Form N-CSR CRM Mutual Fund Trust For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21749

CRM Mutual Fund Trust

(Exact name of registrant as specified in charter)

c/o Cramer Rosenthal McGlynn, LLC.

28 Havemeyer Place

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Corporation Service Company

2711 Centerville Road Suite 400

Wilmington, DE 19808

(Name and address of agent for service)

Copy to:

Lea Anne Copenhefer

Morgan, Lewis & Bockius LLP

One Federal Street

Boston, MA 02110

Registrant’s telephone number, including area code: 212-326-5300

Date of fiscal year end: June 30

Date of reporting period: June 30, 2021

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

June 30, 2021

CRM Small Cap Value Fund

CRM Small/Mid Cap Value Fund

CRM Mid Cap Value Fund

CRM All Cap Value Fund

CRM Long/Short Opportunities Fund |

ANNUAL REPORT

ANNUAL REPORT |

June 30, 2021 |

President’s Message (Unaudited) |

Dear Fellow Shareholders:

While the first half of the fiscal year brought uncertainty as the world began to contemplate life beyond COVID-19, the double shot of fiscal and monetary support was the adrenaline shot needed to move the country from a 9% decline in GDP in the second quarter of 2020 to double digit growth in the second quarter of 2021. As that adrenaline high wears off, we look for the economy and the market to transition from early-cycle to mid-cycle recovery. This more sustainable level of economic growth will be a deceleration from the hyper growth, healing phase but should not be misconstrued as an economic slowdown. The recent rise in COVID-19 cases caused by the Delta variant and China’s recent restrictive policies and slower economic growth are causing investors to question the strength and durability of the global recovery. More recently, this has translated into a desire for safe haven investments such as U.S. Treasuries and large cap growth stocks. A redo of last cycle, which we believe is a mistake.

We find the market today is broadly supportive of value stocks, and particularly our style of relative value. After one of the fastest economic recoveries in U.S. history, we expect markets to recalibrate from unabated risk seeking and to a more balanced position between risk and reward. This next phase of the recovery should bring more selectivity.

We view the June Federal Reserve Open Market Committee meeting as marking the end of early cycle and, importantly, reducing the risk of hyperinflation. This next phase is typically longer in duration and favorable for stock selection. The market will have to absorb this notion of less accommodation, but we still expect to see healthy growth and attractive valuations, particularly in our part of the market. We can envision a more constructive earnings backdrop in the future as labor availability improves, raw material price increases level off and supply chains normalize. This environment should be conducive to stock selection rather than broad macro/factor investing.

The appetite for risk is healthy today given highly supportive central banks and the extraordinary fiscal stimulus. However, we must be vigilant when market sentiment is so positive. We will continue to identify companies that can operate in various economic environments. Importantly, we look to invest in those relative

1 |

value companies, which have pricing power that should allow them to price for higher inflation, while also being highly competitive in a more modest economic backdrop. What we are seeking to avoid in this V-shaped recovery are those highly leveraged, speculative companies, which are the investor darlings today, but will likely face their day of reckoning in the not-too-distant future. We expect this will inevitably occur when credit is not so abundant, and these companies lack the pricing power to operate in a normal to above-average inflationary background.

We continue to see a healthy investing environment for small to mid-cap value stocks. Historically, small cap stocks tend to lead the market following a recession and value stocks tend to outperform growth stocks when GDP is greater than 3%. After two years of P/E multiple expansion in 2019 and 2020, we expect market returns will be more driven by earnings growth. We look for value stocks, particularly small to mid-caps stocks, to generate the fastest earnings growth over the next two years while offering attractive valuations. Lastly, we believe a rising inflationary economy should be highly supportive of stock selection and active management.

We cannot finish this letter without mentioning the historical impact the rally in highly shorted, secularly challenged stocks by retail investors buying on margin (so called “meme stocks”) has on the market, and particularly smaller capitalization stocks. We believe these zombie companies have meaningfully amplified the returns of the indices this year. There are many root causes that have been laid out for this renaissance in retail trading including free trading, pandemic behavior as people were stuck at home, stimulus money, record savings levels, gamification and entertainment value, the strength and resonance of being part of a community, and an outgrowth of persistently low interest rates and Fed policy. Either way, history tells us that these low ROE, nonearners tend to underperform when inflation rises and GDP returns to historical levels. It is important to recognize that nonearners represent the highest percent of the Russell® Index since 1999/2000. Thus, the quality of the Russell® indices appears to be at one of its lowest levels, as represented by ROE and ROA, in its history. We believe this should provide a fruitful environment for active management.

The following is a discussion of factors that influenced the performance of the CRM Funds during the fiscal year ended June 30, 2021.

CRM Small Cap Value Fund returned 55.68% and 55.36% for the Institutional and Investor Share classes, respectively, in the period, as compared to 73.28% and 62.03% for the Russell® 2000 Value Index and the Russell® 2000 Index, respectively1. Despite strong performance during the period, the Fund lagged the benchmark due to stock selection in the Consumer Discretionary sector. This was due largely in part to companies such as AMC Entertainment Holdings and GameStop, which CRM does not hold. Leading contributors to performance for this period included (i)

2 |

branded apparel company, G-III Apparel Group, Ltd.; (ii) Valmont Industries, Inc., a manufacturer of poles and towers for infrastructure, communications, and utility end-markets as well as agricultural irrigation equipment; and (iii) BankUnited, Inc., a regional bank based in Florida and New York. G-III Apparel Group responded positively to vaccine news throughout November as well as a better-than-expected third quarter 2020 earnings report. The company continued to post better-than-expected earnings as a result of aggressive cost mitigation in 2020 and a measured recovery of revenues. Importantly, GIII completed the exit of its money-losing retail business in the fourth quarter of 2020. Valmont Industries, Inc. reported stronger quarterly results following greater optimism over its irrigation business as farmer incomes inflected positively amidst higher commodity prices. The company also recognized revenues on a key Middle East contract tied to food security. BankUnited reported better-than-expected third quarter 2020 and fourth quarter 2020 earnings due to improved credit quality. In addition, the company guided to a stabilizing net interest margin given its ability to lower deposit costs. Finally, the company continued to make solid progress on implementing cost savings from its BankUnited 2.0 profitability initiative.

Individual holdings that negatively impacted performance included (i) PAE Incorporated, a defense and government services contractor; (ii) Clearwater Paper Corporation, a domestic producer of private label consumer paper products, as well as solid bleached sulfate paperboard products; and (iii) Paya Holdings, Inc., a leading provider of integrated payment and frictionless commerce solutions that help customers accept and make payments. PAE Incorporated was a detractor in the period, as the company had to revise its revenue guidance for the year based on pandemic impacts to its non-labor component of revenue. The defense contractor sector similarly underperformed going in to the 2020 presidential election and federal spending pressures given rising pandemic stimulus costs, impacting future budget pressures. Clearwater paper suffered during the second half of the fiscal year from the oversupply of consumer bath tissue inventory at its customers, elevated commodity input pressure, and forced production downtime at its facilities. The company has taken steps to exit unprofitable capacity, as it works to bring down inventories at its customers and its own held finished product. Meanwhile, Clearwater’s paperboard segment is benefitting from strong demand and better pricing dynamics, which is partially moderating softer results in its consumer tissue segment. Paya Holdings Inc. came public via a SPAC transaction, which resulted in the shares being less well known by public investors relative to a traditional IPO. Consequently, the shares trade at a discount to peers despite faster revenue growth and comparable margins. The shares underperformed following the completion of a secondary offering in March.

