Form DEFA14A YUM BRANDS INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x | |||||

Filed by a Party other than the Registrant o | |||||

| Check the appropriate box: | |||||

| o | Preliminary Proxy Statement | ||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) | ||||

| o | Definitive Proxy Statement | ||||

| x | Definitive Additional Materials | ||||

| o | Soliciting Material under §240.14a‑12 | ||||

| YUM! BRANDS, INC. | ||||||||

| (Name of Registrant as Specified In Its Charter) | ||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||

| x | No fee required. | |||||||

| o | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11. | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

| o | Fee paid previously with preliminary materials. | |||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

Commencing on May 4, 2022, the following communication will be sent to certain shareholders of YUM! Brands, Inc.

May 4, 2022

Dear Fellow Shareholders:

We are writing to you in our capacity as the Management Planning & Development Committee (the “Committee”) of the Board of Directors of YUM! Brands, Inc. (“YUM” or the “Company”), to request your support of the proposals put forward in our 2022 Proxy Statement. We would like to urge your support FOR item 3 – the Advisory Vote on Executive Compensation (“Say on Pay”).

The Committee takes seriously its role in overseeing, designing, and approving the Chief Executive Officer and other Named Executive Officer pay. Our commitment is to an enduring structure that drives shareholder value while attracting and retaining the best talent for the long term. We believe our pay-for-performance philosophy and practices are firmly aligned with shareholder value and have contributed to the long-run success of the Company. We have a rigorous shareholder engagement process and received 84% or more support from shareholders for the last six years. The intent of this letter is to:

1.Summarize Company performance and compensation outcomes to align pay with performance; and

2.Address some feedback from proxy advisors regarding our Named Executive Officers’ compensation

Company Performance

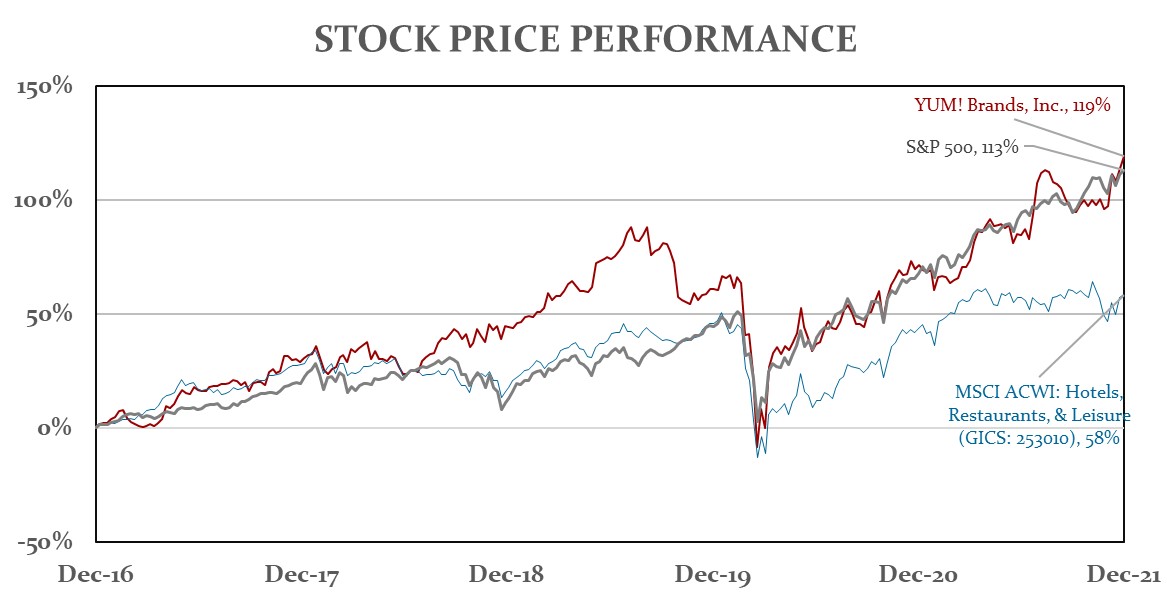

First, our long-term stock price performance has outpaced the S&P 500 and strongly outperformed the Company’s peer group. This is evidenced by the graph depicting five-year stock price returns compared to both our industry and the S&P 500.

