Form N-CSR ASPIRIANT RISK-MANAGED For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23616

Aspiriant Risk-Managed Real Asset Fund

(Exact name of registrant as specified in charter)

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Ann Maurer

235 West Galena Street

Milwaukee, WI 53212

(Name and address of agent for service)

Registrant's telephone number, including area code: (414) 299-2270

Date of fiscal year end: Mar 31

Date of reporting period: March 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Annual Report

March 31, 2022

ASPIRIANT RISK-MANAGED REAL ASSET FUND

TABLE OF CONTENTS

Letter to Shareholders (Unaudited) |

2 |

Growth of a $25,000 Investment and Fund Performance (Unaudited) |

4 |

Schedule of Investments |

5 |

Summary of Investments |

7 |

Statement of Assets and Liabilities |

8 |

Statement of Operations |

9 |

Statement of Changes in Net Assets |

10 |

Statement of Cash Flows |

11 |

Financial Highlights |

12 |

Notes to Financial Statements |

13 |

Report of Independent Registered Public Accounting Firm |

23 |

Other Information (Unaudited) |

24 |

Fund Management (Unaudited) |

25 |

|

2 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Letter to Shareholders

March 31, 2022 (Unaudited)

The Aspiriant Risk-Managed Real Asset Fund (“XARAX” or the “Fund”) returned 18.39% for the one-year period ended March 31, 2022. Over the same period, the Fund’s benchmark, the Dow Jones Global Select Real Estate Securities Index (the “Benchmark”), returned 18.89%.

The Fund’s allocations to exchange-traded funds (ETFs) and some mutual funds provide the Fund a level of liquidity and broad exposure to global real assets. International focused real estate ETFs underperformed the Benchmark. Gold proved to be a positive contributor but did not keep up with the Fund’s Benchmark. However, the Fund’s investment in silver did not have the same positive impact on the Fund and also trailed the Benchmark.

Commingled limited partnerships, ETFs and mutual funds comprise a mix of private high-quality real estate, infrastructure assets and absolute return strategies. ETFs that focused on Master Limited Partnerships and Energy Infrastructure outperformed the Benchmark as energy focused investments recovered during the year. Investments in private debt and water performed well, producing positive returns but did not keep pace with the Benchmark.

Lastly, the Fund’s allocations to private equity contributed positively to the Fund’s performance. Most private equity strategies outperformed the Benchmark except those that focused on international markets or were new private equity investments in the initial investment period.

Thank you for your investment in the Fund.

John Allen

Portfolio Manager

Chief Investment Officer, Aspiriant, LLC

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 1-877-997-9971.

Portfolio composition will change due to ongoing management of the Fund. References to specific securities should not be construed as a recommendation by the Fund, the adviser or distributor.

An investment in the Shares is not suitable for you if you need foreseeable access to the money you invest. The Fund is an appropriate investment only for those investors who can tolerate a high degree of risk and do not require a liquid investment.

The Fund is subject to substantial risks — including market risks, industry concentration risks, strategy risks, valuation risks, and investment advisers to the Investment Funds (the “Underlying Manager”) risks. The Fund allocates its assets to Underlying Managers and invests in Investment Funds that invest in and actively traded securities and other financial instruments using a variety of strategies and investment techniques that may involve significant risks. Investment Funds generally will not be registered as investment companies under the 1940 Act and, therefore, the Fund will not be entitled to the various protections afforded by the 1940 Act with respect to its investments in Investment Funds. The investment adviser will not have any control over the Underlying Managers, thus there can be no assurances that an Underlying Manager will manage its Investment Funds in a manner consistent with the Fund’s investment objective.

|

3 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Letter to Shareholders (Continued)

March 31, 2022 (Unaudited)

The Fund intends to offer to repurchase approximately 5% of its outstanding Shares (generally each quarter), and there is no guarantee that Shareholders will be able to sell all of the Shares that they desire to sell in any particular repurchase offer. If a repurchase offer is oversubscribed, the Fund may repurchase only a pro rata portion of the Shares tendered by each Shareholder. The potential for proration may cause some investors to tender more Shares for repurchase than they wish to have repurchased. The decision to offer to repurchase Shares is at the sole discretion of the Board of Trustees (the “Board”) and the Board may, under certain circumstances, elect not to offer to repurchase Shares. Various other types of risks are also associated with investments in the Fund, including risks relating to the fund of funds structure of the Fund, risks relating to compensation arrangements and risks relating to industry concentration.

Each prospective investor in the Fund will be required to certify that it is an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended. The criteria for qualifying as an “accredited investor” are set forth in the investor application that must be completed by each prospective investor.

The views expressed are those of the authors at the time created. They do not necessarily reflect the views of other persons in the Aspiriant, LLC organization. These views are subject to change at any time based on market and other conditions, and Aspiriant, LLC disclaims any responsibility to update such views. No forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any Aspiriant, LLC portfolio.

Please consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. The prospectus that contains this and other information about the Fund is available by calling 1-877-997-9971 and should be read carefully prior to investing.

The below referenced unmanaged index does not reflect the deduction of fees and taxes associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in their underlying securities.

The Dow Jones Global Select Real Estate Index (DWGRST) is a float-adjusted, market capitalization weighted index that is a measure of the types of global real estate securities that represent the ownership and operation of commercial or residential real estate. In order to be included in the index, a company must be both an equity owner and operator of commercial and/or residential real estate, have a minimum total market capitalization of $200 million at its time of inclusion, have at least 75% of its total revenue derived from the ownership and operation of real estate assets, and the liquidity of its stock must be commensurate with that of other institutionally held real estate securities. It is not possible to invest directly in an index.

|

4 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

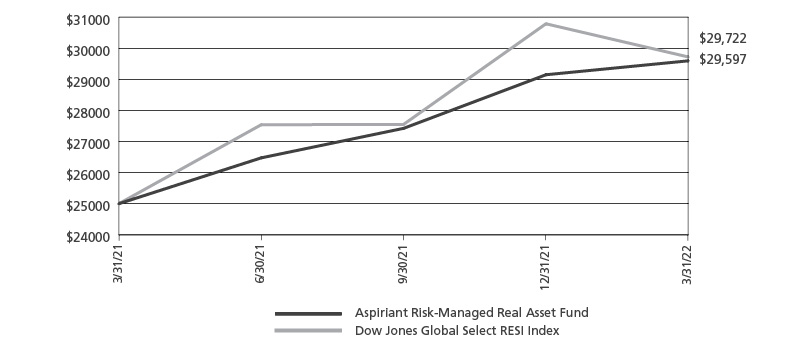

Growth of a $25,000 Investment and Fund Performance

March 31, 2022 (Unaudited)

The above graph compares a hypothetical $25,000 investment in the Fund’s Shares, made at its inception, with similar investment in the Dow Jones Global Select RESI Index.

Total Returns as of March 31, 2022 |

1 Year |

Annualized |

Aspiriant Risk-Managed Real Asset Fund |

18.39% |

18.39% |

Dow Jones Global Select RESI Index (1) |

18.89% |

18.89% |

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 1-877-997-9971, or go to www.aspiriantfunds.com.

