Form N-CSR Chartwell Funds For: Oct 31

| OMB APPROVAL |

|

OMB Number: 3235-0570

Expires: August 31, 2020

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23244 |

| The Chartwell Funds |

| (Exact name of registrant as specified in charter) |

| 1205 Westlakes Drive, Suite 100 Berwyn, Pennsylvania | 19312 |

| (Address of principal executive offices) | (Zip code) |

Timothy J. Riddle

|

| The Chartwell Funds, 1205 Westlakes Drive, Suite 100 Berwyn, Pennsylvania 19312 |

| (Name and address of agent for service) |

With a copy to:

Alan R. Gedrich, Esq.

Stradley Ronon Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103-7018

| Registrant's telephone number, including area code: | (610) 296-1400 |

| Date of fiscal year end: | October 31 | |

| Date of reporting period: | October 31, 2019 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Berwyn Income Fund (BERIX)

Chartwell Mid Cap Value Fund (BERCX)

Chartwell Small Cap Value Fund (CWSIX)

Chartwell Short Duration High Yield Fund (CWFIX)

Chartwell Small Cap Growth Fund (CWSGX)

ANNUAL REPORT

October 31, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at 1-888-995-5505 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-888-995-5505. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

THE CHARTWELL FUNDS

LETTER FROM THE PRESIDENT

October 31, 2019 (Unaudited)

Dear Fellow Shareholder,

As we close out our mutual funds’ fiscal year, I want to thank you for trusting The Chartwell Funds with your assets. At Chartwell, we are committed to enhancing shareholder value every day through the quality of our research and portfolio implementation. As I write this letter, the markets are reaching new highs. Whether we are in a bull market or one with extraordinary volatility, we believe, active management and experience matter. We feel, over time, that our disciplined approach will reward our shareholders. And for that, we thank you for the trust which you have placed in The Chartwell Funds.

Highlighted below are the performance summaries of each of our funds for the fiscal year ending October 31, 2019. We welcome any questions you may have on the fund(s) performance. Inquiries may be directed to Shareholder Services at 888.995.5505 or via our web-site at https://www.chartwellip.com/.

Thank you and we look forward to serving as your mutual funds’ manager in the coming year.

Best Regards,

Timothy Riddle

President of The Chartwell Funds

1

BERWYN INCOME FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

October 31, 2019 (Unaudited)

The 1-year total return to shareholders of the Berwyn Income Fund (BERIX) for the fiscal year ended October 31, 2019 was 7.22 percent. Net asset value increased from $13.18 on October 31, 2018, to $13.26 on October 31, 2019. For the fiscal year, BERIX underperformed the benchmarks which includes the Bloomberg Barclays U.S. Aggregate Bond Index* -11.51% and the FTSE US Broad Investment-Grade Bond Index (USBIG) -11.64%. On March 1, 2019, we changed the portfolio management team, which now includes five individuals with deep experience in both fixed income and equities investing. BERIX’s underperformance for the fiscal year was primarily attributed to some of the inherited legacy positions which had been a drag on the performance. Almost all of these positions have been removed from the fund. In turn, the management team has diversified the fund across a wide array of asset classes, including stocks, corporate credit, preferreds, mortgage backed securities, federal agency debt, Treasuries and Treasury Inflation Protected Securities. We believe the new portfolio is prudently positioned to partake in market upturns while providing downside protection to our investors through high-quality, liquid investments.

|

* |

Effective March 1, 2019, the Fund’s primary benchmark was changed from the FTSE US Broad Investment-Grade Bond Index to the Bloomberg Barclays U.S. Aggregate Bond Index, which more closely aligns with the Fund’s investments. |

2

CHARTWELL MID CAP VALUE FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

October 31, 2019 (Unaudited)

The total return to shareholders of the Chartwell Mid Cap Value Fund (BERCX) for the fiscal year ended October 31, 2019 was 11.47%. Net asset value increased from $15.07 on October 31, 2018, to $15.54 on October 31, 2019. For the fiscal year, BERCX outperformed its reference index, the Russell Midcap Value Index with a return of 10.08%. As 2018 closed with a weak market, BERCX outperformed the Russell Midcap Value benchmark by 195 bps* for Q4 2018, returning -13.00% vs. the benchmark return of -14.95%. Allocation was a modest contributor as a small cash position was helpful, offset by an underweight in the defensive REIT sector during the market correction. The portfolio’s overall quality tilt was a significant tailwind. Regarding sector selection, eight of twelve sectors made positive contributions.

For the first six months of 2019, BERCX underperformed the Russell Midcap Value benchmark by 78 bps, returning 17.24% vs. the benchmark return of 18.02%. Sector allocation was not particularly impactful, but cash created a meaningful drag. Selection was good in nine of twelve sectors with Consumer Services the standout, but poor selection in Technology largely offset those contributions. In the third quarter, BERCX outpaced the Russell Midcap Value benchmark by 55 bps, returning 1.77% vs. the benchmark return of 1.22%. Allocation had little effect thus selection was the primary driver of outperformance, with strong results in a handful of sectors offsetting weakness elsewhere. Health Care and Basic Industry were particularly strong.

As we closed the fiscal year, we made changes in Consumer Staples and Business Services and sold an underperformer in Basic Industry. BERCX ended with an overweight in Business Services, Basic Industry and Consumer Cyclical and underweights in Technology, Consumer Staples and Utilities. BERCX’s positioning results primarily from bottom-up selection decisions but includes a small influence from our top-down economic outlook and sector prospects. We believe a modestly pro-cyclical tilt, balanced by higher quality and lower leverage, seems the best way to position the Fund in the current macro environment.

|

* |

A basis point or “bps” represents a unit equal to 1/100th of 1%. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

3

CHARTWELL SMALL CAP VALUE FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

October 31, 2019 (Unaudited)

The total return to shareholders of the Chartwell Small Cap Value Fund (CWSIX) for the fiscal year ended October 31, 2019 was 7.54%. Net asset value decreased from $18.79 on October 31, 2018, to $18.67 on October 31, 2019. However, for the fiscal year, CWSIX significantly outperformed its reference index, the Russell 2000 Value Index with a return of 3.22%. As 2018 closed with a weak market, CWSIX outpaced the Russell 2000 Value benchmark by 154 bps in Q4 2018, returning -17.13% vs. the benchmark return of -18.67%. Allocation contributed modestly, with an underweight in Energy offsetting the negative impact of an underweight in REITs and an overweight in Capital Spending. The portfolio’s overall quality tilt was a tailwind. Outperformance was primarily driven by selection, with seven of twelve sectors making positive contributions.

In 2019, CWSIX’s performance continued to outpace the benchmark. From January 1, 2019, through the third quarter, the fund outperformed the Russell 2000 Value benchmark by 289 bps, returning 15.71% vs. the benchmark return of 12.82%. Allocation was more impactful than usual, with an underweight in Energy adding to relative returns. But selection was still the primary driver of outperformance, with nine of twelve sectors making positive contributions. Basic Industry was the standout contributor, but Technology and Business Services were a drag on performance.

Late in the fiscal year, we did not make any new investments but trimmed several winners and added opportunistically to smaller positions. The fund ended the fiscal year with overweights in Capital Spending, Basic Industry, and Consumer Staples and underweights in Financial Services, REITs, and Health Care. The portfolio positioning results primarily from bottom-up selection decisions but includes a small influence from our top-down economic outlook and sector prospects. We believe a modestly pro-cyclical tilt, balanced by higher quality and lower leverage, is the best way to position the portfolio in the current macro environment.

4

CHARTWELL SHORT DURATION HIGH YIELD FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

October 31, 2019 (Unaudited)

The 1-year total return to shareholders of the Chartwell Short Duration High Yield Fund (CWFIX) for the fiscal year ended October 31, 2019 was 5.89 percent. Net asset value increased from $9.48 on October 31, 2018, to $9.68 on October 31, 2019, and monthly dividends totaled $0.3497 per share for the twelve month period. For the fiscal year, CWFIX underperformed its reference indices, the Bloomberg Barclays Intermediate US Government/Credit Index -8.74% and the ICE BofAML 1-3 Year BB US Cash Payout High Yield Index -6.95%. Compared to the Bloomberg Barclays Intermediate US Government/Credit index, a significant decline in interest rates during the fiscal year was a headwind for the fund’s relative performance. Compared to the ICE BofAML 1-3 Year BB US Cash Payout High Yield Index, fund expenses and an underweight position in the Technology sector hurt relative performance, which was partially offset by an overweight position and strong credit selection in the Capital Goods sector. As previously disclosed, the fund invests in a narrow slice of the high yield bond market, for which we believe there is no good, replicable index. The fund seeks to generate income with an additional focus on relatively low volatility over full market cycles.

At the end of the fiscal year, the fund’s largest sector weights were Energy (15.0%), Financial Services (14.5%) and Materials (14.1%). The fund’s Energy exposure was comprised of four midstream operators with primarily contracted revenues, one exploration and production company and a land drilling operator. Financial Services exposure was comprised of a diversified group of operators, including specialty real estate finance and consumer finance companies. Capital goods exposure included a heavy equipment manufacturer, an engineered aerospace products manufacturer and two packaging companies. Historically, modest economic growth and low inflation has been a good environment for high yield bond returns. Absent a recession, we believe a portfolio of higher quality short maturity high yield bonds may be a potential source of consistent income in the future.

