Form DEFA14A Enviva Partners, LP

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): November 4, 2021

Enviva Partners, LP

(Exact name of Registrant as specified in its charter)

| Delaware | 001-37363 | 46-4097730 | ||

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

| 7272

Wisconsin Ave, Suite 1800 Bethesda, MD | 20814 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (301) 657-5660

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Units | EVA | New York Stock Exchange | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. | Regulation FD Disclosure. |

On November 4, 2021, Enviva Partners, LP (the “Partnership” or “Enviva”) posted a third-quarter presentation on its website, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”).

Additionally, on November 4, 2021, in connection with its earnings call, the Partnership provided information regarding its planned conversion to a C-corporation (the “Conversion”), which will be the subject of a special meeting of unitholders. A copy of the transcript of the recorded webcast is furnished as Exhibit 99.2 with this Current Report.

The information included in Item 7.01 of this Current Report, including Exhibits 99.1 and 99.2, is being furnished pursuant to Item 7.01 of Form 8-K and will not be deemed “filed” by the Partnership for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section.

Important Information for Unitholders

This communication does not constitute a solicitation of any vote or approval.

In connection with the Conversion, Enviva filed a proxy statement with the U.S. Securities and Exchange Commission (the “SEC”). Enviva also plans to file other documents with the SEC regarding the Conversion. After the proxy statement has been cleared by the SEC, a definitive proxy statement will be mailed to the unitholders of Enviva. UNITHOLDERS OF ENVIVA ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE CONVERSION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE CONVERSION. Unitholders will be able to obtain free copies of the proxy statement and other documents containing important information once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov.

Participants in the Solicitation

Enviva and its general partner’s directors and executive officers may be deemed to be participants in the solicitation of proxies from the unitholders of Enviva in connection with the proposed transaction. Information about such directors and executive officers is set forth in Enviva’s most recent Annual Report on Form 10-K and other filings with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

Cautionary Note Concerning Forward-Looking Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. All statements, other than statements of present or historical fact included herein, regarding the Conversion, Enviva’s ability to consummate the Conversion, the benefits of the Conversion, and Enviva’s future financial performance following the Conversion, as well as Enviva’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans, and objectives of management are forward-looking statements. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms, and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Enviva disclaims any duty to revise or update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Enviva cautions you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Enviva. These risks include, but are not limited to: (i) the volume and quality of products that we are able to produce or source and sell, which could be adversely affected by, among other things, operating or technical difficulties at our wood pellet production plants or deep-water marine terminals; (ii) the prices at which we are able to sell our products; (iii) our ability to successfully negotiate, complete, and integrate acquisitions, including the associated contracts, or to realize the anticipated benefits of such acquisitions; (iv) failure of our customers, vendors, and shipping partners to pay or perform their contractual obligations to us; (v) our inability to successfully execute our project development, expansion, and construction activities on time and within budget; (vi) the creditworthiness of our contract counterparties; (vii) the amount of low-cost wood fiber that we are able to procure and process, which could be adversely affected by, among other things, disruptions in supply or operating or financial difficulties suffered by our suppliers; (viii) changes in the price and availability of natural gas, coal, or other sources of energy; (ix) changes in prevailing economic conditions; (x) unanticipated ground, grade, or water conditions; (xi) inclement or hazardous environmental conditions, including extreme precipitation, temperatures, and flooding; (xii) fires, explosions, or other accidents; (xiii) changes in domestic and foreign laws and regulations (or the interpretation thereof) related to renewable or low-carbon energy, the forestry products industry, the international shipping industry, or power, heat, or combined heat and power generators; (xiv) changes in the regulatory treatment of biomass in core and emerging markets; (xv) our inability to acquire or maintain necessary permits or rights for our production, transportation, or terminaling operations; (xvi) changes in the price and availability of transportation; (xvii) changes in foreign currency exchange or interest rates, and the failure of our hedging arrangements to effectively reduce our exposure to the risks related thereto; (xviii) risks related to our indebtedness; (xix) our failure to maintain effective quality control systems at our wood pellet production plants and deep-water marine terminals, which could lead to the rejection of our products by our customers; (xx) changes in the quality specifications for our products that are required by our customers; (xxi) labor disputes, unionization, or similar collective actions; (xxii) our inability to hire, train, or retain qualified personnel to manage and operate our business and newly acquired assets; (xxiii) the Conversion may not occur, and even if it were to be completed, we may fail to realize the anticipated benefits; (xxiv) the possibility of cyber and malware attacks; (xxv) our inability to borrow funds and access capital markets; and (xxvi) viral contagions or pandemic diseases, such as COVID-19.

Should one or more of the risks or uncertainties described herein and in any oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Enviva’s expectations and projections can be found in Enviva’s periodic filings with the SEC. Enviva’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| 99.1 | Investor Presentation. |

| 99.2 | Conference call script. |

| 104 | The Cover Page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Partnership has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| ENVIVA PARTNERS, LP |

| By: | Enviva Partners GP, LLC, as its sole general partner | |

| Date: November 4, 2021 | ||

| By: | /s/ Jason E. Paral | |

| Jason E. Paral | ||

| Vice President, Associate General Counsel and Secretary |

November 4, 2021 Q3 2021 UPDATE NYSE: EVA

Q3 2021 UPDATE On October 15, 2021, Enviva announced the acquisition of its former sponsor, Enviva Holdings, LP (“Holdings”), and the elimin ati on of incentive distributions rights (the “Simplification Transaction”). Enviva also announced plans to convert from a master limited partner shi p to a corporation under the name of Enviva Inc. by the end of the year (the “Conversion”). This communication does not constitute a solicitation of any vote or approval. In connection with the Conversion, Enviva filed a proxy statement with the U.S. Securities and Exchange Commission (the “SEC” ). Enviva also plans to file other documents with the SEC regarding the Conversion. After the proxy statement has been cleared by the SEC, a de finitive proxy statement will be mailed to the unitholders of Enviva. UNITHOLDERS OF ENVIVA ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE CONVERSION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE CONVERSION. Unitholders will be able to obtain free copies of the proxy statement and other documents c ont aining important information once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec .go v. Participants in the Solicitation Enviva and its general partner’s directors and executive officers may be deemed to be participants in the solicitation of pro xie s from the unitholders of Enviva in connection with the proposed transaction. Information about such directors and executive officers is set forth i n E nviva’s Annual Report on Form 10 - K filed with the SEC on February 25, 2021. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other re lev ant materials to be filed with the SEC when they become available. IMPORTANT INFORMATION FOR UNITHOLDERS 2

Q3 2021 UPDATE FORWARD - LOOKING STATEMENTS Cautionary Note Concerning Forward - Looking Statements The information included herein and in any oral statements made in connection herewith include “forward - looking statements” with in the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or histo ric al fact included herein, regarding the Conversion, Enviva’s ability to consummate the Conversion, the benefits of the Conversion and Enviva’s future financial performance following the Conversion, as well as Enviva’s strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans, and objectives of management are forward - looking statements. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of s uch terms, and other similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words. These forward - looking statements are bas ed on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise re qui red by applicable law, Enviva disclaims any duty to revise or update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circums tances after the date hereof. Enviva cautions you that these forward - looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the co ntr ol of Enviva. These risks include, but are not limited to: (i) the volume and quality of products that we are able to produce or source and sell, which could be adversely affected by, among other things, op erating or technical difficulties at our wood pellet production plants or deep - water marine terminals; (ii) the prices at which we are able to sell our products; (iii) our ability to successfully negotiat e, complete, and integrate acquisitions, including the associated contracts, or to realize the anticipated benefits of such acquisitions; (iv) failure of our customers, vendors, and shipping partners to pay or perfor m t heir contractual obligations to us; (v) our inability to successfully execute our project development, expansion, and construction activities on time and within budget; (vi) the creditworthiness of our contr act counterparties; (vii) the amount of low - cost wood fiber that we are able to procure and process, which could be adversely affected by, among other things, disruptions in supply or operating or financia l d ifficulties suffered by our suppliers; (viii) changes in the price and availability of natural gas, coal, or other sources of energy; (ix) changes in prevailing economic conditions; (x) unanticipated ground, g rad e or water conditions; (xi) inclement or hazardous environmental conditions, including extreme precipitation, temperatures, and flooding; (xii) fires, explosions, or other accidents; (xiii) changes in d ome stic and foreign laws and regulations (or the interpretation thereof) related to renewable or low - carbon energy, the forestry products industry, the international shipping industry, or power, heat, or combined heat and power generators; (xiv) changes in the regulatory treatment of biomass in core and emerging markets; (xv) our inability to acquire or maintain necessary permits or rights for our productio n, transportation, or terminaling operations; (xvi) changes in the price and availability of transportation; (xvii) changes in foreign currency exchange or interest rates, and the failure of our hedging ar rangements to effectively reduce our exposure to the risks related thereto; (xviii) risks related to our indebtedness; (xix) our failure to maintain effective quality control systems at our wood pellet product ion plants and deep - water marine terminals, which could lead to the rejection of our products by our customers; (xx) changes in the quality specifications for our products that are required by our customers; (x xi) labor disputes, unionization or similar collective actions; (xxii) our inability to hire, train or retain qualified personnel to manage and operate our business and newly acquired assets; (xxiii) the Conversio n m ay not occur, and even if it were to be completed, we may fail to realize the anticipated benefits; (xxiv) the possibility of cyber and malware attacks; (xxv) our inability to borrow funds and access cap ita l markets; and (xxvi) viral contagions or pandemic diseases, such as COVID - 19. Should one or more of the risks or uncertainties described herein and in any oral statements made in connection therewith occ ur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward - looking statements. Additional information concerning these and o ther factors that may impact Enviva’s expectations and projections can be found in Enviva’s periodic filings with the SEC. Enviva’s SEC filings are available publicly on the SEC’s website at www.sec. gov . Industry and market data This presentation has been prepared by Enviva and includes market data and other statistical information from third - party source s, including independent industry publications, government publications or other published independent sources. Although Enviva believes these third - party sources are reliable as of their respective date s, Enviva has not independently verified the accuracy or completeness of this information. Some data is also based on Enviva’s good faith estimates, which are derived from its review of internal sou rce s as well as the third - party sources described above. 3