CRM Small/Mid Cap Value Fund returned 68.26% and 67.80% for the Institutional and Investor Share classes, respectively, in the period, as compared to 63.23% and 57.79% for the Russell 2500™ Value Index and the Russell

3 |

2500™ Index, respectively2. Key drivers of strong absolute performance, and relative outperformance versus both benchmarks, in the Fund during the period were stock selection in the Industrials and Financials sectors. Individual holdings that were leading contributors to performance included (i) Sunrun, Inc., the leading residential solar installer in the U.S.; (ii) American Financial Group, Inc. a diversified insurer; and (iii) Valmont Industries, a leading company in utility and wireless infrastructure, as well as irrigation systems for agriculture. Sunrun announced the acquisition of Vivint Solar during the period. American Financial Group reported first quarter 2021 earnings that were better than expected, featuring stronger underwriting profit margins, healthy pricing, and solid premium growth. The company also closed on the sale of its Annuity business and announced a larger-than-expected special dividend with a portion of the sale proceeds. Valmont Industries reported stronger quarterly results during the period following greater optimism over its irrigation business as farmer incomes inflected positively amidst higher commodity prices. The company also recognized revenues on a key Middle East contract tied to food security.

Individual holdings that negatively affected performance included (i) MultiPlan Corporation, a healthcare transaction processor focused on reducing waste, fraud, and abuse; (ii) Webster Financial Corporation, a regional bank based in the Northeast; and (iii) TreeHouse Foods, Inc., the leading U.S. private label food manufacturer. MultiPlan underperformed during the period due to accusations surfacing from a short seller during the fourth quarter 2020 as well as management’s lack of providing 2021 guidance, which continued to depress investor interest in the company. Webster Financial Corporation came under some near-term pressure following the April 2021 announcement that it would be acquiring Sterling Bancorp., a regional bank similarly based in the Northeast. Typically, bank stocks engaging in acquisitions tend to underperform in the period from deal announcement until deal closure (expected in 4Q21) as the market digests potential integration risk. Treehouse Foods underperformed as more defensive names underperformed other more pro-cyclical areas of the market. In addition, given weaker private label category performance relative to branded within packaged food, Treehouse’s private label categories began to lose share, adding to concerns the company would not be able to accelerate its relatively poor organic growth performance over the next year or two.

CRM Mid Cap Value Fund returned 54.44% and 54.09% for the Institutional and Investor Share classes, respectively, in the fiscal year, as compared to 53.06% and 49.80% for the Russell Midcap® Value Index and the Russell Midcap® Index, respectively3. Strong stock selection in most sectors contributed to the Fund’s relative outperformance versus both indices, and strong absolute performance. Stock selection in the Materials and Real Estate sectors acted as a slight headwind to performance. Individual holdings that contributed positively to performance during the period included (i) American Financial Group, Inc., a diversified insurer;

4 |

(ii) Envista Holdings Corporation, a provider of dental consumables, equipment, and services to dental professionals; and (iii) LKQ Corporation., a distributor for aftermarket automotive parts. American Financial Group reported first quarter 2021 earnings that were better than expected, featuring stronger underwriting profit margins, healthy pricing, and solid premium growth. The company also closed on the sale of its Annuity business and announced a larger-than-expected special dividend with a portion of the sale proceeds. Global dental volumes continued to sequentially improve from the April 2020 trough period. Domestically, volumes remain below the prior year period, but Envista’s profits outperformed expectations as improving mix and managing costs brought profits closer to prior year results. Several dental industry peers have similarly reported improved profitability results, as dental offices have remained open during the COVID-19 surges. Results in categories where Envista has been making investments were also above expectations, in infection prevention products and clear aligners, which are additive to sustainable growth and margins. Longer term revenue targets were also raised, as the company exited lower growth segments and products. LKQ Corporation saw continued improvement in many of its geographies from a product demand perspective. The company’s Specialty segment continued to grow above expectations, as elevated aftermarket recreational vehicle parts demand continued.

Holdings that detracted from Fund performance during the fiscal year included (i) MultiPlan Corporation, a healthcare transaction processor focused on reducing waste, fraud, and abuse; (ii) Mohawk Industries, Inc., a U.S. flooring manufacturer; and (iii) Webster Financial Corporation., a regional bank based in the Northeast. MultiPlan underperformed during the period due to accusations surfacing from a short seller during the fourth quarter 2020 as well as management’s lack of providing 2021 guidance, which continued to depress investor interest in the company. Mohawk Industries traded down amid the release of a detailed research report highlighting alleged aggressive accounting practices. In addition, the company reported it received subpoenas from the U.S. Attorney’s Office and SEC over related allegations. We sold the stock in the first half of the fiscal year as these events called into question the recovery from self-inflicted execution mistakes over the last few years and housing related earnings recovery potential. Webster Financial Corporation came under some near-term pressure following the April 2021 announcement that it would be acquiring Sterling Bancorp., a regional bank similarly based in the Northeast. Typically, bank stocks engaging in acquisitions tend to underperform in the period from deal announcement until deal closure (expected in 4Q21) as the market digests potential integration risk.

CRM All Cap Value Fund returned 54.66% and 54.42% for the Institutional and Investor Share classes, respectively, during the period, as compared to 45.40% and 44.16% for the Russell 3000® Value Index and the Russell 3000® Index, respectively4. Strong performance in the Fund during the period was due to positive stock selection in the Energy, Information Technology, Health Care,

5 |

and Consumer Discretionary sectors. Stock selection in the Materials sector was a slight headwind to performance Leading contributors to Fund performance were (i) American Financial Group, Inc., a diversified insurer; (ii) Valmont Industries, Inc., a manufacturer of poles and towers for infrastructure, communications, and utility end-markets as well as agricultural irrigation equipment; and (iii) BankUnited, Inc., a regional bank based in Florida and New York. American Financial Group reported first quarter 2021 earnings that were better than expected, featuring stronger underwriting profit margins, healthy pricing, and solid premium growth. The company also closed on the sale of its Annuity business and announced a larger-than-expected special dividend with a portion of the sale proceeds. Valmont Industries reported stronger quarterly results during the period following greater optimism over its irrigation business as farmer incomes inflected positively amidst higher commodity prices. The company also recognized revenues on a key Middle East contract tied to food security. BankUnited reported better-than-expected third quarter 2020 and fourth quarter 2020 earnings due to improved credit quality. In addition, the company guided to a stabilizing net interest margin given its ability to lower deposit costs. Finally, the company continued to make solid progress on implementing cost savings from its BankUnited 2.0 profitability initiative.

Individual holdings that negatively impacted performance included (i) MultiPlan Corporation, a healthcare transaction processor focused on reducing waste, fraud, and abuse; (ii) Qualcomm Inc., the leading provider of wireless communication technology to enterprises and consumers globally; and (iii) Webster Financial Corporation, a regional bank based in the Northeast. MultiPlan underperformed during the period due to accusations surfacing from a short seller during the fourth quarter 2020 as well as management’s lack of providing 2021 guidance, which continued to depress investor interest in the company. Qualcomm underperformed during the fiscal year as the communications industry is in the early stages of adopting 5G, the latest wireless standard. While the transition is well understood, we believe investor appreciation for its cadence is vastly misunderstood. In addition, the well-documented semiconductor shortage is causing the transition to elongate as supply is constrained. Investors misinterpreted slower growth early in 2021 as a reflection for 5G demand peaking. Webster Financial Corporation came under some near-term pressure following the April 2021 announcement that it would be acquiring Sterling Bancorp., a regional bank similarly based in the Northeast. Typically, bank stocks engaging in acquisitions tend to underperform in the period from deal announcement until deal closure (expected in 4Q21) as the market digests potential integration risk.

CRM Long/Short Opportunities Fund returned 19.49% in the fiscal year versus 40.79% for the S&P 500® Index5. During the fiscal year ended June 30, 2021, our long book contributed to overall performance with strong contribution from most sectors, particularly Industrials and Consumer Discretionary. The Fund’s short book detracted from performance with the majority of negative contribution coming

6 |

from Industrials, Information Technology, and Consumer Discretionary. In terms of exposure during the period, the Fund averaged approximately 101% gross long, 48% gross short, and 53% net long.

