Form DEF 14A Vuzix Corp For: Jun 17

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. [ ])

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the Appropriate Box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 240.14a-12 |

VUZIX CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed

VUZIX CORPORATION

25 Hendrix Road,

West Henrietta, New York 14586

(585) 359-5900

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 17, 2021

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Vuzix Corporation. The meeting will be a virtual online meeting and will take place on June 17, 2021 at 11:00 a.m. (local time), for the following purposes:

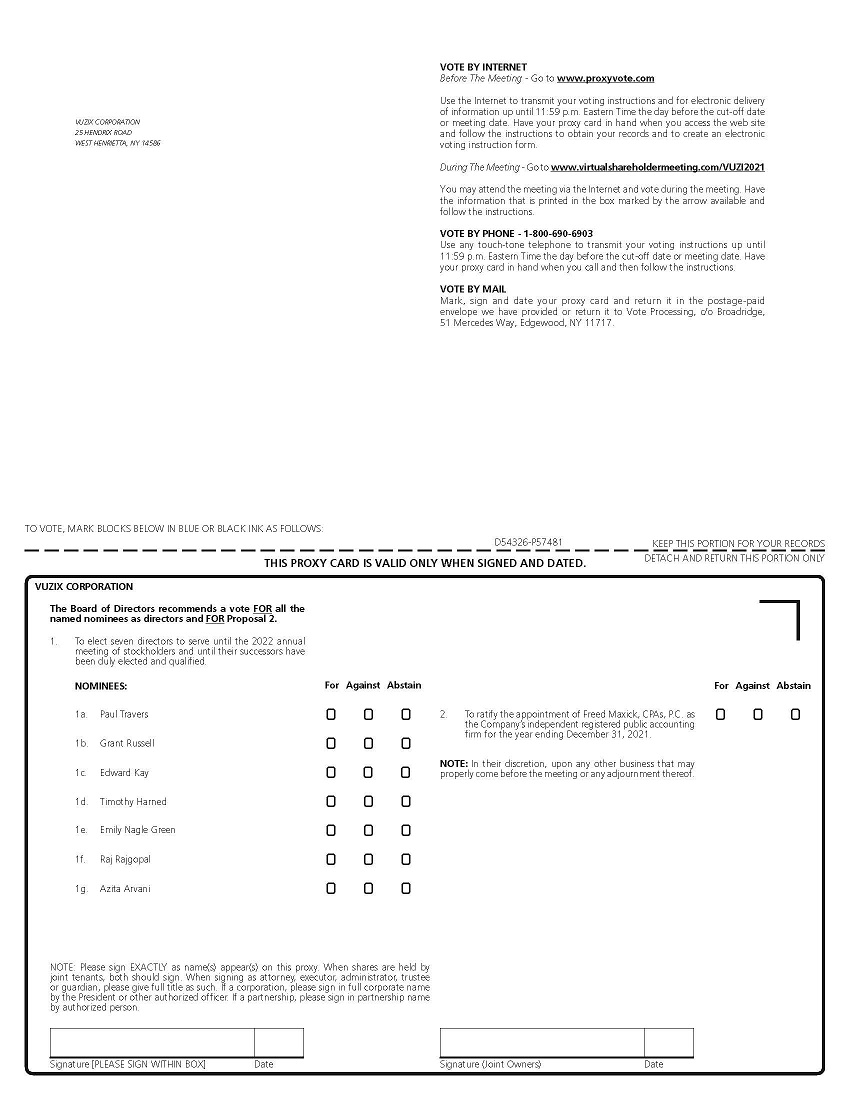

| 1. | To elect seven (7) directors to serve until the 2022 Annual Meeting of Stockholders and until their successors are duly elected and qualified. |

| 2. | To ratify the selection of Freed Maxick CPAs, P.C. as the independent registered public accounting firm of the Company for the year ending December 31, 2021. |

| 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The record date for the annual meeting is April 26, 2021. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof. Our transfer books will not be closed.

| By Order of the Board of Directors | |

| /s/ Nathaniel S. Bank | |

| Nathaniel S. Bank, | |

| Corporate Secretary |

| Dated: | April 29, 2021 |

| West Henrietta, New York |

You are cordially invited to virtually attend the meeting on June 17, 2021 by telephone, mobile device or Internet. We are furnishing proxy materials to some of our shareholders via the Internet by mailing a Notice of Internet Availability of Proxy Materials, instead of mailing or emailing copies of those materials. The Notice of Internet Availability of Proxy Materials directs shareholders to a website where they can access our proxy materials, including our proxy statement and our annual report, and view instructions on how to vote via the Internet, mobile device, or by telephone. If you received a Notice of Internet Availability of Proxy Materials and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials.

1

Table of Contents

2

VUZIX CORPORATION

25 Hendrix Road

West Henrietta, New York 14586

(585) 359-5900

FOR 2021 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished to shareholders in connection with the solicitation of proxies by the Board of Directors of Vuzix Corporation (“Vuzix”, the “Company”, “we”, “our”, or “us”) in connection with the annual meeting of shareholders of the Company to be held on June 17, 2021 at 11:00 a.m., Eastern Time, virtually via the Internet (the "Annual Meeting"). A copy of the Company's Annual Report on Form 10-K for the year ended December 31, 2020, filed with the Securities and Exchange Commission ("SEC") is available without charge upon written request to the Company's Secretary at the Company's corporate offices, or from the SEC's website at www.sec.gov.

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held.

You will be able to attend the Annual Meeting virtually online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/VUZI2021. You also will be able to vote your shares online by attending the Annual Meeting virtually by webcast.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Please note that you will need your 16-digit control number included on your proxy card.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The online meeting will begin promptly at 11:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time leaving ample time for the check-in. Please follow the registration instructions as outlined in this proxy statement.

SOLICITATION AND REVOCABILITY OF PROXIES

The enclosed proxy for the Annual Meeting is being solicited by the Board of Directors of the Company. Shareholders of record may vote by mail, telephone, or via the Internet. The toll-free telephone number and Internet web site are listed on the enclosed proxy. If you vote by telephone or via the Internet you do not need to return your proxy card. If you choose to vote by mail, please mark, date and sign the proxy card, and then return it in the enclosed envelope (no postage is necessary if mailed within the United States). Any person giving a proxy may revoke it at any time prior to the exercise thereof by filing with the Secretary of the Company a written revocation or duly executed proxy bearing a later date. The proxy may also be revoked by a shareholder attending the Meeting, withdrawing the proxy and voting in person virtually by attending the meeting online and voting by webcast.

The expense of preparing, printing and mailing the form of proxy and the material used in the solicitation thereof will be borne by the Company. In addition to solicitation by mail, proxies may be solicited by the directors, officers and regular employees of the Company (who will receive no additional compensation therefor) by means of personal interview, e-mail, telephone or facsimile. It is anticipated that banks, brokerage houses and other institutions, custodians, nominees, fiduciaries or other record holders will be requested to forward the soliciting material to persons for whom they hold shares and to seek authority for the execution of proxies; in such cases, the Company will reimburse such holders for their charges and expenses.

