Form DEF 14A UNITED FIRE GROUP INC For: May 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Materials under § 240.14a-12

UNITED FIRE GROUP, INC.

(Name of registrant as specified in its charter)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which the transaction applies:

(2)Aggregate number of securities to which the transaction applies:

(3)Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

UNITED FIRE GROUP, INC.

118 Second Avenue SE, Cedar Rapids, Iowa 52401

April 6, 2021

Dear Fellow Shareholder:

I am pleased to invite you to join us at United Fire Group, Inc.’s 2021 Annual Meeting of Shareholders (the "Annual Meeting"). This year’s meeting will be held at our principal executive offices at 118 Second Avenue SE, Cedar Rapids, Iowa 52401. Simultaneously, the Annual Meeting will be conducted virtually via live audio webcast. You will be able to attend the Annual Meeting, submit questions and vote online during the Annual Meeting by logging on to www.meetingcenter.io/229967297 using your 15-digit control number provided with the Notice Regarding the Availability of Proxy Materials or on your Proxy Card. The password for the meeting is UFG2021. In light of ongoing public health concerns regarding the novel coronavirus (COVID-19) pandemic, I encourage you to participate virtually rather than in person.

The meeting will take place on Wednesday, May 19, 2021 at 10:00 a.m. Central Time.

At this year’s meeting, you will be asked to vote on the following proposals:

| Proposals | Recommended Vote | |||||||

| 1 | Election of three Class C Directors identified in the proxy statement. | FOR | ||||||

| 2 | Ratification of the Audit Committee’s appointment of Ernst & Young LLP as our independent registered public accounting firm for 2021. | FOR | ||||||

| 3 | Amendment of the United Fire Group, Inc. 2021 Stock and Incentive Plan. | FOR | ||||||

| 4 | Approval, on an advisory basis, of the compensation of the Company’s named executive officers. | FOR | ||||||

Management will also report on United Fire Group, Inc.’s business and shareholders will have an opportunity to ask questions of management and Ernst & Young LLP.

Attached you will find a notice of the Annual Meeting and a proxy statement that contains additional information about the meeting and explains the methods you can use to vote your proxy, including by telephone and over the Internet.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we encourage you to sign your proxy card and return it in the enclosed postage-paid envelope or vote by telephone or Internet prior to the meeting. This ensures that your shares of United Fire Group, Inc.'s Common Stock will be represented and voted at the meeting, even if you cannot attend.

For the Board of Directors,

Jack B. Evans

Chairman of the Board

UNITED FIRE GROUP, INC.

118 Second Avenue SE, Cedar Rapids, Iowa 52401

Notice of 2021 Annual Meeting of Shareholders of United Fire Group, Inc.

Date and time: Wednesday, May 19, 2021, at 10:00 a.m. Central Time

Place: United Fire Group, Inc.'s principal executive offices at 118 Second Avenue SE, Cedar Rapids, IA 52401 and virtually via live audio webcast. Shareholders will be able to attend the 2021 Annual Meeting of Shareholders (the "Annual Meeting"), submit questions and vote online by logging on to www.meetingcenter.io/229967297 at the Annual Meeting date and time using their 15-digit control number provided with the Notice Regarding the Availability of Proxy Materials or on the proxy card. The password for the meeting is UFG2021. In light of ongoing public health concerns regarding the novel coronavirus (COVID-19) pandemic, we encourage shareholders to participate virtually rather than in person.

Items of business: At the Annual Meeting, we will ask shareholders to:

1.Elect three Class C Directors identified in the attached proxy statement to three-year terms expiring in 2024.

2.Ratify the Audit Committee’s appointment of Ernst & Young LLP as our independent registered public accounting firm for 2021.

3.Approve the amendment to the United Fire Group, Inc. 2021 Stock and Incentive Plan.

4.Approve, on an advisory basis, the compensation of our named executive officers.

5.Vote upon such other matters as may properly come before the meeting or at any adjournment or postponement thereof.

Who can vote: You can vote if you were a shareholder of record on March 22, 2021.

On or about April 6, 2021, we will begin mailing to our shareholders a Notice Regarding the Availability of Proxy Materials, which will indicate how to access our proxy materials on the Internet. By furnishing the Notice Regarding the Availability of Proxy Materials, we are lowering the costs and reducing the environmental impact of our Annual Meeting.

The Board of Directors recommends that shareholders vote FOR the election of each director nominee named in Proposal 1 of the proxy statement and FOR Proposals 2, 3 and 4.

By Order of the Board of Directors,

Neal R. Scharmer, Corporate Secretary

Dated April 6, 2021 at Cedar Rapids, Iowa

Your vote is important. Instructions on how to vote are contained in this proxy statement and in the Notice Regarding the Availability of Proxy Materials. Please cast your vote by telephone or over the Internet as described in those materials. Alternatively, if you requested a copy of the proxy/voting instruction card by mail, you may mark, sign, date and return the proxy/voting instruction card in the envelope provided.

Table of Contents

| Page | |||||

| Page | |||||

UNITED FIRE GROUP, INC.

118 Second Avenue SE, Cedar Rapids, Iowa 52401

PROXY STATEMENT FOR THE ANNUAL MEETING

OF SHAREHOLDERS TO BE HELD ON MAY 19, 2021

OF SHAREHOLDERS TO BE HELD ON MAY 19, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE ANNUAL MEETING

OF SHAREHOLDERS TO BE HELD ON MAY 19, 2021:

OF PROXY MATERIALS FOR THE ANNUAL MEETING

OF SHAREHOLDERS TO BE HELD ON MAY 19, 2021:

The Notice of the Annual Meeting, this Proxy Statement, the 2020 Annual Report on Form 10-K and the 2020 Annual Report to Shareholders are available at: http://ir.ufginsurance.com.

This solicitation of proxies is made by the Board of Directors of United Fire Group, Inc. (the “Company,” “we,” “us,” or “our,” as the context requires). Proxies will be used at the Annual Meeting of Shareholders (the "Annual Meeting") of United Fire Group, Inc., an Iowa corporation, to be held on May 19, 2021 at 10:00 a.m. Central Time, and at any adjournment or postponement thereof. This year's Annual Meeting will be held at our principal executive offices at 118 Second Avenue SE, Cedar Rapids, Iowa 52401 and virtually via live audio webcast. Shareholders will be able to attend the Annual Meeting, submit questions and vote online by logging on to www.meetingcenter.io/229967297 using their 15-digit control number provided with the Notice Regarding the Availability of Proxy Materials or on the proxy card. The password for the meeting is UFG2021. In light of ongoing public health concerns regarding the novel coronavirus (COVID-19) pandemic and related travel restrictions, we strongly encourage shareholders to participate virtually rather than in person.

With respect to shares of our $0.001 par value common stock (“Company Common Stock”) held in the United Fire Group, Inc. 401(k) Plan (the “401(k) Plan”), the Board of Directors is soliciting participants on behalf of the Trustee of the 401(k) Plan to direct the Trustee as to how to vote the shares held in the plan.

Under rules adopted by the Securities and Exchange Commission (“SEC”), the Company has chosen to provide its shareholders with the choice of accessing the Annual Meeting proxy materials on the Internet, rather than receiving printed copies of those materials through the mail. In connection with this process, a Notice Regarding the Availability of Proxy Materials (the “Notice”) is being mailed to the Company’s shareholders who have not previously requested electronic access to its proxy materials or printed proxy materials. The Notice contains instructions on how you may access and review the Company’s proxy materials on the Internet and how you may vote your shares over the Internet. The Notice will also tell you how to request the Company’s proxy materials, in either printed form or by email, at no charge. The Notice contains a control number that you will need to vote your shares. We suggest you keep the Notice for your reference through the meeting date.

The Company anticipates that the Notice will be mailed to shareholders and participants in the 401(k) Plan beginning on or about April 6, 2021.

We will solicit proxies principally by mail, but our directors and employees may also solicit proxies by telephone, facsimile, or e-mail. Our directors and employees may also conduct personal solicitations. Our directors and employees will not receive any additional compensation in connection with their solicitation efforts.

