Form DEF 14A Under Armour, Inc. For: May 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

UNDER ARMOUR, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which the transaction applies:

| |||

| (2) | Aggregate number of securities to which the transaction applies:

| |||

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of the transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

UNDER ARMOUR, INC.

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 13, 2021

Notice is hereby given that the Annual Meeting of Stockholders of Under Armour, Inc. will be held on Thursday, May 13, 2021 at 10:00 a.m., Eastern Time, to be held online at www.virtualshareholdermeeting.com/UAA2021 to consider and vote on the following matters:

| 1. | To elect nine directors nominated by the Board of Directors to serve until the next Annual Meeting of Stockholders and until their respective successors are elected and qualified; |

| 2. | To approve, on an advisory basis, our executive compensation; and |

| 3. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2021. |

We will also transact any other business that may properly come before the meeting or any adjournment or postponement thereof.

Our Board of Directors recommends that you vote “FOR” the election of the nine nominees to the Board of Directors listed in the accompanying proxy statement, “FOR” the approval of our executive compensation and “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

Only holders of record of Class A Common Stock or Class B Common Stock as of the close of business on February 26, 2021 are entitled to notice of, or to vote at, the Annual Meeting and any adjournment or postponement thereof. Holders of Class C Common Stock have no voting power as to any items of business that may properly be brought before the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting, which will be conducted online only via a live webcast due to continuing concerns regarding the COVID-19 pandemic. We believe that this virtual format prioritizes the health and well-being of our stockholders, directors and employees amid public health concerns related to the COVID-19 pandemic. During the virtual meeting, holders of our Class A Common Stock and Class B Common Stock may ask questions and will have the opportunity to vote to the same extent as they would at an in-person meeting of stockholders. Holders of our Class C Common Stock may participate in the virtual Annual Meeting in a view-only format and will not be able to submit questions during the meeting or vote on any matter to be considered at the Annual Meeting. However, in advance of the meeting, holders of our Class C Common Stock may submit questions by contacting Investor Relations through the Under Armour website. We will respond to as many inquiries at the Annual Meeting as time allows.

If you plan to attend the Annual Meeting, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. If you are a holder of Class C Common Stock, you may attend the Annual Meeting without a 16-digit control number by following the instructions in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompany your proxy materials. The Annual Meeting will begin promptly at 10:00 a.m., Eastern Time. Online check-in will begin at 9:45 a.m., Eastern Time, and you should allow ample time for the online check-in procedures.

Whether or not you intend to attend the virtual Annual Meeting, please vote your shares promptly by following the voting instructions you have received.

| By Order of the Board of Directors |

| John Stanton |

| General Counsel and Secretary |

Baltimore, Maryland

March 26, 2021

Table of Contents

| 1 | ||||

| Security Ownership of Management and Certain Beneficial Owners of Shares |

5 | |||

| 8 | ||||

| 8 | ||||

| 10 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| Executive Compensation - Compensation Discussion and Analysis |

26 | |||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 31 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| Potential Payments Upon Termination of Employment or Change in Control |

45 | |||

| 49 | ||||

| PROPOSAL 2 - ADVISORY APPROVAL OF OUR EXECUTIVE COMPENSATION |

51 | |||

| 52 | ||||

| 53 | ||||

| 55 | ||||

| 57 | ||||

| PROPOSAL 3 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

58 | |||

| 59 | ||||

| 60 | ||||

UNDER ARMOUR, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

Thursday, May 13, 2021

This Proxy Statement is being provided to solicit proxies on behalf of the Board of Directors of Under Armour, Inc. for use at the Annual Meeting of Stockholders and any adjournment or postponement thereof. The Annual Meeting is to be held on Thursday, May 13, 2021, at 10:00 a.m., Eastern Time, to be held online at www.virtualshareholdermeeting.com/UAA2021. We expect to first send or give stockholders this Proxy Statement, together with our 2020 Annual Report to Stockholders, on March 31, 2021.

Our principal offices are located at 1020 Hull Street, Baltimore, Maryland 21230. In this Proxy Statement we refer to Under Armour, Inc. as “Under Armour,” “we,” “us,” “our” and “company.”

Internet Availability of Proxy Materials

Pursuant to rules of the Securities and Exchange Commission (the “SEC”), we are making our proxy materials available to our stockholders electronically over the Internet rather than mailing the proxy materials. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to holders of our Class A Common Stock and Class B Common Stock. All stockholders will have the ability to access the proxy materials, including this Proxy Statement and our 2020 Annual Report to Stockholders, on the website referred to in the notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found on the notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

The SEC rules require us to notify all stockholders, including those stockholders to whom we have mailed proxy materials, of the availability of our proxy materials over the Internet.

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be held on May 13, 2021

Our Proxy Statement and 2020 Annual Report to Stockholders are available at

https://about.underarmour.com/investor-relations/news-events-presentations/#module-6

Who May Vote

Only holders of record of our Class A Common Stock, which we refer to as Class A Stock, and holders of record of our Class B Convertible Common Stock, which we refer to as Class B Stock, at the close of business on February 26, 2021, or the Record Date, will be entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, 188,621,116 shares of Class A Stock and 34,450,000 shares of Class B Stock were issued and outstanding. Each share of Class A Stock entitles the holder to cast one vote on each matter to be considered at the Annual Meeting and each share of Class B Stock entitles the holder to cast ten votes on each matter to be considered at the Annual Meeting. Holders of Class A Stock and holders of Class B Stock will vote together as a single class on all matters.

Stockholders are not allowed to cumulate their votes in the election of the directors. Holders of our Class C Common Stock, which we refer to as Class C Stock, have no voting power as to any items of business that will be voted on at the Annual Meeting.

1

What Constitutes a Quorum

Stockholders may not take action at a meeting unless there is a quorum present at the meeting. Holders of Class A Stock and Class B Stock entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting, represented in person (virtually) or by proxy, constitute a quorum for the transaction of business at the Annual Meeting.

Vote Required

The election of each director requires a plurality of the votes cast at the Annual Meeting. The approval of our executive compensation and the ratification of the appointment of our independent registered public accounting firm each requires the affirmative vote of a majority of the votes cast at the Annual Meeting.

Voting Process

Shares for which proxies are properly executed and returned will be voted at the Annual Meeting in accordance with the directions given or, in the absence of directions, will be voted “FOR” the election of the nine nominees to the Board of Directors named in this Proxy Statement, “FOR” the advisory approval of our executive compensation and “FOR” the ratification of the appointment of our independent registered public accounting firm. It is not expected that any other matters will be brought before the Annual Meeting. If, however, other matters are properly presented, the persons named as proxies in the proxy card will vote in accordance with their discretion with respect to such matters.

The manner in which your shares may be voted depends on how your shares are held. If you are the record holder of your shares, meaning you appear as the stockholder of your shares on the records of our stock transfer agent, you vote your shares directly through one of the methods described below. If you own shares in street name, meaning you are a beneficial owner with your shares held through a bank or brokerage firm, you instruct your bank or brokerage firm how to vote your shares through the methods described on the voting instruction form provided by your bank or brokerage firm.

How to Vote

Holders of our Class A Stock and Class B Stock as of the Record Date may vote their shares by one of the following methods.

Internet

To vote your shares by Internet, please visit the website listed on your Notice of Internet Availability of Proxy Materials, or the enclosed proxy card or voting instruction form, and follow the on-screen instructions. You will need the control number included on your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form. If you vote by Internet, you do not need to mail your proxy card or voting instruction form.