3

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The close of business on April 26, 2021 has been fixed as the record date for determination of the shareholders entitled to notice of, and to vote at, the Annual Meeting. On that date there were outstanding and entitled to vote 63,072,820 shares of common stock, each of which is entitled to one vote on each matter at the Annual Meeting.

Pursuant to the Company's bylaws and applicable provisions of the Delaware General Corporation Law, the vote of: (i) holders of a majority of the shares for which votes are cast with respect to each director nominee (not including abstentions), in person (virtually in this case, by attending the meeting online and voting by webcast) or by properly executed proxy, will be required to elect members to the Board of Directors, and (ii) the affirmative vote of a majority of shares of common stock cast on this proposal (including abstentions) will be required to ratify the appointment of the independent auditors. See “How many votes are needed to approve each Proposal?”

The presence, in person (virtually in this case, by attending the meeting online and voting by webcast) or by properly executed proxy, of the holders of shares of common stock entitled to cast one-third of all the votes entitled to be cast at the Annual Meeting is necessary to constitute a quorum. Holders of shares of common stock represented by a properly signed, dated and returned proxy will be treated as present at the Annual Meeting for purposes of determining a quorum. Proxies relating to "street name" shares that are voted by brokers will be counted as shares present for purposes of determining the presence of a quorum, but will not be treated as votes cast at the Annual Meeting as to any proposal as to which the brokers do not have voting instructions and discretion. These missing votes are known as “broker non-votes.”

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We are sending you this proxy statement and the enclosed proxy card because the Board of Directors of Vuzix Corporation is soliciting your proxy to vote at the 2021 Annual Meeting of Stockholders. We invite you to attend the Annual Meeting and request that you vote on the proposals described in this proxy statement. The Annual Meeting will be held virtually on Thursday, June 17, 2021 at 11:00 a.m. Eastern Time. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, date, sign and return the enclosed proxy card, or follow the instructions on the proxy card to vote by telephone or via the Internet.

We are providing this notice proxy statement and the accompanying proxy card on or about May 7, 2021 to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 26, 2021, the record date for the meeting, will be entitled to vote at the annual meeting. On April 29, 2021, the filing date of this proxy statement, there were 63,072,820 shares of common stock (each entitled to one vote) outstanding.

Stockholder of Record: Shares Registered in Your Name

If on April 26, 2021, your shares of Vuzix Corporation common stock were registered directly in your name with our transfer agent, Computershare Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting virtually by attending the meeting online and voting by webcast or vote by proxy. Whether or not you plan to virtually attend during the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

4

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 26, 2021, your shares of Vuzix Corporation common stock were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting virtually. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting virtually unless you request and obtain a signed letter or other valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote: (i) the election of seven (7) directors to serve until the 2022 Annual Meeting of stockholders, and (ii) the ratification of the selection of Freed Maxick CPAs, P.C. as our independent registered public accounting firm for the year ending December 31, 2021. Our Board of Directors does not intend to bring any other matters before the meeting and is not aware of anyone else who will submit any other matters for which a vote will be required. However, if any other matters properly come before the Annual Meeting, the people named on the proxy card, or their substitutes, will be authorized to vote on those matters in their own judgment.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 26, 2021.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least one-third of the outstanding shares of common stock entitled to vote are present at the meeting. Your shares are counted as present at the meeting if:

| · | You are present and vote in person at the meeting virtually by attending online and voting by webcast; |

| · | You have properly submitted a proxy card; or |

| · | You have voted via the Internet or by telephone. |

Your shares will be counted towards the quorum only if you submit a valid proxy card, have voted via the Internet, have voted via telephone, or vote in person at the meeting virtually by attending online and voting by webcast. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How do I vote?

The procedures for voting are set forth below:

Stockholder of Record: Shares Registered in Your Name

| · | If you are a stockholder of record, you will be able to vote your shares online by attending the Annual Meeting virtually and voting by webcast. |

| · | Whether or not you plan to attend the virtual meeting, we urge you to vote by submitting your proxy card, via the Internet or by telephone to ensure your vote is counted. |

| · | To vote via the Internet or by telephone, follow the instructions on the enclosed proxy card. |

5

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held in street name and you desire to vote online during the Virtual Annual Meeting, you should follow the instructions provided by your bank, broker or other holder of record to be able to participate in the meeting.

Stockholders as of the close of business on the Record Date may attend the Annual Meeting online, vote your shares electronically and submit your questions during the Meeting, by following the instructions on the Meeting website, www.virtualshareholdermeeting.com/VUZI2021. You will need to have your 16-Digit Control Number included on your notice of internet availability or your proxy card (if you received a printed copy of the proxy materials) to join the Meeting. Online access to the Meeting, which will be an audio-only webcast, will begin at 11:00 a.m., Eastern Time, on June 17, 2021.

How are votes counted?

You may either vote “FOR,” “AGAINST,” OR “ABSTAIN” for authority to vote for each nominee for the Board of Directors. You may vote “FOR”, “AGAINST” or “ABSTAIN” on the proposal to ratify the selection of Freed Maxick CPAs, P.C. as the independent registered public accounting firm of the Company for the year ending December 31, 2021.

If you submit your proxy, vote via the Internet or by telephone but abstain from voting or withhold authority to vote on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of determining a quorum. Your shares also will be counted as present at the Annual Meeting for the purpose of calculating the vote on ratification of the selection of the Company’s accounting firm if you abstained from voting or withheld authority to vote on that matter, meaning your abstention has the same effect as a vote against that proposal. An abstention has no effect on the election of members to the Board of Directors. See “How many votes are needed to approve each Proposal?”

If you hold your shares in street name and do not provide voting instructions to your brokerage firm, the brokerage firm may still be able to vote your shares with respect to certain “discretionary” (or routine) items, but it will not be allowed to vote your shares with respect to certain “non-discretionary” items. In the case of non-discretionary items, for which no instructions are received, the shares will be treated as “broker non-votes”. Shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum but will not be considered entitled to vote on the proposal in question. Your broker does not have discretionary authority to vote on the election of members to the Board of Directors, but will have discretionary authority to vote on the proposal relating to the ratification of the selection of the accounting firm. As a result, if you do not vote your street name shares, your broker has the authority to vote on your behalf with respect to Proposal 2 (the ratification of the selection of the accounting firm). We encourage you to provide instructions to your broker to vote your shares for the nominees to the Board of Directors.

6

How many votes are needed to approve each Proposal?

| · | Proposal 1 - Election of Directors |

Director nominees in uncontested director elections (when the number of director nominees does not exceed the number of board seats) are elected by the affirmative vote of the holders of a majority of the votes represented by the shares of common stock cast for this proposal (excluding abstentions) in person or virtually at the meeting (by attending online and voting by webcast) or by proxy. This means that the number of votes cast “For” a director nominee must exceed the number of votes cast “Against” that nominee. Abstentions and broker non-votes will have no effect.

| · | Proposal 2 – Ratification of the selection of Freed Maxick CPAs, P.C. as the independent registered public accounting firm of the Company for the year ending December 31, 2021. |

To be approved, the ratification of the selection of Freed Maxick CPAs, P.C. as our independent auditors for our 2021 fiscal year, must receive “For” votes from the holders of a majority of shares of common stock cast for this proposal, including abstentions. Broker non-votes will have no effect.

