Form DEF 14A Strongbridge Biopharma For: May 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No )

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant ¨ | |

| Check the appropriate box: | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

| Strongbridge Biopharma plc | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

April 14, 2021

Dear Shareholder:

Our Annual General Meeting of Shareholders will be held at 900 Northbrook Drive, Suite 200, Trevose, Pennsylvania 19053, United States of America, at 11:00 a.m. Eastern Time (4:00 p.m. Dublin Time) on May 13, 2021. Shareholders in Ireland may participate in the Annual General Meeting by audio link at the offices of Arthur Cox LLP, located at Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland. The enclosed Notice of Annual General Meeting of Shareholders sets forth the proposals that will be presented at the meeting, or any adjournments thereof, which are described in more detail in the enclosed proxy statement. Our board of directors unanimously recommends that you vote “FOR” each of the director nominees named in Proposal 1, “FOR” each of Proposals 2 and 3, and with respect to Proposal 4, that you vote for the option to hold future Say-on-Pay votes (as described in the accompanying proxy statement) every ONE YEAR.

In light of the ongoing Coronavirus (COVID-19) pandemic, we are strongly encouraging you to appoint a proxy to attend and vote at the meeting on your behalf as personal attendance at the meeting may pose a health risk to you and others.

| Very truly yours, | |

| |

| Garheng Kong, M.D., Ph.D. | |

| Chairman of the Board of Directors |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on May 13, 2021

Notice is hereby given that the 2021 Annual General Meeting of Shareholders (the “Annual Meeting”) of Strongbridge Biopharma plc, an Irish public limited company (the “Company”), will be held at 900 Northbrook Drive, Suite 200, Trevose, Pennsylvania 19053, United States of America, at 11:00 a.m. Eastern Time (4:00 p.m. Dublin Time) on May 13, 2021, to receive the Company’s Irish statutory financial statements for the fiscal year ended December 31, 2020 and the reports of the directors and auditors thereon, to review the affairs of the Company and to consider and vote upon the following proposals:

| 1. |

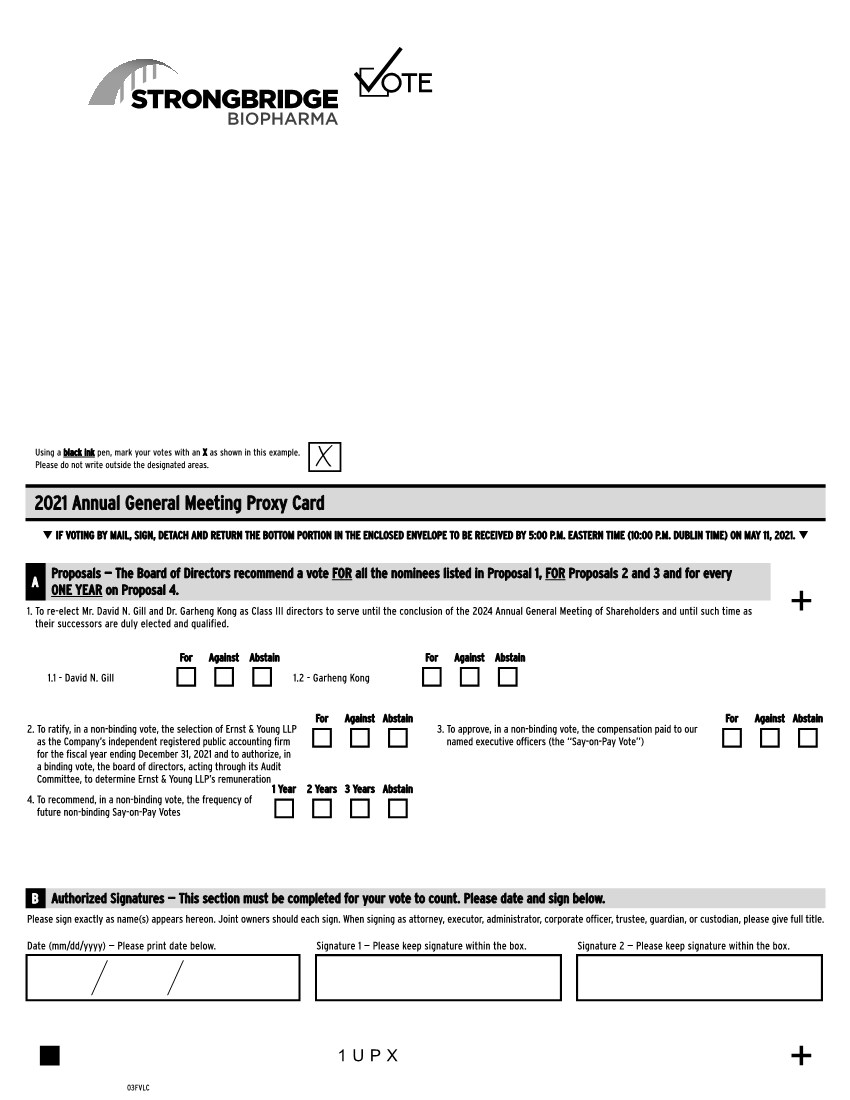

To elect, by separate resolutions, Mr. David N. Gill and Dr. Garheng Kong, who retire in accordance with the Articles of Association of the Company and, being eligible, offer themselves for re-election as Class III directors to serve until the conclusion of the 2024 Annual General Meeting of Shareholders and until such time as their successors are duly elected and qualified (Proposal 1);

| ||

| 2. | To ratify, in a non-binding vote, the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 and to authorize, in a binding vote, the board of directors, acting through its Audit Committee, to determine Ernst & Young LLP’s remuneration (Proposal 2); | ||

| 3. | To approve, in a non-binding vote, the compensation paid to our named executive officers (the “Say-on-Pay Vote”) (Proposal 3); and | ||

| 4. | To recommend, in a non-binding vote, the frequency of future non-binding Say-on-Pay Votes (Proposal 4). |

The proposals to be voted on at the Annual Meeting are more fully described in the enclosed proxy statement.

In respect of Proposal 1, a plurality voting standard applies in respect of the election of our directors, such that both director nominees will be elected by a plurality of the votes cast, in person or by proxy, at the Annual Meeting. Proposals 2 and 3 require approval as ordinary resolutions, meaning they need the affirmative vote of a majority of votes cast (in person or by proxy) to be approved. For Proposal 4, the option receiving the greatest number of votes will be considered the frequency recommended by our shareholders. In addition, shareholders may be asked to consider and vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

The board of directors has fixed the close of business on March 26, 2021 as the record date for the determination of shareholders entitled to receive notice of and to attend, speak and vote at the Annual Meeting. Only shareholders of record at the close of business on March 26, 2021 will be entitled to receive notice of and to attend, speak and vote at the Annual Meeting or any adjournment or postponement thereof.

The board of directors believes that the resolutions to be proposed at the Annual Meeting are in the best interests of the Company and its shareholders. Accordingly, the directors unanimously recommend that you vote “FOR” each of the director nominees (Proposal 1), “FOR” each of Proposals 2 and 3, and with respect to Proposal 4, that you vote for the option to hold future Say-on-Pay Votes every ONE YEAR, as they intend to do in respect of any shares held by them.

in light of the ongoing COVID-19 pandemic, you are strongly encouraged to appoint a proxy to attend and vote at the Annual Meeting on your behalf.

Shareholders in Ireland may participate in the Annual General Meeting by audio link at the offices of Arthur Cox LLP, Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland, at 4:00 p.m. (Dublin Time).

You are encouraged to vote your shares: (i) by 5:00 p.m. Eastern Time (10:00 p.m. Dublin Time) on May 11, 2021 by following the “Vote by Internet” instructions on the enclosed proxy card, (ii) by 5:00 p.m. Eastern Time (10:00 p.m. Dublin Time) on May 11, 2021 by following the “Vote by Phone” instructions on the enclosed proxy card, or (iii) by completing, dating and signing the enclosed proxy card and returning it in the accompanying postage-paid envelope, which must be received by 5:00 p.m. Eastern Time (10:00 p.m. Dublin Time) on May 11, 2021. All proxies will be forwarded electronically to the Irish office of the Company’s transfer agent, Computershare.

