

||||||||

|

Net assets

|

$

|

19,369,552

|

$

|

2,174,642

|

||||

|

Shares outstanding^

|

750,000

|

100,000

|

||||||

|

Net asset value, offering and

|

||||||||

|

redemption price per share

|

$

|

25.83

|

$

|

21.75

|

||||

|

* Identified Cost:

|

||||||||

|

Investments in securities

|

$

|

20,146,374

|

$

|

2,592,887

|

||||

|

Foreign currency

|

$

|

—

|

$

|

3

|

||||

|

^ No par value, unlimited number of shares authorized.

|

||||||||

The accompanying notes are an integral part of these financial statements.

12

AAM ETFs

STATEMENTS OF OPERATIONS

For the Period Ended October 31, 2018

|

AAM

|

AAM

|

|||||||

|

S&P 500

|

S&P Emerging

|

|||||||

|

High

|

Markets High

|

|||||||

|

Dividend

|

Dividend

|

|||||||

|

Value ETF*

|

Value ETF*

|

|||||||

|

INCOME

|

||||||||

|

Dividends^

|

$

|

227,647

|

$

|

123,901

|

||||

|

Interest

|

171

|

204

|

||||||

|

Total investment income

|

227,818

|

124,105

|

||||||

|

EXPENSES

|

||||||||

|

Management fees

|

19,810

|

11,175

|

||||||

|

Total expenses

|

19,810

|

11,175

|

||||||

|

Net investment income (loss)

|

208,008

|

112,930

|

||||||

|

REALIZED AND UNREALIZED

|

||||||||

|

GAIN (LOSS) ON INVESTMENTS

|

||||||||

|

Net realized gain (loss) on:

|

||||||||

|

Investments

|

365,806

|

90,026

|

||||||

|

Foreign currency

|

—

|

(8,548

|

)**

|

|||||

|

Change in unrealized appreciation (depreciation) on:

|

||||||||

|

Investments

|

(834,083

|

)

|

(435,394

|

)

|

||||

|

Foreign currency

|

—

|

(319

|

)

|

|||||

|

Net realized and unrealized

|

||||||||

|

gain (loss) on investments

|

(468,277

|

)

|

(354,235

|

)

|

||||

|

Net increase (decrease) in net assets

|

||||||||

|

resulting from operations

|

$

|

(260,269

|

)

|

$

|

(241,305

|

)

|

||

|

^

|

Net of foreign taxes withheld of $0 and $17,002 respectively.

|

|

|

*

|

Fund inception date of November 28, 2017. The information presented is for the period from November 28, 2017 to October 31, 2018.

|

|

|

**

|

Net of $1,058 in foreign capital gain taxes.

|

The accompanying notes are an integral part of these financial statements.

13

AAM S&P 500 High Dividend Value ETF

STATEMENT OF CHANGES IN NET ASSETS

|

Period Ended

|

||||

|

October 31, 2018*

|

||||

|

OPERATIONS

|

||||

|

Net investment income (loss)

|

$

|

208,008

|

||

|

Net realized gain (loss) on investments

|

365,806

|

|||

|

Change in unrealized appreciation

|

||||

|

(depreciation) of investments

|

(834,083

|

)

|

||

|

Net increase (decrease) in net assets

|

||||

|

resulting from operations

|

(260,269

|

)

|

||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||

|

Distributions to shareholders

|

(180,619

|

)

|

||

|

Total distributions to shareholders

|

(180,619

|

)

|

||

|

CAPITAL SHARE TRANSACTIONS

|

||||

|

Proceeds from subscriptions

|

23,923,010

|

|||

|

Transaction fees (Note 6)

|

10

|

|||

|

Payments for shares redeemed

|

(4,112,580

|

)

|

||

|

Net increase (decrease) in net assets derived

|

||||

|

from capital share transactions (a)

|

19,810,440

|

|||

|

Net increase (decrease) in net assets

|

19,369,552

|

|||

|

NET ASSETS

|

||||

|

Beginning of period

|

$

|

—

|

||

|

End of period

|

$

|

19,369,552

|

||

|

(a)

|

A summary of capital share transactions is as follows:

|

|

Period Ended

|

|||||

|

October 31, 2018*

|

|||||

|

Shares

|

|||||

|

Subscriptions

|

900,000

|

||||

|

Redemptions

|

(150,000

|

)

|

|||

|

Net income (decrease)

|

750,000

|

||||

|

*

|

Fund inception date of November 28, 2017. The information presented is for the period from November 28, 2017 to October 31, 2018.

|

The accompanying notes are an integral part of these financial statements.

