Form N-CSR AMERICAN FUNDS SHORT-TER For: Jul 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-05750

American Funds Short-Term Tax-Exempt Bond Fund

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: July 31

Date of reporting period: July 31, 2018

Steven I. Koszalka

American Funds Short-Term Tax-Exempt Bond Fund

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

|

American Funds Short-Term Tax-Exempt Bond Fund® |

|

| Annual reports for the year ended July 31, 2018 |

Invest in

municipal bonds

for tax-advantaged

income.

American Funds Short-Term Tax-Exempt Bond Fund seeks to provide current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

Limited Term Tax-Exempt Bond Fund of America seeks to provide current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

The Tax-Exempt Bond Fund of America seeks to provide a high level of current income exempt from federal income tax, consistent with the preservation of capital.

American High-Income Municipal Bond Fund seeks to provide a high level of current income exempt from regular federal income tax.

The Tax-Exempt Fund of California seeks to provide a high level of current income exempt from regular federal and California state income taxes. Its secondary objective is preservation of capital.

American Funds Tax-Exempt Fund of New York seeks to provide a high level of current income exempt from regular federal, New York state and New York City income taxes. Its secondary objective is preservation of capital.

Each fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For more than 85 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge had been deducted (maximum 2.50% for American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America; 3.75% for The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York), the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit americanfunds.com.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended June 30, 2018 (the most recent calendar quarter-end), and the total annual fund operating expense ratios as of the prospectus dated October 1, 2018 (unaudited):

| Cumulative total returns | Average annual total returns | Gross | ||||||||||||||

| Class A shares | 1 year | 5 years | 10 years/Lifetime* | expense ratios | ||||||||||||

| Reflecting 2.50% maximum sales charge | ||||||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | –2.18 | % | 0.25 | % | 0.83 | % | .58 | % | ||||||||

| Limited Term Tax-Exempt Bond Fund of America | –1.84 | 1.14 | 2.71 | .59 | ||||||||||||

| Reflecting 3.75% maximum sales charge | ||||||||||||||||

| The Tax-Exempt Bond Fund of America | –1.71 | 2.82 | 3.92 | .52 | ||||||||||||

| American High-Income Municipal Bond Fund | 0.55 | 4.66 | 5.08 | .68 | ||||||||||||

| The Tax-Exempt Fund of California | –1.56 | 3.10 | 4.37 | .60 | ||||||||||||

| American Funds Tax-Exempt Fund of New York | –2.50 | 2.44 | 3.09 | .72 | † | |||||||||||

| * | Applicable only to American Funds Tax-Exempt Fund of New York, which began operations on 11/1/10. All other funds reflect 10-year results. |

| † | The net expense ratio for American Funds Tax-Exempt Fund of New York is .68% as of the prospectus dated October 1, 2018 (unaudited). |

For other share class results, visit americanfunds.com.

The 10-year investment result for American Funds Short-Term Tax-Exempt Bond Fund includes the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore is not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of that period. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers and/or expense reimbursements, without which results would have been lower. The investment adviser is currently reimbursing a portion of other expenses for American Funds Tax-Exempt Fund of New York. Investment results and the net expense ratio reflect the reimbursement, without which the results would have been lower and the expense ratio would have been higher. This reimbursement will be in effect through at least October 1, 2019, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Visit americanfunds.com for more information.

A summary of each fund’s 30-day yield can be found on page 3.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

We are pleased to present this report for American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York. It covers the 12-month period ended July 31, 2018, the conclusion of the funds’ fiscal year.

Rising interest rates, investor enthusiasm for riskier assets and uncertainty about the implications of tax reform weighed on the municipal bond market over the period. Yet in spite of this, tax-exempt bond prices generally finished higher, and all six funds generated positive results. Total returns ranged from 4.05% for American High-Income Municipal Bond Fund to 0.24% for American Funds Short-Term Tax-Exempt Bond Fund. (See pages 4 through 16 for fund specific results and information.)

Economic and market overview

Municipal bond yields rose modestly during the funds’ fiscal year, but total returns outpaced the broader taxable fixed income market. Signs of emerging inflation and uncertainty around global trade policy sparked bouts of volatility. In taxable fixed income markets, bond prices fell on pressure from interest rate hikes and signs of higher inflation amid robust U.S. economic growth. The yield on the benchmark 10-year Treasury note climbed 66 basis points to end the period at 2.96%. At the end of April it briefly drifted above 3% for the first time in four years. By way of comparison, the yield on AAA-rated municipal bonds, as measured by Bloomberg Valuation Service (BVAL), rose 60 basis points to 2.49%.

The U.S. economy grew 4.1% in the second quarter, powered by strong exports and a rebound in consumer spending. The unemployment rate hit 3.8% in May, matching the lowest reading in nearly 50 years. This tight labor market helped to push wages to their highest average growth in a decade. There were also signs of inflation picking up. At 2.9% year-over-year in June, the Consumer Price Index (CPI) hit a level not seen since 2012. Core CPI, which removes volatile food and energy prices, rose to 2.2%. The Federal Reserve continued to reduce its balance sheet. However, the central bank also increased sales of Treasury bonds to help fund the federal deficit. As expected, it raised the federal funds rate by 25 basis points in June to a range of 1.75% to 2.00%, its second hike of the year. Chairman Jay Powell continued to stress that rate increases would be gradual.

The passage of the Tax Cuts and Jobs Act of 2017 (TCJA) in December fueled municipal market instability early in 2018 as investors grappled with its potential impact on tax-exempt bonds. The legislation also resulted in distortions in supply-and-demand dynamics in the municipal market. One provision eliminated the tax-exempt status for advance refunding bonds, which local governments utilize to reduce their interest rate expenses. Municipal bond issuance set a new single-month record last December, as local governments sought to issue before the law took effect. The $62.5 billion in offerings surpassed the old record of $54.7 billion set in December 1985, just prior to the last comprehensive tax overhaul. Since the start of the year, however, issuance has declined substantially. As of June 30, municipal bond issuance was $161 billion, about 20% lower than the $201 billion issued in the first half of 2017.

Demand for municipal bonds has been generally solid since January. Year-to-date fund inflows stood at about $13.7 billion at the end of July, according to data from the Investment Company Institute. This demand, coupled with lower supply, resulted in tighter spreads, which helped

| American Funds Tax-Exempt Funds | 1 |

drive the positive market return. Municipal bonds of lower credit quality recorded the strongest gains of the period, as reflected in the 6.82% increase posted by the Barclays High Yield Municipal Bond Index (a market value-weighted index composed of municipal bonds rated below BBB/Baa). By comparison, the Barclays Municipal Bond Index, a broad measure of the investment-grade market (bonds rated BBB/Baa and above), advanced 0.99%.

