Form DEFA14A MCKESSON CORP

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

Filed by the Registrant |

☐ Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

|

Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

McKESSON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

|

No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) Title of each class of securities to which transaction applies: | ||

| (2) Aggregate number of securities to which transaction applies: | ||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) Proposed maximum aggregate value of transaction: | ||

| (5) Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) Amount Previously Paid: | ||

| (2) Form, Schedule or Registration Statement No.: | ||

| (3) Filing Party: | ||

| (4) Date Filed: | ||

Summer 2021 | Virtual Roadshow McKesson Corporation Shareholder Engagement Program

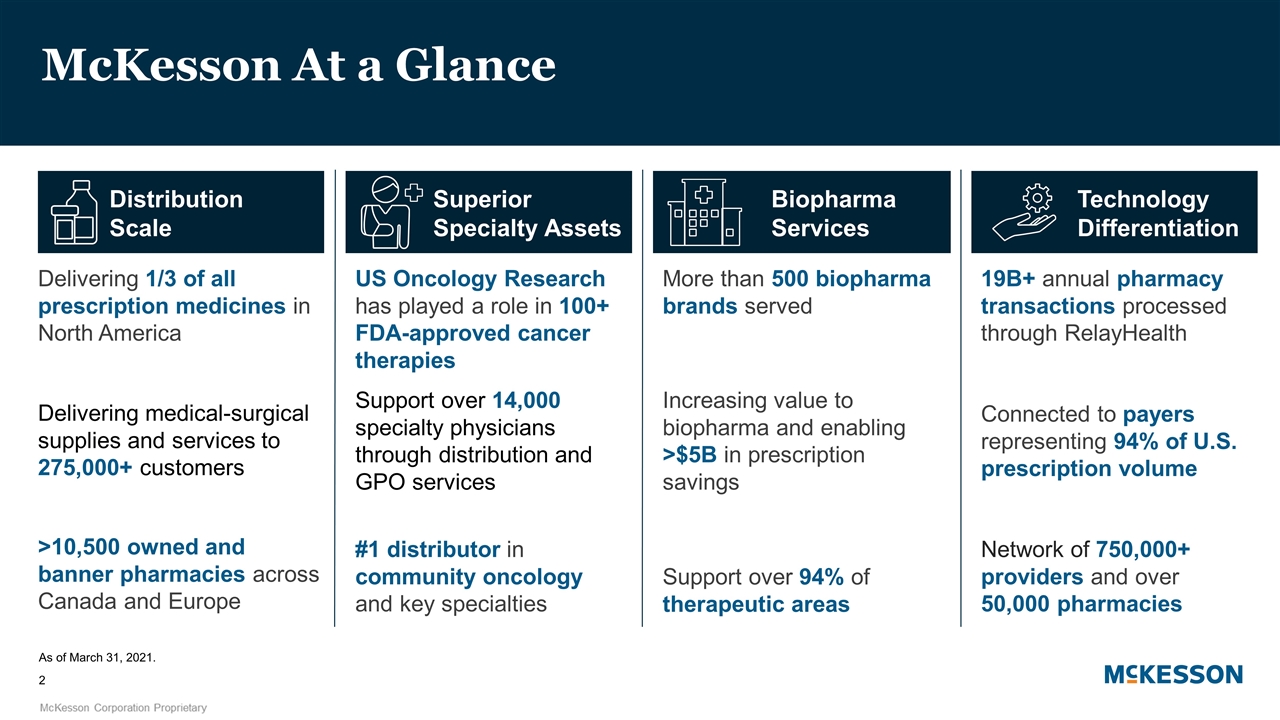

McKesson At a Glance As of March 31, 2021. Delivering 1/3 of all prescription medicines in North America #1 distributor in community oncology and key specialties Delivering medical-surgical supplies and services to 275,000+ customers >10,500 owned and banner pharmacies across Canada and Europe US Oncology Research has played a role in 100+ FDA-approved cancer therapies More than 500 biopharma brands served Support over 94% of therapeutic areas Increasing value to biopharma and enabling >$5B in prescription savings 19B+ annual pharmacy transactions processed through RelayHealth Network of 750,000+ providers and over 50,000 pharmacies Connected to payers representing 94% of U.S. prescription volume Distribution Scale Superior Specialty Assets Biopharma Services Technology Differentiation Support over 14,000 specialty physicians through distribution and GPO services