Telephone

If you received a paper proxy card or voting instruction form and would like to vote your shares by telephone, please follow the instructions on the proxy card or voting instruction form. If you vote by telephone, you do not need to mail your proxy card or voting instruction form.

If you received a paper proxy card or voting instruction form and would like to vote your shares by mail, please follow the instructions on the proxy card or voting instruction form. Please be sure to sign and date your proxy card. If you do not sign your proxy card, your votes cannot be counted. Mail your proxy card or voting instruction form in the pre-addressed, postage-paid envelope.

2

In Person

You may also attend the Annual Meeting and vote in person, electronically. If you own your stock in street name and wish to vote your shares electronically at the Annual Meeting, you must obtain a “legal proxy” from the bank or brokerage firm that holds your shares. You should contact your bank or brokerage account representative to obtain a legal proxy. However, to ensure your shares are represented, we ask that you vote your shares by Internet, telephone or mail, even if you plan to attend the meeting.

Participation in the Annual Meeting

Due to continuing concerns regarding the COVID-19 pandemic and to assist in protecting the health and well-being of our stockholders, directors and employees, this year’s Annual Meeting will be in an online format. You can access the virtual annual meeting at the meeting time at www.virtualshareholdermeeting.com/UAA2021. The virtual meeting has been designed to provide the same rights to participate as you would have at an in-person meeting.

Holders of our Class A Stock, Class B Stock and Class C Stock may attend the virtual Annual Meeting. During the virtual meeting, holders of our Class A Stock and Class B Stock may ask questions and will have the opportunity to vote to the same extent as they would at an in-person meeting of stockholders. However, holders of our Class C Stock may participate in the virtual Annual Meeting in a view-only format and will not be able to submit questions during the meeting or vote on any matter to be considered at the Annual Meeting. However, in advance of the meeting, holders of our Class C Stock may submit questions by contacting Investor Relations through the Under Armour website. We will respond to as many inquiries at the Annual Meeting as time allows.

The Annual Meeting will begin promptly at 10:00 a.m., Eastern Time. Online check-in will begin at 9:45 a.m., Eastern Time, and you should allow ample time for the online check-in procedures. If you plan to attend the Annual Meeting, you will need the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompany your proxy materials. If you are a holder of Class C Stock, you may attend the Annual Meeting without a 16- digit control number by following the instructions in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompany your proxy materials. If any difficulties are encountered while accessing the virtual meeting, contact the technical support number that will be posted on the virtual meeting log-in page. Technical support will be available beginning at the check-in time and will remain available until the meeting has ended.

Revocation

If you are the record holder of your shares, you may revoke or cancel a previously granted proxy at any time before the Annual Meeting by delivering to the Secretary of Under Armour at 1020 Hull Street, Baltimore, Maryland 21230, a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person electronically. Any stockholder owning shares in street name may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the shares or by obtaining a legal proxy from the bank or brokerage firm and voting in person electronically at the Annual Meeting. Your attendance at the meeting does not revoke your proxy. Your last vote, prior to or at the Annual Meeting, is the vote that will be counted.

Abstentions and Broker Non-Votes

Shares held by stockholders present at the Annual Meeting in person (virtually) or by proxy who do not vote on a matter and ballots or proxies marked “abstain” or “withheld” on a matter will be counted as present at the meeting for quorum purposes, but will not be considered votes cast on the matter.

3

If your shares are held in street name through a bank or broker and you do not provide voting instructions before the Annual Meeting, your bank or broker may vote your shares under certain circumstances in accordance with the New York Stock Exchange rules governing banks and brokers. These circumstances include “routine matters,” such as the ratification of the appointment of our independent registered public accounting firm described in this Proxy Statement. Thus, if you do not vote your shares with respect to these matters, your bank or broker may vote your shares on your behalf or leave your shares unvoted.

The election of directors and the advisory approval of our executive compensation are not considered “routine matters.” Thus, if you do not vote your shares with respect to any of these matters, your bank or broker may not vote the shares, and your shares will be left unvoted on the matter.

“Broker non-votes” (which are shares represented by proxies, received from a bank or broker, that are not voted on a matter because the bank or broker did not receive voting instructions from the beneficial owner) will be treated the same as abstentions, which means they will be present at the Annual Meeting and counted toward the quorum, but they will not be counted as votes cast on the matter. Abstentions and broker non-votes will not have an effect on any of the proposals at this meeting because they will not be counted as votes cast.

Householding

The SEC permits us to send a single set of proxy materials to any household at which two or more stockholders reside, unless contrary instructions have been received, but only if we provide advance notice and follow certain procedures. This process, referred to as householding, reduces the volume of duplicate information and reduces printing and mailing expenses. We have not instituted householding for stockholders of record. Certain brokerage firms may have instituted householding for beneficial owners of our common stock held through brokerage firms. If your family has multiple accounts holding our shares, you may have already received a householding notice from your broker. Please contact your broker directly if you have any questions or require additional copies of the proxy materials. The broker will arrange for delivery of a separate copy of this Proxy Statement or our Annual Report promptly upon your written or oral request. You may decide at any time to revoke your decision to household and begin receiving multiple copies.

Solicitation of Proxies

We pay the cost of soliciting proxies for the Annual Meeting. We solicit by mail and arrangements are made with brokerage houses and other custodians, nominees and fiduciaries to send proxy materials to beneficial owners. Upon request, we will reimburse them for their reasonable expenses. In addition, our directors, officers and employees may solicit proxies, either personally or by telephone, facsimile or written or electronic mail. Stockholders are requested to return their proxies without delay.

4

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS OF SHARES

The following table sets forth certain information known to us regarding the beneficial ownership of shares of our common stock by:

| • | each current director and nominee for director; |

| • | our named executive officers included in the 2020 Summary Compensation Table; |

| • | all of our directors and executive officers as a group; and |

| • | each person, or group of affiliated persons, known to us to beneficially own more than 5% of any class of our outstanding shares of Class A Stock. |

Except as otherwise set forth in the footnotes below, the address of each beneficial owner is c/o Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, and, to our knowledge, each person has sole voting and investment power over the shares shown as beneficially owned. Unless otherwise noted, the information is stated as of February 26, 2021, the Record Date for the Annual Meeting. No shares in this table held by our directors or executive officers are pledged as security. The table below does not include restricted stock unit, or RSU, awards with shares issuable more than 60 days from February 26, 2021, stock options exercisable more than 60 days from February 26, 2021, or any RSUs or stock options with performance based vesting conditions that have not yet been satisfied. With respect to our 5% stockholders, the table below does not present their ownership of our Class C Stock due to its non-voting status.

