Form DEF 14A Trulieve Cannabis Corp. For: Jun 17

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

TRULIEVE CANNABIS CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

TRULIEVE CANNABIS CORP.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

OF TRULIEVE CANNABIS CORP.

AND

PROXY STATEMENT

FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 8, 2022

April 28, 2022

This proxy statement is dated April 28, 2022, and is first being made available to shareholders on or about

April 28, 2022.

Table of Contents

Trulieve Cannabis Corp.

Notice of Annual General Meeting of Shareholders (the “Notice”)

The 2022 annual general meeting of shareholders (the “Meeting”) of Trulieve Cannabis Corp., a British Columbia corporation (the “Company”), will be a virtual meeting held on June 8, 2022 beginning at 10:00 a.m. (Eastern Time), at www.virtualshareholdermeeting.com/TCNNF2022.

The following matters will be considered at the Meeting:

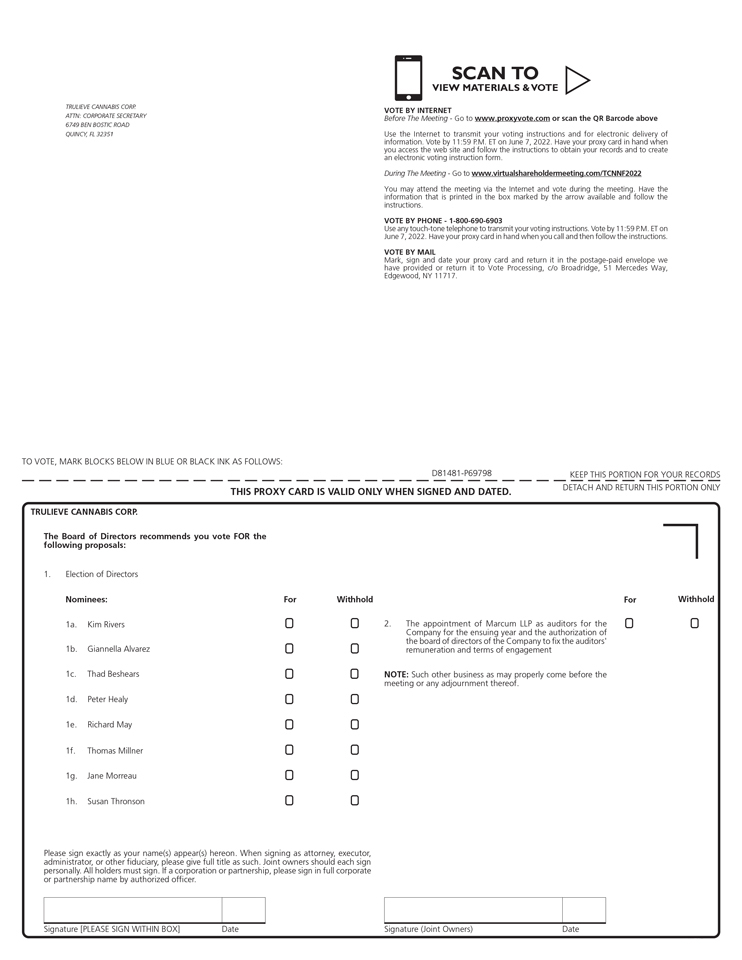

| • | The election of eight directors for the forthcoming year from the nominees proposed by the Board; |

| • | The re-appointment of Marcum LLP, as auditors for the Company and the authorization of the board of directors of the Company (the “Board”) to fix the auditors’ remuneration and terms of engagement; and |

| • | The transaction of such other business as may properly come before the Meeting or any adjournment(s) thereof. |

This Notice of Meeting is accompanied by the proxy statement and the accompanying form of proxy (“Proxy Instrument”). As permitted by applicable securities law, the Company is using notice-and-access to deliver the proxy statement to shareholders. This means that the proxy statement is being posted online to access, rather than being mailed out. Notice-and-access substantially reduces the Company’s printing and mailing costs and is environmentally friendly as it reduces paper and energy consumption. On or about April 28, 2022, we expect to make available the proxy statement, the audited annual consolidated financial statements of the Company for the fiscal year ended December 31, 2021, together with the notes thereto, and the independent auditor’s report thereon and the related management’s discussion and analysis on the “Investors” section of the Company’s website at www.trulieve.com, SEDAR at www.sedar.com and the SEC’s website at www.sec.gov. Shareholders will still receive a Proxy Instrument or a voting instruction form in the mail so they can vote their shares but, instead of receiving a paper copy of the proxy statement, they will receive a notice with information about how they can access the proxy statement electronically and how to request a paper copy.

The record date for the determination of shareholders of the Company entitled to receive notice of and to vote at the Meeting or any adjournment(s) thereof is April 11, 2022 (the “Record Date”). Shareholders of the Company whose names have been entered in the register of shareholders of the Company at the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting or any adjournment(s) thereof.

A shareholder of the Company may attend the Meeting live via webcast or may be represented by proxy. Registered shareholders of the Company who are unable to attend the Meeting or any adjournment(s) thereof via the webcast are requested to date, sign and return the accompanying Proxy Instrument for use at the Meeting or any adjournment(s) thereof.

To be effective, the enclosed Proxy Instrument must be returned to Broadridge (“Broadridge”) by mail using the enclosed return envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Alternatively, you may vote by Internet at www.proxyvote.com and clicking “Vote” or by calling 1-800-690-6903. All instructions are listed on the enclosed Proxy Instrument. Your proxy or voting instructions must be received in each case no later than 11:59 p.m. (Eastern Time) on June 7, 2022 or, if the Meeting is adjourned, at least 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of British Columbia) before the beginning of any adjournment(s) to the Meeting.

Table of Contents

Whether or not you plan to attend the Meeting via live webcast, we encourage you to read this proxy statement and promptly vote your shares. For specific instructions on how to vote your shares, please refer to the section entitled “How You Can Vote” and to the instructions on your proxy or voting instruction card.

| DATED as of April 28, 2022 |

| By Order of the Board of Directors |

| /s/ Eric Powers |

| Eric Powers |

| Chief Legal Officer and Corporate Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 8, 2022.

The Notice of Annual General Meeting and Proxy Statement are available online at the “Investors” section of our website at www.trulieve.com. The 2021 Annual Report to Shareholders, which includes our Form 10-K for the year ended December 31, 2021, is also available online at the “Investors” section of our website at www.trulieve.com.

YOUR VOTE IS IMPORTANT. PLEASE VOTE YOUR PROXY OVER THE INTERNET BY VISITING WWW.PROXYVOTE.COM OR BY TELEPHONE 1-800-690-6903 OR MARK, SIGN, DATE AND RETURN YOUR PROXY CARD BY MAIL WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL GENERAL MEETING.

Table of Contents

PROXY STATEMENT FOR THE 2022 ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 8, 2022

This proxy statement contains information about the 2022 annual general meeting of shareholders (the “Meeting”) of Trulieve Cannabis Corp., to be held via live webcast on June 8, 2022 beginning at 10:00 a.m. (Eastern Time), at www.virtualshareholdermeeting.com/TCNNF2022. The board of directors (the “board of directors” or the “Board”) is using this proxy statement to solicit proxies for use at the Meeting. Unless the context otherwise requires, references to “we,” “us,” “our,” “Company” or “Trulieve” or similar terms refers to Trulieve Cannabis Corp. together with its wholly-owned subsidiaries. The mailing address of our principal executive offices is 6749 Ben Bostic Road, Quincy, FL 32351.

All properly submitted proxies will be voted in accordance with the instructions contained in those proxies. If no instructions are specified, the proxies will be voted in accordance with the recommendation of our Board with respect to each of the matters set forth in the accompanying Notice of Meeting. You may revoke it at any time up to and including the last business day preceding the day of the Meeting by giving our Corporate Secretary written notice to that effect or at the Meeting by providing written notice to our Corporate Secretary to that effect.

