Form DEFR14A SELECTA BIOSCIENCES INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 1

TO

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ | ||||||||||

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ☒ | Definitive Proxy Statement | ||||

| ☐ | Definitive Additional Materials | ||||

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | ||||

SELECTA BIOSCIENCES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box) | ||||||||||||||

| ☒ | No fee required. | |||||||||||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| (5) | Total fee paid: | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| (1) | Amount Previously Paid: | |||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| (3) | Filing Party: | |||||||||||||

| (4) | Date Filed: | |||||||||||||

EXPLANATORY NOTE

This Amendment No. 1 to Schedule 14A (this “Amendment”) is being filed solely to fill in a date that was inadvertently left blank in the Definitive Proxy Statement filed by Selecta Biosciences, Inc. (the “Company”) with the Securities and Exchange Commission on May 3, 2022 (the “Proxy Statement”). After filing the Proxy Statement, the Company discovered that, due to a typographical error, a date indicating when the proxy materials would be made available to the Company’s stockholders was inadvertently left blank in the version of the Proxy Statement that was filed.

SELECTA BIOSCIENCES, INC.

65 Grove Street

Watertown, Massachusetts 02472

To Our Stockholders:

You are cordially invited to attend the 2022 Annual Meeting (the “Annual Meeting”) of Stockholders of Selecta Biosciences, Inc. (the “Company”) to be held on Friday, June 17, 2022 at 10:00 a.m., Eastern Time. We are very pleased that our Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/SELB2022. You will also be able to vote your shares electronically at the Annual Meeting.

We will be using the latest technology to increase access, to improve communication and to obtain cost savings for our stockholders and the Company. Use of a virtual meeting will enable increased stockholder attendance and participation as stockholders can participate from any location.

The Notice of Annual Meeting of Stockholders and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Details regarding how to attend the meeting online and the business to be conducted at the Annual Meeting are more fully described in the Notice of Annual Meeting of Stockholders and Proxy Statement. Please see the section called “Who Can Attend the 2022 Annual Meeting?” on page 4 of the Proxy Statement for more information.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the virtual Annual Meeting, you will be able to vote your shares electronically, even if you have previously submitted your proxy.

On behalf of the Board of Directors, thank you for your continued support and investment in Selecta Biosciences, Inc.

Sincerely, | ||||||||

| May 3, 2022 | /s/ Carsten Brunn, Ph.D. | |||||||

| Carsten Brunn, Ph.D. | ||||||||

| President and Chief Executive Officer, and Director | ||||||||

Table of Contents

| Page | |||||

SELECTA BIOSCIENCES, INC.

65 Grove Street

Watertown, Massachusetts 02472

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

To be held June 17, 2022

The Annual Meeting of Stockholders (the “Annual Meeting”) of Selecta Biosciences, Inc., a Delaware corporation (the “Company”), will be held at 10:00 a.m., Eastern Time, on Friday, June 17, 2022, by virtual meeting online at www.virtualshareholdermeeting.com/SELB2022, for the following purposes:

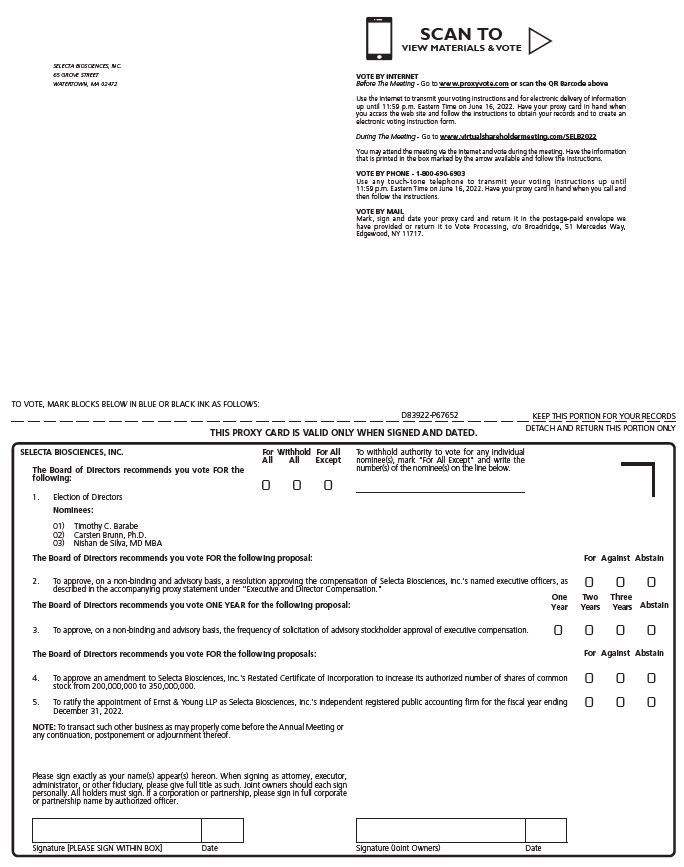

1.To elect Timothy C. Barabe, Carsten Brunn, Ph.D. and Nishan de Silva, M.D., M.B.A. as Class III Directors to serve until the 2025 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

2.To approve, on a non-binding and advisory basis, a resolution approving the compensation of our named executive officers, as described in the accompanying proxy statement under “Executive and Director Compensation”;

3.To approve, on a non-binding and advisory basis, the frequency of solicitation of advisory stockholder approval of executive compensation;

4.To approve an amendment to our Restated Certificate of Incorporation to increase our authorized number of shares of common stock from 200,000,000 to 350,000,000;

5.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

6.To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of our common stock as of the close of business on April 18, 2022 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of these stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to ShareholderRequests@selectabio.com, stating the purpose of the request and providing proof of ownership of our stock. The list of these stockholders will also be available on the bottom panel of your screen during the meeting at www.virtualshareholdermeeting.com/SELB2022 after entering the 16-digit control number included on the Notice of Internet Availability of Proxy Materials or any proxy card that you received, or on the materials provided by your bank or broker. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting webcast, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Note that, in light of possible disruptions in mail service related to COVID-19, we encourage stockholders to submit their proxy via telephone or over the Internet. Submitting your proxy now will not prevent you from voting your shares electronically at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

| By order of the Board of Directors, | |||||

| /s/ Carsten Brunn, Ph.D. | |||||

| Carsten Brunn, Ph.D. | |||||

| President and Chief Executive Officer, Director | |||||

| Watertown, Massachusetts | |||||

| May 3, 2022 | |||||

1

SELECTA BIOSCIENCES, INC.

