Form DEFA14A Owl Rock Capital Corp

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 23, 2020

OWL ROCK CAPITAL CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

Maryland |

|

814-01190 |

|

47-5402460 |

|

(State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

|

399 Park Avenue, |

|

10022 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (212) 419-3000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.01 per share |

|

ORCC |

|

The New York Stock Exchange |

Item 8.01 – Other Events

On December 23, 2020, Owl Rock Capital Group (“Owl Rock”), the parent of the registrant's investment advisor, and Dyal Capital Partners (“Dyal”) announced they are merging to form Blue Owl Capital (“Blue Owl”). Blue Owl will enter the public market via its acquisition by Altimar Acquisition Corporation (NYSE:ATAC) (“Altimar”), a special purpose acquisition company sponsored by an affiliate of HPS Investment Partners, LLC (the “Transaction”). Blue Owl will be a leading alternative asset management firm with over $45 billion in assets under management. As a result of the Transaction, Blue Owl will be listed on the NYSE under the new ticker “OWL.”

Owl Rock has announced that there will be no changes to the investment strategy, team or process of any entities managed by Owl Rock or its affiliates as a result of the Transaction. This includes Owl Rock’s five business development companies (collectively, the “Owl Rock BDCs”) managed by registered investment advisers that are indirect subsidiaries of Owl Rock: Owl Rock Capital Corporation (NYSE: ORCC), Owl Rock Capital Corporation II, Owl Rock Capital Corporation III, Owl Rock Core Income Corp. and Owl Rock Technology Finance Corp. The Owl Rock BDCs will continue to be led by their Chief Executive Officer and Owl Rock co-founder, Craig Packer.

The closing of the Transaction will result in a change of control of the registered investment adviser (the “Owl Rock Advisers”) to each of the Owl Rock BDCs, including the registrant, under the Investment Company Act of 1940, as amended (the “1940 Act”), which will result in the assignment of each Owl Rock BDC’s current investment advisory agreement in accordance with the 1940 Act. As a result, the shareholders of each Owl Rock BDC, as applicable, will be asked to approve an amended and restated investment advisory agreement between such Owl Rock BDC and the applicable Owl Rock Adviser at an upcoming special meeting. The amended and restated investment advisory agreement will replace the current investment advisory agreement upon the consummation of the Transaction. All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements, including that of the registrant, and such agreements, if approved by the Owl Rock BDCs’ shareholders, will become effective upon the closing of the Transaction.

Owl Rock, Dyal and Altimar issued a joint press release regarding the Transaction, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K. In addition, the Owl Rock BDCs provided an investor presentation and frequently asked questions in connection with the Transaction, copies of which are furnished as Exhibits 99.2 and 99.3, respectively, to this Current Report on Form 8-K.

The information disclosed under this Item 8.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Forward Looking Statements

Some of the statements contained herein may include “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than historical facts, including but not limited to statements regarding the expected timing of the Transaction; the expected benefits of the Transaction; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the control of the Owl Rock BDCs and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements including, without limitation, the risks, uncertainties and other factors identified in the Owl Rock BDCs’ filings with the SEC. Investors should not place undue reliance on these forward-looking statements, which apply only as of the date on which such Owl Rock BDC makes them. The Owl Rock BDCs do not undertake any obligation to update or revise any forward-looking statements or any other information contained herein, except as required by applicable law.

Additional Information and Where to Find It

In connection with this Transaction which will result in the change in control of the Owl Rock Advisers, the applicable Owl Rock BDCs intend to file proxy statements in preliminary and definitive form with the Securities and Exchange Commission (the “SEC”) that will contain important information about the proposed transaction and related matters, and deliver a copy of the proxy statement to its shareholders. INVESTORS OF THE OWL ROCK BDCs ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors may obtain a free copy of these materials when they are available and other documents filed by the Owl Rock BDCs with the SEC at the SEC’s website at www.sec.gov or at Owl Rock’s website at www.owlrock.com or www.owlrock.com/proxy/ or, for Owl Rock Capital Corporation, at www.owlrockcapitalcorporation.com. Investors and security holders may also obtain free copies of the proxy statement and other documents filed with the SEC from the Owl Rock BDCs by contacting Investor Relations at (212) 651-4705.

Participants in the Solicitation

The applicable Owl Rock BDCs and their directors, executive officers, employees and other persons may be deemed to be participants in the solicitation of proxies from the shareholders of the applicable Owl Rock BDCs’ common stock in respect of the change in control Transaction. For information regarding the Owl Rock BDCs’ directors and executive officers, please see: Owl Rock Capital Corporation’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Capital Corporation II’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Technology Finance Corp.’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; and Owl Rock Capital Corporation III’s registration statement on Form 10 filed with the SEC on July 17, 2020. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

Item 9.01 — Financial Statements and Exhibits

(d) Exhibits:

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

|

|

99.2 |

|

|

|

99.3 |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

Owl Rock Capital Corporation | ||

|

|

|

| |

|

Date: December 23, 2020 |

By: |

/s/ Alan Kirshenbaum | |

|

|

|

Name: |

Alan Kirshenbaum |

|

|

|

Title: |

Chief Operating Officer and Chief Financial Officer |

Owl Rock Capital Group and Dyal Capital Partners Execute Definitive Business Combination Agreement to Form Blue Owl Capital and List on NYSE via a Business Combination with Altimar Acquisition Corporation

· Owl Rock and Dyal to combine to form Blue Owl, a differentiated alternative asset manager with industry leading Direct Lending and GP Capital Solutions businesses

· Combined firm to manage over $45.0 billion in assets

· Blue Owl to become publicly listed through a business combination with Altimar, a SPAC sponsored by an affiliate of HPS Investment Partners (NYSE:ATAC)

· Blue Owl is expected to be listed on the NYSE under the ticker symbol “OWL” following the expected close of the transaction in the first half of 2021

· Transaction expected to provide approximately $1.8 billion in gross proceeds, comprised of Altimar’s $275 million of cash held in trust (assuming no redemptions) and a $1.5 billion fully committed, oversubscribed, common stock PIPE at $10.00 per share, including investments from ICONIQ Capital, CH Investment Partners, Koch Companies Defined Benefit Master Trust, the Federated Hermes Kaufmann Funds, and Liberty Mutual Investments

· The founders and senior managers of Blue Owl will retain their equity stakes through the combined entity’s transition into a publicly listed company, promoting continued alignment

NEW YORK — December 23, 2020 - Owl Rock Capital Group (“Owl Rock”) and the Dyal Capital Partners (“Dyal”) division of Neuberger Berman Group LLC (“Neuberger Berman”) today announced they entered into a definitive business combination agreement with Altimar Acquisition Corporation (NYSE: ATAC) (“Altimar”) to form Blue Owl Capital Inc. (“Blue Owl”), an alternative asset management firm with over $45.0 billion in assets under management.