5

CHARTWELL SMALL CAP GROWTH FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

October 31, 2019 (Unaudited)

The 1-year total return to shareholders of the Chartwell Small Cap Growth Fund (CWSGX) for the fiscal year ended October 31, 2019 was 2.46 percent. Net asset value increased from $11.55 on October 31, 2018, to $11.78 on October 31, 2019. For the fiscal year ended October 31, 2019, CWSGX underperformed its reference index, the Russell 2000 Growth Index, which returned 6.40%. As we closed out 2018, the Chartwell Small Cap Growth Fund returned -22.31% as compared to the Russell 2000 Growth Index return of -21.65% for Q4 2018. The fund slightly underperformed the index in what has been the most volatile quarter since the 2008-2009 meltdown. Rolling into 2019, the Chartwell Small Cap Growth Fund returned 18.39% as compared to the Russell 2000 Growth Index return of 17.14% for Q1 2019. The strategy significantly outperformed the index in a rebound from the miserable market conditions that were seen in Q4 2018. The drivers behind the recovery was a course correction by the Federal Reserve; the prior policy of interest rate tightening wasn’t appropriate given the worldwide economic slowdown, and the Fed has clearly stated that new the monetary policy is neutral and data dependent. The top performing sector compared to the Russell 2000 Growth benchmark was the Technology sector, where strong stock selection led to alpha for CWSGX. There really wasn’t any underperforming sector in Q1 2019. The largest detractor to performance was CWSGX’s portfolio cash weighting that averaged 7.5%, which in hindsight was too high.

In Q2 2019, CWSGX continued to outperform its reference benchmark returning 3.65% as compared to the Russell 2000 Growth Index return of 2.75%. CWSGX’s outperformance was a result of market conditions continuing to favor growth stocks; where in general, investors seem more willing to pay a premium for assumed growth during economic slowdowns. However, in Q3 2019, CWSGX returned -6.89% as compared to the Russell 2000 Growth Index return of -4.17% for Q3 2019. In October 2019, CWSGX returned 1.38 percent and underperformed the Russell 2000 Growth Index return -2.85%, as there was a significant rotation towards cyclical stocks that occurred during the month of September 2019. Looking ahead, we are monitoring the macro economic data as investors are concerned that the current slowdown in the manufacturing segment extends into the services/consumer-driven segment of the economy. We continue to find compelling investment opportunities, particularly in the Real Estate and medical device industries. Given the dramatically lower interest rates seen globally, REITs as an asset class should continue to be in favor to investors due to their attractive dividend yield. We remain focused on generating alpha and producing the strongest investment results over the long run.

6

BERWYN INCOME FUND

PERFORMANCE INFORMATION

October 31, 2019 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in Berwyn Income Fund versus the Bloomberg Barclays U.S. Aggregate Bond Index, the FTSE US Broad Investment-Grade Bond Index (USBIG), the ICE BofAML High Yield Master II Index and the Lipper Income Fund Index.

This graph compares a hypothetical $10,000 investment in the Fund with a similar investment in the Bloomberg Barclays U.S. Aggregate Bond Index, the FTSE US Broad Investment-Grade Bond Index (USBIG), the ICE BofAML High Yield Master II Index, and the Lipper Income Fund Index for the periods shown. Results include the reinvestment of all dividends and capital gains.

Effective March 1, 2019, the Fund’s primary benchmark was changed from the FTSE US Broad Investment-Grade Bond Index to the Bloomberg Barclays U.S. Aggregate Bond Index, which more closely aligns with the Fund’s investments.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index composed of the Bloomberg Barclays U.S. Government/Credit Index and the Bloomberg Barclays U.S. Mortgage-Backed Securities Index and includes Treasury issues, agency issues, corporate bond issues and mortgage-backed securities and is intended to be generally representative of the bond market as a whole. The FTSE US Broad Investment-Grade Bond Index (USBIG) measures performance of US dollar-denominated bonds issued in the US investment-grade bond market. Introduced in 1985, the index covers US Treasury, government-sponsored, collateralized, and corporate debt and provides a reliable representation of the US investment-grade bond market. The ICE BofAML High Yield

7

BERWYN INCOME FUND

PERFORMANCE INFORMATION (Continued)

October 31, 2019 (Unaudited)

Master II Index is a broad-based index consisting of all US dollar denominated high-yield bonds with a minimum outstanding amount of $100 million and a maturity of over one year. The Lipper Income Fund Index consists of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc. These indices do not reflect expenses, fees, or sales charge, which would lower performance. The indices are unmanaged, and they are not available for investment.

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

Berwyn Income Fund |

7.22% |

3.24% |

5.95% |

Bloomberg Barclays U.S. Aggregate Bond Index |

11.51% |

3.24% |

3.73% |

FTSE US Broad Investment-Grade Bond Index (USBIG) |

11.64% |

3.26% |

3.70% |

ICE BofAML High Yield Master II Index |

8.32% |

5.17% |

7.69% |

Lipper Income Fund Index |

9.29% |

4.43% |

6.19% |

The Fund acquired the assets and liabilities of the Berwyn Income Fund (the “IMST Predecessor Fund”), a series of Investment Managers Series Trust, on July 17, 2017. The IMST Predecessor Fund acquired the assets and liabilities of the Berwyn Income Fund (the “Berwyn Funds Predecessor Fund,” and together with the IMST Predecessor Fund, the “Predecessor Funds”), a series of The Berwyn Funds, on April 29, 2016. As a result of the reorganizations, the Fund is the accounting successor of the Predecessor Funds. Performance results shown reflect the performance of the IMST Predecessor Fund for the period from April 29, 2016 through July 17, 2017, and the performance of the Berwyn Funds Predecessor Fund for the period prior to April 29, 2016.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 0.68% and 0.64%, respectively, as stated in the current prospectus dated March 1, 2019. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 0.64% of the Fund’s average daily net assets. This agreement is in effect until March 1, 2020, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 30 days of purchase will be charged a redemption fee of 1.00%.

8

CHARTWELL MID CAP VALUE FUND

PERFORMANCE INFORMATION

October 31, 2019 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Mid Cap Value Fund versus the Russell Midcap Value Index,

the S&P Mid-Cap 400 Index and the S&P 500 Index.

This graph compares a hypothetical $10,000 investment in the Fund with a similar investment in the Russell Midcap Value Index, the S&P Mid-Cap 400 Index and the S&P 500 Index for the periods shown. Results include the reinvestment of all dividends and capital gains.

The Russell Midcap Value Index measures the performance of those Russell Midcap companies with lower price/book ratios and lower forecasted growth values. The S&P 500 Index tracks the stocks of 500 large US companies. The S&P Mid-Cap 400 Index measures the performance of 400 selected companies with a mid-sized market capitalization. These indices do not reflect expenses, fees, or sales charge, which would lower performance. The indices are unmanaged, and they are not available for investment.

9

CHARTWELL MID CAP VALUE FUND

PERFORMANCE INFORMATION (Continued)

October 31, 2019 (Unaudited)

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

Chartwell Mid Cap Value Fund |

11.47% |

6.38% |

9.27% |

Russell Midcap Value Index |

10.08% |

6.95% |

12.90% |

S&P Mid-Cap 400 Index |

9.02% |

8.37% |

13.21% |

S&P 500 Index |

14.33% |

10.78% |

13.70% |

The Fund acquired the assets and liabilities of the Berwyn Cornerstone Fund (the “IMST Predecessor Fund”), a series of Investment Managers Series Trust, on July 17, 2017. The IMST Predecessor Fund acquired the assets and liabilities of the Berwyn Cornerstone Fund (the “Berwyn Funds Predecessor Fund,” and together with the IMST Predecessor Fund, the “Predecessor Funds”), a series of The Berwyn Funds, on April 29, 2016. As a result of the reorganizations, the Fund is the accounting successor of the Predecessor Funds. Performance results shown reflect the performance of the IMST Predecessor Fund for the period from April 29, 2016 through July 17, 2017, and the performance of the Berwyn Funds Predecessor Fund for the period prior to April 29, 2016. The Fund’s principal investment strategies differ from those of the Predecessor Funds; therefore, the performance and average annual total returns shown for periods prior to the reorganization may have differed had the Fund’s current investment strategy been in effect during those periods.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 1.57% and 0.90%, respectively, as stated in the current prospectus dated March 1, 2019, supplemented September 3, 2019. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 0.90% of the Fund’s average daily net assets. This agreement is in effect until March 1, 2020, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 30 days of purchase will be charged a redemption fee of 1.00%.

10

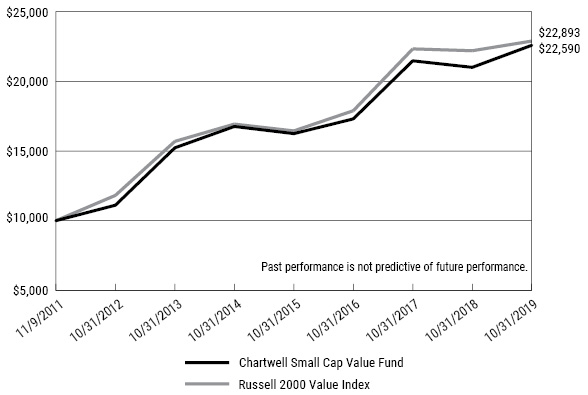

CHARTWELL SMALL CAP VALUE FUND

PERFORMANCE INFORMATION

October 31, 2019 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Small Cap Value Fund versus the Russell 2000 Value Index.