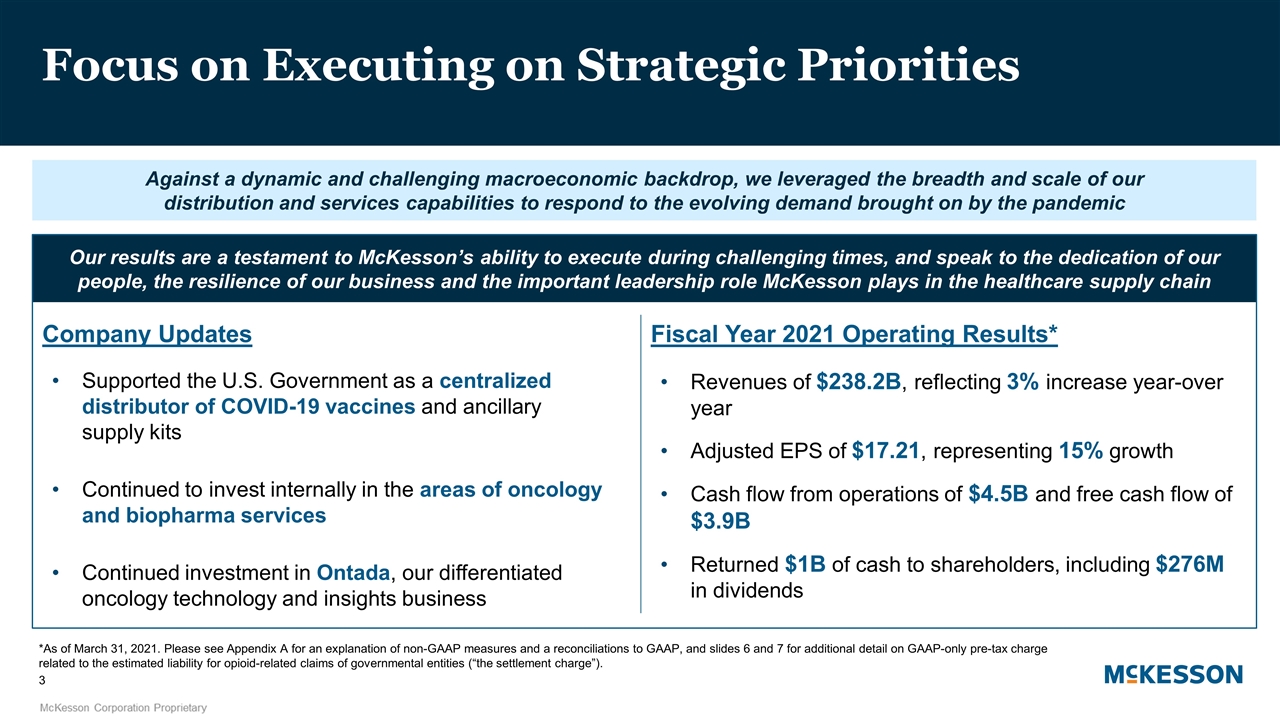

*As of March 31, 2021. Please see Appendix A for an explanation of non-GAAP measures and a reconciliations to GAAP, and slides 6 and 7 for additional detail on GAAP-only pre-tax charge related to the estimated liability for opioid-related claims of governmental entities (“the settlement charge”). Against a dynamic and challenging macroeconomic backdrop, we leveraged the breadth and scale of our distribution and services capabilities to respond to the evolving demand brought on by the pandemic Focus on Executing on Strategic Priorities Our results are a testament to McKesson’s ability to execute during challenging times, and speak to the dedication of our people, the resilience of our business and the important leadership role McKesson plays in the healthcare supply chain Supported the U.S. Government as a centralized distributor of COVID-19 vaccines and ancillary supply kits Continued to invest internally in the areas of oncology and biopharma services Continued investment in Ontada, our differentiated oncology technology and insights business Company Updates Fiscal Year 2021 Operating Results* Revenues of $238.2B, reflecting 3% increase year-over year Adjusted EPS of $17.21, representing 15% growth Cash flow from operations of $4.5B and free cash flow of $3.9B Returned $1B of cash to shareholders, including $276M in dividends

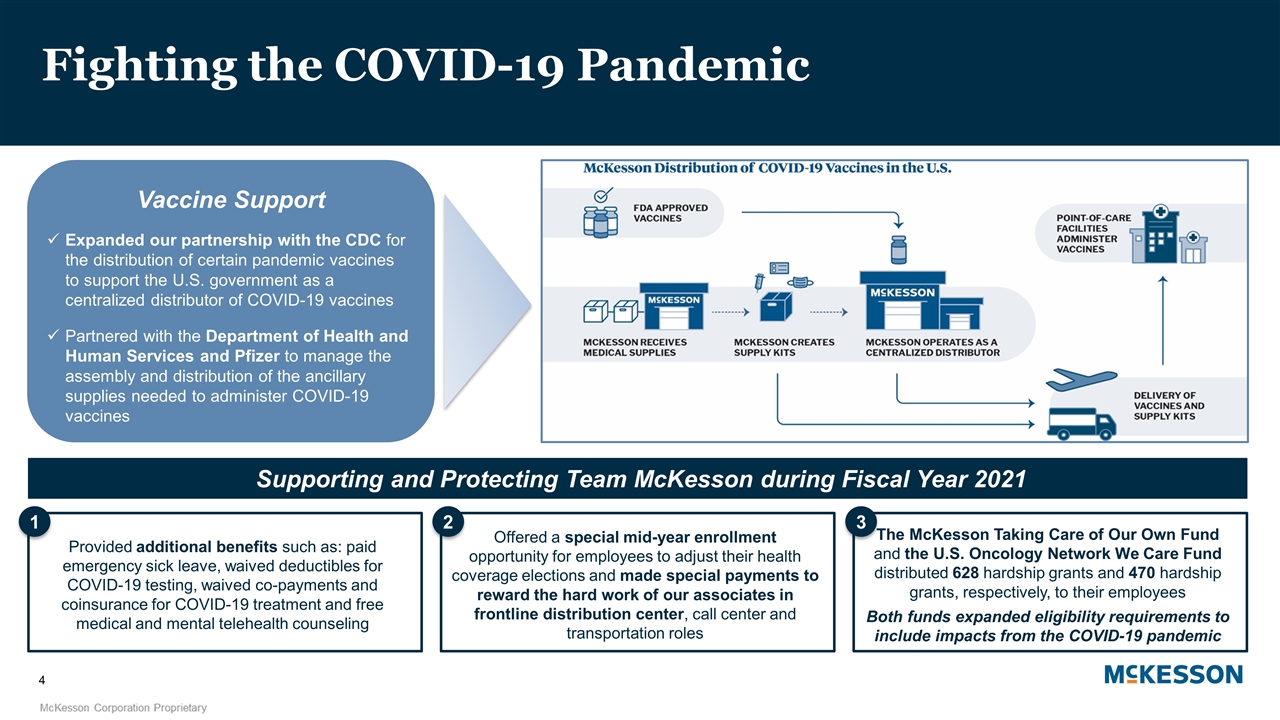

Fighting the COVID-19 Pandemic Vaccine Support Expanded our partnership with the CDC for the distribution of certain pandemic vaccines to support the U.S. government as a centralized distributor of COVID-19 vaccines Partnered with the Department of Health and Human Services and Pfizer to manage the assembly and distribution of the ancillary supplies needed to administer COVID-19 vaccines Supporting and Protecting Team McKesson during Fiscal Year 2021 The McKesson Taking Care of Our Own Fund and the U.S. Oncology Network We Care Fund distributed 628 hardship grants and 470 hardship grants, respectively, to their employees Both funds expanded eligibility requirements to include impacts from the COVID-19 pandemic Provided additional benefits such as: paid emergency sick leave, waived deductibles for COVID-19 testing, waived co-payments and coinsurance for COVID-19 treatment and free medical and mental telehealth counseling Offered a special mid-year enrollment opportunity for employees to adjust their health coverage elections and made special payments to reward the hard work of our associates in frontline distribution center, call center and transportation roles 1 2 3

