Form DEF 14A WILEY JOHN & SONS, INC. For: Sep 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant ☒

|

|

|

Filed by a Party other than the Registrant

|

|

|

Check the appropriate box:

|

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to Section 240.14a-12

|

|

JOHN WILEY & SONS, INC.

|

|

(Name of Registrant as Specified in its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

||

|

☒

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

Matthew S. Kissner

Chairman of the Board

T + 1 201 748 6000

F + 1 201 748 5800

August 17, 2018

To Our Shareholders:

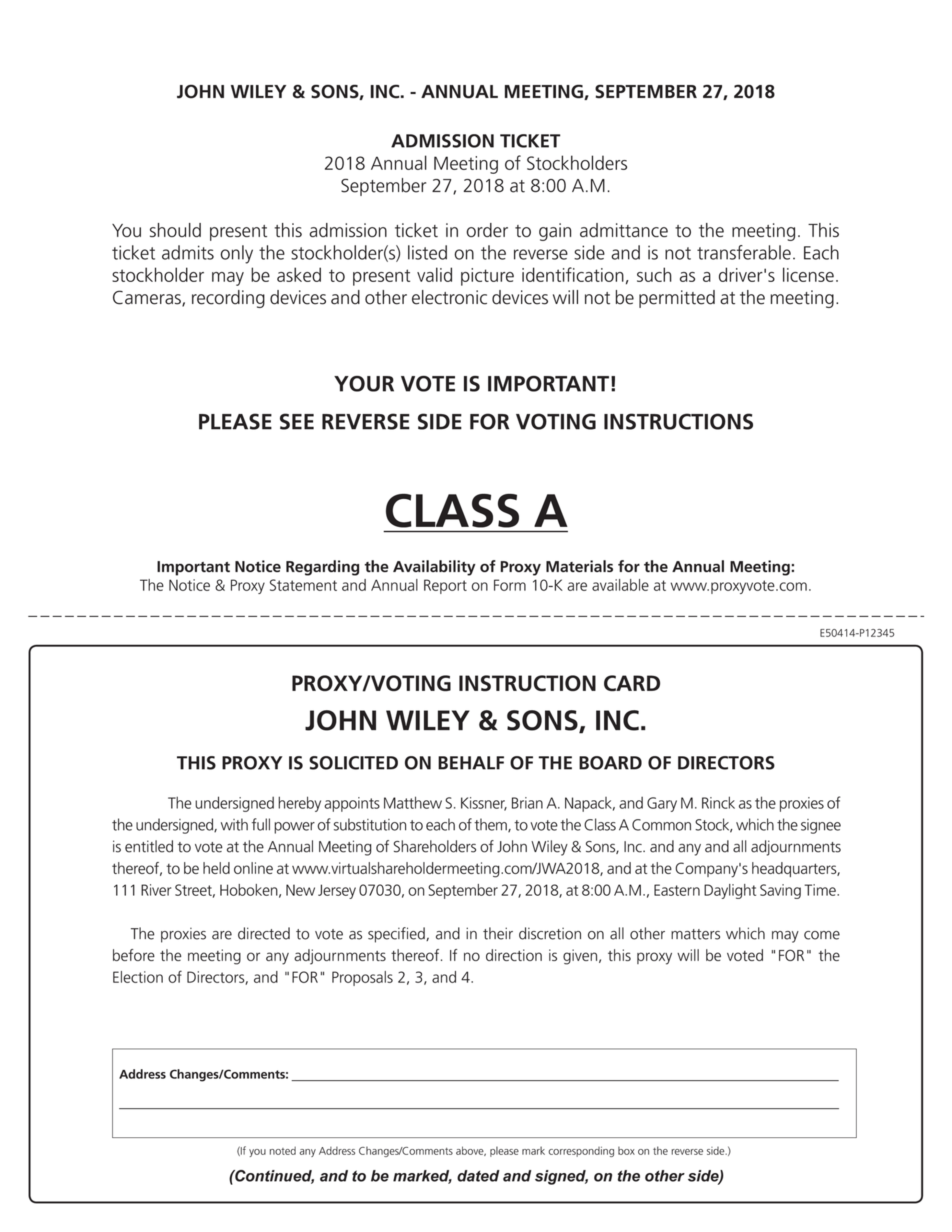

We cordially invite you to attend the 2018 Annual Meeting of Shareholders of John Wiley & Sons, Inc., to be held on Thursday, September 27, 2018, at 8:00 A.M. EDT. We are also hosting our Annual Meeting online to make it easier for our shareholders to attend. The Annual Meeting will be simulcast online at www.virtualshareholdermeeting.com/JWA2018. Details of access to the webcast are provided in the Notice of Meeting. For shareholders who wish to attend the meeting in person, accommodations will be available at the Company’s headquarters, 111 River Street, Hoboken, New Jersey. The official Notice of Meeting, Proxy Statement, and separate forms of proxy for Class A and Class B shareholders are enclosed with this letter. The matters listed in the Notice of Meeting are described in the Proxy Statement.

The Board of Directors welcomes and appreciates the interest of all our shareholders in the Company’s affairs, and encourages those entitled to vote at this Annual Meeting to take the time to do so. We hope you will attend the meeting, but whether or not you expect to be present, please vote your shares, either by signing, dating, and promptly returning the proxy card (or, if you own two classes of shares, both proxy cards) in the accompanying postage-paid envelope, by telephone using the toll-free telephone number printed on the proxy card, or via the Internet using the instructions printed on the proxy card. This will ensure that your shares are represented at the meeting. Even if you execute this proxy, vote by telephone, or vote via the Internet, you may revoke your proxy at any time before it is exercised by giving written notice of revocation to the Corporate Secretary of the Company, by executing and delivering a later-dated proxy (either in writing, by telephone, or via the Internet), or by voting in person or online at the Annual Meeting. If you attend the meeting, you will be able to vote in person if you wish to do so, even if you previously returned your proxy card, voted by telephone, or voted via the Internet prior to the Annual Meeting.

Your vote is important to us, and we appreciate your prompt attention to this matter.

Sincerely,

Chairman of the Board

111 River Street, Hoboken, NJ 07030-5774, U.S.

T +1 201 748 6000

F +1 201 748 5800

www.wiley.com

Joanna Jia

Corporate Secretary

T + 1 201 748 6020

F + 1 201 748 5800

Notice of Annual Meeting of Shareholders

to be held September 27, 2018

To Our Shareholders:

The Annual Meeting of Shareholders of John Wiley & Sons, Inc. will be held online at www.virtualshareholdermeeting.com/JWA2018. For shareholders who wish to attend the meeting in person, accommodations will be available at the Company’s headquarters, 111 River Street, Hoboken, New Jersey. The Annual Meeting will be held on Thursday, September 27, 2018 at 8:00 A.M. EDT, for the following purposes:

1. To elect a board of eleven (11) directors, of whom four (4) are to be elected by the holders of Class A Common Stock voting as a class and seven (7) are to be elected by the holders of Class B Common Stock voting as a class;

2. To ratify the appointment by the Board of Directors of the Company’s independent public accountants for the fiscal year ending April 30, 2019;

3. To hold an advisory vote to approve named executive officer compensation;

4. To approve the 2018 Director’s Stock Plan; and

5. To transact such other business as may properly come before the meeting or any adjournments thereof.

Shareholders of record at the close of business on August 3, 2018 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. Attendance at the Annual Meeting will be limited to shareholders as of the record date. Each shareholder will need to provide an admission ticket or proof of ownership of the Company’s stock and valid picture identification for admission to the meeting. Admission procedures are described further on page 1 of the Proxy Statement.