1

ANNUAL MEETING OF SHAREHOLDERS

Questions and Answers About the Annual Meeting

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act upon the matters listed in the Notice of the Annual Meeting, including (i) the election of three Class C Directors identified in the attached proxy statement to serve three-year terms expiring in 2024, (ii) the ratification of the Audit Committee’s appointment of Ernst & Young LLP as our independent registered public accounting firm for 2021, (iii) approval of the amendment to the United Fire Group, Inc. 2021 Stock and Incentive Plan (iv) the approval, on an advisory basis, of the compensation of our named executive officers. Our management will also report on our performance during fiscal year 2020. Representatives of Ernst & Young LLP will be present at the Annual Meeting, will have the opportunity to make a statement if they choose to, and will be available to respond to appropriate shareholder questions.

How can I attend the Annual Meeting?

The Annual Meeting will be held at our principal executive offices at 118 Second Avenue SE, Cedar Rapids, Iowa 52401 and simultaneously through live audio webcast. Shareholders of record will be able to attend the Annual Meeting in person or virtually. If you attend virtually, you will be able to submit questions during the Annual Meeting and vote online by logging on to www.meetingcenter.io/229967297 using your 15-digit control number provided with the Notice or on your proxy card. The password for the meeting is UFG2021.

The Board of Directors has been monitoring the impact of the COVID-19 pandemic, including with regard to the health and well-being of our employees and shareholders, as well as the related government-imposed restrictions. We encourage shareholders to participate virtually rather than in person. Hosting the Annual Meeting in a hybrid virtual format facilitates participation in the Annual Meeting without the need to travel or gather together in person.

The Annual Meeting will begin promptly at 10:00 a.m. Central Time. Check-in will begin 15 minutes prior to the start of the meeting, and you should allow ample time for check-in procedures, both in person and online.

If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please follow the instructions that will be posted on the virtual shareholder meeting login page.

How do I register to attend the Annual Meeting virtually on the Internet?

If you are a shareholder of record (i.e. you hold your shares registered in your name through Computershare Trust Company, N.A. our transfer agent and registrar), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the Notice or on your proxy card that you received with this Proxy Statement to attend the meeting.

If you hold your shares through an intermediary, such as a broker, bank or other nominee, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register in advance to attend the Annual Meeting virtually on the Internet, you must submit a legal proxy that reflects proof of your proxy power. The legal proxy will show your holdings in Company Common Stock with your name. Please forward a copy of the legal proxy along with your email address to Computershare according to the below instructions.

Requests for registration should be directed as follows:

•By email: Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

•By mail: Computershare, United Fire Group, Inc. Legal Proxy, P.O. Box 505008, Louisville, KY 40233-9814. If you submit materials by mail, please also provide your e-mail address.

Requests for registration must be labeled as "Legal Proxy" and be received no later than 5:00 p.m. Eastern Time on May 14, 2021. You will receive a confirmation of your registration by email after Computershare receives your registration materials.

2

Who may attend the Annual Meeting?

All shareholders of record as of March 22, 2021 (the "Record Date") or their duly appointed proxies may attend the Annual Meeting. If you hold your shares through a broker, bank or other nominee, you will not be admitted to the Annual Meeting unless you bring a copy of a statement (such as a brokerage statement) from your nominee reflecting your stock ownership as of the Record Date, or register as described above under "How do I register to attend the Annual Meeting virtually on the Internet?"

May shareholders ask questions at the Annual Meeting?

Yes. As part of the Annual Meeting, we will hold a live question and answer session, during which we will answer questions that are pertinent to the Company and the meeting matters, as time permits. Shareholders will have the ability to ask questions in person or submit questions online during the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Shareholders of Record

If your shares are registered in your name with Computershare Trust Company, N.A. our transfer agent and registrar, you are considered a shareholder of record. Shareholders of record at the close of business on the Record Date are entitled to receive notice of and to vote at the Annual Meeting or at any postponement or adjournment thereof. At the close of business on the Record Date, there were 25,119,655 shares of Company Common Stock issued and outstanding. Each share of Company Common Stock entitles its record holder to one vote.

Brokerage and Other Account Holders

If your shares are held in a brokerage account or by a bank or other nominee, your name does not appear anywhere in the Company’s shareholder records. Instead, the “street name” of your broker, bank or other nominee who holds the shares for you appears on our records and you are the beneficial owner of the shares. Access to our proxy materials is being forwarded to you by your broker, bank or other nominee. As the beneficial owner, you have the right to direct your brokerage firm, bank or other nominee how to vote your beneficial shares by filling out and returning the voting instruction form provided to you from such other institution. Telephone and Internet voting options may also be available to beneficial owners. As a beneficial owner, you are invited to attend the Annual Meeting, but you must obtain a legal proxy from the record holder of your shares and bring a copy of a statement (such as a brokerage statement) from your nominee reflecting your stock ownership as of the Record Date, or register as described above under above under "How do I register to attend the Annual Meeting virtually on the Internet?".

401(k) Plan Participants

If you are a participant in our 401(k) Plan, your proxy card shows the number of shares of Company Common Stock held for your benefit in those plans, plus any other shares you may own. If you hold stock through the 401(k) Plan, voting your proxy also serves as confidential voting instructions to the Trustee of the 401(k) Plan (Principal Financial Group). The Trustee will vote your shares in accordance with the specific voting instructions that you indicate on your proxy card. If you provide no specific voting instructions, the Trustee of the 401(k) Plan will vote your shares in proportion to the voting instructions it receives from those plan participants who do submit voting instructions.

What constitutes a quorum for the Annual Meeting?

The presence at the Annual Meeting of a majority of the outstanding shares (50% plus one share) of Company Common Stock represented either in person, virtually during the live webcast, or by proxy will constitute a quorum for the transaction of business at the meeting. Abstentions and broker non-votes will each be counted as present for purposes of determining the existence of a quorum at the Annual Meeting.

What is a broker non-vote?

A “broker non-vote” occurs when a broker submits a proxy but lacks discretionary power to vote on a “non-routine” proposal and a beneficial owner fails to give the broker voting instructions on that matter. The ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for fiscal year 2021 is the only matter to be presented at the Annual Meeting that is considered a "routine" matter, and brokers have

3

the discretionary power to vote on this matter without any instructions from the beneficial owners. Each of the other matters to be presented at the Annual Meeting are considered "non-routine."

Therefore, if you hold your shares in “street name” you should give voting instructions to your broker to ensure your shares are counted in the election of directors, and the advisory vote to approve executive compensation. Broker non-votes will have no effect on the voting results of the matters presented at the Annual Meeting.

How do I vote my shares?

You may vote in the following ways:

•In person: We will distribute paper ballots to anyone who wishes to vote in person at the Annual Meeting. However, if you hold your shares in street name, you must request a legal proxy from your broker and bring it to the Annual Meeting in order to vote in person at the Annual Meeting.

•Virtually during the Annual Meeting: See the instructions above under "How can I attend the Annual Meeting?" and "How do I register to attend the Annual Meeting virtually on the Internet?"

•By mail: Complete and sign your proxy card and return it by mail in the enclosed business reply envelope. If you mark your voting instructions on the proxy card, your shares will be voted as you instruct. If an additional proposal comes up for a vote at the Annual Meeting that is not on the proxy card, your shares will be voted in the best judgment of the authorized proxies, Jack B. Evans and Neal R. Scharmer. If you sign and return your proxy card without marking voting instructions, your shares will be voted FOR the election of each of the director nominees identified in this proxy statement, FOR the ratification of the Audit Committee’s appointment of Ernst & Young LLP as our independent registered public accounting firm for 2021, FOR the approval of the amendment to the United Fire Group, Inc. 2021 Stock and Incentive Plan, and FOR approval, on an advisory basis, of the resolution regarding the compensation of our named executive officers.

•By telephone: To vote your shares by telephone, call the toll-free telephone number on your proxy card. You must have a touch-tone or cellular telephone to use this voting method. You will need to follow the instructions on your proxy card and the voice prompts to vote your shares.

•Over the Internet: You may go to the website listed on your proxy card to vote your shares over the Internet. You will need to follow the instructions on your proxy card and the website to vote your shares.

