Form DEF 14A UNITED NATURAL FOODS For: Jan 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

☒ | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

United Natural Foods, Inc. | ||

(Name of Registrant as Specified in its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box): | ||

☒ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

Letter from Our Lead Independent Director

Dear Fellow Stockholders,

As Lead Director, I have had the privilege of working closely with a dynamic and diverse group of executives and directors through these challenging and unprecedented times. The value to our suppliers, customers, and our communities of our full-line of natural and conventional products and expanded delivery network as a result of the Supervalu acquisition was demonstrated throughout fiscal 2020, and continues today, as we navigate the COVID-19 pandemic. In this time of crisis, I am proud of the Board as UNFI delivered on its purpose to keep food on the tables of families throughout North America, while prioritizing the safety and security of our front-line associates. In addition to the pandemic, the Board has been focused on the most critical objectives for UNFI, including appointing a new CEO, appointing new Board members, and seeking input from our investors through our annual engagement process.

Management Succession Planning. Earlier this year, we announced Steve Spinner’s intent to retire from his position as Chief Executive Officer of UNFI. Over the last 12 years, Steve oversaw the tremendous growth of our Company from $3 billion to over $26 billion in annual sales, while strategically positioning UNFI for long-term success. Throughout his tenure, Steve fostered an unwavering commitment to our core value of doing the right thing, including through the challenges of COVID-19, civil unrest, extreme weather events, and the wildfires in the West. Given his deep knowledge of UNFI and our broader industry, we are pleased that Steve has agreed to continue to serve as Executive Chair of the Board after his retirement as CEO.

Board Refreshment and Corporate Governance. We continue to focus on strong corporate governance practices, including Board refreshment. Pursuant to the director retirement age provisions of our Corporate Governance Principles, James Heffernan will not stand for re-election as director. Mr. Heffernan has made significant contributions to the growth and strategic direction of the Company during his 20-year tenure on the Board. The Board and management of the Company are very appreciative of Mr. Heffernan’s service and commitment to the Board and the Company, and we are pleased to have Mr. Heffernan serve as an advisor to the Board through March 31, 2021.

We are actively engaged in a robust director search process using a leading search firm. The Board considered the desired mix of skills, qualifications, and experience needed across the current and future Board members given the evolving strategic direction of the Company following the impact of the pandemic and shifting retail grocery landscape. The Board’s objective with these appointments is to continue to evolve the Board to maximize its value and effectiveness to UNFI.

Stockholder Engagement. We are deeply interested in hearing from you, our stockholders. This summer we conducted our third annual stockholder engagement program and are happy to report that we spoke with holders of approximately 50% of our outstanding common shares across the broad spectrum of matters facing the Company, including the pandemic impact and response, our evolving strategy, Board refreshment, executive compensation, environmental, social and governance (ESG) practices, and other topics. We find these sessions very informative and, as a result of feedback received in prior years, in fiscal 2020, we made several changes to our executive compensation program, which changes were well received by stockholders. We look forward to talking with you again this year, as we navigate the exciting future that lies ahead for UNFI.

On behalf of the Board of Directors, thank you for your continued investment and support as we continue to deliver on our mission to transform the world of food through these unprecedented times.

Sincerely, | |

| |

Peter A. Roy | |

Lead Independent Director | |

Letter from Our CEO and Chairman of the Board

Dear Fellow Stockholders,

Fiscal 2020 was truly a year of unprecedented challenges, as we delivered on our mission through the global pandemic, civil unrest, extreme weather events and wildfires out West. I would like to take this opportunity to thank you for your support of UNFI and the trust you have placed in our Board of Directors and management to oversee our Company’s long-term success over the course of these events and into the evolving landscape that lies ahead.

As I announced in September 2020, I plan to retire as Chief Executive Officer by July 31, 2021. It has been my honor to lead UNFI over these past 12 years, and I am proud of the incredible growth we have achieved while maintaining our culture of doing the right thing. The future has never been stronger for UNFI as our integration work is nearing completion, and we now look toward expansion of new services, technologies, brands, and optimization of our supply chain network. I have great confidence in the strength of our team and the opportunities ahead.

COVID-19 and Strategic Management. Fiscal 2020 presented unprecedented challenges in the face of the COVID-19 pandemic. I am proud of how we prioritized the health and safety of our associates, customers, and communities throughout our response. We were early to adopt a temporary state of emergency pay increase, implement robust safety protocols and attendance flexibility and provide increased grants through our associate assist program. Additionally, we maintained constant communication with our customers, committed over one million dollars to philanthropic organizations helping those impacted by COVID-19, donated over 10 million pounds of food and essential items and continued grants through our UNFI Foundation to support access to healthy food. Our Board met frequently during the early peak of the pandemic to oversee management’s risk and response efforts. And, importantly, we have continued our unrelenting focus on maintaining and evolving our safety protocols as the guidance from the CDC and local agencies has progressed to continue to protect the well-being of our employees, customers and communities.

Diversity and Inclusion. We recognize that we have an important role to play in making our world and our Company a more equal and inclusive place. To that end, we have publicly committed to take action, and have recently hired a Vice President, Diversity and Inclusion to develop and guide our diversity strategy, from the inside out. We are starting on the inside with a review of our recruiting, training and talent development practices. We are also committing to increase our spending with diverse owned suppliers and vendors and providing grants to support food justice in underserved communities through the UNFI Foundation. You can view the pillars of our diversity and inclusion strategy through the link on the main page of our website, www.unfi.com.

Dedication to Strong Corporate Governance Practices and ESG. Our commitment to doing things the right way remains steadfast, and in the “Decade of Action” we are determined to enhance our dedication to good environmental, social and governance (ESG) practices. In 2020, we reinforced our commitment to good corporate governance principles by strengthening certain governance policies, such as our recoupment policy, disclosures policies, stock ownership guidelines and Enterprise Risk Management policies.

We continue to focus on reducing our environmental impact, conserving natural resources and promoting sustainability across our value chain and in our operations. In early 2020, UNFI joined the Climate Collaborative, solidifying commitments to energy efficiency, food waste reduction and sustainable transportation. We also conducted a materiality assessment to identify areas where we can have the largest impact, and are excited to share more on the results and our long-term initiatives in our upcoming ESG report. In the meantime, information on our ESG commitments and primary focus areas can be found under the “ESG” section of our website.

In conclusion, I am very proud and grateful for all of the incredible work of our front-line associates, as well as our corporate support teams during the pandemic and other challenges we faced in fiscal 2020 and that continue today. On behalf of our Board of Directors, and everyone at UNFI, thank you for your continued support of this great Company.

Sincerely, | |

| |

Steven L. Spinner | |

Chairman of the Board and Chief Executive Officer | |

Please vote. Stockholders may vote through the Internet, by telephone or by mail. Please refer to your proxy card or the notice of proxy availability distributed to you on or about November 25, 2020 for information on how to vote through the Internet, by telephone or by mail. | |

Notice of Annual Meeting of Stockholders

Meeting Information

Tuesday, January 12, 2021, 4:00 p.m. EST, with log-in at 3:45 p.m. EST.

You may attend the annual meeting through the Internet by virtual web conference at www.virtualshareholdermeeting.com/unfi2021. The meeting will be a virtual-only meeting, consistent with the two prior years. We believe the virtual meeting allows greater access to participate in the meeting, hear from management and ask questions than an in-person meeting in one geographic location provides.

