Form DEFA14A SHOTSPOTTER, INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

ShotSpotter, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

April 29, 2021

Dear Fellow Shareholders,

The past twelve months since my last shareholder letter have been a remarkable journey for our company, our society and I am sure, for many of us personally. I hope those of you reading this annual shareholder letter are doing well and keeping safe as we come out of this annus horribilis period more resilient and mindful of the things that matter, such as personal health and security, relationships and being of service to those less fortunate than ourselves. This past year has really been an incredible opportunity to further grow and develop what our true capabilities are.

I am very pleased to report that ShotSpotter has not only persevered during one of the most challenging business environments on record but was able to finish 2020 on a positive note. We believe we are well positioned to take advantage of the prevailing tailwinds to deliver strong growth in 2021 and beyond. I can say without reservation that I am more positive about the prospects of the company than I have ever been.

Operations

We have continued to operate as a virtual 100% distributed work-from-home organization while effectively maintaining the high service level and client engagement our customers recognize. Fortunately, our travel restrictions eased a bit in late 2020 enabling us to put boots on the ground for new service deployment and expansion projects and engage in some limited face-to-face onboarding and customer success initiatives. Our sales and marketing organizations have adapted well in their digital outreach to prospects, moving those prospects through the sales pipeline funnel effectively. One of the silver linings, if any from last year has been a reduction in travel expense while maintaining a measurable increase in prospect and customer touch points during the sales cycle due to digital enablement. We grew marketing generated prospect meetings (mostly digital) by 65% year over year and increased new ARR1 pipeline to $8.5 million in 2020 31% more than in 2019.

Our Incident Review Center (IRC) published over 230,000 ShotSpotter Respond gunshot alerts in 2020, a 64% increase over the year prior, demonstrating not only the resiliency and scalability of our IRC but also the measurable uptick in gunfire activity even during the lockdown of many cities. We did not let the pandemic deter our intentional investments in our internal systems, such as deploying an enterprise ready chat system and a distributed incident peer-review capability in order to drive efficiency and increase collaboration between reviewers. We accomplished this while maintaining the high-quality standards (99%+ review accuracy) that our law enforcement customers have come to depend on. We continue to enjoy significant benefits due to the experience curve in our IRC with our 25+ Incident Review staff averaging a 39-months tenure and an average of more than 250,000 incidents reviewed per person. Our Forensic team produced over 250 court admissible “Detailed Forensic Reports” and participated in 18 expert witness testimonies delivered in-person and on Zoom. Several of those engagements were federal cases being prosecuted by US Attorneys.

| We also designed, developed and deployed an enhanced version of our backend location services, LocServer (gunshot location algorithms) which further improves our already excellent location accuracy. We believe this further extends our lead in the outdoor acoustic gunfire space. We also launched ShotSpotter Insight, a planning and analysis tool used by our customers to analyze their aggregated gunfire incidents. Lastly, we kicked off a project to replace our 3G sensors which we expect to complete well before our network providers retire their 3G network services. These investments continue to add onto what we believe to be a considerable competitive moat in acoustic gunshot detection services. |

ShotSpotter Insight |

| 1 | We define annual recurring revenue (ARR) as the revenue we would contractually expect to receive from customers over the following 12 months, without any increase or reduction in any of their subscriptions, and assuming that contracts existing as of the measurement date will all renew at their respective contract expirations. |

The LEEDS Acquisition- Case Management

Our work with agencies that have established Crime Gun Intelligence (CGIC) practices inspired us to pursue adding value to the investigative process. As a reminder, CGIC is about responding to and investigating “all shootings”, not just shootings involving a homicide, or a non-fatal gunshot wound (GSW) victim. The value proposition is simple – the reason you investigate today’s innocuous stop sign shooting is to prevent next week’s homicide or GSW shooting. Shootings are concentrated amongst a handful of serial shooters that drive the vast majority of gun violence. The sooner you can connect the dots of shooting events to the same gun (and shooter), the more quickly you can target focused deterrence interventions on those serial shooters and create safer neighborhoods in the process. Empowering that investigation (connecting the crime scene, to the crime gun and the shooter post-response) has the opportunity to completely transform the CGIC process. Through our years of providing acoustic gunshot detection service, we understand that gun crime is not only larger than what results in a homicide or non-fatal GSW victim but is also significantly under-reported. And while our acoustic gunshot detection solution has been a game changer in revealing that inconvenient truth and facilitating an effective response, we have watched many agencies struggle with the post response process of collecting and integrating the evidence into a robust follow-on investigative process. In short, the powerful promise of CGIC in preventing and reducing gun crime can only be delivered by completely transforming “response” and “investigation”.