Q3 2021 UPDATE ABOUT ENVIVA ....................................................... Q3 2021 HIGHLIGHTS …............................................ APPENDIX .............................................................. NON - GAAP FINANCIAL MEASURES ............................ SUPPLEMENTAL INFORMATION ................................. 4 INDEX 5 7 13 19 28

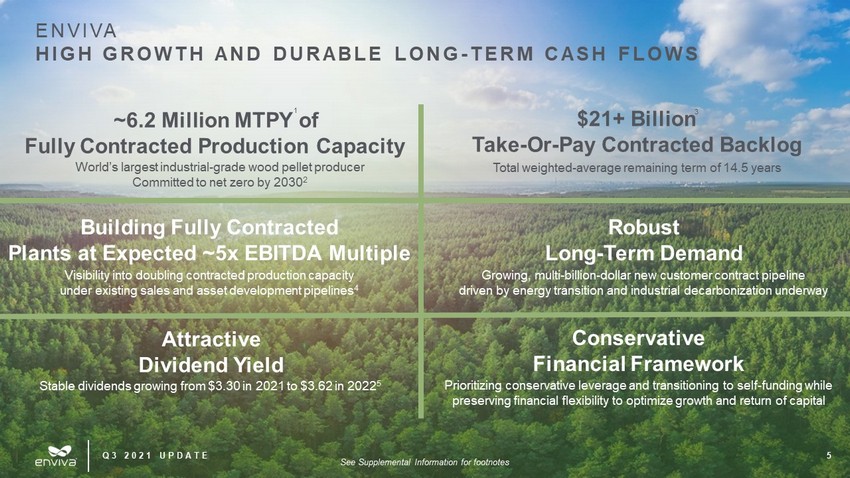

Q3 2021 UPDATE ENVIVA HIGH GROWTH AND DURABLE LONG - TERM CASH FLOWS See Supplemental Information for footnotes 5 Prioritizing conservative leverage and transitioning to self - funding while preserving financial flexibility to optimize growth and return of capital Building Fully Contracted Plants at Expected ~5x EBITDA Multiple Visibility into doubling contracted production capacity under existing sales and asset development pipelines 4 Robust Long - Term Demand Growing, multi - billion - dollar new customer contract pipeline driven by energy transition and industrial decarbonization underway Attractive Dividend Yield Stable dividends growing from $3.30 in 2021 to $3.62 in 2022 5 World’s largest industrial - grade wood pellet producer Committed to net zero by 2030 2 ~6.2 Million MTPY of Fully Contracted Production Capacity 1 Total weighted - average remaining term of 14.5 years $21+ Billion Take - Or - Pay Contracted Backlog 3 Conservative Financial Framework

STRATEGICALLY LOCATED ASSETS 1 CHESAPEAKE CLUSTER (MTPY) Southampton VA (SOU) 4 760k Ahoskie, NC (AHO) 410k Northampton, NC (NOR) 4 750k Port of Chesapeake, VA (CHE) 3 * 2.5M Cottondale, FL (COT) 750k Port of Panama City, FL (PAN) 3 * 780k WILMINGTON CLUSTER (MTPY) Hamlet, NC (HAM) 600k Sampson, NC (SAM) 600k Greenwood, SC (GRE) 5 500k Port of Wilmington, NC (WIL) 3 * 3.0M 6 Amory, MS (AMO) 115k Port of Mobile, AL (MOB) 3 * 115k PASCAGOULA CLUSTER (MTPY) Lucedale, MS (LUC) 6 750k Port of Pascagoula, MS (PAS)* 6 3.0M *throughput capacity See Supplemental Information for footnotes SAVANNAH CLUSTER (MTPY) Waycross, GA (WAY) 800k Port of Savannah, GA (SAV) 3 * 1.5M PLANT SITES UNDER CONTROL / ASSESSMENT 7 TERMINALS UNDER CONSTRUCTION PLANTS UNDER DEVELOPMENT / CONSTRUCTION TERMINALS OWNED OR LEASED PLANTS OWNED AND OPERATED 10 WOOD PELLET PRODUCTION PLANTS ~11M MTPY TOTAL TERMINALING CAPACITY Operations located in the U.S. southeast, where robust natural resource growth drives sustainable, stable low - cost supply 6 DEEP - WATER MARINE TERMINALS ~6.2M MTPY TOTAL PRODUCTION CAPACITY 2

Q3 2021 UPDATE 7 Q3 2021 HIGHLIGHTS

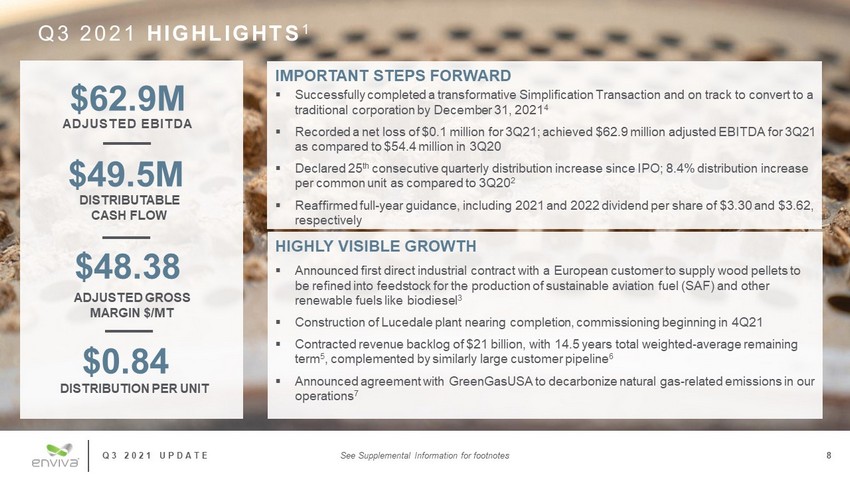

Q3 2021 UPDATE Q3 2021 HIGHLIGHTS 1 IMPORTANT STEPS FORWARD ▪ Successfully completed a transformative Simplification Transaction and on track to convert to a traditional corporation by December 31, 2021 4 ▪ Recorded a net loss of $0.1 million for 3Q21; achieved $62.9 million adjusted EBITDA for 3Q21 as compared to $54.4 million in 3Q20 ▪ Declared 25 th consecutive quarterly distribution increase since IPO; 8.4% distribution increase per common unit as compared to 3Q20 2 ▪ Reaffirmed full - year guidance, including 2021 and 2022 dividend per share of $3.30 and $3.62, respectively $62.9M ADJUSTED EBITDA $49.5M DISTRIBUTABLE CASH FLOW $48.38 ADJUSTED GROSS MARGIN $/MT $0.84 DISTRIBUTION PER UNIT See Supplemental Information for footnotes 8 ▪ Announced first direct industrial contract with a European customer to supply wood pellets to be refined into feedstock for the production of sustainable aviation fuel (SAF) and other renewable fuels like biodiesel 3 ▪ Construction of Lucedale plant nearing completion, commissioning beginning in 4Q21 ▪ Contracted revenue backlog of $21 billion, with 14.5 years total weighted - average remaining term 5 , complemented by similarly large customer pipeline 6 ▪ Announced agreement with GreenGasUSA to decarbonize natural gas - related emissions in our operations 7 HIGHLY VISIBLE GROWTH

Q3 2021 UPDATE 9 FINANCIAL GUIDANCE 1 Double - digit growth forecasted for adjusted EBITDA and distributable cash flow $ millions, unless noted 2021 2 2022 Net Income $4.0 – $14.0 $42.0 – $67.0 Adjusted EBITDA $225.0 – $235.0 $275.0 – $300.0 Distributable Cash Flow $165.0 – $175.0 $210.0 – $235.0 Dividend per Common Share $3.30/share $3.62/share “The future has never been brighter for Enviva. With our transformative Simplification Transaction and Conversion, along with our expanding production capacity underpinned by our existing assets, the plant expansions underway, and the commissioning of the Lucedale plant and Pascagoula terminal, we are entering 2022 with increased size and scale, a significantly improved cost of capital, and a broadening customer base.” - John Keppler (Chairman and CEO) GUIDANCE HIGHLIGHTS See Supplemental Information for footnotes ~25% Forecasted Adjusted EBITDA Growth At the midpoint of guidance ranges, 2022 adjusted EBITDA growth over 2021 is 25% ~30% Forecasted DCF 4 Growth At the midpoint of guidance ranges, 2022 DCF growth over 2021 is ~30%; targeting positive free cash flow post - 2022, depending on cadence of capital investments ~10% Forecasted Dividend Growth Dividend guidance preserved, with $3.30/share expected for 2021, and $3.62 expected for 2022 Cost Reductions Underway 5 Evaluating synergies and streamlining initiatives to further improve cost structure and reduce SG&A costs, which we expect to decline over time *2021 guidance does not reflect a potential recast of historical results, which may be required under GAAP due to the Simplification Transaction.