The Investment Manager has entered into an investment management fee limitation agreement with the Fund, whereby the Investment Manager has agreed to waive its advisory fee from 0.50% to 0.10% through April 1, 2022. Both arrangements may be terminated only by the Fund’s Board of Trustees.

|

* |

For the period April 1, 2021 (commencement of operations) through March 31, 2022. |

|

(1) |

The Dow Jones Global Select Real Estate Securities Index (RESI) tracks the performance of equity real estate investment trusts and real estate operating companies traded globally. Returns include the reinvestment of distributions but do not consider sales charges. Performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund. |

The above referenced unmanaged index does not reflect the deduction of fees and taxes associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest in an index, although they can invest in their underlying securities.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

5 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Schedule of Investments

As of March 31, 2022

Type of Investment |

Units / Shares |

Cost |

Fair Value |

|||||||||||||||||

MARKETABLE SECURITIES (41.90%) |

||||||||||||||||||||

EXCHANGE-TRADED FUNDS (25.13%) |

||||||||||||||||||||

Global X MLP & Energy Infrastructure ETF |

Exchange-traded fund | 47,298 | $ | 1,594,746 | $ | 2,020,571 | ||||||||||||||

Global X MLP ETF |

Exchange-traded fund | 28,108 | 994,553 | 1,132,752 | ||||||||||||||||

Invesco S&P Global Water Index ETF |

Exchange-traded fund | 81,583 | 2,998,485 | 4,276,173 | ||||||||||||||||

iShares Gold Trusta |

Exchange-traded fund | 203,095 | 7,253,054 | 7,479,989 | ||||||||||||||||

iShares Silver Trusta |

Exchange-traded fund | 41,834 | 1,048,405 | 957,162 | ||||||||||||||||

Vanguard Global ex-U.S. Real Estate ETF |

Exchange-traded fund | 229,525 | 12,816,498 | 11,923,824 | ||||||||||||||||

Vanguard Real Estate ETF |

Exchange-traded fund | 173,103 | 14,360,576 | 18,759,172 | ||||||||||||||||

Vanguard Short-Term Inflation-Protected Securities ETF |

Exchange-traded fund | 2,226 | 108,320 | 113,993 | ||||||||||||||||

TOTAL EXCHANGE-TRADED FUNDS |

41,174,637 | 46,663,636 | ||||||||||||||||||

MUTUAL FUNDS (16.77%) |

||||||||||||||||||||

Fidelity International Real Estate Fund |

Mutual Fund | 688,879 | 9,832,724 | 9,217,198 | ||||||||||||||||

GMO Resources Fund VI |

Mutual Fund | 71,723 | 2,069,512 | 2,147,385 | ||||||||||||||||

Lazard Global Listed Infrastructure Institutional Portfolio |

Mutual Fund | 363,873 | 5,900,000 | 6,033,007 | ||||||||||||||||

Principal Real Estate Securities Fund R-6 |

Mutual Fund | 416,766 | 11,450,000 | 13,736,606 | ||||||||||||||||

TOTAL MUTUAL FUNDS |

29,252,236 | 31,134,196 | ||||||||||||||||||

TOTAL MARKETABLE SECURITIES |

70,426,873 | 77,797,832 | ||||||||||||||||||

Investment Strategy |

Acquisition |

|||||||||||||||||||

PORTFOLIO FUNDS b (58.71%) |

||||||||||||||||||||

MEMBERSHIP INTERESTS (13.35%) |

||||||||||||||||||||

Green Courte Real Estate Partners III, LLCa |

Private Real Estate | 3,410,026 | 5,662,771 | 12/6/2011 | ||||||||||||||||

Prime Property Fund, LLC |

Private Real Estate | 823 | 15,002,103 | 19,122,419 | 9/28/2017 | |||||||||||||||

TOTAL MEMBERSHIP INTERESTS |

18,412,129 | 24,785,190 | ||||||||||||||||||

NON-TRADED REAL ESTATE INVESTMENT TRUST (2.89%) |

||||||||||||||||||||

Blackstone Real Estate Income Trust, Inc. |

Private Real Estate | 362,408 | 4,776,188 | 5,371,934 | 6/1/2021 | |||||||||||||||

TOTAL NON-TRADED REAL ESTATE INVESTMENT TRUST |

4,776,188 | 5,371,934 | ||||||||||||||||||

PARTNERSHIP INTERESTS (37.79%) |

||||||||||||||||||||

Beacon Capital Strategic Partners VI, L.P.a |

Private Real Estate | 419,151 | 31,151 | 2/15/2011 | ||||||||||||||||

Carmel Partners Investment Fund III, L.P.a |

Private Real Estate | — | 540,203 | 6/29/2010 | ||||||||||||||||

Carmel Partners Investment Fund IV, L.P.a |

Private Real Estate | — | 818,266 | 3/15/2012 | ||||||||||||||||

Carmel Partners Investment Fund V, L.P.a |

Private Real Estate | 1,768,383 | 5,568,918 | 8/8/2014 | ||||||||||||||||

CBRE U.S. Core Partners, LP |

Private Real Estate | 7,154,471 | 11,159,973 | 14,340,889 | 7/1/2020 | |||||||||||||||