Items to be Voted on

1. | The election of nine nominees as directors to serve until the next annual meeting of stockholders. |

2. | The ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2021. |

3. | The approval, on an advisory basis, of our executive compensation. |

4. | The approval of an amendment to the 2020 Equity Incentive Plan. |

5. | Consideration of such other matters as may properly come before the meeting or any adjournments or postponements thereof. |

Record Date

Only stockholders of record on our books at the close of business on Monday, November 16, 2020, will be entitled to vote at the annual meeting and any adjournments or postponements of the annual meeting.

Proxy Voting

Your vote is important. If you do not attend the annual meeting, we encourage you to vote your shares through the Internet, by telephone or by completing, dating, signing and promptly returning your proxy card to us in the envelope provided. The proxy materials provide you with details on how to vote by these three methods. If you decide to attend the annual meeting through the Internet, you may revoke your proxy and cast your vote during the meeting.

Proxy Materials

In accordance with rules approved by the Securities and Exchange Commission, we furnish proxy materials to our stockholders over the Internet. On or about November 25, 2020, we mailed to all stockholders of record as of the close of business on November 16, 2020, a notice containing instructions on how to access our Annual Report to Stockholders, which contains our audited consolidated financial statements for the fiscal year ended August 1, 2020; our proxy statement; proxy card; and other items of interest to stockholders on the Internet website indicated in our notice, at www.proxyvote.com, as well as instructions on how to vote your shares of common stock in connection with the annual meeting. That notice also provided instructions on how you can request a paper copy of our proxy materials and Annual Report to Stockholders if you desire.

By Order of the Board of Directors, | |

| |

Jill E. Sutton, Esq. | |

Chief Legal Officer, General Counsel and Corporate Secretary November 25, 2020 | |

Table of Contents

Environmental, Social and Governance Practices | |

Outstanding Equity Awards at Fiscal 2020 Year-End | |

Historical Grants and Share Usage | |

Delinquent Section 16(a) Reports | |

Forward Looking Statements

This proxy statement contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Our actual results may differ from our expectations, estimates and projections, and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “might,” “continues,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, our expectations with respect to our future performance and the drivers of that performance. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Most of these factors are outside our control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the impact and duration of the COVID-19 outbreak; (2) risks associated with our high level of debt and leverage; (3) our ability to recognize the anticipated benefits of our acquisition and dispositions, including the acquisition of SUPERVALU INC. (Supervalu), which may be affected by, among other things, increased competition in our industry and the ability of the combined company to grow and manage growth profitably and retain key employees; (4) our ability to optimize our network of distribution centers to serve our customers and retain existing customers; and (5) other risks and uncertainties identified in our filings with the Securities and Exchange Commission (“SEC”). More information about other potential factors that could affect our business and financial results is included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended August 1, 2020 filed with the SEC.

Proxy Statement Summary

For the Annual Meeting of Stockholders, January 12, 2021

Voting Matters

Board of Directors

Our business and affairs are managed under the direction of the Board of Directors. The Board currently consists of ten (10) directors, eight (8) of whom are independent.

Information about our directors and the committees on which they serve is set forth below. Each director serves a one-year term and, other than Mr. Heffernan, who will retire under our governance guidelines as of the date of the annual meeting, has been nominated for re-election. Effective as of the close of business of the annual meeting, given Mr. Heffernan’s departure, the size of the Board will be reduced to nine (9) directors.

Name | Age | Director Since | Audit | Compensation | Nominating and Governance | |||||

Eric F. Artz Independent | 53 | Oct 2016 | — | — | ü | |||||

Ann Torre Bates Independent | 62 | Oct 2013 | O | — | — | |||||

Denise M. Clark Independent | 63 | Feb 2013 | — | — | O | |||||

Daphne J. Dufresne Independent | 48 | Oct 2016 | — | ü | ü | |||||

Michael S. Funk Co-Founder | 66 | Feb 1996 | — | — | — | |||||

James P. Heffernan1 Independent | 74 | Mar 2000 | ü | ü | — | |||||

James L. Muehlbauer Independent | 59 | April 2019 | ü | ü | — | |||||

Peter A. Roy Lead Independent Director | 64 | June 2007 | — | — | ü | |||||

Steven L. Spinner Chairman and Chief Executive Officer | 60 | Sept 2008 | — | — | — | |||||

Jack Stahl Independent | 67 | June 2019 | ü | O | — | |||||

O | Denotes Committee Chair | |

1 | Mr. Heffernan will serve as a member of the Board until his upcoming retirement on January 12, 2021, after which date, he will serve as an advisor to the Board until March 31, 2021. | |

1

Governance Highlights

• | Eight of ten directors are independent | • | Fully independent Audit, Compensation and Nominating and Governance Committees | ||

• | Annual election of directors and majority voting policy | • | Active stockholder engagement for three consecutive years | ||

• | Recent updates to charters and policies to enhance governance processes | • | Comprehensive Board and Committee self-evaluations | ||

• | Lead Independent Director, duties outlined in our Corporate Governance Principles, appointed annually by our independent directors | • | Recently enhanced stock ownership guidelines for directors, executive officers and additional senior officers | ||

• | Strong commitment to Board diversity | • | Proxy access in Bylaws | ||

• | Enhanced business continuity and crisis management team | • | Stockholders with 25% ownership may call a special meeting | ||

• | Robust Board refreshment process | • | Board oversight of ESG | ||

• | Fully integrated and enhanced Enterprise Risk Management Program | • | Industry-Leading safety protocols and procedures for COVID-19 | ||

• | Strong executive compensation governance: | • | Delaware forum selection clause | ||

• | Long-term incentive compensation capped and aligned with pre-determined financial metrics | • | No poison pill | ||

• | Independent compensation consultant | ||||

• | No gross-ups or excessive perquisites | ||||

• | Robust stock ownership guidelines and recoupment policy | ||||

How to Vote:

Phone | Internet before meeting | Mail | During the meeting |

1-800-690-6903 | www.proxyvote.com | Vote Processing c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 | www.virtualshareholdermeeting.com/unfi2021 |

How to attend and ask questions at the meeting:

• | Attend the annual meeting online, including to vote and/or submit questions at www.virtualshareholdermeetings.com/unfi2021 |

• | The annual meeting will begin at approximately 4:00 p.m. EST, with log-in at 3:45 p.m. EST on Tuesday, January 12, 2021 |

• | You may submit questions for the meeting in advance at www.proxyvote.com |

• | You may submit live questions during the meeting at www.virtualshareholdermeeting.com/unfi2021 |

For more information about voting and attending the meeting, see “Information About the Meeting,” beginning on page 66. | ||||

2

Corporate Governance

Governance Highlights

We are committed to best practices in corporate governance. Some of our key corporate governance practices are summarized below, with further information provided in this proxy statement.