Please vote by proxy in one of these ways:

| • | Use the toll-free telephone number shown on your proxy card or voting instructions form (if you receive proxy materials from a broker or bank); |

| • | Visit the Internet website at www.proxyvote.com; or |

| • | Sign, date and promptly return your proxy card in the postage-prepaid envelope provided. |

By Order of the Board of Directors

Joanna Jia

Corporate Secretary

August 17, 2018

Hoboken, New Jersey

Your vote is important to us. Whether or not you plan to be present at the Annual Meeting, please vote your proxy either via the Internet, by telephone, or by mail. Signing and returning the proxy card, voting via the Internet or by telephone does not affect your right to vote in person or online, if you attend the Annual Meeting.

111 River Street, Hoboken, NJ 07030-5774, U.S.

T +1 201 748 6000

F +1 201 748 5800

www.wiley.com

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of John Wiley & Sons, Inc. (the “Company” or “Wiley”) of proxies to be used at the Annual Meeting of Shareholders to be held on September 27, 2018 at the time and place set forth in the accompanying Notice of Meeting and at any and all adjournments thereof. This Proxy Statement and accompanying forms of proxy relating to each class of Common Stock, together with the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2018 (“Fiscal 2018”), are first being sent or given to shareholders on or about August 17, 2018.

The executive offices of the Company are at 111 River Street, Hoboken, New Jersey 07030-5774.

Attending the Annual Meeting

Attendance at the Annual Meeting is limited to shareholders as of August 3, 2018, the record date. You will need to provide proof of ownership to enter the Annual Meeting. If your shares are held beneficially in the name of a bank, broker or other holder of record, you must present proof, such as a bank or brokerage account statement, of your ownership of common stock as of August 3, 2018, to be admitted to the Annual Meeting. For holders of record, please bring either the admission ticket attached to your proxy card or your Notice of Internet Availability of Proxy Materials. At the Annual Meeting, representatives of the Company will confirm your shareholder status. Shareholders must also present a form of photo identification such as a driver’s license or passport to be admitted to the Annual Meeting. No cameras, recording equipment, electronic devices, bags, briefcases, packages or similar items will be permitted at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on September 27, 2018

This year we are again using the “Notice and Access” system adopted by the U.S. Securities and Exchange Commission (the “SEC”) relating to the delivery of proxy materials over the Internet. As a result, we mailed you a notice about the Internet availability of the proxy materials instead of paper copies. Shareholders will have the ability to access the proxy materials over the Internet and to request a paper copy of the materials by mail, by e-mail or by telephone. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found on the Notice of Meeting. We believe that the Notice and Access rules will allow us to use Internet technology that many shareholders prefer, assure more prompt delivery of the proxy materials, lower our cost of printing and delivering the proxy materials, and minimize the environmental impact of printing paper copies.

The Proxy Statement and the Annual Report on Form 10-K are available at www.proxyvote.com.

1

VOTING SECURITIES, RECORD DATE, PRINCIPAL HOLDERS

At the close of business on August 3, 2018, there were 48,392,605 shares of Class A Common Stock, par value $1.00 per share (the “Class A Stock”), and 9,149,493 shares of Class B Common Stock, par value $1.00 per share (the “Class B Stock”), issued and outstanding and entitled to vote. Only shareholders of record at the close of business on August 3, 2018 are entitled to vote at the Annual Meeting of Shareholders on the matters that come before the Annual Meeting.

The holders of Class A Stock, voting as a class, are entitled to elect four (4) directors, and the holders of Class B Stock, voting as a class, are entitled to elect seven (7) directors. Each outstanding share of Class A Stock and Class B Stock is entitled to one vote for each Class A or Class B director, respectively. The presence in person or by proxy of a majority of the outstanding shares of Class A Stock or Class B Stock entitled to vote for directors designated as Class A or Class B directors, as the case may be, will constitute a quorum for the purpose of voting to elect that class of directors. All elections shall be determined by a plurality of the class of shares voting thereon. Only shares that are voted in favor of a particular nominee will be counted toward such nominee’s achievement of a plurality. Shares present at the meeting that are not voted for a particular nominee or shares present by proxy where the shareholder properly withheld authority to vote for such nominee will not be counted toward such nominee’s achievement of a plurality.

The holders of the Class A Stock and Class B Stock vote together as a single class on all other business that properly comes before the Annual Meeting, with each outstanding share of Class A Stock entitled to one-tenth (1/10) of one vote and each outstanding share of Class B Stock entitled to one vote.

Proposals 2, 3 and 4 require approval by a majority of votes cast at the Annual Meeting. Abstentions and broker non-votes are not counted in determining the votes cast for “non-routine” matters, but do have the effect of reducing the number of affirmative votes required to achieve a majority for such matters by reducing the total number of shares from which the majority is calculated.

If you are a beneficial shareholder and your broker holds your shares in its name, the broker is permitted to vote your shares on proposal 2 even if the broker does not receive voting instructions from you as the proposal is considered a “routine matter.”

The following table and footnotes set forth, at the close of business on August 3, 2018, information concerning each person of record, or known to the Company to own beneficially, or who might be deemed to own, 5% or more of its outstanding shares of Class A Stock or Class B Stock. The percentage of ownership is calculated based on 48,392,605 outstanding shares of Class A Stock and 9,149,493 outstanding shares of Class B Stock on August 3, 2018. The table below was prepared from the records of the Company and from information furnished to it. The percent of total voting power reflected below represents the voting power on all matters other than the election of directors, as described above.

Security Ownership of Certain Beneficial Owners

|

Name and Address

|

Title

Of Class |

Amount And

Nature Of Beneficial Ownership |

Percent

Of Class |

Percentage

Of Voting Power |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E.P. Hamilton Trusts, LLC(1)

|

A

|

|

462,338

|

|

|

0.96

|

%

|

|

0.33

|

%

|

||

|

965 Mission Street

|

B

|

|

8,125,536

|

|

|

88.81

|

%

|

|

58.09

|

%

|

||

|

San Francisco, CA

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Deborah E. Wiley(2)(3)(4)

|

A

|

|

1,253,434

|

|

|

2.59

|

%

|

|

0.90

|

%

|

||

|

111 River Street

|

B

|

|

18,643

|

|

|

0.20

|

%

|

|

0.13

|

%

|

||

|

Hoboken, NJ

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Peter Booth Wiley(2)(3)(4)

|

A

|

|

1,227,178

|

|

|

2.54

|

%

|

|

0.88

|

%

|

||

|

111 River Street

|

B

|

|

18,642

|

|

|

0.20

|

%

|

|

0.13

|

%

|

||

|

Hoboken, NJ

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

3

|

Name and Address

|

Title

Of Class |

Amount And

Nature Of Beneficial Ownership |

Percent

Of Class |

Percentage

Of Voting Power |

||||||

|

Bradford Wiley II(2)(3)(4)

|

A

|

|

846,952

|

|

|

1.75

|

%

|

|

0.61

|

%

|

|

111 River Street

|

B

|

|

12,240

|

|

|

0.03

|

%

|

|

0.01

|

%

|

|

Hoboken, NJ

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Franklin Advisers, Inc.