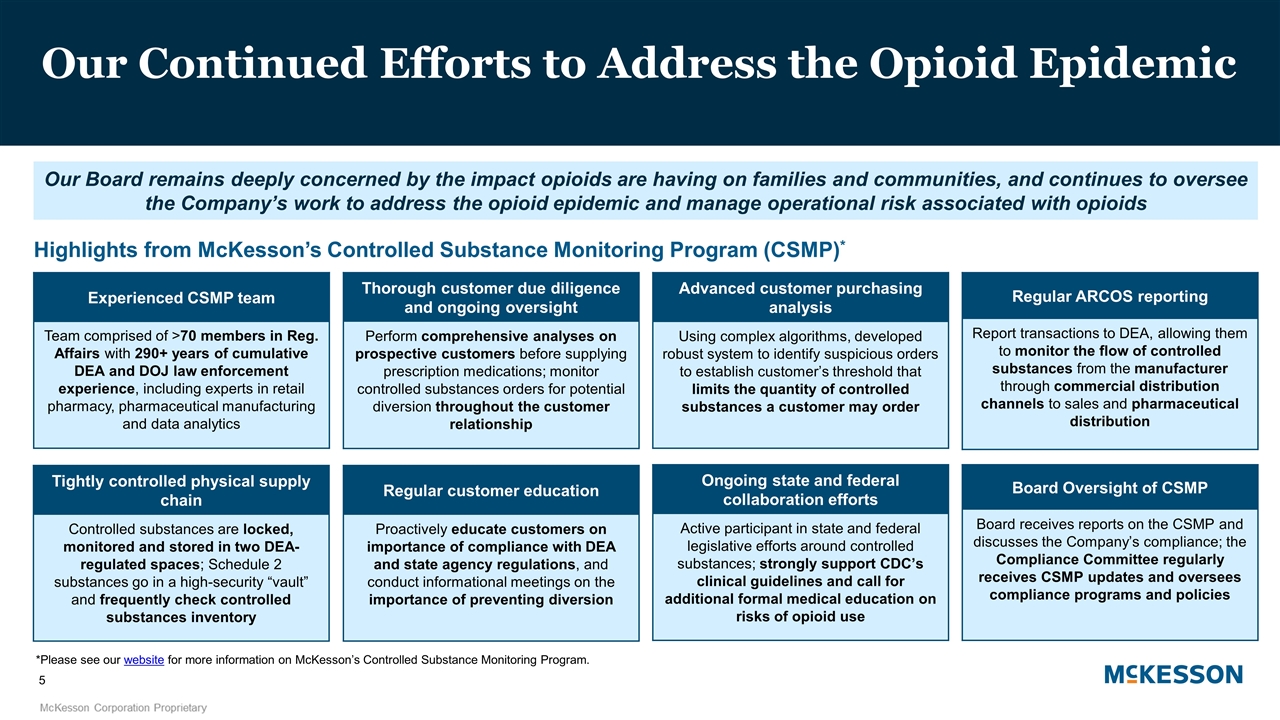

Our Continued Efforts to Address the Opioid Epidemic Highlights from McKesson’s Controlled Substance Monitoring Program (CSMP)* Experienced CSMP team Team comprised of >70 members in Reg. Affairs with 290+ years of cumulative DEA and DOJ law enforcement experience, including experts in retail pharmacy, pharmaceutical manufacturing and data analytics Thorough customer due diligence and ongoing oversight Perform comprehensive analyses on prospective customers before supplying prescription medications; monitor controlled substances orders for potential diversion throughout the customer relationship Advanced customer purchasing analysis Using complex algorithms, developed robust system to identify suspicious orders to establish customer’s threshold that limits the quantity of controlled substances a customer may order Tightly controlled physical supply chain Controlled substances are locked, monitored and stored in two DEA-regulated spaces; Schedule 2 substances go in a high-security “vault” and frequently check controlled substances inventory Regular customer education Proactively educate customers on importance of compliance with DEA and state agency regulations, and conduct informational meetings on the importance of preventing diversion Ongoing state and federal collaboration efforts Active participant in state and federal legislative efforts around controlled substances; strongly support CDC’s clinical guidelines and call for additional formal medical education on risks of opioid use Regular ARCOS reporting Report transactions to DEA, allowing them to monitor the flow of controlled substances from the manufacturer through commercial distribution channels to sales and pharmaceutical distribution *Please see our website for more information on McKesson’s Controlled Substance Monitoring Program. Our Board remains deeply concerned by the impact opioids are having on families and communities, and continues to oversee the Company’s work to address the opioid epidemic and manage operational risk associated with opioids Board Oversight of CSMP Board receives reports on the CSMP and discusses the Company’s compliance; the Compliance Committee regularly receives CSMP updates and oversees compliance programs and policies