| Class A and Class B Stock | Class C Stock | |||||||||||||||||||

| Beneficial Owner |

Beneficially Owned Shares(1) |

Percentage of Shares of Class Outstanding(2) |

Beneficially Owned Shares(1) |

Percentage of Shares of Class Outstanding |

Percentage of Voting Power(3) |

|||||||||||||||

| Kevin A. Plank (4)(5) |

34,742,229 | 15.6% | 34,800,538 | 14.8% | 64.7% | |||||||||||||||

| Patrik Frisk (6) |

14,000 | * | 404,820 | * | * | |||||||||||||||

| George W. Bodenheimer (7) |

3,000 | * | 3,021 | * | * | |||||||||||||||

| Douglas E. Coltharp (7)(8) |

98,914 | * | 99,279 | * | * | |||||||||||||||

| Jerri L. DeVard (7) |

1,200 | * | 0 | * | * | |||||||||||||||

| Mohamed A. El-Erian (7) |

11,650 | * | 3,675 | * | * | |||||||||||||||

| Karen W. Katz (7)(9) |

2,000 | * | 2,014 | * | * | |||||||||||||||

| Westley Moore (7) |

0 | * | 0 | * | * | |||||||||||||||

| Eric T. Olson (7) |

0 | * | 0 | * | * | |||||||||||||||

| Harvey L. Sanders (7) |

184,480 | * | 185,640 | * | * | |||||||||||||||

| David Bergman (10) |

26,835 | * | 150,759 | * | * | |||||||||||||||

| Colin Browne (11) |

0 | * | 174,883 | * | * | |||||||||||||||

| Stephanie Pugliese (12) |

0 | * | 39,485 | * | * | |||||||||||||||

| All Executive Officers and Directors as a Group (7)(13) |

35,129,257 | 15.7% | 36,091,083 | 15.4 | % | 64.7% | ||||||||||||||

| 5% Stockholders |

||||||||||||||||||||

| Credit Suisse AG (14) |

10,429,442 | 4.7% | 2.0% | |||||||||||||||||

| Adage Capital Partners, L.P.(15) |

11,727,141 | 5.3% | 2.2% | |||||||||||||||||

| BlackRock, Inc. (16) |

11,815,151 | 5.3% | 2.2% | |||||||||||||||||

| The Vanguard Group (17) |

19,583,344 | 8.8% | 3.7% | |||||||||||||||||

| * | Less than 1% of the shares. |

5

| (1) | Includes any stock options exercisable within 60 days of February 26, 2021 or shares issuable within 60 days of February 26, 2021 upon the vesting of RSUs. |

| (2) | The percentage of outstanding figures take into account the 34,450,000 shares of outstanding Class B Stock held, directly or indirectly, by Mr. Plank. These shares of Class B Stock may be converted under certain circumstances, including at the option of Mr. Plank, into shares of Class A Stock. If the shares of Class B Stock are not counted, the percentage of outstanding Class A Stock owned is as follows: Mr. Plank, less than one percent; all executive officers and directors as a group, less than one percent; Credit Suisse AG, 5.5%; Adage Capital Partners, L.P.; 6.2%, BlackRock, Inc., 6.3%; and The Vanguard Group, 10.4%. |

| (3) | Each share of Class A Stock has one vote, and each share of Class B Stock has ten votes. The percentage of voting power reflects the combined effects of both Class A Stock and Class B Stock. Our Class C Stock is non-voting. |

| (4) | Includes 181,608 shares of Class A Stock beneficially owned by Mr. Plank, and 110,621 stock options for Class A Stock that are currently exercisable. Mr. Plank’s shares of Class A Stock are held by a limited liability company controlled by Mr. Plank and he holds sole voting and investment power over these shares. In addition, Mr. Plank beneficially owns 34,450,000 shares of Class B Stock indirectly, of which 29,510,624 shares of Class B Stock are held by a limited liability company controlled by Mr. Plank and he has sole voting and investment power over these shares. With respect to the remaining 4,939,376 of these shares of Class B Stock, 1,803,400 shares are held by two limited liability companies of which Mr. Plank is a member. Mr. Plank’s wife has been appointed as the manager of these two limited liability companies, and has voting control and investment power over the shares held by these companies. The remaining 3,135,976 shares of Class B Stock are held by an irrevocable trust, of which Mr. Plank is the grantor and has the ability to replace the trustee. Thomas J. Sippel, a former director of the company, has been appointed trustee of the trust and has voting control over the shares held by the trust and shares investment power with Mr. Plank. Because the 34,450,000 shares of Class B Stock beneficially owned by Mr. Plank, which are all the shares of Class B Stock outstanding, are convertible into shares of Class A Stock on a one-for-one basis under certain circumstances, including at the option of Mr. Plank, he is also deemed to be the beneficial owner of 34,450,000 shares of Class A Stock into which the Class B Stock may be converted. |

| (5) | Includes 980,943 stock options for Class C Stock that are currently exercisable. In addition, Mr. Plank beneficially owns an additional 33,819,595 shares of Class C Stock, and as detailed in Note (4) above, Mr. Plank’s wife has investment power over 1,765,845 of these shares, and Mr. Plank shares investment power with the trustee of the trust described in Note (4) over 3,107,880 of these shares. Does not include RSUs for 208,225 shares of Class C Stock. |

| (6) | Includes 14,000 shares of Class A Stock and 14,000 shares of Class C held in trust by Mr. Frisk. Does not include RSUs for 1,173,854 shares of Class C Stock. |

| (7) | Does not include deferred stock units, or DSUs, for shares of either Class A Stock or Class C Stock, or RSUs for shares of Class C Stock held by non-management directors. The RSUs will be converted into DSUs for Class C Stock on a one-for-one basis upon vesting. The DSUs will be settled in shares of our Class A Stock or Class C Stock, as applicable, on a one-for-one basis six months after the director leaves the Board, or sooner upon death or disability. As of the Record Date, the non-management directors held the following amounts of DSUs and RSUs: |

| Name |

Class A DSUs |

Class C DSUs |

Class C RSUs |

|||||||||

| George W. Bodenheimer |

5,390 | 56,631 | 17,626 | |||||||||

| Douglas E. Coltharp |

54,820 | 109,246 | 17,626 | |||||||||

| Jerri L. DeVard |

0 | 50,529 | 17,626 | |||||||||

| Mohamed A. El-Erian |

0 | 29,166 | 19,350 | |||||||||

| Karen W. Katz |

5,121 | 56,360 | 17,626 | |||||||||

| Westley Moore |

0 | 0 | 19,324 | |||||||||

| Eric T. Olson |

13,758 | 64,609 | 17,626 | |||||||||

| Harvey L. Sanders |

61,426 | 115,515 | 17,626 | |||||||||

6

| (8) | Includes 22,914 shares of Class A Stock owned by an irrevocable trust of which Mr. Coltharp’s wife is the trustee and his two children are the beneficiaries (the “Coltharp Trust”), 75,000 shares owned by his wife and 1,000 shares held by two Uniform Transfer to Minors Act accounts and 22,741 shares of Class C Stock owned by the Coltharp Trust, 75,532 shares owned by his wife and 1,006 shares held by two Uniform Transfer to Minors Act accounts. |

| (9) | Shares of Class A Stock and Class C Stock are held in trust. |

| (10) | Does not include RSUs for 168,409 shares of Class C Stock. |

| (11) | Does not include RSUs for 241,891 shares of Class C Stock. |

| (12) | Does not include RSUs for 214,520 shares of Class C Stock. |

| (13) | Includes shares shown as beneficially owned by the directors and executive officers as a group (17 persons). Does not include RSUs and DSUs for 2,551,222 shares of Class C Stock. |

| (14) | According to its report on Schedule 13G, as of December 31, 2020, Credit Suisse AG was deemed to beneficially own in the aggregate 10,429,442 shares of our Class A Stock. According to the Schedule 13G, the reporting persons had shared power to vote and dispose of all of these shares. The principal business address of Credit Suisse AG is Uetlibergstrasse 231, P.O. Box 900, CH 8070, Zurich, Switzerland. |

| (15) | According to their report on Schedule 13G, as of December 31, 2020, Adage Capital Partners, L.P. and certain affiliates of Adage Capital Partners, L.P., were deemed to beneficially own in the aggregate 11,727,141 shares of our Class A Stock held for investment advisory accounts. According to the Schedule 13G, the reporting persons had shared power to vote and dispose of all of these shares. The principal business address of Adage Capital Partners, L.P. is 200 Clarendon Street, 52nd Floor, Boston, Massachusetts 02116. |

| (16) | According to their report on Schedule 13G, as of December 31, 2020, BlackRock, Inc., or BlackRock, and certain affiliates of BlackRock, were deemed to beneficially own in the aggregate 11,815,151 shares of our Class A Stock. According to the Schedule 13G, the reporting persons had sole power to vote 10,372,814 shares and no power to vote 1,442,337 shares, and sole power to dispose of all of these shares. The principal business address of BlackRock is 55 East 52nd Street, New York, New York 10055. |

| (17) | According to their report on Schedule 13G, as of December 31, 2020, The Vanguard Group, or Vanguard, and certain affiliates of Vanguard, were deemed to beneficially own in the aggregate 19,583,344 shares of our Class A Stock. According to the Schedule 13G, the reporting persons had shared power to vote 290,507 and no power to vote 19,292,837 shares and sole power to dispose of 18,843,182 shares and shared power to dispose of 740,162 shares. The principal business address of Vanguard is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. |