Inside the portfolios

The funds covered in this report continued to focus chiefly on revenue bonds, which support essential services such as water, sewer and electric utilities. This approach proved additive, as revenue bonds produced higher returns than general obligation bonds overall. As has been the case for a number of years — given much tighter spreads across the municipal curve, the stronger economy and rising rates — most of the funds took a relatively conservative approach to the market, maintaining comparatively short duration positions and focusing on bonds of higher quality.

Looking ahead

With the economy healthy and the Fed proceeding with rate hikes, we expect a more challenging environment going forward. We are preparing for muted returns and further volatility. Any increase in supply could put some downward pressure on valuations. After a strong rally in 2017, the municipal bond market has continued to deliver positive results, particularly among higher yielding bonds. In contrast to the taxable market, spreads have gotten increasingly tighter. Given what is in our view limited reward potential for taking additional risk at this point in the market cycle, we are focusing on higher quality bonds across the portfolios.

That said, while broader interest rate moves may create instability in munis, we continue to identify what we believe are promising investment opportunities, chiefly with respect to revenue bond issuers in sectors such as not-for-profit hospitals, transportation, housing and education. Lastly, despite the tax cuts, the after-tax income potential of municipal bonds remains compelling, and we believe municipal bond funds can continue to play a key role in diversified portfolios.

We thank you for the confidence you have placed in us and endeavor to be responsible stewards of your capital.

We look forward to reporting to you again in six months’ time.

Sincerely,

Neil L. Langberg

President, American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California

Chad M. Rach

President, American High-Income Municipal Bond Fund

Jerome H. Solomon

President, American Funds Tax-Exempt Fund of New York

Karl J. Zeile

President, The Tax-Exempt Bond Fund of America

September 13, 2018

For current information about the funds, visit americanfunds.com.

The market indexes shown are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd.

| 2 | American Funds Tax-Exempt Funds |

Funds’ 30-day yields

Below is a summary of each fund’s 30-day yield and 12-month distribution rate for Class A shares as of August 31, 2018. Both measures reflect the 2.50%/3.75% maximum sales charge. Each fund’s 30-day yield is calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula. The SEC yield reflects the rate at which each fund is earning income on its current portfolio of securities while the distribution rate reflects the funds’ past dividends paid to shareholders. Accordingly, the funds’ SEC yields and distribution rates may differ. The equivalent taxable yield assumes a 43.4% tax rate.1

| Class A shares | SEC 30-day yield | Equivalent taxable yield | 12-month distribution rate | |||||||||

| Reflecting 2.50% maximum sales charge | ||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | 1.52 | % | 2.69 | % | 1.32 | % | ||||||

| Limited Term Tax-Exempt Bond Fund of America | 1.73 | 3.06 | 1.96 | |||||||||

| Reflecting 3.75% maximum sales charge | ||||||||||||

| The Tax-Exempt Bond Fund of America | 2.27 | 4.01 | 2.80 | |||||||||

| American High-Income Municipal Bond Fund | 2.92 | 5.16 | 3.52 | |||||||||

| The Tax-Exempt Fund of California | 1.85 | 4.03 | 2 | 2.80 | ||||||||

| American Funds Tax-Exempt Fund of New York | 2.02 | 4.01 | 3 | 2.46 | ||||||||

| 1 | Based on 2018 federal tax rates. For the year 2018, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 40.8% marginal tax rate on their investment income. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 2 | For investors in the 54.10% federal and California state tax bracket. |

| 3 | For investors in the 49.62% federal, New York state and New York City tax bracket. |

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Income may be subject to state or local income taxes and/or federal alternative minimum taxes. Also, certain other income (such as distributions from gains on the sale of certain bonds purchased at less than par value, for The Tax-Exempt Bond Fund of America), as well as capital gain distributions, may be taxable. High-yield/lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade/higher rated bonds. The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York are more susceptible to factors adversely affecting issuers of each state’s tax-exempt securities than a more widely diversified municipal bond fund. Refer to the funds’ prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the funds.

| American Funds Tax-Exempt Funds | 3 |

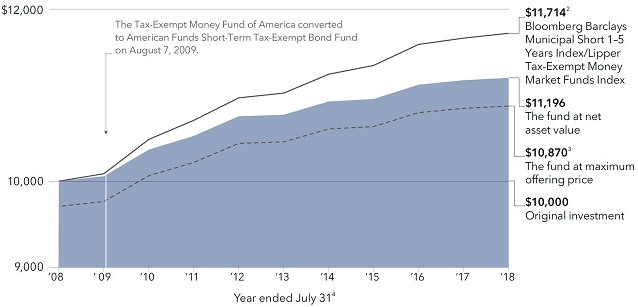

American Funds Short-Term Tax-Exempt Bond Fund

The fund registered a total return of 0.24% for the fiscal year, trailing the 0.48% return of the Bloomberg Barclays Municipal Short 1–5 Years Index, a market value-weighted index that includes investment-grade tax-exempt bonds (rated BBB/Baa and above) with maturities of one to five years. The fund also lagged the Lipper Short Municipal Debt Funds Average, a peer group measure, which recorded a 0.61% return.

The fund paid monthly dividends totaling 13 cents a share for the 12 months. This amounts to a federally tax-exempt income return of 1.33% for investors who reinvested dividends. This is equivalent to a taxable income return of 2.25% for investors in the 40.8%1 maximum federal tax bracket. A portion of the fund’s return also may be exempt from some state and local taxes.

In a period of rising rates and tightening credit spreads, the fund’s managers maintained a conservative approach to the market, focusing on higher quality bonds. As of July 31, 2018, some 74% of the portfolio was invested in bonds rated AAA/Aaa or AA/Aa. Among the fund’s largest contributors were revenue bonds supporting toll roads and hospital facilities.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please view the Quarterly Statistical Update, available at americanfunds.com.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 1.30% tax-exempt distribution rate3 as of July 31, 2018.