The top contributors in the long portfolio were (i) Sunrun, Inc., the leading residential solar installer in the U.S.; (ii) branded apparel company, G-III Apparel Group, Ltd.; and (iii) Valmont Industries, Inc., a manufacturer of poles and towers for infrastructure, communications, and utility end-markets as well as agricultural irrigation equipment. Sunrun announced the acquisition of Vivint Solar during the period. G-III Apparel Group responded positively to vaccine news throughout November as well as a better-than-expected third quarter 2020 earnings report. The company continued to post better-than-expected earnings as a result of aggressive cost mitigation in 2020 and a measured recovery of revenues. Importantly, GIII completed the exit of its money-losing retail business in the fourth quarter of 2020. Valmont Industries reported stronger quarterly results during the period following greater optimism over its irrigation business as farmer incomes inflected positively amidst higher commodity prices. The company also recognized revenues on a key Middle East contract tied to food security.

Top individual names that negatively impacted the long portfolio included (i) MultiPlan Corporation, a healthcare transaction processor focused on reducing waste, fraud, and abuse; (ii) Paya Holdings, Inc., a leading provider of integrated payment and frictionless commerce solutions that help customers accept and make payments; and (iii) Clearwater Paper Corporation, a domestic producer of private label consumer paper products, as well as solid bleached sulfate paperboard products. MultiPlan underperformed during the period due to accusations surfacing from a short seller during the fourth quarter 2020 as well as management’s lack of providing 2021 guidance, which continued to depress investor interest in the company. Paya Holdings came public via a SPAC transaction, which resulted in the shares being less well known by public investors relative to a traditional IPO. Consequently, the shares trade at a discount to peers despite faster revenue growth and comparable margins. The shares underperformed following the completion of a secondary offering in March 2021. Clearwater paper suffered during the second half of the fiscal year from the oversupply of consumer bath tissue inventory at its customers, elevated commodity input pressure, and forced production downtime at its facilities. The company has taken steps to exit unprofitable capacity, as it works to bring down inventories at its customers and its own held finished product. Meanwhile, Clearwater’s paperboard segment is benefitting from strong demand and better pricing dynamics, which is partially moderating softer results in its consumer tissue segment.

Our leading short contributors included (i) a linear media company; (ii) a for profit education company; and (iii) a legacy manufacturer of 3D printing equipment and a service provider to additive manufacturing customers. A linear media company with

7 |

a nascent OTT offering agreed to combine with the vast media portfolio of a telecom conglomerate, which we viewed negatively. This Newco takes the traditional business of high margin, programmed content aimed at a core base of aficionados to a more far flung global business that now includes sports programming, theatrical releases, and subscription media offerings that pit them more closely against Netflix, Disney, and Comcast. This merger also increases the leverage profile of the business and makes the business too large to be an acquisition target itself. A for profit education company is subject to higher regulatory scrutiny from the U.S. Department of Education, as well as operating challenges from a slower enrollment and higher marketing cost profile. A legacy manufacturer of 3D printing equipment and a service provider to additive manufacturing customers, saw its stock pressured as several new companies came public in the additive manufacturing space with aggressive plans to target printing for production environments.

The top detractors in the short portfolio were (i) an enterprise software company; (ii) a solar inverter company; and (iii) a leading LED manufacturer. An enterprise software company became the target of speculative retail frenzy early in the year, pushing the share price to stratospheric levels. We exited our position due to the nature of the speculative bubble. A leading solar inverter company appreciated despite significantly lowering fourth quarter 2020 guidance and announcing further delays in its storage product. Even with this news, clean energy ETFs and retail investors purchased the stock indiscriminately. A leading LED manufacturer appreciated on higher guidance provided for 2021 that we believe to be largely transitory as inventories are restocked, price increases are inflated due to the absence of competitive Chinese product in the key U.S. market, and as cost pressures catch up to results in late 2021 and through 2022.

Sincerely,

Ronald H. McGlynn

Trustee and President, CRM Mutual Fund Trust

8 |

1Russell 2000® Value Index is the Fund’s benchmark. The Russell 2000® Value Index measures the performance of those companies in the Russell 2000® Index with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Index is an unmanaged, capitalization weighted index of 2,000 small cap U.S. companies. It is not possible to invest directly in an index.

2Russell 2500™ Value Index is the Fund’s benchmark. The Russell 2500™ Value Index is an unmanaged index that measures the performance of those companies in the Russell 2500 Index with lower price-to-book ratios and lower forecasted growth values. The Russell 2500™ Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000® Index. It is not possible to invest directly in an index.

3Russell Midcap® Value Index is the Fund’s benchmark. The Russell Midcap® Value Index measures the performance of those companies in the Russell Midcap® Index with lower price-to-book ratios and lower forecasted growth values. The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000® Index, which represents the performance of the 1,000 largest companies in the U.S. equity market. It is not possible to invest directly in an index.

4Russell 3000® Value Index is the Fund’s benchmark. The Russell 3000® Value Index measures the performance of those companies in the Russell 3000® Index with lower price-to-book ratios and lower forecasted growth values. The Russell 3000® Index is an unmanaged, capitalization weighted index of the 3,000 largest U.S. companies, which represent approximately 98% of the investable U.S. equity market. It is not possible to invest directly in an index.

5S&P 500® Index is an index of 500 companies chosen for market size, liquidity and industry grouping, among other factors. The S&P 500® is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. During the period, certain fees and expenses were waived by the Funds’ service providers. Without these waivers, total returns would have been lower. Additional performance figures for the Funds can be found in Comparison of Change in Value section of this report.

Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please refer to the Schedules of Investments for a complete list of Fund holdings. The information contained herein is not a complete analysis of every aspect of any market, industry, security, or Fund. Opinions expressed herein are as of June 30, 2021 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investments in small and mid capitalization companies generally are more volatile due to limited product lines, fewer capital resources and less depth of management than larger companies. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic values or that the investment has not been undervalued by the market. Investments in foreign securities, including emerging markets, involve special risks such as greater social, economic, regulatory, and political uncertainties, and currency fluctuation.

9 |

The Long/Short Opportunities Fund will hold long equity securities that the Fund’s adviser has identified as undervalued and take short positions (through short sales) in equity securities that the Fund’s adviser has identified as overvalued or poised for underperformance. Short sales involve significant risks, including the risk that the Fund may have to cover its short position at a higher price than the short sale price, resulting in a loss. Short sales involve borrowing securities and then selling them, which may cause the value of the Fund’s shares to be more volatile than if the Fund did not borrow.

This report must be preceded or accompanied by the current prospectus for the Funds. Before investing, you should carefully read the prospectus and consider the investment objectives, risks, charges and expenses of the Funds. Additional copies of the prospectus may be obtained at www.crmfunds.com or at 800-CRM-2883.

Distributed by ALPS Distributors, Inc.

10 |

CRM FUNDS CRM SMALL CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) June 30, 2021 |

The following information compares the performance of the CRM Small Cap Value Fund (“Fund”) with the performance of the Russell 2000® Index and Russell 2000® Value Index. The Russell 2000® Index is an unmanaged, capitalization-weighted index of 2,000 small capitalization U.S. companies. The Russell 2000® Value Index measures the performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values. Total return for the Fund assumes reinvestment of dividends and distributions. The index returns reflect the reinvestment of dividends, but exclude the effect of any expenses, which have been deducted from the Fund’s return. The performance in the below tables and graphs does not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemption of Fund shares.

Compared to mutual funds that focus on large capitalization companies, shares of the Fund may be more volatile because of the Fund’s focus on smaller capitalization companies. These companies are more likely to have more limited product lines, fewer capital resources and less depth of management than larger companies.