This graph compares a hypothetical $10,000 investment in the Fund’s shares, made at its inception, with a similar investment in the Russell 2000 Value Index. Results include the reinvestment of all dividends and capital gains. The performance figures include the performance for Class A shares for the periods prior to the start date of the current share class (March 16, 2012). Class A shares were liquidated on June 30, 2016.

The Russell 2000 Value Index measures the performance of the Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. This index does not reflect expenses, fees or sales charges, which would lower performance. The index is unmanaged, and it is not available for investment.

11

CHARTWELL SMALL CAP VALUE FUND

PERFORMANCE INFORMATION (Continued)

October 31, 2019 (Unaudited)

Average Annual Total Returns |

|||

1 Year |

5 Years |

Since |

|

Chartwell Small Cap Value Fund |

7.54% |

6.15% |

10.75% |

Russell 2000 Value Index |

3.22% |

6.24% |

10.94% |

(a) |

Inception date of the Fund was November 9, 2011. The performance figures include the performance for Class A for the periods prior to the start date of current share class (March 16, 2012). Class A shares were liquidated on June 30, 2016. |

On July 17, 2017, the Chartwell Small Cap Value Fund acquired all the assets and liabilities of the Chartwell Small Cap Value Fund, a series of the Investment Managers Series Trust (the “Predecessor Fund”). As a result of the acquisition, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the graph and the performance table above for the periods prior to July 17, 2017 reflect the performance of the Predecessor Fund.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 1.08% and 1.05%, respectively, as stated in the current prospectus dated March 1, 2019. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 1.05% of the Fund’s average daily net assets. This agreement is in effect until March 1, 2020, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 30 days of purchase will be charged a redemption fee of 1.00%.

12

CHARTWELL SHORT DURATION HIGH YIELD FUND

PERFORMANCE INFORMATION

October 31, 2019 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Short Duration High Yield Fund versus

the ICE BofAML 1-3 Year BB US Cash Payout High Yield Index and

the Bloomberg Barclays Intermediate US Government/Credit Index.

This graph compares a hypothetical $10,000 investment in the Fund’s shares, made at its inception, with a similar investment in the ICE BofAML 1-3 Year BB US Cash Payout High Yield Index and the Bloomberg Barclays Intermediate US Government/Credit Index. Results include the reinvestment of all dividends and capital gains.

The ICE BofAML 1-3 Year BB US Cash Payout High Yield Index is a subset of the ICE BofAML US Cash Payout High Yield Index including all securities with a remaining term to final maturity less than 3 years and rated BB1 through BB3, inclusive. The Bloomberg Barclays Intermediate US Government/Credit Index is a broad-based flagship benchmark the measures the non-securitized component of the US Aggregate Index. It includes investment grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. These indices do not reflect expenses, fees or sales charges, which would lower performance. These indices are unmanaged, and they are not available for investment.

13

CHARTWELL SHORT DURATION HIGH YIELD FUND

PERFORMANCE INFORMATION (Continued)

October 31, 2019 (Unaudited)

Average Annual Total Returns |

|||

1 Year |

5 Years |

Since |

|

Chartwell Short Duration High Yield Fund |

5.89% |

2.88% |

2.72% |

ICE BofAML 1-3 Year BB US Cash Payout High Yield Index |

6.95% |

4.34% |

4.13% |

Bloomberg Barclays Intermediate US Government/Credit Index |

8.74% |

2.61% |

2.62% |

(a) |

Commencement of operations was July 15, 2014. |

On July 17, 2017, the Chartwell Short Duration High Yield Fund acquired all the assets and liabilities of the Chartwell Short Duration High Yield Fund, a series of the Investment Managers Series Trust (the “Predecessor Fund”). As a result of the acquisition, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the graph and the performance table above for the periods prior to July 17, 2017 reflect the performance of the Predecessor Fund.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 0.80% and 0.49%, respectively, as stated in the current prospectus dated March 1, 2019. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 0.49% of the Fund’s average daily net assets. This agreement is in effect until March 1, 2020, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 30 days of purchase will be charged a redemption fee of 1.00%.

14

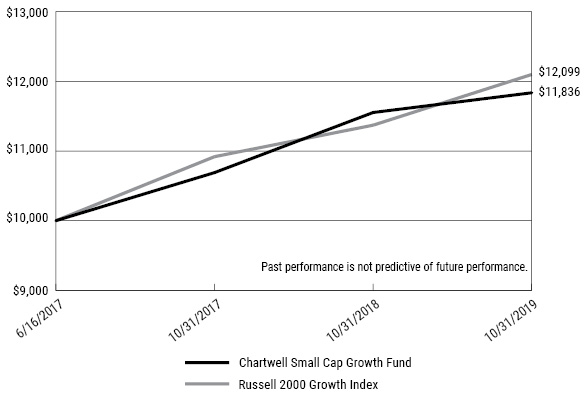

CHARTWELL SMALL CAP GROWTH FUND

PERFORMANCE INFORMATION

October 31, 2019 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in Chartwell Small Cap Growth Fund versus the Russell 2000 Growth Index.

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the Russell 2000 Growth Index. Results include the reinvestment of all dividends and capital gains.

The Russell 2000 Growth Index measures the performance of the constituents that exhibit growth characteristics within the 2000 small-cap companies of the US stock market and is designed to represent the small-cap segment of the US equity universe. This index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged, and it is not available for investment.

15

CHARTWELL SMALL CAP GROWTH FUND

PERFORMANCE INFORMATION (Continued)

October 31, 2019 (Unaudited)

Average Annual Total Returns |

||

1 Year |

Since |

|

Chartwell Small Cap Growth Fund |

2.46% |

7.36% |

Russell 2000 Growth Index |

6.40% |

8.35% |

(a) |

Commencement of operations was June 16, 2017. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (888) 995-5505.

Gross and net expense ratios for the Fund were 2.16% and 1.06%, respectively, both including acquired fund fees and expenses of 0.01%, as stated in the current prospectus dated March 1, 2019. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to reduce its fees and/or reimburse other operating expenses of the Fund to ensure that annual operating expenses do not exceed 1.05% of the Fund’s average daily net assets. This agreement is in effect until March 1, 2020, and it may be terminated prior to such date only by the Trust’s Board of Trustees. In the absence of such fee reductions and expense reimbursements, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 30 days of purchase will be charged a redemption fee of 1.00%.