|

A

|

|

2,603,545

|

|

|

5.38

|

%

|

|

1.86

|

%

|

|

One Franklin Parkway

|

|

|

|

|

|

|

|

|

|

|

|

San Mateo, CA 94403

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group, Inc.(5)

|

A

|

|

4,507,174

|

|

|

9.31

|

%

|

|

3.22

|

%

|

|

100 Vanguard Boulevard V 26

|

|

|

|

|

|

|

|

|

|

|

|

Malvern, PA 19355-2331

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSgA Funds Management, Inc.(5)

|

A

|

|

3,163,287

|

|

|

6.54

|

%

|

|

2.26

|

%

|

|

State Street Financial Center

|

|

|

|

|

|

|

|

|

|

|

|

1 Lincoln Street

|

|

|

|

|

|

|

|

|

|

|

|

Boston, MA 02111-2901

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackRock Fund Advisors(5)

|

A

|

|

4,261,051

|

|

|

8.81

|

%

|

|

3.05

|

%

|

|

400 Howard Street

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94105-2618

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Champlain Investment Partners LLC(5)

|

A

|

|

3,327,065

|

|

|

6.88

|

%

|

|

2.38

|

%

|

|

180 Battery Street, Suite 400

|

|

|

|

|

|

|

|

|

|

|

|

Burlington, VT 05401-5334

|

|

|

|

|

|

|

|

|

|

|

| (1) | Bradford Wiley II, Deborah E. Wiley and Peter Booth Wiley, as members of the E.P. Hamilton Trusts, LLC established for the purpose of investing in, owning and managing securities of John Wiley & Sons, Inc., share investment and voting power. Bradford Wiley II, Deborah E. Wiley and Peter Booth Wiley as members of the E.P. Hamilton Trusts LLC, share voting and investment power with respect to 462,338 shares of Class A Stock and 8,125,536 shares of Class B Stock. |

| (2) | Bradford Wiley II, Deborah E. Wiley and Peter Booth Wiley, as co-trustees, share voting and investment power with respect to 55,072 shares of Class A Stock and 36,720 shares of Class B Stock under the Trust of Esther B. Wiley. For purposes of this table, each is shown as the owner of one-third of such shares. |

| (3) | Includes 400,000 shares of indirectly owned Class A Common Stock representing a membership interest in WG6 LLC. |

| (4) | Bradford Wiley II, Deborah E. Wiley and Peter Booth Wiley, as general partners of a limited partnership, share voting and investment power with respect to 301,645 shares of Class A Stock. For purposes of this table, each is shown as the owner of one-third of such shares. |

| (5) | Based on filings with the Securities and Exchange Commission, including filings as March 31, 2018 pursuant to Rule 13f-1 of the Securities Exchange Act of 1934, and other information deemed reliable by the Company. |

PROPOSALS ON WHICH YOU MAY VOTE

Proposal 1. Election of Directors’ Nominees for the Board of Directors

Process for Identifying and Evaluating Nominees for Director

The Board annually recommends the slate of director nominees for election by the shareholders at the Annual Meeting and is responsible for filling vacancies on the Board at any time during the year. The Governance Committee has a process to identify and review qualified individuals to stand for election, regardless of whether the current directors, a search firm or

4

shareholders recommend the potential nominee. The Governance Committee has the authority to independently engage the services of a third-party search firm or other consultant to assist in identifying and screening potential director nominees, and has engaged a third-party search firm to do so. The full Board reviews and has final approval on all potential director nominees being recommended to the shareholders for election to the Board.

The Board and the Governance Committee consider, at a minimum, the following factors in recommending potential new Board members or the continued service of existing members:

(1) The Board seeks qualified individuals who, taken together, represent the required diversity of skills, backgrounds and experience for the Board taken as a whole; (2) A director should have the required expertise and experience, should have a proven record of professional success and leadership and should be able to offer advice and guidance to the Company; (3) A director should possess the highest personal and professional ethics, integrity and values; must be inquisitive and objective and have the ability to exercise practical and sound business judgment; (4) A director should have the ability to work effectively with others; (5) Assuming that a potential director nominee possesses the required skills, background and experience, the Board also considers ethnic and gender diversity; (6) A majority of directors should be independent; and (7) A director retires from the Board at the annual meeting following his or her 70th birthday, unless an exception is approved by the Board.

Kalpana Raina retired from the Board on December 22, 2017 and will not be seeking re-election at the 2018 Annual Meeting. The Board is actively searching for a candidate to fill the vacancy.

The Company’s Board has identified the following skill sets that are most important to the successful implementation of the Company’s long-range strategic plan: industry experience; strategic planning/business development/managerial experience; financial literacy or expertise; marketing experience; product development and management experience; general operations/manufacturing experience; international experience; information technology experience; government relations/regulatory agency experience; and management development and compensation experience. Information about each director nominee’s specific experience, qualifications and skills can be found in the biographical information below.

There are eleven (11) nominees for election this year. Detailed information on each nominee is provided on pages 6 to 10. Except when the Board fills a vacancy occurring during the year preceding the next Annual Meeting of Shareholders, all directors are elected annually and serve a one-year term until the next Annual Meeting.

Eleven (11) directors are to be elected to hold office until the next Annual Meeting of Shareholders, or until their successors are elected and qualified. Unless contrary instructions are indicated or the proxy is previously revoked, it is the intention of management to vote proxies received for the election of the persons named below as directors. Directors of each class are elected by a plurality of votes cast by that class. If you do not wish your shares to be voted for particular nominees, please so indicate in the space provided on the proxy card, or follow the directions given by the telephone voting service or the Internet voting site. The holders of Class A Stock are entitled to elect 30% of the entire Board and if 30% of the authorized number of directors is not a whole number, the holders of Class A Stock are entitled to elect the nearest higher whole number of directors that is at least 30% of such membership. As a consequence, four (4) directors will be elected by the holders of Class A Stock. The holders of Class B Stock are entitled to elect seven (7) directors.

All of the nominees are currently directors of the Company and were elected to their present terms of office at the Annual Meeting of Shareholders held in September 2017, except Brian A. Napack who was elected to the Board effective December 4, 2017 in conjunction with his appointment as President and Chief Executive Officer of the Company.

Matthew S. Kissner, Brian A. Napack and Gary M. Rinck have agreed to represent shareholders submitting proper proxies by mail, via the Internet, or by telephone, and to vote for the election of the nominees listed herein, unless otherwise directed by the authority granted or

5

withheld on the proxy cards, by telephone or via the Internet. Although the Board has no reason to believe that any of the persons named below as nominees will be unable or decline to serve, if any such person is unable or declines to serve, the persons named above may vote for another person at their discretion.

Directors to be Elected by Class A Shareholders and Their Qualifications

|

George Bell, a director since 2014, has been affiliated with General Catalyst Partners, a venture capital and private equity firm, as a Managing Director and then an Executive in Residence, since 2006. Mr. Bell is a 30-year veteran of creating and growing consumer-facing and software businesses. From October 2010 to November 2013, he was President and CEO of Jumptap, a General Catalyst portfolio company, which sold to Millennial Media (NYSE: MM). Mr. Bell was also President and CEO of Upromise 2001-2006, sold to Sallie Mae; former chairman and CEO of Excite and Excite@Home 1996-2001; founder of The Outdoor Life Network (now NBC Sports Network); former senior vice president of Times Mirror Magazines, overseeing titles such as SKI and Field & Stream; recipient of the Ernst & Young Entrepreneur of the Year Award for California and New England; four-time Emmy Award-winning producer and writer of documentaries on adventure, wildlife, and vanishing cultures. Since January 2015, Mr. Bell has served as Chairman of the Board of Visible Measures, a private, venture-backed company. Mr. Bell has also served on the board of Care.com Inc. (NYSE: CRCM) since September 2017. Age 61.

|

|

|

|

|

Mr. Bell’s qualifications for service on the Company’s Board include: (i) more than 30 years of entrepreneurial experience creating and growing consumer businesses as CEO; (ii) significant operating experience in consumer businesses, including introducing new business models and leveraging technology; and (iii) significant experience in assessing company operations and strategy.

