Form DEF 14A US Foods Holding Corp. For: May 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

US Foods Holding Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

|

No fee required. | |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | |

| (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

|

Fee paid previously with preliminary materials. | |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

April 2, 2021

DEAR FELLOW

STOCKHOLDER:

On behalf of the Board of Directors, I am pleased to invite you to attend US Foods’ 2021 Annual Meeting of Stockholders on Thursday, May 20, 2021, at 9:00 a.m. (CDT). Because of the continuing public health risks related to the coronavirus (COVID-19) pandemic, this year’s annual meeting will again be held entirely online to support the health and safety of our associates and stockholders. Your vote is very important, and whether or not you plan to attend the virtual Annual Meeting, I encourage you to submit your vote as soon as possible.

During 2020, the U.S. foodservice industry faced unprecedented challenges as the COVID-19 pandemic caused substantial disruption across many of our customers’ operations and, in some cases, resulted in permanent closures of restaurants. As a company, we took several actions to increase liquidity, conserve cash, manage working capital, and reduce expenses to align with the decrease in demand. Among these actions, at the onset of the pandemic, our directors, executive leadership team, senior leaders and I determined to temporarily reduce our compensation.

We also acted quickly to protect the health and safety of our communities by directing associates whose functions could be performed remotely to work off site and implementing new protocols and enhanced safety measures to protect our frontline associates and customers, many of whom are “essential workers” and unable to work remotely. As we adapted to rapidly changing conditions, we also increased our efforts to stay connected with:

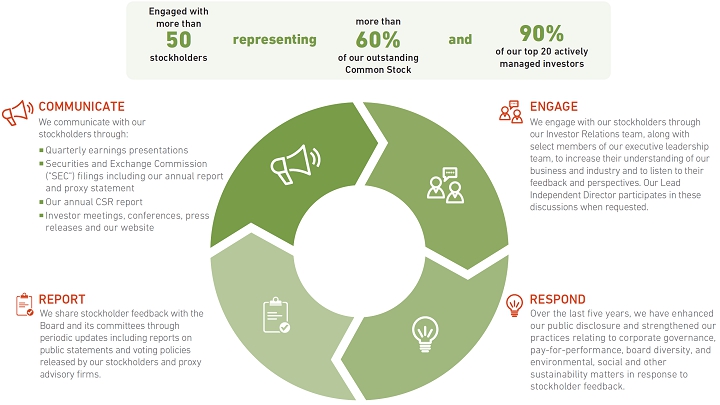

| ■ | Our investors, by providing COVID-19 related updates through press releases, earnings calls, investor presentations, participation in investor conferences and one-on-one stockholder engagements. During 2020, we engaged with more than 50 stockholders who collectively held more than 60% of our outstanding common shares. |

| ■ | Our directors, by holding more frequent meetings and providing periodic updates regarding the impact of COVID-19 on our industry and trends we were seeing within our operations. |

| ■ | Our associates, by enabling widespread video communications, providing more frequent updates, holding monthly town halls, and soliciting associate feedback through frequent “pulse” engagement surveys. |

| ■ | Our customers, by providing webinars, playbooks and consultative services to help them navigate many of the unique challenges of COVID-19, such as accelerating takeout and delivery, applying for CARES Act funds, opening ghost kitchens and managing cash flow. |

I am proud of the work of our associates during 2020 and the support we provided to our customers, communities and associates as our country has weathered COVID-19, economic uncertainty and civil unrest, including:

| ■ | We provided restaurants with free reopening kits containing must-have supplies such as masks, safety guidance posters and a Restaurant Reopening Blueprint to help operators create a safer environment for staff and customers alike. |

| ■ | Between March 2020 and December 2020, we donated more than $35 million of food and supplies to local food banks and charitable organizations across the country. |

| ■ | In June 2020, more than 1,000 associates participated in our first virtual, company-wide Allyship & Anti-Racism Workshop, hosted by two of our associate-led Employee Resource Groups, the US Foods Pride Alliance and the Black Resource Utilization Hub. |

| ■ | We released an expanded 2019 Corporate Social Responsibility Report to provide more transparency in our approach to Corporate Social Responsibility (“CSR”) and each of our key CSR focus areas: People, Planet and Products. |

As our industry recovers and evolves during 2021, US Foods and our 26,000 associates are committed to helping our customers Make It now more than ever.

On behalf of the Board and everyone at US Foods, we are grateful for your continued trust and support. Thank you for being a US Foods stockholder.

Sincerely,

PIETRO SATRIANO

CHAIRMAN AND

CHIEF EXECUTIVE OFFICER

| |

| 9399 W. HIGGINS ROAD SUITE 100 ROSEMONT, IL 60018 |

April 2, 2021

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

THURSDAY, MAY 20, 2021

9:00 a.m. (Central Daylight Time)

We are pleased to provide notice of the 2021 Annual Meeting of Stockholders of US Foods Holding Corp. The Annual Meeting will be held entirely online. You will be able to attend and participate in the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/USFD2021 where you will be able to listen to the meeting live, submit questions, and vote.

At this meeting, our common stockholders and the holders of our Series A Convertible Preferred Stock (“Series A Preferred Stock”), voting together as a single class, will be asked to:

| 1. | Elect the six director nominees named in the proxy statement to the Board of Directors; |

| 2. | Approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed in the proxy statement; |

| 3. | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2021; and |

| 4. | Transact any other business properly before the meeting or any adjournments or postponements of the meeting. |

In addition, the holders of our Series A Preferred Stock, voting as a separate class, will be asked to:

| 1. | Elect a seventh director nominee designated by KKR Fresh Aggregator L.P. and KKR Fresh Holdings L.P. (collectively, “KKR”) under the terms of an Investment Agreement, dated as of April 21, 2020 (the “Investment Agreement”), to the Board of Directors. |

Stockholders of record at the close of business on March 22, 2021 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. A complete list of stockholders entitled to vote at the Annual Meeting may be accessed electronically, upon request, starting ten (10) days prior to the meeting by contacting US Foods Investor Relations via email at [email protected]. In addition, this stockholder list will be posted on the virtual meeting website during the Annual Meeting.

Beginning on or about April 2, 2021, a Notice of Internet Availability of Proxy Materials (“Notice”) will be mailed to each of our stockholders of record as of March 22, 2021. In addition, the proxy statement, the accompanying proxy or voting instruction card, and our 2020 Annual Report to Stockholders are available at https://materials.proxyvote.com/912008. As more fully described in the Notice, all stockholders may choose to access these materials online or may request printed or emailed copies.

We encourage you to vote your shares as soon as possible. Specific instructions for voting over the internet or by telephone or mail are included in the Notice. If you attend the virtual Annual Meeting and vote electronically during the meeting, your vote will replace any earlier vote.

By Order of the Board of Directors,

KRISTIN M. COLEMAN

Executive Vice President,

General Counsel

and Chief Compliance Officer

REVIEW THE PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS:

|

|

|

| |||

| INTERNET | TELEPHONE | AT THE MEETING | ||||

| Visit www.proxyvote.com | Call 1-800-690-6903 or the telephone number on your voting instruction card | Sign, date, and return your proxy or voting instruction card in the enclosed envelope | Attend

the virtual Annual Meeting at www.virtualshareholdermeeting.com/USFD2021 |

Please refer to the Notice or the information forwarded by your bank, broker, or other nominee to see which voting methods are available to you.

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 20, 2021: The proxy statement and our 2020 Annual Report are available at https://materials.proxyvote.com/912008. |

| TABLE OF CONTENTS |

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 4 |

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 5 |

MATTERS TO BE VOTED UPON

At this meeting, our common stockholders and the holders of our Series A Preferred Stock, voting together as a single class, will be asked to vote upon the following matters:

| Board Recommendation |

Page | |

| Proposal 1 – Election of Six Director Nominees | FOR | 9 |

| Proposal 2 – Advisory Approval of Say on Pay Resolution | FOR | 48 |

| Proposal 3 – Ratification of Appointment of Independent Auditor | FOR | 49 |

In addition, the holders of our Series A Preferred Stock will be asked to vote as a separate class on a seventh director nominee designated by KKR under the Investment Agreement.