We made this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 available to shareholders on April 28, 2022.

We are an “emerging growth company” under applicable U.S. federal securities laws and therefore permitted to conform with certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the U.S. Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may take advantage of these exemptions until the last day of the fiscal year in which the fifth anniversary of our initial public offering occurs (December 31, 2026) or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the U.S. Securities and Exchange Commission (the “SEC”) or if we issue more than $1.0 billion of non-convertible debt over a three-year period.

Important Notice Regarding the Availability of Proxy Materials for the Annual General

Meeting of Shareholders to be Held on June 8, 2022:

This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are available for viewing, printing and downloading at www.proxyvote.com.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the SEC on March 30, 2022, except for exhibits, will be furnished without charge to any shareholder upon written request to our Corporate Secretary at [email protected]. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are also available on the “Investors” section of our website at www.trulieve.com, the SEC’s website at www.sec.gov and SEDAR at www.sedar.com.

Table of Contents

| 1 | ||||

| 1 | ||||

| 4 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 20 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

23 | |||

| 25 | ||||

| 25 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| Employment Agreements, Severance and Change in Control Arrangements |

34 | |||

| 37 | ||||

| 38 | ||||

| 39 | ||||

i

Table of Contents

GENERAL INFORMATION ABOUT THE ANNUAL GENERAL MEETING AND VOTING

Why am I receiving these materials?

Our Board is using this proxy statement to solicit proxies for use at the Meeting to be held via live webcast on June 8, 2022 and is making these materials available by posting them online to access, rather than mailing them out unless requested by a shareholder. The cost of any solicitation will be borne by the Company. Proxies may also be solicited personally by employees of the Company at nominal cost to the Company.

As a shareholder, you are invited to attend the Meeting and are entitled and requested to vote on the business items described in this proxy statement. This proxy statement is furnished in connection with the solicitation of proxies by or on behalf of management of the Company and the Board. This proxy statement is designed to assist you in voting your shares and includes information that we are required to provide under the rules of the SEC and applicable Canadian securities laws.

These proxy materials are being sent to both registered and non-registered shareholders. In some instances, the Company has distributed copies of the Notice, the proxy statement and the accompanying Proxy Instrument (collectively, the “Documents”) to clearing agencies, securities dealers, banks and trust companies, or their nominees (collectively “Intermediaries”, and each an “Intermediary”) for onward distribution to shareholders whose shares are held by or in the custody of those Intermediaries (“Non-registered Shareholders”). The Intermediaries are required to forward the Documents to Non-registered Shareholders.

Solicitation of proxies from Non-registered Shareholders will be carried out by Intermediaries, or by the Company if the names and addresses of Non-registered Shareholders are provided by the Intermediaries.

Non-registered Shareholders who have received the Documents from their Intermediary should follow the directions of their Intermediary with respect to the procedure to be followed for voting at the Meeting. Generally, Non-registered Shareholders will either:

| • | receive a form of proxy executed by the Intermediary but otherwise uncompleted. The Non-registered Shareholder may complete the proxy and return it directly to Broadridge; or |

| • | be provided with a request for voting instructions. The Intermediary is required to send the Company an executed form of proxy completed in accordance with any voting instructions received by the Intermediary. |

If you are a Non-registered Shareholder, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained from your Intermediary in accordance with applicable securities regulatory requirements. By choosing to send the Documents to you directly, the Company (and not your Intermediary) has assumed responsibility for: (i) delivering the Documents to you; and (ii) executing your proper voting instructions. Non-registered Shareholders who have elected to receive the Documents by electronic delivery (“e-Delivery”) will have received e-mail notification from the Intermediary that the Documents are available electronically on the Company’s website. Please return your voting instructions as specified in the request for voting instructions.

Receiving Future Meeting Materials by Email

e-Delivery ensures that Shareholders receive documents faster, helps reduce printing and postage expenses and creates less paper waste. Shareholders who wish to enroll in e-Delivery may sign up at www.proxyvote.com.

1

Table of Contents

What is included in the proxy materials?

The proxy materials include:

| • | our Notice of Meeting; |

| • | our proxy statement for the Meeting; |

| • | a Proxy Instrument or voting instruction card; and |

| • | our 2021 Annual Report on Form 10-K. |

What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the Meeting, the voting process, our Board and board committees, corporate governance, the compensation of our directors and executive officers and other required information.

I share an address with another shareholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy?

If you share an address with another shareholder, you may receive only one set of proxy materials unless you have provided contrary instructions. If you wish to receive a separate set of the materials, please request the additional copy by contacting our Corporate Secretary at [email protected] or by calling us at (844) 878-5438.

A separate set of the materials will be sent promptly following receipt of your request.

If you are a shareholder of record and wish to receive a separate set of proxy materials in the future, or if you have received multiple sets of proxy materials and would like to receive only one set in the future, please contact Broadridge Financial Solutions at:

Broadridge

51 Mercedes Way

Edgewood, NY 11717

1-866-540-7095

If you are a beneficial owner of shares and you wish to receive a separate set of proxy materials in the future, or if you have received multiple sets of proxy materials and would like to receive only one set in the future, please contact your bank or broker directly.

Shareholders also may write to, or email us, at the address below to request a separate copy of the proxy materials:

Trulieve Cannabis Corp.

Attn: Corporate Secretary

6749 Ben Bostic Road

Quincy, FL 32351

Note that in light of continued restrictions and orders imposed in connection with the novel coronavirus (“COVID-19”), you should allow more time for receipt and processing of physical mail than under normal circumstances.

Who pays the cost of soliciting proxies for the Meeting?

We will bear the cost of solicitation. This solicitation of proxies is being made to shareholders by mail, but may be supplemented by telephone or other personal contact.

2

Table of Contents

We will not reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy materials to beneficial shareholders.

What items of business will be voted on at the Meeting?

The business items to be voted on at the Meeting are:

| • | The re-election of eight directors for the forthcoming year from the nominees proposed by the Board; |

| • | The re-appointment of Marcum LLP, as auditors for the Company and the authorization of the Board to fix the auditors’ remuneration and terms of engagement; and |

| • | The transaction of such other business as may properly come before the Meeting or any adjournment(s) thereof. |

What are my voting choices?

You may vote “FOR” or “WITHHOLD” the re-election of nominees for election as directors and “FOR” or “WITHHOLD” the appointment of Marcum LLP, as auditors for the ensuing year and the authorization of the Board to fix the auditor’s remuneration.

How does the Board recommend that I vote?

Our Board recommends that you vote your shares “FOR” each of its nominees for re-election to the Board and “FOR” the appointment of Marcum LLP, as auditors for the ensuing year and the authorization of the Board to fix the auditor’s remuneration.

What vote is required to approve each item?

To conduct business at the Meeting, the quorum of shareholders is one person who is, or who represents by proxy, one or more shareholders who, in the aggregate, hold at least 5% of the issued shares entitled to be voted at the Meeting.

If you indicate “WITHHOLD” in respect to the election of directors, your vote will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Meeting. As described below, broker non-votes will be counted for determining the presence or absence of a quorum for the transaction of business at the Meeting, but will not be considered votes cast with respect to the election of any director nominee or on any other proposal.

| Proposal | Required Vote | |||

| 1. | The election of eight directors | Majority of the votes cast on the proposal | ||

| 2. | Appointment and remuneration of auditors | Majority of the votes cast on the proposal | ||

* The Board has adopted a “majority voting” policy (the “Majority Voting Policy”). Pursuant to the Majority Voting Policy, at meetings of shareholders at which directors are to be elected, shareholders will vote in favor of, or withhold from voting for, each nominee separately. If, with respect to any particular nominee, the number of votes withheld exceeds the votes cast in favor of the nominee, then pursuant to the Majority Voting Policy the nominee shall be considered not to have received the support of the shareholders, even though duly elected as a matter of corporate law. An individual who is considered under the Majority Voting Policy not to have the support or confidence of the shareholders is expected forthwith to submit his or her resignation from the Board. Upon receiving such resignation, the nominating and corporate governance committee of our Board (the “Nominating and Corporate Governance Committee”), will consider it and make a recommendation to the Board on whether or not to accept the resignation.