Independent Oversight

• | Seven out of nine director nominees are independent |

• | Lead Independent Director is selected by independent directors and has clearly defined and robust responsibilities |

• | Regular executive sessions of independent directors at Board and Committee meetings |

• | 100% independent Board Committees, with strong Committee mandates |

• | Active Board oversight of the Company’s strategy and risk management |

• | Board and Committees may hire outside advisors independent of management |

• | Board oversight of ESG |

• | Focused meetings and review of COVID risk and response |

Board Skills and Qualifications

• | Regular Board refreshment and mix of tenure of directors |

• | Diverse backgrounds, ages, experiences and qualifications, with a view to making changes as needed to continue to add value and meet strategic needs of UNFI |

• | Diverse gender and ethnicity, with renewed focus going forward |

• | Several directors have deep industry expertise |

• | Annual Board and Committee self-evaluations and individual director performance reviews |

• | Mandatory director retirement age of 75 |

• | Orientation program for new directors and ongoing director education programs for all directors |

• | Limitations on other board memberships |

• | Directors must notify the Chair of the Nominating and Governance Committee in the case of any change in principal occupation or business association, and before accepting any new commitments involving other businesses, non-profit entities or governmental units |

Good Governance Practices

• | Annual comprehensive review of governance policies leading to the following updates in 2020: |

◦ | Recoupment (“clawback”) policy for executives in the event of a financial restatement or inaccurate performance metrics, including inimical conduct and recently expanded to (i) include forfeiture of incentive compensation in certain cases of misconduct resulting in reputational harm and (ii) require public disclosure in certain circumstances |

◦ | Director and executive stock ownership policies requiring meaningful levels of ownership, expanded to include more senior officers and more stringent requirements for share holdings in September 2020 |

◦ | Recently amended our Social and Environmental Policy to further substantiate our commitment to social, environmental and governance (ESG) matters, overseen by our Nominating and Governance Committee, supported by a newly created ESG Executive Committee |

◦ | Enterprise Risk Management program now incorporates fully integrated, operationalized and enhanced risk reporting to our Board and Committees |

• | Restrictions on hedging or pledging of Company stock by directors and executive officers |

• | Strong policies restricting trading by insiders, including discussion-based pre-clearance process |

• | Stockholder engagement initiatives, including an annual off-season outreach program, undertaken for general business and for governance policies and practices, including executive compensation |

3

Stockholder Protections

• | Annual election of all directors |

• | Majority vote and director resignation policy for directors in uncontested elections |

• | Bylaws provide proxy access right for stockholders (3% ownership threshold continuously held for 3 years/2 director nominees or 20% of the Board/20 stockholder aggregation limit) |

• | Stockholder rights to call special meeting for stockholders owning at least 25% of the outstanding shares |

• | One class of shares, with each share entitled to one vote |

• | No poison pill |

We maintain a corporate governance page on our corporate UNFI website that includes key information about our corporate governance initiatives and our Code of Conduct. The corporate governance page can be found at www.unfi.com, by clicking on “Governance” listed under “Investors” at the bottom of our website. Copies of our Corporate Governance Principles, our Code of Conduct, our Social and Environmental Policy and the charters for each of the Board’s Committees can be found on our website. During fiscal 2020, we revised and updated the Compensation Committee charter, Nominating and Governance Committee charter, and the Code of Conduct, and in September 2020, we revised and updated the Social and Environmental Policy, each in connection with our ongoing comprehensive review of our governance practices. Information contained on our website is not incorporated by reference in this proxy statement or considered to be part of this document.

Director Independence

Our Corporate Governance Principles require a majority of the members of the Board to be independent directors as such term is defined in the New York Stock Exchange (NYSE) listing standards. The Board, upon the recommendation of the Nominating and Governance Committee, has determined that eight of its ten current members are independent. Our eight independent directors are Eric F. Artz, Ann Torre Bates, Denise M. Clark, Daphne J. Dufresne, James P. Heffernan, James L. Muehlbauer, Peter A. Roy and Jack Stahl. Michael S. Funk, one of our co-founders, was an employee until January 1, 2019, and Steven L. Spinner is our employee and Chief Executive Officer (CEO), and therefore they are not independent directors.

Our Corporate Governance Principles and the charter for each of the Board’s standing Committees—the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee—require all members of such Committees to be independent within the meaning of the NYSE listing standards and the SEC’s rules. The charter of the Audit Committee also requires each of its members to meet the definition of independence under Section 10A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the SEC’s rules thereunder. The charter of the Compensation Committee requires each of its members to be a non-employee director within the meaning of Rule 16b-3 under the Exchange Act.

Lead Independent Director

The Lead Independent Director is elected annually by the independent directors of the Board. In September 2020, the independent directors appointed Mr. Roy to serve as the Board’s Lead Independent Director for a second consecutive year. In accordance with our Corporate Governance Principles, the Lead Independent Director must be independent. The Lead Independent Director is responsible for coordinating the activities of the other independent directors and for performing such other duties and responsibilities as the Board may determine from time to time, including:

• | Serving as a liaison between the independent directors and the Chair and CEO; |

• | Providing input to the Board and the Nominating and Governance Committee on the membership of various committees; |

• | Advising and assisting the chairs of the Board’s committees in fulfilling such individuals’ roles and responsibilities; |

• | Advising the Chair of the Board as to an appropriate schedule of and agenda for the Board’s meetings and including the Board’s input into the agenda for the Board’s meetings; |

• | Leading the independent directors in their role in the annual evaluation of the performance of the CEO, |

• | Serving as a key member of the ad hoc succession planning committee overseeing the process for CEO succession; |

• | Consulting with the Chair of the Board regarding the retention of advisors and consultants who report directly to the Board; |

• | Acting as the chair of regular and special Board meetings when the Chair is unable to preside; and |

• | Calling meetings of, developing agendas for, and serving as chair of the executive sessions of the Board’s independent directors |

A description of the duties of the Lead Independent Director is included in the Corporate Governance Principles, a copy of which can be found in the “Governance” section of our website at www.unfi.com.

4

Board Leadership Structure

The Board is currently led by the Chair of the Board, Mr. Spinner, and by the Lead Independent Director, Mr. Roy. Our Corporate Governance Principles do not require the Chair of the Board to be independent and do not specify whether the positions of Chair of the Board and the CEO must be separated. The Board regularly considers the appropriate leadership structure for the Company and has concluded that the Company and its stockholders are best served by the Board retaining discretion to determine whether the same individual should serve as both CEO and Chair of the Board, or whether the roles should be separated. The Board believes that it is important to retain the flexibility to make this determination at any point in time based on what it believes will provide the best leadership structure for the Company, based on the circumstances at such time.

The Board believes that having Mr. Spinner serve as both Chairman and CEO, coupled with strong independent director leadership, including the Lead Independent Director, is currently the most appropriate leadership structure for the Company, for several reasons. Having a single person fulfill the roles of Chair and CEO promotes decisive leadership, establishes clear accountability and enhances our ability to communicate with a single and consistent voice to stockholders, employees and other stakeholders. Together with our Lead Independent Director and in consultation with the chairs of the Board’s various standing committees, Mr. Spinner is well-positioned to set the Board’s agenda and provide leadership as to the strategic, compliance, and risk matters subject to the Board’s oversight. With over 30 years of operational and leadership experience with distributors of food and non-food products, Mr. Spinner has exceptional industry knowledge, which the Board believes is critical for the chair of a board of a company in an evolving industry, one that has undergone significant change in particular over the past decade. The Board also has considered Mr. Spinner’s strong performance as a leader. Mr. Spinner has most recently brought his industry knowledge and leadership skills to bear in leading the Company through the significant operational challenges arising in connection with the COVID-19 pandemic, and, prior to that, integrating the business of Supervalu with our Company. At present, the Board believes that combining the roles of Chair and CEO, along with having a Lead Independent Director vested with key duties and responsibilities (as discussed above) and the Board’s standing committees consisting of and being chaired by independent directors, provides a formal structure for strong independent oversight of our management team. We plan to continue to examine our corporate governance policies and leadership structure on an ongoing basis, including in connection with the evaluation and appointment of Mr. Spinner’s successor as CEO, so that our policies and governance processes continue to meet our Company’s evolving needs. In this regard, the Board has determined that upon the appointment of a successor to Mr. Spinner as CEO, Mr. Spinner will continue to serve the Board as an Executive Director, such that the Board and the new CEO continue to benefit from Mr. Spinner’s leadership and knowledge of the Company and industry through the time of the CEO transition.