We engaged in a fairly deliberate decision process of build vs buy and then decided to pursue the buy path and underwent a rigorous evaluation of a few purpose-built case management vendors before landing on LEEDS which we acquired in the fourth quarter of 2020. We were immediately attracted to our shared values of putting customer relationships at the front of everything we do. Those customer-centric values were easy for us to diligence given the fact we share a common customer who raved about their long-term relationship with LEEDS. We also were encouraged that an on-premises version of their case management system had been battled tested and in use within that agency and is credited for helping them produce one of the highest case closure rates for a large police department in the United States. The commercial cloud-based version of the LEEDS case management solution was fully built out and feature rich which reduced development and time to market risks from our perspective. LEEDS also brought a base of annual recurring and professional services revenue from the same customer, creating relationship capital synergies. It was a fantastic combination and enabled us to fulfill our vision of creating a precision policing solution platform by adding case management on top of our acoustic gunshot detection and patrol management solutions.

Revenue Growth and Retention

Our GAAP revenue grew year over year by 12% from $40.8 million in 2019 to $45.7 million in 2020. The revenue increase of $4.9 million was primarily due to new domestic miles of the ShotSpotter Respond service going live from new and existing customers and new go lives from ShotSpotter Connect, along with some limited price increases on selected renewals net of attrition. There was a modest amount of revenue for a partial fourth quarter of 2020 (six-weeks), recognized from our LEEDS acquisition. We were thrilled to be reminded of how sticky our solution has proven to be, even in the face of municipal budget contraction due to the pandemic induced recession and calls to “defund the police”. Our renewal rate was strong demonstrating how valuable our services are in this new environment where the need for law enforcement to better serve their communities without over-policing, is clearer than ever. GAAP revenue attrition was less than $0.5 million or approximately 1%, net of some targeted price increases we recognized for the year. This was well below the 4-5% we estimated going into the pandemic and enabled us to grow our year over year revenues in the double digits. Overall revenue retention for 2020 was 107%, including expansions and price increases, net of attrition and limited price discounts.

|

We believe our success in this area is the result of providing a valuable service along with our focus on customer success including the onboarding process driven by our Customer Success organization and broader company culture that is obsessed with our customers realization of value through implementation of established best practices. Our Net Promoter Score (NPS) grew to a world class 70% in 2020, up significantly from 53% in 2019. While the score is impressive what is most valuable to us as a learning organization is the constructive feedback from customers on where they are seeing value and what areas where we can look to further develop. The following are some quotes and NPS survey questions. |

“ShotSpotter performs above promised performance levels.”

| • | Chief of Police in Florida |

“Invaluable tool to collect evidence and build solid prosecutions. We were hoping to build cases while increasing arrests of the violent offenders. The ROI has been excellent. While costly to utilize ShotSpotter, our community has such a large amount of gunfire, the benefits outweigh the costs.”

| • | Chief of Police in Illinois |

“ShotSpotter has increased our ability to respond to violent crime in a more-timely manner. Our NIBIN evidence has increased significantly, allowing for and leading to more gun crime arrests.”

| • | Chief of Police in Ohio |

When asked, “Do you consider ShotSpotter to be a “True Partner”? 97% respondents indicated that they agree or strongly agree.

The Case for Precision Policing

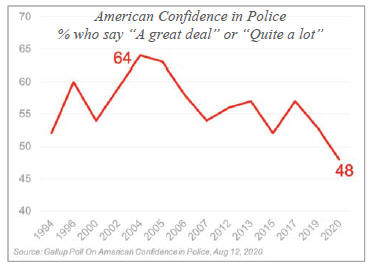

| The profession of policing has never been under more scrutiny than it has been in the past 12 months. The global pandemic; operational complexity due to social distancing mandates; municipal budget contractions; social unrest and calls to “defund the police” as a result from the tragic murder of George Floyd, combined with “Chief Churn” have created unprecedented circumstances. This volatility combined with a marked increase in violent crime has compelled law enforcement agencies to reimagine their practices and look to solution providers like ShotSpotter to help them drive digital transformation strategies in order to help them better serve communities without over-policing. |

|

Commissioner Bill Bratton, a member of our Board of Directors and former Commissioner of the NYPD, coined the term “precision policing”. Mr. Bratton importantly believes that precision policing not only involves focused crime deterrence on the very small percent of criminals whose violence damages communities the most, but more importantly means serving and connecting to the far larger percentage of the population that strengthens a community. Community engagement and collaboration reinforces the notion that public safety is a shared responsibility and is only sustainably achieved when co-produced between police and the communities they are meant to serve.