3

Table of Contents

In reviewing the Nominating and Corporate Governance Committee’s recommendation, the Board shall consider the factors considered by the Nominating and Corporate Governance Committee and such additional factors as the Board considers relevant. The Board is expected to accept the recommendation of the Nominating and Corporate Governance Committee and to otherwise accept the resignation offer except in situations where exceptional circumstances would warrant the director continuing to serve on the Board. A director who has tendered a resignation pursuant to this policy will not participate in any deliberations of the Nominating and Corporate Governance Committee or the Board with respect to his or her resignation. The resignation will be effective when accepted by the Board. Within ninety (90) days of receiving a director’s resignation, the Board will make a decision and issue a press release either announcing the resignation of the director or explaining why it has not been accepted. In determining whether or not to accept the resignation, the Board will take into account the factors considered by the Nominating and Corporate Governance Committee and any other factors the Board determines are relevant.

What happens if additional items are presented at the Meeting?

As of the date of this proxy statement, management of the Company knows of no such amendments, variations or other matters to come before the Meeting. However, if other matters properly come before the Meeting, it is the intention of the persons named in the enclosed Proxy Instrument to vote such proxy according to their best judgment.

Where can I find the voting results?

We expect to announce preliminary voting results at the Meeting and to publish final results in a current report on Form 8-K that we will file with the SEC and in a press release that we will file in Canada on SEDAR promptly following the Meeting. Both the Form 8-K and press release will also be available on the “Investors” section of our website at www.trulieve.com.

What shares can I vote?

You are entitled to vote all shares owned by you on the Record Date, including (1) shares held directly in your name as the shareholder of record and (2) shares held for you as the beneficial owner through a bank, broker or other nominee. On April 11, 2022, there were 368 shareholders of record holding (i) 134,966,243 outstanding Subordinate Voting Shares; and (ii) 34 shareholders of record holding 492,178.99 outstanding Multiple Voting Shares.

REGISTERED SHAREHOLDERS HAVE THE RIGHT TO APPOINT A PERSON TO REPRESENT HIM, HER OR IT AT THE MEETING OTHER THAN THE PERSON(S) DESIGNATED IN THE PROXY INSTRUMENT either by striking out the names of the persons designated in the Proxy Instrument and by inserting the name of the person or company to be appointed in the space provided in the Proxy Instrument or by completing another proper form of proxy and, in either case, delivering the completed proxy to Broadridge by mail using the enclosed return envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Alternatively, you may vote by Internet at www.proxyvote.com and clicking “Vote” or by calling 1-800-690-6903.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Most of our shareholders hold their shares through a bank, broker or other nominee rather than having the shares registered directly in their own name. Summarized below are some distinctions between shares held of record and those owned beneficially.

4

Table of Contents

Shareholder of Record

If your shares are registered directly in your name with our transfer agent, Odyssey Trust Company, you are the shareholder of record of the shares. As the shareholder of record, you have the right to grant a proxy to vote your shares to representatives from the Company or to another person, or to vote your shares electronically at the Meeting. You have received a proxy card to use in voting your shares either by mail or email.

Beneficial Owner

If your shares are held through a bank, broker or other nominee, it is likely that they are registered in the name of the nominee and you are the beneficial owner of shares held in street name.

As the beneficial owner of shares held for your account, you have the right to direct the registered holder to vote your shares as you instruct, and you also are invited to attend the Meeting. Your bank, broker, plan trustee or other nominee has provided a voting instruction card for you to use in directing how your shares are to be voted.

How can I vote at the Meeting?

The Meeting will be held entirely online to allow greater participation. Shareholders may participate in the Meeting by visiting the following website: www.virtualshareholdermeeting.com/TCNNF2022. To participate in the Meeting, you will need the 16-digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the shareholder of record may be voted electronically during the Meeting. Shares for which you are the beneficial owner but not the shareholder of record also may be voted electronically during the Meeting.

Even if you plan to attend the Meeting, we recommend that you also submit your proxy or voting instructions as described below, so that your vote will be counted if you later decide not to attend.

How can I vote without attending the Meeting?

Whether you hold your shares as a shareholder of record or as a beneficial owner, you may direct how your shares are to be voted without attending the Meeting or any adjournment(s) or postponement(s) thereof. If you are a shareholder of record, you may vote by submitting a proxy. If you hold shares as a beneficial owner, you may vote by submitting voting instructions to the registered owner of your shares. Each registered shareholder submitting a proxy has the right to appoint one or more proxy holders (but not more than five) to represent the shareholder at the Meeting to the extent and with the powers conferred by the proxy.

For directions on how to vote, please refer to the following instructions and those included on your proxy or voting instruction card. A proxy form will not be valid unless completed and deposited in accordance with the instructions set out in the proxy form.

Voting by Internet

Shareholders may vote over the Internet by following the instructions on the proxy or voting instruction card.

Voting by Mail

Shareholders may vote by mail by signing, dating and returning their proxy or voting instruction card to the following address:

Vote Processing, c/o Broadridge

51 Mercedes Way

Edgewood, NY 11717

5

Table of Contents

How do I attend the virtual Meeting?

This year’s Meeting will be a completely virtual meeting of shareholders, which will be conducted via live webcast. You are entitled to participate in the Meeting only if you were a registered shareholder as of the close of business on April 11, 2022 or if you hold a valid proxy to vote at the annual meeting.

You will be able to attend the Meeting online by visiting www.virtualshareholdermeeting.com/TCNNF2022. You will also be able to vote your shares electronically at the Meeting. To participate, you will need your 16-digit control number included in your proxy materials, on your proxy card, or on the instructions that accompanied your proxy materials.

The Meeting will begin promptly at 10:00 a.m., Eastern Time. We encourage you to access the Meeting prior to the start time. Online access will open at 9:45 a.m., Eastern Time, and you should allow ample time to log in to the Meeting webcast and test your computer audio system. Technical assistance will be available if you have difficulty logging into the Meeting via a telephone number that will be posted on the login page to the Meeting.

We recommend that you carefully review the procedures needed to gain admission in advance. If you do not comply with the procedures described here for attending the Meeting online, you will not be able to participate online.

What will I need to attend the virtual Meeting?

If you were a shareholder of record as of the close of business on April 11, 2022, or you hold a valid proxy for the Meeting, you may attend the Meeting, vote, and submit a question during the Meeting by visiting www.virtualshareholdermeeting.com/TCNNF2022 and using your 16-digit control number to enter the Meeting. If you are not a shareholder of record but hold shares as a beneficial owner in street name, you may join the meeting by obtaining a proxy from the owner of record. If you do not comply with the procedures outlined above, you will not be admitted to the virtual Meeting.

Will I be able to attend the Meeting without a 16-digit control number?

Yes, you may register to attend the Meeting as a guest, but you will not be able to vote at the Meeting without your 16-digit control number.

Why a virtual annual meeting?

We are excited to embrace virtual meeting technology, which we believe provides expanded access, improved communications and cost and time savings for our shareholders and the Company. A virtual meeting enables increased shareholder attendance and participation from locations around the world. We believe the cost and time savings afforded by a virtual meeting encourages more shareholders to attend the Meeting. In addition, given the potential uncertainties in connection with the current COVID-19 pandemic, including risks related to travel and attending large gatherings, we believe that a virtual-only meeting is the most appropriate format for our shareholders and other Meeting attendees.