Telephone and Internet voting options are available 24 hours a day, seven days a week. The deadline for voting by telephone or the Internet is 12:00 a.m. Central Time on May 19, 2021. When prompted, you will need to enter the 15-digit control number shown on your proxy card. You will then be able to vote your shares and confirm that your instructions have been properly recorded. If you vote by telephone or over the Internet, your vote authorizes the proxies in the same manner as if you had signed, dated and returned your proxy card by mail. Telephone and Internet voting procedures, including the use of control numbers found on the proxy cards, are designed to authenticate shareholders’ identities, to allow shareholders to vote their shares securely and to confirm that their instructions have been properly recorded. If you vote by telephone or over the Internet, you do not need to return your proxy card.

If you hold your shares in street name, you may vote by telephone or over the Internet only if your bank, broker or other nominee makes those methods available to you, in which case your broker, bank or other nominee will provide specific instructions for using those options.

If I hold my shares in a brokerage account and do not return voting instructions, will my shares be voted?

If your shares are held in a brokerage account or by a bank or other nominee, your broker, bank or other nominee will ask you how you want your shares to be voted. If you provide voting instructions, your shares must be voted as you direct. If you do not furnish voting instructions, one of two things can happen, depending upon whether a proposal is “routine.” Under the rules that govern brokers who have record ownership of shares beneficially owned by their clients, brokers have discretion to cast votes on routine matters, such as the ratification of the choice of auditor, without receiving voting instructions from their clients. Brokers are not permitted, however, to cast votes on “non-routine” matters, such as the election of directors, or executive compensation matters, without receiving client voting instructions. A “broker non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting authority for that proposal and has not

4

received voting instructions from the beneficial owner. The proposal to approve the ratification of the Audit Committee’s appointment of Ernst & Young LLP as our independent registered public accounting firm for 2021 is the only routine matter being voted on at the Annual Meeting and, therefore, is the only proposal that may be voted by your broker, bank or other nominee in its discretion without having received voting instructions from you.

Can I revoke my proxy or change my vote after I return my proxy?

Yes. Even after you submit a proxy, you may revoke your proxy or change your vote at any time before the proxy is exercised and vote cast at the Annual Meeting by:

•delivering written notice to our transfer agent, Computershare, P.O. Box 505000, Louisville, KY 40233-5000, or via overnight delivery to Computershare, 462 South 4th St. Ste 1600, Louisville, KY 40202;

•delivering written notice to the Corporate Secretary of United Fire Group, Inc. at P.O. Box 73909, Cedar Rapids, Iowa 52407-3909;

•executing and delivering a later-dated proxy;

•voting again by telephone or Internet;

•appearing and voting in person at the Annual Meeting; or

•attending virtually and voting during the Annual Meeting.

Attendance at the Annual Meeting, either in person or virtually, will not, by itself, revoke a previously granted proxy. If you hold your shares in street name, you may contact your broker, bank or other nominee for instructions as to how to revoke or change your vote.

Who pays for this proxy solicitation?

United Fire Group, Inc. will pay the expenses of this solicitation of proxies. Expenses may include reimbursement to brokerage firms and others of their cost for forwarding solicitation materials to beneficial owners.

Does United Fire Group, Inc. deliver proxy materials electronically?

Yes. In accordance with the SEC’s “Notice and Access” rules, United Fire Group, Inc. mailed the Notice to shareholders beginning on or about April 6, 2021. The Notice describes the matters to be considered at the Annual Meeting and how shareholders may access the proxy materials over the Internet. It also provides instructions on how shareholders may vote their shares. If you received the Notice, you will not receive a printed version of the proxy materials unless you request one. If you would like to receive a printed version of the proxy materials, free of charge, please follow the instructions in the Notice.

What are the benefits of electronic delivery?

Electronic delivery reduces United Fire Group, Inc.’s printing and mailing costs as well as the environmental impact of the Annual Meeting. It is also a convenient way for you to receive your proxy materials and makes it easy to vote your shares over the Internet.

How may I obtain copies of United Fire Group, Inc.’s corporate governance documents?

The following documents are available free of charge to any shareholder who requests them by writing to United Fire Group, Inc., Attn: Investor Relations, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909, or on our public website, http://ir.ufginsurance.com, by selecting Overview and then Governance Documents.

•Anti-Hedging and Anti-Pledging Policy

•Clawback Policy

•Code of Ethics and Business Conduct

•Corporate Governance Guidelines

•Disclosure Policy

•Committee Charters—Audit Committee, Compensation Committee, Executive Committee, Investment Committee, Nominating and Governance Committee and Risk Management Committee

5

In addition, copies of our Articles of Incorporation and Bylaws are available free of charge to any shareholder who requests them by writing to United Fire Group, Inc., Attn: Investor Relations, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909. Our Articles of Incorporation and Bylaws are also available free of charge on the SEC's EDGAR website at www.sec.gov.

Delivery of One Set of Annual Meeting Materials to Shareholders in a Single Residence ("Householding")

SEC rules permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and annual reports to shareholders with respect to two or more shareholders sharing the same address by delivering a single proxy statement and annual report to shareholders addressed to those shareholders. This process, commonly referred to as “householding,” provides cost savings for companies. We and some brokers household proxy materials and annual reports to shareholders unless contrary instructions have been received from the affected shareholders. Once you have received notice from us, your broker, or other designated intermediary that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent.

If, at any time, you no longer wish to participate in householding and would prefer to receive a separate printed proxy statement and annual report to shareholders, notify us by calling our transfer agent at (877) 373-6374, or submit a written request via regular mail to Computershare, P.O. Box 505000, Louisville, KY 40233-5000, or via overnight delivery to Computershare, 462 South 4th St., Ste 1600, Louisville, KY 40202.

Shareholders who currently receive multiple copies of their proxy materials and would like to request householding should submit a written request to: Computershare Trust Company, N.A. at either address above.

Please include the Company’s name, United Fire Group, Inc., and your account number(s) in any correspondence regarding householding. Street name shareholders wishing to cancel or request householding of their proxy materials should contact their brokers directly.

Electronic Availability of Proxy Materials

Electronic versions of our Notice of the Annual Meeting, this Proxy Statement and 2020 Annual Report to Shareholders are available on our public website, http://ir.ufginsurance.com by selecting Financial Documents and then Annual Reports and Proxy. The information provided on our website is not part of this proxy statement and is not incorporated herein by this reference.

BOARD OF DIRECTORS

Our Board of Directors currently consists of 12 directors. The current membership includes: John-Paul E. Besong, Scott L. Carlton, Brenda K. Clancy, Christopher R. Drahozal, Jack B. Evans (Chairman), Lura E. McBride, George D. Milligan, James W. Noyce, Mary K. Quass, Randy A. Ramlo, Kyle D. Skogman and Susan E. Voss. As previously announced, Mr. Evans has notified the Company of his intention not to stand for reelection as a director when his present term will expire at the Annual Meeting. The Company thanks Mr. Evans for his many years of distinguished service to the Company.

Corporate Governance

In order to promote the highest standards of management for the benefit of shareholders, our Board of Directors follows certain governance practices regarding how the Board of Directors conducts its business and fulfills its duties. United Fire Group, Inc.’s Corporate Governance Guidelines may be obtained free of charge by writing to United Fire Group, Inc., Attn: Investor Relations, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909, or on our public website, http://ir.ufginsurance.com, by selecting Overview and then Governance Documents. The following describes the governance practices used by the Board of Directors.

6

Board Size, Composition and Independence Determination

Our Board of Directors consists of 12 members, divided among three classes. Following the departure of Mr. Evans immediately after the Annual Meeting, the size of the Board of Directors will be reduced to 11 members. Two classes will consist of four members, and the other class (Class C) will consist of three members. Mr. Noyce will succeed Mr. Evans as Chairman. Mr. Skogman will succeed Mr. Noyce as Vice Chairman.

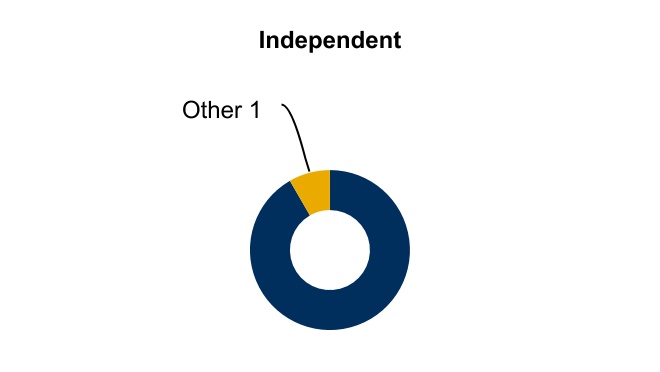

The Board of Directors requires a majority of our directors to be independent, as defined in the listing rules of The NASDAQ Global Select Market (“NASDAQ”). The Board of Directors determines director independence by applying the definition of independence contained in the applicable NASDAQ Listing Rules, both for purposes of NASDAQ’s rule requiring that a majority of the Board of Directors consist of independent directors and its rules requiring the Audit Committee, Nominating and Governance Committee and Compensation Committee to be made up entirely of independent directors.