Q3 2021 UPDATE 10 CAPITALIZATION AND FINANCIAL FRAMEWORK FINANCIAL PRIORITIES Transitioning to an organic growth story with the ability to fully self - fund asset expansions over time is expected to reduce future capital market needs ROBUST DIVIDEND COVERAGE Long - term target of 1.5x or greater dividend coverage 1 CONSERVATIVE LEVERAGE 2 Fully contracted business with only ~22% debt to total capitalization 3 SELF - FUNDED GROWTH FINANCING 4 Cash preservation from IDR elimination and lower investment multiples enable transition to fully self - funding growth model ATTRACTIVE DIVIDEND YIELD Stable growing cash flows enhance financial flexibility and the ability to increase dividends and return of capital to shareholders over time $ millions EVA Capitalization As of September 30, 2021 Cash and Cash Equivalents 12 Revolving Credit Facility 345 Senior Notes 747 Other Debt 55 Net Debt $ 1,135 Common Shares 5 4,086 Total Capitalization $ 5,221 See Supplemental Information for footnotes

Q3 2021 UPDATE NET ZERO PROMISE SCOPE 1 EMISSIONS 1 WE WILL REDUCE, ELIMINATE, OR OFFSET ALL OF OUR DIRECT EMISSIONS ▪ Recently announced contract with GreenGasUSA which is expected to reduce Scope 1 emissions by 75% on an annual basis by replacing natural gas with renewable natural gas 6% 35% 58% COMMITTED TO NET ZERO IN OUR OPERATIONS BY 2030 Our 2020 Emissions SCOPE 2 EMISSIONS 1 WE WILL SOURCE 50% RENEWABLE ENERGY BY 2025, AND 100% BY 2030 ▪ Enviva joined the Renewable Energy Buyers Alliance, a business consortium committed to large - scale purchases of clean renewable energy, and we are evaluating solar installations at multiple plants SCOPE 3 EMISSIONS 1 WE WILL SEEK TO DRIVE INNOVATIVE GHG REDUCTIONS IN OUR SUPPLY CHAIN ▪ Enviva signed an agreement with Mitsui O.S.K Lines to develop and deploy and environmentally friendly bulk carrier to reduce the GHG emission in the transport of our sustainable wood pellets 2 See Supplemental Information for footnotes 11

Q3 2021 UPDATE ENVIVA POSITIONED TO CONTINUE PROVIDING SUPERIOR RETURNS 12 EVA outperformed the S&P 500 by 95% on total return basis over the last 3 years 6 EVA outperformed the MSCI ESG Index by 84% on a total return basis over the last 3 years 6 EVA outperformed the Alerian MLP TR Index by 173% on a total return basis over the last 3 years 6 World’s Largest Industrial Wood Pellet Producer 1 ▪ High - growth renewable energy company with strong, durable, cash flows underpinned by long - term, take - or - pay contracts with credit - worthy counterparties ▪ Substantial distributable cash flow accretion forecasted ▪ Solid dividend with ability to grow over time 2 ▪ Conservative financial policies to ensure balance sheet strength 3 ▪ Index eligibility significantly expanded and corporate structure investable across all geographies See Supplemental Information for footnotes Fully Contracted Assets ▪ ~6.2 million metric tons per year of fully - contracted production capacity 1 ▪ Visibility into doubling production capacity with current sales and asset development pipelines 4 ▪ Potential to develop fully contracted plants at ~5x adjusted EBITDA project investment multiple 5 ▪ Highly - accretive expansion opportunities identified across existing asset fleet Robust Long - term Demand ▪ Global energy transition underway in which wood biomass plays a key role in stabilizing grid - critical power and heat generation assets ▪ Massive decarbonization of industry underway, where wood biomass is a large - scale solution available today ▪ Bioenergy with carbon capture and storage (BECCS) is a valuable negative - emissions solution expected to be increasingly deployed as governments and industrial customers drive to net - zero emissions

APPENDIX

Q3 2021 UPDATE STRONG & GROWING INTERNATIONAL DEMAND Serving critical energy generation and industrial markets undertaking large - scale decarbonization 21 37 2020 2030E 76% Expected Global Wood Pellet Demand for Heat & Power Generation (Million MTPY) 1 EVA’s long - term contracted growth currently in power and heat applications enables energy transition by providing a dispatchable renewable resource to power energy grids 14 EVA Outlook EVA 2021 Contract Mix ~20 Customers Expected Revenue ~$1B 4 EVA 2025 Contract Mix ~40 Customers Target Revenue ~$2B 5 2030 $20B+ Robust and Diversified Market 6 Power/Heat (including BECCS) Industrials Sources of Wood Pellet Demand (Million MTPY) Cement Steel Lime Biofuels Current Industrial Opportunities 20% 18% 15% 15% 14% 7% 4% 6% Germany UK Japan Poland South Korea Taiwan Denmark Other 2030 Estimated Global Wood Pellet Demand – By Country 3 Emerging industrial decarbonization opportunity further accelerates EVA growth profile in applications ranging from green steel to sustainable aviation fuel 9 10 13 2020 2025E 2030E UK 1 See Supplemental Information for footnotes Enviva offices 3 13 0 8 5 2020 2030E Biofuels Steel Cement Lime Expected Global Wood Pellet Demand for Industrial Applications (Million MTPY) 2 29 2 16 18 22 4 16 2020 2025E 2030E EUROPE 2 2 9 9 1 3 2020 2025E 2030E JAPAN 2 1 4 1 2020 2025E 2030E TAIWAN 0 2 AS THE WORLD’S LARGEST SUPPLIER, ENVIVA IS UNIQUELY POSITIONED TO MONETIZE GROWING DECARBONIZATION OPPORTUNITIES IN ENERGY AND INDUSTRY

Q3 2021 UPDATE By 2025, Enviva’s current contract mix is balanced ~50% Japanese customers and ~50% European customers 4 Enviva commenced deliveries to Japan in late 2020, with ~10 shipments expected to be delivered in 2021, ~55 shipments in 2022, and continued increases thereafter as customers ramp energy generation from biomass CURRENT CONTRACT OVERVIEW 15 $21+ billion of fully contracted backlog provides significant cash flow visibility and durability ENVIVA’S 2025 FORECASTED OFF - TAKE CONTRACT MIX Geographically diverse set of high - credit counterparties underpins $21+ billion contract backlog, with a weighted - average remain ing term of 14.5 years 1 Revenue backlog is complemented by a similarly large and growing customer pipeline consisting of long - term off - take opportunitie s in our traditional markets and emerging industrial segments across the globe (including steel, cement, lime, chemicals, SAF and biodiesel) 2 Recently announced new contracts include: First take - or - pay off - take contract to supply an industrial customer with up to ~1.2 million MTPY of wood pellets, to be used as a feedstock in the production of SAF and renewable fuels, with initial annual deliveries of 60,000 MTPY expected to commence in 2023 3 4 th contract signed with U.K. power generator, Drax, for 200,000 MTPY for 5 years, with deliveries scheduled from 2022 to 2026 20 - year, 190,000 MTPY contract with a major Japanese trading house starting in 2024 See Supplemental Information for footnotes 1 4 - 3,000 6,000 9,000 2015 2016 2017 2018 2019 2020 2021E 2025E TOTAL METRIC TONS SOLD POTENTIAL INDUSTRIAL DELIVERIES INDUSTRIAL JAPAN EUROPE

Q3 2021 UPDATE FAVORABLE CONTRACT STRUCTURE RESULTS IN DURABLE MARGINS UNPARALLELED See Supplemental Information for footnotes 16 $250 - $270 1. Majority of delivered price of fiber is comprised of labor, equipment and hauling costs Fiber (“stumpage”) cost is ~10% of sales price, driven by strong fiber basket in the Southeast U.S. 2. ~2:1 green ton to pellet ton conversion (green wood is, on average, composed of approximately 50% water, which varies seasonally. As such, on average, EVA acquires approximately two green tons to convert one pellet ton post the drying process) 3. “Build and copy” approach to allow for certainty of uptime and economy of scale Includes labor, consumables, repairs and maintenance, and energy costs Given fixed asset base, productivity improvements drive substantial margin expansion opportunities 4. Fixed USD / ton transportation costs from plants to port terminals by truck / rail / barge 5. Vertically integrated business model provides substantial operating leverage as business grows 6. Fixed - price, USD / ton denominated shipping contracts matched to length of off - take contracts Bunker fuel costs passed through to customers Shipping costs range from ~$20 / MT (Europe) to ~$45 / MT (Japan) 7. Long - term contracts with diversified customer base Fixed - price (with escalators), take - or - pay off - take contracts $250 - $270 Illustrative ($ per metric ton) $200 Cut, Skid, Haul ~$45 / MT Adj. Gross Margin 1 Production Total Raw Materials in COGS Total Costs of Goods Sold Stumpage Cut, Skid, Haul Stumpage Logistics Ports Shipping 1. 3. 4. 5. 6. 7. 2.