|

|

|

|

|

|

David C. Dobson, joined the Wiley Board on March 22, 2017, and has served as Vice Chairman of the Digital River’s board of directors since July 2018. Mr. Dobson joined Digital River in February 2013, as the company’s Chief Executive Officer. During Mr. Dobson’s 5 years as CEO, the company was successful in transforming into a recognized global, leading ecommerce platform provider to many world class software and consumer electronics brands. Mr. Dobson served as an independent business consultant from July 2012 to February 2013. From July 2010 to July 2012, Mr. Dobson served as executive vice president and group executive, Global Lines of Business, at CA Technologies, a global provider of products and solutions for mainframe, distributed computing and cloud computing environments. From August 2009 to July 2010, Mr. Dobson served as President of Pitney Bowes Management Services, Inc., a wholly owned subsidiary of Pitney Bowes Inc., a manufacturer of software and hardware and a provider of services related to documents, packaging, mailing and shipping. From June 2008 to July 2009, Mr. Dobson served as Executive Vice President and Chief Strategy and Innovation Officer of Pitney Bowes Inc., where he was responsible for leading the development of the company’s long-term strategy. From June 2005 to June 2008, Mr. Dobson served as chief executive officer of Corel Corporation, a global provider of leading software titles. Prior thereto, Mr. Dobson spent 19 years at IBM where he held a number of senior management positions, including corporate vice president, Emerging Business Opportunities, and president and general manager, IBM Printing Systems Division. In addition to John Wiley & Sons, Mr. Dobson also serves on the boards of Digital River and Versapay. Age 56.

|

|

|

|

|

Mr. Dobson’s qualifications for service on the Company’s Board include: (i) extensive experience in senior management positions and (ii) experience with building and growing online businesses on a global basis.

|

6

|

Laurie A. Leshin, a director since 2015, became the 16th president of Worcester Polytechnic Institute (WPI) in June of 2014. Dr. Leshin brings to the Wiley board over 20 years of experience as a leader in academia and government service, and an accomplished record as a space scientist. Prior to joining WPI, Dr. Leshin served as the Dean of the School of Science at Rensselaer Polytechnic Institute in New York, where she expanded and strengthened interdisciplinary scientific research and education, championed diversity in STEM, and significantly expanded fundraising and outreach initiatives. While at Rensselaer, Dr. Leshin continued her work as a scientist for the Mars Curiosity Rover mission and was appointed by President Obama to the Advisory Board for the Smithsonian National Air and Space Museum. Prior to joining Rensselaer, Dr. Leshin served as the deputy director of NASA’s Exploration Systems Mission Directorate, where she was responsible for oversight of NASA’s future human spaceflight programs and activities. Dr. Leshin also worked as the director of science and exploration at NASA’s Goddard Space Flight Center. Dr. Leshin is a recipient of NASA’s Outstanding Leadership Medal, NASA’s Distinguished Public Service Medal, and the Meteoritical Society’s Nier Prize. She has served on the Board of Directors of Women in Aerospace and the Council of the American Geophysical Union. Age 53.

|

|

|

|

|

Dr. Leshin’s qualifications for service on the Company’s Board include: (i) executive leadership experience in academia and government service; (ii) being a leading scientist and educator in her field, (iii) insight into the needs and practices of the academic and research community critical for developing and innovating new business models in our key businesses, (iv) being a proven business leader, experienced general manager and internet marketing veteran.

|

|

|

|

|

|

William Pence, joined the Wiley Board on May 1, 2016. Mr. Pence is an accomplished leader in the digital technology industry with over 25 years of experience. Most recently, Mr. Pence was Global Chief Technology Officer for AOL. In that role he led all aspects of AOL’s global technology strategy, platform development and external technology partnerships, as well as playing a key leadership role in the overall strategy and direction of AOL. He also created and led Area 51, which was focused on synchronizing innovation efforts across AOL’s venture investments, incubators, university relations, and internal R&D. Before joining AOL, Mr. Pence served as Executive Vice President and Chief Technology Officer of WebMD from 2007 to 2014, as well as Chief Operating Officer of WebMD from 2012 to 2014. At WebMD, he led many cross-company initiatives that drove innovative new products, improved operational efficiencies and user experiences for consumers and advertiser partners. He also drove technology and corporate operations improvement through automation, cloud technology and data management systems. Mr. Pence was instrumental in mobile product efforts across WebMD’s properties as well as the company’s global expansion. Prior to WebMD, Mr. Pence served as Chief Technology Officer and Senior Vice President at Napster from 2003 to 2007. From 2001 to 2003, he served as Senior Vice President and Chief Technology Officer of Pressplay, a Universal Music Group/Sony Music Entertainment joint venture, and from 2000 to 2001 he served as Senior Vice President and Chief Technology Officer of Universal Music Group. Previously, Mr. Pence spent more than a decade at IBM. Age 55.

|

|

|

|

|

Mr. Pence’s qualifications for service on the Company’s Board include: (i) 25 years of experience in developing and bringing innovative technology based products to market and (ii) operating experience as a technology executive.

|

7

Directors to be Elected by Class B Shareholders and Their Qualifications

|

Brian A. Napack, was appointed as the Company’s 14th President and Chief Executive Officer on December 4, 2017, and was simultaneously appointed to the Board of Directors. Mr. Napack joined John Wiley & Sons after serving as a senior advisor at Providence Equity Partners since 2012. Before joining Providence, Mr. Napack was President of Macmillan, the global publising company, from 2006 to 2012. Prior to Macmillan, Mr. Napack served as a Partner at L.E.K. Consulting LLC, where he led strategy, operations and M&A engagements throughout the media, entertainment and communications industries. Mr. Napack founded ThinkBox Inc. in 1997 and served as the Chief Executive Officer and President. Mr. Napack also worked at The Walt Disney Company, where he founded and ran Disney Educational Publishing, and was a co-founder of Disney Interactive. Earlier in his career, Mr. Napack held senior roles at Simon & Schuster, a leading education, consumer and professional publisher, and at A.T. Kearney, a global management consulting firm. Mr. Napack currently serves on the boards of Burning Glass and Zero to Three, a leading non-profit advocacy organization for young children. He has held board positions at Ascend Learning, Blackboard, Houghton Mifflin Harcourt, Ingram Industries, RB Media, Isolation Network, EDMC, and Synergis. Age 56.

|

|

|

|

|

Mr. Napack’s qualifications for service on the Company’s Board include: (i) extensive background as a leader and innovator in the media, education and information industries; (ii) proven focus around the creation of businesses in education and entertainment that leverage new technologies and distribution platforms to address evolving market demands; and (iii) significant experience gained through managing and serving on the boards of a wide array of companies in the Company’s industries.

|

|

|

|

|

|

Mari J. Baker, a director since 2011, has held a number of executive officer positions in public and private companies primarily in technology fields, including roles as CEO of PlayFirst, Inc. and Navigenics, Inc., COO of Velti, plc (NASDAQ:VELT), President of BabyCenter, Inc., a Johnson and Johnson company (NYSE: JNJ), and SVP/General Manager at Intuit, Inc. (NASDAQ: INTU). She has been involved in the venture capital community, including serving as executive-in-residence at Kleiner Perkins Caulfield and Byers; in the higher education community, as a Trustee of Stanford University as well as an Advisor to the Clayman Institute at Stanford; and in the executive leadership community, through her service as an officer in Young Presidents Organization. In addition to John Wiley & Sons, Ms. Baker currently serves on the board of Blue Shield of California and Healthline, Inc. Age 53.

|

|

|

|

|

Ms. Baker’s qualifications for service on the Company’s Board include: (i) service on the boards of Velti, PlayFirst, Navigenics and Cozi Group, Inc. and on the Board of Trustees of Stanford University; and (ii) being a proven business leader, experienced general manager and internet marketing veteran.