CRM Small Cap Value Fund — Investor Shares vs. Russell 2000® Index and Russell 2000® Value Index1

CRM Funds |

||

11 |

CRM FUNDS CRM SMALL CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Continued) June 30, 2021 |

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

Small Cap Value Fund - Investor Shares |

55.36% |

10.59% |

8.97% |

Russell 2000® Index |

62.03% |

16.47% |

12.34% |

Russell 2000® Value Index |

73.28% |

13.62% |

10.85% |

Expense Ratio (per prospectus dated 10/28/20) — 1.17%

|

1 |

The Fund is professionally managed, while the indices are unmanaged and are not available for investment. |

This line graph for Investor Shares shows values based on an assumed investment of $10,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

12 |

CRM FUNDS CRM SMALL CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Concluded) June 30, 2021 |

CRM Small Cap Value Fund — Institutional Shares vs. Russell 2000® Index and Russell 2000® Value Index1

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

Small Cap Value Fund - Institutional Shares |

55.68% |

10.85% |

9.22% |

Russell 2000® Index |

62.03% |

16.47% |

12.34% |

Russell 2000® Value Index |

73.28% |

13.62% |

10.85% |

Expense Ratio (per prospectus dated 10/28/20) — 0.93%

|

1 |

The Fund is professionally managed, while the indices are unmanaged and are not available for investment. |

The line graph for Institutional Shares shows values based on an assumed investment of $1,000,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

13 |

CRM FUNDS CRM SMALL/MID CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) June 30, 2021 |

The following information compares the performance of the CRM Small/Mid Cap Value Fund (“Fund”) with the performance of the Russell 2500™ Index and Russell 2500™ Value Index. The Russell 2500™ Value Index is an unmanaged index that measures the performance of those companies in the Russell 2500™ Index with lower price-to-book ratios and lower forecasted growth values. The Russell 2500™ Index measures the performance of the 2,500 smallest companies in the Russell 3000® Index, which represents the performance of the 3,000 largest U.S. companies. Total return for the Fund assumes reinvestment of dividends and distributions. The index returns reflect the reinvestment of dividends, but exclude the effect of any expenses, which have been deducted from the Fund’s return. The performance in the below tables and graphs does not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemption of Fund shares.

Compared to mutual funds that focus on large capitalization companies, shares of the Fund may be more volatile because of the Fund’s focus on smaller capitalization companies. These companies are more likely to have more limited product lines, fewer capital resources and less depth of management than larger companies.

CRM Small/Mid Cap Value Fund — Investor Shares vs. Russell 2500™ Index and Russell 2500™ Value Index1

CRM Funds |

||

14 |

CRM FUNDS CRM SMALL/MID CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Continued) June 30, 2021 |

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

Small/Mid Cap Value Fund - Investor Shares |

67.80% |

15.23% |

11.19% |

Russell 2500TM Index |

57.79% |

16.35% |

12.86% |

Russell 2500TM Value Index |

63.23% |

12.29% |

10.93% |

Expense Ratio (per prospectus dated 10/28/20) — 1.18%

|

1 |

The Fund is professionally managed, while the indices are unmanaged and are not available for investment. |

The line graph for Investor Shares shows values based on an assumed investment of $10,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

15 |

CRM FUNDS CRM SMALL/MID CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Concluded) June 30, 2021 |

CRM Small/Mid Cap Value Fund — Institutional Shares vs.

Russell 2500™ Index and Russell 2500™ Value Index1

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

Small/Mid Cap Value - Institutional Shares |

68.26% |

15.49% |

11.44% |

Russell 2500® Index |

57.79% |

16.35% |

12.86% |

Russell 2500® Value Index |

63.23% |

12.29% |

10.93% |

Expense Ratio (per prospectus dated 10/28/20) — 0.96%

|

1 |

The Fund is professionally managed, while the indices are unmanaged and are not available for investment. |

The line graph for Institutional Shares shows values based on an assumed investment of $1,000,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

16 |

CRM FUNDS CRM MID CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) June 30, 2021 |

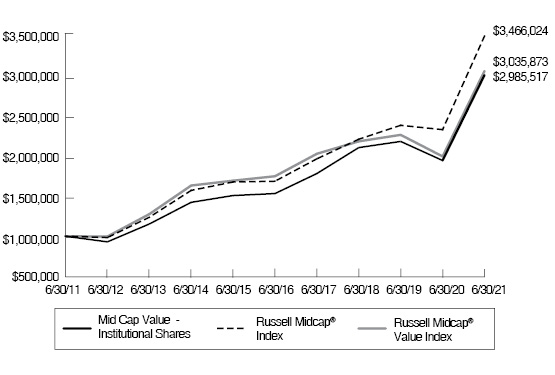

The following information compares the performance of the CRM Mid Cap Value Fund (“Fund”) with the performance of the Russell Midcap® Index and Russell Midcap® Value Index. The Russell Midcap® Index measures the performance of 800 of the smallest companies in the Russell 1000® Index. The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents the performance of the 3,000 largest U.S. companies. The Russell Midcap® Value Index measures the performance of those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. Total return for the Fund assumes reinvestment of dividends and distributions. The index returns reflect reinvestment of dividends but exclude the effect of any expenses, which have been deducted from the Fund’s return. The performance in the below tables and graphs does not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemption of Fund shares.

Compared to mutual funds that focus on large capitalization companies, shares of the Fund may be more volatile because the Fund invests in mid capitalization companies. These companies are more likely to have more limited product lines, fewer capital resources and less depth of management than larger companies.

CRM Mid Cap Value Fund — Investor Shares vs. Russell Midcap® Index and Russell Midcap® Value Index1

CRM Funds |

||

17 |

CRM FUNDS CRM MID CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Continued) June 30, 2021 |

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

Mid Cap Value Fund - Investor Shares |

54.09% |

14.14% |

11.33% |

Russell Midcap® Index |

49.80% |

15.62% |

13.24% |

Russell Midcap® Value Index |

53.06% |

11.79% |

11.75% |

Expense Ratio (per prospectus dated 10/28/20) — 1.17%

|

1 |

The Fund is professionally managed, while the indices are unmanaged and are not available for investment. |

The line graph for Investor Shares shows values based on an assumed investment of $10,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

18 |

CRM FUNDS CRM MID CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Concluded) June 30, 2021 |

CRM Mid Cap Value Fund — Institutional Shares vs. Russell Midcap® Index and Russell Midcap® Value Index1

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

Mid Cap Value - Institutional Shares |

54.44% |

14.37% |

11.56% |

Russell Midcap® Index |

49.80% |

15.62% |

13.24% |

Russell Midcap® Value Index |

53.06% |

11.79% |

11.75% |

Expense Ratio (per prospectus dated 10/28/20) — 0.97%

|

1 |

The Fund is professionally managed, while the indices are unmanaged and are not available for investment. |

This line graph for Institutional Shares shows values based on an assumed investment of $1,000,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

19 |

CRM FUNDS CRM ALL CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) June 30, 2021 |

The following information compares the performance of the CRM All Cap Value Fund (“Fund”) with the performance of the Russell 3000® Index and the Russell 3000® Value Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies. The Russell 3000® Value Index measures the performance of those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. Total return for the Fund assumes reinvestment of dividends and distributions. The index returns reflect the reinvestment of dividends but exclude the effect of any expenses, which have been deducted from the Fund’s return. The performance in the below tables and graphs does not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemption of Fund shares.

Compared to mutual funds that focus exclusively on large capitalization companies, shares of the Fund may be more volatile because, while the Fund may invest in large capitalization companies, the Fund may also invest in small and mid capitalization companies. These companies are more likely to have more limited product lines, fewer capital resources and less depth of management than larger companies.