Q3 2021 UPDATE 17 ASSET DEVELOPMENT PIPELINE PROJECT UPDATE MULTI - PLANT EXPANSIONS 1 Highly - accretive set of initiatives at 3 plants driving ~$20 million in incremental annual expected adjusted EBITDA with ~$50 million capital expenditures; 2.5x adjusted EBITDA project investment multiple 2 EPES PLANT 3 Fully contracted, designed and permitted to produce more than 1 million MTPY once construction is completed, making it the largest industrial wood pellet production plant in the world LUCEDALE EXPANSION 4 Fully permitted expansion option for 300,000 MTPY; capital expenditures of ~$60 million driving ~$15 million of expected incremental annual adjusted EBTIDA; 4.0x adjusted EBITDA project investment multiple 2 BOND PLANT 5 Designed to produce between 750,000 and more than 1 million MTPY; proximity to Port of Pascagoula allows efficient delivery to terminal NEW PLANTS & EXPANSIONS UNDER EVALUATION Sites in the Pascagoula cluster, Chesapeake cluster, Wilmington cluster, and Savannah cluster being evaluated for the next 4 greenfield projects. Highly - accretive potential expansion projects identified across asset fleet Bond Plant 2021 2022 2023 Capacity Additions (MTPY) Forecasted In - service Date Mid - Atlantic Expansions 400,000 Complete in 2021 Greenwood Expansion 100,000 4Q21 Multi - Plant Expansions 100,000 4Q22 Epes Plant 1,000,000+ 2H23 Lucedale Expansion 300,000 1H24 Bond Plant 750,000 – 1,000,000 2H24 ~ 40% Production capacity increase underway over next 3 years, with visibility into doubling size of today’s capacity 6 See Supplemental Information for footnotes

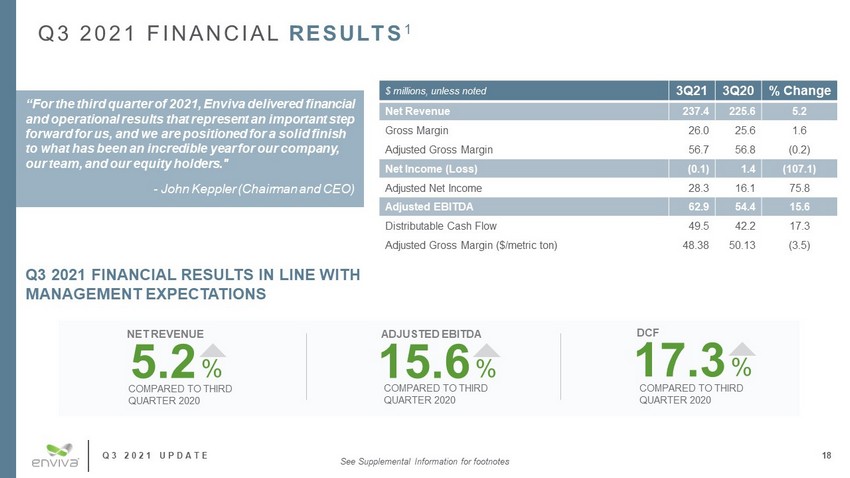

Q3 2021 UPDATE Q3 2021 FINANCIAL RESULTS 1 $ millions, unless noted 3Q21 3Q20 % Change Net Revenue 237.4 225.6 5.2 Gross Margin 26.0 25.6 1.6 Adjusted Gross Margin 56.7 56.8 (0.2) Net Income (Loss) (0.1) 1.4 (107.1) Adjusted Net Income 28.3 16.1 75.8 Adjusted EBITDA 62.9 54.4 15.6 Distributable Cash Flow 49.5 42.2 17.3 Adjusted Gross Margin ($/metric ton) 48.38 50.13 (3.5) 18 Q3 2021 FINANCIAL RESULTS IN LINE WITH MANAGEMENT EXPECTATIONS “For the third quarter of 2021, Enviva delivered financial and operational results that represent an important step forward for us, and we are positioned for a solid finish to what has been an incredible year for our company, our team, and our equity holders." - John Keppler (Chairman and CEO) 15.6 % ADJUSTED EBITDA COMPARED TO THIRD QUARTER 2020 5.2 % NET REVENUE COMPARED TO THIRD QUARTER 2020 17.3 % DCF COMPARED TO THIRD QUARTER 2020 See Supplemental Information for footnotes

NON - GAAP FINANCIAL MEASURES

Q3 2021 UPDATE NON - GAAP FINANCIAL MEASURES This presentation contains certain financial measures that are not presented in accordance with accounting principles general ly accepted in the United States (“GAAP”). Although they should not be considered alternatives to the GAAP presentation of the financial results of the Partners hip, management views such non - GAAP measures as important to reflect the Partnership’s actual performance during the periods presented. Non - GAAP Financial Measures In addition to presenting our financial results in accordance with accounting principles generally accepted in the United Sta tes (“GAAP”), we use adjusted net income, adjusted gross margin, adjusted gross margin per metric ton, adjusted EBITDA, and distributable cash flow to measure our financial performance. In addition, we have included herein 2021 estimated financial results (the “2021 Guidance”), which include the expected post - closin g results of the assets and operations acquired as part of the Simplification Transaction, but do not reflect any recast of our historical financials as a r esult of the Simplification Transaction. If GAAP requires a recast of our historical financials as a result of the Simplification Transaction, the 2021 Guidance const itu tes a Non - GAAP measure. Our management uses our 2021 Guidance as a supplemental measure to represent the financial results of the assets and operations o f t he publicly traded entity. Adjusted Net Income We define adjusted net income as net income excluding interest expense associated with incremental borrowings related to a fi re that occurred in February 2018 at the Chesapeake terminal (the “Chesapeake Incident”) and Hurricanes Florence and Michael (the “Hurricane Events”), early retir eme nt of debt obligation, and acquisition and integration and other costs, adjusting for the effect of certain sales and marketing, scheduling, sustainabil ity , consultation, shipping, and risk management services (collectively, “Commercial Services”), and including, for periods prior to the Simplification Transaction , c ertain non - cash waivers of fees for management services provided to us by our sponsor (collectively, “MSA Fee Waivers”), and for periods after the Simplification Tr ansaction, certain payments under the Support Agreement entered into in connection therewith (“Support Payments”). We believe that adjusted net income enhances in vestors’ ability to compare the past financial performance of our underlying operations with our current performance separate from certain items of gain or l oss that we characterize as unrepresentative of our ongoing operations. 20

Q3 2021 UPDATE NON - GAAP FINANCIAL MEASURES (cont.) Adjusted Gross Margin and Adjusted Gross Margin per Metric Ton We define adjusted gross margin as gross margin excluding loss on disposal of assets, depreciation and amortization, changes in unrealized derivative instruments related to hedged items included in gross margin, non - cash unit compensation expenses, and acquisition and integration costs and other, adjusting for the effect of Commercial Services, and including, for periods prior to the Simplification Transaction, certain MSA Fee Waivers, and for per iod s after the Simplification Transaction, certain Support Payments. We define adjusted gross margin per metric ton as adjusted gross margin per metric ton of wood pell ets sold. We believe adjusted gross margin and adjusted gross margin per metric ton are meaningful measures because they compare our revenue - generating activities t o our operating costs for a view of profitability and performance on a total - dollar and a per - metric ton basis. Adjusted gross margin and adjusted gross margin p er metric ton will primarily be affected by our ability to meet targeted production volumes and to control direct and indirect costs associated with procurement and d eli very of wood fiber to our wood pellet production plants and our production and distribution of wood pellets. Adjusted EBITDA We define adjusted EBITDA as net income excluding depreciation and amortization, interest expense, income tax expense (benefi t), early retirement of debt obligations, non - cash unit compensation expense, loss on disposal of assets, changes in unrealized derivative instruments relate d to hedged items included in gross margin and other income and expense, and acquisition and integration costs and other, adjusting for the effect of Commercial Ser vices, and including, for periods prior to the Simplification Transaction, certain MSA Fee Waivers, and for periods after the Simplification Transaction, certa in Support Payments. Adjusted EBITDA is a supplemental measure used by our management and other users of our financial statements, such as investors, commercial bank s a nd research analysts, to assess the financial performance of our assets without regard to financing methods or capital structure. Distributable Cash Flow We define distributable cash flow as adjusted EBITDA less maintenance capital expenditures, cash income tax expenses, and int ere st expense net of amortization of debt issuance costs, debt premium, original issue discounts, and the impact from incremental borrowings related to the Che sap eake Incident and Hurricane Events. We use distributable cash flow as a performance metric to compare our cash - generating performance from period to period and to compare the cash - generating performance for specific periods to the cash distributions (if any) that are expected to be paid to our unitholder s. We do not rely on distributable cash flow as a liquidity measure. 21