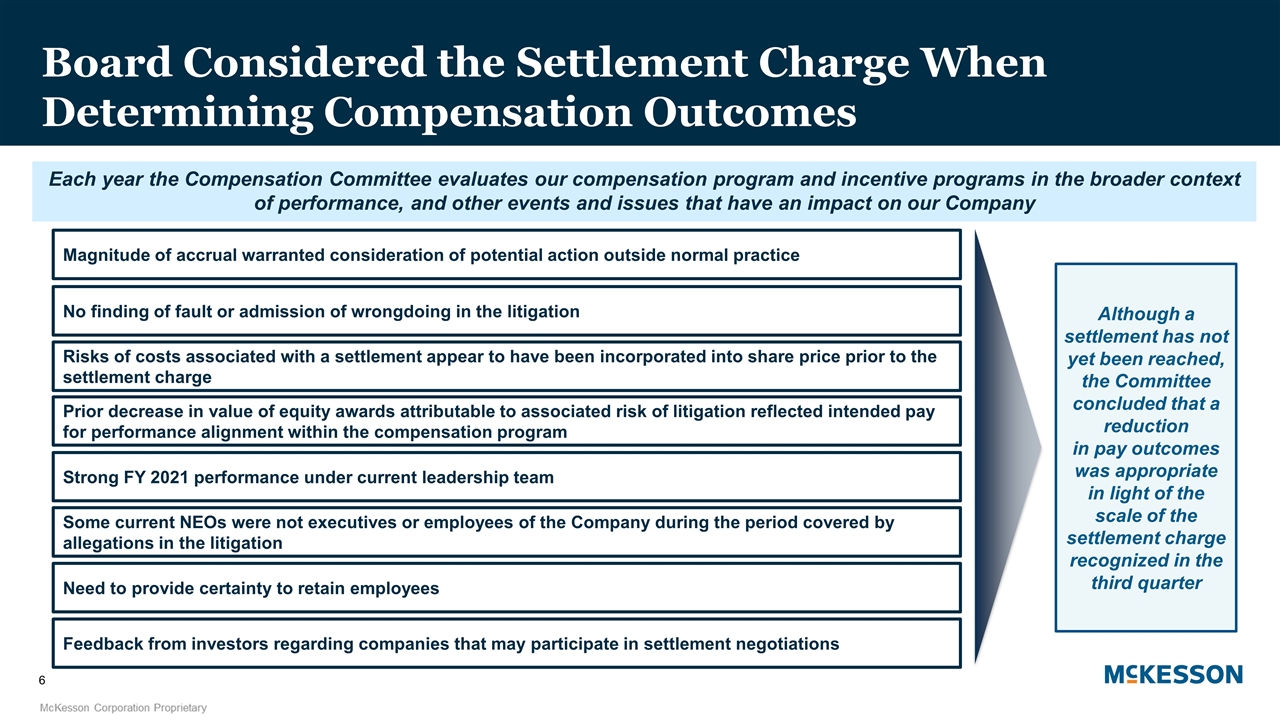

Board Considered the Settlement Charge When Determining Compensation Outcomes Each year the Compensation Committee evaluates our compensation program and incentive programs in the broader context of performance, and other events and issues that have an impact on our Company Although a settlement has not yet been reached, the Committee concluded that a reduction in pay outcomes was appropriate in light of the scale of the settlement charge recognized in the third quarter Magnitude of accrual warranted consideration of potential action outside normal practice No finding of fault or admission of wrongdoing in the litigation Some current NEOs were not executives or employees of the Company during the period covered by allegations in the litigation Strong FY 2021 performance under current leadership team Prior decrease in value of equity awards attributable to associated risk of litigation reflected intended pay for performance alignment within the compensation program Risks of costs associated with a settlement appear to have been incorporated into share price prior to the settlement charge Need to provide certainty to retain employees Feedback from investors regarding companies that may participate in settlement negotiations

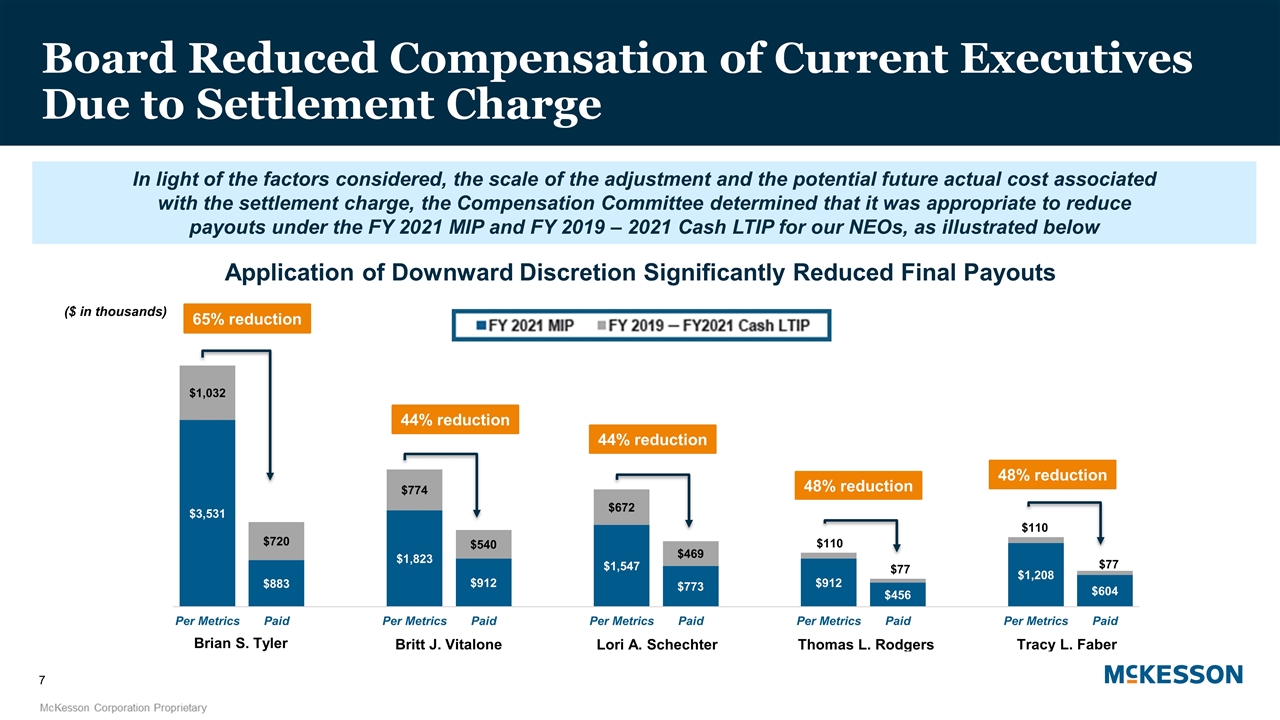

In light of the factors considered, the scale of the adjustment and the potential future actual cost associated with the settlement charge, the Compensation Committee determined that it was appropriate to reduce payouts under the FY 2021 MIP and FY 2019 – 2021 Cash LTIP for our NEOs, as illustrated below Application of Downward Discretion Significantly Reduced Final Payouts 65% reduction 44% reduction 44% reduction 48% reduction 48% reduction ($ in thousands) Board Reduced Compensation of Current Executives Due to Settlement Charge