Similarly, our short-term performance in 2021 was incredibly strong, resulting in system sales growth of 13%, underpinned by 10% same-store sales growth and 6% net unit growth. This growth was the product of $22 billion in digital sales and resulted in a 42% increase in GAAP Operating Profit and 18% increase in Core Operating Profit.

Compensation Outcomes

Second, the outcomes from our plans and the decisions made by the Committee demonstrate our commitment to pay for performance.

2020

•CEO’s target total compensation set below the median of the Company’s peer group to reflect newness in role

•Additionally, the CEO’s actual total compensation was less than target total compensation due to impact of the pandemic on company performance

2021

•CEO’s target total compensation increased to the median of the Company’s peer group in consideration of time in role, performance, and demonstrated leadership and capability

•CEO’s actual total compensation was above target driven by strong 2021 performance and one-time special award (see Accelerating Profitable Growth Award below)

Accelerating Profitable Growth Award

In late 2020, the Board determined that the eventual end of the COVID-19 pandemic would provide a singular chance to galvanize the entire organization around accelerating net-new unit development, a key component of the Company’s growth strategy. This opportunity was viewed as a unique opportunity to create additional shareholder value, increase scale advantages relative to competitors, and accelerate the pace of development beyond historical performance and external expectations. The Committee believed that urgent action was necessary to achieve this goal. To focus management on accomplishing this, the Committee approved an incentive for the top 500 leaders in the Company. The Committee considered several crucial factors when approving the incentives (see page 43 of our 2022 Proxy Statement).

The Committee wanted to ensure any additional compensation earned would require exceptional performance beyond targets in the normal annual incentive plans, which would create enhanced value for shareholders. To accomplish this objective, the performance targets and payout opportunities for this award were carefully considered:

•Threshold set equivalent to company’s highest ever two-year net-new unit performance, excluding acquisitions and 300+ units above analyst consensus on January 1, 2020.

•Target & Maximum set respectively at 1,000+ units and 1,700+ units above analyst consensus on January 1, 2020.

•Payout Potential for PSUs usually provide a maximum payout equal to 200% of target. For this award, maximum was reduced to 125% of target.

It is important to note that given the company’s highly franchised business model, these results are only achieved if the company can demonstrate restaurant economics and returns that result in franchisees using their capital to build new units.

The incentive proved to be a powerful motivator for the Company’s top 500 leaders. In 2021, the Company opened nearly 4,200 restaurants in over 110 countries, marking the strongest growth year in the Company’s history and setting an industry record for unit development. To put that in context, the Company added more net units in 2021 than the Company’s first and second largest global peers combined and opened a new restaurant on average every two hours. This level of unit development is a testament to the health of our business; iconic brands; capable, committed, and well-capitalized franchise partners; and strong unit economics.

Response to Proxy Advisor Feedback

Third, some proxy advisor observations deserve direct responses, specifically:

•Increased CEO’s regular LTI in the same year a sizeable one-time Special Award was awarded.

The Committee, in partnership with their independent compensation consultant, carefully weighed compensation actions for 2021. The Committee considered three separate but related issues - (1) providing an appropriately competitive total compensation package; (2) an LTI award that motivated and rewarded for enduring operating results; and (3) an LTI award that motivated and rewarded for the unique intermediate term opportunities related to global net-new unit development.

Given the CEO’s additional experience in role, performance, and exemplary leadership through the worst part of the pandemic, the Committee believed it was appropriate to align the CEO’s ongoing target total compensation with the median of the Company’s self-disclosed peer group. This package includes PSUs and SARs that, in combination, reward both absolute and relative improvements in shareholder value – enduring standards of success.