Q3 2021 UPDATE NON - GAAP FINANCIAL MEASURES (cont.) 22 Limitations of Non - GAAP Financial Measures Adjusted net income, adjusted gross margin, adjusted gross margin per metric ton, adjusted EBITDA, and distributable cash flo w a re not financial measures presented in accordance with GAAP. We believe that the presentation of these non - GAAP financial measures provides useful informa tion to investors in assessing our financial condition and results of operations. Our non - GAAP financial measures should not be considered as alternatives to t he most directly comparable GAAP financial measures. Each of these non - GAAP financial measures has important limitations as an analytical tool because they exclu de some, but not all, items that affect the most directly comparable GAAP financial measures. You should not consider adjusted net income, adjusted gross marg in, adjusted gross margin per metric ton, adjusted EBITDA, or distributable cash flow in isolation or as substitutes for analysis of our results as reporte d u nder GAAP. Our definitions of these non - GAAP financial measures may not be comparable to similarly titled measures of other companies, ther eby diminishing their utility. The estimated incremental adjusted EBITDA that can be expected from the development of new wood pellet plant capacity by Envi va following the Simplification Transaction is based on an internal financial analysis of the anticipated benefit from the incremental production capacity an d c ost savings we expect to realize as compared to drop - down acquisitions. Such estimates are based on numerous assumptions are inherently uncertain and subject to sig nificant business, economic, financial, regulatory, and competitive risks that could cause actual results and amounts to differ materially from such estim ate s. A reconciliation of the estimated incremental adjusted EBITDA expected to be generated by a new wood pellet production plant constructed by Enviva to the close st GAAP financial measure, net income, is not provided because net income expected to be generated thereby is not available without unreasonable effort, in par t because the amount of estimated incremental interest expense related to the financing of such a plant and depreciation is not available at this time.

Q3 2021 UPDATE NON - GAAP FINANCIAL MEASURES RECONCILIATION Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 (in thousands) Reconciliation of Net (Loss) Income to Adjusted Net Income: Net (loss) income $ (71) $ 1,411 $ 1,109 $ 17,515 Acquisition and integration costs and other 7,294 4,908 8,297 5,865 MSA Fee Waivers 21,125 9,206 36,150 13,963 Interest expense from incremental borrowings related to Chesapeake Incident and Hurricane Events – 554 – 1,672 Commercial services – – – (4,139) Adjusted net income $ 28,348 $ 16,079 $ 45,556 $ 34,876 23 THE FOLLOWING TABLE PROVIDES A RECONCILIATION OF NET (LOSS) INCOME TO ADJUSTED NET INCOME:

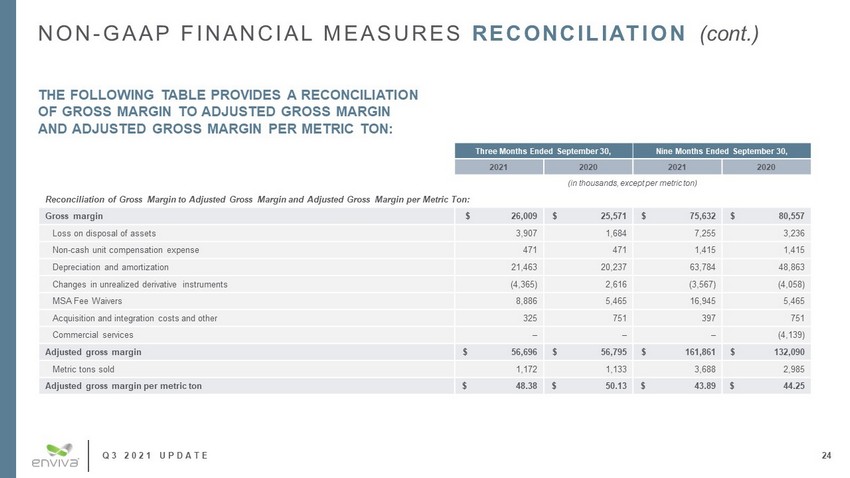

Q3 2021 UPDATE NON - GAAP FINANCIAL MEASURES RECONCILIATION (cont.) Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 (in thousands, except per metric ton) Reconciliation of Gross Margin to Adjusted Gross Margin and Adjusted Gross Margin per Metric Ton: Gross margin $ 26,009 $ 25,571 $ 75,632 $ 80,557 Loss on disposal of assets 3,907 1,684 7,255 3,236 Non - cash unit compensation expense 471 471 1,415 1,415 Depreciation and amortization 21,463 20,237 63,784 48,863 Changes in unrealized derivative instruments (4,365) 2,616 (3,567) (4,058) MSA Fee Waivers 8,886 5,465 16,945 5,465 Acquisition and integration costs and other 325 751 397 751 Commercial services – – – (4,139) Adjusted gross margin $ 56,696 $ 56,795 $ 161,861 $ 132,090 Metric tons sold 1,172 1,133 3,688 2,985 Adjusted gross margin per metric ton $ 48.38 $ 50.13 $ 43.89 $ 44.25 24 THE FOLLOWING TABLE PROVIDES A RECONCILIATION OF GROSS MARGIN TO ADJUSTED GROSS MARGIN AND ADJUSTED GROSS MARGIN PER METRIC TON:

Q3 2021 UPDATE NON - GAAP FINANCIAL MEASURES RECONCILIATION (cont.) Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 (in thousands) Reconciliation of Net (Loss) Income to Adjusted EBITDA: Net (loss) income $ (71) $ 1,411 $ 1,109 $ 17,515 Add: Depreciation and amortization 22,014 20,555 65,238 49,802 Interest expense 10,624 11,950 35,903 32,468 Income tax benefit (66) (275) (59) (275) Non - cash unit compensation expense 2,398 2,347 7,756 6,603 Loss on disposal of assets 3,907 1,684 7,255 3,236 Changes in unrealized derivative instruments (4,365) 2,616 (3,567) (4,058) MSA Fee Waivers 21,125 9,206 36,150 13,963 Acquisitions and integration costs and other 7,294 4,908 8,297 5,865 Commercial services – – – (4,139) Adjusted EBITDA $ 62,860 $ 54,402 $ 158,082 $ 120,980 THE FOLLOWING TABLE PROVIDES A RECONCILIATION OF NET (LOSS) INCOME TO ADJUSTED EBITDA: 25

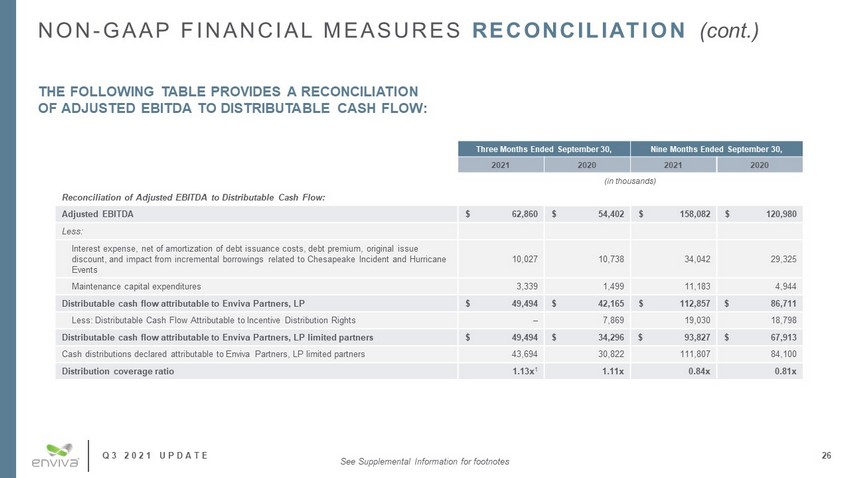

Q3 2021 UPDATE NON - GAAP FINANCIAL MEASURES RECONCILIATION (cont.) Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 (in thousands) Reconciliation of Adjusted EBITDA to Distributable Cash Flow: Adjusted EBITDA $ 62,860 $ 54,402 $ 158,082 $ 120,980 Less: Interest expense, net of amortization of debt issuance costs, debt premium, original issue discount, and impact from incremental borrowings related to Chesapeake Incident and Hurricane Events 10,027 10,738 34,042 29,325 Maintenance capital expenditures 3,339 1,499 11,183 4,944 Distributable cash flow attributable to Enviva Partners, LP $ 49,494 $ 42,165 $ 112,857 $ 86,711 Less: Distributable Cash Flow Attributable to Incentive Distribution Rights – 7,869 19,030 18,798 Distributable cash flow attributable to Enviva Partners, LP limited partners $ 49,494 $ 34,296 $ 93,827 $ 67,913 Cash distributions declared attributable to Enviva Partners, LP limited partners 43,694 30,822 111,807 84,100 Distribution coverage ratio 1.13x 1 1.11x 0.84x 0.81x THE FOLLOWING TABLE PROVIDES A RECONCILIATION OF ADJUSTED EBITDA TO DISTRIBUTABLE CASH FLOW: 26 See Supplemental Information for footnotes