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

Can I change my vote after submitting my proxy, voting via the Internet or by telephone?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy in any one of three ways:

| · | You may submit another properly completed proxy card with a later date. |

| · | You may send a written notice that you are revoking your proxy to our Corporate Secretary, Vuzix Corporation, 25 Hendrix Road, West Henrietta, New York 14586. |

| · | You may attend the Annual Meeting virtually and vote online by webcast. Simply attending the Annual Meeting virtually will not, by itself, revoke your proxy. |

If you hold your shares in street name, contact your broker or other nominee regarding how to revoke your proxy and change your vote.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be disclosed in our report on Form 8-K that we will file with the Securities and Exchange Commission (the “SEC”) within four (4) business days after the Annual Meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, date, sign and return each proxy card, vote your shares via the Internet or by telephone for each proxy card you received to ensure that all of your shares are voted.

Who is paying for this proxy solicitation?

Vuzix Corporation will pay for the entire cost of soliciting proxies. In addition to the proxy materials being provided, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors, officers and employees any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

7

When are stockholder proposals due for next year’s annual meeting?

At our annual meeting each year, our Board of Directors submits to stockholders its nominees for election as Directors and its selection of independent auditors for the current fiscal year. In addition, the Board of Directors may submit other matters to the stockholders for action at the Annual Meeting.

Our stockholders also may submit proposals for inclusion in the proxy material. These proposals must meet the stockholder eligibility and other requirements of the SEC, and for these to be considered for inclusion in next year’s proxy materials, you must submit your proposal in writing by December 31, 2021 to our Corporate Secretary, Vuzix Corporation, 25 Hendrix Road, West Henrietta, New York 14586.

In addition, our bylaws provide that a stockholder may present from the floor a proposal that is not included in the proxy statement if the stockholder delivers written notice to our Corporate Secretary not earlier than 120 days and not later 90 days before the first anniversary of the preceding year’s annual meeting. The notice must set forth the stockholder’s name, address and number of shares of stock they hold, a description of the business to be brought before the meeting, the reasons for conducting such business at the Annual Meeting, any material interest they have in the proposal, and such other information regarding the proposal as would be required to be included in a proxy statement. We have received no such notice for the 2021 Annual Meeting. For the 2022 annual meeting of stockholders, written notice must be delivered to our Corporate Secretary at our principal office, 25 Hendrix Road, West Henrietta, New York, 14586, between February 14, 2022 and March 21, 2022.

Our bylaws also provide that if a stockholder intends to nominate a candidate for election as a member of the Board of Directors, the stockholder must deliver written notice of such intent to our Corporate Secretary. The notice must be delivered not earlier than 120 days and not later 90 days before the first anniversary of the preceding year’s annual meeting. The notice must set forth the stockholder’s name and address and number of shares of stock they own, the name and address of the person to be nominated, a description of all arrangements or understandings between such stockholder and each nominee and any other person (naming such person) pursuant to which the nomination is to be made by such stockholder, the nominee’s business address and experience during the past five years, any other directorships held by the nominee, the nominee’s involvement in certain legal proceedings during the past ten years and such other information concerning the nominee as would be required to be included in a proxy statement soliciting proxies for the election of the nominee. In addition, the notice must include the consent of the nominee to serve as a Director if elected. We have received no such notice for the 2021 Annual Meeting. For the 2022 annual meeting of stockholders, written notice must be delivered to our Corporate Secretary at our principal office, 25 Hendrix Road, West Henrietta, New York 14586, between February 14, 2022 and March 21, 2022.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the amount of our common stock beneficially owned as of April 26, 2021 by (i) each person or group as those terms are used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), believed by us to beneficially own more than 5% of our common stock, (ii) each of our executive officers and directors, and (iii) all of our directors and executive officers as a group. Except as otherwise noted, each person named in the table has sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

| Name and Addresses of Beneficial Owner (1) | Shares Beneficially Owned (2) | Percent of Outstanding Shares Beneficially Owned (3) | ||||||

| Paul Travers | 3,136,628 | (4) | 4.9 | % | ||||

| Grant Russell | 1,360,746 | (5) | 2.2 | % | ||||

| Alexander Ruckdaeschel | 175,147 | (6) | * | |||||

| Edward Kay | 140,474 | * | ||||||

| Timothy Harned | 110,147 | * | ||||||

| State Street Corporation | 4,835,890 | (7) | 7.7 | % | ||||

| Directors and executive officers as a group (5 people) | 4,923,142 | (8) | 7.8 | % | ||||

*less than 1.0%

| (1) | The address for each person, unless otherwise noted, is c/o Vuzix Corporation, 25 Hendrix Road, West Henrietta, New York, 14586. |

| (2) | We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities. In addition, the rules include shares of common stock issuable pursuant to the exercise of stock options or warrants, or, that are either immediately exercisable or convertible, or that will become exercisable within 60 days after April 26, 2021. These shares are deemed to be outstanding and beneficially owned by the person holding those options, warrants, convertible promissory notes or convertible preferred stock for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| (3) | The percentage of shares beneficially owned is based on 63,072,820 shares of our common stock issued and outstanding, as of April 26, 2021. |

| (4) | Includes (i) 1,951,963 outstanding shares of common stock held by Mr. Travers, (ii) 303,541 shares of common stock issuable upon the exercise of options, (iii) 11,124 shares of common stock held by Travers Family Trust LLC, (iv) 609,000 shares of common stock held by Paul Travers Annuity Trust I dated May 14, 2015, (v) 182,700 shares of common stock held by Paul Travers Annuity Trust II dated May 14, 2015, and (vi) 78,300 shares of common stock held by Paul Travers Annuity Trust III dated May 14, 2015. |

| (5) | Represents (i) 1,157,205 shares held by Mr. Russell and his spouse and (ii) 203,541 shares of common stock issuable upon the exercise of options. |

| (6) | Represents (i) 130,147 shares held and (ii) 45,000 shares issuable to Mr. Ruckdaeschel upon exercise of options. |

| (7) | Based on Schedule 13G filed on February 11, 2021. The address of the stockholder is State Street Financial Center, One Lincoln Street, Boston, MA 02111. |

| (8) | Beneficial ownership for Paul Travers, Grant Russell, Alexander Ruckdaeschel, Edward Kay and Timothy Harned. |

9

ELECTION OF DIRECTORS

The number of directors is established by the Board of Directors. Our Board currently consists of seven (7) seats, five (5) of which are occupied by current members and two of which are vacant. Four (4) of the current members have been nominated by the Board for re-election to the Board of Directors at the Annual Meeting. Members renominated by the Board were Messrs. Travers, Russell, Harned and Kay. In addition to the renominated members, the Board of Directors have nominated three (3) new members for election at the Annual Meeting. New members nominated by the Board of Directors include Ms. Arvani, Ms. Green, and Mr. Rajgopal.

Thus, at this Annual Meeting, seven (7) persons, comprised of four (4) existing members and three (3) new members of the Board of Directors, are to be elected. Each elected director will serve until the Company's next annual meeting of shareholders and until a successor is elected and qualified. Our four (4) current board members who are up for reelection, Paul Travers, Grant Russell, Timothy Harned and Edward Kay, were elected by the stockholders at the last annual meeting.