CRM All Cap Value Fund — Investor Shares vs. Russell 3000® Index and Russell 3000® Value Index1

CRM Funds |

||

20 |

CRM FUNDS CRM ALL CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Continued) June 30, 2021 |

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

All Cap Value Fund - Investor Shares2 |

54.42% |

12.31% |

9.95% |

Russell 3000® Index |

44.16% |

17.89% |

14.70% |

Russell 3000® Value Index |

45.40% |

11.99% |

11.54% |

Expense Ratios (per prospectus dated 10/28/20) — Gross: 1.51% Net: 1.46%3

|

1 |

The Fund is professionally managed, while the indices are unmanaged and are not available for investment. |

|

2 |

Total return would have been lower had certain fees and expenses not been waived and/or reimbursed. |

|

3 |

The investment adviser has a contractual obligation to waive a portion of its fees and to assume certain expenses of the Fund to the extent that the total annual fund operating expenses, excluding taxes, extraordinary expenses, brokerage commissions, interest and acquired fund fees and expenses, exceed 1.45% of average daily net assets of the share class. The expense limitation agreement is in effect until November 1, 2021 and the Board has approved the renewal of the agreement for an additional year until November 1, 2022. |

The line graph for Investor Shares shows values based on an assumed investment of $10,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

21 |

CRM FUNDS CRM ALL CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Continued) June 30, 2021 |

CRM All Cap Value Fund — Institutional Shares vs. Russell 3000® Index and Russell 3000® Value Index1

Average Annual Total Returns |

|||

1 Year |

5 Years |

10 Years |

|

All Cap Value Fund - Intitutional Shares2 |

54.66% |

12.56% |

10.21% |

Russell 3000® Index |

44.16% |

17.89% |

14.70% |

Russell 3000® Value Index |

45.40% |

11.99% |

11.54% |

Expense Ratios (per prospectus dated 10/28/20 - Gross: 1.26% Net: 1.21%3

|

1 |

The Fund is professionally managed, while the indices are unmanaged and are not available for investment. |

|

2 |

Total return would have been lower had certain fees and expenses not been waived and/or reimbursed. |

|

3 |

The investment adviser has a contractual obligation to waive a portion of its fees and to assume certain expenses of the Fund to the extent that the total annual fund operating expenses, excluding taxes, extraordinary expenses, brokerage commissions, interest and acquired fund fees and expenses, exceed 1.20% of average daily net assets of the share class. The expense limitation agreement is in effect until November 1, 2021 and the Board has approved the renewal of the agreement for an additional year until November 1, 2022. |

CRM Funds |

||

22 |

CRM FUNDS CRM ALL CAP VALUE FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Concluded) June 30, 2021 |

The line graph for Institutional Shares shows values based on an assumed investment of $1,000,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

23 |

CRM FUNDS CRM LONG/SHORT OPPORTUNITIES FUND COMPARISON OF CHANGE IN VALUE (Unaudited) June 30, 2021 |

The following information compares the performance of the CRM Long/Short Opportunities Fund (“Fund”) with the performance of the S&P 500® Index. The S&P 500® Index is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500® is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. Total return for the Fund assumes reinvestment of dividends and distributions. The index returns reflect reinvestment of dividends but exclude the effect of any expenses, which have been deducted from the Fund’s return. The performance in the below table and graph does not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemption of Fund shares.

The Fund will hold long equity securities that the Fund’s adviser has identified as undervalued and take short positions (through short sales) in equity securities that the Fund’s adviser has identified as overvalued or poised for underperformance. Short sales involve significant risks, including the risk that the Fund may have to cover its short position at a higher price than the short sale price, resulting in a loss. Short sales involve borrowing securities and then selling them, which may cause the value of the Fund’s shares to be more volatile than if the Fund did not borrow.

CRM Long/Short Opportunities Fund — Institutional Shares vs.

S&P 500® Index1

CRM Funds |

||

24 |

CRM FUNDS CRM LONG/SHORT OPPORTUNITIES FUND COMPARISON OF CHANGE IN VALUE (Unaudited) (Concluded) June 30, 2021 |

Average Annual |

||

1 Year |

Since |

|

Long/Short Opportunities Fund - Institutional Shares2 |

19.49% |

5.54% |

S&P 500® Index |

40.79% |

17.19% |

Expense Ratios (per prospectus dated 10/28/20) — Gross: 3.04% Net: 2.96%4

|

1 |

The Fund is professionally managed, while the index is unmanaged and is not available for investment. |

|

2 |

Total return would have been lower had certain fees and expenses not been waived and/or reimbursed. |

|

3 |

Return calculated since the Institutional Shares’ inception on August 16, 2016. |

|

4 |

The investment adviser has a contractual obligation to waive a portion of its fees and to assume certain expenses of the Fund to the extent that the total annual fund operating expenses, excluding taxes, extraordinary expenses, brokerage commissions, interest, dividends and interest expense relating to short sales and acquired fund fees and expenses, exceed 1.60% of average daily net assets of the Fund. The expense limitation agreement is in effect until November 1, 2021 and the Board has approved the renewal of the agreement for an additional year until November 1, 2022. |

The line graph for Institutional Shares shows values based on an assumed investment of $1,000,000.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate. Shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Performance data current to the most recent month-end is available by calling (800) CRM-2883. The Fund’s expense ratio may fluctuate over time, and vary from the Fund’s expenses for the period covered by this report. Please refer to the financial highlights for a more current expense ratio.

CRM Funds |

||

25 |

CRM FUNDS EXPENSE DISCLOSURE (Unaudited)

|

DISCLOSURE OF FUND EXPENSES

The following Expense Tables are shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of a Fund, you incur ongoing costs, including management fees, shareholder servicing fees and other Fund expenses. A Fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (January 1, 2021 through June 30, 2021). The “Annualized Expense Ratio” reflects the actual expenses, net of fee waivers, where applicable, for the six-month period January 1, 2021 to June 30, 2021 and may be different from the expense ratio in the Financial Highlights which is for the fiscal year ended June 30, 2021.

The Expense Tables below illustrate your Fund’s expenses in two ways.

|

● |

Actual fund return. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period. |

|

● |

Hypothetical 5% return. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs that may be levied by

CRM Funds |

||

26 |

CRM FUNDS EXPENSE DISCLOSURE (Unaudited) (Continued)

|

other funds, such as sales charges (loads), redemption fees, or exchange fees, if any. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The “Annualized Expense Ratio” reflects the actual expenses for the period indicated.

For the Six Months Ended June 30, 2021

Expense Table

Fund/Class |

Beginning |

Ending |

Annualized |

Expenses |

||||||||||||

CRM Small Cap Value Fund - Investor Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,180.30 | 1.12 | % | $ | 6.05 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,019.24 | 1.12 | % | $ | 5.61 | ||||||||

CRM Small Cap Value Fund - Institutional Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,181.70 | 0.88 | % | $ | 4.76 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,020.43 | 0.88 | % | $ | 4.41 | ||||||||

CRM Small/Mid Cap Value Fund - Investor Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,222.80 | 1.13 | % | $ | 6.23 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,019.19 | 1.13 | % | $ | 5.66 | ||||||||

CRM Small/Mid Cap Value Fund - Institutional Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,224.50 | 0.91 | % | $ | 5.02 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,020.28 | 0.91 | % | $ | 4.56 | ||||||||

CRM Mid Cap Value Fund - Investor Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,193.40 | 1.12 | % | $ | 6.09 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,019.24 | 1.12 | % | $ | 5.61 | ||||||||

CRM Funds |

||

27 |

CRM FUNDS EXPENSE DISCLOSURE (Unaudited) (Concluded)

|

Fund/Class |

Beginning |

Ending |

Annualized |

Expenses |

||||||||||||

CRM Mid Cap Value Fund - Institutional Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,194.90 | 0.91 | % | $ | 4.95 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,020.28 | 0.91 | % | $ | 4.56 | ||||||||