DIRECTOR HIGHLIGHTS

Our Board of Directors (the “Board”) currently has ten members. Seven directors are standing for election for one-year terms, expiring at the next annual meeting of stockholders and until their respective successors are duly elected and qualified or until their earlier death, resignation, retirement, disqualification, or removal. Six of the director nominees will be voted upon by our common stockholders and the holders of our Series A Preferred Stock, voting together as a single class. The seventh director nominee, who was designated by KKR under the terms of the Investment Agreement, will be voted upon only by the holders of the Series A Preferred Stock, voting as a separate class. The following table provides summary information about each of our current directors.

| Committee Membership | ||||||||||||||

| Name | Age | Director Since | Term Expiring | Audit | Compensation | Executive | Nominating and Corporate Governance | |||||||

| Cheryl A. Bachelder | ||||||||||||||

| Independent | 64 | October 2018 | 2021 | * | — | — | — |  | ||||||

| Court D. Carruthers | ||||||||||||||

| Independent | 48 | July 2016 | 2021 | * |  |  |  | — | ||||||

| Robert M. Dutkowsky | ||||||||||||||

| Lead Independent Director | 66 | January 2017 | 2022 | — | — |  |  | |||||||

| Sunil Gupta | ||||||||||||||

| Independent | 62 | March 2018 | 2022 |  | — | — | — | |||||||

| John A. Lederer | ||||||||||||||

| Independent | 65 | September 2010 | 2021 | * | — | — | — | — | ||||||

| Carl Andrew Pforzheimer | ||||||||||||||

| Independent | 59 | January 2017 | 2021 | * | — | — | — |  | ||||||

| Pietro Satriano | ||||||||||||||

| Chairman and Chief Executive Officer | 58 | July 2015 | 2022 | — | — |  | — | |||||||

| David M. Tehle | ||||||||||||||

| Independent | 64 | July 2016 | 2021 | * |  |  |  | — | ||||||

| Ann E. Ziegler | ||||||||||||||

| Independent | 62 | January 2018 | 2021 | * |  |  | — | — | ||||||

| Nathaniel H. Taylor | ||||||||||||||

| Independent | 44 | May 2020 | 2021 | * | ||||||||||

| * | Denotes standing for re-election at the 2021 Annual Meeting. |

|

Denotes Committee Chairperson |

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 6 |

We believe the composition of the Board strikes a balanced approach to director tenure and allows the Board to benefit from fresh perspectives of newer directors while ensuring we retain the knowledge and experience from longer-serving directors. During 2017 and 2018, we refreshed five of our board positions with independent directors, adding three diverse directors. The average tenure of our directors is 4.4 years.

The Board is comprised of individuals with experience in key areas relevant to US Foods. Each director nominee was nominated based on the unique experience, qualifications and skills that he or she brings to the Board. This blend of diverse backgrounds provides the Board with the benefit of a broad array of perspectives. The table below highlights some of the experience and skills embodied by our directors as a whole.

|

Food Industry | Experience in the food industry provides the Board with an enhanced understanding of the industry and is highly important to strategic planning and risk oversight of our business and operations |  |

5 | |

|

CEO Leadership | CEO leadership experience brings different perspectives into the boardroom and is important for monitoring strategy and developing a high performing executive leadership team |  |

6 | |

|

Public Company Governance | Knowledge of public company governance issues and policies to enhance board practices is important to understanding and protecting stockholders’ interests |  |

8 | |

|

Sustainability and Corporate Responsibility | Brings understanding and experience regarding environmental and social responsibility issues that are relevant to our company and the sustainability of the communities in which we operate |  |

1 | |

|

Accounting/ Finance | Accounting and finance experience is important in overseeing our financial reporting and internal controls |  |

9 | |

|

Risk Management | Experience in risk management is critical in overseeing the risks we face today and anticipating emerging risks that could impact us in the future |  |

7 | |

|

Technology | Experience in technology is important to assess the tools we utilize to support our business infrastructure, supply chain and customer service, and also to oversee cyber and information security risks |  |

2 | |

|

Marketing & Strategy | Marketing and strategy experience is important in understanding our growth strategy and customer-centric focus |  |

5 | |

|

Human Capital Management | Human capital management experience is important to assess compensation practices, diversity mix, talent, training programs and corporate culture, which we depend upon to attract and retain key personnel and motivate our associates to perform and create long-term stockholder value |  |

7 |

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 7 |

GOVERNANCE HIGHLIGHTS

|

Nine of ten directors are independent |  |

Stock ownership guidelines for directors and executives | |

|

Fully independent Audit, Compensation, and Nominating and Corporate Governance Committees |  |

No stock hedging or pledging permitted by directors and executives | |

|

Lead Independent Director |  |

Annual Board and committee self-evaluations | |

|

Strong commitment to diversity |  |

Proactive stockholder engagement | |

|

Comprehensive and strategic approach to enterprise risk management |  |

Majority vote standard in uncontested director elections | |

|

No stockholder rights plan or poison pill |  |

Stockholder can amend bylaws and no supermajority is required | |

|

Annual say on pay vote |  |

Declassification of the Board to be completed at the 2022 annual meeting of stockholders |

EXECUTIVE COMPENSATION HIGHLIGHTS

COVID-19 IMPACT (PAGE 27)

As a result of the immediate and significant financial impact of the COVID-19 pandemic on our business in early March, we moved quickly to conserve cash, including temporarily reducing our executives’ salaries. Net sales, total case volumes and Adjusted EBITDA for fiscal 2020 were negatively impacted by decreased customer demand as a result of the COVID-19 pandemic and measures implemented to mitigate its spread. As a result of the impact of actions taken in response to the COVID-19 pandemic, as well as our lower-than-anticipated fiscal 2020 financial results, the cash compensation paid to our Chief Executive Officer for fiscal 2020 was 62% lower than what he earned for fiscal 2019.

Actions taken by the Compensation Committee that specifically affected our named executive officers during fiscal 2020 included the following:

| -50% |  |

The Compensation Committee reduced the base salary of our Chief Executive Officer by 50% and reduced the base salaries of our other NEOs by 30%. These salary reductions were in effect for the second fiscal quarter of 2020. |

| 0% |  |

The Compensation Committee determined that no make-whole cash bonus payments should be made to our executive officers as a replacement for the awards under our fiscal 2020 Annual Incentive Plan when the performance goals established prior to the COVID-19 pandemic were not met. |

| -26% |  |

CEO compensation, as reported in the summary compensation table, decreased by over 26% from 2019 to 2020. |

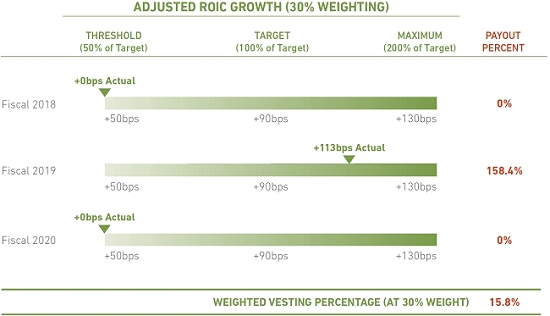

| 28% |  |

The Compensation Committee also determined that the performance goals established for our performance-based equity awards prior to the COVID-19 pandemic should not be modified, and, therefore the performance-based restricted stock awards, which had a three-year performance period ended January 2, 2021, vested on March 26, 2021 at only 28% of target. |

PHILOSOPHY (PAGE 31)

Our executive compensation program is designed to attract, motivate, develop, and retain the right talent, in the right places, at the right time. The following guiding principles form the basis of our executive compensation philosophy:

| ■ | Appropriately balance annual and long-term incentive compensation opportunities to align with our goals, priorities, and the creation of stockholder value; |

| ■ | Balance risk and reward to encourage sustainable financial performance; and |

| ■ | Offer fiscally responsible programs that ensure accountability in meeting our performance goals. |

IMPORTANT DATES FOR 2022 ANNUAL MEETING

| Deadline to include stockholder proposals in our proxy statement |  |

On or before December 3, 2021 |

| Period to submit stockholder proposals not included in our proxy statement |  |

Between January 20, 2022 and February 19, 2022 |

| Period for stockholders to nominate director candidates for election |  |

Between January 20, 2022 and February 19, 2022 |

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 8 |

PROPOSAL 1: ELECTION OF DIRECTORS

Our business and affairs are managed under the direction of the Board. The Board is currently comprised of ten directors, nine of whom are independent under the corporate governance standards of the New York Stock Exchange (the “NYSE”). The terms of seven of our directors expire on the date of the Annual Meeting, subject to the election and qualification of their respective successors. At our 2019 annual meeting of stockholders, our stockholders adopted an amendment and restatement of our Certificate of Incorporation to, among other things, eliminate the classification of the Board over time. As a result, all of our directors standing for election after our 2019 annual meeting (including the seven individuals standing for election at this Annual Meeting) will be elected for one-year terms. Beginning at our 2022 annual meeting, the declassification of the Board will be complete, and all of our directors will be subject to annual election.