You will be able to attend the Meeting online by visiting www.virtualshareholdermeeting.com/TCNNF2022. You will also be able to vote your shares electronically at the Meeting. We encourage you to vote your shares prior to the Meeting to ensure they are represented. Even if you submit a vote prior to the Meeting, you will have an opportunity to vote again during the Meeting and automatically revoke your earlier vote.

What if during the check-in period or during the Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Meeting. If you encounter any difficulties accessing the virtual Meeting during check-in or during the meeting,

6

Table of Contents

please call the technical support number that will be posted on the virtual Meeting login page (www.virtualshareholdermeeting.com/TCNNF2022).

How do I submit questions or comments for the Meeting?

We do not plan to take questions or comments during the Meeting. Shareholders may direct communications to the Company outside of the Meeting at our principal executive offices. The mailing address of our principal executive offices is 6749 Ben Bostic Road, Quincy, FL 32351.

How will my shares be voted?

Shares represented by properly executed proxies in favor of persons designated in the printed portion of the enclosed Proxy Instrument WILL, UNLESS OTHERWISE INDICATED, BE VOTED FOR THE ELECTION OF DIRECTORS AND FOR THE APPOINTMENT OF MARCUM LLP (“MARCUM”), AS THE AUDITORS OF THE COMPANY AND FOR THE AUTHORIZATION OF THE BOARD OF DIRECTORS TO FIX AUDITORS’ REMUNERATION AND TERMS OF ENGAGEMENT. The shares represented by the Proxy Instrument will be voted or withheld from voting in accordance with the instructions of the shareholder on any ballot that may be called for and, if the shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly. The enclosed Proxy Instrument confers discretionary authority on the persons named therein with respect to amendments or variations to matters identified in the Notice or other matters which may properly come before the Meeting. As of the date of this proxy statement, management of the Company knows of no such amendments, variations or other matters to come before the Meeting. However, if other matters properly come before the Meeting, it is the intention of the persons named in the enclosed Proxy Instrument to vote such proxy according to their best judgment.

Will shares I hold in my brokerage account be voted if I do not provide timely voting instructions?

If your shares are held through a brokerage firm, they will be voted as you instruct on the voting instruction card provided by your broker. If you sign and return your card without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board.

If you do not return your voting instruction card on a timely basis, your broker will have the authority to vote your brokerage shares only on the proposal to ratify our independent registered public accounting firm. Your broker will be prohibited from voting your shares without your instructions on the election of directors and on any other proposal. These “broker non-votes” will be counted only for the purpose of determining whether a quorum is present at the Meeting and not as votes cast. Such broker non-votes will have no effect on the outcome of the matter.

Will shares that I own as a shareholder of record be voted if I do not timely return my proxy card?

Shares that you own as a shareholder of record will be voted as you instruct on your proxy card. If you sign and return your proxy card without giving specific instructions, they will be voted in accordance with the procedure set out above under the heading “How will my shares be voted?”

If you do not timely return your proxy card, your shares will not be voted unless you or your proxy holder attends the Meeting via the live webcast and any adjournment(s) or postponement(s) thereof and votes electronically submitted during the Meeting as described above under the heading “How can I vote at the Meeting?”

When is the deadline to vote?

If you hold shares as the shareholder of record, your vote by proxy must be received before 11:59 p.m. (Eastern Time) on June 7, 2022 or 48 hours prior to any adjournment(s) of the Meeting or must be deposited at the Meeting with the chairman of the Meeting before the commencement of the Meeting or any adjournment(s) thereof.

7

Table of Contents

If you hold shares as a beneficial owner, please follow the voting instructions provided by your bank, broker or other nominee.

May I change or revoke my vote?

A shareholder who has given a proxy pursuant to this solicitation may revoke it at any time up to and including the last business day preceding the day of the Meeting or any adjournment(s) thereof at which the proxy is to be used:

| • | by an instrument in writing executed by the Shareholder or by his, her or its attorney authorized in writing and either delivered to the attention of the Corporate Secretary of the Company c/o by mail using the enclosed return envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717; |

| • | by delivering written notice of such revocation to the chairman of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment(s) thereof, or |

| • | in any other manner permitted by law. |

For shares you hold as a beneficial owner, you may change your vote by timely submitting new voting instructions to your bank, broker or other nominee (which revokes your earlier instructions), or, if you have obtained a legal proxy from the nominee giving you the right to vote your shares, by attending the Meeting and voting via the live webcast.

Shareholder Proposals and Director Nominations

What is the deadline to submit shareholder proposals to be included in the proxy materials for next year’s annual meeting?

The Company is subject to the rules of both the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and provisions of the Business Corporations Act (British Columbia) (“BCBCA”) with respect to shareholder proposals. As clearly indicated under the BCBCA and SEC rules under the Exchange Act, simply submitting a shareholder proposal does not guarantee its inclusion in the proxy materials.

Shareholder proposals submitted pursuant to SEC rules under the Exchange Act for inclusion in the Company’s proxy materials for next year’s annual meeting must be received by our Corporate Secretary no later than the close of business (Central time) on December 29, 2022 and must be submitted to our Corporate Secretary at Trulieve Cannabis Corp., 6749 Ben Bostic Road, Quincy, FL 32351. Such proposals must also comply with all applicable provisions of Rule 14a-8 under the Exchange Act.

The BCBCA also sets out the requirements for a valid proposal and provides for the rights and obligations of the Company and the submitter upon a valid proposal being made. Proposals submitted under the applicable provisions of the BCBCA that a shareholder intends to present at next year’s annual meeting and wishes to be considered for inclusion in the Company’s proxy statement and form of proxy relating to next year’s annual meeting must be received at least three (3) months before the anniversary of the Company’s last annual general meeting (March 8, 2023). Such proposals must also comply with all applicable provisions of the BCBCA and the regulations thereunder.

Proposals that are not timely submitted or are submitted to the incorrect address or other than to the attention of our Corporate Secretary may, at our discretion, be excluded from our proxy materials.

See below under the heading “How may I nominate director candidates or present other business for consideration at a meeting?” for a description of the procedures through which shareholders may nominate director candidates for consideration.

8

Table of Contents

How may I nominate director candidates or present other business for consideration at a meeting?

Shareholders who wish to (1) submit director nominees for consideration or (2) present other items of business directly at next year’s annual meeting must give written notice of their intention to do so, in accordance with the deadlines described below, to our Corporate Secretary at the address set forth below under the heading “How do I obtain additional copies of this proxy statement or voting materials?” Any such notice also must include the information required by our Articles of Incorporation (“articles”) (which may be obtained as provided below under the heading “How may I obtain financial and other information about Trulieve Cannabis Corp.?”) and must be updated and supplemented as provided in the articles.

Written notice of director nominees must be received, in the case of an annual meeting, not less than thirty-five (35) days nor more than sixty-five (65) days prior to the date of the annual meeting of shareholders; provided, however, that if the annual meeting of shareholders is to be held on a date that is less than fifty (50) days after the date on which the initial public announcement of the date of the annual meeting of shareholders was made, notice by the nominating shareholder may be made not later than the close of business on the tenth (10th) day following such public announcement. See “Advance Notice Policy” under “Proposal 1—Election of Directors” in this proxy statement.

How may I recommend candidates to serve as directors?

Shareholders may recommend director candidates for consideration by the Board by writing to our Corporate Secretary at the address set forth below under the heading “How do I obtain additional copies of this proxy statement or voting materials?” in accordance with the notice provisions described above under the heading “How may I nominate director candidates or present other business for consideration at a meeting?”