The Board of Directors has analyzed the independence of each director who served on the Board of Directors during 2020 and determined that 11 of our 12 existing directors are independent. All directors except Mr. Ramlo are independent within the meaning of the NASDAQ Listing Rules.

In determining that Mr. Skogman is independent, the Board considered that the Company maintains a relationship with an insurance agency in which Mr. Skogman is a 25% owner. The services provided by us to this agency were in the ordinary course of business on substantially the same terms and conditions as those prevailing at the time for comparable transactions with other customers. The value of the services provided by us to this agency represented an immaterial amount to each party and did not rise to the level requiring formal review and approval by the Board of Directors under its written policy regarding related party transactions. We expect to continue providing services to this agency in the future.

Qualifications, Skills and Diversity of Directors and Director Nominees

Our Nominating and Governance Committee, with input from our Chief Executive Officer, reviews and evaluates all director nominees, including incumbent nominees. The Nominating and Governance Committee and the Board of Directors seek qualified individuals who possess the minimum qualifications and the desirable qualities or skills described under the heading "Director Nomination Process" in this proxy statement.

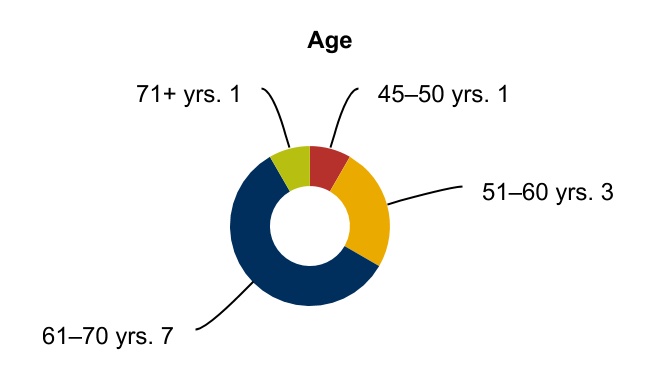

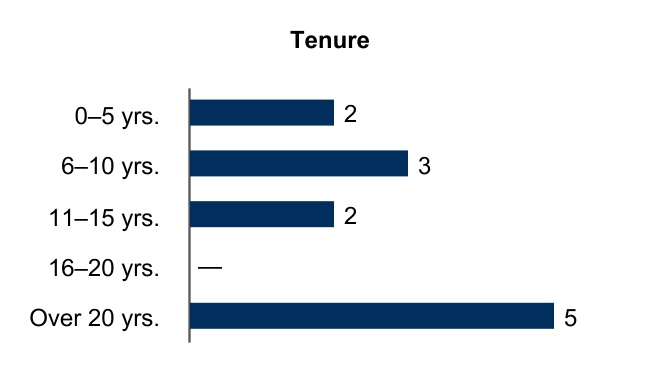

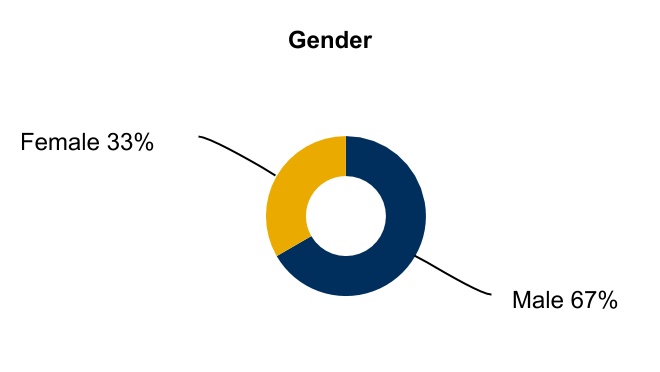

All of our incumbent directors and nominees possess both the specific minimum qualifications and the desirable qualities or skills. The following charts reflect the diversity of our nominees and continuing directors and the qualifications of each of the directors.

7

| Director Qualifications and Experience | John-Paul Besong | Scott Carlton | Brenda Clancy | Chris- topher Drahozal | Jack Evans | Lura McBride | George Milligan | James Noyce | Mary Quass | Randy Ramlo | Kyle Skogman | Susan Voss | ||||||||||||||||||||||||||

| Academia & Education | X | |||||||||||||||||||||||||||||||||||||

| Accounting | X | X | X | |||||||||||||||||||||||||||||||||||

| Actuarial | X | |||||||||||||||||||||||||||||||||||||

| Senior Administration | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||

| Business Operations | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||

| Corporate Governance | X | X | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||

| Finance & Capital | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||

| Financial Statements | X | X | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||

| Insurance Industry | X | X | X | X | X | |||||||||||||||||||||||||||||||||

| Investment | X | X | X | X | ||||||||||||||||||||||||||||||||||

| Marketing | X | X | X | X | ||||||||||||||||||||||||||||||||||

| Regulatory & Government | X | |||||||||||||||||||||||||||||||||||||

| Risk Management | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||

| Technology & Systems | X | X | X | |||||||||||||||||||||||||||||||||||

Our directors provide an effective mix of experience and fresh perspective, as shown on the following charts.

The average age is 63 as of December 31, 2020. The average tenure is 14.3 years.

8

Attendance at Director and Shareholder Meetings

The full Board of Directors met four times during 2020. All of the directors attended 75% or more of the aggregate number of meetings of the Board of Directors and the committees on which they served. Our Corporate Governance Guidelines require directors to attend our Annual Meeting. All directors serving at the time of the 2020 annual meeting of shareholders attended that meeting.

Director Retirement

According to our Bylaws, each director must submit his or her resignation from the Board of Directors no later than the first day of February after he or she reaches age 72, and such resignation must be effective no later than the next Annual Meeting. Pursuant to this policy, Mr. Evans is not standing for reelection at the Annual Meeting.

Director Stock Ownership

We believe that non-employee directors should own and hold Company Common Stock to further align their interests and actions with the interests of our shareholders. Our Articles of Incorporation require that all of our directors own shares of Company Common Stock. The Board of Directors has adopted stock ownership guidelines indicating that each non-employee director should beneficially own at least 100 shares of Company Common Stock when he or she joins the Board of Directors and at least 5,000 shares of Company Common Stock within five years of first being elected to the Board of Directors. A non-employee director shall not sell any shares of Company Common Stock received as a result of an award: (a) if the non-employee director has not met the stock ownership requirement; or (b) if the sale would cause the ownership of the non-employee director to fall below the stock ownership requirement.

Current beneficial stock ownership for each director can be found in the table under "Security Ownership by Certain Beneficial Owners" in this proxy statement.

Board Leadership Structure

Our Board of Directors is led by an independent Chairman who is responsible for providing guidance to our Chief Executive Officer, setting the agenda for Board meetings and presiding at all shareholder and director meetings. We also have an independent Vice Chairman who is responsible for presiding in the Chairman’s absence. Neither our Chairman nor our Vice Chairman serves as our Chief Executive Officer. Our Chief Executive Officer is responsible for setting the strategic direction for our Company and providing day-to-day leadership. We currently separate the roles of Chairman and Chief Executive Officer. We feel that this is the most appropriate leadership structure for our Board of Directors and executive management at this time because we recognize the benefits of separating the two roles to allow full utilization of the different skill sets required to most effectively and efficiently perform these functions to meet the needs of the Company. Our Board of Directors does not have a formal policy requiring the positions of Chairman and Chief Executive Officer to be separate, preferring instead to preserve the freedom to decide from time to time what is in the best interest of the Company. Our Board of Directors strongly endorses the concept of an independent director being in a position to lead our independent directors. If at any time neither our Chairman nor our Vice Chairman is an independent director, the independent directors serving at that time will elect an independent director to serve as lead director.