Based upon the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated seven individuals to be re-elected for one-year terms, expiring at the 2022 annual meeting of stockholders and until their respective successors are duly elected and qualified (or their earlier death, resignation, retirement, disqualification, or removal).

Six of the seven director nominees will be voted upon by our common stockholders and the holders of our Series A Preferred Stock, voting together as a single class. Proxies solicited by the Board will be exercised for the election of each of the following six nominees: Cheryl A. Bachelder, Court D. Carruthers, John A. Lederer, Carl Andrew Pforzheimer, David M. Tehle and Ann E. Ziegler, unless you vote “against” one or more of the nominees or elect to abstain your vote on your proxy card.

One of the seven director nominees, Nathaniel H. Taylor, has been designated by KKR pursuant to the Investment Agreement (the “KKR Designee”). The holders of Series A Preferred Stock will vote separately, as a class, on the election of Mr. Taylor to hold office until the 2022 annual meeting of stockholders and until his successor is duly elected and qualified (or until his earlier death, resignation, retirement, disqualification, or removal). Only the holders of Series A Preferred Stock have the right to vote on the election of Mr. Taylor and proxies solicited by the Board from holders of our Series A Preferred Stock will be exercised for the election of Mr. Taylor. In the event KKR or its affiliates no longer beneficially own at least 50% of the shares of our Series A Preferred Stock purchased under the Investment Agreement or an equivalent amount of our common stock, on an as-converted basis, Mr. Taylor (or his successor) will resign, and KKR and its affiliates will no longer have the ability to designate a nominee to the Board.

The Nominating and Corporate Governance Committee recommends candidates to the Board it believes are qualified and suitable to become members of the Board. The Nominating and Corporate Governance Committee also considers the performance of incumbent directors in determining whether to recommend them for re-election. Recommendations may be received by the Nominating and Corporate Governance Committee from various sources, including current and former directors, a search firm retained by the Nominating and Corporate Governance Committee, stockholders, Company executives, and candidates themselves. Pursuant to the Investment Agreement, the Board has agreed to nominate, and recommend, the KKR Designee for election to the Board at the Annual Meeting.

In the case of a vacancy in the office of a director, including a vacancy created by an increase in the size of the Board, the Nominating and Corporate Governance Committee will recommend to the Board an individual to fill the vacancy (except for a vacancy created by the death, resignation or removal of the KKR Designee).

Stockholders who wish to identify director candidates for consideration by the Nominating and Corporate Governance Committee should write to the address provided in the section entitled “Board Policy Regarding Communications” on page 56. Stockholders may also nominate directors for election to the Board as described in the section entitled “How can I propose someone to be a nominee for election to the Board?” on page 56. All submissions should comply with the requirements set forth in our Bylaws.

SKILLS, EXPERIENCE, AND COMMITMENT TO DIVERSITY

The Board seeks members with varying professional backgrounds and other differentiating personal characteristics who combine a broad spectrum of experience and expertise with a reputation for integrity. The Board believes that maintaining a diverse membership enhances the Board’s discussions and enables the Board to better represent all of the Company’s constituents. The Board is currently comprised of three sitting chief executive officers, three former chief executive officers, two former chief financial officers, a private equity investor and a tenured business school professor. During 2017 and 2018, we refreshed five of our board positions with independent directors, adding three diverse directors such that the Board reflects a more diverse composition, with two of our directors being women and one of our directors being ethnically diverse.

Our Corporate Governance Guidelines provide that individuals will be considered for nomination to the Board based on their business and professional experience, judgment, gender, race and ethnicity, skills, background, and other unique characteristics as the Board deems appropriate. Accordingly, the Board is committed to actively seeking out highly qualified women and individuals from minority groups as well as candidates with diverse or non-traditional backgrounds, skills, and experiences as part of the director search process.

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 9 |

Director candidates should demonstrate a reputation for integrity, strong values, and discipline, high ethical standards, a commitment to full participation on the Board and its committees, and relevant career experience, along with other skills and characteristics that meet the current needs of the Board. The Nominating and Corporate Governance Committee and the Board will also consider whether candidates meet applicable independence standards where appropriate and evaluate any potential conflicts of interest with respect to each candidate.

The seven nominees named below have been recommended to the Board by the Nominating and Corporate Governance Committee and nominated by the Board to serve as directors until our 2022 annual meeting and until their successors are duly elected and qualified (or until their earlier death, resignation, retirement, disqualification or removal). Each nominee has consented to stand for election, and the Board does not anticipate that any nominee will be unavailable to serve. If a director nominee, other than the KKR Designee, should become unavailable to serve at the time of the Annual Meeting, shares represented by proxy may be voted for the election of a substitute nominee to be designated by the Board. Alternatively, in lieu of designating a substitute, the Board may reduce the size of the Board.

BACKGROUND AND EXPERIENCE OF DIRECTORS

The professional background and experience of each member of the Board is provided below. We believe that our directors collectively provide an appropriate mix of experience and skills relevant to the size and nature of our business.

SIX NOMINEES FOR ELECTION AS DIRECTORS WITH A TERM EXPIRING AT THE 2022 ANNUAL MEETING, TO BE ELECTED BY OUR COMMON STOCKHOLDERS AND HOLDERS OF SERIES A PREFERRED STOCK, VOTING TOGETHER AS A SINGLE CLASS

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE FOLLOWING SIX DIRECTOR NOMINEES. |

| CHERYL A. BACHELDER | ||||

Age 64 Director since: 2018 INDEPENDENT COMMITTEES: • Nominating and Corporate Governance |

Ms. Bachelder served as Interim Chief Executive Officer of Pier 1 Imports, Inc., a home furnishings and decor retailer, from December 2018 to November 2019, a role to which she was appointed in connection with her service on the Pier 1 board of directors. Pier 1 filed for Chapter 11 bankruptcy in February 2020. She served as Chief Executive Officer of Popeyes Louisiana Kitchen, Inc., a multi-national restaurant operator and franchisor, from 2007 until her retirement in 2017. Prior to her role with Popeyes, she served as President and Chief Concept Officer of KFC restaurants, a division of Yum! Brands, Inc. Ms. Bachelder’s earlier career included brand leadership roles at Domino’s Pizza, RJR Nabisco, Gillette, and Procter & Gamble. Ms. Bachelder serves on the board of directors of Chick-fil-A, Inc., a family-owned and privately-held restaurant chain, and the advisory board of Procter & Gamble’s franchising venture, Tide Dry Cleaners. | |||

SKILLS AND QUALIFICATIONS: • Ms. Bachelder is an accomplished executive, with extensive experience in the food industry and a track record of creating strong brand value. Her expertise provides valuable insights as the Company executes on our Great Food. Made Easy®. strategy.

|

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • None

PAST PUBLIC COMPANY DIRECTORSHIPS: • Pier 1 Imports, Inc. • Popeyes Louisiana Kitchen, Inc.

| |||

| COURT D. CARRUTHERS | ||||

Age 48 Director since: 2016 INDEPENDENT COMMITTEES: • Audit • Compensation (Chair) • Executive

|

Mr. Carruthers has served as the President and Chief Executive Officer of TricorBraun, Inc., a global leader in the design and supply of primary packaging solutions, since October 2017. He is also the principal and founder of CKAL Advisory Partners, which provides private equity advisory services. Mr. Carruthers previously served W.W. Grainger, Inc., an industrial supply company, as Group President, Americas from August 2013 to July 2015, President, Grainger U.S., from January 2012 to August 2013, President, Grainger International, from February 2009 to December 2011, and President, Acklands-Grainger, from October 2006 to January 2009. He was appointed a Senior Vice President of Grainger in 2007. | |||