5

Risk Oversight

Full Board | |||||||

The Board has overall responsibility for risk oversight. The Board exercises its oversight responsibilities with respect to strategic, operational and competitive risks, as well as risks related to the succession planning of our CEO and other members of senior management. In light of Mr. Spinner’s upcoming retirement as CEO, the Board is actively working with a leading search firm to identify Mr. Spinner’s successor. The Board has delegated responsibility for the oversight of certain risks to its Committees. All Committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise-level risk. Certain risks are overseen by the full Board directly, such as strategic, cyber, other operational and macro-environment risks. | |||||||

Audit Committee | Compensation Committee | Nominating & Governance Committee | |||||

The Audit Committee and full Board receive management’s quarterly Enterprise Risk Management (ERM) report and the Audit Committee discusses significant financial risk exposures and the steps management has taken to monitor, control, and report such exposures with management, the Company’s internal audit department and our independent auditor. During fiscal 2020, we fully integrated our legacy UNFI and Supervalu Risk Management Programs. The integration focused on assessing the current maturity state of our ERM program and desired future state, as well as establishing processes to integrate risk assessment into strategic and operational decision making. | The Compensation Committee is responsible for developing and maintaining compensation policies and programs that are aligned with pay for performance, stockholder interests, and the other elements of the executive compensation philosophy developed and maintained by the Committee. Embedded in this philosophy and foundational to these programs is that they mitigate any unnecessary and excessive risks in our compensation plans and programs that could threaten our long-term value. See further discussion below. | The Nominating and Governance Committee oversees our compliance programs, and oversees our environmental, social and governance programs. This Committee also participates extensively in our Enterprise Risk Management and compliance programs generally, actively considering assessment and mitigation for risks that do not fall within the purview of the Audit Committee or the Compensation Committee. | |||||

Other committees address risk on an ad hoc basis, as appropriate. We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing our Company.

Compensation Risk

Our Compensation Committee charter requires the Compensation Committee to assess, on an annual basis, whether the Company’s compensation policies and practices encourage the Company’s executive officers or other key employees to take unnecessary and excessive risks that could threaten the value of the Company. The Compensation Committee believes that our compensation policies do not encourage the taking of unnecessary and excessive risks. Our compensation and governance practices are designed to align the interests of our executive officers with the interests of stockholders and the achievement of the Company’s performance objectives. For example:

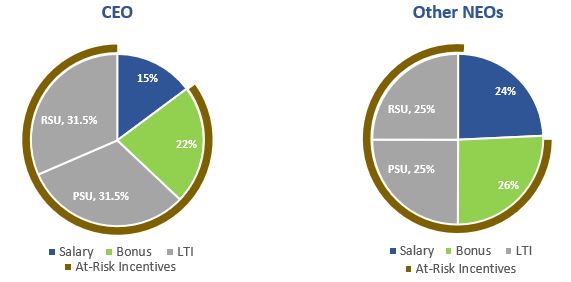

• | A substantial portion of our executive officers’ compensation is “at risk,” including compensation paid in the form of common stock; |

• | Total executive officer compensation is substantially weighted to long-term equity, half of which is tied to longer-term performance targets (which targets were recently extended from two- to three-year targets); |

• | The short-term bonus program has an established performance metric (adjusted EBITDA) that is a long-term growth driver; |

• | We set a maximum level of compensation; there is no uncapped compensation for our executive officers in any element of executive compensation; |

• | Our executive officers are required to maintain certain levels of stock ownership, which are tested each year based on the then-current price of our common stock; |

• | Our executive officers are subject to restrictions on hedging and pledging shares of Company common stock; and |

6

• | Performance-based compensation is subject to recoupment in the event of a restatement of the Company’s financial statements or a material inaccuracy in the performance metrics used to measure performance-based compensation and is subject to forfeiture of incentive compensation in the event of certain misconduct resulting in reputational harm. Additionally, performance-based compensation may be forfeited in the case of misconduct in violation of law or Company policy, including through failure of an executive’s oversight responsibilities, that results in material financial or reputational harm to the Company. |

Anti-Hedging and Insider Trading Policies

Our stock ownership guidelines and our Policy Regarding Trading in Company Securities (“Insider Trading Policy”) include prohibitions against speculative trading activities in relation to Company securities. Senior employees, including executive officers, and non-employee directors are strictly prohibited from entering into any transaction that would operate as a hedge against their ownership position of stock or that would hedge against the financial effect of their building up stock ownership to reach the requirements set forth in our stock ownership guidelines. Under our Insider Trading Policy, directors, certain employees (including executive officers) and other individuals with access to material non-public information about the Company are prohibited from engaging in transactions in Company securities during blackout periods (other than in accordance with a pre-approved Rule 10b5-1 trading plan), and such persons are required to pre-clear (through discussion) any transactions in Company securities with a member of our legal department who specializes in securities law. Under our policy governing 10b5-1 trading plans, we permit all directors and employees, including executive officers, to enter into 10b5-1 plans. All plans must have a 30-day “cooling-off” period between entering into a plan and the start of trading under that plan, and no plan may be shorter than six months or longer than 18 months.

Committees of the Board of Directors

The Board currently has three standing committees: the Compensation Committee, the Audit Committee and the Nominating and Governance Committee. Upon recommendation of the Nominating and Governance Committee, the full Board appoints members of each committee. Each committee is responsible for appointing its chair.

Compensation Committee

The Compensation Committee establishes or approves all policies and procedures related to our human resources function with respect to our executive officers, including employee compensation, incentive programs, and the 401(k) Plan, and administers our stock incentive plans. Additionally, this committee evaluates and establishes the respective compensation of our executive officers on an individual basis, including our CEO and Chief Financial Officer (“CFO”). The Compensation Committee also reviews the compensation of certain other members of our senior management team and recommends to the Board the compensation for our non-employee directors. For a description of the role of the Compensation Committee, its consultants and management in setting executive compensation, please see “Executive Compensation—Compensation Discussion and Analysis—How We Make Decisions Regarding Executive Pay.” The Compensation Committee approves our compensation discussion and analysis included in our annual proxy statements. The Compensation Committee oversees our leadership development and management succession planning, as well as our diversity initiatives.

The agenda for meetings of the Compensation Committee is determined by its Chair with the assistance of our CEO, CFO, Chief Human Resources Officer (“CHRO”) and General Counsel and Secretary. Compensation Committee meetings are regularly attended by the Chairman of the Board and CEO, the CFO, the CHRO and the General Counsel. At certain meetings during fiscal 2020, the Compensation Committee met in executive session. The Compensation Committee’s Chair reports the Committee’s recommendations on CEO executive compensation to the Board, which sets the CEO’s compensation, and reports its determinations on other executive compensation to the Board. Independent advisors and our finance, human resources, benefits and legal departments support the Compensation Committee in its duties and may be delegated authority to fulfill certain administrative duties regarding the compensation programs. The Compensation Committee has authority under its charter to retain, approve fees for (and, as may be necessary or advisable, change or terminate) a compensation consultant, legal counsel or other advisor as it deems necessary to assist in the fulfillment of its responsibilities. The Compensation Committee annually evaluates the independence of its consultants and assesses their performance pursuant to a pre-approval policy.