7

(PROPOSAL 1)

Nine directors will be elected at the 2021 Annual Meeting to hold office until their successors are elected and qualified. There are nine nominees for election, each of whom is currently a member of our Board of Directors. Unless otherwise specified, the proxies received will be voted for the election of the following persons:

| Name | Position at Under Armour, Inc. | Independent | ||

| Kevin A. Plank

|

Executive Chairman and Brand Chief

|

No

| ||

| Douglas E. Coltharp

|

Director

|

✓

| ||

| Jerri L. DeVard

|

Director

|

✓

| ||

| Mohamed A. El-Erian

|

Lead Director

|

✓

| ||

| Patrik Frisk

|

Chief Executive Officer and President

|

No

| ||

| Karen W. Katz

|

Director

|

✓

| ||

| Westley Moore

|

Director

|

✓

| ||

| Eric T. Olson

|

Director

|

✓

| ||

| Harvey L. Sanders

|

Director

|

✓

|

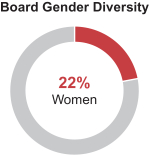

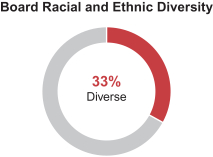

We view the effectiveness of our Board of Directors through an individual and collective lens. We endeavor to have a Board that represents a range of experiences, skills and attributes and embodies principles of diversity, including gender, race and ethnicity. We believe each director nominee contributes to this goal, as described below in the biographies included in “Nominees for Election at the Annual Meeting.” For additional information about how we identify and evaluate nominees for director, see “Corporate Governance and Related Matters—Identifying and Evaluating Director Candidates” below.

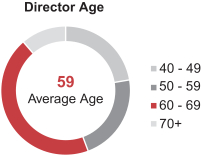

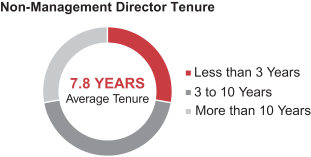

Snapshot of Director Nominees

|

|

|

8

|

|

|

Skills and Experiences of Director Nominees

Our Corporate Governance and Sustainability Committee and Board consider the following key experiences, skills and attributes when recommending a candidate to serve on our Board:

| ✓ | Executive Leadership and Strategy Experience: Directors who have served as CEOs or in other senior leadership roles at other organizations are uniquely positioned to advise, support and oversee our management team to achieve strategic priorities and long-term objectives and contribute practical insight into business strategy. |

| ✓ | Retail Industry Experience: Directors who have experience in the retail industry contribute a deep understanding of our fundamental business needs and industry risks. |

| ✓ | Technology, Digital and eCommerce Experience: Directors with experience in digital and technology, including managing cybersecurity risk and developing and overseeing eCommerce operations and strategy, provide critical perspective regarding our digital business strategies, technology resources and infrastructure and essential risk management functions. |

| ✓ | Marketing, Branding and Media Experience: Our brand’s strength and reputation and our connection with consumers is fundamental to our business and our strategy. Directors with consumer or brand marketing and media experience provide critical insights to our Board. |

| ✓ | Financial Expertise: We place high importance on financial discipline, accurate financial reporting and robust financial controls and compliance, and value directors with an understanding of finance and financial reporting processes. We seek to have multiple directors who qualify as audit committee financial experts. |

| ✓ | International Experience: Directors with exposure to and experience in global markets and/or diverse organizational structures, business environments and cultural perspectives (whether through the private or public sector) offer unique insight into our increasingly complex and expanding global operations. |

| ✓ | Public Company Board Experience: Directors who have served on other public company boards provide essential perspective with respect to board operations and dynamics, prioritizing stockholder interests and corporate governance best practices, including related to executive compensation, risk management and oversight of strategic, operational and compliance-related matters. |

9

We believe that the nine director nominees together provide diverse and relevant experiences to comprise a Board that is well-positioned to provide effective oversight of our company, as illustrated in the following chart:

Nominees for Election at the Annual Meeting

|

Director since our founding Age: 48

Founder, Executive Chairman and Brand Chief |

Kevin A. Plank Executive Chairman and Brand Chief of Under Armour, Inc.

Mr. Plank became Under Armour’s Executive Chairman and Brand Chief in January 2020, after serving as Chief Executive Officer and Chairman of the Board of Directors from 1996 to 2019, and President from 1996 to July 2008 and August 2010 to July 2017. Mr. Plank also serves on the Board of Directors of the National Football Foundation and College Hall of Fame, Inc., and is a member of the Board of Trustees of the University of Maryland College Park Foundation.

As our founder, Brand Chief and controlling stockholder since our inception in 1996 and as the driving force behind our innovative products and our brand, Mr. Plank is uniquely qualified to serve on and lead our Board given his experience, knowledge of our industry and business and strategic vision and insight. | |

10

|

Director since December 2004 Age: 59

Independent

Board Committees:

• Audit (Chair)

• Finance and Capital Planning (Chair)

|

Douglas E. Coltharp Executive Vice President and Chief Financial Officer of Encompass Health Corporation

Since May 2010, Mr. Coltharp has served as Executive Vice President and Chief Financial Officer of Encompass Health Corporation (formerly HealthSouth Corporation). Before that, Mr. Coltharp served as a partner at Arlington Capital Advisors and Arlington Investment Partners, a Birmingham, Alabama based financial advisory and private equity business from May 2007 to April 2010 and as Executive Vice President and Chief Financial Officer of Saks Incorporated and its predecessor organization from 1996 to May 2007.

Mr. Coltharp’s qualifications to serve on our Board include his financial expertise and past executive leadership experience in the consumer retail sector, including 11 years as Chief Financial Officer of Saks Incorporated, a leading publicly traded consumer retailer, and his more recent executive leadership experience as Executive Vice President and Chief Financial Officer of a large publicly traded company, Encompass Health Corporation. | |

|

Director since Age: 62

Independent

Board Committees:

• Human Capital and Compensation

• Corporate Governance and Sustainability |

Jerri L. DeVard Former Executive Vice President, Chief Customer Officer of Office Depot, Inc.