The Board of Directors has six standing committees: Audit Committee, Compensation Committee, Executive Committee, Investment Committee, Nominating and Governance Committee and Risk Management Committee. Only independent directors may serve on the Audit Committee, Compensation Committee and Nominating and Governance Committee. Each committee is governed by a written charter that is reviewed and approved annually by the applicable committee, the Nominating and Governance Committee, and the full Board of Directors. All committee charters are available for review either on our public website, http://ir.ufginsurance.com by selecting Overview and then Governance Documents, or in paper form upon written request to: United Fire Group, Inc., Attn: Investor Relations, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909.

Risk Oversight by the Board of Directors

The Risk Management Committee’s charter requires it to assist the Board of Directors in identifying and evaluating risks inherent in our business and to oversee and review the significant policies, procedures, and practices employed to manage risks.

9

Enterprise Risk Management (“ERM”) is a methodology that helps us assess and manage our overall exposure to risk. In addition to our Risk Management Committee, we have an executive enterprise risk management committee (“executive ERM committee”) that consists of our President & Chief Executive Officer, Executive Vice President & Chief Operating Officer, Executive Vice President & Chief Financial Officer, Vice President & Chief Investment and Strategy Officer, Vice President & Chief Risk Officer, Vice President & Chief Claims Officer, Vice President & General Counsel, Vice President & Chief Marketing Officer, Vice President & Chief Technology Officer, Vice President of Corporate Development, Director of Internal Audit, and Corporate Safety Manager.

The executive ERM committee meets independently of the Risk Management Committee. During 2020, the executive ERM committee met on a quarterly basis to implement risk management strategies. During its meetings, the executive ERM committee discusses the risks that our Company faces and the controls that are in place to mitigate those risks, and identifies potential additional risks.

Collectively, the Risk Management Committee and the executive ERM committee have identified two broad categories of risk faced by our Company: insurance risk and operational risk. We employ a multi-disciplinary approach to risk identification and evaluation, analyzing risk from the point of view of claims, underwriting, finance, and investments. Types of insurance risks generally include, but are not limited to, those risks associated with catastrophes, loss reserving practices, underwriting practices, policy pricing, geographical concentrations of property insured, competition and business mix. Types of operational risks we face generally include, but are not limited to, those risks associated with the diversification and quality of our investments, information technology and cybersecurity, regulatory and legal compliance, business continuity planning, executive succession planning and the application of accounting policies and procedures.

ERM issues are also discussed during quarterly meetings of our full Board of Directors, where directors are updated on ERM issues and the ongoing efforts of the executive ERM committee and our Risk Management Committee. The work of our executive ERM committee, in conjunction with the Risk Management Committee and the Board of Directors, has led to the development of new tools, such as the CATography Underwriter™ tool, designed to aid in the evaluation and mitigation of our Company’s business risks.

In addition, certain Board committees oversee risk within their respective areas of responsibility. For example, the Audit Committee has been delegated with primary oversight of financial, accounting and securities related risk, and the Compensation Committee oversees the risks associated with the Company’s compensation policies and practices, including conducting an annual risk assessment of such policies and practices. Together with the Audit Committee, the Compensation Committee has concluded that the risks arising from our compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

Clawback Policy

To further align management's interests with the interest of shareholders and support good governance practices, the Board of Directors has adopted a clawback policy applicable to incentive-based compensation to executive officers. In the event the Company is required to prepare an accounting restatement due to errors, omissions or fraud, the Board of Directors may direct the Company to recover from each of the executive officers the excess value received from any incentive award over the value actually earned based on the restated performance. Our Clawback Policy may be obtained free of charge by writing to United Fire Group, Inc., Attn: Investor Relations, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909, or on our public website, http://ir.ufginsurance.com, by selecting Overview, then Governance Documents and then Clawback Policy.

Anti-Hedging and Anti-Pledging Policy

Our policies do not permit our directors or executive officers, including our named executive officers, or employees, to "hedge" their ownership by: (a) trading in publicly-traded options, puts, calls, or other derivative instruments related to the Company’s equity or debt securities; or (b) purchase financial instruments, including prepaid variable forward contracts, instruments for the short sale or purchase or sale of call or put options, equity swaps, collars, or units of exchangeable funds, that are designed to or that may reasonably be expected to have the effect of hedging or offsetting a decrease in the market value of any securities of the Company. In addition, directors or officers are not permitted to hold securities of the Company in margin accounts or pledge securities of the Company as collateral for loans. Our Anti-Hedging Policy may be obtained free of charge by writing to United Fire Group, Inc., Attn: Investor

10

Relations, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909, or on our public website, http://ir.ufginsurance.com, by selecting Investors, then Overview, then Governance Documents and then Anti-Hedging Policy.

Chief Executive Officer Performance Evaluation

Representatives of the Executive Committee and Compensation Committee meet each year with our Chief Executive Officer Randy A. Ramlo to review his goals for the current year. During the year, the Executive Committee meets regularly with our Chief Executive Officer to review his performance. The Executive Committee and the Chair of the Compensation Committee annually review the performance of our Chief Executive Officer and assess his performance for that year. The Chief Executive Officer also meets with the Compensation Committee, which considers his performance for the year.

Code of Ethics

Our Board of Directors has adopted a Code of Ethics and Business Conduct that applies to all of our officers, directors, and employees. United Fire Group, Inc.’s Code of Ethics and Business Conduct may be obtained free of charge by writing to United Fire Group, Inc., Attn: Investor Relations, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909, or on our public website, http://ir.ufginsurance.com by selecting Overview, then Governance Documents and then Code of Ethics and Business Conduct. The Code of Ethics and Business Conduct sets forth certain expectations of business conduct and identifies various violations of the code and establishes procedures regarding the reporting of such violations. We intend to include on our website information about any amendments to, or waivers from, a provision of the Code of Ethics and Business Conduct that apply to our principal executive officer, principal financial officer, principal accounting officer or controller.

Board Effectiveness Assessment and Evaluation Process

Our Nominating and Governance Committee conducts an annual survey of the directors to assess the effectiveness of our Board of Directors. The Nominating and Governance Committee reviews and considers the results of the survey, reports its findings to the Board of Directors and addresses any areas of concern. The committee also makes recommendations to the Board of Directors regarding our corporate governance practices. All standing committees of our Board of Directors also conduct annual self-assessments and report such self-assessments to the Board of Directors.

Director Compensation

We have designed the compensation of our non-employee directors to attract and retain qualified directors and to align directors’ interests with the interests of our shareholders. See "Director Compensation" in this proxy statement for a description of our directors’ compensation program and the fees paid to our non-employee directors during 2020.

Executive Sessions of Independent Directors

The independent directors meet in executive session following each meeting of the Board of Directors. The Chairman of the Board presides at meetings of the independent directors. These sessions allow the independent directors to discuss topics without management present. Four executive sessions were held in 2020.

Access to Management and Independent Advisers

The independent directors have access to management and, as necessary and appropriate, to independent advisers.

11

Committees of the Board

The current membership of six standing committees of the Board of Directors is shown in the following table:

| Director Name | Audit Committee | Compensation Committee | Executive Committee | Investment Committee | Nominating and Governance Committee | Risk Management Committee | ||||||||||||||

| Executive Director | ||||||||||||||||||||

| Randy A. Ramlo | M | M | M | |||||||||||||||||

| Independent Directors | ||||||||||||||||||||

| Jack B. Evans, Chairman | M | C | M | M | ||||||||||||||||

| John-Paul E. Besong | M | M | ||||||||||||||||||

| Scott L. Carlton | M, F | M | C | |||||||||||||||||

| Brenda K. Clancy | M, F | M | M | |||||||||||||||||

| Christopher R. Drahozal | M | M | C | |||||||||||||||||

| Lura E. McBride | M | M | M | |||||||||||||||||

| George D. Milligan | M | M | M | C | ||||||||||||||||

| James W. Noyce, Vice Chair | C, F | M | M | M | ||||||||||||||||

| Mary K. Quass | C | M | M | |||||||||||||||||

| Kyle D. Skogman | M | M | M | M | ||||||||||||||||

| Susan E. Voss | M | M | M | |||||||||||||||||

M = Member | C = Chair | F = Audit Committee Financial Expert

Audit Committee

We have a separately designated standing Audit Committee, as defined in Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee is governed by a charter which requires that each member of the Audit Committee be an independent director. All of the members of the Audit Committee are independent under the NASDAQ Listing Rules, applicable law, and the applicable rules and regulations of the SEC, including Section 10A(m)(3) of the Exchange Act. The Board of Directors has determined that Messrs. Carlton and Noyce and Ms. Clancy each possess the skills necessary to qualify as audit committee financial experts as defined by Item 407(d)(5) of Regulation S-K under the Exchange Act.