SKILLS AND QUALIFICATIONS: • Mr. Carruthers has substantial experience as a senior executive for a large international distribution company and extensive knowledge of financial reporting, internal controls and procedures, and risk management. He is a Chartered Professional Accountant (Canada), a Fellow of the Chartered Professional Accountants of Canada (FCPA, FCMA), and an Institute-Certified Director by the Institute of Corporate Directors.

|

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Ryerson Holding Corporation

PAST PUBLIC COMPANY DIRECTORSHIPS: • Foundation Building Materials, Inc. | |||

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 10 |

| JOHN A. LEDERER | ||||

Age 65 Director since: 2010 INDEPENDENT COMMITTEES: • None

|

Mr. Lederer has served as a Senior Advisor with Sycamore Partners, a private equity firm specializing in retail and consumer investments, since September 2017. In that capacity, he serves as Executive Chairman of the board of directors of Staples, Inc. and its U.S. and Canadian businesses. From September 2010 to July 2015, Mr. Lederer served as our President and Chief Executive Officer. From 2008 to 2010, Mr. Lederer was Chairman and Chief Executive Officer of Duane Reade, a retail pharmacy chain. Prior to Duane Reade, he spent 30 years at Loblaw Companies Limited, a Canadian grocery retailer and wholesale food distributor, where he held a number of leadership roles and served as President from 2000 to 2006. He served on the board of directors of Tim Hortons Inc. from 2007 until 2014, when it was acquired by Restaurant Brands International. | |||

SKILLS AND QUALIFICATIONS: • Mr. Lederer has extensive senior executive leadership experience in the food industry, including five years of service as our Chief Executive Officer. |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Maple Leaf Foods Inc. • Walgreens Boots Alliance, Inc.

PAST PUBLIC COMPANY DIRECTORSHIPS: • Restaurant Brands International, Inc.

| |||

| CARL ANDREW PFORZHEIMER | ||||

|

Age 59 Director since: 2017 INDEPENDENT COMMITTEES: • Nominating and Corporate Governance

|

Mr. Pforzheimer is the co-Chief Executive Officer of Tastemaker Acquisition Corp., a special-purpose acquisition corporation formed to make investments in the restaurant and hospitality industry. He was the founder of Barteca Holdings, LLC, a multi-location restaurant group, where he served as Chief Executive Officer from 1995 to August 2016, and Chairman of the Board from 2012 to June 2018. Mr. Pforzheimer currently serves on the boards of directors of several private restaurant companies throughout the U.S., and on the Education Policy Committee of the Culinary Institute of America. | |||

SKILLS AND QUALIFICATIONS: • Mr. Pforzheimer is a successful restaurateur and has served as a member of the Education Policy Committee at the Culinary Institute of America and the board of directors of the Connecticut Restaurant Association. He brings a customer perspective and experience and expertise in the food industry to the Board.

|

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Tastemaker Acquisition Corp. | |||

| DAVID M. TEHLE | ||||

|

Age 64 Director since: 2016 INDEPENDENT COMMITTEES: • Audit (Chair) • Compensation • Executive |

Mr. Tehle served as Executive Vice President and Chief Financial Officer of Dollar General Corporation, a discount retailer, from 2004 until retiring in July 2015. Prior to Dollar General, Mr. Tehle was Chief Financial Officer of Haggar Corporation, a manufacturing, marketing, and retail company, from 1997 to 2004 and held finance positions at several companies, including Ryder System, Inc., a transportation and logistics company, and Texas Instruments Incorporated, a semiconductor design and manufacturing company. | |||

|

SKILLS AND QUALIFICATIONS: • Mr. Tehle has extensive knowledge of financial reporting, internal controls and procedures, and risk management, in addition to significant experience as chief financial officer of a public company. |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Jack in the Box Inc. • National Vision Holdings, Inc.

PAST PUBLIC COMPANY DIRECTORSHIPS: • Genesco Inc.

| |||

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 11 |

| ANN E. ZIEGLER | ||||

|

Age 62 Director since: 2018 INDEPENDENT COMMITTEES: • Audit • Compensation |

Ms. Ziegler served as Senior Vice President and Chief Financial Officer of CDW Corporation, a technology solutions provider, from 2008 until her retirement in 2017. From 2005 to 2008, Ms. Ziegler served as Senior Vice President, Administration and Chief Financial Officer of Sara Lee Food and Beverage, a division of Sara Lee Corporation, a global consumer goods company. From 2003 to 2005, she served as Chief Financial Officer of Sara Lee Bakery Group. From 2000 to 2003, she served as Senior Vice President, Corporate Development of Sara Lee. Prior to joining Sara Lee, Ms. Ziegler was a corporate attorney at the law firm Skadden, Arps, Slate, Meagher & Flom. Ms. Ziegler serves on the board of directors of Wolters Kluwer N.V., a global provider of information, software and services. She also serves on the board of governors of the Smart Museum of Art of the University of Chicago. | |||

SKILLS AND QUALIFICATIONS: • Ms. Ziegler has extensive knowledge of financial reporting, internal controls and procedures, risk management, corporate development, and mergers and acquisitions, in addition to significant experience as a chief financial officer of a public company. |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Hanesbrands Inc. • Reynolds Consumer Products Inc.

PAST PUBLIC COMPANY DIRECTORSHIPS: • Groupon, Inc. | |||

NOMINEE FOR ELECTION AS A DIRECTOR WITH A TERM EXPIRING AT THE 2022 ANNUAL MEETING, TO BE ELECTED SEPARATELY BY THE HOLDERS OF OUR SERIES A PREFERRED STOCK

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE FOLLOWING DIRECTOR NOMINEE. |

| NATHANIEL H. TAYLOR | ||||

|

Age 44 Director since: 2020 INDEPENDENT COMMITTEES: • None

|

Mr. Taylor joined Kohlberg Kravis Roberts & Co., a private equity firm, in 2005 and currently serves as a Partner and Co-Head of Americas Private Equity, a member of the Investment Committee within its Americas Private Equity platform, and a member of the Next-Generation Technology Growth Investment Committee. He has been involved with many investments at the firm, with a particular emphasis on the consumer and technology sectors. Mr. Taylor also helped establish the firm’s operations in India. He currently sits on the board of directors of several privately-held companies, including 1-800 Contacts, Bay Club, BMC Software, Fleet Farm, and The Bountiful Company. Prior to joining Kohlberg Kravis Roberts & Co., Mr. Taylor worked at Bain Capital, where he was involved with investments in the consumer retail, health care and technology sectors. Mr. Taylor previously served as a director of US Foods from 2011 to 2017. Mr. Taylor was designated by KKR as a director nominee under the terms of the Investment Agreement. | |||

SKILLS AND QUALIFICATIONS: • Mr. Taylor has substantial corporate finance and technology experience, as well as experience managing and growing investments in customer-focused and technology-driven companies. |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Academy Sports and Outdoors, Inc.

PAST PUBLIC COMPANY DIRECTORSHIPS: • National Vision Holdings, Inc. | |||

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 12 |

DIRECTORS NOT UP FOR ELECTION WITH A TERM EXPIRING AT THE 2022 ANNUAL MEETING

| ROBERT M. DUTKOWSKY (LEAD INDEPENDENT DIRECTOR) | ||||

|

Age 66 Director since: 2017 INDEPENDENT COMMITTEES: • Executive • Nominating and Corporate Governance (Chair) |

Mr. Dutkowsky served as Executive Chairman of Tech Data Corporation, a technology distributor, from June 2018 to July 2020. He previously served as Chief Executive Officer of Tech Data from October 2006 to June 2018. Prior to joining Tech Data, Mr. Dutkowsky served as President and Chief Executive Officer, and Chairman of the board of directors of Egenera, Inc., a software company, from 2004 to 2006, President and Chief Executive Officer, and Chairman of the board of directors of J.D. Edwards & Co., Inc., a software company, from 2002 to 2004, and President and Chief Executive Officer, and Chairman of the board of directors of GenRad, Inc., an electronic equipment manufacturer, from 2000 to 2002. He also served as Executive Vice President, Markets and Channels, from 1997 to 1999, and President, Data General, in 1999, of EMC Corporation, a data storage manufacturer. Mr. Dutkowsky began his career at IBM, a technology company, where he served in several senior management positions. | |||

SKILLS AND QUALIFICATIONS: • Mr. Dutkowsky has substantial senior executive leadership experience and provides valuable governance perspectives based on his experience as a board member, and, in some cases, chairman, of numerous public and private companies.