A shareholder entitled to attend and vote at the Annual Meeting is entitled, using the form provided (or the form in section 184 of the Companies Act 2014 of Ireland (the “Irish Companies Act”)), to appoint one or more proxies to attend, speak and vote instead of him or her at the Annual Meeting. A proxy need not be a shareholder of record.

| By order of the Board of Directors, | |

| |

| Stephen J. Long | |

| Company Secretary |

Dublin, Ireland

April 14, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 13, 2021

This Notice of Annual General Meeting of Shareholders, the enclosed proxy statement, and Annual Report on Form 10-K for the fiscal year ended December 31, 2020 are available free of charge on www.envisionreports.com/SBBP and on the investor relations page of the Company’s website found at www.strongbridgebio.com. The Company’s Irish statutory financial statements for the fiscal year ended December 31, 2020 will be available free of charge on www.envisionreports.com/SBBP and on the investor relations page of the Company’s website found at www.strongbridgebio.com on or before April 14, 2021.

Presentation of Irish Statutory Financial Statements

The Irish statutory financial statements of the Company for the fiscal year ended December 31, 2020, including the reports of the directors and auditors thereon, will be presented at the Annual Meeting. There is no requirement under Irish law that such statutory financial statements be approved by shareholders, and no such approval will be sought at the Annual Meeting. The Company’s Irish statutory financial statements will be available with the other proxy materials at www.envisionreports.com/SBBP and on the investor relations page of the Company’s website found at www.strongbridgebio.com on or before April 14, 2021.

IMPORTANT NOTICE REGARDING MEASURES TO REDUCE COVID-19 TRANSMISSION AT THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

In light of the ongoing outbreak of Coronavirus (COVID-19), the Company would like to emphasize that we consider the health of our shareholders, employees and other attendees a top priority. We are monitoring guidance issued by the Irish and U.S. governments, the U.S. Center for Disease Control and Prevention (the “CDC”), the Irish Health Service Executive (“HSE”), and the World Health Organization and we have implemented, and will continue to implement the measures advised by the CDC and the HSE to minimize the spread of COVID-19. Information on such measures and on COVID-19 generally is available on the CDC’s website at https://www.cdc.gov/coronavirus/2019-ncov/index.html and on the HSE’s website at https://www2.hse.ie/coronavirus/.

Shareholders are strongly encouraged to appoint a proxy to attend and vote at the Annual Meeting on their behalf, as the preferred means of fully and safely exercising their rights, as personal attendance at the Annual Meeting may present a health risk to themselves and others.

The Annual Meeting will be held in accordance with CDC and HSE guidance, therefore:

| · | the Annual Meeting will be as brief as possible; |

| · | personal attendance is not recommended and shareholders are encouraged to appoint proxies to vote on their behalf; and |

| · | no lunch or any other refreshments will be provided at the Annual Meeting. |

Presentations (if any) will be kept to a minimum at the Annual Meeting and any such presentations will be published on the investor relations page of the Company’s website found at www.strongbridgebio.com as soon as practicable after the Annual Meeting.

In the event that a change of venue is necessitated due to public health recommendations regarding containment of COVID-19, which may include the closure of or restrictions on access to the meeting venue, we will communicate this to shareholders by an announcement, which will be published on the investor relations page of our website found at www.strongbridgebio.com. We advise shareholders to monitor the investor relations page regularly, as circumstances may change at short notice and we recommend that shareholders keep up-to-date with the CDC and HSE guidance regarding travel, self-isolation and health and safety precautions.

