Form DEF 14A UNITED NATURAL FOODS For: Jan 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ | ||||||||

Filed by a Party other than the Registrant o | ||||||||

| Check the appropriate box: | ||||||||

| o | Preliminary Proxy Statement | |||||||

| ☒ | Definitive Proxy Statement | |||||||

| o | Definitive Additional Materials | |||||||

| o | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | |||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| United Natural Foods, Inc. | ||||||||

| (Name of Registrant as Specified in its Charter) | ||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||

| ☒ | No fee required. | |||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

| o | Fee paid previously with preliminary materials. | |||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

Letter from Our Independent Chair of the Board

Letter from Our Independent Chair of the BoardDear Fellow Stockholders,

On behalf of the Board of Directors, I would like to begin by formally welcoming Sandy Douglas to his role as CEO and a director on our Board. After a robust CEO search process, working with a top tier search firm, our Board is confident that Sandy has the right experience, skills and leadership style for our Company, and we are looking forward to working alongside Sandy as we continue to strengthen our partnerships with our customers and deliver on our Fuel the Future strategy.

Upon the appointment of Sandy as CEO, the Board determined it was in the best interest of the Company and you, as our stockholders, to separate the roles of CEO and Chair of the Board. I am honored to serve as the Independent Chair of the Board, and I am looking forward to working closely with a dynamic and diverse group of executives and directors to drive long-term stockholder value while also overseeing the Company’s robust compliance, risk, ESG and governance policies and programs. We are also committed to continuing to seek input from our investors through our annual engagement process.

Board Refreshment, Board Leadership and Corporate Governance. We continue to focus on maintaining and enhancing our strong corporate governance practices, including Board evaluation and refreshment. In January 2021, we appointed Gloria R. Boyland to the Board and in August 2021, we appointed Sandy. We believe that Gloria’s customer-focused and supply-chain experience, together with Sandy’s background and expertise in customer-focused business-to-business-to-consumer distribution, sales, marketing and eCommerce will drive even more value into the Board’s oversight, and the Company’s execution, of our new Fuel the Future strategy. We made several enhancements to our corporate governance policies in fiscal 2021 responsive to stockholder feedback, including strengthening our recoupment policy, adding oversight of human capital management to our Compensation Committee Charter, revising our Corporate Governance Principles to include a diverse slate requirement for all director appointments and adopting a formal Stockholder Engagement Policy.

Better For All. We are extremely proud of our environmental, social and governance (ESG) commitments reflected in our “Better For All” campaign. Key elements of our ESG program include Board oversight of our ESG program, the creation of an ESG Executive Committee, the launch of long-term, ambitious goals, including the recent submission of a science-based emissions reduction target, and heightened focus on diversity, equity and inclusion efforts.

Stockholder Engagement. We continue to be deeply interested in hearing from you, our stockholders. This summer we conducted our fourth annual stockholder engagement program. We are happy to report that we spoke with holders of over 50% of our outstanding common shares across a broad spectrum of matters. These sessions provide us the opportunity to discuss a wide variety of topics with our stockholders, including our new Fuel the Future strategy, Board refreshment, executive compensation, ESG practices and other topics. We find these discussions very informative and, as a result of feedback received, we have made several enhancements to our executive compensation program over the years, including this year.

UNFI has embarked on an exciting journey in fiscal 2021, and on behalf of the entire Board of Directors, I would like to thank you for your continued investment and trust as we drive value for our customers and for you, our stockholders.

| Sincerely, | |||||

| |||||

| Jack Stahl | |||||

| Independent Chair | |||||

Letter from Our CEO

Letter from Our CEO Dear Stockholders,

I am honored to be the new CEO of UNFI and to help execute on our Fuel the Future strategy to support our customers, expand and grow our services business, technologies and brands, focus on our people and optimize our supply chain network and retail banners. I have great confidence in the strength of our team and the opportunities ahead.

Fuel the Future. Fuel the Future is our blueprint for our next phase of growth. From our strong foundation, we are poised to elevate our business and deliver even more for our customers — with a focus on new ways of engaging our customers to support their brand strength and market positioning. Our mission is about making our customers stronger, our supply chain better and our food solutions more inspired. Our new strategic plan is squarely aimed at delivering upon our mission and vision through our corresponding values for us and our customers, with the cornerstone of doing the right thing and putting safety at the forefront. I am excited to be a part of the leadership team working toward achieving these strategic goals.

Diversity and Inclusion. We recognize that we have an important role to play in making our world and our Company a more equal and inclusive place. To that end, in the last year, our diversity and inclusion office has implemented policies and procedures that drive accountability and results, as we build-out metrics and best practices that are engrained in the way we do business. We are also committing to increase our spending with diverse owned suppliers and vendors and providing grants to support food justice in underserved communities through the UNFI Foundation. Additionally, we are committed to electing diverse candidates to our Board because we believe that creating a diverse and inclusive environment at UNFI starts at the top.

Dedication to Strong Corporate Governance Practices and ESG. Our commitment to doing things the right way remains steadfast. We are committed to being good stewards of our planet, our communities and our people through tangible action. In early 2021, we launched Better for All, our environmental, social and governance plan aligned to three pillars: building Better for Our World, Our Communities and Our People. Better for All focuses on six key priorities: climate action, waste reduction, food safety, food access, associate safety and wellbeing and diversity and inclusion. To track our progress against each of these areas, UNFI has established goals and commitments, which are set forth in our 2020 ESG Report, available on our website at www.betterforall.unfi.com.

In conclusion, I am very excited to have joined UNFI. I am proud and grateful for all of the incredible work of our front-line associates, as well as our corporate support teams during the pandemic and other challenges we faced. We are on a journey to Fuel the Future, together. On behalf of our Board of Directors, and everyone at UNFI, thank you for your continued support of this great Company.

| Sincerely, | |||||

| |||||

| Sandy Douglas | |||||

| Chief Executive Officer | |||||

Please vote. Stockholders may vote through the Internet, by telephone or by mail. Please refer to your proxy card or the notice of proxy availability distributed to you on or about November 23, 2021 for information on how to vote through the Internet, by telephone or by mail. | |||||

Notice of Annual Meeting of Stockholders

Meeting Information

Tuesday, January 11, 2022, 4:00 p.m. EST, with log-in at 3:45 p.m. EST.

You may attend our annual meeting of stockholders in January 2022 (Annual Meeting) through the Internet by virtual web conference at www.virtualshareholdermeeting.com/unfi2022. The meeting will be a virtual-only meeting, consistent with the three prior years. We believe the virtual meeting allows greater access for stockholders to participate in the meeting, hear from Management and ask questions than an in-person meeting in one geographic location.

Items to be Voted on

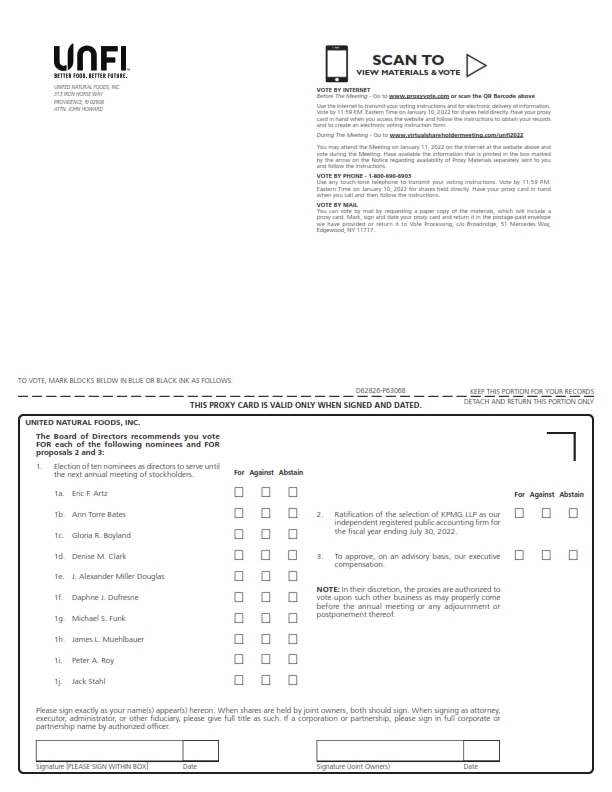

1.The election of ten nominees as directors to serve until the next annual meeting of stockholders.