65 Grove Street

Watertown, Massachusetts 02472

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Selecta Biosciences, Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Friday, June 17, 2022 (the “Annual Meeting”) at 10:00 a.m., Eastern Time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/SELB2022 and entering your 16-digit control number included on your Notice of Internet Availability of Proxy Materials (the “Internet Notice”), on your proxy card or on the instructions that accompanied your proxy materials. Holders of record of shares of common stock, $0.0001 par value (“Common Stock”), as of the close of business on April 18, 2022 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were 151,809,416 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, (as amended, the “2021 Annual Report”) will be released on or about May 3, 2022 to our stockholders on the Record Date.

In this proxy statement, “Selecta”, “Company”, “we”, “us”, and “our” refer to Selecta Biosciences, Inc.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON FRIDAY, JUNE 17, 2022

This Proxy Statement and our 2021 Annual Report are available at http://www.proxyvote.com

PROPOSALS

At the Annual Meeting, our stockholders will be asked:

1.To elect Timothy C. Barabe, Carsten Brunn, Ph.D. and Nishan de Silva, M.D., M.B.A. as Class III Directors to serve until the 2025 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

2.To approve, on a non-binding and advisory basis, a resolution approving the compensation of our named executive officers, as described in the accompanying proxy statement under “Executive and Director Compensation”;

3.To approve, on a non-binding and advisory basis, the frequency of solicitation of advisory stockholder approval of executive compensation;

4.To approve an amendment to our Restated Certificate of Incorporation to increase our authorized number of shares of Common Stock from 200,000,000 to 350,000,000;

5.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

6.To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Stockholders at an annual meeting will only be able to consider proposals or nominations specified in the Notice of Annual Meeting or brought before the meeting by or at the direction of our Board or by a stockholder of record on the Record Date for the meeting who is entitled to vote at the meeting and who has delivered timely written notice in proper form to our Secretary of the stockholder’s intention to bring such business before the meeting. As of the date of this proxy statement, we know of no

2

other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

RECOMMENDATIONS OF THE BOARD

The Board recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of Common Stock will be voted on your behalf as you direct. If not otherwise specified, the shares of Common Stock represented by the proxies will be voted in accordance with the recommendations of the Board. The Board recommends that you vote:

1.FOR the election of Timothy C. Barabe, Carsten Brunn, Ph.D. and Nishan de Silva, M.D., M.B.A. as Class III Directors;

2.FOR the approval, on a non-binding, advisory basis, of the compensation of our named executive officers;

3.FOR the approval, on a non-binding, advisory basis, of “ONE YEAR” as the frequency of solicitation of advisory stockholder approval of executive compensation;

4.FOR the approval of the amendment to our Restated Certificate of Incorporation increasing our authorized number of shares of Common Stock from 200,000,000 to 350,000,000;

5.FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on our proxy card will vote your shares in accordance with their best judgment.

INFORMATION ABOUT THIS PROXY STATEMENT

Why you received this Proxy Statement. You are viewing or have received these proxy materials because Selecta’s Board is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, Selecta is making this proxy statement and its 2021 Annual Report available to its stockholders electronically via the Internet. On or about May 3, 2022, we mailed to our stockholders an Internet Notice containing instructions on how to access this proxy statement and our 2021 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 2021 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. at (866) 540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and received more than one copy of proxy materials, but wish to receive only one copy of future proxy materials for your household, please contact Broadridge at the above phone number or address.

3

Questions and Answers about the 2022 Annual Meeting of Stockholders

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is April 18, 2022. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Common Stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were 151,809,416 shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, please refer to the information from your bank, broker or other nominee on how to submit your voting instructions.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person, or by remove communication, or represented by proxy, of the holders of a majority in voting power of the Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the 2022 Annual Meeting?

You may attend the virtual Annual Meeting only if you are a Selecta stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. The Annual Meeting will be held entirely online to allow greater participation. You will be able to attend the Annual Meeting online and submit your questions by visiting www.virtualshareholdermeeting.com/SELB2022. You also will be able to vote your shares electronically at the Annual Meeting.

To participate in the Annual Meeting, you will need the 16-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 10:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:55 a.m., Eastern Time, and you should allow ample time for the check-in procedures. If your shares are held in street name and you did not receive a 16-digit control number, you may gain access to and vote at the Annual Meeting by logging into your bank or brokerage firm’s website and selecting the shareholder communications mailbox to access the meeting. The control number will automatically populate. Instructions should also be provided on the voting instruction card provided by your bank or brokerage firm. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest,” but you will not be able to vote, ask questions, or access the list of stockholders as of the Record Date.

Why a virtual meeting?

We are excited to embrace the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company while providing stockholders with the same rights and opportunities to participate as they would have at an in-person meeting. Having held successful virtual meetings since 2017, we believe hosting a virtual meeting will enable increased stockholder attendance and participation, because it permits stockholders to participate from any location around the world. Furthermore, in light of the ongoing COVID-19 pandemic, as part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the Annual Meeting, we believe that hosting a virtual meeting is in the best interest of the Company and its stockholders. You will be able to attend the Annual Meeting online and submit your questions by visiting www.virtualshareholdermeeting.com/SELB2022. You also will be able to vote your shares electronically at the Annual Meeting.

4

What if during the check-in time or during the annual meeting I have technical difficulties or trouble assessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, the Chairperson of the Annual Meeting may adjourn the Annual Meeting until a quorum is present or represented.

What does it mean if I receive more than one Internet Notice or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

How do I vote?