Blue Owl will enter the public market through a business combination with Altimar, a special purpose acquisition company sponsored by an affiliate of HPS Investment Partners, LLC. The combined entity is expected to have a post-transaction market capitalization of approximately $12.5 billion. As a result of the transaction, Blue Owl is expected to be listed on the NYSE under the new ticker “OWL.”

The new firm’s main business will focus on two of the fastest growing areas of alternative asset management: Direct Lending, where Owl Rock is one of the leading private credit providers to middle and upper middle market businesses backed by top-tier financial sponsors, and GP Capital Solutions, where Dyal has been a leader and innovator since its founding. The Owl Rock and Dyal businesses will be autonomous but complementary. By bringing together two preeminent businesses in their respective fields, Blue Owl will be positioned as a differentiated provider of holistic solutions to the alternative asset management community. Each business will be led by its current long-tenured management, and its respective investment teams will continue to employ the disciplined investment philosophies that they have delivered since inception.

Doug Ostrover, co-founder of Owl Rock, will serve as Chief Executive Officer of Blue Owl. On the announcement of the strategic combination, he stated: “Blue Owl’s expertise, agility and scale, supported by a substantial permanent capital base, will enable us to offer a holistic platform of capital solutions to private equity firms and privately held businesses. We believe this will broaden and deepen our relationships and provide us with unrivaled access to compelling investment opportunities. In addition, this permanent capital base will allow Blue Owl to continue to strongly grow its business in a consistent and predictable manner. The foundation of our success is the trust our clients and partners place in us based on our experience, investment approach, and commitment to serving them. We look forward to solidifying our position as the capital partner and investment manager of choice for our stakeholders.”

Michael Rees, Dyal founder, and Marc Lipschultz, Owl Rock co-founder, will be co-Presidents of Blue Owl. Rees said: “Our businesses will combine robust growth and a strong margin profile with a high level of earnings visibility and stability, offering investors a compelling way to access the alternative asset management industry.” Lipschultz

added: “By building on this strong foundation, we believe we are well positioned to continue to expand our current platforms and pursue new, complementary business lines to provide differentiated sources of returns for our investors.”

George Walker, Chairman and Chief Executive Officer of Neuberger Berman added: “This partnership is a clear and natural fit. Neuberger Berman, as a meaningful shareholder, looks forward to seeing Blue Owl continue to grow as an industry leader. Moreover, Neuberger Berman has the privilege of continuing to manage $80 billion in alternatives distinct from the Dyal business, and our culture of innovation from which Dyal began will continue to help us deliver for clients in the years to come.”

Upon completion of the transaction, Blue Owl will be a stand-alone firm and Owl Rock and Dyal founders, alongside Neuberger Berman will own meaningful equity positions in Blue Owl.

Blue Owl is expected to combine these strengths:

Owl Rock Direct Lending Highlights:

· Scaled direct lending business with $23.7 billion in assets under management as of September 30, 2020

· Focused on lending to middle- and upper-middle-market, private equity-sponsored companies

· Technology lending strategy capitalizing on the large and growing demand for technology products and services

· Led by an investment team dedicated to direct lending

· Demonstrated ability to source proprietary investment opportunities with $24 billion in originations since inception

· Industry-leading credit performance historically and throughout the COVID-19 pandemic

Dyal GP Capital Solutions Platform Highlights

· Industry leading GP capital solutions business with a proven track record, having completed 57 transactions with 49GPs to date

· Deep and extensive relationships across the alternative asset management ecosystem

· Large permanent capital base totaling $23.3 billion in assets under management (as of November 30, 2020) promotes the formation of strong, value-added partnerships

· Unique Business Services Platform assists GPs in the portfolio with a leading set of strategic and capital raising advisory services

· Led by founder Michael Rees and a senior management team that has an average of 18 years of experience and more than a decade of working together in the GP Capital Solutions business

Blue Owl management believes it will have a uniquely attractive financial profile due to its combination of strong growth and margins with a focus on permanent capital and fee related earnings (“FRE”). Specifically, the firm will have over $45.0 billion in combined assets under management, 92% of which would be permanent capital, and initially will derive its distributable earnings from FRE, which allows for enhanced predictability of earnings. Blue Owl will be well positioned to grow its asset base and distributable earnings due to the complementary client relationships and skillsets of Dyal and Owl Rock, which we believe will further enable new product expansion.

We believe investors in Blue Owl sponsored funds will benefit from a strategic combination without disruption to the service they receive or the investment programs they rely upon. Investment strategies, processes and teams for the company’s funds will remain consistent, while expecting that their investors will gain from the combined company’s expanded platform, broadened and deepened relationships across the alternative asset management landscape, and a broader range of expertise across the firm.

Owl Rock Capital Corporation (“ORCC”), Owl Rock Capital Corporation II, Owl Rock Capital Corporation III, Owl Rock Technology Finance Corp. and Owl Rock Core Income Corp. (the “Owl Rock BDCs”) will continue to be led by their Chief Executive Officer and Owl Rock co-founder, Craig Packer, and will not undertake any change to

their investment strategies, team or process from this transaction. This includes ORCC, which is publicly traded under the “ORCC” ticker.

The closing of the transaction will result in a change of control of the registered investment adviser (the “Owl Rock Advisers”) to each of the Owl Rock BDCs under the Investment Company Act of 1940, as amended (“1940 Act”), and will require the assignment of each Owl Rock BDC’s current investment advisory agreement in accordance with the 1940 Act. As a result, each BDC’s shareholders will be asked to approve an amended and restated investment advisory agreement between such Owl Rock BDC and the applicable Owl Rock Adviser, which will replace its current investment advisory agreement upon the consummation of the transaction. All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements, and such agreements, if approved by the applicable Owl Rock BDCs’ shareholders, will become effective upon the closing of the transaction.