Ms. DeVard served as Executive Vice President, Chief Customer Officer of Office Depot, Inc. from January 2018 to March 2020, leading their eCommerce and Customer Service functions and Marketing and Communications and as Executive Vice President and Chief Marketing Officer from September 2017 to December 2017. Before that, Ms. DeVard served as Senior Vice President and Chief Marketing Officer of The ADT Corporation, a leading provider of home and business security services, from March 2014 through May 2016. From July 2012 to March 2014, she was Principal of DeVard Marketing Group, a firm specializing in advertising, branding, communications and traditional/digital/multicultural marketing strategies. Before that, she served as Executive Vice President of Marketing for Nokia. Ms. DeVard served in a number of senior marketing roles throughout her career, including as Senior Vice President of Marketing and Senior Vice President, Marketing Communications and Brand Management of Verizon Communications, Inc., Chief Marketing Officer of the e-Consumer business at Citibank N.A. and other senior marketing positions at Revlon Inc., Harrah’s Entertainment, the NFL’s Minnesota Vikings and the Pillsbury Company. Ms. DeVard currently serves on the Board of Directors of Cars.com and is a member of its Compensation and Nominating and Governance Committees.

Ms. DeVard’s qualifications to serve on our Board include her broad-based and significant experience in marketing and branding and digital and eCommerce, as well as her executive leadership experience with a number of large global brands.

| |

11

|

Director since October 2018 Age: 62

Independent

Lead Director

Board Committees:

• Audit

• Finance and Capital Planning |

Mohamed A. El-Erian Former Chief Executive Officer and Co-Chief Investment Officer of PIMCO

Dr. El-Erian served as CEO and Co-Chief Investment Officer of PIMCO, one of the world’s premier investment management firms, from December 2007 to March 2014. He currently serves as Chief Economic Advisor of Allianz, the corporate parent of PIMCO, a role he has held since March 2014, and is the President of Queens’ College, Cambridge. Dr. El-Erian joined PIMCO in 1999 as a senior member of the portfolio management and investment strategy group. In February 2006, he became president and CEO of Harvard Management Company, the entity responsible for managing the university’s endowment, before returning to PIMCO in 2007 to serve as co-CEO and co-CIO. From December 2012 to January 2017, he was chair of the U.S. President’s Global Economic Development Council. Previously, he was a managing director at Salomon Smith Barney/Citigroup in London and worked at the International Monetary Fund for 15 years, rising to the position of Deputy Director. He is a board member of the National Bureau of Economic Research serving on its Executive Committee, and chairs the Microsoft Investment Advisory Committee. Dr. El-Erian also serves as non-executive director of Barclays plc and is also a columnist for Bloomberg and a contributing editor at the Financial Times.

Dr. El-Erian’s qualifications to serve on our Board include his financial expertise, his significant international, macroeconomic and government experience and his executive leadership experience gained through his past roles, including as CEO and Co-Chief Investment Officer of PIMCO.

| |

|

Director since January 2020 Age: 58

Chief Executive |

Patrik Frisk Chief Executive Officer and President of Under Armour, Inc.

Mr. Frisk was appointed Chief Executive Officer and President of Under Armour and a member of its Board of Directors in January 2020, after serving as President and Chief Operating Officer since July 2017 when he joined the company. Mr. Frisk has more than 30 years of experience in the apparel, footwear and retail industry. Before joining Under Armour, he was Chief Executive Officer of The ALDO Group, a global footwear and accessories company. Before that, he spent more than a decade with VF Corporation where he held numerous leadership positions including Coalition President of Outdoor Americas (The North Face® and Timberland®), President of the Timberland® brand, President of Outdoor & Action Sports (EMEA), and Vice President and General Manager of The North Face®. Before joining VF Corporation, Mr. Frisk ran his own retail business in Scandinavia and held senior positions with Peak Performance and W.L. Gore & Associates.

Mr. Frisk’s qualifications to serve on our Board include his extensive leadership experience in the apparel, footwear and retail industry and serving as our current CEO.

| |

12

|

Director since October 2014 Age: 64

Independent

Board Committees:

• Audit

• Finance and Capital Planning |

Karen W. Katz Former President and Chief Executive Officer of Neiman Marcus Group LTD LLC

Ms. Katz served as President and CEO of Neiman Marcus Group LTD LLC, one of the world’s leading luxury and fashion retailers, from 2010 to February 2018. Having joined Neiman Marcus in 1985, Ms. Katz served in key executive and leadership roles in the company’s merchant, stores and eCommerce organizations as Executive Vice President—Stores, a member of the Office of the Chairman of Neiman Marcus Group, and President, Neiman Marcus Online, and President and CEO, Neiman Marcus Stores. Ms. Katz serves on the Board of Directors of Humana Inc. and is a member of its Nominating, Governance & Sustainability and Technology Committees, on the Board of Directors of Casper Sleep Inc. and is a member of its Compensation Committee and Chair of its Nominating and Governance Committee and on the Board of Directors of The RealReal, Inc.

Ms. Katz’s qualifications to serve on our Board include her digital and eCommerce experience and her executive leadership experience in the consumer retail sector with Neiman Marcus Group, including as President and Chief Executive Officer.

| |

|

Director since October 2020 Age: 42

Independent

Board Committees:

• Corporate Governance and Sustainability |

Westley Moore Chief Executive Officer of the Robin Hood Foundation

Mr. Moore has served as Chief Executive Officer of the Robin Hood Foundation, one of New York City’s largest poverty-fighting organizations since April 2017. He has announced his expected departure effective May 2021. Before that, Mr. Moore founded and served as Chief Executive Officer of BridgeEdU, an innovative technology platform addressing the college completion and job placement crisis from July 2014 to February 2017 and served as its Chairman from June 2017 to June 2019, when it was acquired. Mr. Moore worked as an investment banker with Citigroup and served as a White House Fellow to Secretary of State Condoleezza Rice from 2006-2007. Mr. Moore is a decorated army combat veteran and a New York Times and Wall Street Journal bestselling author. Mr. Moore currently serves on the Board of Directors of Longview Acquisition Corp. and is a member of its Audit, Compensation and Nominating and Corporate Governance Committees, on the Board of Directors of Green Thumb Industries Inc. and is a member of its Audit and Compensation Committees and on the Board of Directors of IAC/INTERACTIVECORP.

Mr. Moore’s qualifications to serve on our Board include his wide-ranging experiences in digital and technology, government, entrepreneurship and executive leadership, including as the Chief Executive Officer of the Robin Hood Foundation and the founder and former Chief Executive Officer and Chairman of BridgeEdU.

| |

13

|

Director since July 2012 Age: 69

Independent

Board Committees:

• Corporate Governance and Sustainability (Chair) |

Eric T. Olson Admiral U.S. Navy (Retired) and former Commander of U.S. Special Operations Command

Admiral Olson retired from the United States Navy in 2011 as an Admiral after 38 years of military service. He served in special operations units throughout his career, during which he earned a Master’s Degree in National Security Affairs and was awarded several decorations for leadership and valor including the Defense Distinguished Service Medal and the Silver Star. Admiral Olson’s career culminated as the head of the United States Special Operations Command from July 2007 to August 2011, where he was responsible for the mission readiness of all Army, Navy, Air Force, and Marine Corps special operations forces. In this capacity, he led over 60,000 people and managed an annual budget in excess of ten billion dollars. Admiral Olson served as Chief Executive Officer of HANS Premium Water, a clean water solution for homes, from June 2019 to May 2020. He has served as President and Managing Member of ETO Group, LLC since September 2011, supporting a wide range of private and public sector organizations. Admiral Olson also serves on the Board of Directors of Iridium Communications, Inc. and is a member of its Nominating and Corporate Governance committee. Admiral Olson also serves as Chairman Emeritus of the non-profit Special Operations Warrior Foundation.