The Audit Committee is directly responsible for the appointment, compensation and retention (or termination) of our independent registered public accounting firm. The Audit Committee is also responsible for oversight of our internal audit function. The Audit Committee seeks to maintain free and open communications between the directors, the independent registered public accounting firm, the internal auditor and management. Other duties consist of reviewing recommendations by the internal auditor and the independent registered public accounting firm on accounting matters and internal controls; advising the Board of Directors on the scope of audits; reviewing our annual Consolidated Financial Statements and the accounting standards and principles followed; and, if necessary, conducting independent inquiries. The Audit Committee met four times during 2020, including one time in a joint session with the Risk Management Committee and one continuing education meeting.

Compensation Committee

All of the members of our Compensation Committee are independent under the NASDAQ Listing Rules, applicable law, and the applicable rules and regulations of the SEC, including Section 10C(a) of the Exchange Act. No Compensation Committee member is an employee or former employee of our Company, its subsidiaries or affiliates. With the exception of compensation for his or her service on the Board of Directors, no Compensation Committee member received any consulting, advisory, or other compensatory fee from us. No Compensation Committee member had any relationship that, in the opinion of the directors, would interfere with his or her exercise of independent judgment as a member of the committee.

12

Compensation Committee Interlocks and Insider Participation

During 2020, none of our executive officers served on the compensation committee (or its equivalent) or Board of Directors of another entity whose executive officer(s) served on our Board of Directors or Compensation Committee. No Compensation Committee member had any relationship requiring disclosure under the heading "Transactions with Related Persons" in this proxy statement.

Responsibilities and Authority

The role of the Compensation Committee is to assist the Board of Directors in its' responsibilities relating to compensation of our senior executive officers and directors. The Compensation Committee oversees all aspects of the compensation of our executive officers and directors, including our director and management equity plans and deferred compensation plans, and other management incentive compensation programs. In overseeing those plans, the Compensation Committee may delegate authority to Company officers for day-to-day plan administration and interpretation. Management provides information to assist the committee regarding participation and award levels in the management plans. The Compensation Committee may not delegate authority for matters affecting the executive officers. The Compensation Committee’s primary processes with respect to compensation of our named executive officers can be found under the heading "Compensation Discussion and Analysis" in this proxy statement. During 2020, the Compensation Committee engaged the services of Frederic W. Cook & Co. ("FW Cook") as its independent outside compensation consultant to provide advice on executive and director compensation matters. For a discussion of the specific services provided by FW Cook, see the Compensation Discussion and Analysis in this proxy statement. The Compensation Committee met four times during 2020.

Executive Committee

The Executive Committee meets during the intervals between Board of Directors’ meetings and has the right and authority to exercise the full powers of our Board of Directors, except where limited by law, or where responsibility and authority is reserved to the Board of Directors or vested in another committee of the Board of Directors. This committee also meets regularly with our Chief Executive Officer, participates with management in the development of our strategic initiatives, and monitors the implementation of these initiatives. In addition, the Executive Committee provides regular advice and counsel to management. The Executive Committee met six times during 2020.

Investment Committee

The Investment Committee develops and oversees the Investment Policies and Acquisition/Holding Investment Practices of the Company and its subsidiaries. In addition, it reviews the Company’s investments and the quality and performance of, and the risks related to, the Company’s investment portfolios. The Investment Committee meets regularly with our Chief Investment Officer and his staff. The Investment Committee met four times during 2020.

Nominating and Governance Committee

All of the members of our Nominating and Governance Committee are independent under the NASDAQ Listing Rules, applicable law, and the applicable rules and regulations of the SEC. The Nominating and Governance Committee is responsible for reviewing all director nominees, including incumbents, and making recommendations of nominees to the entire Board of Directors. The committee is also responsible for assessing and reporting on nominee qualifications, making assessments of director independence, identifying and reviewing related person transactions, and other matters, including director education and succession planning. The Nominating and Governance Committee met four times during 2020.

Risk Management Committee

For a description of responsibilities and activities of the Risk Management Committee, see "Risk Oversight by the Board of Directors" in this proxy statement. During 2020, the Risk Management Committee met four times as a committee, including one time in a joint session with the Audit Committee, as we believe that both committees should be involved in addressing our Company’s risks.

13

Director Nomination Process

The Nominating and Governance Committee has adopted a written policy with regard to the consideration of director candidates, including candidates recommended by shareholders. The Nominating and Governance Committee evaluates candidates recommended by shareholders in the same manner as it evaluates other candidates. The committee seeks candidates with the following minimum qualifications:

•Each candidate must be prepared to represent the best interests of all of our shareholders and not just one particular constituency.

•Each candidate must be an individual who has demonstrated integrity and ethics in the candidate’s personal, business, and professional life and has an established record of business and professional accomplishment.

•Neither the candidate nor the candidate’s family members (as defined in the NASDAQ Listing Rules), affiliates or associates (as defined in Rule 405 promulgated under the Securities Act of 1933) shall have any material personal, financial, or professional interest in any present or potential competitor of ours.

•Each candidate must, as a director, agree to participate fully in Board of Directors activities, including active membership on at least one Board committee and attendance at, and active participation in, meetings of the Board of Directors and the committee(s) of which he or she is a member and not have other personal, business or professional commitments that would interfere with or limit his or her ability to do so.

•Our Articles of Incorporation require that every director is also a shareholder. Each candidate must be willing to make, and financially capable of making, an investment in Company Common Stock as required by the non-employee director stock ownership guidelines adopted by our Board of Directors.

The Nominating and Governance Committee considers it very desirable for candidates to possess the following qualities or skills:

•Each candidate should contribute to the Board of Directors' overall diversity, which is broadly construed to mean a variety of opinions, perspectives, personal experience, business experience, professional experience, and backgrounds (such as gender, race, and ethnicity), as well as other differentiating characteristics.

•Each candidate should contribute positively to the existing chemistry and collaborative culture among the directors.

•Each candidate should possess professional, business, and personal experience and expertise relevant to the Company’s business. In this regard, the Nominating and Governance Committee will consider financial, management and business background, personal and educational background and experience, community leadership, independence and other qualifications, attributes and potential contributions.

The Nominating and Governance Committee identifies and screens candidates for director and makes its recommendations for director to the Board of Directors. The Nominating and Governance Committee selects and recommends each candidate to the Board of Directors each year based on its assessment of, among other things:

•the candidate’s personal qualifications as discussed above;

•the past and potential contributions of our current directors, and the value of continuity and prior experience on our Board of Directors;

•the need for a director to possess particular attributes or particular experience or expertise; and

•other factors that it considers relevant, including any specific qualifications the Nominating and Governance Committee adopts from time to time.

Any shareholder may recommend a person to be considered as a candidate or nominate one or more persons for election as a director of our Company. A shareholder who desires to make such a recommendation must comply with the same requirements applicable to director nominations set forth in Sections 8 and 9 of Article I of our Bylaws. Our Board of Directors encourages shareholders who wish to recommend candidates to the Nominating and Governance Committee to send their recommendations in writing addressed to the Nominating and Governance Committee, United Fire Group, Inc., Attention: Corporate Secretary, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909 using the procedures discussed below.

14

Communicating with the Board of Directors

Concerns and Complaints

United Fire Group, Inc. has adopted a process for communicating with our Board of Directors or individual directors. To communicate with our Board of Directors or individual directors regarding issues of concern to or about our Company, access our website, http://ir.ufginsurance.com, by selecting Investor Resources and then Concerns/Complaints, call toll free by telephone at 1-877-256-1056, or write to our Audit Committee at United Fire Group, Inc., Attention: Audit Committee Chair—Confidential, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909. Our Vice President, General Counsel and Corporate Secretary, Neal R. Scharmer, and Audit Committee Chair, James W. Noyce, are responsible for reviewing and reporting such communications to our Board of Directors and individual directors. If requested, and to the extent possible, all communications with our Board of Directors are kept strictly confidential.