Transaction Overview

Pursuant to the transaction, Altimar, which currently holds $275 million in cash in trust, will combine with Blue Owl at an estimated $12.5 billion pro forma equity value at closing. Assuming no redemptions by Altimar’s existing public stockholders, the existing equityholders of Owl Rock and Dyal (including Neuberger Berman) will hold approximately 85% of Blue Owl immediately following the closing of the business combination. The founders and senior managers of Blue Owl will retain their equity stakes immediately following the transaction, promoting continued alignment with the combined company’s public investors and clients.

Cash proceeds in connection with the transaction will be funded through a combination of Altimar’s cash in trust and a $1.5 billion fully committed, oversubscribed, common stock private investment in public equity (“PIPE”) at $10.00 per share, including commitments from leading investors including ICONIQ Capital, CH Investment Partners, Koch Companies Defined Benefit Master Trust, the Federated Hermes Kaufmann Funds, and Liberty Mutual Investments.

The board of directors for each of Altimar and Neuberger Berman, as well as the Executive Committee of Owl Rock have unanimously approved the proposed transaction. Completion of the proposed transaction is subject to approvals of Altimar’s stockholders, the equityholders of each of the Owl Rock BDCs to the assignment of its advisory agreement, as discussed above, and Dyal-sponsored fund’s limited partners, in addition to other customary closing conditions, including a registration statement being declared effective by the Securities and Exchange Commission. The transaction is expected to be completed in the first half of 2021.

Management and Board of Directors

Upon completion of the strategic combination, Blue Owl will be led by Doug Ostrover (Owl Rock co-founder) as Chief Executive Officer. The senior management team will also include Michael Rees (founder of Dyal) and Marc Lipschultz (Owl Rock co-founder) as co-Presidents and Alan Kirshenbaum as Chief Financial Officer. Craig Packer (Owl Rock co-founder) will continue as Chief Executive Officer of the Owl Rock BDCs.

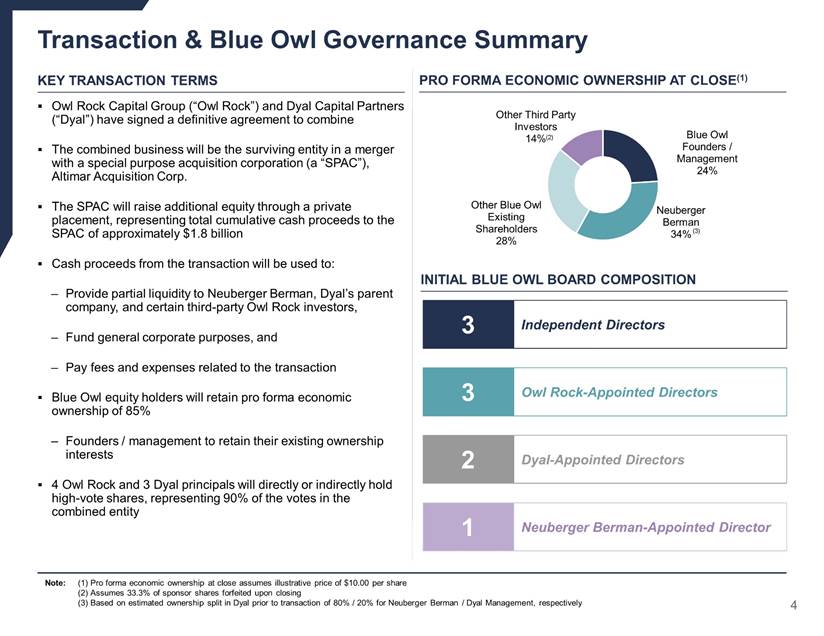

Blue Owl’s nine-person board of directors will be initially composed of three independent directors, three Owl Rock-appointed directors, two Dyal-appointed directors and one Neuberger Berman-appointed director.

Advisors

Perella Weinberg Partners LP, Goldman Sachs & Co. LLC and BofA Securities, Inc. are serving as financial advisors and Kirkland & Ellis LLP is serving as legal counsel to Owl Rock.

Ardea Partners LP is serving as financial advisor for Neuberger Berman and Dyal. Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal counsel to Neuberger Berman. Additionally, Citigroup and UBS are serving as advisors to Neuberger Berman.Evercore Group LLC is serving as financial advisor and Fried, Frank, Harris, Shriver & Jacobson LLP is serving as legal counsel to Dyal.

J.P. Morgan Securities LLC is serving as exclusive financial advisor and Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal counsel to Altimar Acquisition Corporation.

Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC acted as joint placement agents on the PIPE.

Investor Conference Call Information

An investor call and presentation discussing the transaction is available at the link below:

https://dpregister.com/sreg/10150767/dfccfb54ba

Participant Dial In (Toll Free): 1-866-777-2509

Participant International Dial In: 1-412-317-5413

A transcript of the call will also be filed by Altimar with the SEC.

On the call, the presenters will be reviewing an investor presentation, which will be filed with the SEC as an exhibit to a Current Report on Form 8-K prior to the call, and available on the SEC website at www.sec.gov.

About Altimar Acquisition Corporation

Altimar Acquisition Corporation is a special purpose acquisition company sponsored by Altimar Sponsor, LLC, an affiliate of HPS Investment Partners, LLC, formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. For more information, visit www.altimarspac.com.

About Owl Rock

Owl Rock Capital Group, together with its subsidiaries, is a New York-based direct lending platform with approximately $23.7 billion of assets under management as of September 30, 2020. Owl Rock’s platform consists of multiple investment funds and products including business development companies (“BDCs”). Owl Rock is comprised of a team of seasoned investment professionals with significant and diverse experience from some of the world’s leading investment firms and financial institutions. Owl Rock’s relationship-oriented approach to investing seeks to provide companies with sizeable commitments to facilitate transactions and support their growth needs with certainty, speed and transparency throughout the entire investment process.

About Dyal Capital

Dyal Capital seeks to acquire minority equity stakes in and provide financing to established alternative asset managers. With over a decade of experience transacting with institutional financial firms, Dyal has completed over 50 equity and debt transactions and manages approximately $23.3 billion in aggregate capital commitments as of November 30, 2020. Central to Dyal’s success is our Business Services Platform (the “BSP”). The BSP is a team that provides strategic support to underlying management company partners in various areas, primarily including capital strategy and advisory services. Part of Neuberger Berman, the Dyal team is located in New York, London, and Hong Kong.