Stockholders of Record. We recommend that stockholders vote by proxy even if they plan to participate in the virtual Annual Meeting and vote electronically during the meeting. If you are a stockholder of record, you may vote:

•by Telephone - You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card;

•by Internet - You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card or Internet Notice;

•by Mail - You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail; or

•Electronically at the Meeting - You may vote at the Annual Meeting by visiting www.virtualshareholdermeeting.com/SELB2022 and entering the 16-digit control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 10:00 am, Eastern Time, on June 17, 2022.

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on June 16, 2022. To participate in the Annual Meeting, including to vote via the Internet or telephone, you will need the 16-digit control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically. Note that, in light of possible disruptions in mail service related to the COVID-19 pandemic, we encourage stockholders to submit their proxy via the Internet or telephone.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Telephone and Internet voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are held in street name and you would like to vote at the Annual Meeting, you may visit www.virtualshareholdermeeting.com/SELB2022 and enter the 16-digit control number included in the voting instruction card provided to you by your bank or brokerage firm or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Secretary of the Company prior to the Annual Meeting; or

5

•by voting electronically at the virtual Annual Meeting.

Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your participation in the virtual Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote electronically at the virtual Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote electronically at the virtual Annual Meeting by following the instructions above.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are indicated on page 3 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

| Proposal | Votes required | Effect of Votes Withheld/Abstentions and Broker Non-Votes | ||||||

| Proposal 1: Election of Directors | The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class II Directors. | Votes withheld, abstentions, and broker non-votes will have no effect. | ||||||

| Proposal 2: Approval of Compensation of Named Executive Officers | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. | Abstentions and broker non-votes will have no effect. | ||||||

| Proposal 3: Approval of Frequency of Advisory Vote on Compensation | The plurality of the votes cast. This means that the option that receives the highest number of affirmative “FOR” votes will be considered the advisory approval of the stockholders. | Abstentions and broker non-votes will have no effect. | ||||||

| Proposal 4: Approval of Amendment to Restated Certificate of Incorporation | The affirmative vote of the holders of a majority in voting power of shares outstanding and entitled to vote. | Abstentions and broker non-votes will be treated as a vote “AGAINST” proposal 4. | ||||||

| Proposal 5: Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. | Abstentions and broker non-votes will have no effect. | ||||||

What is an abstention and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of the second, third, fourth, and fifth proposals, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes

6

withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors and abstentions have no effect on the second, third and fifth proposals.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the proposed amendment to our Restated Certificate of Incorporation and the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors, the non-binding, advisory vote on executive compensation, and the non-binding, advisory vote on the frequency of future non-binding, advisory votes on executive compensation. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC within four business days of the Annual Meeting.

7

PROPOSAL 1 - Election of Directors

Election of Directors

At the Annual Meeting, three (3) Class III Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2025 and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal.

We currently have nine (9) directors on our Board, including three (3) Class III Directors. Our current Class III Directors are Timothy C. Barabe, who has served on our Board since 2016, Carsten Brunn, Ph.D., who has served on our Board since December 2018, and Nishan de Silva, M.D., M.B.A., who has served on our Board since June 2021. All three members have been nominated for election as a Class III Director at the Annual Meeting.

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

As set forth in our Restated Certificate of Incorporation, the Board is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The current class structure is as follows: Class I, whose current term expires at the 2023 Annual Meeting of Stockholders and whose subsequent term will expire at the 2026 Annual Meeting of Stockholders; Class II, whose current term expires at the 2024 Annual Meeting of Stockholders, and whose subsequent term will expire at the 2027 Annual Meeting of Stockholders; and Class III, whose term will expire at the Annual Meeting and whose subsequent term will expire at the 2025 Annual Meeting of Stockholders. The current Class I Directors are Scott D. Myers, Timothy Springer, Ph.D. and Patrick Zenner; the current Class II Directors are Göran Ando, M.D., Carrie S. Cox, and Aymeric Sallin; and the current Class III Directors are Timothy C. Barabe, Carsten Brunn, Ph.D. and Nishan de Silva, M.D., M.B.A.

Our Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed only by resolution of the Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two thirds of our outstanding voting stock entitled to vote in the election of directors.

There are no family relationships among any of our executive officers or directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented thereby for the election as Class III Directors of the persons whose names and biographies appear below. All of the persons whose names and biographies appear below are currently serving as our directors. In the event any of the nominees should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board or the Board may elect to reduce its size. The Board has no reason to believe that the nominees named below will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

Vote Required

This proposal requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board

The Board unanimously recommends a vote “FOR” the election of the below Class III Director nominees.

8

Nominees for Class III Directors (Terms to Expire at 2025 Annual Meeting of Stockholders)

The current members of the Board who are Class III Directors are as follows:

| Name | Age | Served as a Director Since | Position(s) with Selecta | |||||||||||||||||

| Timothy C. Barabe | 69 | 2016 | Director | |||||||||||||||||

| Carsten Brunn, Ph.D. | 51 | 2018 | President and Chief Executive Officer | |||||||||||||||||

| Nishan de Silva, M.D., M.B.A. | 49 | 2021 | Director | |||||||||||||||||

The principal occupations and business experience, for at least the past five years, of each Class III Director are as follows:

| TIMOTHY C. BARABE | Age | 69 | |||||||||

Timothy C. Barabe has served as a member of our Board since July 2016. Mr. Barabe also served on the boards of Veeva Systems Inc. from September 2015 to June 2021 and serves on the board of directors of Vigilant Biosciences, Inc., a private company, as well as Heartflow, Inc., also a private company. From 2001 to January 2020, Mr. Barabe served on the board of directors of ArQule, Inc., and from 2014 to 2017, Mr. Barabe served on the board of directors of Opexa Therapeutics, Inc. Mr. Barabe retired in June 2013 from his position as Executive Vice President and Chief Financial Officer of Affymetrix, Inc. Previously, from July 2006 until March 2010, he was Senior Vice President and Chief Financial Officer of Human Genome Sciences, Inc. From 2004 to 2006, he served as Chief Financial Officer of Regent Medical Limited, a U.K.-based, privately owned, surgical supply company. Mr. Barabe served with Novartis AG from 1982 through August 2004 in a succession of senior executive positions in finance and general management, most recently as the Chief Financial Officer of Sandoz GmbH, the generic pharmaceutical subsidiary of Novartis. Mr. Barabe received his B.B.A. degree from the University of Massachusetts (Amherst) and his M.B.A. degree from the University of Chicago. Mr. Barabe’s experience as a senior financial executive of life sciences companies and knowledge of the pharmaceutical and biotech industries contributed to our Board’s conclusion that he should serve as a director of our Company.