Shareholder Proposals and Director Nominations for the 2022 Annual Meeting

To be eligible for inclusion in the proxy materials for the annual meeting of shareholders in 2022 (the "2022 Annual Meeting"), a shareholder proposal must be received by our Corporate Secretary by the close of business on December 7, 2021. All proposals must comply with Rule 14a-8 under the Exchange Act, which lists the requirements for the inclusion of shareholder proposals in company-sponsored proxy materials. Proposals must be delivered to our Corporate Secretary at United Fire Group, Inc., Attention: Corporate Secretary, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909.

Any shareholder proposal that is not submitted for inclusion in next year’s proxy statement under SEC Rule 14a-8, but is instead sought to be presented directly at our 2022 Annual Meeting, or any director nomination for our 2022 Annual Meeting, must be received at our principal executive offices no earlier than the close of business on December 20, 2021 and no later than the close of business on January 19, 2022. Proposals and nominations must be delivered to our Chairman at United Fire Group, Inc., Attention: Chairman of the Board, P.O. Box 73909, Cedar Rapids, Iowa 52407-3909.

According to our Articles of Incorporation, minority shareholders who collectively hold at least one-fifth of our outstanding Company Common Stock are entitled to nominate a proportionate number of directors as set forth in Article VII, Section 1(e) of our Articles of Incorporation. Shareholders nominating directors pursuant to this provision must also comply with the provisions of our Bylaws governing director nominations.

PROPOSAL ONE – ELECTION OF DIRECTORS

Our Articles of Incorporation require that our Board of Directors be divided into three classes, A, B and C, with one class elected at each Annual Meeting. The Board of Directors must consist of no more than fifteen and no less than nine members, with the exact number fixed by the Board of Directors. The membership of our Board of Directors is currently fixed at 12, divided among three classes, with each class consisting of four members. Three Class C directors identified in this proxy statement are to be elected at this year’s Annual Meeting. Following the departure of Mr. Evans immediately after the Annual Meeting, the size of the Board of Directors will be reduced to 11 members.

Upon the recommendation of the Nominating and Governance Committee, our Board of Directors has nominated the following individuals for election to our Board of Directors this year.

15

Director Nominees

Directors (Class C) – Terms Expiring in 2021

| Mr. Drahozal is the John M. Rounds Professor of Law at the University of Kansas School of Law in Lawrence, Kansas, where he has taught since 1994. During Fall 2015 and Fall 2018 he was the Mason Ladd Distinguished Visiting Professor of Law at the University of Iowa College of Law. He is on the Board of Directors of The McIntyre Foundation. From 2012 to 2016, Mr. Drahozal served as special advisor to the Consumer Financial Protection Bureau, a government agency headquartered in Washington, D.C., on matters related to the use of arbitration clauses in consumer financial services contracts. Prior to teaching, Mr. Drahozal was in private law practice in Washington, D.C., and served as a law clerk for the Iran-U.S. Claims Tribunal, the United States Court of Appeals for the Fifth Circuit and the United States Supreme Court. Mr. Drahozal is a first cousin by marriage to Mr. Carlton, another director of the Company. | |||||||

| Christopher R. Drahozal | ||||||||

| Age 59 | ||||||||

| Director since 1997 | ||||||||

| Lura E. McBride is the President & CEO at Van Meter Inc. ("Van Meter"), a one-hundred percent employee-owned electrical and automation distributor, a position she has held since 2016. She previously served as Chief Operating Officer at Van Meter since 2010. She has responsibility for the overall vision, direction and growth strategy of Van Meter, employing 485 employee-owners in 16 locations across Iowa, Nebraska, Kansas and Virginia. She has experience building strong leadership and a high performing culture to create lasting value for customers, supplier partners, communities and employee-owners. She serves on the Van Meter Board of Directors, the Werner Electric Supply Board of Directors and the National Association of Electrical Distributors (NAED). Prior to joining Van Meter in 2008, she worked for almost 15 years at Accenture, a global management consulting company based out of Chicago, Illinois. Her work experiences were in the areas of Systems Integration, Change Management, Human Performance, Knowledge Management, Business Process Design and Program Management. Ms. McBride graduated from University of Iowa with degrees in Finance and Marketing. In the community, Ms. McBride serves on various boards and committees including The Tippie School of Business Advisory Board, Tanager Place, The Hall-Perrine Foundation, Unity Point St. Luke’s Hospital, Iowa BIG and the Cedar Rapids Police Chief Council. | |||||||

| Lura E. McBride | ||||||||

| Age 48 | ||||||||

| Director since 2020 | ||||||||

| Mr. Milligan has a strong business background, with service since 1985 as President of The Graham Group, Inc., of Des Moines, Iowa. The Graham Group, Inc. consists of a real estate firm specializing in developing office buildings and a construction firm specializing in constructing hospital facilities. Since 2005, Mr. Milligan has also served as a director of West Bancorporation, Inc. of West Des Moines, Iowa, a bank holding company. Mr. Milligan serves as a director on the loan committee and nominating and governance committee of the West Bancorporation, Inc. Board of Directors. Mr. Milligan previously served as director of Allied Life Insurance Company. Mr. Milligan is a long-time community leader and supporter, being active with the Boy Scouts of America, the Dowling Foundation, and the Variety Club of Iowa. | |||||||

| George D. Milligan | ||||||||

| Age 64 | ||||||||

| Director since 1999 | ||||||||

16

Vote Required and Board Recommendation

Directors in uncontested elections are elected by a majority vote of the shares, represented either in person or by proxy, and entitled to vote in the election at the Annual Meeting at which a quorum is present. In tabulating the voting results for the election of directors, “FOR” votes are counted in favor of the election of a director, and “AGAINST” votes are counted against the election of a director. Abstentions will have the same effect as a vote against the director.

The Board of Directors recommends a vote FOR the election to the Board of each of the three director nominees identified in this proxy statement.

Continuing Directors

The following individuals are continuing members of our Board of Directors who are not up for election at the Annual Meeting.

Directors (Class B) – Terms Expiring in 2022

| Mr. Besong has a strong technical, business and management background, having previously held the position of Senior Vice President of e-Business and Chief Information Officer for Rockwell Collins, a Fortune 500 company based in Cedar Rapids, Iowa, that provides aviation electronics for both commercial and military aircraft. He was appointed Senior Vice President and Chief Information Officer in 2003, serving until 2015. Since 2015, Mr. Besong has served as a director of QCR Holdings, Inc. of Moline, Illinois, a multi-bank holding company. Mr. Besong is a strong community supporter and member of various industry and community boards. He serves on the board of directors of Lean Aerospace Initiative (LAI), Junior Achievement of Eastern Iowa (Cedar Rapids Area), Mercy Medical Center, Iowa Public Television Foundation and Technology Association of Iowa ("TAI") CIO Advisory Board, where he serves as a member and former chair of the executive board of TAI. Mr. Besong’s business background provides him with a very strong understanding of technological advances critical to the insurance industry. The Board of Directors believes that Mr. Besong’s qualifications to serve as director include his business acumen and distinguished management career as an officer and information technology expert of a Fortune 500 company. | |||||||

| John-Paul E. Besong | ||||||||

| Age 67 | ||||||||

| Director since 2013 | ||||||||

| Mr. Noyce has a strong business, accounting and insurance industry background, with extensive public company experience. Before retiring, Mr. Noyce had nearly three decades of experience in the financial services industry, most recently as Chief Executive Officer and Director of FBL Financial Group, Inc. (“FBL”), an insurance holding company headquartered in West Des Moines, Iowa. While at FBL, Mr. Noyce served as Chief Executive Officer and Director (2007-2009), Chief Financial Officer (1996-2007), and Chief Administrative Officer (2002-2007). From January 2000 to July 2002 he was Executive Vice President and General Manager of the property casualty companies managed by FBL. Mr. Noyce began his employment with FBL and its affiliates in 1985. From January to May 2016, Mr. Noyce served as Interim CEO of the Greater Des Moines YMCA while the organization performed a search for a permanent CEO. Since 2009, Mr. Noyce has served as a director of West Bancorporation, Inc. of West Des Moines, Iowa, a bank holding company, and was named Board Chairman in April 2018. Mr. Noyce has held or still holds numerous professional certifications and designations including certified public accountant; Fellow, Casualty Actuarial Society; Associate, Society of Actuaries; Fellow, Life Management Institute; and Member, American Academy of Actuaries. He was named Outstanding CPA in Business and Industry by the Iowa Society of CPAs and was inducted into the American Institute of Certified Public Accountants’ Business and Industry Hall of Fame in 2007. | |||||||