| If your taxable income is … | … then your federal | The fund’s tax-exempt distribution rate of 1.30% is | ||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 9,525 | $ | 0 – | 19,050 | 10.0 | % | 1.44 | % | |||||||

| 9,526 – | 38,700 | 19,051 – | 77,400 | 12.0 | 1.48 | |||||||||||

| 38,701 – | 82,500 | 77,401 – | 165,000 | 22.0 | 1.67 | |||||||||||

| 82,501 – | 157,500 | 165,001 – | 250,000 | 24.0 | 1.71 | |||||||||||

| – | 250,001 – | 315,000 | 27.8 | 1 | 1.80 | |||||||||||

| 157,501 – | 200,000 | – | 32.0 | 1.91 | ||||||||||||

| – | 315,001 – | 400,000 | 35.8 | 1 | 2.02 | |||||||||||

| 200,001 – | 500,000 | 400,001 – | 600,000 | 38.8 | 1 | 2.12 | ||||||||||

| Over 500,000 | Over 600,000 | 40.8 | 1 | 2.20 | ||||||||||||

| 1 | For the year 2018, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 40.8% marginal tax rate on their investment income. |

| 2 | Based on 2018 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2018. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 2.50% on the $10,000 investment.1 Thus, the net amount invested was $9,750. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 4 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $500,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | Consists of the Lipper Tax-Exempt Money Market Funds Index through July 31, 2009 (the period ended prior to the fund’s conversion from a tax-exempt money market fund to a short-term tax-exempt bond fund), and the Bloomberg Barclays Municipal Short 1–5 Years Index thereafter. Results of the Lipper Tax-Exempt Money Market Funds Index do not reflect any sales charges. Source: Thomson Reuters Lipper. The Bloomberg Barclays index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

| 3 | Prior to August 7, 2009, the fund was operated as a money market fund and did not have an initial sales charge. |

| 4 | In 2009, the fund changed its fiscal year-end from September 30 to July 31. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2018*

| 1 year | 5 years | 10 years | ||||

| Class A shares | –2.26% | 0.28% | 0.84% |

| * | Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge. |

The 10-year investment result includes the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore is not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of that period. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect expense reimbursements, without which results would have been lower. Visit americanfunds.com for more information.

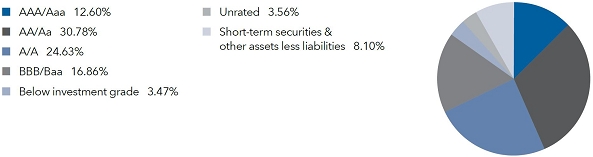

Portfolio quality summary*

Percent of net assets

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 5 |

Limited Term Tax-Exempt Bond Fund of America

The fund generated a total return of 0.40% for the 12 months ended July 31. It outpaced the Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index, a market value-weighted index that includes investment-grade tax-exempt bonds (rated BBB/Baa and above) with maturities of one to 10 years, which rose 0.21%. The fund also bested the 0.39% return of the Lipper Short-Intermediate Municipal Debt Funds Average, a peer group measure.

The fund paid monthly dividends totaling 31 cents a share for the fiscal year. Those individuals who reinvested dividends received a federally tax-exempt income return of 2.00%. This is equivalent to a taxable income return of 3.38% for investors in the 40.8%1 maximum federal tax bracket.

The fund’s managers positioned the portfolio fairly conservatively, seeking to maintain a relatively short duration. This approach helped the fund outpace the broader market, particularly during the first half of the period when the yield curve flattened somewhat. As of July 31, 2018, 55.1% of the portfolio was invested in bonds rated AAA/Aaa or AA/Aa.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please view the Quarterly Statistical Update, available at americanfunds.com.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 1.96% tax-exempt distribution rate3 as of July 31, 2018.

| If your taxable income is … | … then your federal | The fund’s tax-exempt distribution rate of 1.96% is | ||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 9,525 | $ | 0 – | 19,050 | 10.0 | % | 2.18 | % | |||||||

| 9,526 – | 38,700 | 19,051 – | 77,400 | 12.0 | 2.23 | |||||||||||

| 38,701 – | 82,500 | 77,401 – | 165,000 | 22.0 | 2.51 | |||||||||||

| 82,501 – | 157,500 | 165,001 – | 250,000 | 24.0 | 2.58 | |||||||||||

| – | 250,001 – | 315,000 | 27.8 | 1 | 2.71 | |||||||||||

| 157,501 – | 200,000 | – | 32.0 | 2.88 | ||||||||||||

| – | 315,001 – | 400,000 | 35.8 | 1 | 3.05 | |||||||||||

| 200,001 – | 500,000 | 400,001 – | 600,000 | 38.8 | 1 | 3.20 | ||||||||||

| Over 500,000 | Over 600,000 | 40.8 | 1 | 3.31 | ||||||||||||

| 1 | For the year 2018, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 40.8% marginal tax rate on their investment income. |

| 2 | Based on 2018 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2018. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 2.50% on the $10,000 investment.* Thus, the net amount invested was $9,750. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 6 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $500,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2018*

| 1 year | 5 years | 10 years | ||||

| Class A shares | –2.09% | 1.18% | 2.68% |

| * | Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Portfolio quality summary*

Percent of net assets

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 7 |

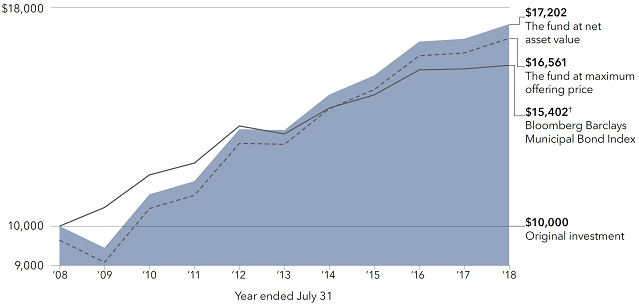

The Tax-Exempt Bond Fund of America

The fund produced a 1.60% total return for the fiscal year, significantly beating the 0.99% return of the Bloomberg Barclays Municipal Bond Index, a market value-weighted index designed to represent the long-term investment-grade (bonds rated BBB/Baa and above) tax-exempt bond market. It also surpassed the 1.48% total return of the Lipper General & Insured Municipal Debt Funds Average, a peer group measure.

For the fiscal year, the fund paid monthly dividends totaling about 38 cents a share, amounting to a federally tax-exempt income return of 2.93% for investors who reinvested dividends. This is equivalent to a taxable income return of 4.95% for investors in the 40.8%1 maximum federal tax bracket. The fund does not invest in bonds subject to the Alternative Minimum Tax (AMT).