14

AAM S&P Emerging Markets High Dividend Value ETF

STATEMENT OF CHANGES IN NET ASSETS

|

Period Ended

|

||||

|

October 31, 2018*

|

||||

|

OPERATIONS

|

||||

|

Net investment income (loss)

|

$

|

112,930

|

||

|

Net realized gain (loss) on investments

|

||||

|

and foreign currency

|

81,478

|

|||

|

Change in unrealized appreciation

|

||||

|

(depreciation) on investments and foreign currency

|

(435,713

|

)

|

||

|

Net increase (decrease) in net assets

|

||||

|

resulting from operations

|

(241,305

|

)

|

||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||

|

Distributions to shareholders

|

(92,758

|

)

|

||

|

Total distributions to shareholders

|

(92,758

|

)

|

||

|

CAPITAL SHARE TRANSACTIONS

|

||||

|

Proceeds from subscriptions

|

3,890,905

|

|||

|

Transaction fees (Note 6)

|

9,785

|

|||

|

Payments for shares redeemed

|

(1,391,985

|

)

|

||

|

Net increase (decrease) in net assets derived

|

||||

|

from capital share transactions (a)

|

2,508,705

|

|||

|

Net increase (decrease) in net assets

|

2,174,642

|

|||

|

NET ASSETS

|

||||

|

Beginning of period

|

$

|

—

|

||

|

End of period

|

$

|

2,174,642

|

||

|

(a)

|

A summary of capital share transactions is as follows:

|

|

Period Ended

|

|||||

|

October 31, 2018*

|

|||||

|

Shares

|

|||||

|

Subscriptions

|

150,000

|

||||

|

Redemptions

|

(50,000

|

)

|

|||

|

Net increase (decrease)

|

100,000

|

||||

|

*

|

Fund inception date of November 28, 2017. The information presented is for the period from November 28, 2017 to October 31, 2018.

|

The accompanying notes are an integral part of these financial statements.

15

AAM S&P 500 High Dividend Value ETF

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout the period

|

Period Ended

|

||||

|

October 31, 2018(1)

|

||||

|

Net asset value, beginning of period

|

$

|

25.00

|

||

|

INCOME (LOSS) FROM INVESTMENT OPERATIONS:

|

||||

|

Net investment income (loss)(2)

|

0.75

|

|||

|

Net realized and unrealized gain (loss) on investments(3)

|

0.76

|

|||

|

Total from investment operations

|

1.51

|

|||

|

DISTRIBUTIONS TO SHAREHOLDERS:

|

||||

|

Distributions from:

|

||||

|

Net investment income

|

(0.68

|

)

|

||

|

Total distributions

|

(0.68

|

)

|

||

|

CAPITAL SHARE TRANSACTIONS:

|

||||

|

Transaction fees (Note 6)

|

0.00

|

(4)

|

||

|

Net asset value, end of period

|

$

|

25.83

|

||

|

Total return

|

5.98

|

%(5)

|

||

|

SUPPLEMENTAL DATA:

|

||||

|

Net assets at end of period (000’s)

|

$

|

19,370

|

||

|

RATIOS TO AVERAGE NET ASSETS:

|

||||

|

Expenses to average net assets

|

0.29

|

%(6)

|

||

|

Net investment income (loss) to average net assets

|

3.05

|

%(6)

|

||

|

Portfolio turnover rate(7)

|

38

|

%(5)

|

||

|

(1)

|

Inception date of November 28, 2017.

|

|

(2)

|

Calculated based on average shares outstanding during the period.

|

|

(3)

|

Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period.

|

|

(4)

|

Less than $0.005.

|

|

(5)

|

Not annualized.

|

|

(6)

|

Annualized.

|

|

(7)

|

Excludes the impact of in-kind transactions.

|

The accompanying notes are an integral part of these financial statements.