The Compensation Committee’s charter is available on our website, www.unfi.com. The charter was most recently amended in September 2019. The Compensation Committee held five meetings during fiscal 2020. The current members of the Compensation Committee are Messrs. Heffernan, Muehlbauer and Stahl (chair) and Ms. Dufresne, each of whom is an independent director under the SEC and NYSE rules applicable to compensation committee members.

Audit Committee

The Audit Committee is responsible for monitoring the integrity of our financial reporting process and systems of disclosure controls and internal controls over financial reporting; monitoring the independence and performance of our independent registered public accounting firm; and overseeing our internal audit department. Among the Audit Committee’s duties are to review the results and scope of the audit and other services provided by our independent registered public accounting firm.

7

The Audit Committee’s charter is available on our website, www.unfi.com. The charter was most recently amended in October 2018. The Audit Committee held four meetings during fiscal 2020. The current members of the Audit Committee are Ms. Bates (chair) and Messrs. Heffernan, Muehlbauer and Stahl, each of whom is an independent director under SEC rules and the NYSE listing standards applicable to audit committee members. The Board has determined that Ms. Bates and Messrs. Heffernan, Muehlbauer and Stahl are audit committee financial experts, as defined by the rules and regulations of the SEC.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for developing, reviewing and recommending to the Board for adoption our Corporate Governance Principles; identifying and nominating candidates for election to the Board; assessing and making recommendations to the Board regarding the size and composition of the Board and the size, composition, scope of authority, responsibilities and reporting obligations of each of the Board’s committees; assisting the Board in conducting performance reviews of the Board and its Committees and members; oversight of our environmental, social and governance programs; and other duties and responsibilities. The Nominating and Governance Committee is also responsible for reviewing related party transactions under our Related Party Transaction Policy and oversees certain compliance matters under our Code of Conduct that are not related to finance or accounting (which are overseen by the Audit Committee), and provides oversight of general risk and compliance areas not falling under the Audit Committee or Compensation Committee.

For information regarding the director nomination process undertaken by the Nominating and Governance Committee, please refer to “Proposal 1—Election of Directors—Nomination of Directors.”

The Nominating and Governance Committee’s charter is available on our website, www.unfi.com. The charter was most recently amended in October 2018. The Nominating and Governance Committee held six meetings during fiscal 2020. The current members of the Nominating and Governance Committee are Mses. Clark (chair) and Dufresne and Messrs. Artz and Roy, each of whom is an independent director under SEC and NYSE rules.

Board Meetings

During fiscal 2020, the Board met 13 times and following each of the Board’s regular quarterly meetings, the independent directors met in executive session without the presence of management (including meetings conducted by telephone conference). All directors attended at least 75% of the aggregate meetings of the Board and of the committees on which they served. We encourage each member of the Board to attend our annual meeting of stockholders. All of our directors attended our last annual meeting virtually.

Stockholder Engagement

Stockholder engagement is an important and regular part of the Company’s strategy so that the Board and management are aware of and respond to stockholder input on a broad spectrum of business and governance matters. Our Lead Independent Director, the Chair of our Compensation Committee, and various members of management, including our Chief Legal Officer and General Counsel, Chief Human Resources Officer, and Head of Investor Relations, as primary participants, have engaged in discussions with stockholders as part of our efforts to gain an understanding of stockholder views. For the third consecutive year, the Company reached out to a significant percentage of its stockholders. Management found its outreach efforts in 2018, 2019 and 2020 to be very helpful in understanding our investors’ perspectives on various business and governance matters and intends to maintain ongoing discussions with a large number of investors each year.

Topics of discussion included corporate governance, specifically business performance and strategy evolution post-integration of Supervalu and as a result of the COVID-19 experience; Board refreshment and Board leadership structure; our safety and risk response to the COVID-19 pandemic, including how we protected the health and well-being of our associates; our commitments to diversity and inclusion; components of our executive compensation, of which many investors acknowledged the improvements made in response to our stockholder engagement last year; and our sustainability and philanthropy programs. Stockholders were supportive of our efforts to strengthen our existing corporate governance policies and were pleased with our efforts regarding Board refreshment.

Board Evaluation and Refreshment

Our Board regularly evaluates its composition, assessing individual director’s skills, qualifications and experience to align the overall Board composition to best meet the needs of the Company’s evolving long-term business strategy. Each year, the Board assesses the directors to be nominated at the annual meeting. The Board uses a skills matrix to assess the different contributions, background and experience of each director. The Nominating and Governance Committee considers prospective candidates and identifies appropriate individuals for the Board’s further consideration. The Nominating and Governance Committee also assesses the proper mix of skills and expertise for directors serving on the Board’s committees, as well as our Board’s commitment to diversity.

8

Summary of Board Skills, Experiences and Qualifications

Skills, Experiences and Qualifications | Director | ||||||||||

Artz | Bates | Clark | Dufresne | Funk | Heffernan | Muehlbauer | Roy | Spinner | Stahl | ||

Significant experience in business, education, the professions or public service | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | |

Commitment to areas aligned with the Company’s public interest commitments | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | |

Service as an executive officer for another public company | ü | ü | ü | ü | ü | ü | |||||

Experience in the Company’s industry | ü | ü | ü | ü | ü | ||||||

Experience with risk oversight | ü | ü | ü | ü | ü | ü | ü | ü | |||

Experience with shareholder engagement | ü | ü | ü | ü | ü | ü | ü | ||||

Information technology experience | ü | ü | |||||||||

International experience | ü | ü | ü | ü | ü | ||||||

Experience in leadership development | ü | ü | ü | ü | ü | ü | ü | ü | |||

Experience with mergers and acquisitions | ü | ü | ü | ü | ü | ü | ü | ü | ü | ||

eCommerce experience | ü | ||||||||||

Supply chain management experience | ü | ü | ü | ü | ü | ü | |||||

Consumer products/retail experience | ü | ü | ü | ü | |||||||

Senior operations management/CEO | ü | ü | ü | ü | ü | ü | |||||

Strategic thinking, planning and execution | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | |

Experience in broad-scale mergers, acquisitions and integration | ü | ü | ü | ü | |||||||

Operating financial expertise (CFO) | ü | ü | ü | ü | |||||||

Senior operations experience in industry or adjacent industry | ü | ü | ü | ü | |||||||

Highly leveraged / “turnaround” structures experience | ü | ü | |||||||||

9

Skills, Experiences and Qualifications | Director | ||||||||||

Artz | Bates | Clark | Dufresne | Funk | Heffernan | Muehlbauer | Roy | Spinner | Stahl | ||

Service on other public companies’ audit committee | ü | ü | ü | ü | ü | ü | |||||

Service in the financial reporting process of another public company | ü | ü | ü | ü | ü | ||||||

Financial expert | ü | ü | ü | ü | ü | ü | |||||

Relevant compensation committee experience | ü | ü | ü | ü | |||||||

Service on the compensation committee of another public company | ü | ü | ü | ü | ü | ||||||

Relevant experience for the nominating and governance committee | ü | ü | ü | ü | ü | ||||||

In September 2020, our Board, upon the recommendation of the Nominating and Governance Committee, revised the composition of the Compensation and Nominating and Governance committees. The current composition of each committee is disclosed above. In September 2020, the Board appointed Mr. Roy as Lead Independent Director for a second year, and appointed a new Chair of the Compensation Committee, Mr. Stahl, in anticipation of Mr. Heffernan’s retirement.