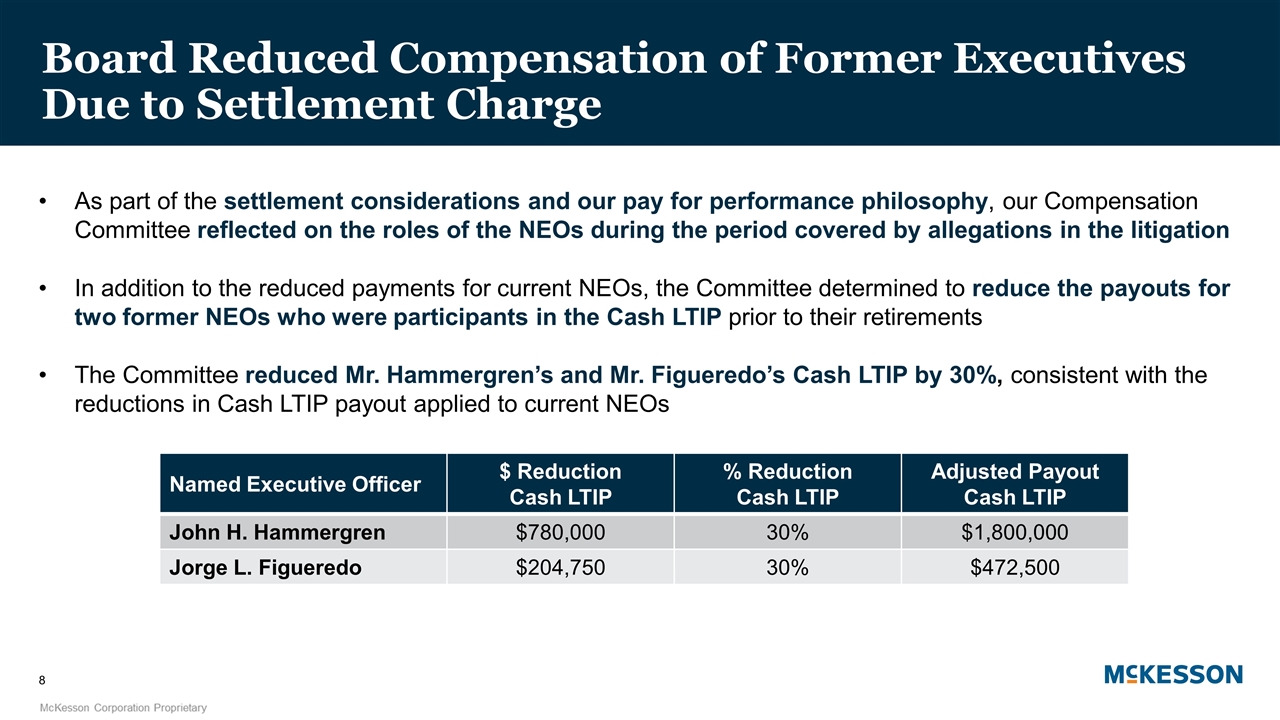

As part of the settlement considerations and our pay for performance philosophy, our Compensation Committee reflected on the roles of the NEOs during the period covered by allegations in the litigation In addition to the reduced payments for current NEOs, the Committee determined to reduce the payouts for two former NEOs who were participants in the Cash LTIP prior to their retirements The Committee reduced Mr. Hammergren’s and Mr. Figueredo’s Cash LTIP by 30%, consistent with the reductions in Cash LTIP payout applied to current NEOs Named Executive Officer $ Reduction Cash LTIP % Reduction Cash LTIP Adjusted Payout Cash LTIP John H. Hammergren $780,000 30% $1,800,000 Jorge L. Figueredo $204,750 30% $472,500 Board Reduced Compensation of Former Executives Due to Settlement Charge