16

BERWYN INCOME FUND |

||||||||

COMMON STOCKS — 28.6% |

Shares |

Value |

||||||

Communication Services — 0.3% |

||||||||

Diversified Telecommunication Services — 0.3% |

||||||||

AT&T, Inc. |

50,561 | $ | 1,946,093 | |||||

Verizon Communications, Inc. |

25,208 | 1,524,328 | ||||||

| 3,470,421 | ||||||||

Consumer Discretionary — 3.5% |

||||||||

Automobiles — 0.1% |

||||||||

General Motors Company |

23,812 | 884,854 | ||||||

Distributors — 0.9% |

||||||||

Genuine Parts Company |

91,142 | 9,349,346 | ||||||

Hotels, Restaurants & Leisure — 0.2% |

||||||||

Carnival Corporation |

20,561 | 881,861 | ||||||

Restaurant Brands International, Inc. |

12,155 | 795,423 | ||||||

Six Flags Entertainment Corporation |

9,562 | 403,421 | ||||||

| 2,080,705 | ||||||||

Household Durables — 0.3% |

||||||||

Toll Brothers, Inc. |

84,768 | 3,371,224 | ||||||

Internet & Direct Marketing Retail — 0.9% |

||||||||

Expedia Group, Inc. |

70,109 | 9,581,096 | ||||||

Specialty Retail — 0.7% |

||||||||

AutoZone, Inc. (a) |

5,456 | 6,243,737 | ||||||

Home Depot, Inc. (The) |

5,400 | 1,266,732 | ||||||

| 7,510,469 | ||||||||

Textiles, Apparel & Luxury Goods — 0.4% |

||||||||

Ralph Lauren Corporation |

36,202 | 3,477,564 | ||||||

Consumer Staples — 1.0% |

||||||||

Beverages — 0.1% |

||||||||

Coca-Cola Company (The) |

23,000 | 1,251,890 | ||||||

Food Products — 0.7% |

||||||||

Lamb Weston Holdings, Inc. |

85,406 | 6,665,084 | ||||||

Household Products — 0.1% |

||||||||

Procter & Gamble Company (The) |

7,801 | 971,303 | ||||||

See accompanying notes to financial statements. |

17 |

BERWYN INCOME FUND |

||||||||

COMMON STOCKS — 28.6% (Continued) |

Shares |

Value |

||||||

Consumer Staples — 1.0% (Continued) |

||||||||

Tobacco — 0.1% |

||||||||

Philip Morris International, Inc. |

14,139 | $ | 1,151,480 | |||||

Energy — 1.6% |

||||||||

Energy Equipment & Services — 0.1% |

||||||||

Helmerich & Payne, Inc. |

10,830 | 406,125 | ||||||

Oil, Gas & Consumable Fuels — 1.5% |

||||||||

ConocoPhillips |

14,927 | 823,971 | ||||||

Diamondback Energy, Inc. |

66,515 | 5,704,326 | ||||||

Exxon Mobil Corporation |

25,711 | 1,737,292 | ||||||

Hess Corporation |

14,956 | 983,357 | ||||||

Occidental Petroleum Corporation |

10,722 | 434,241 | ||||||

Pioneer Natural Resources Company |

43,085 | 5,300,317 | ||||||

Royal Dutch Shell plc - Class A - ADR (b) |

9,335 | 541,150 | ||||||

| 15,524,654 | ||||||||

Financials — 5.4% |

||||||||

Banks — 2.1% |

||||||||

BB&T Corporation |

15,855 | 841,108 | ||||||

First Hawaiian, Inc. |

28,657 | 783,196 | ||||||

JPMorgan Chase & Company |

20,372 | 2,544,870 | ||||||

KeyCorp |

295,096 | 5,302,875 | ||||||

M&T Bank Corporation |

22,307 | 3,491,715 | ||||||

Pinnacle Financial Partners, Inc. |

109,625 | 6,448,143 | ||||||

PNC Financial Services Group, Inc. (The) |

6,945 | 1,018,831 | ||||||

SunTrust Banks, Inc. |

12,339 | 843,247 | ||||||

| 21,273,985 | ||||||||

Capital Markets — 0.3% |

||||||||

Ares Capital Corporation |

72,052 | 1,318,552 | ||||||

CME Group, Inc. |

4,333 | 891,515 | ||||||

Morgan Stanley |

21,771 | 1,002,554 | ||||||

| 3,212,621 | ||||||||

Consumer Finance — 0.4% |

||||||||

Synchrony Financial |

123,010 | 4,350,864 | ||||||

Insurance — 2.5% |

||||||||

Allstate Corporation (The) |

89,230 | 9,495,856 | ||||||

Arthur J. Gallagher & Company |

13,530 | 1,234,207 | ||||||

Hanover Insurance Group, Inc. (The) |

53,538 | 7,051,490 | ||||||

Lincoln National Corporation |

117,911 | 6,659,613 | ||||||

18 |

See accompanying notes to financial statements. |

BERWYN INCOME FUND |

||||||||

COMMON STOCKS — 28.6% (Continued) |

Shares |

Value |

||||||

Financials — 5.4% (Continued) |

||||||||

Insurance — 2.5% (Continued) |

||||||||

Progressive Corporation (The) |

11,225 | $ | 782,382 | |||||

Prudential Financial, Inc. |

6,098 | 555,772 | ||||||

| 25,779,320 | ||||||||

Mortgage Real Estate Investment Trusts (REITs) — 0.1% |

||||||||

Blackstone Mortgage Trust, Inc. - Class A |

22,290 | 809,127 | ||||||

Health Care — 2.2% |

||||||||

Health Care Equipment & Supplies — 0.2% |

||||||||

Abbott Laboratories |

20,700 | 1,730,727 | ||||||

Health Care Providers & Services — 1.5% |

||||||||

Quest Diagnostics, Inc. (b) |

81,607 | 8,262,709 | ||||||

Universal Health Services, Inc. - Class B |

56,521 | 7,769,377 | ||||||

| 16,032,086 | ||||||||

Pharmaceuticals — 0.5% |

||||||||

Johnson & Johnson |

11,188 | 1,477,263 | ||||||

Merck & Company, Inc. |

22,829 | 1,978,361 | ||||||

Pfizer, Inc. |

43,110 | 1,654,131 | ||||||

| 5,109,755 | ||||||||

Industrials — 3.5% |

||||||||

Aerospace & Defense — 0.1% |

||||||||

Lockheed Martin Corporation |

3,160 | 1,190,309 | ||||||

Air Freight & Logistics — 0.1% |

||||||||

United Parcel Service, Inc. - Class B |

6,760 | 778,549 | ||||||

Construction & Engineering — 0.8% |

||||||||

Jacobs Engineering Group, Inc. |

84,768 | 7,932,589 | ||||||

Electrical Equipment — 0.7% |

||||||||

Emerson Electric Company |

16,672 | 1,169,541 | ||||||

Rockwell Automation, Inc. |

34,417 | 5,919,380 | ||||||

| 7,088,921 | ||||||||

Machinery — 0.9% |

||||||||

Caterpillar, Inc. |

6,310 | 869,518 | ||||||

Snap-on, Inc. (b) |

51,626 | 8,398,001 | ||||||

| 9,267,519 | ||||||||

Marine — 0.9% |

||||||||

Kirby Corporation (a) |

117,478 | 9,299,559 | ||||||

See accompanying notes to financial statements. |

19 |

BERWYN INCOME FUND |

||||||||

COMMON STOCKS — 28.6% (Continued) |

Shares |

Value |

||||||

Information Technology — 1.8% |

||||||||

Communications Equipment — 0.1% |

||||||||

Cisco Systems, Inc. |

16,546 | $ | 786,101 | |||||

Electronic Equipment, Instruments & Components — 0.7% |

||||||||

Dolby Laboratories, Inc. - Class A |

105,164 | 6,765,200 | ||||||

Semiconductors & Semiconductor Equipment — 0.2% |

||||||||

Intel Corporation |

26,743 | 1,511,782 | ||||||

Lam Research Corporation |

2,318 | 628,271 | ||||||

| 2,140,053 | ||||||||

Software — 0.7% |

||||||||

Microsoft Corporation |

11,191 | 1,604,453 | ||||||

Teradata Corporation (a) |

203,419 | 6,088,331 | ||||||

| 7,692,784 | ||||||||

Technology Hardware, Storage & Peripherals — 0.1% |

||||||||

Apple, Inc. |

1,610 | 400,504 | ||||||

Western Digital Corporation |

10,544 | 544,597 | ||||||

| 945,101 | ||||||||

Materials — 1.9% |

||||||||

Chemicals — 1.0% |

||||||||

Air Products & Chemicals, Inc. |

5,005 | 1,067,366 | ||||||

FMC Corporation |

103,991 | 9,515,177 | ||||||

| 10,582,543 | ||||||||

Construction Materials — 0.9% |

||||||||

Vulcan Materials Company |

64,373 | 9,196,970 | ||||||

Real Estate — 4.4% |

||||||||

Equity Real Estate Investment Trusts (REITs) — 4.4% |

||||||||

American Campus Communities, Inc. (b) |

118,548 | 5,925,029 | ||||||

Crown Castle International Corporation |