The Board has three directors who have served for more than ten years, in addition to our CEO, while the remaining directors have served for eight or fewer years. The overall average tenure of the Board is approximately nine years.

Our Board is diverse in gender and ethnic background, as well as having a broad range of experience. Three out of ten directors are female, with one member identifying as African American and one member identifying as LGBT. Our Nominating and Governance Committee charter provides for the consideration of gender, race and ethnic diversity when considering Board candidates. The Board is highly skilled and qualified, and committed to the Company’s success, as indicated by the high attendance rate and robust discussion and debate that occurs during each Board and committee meeting.

Following the acquisition of Supervalu in fiscal 2019, the Board conducted a thorough self-evaluation process led by a third-party consultant, as well as comprehensive assessment of skills, experience and qualifications desired as a result of the changing strategic needs of the Company. The Nominating and Governance Committee successfully identified two candidates possessing the desired mix of expertise and background to complement the Board’s then-existing skills and experience. The Board appointed James Muehlbauer in April 2019 and Jack Stahl in June 2019 to serve as directors of the Board in recognition of their extensive financial and strategic backgrounds, as well as executive leadership experience. In fiscal 2020, the Board again completed a thorough self-evaluation process and considered additional skills and experience that may be desirable in light of the impacts on our industry of the COVID-19 pandemic and rapidly evolving retail landscape, many of which we believe are long term in nature. In connection with Mr. Heffernan’s retirement, the Board has commenced a search process for one or two additional Board members to complement the existing Board’s skill set and with a focus on seeking diverse candidates.

Environmental, Social and Governance Practices

We have long been committed to incorporating environmentally sustainable and socially responsible practices into our business operations. This commitment is described in our Social and Environmental Policy, which was most recently updated in September 2020 and is available on our website, www.unfi.com. Our Nominating and Governance Committee has direct oversight of our policies and strategies addressing environmental, social and governmental matters, including sustainability, corporate social responsibility and political contributions, and is responsible for reporting to the Board on such matters at least annually.

Our commitment is further evidenced by more than ten years of issuing Corporate Social Responsibility (CSR) reports highlighting our focus on sustainability and philanthropy. Our fiscal 2019 CSR report also referenced both GRI and SASB standards, and those tables are available on our website. In conjunction with our fiscal 2020 CSR report, we expect to announce our 2030 vision, an ambitious ten-year plan to pioneer solutions across the food system. Our plan includes expanding and enhancing our policies and practices related to climate change, waste reduction, food access, safety and well-being and diversity and inclusion. We expect to release our 2020 CSR report in the coming months, which will include more details on our long-term goals and how

10

we serve our communities, employees and the environment. When issued, the report will be available on the “ESG” section of our website.

Despite our strong track record, we Believe in Better. In fiscal 2020, we undertook a materiality assessment involving key internal and external stakeholders to identify the areas that we believe will drive greater value for the communities we serve and our broader business. Additionally, we created an executive steering committee to oversee implementation of our ESG initiatives and provide executive sponsorship for our ESG strategy and goals. Examples of our ESG initiatives and commitment to doing better are highlighted below. | ||||

Better for Our World | |||

• | Annually report climate performance to CDP | • | Joined the Climate Collaborative |

• | Sixth consecutive year on Food Logistics’ Top Green Provider list | • | Regular recycling of delivery fleet to improve efficiency, lower costs and protect planet |

• | Committed to sourcing 100% of top 20 wild caught fish from MSC- or FIP-certified sources | • | Follow EPA’s Food Recovery Hierarchy to reduce waste |

• | Partner with leading organizations to increase opportunities for diverse-owned businesses, including the National Minority Supplier Development Council | • | LEED- and solar-powered buildings to provide more efficiency and benefit the environment |

Better for Our Communities | |||

• | UNFI Foundation funded 69 nonprofits in 2019 and is committed to providing grants to support food injustice in underserved communities | • | Committed to strength and safety of distribution networks and retail operations during pandemic |

• | Matched associate donations to nonprofits fighting for racial justice and reform | • | Leading distributor of natural, organic, specialty produce and other products |

• | Dedicated to providing healthy food options to school children by supporting FoodCorps | • | 80% of food waste diversion through donations |

Better for Our People | |||

• | Hired a Vice President of Diversity & Inclusion to further enhance commitment to diversity, equity and inclusion | • | Reviewing and improving our recruiting, training, and talent development practices to remove bias and increase diversity in leadership |

• | Hosted “Community Conversations” for our associates to share experiences and process together | • | Partnered with Network of Executive Women to enhance our commitment to the advancement of women in the workplace |

• | Ongoing communication with employees through mid-year and year-end performance reviews | • | Signed pledge to CEO Action for Diversity and Inclusion |

• | Committed to workplace safety and developed robust safety programs, including additional sanitation, social distancing practices, face-covering requirements, temperature checking, and PPE requirements | • | Launched a wellness program to provide employees with tools and resources to encourage healthy habits and track progress |

11

Proposal 1—Election of Directors

Directors and Nominees for Director

The Board currently consists of ten directors, each of whose terms will expire at the annual meeting. On November 20, 2020, the Board resolved to decrease its size to nine members as of the date of the Annual Meeting.

Mses. Bates, Clark and Dufresne and Messrs. Artz, Funk, Muehlbauer, Roy, Spinner and Stahl have been nominated to stand for election as directors at the annual meeting to hold office until the next annual meeting of stockholders and until their successors are elected and qualified. Each nominee has indicated his or her willingness to continue to serve if elected by our stockholders. If any nominee should be unable to serve, the person acting under the proxy may vote the proxy for a substitute nominee. We have no reason to believe any of the nominees will be unable to serve if elected.

We have described below information concerning the business experience and qualifications, and the age as of November 16, 2020, of each of our director nominees.

The Board unanimously recommends that stockholders vote “FOR” each of the director nominees. Proxies received by the Board will be voted “FOR” each of the nominees unless a contrary choice is specified in the proxy. | ||||

Nominees for Election as Directors for a Term Expiring at the Next Annual Meeting

Eric F. Artz, age 53, has served as a member of the Board since October 2015. Mr. Artz is a member of the Nominating and Governance Committee. Mr. Artz previously served as a member of the Compensation Committee from December 2015 to September 2020. Mr. Artz has served as President and Chief Executive Officer, and member of the board of directors, of Recreational Equipment, Inc. (“REI”) since May 2019. He served as Executive Vice President and Chief Operating Officer of REI from August 2014 to May 2019. In addition to this role, Mr. Artz also served as Executive Vice President, Chief Financial Officer and Treasurer of REI from May 2012 to December 2015. Prior to REI, Mr. Artz served as Chief Financial Officer for Urban Outfitters, Inc. from February 2010 to April 2012. From August 1992 until January 2010, Mr. Artz served in various positions of increasing responsibility at VF Corporation.