TABLE OF CONTENTS

PROXY STATEMENT FOR THE ANNUAL GENERAL MEETING OF

SHAREHOLDERS

TO BE HELD ON MAY 13, 2021

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS, ATTENDING AND VOTING AT

THE ANNUAL GENERAL MEETING OF SHAREHOLDERS AND OTHER GENERAL

INFORMATION

1. Why did I receive this proxy statement?

This proxy statement is being made available to you by delivering a printed version to you by mail, because the board of directors (the “board of directors”) of Strongbridge Biopharma plc (the “Company,” “Strongbridge,” “we” or “us”) is soliciting your proxy to vote at the 2021 Annual General Meeting of Shareholders (the “Annual Meeting”) to be held at 900 Northbrook Drive, Suite 200, Trevose, Pennsylvania 19053, United States of America, at 11:00 a.m. Eastern Time (4:00 p.m. Dublin Time) on May 13, 2021, and at any adjournment or postponement thereof. Shareholders in Ireland may participate in the Annual Meeting by audio link at the offices of Arthur Cox LLP, located at Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland.

The Notice of Annual General Meeting of Shareholders, this proxy statement (including a proxy card or voting instruction card, as applicable) and Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “2020 Annual Report”) were first mailed to shareholders on or about April 14, 2021.

The Notice of Annual General Meeting of Shareholders, this proxy statement, and the 2020 Annual Report are available free of charge on www.envisionreports.com/SBBP and on the investor relations section of the Company’s website at www.strongbridgebio.com. The Company’s Irish statutory financial statements for the fiscal year ended December 31, 2020 will be available free of charge on www.envisionreports.com/SBBP and on the investor relations page of the Company’s website found at www.strongbridgebio.com on or before April 14, 2021. We will provide without charge to each shareholder, including any beneficial owner, on the written or oral request of such shareholder, a copy of any such documents. Requests for such copies should be directed to the Company Secretary at 900 Northbrook Drive, Suite 200, Trevose, Pennsylvania 19053, United States of America.

2. Who is eligible to vote and how?

If your shares are actually registered in your name, you are a shareholder of record. Shareholders of record who are entered in the register of members of the Company, as at the close of business on March 26, 2021, will be entitled to attend, speak, ask questions and vote at the Annual Meeting or, if relevant, any adjournment thereof. Changes in the register after that time will be disregarded in determining the right of any person to attend and/or vote at the meeting. As at the record date for the Annual Meeting, the close of business on March 26, 2021, there were 67,545,369 ordinary shares in the share capital of the Company outstanding and entitled to vote.

Depending on whether your shares are registered in your name or whether your shares are held in “street name” the arrangements for voting are as follows:

Shareholder of Record: Shares Registered in Your Name

As a shareholder of record you may vote in one of the following ways:

By Telephone: You may submit your proxy by calling the toll-free number noted on your proxy card. Telephone proxy submission is available 24 hours a day and will be accessible until 5:00 p.m. Eastern Time (10:00 p.m. Dublin Time) on May 11, 2021. Easy to follow voice prompts allow you to submit your proxy and confirm that your instructions have been properly recorded. Shareholders who submit their proxy by telephone should be aware that they may incur costs, such as usage charges from telephone companies, and that these costs must be borne by the shareholder.

1

Over the Internet: You may also choose to vote over the Internet by following the instructions set out in the proxy card enclosed with this proxy statement. Internet voting is also available 24 hours a day and will be accessible until 5:00 p.m. Eastern Time (10:00 p.m. Dublin Time) on May 11, 2021. As with telephone proxy submission, you may confirm that your instructions have been properly recorded. Shareholders who vote through the Internet should be aware that they may incur costs, such as usage charges from Internet service providers, and that these costs must be borne by the shareholder.

By Mail: If you wish to vote by mail, please mark the enclosed proxy card, date and sign it, and promptly return it in the postage-paid envelope provided, to be received by 5:00 p.m. Eastern Time (10:00 p.m. Dublin Time) on May 11, 2021 (which will be forwarded electronically to the Irish office of the Company’s transfer agent, Computershare).

In Person at the Annual Meeting: You may vote in person by attending the Annual Meeting and submitting a ballot. Ballots will be available at the Annual Meeting.