2.The ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending July 30, 2022.

3.The approval, on an advisory basis, of our executive compensation.

4.Consideration of such other matters as may properly come before the meeting or any adjournments or postponements thereof.

Record Date

Only stockholders of record on our books at the close of business on Monday, November 15, 2021, will be entitled to vote at the Annual Meeting and any adjournments or postponements of the Annual Meeting.

Proxy Voting

Your vote is important. If you do not attend the Annual Meeting, we encourage you to vote your shares through the Internet, by telephone or by completing, dating, signing and promptly returning your proxy card to us in the envelope provided. The proxy materials provide you with details on how to vote by these three methods. If you decide to attend the Annual Meeting through the Internet, you may revoke your proxy and cast your vote during the meeting.

Proxy Materials

In accordance with rules approved by the Securities and Exchange Commission, we furnish proxy materials to our stockholders over the Internet. On or about November 23, 2021, we mailed to all stockholders of record as of the close of business on November 15, 2021, a notice containing instructions on how to access our Annual Report to Stockholders, which contains our audited consolidated financial statements for the fiscal year ended July 31, 2021; our proxy statement; proxy card; and other items of interest to stockholders on the Internet website indicated in our notice, at www.proxyvote.com, as well as instructions on how to vote your shares of common stock in connection with the Annual Meeting. That notice also provided instructions on how you can request a paper copy of our proxy materials and Annual Report to Stockholders if you desire.

| By Order of the Board of Directors, | |||||

| |||||

Jill E. Sutton, Esq. | |||||

Chief Legal Officer, General Counsel and Corporate Secretary November 23, 2021 | |||||

Table of Contents

A-1 | |||||

Forward Looking Statements

This proxy statement contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Our actual results may differ from our expectations, estimates and projections, and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “might,” “continues,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, our expectations with respect to our future performance and the drivers of that performance. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Most of these factors are outside our control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the impact and duration of the COVID-19 pandemic; (2) labor and other workforce shortages and challenges; (3) our dependence on principal customers and material changes in our customers relationships; (4) our ability to recognize the anticipated benefits of our acquisitions and strategic initiatives, including the acquisition of SUPERVALU INC. (Supervalu), which may be affected by, among other things, increased competition in our industry and our ability to grow and manage growth profitably and retain key employees; (5) our ability to optimize our network of distribution centers to serve our customers and retain existing customers; and (6) other risks and uncertainties identified in our filings with the Securities and Exchange Commission (SEC). More information about other potential factors that could affect our business and financial results is included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended July 31, 2021 filed with the SEC.

Proxy Statement Summary

For the Annual Meeting of Stockholders, January 11, 2022

Voting Matters

| Proposal | Board Recommendation | Page | ||||||||||||

Proposal 1—Election of Directors | FOR | |||||||||||||

Proposal 2—Ratification of Independent Auditor | FOR | |||||||||||||

Proposal 3—Say on Pay Resolution | FOR | |||||||||||||

Director Nominees

Our business and affairs are managed under the direction of the Board of Directors (the Board). The Board currently consists of ten (10) directors, eight (8) of whom are independent.

Information about our directors and the committees on which they serve is set forth below. Each director serves a one-year term and has been nominated for re-election.

| Name | Age | Director Since | Audit | Compensation | Nominating and Governance | |||||||||||||||||||||||||||

Eric F. Artz Independent | 54 | Oct 2015 | — | ü | ü | |||||||||||||||||||||||||||

Ann Torre Bates Independent | 63 | Oct 2013 | CHAIR | — | — | |||||||||||||||||||||||||||

Gloria R. Boyland Independent | 61 | Jan 2021 | ü | — | ü | |||||||||||||||||||||||||||

Denise M. Clark Independent | 64 | Feb 2013 | — | — | CHAIR | |||||||||||||||||||||||||||

J. Alexander (Sandy) Miller Douglas Chief Executive Officer | 60 | Aug 2021 | — | — | — | |||||||||||||||||||||||||||

Daphne J. Dufresne Independent | 49 | Oct 2016 | — | CHAIR | — | |||||||||||||||||||||||||||

Michael S. Funk Co-Founder | 67 | Feb 1996 | — | — | — | |||||||||||||||||||||||||||

James L. Muehlbauer Independent | 60 | April 2019 | ü | ü | — | |||||||||||||||||||||||||||

Peter A. Roy Independent | 65 | June 2007 | — | ü | ü | |||||||||||||||||||||||||||

Jack Stahl Independent Chair | 68 | June 2019 | ü | — | — | |||||||||||||||||||||||||||

1

New This Year

Fuel the Future Strategy Announced in June 2021

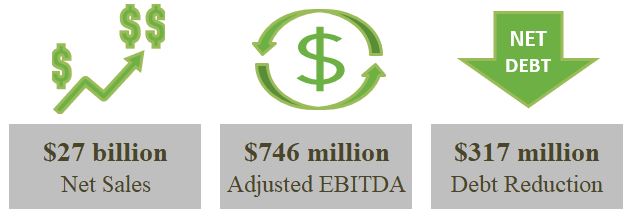

As a leading distributor of natural, organic, specialty, produce and conventional grocery and non-food products, and provider of support services to retailers in the United States and Canada, we believe we are uniquely positioned to provide the broadest array of products and services to customers throughout North America. In fiscal 2021, we continued to leverage our scale and unmatched customer offering to deliver full-year results that were at, or above, our initial expectations. With our Fuel the Future strategy and the six underlying pillars, our new leadership structure and robust governance updates, we believe we are well positioned to drive growth in the years to come.

In June 2021, we announced our new strategy, Fuel the Future, to support our mission to make our customers stronger, our supply chain better and our food solutions more inspired.

ESG - Better For All

•Announced our Better for All ESG campaign, which includes ambitious, long-term goals meant to make the world, our communities, and our people better •Expanded ESG disclosure in last year’s proxy statement and in our 2020 ESG Report issued in January 2021 •Established an ESG Executive Committee to drive strategic execution of our ESG initiatives in addition to Nominating and Governance Committee oversight •Submitted science-based emissions reduction targets to the Science-Based Targets Initiative in October 2021 | ||||||||||||||

2

New Chief Executive Officer (CEO) and Board Leadership

•Appointed Sandy Douglas as CEO and member of the Board in August 2021 after a robust search to succeed Steven Spinner, who announced his retirement in the Fall of 2020 ◦CEO Succession Planning Committee of the Board with mandate to facilitate the CEO selection process ◦Engaged top tier search firm to develop a CEO profile that reflected skills, experience and leadership style aligned with the Company’s strategic needs and future growth objectives ◦Conducted robust interview and assessment process for CEO candidates, internal and external, against this profile and other factors ◦Appointed the new CEO most qualified for service in this role and as a director of the Board, based on this comprehensive process •Separated our Chair and CEO roles and appointed Jack Stahl as Independent Chair upon appointment of CEO •Updated our Corporate Governance Principles in September 2021 to add rotational guidelines for Board and Committee leadership positions | ||||||||||||||