The fund’s managers took a relatively conservative approach to the market, seeking to carefully manage interest rate exposure. This approach helped the fund outpace the broader market, particularly during the first half of the period when the yield curve flattened somewhat. At the close of the period approximately 85% of the portfolio consisted of revenue bonds. Among the largest concentrations were holdings backing health care and transportation initiatives.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please view the Quarterly Statistical Update, available at americanfunds.com.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.82% tax-exempt distribution rate3 as of July 31, 2018.

| If your taxable income is … | … then your federal | The fund’s tax-exempt distribution rate of 2.82% is | ||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 9,525 | $ | 0 – | 19,050 | 10.0 | % | 3.13 | % | |||||||

| 9,526 – | 38,700 | 19,051 – | 77,400 | 12.0 | 3.20 | |||||||||||

| 38,701 – | 82,500 | 77,401 – | 165,000 | 22.0 | 3.62 | |||||||||||

| 82,501 – | 157,500 | 165,001 – | 250,000 | 24.0 | 3.71 | |||||||||||

| – | 250,001 – | 315,000 | 27.8 | 1 | 3.91 | |||||||||||

| 157,501 – | 200,000 | – | 32.0 | 4.15 | ||||||||||||

| – | 315,001 – | 400,000 | 35.8 | 1 | 4.39 | |||||||||||

| 200,001 – | 500,000 | 400,001 – | 600,000 | 38.8 | 1 | 4.61 | ||||||||||

| Over 500,000 | Over 600,000 | 40.8 | 1 | 4.76 | ||||||||||||

| 1 | For the year 2018, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 40.8% marginal tax rate on their investment income. |

| 2 | Based on 2018 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2018. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.* Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 8 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2018*

| 1 year | 5 years | 10 years | ||||

| Class A shares | –2.24% | 3.06% | 3.92% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Portfolio quality summary*

Percent of net assets

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 9 |

American High-Income Municipal Bond Fund

The fund produced a total return of 4.05% for the fiscal year, exceeding the 0.99% return of the Bloomberg Barclays Municipal Bond Index, a measure of the investment-grade municipal market. The fund, which seeks to provide a high level of tax-exempt income by investing in both high-yield and investment-grade municipal bonds, also bettered the 3.97% return of the Lipper High Yield Municipal Debt Funds Average (a peer group measure). However, the fund couldn’t match the 6.82% gain of the Bloomberg Barclays High Yield Municipal Bond Index (a market value-weighted index composed of municipal bonds rated below BBB/Baa).

For the 12 months, the fund paid monthly dividends totaling about 58 cents a share, amounting to a federally tax-exempt income return of 3.74% for investors who reinvested dividends. This is equivalent to a taxable income return of 6.32% for investors in the 40.8%1 maximum federal tax bracket. A portion of the fund’s return also may be exempt from some state and local taxes.

Over a period that saw high-yield municipal bonds outpace the broader tax-exempt market, the fund’s return was solid. However, a relatively light concentration in Puerto Rico- and Virgin Islands-backed issues dampened the fund’s total return on a relative basis.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please view the Quarterly Statistical Update, available at americanfunds.com.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 3.53% tax-exempt distribution rate3 as of July 31, 2018.

| If your taxable income is … | … then your federal | The fund’s tax-exempt distribution rate of 3.53% is | ||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 9,525 | $ | 0 – | 19,050 | 10.0 | % | 3.92 | % | |||||||

| 9,526 – | 38,700 | 19,051 – | 77,400 | 12.0 | 4.01 | |||||||||||

| 38,701 – | 82,500 | 77,401 – | 165,000 | 22.0 | 4.53 | |||||||||||

| 82,501 – | 157,500 | 165,001 – | 250,000 | 24.0 | 4.64 | |||||||||||

| – | 250,001 – | 315,000 | 27.8 | 1 | 4.89 | |||||||||||

| 157,501 – | 200,000 | – | 32.0 | 5.19 | ||||||||||||

| – | 315,001 – | 400,000 | 35.8 | 1 | 5.50 | |||||||||||

| 200,001 – | 500,000 | 400,001 – | 600,000 | 38.8 | 1 | 5.77 | ||||||||||

| Over 500,000 | Over 600,000 | 40.8 | 1 | 5.96 | ||||||||||||

| 1 | For the year 2018, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 40.8% marginal tax rate on their investment income. |

| 2 | Based on 2018 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2018. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.* Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 10 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2018*

| 1 year | 5 years | 10 years | ||||

| Class A shares | 0.17% | 5.06% | 5.17% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Portfolio quality summary*

Percent of net assets

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 11 |

The Tax-Exempt Fund of California

The fund posted a 1.77% total return for the fiscal year. It finished ahead of the Bloomberg Barclays California Municipal Index, a market value-weighted index that includes only investment-grade tax-exempt bonds (rated BBB/Baa and above) of issuers within the state of California, which climbed 1.15%. The fund also outpaced the 1.55% total return of the Lipper California Municipal Debt Funds Average, a peer group measure.

For the period, the fund paid monthly dividends totaling 51 cents a share. Those investors who reinvested dividends received an income return of 2.92%. This is equivalent to a taxable income return of 6.36% for investors in the 54.10%1 effective combined federal and California tax bracket.

The state’s finances remain quite healthy. Higher tax rates have driven demand for sources of tax-exempt income, as credit spreads have tightened across the spectrum. Given what the managers believe is limited potential reward for additional risk, they are maintaining a conservative approach, concentrating on bonds of relatively higher quality and shorter duration.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please view the Quarterly Statistical Update, available at americanfunds.com.

Tax-exempt yields vs. taxable yields

Find your estimated 2018 taxable income below to determine your combined federal and California tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.81% tax-exempt distribution rate3 as of July 31, 2018.

| If your taxable income is … | … then your combined federal and California | The fund’s tax-exempt distribution rate of 2.81% is | ||||||||||||||

| Single | Joint | state tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 8,223 | $ | 0 – | 16,446 | 11.00 | % | 3.16 | % | |||||||

| 8,224 – | 9,525 | 16,447 – | 19,050 | 12.00 | 3.19 | |||||||||||

| 9,526 – | 19,495 | 19,051 – | 38,990 | 14.00 | 3.27 | |||||||||||

| 19,496 – | 30,769 | 38,991 – | 61,538 | 16.00 | 3.35 | |||||||||||

| 30,770 – | 38,700 | 61,539 – | 77,400 | 18.00 | 3.43 | |||||||||||

| 38,701 – | 42,711 | 77,401 – | 85,422 | 28.00 | 3.90 | |||||||||||

| 42,712 – | 53,980 | 85,423 – | 107,960 | 30.00 | 4.01 | |||||||||||

| 53,981 – | 82,500 | 107,961 – | 165,000 | 31.30 | 4.09 | |||||||||||

| 82,501 – | 157,500 | 165,001 – | 250,000 | 33.30 | 4.21 | |||||||||||

| – | 250,001 – | 315,000 | 37.10 | 1 | 4.47 | |||||||||||

| 157,501 – | 200,000 | – | 41.30 | 4.79 | ||||||||||||

| – | 315,001 – | 400,000 | 45.10 | 1 | 5.12 | |||||||||||

| 200,001 – | 275,738 | 400,001 – | 551,476 | 48.10 | 1 | 5.41 | ||||||||||

| 275,739 – | 330,884 | 551,477 – | 600,000 | 49.10 | 1 | 5.52 | ||||||||||

| 330,885 – | 500,000 | – | 50.10 | 1 | 5.63 | |||||||||||

| – | 600,001 – | 661,768 | 51.10 | 1 | 5.75 | |||||||||||

| 500,001 – | 551,473 | 661,769 – | 1,000,000 | 52.10 | 1 | 5.87 | ||||||||||

| 551,474 – | 1,000,000 | 1,000,001 – | 1,102,946 | 53.10 | 1 | 5.99 | ||||||||||

| Over 1,000,000 | Over 1,102,946 | 54.10 | 1 | 6.12 | ||||||||||||

| 1 | For the year 2018, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 54.10% marginal tax rate on their investment income. |

| 2 | Based on 2018 federal and 2017 California tax rates. (State rates from 1.0% to 13.3% are individually calculated for each bracket. The federal brackets are expanded to include additional state brackets.) The effective combined tax rates paid by California residents may be lower than those shown due to the availability of income tax deductions. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2018. Capital gains distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.* Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 12 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2018*

| 1 year | 5 years | 10 years | ||||

| Class A shares | –2.06% | 3.34% | 4.41% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Portfolio quality summary*