Q3 2021 UPDATE 2021 & 2022 GUIDANCE 1 Twelve Months Ending December 31, 2021 2 Twelve Months Ending December 31, 2022 Estimated net income $ 4.0 – 14.0 $ 42.0 – 67.0 Add: Depreciation and amortization 91.0 112.0 Interest expense 48.0 56.0 Income tax expense 1.0 25.0 Non - cash share - based compensation expense 11.0 12.0 Loss on disposal of assets 8.0 4.0 Changes in unrealized derivative instruments (4.0) – MSA Fee Waivers / Support Payments 49.0 24.0 Acquisition and integration costs 16.0 – Other non - cash expenses 1.0 – Estimated adjusted EBITDA $ 225.0 – 235.0 $ 275.0 – 300.0 Less: Interest expense net of amortization of debt issuance costs, debt premium, and original issue discount 46.0 55.0 Cash income tax expense – – Maintenance capital expenditures 14.0 10.0 Estimated distributable cash flow $ 165.0 – 175.0 $ 210.0 – 235.0 The following table provides a reconciliation of the estimated range of adjusted EBITDA and DCF to the estimated range of net income for Enviva for the twelve months ending December 31, 2021, and December 31, 2022 (in millions): 27 See Supplemental Information for footnotes

Q3 2021 UPDATE 28 SUPPLEMENTAL INFORMATION

Q3 2021 UPDATE SUPPLEMENTAL INFORMATION 29 Slide 5 (Enviva ) 1. Enviva’s total expected production capacity as of October 1, 2021, including the Lucedale plant after it is fully constructed an d able to achieve its nameplate throughput capacity. Also included is the nameplate capacity of approximately 600,000 metric tons per year (“MTPY”) for the wood pellet production plan t i n Greenwood, South Carolina (the “Greenwood plant”) after completion of the ongoing expansion project. The total expected production capacity does not include expansion projects under way at the Sampson, Hamlet, and Cottondale plants (the “Multi - Plant Expansions”). 2. On February 17, 2021, Enviva announced our goal of achieving net - zero greenhouse gas (“GHG”) emissions in our operations by 2030 . 3. As of October 1, 2021, and including the initial 60,000 MTPY tranche related to the recently announced industrial contract as we ll as the recently announced contracts with Drax Group PLC and a large Japanese trading house, Enviva’s total weighted - average remaining term of off - take contracts is approximately 14.5 y ears, with a total contracted revenue backlog of over $21 billion. 4. Given the quality and size of our current customer contract pipeline, we believe that we will be able to support the addition of at least six new fully contracted wood pellet production plants and several highly accretive expansion projects, which over approximately the next five years would roughly double the size o f o ur current production capacity. With the benefit of the capabilities, resources, and activities now housed within Enviva, we expect to construct our new fully contracted wood pellet pr oduction plants at an approximately 5x adjusted EBITDA project investment multiple as compared to a historic drop - down acquisition multiple of roughly 7.5x. For an explanation of why we are unable to reconcile the estimated adjusted EBITDA from a plant developed by Enviva internally to the most directly comparable GAAP financial measures, see Appendix. 5. Enviva reaffirmed its previously announced distribution guidance and expects to distribute $3.30 per unit for full - year 2021 and $3.62 per share for 2022.

Q3 2021 UPDATE 30 SUPPLEMENTAL INFORMATION (cont.) Slide 6 (Strategic Assets ) 1. Production volumes disclosed represent nameplate production capacity at each plant. 2. Enviva’s total expected production capacity as of October 1, 2021, including the Lucedale plant after it is fully constructed an d able to achieve its nameplate throughput capacity. Also included is the nameplate capacity of approximately 600,000 MTPY for the Greenwood plant, after completion of the ongoing expansion project. The total expected production capacity does not include the Multi - Plant Expansions (as defined below). 3. We export wood pellets from our wholly owned deep - water marine terminals at the Port of Chesapeake, Virginia (the “Chesapeake te rminal”) and the Port of Wilmington, North Carolina (the “Wilmington terminal”) and from third - party deep - water marine terminals in Mobile, Alabama (the “Mobile terminal”) , Panama City, Florida (the “Panama City terminal”) and Savannah, Georgia (the “Savannah terminal”). 4. Includes increased production capacity pursuant to the ongoing expansion projects (the “Mid - Atlantic Expansions”) at the wood pe llet production plants in Northampton, North Carolina and Southampton, Virginia. The Partnership continues to expect each plant to reach its expanded nameplate production ca pacity of 750,000 and 760,000 MTPY, respectively, by the end of 2021. 5. Enviva expects to complete its project to expand the Greenwood plant’s production capacity to 600,000 MTPY by year - end 2021. 6. After the Lucedale plant and Pascagoula terminal are fully constructed and ramped up and achieve their nameplate production o r t hroughput capacities, as applicable. The acquisition of the Lucedale plant included an embedded, fully permitted option to expand the Lucedale plant by about 300,000 MTP Y for around $60 million in estimated capital expenditures. The expansion at Lucedale, when fully ramped, is expected to generate incremental annual adjusted EBITDA of ~$1 5 m illion. 7. As part of the Simplification Transaction, Enviva acquired projects at 15 plant sites, all in various stages of evaluation an d d evelopment.

Q3 2021 UPDATE 31 SUPPLEMENTAL INFORMATION (cont.) Slide 8 (Q3 2021 Highlights ) 1. Additional details can be found in our press releases issued on November 3, 2021. 2. For the third quarter of 2021, Enviva declared a distribution of $0.840 per common unit, an 8.4% increase over the third quar ter of 2020, and its 25th consecutive quarterly distribution increase since its IPO. Enviva expects to distribute $3.30 and $3.62 per share for full - year 2021 and 2022, respect ively. 3. On November 3, 2021, Today, Enviva announced the signing of a new 10 - year take - or - pay off - take contract to supply our first dire ct industrial customer with 60,000 MTPY of wood pellets to be used as a feedstock in the refining process for SAF and other renewable fuels like biodiesel. Deliveries u nde r the initial tranche of the contract are scheduled to commence in 2023, with volumes potentially increasing to approximately 1.2 million MTPY by 2027, through a series of addit ion al 10 - year take - or - pay tranches, as the customer builds incremental production capacity. Enviva will be the sole supplier of this customer’s incremental wood pellet nee ds. The initial tranche's conditions precedent, are expected to be met during 2022. 4. On October 15, 2021, Enviva announced the acquisition of Enviva Holdings, LP (“Holdings”) and the elimination of incentive di str ibutions rights (the “Simplification Transaction”). Enviva also announced plans to convert from a master limited partnership to a corporation under the name of En viv a Inc. by the end of the year (the “Conversion”); a unitholder meeting is now scheduled to be held on December 17, 2021. 5. As of October 1, 2021, and including the initial 60,000 MTPY tranche related to the recently announced industrial contract, E nvi va’s total weighted - average remaining term of off - take contracts is approximately 14.5 years, with a total contracted revenue backlog of over $21 billion. 6. The contracted revenue backlog of over $21 billion is complemented by a similarly large and growing customer pipeline consist ing of long - term off - take opportunities in our traditional markets for biomass - fired power and heat generation in geographies ranging from the United Kingdom to the European U nion (including emerging opportunities in Germany and Poland), and from Asia (including incremental demand in Japan, emerging potential in Taiwan, and maturing opportu nit ies in South Korea) to developing industrial segments across the globe (including steel, cement, lime, chemicals, SAF, and biodiesel). Over the next 12 months, we expect to progress negotiations and convert numerous contract pipeline opportunities, as well as previously signed exclusive memoranda of understanding, into binding con tra cts. 7. Enviva is making significant progress toward its goal to achieve net zero greenhouse gas emissions in its operations by 2030, in part by using 100% renewable energy at our facilities. Enviva recently announced a supply contract with GreenGasUSA, an integrated renewable natural gas (“RNG”) solutio ns provider, which includes a 10 - year RNG off - take agreement to decarbonize natural gas - related emissions in our operations. The methane captured and emissions eliminated as a result of this contract are expected to offset approximately 75% of Enviva’s current direct emissions from its manufacturing operations, or Scope 1 emissions, on an ann ual basis for the duration of the 10 - year agreement, which includes renewal options for an additional 10 years. Additional details can be found in our press releases i ssu ed on November 3, 2021.