The Company anticipates that the accompanying proxy will be voted in favor of the seven (7) persons listed below to serve as directors unless the stockholder indicates to the contrary on such proxy. All nominees have consented to serve if elected. We expect that each of the nominees will be available for election, but if any of them is not a candidate at the time the election occurs, it is intended that such nomination will be deemed revoked and the director seat will be vacant until filled by the Board of Directors or vote of the stockholders at a meeting.

For the election of directors, only proxies and ballots, Internet votes or telephone votes, marked “FOR” or “AGAINST” one or more designated nominees are counted to determine the total number of votes cast. Abstentions are excluded entirely and will have no effect on the vote for the election of directors. Directors are elected by a majority of the votes cast. This means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee.

10

The term of office of each person elected as a director will continue until the next annual meeting or until his or her successor has been elected and qualified, or until the director’s death, resignation or removal.

The Board of Directors considers diversity, including gender and ethnicity, in the makeup of the Board when evaluating director candidates. Qualifications that it considers include nature and breadth of business experience, professional certification, and education.

The names of current directors and director nominees, their ages as of April 29, 2021, and certain information about them, including their business experience during the past five years and their directorships of other publicly held corporations, are set forth below.

Background of Current Directors and Director Nominees

|

Paul Travers, age 59, is the founder of Vuzix and has served as our President and Chief Executive Officer since 1997 and as a member of our Board of Directors since November 1997. Prior to the formation of Vuzix, Mr. Travers founded both e-Tek Labs, Inc. and Forte Technologies Inc. He has been a driving force behind the development of our products. With more than 30 years’ experience in the consumer electronics field, and 26 years’ experience in the virtual reality and virtual display fields, he is a nationally recognized industry expert. He holds an Associate degree in engineering science from Canton, ATC and a Bachelor of Science degree in electrical and computer engineering from Clarkson University. Mr. Travers resides in Honeoye Falls, New York. Mr. Travers’ experience as our founder and Chief Executive Officer qualifies him to serve on our Board of Directors. |

|

Grant Russell, age 68, has served as our Chief Financial Officer and Executive Vice President since 2000 and as a member of our Board of Directors since April 2009. From 1997 to 2004, Mr. Russell developed and subsequently sold a successful software firm and a new concept computer store and cyber café. In 1984, he co-founded Advanced Gravis Computer (Gravis), which, under his leadership as President, grew to become the world’s largest PC and Macintosh joystick manufacturer with sales of $44 million worldwide and 220 employees. Gravis was listed on NASDAQ and the Toronto Stock Exchange. In September 1996 it was acquired by a US-based Fortune 100 company via a successful public tender offer. Mr. Russell holds a Bachelor of Commerce degree in finance from the University of British Columbia and is both a US Certified Public Accountant and a Canadian Chartered Professional Accountant. Mr. Russell resides in Vancouver, British Columbia, Canada and has a secondary residence in West Henrietta, New York. Mr. Russell’s business executive and financial experience qualifies him to serve on our Board of Directors. |

11

|

Edward W. Kay, Jr., age 65, has been a director of the Company since April 2016. Mr. Kay is a Certified Public Accountant who spent his 33-year career with PricewaterhouseCoopers LLP (PwC) working with companies in a wide variety of industries, including manufacturing, distribution, software and technology. Mr. Kay served as PwC’s Rochester, NY Office Managing Partner for 13 years from 1999 to 2012 and, for a time, Managing Partner of the firm’s Upstate NY practice and had been the Leader of PwC’s high technology practice in Dallas, TX from 1993 to 1999. Mr. Kay was formerly a Board member, Executive Committee member, and Audit Committee Chair of IEC Electronics (NYSE: IEC) from 2013 to 2015 and is currently on the board of a large private company in the product distribution business. During Mr. Kay’s tenure at PwC and through his service on other corporate boards, he accumulated extensive experience in financial, securities, and business matters, including significant leadership roles in dealing with accounting and auditing matters related to public companies, which make Mr. Kay a financial expert and qualifies him to serve on our Board of Directors. |

|

Timothy Harned, age 56, is an investment banking, corporate development, and financial advisory veteran with more than 30 years of experience in mergers and acquisitions, capital markets, and related activities. Mr. Harned is also a technology specialist with more than twenty years of experience in various technology fields, including communications, mobility, and software, and another ten years working with consumer and industrial companies. Over his career, Mr. Harned has led strategic transactions for both Fortune 500 companies as well as earlier stage high-growth enterprises. In addition, he has successfully completed multiple cross-border transactions for U.S. acquirers entering the markets of both established and developing countries. Mr. Harned is currently the Founder and Managing Partner of 8Nineteen Advisory, LLC where he serves as a strategic C-suite consultant regarding growth matters and provides financial advisory services, with a specialty in mergers and acquisitions and corporate and business development. He has been with 8Nineteen Advisory, LLC since December 2016. He began his career at Lehman Brothers (1987 to 1992) within the mergers and acquisitions group and later joined Banc of America Securities (1996 to 2000) where he became a Managing Director. Mr. Harned subsequently joined Morgan Stanley & Co. (2000 to 2002), where he served as an Executive Director focused on merger and acquisition and capital markets advisory for technology companies. Mr. Harned also spent more than a decade (2003 to 2016) with several technology-focused financial and strategic advisory boutiques and has also served as a corporate development executive (1994 to 1996). Mr. Harned’s capital markets, corporate development, mergers and acquisitions, and strategic and financial advisory experience in the technology and consumer fields qualifies him to serve on our Board of Directors. |

|

Azita Arvani, age 58, is a customer-focused Hi-Tech leader who delivers innovation-led revenue growth. With over two decades in digital industries, she brings extensive experience in leveraging disruptive technologies such as 5G, AI, IoT, cloud, and AR/VR, commercializing innovations, and building partnerships and ecosystems. She currently serves as General Manager of Rakuten Mobile Americas where she drives the development, strategy and deployment of the business in the Americas. Prior to joining Rakuten in February 2020, she worked at Nokia, most recently as Head of Innovation Partner & Venture Management. She led the company’s leading-edge global team where she discovered, partnered with, and mentored hundreds of rapid-growth innovative companies. She has deep experience in both established Fortune 500 companies and rapid-growth startups. She is an avid evangelist of true digital transformation for telecommunication companies, as well as other industries. Ms. Arvani has been on the Board of Directors of the Tennant Company (NYSE: TNC) since October 2012 with a focus on innovation and serves on the Compensation and Governance Committees. Her experience in technology markets and innovation and especially in AR/VR use cases is particularly valuable as Vuzix evolves its business to the next level and accelerates its market expansion. For these reasons, Ms. Arvani is qualified to serve on our Board of Directors. |