Governance Updates

•Enhanced our recoupment policy to provide for forfeiture of incentive compensation in certain cases of misconduct resulting in financial harm and to require disclosure in certain circumstances •Adopted a formal Stockholder Engagement Policy to support our robust stockholder engagement process that includes both Management and Directors •Updated our Social and Environmental Policy to align with outcomes of our ESG materiality assessment, articulate our commitment to ESG and outline our principles for achieving our ESG goals •Enhanced our stock ownership guidelines in September 2020 for Directors and executive officers to limit the number of unvested shares that may count toward the guidelines and require ownership by additional senior officers •Revised Corporate Governance Principles in September 2021 to require a diverse slate for all director candidates going forward to complement our commitment to a diverse Board •Amended Compensation Committee Charter to include oversight of human capital management | ||||||||||||||

Board Refreshment

| Assess | è | Identify | è | Evaluate and Recommend | ||||||||||

•Review desired skills against our current strategy •Consider our Director eligibility guidelines, including independence and diversity considerations •Create a director candidate profile | •Third-party recruiter identifies potential candidates •Any director slate must include diverse candidates •Stockholders ability to present candidates to our Board for consideration | •Nominating and Governance Committee reviews skills, qualifications, diversity, independence and potential conflicts •Candidates meet with full Board •Nominating and Governance Committee recommends selected candidates to full Board | ||||||||||||

Results ê 5 new directors (4 Independent) appointed over the last 5 years (including 2 in 2021) | ||||||||||||||

We are committed to actively refreshing our Board and each committee to maintain a mix of short-, medium- and long-tenured directors, which we believe promotes strong Board governance. We also proactively manage potential vacancies due to retirement. The Board engages a top tier third-party recruiter to identify and recommend diverse candidates that will complement the existing skill set and qualifications of our current Board, our strategic vision and our corporate values.

In January 2021, after the retirement of a long-tenured director, the Board appointed Gloria R. Boyland to serve as a Director. Ms. Boyland is currently a member of the Audit Committee and Nominating and Governance Committee. Her appointment adds significant customer-focused experience, as well as large-scale supply chain expertise to the collective experience of the existing Board in areas that serve to advance our long-term strategic objectives. As noted above, the Board recently appointed Mr. Douglas to serve as CEO and a member of the Board. His background and expertise in customer-focused business-to-business-to-consumer distribution, sales, marketing and eCommerce further align with our focus on growing the core business while investing in innovation. The addition of Ms. Boyland and Mr. Douglas further our commitment

3

to ongoing Board refreshment, resulting in the addition of five Directors (four independent) over the last five years with further efforts to refresh the Board underway.

2021 Stockholder Outreach

| Met with holders of over 50% of our stock | Fourth consecutive year of robust engagement | Formal Engagement Policy | ||||||||||||

We engaged with holders of over 50% of our outstanding stock again this year. In these meetings, we discussed significant Company updates, such as the announcement of the new Fuel the Future strategy, the appointment of our new CEO and our ESG programs. We also generally seek investor feedback about how we can further enhance our good governance principles and executive compensation programs. Our ESG team also conducted separate ESG calls with certain investors upon request. Overall, the feedback we received was positive and Management provided a summary of such feedback to the Board for discussion.

| Responsive Actions to Feedback | ||||||||||||||

| Enhanced disclosure | Revised several components of Executive Compensation Program | Strengthened governance policies | ||||||||||||

See “Corporate Governance—Stockholder Engagement” and “Executive Compensation—Compensation Discussion and Analysis—Say on Pay Vote, Investor Engagement and Responsive Action” for more discussion of actions we took in response to these conversations.

Governance Highlights

| ü | Eight of ten directors are independent | ü | Board oversight of ESG; Better For All Campaign launched in 2021 | ||||||||

| ü | Active stockholder engagement four consecutive years - recently adopted formal Stockholder Engagement Policy | ü | Fully integrated and enhanced Enterprise Risk Management Program | ||||||||

| ü | Recently enhanced stock ownership guidelines for directors, executive officers and additional senior officers | ü | Robust Board refreshment process - 5 new Directors in last five years | ||||||||

| ü | Strong Executive Compensation Governance: •Fully independent Compensation Committee with newly appointed Chair •Long-term incentive compensation capped and aligned with predetermined financial metrics •New independent compensation consultant retained in fiscal 2021 •No gross ups or excessive perquisites •Robust Stock Ownership Guidelines and Recoupment Policy | ||||||||||

How to Vote:

| Phone | Internet before meeting | During the meeting | |||||||||

| 1-800-690-6903 | www.proxyvote.com | Vote Processing c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 | www.virtualshareholdermeeting.com/unfi2022 | ||||||||

How to attend and ask questions at the meeting:

•Attend the Annual Meeting online, including to vote and/or submit questions at www.virtualshareholdermeeting.com/unfi2022

•The Annual Meeting will begin at approximately 4:00 p.m. EST (log-in at 3:45 p.m.) on Tuesday, January 11, 2022

•You may submit questions for the meeting in advance at www.proxyvote.com

•You may submit live questions during the meeting at www.virtualshareholdermeeting.com/unfi2022

For more information about voting and attending the meeting, see “Information About the Meeting,” beginning on page 60. | ||||||||||||||

4

Corporate Governance

Governance Highlights

We are committed to best practices in corporate governance. Some of our key corporate governance programs are summarized below, with further information provided throughout this proxy statement.

Independent Oversight

•Independent Board Chair

•Eight out of ten director nominees are independent

•Regular executive sessions of independent directors at Board and Committee meetings

•100% independent Board Committees, with strong Committee mandates and rotating leadership terms

•Comprehensive Board oversight of new Fuel the Future strategy development and execution, including measurement of performance against key performance indicators

•Active Board oversight of the Company’s compliance and risk management, including enhanced Enterprise Risk Management program and strengthened Corporate Compliance Program

•Board and Committees may hire outside advisors independent of Management

•Board oversight of ESG through Nominating and Governance Committee

•Board oversight of human capital management through Compensation Committee

Board Skills and Qualifications

•Regular Board refreshment and mix of tenure of directors

•Diverse backgrounds, ages, experiences and qualifications, with a view to making changes as needed to continue to add value and meet our evolving strategic needs

•Diverse gender, race, ethnicity and sexual orientation, with further commitment to Board diversity demonstrated through formal adoption of diverse slate requirement

•Deep industry expertise

•Annual Board and Committee self-evaluations and individual director performance reviews

•Mandatory director retirement age of 75

•Orientation program for new directors and ongoing director education programs for all directors

•Limitations on other board positions; Directors and executive officers must notify the Chair of the Nominating and Governance Committee and the CEO of potential appointments in advance for review by the Committee

Good Governance Practices

•Annual comprehensive review of governance policies leading to the following updates since the beginning of fiscal 2021:

◦Recoupment (“clawback”) policy for executives expanded to include forfeiture of incentive compensation in certain cases of misconduct resulting in reputational harm and require public disclosure in certain circumstances

◦Director and executive stock ownership policies requiring meaningful levels of ownership, expanded to include additional senior officers and more stringent requirements

◦Amended our Social and Environmental Policy to align with priorities identified through materiality assessment

◦ESG matters overseen by Nominating and Governance Committee, supported by a newly created ESG Executive Committee

◦Adopted a formal Stockholder Engagement Policy to support our robust engagement participation by Management and our Board

◦Corporate Governance Principles amended to require initial pool of director candidates to include diverse individuals, reflect separation of Chair and CEO roles, and provide for rotational guidelines for Board and Committee leadership positions

•Human capital management oversight

◦In Fiscal 2021, we formalized Compensation Committee oversight for human capital management matters with a focus on associate wellbeing across a variety of measures