About Neuberger Berman

Neuberger Berman Group LLC, founded in 1939, is a private, independent, employee-owned investment manager. The firm manages a range of strategies—including equity, fixed income, quantitative and multi-asset class, private equity, real estate and hedge funds—on behalf of institutions, advisors and individual investors globally. With offices in 24 countries, Neuberger Berman’s diverse team has over 2,300 professionals. For six consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more). In 2020, the PRI named Neuberger Berman a Leader, a designation awarded to fewer than 1% of investment firms for excellence in Environmental, Social and Governance (ESG) practices. The PRI also awarded Neuberger Berman an A+ in every eligible category for its approach to ESG integration across asset classes. The firm manages $374 billion in client assets as of September 30, 2020, including $103 billion in alternative assets.

Important Additional Information and Where to Find It

This communication is being made in respect of the proposed business combination transaction involving Altimar and Blue Owl. Altimar intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), which will include a proxy statement and a prospectus of Altimar, and each party will file other documents with the SEC regarding the proposed transaction. A definitive proxy statement/prospectus will also be sent to the stockholders of Altimar, seeking any required stockholder approval. Before making any voting or investment decision, investors and security holders of Altimar are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they

will contain important information about the proposed transaction. The documents filed by Altimar with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Altimar may be obtained free of charge from Altimar at www.altimarspac.com. Alternatively, these documents, when available, can be obtained free of charge from Altimar upon written request to Altimar Acquisition Corp., 40 West 57th Street, New York, New York 10019, Attn: Secretary, or by calling 212-287-6767.

In connection with the proposed transaction which will result in the change in control of the Owl Rock Advisers, the applicable Owl Rock BDCs intend to file proxy statements in preliminary and definitive form with the Securities and Exchange Commission (the “SEC”) that will contain important information about the proposed transaction and related matters, and deliver a copy of the proxy statement to its shareholders. Investors of the Owl Rock BDCs are urged to read the definitive proxy statement and other relevant documents carefully and in their entirety when they become available because they will contain important information about the proposed transaction and related matters. Investors may obtain a free copy of these materials when they are available and other documents filed by the Owl Rock BDCs with the SEC at the SEC’s website at www.sec.gov or at Owl Rock’s website at www.owlrock.com or www.owlrock.com/proxy/ or, for Owl Rock Capital Corporation, at www.owlrockcapitalcorporation.com. Investors and security holders may also obtain free copies of the proxy statement and other documents filed with the SEC from the Owl Rock BDCs by contacting Investor Relations at (212) 651-4705.

Participants in the Solicitation

Altimar and certain of its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Altimar, in favor of the approval of the business combination. For information regarding Altimar’s directors and executive officers, please see Altimar’s final prospectus related to its initial public offering filed with the SEC on October 23, 2020. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding section.

The applicable Owl Rock BDCs and their directors, executive officers, employees and other persons certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders or shareholders of the applicable Owl Rock BDCs’ common stock in respect of the change in control Transaction. For information regarding the Owl Rock BDCs’ directors and executive officers, please see: Owl Rock Capital Corporation’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Capital Corporation II’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Technology Finance Corp.’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; and Owl Rock Capital Corporation III’s registration statement on Form 10 filed with the SEC on July 17, 2020. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction.

Forward-Looking Statements

Certain statements made in this press release, and oral statements made from time to time by representatives of Owl Rock, Dyal and Neuberger Berman are “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Statements regarding the potential combination and expectations regarding the combined business are forward-looking statements. In addition, words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of the parties, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements.

In addition to factors previously disclosed in Altimar’s reports filed with the SEC, including its registration statement on Form S-1 filed in connection with its initial public offering, and those identified elsewhere in this communication, important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) the inability of the parties to enter into a definitive agreement with respect to the potential combination or to complete the contemplated transactions; (ii) matters discovered by any of the parties as they complete their respective due diligence investigation of the other parties; (iii) the risk that requisite regulatory, corporate and other approvals and consents for the potential transaction are not obtained or are delayed; (iv) the inability to recognize the anticipated benefits of the proposed combination; (v) delays in signing or closing a transaction; (vi) difficulties, delays or unanticipated costs in integrating the operations or personnel of Owl Rock and Dyal; (vii) unexpected costs resulting from the transaction; (viii) changes in general economic conditions, including as a result of the COVID-19 pandemic and (ix) regulatory conditions and developments. Forward-looking statements speak only as of the date they are made, and none of Owl Rock, Dyal or Neuberger Berman undertakes any obligation, and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Readers should carefully review the statements set forth in the reports, which Altimar has filed or will file from time to time with the SEC.

Non-GAAP Financial Measures

This press release includes references to fee related earnings, or FRE, which is a supplemental measure that is not required by, or prepared in accordance with, accounting principles generally accepted in the United States (“GAAP”).

FRE is used to assess core operating performance by determining whether recurring revenue is sufficient to cover operating expenses and to generate profits. FRE is derived from and reconciled to, but not equivalent to, its most directly comparable GAAP measure of Net Income (Loss) Before Income Taxes. FRE differs from income before taxes computed in accordance with GAAP as it excludes performance income, performance related compensation, investment net gains (losses) and certain other items that we believe are not indicative of our core operating performance. We use FRE as a non-GAAP measure to assess and track our performance. FRE is not a measurement of our financial performance under GAAP and should be considered in addition to, and not in lieu of, the results of operations which are derived in accordance with GAAP.

Altimar Contact

Prosek Partners

Mike Geller

Owl Rock and Dyal Contacts

Prosek Partners

David Wells / Andy Merrill / Josh Clarkson / Emily Goldberg

[email protected] / [email protected] / [email protected] / [email protected]

Merger of Owl Rock Capital Group and Dyal Capital Partners December 2020 Blue Owl Overview