|

Emily Nagle Green, age 63, is a long-time executive in the technology sector, with over 30 years of experience in introducing and scaling a wide variety of advanced technologies. Following completion of a M.S. Engineering in computer graphics and artificial intelligence, she began her professional career developing special-effects software for supercomputers; later she led marketing for a fiber-optic communications technology firm. She served for 8 years with Forrester Research, a leading technology advisory firm, where she predicted consumer technology adoption, advised executives, and later built the firm’s European operations. She was the CEO and later Chairman of Yankee Group Research, and the launching CEO of Smart Lunches, a fast-growing ecommerce startup. She is an accomplished author and currently serves on the boards of Casella Waste Systems (NASD: CWST) and Centerspace Residential (NYSE: CSR), chairing the Nominating & Governance committees for both companies. Since 2015, she has professionally coached over 30 CEOs in the tech sector on strategy, leadership, and board management. In the non-profit sector she leads the Boston Chapter of All Raise, the national organization that supports women founders and funders. She is a member of NACD and Women Corporate Directors. We believe Ms. Green’s success in scaling advanced technologies, her experience as a CEO, and the breadth of her public board experience particularly in governance qualify her to serve on our Board of Directors. |

|

Raj Rajgopal, age 60, is a seasoned industry executive with over 30 years of experience working with large enterprises implementing digital strategies and driving transformational growth. He is currently the President of RR Advisory Services, LLC, an advisory firm he founded in 2019 that offers due diligence and consulting services to venture capital and private equity investors. Prior to that, he served in various leadership roles at Virtusa Corporation, including President, where he successfully led the company’s growth from under $50 million to a leading digital solutions provider with revenues of more than $1 billion. During his tenure as President at Virtusa, he supported the company’s 28 consecutive quarters of growth and led due diligence efforts on a number of successful acquisitions. Prior to Virtusa, he held multiple leadership roles in both the U.S. and the U.K. at Capgemini, a global leader in consulting, technology services and digital transformation. At Capgemini, he helped technology and telecommunication clients build differentiated strategies to scale their business. He was also a Director of Advanced Technologies at BGS Systems, Inc. He has an undergraduate degree in Mechanical Engineering and advanced degrees in Computer Science, Industrial Engineering and Business. Mr. Rajgopal currently serves as a member of the Directors at CTG Corporation (Nasdaq: CTG) and as a Board Observer at Wevo Conversion. His deep knowledge of enterprise markets, expertise in digital transformation, experience rapidly scaling a small enterprise and his relevant degrees in engineering and business, qualify him to serve on our Board of Directors. |

Alexander Ruckdaeschel (outgoing director), age 48, joined our Board of Directors in November 2012. Since March 2001, Mr. Ruckdaeschel has worked in the financial industry in the United States and Europe as a co-founder, partner and/or in senior management. Mr. Ruckdaeschel co-founded Herakles Capital Management and AMK Capital Advisors in 2008. Mr. Ruckdaeschel has also been a partner with Alpha Plus Advisors, from 2006 to 2010, and Nanostart AG, from 2002 to 2006, where he was the head of their US group. Mr. Ruckdaeschel has significant experience in startup operations as the manager of DAC Nanotech-Fund and Biotech-Fund from 2002 to 2006. Following service in the German military, Mr. Ruckdaeschel was a research assistant at Dunmore Management focusing on intrinsic value identifying firms that were undervalued and had global scale potential. From October 1992 to October 2000 Mr. Ruckdaeschel was in the German military and supported active operations throughout the Middle East while also participating as a professional biathlon athlete. Mr. Ruckdaeschel’s financial experience qualifies him to serve on our Board of Directors.

12

RECOMMENDATION OF THE BOARD FOR PROPOSAL 1

Our

Board of Directors unanimously recommend A VOTE FOR THE ELECTION

AS DIRECTORS OF THE NOMINEES LISTED ABOVE

Information Regarding the Board and its Committees

Director Meeting and Attendance

During 2020, our Board of Directors held one (1) in-person and five (5) conference call regular meetings, seven (7) additional conference-call meetings, and acted five (5) times by unanimous written consent. In addition, the directors considered Company matters and had frequent communication with each other apart from the formal meetings. No board member attended fewer than 75% of the total board meetings or of meetings held by all committees on which such member served during 2020.

Our Board of Directors currently consists of Messrs. Travers, Russell, Ruckdaeschel, Kay, and Harned. Biographical information regarding Messrs. Travers, Russell, Kay, Harned, and Ruckdaeschel is set forth above.

Board Independence

Our Board of Directors has determined that each of our current directors and director nominees, other than Mr. Travers and Mr. Russell, is an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and NASDAQ rules. We believe that we are compliant with the independence criteria for boards of directors under applicable laws and regulations and the NASDAQ Stock Market. The board has met and may continue to meet independently of management as required.

Board Committees

We have an Audit Committee, a Compensation Committee and a Nominating Committee.

Audit Committee

Our Audit Committee consists of Edward Kay, Timothy Harned, and Alexander Ruckdaeschel, each of whom is a non-employee director. Our Board of Directors has determined that each member of our Audit Committee is an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and meets the requirements of financial literacy under SEC rules and regulations and the NASDAQ Stock Market. Mr. Kay is the chairperson of our Audit Committee and is considered an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and meets the requirements of financial literacy under SEC rules and regulations and the NASDAQ Stock Market. Mr. Kay serves as our Audit Committee financial expert, as defined under SEC rules. Our Audit Committee met five (5) times during 2020.

Our Audit Committee is responsible for, among other things:

| · | selecting and hiring our independent auditors, and approving the audit and non-audit services to be performed by our independent auditors; |

| · | evaluating the qualifications, performance and independence of our independent auditors; |

| · | monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| · | reviewing the adequacy and effectiveness of our internal control policies and procedures; |

| · | discussing the scope and results of the audit with the independent auditors and reviewing with management and the independent auditors our interim and year-end operating results; and |

| · | preparing the Audit Committee report that the SEC requires in our annual proxy statement. |

Our Board of Directors has adopted a written charter for our Audit Committee, which is available on the investor relations section of our website (www.vuzix.com).

Compensation Committee

Our Compensation Committee consists of Alexander Ruckdaeschel, Edward Kay and Timothy Harned, each of whom is a non-employee director. Mr. Ruckdaeschel is the chairperson of our Compensation Committee. Our Board of Directors has determined that each member of our Compensation Committee is an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and under the current rules of the NASDAQ Stock Market. Our Compensation Committee met six (6) times in 2020.

13

Our Compensation Committee is responsible for, among other things:

| · | reviewing and approving compensation of our executive officers including annual base salary, annual incentive bonuses, specific goals, equity compensation, employment agreements, severance and change-in-control arrangements, and any other benefits, compensation or arrangements; |

| · | reviewing and recommending compensation goals, bonus, and stock compensation criteria for our employees; |

| · | preparing any Compensation Committee report required by the rules of the SEC to be included in our annual proxy statement; and |

| · | administering, reviewing and making recommendations with respect to our equity compensation plans. |

Our Board of Directors has adopted a written charter for our Compensation Committee, which is available on the investor relations section of our website (www.vuzix.com).

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2020, no member of our Compensation Committee was one of our officers or employees. Moreover, none of our executive officers served as a member of the Board of Directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our Board of Directors or Compensation Committee during 2020.

Involvement in Certain Legal Proceedings

None of our directors or executive officers has been involved in any legal proceeding in the past 10 years that would require disclosure under Item 401(f) of Regulation S-K.