5

◦Human capital management and diversity and inclusion are key elements of our UNFI Pride strategic pillar

◦Focus on associate engagement, empowerment and safety to allow for innovation and best-in-class solutions for our customers and suppliers

•Prohibition on hedging or pledging of Company stock by directors and executive officers included in stock ownership guidelines and insider trading policy

•Strong policies restricting trading by insiders, including discussion-based preclearance process

•Ongoing Board review and implementation of robust data and cyber security programs

Stockholder Rights

•Annual election of all directors

•Majority vote and director resignation policy for directors in uncontested elections

•Bylaws provide proxy access right for stockholders (3% ownership threshold continuously held for 3 years/2 director nominees or 20% of the Board/20 stockholder aggregation limit)

•Stockholder right to call special meeting by stockholders owning at least 25% of the outstanding shares

•One class of shares, with each share entitled to one vote

•No poison pill

We maintain a corporate governance section on our corporate UNFI website that includes key information about our corporate governance initiatives and our Code of Conduct. The corporate governance information can be found at www.unfi.com, by clicking on “Governance” listed under “Investors” at the bottom of our website. Copies of our Corporate Governance Principles, our Code of Conduct, our Social and Environmental Policy and the charters for each of the Board’s Committees can be found on our website. During fiscal 2021, we revised and updated the charters for each Committee and in September 2021, we updated the Corporate Governance Principles, each in connection with our ongoing comprehensive review of our governance practices. Information contained on our website is not incorporated by reference in this proxy statement or considered to be part of this document.

Director Independence

Our Corporate Governance Principles require a majority of the members of the Board to be independent directors as such term is defined in the New York Stock Exchange (NYSE) listing standards. The Board, upon the recommendation of the Nominating and Governance Committee, has determined that eight of its ten current members are independent. Our eight independent directors are Eric F. Artz, Ann Torre Bates, Gloria R. Boyland, Denise M. Clark, Daphne J. Dufresne, James L. Muehlbauer, Peter A. Roy and Jack Stahl. Michael S. Funk, one of our co-founders, was an employee until January 1, 2019, and will qualify as independent under the NYSE rules in calendar year 2022. Sandy Douglas is our CEO.

Our Corporate Governance Principles and the charter for each of the Board’s standing Committees—the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee—require all members of such Committees to be independent within the meaning of the NYSE listing standards and the SEC’s rules. The charter of the Audit Committee requires each of its members to meet the definition of independence under Section 10A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the SEC’s rules thereunder. The charter of the Compensation Committee requires each of its members to be a non-employee director within the meaning of Rule 16b-3 under the Exchange Act.

Independent Chair

The Independent Chair is elected annually by the independent directors of the Board. Upon the appointment of Mr. Douglas as the new CEO effective August 2021, the independent directors appointed Mr. Stahl to serve as the Board’s Independent Chair. Mr. Roy, our Lead Independent Director since 2019, stepped down from that role, which was eliminated with the appointment of an independent chair. In accordance with our recently revised Corporate Governance Principles, the Board must elect an Independent Chair annually and will consider rotation of the Independent Chair every three to five years based on the best interests of the Company at that time. The Independent Chair is responsible for coordinating the activities of the other directors and for performing such other duties and responsibilities as the Board may determine from time to time, which are set forth in our Corporate Governance Principles, including:

•Providing leadership of the Board;

•Serving as principal liaison between the Directors and senior Management, and particularly the CEO;

•Providing input to the Board and the Nominating and Governance Committee on the membership of various committees;

6

•Advising and assisting the chairs of the Board’s committees in fulfilling such individuals’ roles and responsibilities;

•Suggesting an appropriate schedule of and agenda for the Board’s meetings and including the Board’s and CEO’s input into the agenda for the Board’s meetings;

•Leading the independent directors in their role in the annual evaluation of the performance of the CEO, providing any feedback to the Chair of the Nominating and Governance Committee and overseeing actions to address the outcomes of such evaluations;

•Overseeing the process for CEO succession in coordination with the Nominating and Governance Committee;

•Determining the retention of advisors and consultants who report directly to the Board;

•Chairing regular and special Board meetings and shareholder meetings; and

•Presiding at meetings in executive session.

A description of the duties of the Independent Chair is included in the Corporate Governance Principles, a copy of which can be found in the “Governance” section of our website at www.unfi.com.

Board Leadership Structure

As of August 2021, our Board is led by an Independent Chair, Mr. Stahl. Upon the appointment of a new CEO, the Board determined that the positions of CEO and Chair should be separated and that the two roles, with separate and delineated accountabilities, were most appropriate for the Company at the current time. In making this determination, the Board considered that separating the roles would allow the new CEO to focus his time on the day-to-day operations of the business and execution of the Company’s strategy. The allocation of Board accountability and oversight to Mr. Stahl, an independent Board member with substantial public company executive and board oversight experience, would further this objective while also creating the opportunity for Mr. Stahl to work closely with the new CEO on matters coming before the Board. In making this decision, the Board also considered the input of certain stockholders reflecting a desire for the separation of the Chair and CEO roles.

Our Corporate Governance Principles do not require the Chair of the Board to be independent and do not specify whether the positions of Chair of the Board and the CEO must be separated. The Board will regularly consider the appropriate leadership structure for the Company at any given time and has determined that the Company and its stockholders are best served by the Board retaining discretion to determine whether the same individual should serve as both CEO and Chair, or whether the roles should be separated. The Board believes that it is important to retain the flexibility to make this determination at any point in time based on what it believes will provide the best leadership structure for the Company, based on the prevailing facts and circumstances at such time.

7

Risk Oversight

Full Board | |||||||||||||||||||||||

The Board has overall responsibility for risk oversight. The Board exercises its oversight responsibilities with respect to strategic, operational and competitive risks, as well as risks related to the succession planning of our CEO and other members of senior Management. The Board has delegated responsibility for the oversight of certain risks to its Committees. All Committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise-level risk. Certain risks are overseen by the full Board directly, such as strategic, cyber, other operational and macro-environment risks. | |||||||||||||||||||||||

Audit Committee | Compensation Committee | Nominating & Governance Committee | |||||||||||||||||||||

The Audit Committee and full Board receive Management’s quarterly Enterprise Risk Management (ERM) report and the Audit Committee discusses significant financial risk exposures and the steps Management has taken to monitor, control, and report such exposures with Management, the Company’s internal audit department and our independent auditor. | The Compensation Committee is responsible for developing and maintaining compensation policies and programs that are aligned with pay for performance, stockholder interests and the other elements of the executive compensation philosophy developed and maintained by the Committee. Embedded in this philosophy and foundational to these programs is that they mitigate any unnecessary and excessive risks in our compensation plans and programs that could threaten our long-term value. For more discussion of risk considerations in our compensation programs, see “Executive Compensation—Compensation Discussion and Analysis—Compensation Risk Assessment.” | The Nominating and Governance Committee oversees our compliance programs and our ESG programs. This Committee also participates extensively in our Enterprise Risk Management and compliance programs generally, actively considering assessment and mitigation for risks that do not fall within the purview of the Audit Committee or the Compensation Committee, as well as overseeing active CEO succession planning process and other risks that fall within the matters covered by its charter. | |||||||||||||||||||||

Committees may address other risks on an ad hoc basis, as appropriate. We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing our Company, allowing the consideration of key risks to be allocated across Committees so that sufficient time, attention and expertise are directed to the respective risks the Company faces.