To be in proper written form, such notice must set forth the nominee’s name, age, business and residential address, and principal occupation or employment for the past five (5) years, his or her direct or indirect beneficial ownership in, or control or direction over, any class or series of securities of the Company, including the number or principal amount and such other information on the nominee and the nominating shareholder as set forth in our articles, which may be obtained in accordance with the instructions below under the heading “How may I obtain financial and other information about Trulieve Cannabis Corp.?”

Description of the Company’s Voting Securities

The Company is authorized to issue an unlimited number of Subordinate Voting Shares and an unlimited number of Multiple Voting Shares.

On April 11, 2022, there were 368 shareholders of record holding (i) 134,966,243 outstanding Subordinate Voting Shares; and (ii) 34 shareholders of record holding 492,178.99 outstanding Multiple Voting Shares.

The Subordinate Voting Shares and Multiple Voting Shares are “restricted securities” within the meaning of such term under applicable Canadian securities laws. Under Canadian securities laws, a “restricted security” means an equity security of a reporting issuer if, among other things, there is another class of securities of the reporting issuer that carries a greater number of votes per security relative to the equity security. As of April 11, 2022, the Subordinate Voting Shares represent approximately 73.3% of voting rights attached to outstanding securities of the Company and the Multiple Voting Shares represent approximately 26.7% of voting rights attached to outstanding securities of the Company.

The total number of equity shares assuming all are converted into Subordinate Voting Shares as of April 11, 2022 would be 184,184,142.

Holders of Subordinate Voting Shares are entitled to notice of and to attend at any meeting of the shareholders of the Company, except a meeting of which only holders of another particular class or series of shares of the Company have the right to vote. At each such meeting, holders of Subordinate Voting Shares are entitled to one vote in respect of each Subordinate Voting Share held.

9

Table of Contents

Holders of Multiple Voting Shares are entitled to notice of and to attend any meeting of the shareholders of the Company, except a meeting of which only holders of another particular class or series of shares of the Company have the right to vote. At each such meeting, holders of Multiple Voting Shares are entitled to one vote in respect of each Subordinate Voting Share into which such Multiple Voting Share could then be converted (currently 100 votes per Multiple Voting Share held).

The Company is using the “Notice-and-Access” provisions of applicable securities laws under Rule 14a-16 under the Exchange Act. Under notice-and-access, companies may post electronic versions of such materials on a website for investor access and review and will make such documents available in hard copy upon request at no cost. Notice-and-access substantially reduces the Company’s printing and mailing costs and is environmentally friendly as it reduces paper and energy consumption. The proxy statement, the Annual Report on Form 10-K for the fiscal year ended December 31, 2021, together with the notes thereto, and the independent auditor’s report thereon and the related management’s discussion and analysis are available on the “Investors” section of our website at www.trulieve.com, SEDAR at www.sedar.com and the SEC’s website at www.sec.gov. The Company has elected not to use the procedure known as “stratification” in relation to its use of the “Notice-and-Access” rules.

Obtaining Additional Information

How may I obtain financial and other information about Trulieve Cannabis Corp.?

Our consolidated financial statements are included in our Annual Report on Form 10-K. We filed our Annual Report on Form 10-K with the SEC on March 30, 2022. We will furnish a copy of our Annual Report on Form 10-K (excluding exhibits, except those that are specifically requested) without charge to any shareholder who so requests by writing to our Corporate Secretary at the address below under the heading in “How do I obtain additional copies of this proxy statement or voting materials?” The Annual Report on Form 10-K is also available free of charge on the “Investors” section of our website at www.trulieve.com, on the SEC’s website at www.sec.gov, and on SEDAR at www.sedar.com.

By writing to us, shareholders also may obtain, without charge, a copy of our articles, code of conduct and Board standing committee charters.

What if I have questions for the Company’s transfer agent?

If you are a shareholder of record and have questions concerning share certificates, ownership transfer or other matters relating to your share account, please contact our transfer agent at the following address:

Odyssey Trust Company

835 - 409 Granville Street

Vancouver BC V6C 1T2

How do I obtain additional copies of this proxy statement or voting materials?

If you need additional copies of this proxy statement or voting materials, please contact us at:

Trulieve Cannabis Corp.

Attn: Corporate Secretary

6749 Ben Bostic Road

Quincy, FL 32351

10

Table of Contents

OVERVIEW OF PROPOSALS TO BE VOTED ON

Proposals 1 and 2 are included in this proxy statement at the direction of our Board. Our Board unanimously recommends that you vote “FOR” the re-election of the eight nominees in Proposal 1 and “FOR” the appointment and remuneration of auditors in Proposal 2.

PROPOSAL 1—ELECTION OF DIRECTORS

The board currently consists of eight directors. The Board proposes to nominate at the Meeting each of Kim Rivers, Giannella Alvarez, Thad Beshears, Peter Healy, Richard May, Thomas Millner, Jane Morreau and Susan Thronson, each to serve as a director of the Company until the next Meeting at which the election of directors is considered, or until his/her successor is duly elected or appointed, unless he/she resigns, is removed or becomes disqualified in accordance with the articles of the Company or the BCBCA. The persons named in the accompanying Proxy Instrument intend to vote for the election of such persons at the Meeting, unless otherwise directed. The Board does not contemplate that any of the nominees will be unable to serve as a director of the Company. However, if anyone nominated by the Board is unable to accept election, the proxies will be voted for the election of such other person or persons as the board may recommend.

The following table and the notes thereto set out the name and age of each current director and director nominee (as of April 11, 2022), their respective positions and, if applicable, the period during which he/she has been a director of the Company.

| Name |

Age | Position(s) |

Location of Residence |

Director Since | ||||

| Kim Rivers(1) |

43 | Chair and Chief Executive Officer |

Tallahassee, FL |

2015 | ||||

| Giannella Alvarez(1) |

62 | Director |

Austin, TX |

2021 | ||||

| Thad Beshears(1)(2) |

47 | Director |

Monticello, FL |

2015 | ||||

| Peter Healy(1)(2)(3)(4) |

70 | Lead Director, Chair of Nominating and Corporate Governance |

Hillsborough, CA |

2019 | ||||

| Richard May(2) |

44 | Director |

Quincy, FL |

2017 | ||||

| Thomas Millner(1)(3) |

68 | Director, Chair of Audit Committee |

Monticello, GA |

2020 | ||||

| Jane Morreau(3) |

63 | Director |

Louisville, KY |

2021 | ||||

| Susan Thronson(2)(3) |

60 | Director, Chair of Compensation Committee |

La Quinta, CA |

2020 |

| (1) | Nominating and Corporate Governance Committee member. |

| (2) | Compensation Committee member. |

| (3) | Audit Committee member. |

| (4) | Lead Director. |

Biographical Information

The biographies of the proposed nominees for the Board are set out below.

Kim Rivers has served as the Chair of the board of directors and as Chief Executive Officer since 2015. She also previously served as President from 2015 until 2021. Ms. Rivers received her Bachelor’s degree in Multinational Business and Political Science from Florida State University and her Juris Doctorate from the University of Florida. Ms. Rivers is a member of the Georgia Bar Association and she spent several years in private practice as a lawyer where she specialized in mergers, acquisitions, and securities for multi-million dollar companies. For over a decade, Ms. Rivers has run numerous successful businesses from real estate to finance, including as Principal of Inkbridge LLC, an investment firm, since 2011. We believe Ms. Rivers is qualified to serve on our board of directors due to her service as our Chief Executive Officer and her substantial experience in the cannabis industry.