|

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Pitney Bowes Inc. • Raymond James Financial, Inc. • The Hershey Company

PAST PUBLIC COMPANY DIRECTORSHIPS: • Tech Data Corporation • The ADT Corporation

| |||

| SUNIL GUPTA | ||||

|

Age 62 Director since: 2018 INDEPENDENT COMMITTEES: • Audit |

Prof. Gupta joined Harvard Business School in 2006 as a Professor and was named the Edward W. Carter Professor of Business Administration in 2007. He has served as the Chair of the General Management Program for senior executives and Co-Chair of the Driving Digital Strategy executive education program since 2013 and, prior to that, served as the Chair of the Marketing Department from 2008 to 2013. Before joining Harvard Business School, Prof. Gupta held a number of positions at the Columbia University Graduate School of Business, including serving as the Meyer Feldberg Professor of Business from 2000 to 2006. | |||

|

SKILLS AND QUALIFICATIONS: • Prof. Gupta has over 30 years of research, teaching, and consulting experience in marketing and strategy, including over 10 years in digital marketing, as well as a Ph.D. in Marketing from Columbia University.

|

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • None

| |||

| PIETRO SATRIANO (CHAIRMAN) | ||||

|

Age 58 Director since: 2015 COMMITTEES: • Executive (Chair) |

Mr. Satriano has served as our Chief Executive Officer since July 2015, and was elected Chairman of the Board in December 2017. From February 2011 to July 2015, Mr. Satriano served as our Chief Merchandising Officer. Prior to joining US Foods, Mr. Satriano was President of LoyaltyOne Canada, a provider of loyalty marketing and programs, from 2009 to 2011. From 2002 to 2008, he served in a number of leadership positions at Loblaw Companies Limited, a Canadian grocery retailer and wholesale food distributor, including Executive Vice President, Loblaw Brands, and Executive Vice President, Food Segment. Mr. Satriano began his career in strategy consulting, first in Toronto, Canada with Canada Consulting Group and then in Milan, Italy with the Monitor Company. | |||

SKILLS AND QUALIFICATIONS: • Mr. Satriano has extensive experience and leadership in the food industry and setting and executing corporate strategy. Additionally, his role as our Chief Executive Officer provides valuable insight into our operations and brings a management perspective to the deliberations of the Board. |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • CarMax, Inc.

| |||

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 13 |

We recognize the value of listening to, and considering the perspectives of, our stockholders on our business, including related to matters of corporate governance, executive compensation, human capital and sustainability. Developing relationships with our stockholders is an integral part of that process.

HIGHLIGHTS OF FISCAL 2020 ENGAGEMENT

During fiscal 2020, we engaged in discussions with our stockholders on a variety of topics:

| ■ | COVID-19 impacts: Our stockholders were interested in the impact of the COVID-19 pandemic on our customers, liquidity, debt covenants, margins and competition, as well as the cost reduction measures we took in response to the COVID-19 pandemic. |

| ■ | Environmental, Social and Governance (ESG): Our stockholders engaged with us regarding corporate governance, associate development, sustainable products, fleet emissions, deforestation, paper and packaging and nutrition, health and wellness. |

| ■ | Diversity and inclusion: Our stockholders expressed their interest in our respectful workplace training, employee resource groups, supplier diversity, and ethnic and gender diversity representation among our associates. |

| ■ | Strategic, financial and operations matters: We engaged in discussions with our stockholders regarding our cost structure, 2019 acquisition of five foodservice companies (the “Food Group”), 2020 acquisition of Smart Stores Holding Corp. (“Smart Foodservice”), KKR’s Series A Preferred Stock investment, cost saving opportunities, capital structure and competition. |

We are continuing to actively engage with current and prospective stockholders during fiscal 2021, including through participation at industry and investment community conferences, analyst meetings, and select one-on-one meetings with stockholders.

In addition to direct engagement, we have instituted a number of complementary mechanisms that allow stockholders to effectively communicate with the Board and management, including our policy regarding direct correspondence with individual directors and the Board as a whole described in the section entitled “Board Policy Regarding Communications” on page 56, our commitment

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 14 |

to thoughtfully consider stockholder proposals submitted to the Company, an annual advisory vote to approve executive compensation, and director attendance at our annual stockholder meetings. Our investor relations website (at https://ir.usfoods.com) features substantive information and materials for the reference of our stockholders, including earnings and investor conference presentations and webcast replays, corporate governance documents, public filings, and news releases.

The Board has no policy regarding the separation of the offices of Chairman of the Board and Chief Executive Officer. The Board believes it is important to retain its flexibility to allocate the responsibilities of the Chairman of the Board and the Chief Executive Officer in any way that it deems to be in the best interests of the Company at a given point in time. Because the roles of Chief Executive Officer and Chairman of the Board are currently combined, Mr. Dutkowsky has been appointed Lead Independent Director.

| Pietro Satriano Chairman and Chief Executive Officer |

Robert M. Dutkowsky Lead Independent Director | |

|

As Chief Executive Officer, Mr. Satriano:

■ Sets strategic direction for the Company ■ Provides day-to-day leadership over operations ■ Focuses on execution of the Company’s goals ■ Sets the “tone at the top”

As Chairman, Mr. Satriano:

■ Presides over Board meetings ■ Serves as a liaison between management and the Board ■ Sets the Board’s schedule and meeting agendas ■ Calls special meetings of the Board ■ Reviews correspondence addressed to the Board and leads the Board’s stockholder engagement efforts

|

As Lead Independent Director, Mr. Dutkowsky:

■ Presides over and has the authority to set the agenda for executive sessions of the independent directors, which are held at each regularly scheduled meeting of the Board ■ Serves as a liaison between Mr. Satriano and the independent directors ■ Consults with Mr. Satriano regarding the Board’s schedule and meeting agendas ■ Consults with Mr. Satriano regarding correspondence addressed to the Board ■ Reviews and responds to correspondence addressed to the independent directors ■ Acts as an advisor to Mr. Satriano regarding strategic aspects of the business ■ May be called on to speak to stockholders on behalf of the Board |

The Board believes this allocation of responsibilities provides a clear and efficient leadership structure for the Company.

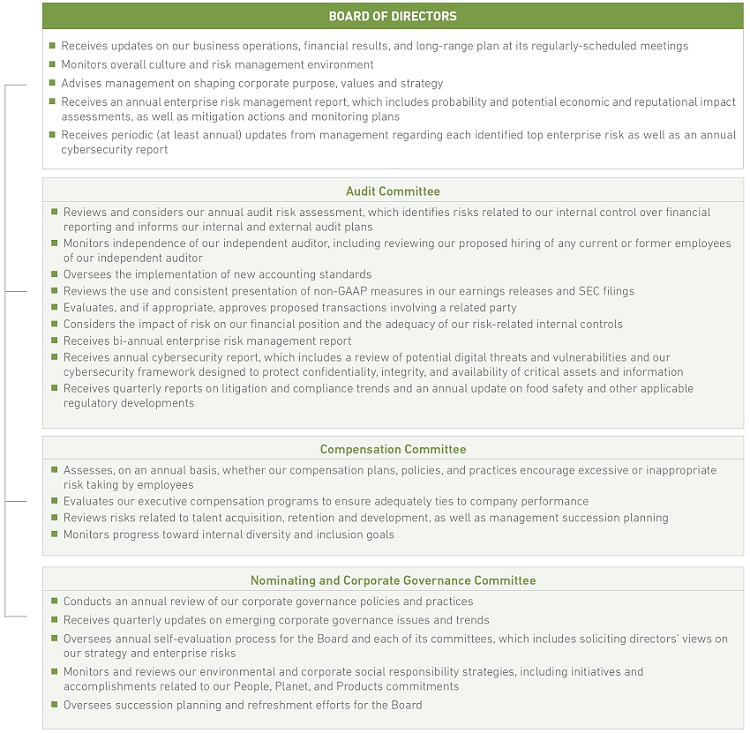

Our approach to enterprise risk management is designed to effectively identify, assess, prioritize, mitigate, and monitor the Company’s principal risks. Management is responsible for the Company’s day-to-day risk management activities. The Board’s role is to exercise informed risk oversight, which is done both directly and indirectly through its committees. In addition, for each of the Company’s top risks, the Board and/or its applicable committee receives periodic updates from a senior member of management. The Board’s effectiveness in risk oversight is bolstered through open dialogue with management, established monitoring and reporting processes and the collective knowledge and experience of its members.