CRM All Cap Value Fund - Investor Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,159.30 | 1.36 | % | $ | 7.28 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,018.05 | 1.36 | % | $ | 6.80 | ||||||||

CRM All Cap Value Fund - Institutional Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,160.30 | 1.10 | % | $ | 5.89 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,019.34 | 1.10 | % | $ | 5.51 | ||||||||

CRM Long/Short Opportunities Fund - Institutional Shares |

||||||||||||||||

Actual Fund Return |

$ | 1,000.00 | $ | 1,009.60 | 2.99 | % | $ | 14.90 | ||||||||

Hypothetical (5% Return Before Expenses) |

$ | 1,000.00 | $ | 1,009.97 | 2.99 | % | $ | 14.90 | ||||||||

|

(1) |

The expense ratio for CRM Long/Short Opportunities Fund includes the impact of dividend expense and net interest expense (when applicable), on securities sold short. Excluding such expenses, the ratio of expenses to average net assets would have been 1.60%. |

|

(2) |

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181/ 365 (to reflect the most recent one-half year period). |

CRM Funds |

||

28 |

CRM FUNDS DISCLOSURE OF PORTFOLIO HOLDINGS (Unaudited)

|

PORTFOLIO HOLDINGS

June 30, 2021

The following tables present a summary of the portfolio holdings of each of the CRM Funds as a percentage of their total investments, before short-term investments held as collateral for loaned securities.

CRM Small Cap Value Fund- |

|

Common Stock |

|

Financials |

23.3% |

Industrials |

22.0 |

Consumer Discretionary |

18.1 |

Real Estate |

8.5 |

Technology |

8.4 |

Materials |

4.6 |

Energy |

3.6 |

Consumer Staples |

3.5 |

Utilities |

3.0 |

Health Care |

2.0 |

Communications |

1.8 |

Short-Term Investments |

1.2 |

100.0% |

|

CRM Small/Mid Cap Value Fund- |

|

Common Stock |

|

Industrials |

25.7% |

Financials |

17.1 |

Consumer Discretionary |

14.1 |

Materials |

8.7 |

Technology |

7.8 |

Health Care |

6.8 |

Energy |

5.9 |

Consumer Staples |

4.2 |

Real Estate |

4.2 |

Utilities |

3.0 |

Short-Term Investments |

2.5 |

100.0% |

|

CRM Mid Cap Value Fund- |

|

Common Stock |

|

Industrials |

23.1% |

Financials |

13.7 |

Technology |

12.9 |

Consumer Discretionary |

11.9 |

Health Care |

9.2 |

Materials |

8.7 |

Utilities |

6.1 |

Energy |

4.9 |

Real Estate |

3.1 |

Consumer Staples |

1.5 |

Short-Term Investments |

4.9 |

100.0% |

|

CRM All Cap Value Fund- |

|

Common Stock |

|

Financials |

20.8% |

Industrials |

19.8 |

Technology |

15.8 |

Consumer Discretionary |

14.4 |

Health Care |

9.5 |

Energy |

4.8 |

Materials |

4.4 |

Consumer Staples |

2.5 |

Real Estate |

2.3 |

Communications |

2.3 |

Utilities |

2.0 |

Short-Term Investments |

1.4 |

100.0% |

|

CRM Funds |

||

29 |

CRM FUNDS DISCLOSURE OF PORTFOLIO HOLDINGS (Unaudited) (Concluded)

|

The following tables present a summary of the portfolio holdings of the CRM Long/Short Opportunities Fund as a percentage of its total net assets.

CRM Long/Short Opportunities Fund- |

|

Common Stock |

|

Consumer Discretionary |

24.7% |

Industrials |

21.1 |

Technology |

15.4 |

Health Care |

8.3 |

Financials |

7.2 |

Energy |

5.8 |

Communications |

5.1 |

Utilities |

3.4 |

Consumer Staples |

3.3 |

Materials |

2.0 |

Short-Term Investments |

3.5 |

Common Stock Sold Short |

|

Utilities |

(0.6) |

Energy |

(0.7) |

Financials |

(0.3) |

Health Care |

(1.2) |

Communications |

(4.0) |

Technology |

(5.8) |

Industrials |

(7.6) |

Consumer Staples |

(9.1) |

Consumer Discretionary |

(9.2) |

61.3% |

|

Portfolio holdings are subject to change at any time.