Q3 2021 UPDATE 32 SUPPLEMENTAL INFORMATION (cont.) Slide 9 (Financial Guidance ) 1. On October 15, 2021, Enviva updated full - year 2021 and 2022 guidance as a result of the Simplification Transaction and Conversio n. Updated guidance for full - year 2021 includes the expected post - closing results of the assets and operations acquired as part of the Simplification Transaction, incl uding approximately $15 million to $20 million of incremental selling, general, and administrative expenses (“SG&A”). For full - year 2022, Enviva expects SG&A related to activitie s acquired with the Simplification Transaction to range from $37 million to $43 million. Additional details can be found in our press releases issued on November 3, 2021. 2. Our guidance for full - year 2021 is based on our actual performance on a stand - alone basis from January 1, 2021 through October 1 4, 2021 (the closing date of the Simplification Transaction), and our expected performance on a consolidated basis, inclusive of the assets and operations acq uir ed as part of the Simplification Transaction, from the closing date through the balance of the year ending December 31, 2021. This full - year 2021 guidance does not, however, reflect a potential recast of our historical results, which may be required under GAAP due to the Simplification Transaction. If recast, our results would reflect the acq uis ition of our former sponsor for the three - year period beginning January 1, 2019, even though the acquisition closed on October 14, 2021. We expect the addition of our forme r s ponsor’s development - related expenses and the elimination of intercompany transactions, including the MSA Fee Waivers and other forms of sponsor support, would cause o ur 2021 GAAP results on a recast basis to be significantly different from and lower than the 2021 guidance described below. We believe our 2021 guidance provides investor s w ith the best and most relevant information to evaluate the company’s financial and operating performance because it reflects Enviva’s actual and historically reported perf orm ance on a stand - alone basis through the closing date of the Simplification Transaction and expected performance on a consolidated basis from the closing date until y ear - end. We are currently unable to reconcile the 2021 guidance set forth below to the closest GAAP financial measures because we have neither prepared such a recast nor concl ude d it will be required; however, for purposes of comparability and transparency, we plan to measure our 2021 results on a non - recast basis against our 2021 guidance. 3. Enviva’s target leverage ratio is calculated pursuant to our credit facility. 4. Distributable Cash Flow. 5. We expect SG&A resulting from the Simplification Transaction to decline over time as we benefit from synergies and execute st rea mlining initiatives, with the expectation that we will reduce these expenses by approximately $5 million on an annual run - rate basis commencing in 2023.

Q3 2021 UPDATE SUPPLEMENTAL INFORMATION (cont.) 33 Slide 10 (Capitalization and Financial Framework ) 1. Dividend coverage ratio for the third quarter of 2021 is calculated on a cash basis, which means the unit count includes 7 mi lli on of the 16 million units issued on October 14, 2021. The 7 million units are not part of the dividend reinvestment commitment and therefore receive cash distributions on a qua rterly basis. 2. Enviva remains committed to conservatively managing its balance sheet, targeting a leverage ratio between 3.5 and 4.0 times, as calculated pursuant to our credit facility. 3. Debt to total capitalization calculation based on net debt divided by total capitalization figures provided on Slide 11. 4. We expect to retain an incremental ~$1 billion of cash flow over the next 5 years compared to the prior sponsor - led structure, d riven by the elimination of IDRs and lower plant investment multiples. Spanning the next 5 years, we anticipate that this improved return on invested capital will generate ov er $500 million of the approximately $1 billion of forecasted retained cash flow, with the other half coming from the elimination of IDRs, which represented an increasingly sig nif icant annual cash obligation. 5. Based on EVA’s closing price on October 29, 2021; $66.96. Based on 61,017,303 units outstanding as of October 29, 2021. Slide 11 (Net Zero Promise) 1. Scope 1 emissions are direct emissions from assets owned and controlled by Enviva. Scope 2 emissions are indirect emissions f rom heat, steam or electricity purchased by Enviva. Scope 3 emissions are indirect emissions in Enviva’s upstream or downstream value chain. 2. Additional details can be found in Enviva’s press release issued on March 30, 2021 . Slide 12 (Enviva II ) 1. Enviva’s total expected production capacity as of October 1, 2021, including the Lucedale plant after it is fully constructed an d able to achieve its nameplate throughput capacity. Also included is the nameplate capacity of approximately 600,000 MTPY for the Greenwood plant, after completion of the ongoing expansion project. The total expected production capacity does not include the Multi - Plant Expansions. 2. Enviva expects to distribute $3.30 and $3.62 per share for full - year 2021 and 2022, respectively. 3. Enviva remains committed to conservatively managing its balance sheet, targeting a leverage ratio between 3.5 and 4.0 times. 4. Given the quality and size of our current customer contract pipeline, we believe that we will be able to support the addition of at least six new fully contracted wood pellet production plants and several highly accretive expansion projects, which over approximately the next five years would roughly do uble the size of our current production capacity. 5. With the benefit of the capabilities, resources, and activities now housed within Enviva, we expect to construct our new full y c ontracted wood pellet production plants at an approximately 5x adjusted EBITDA project investment multiple as compared to a historic drop - down acquisition multiple of roughly 7.5x. For an explanation of why we are unable to reconcile the estimated adjusted EBITDA from the Lucedale plant expansion option to the most directly comparable GA AP financial measures, see Appendix. 6. As of October 29, 2021, based on Bloomberg’s total return data, which assumes reinvestment of distributions/dividends.

Q3 2021 UPDATE SUPPLEMENTAL INFORMATION (cont.) Slide 14 (International Demand ) 1. Hawkins Wright: The Outlook for Wood Pellets – Demand, Supply, Costs and Prices; 3rd Quarter 2021. 2. Conclusions from a market sizing and adoption study we recently commissioned from a leading international consultancy suggest th at these segments are expected increase from virtually zero today, to as much as 29 million MTPY of industrial - grade wood pellets by 2030. 3. Company Estimates. Fastmarkets RISI: Global Pellet Demand Outlook: Special Market Analysis Study 2021. 4. Based on forecasts for FY 2021. 5. Contract mix, customers and target revenue based on EVA’s current firm contracted backlog and company estimates. 6. Based on the market sizing and adoption study we recently commissioned, and company estimates. Slide 15 (Current Contract Overview ) 1. As of October 1, 2021, and including the initial 60,000 MTPY tranche related to the recently announced industrial contract, E nvi va’s total weighted - average remaining term of off - take contracts is approximately 14.5 years, with a total contracted revenue backlog of over $21 billion. 2. The contracted revenue backlog of over $21 billion is complemented by a similarly large and growing customer pipeline consist ing of long - term off - take opportunities in our traditional markets for biomass - fired power and heat generation in geographies ranging from the United Kingdom to the European U nion (including emerging opportunities in Germany and Poland), and from Asia (including incremental demand in Japan, emerging potential in Taiwan, and maturing opportu nit ies in South Korea) to developing industrial segments across the globe (including steel, cement, lime, chemicals, SAF, and biodiesel). Over the next 12 months, we expect to progress negotiations and convert numerous contract pipeline opportunities, as well as previously signed exclusive memoranda of understanding, into binding con tra cts. 3. On November 3, 2021, Today, Enviva announced the signing of a new 10 - year take - or - pay off - take contract to supply our first dire ct industrial customer with 60,000 MTPY of wood pellets to be used as a feedstock in the refining process for SAF and other renewable fuels like biodiesel. Deliveries u nde r the initial tranche of the contract are scheduled to commence in 2023, with volumes potentially increasing to approximately 1.2 million MTPY by 2027, through a series of addit ion al 10 - year take - or - pay tranches, as the customer builds incremental production capacity. Enviva will be the sole supplier of this customer’s incremental wood pellet nee ds. The initial tranche's conditions precedent, are expected to be met during 2022. 34

Q3 2021 UPDATE SUPPLEMENTAL INFORMATION (cont.) Slide 17 (Asset Development Pipeline ) 1. We have made significant investments in the Multi - Plant Expansions, commencing at Enviva’s Sampson and Hamlet plants, with Cotto ndale to follow. For an explanation of why we are unable to reconcile the estimated adjusted EBITDA from the Multi - Plant Expansions and the Lucedale plant expansion op tion to the most directly comparable GAAP financial measures, see Appendix. 2. For an explanation of why we are unable to reconcile the estimated adjusted EBITDA for the Multi - Plant Expansions and the Luceda le plant expansion option to the most directly comparable GAAP financial measures, see Appendix. 3. As part of the Simplification Transaction, Enviva acquired projects at 15 plant sites, all in various stages of evaluation an d d evelopment. One of these acquired sites is the fully contracted Epes plant, which is currently under development. We expect to commence construction in early 2022, with an in - servic e date scheduled for mid - 2023. Epes is designed and permitted to produce more than one million MTPY of wood pellets, which would make it the largest wood pellet pro duc tion plant in the world. 4. Construction of the Lucedale plant is nearing completion, and we expect commissioning to commence in late fourth - quarter 2021. F or an explanation of why we are unable to reconcile the estimated adjusted EBITDA from the Multi - Plant Expansions and the Lucedale plant expansion option to the most dire ctly comparable GAAP financial measures, see Appendix. 5. We expect construction of a prospective production plant in Bond, Mississippi (“Bond”) to commence once Epes is operational, but timing of construction could be expedited depending on the schedule and delivery requirements of additional off - take contract opportunities under negotiation and general market conditions. The Bond plant is being developed to produce between 750,000 and more than 1 million MTPY of wood pellets. 6. Given the quality and size of our current customer contract pipeline, we believe that we will be able to support the addition of at least six new fully contracted wood pellet production plants and several highly accretive expansion projects, which over approximately the next five years would roughly do uble the size of our current production capacity. With the benefit of the capabilities, resources, and activities now housed within Enviva, we expect to construct ou r n ew fully contracted wood pellet production plants at an approximately 5x adjusted EBITDA project investment multiple as compared to a historic drop - down acquisition multiple of r oughly 7.5x 35 Slide 16 (Contract Structure ) 1. Adjusted Gross Margin per Metric Ton defined in Appendix. Slide 18 (Q3 2021 Financial Results ) 1. Additional details can be found in our press releases issued on November 3, 2021, and in our Non - GAAP disclosures starting on sl ide 19 of this presentation.