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 15 |

There are several ways the Board and its committees undertake their risk oversight responsibilities, including:

ANNUAL BOARD AND COMMITTEE SELF-EVALUATIONS

The Nominating and Corporate Governance Committee oversees the annual self-evaluation process for the Board and each of its committees. These self-evaluations are designed to assess whether the Board or the respective committee is functioning effectively and to provide a mechanism for the Board or the respective committee to identify potential areas for improvement. For example, in furtherance of the Board’s commitment to maintaining a diverse Board membership, the Board self-evaluation specifically asks directors to assess the Board’s progress against that commitment. Once completed, the results of the self-evaluations and any appropriate recommendations or action plans are discussed among the members of the Board and each of its committees.

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 16 |

MEETINGS OF THE BOARD AND ITS COMMITTEES

| 8 | 100% |

| Total Board meetings during 2020 | Attendance at Board and committee meetings during 2020 |

COMMITTEES

| Audit | Compensation | Executive | Nominating and Corporate Governance | |||||

| Total number of committee meetings during 2020 | 6 | 5 | 0 | 4 | ||||

| Cheryl A. Bachelder | — | — | — |  | ||||

| Court D. Carruthers |  |

|

|

— | ||||

| Robert M. Dutkowsky | — | — |  |

| ||||

| Sunil Gupta |  |

— | — | — | ||||

| Carl Andrew Pforzheimer | — | — | — |  | ||||

| Pietro Satriano | — | — |  |

— | ||||

| Nathaniel H. Taylor | — | — | — | — | ||||

| David M. Tehle |  |

|

|

— | ||||

| Ann E. Ziegler |  |

|

— | — |

AUDIT COMMITTEE

|

Mr. Carruthers

Meetings during 2020: 6

|

The Audit Committee assists the Board in overseeing and monitoring: (1) the quality and integrity of our financial statements, (2) our compliance with legal and regulatory requirements, (3) our independent registered public accounting firm’s qualifications, independence, and performance, (4) the performance of our internal audit function, and (5) our risk management policies and procedures.

The Board has determined that Messrs. Carruthers, Gupta, and Tehle and Ms. Ziegler each qualifies as an independent director under the corporate governance standards of the NYSE and the additional audit committee independence requirements under the rules of the SEC. The Board has also determined that Mr. Tehle and Ms. Ziegler each qualifies as an “audit committee financial expert,” as defined by SEC rules. All members of the Audit Committee are familiar with finance and accounting practices and principles and are financially literate. |

COMPENSATION COMMITTEE

|

Mr. Carruthers (Chair)

Meetings during 2020: 5

|

The Compensation Committee assists the Board in discharging its responsibilities relating to: (1) establishing our compensation program and setting the compensation of our executives, (2) overseeing our incentive and equity-based compensation plans, and (3) preparing the compensation committee report required to be included in our proxy statement under the rules of the SEC.

The Board has determined that Messrs. Carruthers and Tehle and Ms. Ziegler each qualifies as an independent director under the corporate governance standards of the NYSE, including the additional compensation committee independence requirements. |

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 17 |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

|

Ms. Bachelder

Meetings during 2020: 4

|

The Nominating and Corporate Governance Committee (1) assists the Board by identifying individuals qualified for membership on the Board and its committees, (2) recommends individuals to the Board for nomination as members of the Board and its committees, (3) oversees the Company’s environmental and corporate social responsibility efforts and (4) advises and makes recommendations to the Board on corporate governance matters and the overall governance structure of our Company and Board. The Nominating and Corporate Governance Committee also oversees the annual self-evaluation process for the Board and each of its committees, as well as the progress of the Company’s corporate social responsibility strategies.

The Board has determined that Ms. Bachelder and Messrs. Dutkowsky and Pforzheimer each qualifies as an independent director under the corporate governance standards of the NYSE. |

EXECUTIVE COMMITTEE

|

Mr. Carruthers

Meetings during 2020: 0 |

The Executive Committee meets and may exercise certain powers of the Board as may be delegated from time to time, except as limited by law, between regularly scheduled meetings of the Board when it is not practical or feasible for the Board to meet or as otherwise directed by the Board. |

BOARD ATTENDANCE AT THE ANNUAL MEETING

Although the Company does not have a written policy concerning Board attendance at annual meetings of the Company’s stockholders, it is our expectation that all directors attend the annual meetings of our stockholders. All of our directors attended the 2020 virtual annual meeting.

ANTI-HEDGING AND ANTI-PLEDGING POLICY

Under the terms of the Company’s insider trading policy, our directors and executive officers are prohibited from engaging in transactions that involve short-term trades, short sales, exchange-traded options, hedging, margin loans, or pledging of or relating to our Common Stock. The Company’s insider trading policy does not currently prevent employees, other than executive officers, from engaging in hedging, pledging or other speculative transactions, but it allows management to consider whether to prohibit employees from engaging in these transactions.

The Board has adopted a written policy related to the review and approval of related party transactions. Under the policy, the Audit Committee evaluates, and if appropriate, approves any proposed transactions involving the Company and in which any of our directors, nominees for director, executive officers or significant stockholders (or persons related to any of them) has a direct or indirect interest. Under the policy, certain related party transactions are deemed to be pre-approved, for example, those transactions where the aggregate amount will not exceed $120,000 or where the rates or charges involved are determined by competitive bids. In determining whether to approve a proposed related party transaction, the Audit Committee considers, among other things, whether: the terms of the transaction are fair to the Company and would apply if the transaction did not involve a related party; there are compelling business reasons for the Company to enter into the related party transaction and the nature of any available alternative transactions; the transaction would impair the independence of an otherwise independent director; or the transaction would create an improper conflict of interest for any director or executive officer of the Company, taking into account the size of the transaction, the overall financial position of the related party, the direct or indirect nature of the related party’s interest in the transaction and the ongoing nature of any proposed relationship.

KKR INVESTMENT

On May 6, 2020 (the “Issuance Date”), the Company issued 500,000 shares of its Series A Preferred Stock to KKR for an aggregate purchase price of $500 million, or $1,000 per share, pursuant to the Investment Agreement. In connection with the investment, under a registration rights agreement, dated May 6, 2020, the Company agreed to provide KKR with certain customary registration rights with respect to shares of the Company’s common stock issued in connection with any future conversion of the Series A Preferred Stock.

The Series A Preferred Stock ranks senior to the shares of common stock, with respect to dividend rights and rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company. The Series A Preferred Stock has a liquidation preference of $1,000 per share. Holders of the Series A Convertible Stock are entitled to a cumulative dividend at the rate of 7.0% per annum, payable quarterly in arrears. If the Company does not declare and pay a dividend on the Series A

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 18 |

Preferred Stock, the dividend rate will increase by 3.0% to 10.0% per annum until all accrued but unpaid dividends have been paid in full. Dividends are payable in kind, through the issuance of additional shares of Series A Preferred Stock, for the first four dividend payment dates, after which dividends are payable in cash or in kind (or a combination of both) at the option of the Company.

Through the Record Date, the Company paid dividends in-kind to KKR of 23,127 shares of Series A Preferred Stock, and as of the Record Date, KKR held 523,127 shares of Series A Preferred Stock, which represented approximately 10% of the Company’s common stock on an as-converted basis.

The Series A Preferred Stock is convertible at the option of the holders at any time into shares of common stock at an initial conversion price of $21.50 per share and an initial conversion rate of 46.5116 shares of common stock per share of Series A Preferred Stock, subject to certain anti-dilution adjustments. At any time after the third anniversary of the Issuance Date, if the volume weighted average price of common stock exceeds the mandatory conversion price of $43.00 per share, as may be adjusted, for at least twenty trading days in any period of thirty consecutive trading days, the Company has the option to convert all of the outstanding shares of Series A Preferred Stock into common stock.

At any time following the fifth anniversary of the Issuance Date, the Company may redeem some or all of the Series A Preferred Stock for a per share amount in cash equal to: (i) the sum of 100% of the liquidation preference thereof, plus all accrued and unpaid dividends, multiplied by (ii) (A) 105% if the redemption occurs at any time after the fifth anniversary of the Issuance Date and prior to the sixth anniversary of the Issuance Date, (B) 103% if the redemption occurs at any time after the sixth anniversary of the Issuance Date and prior to the seventh anniversary of the Issuance Date, and (C) 100% if the redemption occurs at any time after the seventh anniversary of the Issuance Date.