Admiral Olson’s qualifications to serve on our Board include his experience in technology and his significant government and leadership experience as an Admiral in the United States Navy, including his management of a large and complex organization as head of the United States Special Operations Command.

| |

|

Director since Age: 71

Independent

Board Committees:

• Human Capital and Compensation (Chair) |

Harvey L. Sanders Former Chief Executive Officer and Chairman of Nautica Enterprises, Inc.

Mr. Sanders is the former Chairman of the Board of Directors, Chief Executive Officer and President of Nautica Enterprises, Inc. He served as Chairman from 1993 to 2003 and as Chief Executive Officer and President from 1977 to 2003, until VF Corporation acquired Nautica Enterprises, Inc. in 2003. Mr. Sanders currently serves as a member of the Board of Directors for the Boomer Esiason Foundation for Cystic Fibrosis and the enCourageKids Foundation and as a member of the Board of Trustees of the University of Maryland College Park Foundation.

Mr. Sanders’ qualifications to serve on our Board include his executive leadership experience in the consumer retail sector, including over 25 years as President and Chief Executive Officer and 10 years as Chairman of the Board of Nautica Enterprises, Inc., a former leading publicly-traded apparel brand and retailer. | |

14

The election of each director requires a plurality of the votes cast at the Annual Meeting.

The Board of Directors recommends that you vote “FOR” the election of the nine nominees for director.

George Bodenheimer, who has served as a director of our company since 2014, is not standing for reelection at the Annual Meeting. The Board thanks Mr. Bodenheimer for his many years of service to our company.

|

Director since August 2014 Age: 62

Independent

Board Committees:

• Human Capital and Compensation

• Corporate Governance and Sustainability |

George W. Bodenheimer Former President of ESPN, Inc. and ABC Sports

Mr. Bodenheimer served as Executive Chairman of ESPN, Inc., a multimedia, multinational sports entertainment company from January 2012 to June 2014, and served as Acting Chairman of ESPN from December 2017 to March 2018. Prior thereto, he served as Co-Chairman of Disney Media Networks from April 2004 to January 2012, President of ABC Sports from March 2003 to January 2012 and President of ESPN from November 1998 to January 2012. With ESPN since 1981, Mr. Bodenheimer served in a variety of senior sales and marketing positions before he was appointed as President. From September 2013 to September 2020, Mr. Bodenheimer served on the Board of Directors of Sirius XM Holdings, Inc. | |

15

CORPORATE GOVERNANCE AND RELATED MATTERS

Corporate Governance Highlights

Our Board of Directors has a long-standing commitment to sound and effective corporate governance, which begins with and fully reflects our Purpose and Values, set forth at the beginning of this Proxy Statement. Our strong corporate governance practices, including those highlighted below, are codified in our Corporate Governance Guidelines and other key governance documents, and demonstrate the commitment of our Board of Directors to enabling an effective structure to support the successful oversight of our business and long-term objectives:

| ✓ | Separate Chairman and CEO |

| ✓ | Lead independent director |

| ✓ | Majority independent Board |

| ✓ | Fully independent Board committees |

| ✓ | Regular executive sessions of non-management directors |

| ✓ | Risk oversight |

| ✓ | Full access to management and internal and external auditors |

| ✓ | Board and committees have authority to engage independent advisors as they deem appropriate |

| ✓ | Board oversight of succession planning for the CEO and other senior management |

| ✓ | Annual Board and committee self-evaluation |

Our governing documents provide our Board of Directors discretion to combine or separate the positions of Chairman and Chief Executive Officer as it may deem appropriate in light of prevailing circumstances. Currently, Kevin Plank serves as our Executive Chairman and Brand Chief, and Patrik Frisk serves as our Chief Executive Officer and President and a member of the Board. We believe that the current separation of the roles of Chairman and Chief Executive Officer is appropriate given our company’s strategic and operational priorities. This structure allows the Chief Executive Officer to focus on our company’s business, operations and strategy, while continuing to leverage the Chairman’s experience, perspective and vision.

To further strengthen our corporate governance structure and provide independent oversight of our company, on an annual basis our non-management directors elect an independent director to serve as Lead Director. Dr. El-Erian has been elected to serve as our Lead Director. He acts as a liaison between our Board’s non-management directors and Mr. Plank, Mr. Frisk and the other members of our management team, chairs regular executive sessions of the Board without Mr. Plank and Mr. Frisk present, and performs other functions as requested by the non-management directors.

Our Board of Directors currently consists of ten directors, eight of which (80%) are independent non-management directors. George Bodenheimer, who has served as an independent director of our company since 2014, is not standing for reelection at the Annual Meeting.

The Board has determined that the following seven directors standing for election at our 2021 Annual Meeting are independent under the corporate governance listing standards of the New York

16

Stock Exchange, or NYSE: Douglas E. Coltharp, Jerri L. DeVard, Mohamed A. El-Erian, Karen W. Katz, Westley Moore, Eric T. Olson and Harvey L. Sanders. Mr. Plank and Mr. Frisk are not independent because they are our Executive Chairman and Brand Chief and Chief Executive Officer, respectively.

Our charter includes additional factors for the Board to consider when determining whether a director will be “independent” under the NYSE standards. Specifically, the Board must consider whether any independent directors have any material financial or service relationship with Mr. Plank or any of his family members. The Board has considered these factors and determined that none of the independent directors have any such relationships. A copy of our charter that includes these requirements is available through our website at https://about.underarmour.com/investor- relations/governance, under “Investors-Corporate Governance.”

Role of Board in Risk Oversight

Our Board of Directors is responsible for overseeing our management team’s overall approach to risk management. Our Board of Directors regularly reviews our financial and strategic plans and objectives, including the risks that may affect the achievement of these plans and objectives, and receives regular reports from our Chief Executive Officer, Chief Financial Officer, General Counsel and other key executive officers regarding various enterprise risk matters. In accordance with our Corporate Governance Guidelines, our non-management directors also meet at least once each year in executive session with our Chairman and Chief Executive Officer to review succession planning for our Chief Executive Officer and other senior executive positions.

In addition, our Board of Directors has delegated to each Board committee primary responsibility to oversee the management of risks that fall within their respective areas of responsibility, as described further below. In performing this function, each Board committee has full access to management, as well as the ability to engage independent outside advisors. At each Board meeting, the chairperson of each Board committee reports on the applicable committee’s activities, including risk management, which provides an opportunity to discuss significant risks with the full Board.

| • | Audit Committee: Under its charter, the Audit Committee’s responsibilities include inquiring of management and our independent registered public accounting firm about significant financial risks or exposures, the company’s processes and policies for risk assessment and the steps management has taken to mitigate these risks to the company. The committee receives periodic reports from management on our enterprise risk management program and our risk mitigation efforts. The committee also oversees our legal and regulatory compliance programs and our internal audit function and receives regular reports regarding our cybersecurity risks, with at least one comprehensive briefing by senior management annually and periodic updates as appropriate. |

| • | Human Capital and Compensation Committee: The Human Capital and Compensation Committee has the responsibility to review the risks of our compensation policies and practices, including the review of our annual compensation risk assessment. Beginning in 2021, the committee also oversees risks related to our company’s key human capital management strategies and programs, including relating to diversity, equity and inclusion. |

| • | Corporate Governance and Sustainability Committee: Beginning in late 2020, the Corporate Governance and Sustainability Committee oversees risks relating to sustainability, including environmental and human rights issues and impacts. |

| • | Finance and Capital Planning Committee: The Finance and Capital Planning Committee oversees certain financial matters and risks relating to our capital structure and liquidity, hedging and foreign currency transactions, acquisitions and divestitures and significant capital projects. |

17

Our Board meets regularly throughout the year. During 2020, there were 13 meetings of the Board and several committee meetings as noted in the table below, including several special meetings relating to key financing transactions, the divestiture of the MyFitnessPal platform and the COVID-19 pandemic. In 2020, all directors attended at least 75% of the aggregate meetings of the Board and the committees of which they were members during that period. In accordance with our Corporate Governance Guidelines, our non-management directors also meet in executive sessions without management at each regularly scheduled Board meeting.