Disclaimers This Investor Presentation is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instrument of any of Owl Rock, Dyal or the Company in any jurisdiction in which the offer, solicitation, recommendation or sale would be unlawful. The information contained herein does not purport to be comprehensive. The data contained herein is derived from various internal and external sources, which has not been independently verified by Owl Rock, Dyal or the Company. No representation is made as to the reasonableness of the assumptions underlying, or the accuracy or completeness of any, modeling or back-testing or any other information contained herein. All levels, prices and spreads are historical and do not represent current market levels, prices or spreads, some or all of which may have been changed since the issuance of this document. Any data on past performance, modeling or back-testing contained herein is not an indication as to future performance. Use of Projections This Investor Presentation contains financial forecasts or projections with respect to Dyal, Owl Rock or the Company. Projected performance with respect to Dyal, Owl Rock, the Company, the investment vehicles they manage or expect to manage, and the investments such vehicles make or expect to make is provided on a pro forma basis and is based on certain good faith assumptions that Dyal and Owl Rock believe are reasonable (including, without limitation, estimates and targets of future operating results or cash flows). The actual performance will depend on, among other factors, future operating results, including of the investment vehicles and their portfolio companies, the value of certain assets and market conditions at the time of establishment, acquisition or disposition, any related transaction costs, and time and manner of establishment, acquisition and disposition, all of which may differ from the underlying assumptions on which the projected performance data contained herein are based. In addition, there are many risk factors that could cause Dyal and Owl Rock’s assumptions to prove to be incorrect. These risks therefore could cause the actual performance of the Company to be materially different from the current projected, targeted or estimated performance. These projections are provided solely for illustrative purpose, and there can be no assurances that any projections or targets will ultimately be realized, in the manner illustrated herein or at all. No independent registered public accounting firm of Dyal, Owl Rock or the Company has audited, reviewed, compiled, or performed any procedures with respect to the financial forecasts or projections for the purpose of their inclusion in this Investor Presentation, and accordingly, none of them expresses an opinion or provides any other form of assurance with respect thereto for the purpose of this Investor Presentation. These financial forecasts and projections should not be relied upon as being necessarily indicative of future results. Forward Looking Statements This Investor Presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of the Company are based on current expectations that are subject to risks and uncertainties, including those described below. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. Investing in unseasoned companies and in sponsors of alternative investment platforms carries significant risk. Operating results in a specified period will be difficult to predict. The performance of Dyal and Owl Rock, and thus the Company, will depend upon their success in structuring, distributing and operating alternative investment vehicles, including current and potential future vehicles, which will impact the operating results of each of Dyal, Owl Rock, the Company, the investment vehicles they manage or expect to manage, and the investments such vehicles make or expect to make are and will be subject to various risks relating to such entities’ operations, including, but not limited to: weaker-than anticipated market acceptance of products and services; disruptions in technology development; an inability to successfully manage expanding operations; an inability to attract and retain key management and technical personnel; competition posed by established enterprises; changes in accounting rules or government regulation; weakness in the applicable industries as well as the U.S. and global economy; currency fluctuations; and the effects of other geopolitical events. Each of Dyal, Owl Rock, the Company, the investment vehicles they manage or expect to manage, and the investments such vehicles make or expect to make is subject to the ongoing effects of the COVID-19 pandemic, the impact of which is particularly difficult to forecast. Because all forward-looking statements involve risks and uncertainties, actual results of the Dyal, Owl Rock and the Company may differ materially from any expectations, projections or predictions made or implicated in such forward-looking statements. Prospective investors are therefore cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date made. None of Owl Rock, Dyal or the Company commits to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

Transaction Summary

Transaction & Blue Owl Governance Summary Key transaction terms Owl Rock Capital Group (“Owl Rock”) and Dyal Capital Partners (“Dyal”) have signed a definitive agreement to combine The combined business will be the surviving entity in a merger with a special purpose acquisition corporation (a “SPAC”), Altimar Acquisition Corp. The SPAC will raise additional equity through a private placement, representing total cumulative cash proceeds to the SPAC of approximately $1.8 billion Cash proceeds from the transaction will be used to: Provide partial liquidity to Neuberger Berman, Dyal’s parent company, and certain third-party Owl Rock investors, Fund general corporate purposes, and Pay fees and expenses related to the transaction Blue Owl equity holders will retain pro forma economic ownership of 86% Founders / management to retain their existing ownership interests 4 Owl Rock and 3 Dyal principals will directly or indirectly hold high-vote shares, representing 90% of the votes in the combined entity Note: (1) Pro forma economic ownership at close assumes illustrative price of $10.00 per share (2) Assumes 33.3% of sponsor shares forfeited upon closing (3) Based on estimated ownership split in Dyal prior to transaction of 80% / 20% for Neuberger Berman / Dyal Management, respectively Pro forma economic ownership at close(1) (2) (3) Independent Directors 3 Owl Rock-Appointed Directors 3 Dyal-Appointed Directors 2 Neuberger Berman-Appointed Director 1 Initial Blue Owl board composition Blue Owl Founders / Management 24% Neuberger Berman 34% Other Blue Owl Existing Shareholders 28% SPAC Shares 2% PIPE Shares 12% Sponsor Shares 0.4%

Implications for Owl Rock BDCs

Implications for Owl Rock BDCs The closing of the merger will result in a deemed change in control of the advisor(s) to Owl Rock’s managed BDCs (the “Owl Rock BDCs”) As a result, shareholders of Owl Rock’s managed BDCs, as applicable, will be asked to approve an amended and restated investment advisory agreement All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements Investor Proxy Timeline Owl rock Managed BDC Impact No Change to the Investment Team Team No Change to the Investment Process Process No change to the Investment Committee BDC IC No change to Investment Terms Terms Merger Announcement: December 23, 2020 1 Proxy Voting Starts: January 2021 2 Transaction Closes: First Half 2021 4 Shareholder Meeting: March 2021 3

III. Blue Owl Platform Highlights

Strategic Benefits of Blue Owl: A Leading Provider of GP Solutions Note: Metrics based on Owl Rock AUM as of 9/30/20 and Dyal AUM as of 11/30/20; Dyal AUM includes $1.4bn of closed commitments from Fund V Blue Owl Direct Lending Platform AUM: $23.7bn GP Capital Solutions AUM: $23.3bn Founded in 2016 by Doug Ostrover, Marc Lipschultz and Craig Packer $19.7bn in permanent capital Provides lending solutions to leading private market sponsors Founded in 2010 by Michael Rees $23.3bn in permanent capital Provides minority stake equity and financing solutions to leading private market sponsors strategic rationale Enhanced origination opportunities for Direct Lending business through ownership relationships in GP Capital Solutions business Enhanced origination opportunities for GP Capital Solutions business through larger origination network and in-depth firm insights from Direct Lending business Significant opportunity to expand and diversify the investor base across all products due to limited overlap of current product investors P P P Superior new product development through combined skills, experience and knowledge P Differentiated Retail and Institutional Distribution Platform