Cerberus Institutional Real Estate Partners III, L.P.a |

Private Real Estate | — | 3,832,875 | 4/29/2013 | ||||||||||||||||

Cross Lake Real Estate Fund III L.P.a |

Private Real Estate | 2,266,007 | 2,441,106 | 10/11/2019 | ||||||||||||||||

Electron Global Fund, L.P.a |

Long/Short | 3,000,000 | 3,073,228 | 6/1/2021 | ||||||||||||||||

Energy Impact Fund II, L.P.a |

Infrastructure | 2,101,756 | 2,198,506 | 10/28/2021 | ||||||||||||||||

|

6 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2022

Investment Strategy |

Units / Shares |

Cost |

Fair Value |

Acquisition |

||||||||||||||||

Portfolio Funds b (Continued) |

||||||||||||||||||||

Partnership Interests (Continued) |

||||||||||||||||||||

Europe Fund III, L.P.a |

Private Real Estate | $ | 1,620,523 | $ | 5,421 | 5/14/2007 | ||||||||||||||

GEM Realty Fund IV, L.P.a |

Private Real Estate | 436,459 | 15,839 | 6/29/2010 | ||||||||||||||||

GEM Realty Securities Flagship, L.P.a |

Long/Short | 7,132,747 | 13,301,057 | 8/3/2009 | ||||||||||||||||

GI Data Infrastructure Fund L.P.a |

Infrastructure | 3,230,456 | 3,477,582 | 7/24/2020 | ||||||||||||||||

Hampshire Partners Fund VIII, L.P.a |

Private Real Estate | — | 407,073 | 11/15/2010 | ||||||||||||||||

Heitman America Real Estate Trust L.P. |

Private Real Estate | 4,974 | 5,850,375 | 7,590,606 | 7/5/2018 | |||||||||||||||

HighBrook Income Property Fund, L.P.a |

Private Real Estate | 750,228 | 523,987 | 11/2/2012 | ||||||||||||||||

HighBrook Property Fund IV (Main), L.P. a |

Private Real Estate | — | 1,148,779 | 2/22/2022 | ||||||||||||||||

Metropolitan Real Estate Partners International III-T, L.P.a |

Private Real Estate | 501,751 | 316,336 | 12/30/2009 | ||||||||||||||||

Paladin Realty Brazil Investors III (US-A), L.P.a |

Private Real Estate | 2,278,778 | 255,259 | 6/17/2011 | ||||||||||||||||

Paladin Realty Latin America Investors II, L.P.a |

Private Real Estate | 781,118 | 59,100 | 1/4/2007 | ||||||||||||||||

Paladin Realty Latin America Investors III, Liquidating Trusta |

Private Real Estate | 1,866,188 | (158,308 | ) | 9/30/2009 | |||||||||||||||

Paulson Real Estate Fund II, L.P.a |

Private Real Estate | 1,417,349 | 7,902,231 | 5/24/2013 | ||||||||||||||||

Prime Finance Partners IV, L.P.a |

Structured Credit | — | 262,744 | 12/29/2014 | ||||||||||||||||

Sculptor Real Estate Fund IV L.P.a |

Private Real Estate | 2,164,497 | 1,921,139 | 4/6/2020 | ||||||||||||||||

Square Mile Partners III, L.P.a |

Structured Credit | 394,030 | 16,802 | 7/29/2008 | ||||||||||||||||

Sustainable Asset Fund III, L.P.a |

Infrastructure | 360,114 | 284,968 | 12/13/2021 | ||||||||||||||||

TOTAL PARTNERSHIP INTERESTS |

49,499,883 | 70,175,757 | ||||||||||||||||||

SHARES OF BENEFICIAL INTEREST (4.68%) |

||||||||||||||||||||

AG Mortgage Value Partners, Ltd.a |

Structured Credit | 7,942 | 7,941,506 | 8,471,516 | 1/1/2020 | |||||||||||||||

AG REDI, Ltd.a |

Structured Credit | 261 | 980,871 | 212,628 | 1/1/2020 | |||||||||||||||

TOTAL SHARES OF BENEFICIAL INTEREST |

8,922,377 | 8,684,144 | ||||||||||||||||||

TOTAL PORTFOLIO FUNDS |

81,610,577 | 109,017,025 | ||||||||||||||||||

Type of Investment |

||||||||||||||||||||

SHORT-TERM INVESTMENT (1.11%) |

||||||||||||||||||||

Fidelity Investments Money Market Government Portfolio I, 0.12c |

Money Market Fund | 2,069,148 | 2,069,148 | 2,069,148 | ||||||||||||||||

TOTAL SHORT-TERM INVESTMENT |

2,069,148 | 2,069,148 | ||||||||||||||||||

TOTAL INVESTMENTS (101.72%) |

$ | 154,106,598 | $ | 188,884,005 | ||||||||||||||||

Liabilities in excess of other assets (-1.72%) |

(3,198,358 | ) | ||||||||||||||||||

TOTAL NET ASSETS (100.00%) |

$ | 185,685,647 | ||||||||||||||||||

|

a |

Non-income producing security. |

|

b |

Portfolio Funds are generally offered in private placement transactions and as such are illiquid and generally restricted as to resale (See Notes 3 and 5). |

|

c |

The rate is the annualized seven-day yield at period end. |

All investments are domiciled in the United States of America, except Europe Fund III, L.P. which is domiciled in the United Kingdom.

See accompanying Notes to Financial Statements.

|

7 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Summary of Investments

As of March 31, 2022

Security Type |

Percent of Total |

|||

MARKETABLE SECURITIES |

||||

Exchange-Traded Funds |

25.13 | % | ||

Mutual Funds |

16.77 | |||

TOTAL MARKETABLE SECURITIES |

41.90 | |||

PORTFOLIO FUNDS |

||||

Membership Interests |

13.35 | |||

Non-Traded Real Estate Investment Trust |

2.89 | |||

Partnership Interests |

37.79 | |||

Shares of Beneficial Interest |

4.68 | |||

TOTAL PORTFOLIO FUNDS |

58.71 | |||

SHORT-TERM INVESTMENT |

1.11 | |||

TOTAL INVESTMENTS |

101.72 | |||

Liabilities in excess of other assets |

(1.72 | ) | ||

TOTAL NET ASSETS |

100.00 | % | ||

See accompanying Notes to Financial Statements.

|

8 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Statement of Assets and Liabilities

As of March 31, 2022

Assets: |

||||

Investments, at fair value (cost $154,106,598) |

$ | 188,884,005 | ||

Cash held in escrow |

6,673,998 | |||

Due from Portfolio Funds |

71,170 | |||

Dividend receivable |

114 | |||

Prepaid expenses |

40,977 | |||

Total Assets |

$ | 195,670,264 | ||

Liabilities: |

||||

Subscriptions received in advance |

$ | 6,200,000 | ||

Payable for shares redeemed |

3,549,602 | |||

Administration and accounting fees payable |

55,752 | |||

Management fee payable |

47,521 | |||

Administrative services fees payable |

47,521 | |||

Transfer agent fees and expenses payable |

6,549 | |||

Custody fees payable |

5,062 | |||

Other expenses payable |

72,610 | |||

Total Liabilities |

9,984,617 | |||

NET ASSETS |

$ | 185,685,647 | ||

NET ASSETS CONSIST OF: |

||||

Paid-in capital (Unlimited shares authorized, par value of $0.001 per share) |

143,634,464 | |||

Total distributable earnings1 |

42,051,183 | |||

NET ASSETS APPLICABLE TO OUTSTANDING SHARES |

$ | 185,685,647 | ||

SHARES ISSUED AND OUTSTANDING |

16,521,187 | |||

NET ASSET VALUE PER SHARE |

$ | 11.24 |

|

1 |

Includes $17,610,837 of unrealized appreciation on investments received from an in-kind transfer effective April 1, 2021 (See Note 2). |

See accompanying Notes to Financial Statements.

|

9 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Statement of Operations

For the Year Ended March 31, 20221

INVESTMENT INCOME: |

||||

Dividend income (net of withholding taxes of $46,621) |

$ | 3,873,780 | ||

Other income |

38,884 | |||

Interest income |

44 | |||

Total Income |

3,912,708 | |||

Expenses: |

||||

Management fee |

901,275 | |||

Administration and accounting fees |

205,948 | |||

Administrative services fees |

180,255 | |||

Audit fees |

62,500 | |||

Legal fees |

62,031 | |||

Trustees’ fees and expenses |

45,000 | |||

Transfer agent fees and expenses |

34,622 | |||

Offering costs |

30,771 | |||

Registration fees |

24,283 | |||

Custody fees |

23,800 | |||

Insurance fees |

23,153 | |||

Compliance fees |

16,050 | |||

Professional fees |

11,490 | |||

Other expenses |

31,533 | |||

Total Expenses |

1,652,711 | |||

Expenses Waived by Adviser |

(721,020 | ) | ||

Net Expenses |

931,691 | |||

Net Investment Income |

2,981,017 | |||

NET REALIZED GAIN AND NET CHANGE IN UNREALIZED GAIN ON INVESTMENTS: |

||||

Net realized gain on investments |

8,763,017 | |||

Capital gain distributions from marketable securities |

444,073 | |||

Net change in unrealized appreciation (depreciation) on investments |

17,166,570 | |||

Total Net Realized Gain and Net Change in Unrealized Appreciation on Investments |

26,373,660 | |||

Net Increase in Net Assets Resulting from Operations |

$ | 29,354,677 |

|

1 |

Reflects operations from April 1, 2021 (commencement of operations) to March 31, 2022. |

See accompanying Notes to Financial Statements.

|

10 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Statement of Changes in Net Assets