9,315 | 1,292,829 | ||||||

Duke Realty Corporation (b) |

333,975 | 11,735,881 | ||||||

Healthcare Trust of America, Inc. - Class A (b) |

309,347 | 9,589,757 | ||||||

Host Hotels & Resorts, Inc. |

362,018 | 5,933,475 | ||||||

Lamar Advertising Company - Class A (b) |

11,387 | 911,074 | ||||||

Mid-America Apartment Communities, Inc. |

63,608 | 8,840,876 | ||||||

Weyerhaeuser Company |

31,538 | 921,225 | ||||||

| 45,150,146 | ||||||||

Utilities — 3.0% |

||||||||

Electric Utilities — 0.3% |

||||||||

American Electric Power Company, Inc. (b) |

14,045 | 1,325,707 | ||||||

Exelon Corporation |

21,038 | 957,019 | ||||||

20 |

See accompanying notes to financial statements. |

BERWYN INCOME FUND |

||||||||

COMMON STOCKS — 28.6% (Continued) |

Shares |

Value |

||||||

Utilities — 3.0% (Continued) |

||||||||

Electric Utilities — 0.3% (Continued) |

||||||||

PPL Corporation |

30,695 | $ | 1,027,975 | |||||

| 3,310,701 | ||||||||

Multi-Utilities — 2.7% |

||||||||

Ameren Corporation |

108,096 | 8,399,059 | ||||||

CMS Energy Corporation |

159,976 | 10,225,666 | ||||||

Public Service Enterprise Group, Inc. |

149,141 | 9,442,117 | ||||||

| 28,066,842 | ||||||||

Total Common Stocks (Cost $278,790,938) |

$ | 294,188,587 | ||||||

PREFERRED STOCKS — 1.9% |

Shares |

Value |

||||||

Energy — 1.2% |

||||||||

Chesapeake Energy Corporation, 5.000% CV (c) |

418,633 | $ | 12,140,357 | |||||

Health Care — 0.1% |

||||||||

Becton, Dickinson and Company, 6.125% - Series A CV |

13,925 | 860,047 | ||||||

Industrials — 0.6% |

||||||||

Pitney Bowes, Inc., 6.700%, 3/7/2043 (c) |

336,655 | 6,988,958 | ||||||

Total Preferred Stocks (Cost $31,621,398) |

$ | 19,989,362 | ||||||

CORPORATE BONDS – 36.4% |

Par Value |

Value |

||||||

Communication Services – 1.4% |

||||||||

AT&T, Inc., 3.40%, due 5/15/2025 |

$ | 5,000,000 | $ | 5,239,013 | ||||

CenturyLink, Inc., 7.65%, due 3/15/2042 |

4,260,000 | 4,323,900 | ||||||

Cincinnati Bell, Inc., 8.00%, due 10/15/2025 (d) |

2,500,000 | 2,231,250 | ||||||

Consolidated Communications, Inc., 6.50%, due 10/1/2022 (b) |

2,500,000 | 2,256,250 | ||||||

T-Mobile USA, Inc., 4.00%, due 4/15/2022 |

750,000 | 774,157 | ||||||

| 14,824,570 | ||||||||

Consumer Discretionary — 9.2% |

||||||||

American Axle & Manufacturing, Inc., 6.25%, due 4/1/2025 (b) |

2,500,000 | 2,409,375 | ||||||

AutoNation, Inc., 3.80%, due 11/15/2027 (e) |

10,000,000 | 10,148,255 | ||||||

Bed Bath & Beyond, Inc., 5.165%, due 8/1/2044 |

10,263,000 | 7,444,267 | ||||||

Carriage Services, Inc., 6.625%, due 6/1/2026 (d) |

2,757,000 | 2,867,280 | ||||||

Clearwater Seafoods, Inc., 6.875%, due 5/1/2025 (d) |

2,500,000 | 2,568,750 | ||||||

See accompanying notes to financial statements. |

21 |

BERWYN INCOME FUND |

||||||||

CORPORATE BONDS – 36.4% (Continued) |

Par Value |

Value |

||||||

Consumer Discretionary — 9.2% (Continued) |

||||||||

Coach, Inc., 4.125%, due 7/15/2027 |

$ | 15,873,000 | $ | 16,169,385 | ||||

Diamond Sports Group, LLC/Diamond Sports Finance Company, 5.375%, due 8/15/2026 (d) |

2,000,000 | 2,090,000 | ||||||

Dollar Tree, Inc., 4.00%, due 5/15/2025 |

10,393,000 | 11,175,426 | ||||||

Downstream Development Authority of the Quapaw Tribe of Oklahoma, 10.50%, due 2/15/2023 (d) |

2,000,000 | 2,105,000 | ||||||

HLF Financing Sarl, LLC/Herbalife International, Inc., 7.25%, due 8/15/2026 (b)(d) |

2,500,000 | 2,615,625 | ||||||

L Brands, Inc., 5.25%, due 2/1/2028 (b) |

2,500,000 | 2,318,750 | ||||||

National CineMedia, LLC, 5.75%, due 8/15/2026 |

2,500,000 | 2,443,750 | ||||||

Penn National Gaming, Inc., 5.625%, due 1/15/2027 (b)(d) |

2,500,000 | 2,575,000 | ||||||

Quad Graphics, Inc., 7.00%, due 5/1/2022 (b) |

2,000,000 | 1,930,755 | ||||||

Sonic Automotive, Inc., 6.125%, due 3/15/2027 |

2,500,000 | 2,587,500 | ||||||

Tiffany & Company, 4.90%, due 10/1/2044 |

16,744,000 | 19,035,082 | ||||||

Truck Hero, Inc., 8.50%, due 4/21/2024 (d) |

2,600,000 | 2,580,500 | ||||||

Wolverine World Wide, Inc., 5.00%, due 9/1/2026 (d) |

1,500,000 | 1,518,750 | ||||||

| 94,583,450 | ||||||||

Consumer Staples — 0.5% |

||||||||

Clearwater Paper Corporation, 4.50%, due 2/1/2023 (b) |

2,500,000 | 2,509,375 | ||||||

KEHE Distributors, LLC, 8.625%, due 10/15/2026 (d) |

2,500,000 | 2,564,063 | ||||||

| 5,073,438 | ||||||||

Energy — 2.8% |

||||||||

Antero Resources Corporation, 5.375%, due 11/1/2021 (b) |

5,725,000 | 5,109,562 | ||||||

Blue Racer Midstream, LLC/Blue Racer Finance Corporation, 6.625%, due 7/15/2026 (d) |

1,903,000 | 1,779,305 | ||||||

Energy Transfer Partners, L.P., 6.25%, due 4/15/2049 (b) |

3,085,000 | 3,684,338 | ||||||

Ensign Drilling, Inc., 9.25%, due 4/15/2024 (d) |

4,000,000 | 3,400,000 | ||||||

Genesis Energy, L.P./Genesis Energy Finance Corporation, 5.625%, due 6/15/2024 (b) |

2,500,000 | 2,337,500 | ||||||

NLG Energy Partners, L.P., 6.125%, due 3/1/2025 |

2,490,000 | 2,303,250 | ||||||

Parkland Fuel Corporation, 5.875%, due 7/15/2027 (d) |

2,500,000 | 2,645,800 | ||||||

Sunoco, L.P./Sunoco Finance Corporation, Series WI, 4.875%, due 1/15/2023 |

4,000,000 | 4,105,000 | ||||||

Targa Resources Partners L.P., 5.25%, due 5/1/2023 |

4,000,000 | 4,015,000 | ||||||

| 29,379,755 | ||||||||

Financials — 11.2% |

||||||||

AAG FH, L.P./AAG FH Finco, Inc., 9.75%, due 7/15/2024 (d) |

2,550,000 | 2,352,375 | ||||||

Ares Capital Corporation, 3.50%, due 2/10/2023 |

6,185,000 | 6,279,577 | ||||||

Ares Capital Corporation, 4.20%, due 6/10/2024 (b) |

7,995,000 | 8,303,786 | ||||||

Bank of America Corporation, 2.878% (3MO LIBOR + 76), due 9/15/2026 (e) |

15,377,000 | 14,935,487 | ||||||

Citigroup, Inc., 3.352%, due 4/24/2025 |

8,900,000 | 9,259,201 | ||||||

22 |

See accompanying notes to financial statements. |

BERWYN INCOME FUND |

||||||||

CORPORATE BONDS – 36.4% (Continued) |

Par Value |

Value |

||||||

Financials — 11.2% (Continued) |

||||||||

Compass Group Diversified Holdings, LLC, 8.00%, due 5/1/2026 (d) |

$ | 2,500,000 | $ | 2,687,500 | ||||

Ford Motor Credit Company, LLC, 5.584%, due 3/18/2024 (b) |

6,360,000 | 6,778,289 | ||||||

General Motors Financial Company, Inc., 5.65%, due 1/17/2029 (b) |

6,669,000 | 7,456,982 | ||||||

Goldman Sachs Group, Inc. (The), 3.177% (3MO LIBOR + 105), due 6/5/2023 (e) |

10,536,000 | 10,629,247 | ||||||

Goldman Sachs Group, Inc. (The), 3.691%, due 6/5/2028 |

4,437,000 | 4,685,973 | ||||||

Icahn Enterprises, L.P., 5.875%, due 2/1/2022 |

4,000,000 | 4,035,000 | ||||||

Jefferies Group, LLC, 6.50%, due 1/20/2043 |

3,950,000 | 4,659,360 | ||||||

JPMorgan Chase & Company, 3.166% (3MO LIBOR + 123), due 10/24/2023 (e) |

17,734,000 | 18,043,731 | ||||||

Lincoln National Corporation, 3.05%, due 1/15/2030 |

4,330,000 | 4,373,979 | ||||||

Provident Funding Associates, L.P./PFG Finance Corporation, 6.375%, due 6/15/2025 (d) |