Upon certain change of control events involving the Company, on or before the fifth business day prior to the effective date of such change of control event, the holders of the Series A Preferred Stock must either (i) convert their shares of Series A Preferred Stock into common stock at the then-current conversion price or (ii) cause the Company to redeem their shares of Series A Preferred Stock for an amount in cash equal to 100% of the liquidation preference thereof plus all accrued but unpaid dividends. In the case of either clause (i) or (ii) above, if such change of control occurs on or before the fifth anniversary of the Issuance Date, the Company will also be required to pay the holders of the Series A Preferred Stock a “make-whole” premium.

The holders of our Series A Preferred Stock are entitled to vote with our common stockholders on an as-converted basis, voting together as a single class. Holders of the Series A Preferred Stock are also entitled to a separate class vote with respect to, among other things, amendments to the Company’s organizational documents that have an adverse effect on the Series A Preferred Stock, authorizations or issuances by the Company of securities that are senior to, or equal in priority with, the Series A Preferred Stock, increases or decreases in the number of authorized shares of Series A Preferred Stock and issuances of shares of Series A Preferred Stock after the Issuance Date, other than shares issued as in kind dividends with respect to shares of Series A Preferred Stock issued on the Issuance Date. So long as KKR or its affiliates beneficially own shares of Series A Preferred Stock and/or shares of common stock that represent, in the aggregate and on an as-converted basis, at least 50% of the shares of common stock beneficially owned by KKR, on an as converted basis, as of the Issuance Date, KKR has the right to designate one director to be nominated by the Board for election to the Board.

Until KKR no longer has the right to designate a director for election to the Board, it and its affiliates have committed to vote all of their shares of Series A Preferred Stock and/or common stock (i) in favor of each director nominated and recommended for election by the Board, (ii) against any stockholder nominations for director which are not approved and recommended for election by the Board, (iii) in favor of the Company’s proposal for ratification of the appointment of the Company’s independent registered public accounting firm and (iv) for any proposal approved by the KKR-designated director. With regard to all other matters submitted to the vote of stockholders, KKR and its affiliates are under no obligation to vote in the same manner as recommended by the Board or otherwise.

Prior to the closing of KKR’s investment in the Series A Preferred Stock, KKR Capital Markets, LLC (“KCM”), an affiliate of KKR, provided debt advisory services to the Company in connection with the Company’s financing of its acquisition of Smart Foodservice in April 2020, for which the Company paid KCM $6 million. In addition, as of January 2, 2021, investment funds managed by an affiliate of KKR held approximately $65 million in aggregate principal amount of our senior secured term loan due 2023 and our incremental senior secured term loan due 2026, as reported by the administrative agent. Most recently, in February 2021, KCM acted as a joint bookrunning manager in the private offering by our direct, wholly-owned subsidiary, US Foods, Inc., of $900 million aggregate principal amount of its 4.750% Senior Notes due 2029 and realized $1,113,750 in fees in the form of a discount to the purchase price which was equivalent to the fees realized by the other lead joint bookrunning manager for the offering.

CORPORATE GOVERNANCE MATERIALS

The Board has adopted Corporate Governance Guidelines in furtherance of its commitment to the principles of good corporate governance. The Board and the Nominating and Corporate Governance Committee review the Corporate Governance Guidelines annually and make amendments, as they deem necessary or appropriate, based on stockholder feedback, changes in the rules of the SEC or the corporate governance standards of the NYSE, or best practices.

The Board has also adopted a Code of Conduct that applies to all of our directors, officers, and employees, including our principal executive officer, principal financial officer, and principal accounting officer. We intend to make available any legally required disclosures regarding amendments to, or waivers of, provisions of our Code of Conduct on our investor relations website.

Copies of our Corporate Governance Guidelines; the charters of each of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee; and our Code of Conduct are publicly available and may be found by visiting the “Corporate Governance—Governance Documents” page of our investor relations website at https://ir.usfoods.com/investors/corporate-governance/governance-documents.

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 19 |

CORPORATE SOCIAL RESPONSIBILITY

Our Nominating and Corporate Governance Committee oversees the Company’s corporate social responsibility initiatives and strategy, receiving CSR updates multiple times each year. Our Executive Vice President, General Counsel and Chief Compliance Officer leads our cross-functional CSR working group that includes senior leaders and subject matter experts with responsibility for areas such as supply chain, real estate, merchandising, food safety, human resources, communications, and investor relations.

In 2020, we drove progress against our Corporate Social Responsibility (CSR) strategy through key initiatives within each of our three pillars of focus: People, Planet, and Products. Our most recent Corporate Social Responsibility Report and additional information regarding our efforts, initiatives, and accomplishments can be found at www.usfoods.com/csr.

PEOPLE

At US Foods, we strive to make a positive difference in the lives of our associates and in the communities we serve.

IN OUR WORKPLACE

Through training, mentoring, and on-the-job development, we help associates at all levels of our organization learn and grow. In 2020 we reimagined many of our programs to help associates continue to thrive in virtual settings. Our new Associate Resource Hub features an online library of tools and content for navigating the remote work environment, including communication guides for virtual teams, technology training, virtual leadership webinars and more.

6,000+

associates accessed online training resources in 2020

IN OUR COMMUNITIES

As a national foodservice distributor, we strive to make a meaningful difference by donating our time and resources. Over the last year, US Foods has acted urgently to support food banks and other nonprofits helping to nourish communities devastated by the pandemic.

| $35M | 60 | |

in food and supplies donated to support COVID-19 relief efforts |

Feeding America food banks supported through product donations |

Launched in 2017, our US Foods Scholars program addresses two pressing needs: providing economic opportunity to underserved students and helping tackle the talent shortage facing the restaurant industry. The program provides individual awards of up to $20,000 in financial support and professional development to outstanding students seeking to achieve their dreams in the culinary arts.

PLANET

We are continually improving the efficiency of our facilities and fleet, reducing our environmental footprint.

IN OUR FACILITIES

Our distribution centers require significant amounts of energy to store, refrigerate and manage our vast portfolio of products. We work diligently to reduce the energy intensity of our business.

US Foods currently operates three Leadership in Energy and Environmental Design (LEED) Silver-certified facilities, with two additional locations in Marrero, LA and Sacramento, CA in progress. LEED-certified buildings have been shown to lower environmental impact and operating costs, while providing a healthier working environment for associates.

Solar arrays have been installed on six of our distribution centers, including an 8.4-megawatt solar installation in Perth Amboy, New Jersey – one of the largest rooftop solar installations in the state.

13M+

kilowatt hours (kWh) of electricity generated annually from our solar installations

Across our facilities, we work to monitor and reduce waste generated in our direct operations through both recycling and product donation initiatives. These initiatives include material recycling efforts that span multiple categories, including cardboard, paper, plastic, and electronics, as well as the donation of surplus or unsaleable product to community organizations and nonprofits.

14,000+TONS

of waste diverted from landfills in 2020

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 20 |

IN OUR FLEET

We’re optimizing our routing to reduce miles driven and rightsizing our vehicles by route type to improve transportation efficiency.

| 6.9% | 7.3% | |

| reduction since 2015 in gallons of fuel per case delivered in our broadline business(1) | reduction in Scope 1 and Scope 2 emissions since 2015, measured in pounds of CO2e per case delivered(1)(2) |

As we update and add to our fleet, we’re choosing new vehicle models with features designed to reduce fuel consumption and testing alternative-fuel technology like our 54 compressed natural gas (CNG) vehicles across Texas and Oklahoma. CNG trucks emit 22-29% fewer greenhouse gas emissions than comparable gas or diesel fuel vehicles.

| (1) | Includes the Food Group and reflects transportation inefficiencies with reduced volumes caused by the COVID-19 pandemic. |

| (2) | Includes Smart Foodservice. |

PRODUCTS

We are committed to providing a portfolio of responsibly and sustainably sourced products. Through a third-party sustainable product materiality assessment that included feedback from internal and external stakeholders, US Foods has prioritized key initiatives we believe will have the most impact.

HUNGRY FOR BETTER STRATEGY

At US Foods, we understand that our customers want authentic, simple ingredients from sources they know and trust, along with clear information to help them choose the best products for their establishments. Our Hungry for Better strategy was developed to help meet this need and deliver on our commitment to working with our partners and suppliers to offer products that are local, sustainable or support well-being.