If you are a shareholder of record and you choose to submit your proxy by telephone by calling the toll-free number on your proxy card, your use of that telephone system, and in particular the entry of your pin number/other unique identifier, will be deemed to constitute your appointment, in writing and under hand, and for all purposes of the Irish Companies Act, of each of Richard Kollender and Stephen Long, each with the power of substitution, as your proxy to vote your shares on your behalf in accordance with your telephone instructions.

If your proxy is properly completed, the shares it represents will be voted at the Annual Meeting as you instruct. If you submit your proxy, but do not provide instructions, your proxy will be voted in accordance with the board of directors’ recommendations as set forth in the Notice of Annual General Meeting of Shareholders and as the proxy holders may determine in their absolute discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

The appointment of a proxy to vote your shares will not preclude you from attending, speaking, asking questions and voting at the Annual Meeting should you subsequently wish to do so but please bear in mind that the Company encourages shareholders to submit proxies, rather than attend the Annual Meeting in person. Please refer to the Notice Regarding Measures to Reduce COVID-19 Transmission at the Annual General Meeting of Shareholders contained in the Notice of Annual General Meeting of Shareholders section of this proxy statement for more information. A proxy need not be a shareholder of the Company.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, as at close of business on March 26, 2021, your shares were not held in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, who in turn hold through The Depository Trust Company (“DTC”), then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization, together with instructions as to voting. You will need to carefully follow the instructions from your broker, bank or other agent and/or contact your broker, bank or other agent if you have any queries.

As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account as per the instructions enclosed by your broker. You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the Annual Meeting unless you contact your broker and obtain a valid proxy card from your broker or other agent.

As a beneficial owner of shares registered in the name of your broker, bank or other agent, who in turn holds through DTC, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card as per the instructions provided by your broker, bank or other agent to ensure that your vote is counted.

2

3. What is the “quorum” requirement for the Annual Meeting?

A quorum is required in order to proceed with any business at the Annual Meeting. A quorum requires the presence, in person or by proxy, of the holders of shares entitled to exercise a majority of the voting power of the Company. For the purposes of establishing a quorum, abstentions and “broker non-votes” (as described below) will be counted as present.

4. Assuming there is a quorum, what vote is required to approve each proposal being voted upon at the Annual Meeting?

Every shareholder present, in person or by proxy, will have one vote for every ordinary share he or she holds. The voting requirements for each of the proposals are as follows:

Proposal 1: To Elect Directors

Each of our director nominees will be elected by a plurality of the votes cast, in person or by proxy at the Annual Meeting (including any adjournment thereof).

Proposal 2: To Ratify, in a Non-Binding Vote, the Selection of Ernst & Young LLP as the Company’s Independent Public Accounting Firm and to Authorize, in a Binding Vote, the Board of Directors, Acting through its Audit Committee, to Determine its Remuneration

A simple majority of votes cast at the Annual Meeting (including any adjournment thereof) is required to ratify, on a non-binding basis, the selection of Ernst & Young LLP as the Company’s independent auditor for the fiscal year ending December 31, 2021 and authorize, on a binding basis, the board of directors acting through its Audit Committee, to determine Ernst & Young LLP’s remuneration.

Proposal 3: To approve (on an advisory basis) the compensation paid to the Company’s named executive officers (the “Say-on-Pay” Vote)

Proposal 3 is a non-binding resolution and must receive the affirmative vote of a majority of the votes cast in person or by proxy at the Annual Meeting (including any adjournment thereof) in order to be approved.

Proposal 4: To recommend the frequency of future Say-on-Pay Votes

For Proposal 4, the option receiving the greatest number of votes will be considered the frequency recommended by our shareholders.

5. What is a Broker Non-Vote?

A “broker non-vote” occurs when a broker holding shares for a beneficial owner (that is, in “street name”) does not vote on a particular proposal because the broker does not have discretionary authority to vote on such proposal and has not received instructions from the beneficial owner with respect to such proposal. Although brokers have discretionary authority to vote your shares with respect to “routine” matters, they do not have discretionary authority to vote your shares on “non-routine” matters pursuant to New York Stock Exchange (“NYSE”) rules.