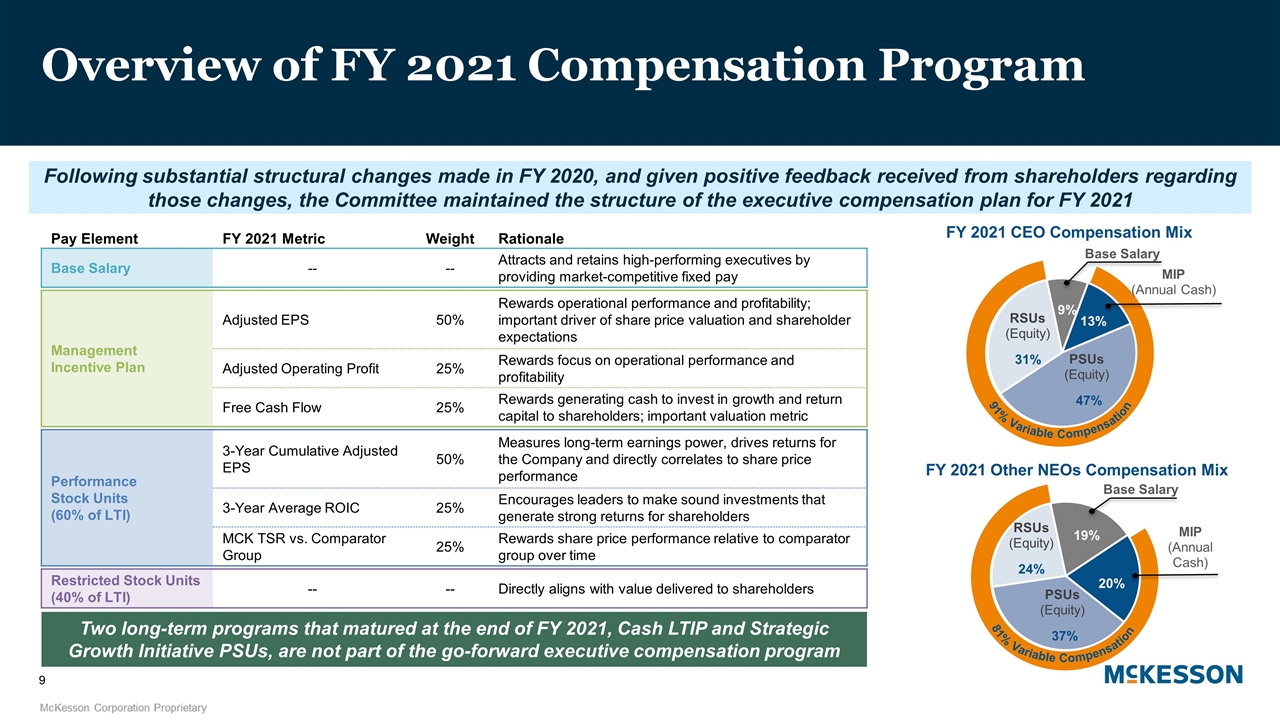

Pay Element FY 2021 Metric Weight Rationale Base Salary -- -- Attracts and retains high-performing executives by providing market-competitive fixed pay Management Incentive Plan Adjusted EPS 50% Rewards operational performance and profitability; important driver of share price valuation and shareholder expectations Adjusted Operating Profit 25% Rewards focus on operational performance and profitability Free Cash Flow 25% Rewards generating cash to invest in growth and return capital to shareholders; important valuation metric Performance Stock Units (60% of LTI) 3-Year Cumulative Adjusted EPS 50% Measures long-term earnings power, drives returns for the Company and directly correlates to share price performance 3-Year Average ROIC 25% Encourages leaders to make sound investments that generate strong returns for shareholders MCK TSR vs. Comparator Group 25% Rewards share price performance relative to comparator group over time Restricted Stock Units (40% of LTI) -- -- Directly aligns with value delivered to shareholders Overview of FY 2021 Compensation Program Following substantial structural changes made in FY 2020, and given positive feedback received from shareholders regarding those changes, the Committee maintained the structure of the executive compensation plan for FY 2021 FY 2021 CEO Compensation Mix 9% 13% FY 2021 Other NEOs Compensation Mix 19% 20% 81% Variable Compensation Two long-term programs that matured at the end of FY 2021, Cash LTIP and Strategic Growth Initiative PSUs, are not part of the go-forward executive compensation program

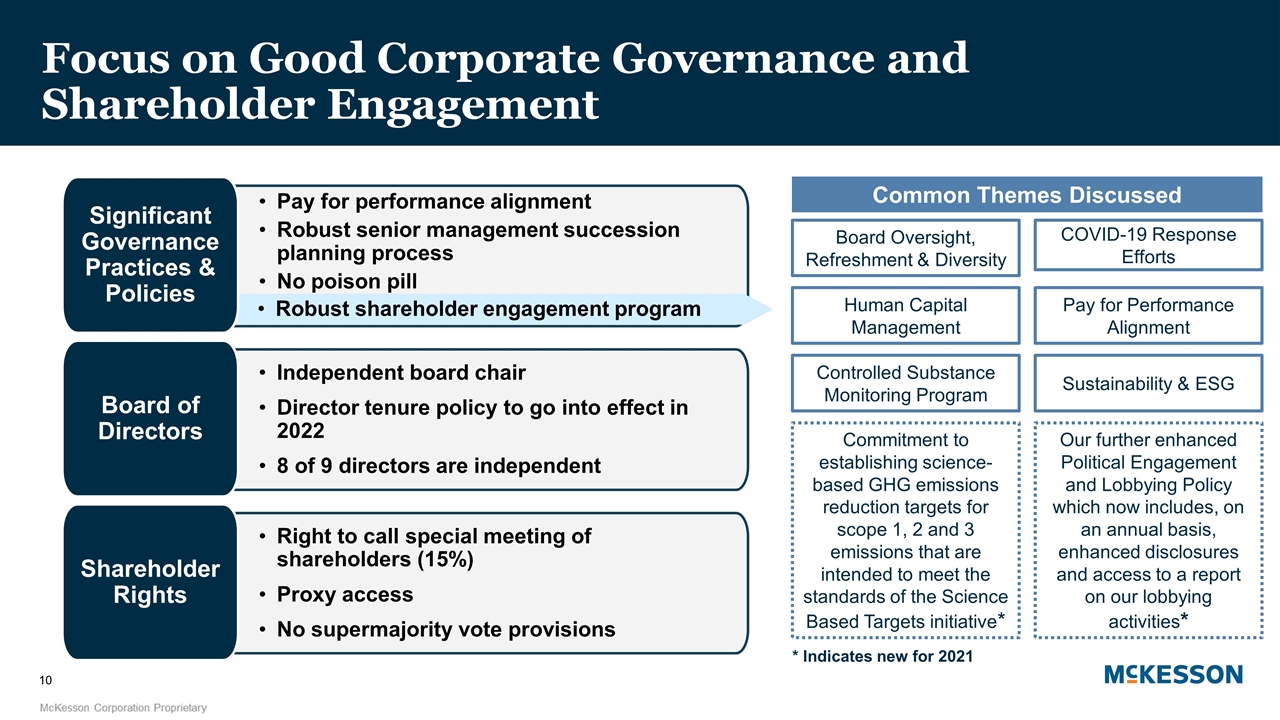

Independent board chair Director tenure policy to go into effect in 2022 8 of 9 directors are independent Board of Directors Right to call special meeting of shareholders (15%) Proxy access No supermajority vote provisions Shareholder Rights Pay for performance alignment Robust senior management succession planning process No poison pill Robust shareholder engagement program Robust shareholder engagement program Board Oversight, Refreshment & Diversity Common Themes Discussed COVID-19 Response Efforts Human Capital Management Pay for Performance Alignment Controlled Substance Monitoring Program Sustainability & ESG Commitment to establishing science-based GHG emissions reduction targets for scope 1, 2 and 3 emissions that are intended to meet the standards of the Science Based Targets initiative* Our further enhanced Political Engagement and Lobbying Policy which now includes, on an annual basis, enhanced disclosures and access to a report on our lobbying activities* * Indicates new for 2021 Significant Governance Practices & Policies Focus on Good Corporate Governance and Shareholder Engagement