Our Board has the following four standing committees: an Audit Committee, a Human Capital and Compensation Committee, a Corporate Governance and Sustainability Committee and a Finance and Capital Planning Committee. The table below provides current membership and meeting information for 2020 for each of these committees.

| Name | Audit Committee | Human Capital and Compensation |

Corporate Governance and Sustainability Committee |

Finance and Capital Planning Committee | ||||

| George W. Bodenheimer(1)

|

✓

|

✓

|

||||||

| Douglas E. Coltharp

|

C

|

C

| ||||||

| Jerri L. DeVard

|

✓

|

✓

|

||||||

| Mohamed A. El-Erian

|

✓

|

✓

| ||||||

| Karen W. Katz

|

✓

|

✓

| ||||||

| Westley Moore(2)

|

✓

|

|||||||

| Eric T. Olson

|

C

|

|||||||

| Harvey L. Sanders

|

C

|

|||||||

| Total Meetings in 2020 |

14 | 8 | 5 | 9 |

✓ = Committee Member

C = Committee Chair

| (1) | Mr. Bodenheimer is not standing for reelection at the Annual Meeting. |

| (2) | Upon being appointed to our Board, Mr. Moore became a member of the Corporate Governance and Sustainability Committee on October 1, 2020. |

The functions performed by these standing committees are summarized below and are set forth in more detail in their charters. The complete text of the charters for each standing committee can be found on our website at https://about.underarmour.com/investor-relations/governance, under “Investors-Corporate Governance.” The Board has determined that each member of the Audit, Human Capital and Compensation and Corporate Governance and Sustainability Committees is independent as required under NYSE listing standards and our charter. Each member of our Finance and Capital Planning Committee is also independent.

Audit Committee

The Audit Committee assists the Board of Directors with oversight of matters relating to accounting, internal control, auditing, financial reporting, risk and legal and regulatory compliance. The committee oversees the audit and other services provided by our independent registered public accounting firm, and is directly responsible for the appointment, independence, qualifications, compensation and oversight of the independent registered public accounting firm, which reports directly to the committee. The committee also oversees the company’s internal audit function and the chief audit executive, who reports directly to the committee. The Audit Committee Report for 2020 is included in this Proxy Statement under “Audit Committee Report.”

18

The Board has determined that all of the committee members are independent, financially literate and qualify as “audit committee financial experts” under SEC rules and NYSE listing standards.

Human Capital and Compensation Committee

The Human Capital and Compensation Committee approves the compensation of our Chief Executive Officer, or CEO, and our other executive officers, administers our executive benefit plans, including the granting of awards under our equity incentive plans, and advises the Board on director compensation. In February 2021, the Board expanded the role and responsibilities of the Compensation Committee, renamed the Human Capital and Compensation Committee, to include primary oversight of our company’s key human capital management strategies and programs, including relating to diversity, equity and inclusion.

Our CEO, Executive Chairman and Brand Chief and other senior executives evaluate the performance of our executive officers and make recommendations to the Human Capital and Compensation Committee concerning their compensation. The committee considers these evaluations and recommendations, and its evaluation of the Executive Chairman and Brand Chief and the CEO in determining the compensation of our Executive Chairman and Brand Chief, CEO and our other executive officers.

The Human Capital and Compensation Committee is also primarily responsible for reviewing and assessing risks arising from our compensation policies and practices. In early 2021, the committee conducted, with the assistance of management, a risk assessment of our compensation policies and practices, which included a review of our material compensation programs, the structure and nature of these programs, the short-term and long-term performance incentive targets used in these programs and how they relate to our business plans and creating stockholder value, corporate governance policies with respect to our compensation programs and other aspects of our compensation programs. Based on this review and assessment, the committee concluded that the risks related to our compensation policies and practices are not reasonably likely to have a material adverse effect on our company.

Pursuant to its charter, the Human Capital and Compensation Committee has the authority to obtain advice and assistance from advisors, including compensation consultants. In 2020, the committee engaged the services of an independent compensation consultant, Willis Towers Watson, or WTW, to provide executive compensation consulting services to the committee. This independent consultant reports directly to the committee and the committee retains sole authority to retain and terminate the consulting relationship. In carrying out its responsibilities, the independent consultant collaborates with management to obtain data, provide background on compensation programs and practices, and clarify pertinent information. The committee obtained from the independent consultant competitive market data on compensation for executives to assess generally the competitiveness of our executive compensation. The competitive market data was based on a peer group and WTW’s published industry survey data. The committee generally has not relied on the independent consultant to determine or recommend the amount or form of executive compensation.

Additional information concerning the processes and procedures for considering and determining executive officer compensation is included in the “Compensation Discussion and Analysis” section of this Proxy Statement. The Human Capital and Compensation Committee Report for 2020 is included under the “Human Capital and Compensation Committee Report” section of this Proxy Statement.

A description of the compensation program for our non-management directors, including updates to the program for 2021, is included below under the “—Compensation of Directors” section of this Proxy Statement. In late 2020, management researched director compensation practices of competitor companies and reviewed the data with the committee. The committee also reviewed a summary of published third-party surveys on public company director compensation practices of similarly sized

19

companies and director compensation of industry peers. These materials were shared with and reviewed by WTW, the committee’s independent consultant.

Corporate Governance and Sustainability Committee

The Corporate Governance and Sustainability Committee identifies individuals qualified to become members of our Board of Directors, recommends candidates for election or reelection to our Board, oversees the evaluation of our Board and advises our Board regarding committee composition and structure and other corporate governance matters, including reevaluating our Corporate Governance Guidelines on an annual basis. In November 2020, the Board expanded the role and responsibilities of the Corporate Governance Committee, renamed the Corporate Governance and Sustainability Committee, to also oversee our company’s significant strategies, programs, policies and practices relating to sustainability (including environmental and human rights issues and impacts) and corporate responsibility.

Finance and Capital Planning Committee

The Finance and Capital Planning Committee assists our Board in overseeing our company’s financial and capital investment policies, planning and activities, including matters relating to our capital structure and liquidity, hedging and foreign currency transactions, acquisitions and divestitures and capital projects.

Stockholders Meeting Attendance

Directors are encouraged to attend annual meetings of stockholders, but we have no specific policy requiring directors’ attendance at such meetings. All of our directors who were directors at that time attended our 2020 Annual Meeting of Stockholders.

Identifying and Evaluating Director Candidates

The Corporate Governance and Sustainability Committee recommends to the Board candidates to fill vacancies or for election or reelection to the Board. The Board then appoints new Board members to fill vacancies or nominates candidates each year for election or reelection by stockholders. The committee does not have a specific written policy or process regarding the nominations of directors, nor does it maintain minimum standards for director nominees other than as set forth in the committee’s charter as described below.