Anti-Hedging and Insider Trading Policies

Our stock ownership guidelines and our Policy Regarding Trading in Company Securities (Insider Trading Policy) include prohibitions against speculative trading activities in relation to Company securities. Senior employees, including executive officers and non-employee directors, are strictly prohibited from entering into any transaction that would operate as a hedge against their stock ownership position or that would hedge against the financial effect of their building up stock ownership to reach the requirements set forth in our stock ownership guidelines. Under our Insider Trading Policy, directors, certain employees (including executive officers) and other individuals with access to material non-public information about the Company are prohibited from engaging in transactions in Company securities during blackout periods (other than in accordance with a pre-approved Rule 10b5-1 trading plan), and such persons are required to preclear (through discussion) any transactions in Company securities with a member of our legal department who is trained in these conversations. Certain insiders who have been identified as regularly having access to material nonpublic information are restricted to trading during quarterly open window periods, and then may trade only after preclearance. Under our policy governing 10b5-1 trading plans, we permit all directors and employees, including executive officers, to enter into 10b5-1 plans during an open window period when they are not in possession of material nonpublic information. All plans must have a 30-day “cooling-off” period between entering into a plan and the start of trading under that plan, and no plan may be shorter than six months or longer than 18 months.

Committees of the Board of Directors

The Board currently has three standing committees: the Compensation Committee, the Audit Committee and the Nominating and Governance Committee. Upon recommendation of the Nominating and Governance Committee, the full Board appoints members of each committee. Each committee is responsible for appointing its chair.

8

Compensation Committee

The Compensation Committee establishes or approves all policies and procedures related to our human resources function with respect to our executive officers, including employee compensation, incentive programs, and the 401(k) Plan, and administers our stock incentive plans. Additionally, this Committee evaluates and establishes the respective compensation of our executive officers on an individual basis, including our Chief Financial Officer (CFO), and recommends compensation of our CEO for approval by the Board. The Compensation Committee also reviews the compensation of certain other members of our senior management team and recommends to the Board the compensation for our non-employee directors. For a description of the role of the Compensation Committee, its consultants and management in setting executive compensation, see “Executive Compensation—Compensation Discussion and Analysis—How We Make Decisions Regarding Executive Pay.” The Compensation Committee also approves our compensation discussion and analysis included in our annual proxy statements. The Compensation Committee oversees our leadership development and management succession planning (although the Nominating and Governance Committee oversees active CEO succession planning process), as well as our diversity initiatives. Additionally, the Compensation Committee oversees human capital management matters, including reviewing and overseeing key diversity and inclusion initiatives and Human Resources policies and practices.

The agenda for meetings of the Compensation Committee is determined by its Chair with the assistance of our CEO, CFO, Chief Human Resources Officer (CHRO) and Chief Legal Officer, General Counsel and Secretary. Compensation Committee meetings are regularly attended by the CEO, the CFO, the CHRO and the Chief Legal Officer. At certain meetings during fiscal 2021, including each of its regular meetings, the Compensation Committee met in executive session. The Compensation Committee’s Chair reports the Committee’s recommendations on CEO executive compensation to the Board, which sets the CEO’s compensation, and reports its determinations on other executive compensation to the Board. Independent advisors and our finance, human resources, benefits and legal departments support the Compensation Committee in its duties and may be delegated authority to fulfill certain administrative duties regarding the compensation programs. The Compensation Committee has authority under its charter to retain, approve fees for (and, as may be necessary or advisable, change or terminate) a compensation consultant, legal counsel or other advisor as it deems necessary to assist in the fulfillment of its responsibilities. The Compensation Committee annually evaluates the independence of its consultants, assesses their performance and establishes annual scope of work and fees for the consultants pursuant to a pre-approval policy. Following a thorough search process, the Compensation Committee engaged a new compensation consultant, Frederic W. Cook & Co. (FW Cook) during fiscal 2021 as a good governance practice given the tenure of the prior consultant.

The Compensation Committee’s charter is available on our website, www.unfi.com. The charter was most recently amended in March 2021. The Compensation Committee held six meetings during fiscal 2021. The current members of the Compensation Committee are Ms. Dufresne (chair) and Messrs. Artz, Muehlbauer and Roy, each of whom is an independent director under the SEC and NYSE rules applicable to compensation committee members.

Audit Committee

The Audit Committee is responsible for monitoring the integrity of our financial reporting process and systems of disclosure controls and internal controls over financial reporting; monitoring the independence and performance of our independent registered public accounting firm; and overseeing our internal audit department. Among the Audit Committee’s duties are to review the results and scope of the audit and other services provided by our independent registered public accounting firm. The Audit Committee is also responsible for overseeing the finance and accounting matters regarding related party transactions under our Related Party Transaction Policy and certain compliance matters under our Code of Conduct.

The Audit Committee’s charter is available on our website, www.unfi.com. The charter was most recently amended in March 2021. The Audit Committee held four meetings during fiscal 2021. The current members of the Audit Committee are Mses. Bates (chair) and Boyland and Messrs. Muehlbauer and Stahl, each of whom is an independent director under SEC rules and the NYSE listing standards applicable to audit committee members. The Board has determined that all members of the Audit Committee are financially literate and Ms. Bates and Messrs. Muehlbauer and Stahl are audit committee financial experts, as defined by the rules and regulations of the SEC.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for developing, reviewing and recommending to the Board for adoption our Corporate Governance Principles; identifying and nominating candidates for election to the Board; assessing and making recommendations to the Board regarding the size and composition of the Board; making recommendations to the Board regarding the size, composition, scope of authority, responsibilities and reporting obligations of each of the Board’s Committees; assisting the Board in conducting performance reviews process of the Board and its Committees and members; oversight of our ESG programs; oversight of active CEO succession planning process; and other duties and responsibilities. The Nominating and Governance Committee is also responsible for reviewing related party transactions under our Related Party Transaction Policy and oversees certain compliance matters under our Code of Conduct that are not related to finance or accounting (which are overseen by the Audit Committee), and provides oversight of general risk and compliance areas not

9

falling under the Audit Committee or Compensation Committee. Additionally, the Nominating and Governance Committee oversees our political contributions, policies and commitments. Our Political Activities and Government Relations Policy, together with our Code of Conduct, provide for oversight of political contributions, including that any corporate contributions must be reviewed and approved in writing by our Chief Legal Officer, be in compliance with applicable law and be properly disclosed.

For information regarding the director nomination process undertaken by the Nominating and Governance Committee, please refer to “Proposal 1—Election of Directors—Nomination of Directors.”

The Nominating and Governance Committee’s charter is available on our website, www.unfi.com. The charter was most recently amended in March 2021. The Nominating and Governance Committee held nine meetings during fiscal 2021. The current members of the Nominating and Governance Committee are Mses. Clark (chair) and Boyland and Messrs. Artz and Roy, each of whom is an independent director under SEC and NYSE rules.

Board Meetings

During fiscal 2021, the Board met twelve times and following each of the Board’s regularly scheduled quarterly meetings, the independent directors met in executive session without the presence of Management. All directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which they served. We encourage each member of the Board to attend our annual meeting of stockholders. All nine of our directors who were standing for re-election attended our last annual meeting.

Stockholder Engagement

Stockholder engagement is an important and regular part of the Company’s strategy so that the Board and Management are aware of and respond to stockholder input on a broad spectrum of business and governance matters. Members of Management, including our Chief Legal Officer, General Counsel and Secretary, CHRO and Head of Investor Relations, as primary participants, have engaged in discussions with stockholders as part of our efforts to gain an understanding of stockholder views. Directors are generally available to participate in our engagement meetings upon request from stockholders. For the fourth consecutive year, the Company reached out to a significant percentage of its stockholders, and we met with holders representing more than 50% of our outstanding shares. Management found its outreach efforts over the past four years to be very helpful in understanding our investors’ perspectives on various business and governance matters and intends to maintain ongoing discussions with a large number of investors each year. Additionally, members of our ESG team engaged in ESG-focused meetings with certain investors, upon request.