For the Year |

||||

CHANGE IN NET ASSETS FROM: |

||||

OPERATIONS: |

||||

Net investment income |

$ | 2,981,017 | ||

Net realized gain on investments |

8,763,017 | |||

Capital gain distributions from marketable securities |

444,073 | |||

Net change in unrealized appreciation (depreciation) on investments |

17,166,570 | |||

Change in Net Assets Resulting from Operations |

29,354,677 | |||

DISTRIBUTIONS TO SHAREHOLDERS: |

||||

Change in net assets resulting from distributions to shareholders |

(8,906,412 | ) | ||

CAPITAL SHARE TRANSACTIONS: |

||||

Shares sold2 |

170,713,262 | |||

Shares issued for reinvestment of distributions |

8,769,688 | |||

Shares redeemed |

(14,345,568 | ) | ||

Change in Net Assets Resulting from Capital Transactions |

165,137,382 | |||

Change in Net Assets |

$ | 185,585,647 | ||

NET ASSETS: |

||||

Beginning of period3 |

100,000 | |||

End of period |

$ | 185,685,647 | ||

TRANSACTIONS IN SHARES: |

||||

Shares sold4 |

16,975,025 | |||

Shares issued for reinvestment of distributions |

842,025 | |||

Shares redeemed |

(1,305,863 | ) | ||

Change in Shares Outstanding |

16,511,187 | |||

|

1 |

Reflects operations from April 1, 2021 (commencement of operations) to March 31, 2022. |

|

2 |

Includes $158,321,263 of paid-in-capital received from an in-kind subscription effective April 1, 2021 (See note 2). |

|

3 |

The Investment Adviser made an initial purchase of 10,000 shares for $100,000 at a $10.00 net asset value on March 5, 2021. |

|

4 |

Includes 15,832,126 shares received from an in-kind subscription effective April 1, 2021 (See note 2). |

See accompanying Notes to Financial Statements.

|

11 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Statement of Cash Flows

For the Year Ended March 31, 20221

CASH FLOWS FROM OPERATING ACTIVITIES: |

||||

Net increase in net assets from operations |

$ | 29,354,677 | ||

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: |

||||

Purchases of investments |

(45,568,853 | ) | ||

Proceeds from sales of investments |

26,285,080 | |||

Proceeds from return of capital of Portfolio Funds |

14,074,195 | |||

Net realized gain on investments |

(8,763,017 | ) | ||

Capital gain distributions from marketable securities |

(444,073 | ) | ||

Net change in unrealized appreciation (depreciation) on investments |

(17,166,570 | ) | ||

Change in operating assets and liabilities: |

||||

Due from Portfolio Funds |

(71,170 | ) | ||

Dividend receivable |

(114 | ) | ||

Prepaid expenses |

(40,977 | ) | ||

Administration and accounting fees payable |

55,752 | |||

Management fee payable |

47,521 | |||

Administrative services fees payable |

47,521 | |||

Transfer agent fees and expenses payable |

6,549 | |||

Custody fees payable |

5,062 | |||

Other expenses payable |

72,610 | |||

Net Cash Used in Operating Activities |

(2,105,807 | ) | ||

CASH FLOWS FROM FINANCING ACTIVITIES: |

||||

Shares sold (net of subscriptions received in advance) |

19,612,495 | |||

Cash distributions paid, net of reinvestments |

(136,724 | ) | ||

Shares redeemed (net of payable for shares redeemed) |

(10,795,966 | ) | ||

Net Cash Provided by Financing Activities |

8,679,805 | |||

Net Change in Cash |

6,573,998 | |||

Cash at Beginning of Period |

100,000 | |||

Cash at End of Period2 |

$ | 6,673,998 | ||

SUPPLEMENTAL NONCASH ACTIVITIES: |

Reinvested dividends of 8,769,688; and

On April 1, 2021, the Fund received an in-kind transfer of assets and liabilities from the Private Fund, including the transfer of all Private Fund’s investments. Such investments had a fair value of $157,300,768 at the time of transfer and are excluded from the cash flows from financing activities above above (See note 2).

|

1 |

Reflects operations from April 1, 2021 (commencement of operations) to March 31, 2022. |

|

2 |

Cash includes cash and cash held in escrow, as outlined further on the Statement of Assets and Liabilities. |

See accompanying Notes to Financial Statements.

|

12 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Financial Highlights

Per share data and ratios for a share outstanding throughout the period.

For the Year |

||||

Net Asset Value, Beginning of Period |

$ | 10.00 | ||

Income from Investment Operations: |

||||

Net investment income2 |

0.19 | |||

Net realized and unrealized gain on investments |

1.60 | |||

Total from investment operations |

1.79 | |||

Less Distributions: |

||||

From net investment income |

(0.15 | ) | ||

From net realized gain |

(0.40 | ) | ||

Total distributions |

(0.55 | ) | ||

Net Asset Value, End of Period |

$ | 11.24 | ||

Total Return |

18.39 | % | ||

Ratios and Supplemental Data: |

||||

Net assets, end of period (in thousands) |

$ | 185,686 | ||

Net investment income3 |

1.65 | % | ||

Gross expenses3,4 |

0.92 | % | ||

Net expenses3,5 |

0.52 | % | ||

Portfolio turnover rate |

15 | % | ||

|

1 |

Reflects operations from April 1, 2021 (commencement of operations) to March 31, 2022. |

|

2 |

Per share data is computed using the average shares method. |

|

3 |

The ratios of expenses and net investment income or loss to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

|

4 |

Represents the ratio of expenses to average net assets absent of fee waivers and/or expense reimbursements. |

|

5 |

Represents the ratio of expenses to average net assets inclusive of fee waivers and/or reimbursements by the Adviser (See note 6). |

See accompanying Notes to Financial Statements.

|

13 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Notes to Financial Statements

March 31, 2022

1. ORGANIZATION

Aspiriant Risk-Managed Real Asset Fund (the “Fund”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund operates under an Agreement and Declaration of Trust dated October 26, 2020. The Fund commenced its operations on April 1, 2021, after the conversion of the Global Real Estate Opportunities, L.P. (the “Private Fund”), a privately offered investment fund managed by the Investment Manager (as defined below) with investment policies, objectives, guidelines, and restrictions that were in all material respects equivalent to those of the Fund. Aspiriant, LLC serves as the investment adviser (the “Investment Manager”) of the Fund. The Investment Manager is an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended. The investment objective of the Fund is to seek long term capital appreciation. The Fund is a “fund of funds” that intends to invest primarily in general or limited partnerships, funds, corporations, trusts or other investment vehicles (collectively, “Investment Funds”) that invest substantially all their assets in real estate, infrastructure, commodities and other real asset securities and funds. Under normal circumstances, the Fund intends to invest at least 80% of its net assets in Investment Funds that hold equity, debt and other economic interests in real assets or real asset companies.

The Board of Trustees (the “Board”) of the Fund has the overall responsibility for monitoring the operations of the Fund, including the Investment Manager.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation and Use of Estimates — The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies (“ASC 946”). The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Cash — Cash and cash held in escrow for shares tendered and shares received in advance, if any, may include demand deposits. Such deposits, at times, may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts.

Investment Valuation — Investments in Portfolio Funds – As a practical expedient, the Fund estimates the fair value of interests in Portfolio Funds (“Portfolio Funds’ Interests”) that do not have a readily determinable fair value using the net asset value per share (or equivalent, such as member units, or an ownership interest in partners’ capital to which a proportionate share of net assets is attributed) of the Portfolio Funds as determined by the respective investment manager (“Portfolio Fund’s Manager”), if the net asset value per share of the Portfolio Fund (or its equivalent) is calculated in a manner consistent with measurement principles in ASC 946 as of the reporting entity’s measurement date. If the net asset value per share (or its equivalent) of the Portfolio Fund is not as of the Fund’s measurement date or is not calculated in a manner consistent with the measurement principles of ASC 946, the Fund may adjust the most recent net asset value per share (or its equivalent) as necessary in order to estimate the fair value for the Portfolio Fund in a manner consistent with the measurement principles of ASC 946 as of the Fund’s measurement date. The Fund will deviate from the net asset value (or its equivalent) if it is probable at the measurement date that the Fund will redeem a portion of a Portfolio Fund at an amount different from the net asset value per share (or its equivalent).