The Corporate Governance and Sustainability Committee’s charter requires the committee to establish criteria for selecting new directors, which reflects at a minimum a candidate’s strength of character, judgment, business experience, specific areas of expertise, factors relating to the composition of the Board, including its size and structure, and principles of diversity, including gender, race and ethnicity. The committee also considers the statutory requirements applicable to the composition of the Board and its committees, including the NYSE’s independence requirements. The committee considers each candidate’s experiences, skills and attributes relative to what skills and experiences can best contribute to our Board’s effective operation, particularly in light of our company’s evolving needs and long-term strategy. We believe the nominees for election to the Board contribute a wide range of experiences, skills and attributes to comprise a Board that is well-positioned to provide effective oversight of our company, as illustrated above in each director’s biography set forth in “Election of Directors—Nominees for Election at the Annual Meeting” and the charts included in “Election of Directors—Overview of Director Nominees.”

The Board has not established term limits for directors because of the concern that term limits may deprive the company and its stockholders of the contribution of directors who have developed valuable insights into the company and its operations over time. The tenure of our non-management directors

20

ranges from less than one to sixteen years, with an average tenure of 7.8 years. We have added three new independent directors since mid-2017. We believe the tenure of our Board members provides an appropriate balance of expertise, experience, continuity and perspective that serves the best interests of our stockholders. Our Corporate Governance Guidelines do provide that a director is expected not to stand for reelection after the age of 75. For additional information regarding the age and tenure of the nine director nominees for election at the Annual Meeting, see “Election of Directors.”

The Corporate Governance and Sustainability Committee does not have a formal policy with respect to considering diversity, including gender, race and ethnicity, in identifying director nominees. Consistent with the committee’s charter, when identifying director nominees, the committee considers general principles of diversity, and does so in the broadest sense, considering diversity in terms of business leadership, experience, industry background and geography, as well as gender, race and ethnicity. However, the committee and the Board believe that considering gender, racial and ethnic diversity is consistent with creating a Board that best serves our company’s needs and the interests of our stockholders, and they are important factors considered when identifying individuals for Board membership. The committee strives for directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and oversight of our business, and we hope to continue to attract directors with a broader range of backgrounds and experiences. For additional information regarding the diversity of the nine director nominees for election at the Annual Meeting, see “Election of Directors—Overview of Director Nominees.”

The Corporate Governance and Sustainability Committee periodically considers criteria for identifying possible new director candidates as needed, in consultation with the CEO and Chairman of the Board and other Board members and management, and works with management and other Board members in recruiting new candidates. Candidates identified through this process are considered by the full committee for possible recommendation to the Board. From time to time, the committee uses the services of a third-party search firm to assist it in identifying and screening candidates. Mr. Moore was elected to the Board in October 2020. Mr. Plank, our Executive Chairman and Brand Chief and largest stockholder, recommended Mr. Moore to our Corporate Governance and Sustainability Committee for consideration, which unanimously recommended him for nomination.

In addition, the Corporate Governance and Sustainability Committee will consider director candidates suggested by stockholders. Any stockholder who wishes to recommend a director candidate for consideration by the committee may do so by submitting the candidate’s name and qualifications to the committee’s chairman. See “Communications with Directors” above for how to communicate with the chairman of the committee. Our Bylaws include requirements for direct nominations by a stockholder of persons for election to our Board. These requirements are described under “Stockholder Proposals” at the end of this Proxy Statement.

Environmental, Social and Governance Oversight

We are a purpose-led, values-based organization. Our Purpose — We Empower Those Who Strive for More — articulates why Under Armour exists. Our Values, which are listed at the beginning of this Proxy Statement, capture the beliefs and behaviors that shape our culture and define how we operate as a company and global citizen. Our Purpose and Values steer the ambitions we set as an organization, the questions we ask to guide our strategy and planning, the decisions we make for our culture and brand and the actions we take, including with respect to environmental and social issues.

Sustainability

Beginning in November 2020, our Board of Directors has delegated to our Corporate Governance and Sustainability Committee oversight of our significant sustainability strategies, programs, policies and practices. The committee receives regular updates from our Chief Sustainability Officer on these

21

matters, and reviews and approves significant sustainability and corporate responsibility policies and reports.

Our corporate strategy is based on responsible business practices, including a commitment to sustainability and championing human rights. Our sustainability strategies and goals are reviewed and approved by our Chief Executive Officer and President, our Executive Leadership Team and our Sustainability Leadership Council, composed of our Chief Sustainability Officer, Chief Operating Officer, Chief Product Officer and General Counsel. Our Sustainability team, led by our Chief Sustainability Officer, is responsible for the implementation and day-to-day management of our sustainability program, which addresses environmental and human rights issues and impacts. We encourage you to learn more about our sustainability initiatives by reviewing our website at https://about.underarmour.com/community/sustainability.

Diversity, Equity and Inclusion

Our commitment to diversity, equity and inclusion starts with our Board of Directors and its ongoing commitment to considering principles of diversity, including gender, race and ethnicity, in identifying new director candidates, as described in “Identifying and Evaluating Director Candidates” above. In 2020, our Board of Directors received regular updates on our diversity, equity and inclusion strategy and initiatives. Beginning in 2021, our Board has delegated to our Human Capital and Compensation Committee oversight of our key human capital management strategies and programs, including with respect to diversity, equity and inclusion. The committee regularly reviews our progress towards achieving our diversity, equity and inclusion goals.

Our Purpose challenges us continually to protect and evolve our culture. Our Values reflect our foundational belief that having an engaged, diverse and committed workforce enhances our culture and drives our business success, ultimately helping us deliver the most innovative products that make athletes better. We have set measurable goals for improving diversity amongst our team, including a commitment to increase the number of historically underrepresented employees throughout our leadership levels by 2023. These goals are publicly outlined at https://about.underarmour.com/community/diversity-equity-inclusion, where we also publish our representation statistics annually. We are also committed to increasing representation of women in our business’s critical areas, particularly in leadership, commercial and technical roles globally. Our annual incentive plan for all employees, including our executives as described below in “Executive Compensation—Compensation Discussion and Analysis—Components of Our 2020 Compensation Program”, incorporates performance measures to further our diversity, equity and inclusion goals.

Availability of Corporate Governance Information

For additional information on our corporate governance, including Board committee charters, our Corporate Governance Guidelines and our code of business conduct and ethics, visit our investor relations website at https://about.underarmour.com/investor-relations/governance, under “Investors- Corporate Governance.”

Our Board of Directors has adopted stock ownership guidelines to align the financial interests of the company’s executives and non-management directors with the interests of our stockholders. The guidelines currently provide that executive officers should own company stock with a value at least equal to six times the annual base salary for the Chief Executive Officer, three times annual base salary for Executive Vice Presidents and one times annual base salary for all other executive officers, in each case based on the average closing price of our stock for the prior calendar year. The guidelines provide that non-management directors should own company stock with a value at least

22

equal to three times the amount of the annual retainer paid to directors. Executive officers are expected to achieve the stock ownership levels under these guidelines within five years of their hire or promotion to executive officer and non-management directors within three years of joining our Board. The company’s stock ownership guidelines can be found on our website at https://about.underarmour.com/investor-relations/governance, under “Investors-Corporate Governance.”

All executive officers and non-management directors are in compliance with the guidelines as of the last measuring date, except for persons new to their roles within the last few years. We anticipate our remaining executive officers and non-management directors will be in compliance with the guidelines within the required time frame.

If stockholders or other interested parties wish to communicate with non-management directors, they should write to Under Armour, Inc., Attention: Corporate Secretary, 1020 Hull Street, Baltimore, Maryland 21230. Further information concerning contacting our Board is available through our investor relations website at https://about.underarmour.com/investor-relations/governance, under “Investors- Corporate Governance.”

Indemnification of Directors in Derivative Actions