The one-time equity award requires performance well above normal operating performance and significantly above shareholder expectations. This award is specifically geared toward executing unique intermediate term business opportunities. If the aggressive threshold goals are not met, the award will not pay out.

•Special Award utilizes a two-year measurement period and metric shared with STI plan.

The Committee recognized the overlap between the metric in the special award and the annual incentive plan. The Committee believed it was vitally important for leaders to be focused on the current year’s development plan, as well as accelerating the development for the following year. Additionally, given the award required performance beyond the targets in the annual incentive plan, it seemed appropriate to allow an overlap in the measures.

The Committee believed the two-year measurement period was important to align with the timing and expectations around intended organizational results. Because the Committee intended to ensure this was a long-term incentive award, it set the vesting period at three years, rather than two. The third year not only aids in the retention of the top 500 leaders of the Company, but it also allows the Committee to review the impact of the development achieved in the first two years before certifying final payouts. As always, the Committee retains the ability to apply negative discretion if compensation earned does not align with shareholder value.

•STI payout formula allows for a large increase in total payouts based on the Committee’s subjective assessment of individual performance, resulting in relatively high maximum STI opportunity that could allow for outsized bonuses.

The Company’s annual incentive plan has not changed in over 20 years and has always been strongly supported by shareholders.

A rigorous and thorough process is followed by the Committee when evaluating the individual performance:

◦Committee approves individual goals at the beginning of the year tied to the Company’s four key growth drivers, the Recipe for Good, and shareholder promises

◦Committee receives a mid-year update

◦Committee receives a final year-end summary of results and accomplishments. These results are calibrated to ensure strong alignment with operating results.

Additionally, five of the seven categories evaluated by the Committee are directly correlated to financial metrics, and the other two are tied to people and ESG objectives. The Committee believes strongly that leaders should be held accountable for having extraordinary talent, creating a winning culture, and making progress in ESG. These areas are critically important to our shareholders and having two of the seven categories assessed tied to people and ESG is a sensible and necessary weighting.

•2021-2023 PSU Plan based on TSR targets merely median performance, without negative TSR cap.

According to Meridian Compensation Partners 2021 Corporate Governance and Incentive Design, which included 200 large publicly traded companies across a variety of industries (the “Meridian 200”) with median revenues and market capitalization of $16.9B and $30.3B, respectively, 73% of companies provide a target payout for median performance. Similarly, 69% of companies do not provide a negative TSR cap.

Furthermore, it seems reasonable to provide a target payout for median performance when target compensation is set at median. To require above median performance to earn a median payout would be a misalignment between pay and performance.

The Committee believes our PSU plan properly aligns pay and performance, appropriately motivates management, aligns with shareholder interests, and is consistent with market best practice.

Executive compensation is both an important outcome of, and a driver of our long-term performance. In this regard, we call your attention to the Compensation Discussion and Analysis in this year’s proxy statement. The importance and care applied to these considerations have been provided in detail. Our goal is to motivate and align rewards to management with the creation of long-term shareholder value. We believe our programs have and will continue to accomplish this.

With this additional information, we ask that you vote FOR our Say on Pay proposal to approve our executive compensation, as recommended by the Board in our 2022 proxy statement.

Sincerely,

THE MANAGEMENT PLANNING AND DEVELOPMENT COMMITTEE

CHRISTOPHER M. CONNOR, Chair

KEITH BARR

BRIAN C. CORNELL

MIRIAN M. GRADDIC-WEIR

THOMAS C. NELSON

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Yum! Brands (YUM) PT Lowered to $162 at Citi

- TuminEwap to Collaborate with Japanese Financial Giant, Accelerating Expansion in Asian Markets

- Twin Disc Announces Update to Timing of its Fiscal 2024 Third Quarter Earnings Webcast and Conference Call

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share