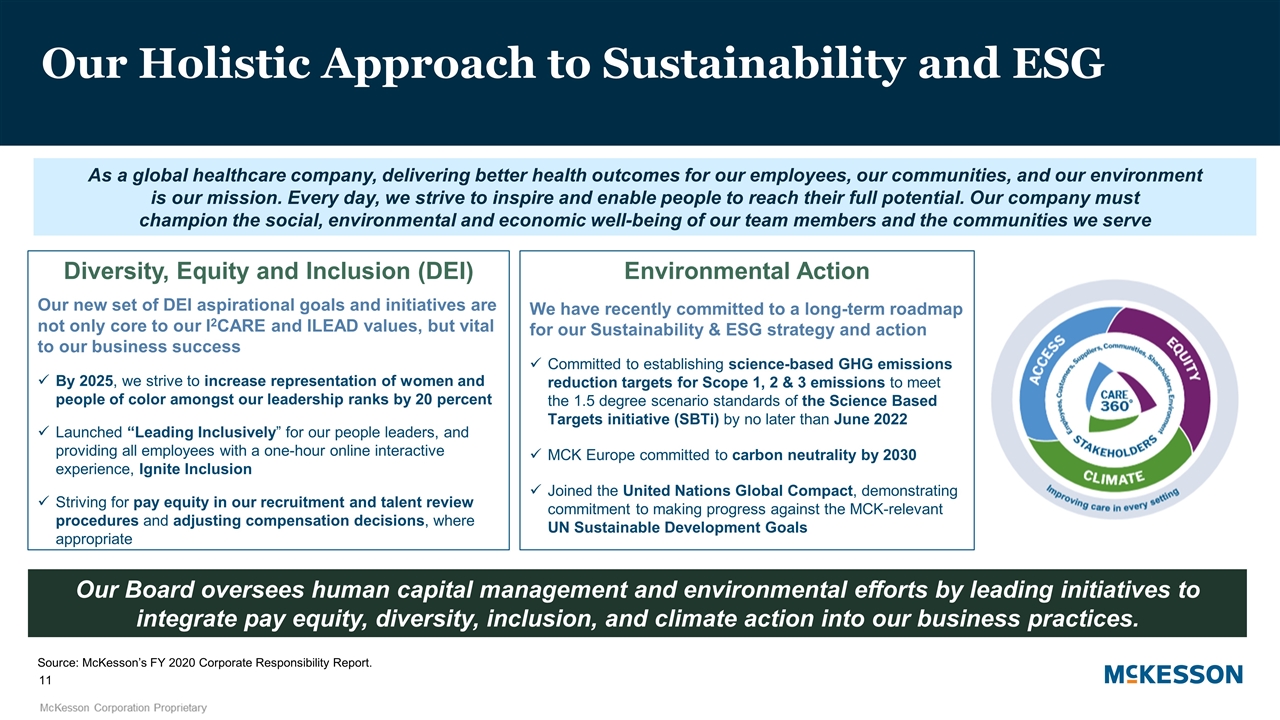

Our Holistic Approach to Sustainability and ESG Source: McKesson’s FY 2020 Corporate Responsibility Report. As a global healthcare company, delivering better health outcomes for our employees, our communities, and our environment is our mission. Every day, we strive to inspire and enable people to reach their full potential. Our company must champion the social, environmental and economic well-being of our team members and the communities we serve Diversity, Equity and Inclusion (DEI) Our new set of DEI aspirational goals and initiatives are not only core to our I2CARE and ILEAD values, but vital to our business success By 2025, we strive to increase representation of women and people of color amongst our leadership ranks by 20 percent Launched “Leading Inclusively” for our people leaders, and providing all employees with a one-hour online interactive experience, Ignite Inclusion Striving for pay equity in our recruitment and talent review procedures and adjusting compensation decisions, where appropriate Environmental Action We have recently committed to a long-term roadmap for our Sustainability & ESG strategy and action Committed to establishing science-based GHG emissions reduction targets for Scope 1, 2 & 3 emissions to meet the 1.5 degree scenario standards of the Science Based Targets initiative (SBTi) by no later than June 2022 MCK Europe committed to carbon neutrality by 2030 Joined the United Nations Global Compact, demonstrating commitment to making progress against the MCK-relevant UN Sustainable Development Goals Our Board oversees human capital management and environmental efforts by leading initiatives to integrate pay equity, diversity, inclusion, and climate action into our business practices.

Our Directors’ Backgrounds Contribute to an Effective and Well-Balanced Board Edward A. Mueller (Independent Chair) Retd. Chairman & CEO, Qwest Communications International Brian S. Tyler (Chief Executive Officer) CEO, McKesson Corporation Dominic J. Caruso Retd. EVP & CFO, Johnson & Johnson Joined Sept. 2018 Donald R. Knauss Retd. Chairman & CEO, The Clorox Company Breadth of Director Skills Bradley E. Lerman Senior VP, General Counsel & Corporate Secretary, Medtronic Joined Apr. 2018 Maria Martinez EVP & COO, Cisco Systems Joined Oct. 2019 Kenneth E. Washington CTO, Ford Motor Company Joined Jul. 2019 Susan R. Salka CEO & President, AMN Healthcare Services Linda Mantia Retd. SVP & COO, Manulife Financial Joined Oct. 2020 At least 1 director joined our Board each year since 2018 8 out of 9 directors are independent Average Director Tenure 4.2 years Caruso Knauss Lerman Mantia Martinez Mueller Salka Tyler Washington Senior Executive Leadership Other Public Company Board Service Business Transformation / M&A Financial / Accounting Healthcare Industry Experience Distribution / Supply Chain Experience Risk Management and Compliance Sustainability and ESG Cybersecurity / Technology Global / International Experience Marketing / Public Relations / Communications 22% Ethnic Diversity 33% Gender Diversity