|

14 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

Investments in Portfolio Funds are subject to the terms of the Portfolio Funds’ offering documents. Valuations of Portfolio Funds may be subject to estimates and are net of management and performance incentive fees or allocations payable to the Portfolio Funds’ Managers as required by the Portfolio Funds’ offering documents. If the Investment Manager determines that the most recent net asset value (or its equivalent) reported by the Portfolio Fund does not represent fair value or if the Portfolio Fund fails to report a net asset value to the Fund, a fair value determination is made under procedures established by and under the general supervision of the valuation committee (the “Valuation Committee”). Because of the inherent uncertainty in valuation, the estimated values may differ from the values that would have been used had a ready market for the securities existed, and the differences could be material. Prospective investors should be aware that situations involving uncertainties as to the value of portfolio positions could have an adverse effect on the Fund’s net assets if the judgments of the Valuation Committee, or the Portfolio Funds’ Managers should prove to be incorrect. Portfolio Funds’ Managers only provide determinations of the net asset values of the Portfolio Funds on a monthly/ quarterly basis, in which event it will not be possible to determine the net asset value of the Fund more frequently. The Portfolio Funds’ Interests in which the Fund invests or plans to invest are generally illiquid. The Fund may not be able to dispose of Portfolio Funds’ Interests that it has purchased. As of March 31, 2022, investments in Portfolio Funds were valued at $109,017,025, which represented 58.71% of the net asset value of the Fund.

Investment Valuation – Marketable Securities — Investments in marketable securities listed or traded on an exchange are valued at their last traded price, as of the exchange’s official close of business. The Fund does not adjust the quoted price for these investments even in situations where the Fund holds a large position and a sale could reasonably impact the quoted price.

Offering Costs — The Fund’s total offering costs of $30,771 represent the total amount incurred in connection with the initial offering and registration and is being amortized on a straight-line basis over the first twelve months of the Fund’s operations which began on April 1, 2021, the commencement of operations date. As of March 31, 2022, $30,771 of offering costs has been expensed.

Transfer In-Kind — On April 1, 2021, the Fund received an in-kind transfer of assets and liabilities from the Private Fund. The transfer was non-taxable, whereby the Fund issued shares (“Shares”) equal to the fair value of the net assets received. For financial reporting purposes, net assets received and ownership amounts in the Fund were recorded at fair value and the historical cost basis was retained as a result of the non-taxable nature of the transfer. The investments received by the Fund were evaluated using fair value procedures adopted by the Board. The characteristics of the value received are presented as follows:

Fund |

Paid-In-Capital |

Character of Value Received |

Value Received |

||||||

The Fund |

$ | 158,321,263 | Investments at cost |

$ | 139,689,931 | ||||

Net unrealized appreciation on investments |

17,610,837 | ||||||||

Total |

$ | 158,321,263 | Cash |

1,374,145 | |||||

Liabilities in excess of other assets |

(353,650 | ) | |||||||

Total |

$ | 158,321,263 | |||||||

15,832,126.30 shares were issued with an initial NAV of $10.00.

The Fund obtained $30,135,239 in outstanding commitments in Portfolio Funds from the Private Fund.

|

15 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

Investment Transactions and Related Investment Income — All investment transactions are recorded on the trade date. Interest income on cash held in the Fund’s interest-bearing accounts is recognized on an accrual basis. Dividend income is recorded on ex-dividend dates. Distributions from marketable securities are classified as investment income or realized gains based on the U.S. income tax characteristics of the distribution. Distributions received from Portfolio Funds are recorded on the effective date, based on the character determined by the underlying Fund. Return of capital or security distributions received from Portfolio Funds and securities are accounted for as a reduction to cost. Net realized gain or loss on investments includes net investment gains or losses from marketable securities and realized gains or losses indirectly allocated to the Fund from investments in Portfolio Funds. Realized gains and losses from investments in Portfolio Funds are recognized when reported by those Portfolio Funds. Realized gains and losses from other investments are recorded on a specific identification basis.

Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Assets and liabilities denominated in foreign currencies are translated into U.S. dollar equivalents using period-end spot foreign currency exchange rates. Purchases and sales of investments, and their related income and expenses are translated at the rate of exchange on the respective dates of such transactions. Realized and unrealized gains and losses resulting from foreign currency changes are reflected in the Statement of Operations as a component of net realized gain/(loss) and net change in unrealized gain/(loss) on marketable securities and Portfolio Funds.

Federal Income Taxes — The Fund’s policy is to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required. The Fund may utilize earnings and profits on redemption of shares as part of the dividends paid deduction.

Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax return to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations.

The Income Tax Statement requires management of the Fund to analyze all open tax years for all major jurisdictions, which the Fund considers to be its federal income tax filings. The open tax years include the current year plus the prior three tax years, or all years if the Fund has been in existence for less than three years. As of and during the year ended March 31, 2022, the Fund did not record a liability for any unrecognized tax benefits. The Fund has no examinations in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

3. FAIR VALUE DISCLOSURE

In accordance with FASB ASC 820-10, Fair Value Measurement (“ASC 820”), the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical

|

16 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

3. FAIR VALUE DISCLOSURE (Continued)

assets or liabilities (Level I measurement) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level III measurements). ASC 820 provides three levels of the fair value hierarchy as follows:

Level I — Unadjusted quoted prices for identical assets or liabilities in active markets that are accessible at the measurement date and on an-ongoing basis. Investments in marketable securities are classified at Level I in the fair value hierarchy.

Level II — Valuations based on observable inputs other than quoted prices in active markets for identical assets or liabilities.

Level III —Valuation techniques that require inputs that are both significant to the fair value measurement and are unobservable (i.e. supported by little or no market activity).

Portfolio Fund investments in limited partnership interests and other investment funds are recorded at fair value, using the Portfolio Funds’ net asset value (or its equivalent) as a practical expedient. If the Investment Manager determines that the most recent net asset value (or its equivalent) does not represent fair value or if the Portfolio Fund fails to report a net asset value, a fair value determination is made under procedures established by the Valuation Committee and is generally classified as Level III in the fair value hierarchy.

The following table summarizes the valuation of the Fund’s investments as of March 31, 2022, by the fair value hierarchy levels:

Fair Value Measurements |

||||||||||||||||||||

Assets |

Level I |

Level II |

Level III |

NAV as |

Total |

|||||||||||||||

Marketable securities |

$ | 77,797,832 | $ | — | $ | — | $ | — | $ | 77,797,832 | ||||||||||

Portfolio funds |

— | — | — | 109,017,025 | 109,017,025 | |||||||||||||||

Short-term investment |

2,069,148 | — | — | — | 2,069,148 | |||||||||||||||

Total Assets |

$ | 79,866,980 | $ | — | $ | — | $ | 109,017,025 | $ | 188,884,005 | ||||||||||

|

17 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

3. FAIR VALUE DISCLOSURE (Continued)

A listing of the Portfolio Fund types held by the Partnership and the related attributes, as of March 31, 2022 are shown in the table below:

Investment |

Fair Value |

Unfunded |

Remaining |

Redemption |

Notice Period |

Redemption |

||||||

Core(1) |

$ | 71,484 | $ | — | Indefinite |

Monthly-Quarterly |

0-90 |

May be subject to lockup periods or investor and/or fund level gates |

||||

Opportunistic(2) |

37,533 | 41,424 | Up to 12 years, subject to extension |

None |

N/A |

N/A |

||||||

| $ | 109,017 | $ | 41,424 | (3) | ||||||||

|

(1) |

Investments in commingled limited partnerships that have exposure to a range of security types. |

|

(2) |

Consists of both private equity and venture capital investments. |

|

(3) |

As of March 31, 2022, the Fund had total outstanding commitments of $40,466,316 and $957,709 to the partnership interests and membership interests of Portfolio Funds, respectively. |

|

* |

The information summarized in the table above represents the general terms for the specified asset class. Individual Portfolio Funds may have terms that are more or less restrictive than those terms indicated for the asset class as a whole. In addition, most Portfolio Funds have the flexibility, as provided for in their constituent documents, to modify and waive such terms. |

4. RISK FACTORS

The Fund’s investment activities expose it to various risks, which are associated with the markets and the financial instruments in which it invests (as discussed in Notes 2 and 3). The following summary is not intended to be a comprehensive summary of all risks inherent in investing in the Fund.