Mr. Artz brings valuable knowledge and insight to our Board. The Board values his experience as a Chief Executive Officer, Chief Operating Officer and Chief Financial Officer, which provides him with valuable knowledge and insight regarding operations of retailers as well as the background and experience in overseeing the audits of financial statements, communicating with independent auditors and assisting with the general oversight of accounting and financial reporting processes.

Ann Torre Bates, age 62, has served as a member of the Board since October 2013. Ms. Bates serves as the Chair of the Audit Committee. Ms. Bates has served as a member of the board of directors of Ares Capital Corporation since 2010 and held a directorship at Allied Capital Corporation until it was acquired by Ares Capital Corporation in 2010. Ms. Bates also serves as director or trustee of 17 investment companies in the Franklin Templeton Group of mutual funds. Ms. Bates was a strategic and financial consultant from 1997 to 2012. From 1995 to 1997, Ms. Bates served as Executive Vice President, Chief Financial Officer and Treasurer of NHP, Inc., a national real estate services firm. Ms. Bates previously served as a member of the board of directors of Navient Corporation from April 2014 to August 2016, and she served on the board of directors of Navient’s predecessor, SLM Corporations, from 1997 to 2014.

Ms. Bates’ professional experience and service on other boards brings valuable knowledge and insight to our Board. The Board values her experience serving on audit committees, which provide her with the background and experience in overseeing the audits of financial statements, communicating with independent auditors and assisting with the general oversight of accounting and financial reporting processes.

Denise M. Clark, age 63, has served as a member of the Board since February 2013. Ms. Clark serves as the Chair of the Nominating and Governance Committee. Since October 2018, Ms. Clark has served as a member of the Board of Directors of Caesars Entertainment Corporation and also serves as a member of its Compensation Committee. Ms. Clark served as Senior Vice President and Global Chief Information Officer for The Estée Lauder Companies Inc. from November 2012 until her retirement in March 2017. Prior to that role, Ms. Clark served as Senior Vice President and Chief Information Officer for Hasbro Inc. from October 2007 to November 2012. Ms. Clark also served at Mattel, Inc., where she was Global Chief Technology Officer and later Chief Information Officer for the Fisher Price brand between January 2000 and February 2007. Ms. Clark’s previous experience includes two other consumer goods companies, Warner Music Group, formerly a division of Time Warner Inc., and Apple Inc. Ms. Clark has over 20 years of experience in the delivery of enterprise resource planning, digital platforms and innovative business transformation initiatives.

12

Ms. Clark’s extensive background in complex organizations, particularly her expertise involving information technology, allows her to provide the Board valuable guidance on our strategic initiatives, especially as it relates to information technology solutions, and leadership development.

Daphne J. Dufresne, age 48, has served as a member of the Board since October 2016. Ms. Dufresne is a member of the Compensation Committee and Nominating and Governance Committee. Ms. Dufresne has been a Managing Partner of GenNx360 Capital Partners since January 2017. Ms. Dufresne was previously a Managing Director of RLJ Equity Partners, a private equity fund, from December 2005 to June 2016. Ms. Dufresne participated in building the RLJ investment team, raising capital to fund its operations and constructing a partnership with The Carlyle Group, a global private equity firm. Prior to that role, Ms. Dufresne was a Venture Partner during 2005 with Parish Capital Advisors, an investment fund for emerging and experienced institutional investors and a Principal from 1999 to 2005 at Weston Presidio Capital, a private equity organization. She also served as Associate Director in 1997 in the Bank of Scotland’s Structured Finance Group. Ms. Dufresne has been a director of Condor Hospitality Trust, Inc. since June 2015, and was appointed chair in May 2019.

Ms. Dufresne’s professional experience, including her role as an equity investor for over 23 years, brings valuable knowledge and insight to our Board. Ms. Dufresne is very familiar with conducting due diligence, negotiating purchase and sale agreements and leading the board during these processes. She possesses experience in owning and managing enterprises like our Company and is familiar with corporate finance, strategic business planning activity and general issues involving various types of stockholders.

Michael S. Funk, age 66, has been a member of the Board since February 1996 and served as Chair of the Board from January 2003 to December 2003, and again from September 2008 to December 2016. Mr. Funk served as our President and Chief Executive Officer from October 2005 to September 2008. Mr. Funk also served as Vice Chair of the Board from February 1996 until December 2002, as our Chief Executive Officer from December 1999 until December 2002 and as our President from October 1996 until December 1999. From its inception in July 1976 until April 2001, Mr. Funk served as President of Mountain People’s Warehouse, Inc., now known as United Natural Foods West, Inc., one of our wholly-owned subsidiaries.

Mr. Funk’s extensive knowledge of our industry and our historical operations, as well as his past service as our Chief Executive Officer, brings to the Board valuable insight into the core operations of our Company and a deep understanding of the natural and organic products distribution business. His institutional knowledge of all operational aspects of our business resulting from his long-term involvement with our Company is valuable to the Board.

James L. Muehlbauer, age 59, has served as a member of the Board of Directors since April 2019. Mr. Muehlbauer serves as a member of the Audit Committee and Compensation Committee. Mr. Muehlbauer previously served as a member of the Nominating and Governance Committee from May 2019 to September 2020. Mr. Muehlbauer served as the Executive Vice President, Chief Financial and Administrative Officer for The Valspar Corporation from 2013 to 2017. Prior to that role, Mr. Muehlbauer served as Executive Vice President and Chief Financial Officer of Best Buy Co., Inc. from 2007 to 2013.

Mr. Muehlbauer’s extensive finance, commercial and leadership experience with complex, multinational organizations provide him with background and experience in strategic planning, financial oversight, and large-scale business transformations. Mr. Muehlbauer’s knowledge and experience in broad strategic transitions and large-scale integration efforts are valuable to our Board.

Peter A. Roy, age 64, has served as a member of the Board since June 2007 and as the Lead Independent Director since September 2019. Mr. Roy serves as a member of the Nominating and Governance Committee. Mr. Roy is an entrepreneur and since 1999, Mr. Roy has served as a strategic advisor to North Castle Partners, a private equity firm focused on healthy living and aging investments. Mr. Roy has worked with many iconic brands such as Stonyfield Farms and Applegate. From 1993 to 1998, Mr. Roy served as President of Whole Foods Market, Inc. and, for five years prior to that, served as President of that company’s West Coast Region.

Mr. Roy’s experience as the President of Whole Foods Market, Inc. allows him to provide the Board essential insight and guidance into the day-to-day operations of natural and organic products retailers, including our largest customer. In addition, his experience in the healthy lifestyle industry helps the Board maintain its focus on our core values, including our sustainability goals.

Steven L. Spinner, age 60, has served as Chairman of the Board since December 2016 and as our Chief Executive Officer and as a member of the Board since September 2008. He also served as our President from September 2008 until August 2018. Prior to joining the Company in September 2008, Mr. Spinner served as a director and as Chief Executive Officer of Performance Food Group Company (“PFG”) from October 2006 to May 2008, when PFG was acquired by affiliates of The Blackstone Group and Wellspring Capital Management. Mr. Spinner previously had served as PFG’s President and Chief Operating Officer beginning in May 2005. Mr. Spinner served as PFG’s Senior Vice President and Chief Executive Officer—Broadline Division from February 2002 to May 2005 and as PFG’s Broadline Division President from August 2001 to February 2002. Mr. Spinner has served as a

13

Director of ArcBest Corporation, a holding company of businesses providing integrated logistics solution, since July 2011 and as its Lead Independent Director since April 2016.