Working closely with numerous police departments over the years we have developed key trusted relationships and deep insights into those challenges and needs. We know that 80-90% of gunfire incidents never get reported; that gut-based patrolling leads to biased over-policing and that siloed data and manual rudimentary investigative processes result in lower case closure rates. These challenges lead to a public safety gap and strains the trust between police and citizenry. Based on that proprietary insight we have expanded our suite of technology tools to move beyond our franchise gunshot detection service to include patrol management and more recently investigative case management with our acquisition of LEEDS.

Our new Precision Policing Platform enables public safety agencies to not only respond to gun violence, but also improve their street-level policing by connecting daily crime data into more effective patrol strategies. Our soon to be launched case management systems enhances how crime investigations are conducted, digitally managed and resolved. Our value proposition is to make policing smarter and community inspired. We believe technology can enable data-informed precision policing and help agencies direct their limited resources more precisely to focus on the limited elements that drive most of the crime while protecting and serving residents in our most challenged and at-risk neighborhoods.

This new platform is a complete vision and is exactly what police departments need at this critical juncture. We believe having these expanded offerings significantly expands our existing total addressable market, opportunity to have impact and leverages our strength and entry point from our gunshot detection heritage.

A Word about ESG

As many of you know, there has been an increasing focus on companies that demonstrate key capabilities in the key areas of environmental, social and government. We are confident, although our focus on these areas is already strong, that our continued efforts will improve our impact even further.

We have two strong examples of our environmental efforts. We deployed gunshot detection services in South Africa’s Kruger National Park in 2014 and have successfully reduced poaching of white rhino, an endangered species in those coverage areas. Our recent efforts in South Asia deploying waterborne acoustic sensors help reduce blast-fishing, which ultimately helps reduce associated damage to coral reefs which are vital to healthy marine life and food security in South Asia.

Socially, we continue to focus on helping communities address gun violence with our Respond gunshot detection services which are in use by over 110 communities and growing. These efforts also assist police agencies with opportunities to improve relationships with under-served communities. In one city they reported finding 96 GSW victims over the course of 2020 based on ShotSpotter alerts alone with no corresponding 911 call. The officers provided first aid and called for an ambulance to get those victims to a hospital. Cooper University Health Care’s Level 1 Trauma Center in Camden, New Jersey published a study that measured and analyzed the positive outcomes of gunshot wound victims getting faster life-saving treatment because of a ShotSpotter alert. As Dr. John Porter, Head of Trauma Surgery, Cooper University Health Care explained, “People can bleed to death in minutes. The faster we get the person to the hospital, the better.”

From a Diversity, Equity & Inclusion (DEI) perspective, we are well positioned with our Leadership Team and Boards of Directors, including over 33% and 43% being persons of color/persons from underrepresented communities, respectively, and have ongoing efforts to expand our DEI impact even further.

Growth Strategy and Business Model

We believe we are well positioned to more than double the revenue from $45.7 million in 2020 to $100 million in the next four to five years (2024-2025) by growing at a compounded rate of growth of 17% to 22% from 2020. We are targeting a gross margin profile of 70%+ and Adjusted EBITDA2 margin profile of $45%+ at that $100 million in revenue target, effectively almost quadrupling the Adjusted EBITDA dollars from $11.9 million in 2020 to $45.0 million + in the same period. The combined revenue growth plus Adjusted EBITDA margin would place us well beyond the Rule of 40.

We get there by growing our franchise domestic gunshot detection service, ShotSpotter Respond sold to local police departments by adding another $20-25 million in ARR net of attrition. This can be accomplished by adding 100-110 miles of coverage area per year from new customers and expansions. We will also need to drive a combined with $17-19 million ARR net of attrition from gunshot detection in the international and security verticals along with contributions from ShotSpotter Investigate and ShotSpotter Connect.