16

AAM S&P Emerging Markets High Dividend Value ETF

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout the period

|

Period Ended

|

||||

|

October 31, 2018(1)

|

||||

|

Net asset value, beginning of period

|

$

|

25.00

|

||

|

INCOME (LOSS) FROM INVESTMENT OPERATIONS:

|

||||

|

Net investment income (loss)(2)

|

1.13

|

|||

|

Net realized and unrealized gain (loss) on investments

|

||||

|

and foreign currency

|

(3.55

|

)

|

||

|

Total from investment operations

|

(2.42

|

)

|

||

|

DISTRIBUTIONS TO SHAREHOLDERS:

|

||||

|

Distribution from:

|

||||

|

Net investment income

|

(0.93

|

)

|

||

|

Total distributions

|

(0.93

|

)

|

||

|

CAPITAL SHARE TRANSACTIONS:

|

||||

|

Transaction fees (Note 6)

|

0.10

|

|||

|

Net asset value, end of period

|

$

|

21.75

|

||

|

Total return

|

-9.65

|

%(3)

|

||

|

SUPPLEMENTAL DATA:

|

||||

|

Net assets at end of period (000’s)

|

$

|

2,175

|

||

|

RATIOS TO AVERAGE NET ASSETS:

|

||||

|

Expenses to average net assets

|

0.49

|

%(4)

|

||

|

Net investment income (loss) to average net assets

|

4.95

|

%(4)

|

||

|

Portfolio turnover rate(5)

|

104

|

%(3)

|

||

|

(1)

|

Inception date of November 28, 2017.

|

|

(2)

|

Calculated based on average shares outstanding during the period.

|

|

(3)

|

Not annualized.

|

|

(4)

|

Annualized.

|

|

(5)

|

Excludes the impact of in-kind transactions.

|

The accompanying notes are an integral part of these financial statements.

17

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018

NOTE 1 – ORGANIZATION

AAM S&P 500 High Dividend Value ETF and AAM S&P Emerging Markets High Dividend Value ETF (individually each a “Fund” or collectively the “Funds”) are diversified series of ETF Series Solutions (“ESS” or the “Trust”), an open-end management investment company consisting of multiple investment series, organized as a Delaware statutory trust on February 9, 2012. The Trust is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Funds’ shares is registered under the Securities Act of 1933, as amended (the “Securities Act”). The investment objective of the AAM S&P 500 High Dividend Value ETF is to track the performance, before fees and expenses, of the S&P 500 Dividend and Free Cash Flow Yield Index. The investments objective of the AAM S&P Emerging Markets High Dividend Value ETF is to track the performance, before fees and expenses, of the S&P Emerging Markets Dividend Free Cash Flow Yield Index. AAM S&P 500 High Dividend Value ETF and AAM S&P Emerging Markets High Dividend Value ETF commenced operations on November 28, 2017.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies.

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with the United States of America generally accepted accounting principles (“U.S. GAAP”).

|

A.

|

Security Valuation. All equity securities, including domestic and foreign common stocks, preferred stocks, and exchange traded funds that are traded on a national securities exchange, except those listed on The Nasdaq Stock Market®, Nasdaq Global Select Markets® and Nasdaq Capital Market Exchange® (collectively, “Nasdaq”), are valued at the last reported sale price on the exchange on which the security is principally traded. Securities traded on Nasdaq will be valued at the Nasdaq Official Closing Price (“NOCP”) If, on a particular day, an exchange-traded or Nasdaq security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. Prices denominated in foreign currencies are

|

18

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (Continued)

|

converted to U.S. dollar equivalents at the current exchange rate, which approximates fair value. Investments in mutual funds, including money market funds, are valued at their net asset value (“NAV”) per share. Short-term securities that have maturities of less than 60 days at the time of purchase are valued at amortized cost, which, when combined with accrued interest, approximates fair value.

|

|

|

Securities for which quotations are not readily available are valued at their respective fair values in accordance with pricing procedures adopted by the Funds’ Board of Trustees (the “Board”). When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Board. The use of fair value pricing by the Funds may cause the NAV of their shares to differ significantly from the NAV that would be calculated without regard to such considerations.

|

|

|

As described above, the Funds utilize various methods to measure the fair value of their investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuations methods. The three levels of inputs are:

|

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access.