Blue Owl is a Preeminent Provider of Private Market GP Solutions Deep relationships facilitate a differentiated ecosystem to deliver GP solutions Note: Metrics based on Owl Rock AUM as of 9/30/20 and Dyal AUM as of 11/30/20 (1) Includes closed commitments from Fund V of $1.4bn as of November 2020 BROAD range of capital solution strategies & Extensive network of relationships Portfolio Companies Fund Solutions GP Solutions Diversified Lending First Lien Lending Technology Lending Opportunistic Lending Co-Investments Secondary Solutions GP Lending GP Stakes AUM: $15.2bn AUM: $2.9bn AUM: $4.5bn AUM: $1.1bn To launch To launch AUM: $1.0bn AUM: $22.3bn(1) Advent International Global Private Equity Altamont Capital Partners American Securities Aquiline Capital Partners Arcmont Asset Management Audux Group Bain Capital Private Equity Berkshire Partners Bridgepoint Advisers Cerberus Capital Management Clayton, Dubilier & Rice Clearlake Capital Group Cross Harbor Capital Partners Francisco Partners Genstar Capital Golden Gate Capital Goldman Sachs GTCR Private Equity HG Capital HGGC HLG Capital I Squared Capital KKR & Co Kohlberg & Company KPS Capital Partners L Catterton MSD Capital New Mountain Capital Odyssey Investment Partners ONEX Corporation Platinum Equity Providence Equity Partners RXR Realty Silver Lake Partners SoftBank Starwood Capital Group Summit Partners TA Associates Thoma Bravo Towerbrook Capital Partners TPG Capital TSG Consumer Partners Vector Capital Veritas Capital Vista Equity Partners Warburg Pincus

Senior Leadership Doug Ostrover CEO Co-Founder and CEO of Owl Rock Capital Partners and a member of the Advisors’ Investment Committee Co-CIO of Owl Rock Capital Advisors Prior to founding Owl Rock, was one of the founders of GSO Capital Partners and a Senior Managing Director at Blackstone 25+ years of experience Marc Lipschultz Co-President Co-Founder and President of Owl Rock Capital Partners Co-CIO of Owl Rock Capital Advisors Prior to founding Owl Rock, spent more than two decades at KKR, serving on the firm’s Management Committee and as the Global Head of Energy and Infrastructure 25+ years of experience Michael Rees Co-President Managing Director and Head of Dyal Capital Partners and a member of Neuberger Berman’s Partnership Committee Prior to founding Dyal, was a founding employee and shareholder of Neuberger Berman Group and the first Chief Operating Officer of the NB Alternatives business 20+ years of experience Alan Kirshenbaum CFO Chief Operating Officer & Chief Financial Officer of Owl Rock Capital Partners, ORCC, ORTF and Owl Rock Capital Advisors, as well as the Chief Operating Officer of ORCC III Prior to Owl Rock, was the CFO of TPG Specialty Lending, Inc. 25+ years of experience

Business Overviews

Direct Lending Key Highlights Blue Owl is one of the leading direct lending platforms managed by a seasoned executive team Scale Robust proprietary deal flow driven by an extensive network of sponsors Significant backing from highly sophisticated investors Deep bench of experienced investment professionals $23.7bn Assets Under Management Track Record Demonstrated ability to source proprietary investment opportunities with $24bn in originations Strong credit performance across the platform with below market payment defaults Successfully listed Owl Rock Capital Corporation (“ORCC”) on NYSE(1) 11.8% IRR on Realized Investments Since Inception Alignment Not affiliated with a controlling equity sponsor Entire investment team is focused on direct lending Relationship-oriented approach at all levels $465m+ Owl Rock Executive and Employee Capital Commitments Experience Founders: Douglas Ostrover, Marc Lipschultz and Craig Packer Senior executive roles at GSO / Blackstone, KKR and Goldman Sachs Extensive experience building and managing investment businesses 25+ Each of Co-Founder’s Years of Experience Note: As of 9/30/20. Direct Lending does not include Dyal Financing Fund, which is included in GP Capital Solutions. Past performance is not a guarantee of future results. Internal Rate of Return (“IRR”) only reflects fully realized investments for Owl Rock’s diversified lending, first lien and technology lending strategies and would be different (and potentially higher or lower) if the IRR on unrealized investments were factored into the calculations. In addition, as the IRR shown only represents the IRR on investments, it does not include the impact of management and incentive fees or fund level expenses, including taxes, which would be borne by Owl Rock funds or their shareholders. As such an actual investor in the Owl Rock Funds would have achieved an IRR on its realized investments lower than the one shown (1) Listed on 7/17/19

Complementary verticals that leverage existing origination and underwriting functions Direct Lending Platform Breakdown Note: As of 9/30/20. Past performance is not a guarantee of future results (1) Represents the total capital commitments provided by investors, the total accepted by ORCC III is a lower amount $23.7bn Assets Under Management Diversified Lending First Lien Lending Technology Lending Opportunistic Lending Funds ORCC, ORCC II, ORCC III, ORDL, ORCIC First Lien Fund, Managed Accounts Tech. Finance Corp. Opportunistic Fund, Managed Accounts Assets Under Management $15.2 billion(1) $2.9 billion $4.5 billion $1.1 billion Structure(s) Public, Private, and non-traded BDCs, Limited Partnership Limited Partnership, Managed Accounts Private BDC Limited Partnership, Managed Accounts Commencement of Strategy ORCC / ORCC II: 2016 / 2017 ORCC III / ORDL 2020: 2020 ORCIC: 2021 2018 2018 2020 Equity Raised ORCC: $5.9 billion ORCC II: $1.2 billion ORCC III: $1.2 billion(1) $1.6 billion $3.0 billion $1.0 billion Focus Private equity sponsored companies and other corporate situations Directly originated senior secured, floating rate loans (first lien, second lien, unitranche) Private equity sponsored companies and other corporate situations Directly originated senior secured, floating rate first lien loans Private equity and late stage venture capital sponsored companies and other corporate situations Directly originated debt and equity investments in U.S. companies in the technology sector Private equity sponsored companies and other corporate situations Directly originated debt and equity investments in U.S. companies facing challenges