11

Table of Contents

Giannella Alvarez has served as a member of our board of directors since 2021. Ms. Alvarez has experience in strategic planning, branding, innovation, digital marketing, consumer insights, technology, and scaling businesses. She was the Chief Executive Officer of Beanitos, Inc., a privately held snack food company from January 2018 until December 2019. Prior to that she served as President and Chief Executive Officer of Harmless Harvest, Inc., an organic beverage company from 2015 to 2018. Prior to joining Harmless Harvest, Ms. Alvarez held a number of increasingly senior positions in marketing, innovation and general management with Del Monte Corporation, Barilla S.p.A., The Coca Cola Company, Kimberly-Clark Corporation and Procter & Gamble. Ms. Alvarez currently serves as a director of Ruth’s Chris Hospitality Group, Driscoll’s and as board chair at Del Real Foods. She served at the board of Domtar Corporation from 2012 to 2021. We believe Ms. Alvarez is qualified to serve on our board of directors due to her broad global experience with branding, customer relations, franchising, international operations, corporate governance and ESG, as well as her executive leadership skills.

Thad Beshears has served as a member of our board of directors since 2015. Mr. Beshears is the Co-Owner and Chief Operating Officer of Simpson Nurseries LAA and has served as its President since 2015. He is responsible for all sales operations, production, and inventory tracking for the operation. Mr. Beshears is also the President and owner of Simpson Nurseries of Tennessee since 2013, where he develops and implements the company’s strategic vision while monitoring the market for opportunities for growth and expansion. Mr. Beshears is a founding member of Trulieve. We believe Mr. Beshears is qualified to serve on our board of directors due to his agricultural and cannabis industry experience.

Peter Healy has served as a member of our board of directors since 2019. An accomplished legal counsel with more than 30 years of experience, Mr. Healy manages a broad-based corporate practice, advising companies on a range of issues, including corporate governance, capital markets, mergers and acquisitions and private equity. His diverse clientele includes both public companies, private equity firms and major investment banking firms in a range of industries, including finance, technology, healthcare, biotechnology, real estate, consumer products, among others. He is currently a Partner at McDermott Will & Emery LLP. He previously was a Partner and Of Counsel at O’Melveny & Myers LLP from 1989 and March of 2020. He holds a Bachelor of Science degree in economics from Santa Clara University, an MBA degree (with distinction) from Cornell University and a JD degree from University of California Hastings. We believe Mr. Healy is qualified to serve on our board of directors due to his experience representing public and private companies in a wide variety of industries.

Richard May has served as a member of our board of directors since 2017. Mr. May is the President and co-owner of May Nursery, Inc., and has been with May Nursery, Inc. since 2002. He has sat on several agricultural industry and community boards, including as director and chairman of the Gadsden County Chamber of Commerce from 2010 to 2016, as the treasurer and trustee of the Robert F. Munroe Day School from 2012 to 2018 and as a director and president of the Southern Nursery Association from 2010 to 2016. Mr. May graduated from Auburn University with Bachelor of Science degrees in Agricultural Economics and Horticulture. He is a graduate of the Wedgeworth Leadership Institute for Agriculture and Natural Resources from the University of Florida, and a graduate of the Executive Academy for Growth and Leadership from Texas A&M. Mr. May is a founding member of Trulieve. We believe Mr. May is qualified to serve on our board of directors due to his agricultural and cannabis industry expertise.

Thomas Millner has served as a member of our board of directors since 2020. Mr. Millner brings a combination of executive leadership, merchandising and multichannel operational skills, and a strong philanthropic background to Trulieve. Mr. Millner, who has been retired since 2017, was formerly the CEO of Cabela’s, a direct marketer and specialty retailer of outdoor recreation merchandise, from 2009 to 2017. Prior to Cabela’s, Mr. Millner was president and CEO of North Carolina’s Remington Arms Company from 1994 to 2009, an American manufacturer of firearms and ammunition. Since 2014, Mr. Millner has served as a director and the chair of the audit committee of Best Buy, a multinational consumer electronics retailer. Mr. Millner previously served as a director and chair of the audit committee of Stanley Furniture, a furniture manufacturer and retailer from 2001 to 2008, as a director of Total Wine & More, a large, family-owned, privately held American alcohol retailer from 2015 to 2019 and as a director of Menards, a privately held home improvement company, from

12

Table of Contents

2017 to 2019. We believe Mr. Millner is qualified to serve on our board of directors due to his service as an officer and director of large multi-state corporations in the United States.

Jane Morreau has served as a member of our board of directors since 2021. Ms. Morreau is a seasoned global finance executive and an experienced independent director, with a broad skill set and expertise that also includes supply chain management, manufacturing operations, information technology, retail operations, mergers and acquisitions and corporate strategy. Ms. Morreau most recently was the Executive Vice President and Chief Financial Officer of Brown-Forman Corporation, a position she held from 2014 to 2021. She joined Brown-Forman, the largest American-owned and publicly traded spirits and wine company with a global reach, in 1991, and held various senior management and executive leadership finance and operational roles during her 30-year career. Since 2021, Ms. Morreau has served as a director and the chair of the audit committee of Vita Coco, a leading high-growth platform of better-for-you beverage brands. She holds a Bachelor of Science degree in accounting (with high honors) and an MBA degree, both from the University of Louisville and is a Certified Public Accountant. We believe Ms. Morreau is qualified to serve on our board of directors due to her significant corporate finance strategy and executive leadership experience, her board of director service, and overall broad set of skills.

Susan Thronson has served as a member of our board of directors since 2020. Ms. Thronson is an experienced independent director with global digital, ecommerce and loyalty marketing experience. Ms. Thronson held various operational roles at Marriott International from 1989 to 2005, and was Senior Vice President of Global Marketing for Marriott International from 2005 to 2013, leading Marriott’s worldwide integrated marketing strategy and execution for its 15 hotel brands. Since 2013, Ms. Thronson has been self-employed as a management consultant. Ms. Thronson formerly served as a director of Angie’s List from 2012 to 2017, an internet service company, and SONIC Drive-In from 2015 to 2018, an operator of an American drive-in fast-food restaurant chain based in Oklahoma City, Oklahoma. She has maintained a National Association of Corporate Directors Governance Fellow credential since 2015 and holds a Bachelor of Arts in Journalism from the University of Nevada, Reno. We believe Ms. Thronson is qualified to serve on our board of directors due to her service in the hospitality industry and on the board of directors of corporations with operations across the United States.

The persons named in the accompanying Proxy Instrument (if named and absent contrary directions) intend to vote the shares represented thereby FOR the re-election of each of the aforementioned named nominees unless otherwise instructed on a properly executed and validly deposited proxy. Management of the Company does not contemplate that any nominees named above will be unable to serve as a director, but, if that should occur for any reason prior to the Meeting, the persons named in the enclosed form of proxy reserve the right to vote for another nominee at their discretion.

Majority Voting for Election of Directors

The Board has adopted the Majority Voting Policy. Pursuant to the Majority Voting Policy, at meetings of Shareholders at which directors are to be elected, Shareholders will vote in favor of, or withhold from voting for, each nominee separately. If, with respect to any particular nominee, the number of votes withheld exceeds the votes cast in favor of the nominee, then pursuant to the Majority Voting Policy the nominee shall be considered not to have received the support of the Shareholders, even though duly elected as a matter of corporate law. An individual who is considered under the Majority Voting Policy not to have the support or confidence of the Shareholders is expected forthwith to submit his or her resignation from the Board. Upon receiving such resignation, the Nominating and Corporate Governance Committee will consider it and make a recommendation to the Board on whether or not to accept the resignation.