|

|

|

|

|

|

Matthew S. Kissner, was elected Chairman of the Board of Directors of John Wiley & Sons in October 2015, having served as director of the company since 2003. He is also a member of the Board Executive Committee of the Regional Plan Association, a non-profit urban research and advocacy organization that develops long-range plans and policies to guide the growth and improve the prosperity, infrastructure, sustainability, and quality of life of the New York/New Jersey/Connecticut metropolitan region. Age 64.

|

|

|

|

|

Mr. Kissner’s extensive leadership experience includes several senior positions with Pitney Bowes, where he led a number of businesses, as well as leadership roles with Bankers Trust, Citibank, and Morgan Stanley. He has also been a private equity operating partner focusing on business, financial, and healthcare services. Mr. Kissner is an alumnus of New York University, where he obtained an MBA and a BS in Education, both with honors.

|

|

|

|

8

|

Raymond W. McDaniel, Jr., a director since 2005, has been Chief Executive Officer of Moody’s Corporation since April 2005. From 2005 to April 2012 he also served as Chairman of Moody’s Corporation. In April 2012 he was named President of Moody’s Corporation in addition to Chief Executive Officer. He previously served as Chief Operating Officer of Moody’s Corporation from January 2004; President of Moody’s Corporation from October 2004; and President of Moody’s Investors Service since 2001. In prior assignments with Moody’s, he served as Senior Managing Director for Global Ratings & Research; Managing Director for International; and Director of Moody’s Europe, based in London. He has been a member of Moody’s Corporation Board of Directors since 2003. In 2015 Mr. McDaniel was named as a member of the Board of Trustees of Muhlenberg College. Age 60.

|

|

|

|

|

Mr. McDaniel’s qualifications for service on the Company’s Board include: (i) over eight years of experience as Chairman and over 13 years of experience as Chief Executive Officer of Moody’s Corporation; (ii) extensive international experience; and (iii) experience in implementing international business expansion and new products.

|

|

|

|

|

|

William J. Pesce, a director since 1998, served as the Company’s 10th President and Chief Executive Officer for 13 years from May 1998 to April 2011, when he retired after nearly 22 years at the Company. Mr. Pesce is a member of the Board of Trustees of William Paterson University, where he serves as a member of the Executive Committee, Chair of the Educational Policy and Student Development Committee and member of the Nominations and Governance Committee. Mr. Pesce is a benefactor and advisor to the Pesce Family Mentoring Institute at William Paterson University. He served on the Board of Overseers of NYU’s Stern School of Business for 17 years. Mr. Pesce serves as a guest lecturer, speaking with students about leadership, ethics and integrity. He launched Pesce Family Ventures, LLC in 2015 to invest in early stage companies, particularly entities that leverage enabling technology to serve customers. Age 67.

|

|

|

|

|

Mr. Pesce’s qualifications for service on the Company’s Board include: (i) over three decades of experience in publishing; (ii) 13 years as President and Chief Executive Officer, a period in which the Company recorded double-digit compound annual growth in revenue, EPS and the Company’s stock price, while being named to several “best companies” lists; extensive experience with leading a global public company, strategic planning, financial planning and analysis, acquisitions and partnerships, and investor relations; active engagement with leaders, faculty and students in the academic community; and exposure to innovative, technology-enabled business models at early stage companies.

|

|

|

|

|

|

William B. Plummer, a director since 2003, has been Executive Vice President and Chief Financial Officer of United Rentals, Inc. since December 2008. Previously he was Executive Vice President and Chief Financial Officer of Dow Jones & Company, Inc. from September 2006 to December 2007. Prior to that he was Vice President & Treasurer of Alcoa, Inc. since 2000. Before joining Alcoa, he was with Mead Corporation as President, Gilbert Paper Division during 2000; Vice President, Corporate Strategy and Planning from 1998 to 2000; and Treasurer from 1997 to 1998. Prior to joining Mead, he held a number of increasingly responsible positions with the General Electric Company, most recently as Vice President, Equity Capital Group, General Electric Capital Corporation from 1995 to 1997. Mr. Plummer formerly served on the board of UIL Holdings Corporation, where he was a member of both the Compensation and Executive Development committee and the Retirement Benefits Plans Investment committee. He currently serves on the board of Global Payments, Inc., where he chairs the Audit committee and is a member of the Risk Oversight committee. Age 59.

|

|

|

|

|

Mr. Plummer’s qualifications for service on the Company’s Board include: (i) over ten years of service as the Chief Financial Officer or Treasurer of publicly-traded companies, including operating experience as President of an operating division of Mead Corporation; (ii) audit committee experience; and (iii) experience in acquisitions and divestitures.

|

|

|

|

9

|

Jesse C. Wiley, a director since 2012, has been an employee of the Company since 2003. Mr. Wiley works in Wiley’s Research division on business development including building partnerships with academic societies and helping grow business and partnerships in China. Previously he worked in corporate M&A and strategy development, and on international business development, digital and new business initiatives, and product development within the division formerly known as Professional Development. Prior to that, he worked as a marketer and then editor of professional books. Age 48.

|

|

|

|

|

Mr. Wiley’s qualifications for service on the Company’s Board include broad and deep experience working with partners and customers in the markets Wiley serves, as well as in depth knowledge of many business units and functions within the Company, including working at the forefront of digital publishing and learning, developing new products and business models, and developing and executing partnerships and acquisitions. He has a Certificate of Director Education from the National Association of Corporate Directors.

|

The Board recommends a vote “FOR” the election of its nominees.

10

Proposal 2. Ratification of KPMG as Independent Accounting Firm

The Audit Committee is responsible for the appointment, compensation and oversight of the independent auditor. The Audit Committee has appointed KPMG LLP (“KPMG”) as the Company’s independent auditors for Fiscal 2019. Although the Company is not required to do so, we are submitting the selection of KPMG for ratification by the shareholders because we believe it is a matter of good corporate practice.

The Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change is in the best interests of the Company and its shareholders. Representatives of KPMG are expected to be present at the Annual Meeting with the opportunity to make a statement, if they desire to do so, and such representatives are expected to be available to respond to appropriate questions.

Unless contrary instructions are noted thereon, the proxies will be voted in favor of the following resolution, which will be submitted at the Annual Meeting:

“RESOLVED, that the appointment by the Audit Committee of KPMG LLP as independent public accountants for the Company for the fiscal year ending April 30, 2019 be, and it hereby is, ratified.”

In the event that the foregoing proposal is defeated, the adverse vote will be considered by the Audit Committee in its selection of auditors for the following year. However, because of the difficulty and expense of making any substitution of auditors so long after the beginning of the current fiscal year, it is contemplated that the appointment for the fiscal year ending April 30, 2019 will be permitted to stand unless the Audit Committee finds other good reason for making a change. If the proposal is adopted, the Audit Committee, in its discretion, may still direct the appointment of new independent auditors at any time during the fiscal year if it believes that such a change would be in the best interests of the Company and its shareholders.

The Board of Directors recommends a vote “FOR” the ratification of the appointment of independent public accountants.

Proposal 3. Advisory Vote on Named Executive Officer Compensation

We are requesting that shareholders indicate their approval of our Named Executive Officers’ compensation, as described in the compensation tables, narrative discussion, and Compensation Discussion and Analysis set forth in this Proxy Statement. This proposal, known as a “say-on-pay” proposal, allows shareholders the opportunity to express their views on these matters. The “say on pay” vote is an advisory vote, which is therefore not binding on the Company, the Compensation Committee or the Board of Directors. However, the views of our shareholders are important to the Company, and will be given careful consideration by the Company, the Compensation Committee and the Board of Directors.