|

|

|

Level 2 –

|

Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

|

|

|

Level 3 –

|

Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

|

|

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

|

19

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (Continued)

|

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

|

|

|

The following is a summary of the inputs used to value the Funds’ investments as of October 31, 2018:

|

|

AAM S&P 500 High Dividend Value ETF

|

|||||||||||||||||

|

Assets^

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Common Stocks

|

$

|

19,302,665

|

$

|

—

|

$

|

—

|

$

|

19,302,665

|

|||||||||

|

Short-Term Investments

|

9,626

|

—

|

—

|

9,626

|

|||||||||||||

|

Total Investments

|

|||||||||||||||||

|

in Securities

|

$

|

19,312,291

|

$

|

—

|

$

|

—

|

$

|

19,312,291

|

|||||||||

|

^ See Schedule of Investments for breakout of investments by sector classification.

|

|||||||||||||||||

|

AAM S&P Emerging Markets High Dividend Value ETF

|

|||||||||||||||||

|

Assets^

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Common Stocks

|

$

|

2,095,613

|

$

|

—

|

$

|

—

|

$

|

2,095,613

|

|||||||||

|

Preferred Stocks

|

57,004

|

—

|

—

|

57,004

|

|||||||||||||

|

Short-Term Investments

|

4,876

|

—

|

—

|

4,876

|

|||||||||||||

|

Total Investments

|

|||||||||||||||||

|

in Securities

|

$

|

2,157,493

|

$

|

—

|

$

|

—

|

$

|

2,175,493

|

|||||||||

|

^ See Schedule of Investments for breakout of investments by country.

|

|||||||||||||||||

|

For the period ended October 31, 2018, the Funds did not recognize any transfers to or from Level 3.

|

||

|

B.

|

Federal Income Taxes. The Funds’ policy is to comply with the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute substantially all of their net investment income and net capital gains to shareholders. Therefore, no federal income tax provision is required. Each Fund plans to file U.S. Federal and various state and local tax returns.

|

|

|

Each Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed each Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months. Income and capital gain

|

20

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (Continued)

|

distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expenses in the Statements of Operations. During the most recently completed fiscal period end, the Funds did not occur any interest or penalties.

|

||

|

C.

|

Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis. Withholding taxes on foreign dividends and foreign taxes on capital gains have been provided for in accordance with the Funds’ understanding of the applicable tax rules and regulations.

|

|

|

Distributions received from investments in real estate investment trusts (“REITs”) may be characterized as ordinary income, net capital gain, or a return of capital. The proper characterization of REIT distributions is generally not known until after the end of each calendar year. As such, the Funds must use estimates in reporting the character of income and distributions for financial statement purposes. The actual character of distribution to a Fund’s shareholders will be reflected on the Form 1099 received by shareholders after the end of the calendar year. Due to the nature of REIT investments, a portion of the distributions received by a Fund’s shareholders may represent a return of capital.

|

||

|

D.

|

Foreign Currency. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments and currency gains or losses realized between the trade and settlement dates on securities transactions from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments. The Funds report net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign currency transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets

|

21

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (Continued)

|

and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

|

||

|

E.

|

Distributions to Shareholders. Distributions to shareholders from net investment income on securities are declared and paid by the Funds on a monthly basis. Net realized gains on securities are declared and paid by the Funds on an annual basis. Distributions are recorded on the ex-dividend date.

|

|

|

F.

|

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

|

|

|

G.

|

Share Valuation. The NAV per share of each Fund is calculated by dividing the sum of the value of the securities held by each Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of outstanding shares for each Fund, rounded to the nearest cent. The Funds’ shares will not be priced on the days on which the New York Stock Exchange (“NYSE”) is closed for trading. The offering and redemption price per share for creation units of each Fund is equal to each Fund’s NAV per share.

|

|

|

H.

|

Reclassification of Capital Accounts. U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share.

|

|

|

The permanent differences primarily relate to redemptions in-kind. For the period ended October 31, 2018, the following table shows the reclassifications made:

|

|

Distributable

|

|||

|

Earnings/

|

|||

|

(Accumulated

|

Paid-In

|

||

|

Deficit)

|

Capital

|

||

|

AAM S&P 500 High Dividend Value ETF

|

$(456,004)

|

$456,004

|

|

|

AAM S&P Emerging Markets

|

|||

|

High Dividend Value ETF

|

$(196,192)

|

$196,192

|

|

During the period ended October 31, 2018, the Funds realized the following net capital gains resulting from in-kind redemptions, in which shareholders exchanged Fund shares for securities held by the Funds rather than for cash. Because such gains are not taxable to the Funds, and are not distributed to shareholders, they have been reclassified from distributable earnings/(accumulated deficit) to paid in capital.