In reviewing the Nominating and Corporate Governance Committee’s recommendation, the Board shall consider the factors considered by the Nominating and Corporate Governance Committee and such additional factors as the Board considers relevant. The Board is expected to accept the recommendation of the Nominating and

13

Table of Contents

Corporate Governance Committee and to otherwise accept the resignation offer except in situations where exceptional circumstances would warrant the director continuing to serve on the Board. A director who has tendered a resignation pursuant to this policy will not participate in any deliberations of the Nominating and Corporate Governance Committee or the Board with respect to his or her resignation. The resignation will be effective when accepted by the Board. Within 90 days of receiving a director’s resignation, the Board will make a decision and issue a press release either announcing the resignation of the director or explaining why it has not been accepted. In determining whether or not to accept the resignation, the Board will take into account the factors considered by the Nominating and Corporate Governance Committee and any other factors the Board determines are relevant.

Replacement or Removal of Directors

To the extent directors are elected or appointed to fill casual vacancies or vacancies arising from the removal of directors, in both instances whether by shareholders or directors, the directors shall hold office until the remainder of the unexpired portion of the term of the departed director that was replaced.

Advance Notice Policy

Our articles include advance notice provisions for the nomination for election of directors (the “Advance Notice Policy”). The Advance Notice Policy provides that any shareholder seeking to nominate a candidate for election as a director (a “Nominating Shareholder”) at any annual meeting of the shareholders, or at any special meeting of shareholders if one of the purposes for which the special meeting was called was the election of directors, must give timely notice thereof in proper written form to our Corporate Secretary.

To be timely, a Nominating Shareholder’s notice must be made: (i) in the case of an annual general meeting of shareholders (including an annual and special meeting), not less than thirty-five (35) days nor more than sixty-five (65) days prior to the date of the annual meeting of shareholders, provided, however, that in the event that the annual meeting of shareholders is to be held on a date that is less than fifty (50) days after the date on which the first public announcement of the meeting was made, notice by the Nominating Shareholder may be made not later than the close of business on the tenth (10th) day following the date of such first public announcement; and (ii) in the case of a special meeting of shareholders (which is not also an annual meeting) called for the purpose of electing directors (whether or not called for other purposes as well), not later than the close of business on the fifteenth (15th) day following the day on which the first public announcement of the date of the special meeting of shareholders was made. The articles also prescribe the proper written form for a Nominating Shareholder’s notice.

The chair of the meeting shall have the power and duty to determine whether a nomination was made in accordance with the notice procedures set forth in the articles and, if any proposed nomination is not in compliance with such provisions, the discretion to declare that such defective nomination will be disregarded.

Notwithstanding the foregoing, the Board may, in their sole discretion, waive any requirement in the Advance Notice Policy.

Corporate Cease Trade Orders, Bankruptcies Penalties or Sanctions

To the Company’s knowledge, no proposed director is or, within the ten (10) years prior to the date of this proxy statement, has been, a director, Chief Executive Officer or Chief Financial Officer of any company (including the Company) that: (i) while that person was acting in that capacity was the subject of a cease trade order or similar order, or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than thirty (30) consecutive days (an “order”); or (ii) after that person ceased acting in that capacity, was subject to an order, which resulted from an event that occurred while that person was acting in the capacity of director, Chief Executive Officer or Chief Financial Officer.

14

Table of Contents

To the Company’s knowledge, no proposed director is or, within the ten (10) years prior to the date hereof, has been, a director or executive officer of any company (including the Company) that while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

To the Company’s knowledge, no proposed director has, during the ten (10) years prior to the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or became subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold assets of the proposed director.

Certain Relationships and Related Transactions

In addition to the compensation arrangements discussed under “Executive Compensation,” below, since January 1, 2021, the Company has entered into the following Related Party Transactions:

Related Party Loans

During the years ended December 31, 2016, 2017, 2018 and 2019, we entered into various promissory notes and lines of credit with C2C and other entities controlled by Benjamin Atkins, a former director and shareholder of Trulieve, to finance the buildout of various dispensary locations. Each promissory note and line of credit bears 8% annual interest and, depending on the amount, matures between one to three years from initial issuance or drawdown. Pursuant to the terms of the promissory notes and lines of credit, we have paid aggregate principal of $221,633, $1,541,134, $1,520,079, $940,828 and $4,011,562 and interest of $231,144, $717,924, $680,812, $393,275 and $419,726 during the years ended December 31, 2017, December 31, 2018, December 31, 2019, December 31, 2020, and December 31, 2021, respectively. The largest aggregate principal amount outstanding since January 1, 2017 for the promissory notes and lines of credit with C2C and all other entities controlled by Mr. Atkins, including Clearwater GPC (discussed below), is $12,569,363. On February 28, 2021, $11,562 of principal remaining under a promissory note issued to Venice Property Group, LLC, an entity controlled by Mr. Atkins, was repaid. On November 11, 2021, the aggregate outstanding principal amount under the promissory notes with Mr. Atkins were repaid in full. All lines of credit previously outstanding have been drawn and have either matured or been repaid, and no such lines of credit remain outstanding.

In September 2017, Trulieve US issued a $1,300,000 promissory note to a shareholder of the Company (the “Beshears Note”). The Beshears Note bears interest at an annual rate of 12%. The Beshears Note, would have matured in January 2018, but was rolled into a subsequent financing and exchanged for the Clearwater GPC, Traunch Four and Rivers Notes (discussed below).

In November 2017, Trulieve US issued a $1,844,596 promissory note to Inkbridge, LLC (the “Inkbridge Note”), an entity controlled by Kim Rivers, our Chief Executive Officer. The Inkbridge Note bears interest at an annual rate of 12% and would have matured in November 2019, but it was rolled into a subsequent financing and exchanged for the Clearwater GPC, Traunch Four and Rivers Notes (discussed below).

In April 2018, we borrowed an original principal amount of $6,000,000 from Clearwater GPC, an entity controlled by Mr. Atkins, evidenced by an unsecured promissory note. The maturity date of the note was April 2, 2020 with interest accruing at 12% per annum. We were required to make monthly interest payments to the lender and all outstanding principal and any unpaid accrued interest was due and payable in full on maturity. The note was paid in full in connection with the reverse takeover of Schyan Exploration Inc. (“Schyan”) by Trulieve, Inc. and the change in the business of Schyan from a mining issuer to a marijuana issuer (the “Transaction”) in September 2018. During the term of the note, we made interest payments in the aggregate amount of $357,616.

15

Table of Contents

In May 2018, we borrowed an aggregate original principal amount of $12,000,000 evidenced by two unsecured promissory notes (each the “Traunch Four Note” and the “Rivers Note” and collectively, the “Notes”). The Traunch Four Note has an original principal amount of $6,000,000 and was issued to Traunch Four, LLC, an entity whose direct and indirect owners include Kim Rivers, our Chief Executive Officer and Chair of the Board, as well as Thad Beshears, Richard May, both of whom are directors of Trulieve, George Hackney, a former director of Trulieve, and certain of Richard May’s family members. The Rivers Note has an original principal amount of $6,000,000 and was issued to Kim Rivers. Each Note originally matured on May 24, 2020 and accrues interest at a 12% per annum. Each Note was amended in December 2019 to extend its maturity date one year to May 24, 2021 and then was further amended in May 2021 to extend its maturity date to May 24, 2022, and all other terms remain unchanged. On November 11, 2021, $6,000,000 of principal remaining under the Traunch Four Note and $6,000,000 of principal remaining under the Rivers Note, was repaid in full. During the respective terms of the Notes, we made interest payments in the aggregate amount of $2,483,671 and $2,483,671 under the Traunch Four Note and the Rivers Note, respectively.