If you do not provide voting instructions for proposals which are considered “non-routine”, a “broker non-vote” occurs. The non-binding vote to ratify Ernst & Young LLP as our independent registered public accounting firm and the binding vote to authorize the board of directors, acting through its Audit Committee, to determine Ernst & Young LLP’s remuneration (Proposal 2) is considered a “routine” matter under applicable NYSE rules, and your brokerage firm will be able to vote on these items even if it does not receive voting instructions from you, so long as it holds your shares in its name. The election of directors (Proposal 1), the proposal to approve the compensation paid to the Company’s named executive officers (Proposal 3), and the proposal to recommend the frequency of future votes to approve the compensation paid to the Company’s named executive officers (Proposal 4) will be treated as a “non-routine” matters under applicable NYSE rules and, therefore, your broker will not be able to vote your shares with respect to these proposals unless the broker receives specific instructions from you. Please instruct your bank or broker accordingly so that your vote is counted.

3

6. Can I change my vote after submitting my proxy?

Shareholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy before it is voted at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| · | you may submit another properly completed proxy on a later date before the proxy voting deadlines described above by Internet or by telephone or by signing and returning a new proxy card with a later date; | ||

| · | you may send a written notice that you are revoking your proxy to Stephen Long, Company Secretary, Strongbridge Biopharma plc at 900 Northbrook Drive, Suite 200, Trevose, PA 19053, United States of America or by email to [email protected]. Your notice must be received before the commencement of the meeting at 11:00 a.m. Eastern Time (4:00 p.m. Dublin Time) on May 13, 2021 or if the Annual Meeting is adjourned, before the commencement of the adjourned meeting; or | ||

| · | you may attend the Annual Meeting and vote in person. |

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

Persons who hold their shares through a bank, brokerage firm or other nominee may change their voting instructions by following the instructions of their bank or broker, or by obtaining a legal proxy from their bank or broker and submitting the legal proxy before the proxy voting deadlines described above.

7. Will I have dissenters’ rights?

No dissenters’ rights are available under Irish law or our Articles of Association to any shareholder with respect to any of the matters proposed to be voted on at the Annual Meeting.

8. What does it mean if I receive more than one set of materials?

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must sign and return all of the proxy cards or follow the instructions for any alternative voting procedure in each set of materials you receive.

4

Set forth below are the names and certain biographical information about each member of our board of directors as of the date of this proxy statement.

Mr. Gill and Dr. Kong are standing for election as Class III directors at the Annual Meeting.

The information presented below includes each director’s principal occupation and business experience for at least the past five years and the names of other public companies for which he or she has served as a director during the past five years.