2,500,000 | 2,430,500 | ||||||

Springleaf Finance Corporation, 5.625%, due 3/15/2023 |

4,000,000 | 4,290,000 | ||||||

Starwood Property Trust, 5.00%, due 12/15/2021 |

3,580,000 | 3,705,300 | ||||||

| 114,906,287 | ||||||||

Health Care — 2.1% |

||||||||

Anthem, Inc., 3.65%, due 12/1/2027 (b) |

11,025,000 | 11,660,244 | ||||||

CVS Health Corporation, 4.30%, due 3/25/2028 (b) |

7,000,000 | 7,613,459 | ||||||

Horizon Pharma USA, Inc., 5.50%, due 8/1/2027 (d) |

2,435,000 | 2,541,531 | ||||||

| 21,815,234 | ||||||||

Industrials — 2.3% |

||||||||

ADT Corporation (The), 6.25%, due 10/15/2021 |

4,000,000 | 4,265,000 | ||||||

Avis Budget Group, Inc., 6.375%, due 4/1/2024 (d) |

2,000,000 | 2,082,500 | ||||||

FXI Holdings, Inc., 7.875%, due 11/1/2024 (d) |

2,400,000 | 2,132,400 | ||||||

Grinding Media, Inc., 7.375%, due 12/15/2023 (d) |

2,500,000 | 2,412,500 | ||||||

H&E Equipment Services, Inc., 5.625%, due 9/1/2025 |

2,500,000 | 2,628,125 | ||||||

Intertape Polymer Group, Inc., 7.00%, due 10/15/2026 (d) |

2,500,000 | 2,615,250 | ||||||

JPW Industries Holding Corporation, 9.00%, due 10/1/2024 (d) |

1,195,000 | 1,117,325 | ||||||

Neon Holdings, Inc., 10.125%, due 4/1/2026 (d) |

2,340,000 | 2,313,675 | ||||||

United Rentals North America, Inc., 4.625%, due 7/15/2023 |

4,000,000 | 4,086,000 | ||||||

| 23,652,775 | ||||||||

Information Technology — 2.1% |

||||||||

Apple, Inc., 3.85%, due 5/4/2043 |

4,000,000 | 4,489,966 | ||||||

Belo Corporation, 7.25%, due 9/15/2027 (b) |

2,500,000 | 2,850,000 | ||||||

CBS Radio, Inc., 7.25%, due 11/1/2024 (b)(d) |

2,500,000 | 2,606,250 | ||||||

Dell, Inc., 5.875%, due 6/15/2021 (d) |

2,644,000 | 2,684,665 | ||||||

Hewlett Packard Enterprise Company, 6.35%, due 10/15/2045 |

7,739,000 | 9,196,187 | ||||||

| 21,827,068 | ||||||||

See accompanying notes to financial statements. |

23 |

BERWYN INCOME FUND |

||||||||

CORPORATE BONDS – 36.4% (Continued) |

Par Value |

Value |

||||||

Materials — 2.6% |

||||||||

Cascades, Inc., 5.75%, due 7/15/2023 (d) |

$ | 1,750,000 | $ | 1,793,750 | ||||

Cliffs Natural Resources, Inc., 6.25%, due 10/1/2040 (b) |

4,320,000 | 3,672,000 | ||||||

Commercial Metals Company, 5.375%, due 7/15/2027 |

2,500,000 | 2,565,625 | ||||||

JW Aluminum Continuous Cast Company, 10.25%, due 6/1/2026 (d) |

2,500,000 | 2,631,250 | ||||||

Mercer International, Inc., 5.50%, due 1/15/2026 |

2,500,000 | 2,423,325 | ||||||

Mosaic Company (The), 4.05%, due 11/15/2027 (b) |

2,000,000 | 2,114,395 | ||||||

Mountain Province Diamonds, Inc., 8.00%, due 12/15/2022 (b)(d) |

2,500,000 | 2,425,000 | ||||||

Plastipak Holdings, Inc., 6.25%, due 10/15/2025 (b)(d) |

2,500,000 | 2,062,500 | ||||||

Schweitzer-Mauduit International, Inc., 6.875%, due 10/1/2026 (d) |

2,500,000 | 2,668,750 | ||||||

Steel Dynamics, Inc., 5.125%, due 10/1/2021 |

4,000,000 | 4,014,000 | ||||||

| 26,370,595 | ||||||||

Real Estate — 1.3% |

||||||||

Greystar Real Estate Partners, LLC, 5.75%, due 12/1/2025 (d) |

4,000,000 | 4,170,000 | ||||||

iStar, Inc., 6.00%, due 4/1/2022 |

1,560,000 | 1,600,950 | ||||||

iStar, Inc., 4.75%, due 10/1/2024 |

2,000,000 | 2,062,500 | ||||||

LGI Homes, Inc., 6.875%, due 7/15/2026 (d) |

2,500,000 | 2,587,500 | ||||||

TRI Pointe Group, Inc., 5.25%, due 6/1/2027 |

2,500,000 | 2,587,500 | ||||||

| 13,008,450 | ||||||||

Utilities — 0.9% |

||||||||

AES Corporation, 4.00%, due 3/15/2021 |

4,000,000 | 4,065,000 | ||||||

Suburban Propane Partners, L.P., 5.875%, due 3/1/2027 |

2,800,000 | 2,898,000 | ||||||

Talen Energy Supply, LLC, 6.625%, due 1/15/2028 (d) |

2,825,000 | 2,726,125 | ||||||

| 9,689,125 | ||||||||

Total Corporate Bonds (Cost $361,811,846) |

$ | 375,130,747 | ||||||

ASSET-BACKED SECURITIES — 1.5% |

Par Value |

Value |

||||||

Latitude Management Real Estate Investors, Inc., Series 2019-CRE3, 3.567% (1MO LIBOR + 140), due 12/22/2035 (d)(e) |

$ | 6,280,000 | $ | 6,307,444 | ||||

Onslow Bay Financial LLC, Series 2019-EXP3, 3.50%, due 10/25/2059 |

2,760,000 | 2,787,172 | ||||||

ORIX Credit Alliance Owner Trust, Series 2018-CRE1, 3.094% (1MO LIBOR + 118), due 6/15/2036 (d)(e) |

6,750,000 | 6,756,277 | ||||||

Total Asset-Backed Securities (Cost $15,827,757) |

$ | 15,850,893 | ||||||

24 |

See accompanying notes to financial statements. |

BERWYN INCOME FUND |

||||||||

MORTGAGE-BACKED SECURITIES — 5.9% |

Par Value |

Value |

||||||

Commercial — 5.9% |

||||||||

Agate Bay Mortgage Loan Trust, Series 2016-2, 3.50%, due 3/25/2046 (d) |

$ | 6,621,880 | $ | 6,752,881 | ||||

Bancorp Commercial Mortgage Trust (The), Series 2019-CRE5, 3.027% (1MO LIBOR + 100), due 1/15/2022 (d)(e) |

4,183,330 | 4,183,324 | ||||||

BDS Ltd., Series 2019-FL4, 3.013% (1MO LIBOR + 110), due 8/15/2036 (d)(e) |

3,640,000 | 3,641,128 | ||||||

Colony American Finance Ltd., Series 2019-1, 3.324%, due 1/15/2029 (d)(e) |

4,975,494 | 5,168,839 | ||||||

Credit Suisse Mortgage Trust, Series 2018-J1, 3.50%, due 2/25/2048 (d) |

6,467,665 | 6,587,122 | ||||||

Ellington Financial Mortgage Trust, Series 2019-1, 2.934%, due 6/25/2059 (d) |

5,547,007 | 5,581,511 | ||||||

Exantas Capital Corporation, Series 2019-RS07, 3.025% (1MO LIBOR + 100), due 4/15/2022 (d)(e) |