Mr. Spinner’s extensive experience of over 30 years in the wholesale food distribution business, including having held executive management positions with major distribution businesses in the United States, brings valuable insight to the Board beyond the knowledge and insight he brings from being our Chief Executive Officer.

Jack Stahl, age 67, has served as a member of our Board since June 2019. Mr. Stahl serves as Chair of the Compensation Committee and as a member of the Audit Committee. Mr. Stahl has served as a member of the Board and the Lead Director of Catalent, Inc., a contract manufacturing and development company for drugs, biologics and consumer health products since August 2014. Mr. Stahl served as President and Chief Executive Officer of Revlon Inc., a multinational cosmetics, skin care, fragrance and personal care company, from 2002 until his retirement in 2006. Prior to joining Revlon, Mr. Stahl served as President and Chief Operating Officer of The Coca-Cola Company from 2000 to 2001, after previously serving in various management positions of increasing responsibility, including Chief Financial Officer, during a tenure with Coca-Cola which began in 1979. Today, Mr. Stahl also serves on the U.S. board of advisors of CVC Capital, a private equity firm. Additionally, he formerly served on the Boards of Board of Advantage Solutions LLC, Schering Plough Corporation, Dr Pepper Snapple Group, Saks, Inc., Coty Inc. and Ahold Delhaize, and was chairman of the board of managers of New Avon LLC.

Mr. Stahl has extensive leadership and significant Board experience. Mr. Stahl has a long-term record of profit and value driving performance in both stable and turnaround operating environments, and significant experience with complex, large, and dynamic organizations. At The Coca-Cola Company and at Revlon, he gained significant skills and general management experience in building brands, maximizing customer relationships, and reducing costs.

Majority Vote Standard for Election of Directors

Our Bylaws provide for a majority voting standard for the election of directors in an uncontested election. If the number of nominees exceeds the number of directors to be elected in an election (a contested election), directors will be elected by a plurality standard. When the number of nominees does not exceed the number of directors to be elected (an uncontested election), however, as is the case at this year’s annual meeting, our Bylaws require each of the directors to be elected by a majority of the votes cast (that is, the number of shares voted “for” a director must exceed the number of shares voted “against” that director). If a nominee who is serving as a director is not elected at the annual meeting, under Delaware law the director would continue to serve on the Board as a “holdover director.” However, under our Bylaws, any director who fails to be elected must offer to tender his or her resignation to the Board. The Nominating and Governance Committee would then make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Nominating and Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified. The director who offers to tender his or her resignation will not participate in the Board’s decision or the Nominating and Governance Committee’s deliberations (if the director is a member of that committee). All nominees for election as directors at the annual meeting are currently serving on the Board.

Nomination of Directors

The Nominating and Governance Committee reviews the qualifications of every person recommended as a nominee to the Board, including potential nominees recommended by third-party recruiting firms, to determine whether the recommended nominees are qualified to serve on the Board. The Nominating and Governance Committee has adopted standards by which it identifies nominees and determines if nominees are qualified to serve on the Board. The Nominating and Governance Committee evaluates recommended nominees in accordance with the following criteria:

• | Personal Characteristics. The Nominating and Governance Committee considers the personal characteristics of each nominee, including the nominee’s integrity, accountability, ability to make informed judgments, financial literacy, professionalism and willingness to meaningfully contribute to the Board (including by possessing the ability to communicate persuasively and address difficult issues). In addition, the Nominating and Governance Committee evaluates whether the nominee’s previous experience reflects a willingness to establish and meet high standards of performance, both for him or herself and for others. |

• | Core Competencies. The Nominating and Governance Committee considers whether the nominee’s knowledge and experience would contribute to the Board possessing certain core competencies. The Nominating and Governance Committee believes that the Board, as a whole, should possess competencies in accounting and finance, business judgment, management best practices, senior leadership, crisis response, industry knowledge, strategy and vision, and broad-scale transition and transformation, and it periodically reassesses the specific skill sets that are needed by the Board. |

• | Board Independence. The Nominating and Governance Committee considers whether the nominee would qualify as “independent” under SEC rules and the NYSE listing standards. |

14

• | Director Commitment. The Nominating and Governance Committee expects that each of our directors will prepare for and actively participate in meetings of the Board and its committees, provide advice and counsel to our management, develop a broad knowledge of our business and industry and, with respect to an incumbent director, maintain the expertise that led the Nominating and Governance Committee to initially select the director as a nominee. The Nominating and Governance Committee evaluates each nominee on his or her ability to provide this level of commitment if elected to the Board. |

• | Additional Considerations. Each nominee also is evaluated based on the overall needs of the Board and the diversity of experience he or she can bring to the Board, whether in terms of specialized knowledge, skills or expertise. Our Nominating and Governance Committee charter provides for the consideration of gender, race, and ethnic diversity when considering Board candidates, and the Committee is committed to maintaining a diverse Board. The Nominating and Governance Committee strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee our businesses and add value to strategic plans and initiatives. |

Following this evaluation, the Nominating and Governance Committee will ultimately make recommendations for membership on the Board and review such recommendations with the Board, which will decide whether to appoint the candidate to the Board.

Stockholder Director Recommendations and Proxy Access

Stockholder Director Recommendations

The Nominating and Governance Committee evaluates nominees recommended by stockholders on the same basis as nominees recommended by any other sources, including determining whether the candidate is qualified to serve on the Board based on the qualitative standards described above. To have a nominee considered by the Nominating and Governance Committee, a stockholder must follow the procedures in our Bylaws related to director nominations described under “Other Matters—Stockholder Proposals for the Next Annual Meeting of Stockholders.” Written notice must be delivered or sent by first class U.S. mail addressed to Corporate Secretary, United Natural Foods, Inc., 313 Iron Horse Way, Providence, RI 02908.

Proxy Access

We have also adopted a proxy access provision in our Bylaws that permits a stockholder, or a group of up to 20 stockholders, owning, continuously for at least three years, shares of our stock representing an aggregate of at least 3% of the voting power entitled to vote in the election of directors, to nominate and include in our proxy materials director nominees, provided that the stockholder(s), the nominee(s), and the notice satisfy the requirements in our Bylaws. The number of potential proxy access nominees nominated by all eligible stockholders shall not exceed the greater of (A) two or (B) 20% of the directors then in office. Under our Bylaws, to be timely, notice of proxy access director nominations must be received by our Corporate Secretary at the address specified above no earlier than 150 days and no later than 120 days prior to the first anniversary of the date the Company mailed its proxy statement for the preceding year’s annual meeting; provided, however, that if (A) the annual meeting is not within 30 days before or after the anniversary date of the preceding year’s annual meeting, or (B) no annual meeting was held during the preceding year, to be timely the stockholder notice must be received no later than 120 days prior to such annual meeting or, if later, the tenth day after the day on which notice of the date of the meeting was mailed or public disclosure of the date of the annual meeting is first made, whichever occurs first.

Communication with the Board of Directors

Our stockholders may communicate directly with the Board. All communications should be in written form and directed to our Corporate Secretary, United Natural Foods, Inc., 313 Iron Horse Way, Providence, RI 02908, who will forward such communications to the appropriate party. All correspondence will be compiled and summarized by the Corporate Secretary and periodically submitted to the Board or individual directors. The Corporate Secretary may also forward certain correspondence elsewhere within the Company for review by a subject matter expert and for a response, as appropriate.

15

Director Compensation