Q3 2021 UPDATE SUPPLEMENTAL INFORMATION (cont.) 36 Slide 27 (2021 & 2022 Guidance ) 1. The table and narrative include Enviva’s guidance for 2021 and 2022. Our guidance for full - year 2021 is based on our actual perf ormance on a stand - alone basis from January 1, 2021 through October 14, 2021 (the closing date of the Simplification Transaction), and our expected performance on a cons oli dated basis, inclusive of the assets and operations acquired as part of the Simplification Transaction, from the closing date through the balance of the year ending D ece mber 31, 2021. This full - year 2021 guidance does not, however, reflect a potential recast of our historical results, which may be required under GAAP due to the Simplifi cat ion Transaction. If recast, our results would reflect the acquisition of our former sponsor for the three - year period beginning January 1, 2019, even though the acquisition c losed on October 14, 2021. We expect the addition of our former sponsor’s development - related expenses and the elimination of intercompany transactions, including the MS A Fee Waivers and other forms of sponsor support, would cause our 2021 GAAP results on a recast basis to be significantly different from and lower than the 2021 guida nce described below. We believe our 2021 guidance provides investors with the best and most relevant information to evaluate the company’s financial and operating per for mance because it reflects Enviva’s actual and historically reported performance on a stand - alone basis through the closing date of the Simplification Transaction and expected performance on a consolidated basis from the closing date until year - end. We are currently unable to reconcile the 2021 guidance set forth below to the closest GAAP financia l measures because we have neither prepared such a recast nor concluded it will be required; however, for purposes of comparability and transparency, we plan to measure our 2021 results on a non - recast basis against our 2021 guidance. 2. On October 15, 2021, Enviva updated full - year 2021 and 2022 guidance as a result of the Simplification Transaction and Conversio n. Updated guidance for full - year 2021 includes the expected post - closing results of the assets and operations acquired as part of the Simplification Transaction, incl uding approximately $15 million to $20 million of incremental SG&A expenses. For full - year 2022, Enviva expects SG&A expenses related to activities acquired through the Simplific ation Transaction to range from $37 million to $43 million. Slide 26 (Adjusted EBITDA to Distributable Cash Flow ) 1. Dividend coverage ratio for the third quarter of 2021 is calculated on a cash basis, which means the unit count includes 7 mi lli on of the 16 million units issued on October 14, 2021. The 7 million units are not part of the dividend reinvestment commitment and therefore receive cash distributions on a qua rterly basis.

Kate Walsh Vice President, Investor Relations +1 240 - 482 - 3793 [email protected]

Enviva Third Quarter 2021 Conference Call

11/04/2021

Note: This transcript may not be 100 percent accurate and may contain misspellings and other inaccuracies.

Company Participants:

John Keppler, Chief Executive Officer

Shai S. Even, Chief Financial Officer, Executive Vice President

Kate Walsh, Vice President, Investor Relations

Other Participants:

John Mackay

Mark Strouse

Ryan Levine

Elvira Scotto

Operator:

Good morning and welcome to Enviva’s third quarter of 2021 earnings conference call. All participants will be in listen-only mode. Should you need assistance, please signal a Conference Specialist by pressing the star key followed by zero.

After today’s presentation, there will be an opportunity to ask questions. Please note, this event is being recorded. I would now like to turn the conference over to Kate Walsh, Vice President of Investor Relations. Please go ahead.

Kate Walsh:

Thank you. Good morning everyone and welcome to Enviva’s third quarter of 2021 earnings conference call. We appreciate your interest in Enviva and thank you for participating today.

On this morning’s call we have John Keppler, Chairman and CEO, and Shai Even, Chief Financial Officer. Our agenda will be for John and Shai to discuss our financial results and provide an update on our current business outlook and operations. Then, we will open up the call for questions.

During the course of our remarks and the subsequent Q&A session, we will be making forward-looking statements which are subject to a variety of risks.

Information concerning the risks and uncertainties that could cause our actual results to differ materially from those in our forward-looking statements can be found in our earnings release, as well as in our other SEC filings.

We assume no obligation to update any forward-looking statements to reflect new or changed events or circumstances.

In addition to presenting our financial results in accordance with GAAP, we will also be discussing Adjusted EBITDA and certain other non-GAAP financial measures pertaining to completed reporting periods as well as our forecasts. Information concerning the reconciliations of these non-GAAP measures to their most directly comparable GAAP measures and other relevant disclosures are included in our earnings release

It’s also important to note that our guidance for full-year 2021 does not reflect a potential recast of our historical results, which may be required under GAAP due to the Simplification Transaction.

Our 2021 guidance reflects our stand-alone reported performance through October 14, when we closed the Simplification Transaction, combined with our expected performance on a consolidated basis from the closing date through year-end. We believe our 2021 guidance provides investors with the best information to evaluate the company’s financial and operating performance.

I would like to now turn the call over to John.

John Keppler:

Thank you, Kate. Good morning everyone and thanks for joining us today.

It’s only been a few weeks since we were last on a call together, where we announced our transformative Simplification Transaction and our plans to convert our organizational structure from a master limited partnership to a corporation. Since that time, we’ve had the pleasure of meeting with dozens of investors, and the feedback has been universally positive. It has been really good to see a constructive market reaction to a transaction, structured to be non-taxable to our unitholders, that eliminated our IDRs, bought in a tremendous growth profile, lowered our cost of capital and ultimately moves us to a structure that makes us investable by the broadest global investor base possible. All this while preserving our dividend guidance and growth for next year and maintaining our conservative balance sheet. We are pretty excited about the first steps we’ve taken to unlock significant value to shareholders as we evolve our same great business into an even better corporate structure.

We are progressing quickly with our conversion from an MLP to a corporation, and as you will have seen from a press release we issued yesterday afternoon, we have established November 19th as the record date for our unitholder meeting, which will be held on December 17th.

We expect the conversion to be completed by the end of the year, and our first expected trading day as a corporation is Monday, January 3rd, 2022. Once we are trading as a corporation, we will have created a unique opportunity for investors across the globe to participate in the step-change accretion we have ahead of us, whether that’s through investing in Enviva Inc., or passively through one of the many indices in which we will become eligible for inclusion.

One exciting tailwind supporting our growth is the rapidly decarbonizing industrial sector. Today, we are very pleased to announce our inaugural contract with a European customer who will process our solid biomass into refined liquids that ultimately become high-grade renewable fuels like sustainable aviation fuel and biodiesel. This is an important milestone for us, and is the first of many we see ahead, as we work with large industrial customers around the world to not only decarbonize their energy supply chain, but also to make their difficult-to-abate industrial processes less Greenhouse gas-intensive and more sustainable.

Our initial tranche under the industrial contract I referenced is for 60 thousand metric tons per year of wood pellets, with a tenor of 10-years. We expect deliveries to commence in 2023, subject to certain conditions precedent. As our new customer brings on additional production trains each year over the following 5 years, we, as their sole-source wood pellet supplier, forecast our contracted volumes to grow in lockstep, growing to an expected 1.2 million metric tons per year once the customer’s production capacity is fully ramped.

Shai will discuss our third quarter financial results in more detail which were right in line with the expectations we outlined several weeks ago. As I shared with you during our Simplification Transaction and Conversion call, we expected to generate between $61 million and $65 million of adjusted EBITDA for the quarter, and we landed at the mid-point of that range, delivering about $63 million dollars.

Based on the durability of our business model and the strong cash flow visibility we have going forward, our board of directors declared a distribution of eighty-four cents per unit for the third quarter of 2021, an 8.4 percent increase over the distribution paid for the same quarter of last year. This represents our 25th consecutive distribution increase since our IPO and maintains the 12% distribution CAGR we have delivered since then.

We are also reaffirming the full-year 2021 and 2022 guidance we discussed recently, which we updated alongside our Simplification Transaction and Conversion announcement. From a distribution standpoint, we are reaffirming $3.30 per share for full-year 2021, and $3.62 per share for 2022. Returning capital to our shareholders has always been a critical part of the way we manage our business, and like all great things about Enviva, that’s not going to change with the simplification of our structure and conversion to a corporation. As Enviva Inc., our dividend policy will continue to reflect the fundamental commitment we have to deliver a durable, stable, and over time, growing return of capital to our shareholders.

Now, I’d like to turn it over to Shai to share more detail on our third quarter results and financial highlights.

Shai S. Even:

Thank you John and good morning everyone.