Credit — Financial instruments which potentially subject the Fund to concentrations of credit risk consist primarily of cash and cash equivalents. Substantially, all of the Fund’s cash is deposited with one financial institution. Deposits, at times, may be in excess of federally insured limits. The Fund has not experienced any losses on its cash and cash equivalents, nor does it believe it is exposed to any significant credit risk.

Liquidity Constraints of Portfolio Funds — Since the Fund may make additional investments in or affect withdrawals from a Portfolio Fund only at certain times pursuant to limitations set forth in the governing documents of the Portfolio Fund, the Fund from time to time may have to invest a greater portion of its assets temporarily in money market securities than it otherwise might wish to invest and may have to borrow money to repurchase Shares. The redemption or withdrawal provisions regarding the Portfolio Funds vary from fund to fund. Therefore, the Fund may not be able to withdraw its investment in a Portfolio Fund promptly after it has made a decision to do so. Some Investment Funds may impose early redemption fees while others may not. This may adversely affect the Fund’s investment return or increase the Fund’s expenses and limit the Fund’s ability to make offers to repurchase Shares from Shareholders. Portfolio Funds may be permitted to redeem their interests in-kind. Thus, upon the Fund’s withdrawal of all or a portion of its interest in an Investment Fund, it may receive securities that are illiquid or difficult to value.

|

18 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

4. RISK FACTORS (Continued)

Limited Liquidity — Shares in the Fund provide limited liquidity since shareholders will not be able to redeem shares on a daily basis. A shareholder may not be able to tender its Shares in the Fund promptly after it has made a decision to do so. There is no assurance that you will be able to tender your shares when or in the amount that you desire. In addition, with very limited exceptions, shares are not transferable, and liquidity will be provided only through repurchase offers made quarterly by the Fund. Shares in the Fund are therefore suitable only for investors who can bear the risks associated with the limited liquidity of shares and should be viewed as a long-term investment.

Non-Diversified Status — The Fund is a “non-diversified” management investment company. Thus, there are no percentage limitations imposed by the 1940 Act on the Fund’s assets that may be invested, directly or indirectly, in the securities of any one issuer. Consequently, if one or more securities are allocated a relatively large percentage of the Fund’s assets, losses suffered by such securities could result in a higher reduction in the Fund’s capital than if such capital had been more proportionately allocated among a larger number of securities. The Fund may also be more susceptible to any single economic or regulatory occurrence than a diversified investment company.

Leverage Risk — The Fund does not generally intend to utilize leverage, however, the Fund is permitted to and may, in the sole discretion of the Adviser, leverage its investment positions, when deemed appropriate by the Adviser for any reason. Furthermore, the strategies implemented by the Portfolio Funds typically are leveraged. While leverage presents opportunities for increasing the total return on investments, it has the effect of potentially increasing losses as well. Accordingly, any event which adversely affects the value of an investment could be magnified to the extent leverage is utilized. The cumulative effect of the use of leverage with respect to any investments in a market that moves adversely to such investments could result in a substantial loss that would be greater than if the investment were not leveraged.

Market Risk — Market risk arises primarily from changes in the market value of financial instruments. Exposure to market risk is influenced by a number of factors, including the relationships between financial instruments, and the volatility and liquidity in the markets in which the financial instruments are traded. In many cases, the use of financial instruments serves to modify or offset market risk associated with other transactions, and accordingly, serves to decrease the Fund’s overall exposure to market risk. The Fund attempts to control its exposure to market risk through various analytical monitoring techniques.

5. INVESTMENTS BY THE FUND

The Fund, generally, has the ability to liquidate its investments periodically, depending on the type of investment, and for the Portfolio Funds, depending on the provisions of the respective Portfolio Fund’s governing agreements. Contribution requirements may also vary based on each Portfolio Fund’s governing agreements. Investment advisors who manage accounts in the name of the Fund, or who operate other Portfolio Funds in which the Fund invests, receive fees for their services. The fees include management fees, performance allocations and direct expenses based upon the net asset value of the Fund’s investment. These fees are deducted directly from the trading account or Portfolio Fund investment balance in accordance with an advisory or limited partnership agreement. The management fees ranged from 0%–2% (with possible performance or high water mark fees ranging from 0% to 20%).

The Fund can liquidate or redeem the marketable securities on a daily basis, and there are no restrictions or limitations placed on these marketable securities. Additionally, the Fund has limited ability to liquidate its Portfolio Funds due to lockup periods up to 12 years. After the lock-up has expired, the Fund must meet certain provisions in order to liquidate the Portfolio Funds.

|

19 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

5. INVESTMENTS BY THE FUND (Continued)

The Fund’s Share of Portfolio Funds that were 5% or more of its net assets as of March 31, 2022 is as follows:

Investment |

Percentage |

Fair Value |

Redemptions Permitted/Restrictions |

||||||

Prime Property Fund, LLC (a) (Private Real Estate Fund) |

10.3% | $ | 19,122,419 | Quarterly withdrawals (90 days’ notice required) |

|||||

CBRE U.S. Core Partners, LP (a) (Private Real Estate Fund) |

7.7% | $ | 14,340,889 | Quarterly withdrawals (60 days’ notice required) |

|||||

GEM Realty Securities Flagship, L.P. (b) (Long/Short Fund) |

7.2% | $ | 13,301,057 | Quarterly withdrawals (60 days’ notice required) |

|||||

|

(a) |

This strategy includes the funds that invest in real estate opportunities. |

|

(b) |

This strategy includes the funds that employ long and short trading in publicly traded common stock, preferred stock, and debt securities, primarily in REITs, real estate operating companies, homebuilders and companies that have a significant real estate component. |

Additionally, the terms of the Portfolio Funds’ governing documents generally provide for restrictions on transferability, minimum holding periods or lock-ups, the suspension of redemptions/withdrawals or the institution of gates on redemptions/withdrawals, at the discretion of the Portfolio Funds’ Managers, and as a result, the Fund may not be able to redeem/withdraw from an investment in a Portfolio Fund without continued exposure to changes in valuations, which could be material.

6. INVESTMENT MANAGEMENT FEE AND OTHER TRANSACTIONS WITH SERVICE PROVIDERS

Investment Management Fee — The Fund pays to the Investment Manager an investment management fee (the “Investment Management Fee”) in consideration of the advisory and other services provided by the Investment Manager to the Fund. Pursuant to an investment management agreement (the “Investment Management Agreement”), the Fund pays the Investment Manager a quarterly Investment Management Fee equal to 0.50% on an annualized basis of the Fund’s net asset value (“NAV”) as of each quarter-end. NAV means the total value of all assets of the Fund, less an amount equal to all accrued debts, liabilities and obligations of the Fund. For purposes of determining the Investment Management Fee payable to the Investment Manager for any quarter, NAV will be calculated prior to any reduction for any fees and expenses of the Fund for that quarter, including, without limitation, the Investment Management Fee payable to the Investment Manager for that quarter, and before giving effect to any repurchase of Shares in the Fund effective as of that date. For the year ended March 31, 2022, the Fund incurred $901,275 in management fees.