GP Capital Solutions Key Highlights Blue Owl is a leading provider of capital solutions to private markets managers Long-Term Partner Permanent capital enables formation of stable, value-added partnerships 34-person Business Services Platform team collaborates with partner managers to achieve their unique business goals by offering a range of advisory services and capital strategies to support growth 100% Permanent Capital Note: (1) As of 11/30/20; Includes closed commitments of $1.4bn from Fund V as of November 2020 Size & Scale Strong and extensive relationships across the alternative asset management ecosystem Large base of stable capital facilitates partnership with leading alternative managers Recognized as a market leader in the GP-stake universe $23.3bn Assets Under Management(1) Experience Founder: Michael Rees Average 18 years of experience across senior management team Completed 57 equity and debt transactions across 49 managers 10+ Years of Team Experience Executing Minority Partnership Strategy

Complementary strategies providing a range of solutions to capital-constrained ecosystems GP Capital Solutions Platform Breakdown Existing strategies Newly launched strategies Alternative manager Gp stakes Private equity GP Financing Co-investments & structured equity Professional Sports minority Stakes Funds Funds I-V Financing Fund (DFF) Strategic Capital HomeCourt Partners mandate Funds I-II: Primarily hedge fund minority stakes Funds III-V: Primarily private equity minority stakes Long-term financing to private alternative asset managers Minority equity investments in portfolio companies of private equity partners NBA franchise minority equity stakes Structure Closed-End Permanent Capital Fund Open-Ended Permanent Capital Fund Open-Ended Permanent Capital Fund Open-Ended Permanent Capital Fund Committed capital / Initial Investment Capacity $19.2bn(1) Expected Initial Investment Capacity of $3.0bn Expected Initial Investment Capacity of $3.0bn Expected Initial Investment Capacity of $2.0bn Commencement of Strategy 2010 2019 # of Partnerships 49 3 Note: Strategic Capital and HomeCourt Partners are expected new strategies of the Dyal business. There can be no assurance that such strategies will launch as expected (1) Includes closed commitments from Fund V of $1.4bn as of November 2020; excludes co-investments

Owl Rock & Dyal Merger — Frequently Asked Questions

I. Transaction Overview

1. Describe the transaction.

Owl Rock Capital Group (“Owl Rock”) and Dyal Capital Partners (“Dyal”) have signed a definitive agreement to combine in a strategic transaction that will bring together two industry leading investment platforms focused on providing capital solutions to the alternative asset management industry.

The combined business will be the surviving entity in a merger with a special purpose acquisition corporation (a “SPAC”), which will raise additional equity through a private placement, representing total cumulative cash proceeds to the SPAC of approximately $1.775 billion that it will use to facilitate the transaction. The surviving combined business, Blue Owl Capital, will be listed on the New York Stock Exchange (NYSE: OWL).

Proceeds from the transaction will be used to provide partial liquidity to Neuberger Berman, Dyal’s parent company, and certain third-party Owl Rock investors, to fund general corporate purposes, and to pay fees and expenses related to the transaction. Owl Rock’s management team will retain their existing ownership stakes and will not sell their interests in connection with the transaction.

It is expected that Owl Rock and Dyal will be led by their current respective long-tenured management and their respective investment teams will continue to employ their longstanding disciplined investment philosophies.

2. Discuss the strategic rationale for the transaction.

The transaction will bring together two industry leading investment platforms that provide capital solutions to the alternative asset management industry: Owl Rock, one of the leading direct lenders to upper middle market businesses backed by top-tier financial sponsors, and Dyal, which focuses on GP Capital Solutions, an industry Dyal has been at the forefront of since its founding. Owl Rock and Dyal will operate as distinct but complementary segments. By bringing together two preeminent franchises in these respective fields Blue Owl will be positioned as a differentiated provider of holistic solutions to the alternative asset management community. We believe this will solidify Blue Owl’s ability to offer a full suite of capital solutions to the financial sponsor community. In addition, Blue Owl is expected to benefit from the increased scale and resources that a larger, more global platform will provide.

II. Owl Rock’s Strategy and Approach

1. Will Owl Rock’s investment process or team change?

No. Owl Rock’s investment approach and process will not change. Further, there will be no changes to Owl Rock’s investment committees or investment team as a result of the transaction.

2. How will talend be retained?

We believe employees across both firms will be excited by the opportunities that the combined platform should provide. Senior management believes that Owl Rock and Dyal’s greatest assets are its teams, and expects to maintain the existing approaches to employee retention, which has proven successful, and potentially make additional enhancements.

3. Will Owl Rock’s allocation policy change?

We expect to revise our existing allocation policy to take into account the Dyal strategy and enhance our allocation procedures but we do not anticipate any material changes to Owl Rock’s allocation policy as a result of the transaction.

4. Does the merger result in any changes to Owl Rock’s managed products?

There will be no changes to the investment strategy, team or process of any entities managed by Owl Rock or its affiliates as a result of the transaction. This includes Owl Rock’s five business development companies (collectively, the “Owl Rock BDCs”) managed by registered investment advisers that are indirect subsidiaries of Owl Rock: Owl Rock Capital Corporation (NYSE: ORCC), Owl Rock Capital Corporation II, Owl Rock Capital Corporation III, Owl Rock Core Income Corp. and Owl Rock Technology Finance Corp. As discussed below, the shareholders of each Owl Rock BDC, as applicable, will be asked to approve an amended and restated investment advisory agreement between such Owl Rock BDC and its Owl Rock Adviser (as defined below) at an upcoming special meeting. All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements, and such agreements, if approved by the Owl Rock BDCs’ shareholders, will become effective upon the closing of the transaction.

III. Ownership, Governance and Additional Considerations

1. What is the pro forma ownership of Blue Owl Capital?

Please see below for Blue Owl Capital’s expected pro forma economic ownership breakdown:

In terms of governance, Blue Owl Capital will have a multi-share class structure. Seven individuals, comprised of four Owl Rock principals and three Dyal principals, will have “high vote” shares in Blue Owl Capital. These shares are expected to collectively control approximately 90% of the votes in Blue Owl Capital.

2. Who will be on Blue Owl Capital’s senior management team?

· Doug Ostrover, Chief Executive Officer: Previously Co-Founder, CEO and Co-Chief Investment Officer (“CIO”) of Owl Rock; former founder of GSO Capital Partners and Senior Managing Director of Blackstone

· Marc Lipschultz, Co-President: Previously Co-Founder, President and Co-CIO of Owl Rock; former KKR Management Committee Member and Global Head of Energy and Infrastructure

· Michael Rees, Co-President: Previously Managing Director and Head of Dyal; former founding employee of Neuberger Berman and Chief Operating Officer of Neuberger Bermans’ alternatives business

· Alan Kirshenbaum, Chief Financial Officer: Previously Chief Operating Officer and CFO of Owl Rock; formerly CFO of TPG Specialty Lending, Inc.