8,167,243 | 8,169,775 | ||||||

PSMC 2018-1 Trust, Series 2019-1, 4.00%, due 7/25/2049 (d) |

4,991,977 | 5,082,457 | ||||||

Starwood Mortgage Residential Trust, Series 2019-1, 2.941%, due 6/25/2049 (d) |

5,551,214 | 5,568,632 | ||||||

Wells Fargo Mortgage Back Securities, Series 2019-2, 4.00%, due 4/25/2049 (d) |

9,478,953 | 9,549,612 | ||||||

Total Mortgage-Backed Securities (Cost $60,151,430) |

$ | 60,285,281 | ||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 15.8% |

Par Value |

Value |

||||||

Federal Farm Credit Bank — 5.1% |

||||||||

Federal Farm Credit Bank, 2.045% (1MO LIBOR + 200), 9/17/2021 (e) |

$ | 5,000,000 | $ | 4,988,701 | ||||

Federal Farm Credit Bank, 2.49%, 9/24/2025 |

5,555,000 | 5,556,081 | ||||||

Federal Farm Credit Bank, 2.99%, 4/16/2026 |

16,972,000 | 17,036,875 | ||||||

Federal Farm Credit Bank, 2.53%, 8/21/2026 |

5,000,000 | 4,962,308 | ||||||

Federal Farm Credit Bank, 2.625%, 2/12/2027 |

4,000,000 | 4,000,048 | ||||||

Federal Farm Credit Bank, 2.89%, 8/1/2028 |

10,550,000 | 10,550,034 | ||||||

Federal Farm Credit Bank, 3.50%, 2/1/2033 |

5,000,000 | 5,079,642 | ||||||

| 52,173,689 | ||||||||

See accompanying notes to financial statements. |

25 |

BERWYN INCOME FUND |

||||||||

U.S. GOVERNMENT AGENCY OBLIGATIONS — 15.8% (Continued) |

Par Value |

Value |

||||||

Federal Home Loan Bank — 1.5% |

||||||||

Federal Home Loan Bank, 3.13%, 10/30/2029 |

$ | 12,000,000 | $ | 12,000,061 | ||||

Federal Home Loan Bank, 3.50%, 6/6/2034 |

3,535,000 | 3,536,382 | ||||||

| 15,536,443 | ||||||||

Federal Home Loan Mortgage Corporation — 2.8% |

||||||||

Federal Home Loan Mortgage Corporation, 3.50%, 1/1/2048 |

9,583,399 | 9,932,103 | ||||||

Federal Home Loan Mortgage Corporation, 3.00%, 2/1/2048 |

4,423,032 | 4,516,894 | ||||||

Federal Home Loan Mortgage Corporation, 3.00%, 6/1/2049 |

6,756,959 | 6,873,623 | ||||||

Federal Home Loan Mortgage Corporation, 3.00%, 7/1/2049 |

7,265,825 | 7,390,994 | ||||||

| 28,713,614 | ||||||||

Federal National Mortgage Association — 4.4% |

||||||||

Federal National Mortgage Association, 3.00%, 9/1/2029 |

2,211,807 | 2,253,247 | ||||||

Federal National Mortgage Association, 2.45%, 4/7/2031 (f) |

645,000 | 644,577 | ||||||

Federal National Mortgage Association, 2.50%, 3/1/2032 |

15,695,703 | 15,927,172 | ||||||

Federal National Mortgage Association, 3.00%, 12/1/2033 |

5,034,285 | 5,154,801 | ||||||

Federal National Mortgage Association, 3.00%, 11/1/2038 |

9,585,236 | 9,864,512 | ||||||

Federal National Mortgage Association, 3.00%, 9/1/2049 |

11,857,135 | 12,067,797 | ||||||

| 45,912,106 | ||||||||

Small Business Administration — 2.0% |

||||||||

Small Business Administration Participation Certificates, 2.82%, 2/1/2037 |

12,886,786 | 13,312,936 | ||||||

Small Business Administration Participation Certificates, 3.20%, 3/1/2039 |

6,849,052 | 7,270,854 | ||||||

| 20,583,790 | ||||||||

Total U.S. Government Agency Obligations (Cost $160,687,346) |

$ | 162,919,642 | ||||||

U.S. TREASURY OBLIGATIONS — 7.0% |

Par Value |

Value |

||||||

U.S. Treasury Inflation-Protected Notes — 3.3% |

||||||||

U.S. Treasury Inflation-Protected Note, 1.125%, due 1/15/2021 |

$ | 6,350,820 | $ | 6,392,191 | ||||

U.S. Treasury Inflation-Protected Note, 0.625%, due 1/15/2024 |

6,817,210 | 6,932,731 | ||||||

U.S. Treasury Inflation-Protected Note, 0.875%, due 2/15/2047 |

18,546,384 | 20,059,420 | ||||||

| 33,384,342 | ||||||||

U.S. Treasury Notes — 3.7% |

||||||||

U.S. Treasury Note, 1.625%, due 7/31/2020 |

15,000,000 | 15,001,172 | ||||||

U.S. Treasury Note, 2.625%, due 3/31/2025 |

6,635,000 | 6,999,148 | ||||||

U.S. Treasury Note, 2.625%, due 2/15/2029 |

15,000,000 | 16,217,578 | ||||||

| 38,217,898 | ||||||||

Total U.S. Treasury Obligations (Cost $70,211,931) |

$ | 71,602,240 | ||||||

26 |

See accompanying notes to financial statements. |

BERWYN INCOME FUND |

||||||||

MONEY MARKET FUNDS — 2.8% |

Shares |

Value |

||||||

BlackRock Liquidity Funds FedFund Portfolio - Institutional Shares, 1.72% (g)(h) |

880,860 | $ | 880,860 | |||||

Fidelity Institutional Money Market Government Portfolio - Class I, 1.72% (g)(h) |

27,387,245 | 27,387,245 | ||||||

Invesco Short-Term Investment Trust Government & Agency Portfolio - Institutional Class, 1.71% (g)(h) |

778,142 | 778,142 | ||||||

Total Money Market Funds (Cost $29,046,247) |

$ | 29,046,247 | ||||||

Investments at Value — 99.9% (Cost $1,008,148,893) |

$ | 1,029,012,999 | ||||||

Other Assets in Excess of Liabilities — 0.1% |

1,234,627 | |||||||

Net Assets — 100.0% |

$ | 1,030,247,626 | ||||||

(a) |

Non-income producing security. |

(b) |

All or a portion of the security is on loan. The total value of the securities on loan as of October 31, 2019 is $27,569,496 (Note 8). |

(c) |

Security has a perpetual maturity date. |

(d) |

Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. The total value of such securities is $153,931,671 as of October 31, 2019, representing 14.9% of net assets. |

(e) |

Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of October 31, 2019. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities, therefore, do not indicate a reference rate and spread. |

(f) |

Step coupon. Rate shown is the coupon in effect as of October 31, 2019. |

(g) |

The rate shown is the 7-day effective yield as of October 31, 2019. |

(h) |

All or a portion of this security was purchased with cash collateral held from securities on loan. The total value of such securities as of October 31, 2019 was $28,408,725 (Note 8). |

ADR – American Depositary Receipt |

|

CV – Convertible Security |

|

LIBOR – London Interbank Offered Rate |

|

See accompanying notes to financial statements. |

27 |

BERWYN INCOME FUND

SUMMARY OF INVESTMENTS

As of October 31, 2019 (Unaudited)

Security Type / Sector |

Percent of |

Common Stocks |

|

Financials |

5.4% |

Real Estate |

4.4% |

Consumer Discretionary |

3.5% |

Industrials |

3.5% |

Utilities |

3.0% |

Health Care |

2.2% |

Materials |

1.9% |

Information Technology |

1.8% |

Energy |

1.6% |

Consumer Staples |

1.0% |

Communication Services |

0.3% |

Total Common Stocks |

28.6% |

Preferred Stocks |

|

Energy |

1.2% |

Industrials |

0.6% |

Health Care |

0.1% |

Total Preferred Stocks |

1.9% |

Corporate Bonds |

|

Financials |

11.2% |

Consumer Discretionary |

9.2% |

Energy |

2.8% |

Materials |

2.6% |

Industrials |

2.3% |

Information Technology |

2.1% |

Health Care |

2.1% |

Communication Services |

1.4% |

Real Estate |

1.3% |

Utilities |

0.9% |

Consumer Staples |

0.5% |

Total Corporate Bonds |

36.4% |

Asset-Backed Securities |

1.5% |

Mortgage-Backed Securities |

5.9% |

U.S. Government Agency Obligations |

15.8% |

U.S. Treasury Obligations |

7.0% |

Money Market Funds |

2.8% |

Investments |

99.9% |

Other Assets in Excess of Liabilities |

0.1% |

Net Assets |

100.0% |

28

CHARTWELL MID CAP VALUE FUND |

||||||||

COMMON STOCKS — 93.8% |

Shares |

Value |

||||||

Consumer Discretionary — 12.4% |

||||||||

Distributors — 3.6% |

||||||||

Genuine Parts Company |

9,100 | $ | 933,478 | |||||

Household Durables — 1.3% |

||||||||

Toll Brothers, Inc. |

8,455 | 336,255 | ||||||

Internet & Direct Marketing Retail — 3.7% |

||||||||

Expedia Group, Inc. |

6,995 | 955,937 | ||||||

Specialty Retail — 2.4% |

||||||||

AutoZone, Inc. (a) |

538 | 615,676 | ||||||

Textiles, Apparel & Luxury Goods — 1.4% |

||||||||

Ralph Lauren Corporation |

3,613 | 347,065 | ||||||

Consumer Staples — 2.6% |

||||||||

Food Products — 2.6% |

||||||||

Lamb Weston Holdings, Inc. |

8,525 | 665,291 | ||||||

Energy — 4.3% |

||||||||

Oil, Gas & Consumable Fuels — 4.3% |

||||||||

Diamondback Energy, Inc. |

6,642 | 569,618 | ||||||

Pioneer Natural Resources Company |

4,295 | 528,371 | ||||||

| 1,097,989 | ||||||||

Financials — 16.6% |

||||||||

Banks — 5.9% |

||||||||

KeyCorp |

29,450 | 529,216 | ||||||

M&T Bank Corporation |

2,225 | 348,279 | ||||||

Pinnacle Financial Partners, Inc. |

10,940 | 643,491 | ||||||

| 1,520,986 | ||||||||

Consumer Finance — 1.7% |

||||||||

Synchrony Financial |

12,275 | 434,167 | ||||||

Insurance — 9.0% |

||||||||

Allstate Corporation (The) |

8,905 | 947,670 | ||||||

Hanover Insurance Group, Inc. (The) |

5,350 | 704,649 | ||||||

Lincoln National Corporation |

11,755 | 663,922 | ||||||

| 2,316,241 | ||||||||

See accompanying notes to financial statements. |

29 |

CHARTWELL MID CAP VALUE FUND |

||||||||

COMMON STOCKS — 93.8% (Continued) |

Shares |

Value |

||||||

Health Care — 6.2% |

||||||||

Health Care Providers & Services — 6.2% |

||||||||

Quest Diagnostics, Inc. |

8,156 | $ | 825,795 | |||||

Universal Health Services, Inc. - Class B |

5,637 | 774,862 | ||||||

| 1,600,657 | ||||||||

Industrials — 12.2% |

||||||||

Construction & Engineering — 3.1% |

||||||||

Jacobs Engineering Group, Inc. |

8,455 | 791,219 | ||||||

Electrical Equipment — 2.3% |

||||||||

Rockwell Automation, Inc. |

3,425 | 589,066 | ||||||

Machinery — 3.2% |

||||||||

Snap-on, Inc. |

5,140 | 836,124 | ||||||

Marine — 3.6% |

||||||||

Kirby Corporation (a) |

11,713 | 927,201 | ||||||

Information Technology — 5.0% |

||||||||

Electronic Equipment, Instruments & Components — 2.6% |

||||||||

Dolby Laboratories, Inc. - Class A |

10,495 | 675,144 | ||||||

Software — 2.4% |

||||||||

Teradata Corporation (a) |

20,299 | 607,549 | ||||||

Materials — 7.3% |

||||||||

Chemicals — 3.7% |

||||||||

FMC Corporation |

10,369 | 948,763 | ||||||

Construction Materials — 3.6% |

||||||||

Vulcan Materials Company |

6,425 | 917,940 | ||||||

Real Estate — 16.3% |

||||||||

Equity Real Estate Investment Trusts (REITs) — 16.3% |

||||||||

American Campus Communities, Inc. |

11,835 | 591,513 | ||||||

Duke Realty Corporation |

33,335 | 1,171,392 | ||||||

Healthcare Trust of America, Inc. - Class A (b) |

30,879 | 957,249 | ||||||

Host Hotels & Resorts, Inc. |

36,125 | 592,089 | ||||||

Mid-America Apartment Communities, Inc. |

6,355 | 883,281 | ||||||

| 4,195,524 | ||||||||

30 |

See accompanying notes to financial statements. |

CHARTWELL MID CAP VALUE FUND |

||||||||

COMMON STOCKS — 93.8% (Continued) |

Shares |

Value |

||||||

Utilities — 10.9% |

||||||||

Multi-Utilities — 10.9% |

||||||||

Ameren Corporation |

10,795 | $ | 838,772 | |||||

CMS Energy Corporation |

15,960 | 1,020,163 | ||||||

Public Service Enterprise Group, Inc. |

14,895 | 943,002 | ||||||

| 2,801,937 | ||||||||

Total Common Stocks (Cost $22,642,267) |

$ | 24,114,209 | ||||||

MONEY MARKET FUNDS — 4.8% |

Shares |

Value |

||||||

BlackRock Liquidity Funds FedFund Portfolio - Institutional Shares, 1.72% (c)(d) |