Nominating Committee

Our Nominating Committee consists of Alexander Ruckdaeschel, Timothy Harned and Edward Kay, each of whom is a non-employee member of our Board of Directors. Mr. Harned is the chairperson of our Nominating Committee. Our Board of Directors has determined that each member of our Nominating Committee is an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and under the rules of the NASDAQ Stock Market. Our Nominating Committee met four (4) times in 2020.

Our Nominating Committee is responsible for, among other things:

| · | presenting a list of individuals recommended for nomination for election to the Board of Directors at the annual meeting of shareholders; |

| · | reviewing the composition of each committee and present recommendations for committee memberships to the Board of Directors as needed; |

| · | establishing and reviewing on an annual basis the nominating committee’s policy with regard to the consideration of any director candidates recommended by the Company’s shareholders, including the procedures to be followed by the Company’s shareholders in submitting such recommendations; and |

| · | evaluating and reporting to the Board on the performance and effectiveness of the Board to facilitate the directors fulfilling their responsibilities in a manner that serves the interests of the Company’s shareholders. |

Our Board of Directors has adopted a written charter for our Nominating Committee, which is available on the investor relations section of our website (www.vuzix.com).

Nominating Process

The process followed by the Nominating Committee to identify and evaluate candidates includes requests to board members, the chief executive officer, and others for recommendations, meetings from time to time to evaluate any biographical information and background material relating to potential candidates and their qualifications, and interviews of selected candidates. Nominations of persons for election to our Board of Directors may be made at a meeting of stockholders only (i) by or at the direction of the board; or (ii) by any stockholder who has complied with the notice procedures set forth in our bylaws and in the section entitled “Questions and Answers About This Proxy Material and Voting – When are stockholder proposals due for next year’s annual meeting?” In addition, stockholders who wish to recommend a prospective nominee for the Nominating Committee’s consideration should submit the candidate’s name and qualifications to our Corporate Secretary, 25 Hendrix Road, West Henrietta, New York 14586.

14

In evaluating the suitability of candidates to serve on the Board of Directors, including stockholder nominees, the Nominating Committee seeks candidates who are independent as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and the rules of the NASDAQ Stock Market, and who meet certain selection criteria established by the committee. The committee also considers an individual’s skills, character and professional ethics, judgment, leadership experience, business experience and acumen, familiarity with relevant industry issues, and other relevant criteria that may contribute to our success. This evaluation is performed in light of the skill set and other characteristics that would most complement those of the current directors, including the diversity, maturity, skills and experience of the Board of Directors as a whole. The board seeks the best director candidates based on the skills and characteristics required without regard to race, color, national origin, religion, disability, marital status, age, sexual orientation, gender identity and expression, or any other basis protected by federal, state or local law.

Code of Ethics and Business Conduct

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors. The full text of our code of business conduct and ethics is posted on the investor relations section of our website (www.vuzix.com).

Corporate Governance and Related Matters

Board Leadership Structure

Our Board of Directors is responsible for the selection of the chairman of the board and the chief executive officer. Our board does not have a policy on whether or not the roles of chief executive officer and chairman should be separate and, if they are to be separate, whether the chairman should be selected from the non-employee directors or be an employee. Currently our chief executive officer acts as chairman. Our board believes that Paul Travers, our founder and chief executive officer, is best suited to act as chairman of the board because he is the director most familiar with the Company’s business and industry and is therefore best able to identify the strategic priorities to be discussed by the board.

Our board believes that the most effective board structure is one that emphasizes board independence and ensures that the board’s deliberations are not dominated by management. Three of our five current directors qualify as independent directors within the meaning of Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and NASDAQ rules and regulations. Each of our standing board committees is comprised of only independent directors, including our Nominating Committee, which is charged with evaluating and reporting to the board on the performance and effectiveness of the board, as necessary. Our board has not appointed a lead independent director.

Our Board’s Role in Risk Oversight

Our management is responsible for risk management on a day-to-day basis. The role of our board and its committees includes overseeing the risk management activities of management. Our board oversees our risk management processes directly and through its committees. The Audit Committee assists the board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements, and discusses policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which our exposure to risk is handled. The Compensation Committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The Nominating Committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, and succession planning for our directors.

15

Communications with the Board of Directors

Stockholders and other parties may communicate directly with the Board of Directors or the relevant board member by addressing communications to:

Vuzix Corporation

c/o Corporate Secretary

25 Hendrix Road,

West Henrietta, New York 14586

All stockholder correspondence will be compiled by our corporate secretary and forwarded as appropriate.

Director Attendance at Annual Meetings

We have scheduled a Board of Directors meeting in conjunction with our annual meeting of stockholders and, while we do not have a formal policy regarding attendance at annual meetings, we as a general matter expect that the directors will attend the annual meeting, except in the case of virtual online-only meetings. All of our directors attended our 2020 annual meeting virtually.

RATIFICATION OF THE SELECTION OF THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2021

The Audit Committee has selected the accounting firm of Freed Maxick CPAs, P.C. (“Freed Maxick”) to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2021. Freed Maxick has served as the Company’s independent registered public accounting firm since October 2014 and is considered by the Audit Committee, the Board of Directors, and management of the Company to be well qualified.

The stockholders are being asked to ratify the Audit Committee’s appointment of Freed Maxick CPAs, P.C. for the year ending December 31, 2021. If the stockholders fail to ratify this appointment, the Audit Committee may, but will not be required to, reconsider whether to retain that firm. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders. A representative of Freed Maxick, CPAs, P.C. will be present at the annual meeting virtually and will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Fees Paid to Freed Maxick CPAs, P.C.

The following table shows the fees that were billed by Freed Maxick CPAs, P.C. to the Company for professional services rendered in 2020 and 2019.

| 2020 | 2019 | |||||||

| Audit Fees (1) | $ | 241,500 | $ | 236,000 | ||||

| Audit-Related Fees (2) | - | 2,000 | ||||||

| Tax Fees (3) | 18,400 | 20,800 | ||||||

| All Other Fees | - | - | ||||||

| Total Freed Maxick CPAs, P.C. Fees | $ | 259,900 | $ | 258,800 | ||||

(1) Audit fees primarily represent amounts billed for the audit of our annual consolidated financial statements for such fiscal year and quarterly reviews of our consolidated financial statements.

(2) Audit-related fees represent fees for services rendered in connection with work related to comfort letters, registration statements and due diligence performed in the fiscal year noted above.

(3) Professional services billed for tax compliance.

16

Pre-Approval of Fees by Audit Committee

In accordance with applicable laws, rules and regulations, our Audit Committee charter and pre-approval policies established by the Audit Committee require that the Audit Committee review and approve in advance all audit and permitted non-audit services provided to us by our independent registered public accounting firm. The services performed by, and the fees to be paid to, Freed Maxick CPAs, P.C. in 2020 and 2019 were approved by the Audit Committee.

Independence Analysis by Audit Committee

The Audit Committee has considered whether the provision of the services described above was compatible with maintaining the independence of Freed Maxick CPAs, P.C. and determined that the provision of such services was compatible with such firm’s independence. For 2020 and 2019, Freed Maxick CPAs, P.C. provided no services other than those services described above.