Percent of net assets

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 13 |

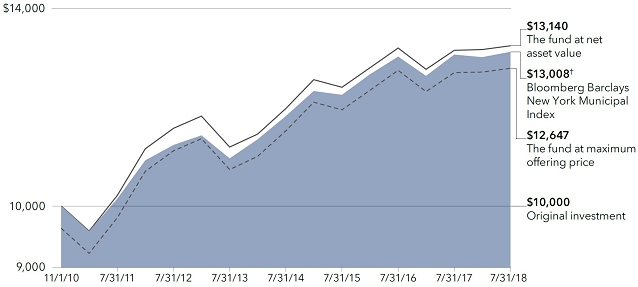

American Funds Tax-Exempt Fund of New York

The fund recorded a total return of 0.75% for the fiscal year, outpacing the 0.49% gain of the Bloomberg Barclays New York Municipal Index, a market value-weighted index that includes only investment-grade tax-exempt bonds (rated BBB/Baa and above) of issuers within the state of New York. By way of comparison, the Lipper New York Municipal Debt Funds Average, a peer group measure, advanced 0.94%.

The fund paid monthly dividends totaling 27 cents a share for the 12 months. This represents an income return of 2.53% for those who reinvested dividends. For investors in the 49.62%1 combined effective federal and New York state bracket, this is equivalent to a taxable income return of 5.02%.

The fund received positive contributions from revenue bonds supporting a wide range of initiatives. The portfolio’s two highest concentrations at the close of the period were in revenue bonds supporting higher education and hospital facilities.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please view the Quarterly Statistical Update, available at americanfunds.com.

Tax-exempt yields vs. taxable yields

Find your estimated 2018 taxable income below to determine your combined federal and New York state tax rate,2,3 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.45% tax-exempt distribution rate4 as of July 31, 2018.

| If your taxable income is … | … then your combined federal and New York | The fund’s tax-exempt distribution rate of 2.45% is | ||||||||||||||

| Single | Joint | state tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 8,500 | $ | 0 – | 17,150 | 14.00 | % | 2.85 | % | |||||||

| 8,501 – | 9,525 | 17,151 – | 19,050 | 14.50 | 2.87 | |||||||||||

| 9,526 – | 11,700 | 19,051 – | 23,600 | 16.50 | 2.93 | |||||||||||

| 11,701 – | 13,900 | 23,601 – | 27,900 | 17.25 | 2.96 | |||||||||||

| 13,901 – | 21,400 | 27,901 – | 43,000 | 17.90 | 2.98 | |||||||||||

| 21,401 – | 38,700 | 43,001 – | 77,400 | 18.45 | 3.00 | |||||||||||

| 38,701 – | 80,650 | 77,401 – | 161,550 | 28.45 | 3.42 | |||||||||||

| 80,651 – | 82,500 | 161,551 – | 165,000 | 28.65 | 3.43 | |||||||||||

| 82,501 – | 157,500 | 165,001 – | 250,000 | 30.65 | 3.53 | |||||||||||

| – | 250,001 – | 315,000 | 34.45 | 1 | 3.74 | |||||||||||

| 157,501 – | 200,000 | – | 38.65 | 3.99 | ||||||||||||

| – | 315,001 – | 323,200 | 42.45 | 1 | 4.26 | |||||||||||

| – | 323,201 – | 400,000 | 42.65 | 1 | 4.27 | |||||||||||

| 200,001 – | 215,400 | – | 45.45 | 1 | 4.49 | |||||||||||

| 215,401 – | 500,000 | 400,001 – | 600,000 | 45.65 | 1 | 4.51 | ||||||||||

| 500,001 – | 1,077,550 | 600,001 – | 2,155,350 | 47.65 | 1 | 4.68 | ||||||||||

| Over 1,077,550 | Over 2,155,350 | 49.62 | 1 | 4.86 | ||||||||||||

| 1 | For the year 2018, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 49.62% marginal tax rate on their investment income. |

| 2 | Income generated by the fund’s investments is also generally exempt from New York City taxes, offering additional tax advantages to New York City residents. |

| 3 | Based on 2018 federal and 2017 New York state tax rates. (State rates from 4.00% to 8.82% are individually calculated for each bracket. The federal brackets are expanded to include additional state brackets.) The effective combined tax rates paid by New York residents may be lower than those shown due to the availability of income tax deductions. |

| 4 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2018. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.* Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 14 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

(for the period November 1, 2010, to July 31, 2018, with dividends reinvested)

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2018*

| 1 year | 5 years | Lifetime | ||||

| Class A shares | –3.02% | 2.72% | 3.08% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect expense reimbursements, without which results would have been lower. The investment adviser is currently reimbursing a portion of other expenses. This reimbursement will be in effect through at least October 1, 2018, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Visit americanfunds.com for more information.