700 | $ | 700 | |||||

Fidelity Institutional Money Market Government Portfolio - Class I, 1.72% (c)(d) |

1,240,156 | 1,240,156 | ||||||

Invesco Short-Term Investment Trust Government & Agency Portfolio - Institutional Class, 1.71% (c)(d) |

618 | 618 | ||||||

Total Money Market Funds (Cost $1,241,474) |

$ | 1,241,474 | ||||||

Investments at Value – 98.6% (Cost $23,883,741) |

$ | 25,355,683 | ||||||

Other Assets in Excess of Liabilities — 1.4% |

347,849 | |||||||

Net Assets — 100.0% |

$ | 25,703,532 | ||||||

(a) |

Non-income producing security. |

(b) |

All or a portion of the security is on loan. The total value of the securities on loan as of October 31, 2019 is $21,855 (Note 8). |

(c) |

The rate shown is the 7-day effective yield as of October 31, 2019. |

(d) |

All or a portion of this security was purchased with cash collateral held from securities on loan. The total value of such securities as of October 31, 2019 was $22,560 (Note 8). |

See accompanying notes to financial statements. |

31 |

CHARTWELL MID CAP VALUE FUND

SUMMARY OF INVESTMENTS

As of October 31, 2019 (Unaudited)

Security Type / Sector |

Percent of |

Common Stocks |

|

Financials |

16.6% |

Real Estate |

16.3% |

Consumer Discretionary |

12.4% |

Industrials |

12.2% |

Utilities |

10.9% |

Materials |

7.3% |

Health Care |

6.2% |

Information Technology |

5.0% |

Energy |

4.3% |

Consumer Staples |

2.6% |

Total Common Stocks |

93.8% |

Money Market Funds |

4.8% |

Investments |

98.6% |

Other Assets in Excess of Liabilities |

1.4% |

Net Assets |

100.0% |

32

CHARTWELL SMALL CAP VALUE FUND |

||||||||

COMMON STOCKS — 96.9% |

Shares |

Value |

||||||

Communication Services — 1.4% |

||||||||

Media — 1.4% |

||||||||

Scholastic Corporation |

62,290 | $ | 2,398,165 | |||||

Consumer Discretionary — 7.3% |

||||||||

Hotels, Restaurants & Leisure — 3.6% |

||||||||

Cheesecake Factory, Inc. (The) (a) |

53,325 | 2,228,452 | ||||||

Denny’s Corporation (b) |

197,810 | 3,979,937 | ||||||

| 6,208,389 | ||||||||

Household Durables — 1.1% |

||||||||

TRI Pointe Group, Inc. (b) |

124,875 | 1,965,533 | ||||||

Textiles, Apparel & Luxury Goods — 2.6% |

||||||||

G-III Apparel Group Ltd. (b) |

58,880 | 1,478,477 | ||||||

Oxford Industries, Inc. |

17,125 | 1,179,227 | ||||||

Wolverine World Wide, Inc. |

61,925 | 1,837,934 | ||||||

| 4,495,638 | ||||||||

Consumer Staples — 2.8% |

||||||||

Food Products — 2.8% |

||||||||

Fresh Del Monte Produce, Inc. |

60,516 | 1,930,460 | ||||||

Sanderson Farms, Inc. (a) |

19,150 | 2,964,612 | ||||||

| 4,895,072 | ||||||||

Energy — 2.7% |

||||||||

Energy Equipment & Services — 2.2% |

||||||||

Apergy Corporation (b) |

64,250 | 1,617,172 | ||||||

Cactus, Inc. - Class A (b) |

72,000 | 2,139,840 | ||||||

| 3,757,012 | ||||||||

Oil, Gas & Consumable Fuels — 0.5% |

||||||||

SRC Energy, Inc. (b) |

280,875 | 876,330 | ||||||

Financials — 24.3% |

||||||||

Banks — 18.5% |

||||||||

Columbia Banking System, Inc. |

69,045 | 2,713,469 | ||||||

CVB Financial Corporation |

83,700 | 1,739,286 | ||||||

First Financial Bancorp (a) |

90,665 | 2,125,188 | ||||||

First Midwest Bancorp, Inc. |

91,900 | 1,887,626 | ||||||

FNB Corporation |

112,350 | 1,354,941 | ||||||

Hope Bancorp, Inc. |

119,510 | 1,705,408 | ||||||

Independent Bank Group, Inc. |

44,643 | 2,387,061 | ||||||

Renasant Corporation |

55,650 | 1,931,055 | ||||||

Sandy Spring Bancorp, Inc. |

72,575 | 2,503,837 | ||||||

See accompanying notes to financial statements. |

33 |

CHARTWELL SMALL CAP VALUE FUND |

||||||||

COMMON STOCKS — 96.9% (Continued) |

Shares |

Value |

||||||

Financials — 24.3% (Continued) |

||||||||

Banks — 18.5% (Continued) |

||||||||

South State Corporation |

32,320 | $ | 2,548,755 | |||||

Synovus Financial Corporation |

37,225 | 1,260,811 | ||||||

TowneBank |

72,992 | 2,050,345 | ||||||

UMB Financial Corporation |

28,370 | 1,851,426 | ||||||

Umpqua Holdings Corporation |

98,900 | 1,564,598 | ||||||

United Bankshares, Inc. |

42,750 | 1,690,335 | ||||||

United Community Banks, Inc. |

89,570 | 2,705,910 | ||||||

| 32,020,051 | ||||||||

Consumer Finance — 1.7% |

||||||||

PRA Group, Inc. (b) |

84,170 | 2,855,888 | ||||||

Insurance — 4.1% |

||||||||

American Equity Investment Life Holding Company |

71,113 | 1,755,069 | ||||||

Argo Group International Holdings Ltd. |

49,147 | 3,040,725 | ||||||

Selective Insurance Group, Inc. |

34,057 | 2,354,019 | ||||||

| 7,149,813 | ||||||||

Health Care — 2.1% |

||||||||

Biotechnology — 1.3% |

||||||||

Eagle Pharmaceuticals, Inc. (b) |

35,960 | 2,254,692 | ||||||

Pharmaceuticals — 0.8% |

||||||||

Phibro Animal Health Corporation - Class A |

56,975 | 1,365,121 | ||||||

Industrials — 24.6% |

||||||||

Air Freight & Logistics — 1.0% |

||||||||

Hub Group, Inc. - Class A (b) |

39,805 | 1,823,069 | ||||||

Commercial Services & Supplies — 6.3% |

||||||||

Interface, Inc. |

160,135 | 2,663,045 | ||||||

Knoll, Inc. |

88,466 | 2,365,581 | ||||||

Matthews International Corporation - Class A (a) |

27,820 | 1,028,784 | ||||||

McGrath RentCorp |

33,284 | 2,539,902 | ||||||

UniFirst Corporation |

11,075 | 2,224,303 | ||||||

| 10,821,615 | ||||||||

Construction & Engineering — 1.1% |

||||||||

Dycom Industries, Inc. (b) |

43,575 | 1,986,584 | ||||||

34 |

See accompanying notes to financial statements. |

CHARTWELL SMALL CAP VALUE FUND |

||||||||

COMMON STOCKS — 96.9% (Continued) |

Shares |

Value |

||||||

Industrials — 24.6% (Continued) |

||||||||

Machinery — 10.1% |

||||||||

Barnes Group, Inc. |

40,225 | $ | 2,351,151 | |||||

EnPro Industries, Inc. |

17,658 | 1,228,114 | ||||||

ESCO Technologies, Inc. |

33,295 | 2,813,095 | ||||||

Franklin Electric Company, Inc. |

38,255 | 2,060,032 | ||||||

Harsco Corporation (b) |

117,300 | 2,377,671 | ||||||

ITT, Inc. |

63,525 | 3,776,561 | ||||||

Mueller Water Products, Inc. - Series A |

237,810 | 2,782,377 | ||||||