Compensation for our Named Executive Officers in Fiscal 2018 was consistent with the principles of our compensation philosophy and reflects our financial performance, the cumulative return to shareholders in Fiscal 2018 and achievements of the executive team. Our compensation philosophy is designed to (i) align the Company’s goals with shareholder interests; (ii) attract and retain world-class talent; (iii) pay competitively compared with our peer group and the marketplace; and (iv) reward superior performance and limit rewards for performance below targets. Our Fiscal 2018 compensation packages reflect these guiding principles.

The discussion set forth in the Compensation Discussion and Analysis on pages 27 to 53 of this Proxy Statement provides a complete discussion of our compensation programs and policies, including design, implementation, oversight, administration, ongoing review and risk assessment of our programs and policies. Our Compensation Committee and Board of Directors believe that our compensation programs and policies are designed and carried out to allow us to achieve our business goals and reflect the guiding principles of our compensation philosophy.

11

A vote “FOR” approval will be a vote in favor of the following resolution:

“RESOLVED, that the shareholders of John Wiley & Sons, Inc. hereby approve on an advisory basis the compensation of the Company’s Named Executive Officers, as described in the compensation tables, narrative discussion and Compensation Discussion and Analysis, set forth in this Proxy Statement.”

The Board of Directors recommends a vote “For” approval, on an advisory basis, of the compensation of John Wiley & Sons, Inc.’s Named Executive Officers as disclosed in this Proxy Statement.

Proposal 4. Approval of the 2018 Director’s Stock Plan

Background

The Board has been using 2014 Director Stock Plan (the “Prior Director Plan”) as a means of attracting and retaining highly qualified individuals to serve as directors of the Company and to increase the Non-Employee Directors’ (as defined below) stock ownership of the Company. On June 20, 2018, the Board, subject to the approval of the Company’s shareholders, adopted the 2018 Director’s Stock Plan (the “Director Plan”). The Director Plan is intended to replace the Prior Director Plan. If the shareholders approve the Director Plan, no further shares will be issued under the Prior Director Plan. The Director Plan is annexed hereto as Exhibit A. This summary of the Director Plan is qualified in its entirety by the text of the Director Plan.

Effective Date

Provided that it is approved by the shareholders, the Director Plan shall be effective as of September 27, 2018 (the “Effective Date”).

Administration

The Board as a whole shall administer and interpret the Director Plan in its sole discretion.

Eligibility

Only Non-Employee Directors shall be able to participate in the Director Plan. A Non-Employee Director is a person who is serving as a director of the Company and is not an employee of the Company or any subsidiary or affiliate of the Company.

Shares of Stock

No more than 200,000 shares of Common Stock, which shall be treasury stock, shall be available under the Director Plan. All shares awarded under the Director Plan will be charged against the total available for grant.

The total number of shares of Common Stock that may be issued under the Director Plan (and any outstanding awards) shall be appropriately adjusted for any change in the outstanding shares of Common Stock through recapitalization, stock split, stock dividend, extraordinary cash dividend or other change in the corporate structure, or through merger or consolidation in which the Company is the surviving corporation. The Board in its discretion will determine such adjustments and the manner of application.

Plan Awards

Beginning with the Company’s annual meeting held in September 2018, and as soon as practicable after every annual meeting in 2019 and thereafter, each Non-Employee Director shall receive a grant of restricted shares of Common Stock, rounded upward or downward to the nearest whole share, with a value of no more than $110,000. These shares shall vest on the earliest of (i) the day before the next Annual Meeting following the grant, (ii) the Non-Employee Director’s death or disability (as determined by the Governance Committee), or (iii) a Change in Control (as defined in the 2014 Key Employee Stock Plan) (each a “Vesting Event”). Unless the Board or the Governance Committee determines otherwise, the grant shall be forfeited if the Non-Employee Director’s service terminates for any reason before a Vesting Event. Unless otherwise determined, any dividends paid on shares of Common Stock will be paid with respect to the granted shares at the same time and in the same manner as such dividends are paid generally. If a Non-Employee Director becomes a director between annual meetings after September 2018, the value of the

12

restricted shares shall be proportionately reduced to reflect the Non-Employee Director’s actual days of service during the applicable period. If a Non-Employee Director has elected to defer receipt of the shares under the Deferred Compensation Plan for Directors (or any successor plan), the grant will be in the form of deferred stock rather than restricted shares of Common Stock. Notwithstanding the foregoing, prior to the grant date at subsequent annual meetings, the Governance Committee shall have the right to make adjustments to the amount of the grant share value, but in no event shall grants with respect to an annual meeting have a value exceeding $300,000 per director (excluding for this purpose the value of any dividend equivalents credited on deferred stock and the value of any grants pursuant to an election to receive shares in lieu of cash as described in the paragraph which follows). The Governance Committee may also grant additional awards to the Chairman of the Board. Shares granted under the Director Plan may not be sold or transferred during the time the Non-Employee Director remains a director, but may be sold or transferred in the case of death or disability of the Non-Employee Director.

In addition, each Non-Employee Director may elect to receive restricted shares of Common Stock or deferred stock in lieu of all or a portion of the cash retainer fees otherwise payable for services to be rendered by the Non-Employee Director. Such Common Stock to be received by a Non-Employee Director pursuant to his or her election shall be distributed when the related cash compensation otherwise would have been paid or distributed pursuant to the terms of the Deferred Compensation Plan for Directors (or any successor plan).

Furthermore, the amount of cash compensation paid or payable by the Company to a Non-Employee Director with respect to any calendar year shall be $100,000 (with additional cash compensation of $15,000 for committee chair ships for Audit, Executive Compensation and Development, and Governance Committees), which such cash compensation shall be pro-rated for the year an individual first becomes a Non-Employee Director. The Board or the Governance Committee may reallocate the cash compensation and grant of restricted shares of Common Stock referenced in Section 5 as long as the total aggregate value remains unchanged (for example, $150,000 of stock grants and $60,000 of base cash compensation). Notwithstanding the foregoing, the Governance Committee or the Board shall have the right to make adjustments to the annual cash compensation amount, so long as the cash payment to a Non-Employee Director does not exceed $200,000 per director in a calendar year. The Governance Committee may also grant additional cash compensation to the Chairman of the Board.

Federal Income Tax Consequences

The following is a brief discussion of certain U.S. federal income tax consequences relevant to participants in the Director Plan who are subject to federal income tax and the Company. It is not intended to be a complete description of all possible tax consequences with respect to awards granted under the Director Plan and does not address state, local or foreign tax consequences. A Non-Employee Director generally will recognize ordinary income in the taxable year in which shares of Common Stock are delivered under the Director Plan, based on their fair market value at such time. The Company generally will then be entitled to a tax deduction equal to the amount of income recognized by the Director.

Amendment to the Plan

The Director Plan may be amended at any time by action of the Board and approval of the shareholders (to the extent such approval is required by law or pursuant to the listing rules of the New York Stock Exchange), or terminated at any time by action of the Board.

The Board of Directors recommends a vote “FOR” approval of the 2018 Director Stock Plan.

13

GOVERNANCE OF THE COMPANY AND BOARD STRUCTURE

The Company’s Board of Directors is elected annually by the shareholders to provide oversight so that the long-term interests of the shareholders are served. The Company’s business is conducted by its employees under the direction of the CEO and with the oversight of the Board.

Board of Directors and Corporate Governance

Director Independence

The Board is currently composed of eleven (11) members. Brian A. Napack is the Company’s President & CEO. Jesse C. Wiley is a member of the Wiley family. The Board has affirmatively determined that all of our directors, except Brian A. Napack and Jesse C. Wiley, meet the independence guidelines the Board sets forth in its Corporate Governance Principles, which are published on our web site at https://www.wiley.com/en-us/corporategovernance.

Board Leadership Structure

The Board of Directors is currently led by Matthew S. Kissner, the Chairman of the Board.