Portfolio quality summary*

Percent of net assets

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 15 |

Results at a glance

For periods ended July 31, 2018, with distributions reinvested

| Cumulative total returns | Average annual total returns | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime* | |||||||||||||

| American Funds Short-Term Tax-Exempt Bond

Fund (Class A shares) | 0.24 | % | 0.78 | % | — | 1.20 | % | |||||||||

| Bloomberg Barclays Municipal Short 1–5 Years Index | 0.48 | 1.23 | — | 1.67 | ||||||||||||

| Lipper Short Municipal Debt Funds Average | 0.61 | 0.74 | — | 1.12 | ||||||||||||

| Limited Term Tax-Exempt Bond Fund of America (Class A shares) | 0.40 | 1.69 | 2.94 | % | 3.81 | |||||||||||

| Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index | 0.21 | 2.08 | 3.11 | 4.06 | ||||||||||||

| Lipper Short-Intermediate Municipal Debt Funds Average | 0.39 | 1.50 | 2.35 | 3.37 | ||||||||||||

| The Tax-Exempt Bond Fund of America (Class A shares) | 1.60 | 3.84 | 4.33 | 6.36 | ||||||||||||

| Bloomberg Barclays Municipal Bond Index | 0.99 | 3.76 | 4.41 | — | † | |||||||||||

| Lipper General & Insured Municipal Debt Funds Average | 1.48 | 3.90 | 4.18 | 6.15 | ||||||||||||

| American High-Income Municipal Bond Fund (Class A shares) | 4.05 | 5.86 | 5.57 | 5.52 | ||||||||||||

| Bloomberg Barclays Municipal Bond Index | 0.99 | 3.76 | 4.41 | 5.24 | ||||||||||||

| Bloomberg Barclays High Yield Municipal Bond Index | 6.82 | 6.11 | 6.09 | — | † | |||||||||||

| Lipper High Yield Municipal Debt Funds Average | 3.97 | 5.70 | 4.99 | 5.04 | ||||||||||||

| The Tax-Exempt Fund of California (Class A shares) | 1.77 | 4.13 | 4.80 | 5.44 | ||||||||||||

| Bloomberg Barclays California Municipal Index | 1.15 | 4.15 | 4.74 | — | † | |||||||||||

| Lipper California Municipal Debt Funds Average | 1.55 | 4.48 | 4.58 | 5.45 | ||||||||||||

| American Funds Tax-Exempt Fund of New York (Class A shares) | 0.75 | 3.51 | — | 3.59 | ||||||||||||

| Bloomberg Barclays New York Municipal Index | 0.49 | 3.71 | — | 3.45 | ||||||||||||

| Lipper New York Municipal Debt Funds Average | 0.94 | 3.69 | — | 3.20 | ||||||||||||

| * | Since 8/7/09 (American Funds Short-Term Tax-Exempt Bond Fund), 10/6/93 (Limited Term Tax-Exempt Bond Fund of America), 10/3/79 (The Tax-Exempt Bond Fund of America), 9/26/94 (American High-Income Municipal Bond Fund), 10/28/86 (The Tax-Exempt Fund of California) and 11/1/10 (American Funds Tax-Exempt Fund of New York). |

| † | This index did not exist at the fund’s inception. |

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please view the Quarterly Statistical Update, available at americanfunds.com.

| 16 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

Summary investment portfolio July 31, 2018

| Bonds, notes & other debt instruments 89.79% | Principal amount (000) | Value (000) | ||||||

| Alabama 2.21% | ||||||||

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2016-A, 4.00% 2046 (put 2021) | $ | 7,500 | $ | 7,826 | ||||

| Other securities | 13,769 | |||||||

| 21,595 | ||||||||

| California 6.14% | ||||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2006-C-1, (SIFMA Municipal Swap Index + 0.90%) 1.84% 2045 (put 2023)1 | 6,600 | 6,720 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2007-E-3, (SIFMA Municipal Swap Index + 0.70%) 1.64% 2047 (put 2019)1 | 3,000 | 3,010 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2008-A-1, (SIFMA Municipal Swap Index + 0.90%) 1.84% 2045 (put 2023)1 | 1,250 | 1,273 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2014-G, (SIFMA Municipal Swap Index + 0.60%) 1.54% 2034 (put 2020)1 | 2,000 | 2,011 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2017-D, (3-month USD-LIBOR x 0.70 + 0.55%) 2.186% 2045 (put 2021)1 | 500 | 504 | ||||||

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (Pacific Gas and Electric Company), Series 2008-F, 1.75% 2026 (put 2022) | 6,070 | 5,766 | ||||||

| Other securities | 40,776 | |||||||

| 60,060 | ||||||||

| Florida 3.10% | ||||||||

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Senior Secured Bonds, Series 2012-A-1, 5.00% 2019 | 7,450 | 7,660 | ||||||

| JEA, Electric System Rev. Bonds, Series 2012-B, 5.00% 2026 (preref. 2021) | 4,650 | 5,093 | ||||||

| Other securities | 17,537 | |||||||

| 30,290 | ||||||||

| Georgia 1.63% | ||||||||

| County of Floyd, Dev. Auth., Pollution Control Rev. Bonds (Georgia Power Company Plant Hammond Project), Series 2010, 2.35% 2022 (put 2020) | 4,000 | 4,023 | ||||||

| Other securities | 11,895 | |||||||

| 15,918 | ||||||||

| Illinois 10.27% | ||||||||

| Build Illinois Bonds, Sales Tax Rev. Bonds, Series 2013, 5.00% 2020 | 6,300 | 6,617 | ||||||

| Educational Facs. Auth., Rev. Bonds (University of Chicago), Series 1998-B, 1.65% 2025 (put 2019) | 10,390 | 10,390 | ||||||

| Housing Dev. Auth., Multi Family Housing Rev. Notes (Marshall Field Garden Apartment Homes), Series 2015, (SIFMA Municipal Swap Index + 1.00%) 1.94% 2050 (put 2025)1 | 5,525 | 5,474 | ||||||

| Regional Transportation Auth., G.O. Rev. Ref. Bonds, Series 2017-A, 5.00% 2023 | 5,000 | 5,602 | ||||||

| Other securities | 72,367 | |||||||

| 100,450 | ||||||||

| Indiana 1.88% | ||||||||

| Dev. Fin. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2001, AMT, 1.75% 2031 (put 2018) | 500 | 500 | ||||||

| Hobart Building Corp. (Lake County), First Mortgage Bonds, Series 2006, National insured, 6.50% 2029 (preref. 2020) | 6,000 | 6,421 | ||||||

| Other securities | 11,508 | |||||||

| 18,429 | ||||||||

| Kansas 0.92% | ||||||||

| Dept. of Transportation, Highway Rev. Bonds, Series 2004-C-3, (1-month USD-LIBOR x 0.70 + 0.40%) 1.865% 20231 | 5,000 | 5,014 | ||||||

| Other securities | 4,012 | |||||||

| 9,026 | ||||||||

| Kentucky 0.72% | ||||||||

| Property and Buildings Commission, Rev. Ref. Bonds (Project No. 112), Series 2016-B, 5.00% 2022 | 4,500 | 4,991 | ||||||

| Other securities | 2,020 | |||||||

| 7,011 | ||||||||

| American Funds Tax-Exempt Funds | 17 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| Maryland 1.33% | ||||||||

| University System, Auxiliary Fac. and Tuition Rev. Ref. Bonds, Series 2017-B, 5.00% 2021 | $ | 4,500 | $ | 4,878 | ||||

