Form DEFA14A Invesco Ltd.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant ☑ | Filed by a Party other than the Registrant ☐ | |

| Check the appropriate box: | ||

| ☐ Preliminary proxy statement | ||

| ☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| ☐ Definitive Proxy Statement | ||

| ☑ Definitive Additional Materials | ||

| ☐ Soliciting Material Pursuant to § 240.14a-12 | ||

Invesco Ltd.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. |

| ☐ | Fee computed below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

On May 4, 2021, Invesco Ltd. made the following disclosure to update certain sections of its Proxy Statement (the “Proxy Statement”) filed with the Securities and Exchange Commission on March 26, 2021 (with the amendments to the original text in bold italics and all charts shown below being either revised or new, as indicated).

Company scorecard results for 2020 – aligning pay with results

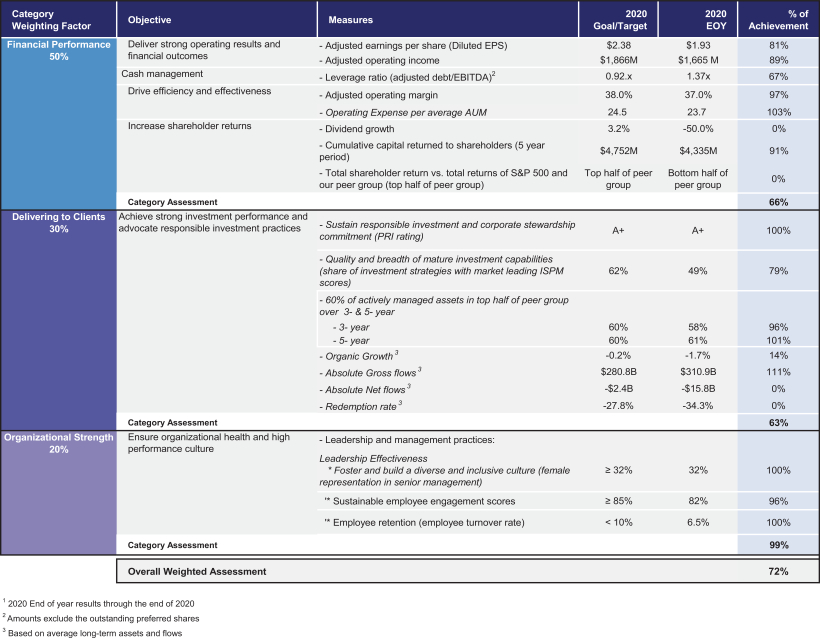

The 2020 company scorecard on page 42 of the Proxy Statement is updated as follows:

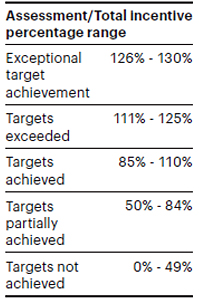

The outcomes for our 2020 company scorecard are described below with an overall company score of 72%—targets partially achieved. In addition, the scorecard shows for each measure the 2020 Goal or Target, 2020 end of year outcome and the percentage achieved. All measures within each category are equally weighted and the three categories are weighted as shown in the scorecard.

Performance-based equity awards – Performance award vesting matrix

The vesting matrix that begins on page 55 of the Proxy Statement is updated as follows:

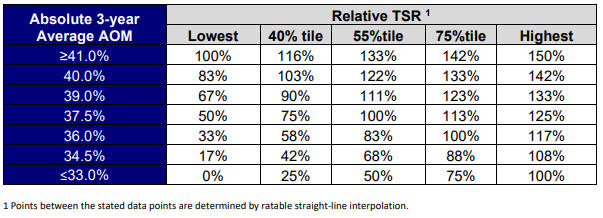

The number of shares that vest will equal the target award amount multiplied by the vesting percentage associated with the Average AOM and Relative TSR ranking on the chart below. The company has revised the vesting matrix to require Relative TSR to equal the 55% percentile (previously the matrix required a “median” outcome) to achieve 100% vesting — assuming Absolute 3-year Average AOM is 37.5%. Vesting may range from 0% to 150%; provided, however, if the company’s 3-year absolute TSR is negative, vesting will be capped at 100%. We believe that the linked vesting performance thresholds provide significant rigor to our incentive program, as payouts are not a range of outcomes but represent specific performance levels.

The below revised vesting matrix is for performance-based equity awards granted in connection with 2020 pay.

If Invesco’s Relative TSR is the lowest percentile and Absolute 3-year Average AOM is 33% or less, then our CEO and each of our executives will not be entitled to a distribution of any shares or accrued dividends. In addition, if the company’s 3-year absolute TSR is negative, vesting will be capped at 100%.

The rigor of the thresholds, as well as the partial vesting of awards for failure to meet the target range and an upside opportunity for performance beyond the target range, align with the company’s operating plan and committee’s belief that the company’s performance-based awards demonstrate our pay-for-performance philosophy.

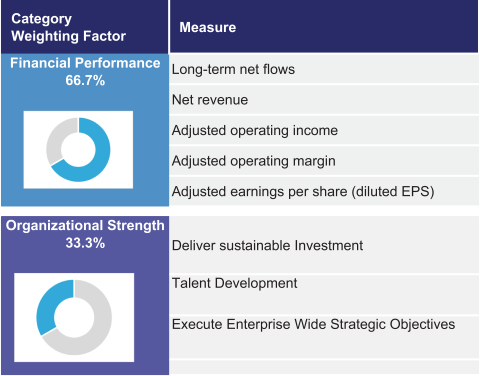

2021 Company Scorecard

As shown below, for 2021, we will further reduce the number of company scorecard metrics and update the weightings of the categories to increase the impact of financial factors. Consistent with our revised disclosure for the 2020 company scorecard, the company intends to publish for the 2021 company scorecard for each measure the 2021 goal or target, 2021 end of year outcome and percentage achieved.

All metrics are equally weighted within each of the two categories. The score for each of the categories are weighted as shown.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Invesco (IVZ) PT Raised to $17 at Morgan Stanley

- North American Construction Group Ltd. First Quarter Results Conference Call and Webcast Notification

- Lion Group Holding Announced Receipt of Nasdaq Listing Delinquency Notice

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share