The Investment Manager has entered into an investment management fee limitation agreement (the “Management Fee Limitation Agreement”) with the Fund, whereby the Investment Manager has agreed to waive 0.40% of its Investment Management Fee. The Management Fee Limitation Agreement is in effect for one year from the commencement of operations and will automatically renew for consecutive one-year terms thereafter (each, a “Current Term”). Neither the Fund nor the Investment Manager may terminate the Management Fee Limitation Agreement during the Current Term. The Investment Management Fee waiver is not subject for recoupment. For the year ended March 31, 2022, the Fund waived $721,020 in Investment Management Fees. Certain officers of the Fund are employees of the Investment Manager and are not paid by the Fund for the services they provide to the Fund.

|

20 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

6. INVESTMENT MANAGEMENT FEE AND OTHER TRANSACTIONS WITH SERVICE PROVIDERS (Continued)

Administrative Services Fee — Pursuant to an administrative services agreement with the Fund, the Investment Manager is entitled to a fee calculated at an annual rate of 0.10%, payable quarterly in arrears, based upon the Fund’s net assets as of quarter-end for providing administrative services to the Fund. Such services include the review of shareholder reports and other filings with the SEC; oversight of the Fund’s primary service providers; periodic due diligence reviews of the Fund’s primary service providers; coordination and negotiation of all of the contracts and pricing relating to the Fund’s primary service providers, with the advice of Fund counsel; providing information to the Board relating to the review and selection of the Fund’s primary service providers; and all such other duties or services necessary for the appropriate administration of the Fund that are incidental to the foregoing services.

Distributor — UMB Distribution Services, LLC is the distributor (also known as principal underwriter) of the Shares of the Fund and acts as the agent of the Trust in connection with the continuous offering of Shares of the Fund.

Administrator — UMB Fund Services, Inc. (the “Administrator”) serves as administrator to the Fund and provides certain administrative, clerical, bookkeeping and investor related services. For these services the Administrator receives a quarterly fee, as well as reasonable out of pocket expenses. For the year ended March 31, 2022, the Fund paid $205,948 in administration fees.

Certain trustees and officers of the Fund are employees of the Administrator and are not paid by the Fund for the services they provide to the Fund.

Custodian — UMB Bank, n.a. (the “Custodian”), an affiliate of the Administrator, serves as the primary custodian of the assets of the Fund, and may maintain custody of such assets with U.S. and non-U.S. sub custodians (which may be banks and trust companies), securities depositories and clearing agencies in accordance with the requirements of Section 17(f) of the 1940 Act and the rules thereunder. Assets of the Fund are not held by the Investment Manager or commingled with the assets of other accounts other than to the extent that securities are held in the name of the Custodian or U.S. or non-U.S. sub custodians in a securities depository, clearing agency or omnibus customer account of such custodian. In consideration for these services, the Fund pays the Custodian a minimum quarterly custodian fee.

Chief Compliance Officer — Vigilant Compliance, LLC (“Vigilant”) provides Chief Compliance Officer (“CCO”) services to the Fund. An officer of the Fund is an employee of Vigilant.

Guarantees and Indemnification — In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

7. CAPITAL CONTRIBUTIONS AND WITHDRAWALS

The Fund will generally offer Shares for purchase as of the first business day of each calendar quarter, except that Shares may be offered more or less frequently as determined by the Board in its sole discretion. The Board may also suspend or terminate offerings of Shares at any time.

A substantial portion of the Fund’s investments are illiquid. For this reason, the Fund is structured as a closed-end fund, which means that the Shareholders will not have the right to redeem their Shares on a daily basis. In addition, the Fund does not expect any trading market to develop for the Shares. As a result, if investors decide to invest in the Fund, they will have very limited opportunity to sell their Shares. At the discretion of the Board and provided that it is in the best interests of the Fund and the Shareholders to do so, the Fund intends to provide a limited degree

|

21 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

7. CAPITAL CONTRIBUTIONS AND WITHDRAWALS (Continued)

of liquidity for the Shareholders by conducting repurchase offers generally quarterly with a valuation date on or about March 31, June 30, September 30 and December 31 of each year. Each repurchase offer ordinarily will be limited to the repurchase of approximately 5% of the Shares outstanding, but if the value of Shares tendered for repurchase exceeds the value the Fund intended to repurchase, the Fund may determine to repurchase less than the full number of Shares tendered. In such event, Shareholders will have their Shares repurchased on a pro rata basis, and tendering Shareholders will not have all of their tendered Shares repurchased by the Fund. No Shareholder will have the right to require the Fund to redeem its Shares.

8. FEDERAL TAX INFORMATION

At March 31, 2022, the cost of investments on a tax basis and gross unrealized appreciation/(depreciation) on investments for federal income tax purposes were as follows:

| Cost of investments | $ | 148,521,218 | ||

| Gross unrealized appreciation | 50,772,661 | |||

| Gross unrealized depreciation | (10,409,874 | ) | ||

| Net unrealized appreciation/(depreciation) on investments | $ | 40,362,787 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses on security transactions.

U.S. GAAP requires that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. For the fiscal tax year ended October 31, 2021, permanent differences in book and tax accounting have been reclassified to paid-in capital and total distributable earnings/(losses) as follows:

Increase(Decrease) |

|

Paid-In Capital |

Total Distributable |

$ (3,992,081) |

$ 3,992,081 |

As of October 31, 2021, the components of accumulated earnings/(losses) on a tax basis were as follows:

| Undistributed ordinary income | $ | 1,103,054 | ||

| Undistributed long-term capital gains | 2,237,749 | |||

| Tax Accumulated earnings | 3,340,803 | |||

| Accumulated capital and other losses | — | |||

| Unrealized appreciation on investments | 33,714,562 | |||

| Total distributable earnings | $ | 37,055,365 |

There were no distributions paid by the Fund during the fiscal tax year ended October 31, 2021.

|

22 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2022

9. INVESTMENT TRANSACTIONS

For the year ended March 31, 2022, the total purchases and total distribution proceeds from sale, redemption or other disposition of investments, excluding cash equivalents, amounted to $43,499,710 and $25,841,008, respectively.

10. RECENT MARKET DEVELOPMENTS

The Fund may be subject to various risks as described in the Funds’ prospectus. Political tensions and armed conflicts, including the Russian invasion of Ukraine, and any resulting economic sanctions on entities and/or individuals of a particular country could lead such a country into an economic recession. The COVID-19 disease has resulted in significant disruptions to global business activity. A widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, which may lead to less liquidity in certain instruments, industries, sectors or the markets generally, and may ultimately affect the performance of the Fund.

11. SUBSEQUENT EVENTS

The Fund has evaluated the events and transactions through the date the financial statements were issued and determined there were no subsequent events that required adjustment to or disclosure in the financial statements.

|

23 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

Aspiriant Risk-Managed Real Asset Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Aspiriant Risk-Managed Real Asset Fund (the “Fund”) as of March 31, 2022, the related statements of operations, cash flows, and changes in net assets, the related notes, and the financial highlights for the year then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2022, the results of its operations and cash flows, the changes in net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities and private investment funds owned as of March 31, 2022, by correspondence with the custodian and underlying fund managers; when replies were not received from underlying fund managers, we performed other auditing procedures. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2021.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

May 31, 2022

|

24 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Other Information

March 31, 2022 (Unaudited)

PROXY VOTING POLICIES AND PROCEDURES

For a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call 1-877-997-9971 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the U.S. Securities and Exchange Commission at www.sec.gov as well as the Fund’s website at www.aspiriantfunds.com.