We have demonstrated operational leverage by achieving GAAP profitability at $10 million of quarterly revenue. While we expect to increase investment in our go to market to take advantage of our new precision policing platform at this opportune time to accelerate growth, we still expect to maintain profitability. In 2020, our cost to produce an annualized dollar of revenue was only $0.51.

There are three factors that are driving what we feel is a near-term opportunity to be aggressive in investing in growth. First, the increase in social unrest and increased violence are motivating agencies to pursue transformation strategies. Technology has to be part of the discussion. We will have two solutions (patrol management and later this year, case management), beyond acoustic gunshot detection that are relevant to cities that do not have an elevated gun crime problem effectively providing us a much larger TAM in which to have impact. Second, and what is unique to our specific situation, are regional and smaller agency vertical tipping points that are coming into play with increasing frequency. We have discussed our regional tipping-point experience in Ohio, where one agency moves forward and demonstrates the impact that our solutions can provide, then we then quickly see other agencies follow. We are beginning to see an early-tipping point cadence play out within the Tier 4/5 vertical markets we only just pursued. In the past year we have already booked six and deployed in five Tier 4/5 agencies. We believe we are similarly situated in in Texas with our Houston pilot and recent Harris County deployments. If our experience in Texas mimics Ohio we might have several large, medium and small cities to follow that cumulatively could add a large number of miles within the state. Third, we are positively thrilled to see the Biden Administration American Rescue Plan

| 2 | We define Adjusted EBITDA margin as net income or loss before interest (income) expense, income taxes, depreciation and amortization, stock-based compensation expense and acquisition related expenses divided by total revenues. |

funding combined with the return of earmarks into the federal appropriations process. This is a game changer for our customers looking to procure public safety solutions. In our case it has already accelerated some agencies consideration of ShotSpotter and converted a potential customer attrition situation into a renew AND expand opportunity.

Summary

I continue to be inspired by the work that our team does in collaboration with our many customers. This past year has only strengthened our resolve to be the very best partner we can be as our law enforcement customers are navigating this watershed moment in the public safety environs. We believe we have a unique and compelling set of precision policing solutions for many of the new challenges facing agencies that need to effectively address the costly public safety gap.

At the business level we enjoy an enviable position with a unique, highly specialized and protected technology platform, good revenue visibility producing positive cashflow – and we do so with a strong balance sheet and zero debt. We have a green field opportunity in an underpenetrated market to grow for the foreseeable future and we get to do “work that matters” along the way.

We are grateful. Thank you for supporting us and we look forward to our journey with you over the next year and beyond.

| Sincerely, |

|

| Ralph Clark |

This letter contains forward-looking statements, including but not limited to statements regarding: the duration of the company’s headquarters closure and travel ban and their impact on the company’s operations; the company’s ability to maintain a high revenue retention rate, high NPS and low customer acquisition costs; the company’s plans to grow its go to market and customer success organizations in 2021; the company’s plans to retain existing customers including its NYPD relationship through LEEDS, take advantage of expansion opportunities within its existing customer base, and add additional customers, both internationally and domestically; the company’s plans to generate revenues from sales of ShotSpotter Connect, its security product offering and it’s to be launched ShotSpotter Investigate solution; and the company’s efforts to assist its customers with securing funding for purchases of the company’s services. The company’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, such as the duration and extent of the COVID-19 crisis and including those described in the risk factors included in the company’s most recent annual report on Form 10-K and other SEC filings. These forward-looking statements are made as of the date of this letter and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Except as required by law, the company undertakes no duty or obligation to update any forward-looking statements contained in this letter as a result of new information, future events or changes in its expectations.

ShotSpotter, Inc.

7979 Gateway Blvd., Suite #210 Newark, California 94560 +1.510.794.3100 main +1.888.274.6877 toll free www.shotspotter.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Melanie McFaddin with Wiley Bros – Aintree Capital &Partners, LLC Represents Theoris, Inc. in its Acquisition by CoreTech Consulting Group, LLC

- Twill Payments Secures Pre-Seed Funding to Revolutionize Data Analytics with AI

- Dr. Anthony Fletcher Installed as President of the Association of Black Cardiologists

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share