| James W. Noyce | ||||||||

| Age 65 | ||||||||

| Director since 2009 | ||||||||

17

| Ms. Quass is President and Chief Executive Officer of NRG Media, LLC, headquartered in Cedar Rapids, Iowa, a position that she has held since 2005. NRG Media, LLC is a broadcast group consisting of 42 analog radio stations and 20 digital streaming radio stations in the Midwest. Ms. Quass also served on the board of directors for Van Meter Inc., a distributor of electrical and mechanical supplies, services and solutions in Cedar Rapids, Iowa, and the Cedar Rapids, Iowa, region of U.S. Bank. Ms. Quass’ service extends to community boards as Chair for Mercy Medical Center in Cedar Rapids, Iowa and Trustee of United Way East Central Iowa. Ms. Quass is involved in professional organizations including service on the Board of Directors and Executive Committee of the National Association of Broadcasters and the Radio Advertising Bureau Executive Committee, and as Treasurer of the QMac IBA Foundation and past Chair of the Iowa Broadcasters Association. Ms. Quass has been recognized by the broadcast industry as one of the 40 Most Powerful Broadcasters (2005-2010). In 2017, Ms. Quass was recognized by the Radio Industry, receiving the Radio Wayne "Americas Best Broadcaster Award and MIW Trailblazer Award given to Outstanding Women leaders. In 2019, Ms. Quass received the National Association of Broadcasters National Radio Award. Ms. Quass has a very strong understanding of the insurance industry in general and our business operations in particular due to her service on our Board of Directors. | |||||||

| Mary K. Quass | ||||||||

| Age 70 | ||||||||

| Director since 1998 | ||||||||

| Mr. Skogman possesses a strong business background. He has served as President of Skogman Construction Co. of Iowa from 1990 to 2020, a company that specializes in residential construction and real estate sales, primarily in Cedar Rapids, Iowa. Skogman Homes built over 6,200 homes while Mr. Skogman served as President. Mr. Skogman also owns an interest in a property-casualty insurance agency. He was inducted into the Cedar Rapids Area Homebuilders Association Hall of Fame in 2008. He serves on the Board of Directors of Mercy Medical Center in Cedar Rapids, Iowa. | |||||||

| Kyle D. Skogman | ||||||||

| Age 70 | ||||||||

| Director since 2000 | ||||||||

Directors (Class A) – Terms Expiring in 2023

| Mr. Carlton has a strong international business background and extensive experience within the finance and accounting functions in a global public company. He is currently the President of Tokai Carbon GE LLC, the US subsidiary of Tokai Carbon, a global leader in carbon-based materials, a position he has held since 2017. Prior to this position, Mr. Carlton was the President of SGL Carbon LLC ("SGL Carbon") for 10 years, leading the U.S. companies of SGL Carbon, a leading worldwide manufacturer of carbon-based products. From 2002 until 2007, Mr. Carlton served as Vice President of Finance and Controlling for the largest business unit of SGL Carbon, and in that capacity was responsible for the controlling, finance and accounting functions. Since beginning his career with SGL Carbon in 1994, Mr. Carlton has worked in a variety of accounting and financial positions at various locations within and outside of the U.S. Mr. Carlton holds a bachelor's degree in financial management, a masters of business administration degree and completed the Senior Executive Education Program at the London Business School. Mr. Carlton also has insurance experience on both a domestic and international scale. He is also a director of the Carolina chapter of the National Association of Corporate Directors (“NACD”) and is a registered NACD Governance Fellow. Mr. Carlton serves on the board of E4 Carolinas of Charlotte, North Carolina. Mr. Carlton is a first cousin by marriage to Mr. Drahozal, another director of the Company. | |||||||

| Scott L. Carlton | ||||||||

| Age 52 | ||||||||

| Director since 2012 | ||||||||

18

| Ms. Clancy has a wealth of valuable experience in the insurance industry, having most recently served as the Global Chief Technology Officer for AEGON N.V. ("AEGON") (2013-2016), which is a multinational life insurance, pensions and asset management company headquartered in The Hague, Netherlands. AEGON is a parent company of Transamerica Corporation, an American holding company for various life insurance companies and investment firms doing business primarily in the United States, offering life and supplemental health insurance, investments, and retirement services. Throughout her 40-year career with AEGON, Ms. Clancy held numerous financial leadership positions including President of Transamerica Life Insurance Company (2008-2016), Executive Vice President and Chief Operating Officer of Transamerica Life Insurance Company (2004-2008), Senior Vice President, Information & Finance and Treasurer of Life Investors Insurance Co. of America (1997-2004), and Vice President and Controller of Life Investors Insurance Co. of America (1992-1997). She was actively involved in all major acquisitions, strategy development, change initiatives and business integration. Ms. Clancy is currently a Director for UnityPoint Health, a nonprofit healthcare organization operating in Iowa, Illinois and Wisconsin. | |||||||

| Brenda K. Clancy | ||||||||

| Age 66 | ||||||||

| Director since 2016 | ||||||||

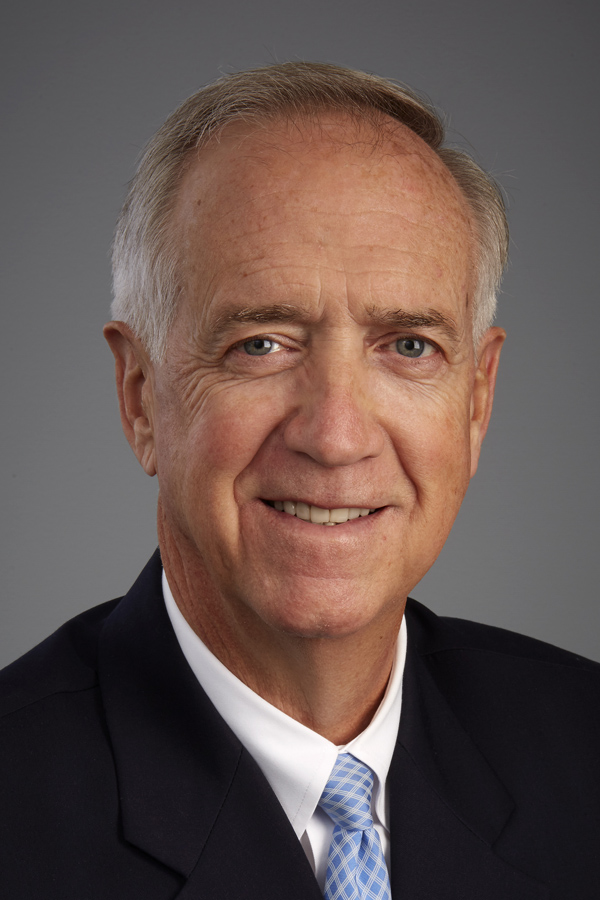

| Mr. Ramlo has served as our President and Chief Executive Officer since May 2007. He previously served as Chief Operating Officer (2006-2007), as Executive Vice President (2004-2007), and as Vice President, Fidelity and Surety (2001-2004). Mr. Ramlo has been with the Company since 1984 and has a very strong knowledge of our business and the insurance industry. He holds numerous professional insurance designations, including Chartered Property and Casualty Underwriter, Associate in Fidelity and Surety Bonding, Associate in Management and Associate in Risk Management. Mr. Ramlo is a long-time community leader and supporter, with service to many diverse organizations. He serves as a director of Cedar Rapids Metro Economic Alliance, an economic development organization, a member of the board of trustees of the Cedar Rapids Public Library, a member of the University of Northern Iowa School of Business Executive Advisory Board, a trustee on the Iowa College Foundation Board and a trustee of the Eastern Iowa Branch of the Juvenile Diabetes Research Foundation International. | |||||||

| Randy A. Ramlo | ||||||||

| Age 59 | ||||||||

| Director since 2008 | ||||||||