Required Vote

The affirmative vote of the holders of a majority of the shares of common stock cast on the matter is needed to ratify the appointment of Freed Maxick CPAs, P.C. as our independent registered public accounting firm for the year ending December 31, 2021. An abstention will have the same legal effect as a vote against the ratification of Freed Maxick CPAs, P.C., and broker non-votes will have no effect on the outcome of the ratification of the independent registered public accounting firm.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 2:

Our Board of Directors unanimously recommend that the

stockholders vote FOR ratification of the appointment of FREED MAXICK CPAS,

P.C. as our independent registered public accounting firm

for the year ending December 31, 2021.

Membership and Role of Audit Committee

The Audit Committee of our Board of Directors is responsible for providing independent, objective oversight and review of our accounting functions, internal controls and financial reporting process. Currently, the Audit Committee is comprised of Messrs. Kay, Harned, and Ruckdaeschel. The Audit Committee operates pursuant to a written charter adopted by the Board of Directors in December 2009 which may be found on the investor relations section of our website (www.vuzix.com) under the “Investors-Corporate Governance” section. We believe that each of the members of the Audit Committee is independent as defined by applicable laws and regulations.

Management has the primary responsibility for the financial statements and the reporting process, including our system of internal controls, and for the preparation of the consolidated financial statements in accordance with generally accepted accounting principles. Our independent accountants are responsible for performing an independent audit of those financial statements in accordance with the standards of the Public Company Accounting Oversight Board (PCAOB) and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes on behalf of the Board of Directors. Two of the three members of the Audit Committee are not professional accountants or auditors and their functions are not intended to duplicate or certify the activities of management and the independent auditors. Edward Kay, a Certified Public Accountant, is chair of the Audit Committee.

17

Review of our Audited Financial Statements

In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in our Annual Report on Form 10-K with management and discussed the quality and acceptability of our accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in our financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality and acceptability of our accounting principles and such other matters as are required to be discussed with the committee under the standards of the Public Company Accounting Oversight Board (PCAOB), including Auditing Standard 1301 (Communications with Audit Committees). In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from management and us, including the matters in the written disclosures required by Independence Standards Board Standard No. 1 (Independent Discussions with Audit Committees), which were submitted to us, and considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee discussed with our independent auditors the overall scope and plans for their audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examination, their evaluation of our internal controls, and the overall quality of our financial reporting.

In reliance on these reviews and discussions, the Audit Committee recommended to our Board of Directors (and our board has approved) that our audited financial statements for the year ended December 31, 2020 be included in the Annual Report on Form 10-K for the year ended December 31, 2020 for filing with the Securities and Exchange Commission.

The Audit Committee selects the Company’s independent registered public accounting firm annually and has submitted such selection for the year ending December 31, 2021 for ratification by stockholders at the Company’s annual meeting.

The Audit Committee currently consists of Mr. Kay (Chairperson) and Messrs. Harned and Ruckdaeschel.

The material in this report is not deemed to be “soliciting material,” or to be “filed” with the Securities and Exchange Commission and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filings.

Compensation Philosophy

We believe that the products and technology of the Company and their evolution are critical to our future growth. Smart glasses, wearable computing and waveguide optics are still evolving rapidly and with varying degrees of enterprise and consumer adoption, so we attempt to strike a balance between longer-term strategic initiatives and short-term financial metrics as performance indicators. As such, we believe it is important to reward not just financial achievement but progress in our strategic initiatives such as the development of new products and/or technologies. As a result, we strive to create an acceptable balance of our employee retention objectives with pay-for-performance objectives. We believe we accomplish this by compensating our executives with a combination of base salary and performance bonus awards and long-term equity-based incentive compensation. In addition, we periodically use benchmarks and peer group comparisons to assist us in determining whether our executive compensation is appropriate in light of our compensation objectives and philosophy. We currently have no pre-established policy for the allocation between either cash or non-cash compensation but we do emphasize long-term results over annual achievements.

18

Role of the Compensation Committee

The Compensation Committee of our Board of Directors sets our executive compensation policies and determines the amounts and elements of compensation for our executive officers. As set forth in the Compensation Committee’s written charter, its responsibilities include establishing compensation policies for our directors and executive officers; reviewing and approving the CEO’s and CFO’s annual compensation; approving employment agreements or arrangements with executive officers; administering our 2014 Equity Incentive Plan and approving grants under the 2014 Plan; and making recommendations regarding any other incentive compensation or equity-based plans. The Compensation Committee may delegate certain authority with respect to compensation matters to our executive officers.

For all executive officers other than our CEO and CFO, the Compensation Committee establishes and approves the base salary compensation based upon recommendations from the CEO.

With respect to compensation of our CEO and CFO, the Compensation Committee establishes and approves the compensation determinations based on the Compensation Committee’s evaluation and performance reviews of our CEO and CFO.

A copy of the Compensation Committee charter is posted on the investor relations section of our website (www.vuzix.com), under the heading “Investors: Corporate Governance”. In 2020, our Compensation Committee consisted of Mr. Ruckdaeschel (Chairperson) and Messrs. Harned and Kay, each of whom is an independent director as determined by our Board of Directors, based upon the NASDAQ Rules and our independence guidelines.

The Role of Management

At the request of the Compensation Committee, the NEOs of the Company may be present at Compensation Committee meetings for discussion purposes. However, they have no involvement in the decisions made by the Committee, nor do they have a vote on any matters brought before the Committee. The Compensation Committee meets with the CEO to discuss his performance and compensation package, but ultimately decisions regarding his compensation package are made solely based upon the Committee’s deliberations, as well as input from the compensation consultant, as requested. The Compensation Committee considers recommendations from the CEO, as well as input from the compensation consultant, as requested, to make decisions regarding any other NEOs.

Role of the Compensation Consultant

The Compensation Committee is comprised exclusively of independent outside directors. In making its determinations with respect to executive compensation, the Compensation Committee has the authority to engage its own advisors to assist in carrying out its responsibilities. The engagement of services from the compensation consultant provides input on trends in executive compensation and an outside perspective on our executive compensation practices and assists with our peer group benchmarking analysis. The Compensation Committee uses the consultant to assist in the identification and selection of peer companies for purposes of comparing compensation practices, to provide guidance regarding the amount and types of compensation that we provide to our executives and Board of Directors, and other compensation-related matters.

19

In making its determinations with respect to executive compensation, the Compensation Committee has periodically engaged the services of a compensation consultant to provide input on trends in executive compensation and to obtain an outside perspective on our executive compensation practices and assist with our peer group benchmarking analysis. The Compensation Committee does not believe a formal annual peer group assessment by an independent third party is necessary unless either internal factors, such as employee turn-over, or external factors, such as published reports in industry periodicals, indicate significant changes in executive compensation have taken place. In 2020, the Company engaged Burke Group, LLC (“Burke”) as the compensation consultant to provide the following services:

| • | Recommend changes to the peer group of comparable companies; |

| • | Complete a competitive analysis of compensation for each executive utilizing comparable peer company compensation data; |

| • | Provide assistance with our long-term incentive strategy; and |

| • | Provide general executive compensation advice. |

In addition, the Company asked Burke for assistance in benchmarking the compensation and long-term incentives of the CEO and other NEOs and to review a draft of the proxy statement.