Meetings of the Board of Directors are called to order and led by the Chairman. All members of the Board are elected annually.

The Board of Directors believes separating the roles of Chairman and Chief Executive Officer allows our Chief Executive Officer to focus on developing and implementing the Company’s strategic business plans and managing the Company’s day-to-day business operations and allows our Chairman to lead the Board of Directors in its oversight and advisory roles. Because of the many responsibilities of the Board of Directors and the significant amount of time and effort required by each of the Chairman and the Chief Executive Officer to perform their respective duties, the Company believes that having separate persons in these roles enhances the ability of each to discharge those duties effectively and, as a corollary, enhances the Company’s prospects for success.

For the foregoing reasons, the Board of Directors has determined that its current leadership structure is appropriate and in the best interests of the Company’s shareholders.

Other Governance Practices

Non-Management Executive Sessions: The Board has regularly scheduled non-management executive sessions of non-management directors following each Board meeting.

Orientation and Continuing Education: The Company’s new directors are required to attend orientation sessions. The Company also conducts ongoing training or continuing director education for its Board members and is supportive of, and reimburses its directors for, attending director education programs.

Annual Meeting: The Company does not have a policy that requires the attendance of all directors at the Annual Meetings, but it has been a long-standing practice for directors to attend. In September 2017, all directors standing for election attended the Annual Meeting.

Annual Evaluation: The Board annually conducts a self-evaluation of the Board and its individual members, including the Chairman of the Board.

In 2018, the Board engaged a third party facilitator to help administer the annual Board Evaluation in September. The objective of the annual evaluation is to ensure that the Board as a whole, its committees, and its individual directors are functioning at a high level and are providing the best value and performance for the Company’s stakeholders, management and employees. The Board’s Governance Committee is responsible for the design and administration of the annual Board evaluation process and uses a variety of methods to produce an evaluation of the full Board, Board committees and individual directors. The information obtained from the annual evaluations is used to promote director development, direct future Board agendas and meeting structures, ensure good communication among the directors and with management, and to review future board candidate qualifications.

Code of Ethics. The Company has adopted a Business Conduct and Ethics Policy (the “Code of Ethics”) that applies to the Company’s principal executive officer, principal financial officer,

14

principal accounting officer, controller, and any persons performing similar functions, as well as all directors, officers and employees of the Company. The Company also maintains a Code of Ethics policy for its Senior Financial Officers. The Code of Ethics is posted on the Company’s website at https://www.wiley.com/en-us/corporategovernance. The Company intends to satisfy the disclosure requirements regarding any amendments to, or waivers from, a provision of the Code of Ethics for the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by posting such information on its website.

Committees of the Board of Directors and Certain Other Information Concerning the Board

Committee Structure

The Board has established five standing committees: the Audit Committee, the Executive Compensation & Development Committee, the Governance Committee, the Executive Committee, and the Technology Committee. Each Committee conducts an annual self-evaluation of performance and reviews compliance with the current charter of the committee. The Board reviews and approves the committee charters annually. Copies of the committee charters can be found on our website at https://www.wiley.com/en-us/corporategovernance.

The following table indicates Board membership and total meetings of the Board and its standing committees in Fiscal 2018:

|

Name

|

Board

|

Audit

|

Compensation

|

Executive

|

Governance

|

Technology

|

|

Brian A. Napack**

|

X

|

|

|

|

|

|

|

Mari Jean Baker

|

X

|

C*

|

|

|

|

X

|

|

George Bell

|

X

|

|

X

|

|

C*

|

|

|

David C. Dobson

|

X

|

X

|

|

|

|

|

|

Matthew S. Kissner

|

C*

|

|

|

|

|

|

|

Raymond W. McDaniel, Jr.

|

X

|

|

C*

|

X

|

|

|

|

Laurie A. Leshin

|

X

|

|

X

|

|

|

|

|

William Pence

|

X

|

|

|

|

X

|

X

|

|

William J. Pesce

|

X

|

|

|

C*

|

X

|

|

|

William B. Plummer

|

X

|

X

|

|

|

|

X

|

|

Kalpana Raina***

|

X

|

X

|

|

|

|

|

|

Jesse C. Wiley

|

X

|

|

|

X

|

X

|

C*

|

|

Fiscal 2018 Meetings

|

10

|

8

|

7

|

14

|

7

|

4

|

| * | Committee Chair |

| ** | Mr. Napack joined the Board on December 4, 2017. |

| *** | Ms. Raina retired from the Board on December 22, 2017 and will not be standing for re-election at the 2018 Annual Meeting. |

During Fiscal 2018, all of the Directors attended at least 75% of the meetings of the Board of Directors and the respective committees of the Board of Directors of which they were a member.

Executive Committee. The Executive Committee exercises the powers of the Board as appropriate in any case where immediate action is required and the matter is such that an emergency meeting of the full Board is not deemed necessary or possible. The Executive Committee reviews the annual objectives of the Chairman and CEO and recommends approval of the objectives by the Board. The Executive Committee also evaluates the performance of the Chairman and CEO throughout the year relative to the approved objectives, and provides an annual assessment to the Executive Compensation and Development Committee (for compensation) and the Board of Directors (for approval of assessment).

Audit Committee. The Audit Committee assists the Board in fulfilling its fiduciary oversight responsibilities relating to the integrity of the Company’s financial statements filed with the SEC, accounting policies, adequacy of disclosures, the Company’s compliance with legal and regulatory requirements, the financial reporting process, the systems of internal accounting and financial

15

controls, and the sufficiency of auditing relative thereto. The Audit Committee is also responsible for evaluating the qualification, independence and performance of the independent public accounting firm engaged to audit the Company’s financial statements, including reviewing and discussing with such firm their independence and whether providing any permitted non-audit services is compatible with their independence; maintaining financial oversight of the Company’s employees’ retirement and other benefit plans and making recommendations to the Board with respect to such matters; oversight of the Company’s Enterprise Resources Platform (ERP), along with the Technology Committee; and review, ratification and/or approval of related person transactions. The Audit Committee holds discussions with management prior to the release of quarterly earnings, and also reviews quarterly results prior to filings.

The Board has determined that Ms. Baker and Mr. Plummer are “audit committee financial experts,” as defined under the SEC rules. All members of the Committee are independent under the rules of the New York Stock Exchange (the “NYSE”) and are financially literate under the NYSE rules.

The Audit Committee Charter is available on the Company’s website at: https://www.wiley.com/en-us/corporategovernance.

Executive Compensation and Development Committee. The Executive Compensation and Development Committee (the “ECDC” or the “Compensation Committee”) sets appropriate compensation levels for the CEO based on market data, and determines the appropriate incentive compensation for the CEO based on objectives and the performance evaluation against those objectives by the Executive Committee, and reports its decisions to the Board; reviews and approves the principles and policies for global compensation and benefit programs company-wide; and oversees the development and utilization of appropriate policies and programs to attract and retain superior individuals. All members of the Committee are independent under the rules of the NYSE and are outside directors as defined by Treasury Regulation Section 1.162-27(e) (3) under Section 162 (m) of the Internal Revenue Code.

In December 2016, the Compensation Committee delegated limited authority to the CEO and the Chief Human Resources Officer to make certain “off-cycle” equity grants outside of the annual equity grant process to existing employees who are neither Company executive officers nor directors. The delegation is subject to maximum shares that can be granted per fiscal year, as well as a maximum to any one person per fiscal year. Shares awarded pursuant to this delegation will be valued based on the closing price of the Company’s stock on the NYSE as of the last day of the quarter and will be issued after quarter-end. Any grants made “off-cycle” are reported to the Compensation Committee at the next regularly scheduled quarterly meeting following such awards.