Burnette Construction

J.T. Burnette, the spouse of Kim Rivers, our Chief Executive Officer and Chair of the board of directors, is a 10% owner of Burnette Construction (“Supplier”), that provides construction and related services to us. The Supplier is responsible for the construction of our cultivation and processing facilities, and provides labor, materials and equipment on a cost-plus basis. For the years ended December 31, 2021, and 2020, property and equipment purchases totaled $148.4 million and $96.7 million, respectively. As of December 31, 2021, and 2020, $11.4 million and $10.4 million was included in accounts payable in the consolidated balance sheets. For the facility located in Holyoke, Massachusetts, the Company paid $2,645,283 as of December 31, 2019, $34,329,106 as of December 31, 2020, and $6,795,163 as of December 31, 2021. For the facilities located in Florida, the Company paid $37,273,470 as of December 31, 2019, $43,250,370 as of December 31, 2020 and $133,936,602 as of December 31, 2021. For the facility located in Lesage, West Virginia, the Company paid $18,993,218 as of December 31, 2021. The use of the Supplier was reviewed and approved by the independent members of the board of directors, and all invoices are reviewed by our Chief Legal Officer. As of January 1, 2022, the Supplier is no longer a related party of the Company.

Leases with Related Parties

We lease a cultivation facility in Quincy, Florida from One More Wish, LLC, which is an entity that is directly or indirectly owned by Kim Rivers, our Chief Executive Officer and Chair of the board of directors, George Hackney, a former member of our board of directors, and Richard May, a member of our board of directors. Pursuant to the terms of the lease, we have paid aggregate rent of $3,870, $15,485, $15,480 and $16,456 for the years ended December 31, 2018, December 31, 2019, December 31, 2020, and December 31, 2021, respectively. The total aggregate amount of periodic payments and installments due on or after December 31, 2021 for this lease is $109,786.

We lease a corporate office facility in Tallahassee, Florida from One More Wish II, LLC, which is an entity that is directly or indirectly owned by Kim Rivers, our Chief Executive Officer and Chair of the board of directors, George Hackney, a former member of our board of directors, and Richard May, a member of our board of directors. Pursuant to the terms of the lease, we have paid aggregate rent of $55,088, $165,297, $168,929 and $165,323 for the years ended December 31, 2018, December 31, 2019, December 31, 2020, and December 31, 2021, respectively. The total aggregate amount of periodic payments and installments due on or after December 31, 2021 for this lease is $1,237,580.

We lease retail, cultivation, office and training facilities from the following real estate holding companies that are managed and controlled by Mr. Atkins: 1730 Calumet RE Holding, LLC, Beach Office Holdings, LLC, Bradenton 14 RE Holding, LLC, Broward RE Holdings, LLC, Dania RE, LLC, Gainesville 6th Street RE, LLC, HWY 19 RE Group II, LLC, HWY 19 RE Group, LLC, Miami RE Holding Group of CLW, LLC, North Orange

16

Table of Contents

Blossom Orlando RE Holding, LLC, Oviedo Executive RE LLC, Palm Coast RE, LLC, PS Prop CO Holdings, RE Beach Jax, LLC, Real Estate Holding Group NPR, LLC, SP 4th RE Holding, LLC, Tall RE Development LLC, TPA Real Estate 8701 NDM, LLC, Venice Property Group, LLC and Vero FL Commerce RE, LLC. Pursuant to the terms of these leases, we have paid aggregate rent of $553,368, $1,980,092, $3,094,617, $3,299,026 and $2,567,652 for the years ended December 31, 2017, December 31, 2018, December 31, 2019, December 31, 2020 and December 31, 2021, respectively. The total aggregate amount of periodic payments and installments due on or after January 1, 2019 for these leases is $21,798,127. In August 2021, Mr. Atkins sold the properties associated with the following real estate holding companies: Beach Office Holdings, LLC, Dania RE, LLC, Gainesville 6th Street RE, LLC, Miami RE Holding Group of CLW, LLC, Oviedo Executive RE, LLC, Palm Coast RE, LLC, RE Beach Jax, LLC, Tall RE Development, LLC, Venice Property Group, LLC, and Vero FL Commerce RE, LLC. The total aggregate amount of periodic payments and installments due on or after December 31, 2021 for the remaining related party leases with Mr. Atkins is $4,851,406.

Harvest of Ohio LLC

On October 1, 2021, the Company completed its acquisition of Harvest Health & Recreation Inc. (“Harvest”). Prior to the acquisition, Harvest issued two secured promissory notes to Harvest of Ohio LLC, which is owned 49% by Mr. White, our President. The first secured promissory note was issued in February 2020 in the original principal amount of $5.0 million, accrues interest at a rate of 6% per annum due at maturity and will mature on March 21, 2023. The note was subsequently amended to $5.4M on February 10, 2021 and the second secured promissory note was issued in February 2021 in the original principal amount of $3.0 million, accrues interest at a rate of 17% per annum due at maturity and will mature on March 21, 2024.

Policy Regarding Related Party Transactions

Our board of directors has adopted written policies and procedures for the review and approval of any transaction, arrangement or relationship between us and a related party by our Nominating and Corporate Governance Committee. Our board of directors plans to amend these policies and procedures to provide for review of any transaction, arrangement or relationship in which we are a participant, the amount involved exceeds $120,000 and one of our executive officers, directors, director nominees or 5% shareholders, or their immediate family members, each of whom we refer to as a “related person,” has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which we refer to as a “related person transaction,” the related person will be required to report the proposed related person transaction to our Chief Legal Officer. The amended policy will call for the proposed related person transaction to be reviewed and, if deemed appropriate, approved by our Nominating and Corporate Governance Committee. Whenever practicable, the reporting, review and approval will occur prior to entry into the transaction. If advance review and approval is not practicable, the committee will review, and, in its discretion, may ratify the related person transaction. The amended policy will permit the chairman of the committee to review and, if deemed appropriate, approve proposed related person transactions that arise between committee meetings, subject to ratification by the committee at its next meeting. Any related person transactions that are ongoing in nature will be reviewed at least quarterly.

A related person transaction reviewed under the amended policy will be considered approved or ratified if it is authorized by the committee after full disclosure of the related person’s interest in the transaction. As appropriate for the circumstances, the committee will review and consider:

| • | the related person’s interest in the related person transaction; |

| • | the approximate dollar value of the amount involved in the related person transaction; |

| • | the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss; |

17

Table of Contents

| • | whether the transaction was undertaken in the ordinary course of our business; |

| • | whether the terms of the transaction are no less favorable to us than terms that could have been reached with an unrelated third party; |

| • | the purpose of, and the potential benefits to us of, the transaction; and |

| • | any other information regarding the related person transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

The committee may approve or ratify the transaction only if the committee determines that, under all of the circumstances, the transaction is in our best interests. The committee may impose any conditions on the related person transaction that it deems appropriate.

In addition to the transactions that are excluded by the instructions to the SEC’s related person transaction disclosure rule, we expect our board of directors will determine that the following transactions do not create a material direct or indirect interest on behalf of related persons and, therefore, are not related person transactions for purposes of the amended policy:

| • | Compensation to an executive officer or director if the compensation is required to be reported in our proxy statement pursuant to Item 402 of Regulation S-K or compensation to an executive officer who is not an immediate family member of another related person, if such compensation would have been required to be reported under Item 402 as compensation earned for services provided to us if the executive was a “named executive officer” in the proxy statement and such compensation has been approved, or recommended to our board of directors for approval, by the compensation committee of our board of directors (the “Compensation Committee”); |

| • | Transactions that are in our ordinary course of business and where the interest of the related person arises only (a) from the related person’s position solely as a director of another corporation or organization that is a party to the transaction; (b) from the direct or indirect ownership by such related person and all other related persons, in the aggregate, of less than a 5% equity interest in another person (other than a partnership) which is a party to the transaction; (c) from both such positions described in (a) and such ownership described in (b); or (d) from the related person’s position as a limited partner in a partnership in which the related person and all other related persons, in the aggregate, have an interest of less than 5%, and the related person is not a general partner of and does not otherwise exercise control over the partnership; |