In addition, Craig Packer (Owl Rock co-CIO and co-founder) will continue as Chief Executive Officer of the Owl Rock BDCs. Alexis Maged will remain Head of Credit at Owl Rock.

3. Is anyone on Owl Rock’s management team selling their interests in the business in connection with the transaction?

No.

(1) Includes an investment made by a fund managed by Dyal Capital Partners.

4. Who is expected to comprise Blue Owl Capital’s Board of Directors?

Blue Owl Capital’s nine person Board of Directors is expected to be comprised of three independent directors, three Owl Rock-appointed directors, two Dyal-appointed directors, and one Neuberger Berman-appointed director.

5. Identify the specialty purpose acquisition corporation team and describe their role.

The SPAC, Altimar Acquisition Corp. (NYSE: ATAC-UN), is sponsored by HPS Investment Partners. The merger is subject to a mandatory shareholder vote, requiring a 50% majority and sponsor commitment to vote “yes.” If the merger is approved by the SPAC’s shareholders, the business combination of Owl Rock, Dyal and the SPAC will be consummated with Blue Owl Capital as the surviving entity. Thereafter, SPAC management will have a de minimis equity position in the resulting publicly traded entity, Blue Owl Capital. The existing SPAC management will not have any role in management or on the board of directors of Blue Owl Capital.

6. Describe Neuberger Berman’s involvement in the transaction.

As part of the transaction Neuberger Berman will be selling a portion of its preexisting ownership stake in Dyal. Neuberger Berman will retain a large stake in Blue Owl Capital upon completion of the transaction and will have a board seat on Blue Owl Capital’s board.

7. What happens to Dyal Fund IV’s minority interest in Owl Rock as a result of the transaction?

Dyal Fund IV, a fund managed by Dyal, previously acquired a minority, non-voting interest in Owl Rock. Pro forma for the transaction Dyal Fund IV will own an interest in Blue Owl Capital and will be managed by Blue Owl Capital.

8. When will the transaction close?

The transaction was formally announced on December 23, 2020 and we expect it to close in 1H’21 subject to satisfaction of a number of terms and conditions. The Transaction is subject to, among other closing conditions, approval by the SPAC shareholders, approval of the equityholders of each of the Owl Rock BDCs to the assignment of its advisory agreement, and the approval of Dyal’s Limited Partners.

9. How are the investors of Owl Rock’s managed BDCs and funds involved in the transaction?

Consummation of the transaction will result in a change of control of the registered investment adviser to each of the Owl Rock BDCs (the “Owl Rock Advisers”) under the Investment Company Act of 1940, as amended (the “1940 Act”), which will result in the assignment of each Owl Rock BDC’s current investment advisory agreement in accordance with the 1940 Act. As a result, the shareholders of each Owl Rock BDC, as applicable, will be asked to approve an amended and restated investment advisory agreement between such Owl Rock BDC and its Owl Rock Adviser at an upcoming special meeting. The amended and restated investment advisory agreements will replace the current investment advisory agreement upon the consummation of the transaction.

All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements, and such agreements, if approved by the Owl Rock BDCs’ shareholders, will become effective upon the closing of the transaction.

In addition, limited partners in Owl Rock’s private funds will be required to provide consent for the transaction in accordance with their fund documentation. Owl Rock will be in communication with the respective investors of each managed product with additional details on these processes and their timing.

10. Who can I call with questions?

Please contact your Owl Rock representative or call Owl Rock’s sales desk at (212) 419-3000 for additional information.

Forward Looking Statements

Some of the statements contained herein may include “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than historical facts, including but not limited to statements regarding the expected timing of the transaction; the expected benefits of the transaction; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the control of Owl Rock Capital Corporation (NYSE: ORCC), Owl Rock Capital Corporation II, Owl Rock Capital Corporation III, Owl Rock Core Income Corp. and Owl Rock Technology Finance Corp. (collectively, the “Owl Rock BDCs”) and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements including, without limitation, the risks, uncertainties and other factors identified in the Owl Rock BDCs’ filings with the Securities and Exchange Commission (the “SEC”). Investors should not place undue reliance on these forward-looking statements, which apply only as of the date on which such Owl Rock BDC makes them. The Owl Rock BDCs do not undertake any obligation to update or revise any forward-looking statements or any other information contained herein, except as required by applicable law.

Additional Information and Where to Find It

In connection with this transaction which will result in the change in control of the Owl Rock Advisers, the applicable Owl Rock BDCs intend to file proxy statements in preliminary and definitive form with the SEC that will contain important information about the proposed transaction and related matters, and deliver a copy of the proxy statement to its shareholders. INVESTORS OF THE OWL ROCK BDCs ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors may obtain a free copy of these materials when they are available and other documents filed by the Owl Rock BDCs with the SEC at the SEC’s website at www.sec.gov or at Owl Rock’s website at www.owlrock.com or www.owlrock.com/proxy/ or, for Owl Rock Capital Corporation, at

www.owlrockcapitalcorporation.com. Investors and security holders may also obtain free copies of the proxy statement and other documents filed with the SEC from the Owl Rock BDCs by contacting Investor Relations at (212) 651-4705.

Participants in the Solicitation

The applicable Owl Rock BDCs and their directors, executive officers, employees and other persons may be deemed to be participants in the solicitation of proxies from the shareholders of the applicable Owl Rock BDCs’ common stock in respect of the change in control transaction. For information regarding the Owl Rock BDCs’ directors and executive officers, please see: Owl Rock Capital Corporation’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Capital Corporation II’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Technology Finance Corp.’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Capital Corporation III’s registration statement on Form 10 filed with the SEC on July 17, 2020. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

Owl Rock Capital Securities LLC is a member of FINRA/SIPC.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Foxtron and Cerence Collaborate to Bring First-of-its-Kind Intuitive Interaction to Foxtron’s New Electric Vehicles in Taiwan

- Assertio Holdings, Inc. to Report First Quarter 2024 Financial Results on May 6, 2024

- BioVie Presents Data Showing Potential for Bezisterim (NE3107) to Reduce Inflammation and Restore Homeostasis in a Manner Correlated with Alzheimer’s Disease and Biomarker Endpoints

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share