The Compensation Committee Charter is available on the Company’s website at: https://www.wiley.com/en-us/corporategovernance.

Governance Committee. The Governance Committee assists the Board in the identification of qualified individuals to serve as directors, and recommends to the Board candidates for nomination for election at the annual meeting of shareholders or to fill Board vacancies between annual meetings; assists the Chairman of the Board in proposing committee assignments, including committee memberships and chairs; coordinates and oversees the annual self-evaluation process; evaluates director compensation and benefits; and makes recommendations to the Board regarding corporate governance policies.

Shareholders who wish to recommend a director candidate to the Governance Committee should follow the procedures set forth under “Deadline for Submission of Shareholder Proposals” on page 57 of this proxy statement. The recommendation should include the candidate’s name, biographical data, and a description of his or her qualifications.

The Governance Committee Charter is available on the Company’s website at: https://www.wiley.com/en-us/corporategovernance.

Technology Committee. The Technology Committee assists the Board in fulfilling oversight responsibilities by reviewing, giving guidance and making recommendations to management and the Board related to the Company’s technology strategy, initiatives and investments in support of overall Company strategy and performance.

16

The Technology Committee Charter is available on the Company’s website at: https://www.wiley.com/en-us/corporategovernance.

Board and Committee Oversight of Risk

Management of risk is the direct responsibility of the Company’s President & CEO and the executive leadership team. The Board has oversight responsibility, focusing on the adequacy of the Company’s risk management and risk mitigation processes.

The Company’s Board of Directors administers its risk oversight function directly and through its Audit Committee, Executive Compensation & Development Committee and Technology Committee. The Board receives regular reports from these committees, which include reports on those areas over which they have risk oversight responsibility, as appropriate.

Audit Committee: The Audit Committee has oversight responsibility for Enterprise Risk Management (ERM), and specifically, oversight of major financial risk exposures, including litigation and compliance risk and the steps management has taken to monitor and mitigate such exposures. The Committee reviews with management, and the Technology Committee as appropriate, the development and administration of the Company’s information technology with particular emphasis on the security of and risks related to information technology systems and procedures, continuity of operations, reliability of internal controls, and realization of investment objectives. The Committee also receives regular updates from management, including the General Counsel, on litigation risk.

Executive Compensation & Development Committee: The Compensation Committee has oversight responsibility for the management of risk relating to the Company’s annual and long-term compensation program. The Committee aims to ensure that the Company’s annual and long-term incentive plans do not incentivize or encourage excessive or unnecessary risk-taking.

Technology Committee: The Technology Committee has oversight responsibility of risks related the Company’s management and development of technology, primarily those relevant to customer facing products and services, and internal IT systems. The Committee receives regular updates from management on risks in these areas, including data and enterprise security.

How Do We Address Risk in Our Compensation Program?

The Company’s compensation program is designed to attract, retain, motivate and reward talented executives and colleagues whose efforts will enable the Company to produce superior results and maximize return to shareholders. Our pay-for-performance philosophy focuses colleagues’ efforts on delivering short-term and long-term financial success for our shareholders without encouraging excessive risk taking. The Compensation Committee, which consists entirely of independent Board members, oversees the executive compensation program for the named executive officers, as well as other senior officers of the Company.

The following is a description of both Compensation Committee and management processes related to the compensation risk assessment process, as well as a description of the Company’s compensation risk mitigation techniques.

The Compensation Committee reviews and approves the annual and long-term plan performance measures and goals annually. This includes setting appropriate threshold and outstanding performance levels for each performance metric. As a part of this process, the Compensation Committee focuses on what behavior it is attempting to incentivize and the potential associated risks. The Compensation Committee periodically receives financial information from the Chief Financial Officer, and information on accounting matters that may have an impact on the performance goals, including any material changes in accounting methodology and information about extraordinary/special items excluded in the evaluation of performance, as permitted by the 2014 Executive Annual Incentive Plan and the 2014 Key Employee Stock Plan (i.e., the shareholder plans), so that the Compensation Committee members may understand how the exercise of management judgment in accounting and financial decisions

17

affects plan payouts. Members of the Compensation Committee approve the final incentive compensation awards after reviewing executive, corporate and business performance, and may utilize negative discretion if they believe the level of compensation is not commensurate with performance.

The following compensation policies and practices serve to reduce the likelihood of excessive risk taking:

| • | An appropriate compensation mix that is designed to balance the emphasis on short- term and long-term performance. |

| • | The majority of incentive compensation for top level executives is associated with the long term performance of the Company. This discourages short-term risk taking. |

| • | The focus on performance share units in our executive long-term plan ensures a correlation between executive rewards and shareholder return. |

| • | Financial performance measures used for incentive plans covering colleagues at all levels of the Company include a mix of financial metrics that are in line with operating and strategic plans. |

| • | Financial performance measures used for our annual incentive plan are different than the performance measures used in our long-term incentive plan. |

| • | A significant portion of annual and long-term incentive payments are based on Company and business profitability, ensuring a correlation between pay and performance. |

| • | Financial targets are appropriately set, and if not achieved, result in a large percentage loss of compensation. |

| • | Executive and broad-based incentive plans cap the maximum award payable to any individual. Annual and long-term incentive plans generally have a maximum payout of 1.5 times the target amount. |

| • | Recoupment or “clawback” provisions for top executives and key finance executives in the event that an executive’s conduct leads to a restatement of the Company’s financial results. |

| • | Stock ownership guidelines and stock retention requirements for our named executive officers, other senior officers and directors discourage excessive risk taking. |

We are confident that our compensation program rewards for performance, is aligned with the interests of our shareholders and does not involve risks that are reasonably likely to have a material adverse effect on the Company. A more detailed discussion of the Company’s executive compensation program can be found in the Compensation Discussion and Analysis beginning on page 27.

Under Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(u) of Regulation S-K, the Company is required to provide the ratio of the annual total compensation of the Company’s Chief Executive Officer to the annual total compensation of the median employee of the Company (the “Pay Ratio Disclosure”).

For fiscal year 2018, the median annual total compensation of all employees of the Company was $55,383. Mr. Napack’s annual total compensation for fiscal year 2018 for purposes of the Pay Ratio Disclosure was $9,781,572. Based on this information, for fiscal year 2018, the ratio of the compensation of the Chief Executive Officer to the median annual total compensation of all other employees was estimated to be 179 to 1.

If Mr. Napack’s one-time, sign-on stock award is excluded, his fiscal year 2018 annual total compensation would have been $5,433,750, and the estimated pay ratio would have been 100 to 1.

18

Identification of Median Employee

To identify the median employee in relation to the Pay Ratio Disclosure, we used the following methodology:

| • | Base pay as of April 30, 2018, was our consistently applied compensation measure |

| • | All employees, U.S. and non-U.S., full-time, part-time, temporary and contingent were included |

| • | Base pay was converted to USD using April 2018 fiscal year average exchange rates |

Using this methodology, we determined that the median employee was a full-time employee located in the U.S.

Annual Total Compensation

In connection to the Pay Ratio Disclosure, our median employee’s annual total compensation for fiscal year 2018 was calculated using the same methodology we use for our named executive officers as set forth in the “Summary Compensation Table” in this proxy statement.

Since Mr. Napack did not serve as the CEO for the entirety of 2018, we elected to annualize the following components of his compensation for purposes of the Pay Ratio Disclosure as if he were the Chief Executive Officer for the full year ending April 30, 2018: base salary, annual incentive, value of perquisites, and the Company’s matching contributions to the 401(k) Plan and the Deferred Compensation Plan. No other adjustments were made to the remaining components of Mr. Napack’s annual total compensation as reported in the 2018 Summary Compensation Table.