| NAME | AGE | POSITION | ||||||

| John H. Johnson | 63 | Chief Executive Officer and Director | ||||||

| Garheng Kong, M.D., Ph.D. | 45 | Director, Chairman of the Board | ||||||

| David N. Gill | 66 | Director | ||||||

| Jeffrey W. Sherman, M.D., FACP | 66 | Director | ||||||

| Mårten Steen, M.D., Ph.D. | 45 | Director | ||||||

| Hilde H. Steineger, Ph.D. | 55 | Director | ||||||

John H. Johnson has served as our Chief Executive Officer since July 2020 and as a director of the Company since March 2015. He served as Chairman of the board of directors from March 2015 until November 2019 and Executive Chairman from November 2019 until July 2, 2020. Mr. Johnson recently served as a board member of Melinta Pharmaceuticals, Inc. through September 2019, having served as Chief Executive Officer from February 2019 through August 2019 and as interim Chief Executive Officer from October 2018 through February 2019. Mr. Johnson is also a member of the board of directors of Verastem, Inc. (also known as Verastem Oncology). From January 2012 until August 2014, Mr. Johnson served as the President and Chief Executive Officer of Dendreon Corporation and as its Chairman from January 2012 until June 2014. From January 2011 until January 2012, he served as the Chief Executive Officer and a member of the board of Savient Pharmaceuticals, Inc. From November 2008 until January 2011, Mr. Johnson served as Senior Vice President and President of Eli Lilly and Company’s Oncology unit. He was also Chief Executive Officer of ImClone Systems Incorporated, which develops targeted biologic cancer treatments, from August 2007 until November 2008, and served on ImClone’s board of directors until it was acquired by Eli Lilly in November 2008. From 2005 to 2007, Mr. Johnson served as Company Group Chairman of Johnson & Johnson’s Worldwide Biopharmaceuticals unit, President of its Ortho Biotech Products LP and Ortho Biotech Canada units from 2003 to 2005, and Worldwide Vice President of its CNS, Pharmaceuticals Group Strategic unit from 2001 to 2003. Prior to joining Johnson & Johnson, he also held several executive positions at Parkstone Medical Information Systems, Inc., OrthoMcNeil Pharmaceutical Corporation and Pfizer, Inc. Mr. Johnson is the former Chairman of Tranzyme Pharma, Inc., former lead independent director of Sucampo Pharmaceuticals, Inc. and a former director of Histogenics Corporation, AVEO Pharmaceuticals, Inc. and Portola Pharmaceuticals, Inc. He previously served as a member of the board of directors for the Pharmaceutical Research and Manufacturers of America and the Health Section Governing Board of Biotechnology Industry Organization. Mr. Johnson holds a B.S. from the East Stroudsburg University of Pennsylvania.

Qualifications: Mr. Johnson brings to our board of directors extensive leadership, business and governance experience having served as a chief executive office and on the board of directors of numerous public biopharmaceutical companies. Mr. Johnson’s strong leadership qualities and industry knowledge position him well to provide valuable insights to both management and his fellow board members on issues facing our Company.

David N. Gill has served as a member of our board of directors since September 2019. Mr. Gill is currently the Chief Financial Officer of Perspectum, Ltd, a healthcare technology company which transforms the clinical management of metabolic disease and cancer. Previously he served as the President and Chief Financial Officer of EndoChoice, Inc., a medical device company focused on gastrointestinal disease from April 2016 through the sale of the company to Boston Scientific in November 2016 and as Chief Financial Officer from August 2014 to April 2016. Mr. Gill also currently serves as a director of Y-mAbs Therapeutics, Inc. and Evolus, Inc., Previously he served on the board of directors of Melinta Therapeutics, Histogenics Corporation. and Strata Skin Sciences. Earlier in his career, Mr. Gill served in a variety of senior executive leadership roles for several publicly-traded and private healthcare related companies, including INC Research (now known as Syneos), TransEnterix, NxStage Medical, Inc., CTI Molecular Imaging, Inc., and Novoste Corporation. Mr. Gill holds a B.S. degree, cum laude, in Accounting from Wake Forest University and an M.B.A. degree, with honors, from Emory University, and was formerly a certified public accountant.

5

Qualifications: Mr. Gill has extensive experience as an executive in the medical device industry. This experience and his extensive prior and current service as a director of other public life sciences companies make him a valuable contributor to our board of directors.

Garheng Kong, M.D., Ph.D. has served as Chairman of our board of directors since July 2020, as Lead Independent Director of our board of directors since November 2019 through July 2020, and as a member of our board of directors since September 2015. In July 2013, he founded, and has since served as managing partner of, HealthQuest Capital, a healthcare venture growth fund. Dr. Kong was a general partner at Sofinnova Ventures, a venture firm focused on life sciences, from September 2010 to December 2013. From May 2000 to September 2010, he worked at Intersouth Partners, a venture capital firm, serving most recently as a general partner. Dr. Kong currently serves as a director of Venus Concept, Alimera Sciences, Inc. and Laboratory Corporation of America Holdings. Dr. Kong previously served on the board of directors of Histogenics Corporation, Melinta Therapeutics, Inc. and Avedro, Inc. Dr. Kong holds a B.S. from Stanford University and an M.D., Ph.D. and M.B.A. from Duke University.