Information on how the Fund voted proxies relating to portfolio securities during the 12-month period ended June 30 is available without charge, upon request, by calling 1-877-997-9971 or by accessing the website of the U.S. Securities and Exchange Commission.

DISCLOSURE OF PORTFOLIO HOLDINGS

The Fund files complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Forms N-PORT are available on the website of the U.S. Securities and Exchange Commission at www.sec.gov, and may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

|

25 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Fund Management

March 31, 2022 (Unaudited)

The identity of the members of the Board and the Fund’s officers and brief biographical information is set forth below. The Fund’s Statement of Additional Information includes additional information about the membership of the Board.

INDEPENDENT TRUSTEES |

|||||

NAME, ADDRESS* |

POSITION(S) |

LENGTH |

PRINCIPAL OCCUPATION(S) |

NUMBER OF |

OTHER |

David G. Lee Year of Birth: 1952 |

Chairman and Trustee |

Chairman since May 2019; Trustee since Inception |

Retired (since 2012); President and Director, Client Opinions, Inc. (2003-2012); Chief Operating Officer, Brandywine Global Investment Management (1998-2002). |

15 |

None |

Robert Seyferth Year of Birth: 1952 |

Trustee |

Since Inception |

Retired (since 2009); Chief Procurement Officer/Senior Managing Director, Bear Stearns/JP Morgan Chase (1993-2009). |

15 |

None |

Gary E. Shugrue Year of Birth: 1954 |

Trustee |

Since September 2021 |

Managing Director, Veritable LP (2016-Present); Founder/President, Ascendant Capital Partners, LP (2001-2015). |

13 |

Trustee, Quaker Investment Trust (5 portfolios) (registered investment company). |

|

26 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Fund Management (Continued)

March 31, 2022 (Unaudited)

INTERESTED TRUSTEE AND OFFICERS |

|||||

NAME, ADDRESS* AND YEAR OF BIRTH |

POSITION(S) HELD WITH THE FUND |

LENGTH OF TIME SERVED |

PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS |

NUMBER OF PORTFOLIOS IN FUND COMPLEX** OVERSEEN BY TRUSTEE |

OTHER DIRECTORSHIPS HELD BY TRUSTEES |

Terrance P. Gallagher*** Year of Birth: 1958 |

Trustee |

Since June 2020 |

Executive Vice President and Director of Fund Accounting, Administration and Tax; UMB Fund Service, Inc. (2007-Present); President, Investment Managers Series Trust II (registered investment company) (2013-Present); Treasurer, American Independence Funds Trust (registered investment company) (2016-2018); Treasurer, Commonwealth International Series Trust (registered investment company) (2010-2015). |

15 |

Trustee, Investment Managers Series Trust II (19 portfolios) (registered investment company) |

Marc Castellani Year of Birth: 1969 |

President |

Since Inception |

Managing Director, Aspiriant, LLC (2015-present); J.P. Morgan Private Bank (2012-2015). |

N/A |

N/A |

Benjamin Schmidt Year of Birth: 1976 |

Treasurer |

Since Inception |

Assistant Treasurer; Chief Compliance Officer; Anti-Money Laundering Officer, Aspiriant Trust (2015-Present); AVP Fund Administration, UMB Fund Services, Inc. (2000-2015). |

N/A |

N/A |

Laura Boucher Year of Birth: 1981 |

Assistant Treasurer |

Since Inception |

Manager, Fund Administration, Aspiriant, LLC (2015-Present); Auditor, Cohen & Company, Ltd. (June 2015-October 2015); Lead Fund Administration, UMB Fund Services, Inc. (2011-2015). |

N/A |

N/A |

|

27 |

ASPIRIANT RISK-MANAGED REAL ASSET FUND

Fund Management (Continued)

March 31, 2022 (Unaudited)

INTERESTED TRUSTEE AND OFFICERS |

|||||

NAME, ADDRESS* AND YEAR OF BIRTH |

POSITION(S) HELD WITH THE FUND |

LENGTH OF TIME SERVED |

PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS |

NUMBER OF PORTFOLIOS IN FUND COMPLEX** OVERSEEN BY TRUSTEE |

OTHER DIRECTORSHIPS HELD BY TRUSTEES |

Perpetua Seidenberg Year of Birth: 1990 |

Chief Compliance Officer |

Since Inception |

Compliance Director, Vigilant Compliance, LLC (an investment management services company) (2014-Present); Auditor, PricewaterhouseCoopers (2012-2014). |

N/A |

N/A |

Ann Maurer Year of Birth: 1972 |

Secretary |

Since Inception |

Senior Vice President, Client Services (2017-Present); Vice President, Senior Client Service Manager (2013-2017); Assistant Vice President, Client Relations Manager (2002-2013); UMB Fund Services, Inc. |

N/A |

N/A |

|

* |

Address for Trustees and Officers: c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, Wisconsin 53212 |

|

** |

As of March 31, 2022, the fund complex consists of the Fund, Agility Multi-Asset Income Fund, Aspiriant Risk-Managed Capital Appreciation Fund, Corbin Multi-Strategy Fund, LLC, First Trust Alternative Opportunities Fund, First Trust Private Assets Fund, First Trust Private Credit Fund, First Trust Real Assets Fund, Infinity Core Alternative Fund, Infinity Long/Short Equity Fund, LLC, First Trust Alternative Opportunities Fund, Keystone Private Income Fund, Optima Dynamic Alternatives Fund, Variant Alternative Income Fund, , and Variant Impact Fund. |

|

*** |

Mr. Gallagher is deemed an interested person of the Fund because of his affiliation with the Fund’s Administrator. |

[ THIS PAGE INTENTIONALLY LEFT BLANK ]

[ THIS PAGE INTENTIONALLY LEFT BLANK ]

|

ASPIRIANT RISK-MANAGED REAL ASSET FUND

INVESTMENT MANAGER

Aspiriant, LLC

11100 Santa Monica Blvd., Suite 600

Los Angeles, CA 90025

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

342 North Water Street, Suite 830

Milwaukee, WI 53202

FUND COUNSEL

Faegre Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, PA 19103-6996

CUSTODIAN BANK

UMB Bank, n.a.

1010 Grand Blvd.

Kansas City, MO 64106

TRANSFER AGENT / ADMINISTRATOR

UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

DISTRIBUTOR

UMB Distribution Services, LLC

235 W. Galena Street

Milwaukee, WI 53212

(b) Not applicable.

Item 2. Code of Ethics

(a) The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(c) There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics description.

(d) The registrant has not granted any waivers, during the period covered by this report, including an implicit waiver, from a provision of the code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item's instructions.

Item 3. Audit Committee Financial Expert

As of the end of the period covered by the report, the registrant's board of trustees has determined that Mr. David G. Lee and Mr. Robert Seyferth are qualified to serve as the audit committee financial experts serving on its audit committee and that they are "independent," as defined by Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services

The aggregate fees billed for professional services by the principal accountant during the Registrant's first fiscal year is as follows:

(a) Audit Fees for Registrant.

| Fiscal year ended March 31, 2022 | $45,000 |

(b) Audit-Related Fees for Registrant. These fees were billed by the Registrant's independent auditors for assurance and related services that were reasonably related to the performance of the audit of the Registrant's financial statements.

| Fiscal year ended March 31, 2022 | None |

(c) Tax Fees for Registrant. These fees were billed for professional services rendered by the Registrant's independent auditors for tax compliance, tax advice, and tax planning.

| Fiscal year ended March 31, 2022 | $17,500 |

(d) All Other Fees.

| Fiscal year ended March 31, 2022 | None |