|

22

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (Continued)

|

AAM S&P 500 High Dividend Value ETF

|

$456,004

|

|

|

AAM S&P Emerging Markets High Dividend Value ETF

|

$196,192

|

|

I.

|

Guarantees and Indemnifications. In the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

|

|

|

J.

|

Subsequent Events. In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. There were no events or transactions that occurred during the period subsequent to October 31, 2018, that materially impacted the amounts or disclosures in the Funds’ financial statements.

|

|

|

K.

|

New Accounting Pronouncements and Other Matters. In August 2018, FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The primary focus of ASU 2018-13 is to improve the effectiveness of the disclosure requirements for fair value measurements. The changes affect all companies that are required to include fair value measurement disclosures. In general, the amendments in ASU 2018-13 are effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15, 2019. An entity is permitted to early adopt the removed or modified disclosures upon the issuance of ASU 2018-13 and may delay adoption of the additional disclosures, which are required for public companies only, until their effective date. Management has evaluated the ASU 2018-13 and has adopted the framework.

|

NOTE 3 – COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS

Advisors Asset Management, Inc. (the “Adviser”), serves as the investment adviser to the Funds. Pursuant to an Investment Advisory Agreement (“Advisory Agreement”) between the Trust, on behalf of the Funds, and the Adviser, the Adviser provides investment advice to the Funds and oversees the day-to-day operations of the Funds, subject to the direction and control of the Board and the officers of the Trust. Under the Advisory Agreement, the Adviser also is responsible for arranging, in consulting with Vident Investment Advisory, LLC (“VIA” or the “Sub-Adviser”), transfer agency, custody, fund administration and accounting, and other related services necessary for the Funds to operate. Under the Advisory Agreement, the Adviser has agreed to pay all expenses of each Fund, except for: the fee paid to the Adviser pursuant to the Advisory Agreement, interest charges on any

23

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (Continued)

borrowings, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and expenses. For services provided to the Funds, AAM S&P 500 High Dividend Value ETF pays the Adviser 0.29% and AAM S&P Emerging Markets High Dividend Value ETF pays the Adviser 0.49% at an annual rate based on each Funds’ average daily net assets.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, LLC (“Fund Services” or “Administrator”), acts as the Funds’ Administrator and, in that capacity, performs various administrative and accounting services for the Funds. The Administrator prepares various federal and state regulatory filings, reports and returns for the Funds, including regulatory compliance monitoring and financial reporting; prepares reports and materials to be supplied to the Board; monitors the activities of the Funds’ Custodian, transfer agent and accountants. Fund Services also serves as the transfer agent and fund accountant to the Funds. U.S. Bank N.A. (the “Custodian”), an affiliate of Fund Services, serves as the Funds’ Custodian.

Quasar Distributors, LLC, (the “Distributor”) acts as the Funds’ principal underwriter in a continuous public offering of the Funds’ shares. The Distributor is an affiliate of the Administrator.

A Trustee and all officers of the Trust are affiliated with the Administrator, Distributor, and Custodian.

NOTE 4 – PURCHASES AND SALES OF SECURITIES

During the period ended October 31, 2018, purchases and sales of securities by the Funds, excluding short-term securities and in-kind transactions, were as follows:

|

Purchases

|

Sales

|

||

|

AAM S&P 500 High Dividend Value ETF

|

$3,039,601

|

$2,981,765

|

|

|

AAM S&P Emerging Markets

|

|||

|

High Dividend Value ETF

|

$4,726,253

|

$2,564,213

|

During the period ended October 31, 2018, there were no purchases or sales of U.S. Government securities by the Funds.