| CARSTEN BRUNN, PH.D. | Age | 51 | |||||||||

Carsten Brunn, Ph.D. has served as our President, Chief Executive Officer and member of our Board since December 2018. Prior to joining Selecta Biosciences, Inc., Dr. Brunn was the President of Pharmaceuticals for the Americas Region and a member of the Global Pharmaceutical Executive Committee at Bayer AG, a pharmaceutical company, since January 2017. Previously, he served as President of Bayer Pharmaceuticals in Japan, a role he held since March 2013. He also served as the Chairman of the European Federation of Pharmaceutical Industries and Associations (EFPIA) Japan, an organization representing innovative pharmaceutical companies in Japan. Dr. Brunn has held a number of senior leadership positions at Eli Lilly, Novartis, Basilea and Bausch and Lomb in Europe, Asia and the United States. He currently serves on the board of directors of the Biotechnology Innovation Organization (BIO). Dr. Brunn holds a Ph.D. in Chemistry from the University of Hamburg and a Master of Science in Pharmaceutical Sciences from the University of Freiburg. He also studied at the University of Washington under a research scholarship and completed his executive education at London Business School. Dr. Brunn’s experience as a senior executive of life sciences companies and knowledge of the pharmaceutical and biotechnology industries contributed to our Board’s conclusion that he should serve as a director of our Company.

| NISHAN DE SILVA, M.D., M.B.A. | Age | 49 | |||||||||

Nishan de Silva, M.D., M.B.A. has served as a member of our Board since June 2021. Dr. de Silva currently serves as Chief Executive Officer of Radionetics Oncology, a private company, where he joined in March 2022. Prior to joining Radionetics Oncology, Dr. de Silva had served as Chief Executive Officer of AFYX Therapeutics, a private biotechnology company from April 2018 to February 2022, and served as a director at AFYX Therapeutics since May 2020 to February 2022. Previously, Dr. de Silva served as President, Chief Operating Officer, and director of Poseida Therapeutics, a cell- and gene therapy-focused biopharmaceutical company, from June 2015 to March 2018. Dr. de Silva also previously served as Vice President Finance and Strategy, and Chief Financial Officer at Ligand Pharmaceuticals from February 2012 to May 2015. Dr. de Silva graduated Summa Cum Laude with a Bachelor of Arts degree in Biology from Harvard University, and received his M.D. degree from the University of Pennsylvania School of Medicine, as well as an M.B.A. degree from The Wharton School of the University of Pennsylvania. Dr. de Silva’s experience in the biotechnology industry, and his knowledge of gene therapies and clinical development contributed to our Board’s conclusion that he should serve as a director of our Company.

9

Continuing Members of the Board

Class I Directors (Terms Expire at 2023 Annual Meeting of Stockholders)

The current members of the Board who are Class I Directors are as follows:

| Name | Age | Served as a Director Since | Position(s) with Selecta | |||||||||||||||||

| Scott D. Myers | 56 | 2019 | Director | |||||||||||||||||

| Timothy A. Springer, Ph.D. | 74 | 2016 | Director | |||||||||||||||||

| Patrick Zenner | 75 | 2017 | Director | |||||||||||||||||

The principal occupations and business experience, for at least the past five years, of each Class I nominee for election at the Annual Meeting are as follows:

| SCOTT D. MYERS | Age | 56 | |||||||||

Scott D. Myers has served as a member of our Board since June 2019. Mr. Myers most recently served as president and chief executive officer of AMAG Pharmaceuticals, Inc., from April 2020 through its acquisition by Covis Group in October 2020. Previously, Mr. Myers served as chief executive officer and chairman of the board of Rainier Therapeutics, formerly known as BioClin Therapeutics, an oncology biotechnology company focused on late-stage bladder cancer from June 2018 until January 2020, as chief executive officer and member of the board of directors of Cascadian Therapeutics, Inc., an oncology company, from April 2016 through its acquisition by Seattle Genetics in March 2018. Prior to Cascadian, Mr. Myers served as chief executive officer of Aerocrine AB, a medical device company, from 2011 through its acquisition by Circassia Pharmaceuticals plc in 2015. He is currently a member of the board of directors and remuneration committee of Sensorion SA, which he joined in December 2021, the board of directors of Dynavax Technologies Corporation, which he joined in October 2021, and of the board of directors, audit committee and nomination and governance committee of Harpoon Therapeutics since August 2018. Mr. Myers previously served on the board of directors of Cascadian Therapeutics from 2016 through 2018 and on the board of directors of Trillium Therapeutics Inc. from April 2021 until its acquisition by Pfizer Inc. in November 2021. Mr. Myers’ experience as a senior executive of life sciences companies and knowledge of the pharmaceutical and biotechnology industries contributed to our Board’s conclusion that he should serve as a director of our Company.

| TIMOTHY A. SPRINGER, PH.D. | Age | 74 | |||||||||

Timothy A. Springer, Ph.D. has served as a member of our Board since June 2016 and as a scientific advisor to us since December 2008. Since 1989, Dr. Springer has served as the Latham Family Professor at Harvard Medical School. He has also served as Senior Investigator in the Program in Cellular and Molecular Medicine at Boston Children’s Hospital since 2012, and as Professor of Biological Chemistry and Molecular Pharmacology at Harvard Medical School and Professor of Medicine at Boston Children’s Hospital since 2011. Dr. Springer was the Founder of LeukoSite, a biotechnology company acquired by Millennium Pharmaceuticals in 1999. Additionally, he is a founder, investor and board member of Scholar Rock and has served on the board of directors of Morphic Holding Inc. since July 2016. Dr. Springer is a member of the National Academy of Sciences and his honors include the Crafoord Prize, the American Association of Immunologists Meritorious Career Award, the Stratton Medal from the American Society of Hematology, and the Basic Research Prize from the American Heart Association. Dr. Springer received a B.A. from the University of California, Berkeley, and a Ph.D. from Harvard University. Dr. Springer’s extensive knowledge of our business and the nanomedicine field contributed to our Board’s conclusion that he should serve as a director of our company.

| PATRICK ZENNER | Age | 75 | |||||||||

Patrick Zenner has served as a member of our Board since June 2017, also serving as our Lead Director from June 2018 to November 2019. Mr. Zenner retired in 2001 from the position of President and Chief Executive Officer of Hoffmann-La Roche Inc., North America, based in Nutley, N.J. Mr. Zenner held various executive positions during his 32-year career with the company. Mr. Zenner is currently a member of the board of trustees of Creighton University and is Chairman of the board of trustees of Fairleigh Dickinson University. In addition, Mr. Zenner is Chairman of the board and a director of West Pharmaceutical Services, Inc. From 2002 until January 2020, Mr. Zenner served as Chairman of the board and a director of ArQule, Inc. Until its sale in 2012, Mr. Zenner was a director of Par Pharmaceuticals, Inc. In 2010, he resigned from the boards of Geron Corporation, Xoma Ltd. and Exact Sciences, Inc. Until its sale in September 2009, Mr. Zenner was a director of CuraGen Corporation. Mr. Zenner received a B.S./B.A. from Creighton University and an M.B.A. from Fairleigh Dickinson University. Mr. Zenner’s extensive experience as a senior pharmaceutical executive and board member to numerous companies in the biotechnology industry contributed to our Board’s conclusion that he should serve as a director of our company.

10

Class II Directors (Terms Expire at 2024 Annual Meeting of Stockholders)

The current members of the Board who are Class II Directors are as follows:

| Name | Age | Served as a Director Since | Position(s) with Selecta | |||||||||||||||||

| Göran Ando, M.D. | 73 | 2020 | Director | |||||||||||||||||

| Carrie S. Cox | 64 | 2019 | Chairman of the Board | |||||||||||||||||

| Aymeric Sallin | 48 | 2008 | Director | |||||||||||||||||

The principal occupations and business experience, for at least the past five years, of each Class II Director are as follows:

| GÖRAN ANDO, M.D. | Age | 73 | |||||||||

Göran Ando, M.D. has served as a member of our Board since April 2020. Dr. Ando has also served as Chairman of the board of directors of EyePoint Pharmaceuticals, Inc., a public pharmaceutical company, since September 2018, and served as Vice-Chairman of the board of directors of Molecular Partners AG, a clinical-stage biopharmaceutical company, from April 2011 to May 2020. In March 2018, he retired as Chairman of Novo Nordisk A/S, a multinational pharmaceutical company, a position he had held since 2013, after serving as Vice Chair of the board of directors since 2006, and serving on the board of directors since 2005. Dr. Ando previously served as the Chief Executive Officer of Celltech Group plc. from 2003 to 2005. Before that, he served as Executive Vice President and Deputy Chief Executive Officer of Pharmacia AB until its acquisition by Pfizer, Inc. in 2003. Prior to Pharmacia, he held various senior appointments at Glaxo, now GlaxoSmithKline plc, including Research and Development Director for Glaxo Group Research. He has also been a Senior Advisor at EW Healthcare Partners since 2007. Dr. Ando received his Bachelor of Arts degree from Uppsala University in Sweden and Doctor of Medicine degree from Linköping University in Sweden. Dr. Ando’s extensive experience as an executive officer and director in the life sciences industry and knowledge of manufacturing, information technology, business development and commercialization contributed to our Board’s conclusion that he should serve as a director of our Company.

| CARRIE S. COX | Age | 64 | |||||||||

Carrie S. Cox has served as a member of our Board and as chairman of the Board since November 2019. Ms. Cox has also served as a member of the board of directors of Organon & Co. since June 2021. Ms. Cox most recently served as the Chief Executive Officer of Humacyte, Inc., a regenerative medicine company based in Durham, North Carolina, from 2010 to June 2018, and served as a member of its board of directors from 2010 to August 2021, serving as chairman from 2011 to June 2019. Ms. Cox has served on the boards of directors of Texas Instruments Incorporated since 2004 and Cardinal Health, Inc. since 2009. Ms. Cox previously served as the chairman of the board of directors of electroCore, Inc. from July 2018 to March 2020 and Array BioPharma, Inc. from August 2018 to July 2019, and served on the board of directors of Celgene Corporation from December 2009 to November 2019. Ms. Cox received a B.S. from the Massachusetts College of Pharmacy and was a registered pharmacist. The Company believes Ms. Cox’s vast experience as a pharmaceutical executive and member of multiple boards of directors in the biotechnology industry as well as her knowledge of corporate strategy contributed to our Board’s conclusion that she should serve as a director of our Company.

| AYMERIC SALLIN | Age | 48 | |||||||||

Aymeric Sallin, M.S. has served as a member of our Board since 2008. Mr. Sallin has served as the Chief Executive Officer of NanoDimension, a venture capital firm, since 2002 and is the founder of that firm. Since 2014, Mr. Sallin has served as a strategic advisory board member of the École Polytechnique Fédérale de Lausanne, or EPFL. Since 2002, Mr. Sallin has worked to promote nanotechnology around the world, and has received the NSTI Fellow Award and 2012 EPFL Alumni award for his contribution to the field of nanotechnology. He currently serves as a board member of numerous private companies, including H55, Inc., Natron Energy, and Tarveda Therapeutics. Mr. Sallin is also a member of the Swiss Academy of Engineering Science. Mr. Sallin received his Master’s in Physical Engineering from EPFL in Lausanne, Switzerland. Mr. Sallin’s extensive knowledge of our business and the nanomedicine field contributed to our Board’s conclusion that he should serve as a director of our Company.

11

PROPOSAL 2 - Non-Binding, Advisory Approval of Compensation of Named Executive Officers

We are providing our stockholders with the opportunity to cast a non-binding, advisory vote regarding the compensation of our named executive officers.

As more fully described in the sections of this proxy statement entitled “Executive and Director Compensation ⸻ Executive Compensation” and “Compensation Discussion and Analysis” and related compensation tables, our executive compensation program is designed to attract, retain, and motivate talented individuals with executive expertise in the biotechnology and life sciences industries and leadership skills necessary for us to fulfill our mission to develop tolerogenic therapies to improve the lives of patients who suffer from serious and debilitating diseases.

The following proposal gives our stockholders the opportunity to endorse or not to endorse the compensation paid to our named executive officers. The vote is not intended to address any specific item of compensation or the compensation of any particular named executive officer, but rather the overall compensation of our named executive officers and our compensation philosophy, policies and practices as discussed in this proxy statement.

Before voting, we recommend you read the sections of this proxy statement entitled “Executive and Director Compensation ⸻ Executive Compensation” and “Compensation Discussion and Analysis” for additional details on our executive compensation programs and philosophy.

This vote is advisory, and therefore not binding on us, the Board or the Compensation Committee of the Board (the “Compensation Committee”). However, our Board and Compensation Committee value the opinions of our stockholders and intend to take into account the outcome of the vote when considering future compensation decisions for our named executive officers.

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board

The Board unanimously recommends a vote “FOR” approval, on a non-binding, advisory basis, of the compensation of our named executive officers.

12

PROPOSAL 3 - Advisory Vote on the Frequency of Solicitation of Non-Binding, Advisory Approval of Compensation of Named Executive Officers

We are asking stockholders to indicate their preference on the frequency of an advisory vote on the compensation of our named executive officers. Stockholders may vote in favor of a frequency of such vote of every year, every two years, or every three years.

The Board believes that an annual advisory vote on the compensation of our named executive officers will provide the most timely feedback regarding our executive compensation practices. While the Board believes that its recommendation is appropriate at this time, the vote is being conducted on an advisory basis and the option among those choices that receives the highest number of votes will be deemed to be the frequency preferred by the stockholders but will not be binding upon our Company.

Vote Required

This proposal requires the approval of a plurality of the votes cast. This means that the option receiving the highest number of affirmative “FOR” votes will be deemed to be the advisory approval of the stockholders. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board

The Board unanimously recommends a vote “FOR,” on a non-binding, advisory basis, a frequency of one year.

13

PROPOSAL 4 - Amendment to Restated Certificate of Incorporation to Increase the Number of Authorized Shares of our Common Stock, $0.0001 par value per share, from 200,000,000 to 350,000,000

Stockholders are being asked to approve an amendment to our Restated Certificate of Incorporation (our “Charter”) to increase the number of authorized shares of Common Stock from 200,000,000 shares to 350,000,000 shares (the “Charter Amendment”). On April 21, 2022, the Board approved the Charter Amendment, subject to stockholder approval, and directed that the Charter Amendment be submitted to a vote of our stockholders at this Annual Meeting.

Our Charter currently authorizes us to issue a total of 200,000,000 shares of Common Stock. As of the close of business on the record date of April 18, 2022, 151,809,416 shares of Common Stock were outstanding. In addition, as of the close of business on April 18, 2022, we had:

•15,195,118 shares of Common Stock issuable upon exercise of stock options outstanding at a weighted-average exercise price of $3.83 per share;

•1,117,308 shares of Common Stock issuable upon vesting of restricted stock units outstanding;

•31,307,409 shares of Common Stock issuable upon the exercise of warrants outstanding at a weighted-average exercise price of $1.57 per share;

•1,893,210 shares of Common Stock reserved for future issuance under our 2016 Incentive Award Plan;

•1,591,661 shares of Common Stock reserved for future issuance under our 2018 Employment Inducement Incentive Award Plan; and

•3,677,538 shares of Common Stock reserved for future issuance under our 2016 Employee Stock Purchase Plan.

Accordingly, as of April 18, 2022, we had only 570,749 shares of Common Stock available for all other purposes. The Charter also authorizes the issuance of 10,000,000 shares of preferred stock, with no shares of preferred stock issued and outstanding as of April 18, 2022. The Charter Amendment will not increase or otherwise affect the Company’s authorized preferred stock or otherwise affect any other provisions of the Charter.

Purpose of the Charter Amendment

The Board believes it is in the best interest of our Company to increase the number of authorized shares of Common Stock in order to give us greater flexibility in conducting our ongoing business operations.

Possible Effects of the Charter Amendment and Additional Anti-takeover Considerations

If the Charter Amendment is approved, the additional unauthorized shares of Common Stock would be available for issuance at the discretion of the Board and without further stockholder approval, except as may be required by law or the rules of the Nasdaq Stock Market LLC (“Nasdaq”). The additional shares of authorized Common Stock would have the same rights and privileges as the shares of Common Stock currently issued and outstanding. The adoption of the Charter Amendment would not have any immediate dilutive effect on the proportionate voting power or other rights of existing stockholders. Shares of Common Stock issued otherwise than for a stock split may decrease existing stockholders’ percentage equity ownership and, depending on the price at which they are issued, could be dilutive to the voting rights of existing stockholders and have a negative effect on the market price of the Common Stock. The Common Stock carries no preemptive rights to purchase additional shares of Common Stock.

We have not proposed the increase in the number of authorized shares of Common Stock with the intention of using the additional authorized shares for anti-takeover purposes, but we would be able to use the additional shares to oppose a hostile takeover attempt or delay or prevent changes in control or management of our Company. For example, without further stockholder approval, the Board could issue and sell shares of Common Stock in a private transaction to purchasers who would oppose a takeover or favor the current Board. Although this proposal to increase the authorized number of shares of Common Stock has been prompted by business and financial considerations and not by the threat of any known or threatened hostile takeover attempt, stockholders should be aware that approval of this proposal could facilitate future efforts by the Company to oppose changes in control of the Company and perpetuate the Company’s existing management, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices.

If our stockholders approve the Charter Amendment, the Board will have authority to file with the Secretary of State of Delaware the Charter Amendment. The Charter Amendment will become effective on the date it is filed. The Board reserves the right to abandon or delay the filing of the Charter Amendment even if it is approved by our stockholders.

None of Delaware law, the Charter, nor the Company’s Amended and Restated Bylaws provide for appraisal or other similar rights for dissenting stockholders in connection with this proposal. Accordingly, our stockholders will have no right to dissent and obtain payment for their shares.

14

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of shares outstanding and entitled to vote. Abstentions and broker non-votes will have the same effect as votes “AGAINST” this proposal. The Company expects that brokers, banks and other nominees will have discretionary authority to vote on this proposal.

Recommendation of the Board

The Board unanimously recommends a vote “FOR” this proposal.

15

PROPOSAL 5 - Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee of our Board (the “Audit Committee”) has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. Our Board has directed that this appointment be submitted to our stockholders for ratification. Although ratification of our appointment of Ernst & Young LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

Ernst & Young LLP also served as our independent registered public accounting firm for the fiscal year ended December 31, 2021. Neither Ernst & Young LLP nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and other services. A representative of Ernst & Young LLP is expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

In the event that the appointment of Ernst & Young LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2023. Even if the appointment of Ernst & Young LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of the Company.

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board

The Board unanimously recommends a vote “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm.

16

Report of the Audit Committee of the Board

The Audit Committee has reviewed the Company’s audited financial statements for the fiscal year ended December 31, 2021 and has discussed these financial statements with management and the Company’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by statement on Auditing Standards No. 1301, as adopted by the Public Company Accounting Oversight Board (“PCAOB”).

The Company’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and the Company, including the disclosures required by the applicable PCAOB requirements regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from Selecta Biosciences, Inc. The Audit Committee also considered whether the independent registered public accounting firm’s provision of certain other non-audit related services to the Company is compatible with maintaining such firm’s independence.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

| THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS OF SELECTA BIOSCIENCES, INC. | |||||

| Timothy C. Barabe (Chair) | |||||

| Carrie S. Cox | |||||

| Nishan de Silva, M.D., M.B.A. | |||||

| Patrick Zenner | |||||

17

Independent Registered Public Accounting Firm Fees and Other Matters

The following table summarizes the fees of Ernst & Young LLP, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services, tax services and for all other services:

| Fee Category | 2021 | 2020 | ||||||||||||

Audit Fees(1) | $ | 1,005,344 | $ | 1,067,199 | ||||||||||

Tax Fees(2) | 27,500 | 88,200 | ||||||||||||

All Other Fees(3) | 4,870 | 1,985 | ||||||||||||

| Total Fees | $ | 1,037,714 | $ | 1,157,384 | ||||||||||

(1)Audit fees consist of fees billed for the audit of our annual consolidated financial statements, the review of the interim consolidated financial statements, and related services that are normally provided in connection with registration statements. For 2020, audit fees also include services related to the Swedish Orphan Biovitrum AB agreement and debt restructuring.

(2)Tax fees consist of fees for professional services, including tax consulting and compliance performed by Ernst & Young LLP. For 2020, tax fees also include services related to the Swedish Orphan Biovitrum AB agreement and debt restructuring.

(3)All other fees are those associated with services not captured in the other categories, including the utilization of a research tool provided by Ernst & Young LLP.

Audit Committee Pre-Approval Policy And Procedures

The Audit Committee has adopted a policy (the “Pre-Approval Policy”) which sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by the independent auditor may be pre-approved. The Pre-Approval Policy generally provides that we will not engage Ernst & Young LLP to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by Ernst & Young LLP has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre-approvals. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence. The Audit Committee will also consider whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company’s business, people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality. All such factors will be considered as a whole, and no one factor should necessarily be determinative. On an annual basis, the Audit Committee reviews and generally pre-approves the services (and related fee levels or budgeted amounts) that may be provided by Ernst & Young LLP without first obtaining specific pre-approval from the Audit Committee. The Audit Committee may revise the list of general pre-approved services from time to time, based on subsequent determinations. All of the services provided by Ernst & Young LLP during 2021 and 2020 were pre-approved.

18

Executive Officers

The following table identifies our current executive officers:

| Name | Age | Position(s) | ||||||||||||

Carsten Brunn, Ph.D. 1 | 51 | President and Chief Executive Officer | ||||||||||||

Kevin Tan 2 | 45 | Chief Financial Officer | ||||||||||||

Lloyd Johnston, Ph.D. 3 | 54 | Chief Operations Officer and Senior Vice President, Research and Development | ||||||||||||

Takashi Kei Kishimoto, Ph.D. 4 | 62 | Chief Scientific Officer | ||||||||||||

Peter G. Traber, M.D. 5 | 67 | Chief Medical Officer | ||||||||||||

1 See biography on page 9 of this proxy statement.

2 Kevin Tan has served as our Chief Financial Officer since September 2021. Prior to joining our Company, Mr. Tan served as Treasurer at Sarepta Therapeutics, Inc., a publicly-traded biotechnology company, from July 2020 to September 2021. Prior to becoming Treasurer, he served as Assistant Treasurer from May 2018 to June 2020. Before joining Sarepta, Mr. Tan worked as a freelance consultant from February 2017 to April 2018, providing independent financial advice and advisory services to individuals and private companies. From June 2012 to November 2016, Mr. Tan served as Senior Portfolio Manager – Public Market Investments at CPP Investments (FKA the Canada Pension Plan Investment Board). He has also served in various positions at Macquarie Capital (USA) Inc., Arrowhawk Capital Partners LLC, and Lehman Brothers Inc. (subsequently acquired by Barclays Capital Inc.). Mr. Tan holds a Bachelor of Commerce degree from Queen’s University at Kingston, as well as a Master of Engineering degree from The Graduate School at Princeton University, and a Master of Business Administration degree from the University of Chicago Booth School of Business.

3 Lloyd Johnston, Ph.D. has served as our Chief Operations Officer and Senior Vice President, Research and Development since January 2014. Dr. Johnston served as Selecta’s Senior Vice President of Pharmaceutical Research, Development and Operations from 2011 to 2013 and Vice President of Pharmaceutical Research from July 2008 to 2011. Prior to joining Selecta, Dr. Johnston was Vice President of Operations for Alkermes, Inc. from 2004 to 2008, and served in several roles, including Director of Manufacturing, from 1999 to 2004, with responsibility for process development, scale-up, and clinical manufacturing for pulmonary and sustained release injectable products, as well as leadership of Alkermes’ manufacturing facility in Chelsea, MA. At Alkermes, Dr. Johnston was also a project leader and member of Steering Committees for numerous products through various stages of development from Phase 1 through registration. Dr. Johnston was an original member of Advanced Inhalation Research Inc., or AIR, a private company formed in 1998 and acquired by Alkermes in 1999. Prior to joining AIR, Dr. Johnston was a lecturer in the Department of Chemical Engineering at the University of New South Wales in Sydney, Australia. He received his B.Sc. in Chemical Engineering from Queen’s University in Ontario, Canada, and his M.S. and Ph.D. in Chemical Engineering from MIT.

4 Takashi Kei Kishimoto, Ph.D. has served as our Chief Scientific Officer since June 2011. Prior to joining Selecta, Dr. Kishimoto was Vice President of Discovery Research at Momenta Pharmaceuticals, Inc., where he served in several leadership positions from March 2006 to June 2011 and led a multidisciplinary team in advancing both novel and complex generic products for inflammation, oncology, and cardiovascular disease. He served as Senior Director of Inflammation Research at Millennium Pharmaceuticals, Inc. from 1999 to 2006, where he provided the scientific leadership for four programs in clinical development, and before his time at Millennium Pharmaceuticals, he was the Associate Director of Research at Boehringer Ingelheim Pharmaceuticals. Dr. Kishimoto has published over 60 peer-reviewed articles in scientific journals, including Nature, Science, Cell and the New England Journal of Medicine. Dr. Kishimoto received his B.A. from New College of the University of South Florida and his Ph.D. in Immunology from Harvard University.

5 Peter G. Traber, M.D. has served as our Chief Medical Officer since August 2020. Dr. Traber also serves as a member of the board of directors of Caladrius Biosciences since January 2015. Prior to joining Selecta Biosciences in 2020, from July 2018 to July 2020 Dr. Traber served as a Partner at Alacrita Consulting, providing drug development consulting services and served as the interim Chief Medical Officer (CMO) for Morphic Therapeutic supporting integrin inhibitor drug development. From March 2011 until June 2018, he served as President and Chief Executive Officer of Galectin Therapeutics and from 2010 to March 2011 served as Chief Medical Officer at Galectin Therapeutics, developing drugs for fibrotic liver disease and cancer. Previously, he served as CMO and SVP of Clinical Development and Medical Affairs at GSK, CEO of Baylor College of Medicine, and Chair of Medicine and CEO of the University of Pennsylvania Health System. He received his MD from Wayne State School of Medicine, a BS in Chemical Engineering from the University of Michigan, and a certificate in Medical Leadership from Wharton Business School. He is currently an Adjunct Professor of Medicine at the University of Pennsylvania.

None of our executive officers are related to any other executive officer or to any of our directors.

19

Corporate Governance

General

Our Board has adopted Corporate Governance Guidelines, a Code of Business Conduct and Ethics and charters for the Nominating and Corporate Governance Committee of our Board (the “Nominating and Corporate Governance Committee”), Audit Committee and Compensation Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of the Company. You can access our current committee charters, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics in the “Corporate Governance” section of the “Investors & Media” page of our website located at www.selectabio.com, or by writing to our Secretary at our offices at 65 Grove Street, Watertown, Massachusetts 02472.

Board Composition

Our Board currently consists of nine members: Göran Ando, M.D., Timothy C. Barabe, Carsten Brunn, Ph.D., Carrie S. Cox, Nishan de Silva, M.D., M.B.A., Scott D. Myers, Aymeric Sallin, Timothy Springer, Ph.D. and Patrick Zenner. As set forth in our Restated Certificate of Incorporation, the Board is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed only by resolution of the Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock entitled to vote in the election of directors.

Director Independence

All of our directors and Class III director nominees, other than Carsten Brunn, Ph.D., qualify as “independent” in accordance with the listing requirements of Nasdaq. The Nasdaq independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his family members has engaged in various types of business dealings with us. In addition, as required by Nasdaq rules, our Board has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our Board reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management, including that Dr. Springer is affiliated with one of our significant stockholders. Dr. Brunn is not independent because he is the President and Chief Executive Officer of Selecta. There are no family relationships among any of our directors or executive officers.

Director Candidates

The Nominating and Corporate Governance Committee is primarily responsible for searching for qualified director candidates for election to the Board and filling vacancies on the Board. To facilitate the search process, the Nominating and Corporate Governance Committee may solicit current directors and executives of the Company for the names of potentially qualified candidates or ask directors and executives to pursue their own business contacts for the names of potentially qualified candidates. The Nominating and Corporate Governance Committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates, or consider director candidates recommended by our stockholders. Once potential candidates are identified, the Nominating and Corporate Governance Committee reviews the backgrounds of those candidates, evaluates candidates’ independence from the Company and potential conflicts of interest and determines if candidates meet the qualifications desired by the Nominating and Corporate Governance Committee of candidates for election as a director.