Topics of discussion included business performance; our updated strategy; our safety protocols and procedures in response to the COVID-19 pandemic; our CEO succession plan; our corporate governance, including Board refreshment and Board leadership structure; our commitments to diversity and inclusion; our executive compensation, and many investors acknowledged the improvements made in response to our stockholder engagement over the last two years; and our ESG programs and initiatives. After our engagement discussions, Management provides the feedback received from our stockholders to the Board. Since the beginning of fiscal 2021, we have taken the following governance actions directly responsive to our stockholder conversations:

| WHAT WE HEARD | WHAT WE DID | |||||||

| Separate role of CEO and Chair | → | Upon appointing a new CEO, we separated the role of CEO and Chair of the Board and appointed an Independent Chair | ||||||

| Enhance proxy statement disclosure to include Director skills matrix | → | Added our Director skills matrix in our 2020 proxy statement | ||||||

| Disclose metrics of Board composition and diversity | → | Included Board composition and diversity metrics in our proxy statement disclosure | ||||||

| Expand ESG disclosure | → | Expanded ESG disclosure in our proxy statement, ESG Report and through the launch of our Better for All campaign | ||||||

| Continue Board evaluation and refreshment | → | Continuously evaluate our Board and refreshment efforts (added four new independent directors in last five years, including one in 2021) | ||||||

See “Executive Compensation—Compensation Discussion and Analysis—Say on Pay Vote, Investor Engagement and Responsive Action” for a discussion of actions we took in response to conversations regarding executive compensation.

10

Board Evaluation and Refreshment

Our Board regularly evaluates its composition, assessing individual director’s skills, qualifications and experience to align the overall Board composition to best meet the needs of the Company’s evolving long-term business strategy. Each year, the Board undertakes a thorough Board and Committee evaluation process, including peer feedback on individual directors, using a comprehensive set of questionnaires requesting quantitative and qualitative input from directors. The Board uses a skills matrix to assess the contributions, background and experience of each director with those sought-after skills. The process also includes individual discussions with the Chair of the Nominating and Governance Committee. The Nominating and Governance Committee also considers any additional skills, qualifications and experience that may be needed to meet the evolving strategic needs of the Company. In addition, the Nominating and Governance Committee is committed to considering a facilitated, third-party assessment every two to three years.

The Committee considers prospective candidates and identifies appropriate individuals for the Board’s further consideration. The Nominating and Governance Committee also assesses the proper mix of skills and expertise for directors serving on the Board’s committees. The Board is highly skilled and qualified, and committed to the Company’s success, as indicated by the high attendance rate and robust discussion and debate that occurs during each Board and committee meeting.

In August 2021, upon the appointment of Mr. Douglas as our new CEO and board member, the Board, upon the recommendation of the Nominating and Governance Committee, appointed Mr. Stahl as Independent Chair of the Board and Mr. Roy stepped down as Lead Independent Director. Additionally, Ms. Dufresne was appointed as Chair of the Compensation Committee. Further, in September 2021, our Board, upon the recommendation of the Nominating and Governance Committee, revised the composition of the Compensation Committee and the Nominating and Governance Committee. The current composition of each committee is disclosed above.

In fiscal 2021, the Board completed its annual self-evaluation process and considered additional skills and experience that may be desirable in light of our new strategy, the ongoing impacts on our industry of the COVID-19 pandemic and rapidly evolving retail landscape. In connection with Mr. Heffernan’s retirement, the Board appointed Ms. Boyland to the Board in January 2021. Ms. Boyland had been recommended to us by a search firm retained by the Nominating and Governance Committee. Additionally, after reviewing the results of the self-evaluation process and appointing a new CEO and Board member, the Board continues to work with a third-party consultant to appoint at least one additional director to complement the existing Board’s skill set with additional targeted experience in eCommerce programs and including diverse candidates.

Board Tenure

Average Director Tenure is 7.4 years | |||||||||||||||||||||||||||||||||||

| 4 Directors | 4 Directors | 2 Directors | |||||||||||||||||||||||||||||||||

| 0 - 4 years | 5 - 9 years | 10+ years | |||||||||||||||||||||||||||||||||

| 4 Independent Directors added in last 5 years | |||||||||||||||||||||||||||||||||||

Board Diversity

Our Board is diverse in gender and ethnic background, as well as having a broad range of experience. The Nominating and Governance Committee charter provides for the consideration of diversity, including gender, race, ethnicity and sexual orientation, when considering Board candidates. Additionally, in September 2021, the Board amended our Corporate Governance Principles to formally require the initial pool of director candidates for any director search to include qualified diverse candidates to further support our commitment to a diverse and qualified Board.

| 4 | 2 | 1 | |||||||||||||||||||||||||||||||||||||||

| are female | identify as African American | identifies as LGBTQ+ | |||||||||||||||||||||||||||||||||||||||

11

Summary of Board Skills, Experiences and Qualifications

| Skills, Experiences and Qualifications | Director | |||||||||||||||||||||||||||||||

| Artz | Bates | Boyland | Clark | Douglas | Dufresne | Funk | Muehlbauer | Roy | Stahl | |||||||||||||||||||||||

| Significant experience in business, education, the professions or public service | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||

| Commitment to areas aligned with the Company’s public interest commitments | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||

| Service as an executive officer for another public company | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||

| Experience in the Company’s industry | ü | ü | ü | ü | ||||||||||||||||||||||||||||

| Experience with risk oversight | ü | ü | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||

| Experience with stockholder engagement | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||||

| Information technology experience | ü | ü | ü | |||||||||||||||||||||||||||||

| International experience | ü | ü | ü | ü | ||||||||||||||||||||||||||||

| Experience in leadership development | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||

| Experience with mergers and acquisitions | ü | ü | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||

| eCommerce experience | ü | ü | ||||||||||||||||||||||||||||||

| Supply chain management experience | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||||

| Consumer products/retail experience | ü | ü | ü | ü | ü | |||||||||||||||||||||||||||

| Senior operations management/CEO | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||

| Strategic thinking, planning and execution | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||

| Experience in broad-scale mergers, acquisitions and integration | ü | ü | ü | ü | ü | |||||||||||||||||||||||||||

| Operating financial expertise (CFO) | ü | ü | ü | ü | ||||||||||||||||||||||||||||

| Senior operations experience in industry or adjacent industry | ü | ü | ü | ü | ||||||||||||||||||||||||||||

| Highly leveraged / “turnaround” structures experience | ü | ü | ||||||||||||||||||||||||||||||

| Regulatory/Public Service/Public Health | ü | |||||||||||||||||||||||||||||||

Environmental, Social and Governance Practices

We have long been committed to incorporating environmentally sustainable and socially responsible practices into our business operations. This commitment is described in our Social and Environmental Policy, which was most recently updated in September 2020 and is available on our website, www.unfi.com. Our Nominating and Governance Committee has direct oversight of our policies and strategies addressing environmental, social and governmental matters, including sustainability, corporate social responsibility and political contributions, and is responsible for reporting to the Board on such matters at least annually. In fiscal 2021, we created the ESG Executive Committe, an executive steering committee to oversee implementation of our ESG initiatives and provide executive sponsorship for our ESG strategy and goals.

Our commitment is further evidenced by more than ten years of issuing Corporate Social Responsibility (CSR) reports, now ESG reports, highlighting our focus on sustainability and philanthropy. Our 2020 ESG Report referenced Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) standards and Task Force on Climate Related Financial Disclosures (TCFD). The GRI and SASB tables are available on our website.