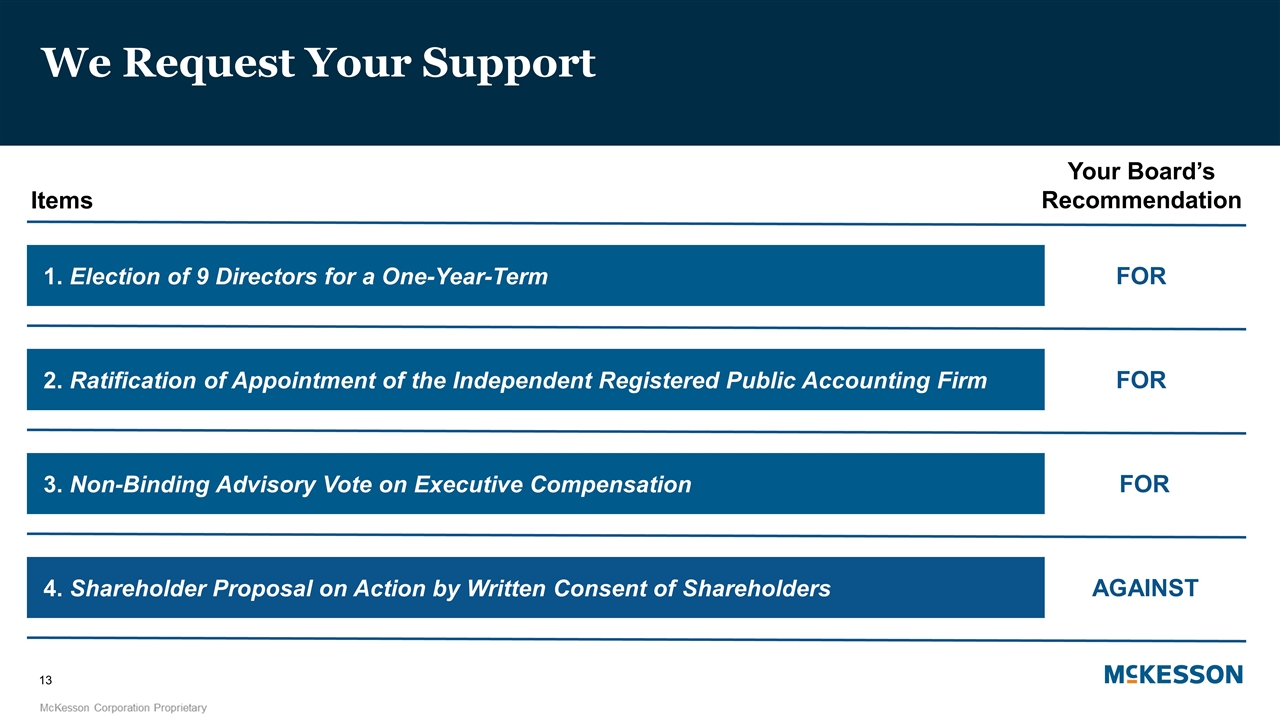

We Request Your Support 1. Election of 9 Directors for a One-Year-Term 2. Ratification of Appointment of the Independent Registered Public Accounting Firm 3. Non-Binding Advisory Vote on Executive Compensation 4. Shareholder Proposal on Action by Written Consent of Shareholders Items Your Board’s Recommendation FOR FOR FOR AGAINST

Appendix A Cautionary Statement Except for historical information contained in this presentation, matters discussed may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, that involve risks and uncertainties that could cause actual results to differ materially from those in those statements. It is not possible to identify all such risks and uncertainties. The reader should not place undue reliance on forward-looking statements, such as energy usage goals, which speak only as of the date they are first made. Except to the extent required by law, the company undertakes no obligation to publicly update forward-looking statements. Forward-looking statements may be identified by their use of terminology such as “believes”, “expects”, “anticipates”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates” or the negative of these words or other comparable terminology. The discussion of financial trends, strategy, plans, assumptions or intentions may also include forward-looking statements. We encourage investors to read the important risk factors described in the company’s Form 10-K, Form 10-Q and Form 8-K reports filed with the Securities and Exchange Commission. These risk factors include, but are not limited to: we experience costly and disruptive legal disputes, including regarding our role in distributing controlled substances such as opioids; we might experience losses not covered by insurance; we might record significant charges from impairment to goodwill, intangibles and other assets or investments; we may be unsuccessful in retail pharmacy profitability; we might be harmed by large customer purchase reductions, payment defaults or contract non-renewal; our contracts with government entities involve future funding and compliance risks; we might be harmed by changes in our relationships or contracts with suppliers; we might be adversely impacted by healthcare reform such as changes in pricing and reimbursement models; we might be adversely impacted by changes or disruptions in product supply and we have experienced and may experience difficulties in sourcing products due to the effects of the COVID-19 pandemic on supply chains; we might be adversely impacted as a result of our distribution of generic pharmaceuticals; we might be adversely impacted by an economic slowdown (including the effects we have experienced from the COVID-19 pandemic) or recession and by disruption in capital and credit markets that might impede our access credit, increase our borrowing costs and impair the financial soundness of our customers and suppliers; we might be adversely impacted by fluctuations in foreign currency exchange rates; we might be adversely impacted by events outside of our control, such as widespread public health issues (including the effects we have experienced from the COVID-19 pandemic), natural disasters, political events and other catastrophic events; and we face uncertainties and risks related to vaccination distribution programs. Statements regarding our future direction and intent are subject to change or withdrawal without notice and represent goals and objectives only. The inclusion of information or the absence of information in this report should not be construed to represent McKesson’s belief regarding the materiality or financial impact of that information. For a discussion of information that is material to McKesson, please see our filings with the Securities and Exchange Commission, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- McKesson (MCK) Declares $0.62 Quarterly Dividend; 0.5% Yield

- Net Asset Value(s)

- Form 8.5 (EPT/RI) - musicMagpie Plc

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share