| Other securities | 8,130 | |||||||

| 13,008 | ||||||||

| Massachusetts 2.91% | ||||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 167, 4.00% 2043 | 790 | 819 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 169, 4.00% 2044 | 505 | 523 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 172, 4.00% 2045 | 1,000 | 1,041 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 181, 4.00% 2044 | 785 | 819 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 183, 3.50% 2046 | 805 | 828 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 160, AMT, 3.75% 2034 | 300 | 306 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 162, 2.75% 2041 | 235 | 237 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 165, 2.65% 2041 | 810 | 815 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 171, 4.00% 2044 | 570 | 592 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 177, AMT, 4.00% 2039 | 3,125 | 3,252 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 188, AMT, 4.00% 2043 | 815 | 856 | ||||||

| Other securities | 18,388 | |||||||

| 28,476 | ||||||||

| Minnesota 1.52% | ||||||||

| Housing Fin. Agcy., Homeownership Fin. Bonds (Mortgage-Backed Securities Program), Series 2011-G, 4.25% 2035 | 280 | 287 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2012-D, 4.00% 2040 | 435 | 446 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2013-A, AMT, 3.00% 2031 | 510 | 516 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2014-A, 4.00% 2038 | 805 | 838 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2014-C, AMT, 4.00% 2045 | 6,420 | 6,697 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2015-A, AMT, 4.00% 2041 | 655 | 680 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2015-E, AMT, 3.50% 2046 | 695 | 714 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2016-E, 4.00% 2047 | 210 | 219 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2017-E, 4.00% 2048 | 975 | 1,028 | ||||||

| Other securities | 3,481 | |||||||

| 14,906 | ||||||||

| Nebraska 1.43% | ||||||||

| Central Plains Energy Project, Gas Supply Rev. Ref. Bonds, Series 2014, 5.00% 2039 (put 2019) | 6,700 | 6,981 | ||||||

| Other securities | 7,043 | |||||||

| 14,024 | ||||||||

| Nevada 1.53% | ||||||||

| County of Clark, Pollution Control Rev. Ref. Bonds (Southern California Edison Company), Series 2010, 1.875% 2031 (put 2020) | 5,500 | 5,470 | ||||||

| Other securities | 9,439 | |||||||

| 14,909 | ||||||||

| New Jersey 2.93% | ||||||||

| Econ. Dev. Auth., School Facs. Construction Rev. Ref. Bonds, Series 2014-PP, 5.00% 2019 | 4,000 | 4,109 | ||||||

| Housing and Mortgage Fin. Agcy., Single Family Housing Rev. Bonds, Series 2018-A, 4.50% 2048 | 5,000 | 5,367 | ||||||

| Other securities | 19,186 | |||||||

| 28,662 | ||||||||

| New Mexico 0.92% | ||||||||

| City of Farmington, Pollution Control Rev. Ref. Bonds (Southern California Edison Company Four Corners Project), Series 2005-A, 1.875% 2029 (put 2020) | 2,000 | 1,989 | ||||||

| City of Farmington, Pollution Control Rev. Ref. Bonds (Southern California Edison Company Four Corners Project), Series 2005-B, 1.875% 2029 (put 2020) | 2,250 | 2,238 | ||||||

| City of Farmington, Pollution Control Rev. Ref. Bonds (Southern California Edison Company Four Corners Project), Series 2011, 1.875% 2029 (put 2020) | 2,000 | 1,989 | ||||||

| Other securities | 2,730 | |||||||

| 8,946 | ||||||||

| 18 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

| Principal amount (000) |

Value (000) |

|||||||

| New York 8.34% | ||||||||

| Dormitory Auth., State Personal Income Tax Rev. Bonds (General Purpose), Series 2017-B, 5.00% 2023 | $ | 5,000 | $ | 5,647 | ||||

| Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2015-A-2, (SIFMA Municipal Swap Index + 0.58%) 1.52% 2039 (put 2020)1 | 6,250 | 6,258 | ||||||

| Metropolitan Transportation Auth., Transportation Rev. Ref. Bonds, Series 2002-D-2A, Assured Guaranty Municipal insured, (1-month USD-LIBOR x 0.69 + 0.68%) 2.123% 2032 (put 2021)1 | 4,000 | 4,033 | ||||||

| New York City Housing Dev. Corp., Multi Family Housing Rev. Bonds (Sustainable Neighborhood Bonds), Series 2017-C-2, 1.70% 2021 | 5,250 | 5,206 | ||||||

| Thruway Auth., General Rev. Junior Indebtedness Obligations, Series 2013-A, 5.00% 2019 | 4,700 | 4,823 | ||||||

| Other securities | 55,596 | |||||||

| 81,563 | ||||||||

| North Dakota 0.99% | ||||||||

| Housing Fin. Agcy., Housing Fin. Program Bonds (Home Mortgage Fin. Program), Series 2016-B, AMT, 4.00% 2047 | 4,005 | 4,183 | ||||||

| Other securities | 5,498 | |||||||

| 9,681 | ||||||||

| Ohio 1.79% | ||||||||

| Water Dev. Auth., Solid Waste Disposal Rev. Bonds (Waste Management Inc. Project), Series 2002, AMT, 1.70% 2022 (put 2018) | 2,500 | 2,500 | ||||||

| Other securities | 15,021 | |||||||

| 17,521 | ||||||||

| Pennsylvania 3.23% | ||||||||

| Econ. Dev. Fncg. Auth., UPMC Rev. Bonds, Series 2017-A, 4.00% 2018 | 4,780 | 4,816 | ||||||

| Housing Fin. Agcy., Single Family Mortgage Rev. Bonds, Series 2015-118-A, AMT, 3.50% 2040 | 5,490 | 5,621 | ||||||

| Other securities | 21,152 | |||||||

| 31,589 | ||||||||

| Texas 10.40% | ||||||||

| Clear Creek Independent School Dist., Unlimited Tax School Building Bonds, Series 2013-B, 3.00% 2032 (put 2019) | 5,000 | 5,066 | ||||||

| Cypress-Fairbanks Independent School Dist., Unlimited Tax School Building Bonds, Series 2017-A-2, 2.50% 2036 (put 2019) | 4,000 | 4,033 | ||||||

| City of Houston, Combined Utility System Rev. Ref. Bonds, Series 2018-C, (1-month USD-LIBOR x 0.70 + 0.36%) 1.811% 2034 (put 2021)1 | 5,650 | 5,655 | ||||||

| City of Houston, Public Improvement Rev. Ref. Bonds, Series 2017-A, 5.00% 2020 | 2,850 | 2,996 | ||||||

| North Texas Tollway Auth., System Rev. Ref. Bonds, Series 2011-A, (SIFMA Municipal Swap Index + 0.80%) 1.74% 2050 (put 2019)1 | 4,095 | 4,095 | ||||||

| North Texas Tollway Auth., System Rev. Ref. Bonds, Series 2012-C, 1.95% 2038 (put 2019) | 2,380 | 2,380 | ||||||

| North Texas Tollway Auth., System Rev. Ref. Bonds, Series 2017-A, 5.00% 2019 | 4,500 | 4,567 | ||||||