12

In fiscal 2021, we launched our “Better for All” campaign and discussed our 2030 vision, an ambitious ten-year plan to pioneer solutions across the food system. Our plan includes expanding and enhancing our policies and practices related to climate change, waste reduction, food access, safety and well-being and diversity and inclusion. | ||||||||||||||

We expect to release our 2021 ESG report in the coming months, which will include more detail on our long-term goals and how we serve our communities, employees and the environment. When issued, the report will be available on the “ESG” section of our website. Examples of our ESG initiatives and commitment to doing better are highlighted below.

Better for Our World | ||||||||||||||

•Science-based target submitted for approval to the Science Based Targets initiative •Joined U.S. Food Loss and Waste 2030 Champions •Cross-functional team creating a consolidated set of policies, standard operating procedures and training to reduce food waste •UNFI Climate Action Hub to officially launch in the coming months, which will offer opportunities for partnership across our supply chain •Added more than 53 all-electric trailers to fleet in California | ||||||||||||||

Better for Our Communities | ||||||||||||||

•Nearly 28 million pounds of food donated in fiscal 2021 •UNFI Foundation grants support food justice in our communities (greater than $1 million in fiscal 2021) •Outstanding recent Safe Quality Food (SQF) audit scores (averaging over 95% in fiscal 2021) •Continued improvement in Cub Ecolab food safety scores •Creating council of experts to guide food access strategy | ||||||||||||||

Better for Our People | ||||||||||||||

•Launched new Safety Brand in June – Every Moment Matters – including enhanced safety programs and training and safety observations •Expanding access to wellbeing and EAP programs, and launched a wellness program to provide employees with tools and resources to encourage healthy habits and track progress •Piloting “mental health first aid” sessions •Established Diversity Council and launched four Belonging and Innovation Groups •Inclusion 101 Guide launched to associates •Rolled out “Real Talk”, a series of diversity, equity and inclusion conversations •Revamping supplier diversity program to further support commitment to diversity, equity and inclusion •Partnered with Network of Executive Women to enhance our commitment to the advancement of women in the workplace •Signed pledge to CEO Action for Diversity and Inclusion •Adopted an expanded Paid Parental Leave Policy | ||||||||||||||

Human Capital Management

A major part of our ESG initiatives and key element of our UNFI Pride strategic pillar is creating a diverse and inclusive workplace. Our employees are critical to supporting our values and achieving our strategic vision. We are focused on associate engagement, empowerment and safety that allow for innovation and bringing best-in-class solutions to our customers and suppliers, and includes committing to a diverse and inclusive environment, developing talent, providing exceptional compensation and benefits and creating a safe environment.

We discuss our dedication to human capital management, including disclosure of certain diversity metrics, in our 2020 ESG report, which can be found on our ESG website, www.betterforall.unfi.com. More information regarding human capital management may be found in our recently filed Annual Report on Form 10-K.

13

Diversity and Inclusion

We pledge to promote equity, celebrate diversity, dismantle systemic racism, and support justice and inclusion for all. Our Board is diverse in gender and ethnic background, as well as having a broad range of experience. Four out of ten directors are female, with two members identifying as African American and one member identifying as LGBTQ+. We recognize that innovation thrives when there is unity and respect for diverse backgrounds and perspectives. Additionally, we aim to foster a culture of belonging, equity and empathy through open dialogues, educational opportunities and by honoring the experiences and special events that speak to our associates’ many identities. Over the last two years, we are actively working on the following initiatives to promote our pledge of creating an equitable, diverse and inclusive environment for all:

•Joined CEO pledge to advance diversity and inclusion in our workplace in 2020 •Adopted a diversity requirement for director candidates in September 2021 to further support diversity among our Board •Built a diversity and inclusion team and created a diversity and inclusion strategy, including: ◦Hiring a Vice President of Diversity and Inclusion; ◦Establishing a diversity council which has taken an active role in advocating for and celebrating; ◦Providing helpful diversity and inclusion information on our associate platforms, including diversity and inclusion training; and ◦Launching UCount, a campaign to encourage associates to self-identify, and rolling out Real Talk, a series of conversations on various dimensions of diversity. •Formalized the Compensation Committee’s oversight of human capital management matters with a focus on associate wellbeing across a variety of measures •Matched associate donations to organizations fighting for racial justice and reform, including the NAACP Legal Defense and Educational Fund and the American Civil Liberties Union (ACLU) Foundation •Incorporated gender, ethnicity, tenure and generation metrics into our year-end performance review calibration to mitigate against unconscious bias | ||||||||||||||

Developing Talent

Attracting and retaining talent is one of our top priorities. Our goal is to differentiate ourselves in the market by offering unprecedented flexibility to associates in the way, when and how they work. To reduce turnover, we have an emphasized focus on and commitment to our associates, their experiences as well as their continued engagement. We are committed to the continued support and development of our associates and provide access to robust leadership development programming, role-based training and other career development opportunities at every stage of an associate’s tenure. Designed to enhance the leadership capabilities of our people, the Emerge program for front-line leaders and the Evolve program for our mid-level managers invite participants from all departments to come together to learn and practice their management skills and identify opportunities to lead more effectively. The Elevate program for Director-level and above associates, as well as the Operations Leadership Academy for leaders in our distribution centers, work to solidify our talent pipeline and promote the success of the organization’s future leaders. In addition, we partner with key groups within the organization, such as Sales and Risk & Safety, to develop role-based training to drive greater productivity and safety. We also offer associates additional learning and career development opportunities that extend from skills-based training deployed electronically through our BetterU learning system, to mentorship programs and career development discussions and beyond.

Compensation and Benefits

Our compensation and benefits programs are designed to promote a culture of wellbeing and recognize our associates for their outstanding achievements and dedication to serving our customers and keeping them safe during even the most challenging of times. We are committed to offering market competitive pay programs which reward high levels of performance, and behaviors that challenge convention and drive company success. Our short-term incentive programs model the Company’s financial goals and are intended to align our eligible associates’ rewards with our financial success. Long-term incentives, including restricted stock units and performance awards, are designed to attract and retain innovative leaders and align their financial interests with those of our stockholders and other stakeholders. As part of our commitment to recognize our associates’ “whole self” – health, finances and overall wellbeing – we offer the following benefits to eligible associates:

14

•Comprehensive health and welfare benefit program providing a variety of medical, dental and vision options •Voluntary benefits like long-term disability and optional life insurance •No-cost wellness program •Paid time off programs, including parental paid leave •Employee assistance program •401(k) plan •Back-up childcare program | ||||||||||||||

Creating a Safe Environment

Safety is at the forefront of everything we do. We continue to focus on the safety of our associates, customers and communities through the COVID-19 pandemic, with enhanced sanitation and increased safety measures. We also have invested in several initiatives, including the development and implementation of a new safety brand and pledge, Every Moment Matters, that is designed to foster a caring culture, the implementation of interactive and proven training programs, which are rolled out across our network, and enhanced safety auditing. Safety is one of our core values and a part of our UNFI Pride strategic pillar as we strive for zero injuries.

15

Proposal 1—Election of Directors

Directors and Nominees for Director

The Board currently consists of ten directors, each of whose terms will expire at the Annual Meeting.

Mses. Bates, Boyland, Clark and Dufresne and Messrs. Artz, Douglas, Funk, Muehlbauer, Roy and Stahl have been nominated to stand for election as directors at the Annual Meeting to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified. Each nominee has indicated his or her willingness to continue to serve if elected by our stockholders. If any nominee should be unable to serve, the person acting under the proxy may vote the proxy for a substitute nominee. We have no reason to believe any of the nominees will be unable to serve if elected.