The compensation consultant reports directly to the Compensation Committee and carries out responsibilities as assigned by the Committee. The Compensation Committee has the sole authority to retain and terminate the compensation consultant and to approve the compensation consultant’s fees and all other terms of the engagement. The Committee exercised this authority to engage Burke as its independent compensation consultant and has direct access to the compensation consultant throughout the year. Burke serves as an advisor to the Compensation Committee on topics primarily related to Board and executive compensation. Burke does not provide us with any services other than the services provided at the request of the Compensation Committee.

The Compensation Committee regularly reviews the services provided by its outside consultants and believes that Burke is independent in providing executive compensation consulting services. The Compensation Committee conducted a specific review of its relationship with Burke in 2020 and determined that Burke’s work for the Compensation Committee did not raise any conflicts of interest, and further determined that such is still the case in 2021, consistent with the guidance provided under the Dodd-Frank Wall Street Reform and Consumer Protection Act, and by the SEC and the Nasdaq Global Market.

Elements of Executive Compensation

Our compensation program is designed to be simple, straightforward and fair. We use the following compensation and benefits elements to provide an overall competitive compensation and benefits package that is tied to creating stockholder value and supporting the execution of our business strategies:

| • | Base salary; |

| • | Annual bonus; and |

| • | Long-term incentives. |

20

The Compensation Committee evaluates the overall performance of the NEOs during the year against annual budgets; evaluates the CEO’s achievements against the Board’s expectations; obtains input from the CEO on the performance reviews of the other executive officers; evaluates the potential for future contributions by each executive to our long-term success; and periodically compares our executive compensation against a benchmarking analysis of a group of peer companies.

Salary

Base salary is the primary fixed element in the Company’s compensation program and is intended to provide an element of certainty and security to the Company’s executive officers on an ongoing basis. Salaries are based on the executive’s level of experience, functional specialty, and responsibility. Executive salaries are reviewed on an annual basis by the Compensation Committee. Any increases in salary are based on an evaluation of the individual’s performance, level of responsibility and, when such information is available, the level of pay compared to the salaries paid to persons in similar positions in the Company’s peer group or as shown in survey data.

The following table summarizes the annualized base salaries in effect as of December 31, 2020, 2019 and 2018 for the named executive officers:

| Officer | 2020 Salary | 2019 Salary | Percent Change ‘20 vs ‘19 | 2018 Salary | Percent Change ‘19 vs 18’ | |||||||||||||||

| Paul Travers | $ | 500,000 | $ | 500,000 | 0 | % | $ | 500,000 | 0 | % | ||||||||||

| Grant Russell | 425,000 | 425,000 | 0 | % | 425,000 | 0 | % | |||||||||||||

The Compensation Committee approves all option grants with input and recommendations from the CEO, with the exception that the CEO and CFO have been delegated authority to approve initial grants made to newly hired employees. New employees may receive a stock option grant when hired in order to immediately align their interests with us and may be eligible for additional option grants going forward.

Cash Bonuses

Generally, short-term bonuses or cash incentive awards to executive officers are tied to achieving performance metrics established by the Compensation Committee, with input from the CEO and CFO, and are not reset during the year, regardless of Company performance or economic conditions. The program creates incentive for the executive officers to direct their efforts toward achieving specified company goals and individual goals. To measure our 2020 performance, the Compensation Committee established goals related to the Company’s financial performance, attainment of strategic milestones and approved individual goals for executives. In 2020, two elements of the management incentive bonus program were awarded: (i) the target of net loss from operations (exclusive of non-cash items such as depreciation and stock-based compensation) of no greater than $15 million was achieved, and (ii) a discretionary award approved by the Compensation Committee for management’s achievements not tied to performance metrics with regards to improving the Company’s balance sheet, particularly cash and cash equivalents held. Total management cash incentive bonuses earned in 2020 for Messrs. Travers and Russell were $120,000 and $102,000, respectively.

Equity Awards and Long-Term Incentives

We believe that including an equity-based incentive component of compensation is a critical tool for motivating our executives and certain employees. We believe that granting equity awards to our executives aligns executive compensation with long-term stockholder value. By awarding executive officers with equity awards that vest over time, we believe that our executive officers will have a continuing stake in our long-term success.

We have historically sought to weight our total executive compensation towards restricted stock and option awards which either vest upon the achievement of certain performance milestones or vest over time. While our management can improve our financial performance through the sales of our current products, cost reduction efforts, process improvements and other short-term advancements, we believe that our executive officers’ focus on long-term achievements, particularly increasing our product and patent portfolios, will create the greatest stockholder value. We believe that by granting our executives meaningful levels of equity awards that either vest over the long-term or based upon the Company’s market capitalization, revenues, and adjusted EBITDA margins, as reflected in the previously announced March 17, 2021 performance stock option awards granted to the executive officers, we will achieve the proper balance between incentivizing them to focus on the current fiscal year’s results and longer-term strategies and performance of the Company.

21

In determining the size of each equity award granted to our executive officers, the Compensation Committee considers:

| • | the amount previously awarded on an annual basis to the executive; |

| • | recommendations from the compensation consultant; |

| • | the total value of unvested equity awards held by the executive; and |

| • | the executive’s overall performance, our performance during the year, and the dilution to the stockholders. |

In 2020, we granted our employees 1,381,000 stock options and 474,929 shares of stock awards were granted as part of our voluntary salary reduction program in May 2020. In 2020, we granted our external directors 45,000 shares of stock awards as part of their annual services as board members, 22,500 shares of discretionary stock awards and 53,268 shares of stock awards as part of our retainer fee and salary reduction program. In 2020, our CEO and CFO were granted 100,000 stock options, 45,000 shares of discretionary stock awards and 302,288 shares of stock awards as part of our salary reduction program, where they received shares in lieu of a 50% reduction in their normal cash compensation for approximately 8 months in 2020.

Perquisites

The Company offers certain perquisites for the exclusive benefit of the NEOs. Our healthcare, insurance, and other welfare and employee-benefit programs are the same for all eligible domestic employees, including executive officers. Benefits provided include health and dental coverage, group term life insurance, and disability programs. We share the cost of health and welfare benefits with our employees, a cost that is dependent upon the level of benefits coverage that each employee elects. The benefits provided to foreign employees are typically determined by the laws of the applicable country in which the employee resides or we reimburse their costs of obtaining equivalent benefit coverages. We have no outstanding loans of any kind to our executive officers.

Claw-back Policy

In 2018, we adopted a Claw-back Policy that provides that certain performance-based compensation is recoverable from an executive officer if the Company determines that an officer has engaged in knowingly or intentionally fraudulent or illegal conduct that caused or substantially caused the need for a restatement of the Company’s financial results. If the Board of Directors or an authorized committee determines that any such performance-based compensation would have been at a lower amount had it been based on the restated financial results, the Company will, to the extent practicable and permitted by applicable law, seek recoupment from such officer of the portion of such performance-based compensation that is greater than that which would have been awarded or earned had such compensation been calculated on the basis of the restated financial results.

Employment and Other Agreements