CRM Funds |

||

30 |

CRM FUNDS CRM SMALL CAP VALUE FUND SCHEDULE OF INVESTMENTS June 30, 2021 |

Shares |

Value |

|||||||

COMMON STOCK — 98.6% |

||||||||

Communications — 1.8% |

||||||||

Telecommunications — 1.8% |

||||||||

| 416,995 | Vonage Holdings Corp.1 |

$ | 6,008,898 | |||||

Consumer Discretionary — 18.1% |

||||||||

Apparel & Textile Products — 3.9% |

||||||||

| 302,138 | Steven Madden Ltd. |

13,221,559 | ||||||

Consumer Services — 3.5% |

||||||||

| 1,280,123 | Regis Corp.1 |

11,981,951 | ||||||

Home Construction — 4.2% |

||||||||

| 252,814 | JELD-WEN Holding, Inc.1 |

6,638,896 | ||||||

| 140,334 | Skyline Champion Corp.1 |

7,479,802 | ||||||

| 14,118,698 | ||||||||

Leisure Facilities & Services — 2.1% |

||||||||

| 143,109 | BJ’s Restaurants, Inc.1 |

7,032,376 | ||||||

Wholesale - Discretionary — 4.4% |

||||||||

| 450,986 | G-III Apparel Group Ltd.1 |

14,819,400 | ||||||

Total Consumer Discretionary |

61,173,984 | |||||||

Consumer Staples — 3.5% |

||||||||

Beverages — 2.5% |

||||||||

| 505,469 | Primo Water Corp. |

8,456,496 | ||||||

Household Products — 1.0% |

||||||||

| 116,800 | Clearwater Paper Corp.1 |

3,383,696 | ||||||

Total Consumer Staples |

11,840,192 | |||||||

Energy — 3.6% |

||||||||

Oil & Gas Services & Equipment — 3.6% |

||||||||

| 467,554 | ChampionX Corp.1 |

11,992,760 | ||||||

Financials — 23.2% |

||||||||

Banking — 18.2% |

||||||||

| 150,947 | Amalgamated Financial Corp. |

2,359,302 | ||||||

| 315,860 | Associated Banc-Corp. |

6,468,813 | ||||||

| 269,754 | BancorpSouth Bank |

7,642,131 | ||||||

| 179,707 | BankUnited, Inc. |

7,671,692 | ||||||

Shares |

Value |

|||||||

Financials — (continued) |

||||||||

Banking — (continued) |

||||||||

| 344,904 | Central Pacific Financial Corp. |

$ | 8,988,198 | |||||

| 305,106 | Great Western Bancorp, Inc. |

10,004,426 | ||||||

| 278,723 | Hancock Whitney Corporation |

12,386,450 | ||||||

| 413,336 | Investors Bancorp, Inc. |

5,894,171 | ||||||

| 61,415,183 | ||||||||

Institutional Financial Services — 0.8% |

||||||||

| 46,883 | Moelis & Co., Class A |

2,667,174 | ||||||

Insurance — 2.7% |

||||||||

| 246,400 | James River Group Holdings, Ltd. |

9,244,928 | ||||||

Specialty Finance — 1.5% |

||||||||

| 89,422 | Stewart Information Services Corp. |

5,069,333 | ||||||

Total Financials |

78,396,618 | |||||||

Health Care — 2.0% |

||||||||

Medical Equipment & Devices — 2.0% |

||||||||

| 157,750 | Envista Holdings Corp.1 |

6,816,378 | ||||||

Industrials — 21.9% |

||||||||

Aerospace & Defense — 6.1% |

||||||||

| 191,880 | Barnes Group, Inc. |

9,833,850 | ||||||

| 213,177 | Kaman Corp. |

10,744,121 | ||||||

| 20,577,971 | ||||||||

Commercial Support Services — 3.4% |

||||||||

| 122,157 | Clean Harbors, Inc.1 |

11,377,703 | ||||||

Electrical Equipment — 3.7% |

||||||||

| 207,505 | SPX Corp.1 |

12,674,405 | ||||||

Industrial Intermediate Products — 3.5% |

||||||||

| 50,104 | Valmont Industries, Inc. |

11,827,049 | ||||||

Industrial Support Services — 1.9% |

||||||||

| 70,832 | Applied Industrial Technologies, Inc. |

6,449,962 | ||||||

See accompanying notes to financial statements. |

CRM Funds |

|

31 |

||

CRM FUNDS CRM SMALL CAP VALUE FUND SCHEDULE OF INVESTMENTS (Continued) June 30, 2021 |

Shares |

Value |

|||||||

Industrials — (continued) |

||||||||

Transportation & Logistics — 3.3% |

||||||||

| 183,484 | Kirby Corp.1 |

$ | 11,126,470 | |||||

Total Industrials |

74,033,560 | |||||||

Materials — 4.6% |

||||||||

Chemicals — 4.6% |

||||||||

| 113,758 | Ferro Corp.1 |

2,453,760 | ||||||

| 94,078 | HB Fuller Co. |

5,984,302 | ||||||

| 35,030 | Rogers Corp.1 |

7,034,024 | ||||||

Total Materials |

15,472,086 | |||||||

Real Estate — 8.5% |

||||||||

REIT — 8.5% |

||||||||

| 294,355 | American Assets Trust, Inc. |

10,976,498 | ||||||

| 223,467 | Corporate Office Properties Trust |

6,254,841 | ||||||

| 276,351 | Urban Edge Properties |

5,278,304 | ||||||

| 334,459 | Xenia Hotels & Resorts, Inc.1 |

6,264,417 | ||||||

Total Real Estate |

28,774,060 | |||||||

Technology — 8.4% |

||||||||

Software — 2.8% |

||||||||

| 87,029 | Agilysys, Inc.1 |

4,949,339 | ||||||

| 58,232 | Envestnet, Inc.1 |

4,417,480 | ||||||

| 9,366,819 | ||||||||

Technology Services — 5.6% |

||||||||

| 140,577 | Open Lending Corp.1 |

6,057,463 | ||||||

| 869,894 | PAE, Inc.1 |

7,742,056 | ||||||

| 464,851 | Paya Holdings, Inc.1 |

5,122,658 | ||||||

| 18,922,177 | ||||||||

Total Technology |

28,288,996 | |||||||

Utilities — 3.0% |

||||||||

Electric Utilities — 2.1% |

||||||||

| 107,357 | Black Hills Corp. |

7,045,840 | ||||||

Gas & Water Utilities — 0.9% |

||||||||

| 50,960 | SJW Group |

3,225,768 | ||||||

Total Utilities |

10,271,608 | |||||||

TOTAL COMMON STOCK (Cost $256,120,949) |

333,069,140 | |||||||

Shares |

Value |

|||||||

SHORT-TERM INVESTMENTS — 1.2% |

||||||||

| 2,011,219 | Blackrock Liquity Funds T-Fund, Institutional Series, 0.01%2 |

$ | 2,011,219 | |||||

| 2,011,216 | Federated Hermes Treasury Obligations Fund, Institutional Series, 0.01%2 |

2,011,216 | ||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $4,022,435) |

4,022,435 | |||||||

TOTAL INVESTMENTS — 99.8% (Cost $260,143,384) |

337,091,575 | |||||||

OTHER ASSETS IN EXCESS OF LIABILITIES — 0.2% |

627,175 | |||||||

NET ASSETS — 100.0% |

$ | 337,718,750 | ||||||

See accompanying notes to financial statements. |

CRM Funds |

|

32 |

||

CRM FUNDS CRM SMALL CAP VALUE FUND SCHEDULE OF INVESTMENTS (Concluded) June 30, 2021 |

Assets |

Level 1 |

Level 2 |

Level 3 |

Investments |

||||||||||||

Common Stock |

$ | 333,069,140 | $ | — | $ | — | $ | 333,069,140 | ||||||||

Short-Term Investments |

4,022,435 | — | — | 4,022,435 | ||||||||||||

Total |

$ | 337,091,575 | $ | — | $ | — | $ | 337,091,575 | ||||||||

There were no transfers into or out of Level 3 related to securities held at June 30, 2021.