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2009-A, 5.25% 2024 (preref. 2019) | 1,100 | 1,121 | ||||||

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2012-C, 2.00% 2027 (put 2018) | 1,625 | 1,627 | ||||||

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2015-A, 2.25% 2033 (put 2019) | 9,000 | 9,065 | ||||||

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2015-B, 2.00% 2033 (put 2021) | 3,040 | 3,023 | ||||||

| Transportation Commission, G.O. Mobility Fund Bonds, Series 2014-B, (SIFMA Municipal Swap Index + 0.38%) 1.32% 2041 (put 2018)1 | 6,500 | 6,501 | ||||||

| Other securities | 51,626 | |||||||

| 101,755 | ||||||||

| Washington 3.07% | ||||||||

| Econ. Dev. Fin. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2008, 2.125% 20202 | 5,000 | 5,002 | ||||||

| Various Purpose G.O. Rev. Ref. Bonds, Series 2018-R-C, 5.00% 2021 | 5,000 | 5,472 | ||||||

| Other securities | 19,561 | |||||||

| 30,035 | ||||||||

| American Funds Tax-Exempt Funds | 19 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| Wisconsin 4.26% | ||||||||

| G.O. Bonds, Series 2013-A, 5.00% 2025 (preref. 2022) | $ | 5,000 | $ | 5,554 | ||||

| G.O. Bonds, Series 2015-A, 5.00% 2031 (preref. 2023) | 5,000 | 5,686 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Senior Credit Group), Series 2013-B-1, 1.375% 2038 (put 2019) | 2,150 | 2,137 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Senior Credit Group), Series 2013-B-2, 4.00% 2043 (put 2019) | 6,000 | 6,109 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Senior Credit Group), Series 2013-B-3, 5.00% 2043 (put 2020) | 4,500 | 4,753 | ||||||

| Housing and Econ. Dev. Auth., Home Ownership Rev. Bonds, Series 2016-A, AMT, 3.50% 2046 | 5,415 | 5,563 | ||||||

| Public Fin. Auth., Solid Waste Disposal Rev. Ref. Bonds (Waste Management, Inc. Project), Series 2016-A-4, AMT, 2.00% 2033 (put 2021) | 1,500 | 1,473 | ||||||

| Other securities | 10,426 | |||||||

| 41,701 | ||||||||

| Other states & U.S. territories 18.27% | ||||||||

| Other securities | 178,698 | |||||||

| Total bonds, notes & other debt instruments (cost: $882,948,000) | 878,253 | |||||||

| Short-term securities 10.38% | ||||||||

| State of Arizona, City of Phoenix, Industrial Dev. Auth., Health Care Facs. Rev. Bonds (Mayo Clinic), Series 2014-A, 1.38% 20521 | 7,000 | 7,000 | ||||||

| State of Maryland, County of Montgomery, IAM Commercial Paper, Series 2009, 1.64% 8/2/2018 | 5,000 | 5,000 | ||||||

| State of Maryland, County of Montgomery, IAM Commercial Paper, Series 2009-B, 1.13% 8/9/2018 | 2,000 | 2,000 | ||||||

| State of Michigan, Strategic Fund, Demand Limited Obligation Rev. Bonds (Air Products and Chemicals, Inc. Project), Series 2007, 1.45% 20421 | 18,980 | 18,980 | ||||||

| State of Missouri, Health and Educational Facs. Auth., Demand Educational Facs. Rev. Bonds (Washington University), Series 2000-B, 1.49% 20401 | 5,000 | 5,000 | ||||||

| State of New York, Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2017-C-2A, 4.00% 5/15/2019 | 7,300 | 7,445 | ||||||

| State of New York, New York City Transitional Fin. Auth., Future Tax Secured Bonds, Series 2010-G-5, 1.05% 20341 | 1,500 | 1,500 | ||||||

| State of New York, New York City Transitional Fin. Auth., Future Tax Secured Rev. Ref. Bonds, Series 2015-E-3, 1.50% 20451 | 1,000 | 1,000 | ||||||

| State of New York, New York City Transitional Fin. Auth., Future Tax Secured Rev. Ref. Bonds, Series 2016-E-4, 1.50% 20451 | 3,500 | 3,500 | ||||||

| State of New York, New York City Transitional Fin. Auth., Recovery Bonds, Fiscal 2003, Series 2002-1-C, 1.50% 20221 | 2,880 | 2,880 | ||||||

| State of Pennsylvania, Econ. Dev. Fncg. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2013, AMT, 1.80% 2045 (put 2018)1,3 | 1,200 | 1,200 | ||||||

| State of Texas, City of Houston, Tax and Rev. Anticipation Notes, Series 2018, 4.00% 6/28/2019 | 4,000 | 4,089 | ||||||

| State of Texas, Tax and Rev. Anticipation Notes, Series 2017, 4.00% 8/30/2018 | 12,000 | 12,026 | ||||||

| State of Washington, Central Puget Sound Regional Transit Auth., Sales Tax Improvement Green Bonds, Series 2015-S-2B, (SIFMA Municipal Swap Index + 0.45%) 1.39% 2045 (put 2023)1 | 6,150 | 6,155 | ||||||

| Other securities | 23,775 | |||||||

| Total short-term securities (cost: $101,533,000) | 101,550 | |||||||

| Total investment securities 100.17% (cost: $984,481,000) | 979,803 | |||||||

| Other assets less liabilities (0.17)% | (1,616 | ) | ||||||

| Net assets 100.00% | $ | 978,187 | ||||||

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

| 20 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

Futures contracts

| Number of | Notional amount |

4 | Value at 7/31/2018 |

5 | Unrealized depreciation at 7/31/2018 |

||||||||

| Contracts | Type | contracts | Expiration | (000) | (000) | (000) | |||||||

| 2 Year U.S. Treasury Note Futures | Long | 280 | October 2018 | $56,000 | $59,185 | $(101 | ) |

| 1 | Coupon rate may change periodically. For short-term securities, the date of the next scheduled coupon rate change is considered to be the maturity date. |

| 2 | Acquired in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $5,002,000, which represented .51% of the net assets of the fund. |

| 3 | For short-term securities, the mandatory put date is considered to be the maturity date. |

| 4 | Notional amount is calculated based on the number of contracts and notional contract size. |

| 5 | Value is calculated based on the notional amount and current market price. |

Key to abbreviations and symbol

Agcy. = Agency

AMT = Alternative Minimum Tax

Auth. = Authority

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic