Form DEFM14A Nightstar Therapeutics

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under Rule 14a-12 | |

NIGHTSTAR THERAPEUTICS PLC

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☒ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. THIS DOCUMENT CONTAINS A PROPOSAL WHICH, IF IMPLEMENTED, WILL RESULT IN THE CANCELLATION OF THE LISTING OF NIGHTSTAR THERAPEUTICS PLC’S ADSs ON THE NASDAQ GLOBAL SELECT MARKET. PART II (EXPLANATORY STATEMENT) OF THIS DOCUMENT COMPRISES AN EXPLANATORY STATEMENT IN COMPLIANCE WITH SECTION 897 OF THE COMPANIES ACT 2006.

If you are in any doubt as to the action you should take, you should consult your stockbroker, bank manager, attorney, solicitor, accountant or other independent professional adviser who, if you are taking advice in the United Kingdom, is authorised pursuant to the Financial Services and Markets Act 2000 or, if you are in a territory outside the United Kingdom, is an appropriately authorised independent financial adviser.

If you sell, or have sold or otherwise transferred all of your Nightstar Shares or Nightstar ADSs, please send this document (but not any accompanying personalised documents) at once to the purchaser or transferee, or to the bank, stockbroker or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee. If you have sold or otherwise transferred part of your holding of Nightstar Shares or Nightstar ADSs, please consult the bank, stockbroker or other agent through whom the sale or transfer was effected.

The distribution of this document in jurisdictions other than the United Kingdom and United States may be restricted by the laws of those jurisdictions, and therefore persons into whose possession this document and any accompanying documents come should inform themselves about, and observe, any such restrictions. Any failure to comply with those restrictions may constitute a violation of the securities laws of any such jurisdiction.

The accompanying Forms of Proxy and ADS Voting Instruction Card are personalised. If you have recently purchased or been transferred Nightstar Shares or Nightstar ADSs, you should contact Nightstar’s registrars, Computershare, on the telephone number set out on page xvii of this document to obtain replacements for these documents.

Recommended acquisition of

NIGHTSTAR THERAPEUTICS PLC

by

TUNGSTEN BIDCO LIMITED

A WHOLLY-OWNED SUBSIDIARY OF

BIOGEN SWITZERLAND HOLDINGS GMBH

to be effected by means of a

scheme of arrangement under Part 26 of

the Companies Act 2006

Nightstar Shareholders and Nightstar ADS Holders should read carefully the whole of this document and the accompanying Forms of Proxy (or, if applicable, the ADS Voting Instruction Card). Your attention is drawn to the letter from the Chairman of Nightstar in Part I (Letter from the Chairman of Nightstar Therapeutics plc) of this document, which contains the unanimous recommendation of the Nightstar Directors that you vote in favour of the Scheme at the Court Meeting and in favour of the Resolutions to be proposed at the General Meeting. An explanatory statement explaining the Scheme in greater detail is set out in Part II (Explanatory Statement) of this document.

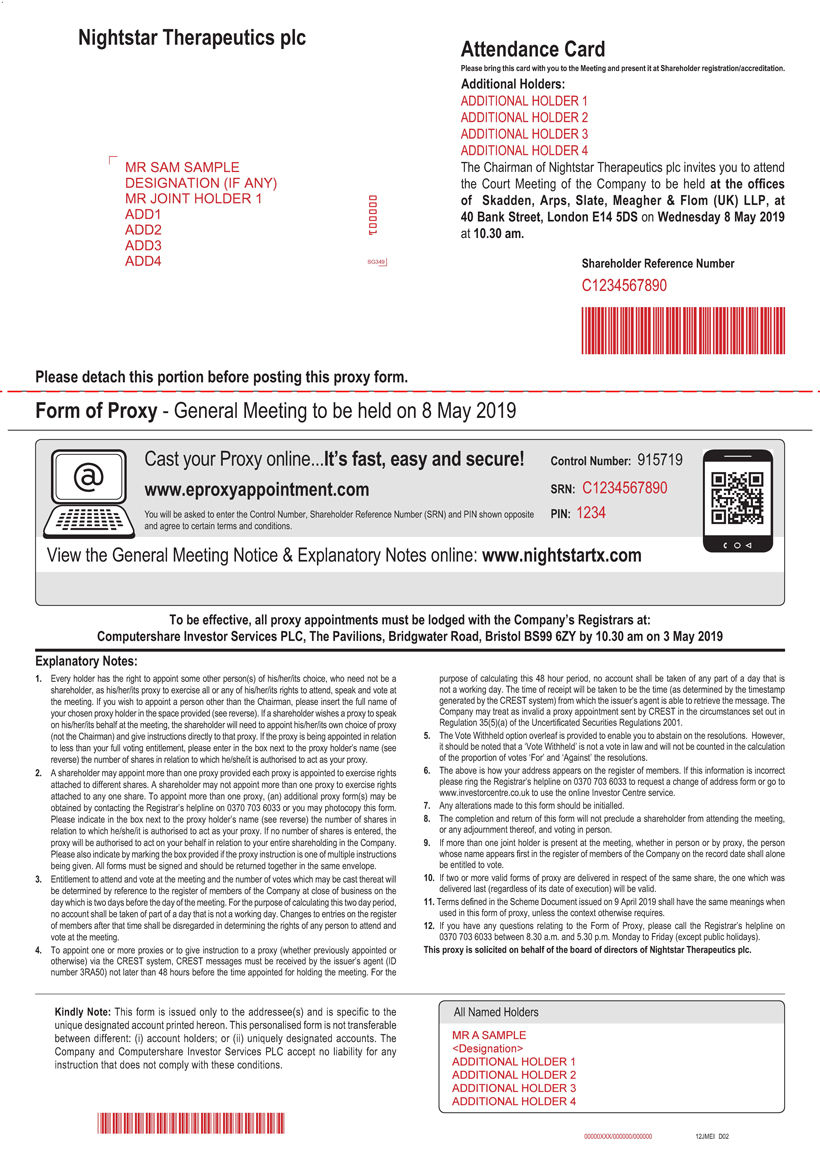

Notices of the Court Meeting and the General Meeting, both of which are to be held at the offices of Nightstar’s solicitors, Skadden, at 40 Bank Street, London E14 5DS on 8 May 2019, are set out at the beginning of this document. The General Meeting will start at 10.30 a.m. and the Court Meeting will start at 10.40 a.m. (or as soon thereafter as the General Meeting has been concluded or adjourned).

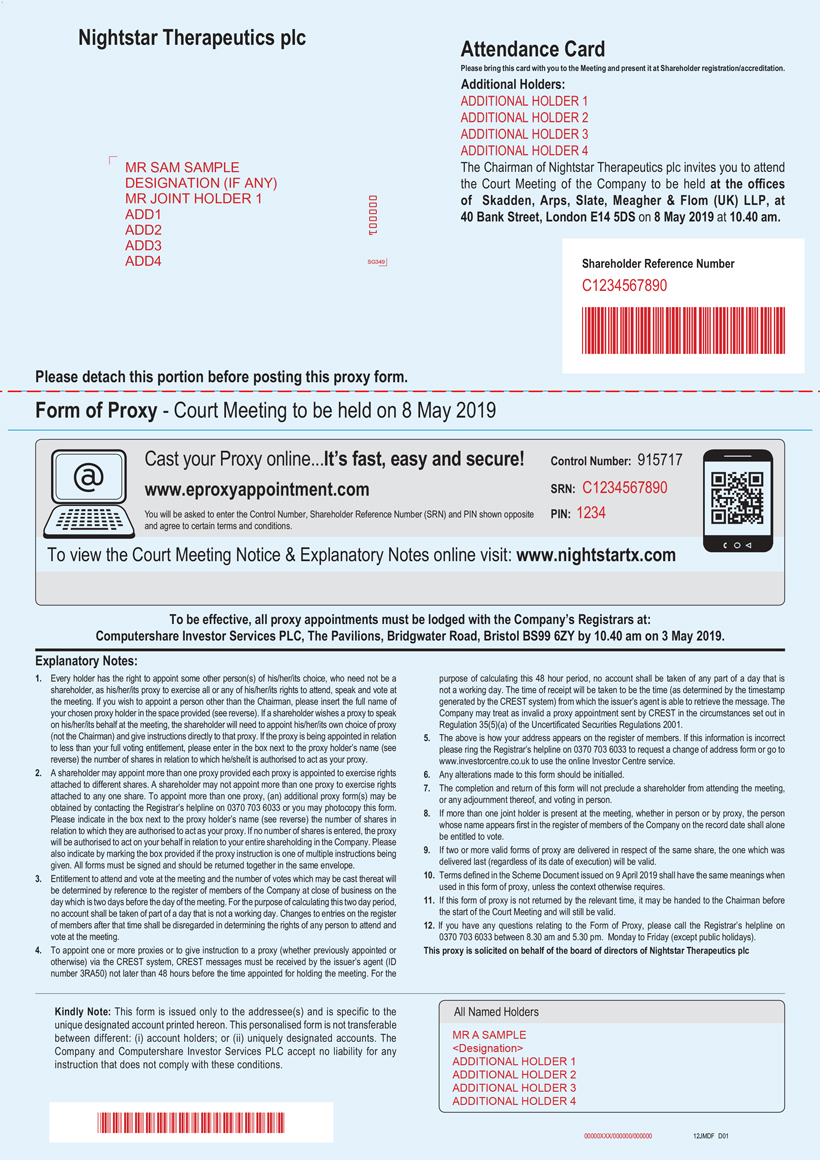

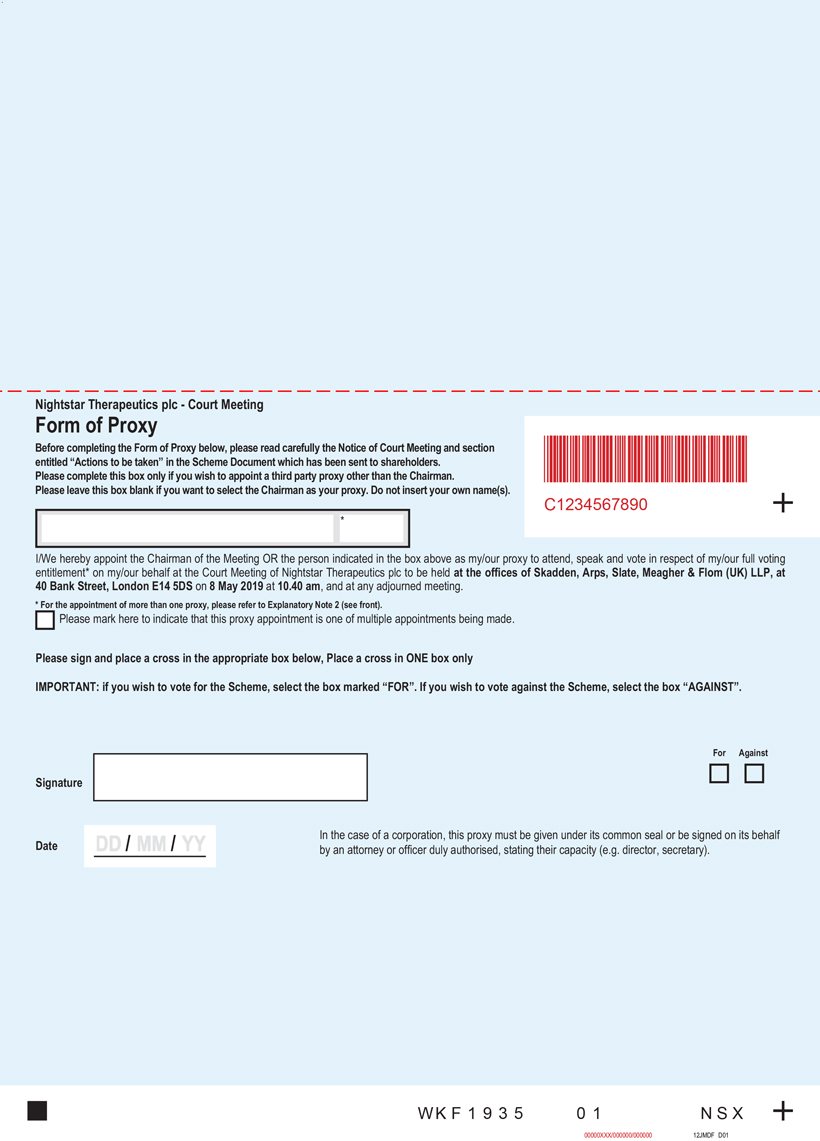

The action to be taken by Nightstar Shareholders in respect of the Court Meeting and General Meeting is set out on pages xviii and xix. Whether or not you intend to be present at the Court Meeting and/or the General Meeting, please complete and sign both Forms of Proxy accompanying this document, BLUE for the Court Meeting and WHITE for the General Meeting, in accordance with the instructions set out on pages vi to viii of this document (Notice of Court Meeting) and pages ix to xiii of this document (Notice of General Meeting) of this document and return them using the prepaid envelope provided to Nightstar’s registrars, Computershare, as soon as possible, and in any event so as to be received by Computershare at The Pavilions, Bridgwater Road, Bristol, BS13 8AE, United Kingdom not later than 10.30 a.m. on 3 May 2019 in the case of the General Meeting and not later than 10.40 a.m. on 3 May 2019 in the case of the Court Meeting or, in the case of any adjournment, not later than 48 hours (excluding any part of a day that is not a Business Day) before the time fixed for the holding of the adjourned meeting. Alternatively, the Form of Proxy for the Court Meeting (but not the General Meeting) may be handed to the Chairman of the Court Meeting at the commencement of that meeting. Forms of Proxy returned by fax will not be accepted. You can also lodge your proxy vote online at www.eproxyappointment.com, so as to be received not later than 48 hours before the relevant meeting. The return of a completed Form of Proxy, the electronic appointment of a proxy or the submission of a proxy via CREST will not prevent you from attending the Court Meeting and/or the General Meeting, or any adjournment thereof, and voting in person if you so wish and if you are entitled to do so.

Registered Nightstar ADS Holders are asked to complete and return their ADS Voting Instruction Cards in accordance with the instructions on the ADS Voting Instruction Card as soon as possible. If you hold such Nightstar ADSs indirectly, you must rely on the procedures of the broker, bank or other nominee through which you hold your Nightstar ADSs.

This document is dated 9 April 2019 and is first being mailed to Nightstar Shareholders on or about 9 April 2019.

Table of Contents

If you hold your Nightstar Shares in uncertificated form through CREST, you may vote using the CREST Proxy Voting Service in accordance with the procedures set out in the CREST Manual (please also refer to the accompanying notes to the notice of the General Meeting set out at the end of this document). Proxies submitted via CREST (under CREST participant ID 3RA50) must be received by Computershare not later than 10.30 a.m. on 3 May 2019 in the case of the General Meeting and not later than 10.40 a.m. on 3 May 2019 in the case of the Court Meeting or, in the case of any adjournment, not later than 48 hours (excluding any part of a day that is not a Business Day) before the time fixed for the holding of the adjourned meeting.

Capitalised words and phrases used in this document shall have the meanings given to them in Part VII (Definitions).

Centerview UK, which is authorised and regulated by the FCA, and Centerview are acting exclusively for Nightstar and no one else in connection with the matters referred to in this document. Centerview UK and Centerview are not and will not be responsible to anyone other than Nightstar for providing the protections afforded to its clients or for providing advice in connection with the contents of this document or any matter referred to in this document.

Goldman Sachs International, which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom, is acting exclusively for Bidder and no one else in connection with the matters referred to in this document and will not be responsible to anyone other than Bidder for providing the protections afforded to clients of Goldman Sachs International or for providing advice in connection with the matters referred to in this document.

IMPORTANT NOTICE

This document has been prepared for the purposes of complying with English law and U.S. securities law and the information disclosed herein may not be the same as that which would have been disclosed if this document had been prepared in accordance with the laws of any other jurisdiction.

The distribution of this document in jurisdictions other than the United Kingdom and the United States may be restricted by law, and therefore, persons into whose possession this document comes should inform themselves about, and should observe, such restrictions. Any failure to comply with the restrictions may constitute a violation of the securities laws of any such jurisdiction. This document does not constitute an offer or an invitation to purchase or subscribe for any securities, or a solicitation of an offer to buy any securities, pursuant to the document or otherwise, in any jurisdiction in which such offer or solicitation is unlawful.

The statements contained herein are made as at the date of this document, unless some other time is specified in relation to them, and service of this document shall not give rise to any implication that there has been no change in the facts set forth herein since such date. Nothing contained in this document shall be deemed to be a forecast and service of this document shall not give rise to any implication that there has been no change in the facts set out in this document since such date. Nothing contained in this document shall be deemed to be a forecast, projection or estimate of the future financial performance of Nightstar or Bidder except where otherwise expressly stated. Neither Nightstar nor Bidco nor Bidder intends, or undertakes any obligation, to update information contained in this document, except as required by applicable law.

No person has been authorised to make any representations on behalf of Nightstar, the Nightstar Group, Bidco, Bidder or the Bidder Group concerning the Acquisition or the Scheme which are inconsistent with the statements contained in this document and any such representations, if made, may not be relied upon as having been authorised.

-ii-

Table of Contents

WARNING REGARDING FORWARD-LOOKING STATEMENTS

All statements included in this document, other than statements or characterisations of historical fact, are forward-looking statements within the meaning of the federal securities laws, including Section 21E of the U.S. Exchange Act, and other securities laws. Whenever Nightstar uses words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “will,” “may,” “predict,” “could,” “seek,” “forecast” and negatives or derivatives of these or similar expressions, they are making forward-looking statements. Examples of such forward-looking statements include, but are not limited to, references to the anticipated benefits of the Acquisition and the expected time of effectiveness of the Acquisition. These forward-looking statements are based upon Nightstar’s present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur.

Nightstar Shareholders are cautioned that any forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements. Important risk factors that may cause Nightstar’s actual results to differ materially from their forward-looking statements include, but are not limited to: (1) the Acquisition is subject to the satisfaction or waiver of certain conditions, including the receipt of requisite approvals by Nightstar Shareholders, the sanction of the Scheme by the Court, and the expiration or termination of any applicable waiting periods under the U.S. HSR Act, which conditions may not be satisfied or waived; (2) uncertainties as to the timing of the consummation of the Acquisition and the ability of each party to consummate the Acquisition; (3) the risk that the Acquisition disrupts the parties’ current operations or affects their ability to retain or recruit key employees; (4) the possible diversion of management time on Acquisition-related issues; (5) litigation relating to the Acquisition; (6) unexpected costs, charges or expenses resulting from the Acquisition; and (7) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Acquisition.

The information contained in Nightstar’s filings with the SEC, including in Nightstar’s Form 10-K for the year ended 31 December 2018, identifies other important factors that could cause actual results to differ materially from those stated in or implied by the forward-looking statements in this document. Nightstar’s filings with the SEC are available on the SEC’s website at www.sec.gov. You should not place undue reliance upon forward-looking statements. Except as required by law, Nightstar does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.

INFORMATION FOR OVERSEAS SHAREHOLDERS

The release, publication or distribution of this document in jurisdictions other than the United Kingdom and the United States may be restricted by law and therefore any persons who are subject to the laws of any jurisdiction other than the United Kingdom or the United States (including Restricted Jurisdictions) should inform themselves about, and observe, any applicable legal or regulatory requirements. In particular, the ability of persons who are not resident in the United Kingdom or the United States or who are subject to the laws of another jurisdiction to vote their Nightstar Scheme Shares in respect of the Scheme at the Court Meeting, or to execute and deliver Forms of Proxy appointing another to vote at the Court Meeting on their behalf, may be affected by the laws of the relevant jurisdictions in which they are located or to which they are subject. Any failure to comply with applicable legal or regulatory requirements of any jurisdiction may constitute a violation of securities laws in that jurisdiction. This document has been prepared for the purpose of complying with English law and U.S. proxy rules and the information disclosed may not be the same as that which would have been disclosed if this document had been prepared in accordance with the laws of jurisdictions outside the United Kingdom and the United States.

Copies of this document and any formal documentation relating to the Acquisition are not being, and must not be, directly or indirectly, mailed or otherwise forwarded, distributed or sent in or into or from any Restricted

-iii-

Table of Contents

Jurisdiction or any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction and persons receiving such documents (including custodians, nominees and trustees) must not mail or otherwise forward, distribute or send them in or into or from any Restricted Jurisdiction. Doing so may render invalid any related purported vote in respect of the Acquisition.

If the Acquisition is implemented by way of an Offer, the Offer may not (unless otherwise permitted by applicable law and regulation) be made, directly or indirectly, in or into or by use of the mails or any other means or instrumentality (including, without limitation, facsimile, e-mail or other electronic transmission, telex or telephone) of interstate or foreign commerce of, or any facility of a national, state or other securities exchange of any Restricted Jurisdiction and the Acquisition will not be capable of acceptance by any such use, means, instrumentality or facilities or from within any Restricted Jurisdiction.

NOTICE TO UNITED STATES NIGHTSTAR SHAREHOLDERS

The Acquisition relates to the shares of a U.K. company and is being made by means of a scheme of arrangement provided for under Part 26 of the Companies Act 2006. The Acquisition is to be implemented by way of a scheme of arrangement. If, in the future, Bidder or Bidco exercises its right to implement the Acquisition by way of an Offer, subject to the terms of the Implementation Agreement, and determines to extend the Offer into the U.S., the Acquisition will be made in compliance with applicable U.S. laws and regulations.

It may be difficult for U.S. Nightstar Shareholders and Nightstar ADS Holders to enforce their rights and any claim arising out of the U.S. federal securities laws, because Nightstar is located outside of the U.S., and some or all of its officers and directors are residents of countries outside of the U.S. U.S. Nightstar Shareholders and Nightstar ADS Holders may not be able to sue a non-U.S. company or its officers or directors in a non-U.S. court for violations of the U.S. securities laws. Further, it may be difficult to compel a non-U.S. company and its affiliates to subject themselves to a U.S. court’s judgment.

U.S. Nightstar Shareholders and Nightstar ADS Holders also should be aware that the transaction contemplated herein may have tax consequences in the U.S. A summary of certain United Kingdom and United States taxation consequences of the implementation of the Scheme for certain Nightstar Shareholders and Nightstar ADS Holders is set out in paragraph 6 of Part V (Additional Information) of this document. U.S. Nightstar Shareholders and Nightstar ADS Holders are urged to consult with legal, tax and financial advisers in connection with making a decision regarding this transaction.

PUBLICATION ON WEBSITE

A copy of this document, together with all information incorporated into this document by reference to another source, will be made available, subject to certain restrictions relating to persons resident in, or subject to the laws and/or regulations, of any Restricted Jurisdiction or resident in any jurisdiction where the extension or availability of the Acquisition would breach any applicable law, on Nightstar’s website, at https://ir.nightstartx.com, on the date following publication of this document. For the avoidance of doubt, neither the contents of such website nor the contents of any website accessible from hyperlinks on such website (or any other websites referred to in this document) are incorporated into, or form part of, this document.

ROUNDING

Certain figures included in this document have been subjected to rounding adjustments. Accordingly, figures shown for the same category presented in different tables may vary slightly and figures shown as totals in certain tables may not be an arithmetical aggregation of the figures that precede them.

-iv-

Table of Contents

It is important that, for the Court Meeting, as many votes as possible are cast so that the Court may be satisfied that there is a fair representation of the opinion of Nightstar Scheme Shareholders. Therefore, whether or not you plan to attend the Nightstar Shareholder Meetings, please complete and sign both the enclosed BLUE and WHITE Forms of Proxy, or deliver your voting instructions by one of the other methods mentioned below, as soon as possible.

Date

This document is published on 9 April 2019.

-v-

Table of Contents

| IN THE HIGH COURT OF JUSTICE BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES COMPANIES COURT (ChD) ICC JUDGE MULLEN |

CR-2019-001978 |

IN THE MATTER OF NIGHTSTAR THERAPEUTICS PLC

and

IN THE MATTER OF THE COMPANIES ACT 2006

NOTICE IS HEREBY GIVEN that by an Order dated 5 April 2019 made in the above matters, the Court has given permission for a meeting (the “Court Meeting”) to be convened of the holders of Nightstar Scheme Shares (as defined in the Scheme of Arrangement hereinafter mentioned) for the purpose of considering and, if thought fit, approving (with or subject to any modification, addition or condition which the Company and Biogen Switzerland Holdings GmbH may agree and which the Court approves) a scheme of arrangement (the “Scheme of Arrangement”) proposed to be made between (i) Nightstar Therapeutics plc, a public limited company incorporated in England and Wales with its registered office at 10 Midford Place, London, W1T 5BJ (the “Company” or “Nightstar”); and (ii) the holders of Nightstar Scheme Shares, and that the Court Meeting will be held at the offices of Nightstar’s solicitors, Skadden, Arps, Slate, Meagher & Flom (UK) LLP, at 40 Bank Street, London E14 5DS on 8 May 2019 at 10.40 a.m. (or as soon thereafter as the General Meeting has been concluded or adjourned) at which place and time all Nightstar Scheme Shareholders (as defined in the Scheme of Arrangement) are requested to attend.

A copy of the Scheme of Arrangement and a copy of the Explanatory Statement required to be furnished pursuant to Part 26 of the Companies Act 2006 are incorporated in the document of which this Notice forms part.

Voting on the resolution to approve the Scheme of Arrangement will be by poll, which shall be conducted as the Chairman of the Court Meeting may determine.

Nightstar Scheme Shareholders entitled to attend and vote at the Court Meeting may vote in person at the Court Meeting or they may appoint another person or persons, whether or not a member of Nightstar, as their proxy or proxies to attend and vote in their stead.

A blue Form of Proxy for use in connection with the Court Meeting is enclosed with this Notice or shall be sent in a separate mailing to those Nightstar Scheme Shareholders who have elected or are deemed to have elected to receive documents and notices from the Company via Nightstar’s website. Nightstar Scheme Shareholders entitled to attend and vote at the meeting, who hold their shares through CREST, may appoint a proxy using the CREST Electronic Proxy Appointment Service.

CREST members who wish to appoint a proxy or proxies through the CREST Electronic Proxy Appointment Service may do so for the Court Meeting and any adjournment(s) thereof by using the procedures described in the CREST Manual.

In order for a proxy appointment or instruction made using the CREST service to be valid, the appropriate CREST message (a “CREST Proxy Instruction”) must be properly authenticated in accordance with the specifications of Euroclear UK & Ireland Limited (“Euroclear”) and must contain the information required for such instructions, as described in the CREST Manual. The message, regardless of whether it relates to the

-vi-

Table of Contents

appointment of a proxy or to an amendment to the instruction given to a previously appointed proxy must, in order to be valid, be transmitted so as to be received by the Company’s registrars, Computershare, (under CREST participant ID 3RA50) by 10.40 a.m. on 3 May 2019 or in the case of any adjournment, not later than 48 hours before the time appointed for the adjourned Court Meeting. For this purpose, the time of receipt will be taken to be the time (as determined by the time stamp applied to the message by the CREST Applications Host) from which Computershare is able to retrieve the message by enquiry to CREST in the manner prescribed by CREST.

Nightstar may treat as invalid a CREST Proxy Instruction in the circumstances set out in Regulation 35(5)(a) of the Uncertificated Securities Regulations 2001.

Completion and return of a blue Form of Proxy will not prevent a Nightstar Scheme Shareholder from attending and voting in person at the Court Meeting or at any adjournment thereof.

In the case of joint holders, the vote of the Nightstar Scheme Shareholder whose name is first listed in the register of members of Nightstar in respect of the joint holding will be accepted to the exclusion of the votes of the other joint holders.

Nightstar Scheme Shareholders are entitled to appoint a proxy in respect of some or all of their shares. Nightstar Scheme Shareholders are also entitled to appoint more than one proxy, provided that each proxy is appointed to exercise the rights attached to a different share or shares held by such Nightstar Scheme Shareholder. A space has been included in the blue Form of Proxy to allow Nightstar Scheme Shareholders to specify the number of shares in respect of which that proxy is appointed. Nightstar Scheme Shareholders who return the blue Form of Proxy duly executed but leave this space blank shall be deemed to have appointed the proxy in respect of all their Nightstar Scheme Shares.

Nightstar Scheme Shareholders who wish to appoint more than one proxy in respect of their shareholding should contact the Company’s registrars, Computershare at The Pavilions, Bridgwater Road, Bristol, BS13 8AE, United Kingdom, for further blue Forms of Proxy, or photocopy the blue Form of Proxy as required. Such Nightstar Scheme Shareholders should also read the information regarding the appointment of multiple proxies set out on page xxi of the document of which this Notice forms part and on the blue Form of Proxy.

As an alternative to appointing a proxy, any Nightstar Scheme Shareholder which is a corporation may appoint one or more corporate representatives who may exercise on its behalf, all of its powers as a member, provided that they do not do so in relation to the same shares. Only one corporate representative is to be counted in determining whether under section 899(1) of the Companies Act 2006 a majority in number of the Nightstar Scheme Shareholders approved the Scheme of Arrangement. The Chairman of the Court Meeting may require a corporate representative to produce to the Company’s registrars, Computershare, his or her written authority to attend and vote at the Court Meeting at any time before the start of the Court Meeting. The representative shall not be entitled to exercise the powers conferred on them by the Nightstar Scheme Shareholder until any such demand has been satisfied.

It is requested that blue Forms of Proxy be returned using the prepaid envelope provided to Computershare at The Pavilions, Bridgwater Road, Bristol, BS13 8AE, United Kingdom by 10.40 a.m. on 3 May 2019 or in the case of any adjournment, not later than 48 hours (excluding any part of a day that is not a working day) before the time appointed for the adjourned Court Meeting, but if blue Forms of Proxy are not so returned they may be handed to the Chairman of the Court Meeting at the commencement of the Court Meeting.

Only those Nightstar Scheme Shareholders registered in the register of members of Nightstar as at 6.00 p.m. on 3 May 2019 or, in the event that the Court Meeting is adjourned, in the register of members at 6.00 p.m. 48 hours (excluding any part of a day that is not a working day) before the day of any adjourned meeting shall be entitled to attend or vote in respect of the number of shares registered in their name at the relevant time. Changes

-vii-

Table of Contents

to entries in the relevant register of members after 6.00 p.m. on 3 May 2019 or, in the event that the Court Meeting is adjourned, after 6.00 p.m. 48 hours (excluding any part of a day that is not a working day) before the day of any adjourned meeting shall be disregarded in determining the rights of any person to attend or vote at the Court Meeting. Nightstar Shareholders who hold their Nightstar Scheme Shares in the name of a broker, bank or other nominee should follow the voting instructions provided by such nominee to ensure that their Nightstar Scheme Shares are represented at the Court Meeting.

By the said order, the Court has appointed Chris Hollowood or, failing him, any other director of the Company to act as Chairman of the Court Meeting and has directed the Chairman to report the result of the Court Meeting to the Court.

The Scheme of Arrangement will be subject to the subsequent approval of the Court.

DATED: 9 April 2019

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

40 Bank Street

London E14 5DS

Solicitors for the Company

-viii-

Table of Contents

NIGHTSTAR THERAPEUTICS PLC

(incorporated in England and Wales with registered number 10852952)

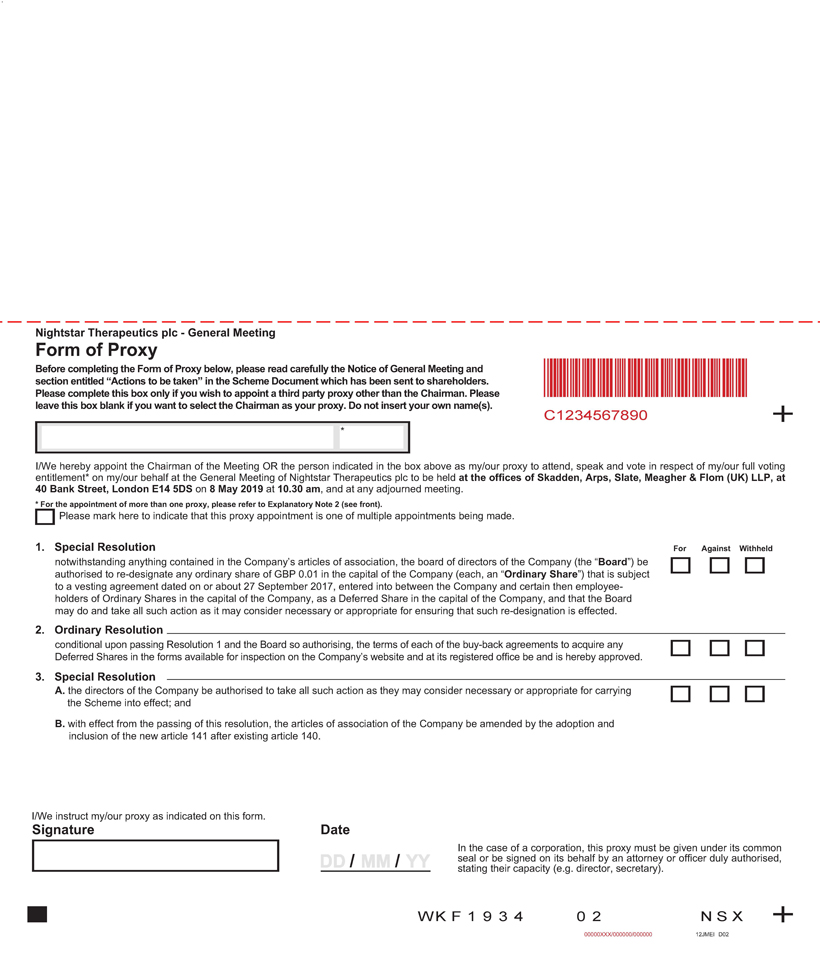

NOTICE IS HEREBY GIVEN that a General Meeting of Nightstar Therapeutics plc, a public limited company incorporated in England and Wales with its registered office at 10 Midford Place, London, W1T 5BJ (the “Company”) will be held at the offices of Nightstar’s solicitors, Skadden, Arps, Slate, Meagher & Flom (UK) LLP, at 40 Bank Street, London E14 5DS on 8 May 2019 at 10.30 a.m. for the purpose of considering and, if thought fit, passing the resolutions set out below, which in the case of Resolutions 1 and 3 will be proposed as a special resolution and Resolution 2 will be proposed as an ordinary resolution.

SPECIAL RESOLUTION

| 1. | THAT: |

notwithstanding anything contained in the Company’s articles of association, the board of directors of the Company (the “Board”) be authorised to re-designate any ordinary share of GBP 0.01 in the capital of the Company (each, an “Ordinary Share”) that is subject to a vesting agreement dated on or about 27 September 2017, entered into between the Company and certain then employee-holders of Ordinary Shares in the capital of the Company, as a Deferred Share in the capital of the Company, and that the Board may do and take all such action as it may consider necessary or appropriate for ensuring that such re-designation is effected.

ORDINARY RESOLUTION

| 2. | THAT: |

conditional upon passing Resolution 1 and the Board so authorising, the terms of each of the buy-back agreements to acquire any Deferred Shares in the forms available for inspection on the Company’s website and at its registered office be and is hereby approved.

SPECIAL RESOLUTION

| 3. | THAT: |

for the purpose of giving effect to the scheme of arrangement dated 9 April 2019 (the “Scheme”) between the Company and the holders of the Nightstar Scheme Shares (as defined in the Scheme), a print of which has been produced to this meeting and for the purposes of identification signed by the Chairman hereof, in its original form or subject to such modification, addition or condition agreed between the Company and Biogen Switzerland Holdings GmbH and approved or imposed by the Court:

| (i) | the directors of the Company be authorised to take all such action as they may consider necessary or appropriate for carrying the Scheme into effect; and |

| (ii) | with effect from the passing of this resolution, the articles of association of the Company be amended by the adoption and inclusion of the following new article 141 after existing article 140: |

| “141. | SCHEME OF ARRANGEMENT |

| 141.1 | In this Article, references to the “Scheme” are to the scheme of arrangement dated 9 April 2019 between the Company and the holders of Nightstar Scheme Shares (as defined in the Scheme) under Part 26 of the Act in its original form or with or subject to any modification, addition or condition agreed by the Company and Biogen Switzerland Holdings GmbH (“Bidder”) (which expression includes any other name which Bidder may adopt from time to time) and which the Court may approve and (save as defined in this Article) expressions defined in the Scheme shall have the same meanings in this Article. |

-ix-

Table of Contents

| 141.2 | Notwithstanding any other provision of these Articles or the terms of any resolution, whether ordinary or special, passed by the Company in general meeting, if the Company issues any ordinary shares (other than to Bidder or Tungsten Bidco Limited, a wholly-owned subsidiary of Bidder (“Bidco”) or any parent undertaking or subsidiary undertaking or nominee of Bidder or Bidco) on or after the adoption of this Article and on or prior to the Scheme Record Time (as defined in the Scheme), such shares shall be issued subject to the terms of the Scheme (and shall be Nightstar Scheme Shares for the purposes thereof) and the original or any subsequent holder or holders of such ordinary shares shall be bound by the Scheme accordingly. |

| 141.3 | Subject to the Scheme becoming Effective, if the Company issues or is obliged to issue any ordinary shares in the Company to any person (a “New Member”) after the Scheme Record Time (other than under the Scheme or to Bidder, Bidco or any parent undertaking or subsidiary undertaking or nominee of Bidder or Bidco) (the “Post-Scheme Shares”), such New Member (or any subsequent holder or any nominee of such New Member or any such subsequent holder) will, provided the Scheme has become Effective, be obliged to transfer all the ordinary shares in the Company held by the New Member (or any subsequent holder or any nominee of such New Member or any such subsequent holder) to Bidco (or as Bidco may direct) who shall be obliged to acquire all of the Post-Scheme Shares. In consideration for the transfer of the Post-Scheme Shares, the purchaser shall pay to the New Member the Consideration for each Post-Scheme Share transferred to it (or such lesser or greater amount as may be payable for Nightstar Scheme Shares under the Scheme if each Post-Scheme Share were a Nightstar Scheme Share), provided that any New Member may, prior to the issue of any Post-Scheme Shares to such New Member pursuant to the exercise of an option or satisfaction of an award under any of the Nightstar Share Schemes, give not less than five Business Days’ written notice to the Company in such manner as the board shall prescribe of their intention to transfer some or all of such Post-Scheme Shares to their spouse or civil partner. Any such New Member may, if such notice has been validly given, on such Post-Scheme Shares being issued to such New Member, immediately transfer to their spouse or civil partner any such Post-Scheme Shares, provided that such Post-Scheme Shares shall then be immediately transferred from that spouse or civil partner to Bidco (or as Bidco may direct) pursuant to this Article as if the spouse or civil partner were a New Member. Where a transfer of Post-Scheme Shares to a New Member’s spouse or civil partner takes place in accordance with this Article, references to “New Member” in this Article shall be taken as referring to the spouse or civil partner of the New Member. If notice has been validly given pursuant to this Article but the New Member does not immediately transfer to their spouse or civil partner the Post-Scheme Shares in respect of which notice was given, such shares shall be transferred directly to Bidco (or as Bidco may direct) pursuant to this Article. |

For the purposes of this Article, “Nightstar Share Schemes” means:

| (i) | the Nightstar Therapeutics plc 2017 Equity Incentive Plan; and |

| (ii) | the terms governing the Pre-IPO Equity Awards, |

each as amended from time to time.

| 141.4 | On any reorganisation of, or material alteration to, the share capital of the Company (including, without limitation, any subdivision and/or consolidation) effected after the Effective Date, the amount of Consideration due to a New Member for each Post-Scheme Share pursuant to Article 141.3 above may be adjusted by the board of the Company and the directors of Bidder in such manner as the auditors of the Company may determine to be appropriate to reflect such reorganisation or alteration. References in this Article to ordinary shares shall, following such adjustment, be construed accordingly. |

| 141.5 | To give effect to any transfer of Post-Scheme Shares, the Company may appoint any person as attorney and agent for the New Member (the “agent”) to transfer the Post-Scheme Shares to Bidco (or as Bidco may direct) and do all such other things and execute and deliver all such documents as may in the opinion of the agent be necessary or desirable to vest the Post-Scheme Shares in Bidco (or another person as directed by Bidco), and pending such vesting to exercise all such rights attaching to the Post-Scheme |

-x-

Table of Contents

| Shares as Bidco may direct. If an agent is so appointed, the New Member shall not thereafter (except to the extent that the agent fails to act in accordance with the directions of Bidco) be entitled to exercise any rights attaching to the Post-Scheme Shares unless so agreed by Bidco. The agent shall be empowered to execute and deliver as transferor a form of transfer or other instrument or instruction of transfer on behalf of the New Member (or any subsequent holder) in favour of Bidco and/or another person as directed by Bidco and the Company may give a good receipt for the Consideration for the Post-Scheme Shares and may register Bidco and/or another person as directed by Bidco as holder thereof and issue to it certificates for the same. The Company shall not be obliged to issue a certificate to the New Member for the Post-Scheme Shares. Bidco shall, subject to Article 141.3 above, settle the Consideration due to the New Member within 14 days of the issue of the Post-Scheme Shares to the New Member. |

| 141.6 | Notwithstanding any other provision of these Articles, neither the Company nor the board shall register the transfer of any Nightstar Scheme Shares effected between the Scheme Record Time and the Effective Date. |

| 141.7 | If the Scheme shall not have become Effective by the date referred to in Clause 5 of the Scheme, this Article 141 shall be of no effect.” |

| Registered Office: Nightstar Therapeutics plc 10 Midford Place London W1T 5BJ |

By order of the Board

Bryan Yoon Group Company Secretary | |

| Dated 9 April 2019 |

Notes

The following notes explain your general rights as a shareholder and your rights to attend and vote at the General Meeting or to appoint someone else to vote on your behalf.

| 1. | Pursuant to Regulation 41 of the Uncertificated Securities Regulations 2001 and section 360B of the Companies Act 2006, the Company specifies that only persons on the register of members as at 6.00 p.m. on 3 May 2019 (or, if the meeting is adjourned, at 6.00 p.m. on the date which is not later than 48 hours (excluding any part of a day that is not a working day) prior to the date set for the adjourned meeting) shall be entitled to attend the General Meeting either in person or by proxy and the number of shares then registered in their respective names shall determine the number of votes such persons are entitled to cast on a poll at the meeting. Changes to entries on the register after that time shall be disregarded in determining the rights of any person to attend or vote at the General Meeting. |

| 2. | A shareholder is entitled to appoint a proxy to exercise all or any of his rights to attend and to speak and vote instead of him at the General Meeting. A white Form of Proxy is enclosed with this notice for use in relation to the General Meeting. A shareholder may appoint more than one proxy in relation to the General Meeting provided that each proxy is appointed to exercise the rights attached to a different share or shares held by him. A proxy need not be a shareholder of the Company. If you do not have a proxy form and believe that you should have one, or if you require additional forms, please contact the Company’s registrars, Computershare. Instructions for use are shown on the white Form of Proxy. Completion and return of a white Form of Proxy, an electronic proxy, or any CREST Proxy Instruction (as described in note 8 below) will not preclude a shareholder from attending the meeting and voting there in person. |

| 3. | The ordinary resolution and special resolutions to be put to the General Meeting will be voted on by way of a poll. |

| 4. | If you have been nominated to receive general shareholder communications directly from the Company, it is important to remember that your main contact in terms of your investment remains the broker, bank or other nominee who administers the investment on your behalf. Therefore, any changes or queries relating to your |

-xi-

Table of Contents

| personal details and holding (including any administration) must continue to be directed to your existing contact at your investment manager or custodian. Nightstar Shareholders who hold their Nightstar Shares in the name of a broker, bank or other nominee should follow the voting instructions provided by such nominee to ensure that their Nightstar Shares are represented at the General Meeting. The Company cannot guarantee dealing with matters that are directed to them in error. The only exception to this is where the Company, in exercising one of its powers under the Companies Act 2006, writes to you directly for a response. |

| 5. | To be valid, the Form of Proxy must be executed by or on behalf of the shareholder or, if the shareholder is a corporate, under its common seal or be signed on its behalf by an attorney or officer duly authorised, stating their capacity (e.g. director or secretary). |

| 6. | If two or more valid, but differing, appointments of proxy are delivered or received in respect of the same share, the one which is last validly delivered or received (regardless of its date or of the date of its execution) shall be treated as replacing and revoking the other or others as regards that share. If the Company is unable to determine which instrument was last validly delivered or received, none of them shall be treated as valid in respect of that share. |

| 7. | The Form of Proxy and power of attorney or other authority, if any, under which it is signed or a notarially certified or copy of such power or authority must be received by the Company’s registrars, Computershare, The Pavilions, Bridgwater Road, Bristol, BS13 8AE, United Kingdom, not later than 10.30 a.m. on 3 May 2019, or if the General Meeting is adjourned, 48 hours (excluding any part of a day that is not a working day) prior to the adjourned meeting. Shareholders may also lodge their proxy vote online at www.eproxyappointment.com. In order for an online proxy vote to be valid it must be received by Computershare not later than 10.30 a.m. on 3 May 2019. Any communication found to contain a computer virus will not be accepted. In order to access the voting system, shareholders will need their shareholder investor code which can be found on their proxy card. Return of the Form of Proxy, submitting an online proxy vote or any CREST Proxy Instruction (as described in note 8 below) will not prevent you from attending and voting at the meeting instead of the proxy, if you wish. If you do this and there is a poll vote, your proxy votes will be ignored. |

| 8. | CREST members who wish to appoint a proxy or proxies by utilising the CREST Electronic Proxy Appointment Service may do so for the meeting and any adjournment(s) thereof by utilising the procedures described in the CREST Manual. CREST personal members or other CREST sponsored members, and those CREST members who have appointed a voting service provider(s), should refer to their CREST sponsor or voting service provider(s), who will be able to take the appropriate action on their behalf. |

In order for a proxy appointment made by means of CREST to be valid, the appropriate CREST message (a CREST Proxy Instruction) must be properly authenticated in accordance with Euroclear UK & Ireland Limited’s specifications and must contain the information required for such instructions, as described in the CREST Manual. The message must be transmitted so as to be received by Computershare (under CREST participant ID 3RA50) not later than 10.30 a.m. on 3 May 2019. For this purpose, the time of receipt will be taken to be the time (as determined by the timestamp applied to the message by the CREST Applications Host) from which Computershare is able to retrieve the message by enquiry to CREST. After this time, any change of instructions to proxies appointed through CREST should be communicated to the appointee through other means.

CREST members and, where applicable, their CREST sponsors or voting service providers should note that Euroclear UK & Ireland Limited does not make available special procedures in CREST for any particular messages. Normal system timings and limitations will therefore apply in relation to the input of CREST Proxy Instructions. It is the responsibility of the CREST member concerned to take (or, if the CREST member is a CREST personal member or sponsored member or has appointed a voting service provider(s), to procure that his CREST sponsor or voting service provider(s) take(s)) such action as shall be necessary to ensure that a message is transmitted by means of the CREST system by any particular time. In this connection, CREST members and, where applicable, their CREST sponsors or voting service providers are

-xii-

Table of Contents

referred, in particular, to those sections of the CREST Manual concerning practical limitations of the CREST system and timings.

The Company may treat as invalid a CREST Proxy Instruction in the circumstances set out in Regulation 35(5)(a) of the Uncertificated Securities Regulations 2001.

| 9. | Any corporation which is a shareholder can appoint one or more corporate representatives who may exercise on its behalf all of its powers as a shareholder, provided that they do not do so in relation to the same shares. |

| 10. | Shareholders attending the meeting have the right to ask questions. The Company has an obligation to answer such questions relating to the business being dealt with at the meeting, but no such answer need be given if: (i) it is undesirable in the interest of the Company or the good order of the meeting; (ii) to do so would unduly interfere with the preparation for the meeting or involve the disclosure of confidential information; or (iii) the answer has already been given on a website in the form of an answer to a question. |

| 11. | The “Vote Withheld” option is provided to enable you to abstain on the specified resolution. However, it should be noted that a “Vote Withheld” is not a vote in law and will not be counted in the calculation of the proportion of votes “For” and “Against” the specified resolution. |

| 12. | In the case of joint holders, the vote of the Shareholder whose name is first listed in the register of members of the Company in respect of the joint holding will be accepted to the exclusion of the votes of the other joint holders. |

| 13. | As at 5 April 2019 (being the last practicable date prior to the publication of this notice), the Company’s issued share capital consisted of 33,536,214 Nightstar Shares, carrying one vote each. As at 5 April 2019 (being the last practicable date prior to the publication of this notice), the Company held 0 shares in treasury. Therefore, the total voting rights in the Company as at 5 April 2019 was 33,536,214. On a vote by poll, every shareholder who is present in person or by proxy has one vote for every Nightstar Share held. |

| 14. | A copy of this notice, and other information required by section 311A of the Companies Act 2006, can be found at https://ir.nightstartx.com. |

| 15. | Copies of the Company’s existing articles of association and the articles of association as proposed to be amended by the special resolution set out in this notice are available for inspection at the offices of the Company’s Solicitors, Skadden, Arps, Slate, Meagher & Flom (UK) LLP, at 40 Bank Street, London E14 5DS during normal business hours on any weekday (excluding Saturdays, Sundays and public holidays), until the opening of business on the day on which the meeting is held, and will also be available for inspection at the place of the meeting for at least 15 minutes prior to and during the meeting. |

| 16. | Except as provided above, shareholders who have general queries about the meeting should use the following means of communication (no other methods of communication will be accepted): call our general shareholder helpline on +44 370 703 6033; or write to the Company’s registrars, Computershare, The Pavilions, Bridgwater Road, Bristol, BS13 8AE, United Kingdom. Shareholders may not use any electronic address provided either in this notice or any related documents (including the Chairman’s letter and white Form of Proxy) to communicate with the Company for any purposes other than those expressly stated. Calls from outside the U.K. will be charged at applicable international rates. Different charges may apply to calls from mobile telephones and calls may be recorded and randomly monitored for security and training purposes. Please note that Computershare cannot provide advice on the merits of the Acquisition or give any financial, legal or tax advice. |

-xiii-

Table of Contents

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

| Event |

Time/date(1) | |

| Nightstar ADS Voting Record Time |

5.00 p.m. (New York time) on 4 April 2019 | |

| Publication of this document |

9 April 2019 | |

| Latest time for receipt of ADS Voting Instruction Cards for the Nightstar Shareholder Meetings |

10.00 a.m. (New York time) on 30 April 2019 | |

| Latest Time for Nightstar ADS Holders to cancel out of the Nightstar ADS Programme and receive Nightstar Shares ahead of the Scheme Voting Record Time |

5.00 p.m. (New York time) on 25 April 2019 | |

| Latest time for lodging Forms of Proxy for use at the General Meeting (WHITE Form of Proxy) |

10.30 a.m. on 3 May 2019(2) | |

| Latest time for lodging Forms of Proxy for use at the Court Meeting (BLUE Form of Proxy) |

10.40 a.m. on 3 May 2019(3) | |

| Scheme Voting Record Time |

6.00 p.m. on 3 May 2019(4) | |

| General Meeting | 10.30 a.m. on 8 May 2019 | |

| Court Meeting | 10.40 a.m. on 8 May 2019(5) | |

The expected date of the Court Hearing to sanction the Scheme and each of the other dates and times set out below will depend, among other things, on the date on which the conditions to the Scheme and the Acquisition are satisfied or, if capable of waiver, waived. They are accordingly presented as indicative and referable to the date on which those conditions are satisfied or waived (as the case may be). Further details of the conditions are set out in Part III (Conditions to and Further Terms of the Scheme and the Acquisition) of this document.

Nightstar will give notice of each of the below dates and times, when known, by issuing an announcement through GlobeNewswire or another national news wire service and by making such announcement available on Nightstar’s website https://ir.nightstartx.com. Further updates or changes to other times or dates indicated below shall be notified in the same manner.

| Event |

Time/date(1) | |||

| Latest Time for Nightstar ADS Holders to cancel out of the Nightstar ADS Programme and receive Nightstar Shares ahead of the Scheme Record Time |

|

5.00 p.m. (New York time) on D – 4 Business Days |

| |

| Last day of trading in Nightstar ADSs on Nasdaq |

D(6) | |||

| Court Hearing to sanction the Scheme |

D | |||

| Scheme Record Time |

6.00 p.m. on D | |||

| Effective Date of the Scheme |

D+1 Business Day(7) | |||

| Suspension of trading in Nightstar ADSs on Nasdaq |

|

by 8.00 a.m. (New York time) on D+2 Business Days(7) |

| |

| Cancellation of listing of Nightstar ADSs on Nasdaq |

|

D+11 days |

| |

| Despatch of cheques and crediting of CREST for Consideration due under the Scheme |

|

as soon as practicable after the Effective Date and in any event within 14 days of the Effective Date |

| |

| Long Stop Date | 4 September 2019(8) | |||

The General Meeting and the Court Meeting will each be held at the offices of Nightstar’s solicitors, Skadden, at 40 Bank Street, London E14 5DS, at 10.30 a.m. and 10.40 a.m., respectively, on 8 May 2019.

-xiv-

Table of Contents

| (1) | These times and dates are indicative only and will depend, amongst other things, on the dates upon which: (i) the Conditions are satisfied or (where applicable) waived; (ii) the Court sanctions the Scheme; and (iii) a copy of the Court Order is delivered to the Registrar of Companies. Nightstar will give notice of any change(s) by issuing an announcement through GlobeNewswire or other national news wire service. |

| (2) | White Forms of Proxy for the General Meeting must be lodged not later than 10.30 a.m. on 3 May 2019 in order to be valid or, if the General Meeting is adjourned, not later than 48 hours before the time appointed for the holding of the adjourned meeting. White Forms of Proxy cannot be handed to the Chairman of the General Meeting at that meeting. |

| (3) | It is requested that blue Forms of Proxy for the Court Meeting be lodged not later than 10.40 a.m. on 3 May 2019 or, if the Court Meeting is adjourned, not later than 48 hours before the time appointed for the holding of the adjourned meeting. However, blue Forms of Proxy not so lodged may be handed to the Chairman of the Court Meeting before the start of the Court Meeting. |

| (4) | If either of the Nightstar Shareholder Meetings is adjourned, the Scheme Voting Record Time for the relevant adjourned meeting will be 6.00 p.m. on the date 48 hours (excluding any part of a day that is not a working day) before the date set for the adjourned meeting. |

| (5) | To commence at 10.40 a.m. or, if later, immediately after the conclusion or adjournment of the General Meeting. |

| (6) | A date expected to be mid-year 2019, and no earlier than 7 June 2019, subject to obtaining Clearances. |

| (7) | These dates depend, among other things, on the date upon which the Court sanctions the Scheme and the date which the Court Order sanctioning the Scheme is delivered to and, if ordered by the Court, registered by, the Registrar of Companies. |

| (8) | This date may be extended to such date as Nightstar, Bidco and Bidder may agree and the Court (if required) may allow. |

All references in this timetable to times are to times in London (unless otherwise stated).

-xv-

Table of Contents

TO VOTE ON THE PROPOSALS

The General Meeting and the Court Meeting will be held at the offices of Nightstar’s solicitors, Skadden, at 40 Bank Street, London E14 5DS on 8 May 2019 at 10.30 a.m. and 10.40 a.m., respectively (or, in the case of the Court Meeting, as soon thereafter as the General Meeting has been concluded or adjourned). In respect of the General Meeting, you are entitled to one vote for each Nightstar Share that you hold as at the Scheme Voting Record Time. In respect of the Court Meeting, you are entitled to one vote for each Nightstar Scheme Share that you hold as at the Scheme Voting Record Time. As at 5 April 2019 (being the last practicable date prior to the publication of this document), there were 33,536,214 Nightstar Shares issued and outstanding.

Whether or not you plan to attend the Nightstar Shareholder Meetings, if you are a Nightstar Shareholder, please:

| • | complete and return the BLUE Form of Proxy (for the Court Meeting); and |

| • | complete and return the WHITE Form of Proxy (for the General Meeting), |

so that they are received no later than 10.40 a.m. on 3 May 2019 (in the case of the BLUE Form of Proxy for the Court Meeting) or 10.30 a.m. on 3 May 2019 (in the case of the WHITE Form of Proxy for the General Meeting). A prepaid envelope is provided for this purpose in the U.K. only. Your vote will be cast as specified on the applicable Form of Proxy.

Alternatively, BLUE Forms of Proxy (but NOT WHITE Forms of Proxy) may be handed to a representative of Computershare, on behalf of the Chairman of the Court Meeting, at the venue of the Court Meeting or the Chairman of the Court Meeting before the start of the Court Meeting on 8 May 2019. In the case of the General Meeting, unless the WHITE Form of Proxy is returned by the time and date mentioned in the instructions printed thereon, it will be invalid.

The completion and return of the Forms of Proxy will not prevent eligible Nightstar Shareholders from attending and voting at the Court Meeting or the General Meeting, or any adjournment thereof, in person.

Nightstar Shareholders who hold Nightstar Shares in CREST may appoint a proxy or proxies through the CREST Electronic Proxy Appointment Service using the procedures described in the CREST Manual.

Nightstar Shareholders who prefer to register the appointment of their proxy electronically via the internet can do so through www.eproxyappointment.com using their shareholder investor code found on their Form of Proxy and following the online instructions. Further details in relation to electronic appointment of proxies are set out on page xxii of this document.

IT IS IMPORTANT THAT, FOR THE COURT MEETING, AS MANY VOTES AS POSSIBLE ARE CAST SO THAT THE COURT MAY BE SATISFIED THAT THERE IS A FAIR REPRESENTATION OF NIGHTSTAR SHAREHOLDER OPINION. YOU ARE THEREFORE STRONGLY URGED TO SIGN THE FORMS OF PROXY AND RETURN THEM BY POST USING THE PREPAID ENVELOPE PROVIDED, DURING NORMAL BUSINESS HOURS ONLY, TO COMPUTERSHARE AT THE PAVILIONS, BRIDGWATER ROAD, BRISTOL, BS13 8AE, UNITED KINGDOM, AS SOON AS POSSIBLE AND, IN ANY EVENT, SO AS TO BE RECEIVED BY COMPUTERSHARE PRIOR TO THE DEADLINES SET OUT ABOVE, OR IN THE CASE OF AN ADJOURNED MEETING, NOT LESS THAN 48 HOURS PRIOR TO THE TIME AND DATE SET FOR THE ADJOURNED MEETING.

IF YOU ARE A NIGHTSTAR SHAREHOLDER, YOUR ATTENTION IS DRAWN TO THE REGIME FOR THE APPOINTMENT OF PROXIES SET OUT IN THE NOTES TO THE FORMS OF PROXY AND THE NOTES SET OUT IN THE NOTICE OF COURT MEETING AND THE NOTICE OF THE GENERAL MEETING, INCLUDING IN RESPECT OF THE APPOINTMENT OF MULTIPLE PROXIES.

-xvi-

Table of Contents

This page should be read in conjunction with the section entitled “ACTION TO BE TAKEN” on pages xviii and xix of this document and the section entitled “FORM OF PROXY FOR VOTING AT THE COURT MEETING AND GENERAL MEETING” on page xx of this document, the rest of this document and the accompanying Forms of Proxy.

Nightstar Shareholder Helpline

If you have any queries relating to this document or the completion and return of the Forms of Proxy, please call the Nightstar Shareholder Helpline at +44 370 703 6033. Lines are open Monday to Friday (except public holidays) between 8.30 a.m. and 5.30 p.m.

Nightstar ADS Holders who have any questions should contact the Nightstar Depositary using the contact details provided on the ADS Voting Instruction Card provided to you or found at www.citi.com/dr. If you hold Nightstar ADSs indirectly, you should contact the bank, broker, financial institution or administrator through which you hold Nightstar ADSs.

Calls will be charged at the standard geographic rate and will vary by provider. International calls will be charged at the applicable international rate. Different charges may apply to calls from mobile telephones and calls may be recorded and randomly monitored for security and training purposes. Please note that the Nightstar Shareholder Helpline operators cannot provide advice on the merits of the Scheme or the Acquisition or give any financial, legal, investment or tax advice.

Proposals

At the Court Meeting you will be asked to approve the Scheme, with or subject to any modification, addition or condition which Nightstar and Bidder may agree and which the Court may approve or impose, pursuant to which the Nightstar Scheme Shares will be acquired by Bidco.

At the General Meeting you will be asked to approve resolutions (i) to authorise the Nightstar Board to re-designate any Nightstar Share as a Deferred Share in respect of individuals who have entered into a Vesting Agreement with Nightstar, (ii) to approve, conditional upon the passing of the preceding resolution, the terms of each of the Buy-Back Agreements available for inspection on Nightstar’s website and at its registered office, and in a form substantially identical to Annex E, and (iii) to authorise the Nightstar Directors to take all such action as they may consider necessary or appropriate for carrying the Scheme into effect, and to amend, with effect from the passing of such resolution, the Nightstar Articles to ensure that any Nightstar Shares issued after the General Meeting will be subject to the Scheme or otherwise transferred to Bidco.

Nightstar Scheme Shareholders who currently hold Nightstar Shares which are proposed to be re-designated as Deferred Shares under the terms of a Vesting Agreement will not (subject to the passing of the Re-designation Special Resolution) be entitled to vote on the Ordinary Resolution or the Scheme Special Resolution.

Recommendation and Voting by Nightstar Directors

For the reasons set out in this document, the Nightstar Directors, who have been so advised by Centerview as to the financial terms of the Acquisition, consider the terms of the Acquisition to be fair and reasonable. In providing advice to the Nightstar Directors, Centerview has taken into account the commercial assessments of the Nightstar Directors. Centerview’s advice to the Nightstar Directors is set out in its written opinion, dated 3 March 2019, attached hereto as Annex B and which also sets out in full the relevant assumptions and qualifications to such advice.

The Nightstar Directors believe that the terms of the Acquisition, including the terms of the Implementation Agreement, are fair and reasonable and that proceeding with the Acquisition is likely to promote the success

-xvii-

Table of Contents

of Nightstar for the benefit of its shareholders, having had regard to the interests of other stakeholders, and unanimously recommend that you vote in favour of the Scheme at the Court Meeting and the Resolutions to be proposed at the General Meeting, as the Nightstar Directors have irrevocably undertaken to do, or to procure, in respect of their own beneficial holdings of Nightstar Shares amounting to, in aggregate, 758,019 Nightstar Shares representing approximately 2.3 per cent. of the existing issued ordinary share capital of Nightstar on 5 April 2019 (being the last practicable date prior to the publication of this document). Further details of these Irrevocable Undertakings are contained in paragraph 7 of Part V (Additional Information) of this document.

ACTION TO BE TAKEN / GENERAL INFORMATION

The Scheme requires approval at a meeting of the Nightstar Scheme Shareholders convened with the permission of the Court (known as the Court Meeting) and at the General Meeting. The General Meeting and the Court Meeting will be held at the offices of Nightstar’s solicitors, Skadden, at 40 Bank Street, London E14 5DS on 8 May 2019 at 10.30 a.m. and 10.40 a.m., respectively (or, in the case of the Court Meeting, as soon thereafter as the General Meeting has been concluded or adjourned).

Please check you have received the following with this document:

All Nightstar Shareholders:

| • | a BLUE Form of Proxy for use in respect of the Court Meeting on 8 May 2019; |

| • | a WHITE Form of Proxy for use in respect of the General Meeting on 8 May 2019; and |

| • | a prepaid envelope. |

If you have not received these documents, please contact Nightstar’s registrars, Computershare, on the Nightstar Shareholder Helpline referred to on page xvii of this document, or your broker, bank or other nominee.

All Nightstar ADS Holders:

| • | an ADS Voting Instruction Card; and |

| • | the Notice of Court Meeting and General Meeting document issued by the Nightstar Depositary. |

If you have not received these documents, please contact the Nightstar Depositary’s ADS shareholder services at +1-877-248-4237, or your broker, bank or other nominee.

Solicitation of Proxies

The Nightstar Directors are soliciting your proxy, and Nightstar will bear the cost of this solicitation of proxies. This includes the charges and expenses of brokerage firms and others for forwarding solicitation material to Nightstar Shareholders.

Nightstar has retained MacKenzie Partners, Inc., a proxy solicitation firm, to assist the Nightstar Directors in the solicitation of proxies for the Court Meeting and the General Meeting. Nightstar expects to pay MacKenzie Partners, Inc., approximately USD 20,000, plus reimbursement of out-of-pocket expenses. Proxies may be solicited by mail, personal interview, e-mail, telephone, or via the internet by MacKenzie Partners, Inc. or, without additional compensation, by certain Nightstar Directors, officers and employees.

Shareholder Proposals

Under English law, except as provided below, there is no general right for a shareholder of a U.K. public limited company to put items on the agenda of a general meeting (save for the annual general meeting) that has been

-xviii-

Table of Contents

convened by directors. English law provides that shareholders holding not less than 5 per cent. of Nightstar’s paid up share capital carrying voting rights may requisition the Nightstar Board to convene a general meeting and may require resolutions to be put before a general meeting they have convened.

If the Acquisition does not become Effective, Nightstar Shareholders will be entitled to attend and participate in Nightstar’s annual general meeting. Under the Companies Act 2006, Nightstar is required to hold its 2019 annual general meeting by no later than 30 June 2019. If any such annual general meeting is held, shareholder proposals will be eligible for consideration for inclusion in the proxy statement and form of proxy for such annual general meeting in accordance with Rule 14a-8 under the U.S. Exchange Act and the Nightstar Articles.

Because the 2019 annual general meeting would be Nightstar’s first annual general meeting, pursuant to Rule 14a-8 under the U.S. Exchange Act, Nightstar may set a deadline for receipt of Rule 14a-8 shareholder proposals that is a reasonable time before Nightstar plans to print and send its proxy materials. Nightstar Shareholders who wish to have a proposal considered for inclusion in Nightstar’s proxy materials for its 2019 annual general meeting pursuant to Rule 14a-8 must ensure that their proposal is received at Nightstar’s registered office by 30 April 2019, which Nightstar has determined to be a reasonable time before it expects to begin to print and send its proxy materials. The 30 April 2019 deadline will also apply in determining whether notice of a shareholder proposal is timely for purposes of exercising discretionary voting authority with respect to proxies under Rule 14a-4(c) under the U.S. Exchange Act.

In addition to the process under the U.S. Exchange Act described above, under the Companies Act 2006, shareholders representing at least 5 per cent. of the total voting rights of all shareholders who have a right to vote at the 2019 annual general meeting of Nightstar can require Nightstar to give Nightstar Shareholders notice of a resolution which may be and is intended to be moved at the 2019 annual general meeting of Nightstar unless (a) the resolution would, if passed, be ineffective (whether by reason of inconsistency with any enactment or Nightstar’s Articles or otherwise); (b) it is defamatory of any person; or (c) it is frivolous or vexatious. Such a request, made by the requisite number of Nightstar Shareholders, must be received by Nightstar not later than six weeks before the annual general meeting.

-xix-

Table of Contents

FORM OF PROXY FOR VOTING AT THE COURT MEETING

AND GENERAL MEETING

It is important that, for the Court Meeting, as many votes as possible are cast so that the Court may be satisfied that there is a fair representation of the opinion of Nightstar Scheme Shareholders. Therefore, whether or not you plan to attend the Nightstar Shareholder Meetings, please complete and sign both the enclosed BLUE and WHITE Forms of Proxy, or deliver your voting instructions by one of the other methods mentioned below, as soon as possible. Your vote will be cast as specified on the applicable Form of Proxy.

Sending Forms of Proxy by post

Nightstar Shareholders will find enclosed with this document a BLUE Form of Proxy for use in connection with the Court Meeting and a WHITE Form of Proxy for use in connection with the General Meeting. Please complete and sign the enclosed Forms of Proxy in accordance with the instructions printed thereon and return them by post using the prepaid envelope provided to Computershare at The Pavilions, Bridgwater Road, Bristol, BS13 8AE, United Kingdom, so as to be received as soon as possible and in any event not later than:

| • WHITE Forms of Proxy for the General Meeting |

10.30 a.m. on 3 May 2019 | |

| • BLUE Forms of Proxy for the Court Meeting |

10.40 a.m. on 3 May 2019 | |

or, in the case of either meeting being adjourned, not later than 48 hours before the time fixed for the holding of the adjourned meeting. A prepaid envelope is provided for this purpose in the U.K. only, Forms of Proxy returned by fax will not be accepted. This will enable your votes to be counted at the Nightstar Shareholder Meetings in the event of your absence.

If the BLUE Form of Proxy for use at the Court Meeting is not returned by such time, it may be handed to the Chairman of the Court Meeting or a representative of Nightstar’s registrars, Computershare, on behalf of the Chairman of the Court Meeting, before the start of that meeting. However, in the case of the General Meeting, the WHITE Form of Proxy must be received by the time mentioned above, or it will be invalid.

Proxy appointment

Nightstar Shareholders entitled to attend and vote at the Court Meeting and the General Meeting may appoint a proxy to attend and to speak and vote in his/her place.

Nightstar Shareholders are entitled to appoint a proxy in respect of some or all of their Nightstar Shares and may also appoint more than one proxy, provided that each proxy is appointed to exercise the rights attached to a different share or shares held by such holder. A proxy need not be a member of Nightstar.

Please note that the appointment of a proxy or proxies is separate for each of the Court Meeting and the General Meeting.

To be valid, Forms of Proxy must be executed by or on behalf of the Nightstar Shareholder or, if you are a corporate, under the hand of a duly authorised officer or attorney.

If two or more valid, but differing, appointments of proxy are delivered or received in respect of the same share, the one which is last validly delivered or received (regardless of its date or of the date of its execution) shall be treated as replacing and revoking the other or others as regards that share. If Nightstar is unable to determine which instrument was last validly delivered or received, none of them shall be treated as valid in respect of that share.

-xx-

Table of Contents

The completion and return of the Forms of Proxy, or the appointment of a proxy electronically using CREST (or any other procedure listed below), will not prevent Nightstar Shareholders from attending and voting in person at the Court Meeting and/or the General Meeting, or any adjournment thereof, if you wish and are entitled to do so. Shareholders who hold their Nightstar Shares in the name of a broker, bank or other nominee should follow the voting instructions provided by such nominee to ensure that their Nightstar Shares are represented at the Court Meeting and the General Meeting.

Revocability of proxies

Any person submitting a Form of Proxy pursuant to this solicitation has the power to revoke and change it at any time before it is voted. If you are a Nightstar Shareholder of record, you may revoke your proxy at any time before the vote is taken at the Court Meeting or the General Meeting, as applicable, by:

| • | submitting a new Form of Proxy with a later date, by using the telephone or electronic proxy submission procedures described herein, or by completing, signing, dating and returning a new Form of Proxy by mail to Computershare; |

| • | attending the Court Meeting and/or the General Meeting and voting in person; or |

| • | delivering a written notice of revocation by mail to Computershare at The Pavilions, Bridgwater Road, Bristol, BS13 8AE, United Kingdom. |

Please note, however, that only your last validly delivered or received proxy will count (regardless of its date or of the date of its execution). Attending the Court Meeting or General Meeting without taking one of the actions described above will not in itself revoke your proxy.

If you hold your shares indirectly through a broker, bank or other nominee, you will need to follow the instructions provided to you by your broker, bank or other nominee in order to revoke your proxy or submit new voting instructions. If you hold your shares indirectly, you may also revoke a prior proxy by voting in person at the Court Meeting and/or General Meeting if you obtain a Form of Proxy executed in your favour from your broker, bank or other nominee in order to be able to vote in person at such meeting.

Effect of abstentions and broker non-votes

An abstention occurs when a shareholder abstains from voting (either in person or by proxy) on one or more of the proposals. Broker non-votes occur when a broker, bank, trust or other nominee returns a proxy but does not have authority to vote on a particular proposal.

In connection with the Court Meeting, abstentions and broker non-votes will not be considered votes cast and will therefore not have any effect on the outcome of the vote at the Court Meeting.

In connection with the General Meeting, abstentions and broker non-votes will be considered in determining the presence of a quorum. However, abstentions and broker non-votes are not considered votes cast and therefore will not have any effect on the outcome of the vote for the purposes of determining whether the Resolutions have been approved.

Multiple proxy voting instructions

Nightstar Shareholders who wish to appoint more than one proxy in respect of their shareholding should photocopy the Form of Proxy or call the Nightstar Shareholder Helpline on the telephone number set out on page xvii of this document. You should also indicate by ticking the box provided if the proxy is one of multiple instructions being given, fill in the name of the proxy and the number of shares in respect of which the proxy is appointed and return the multiple forms together (please ensure that all of the multiple Forms of Proxy in respect of one registered holding are sent in the same envelope if possible) by the time and date mentioned above.

-xxi-

Table of Contents

Online appointment of proxies

As an alternative to completing and returning the printed Forms of Proxy, Forms of Proxy may be submitted electronically by logging on to the following website: www.eproxyappointment.com and following the instructions there. For an electronic proxy appointment to be valid, the appointment must be received by Computershare no later than:

| • | 10.30 a.m. on 3 May 2019 in the case of the General Meeting; and |

| • | 10.40 a.m. on 3 May 2019 in the case of the Court Meeting, |

or, in the case of either meeting being adjourned, no later than 48 hours before the time fixed for the holding of the adjourned meeting. In order to access the voting system, Nightstar Shareholders will need their shareholder investor code found on their Form of Proxy.

In the case of the Court Meeting only, if you have not appointed a proxy electronically by such time you may complete the BLUE Form of Proxy and hand it to the Chairman of the Court Meeting or a representative of Computershare, on behalf of the Chairman of the Court Meeting, before the start of that meeting.

Electronic appointment of proxies through CREST

If you hold your Nightstar Shares in uncertificated form through CREST and wish to appoint a proxy or proxies for the Nightstar Shareholder Meetings (or any adjourned meeting) by using the CREST Electronic Proxy Appointment Service, you may do so using the procedures described in the CREST Manual (available at www.euroclear.com). CREST personal members or other CREST sponsored members, and those CREST members who have appointed any voting service provider(s), should refer to their CREST sponsor or voting service providers, who will be able to take the appropriate action on their behalf.