We have included below information concerning the business experience and qualifications, and the age as of November 15, 2021, of each of our director nominees.

| The Board unanimously recommends that stockholders vote “FOR” each of the director nominees. Proxies received by the Board will be voted “FOR” each of the nominees unless a contrary choice is specified in the proxy. | ||||||||||||||

Nominees for Election as Directors for a Term Expiring at the Next Annual Meeting

| Eric F. Artz | ||

| Age: 54 | ||

| Board Member since October 2015 | ||

| Compensation Committee Member | ||

| Nominating & Governance Committee Member | ||

Mr. Artz previously served on the Compensation Committee from December 2015 to September 2020. Mr. Artz has served as President and Chief Executive Officer, as well as served on the board of directors, of Recreational Equipment, Inc. (REI), an American retail and outdoor recreation services corporation, since May 2019. He served as Executive Vice President and Chief Operating Officer of REI from August 2014 to May 2019. In addition to this role, Mr. Artz also served as Executive Vice President, Chief Financial Officer and Treasurer of REI from May 2012 to December 2015. Prior to REI, Mr. Artz served as Chief Financial Officer for Urban Outfitters, Inc. from February 2010 to April 2012. From August 1992 until January 2010, Mr. Artz served in various positions of increasing responsibility at VF Corporation.

Skills and Qualifications: Mr. Artz’s professional experience brings valuable knowledge and insight to our Board. The Board values his experience as a Chief Executive Officer, Chief Operating Officer and Chief Financial Officer, which provides him with valuable knowledge and insight regarding operations of retailers as well as the background and experience in overseeing the audits of financial statements, communicating with independent auditors and assisting with the general oversight of accounting and financial reporting processes.

| Ann Torre Bates | ||

| Age: 63 | ||

| Board Member since October 2013 | ||

| Chair of the Audit Committee | ||

Ms. Bates has served as a member of the board of directors of Ares Capital Corporation since 2010 and currently chairs its Audit Committee. She held a directorship at Allied Capital Corporation until it was acquired by Ares Capital Corporation in 2010. Ms. Bates also serves as director or trustee of 17 investment companies in the Franklin Templeton Group of mutual

16

funds. Ms. Bates was a strategic and financial consultant from 1997 to 2012. From 1995 to 1997, Ms. Bates served as Executive Vice President, Chief Financial Officer and Treasurer of NHP, Inc., a national real estate services firm. Ms. Bates previously served as a member of the board of directors of Navient Corporation from April 2014 to August 2016, and she served on the board of directors of Navient’s predecessor, SLM Corporations, from 1997 to 2014.

Skills and Qualifications: Ms. Bates’ professional experience and service on other boards brings valuable knowledge and insight to our Board. The Board values her experience serving on audit committees, which provide her with the background and experience in overseeing the audits of financial statements, communicating with independent auditors and assisting with the general oversight of accounting and financial reporting processes.

| Gloria R. Boyland | ||

| Age: 61 | ||

| Board Member since January 2021 | ||

| Audit Committee Member | ||

| Nominating & Governance Committee Member | ||

Ms. Boyland currently serves as a strategic advisor of Aurora Technologies, LLC, a position she has held since June 2020. Prior to that, Ms. Boyland served as Staff Vice President (beginning in 2004) and Corporate Vice President (beginning in 2015) at FedEx Corporation, an American multinational conglomerate holding company which focuses on transportation, e-commerce and business services, where she was responsible for evaluation and leadership of advanced operations technology initiatives, service quality and customer experience improvements, and new service offerings for the company. Prior to her tenure at FedEx, Ms. Boyland held leadership positions in various functions at GE Capital Corporation, including Six Sigma Quality, mergers and acquisitions and acquisition integration. She also practiced for eight years as a commercial transactions and investment attorney at GE. Ms. Boyland currently serves on the boards of directors of Chesapeake Energy Corporation and Vontier Corporation and previously served as a member of the board of UMRF Ventures, Inc. In 2016, Ms. Boyland was appointed to the U.S. DOT Advisory Committee on Automation in Transportation.

Skills and Qualifications: Ms. Boyland’s extensive experience leading operational transformation at global companies and customer service, coupled with her leading-edge, future-focused logistics and supply chain knowledge, make her a valuable addition to our Board.

| Denise M. Clark | ||

| Age: 64 | ||

| Board Member since February 2013 | ||

| Chair of the Nominating & Governance Committee | ||

Ms. Clark served as Senior Vice President and Global Chief Information Officer for The Estée Lauder Companies Inc. from November 2012 until her retirement in March 2017. Prior to that role, Ms. Clark served as Senior Vice President and Chief Information Officer for Hasbro Inc. from October 2007 to November 2012. Ms. Clark also served at Mattel, Inc., where she was Global Chief Technology Officer and later Chief Information Officer for the Fisher Price brand between January 2000 and February 2007. Ms. Clark's previous experience includes two other consumer goods companies, Warner Music Group, formerly a division of Time Warner Inc., and Apple Inc. Ms. Clark has over 20 years of experience in the delivery of enterprise resource planning, digital platforms and innovative business transformation initiatives. Ms. Clark currently serves as a director of Six Flags Entertainment Corporation and previously served as a member of the board of directors of Caesars Entertainment Corporation and as chair of its compensation committee from October 2018 to July 2020.

Skills and Qualifications: Ms. Clark’s extensive background, particularly her expertise involving information technology and transformation initiatives, allows her to provide the Board valuable guidance on our strategic initiatives, especially as it relates to information technology solutions.

17

| J. Alexander (Sandy) Miller Douglas | ||

| Age: 60 | ||

| Board Member since August 2021 | ||

| UNFI Chief Executive Officer | ||

Mr. Douglas, was appointed as our CEO in August 2021 and most recently served as the Chief Executive Officer of Staples, Inc., an office retail company, from April 2018 to June 2021, which included leading that company’s business-to-business distribution platform. Prior to Staples, Mr. Douglas served as President of Coca-Cola North America until February 2018, where he led the $10 billion revenue business, encompassing all aspects of its consumer and business-to-business operations. During Mr. Douglas’ 30-year tenure at Coca-Cola, he also served as Global Chief Customer Officer, and held a variety of positions across sales and marketing. Mr. Douglas began his career at The Procter & Gamble Company in sales and sales management positions. Since May 2020, Mr. Douglas has served as a member of the board of directors of Wawa Inc., a leading convenience retailer in the Eastern United States.

Skills and Qualifications: Mr. Douglas’s experience at large public companies, including his extensive experiences leading consumer and business-to-business-to-consumer distribution operations, brings valuable insight to the Board beyond the knowledge and insight he brings from being our Chief Executive Officer.

| Daphne J. Dufresne | ||

| Age: 49 | ||

| Board Member since October 2016 | ||

| Chair of the Compensation Committee | ||

Ms. Dufresne served on the Nominating and Governance Committee until September 2021. Ms. Dufresne has been a Managing Partner of GenNx360 Capital Partners, a venture capital firm that specializes in acquisition, buyouts, and turnaround of underperforming businesses, since January 2017. Ms. Dufresne was previously a Managing Director of RLJ Equity Partners, a private equity fund, from December 2005 to June 2016. Ms. Dufresne participated in building the RLJ investment team, raising capital to fund its operations and constructing a partnership with The Carlyle Group, a global private equity firm. Prior to that role, Ms. Dufresne was a Venture Partner during 2005 with Parish Capital Advisors, an investment fund for emerging and experienced institutional investors and a Principal from 1999 to 2005 at Weston Presidio Capital, a private equity organization. She also served as Associate Director in 1997 in the Bank of Scotland's Structured Finance Group. Ms. Dufresne has been a director of Condor Hospitality Trust, Inc. since June 2015, and was appointed chair in May 2019