During the period ended October 31, 2018, in-kind transactions associated with creations and redemptions for the Funds were as follows:

|

Purchases

|

Sales

|

||

|

AAM S&P 500 High Dividend Value ETF

|

$23,830,658

|

$4,105,545

|

|

|

AAM S&P Emerging Markets

|

|||

|

High Dividend Value ETF

|

$ 1,738,515

|

$1,399,284

|

24

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (Continued)

NOTE 5 – INCOME TAX INFORMATION

The components of distributable earnings/(accumulated deficit) and cost basis of investments for federal income tax purposes at October 31, 2018 were as follows:

|

AAM S&P

|

|||||||||

|

AAM S&P 500

|

Emerging Markets

|

||||||||

|

High Dividend

|

High Dividend

|

||||||||

|

Value ETF

|

Value ETF

|

||||||||

|

Tax cost of investments

|

$

|

20,250,802

|

$

|

2,599,011

|

|||||

|

Gross tax unrealized appreciation

|

562,227

|

41,436

|

|||||||

|

Gross tax unrealized depreciation

|

(1,500,738

|

)

|

(483,273

|

)

|

|||||

|

Total unrealized appreciation/(depreciation)

|

$

|

(938,511

|

)

|

$

|

(441,837

|

)

|

|||

|

Undistributed ordinary income

|

41,619

|

13,026

|

|||||||

|

Undistributed long term capital gains

|

—

|

—

|

|||||||

|

Total accumulated gain/(loss)

|

41,619

|

13,026

|

|||||||

|

Other accumulated gain/(loss)

|

—

|

(101,444

|

)

|

||||||

|

Distributable earnings/(accumulated deficit)

|

$

|

(896,892

|

)

|

$

|

(530,255

|

)

|

|||

The differences between the cost basis for financial statement and federal income tax purposes are primarily due to timing differences in recognizing wash sales.

As of October 31, 2018, the Funds deferred, on a tax basis, no late-year losses and no post-October capital losses.

As of October 31, 2018, the Funds had the following capital loss carryforwards:

|

Short-Term

|

Long-Term

|

||

|

AAM S&P 500 High Dividend Value ETF

|

$ —

|

$ —

|

|

|

AAM S&P Emerging Markets

|

|||

|

High Dividend Value ETF

|

$101,444

|

$ —

|

These amounts do not have an expiration date.

The tax character of distributions paid by the Funds during the fiscal period ended October 31, 2018 were as follows:

|

Ordinary Income

|

Capital Gains

|

||

|

AAM S&P 500 High Dividend Value ETF

|

$180,619

|

$ —

|

|

|

AAM S&P Emerging Markets

|

|||

|

High Dividend Value ETF

|

$ 92,758

|

$ —

|

NOTE 6 – SHARE TRANSACTIONS

Shares of each Fund are listed and trade on the New York Stock Exchange Arca, Inc. (“NYSE Arca”). Market prices for the shares may be different from their NAV. The Funds issue and redeem shares on a continuous basis at NAV generallly in blocks of 50,000 shares called “Creation Units.” Creation Units are issued and

25

AAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (Continued)

redeemed principally in-kind for securities included in a specified universe. Once created, shares generally trade in the secondary market at market prices that change throughout the day. Except when aggregated in Creation Units, shares are not redeemable securities of the Funds. Creation Units may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem shares directly from the Funds. Rather, most retail investors may purchase shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

The Funds each currently offer one class of shares, which has no front end sales load, no deferred sales charge, and no redemption fee. A fixed transaction fee is imposed for the transfer and other transaction costs associated with the purchase or sale of Creation Units. The standard fixed transaction of $250 for AAM S&P 500 High Dividend Value ETF and $1,000 for AAM S&P Emerging Markets High Dividend ETF, payable to the Custodian. In addition, a variable fee may be charged on all cash transactions or substitutes for Creation Units of up to a maximum of 2% as a percentage of the value of the Creation Units subject to the transaction. Variable fees are imposed to compensate the Funds for the transaction costs associated with the cash transactions. Variable fees received by the Funds, if any, are displayed in the capital shares transactions section of the Statements of Changes in Net Assets. The Funds may issue an unlimited number of shares of beneficial interest, with no par value. All shares of the Funds have equal rights and privileges.

26

AAM ETFs

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of AAM S&P 500 High Dividend Value ETF and AAM S&P Emerging Markets High Dividend Value ETF and Board of Trustees of ETF Series Solutions

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of AAM S&P 500 High Dividend Value ETF and AAM S&P Emerging Markets High Dividend Value ETF (the “Funds”), each a series of ETF Series Solutions, as of October 31, 2018, and the related statements of operations and changes in net assets and the financial highlights for the period November 28, 2017 (commencement of operations) to October 31, 2018, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of October 31, 2018, and the results of their operations, the changes in their net assets and the financial highlights for the period indicated above, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.