SERVE GOOD®

Our Serve Good program features a growing portfolio of products that are developed in collaboration with our suppliers. The products adhere to responsible practices and many come with a third-party certification. Every Serve Good product must come with a claim of responsible sourcing or contribution to waste reduction.

| 900+ | 270+ | |

| Serve Good and Progress Check products | products classified as responsible disposables |

PROGRESS CHECK®

Our Progress Check program recognizes seafood products and vendors that have made significant progress toward meeting our Serve Good program standards and serves as a gateway for inclusion in Serve Good. In 2018, we published a Responsibly Sourced Seafood Policy that outlines our forward-looking commitments and goals for sustainable seafood products.

OUR COMMITMENTS

We achieved our 2020 Responsibly Sourced Seafood commitment.

100%

of the products in our Harbor Banks seafood portfolio now meet either Progress Check® or Serve Good® standards

BUILDING A CULTURE OF SAFETY, INCLUSION & ENGAGEMENT

US Foods is committed to creating a safe, inclusive, and dynamic workplace where our associates can grow and thrive.

SUPPORTING OUR ASSOCIATES DURING COVID-19

As we address the ever-evolving needs of our business due to the pandemic, the health and safety of our associates, customers and communities have remained our top priorities. To support this commitment, we have instituted a variety of policies and procedures to help prevent the spread of COVID-19. These include illness prevention guidelines that require an associate to stay home if they are sick or have symptoms associated with COVID-19, wellness checks with temperature screenings before entering any US Foods facility, requiring associates to wear masks, and enhanced hygiene and cleaning procedures in all facilities. We have also enhanced our work from home policies and leverage social distancing and new, essential employee protocols designed to limit close contact, and to provide personal protective equipment (PPE) as well as cleaning and sanitizing products. In addition, we have protocols in place for managing COVID-19 cases, including isolating impacted associates from our facilities, conducting a traceback interview with associates who have tested positive, notifying associates and customers with whom they came into contact, and conducting enhanced cleaning procedures.

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 21 |

To support our associates during COVID-19, we offer additional benefits such as enhanced leave policies for an associate who is ill with COVID-19, or taking care of a loved one with COVID-19 at home. In addition, we offer free COVID-19 testing for associates in qualified situations to facilitate a safe return to work.

DIVERSITY & INCLUSION

At US Foods, we believe that success and innovation are only achieved when all voices and perspectives are heard and valued. We perform at our best by connecting with associates, customers and communities in ways that embrace diversity of all kinds, including diversity of race, ethnicity, culture, gender identity, age, sex, disability and experience. Our commitment to diversity and inclusion is defined by our D&I strategy, which is focused on working toward a more equitable environment in our workplace and communities. As of January 2021, 51% percent of our associates are women or people of color and 32% of our director-level and above leaders are women or people of color.

Over the past several years, we have been working to increase the diversity of our director-level and above leadership roles through accelerated development programs for diverse associates and expanded external recruiting partnerships to reach more diverse candidates. We have also enhanced our hiring process to require diverse candidate slates for leadership roles and introduced unconscious bias training for leaders. Moving forward, our goal is to fill 40% of our new or open leadership roles with diverse candidates.

Specifically, in 2020, we implemented the following key initiatives to execute against our strategy:

| ■ | Continued to invest in our diverse supplier network, spending $385M+ in trade and indirect spend with 435+ Tier 1 suppliers owned and operated by a diverse spectrum of people consisting of women, minorities, veterans, LGBT+, and individuals with disabilities. |

| ■ | Continued the launch of our Learning Partners program to match diverse, high-potential US Foods leaders with senior leaders to facilitate one-on-one, two-way learning and help prepare diverse leaders for greater responsibility. |

| ■ | Rolled out new Disrupting Bias Training to provide a common framework for recognizing and addressing bias in the workplace. 93% of senior leaders completed the training in 2020. |

| ■ | Expanded our Employee Resource Group (ERG) program from our corporate offices to all US Foods locations, enabling field and frontline associates to participate in our eight associate-led ERGs, including the Black Resource Utilization Hub, Collective Asian Network, Hispanic and Latino ERG, Link-Up, Pride Alliance, Those Who Serve – Military ERG, Women In Network, and Younger Professionals ERG. |

| SPOTLIGHT ON “Allyship & Anti-Racism” Workshops |

| In June 2020, the US Foods Pride Alliance and the Black Resource Utilization Hub ERGs teamed up to host a virtual, companywide Allyship & Anti-Racism Workshop attended by more than 1,000 associates focused on helping associates navigate conversations around racism, understanding different perspectives and experiences through storytelling from leaders, and discussing ways to act as an ally both in and outside of the workplace. To further promote this dialogue, US Foods trained 200 leaders to facilitate their own Allyship and Anti-Racism workshops for corporate and frontline associates at the local level, including drivers and selectors. |

ASSOCIATE ENGAGEMENT

Through our associate engagement survey and pulse survey programs, we invite our associates to provide important feedback that allows us to implement positive changes across our company. These surveys, along with regular associate roundtables, help us continually improve how we demonstrate our Cultural Beliefs and support other focus areas such as safety, manager effectiveness and customer service.

In 2020, we increased the frequency of our pulse surveys and implemented monthly “open mic” meetings with Executive Leaders to keep associates fully informed of COVID-19 developments and provide regular opportunities for associates to share feedback, ask questions, and make suggestions for the business. Throughout 2020, we received a total of 30,000 associate survey responses.

| US FOODS HOLDING CORP. | 2021 PROXY STATEMENT | 22 |

Non-employee directors serving on the Board each receive an annual cash retainer of $100,000. Our Lead Independent Director and the Chair of the Audit Committee each receives an additional annual cash retainer of $25,000, and the Chair of the Compensation Committee and the Chair of the Nominating and Corporate Governance Committee each receives an additional annual cash retainer of $20,000. All cash retainers are paid quarterly, in arrears. In addition, each non-employee director receives an annual equity grant consisting of $150,000 in restricted stock units (“RSUs”), which generally vest on the earlier of the first anniversary of the grant date and our first annual meeting of stockholders that occurs after the grant date. Mr. Satriano, who is also an employee, does not receive additional compensation for serving on the Board. Mr. Taylor has elected to waive his right to receive compensation for serving on the Board, including any annual cash retainer or RSU grant.

The Nominating and Corporate Governance Committee is responsible for reviewing and making recommendations to the Board regarding our director compensation. In completing its review, the Nominating and Corporate Governance Committee receives assistance from an independent compensation consultant, Meridian Compensation Partners, LLC (“Meridian”).

The Board reviews the recommendations of the Nominating and Corporate Governance Committee and determines the form and amount of director compensation. In July 2019, the Nominating and Corporate Governance Committee recommended, and the Board approved, (i) an increase in the value of the annual equity grant for our non-employee directors from $100,000 to $150,000 to more closely align with peer group director compensation levels and (ii) a change in the RSUs’ vesting period from three years to one year to coincide with the de-classification of the Board and our directors’ new one-year terms.

Effective as of January 1, 2020, we updated the stock ownership guidelines that apply to each of our non-employee directors to provide that each non-employee director is expected to own and retain shares of our Common Stock with a value of at least five times the annual cash retainer, or $500,000 (up from four times the annual cash retainer, or $400,000), within five years of the date the director joins the Board. Our stock ownership guidelines do not apply to Mr. Taylor since he has waived his right to receive compensation for serving on the Board. All applicable non-employee directors were in compliance with the guidelines at the end of fiscal 2020.

The following table reflects the fees earned by our non-employee directors who were compensated for their service in fiscal 2020:

| Name | Fees Earned or Paid in Cash(1) ($) |

Stock Awards(2)(3) ($) |

Option Awards(4) ($) |

Total ($) |

|||||

| Ms. Bachelder | 87,500 | 150,007 | — | 237,507 | |||||

| Mr. Carruthers | 105,000 | 150,007 | — | 255,007 | |||||

| Mr. Dutkowsky | 126,875 | 150,007 | — | 276,882 | |||||

| Mr. Gupta | 87,500 | 150,007 | — | 237,507 | |||||

| Mr. Lederer | 100,000 | 150,007 | — | 250,007 | |||||