|

1 |

Non-income producing security. |

|

2 |

Rate disclosed is the seven day effective yield as of June 30, 2021. |

See accompanying notes to financial statements. |

CRM Funds |

|

33 |

||

CRM FUNDS CRM SMALL/MID CAP VALUE FUND SCHEDULE OF INVESTMENTS June 30, 2021 |

Shares |

Value |

|||||||

COMMON STOCK — 97.6% |

||||||||

Consumer Discretionary — 14.1% |

||||||||

Home Construction — 2.1% |

||||||||

| 126,643 | Skyline Champion Corp.1 |

$ | 6,750,072 | |||||

Leisure Facilities & Services — 1.4% |

||||||||

| 28,711 | Marriott Vacations Worldwide Corp.1 |

4,573,662 | ||||||

Retail - Discretionary — 2.2% |

||||||||

| 10,067 | RH1 |

6,835,493 | ||||||

Wholesale - Discretionary — 8.4% |

||||||||

| 401,243 | G-III Apparel Group Ltd.1 |

13,184,846 | ||||||

| 264,006 | LKQ Corp.1 |

12,994,375 | ||||||

| 26,179,221 | ||||||||

Total Consumer Discretionary |

44,338,448 | |||||||

Consumer Staples — 4.2% |

||||||||

Beverages — 2.7% |

||||||||

| 499,846 | Primo Water Corp.2 |

8,362,424 | ||||||

Food — 1.5% |

||||||||

| 168,556 | Nomad Foods Ltd.1 |

4,765,078 | ||||||

Total Consumer Staples |

13,127,502 | |||||||

Energy — 5.9% |

||||||||

Oil & Gas Producers — 2.2% |

||||||||

| 42,628 | Pioneer Natural Resources Co. |

6,927,903 | ||||||

Oil & Gas Services & Equipment — 2.5% |

||||||||

| 303,654 | ChampionX Corp.1 |

7,788,724 | ||||||

Renewable Energy — 1.2% |

||||||||

| 66,924 | Sunrun, Inc.1 |

3,733,021 | ||||||

Total Energy |

18,449,648 | |||||||

Financials — 17.2% |

||||||||

Banking — 7.0% |

||||||||

| 181,205 | BancorpSouth Bank |

5,133,538 | ||||||

| 259,326 | Great Western Bancorp, Inc. |

8,503,299 | ||||||

| 153,724 | Webster Financial Corp. |

8,199,638 | ||||||

| 21,836,475 | ||||||||

Financials — (continued) |

||||||||

Insurance — 10.2% |

||||||||

| 99,721 | American Financial Group, Inc. |

$ | 12,437,203 | |||||

| 30,993 | Assurant, Inc. |

4,840,487 | ||||||

| 238,528 | James River Group Holdings, Ltd. |

8,949,571 | ||||||

| 77,107 | W.R. Berkley Corp. |

5,739,074 | ||||||

| 31,966,335 | ||||||||

Total Financials |

53,802,810 | |||||||

Health Care — 6.8% |

||||||||

Health Care Facilities & Services — 2.4% |

||||||||

| 351,204 | Ortho Clincial Diagnostics Holdings PLC1,3 |

7,519,278 | ||||||

Medical Equipment & Devices — 4.4% |

||||||||

| 6,956 | Bio-Rad Laboratories, Inc., Class A1 |

4,481,681 | ||||||

| 215,353 | Envista Holdings Corp.1 |

9,305,403 | ||||||

| 13,787,084 | ||||||||

Total Health Care |

21,306,362 | |||||||

Industrials — 25.7% |

||||||||

Aerospace & Defense — 4.4% |

||||||||

| 193,438 | Kaman Corp. |

9,749,275 | ||||||

| 9,389 | Teledyne Technologies, Inc.1 |

3,932,395 | ||||||

| 13,681,670 | ||||||||

Commercial Support Services — 4.9% |

||||||||

| 95,495 | Clean Harbors, Inc.1 |

8,894,404 | ||||||

| 133,445 | Terminix Global Holdings, Inc.1 |

6,366,661 | ||||||

| 15,261,065 | ||||||||

Electrical Equipment — 5.7% |

||||||||

| 429,287 | Hayward Holdings, Inc.1,2 |

11,170,047 | ||||||

| 214,276 | nVent Electric PLC3 |

6,693,982 | ||||||

| 17,864,029 | ||||||||

See accompanying notes to financial statements. |

CRM Funds |

|

34 |

||

CRM FUNDS CRM SMALL/MID CAP VALUE FUND SCHEDULE OF INVESTMENTS (Continued) June 30, 2021 |

Shares |

Value |

|||||||

Industrials — (continued) |

||||||||

Industrial Intermediate Products — 3.6% |

||||||||

| 47,845 | Valmont Industries, Inc. |

$ | 11,293,812 | |||||

Industrial Support Services — 1.6% |

||||||||

| 56,485 | Applied Industrial Technologies, Inc. |

5,143,524 | ||||||

Machinery — 2.7% |

||||||||

| 63,688 | Regal-Beloit Corp. |

8,502,985 | ||||||

Transportation & Logistics — 2.8% |

||||||||

| 144,128 | Kirby Corp.1 |

8,739,922 | ||||||

Total Industrials |

80,487,007 | |||||||

Materials — 8.7% |

||||||||

Chemicals — 4.7% |

||||||||

| 81,486 | Ashland Global Holdings, Inc. |

7,130,025 | ||||||

| 87,024 | RPM International, Inc. |

7,717,289 | ||||||

| 14,847,314 | ||||||||

Construction Materials — 4.0% |

||||||||

| 29,222 | Carlisle Cos., Inc. |

5,592,506 | ||||||

| 47,636 | Eagle Materials, Inc. |

6,769,552 | ||||||

| 12,362,058 | ||||||||

Total Materials |

27,209,372 | |||||||

Real Estate — 4.2% |

||||||||

REIT — 4.2% |

||||||||

| 196,712 | American Assets Trust, Inc. |

7,335,390 | ||||||

| 205,614 | Corporate Office Properties Trust |

5,755,136 | ||||||

Total Real Estate |

13,090,526 | |||||||

Technology — 7.8% |

||||||||

Software — 5.7% |

||||||||

| 242,917 | Clarivate PLC1,3 |

6,687,505 | ||||||

| 29,376 | PTC, Inc.1 |

4,149,654 | ||||||

| 165,768 | Tenable Holdings, Inc.1 |

6,854,507 | ||||||

| 17,691,666 | ||||||||

Technology — (continued) |

||||||||

Technology Services — 2.1% |

||||||||

| 701,520 | Multiplan Corp.1,2 |

$ | 6,678,470 | |||||

Total Technology |

24,370,136 | |||||||

Utilities — 3.0% |

||||||||

Electric Utilities — 1.0% |

||||||||

| 50,904 | Black Hills Corp. |

3,340,830 | ||||||

Gas & Water Utilities — 2.0% |

||||||||

| 251,274 | Nisource, Inc. |

6,156,213 | ||||||

Total Utilities |

9,497,043 | |||||||

TOTAL COMMON STOCK (Cost $202,278,435) |

305,678,854 | |||||||

SHORT-TERM INVESTMENTS — 2.5% |

||||||||

| 3,963,432 | BlackRock Liquidity Funds T-Fund, Institutional Series, 0.01%4 |

3,963,432 | ||||||

| 3,963,433 | Federated Hermes Treasury Obligations Fund, Institutional Series, 0.01%4 |

3,963,433 | ||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $7,926,865) |

7,926,865 | |||||||

TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR LOANED SECURITIES — 100.1% (Cost $210,205,300) |

313,605,719 | |||||||

SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR LOANED SECURITIES — 4.2% |

||||||||

TIME DEPOSITS — 2.0% |

||||||||

| 550,000 | Australia & New Zealand, 0.07%, 7/1/2021 |

550,000 | ||||||

| 580,000 | Barclays Bank PLC, 0.10%, 7/1/2021 |

580,000 | ||||||

| 550,000 | BNP Paribas, 0.06%, 7/1/2021 |

550,000 | ||||||

See accompanying notes to financial statements. |

CRM Funds |

|

35 |

||

CRM FUNDS CRM SMALL/MID CAP VALUE FUND SCHEDULE OF INVESTMENTS (Continued) June 30, 2021 |

Shares |

Value |

|||||||

TIME DEPOSITS — (continued) |

||||||||

| 420,000 | Canadian Imperial Bank of Canada, 0.05%, 7/1/2021 |

$ | 420,000 | |||||

| 580,000 | Credit Agricole CIB, 0.06%, 7/1/2021 |

580,000 | ||||||

| 370,000 | DNB Bank ASA, 0.03%, 7/1/2021 |

370,000 | ||||||

| 540,000 | Landesbank Baden-Wurttemberg, 0.05%, 7/1/2021 |

540,000 | ||||||

| 580,000 | Mizuho Bank Ltd., 0.08%, 7/1/2021 |

580,000 | ||||||

| 580,000 | National Australia Bank, 0.05%, 7/1/2021 |

580,000 | ||||||

| 570,000 | Royal Bank of Canada, 0.04%, 7/1/2021 |

570,000 | ||||||

| 530,000 | Skandinaviska Enskilda, 0.03%, 7/1/2021 |

530,000 | ||||||

| 580,000 | Svenska Handelsbanken, 0.03%, 7/1/2021 |

580,000 | ||||||

TOTAL TIME DEPOSITS |

6,430,000 | |||||||

MONEY MARKET FUNDS — 1.9% |

||||||||

| 1,186,000 | BlackRock Liquidity FedFund |

1,186,000 | ||||||

| 952,000 | Federated Government Obligations Fund |

952,000 | ||||||

| 880,000 | Goldman Sachs Financial Square Government Fund |

880,000 | ||||||

| 952,000 | Invesco Short-Term Investment Trust Government & Agency Portfolio |

952,000 | ||||||

| 1,030,000 | JPMorgan US Government Money Market Fund |

1,030,000 | ||||||

| 820,000 | Morgan Stanley Institutional Liquidity Funds |

820,000 | ||||||

TOTAL MONEY MARKET FUNDS |

5,820,000 | |||||||

Principal |

Value |

|||||||

REPURCHASE AGREEMENTS— 0.3% |

||||||||

| $ | 932,284 | With TD Securities USA, LLC.: at 0.05%, dated 6/30/21, to be repurchased on 7/1/21, repurchase price $932,285 (collateralized by US Treasury Securities, par values ranging from $84,369 - $266,909, coupon rates ranging from 0.13% to 2.63%, 9/30/21 - 2/29/24; Total Market Value $950,930) |

$ | 932,284 | ||||

TOTAL REPURCHASE AGREEMENTS |

932,284 | |||||||

TOTAL SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR LOANED SECURITIES – (Cost $13,182,284) |