Qualifications: Dr. Kong brings to the board of directors extensive knowledge and experience in both the healthcare and finance fields due to his medical background and his work in life science-related venture capital firms and has significant prior board experience with both public and privately held companies.

Jeffrey W. Sherman, M.D., FACP has served as a member of our board of directors since October 2016. Since 2009, he has served as Chief Medical Officer and Executive Vice President of Horizon Therapeutics plc. He has also served as a member of the Xeris Pharmaceuticals board of directors since April 2018. He previously held positions at IDM Pharma, Takeda Global Research and Development, NeoPharm, Searle/Pharmacia, Bristol-Myers Squibb, and is a past president of the Drug Information Association (DIA). He is a member of a number of professional societies, a diplomat of the National Board of Medical Examiners and the American Board of Internal Medicine, and also serves on the Board of Advisors of the Center for Information and Study on Clinical Research Participation (CISCRP). Dr. Sherman earned his MD from the Rosalind Franklin University of Medicine and Science/The Chicago Medical School. He completed internship, residency and chief residency programs in internal medicine at Northwestern University Feinberg School of Medicine, where he currently serves as an adjunct assistant professor and a member of the alumni board, and a fellowship program in infectious diseases at the University of California San Francisco, where he was also a research associate at the Howard Hughes Medical Institute in allergy and immunology. He received a BA in Biology from Lake Forest College.

Qualifications: With over 25 years of research, clinical development, regulatory and commercialization experience within the biopharmaceutical industry, Dr. Sherman brings critical knowledge and expertise to our board of directors relating to the development and commercialization of biopharmaceutical products. In addition, his experience serving in senior leadership positions at multiple public biopharmaceutical companies provides him with keen insight into the issues facing these companies.

Mårten Steen, M.D., Ph.D. has served as a member of our board of directors since December 2014. Since April 2010, he has served as a Partner of HealthCap VI LP, a venture capital firm investing in life science companies. Prior to HealthCap, from February 2008 until March 2010, Dr. Steen served as director at Merck Serono SA, a biopharmaceutical company. He previously served on the boards of Ultragenyx Pharmaceutical Inc., Wilson Therapeutics AB, Altimmune, Inc. and FerroKin Biosciences. Dr. Steen holds a B.Sc. in Business Administration, an M.D., and a Ph.D. in Clinical Chemistry, all from Lund University.

6

Qualifications: Dr. Steen brings extensive venture capital experience in evaluating opportunities and managing healthcare portfolio businesses as well as multiple board experiences at other biopharmaceutical companies, providing him with critical insights on the issues facing our Company. His experience working with global business development, focusing on both product and technology licensing, is also extremely valuable to management.

Hilde H. Steineger, Ph.D. has served as a member of our board of directors since January 2014. She is currently Chief Executive Officer at Staten Biotechnology. She also serves as Chief Operations Officer and Co-founder of NorthSea Therapeutics B.V. Dr. Steineger is a board member of Nordic Nanovector ASA. Dr. Steineger previously served as Head of Strategic Innovation Management in Nutrition & Health Division of BASF, and as Head of Global Omega-3 Innovation Management at Pronova BioPharma ASA, a BASF company, from April 2013 to May 2015. From August 2007 to June 2010, Dr. Steineger was Head of Investor Relations for Pronova BioPharma and Vice President Business Development in Pronova BioPharma from November 2009 to April 2013. She previously served as a member of the board of directors of PCI Biotech AS, Afiew AS, Algeta ASA, Weifa AS, Inven2 AS, Alertis AS, Clavis Pharma ASA and Biotech Pharmacon ASA. Dr. Steineger holds an MSc in molecular biology/biotechnology and a Ph.D. in medical biochemistry, both from University of Oslo.

Qualifications: Dr. Steineger brings extensive experience in the business/finance and life sciences areas, including as a financial analyst covering life sciences companies, as a venture capitalist at a life science venture fund and as head of business development at a leading pharmaceutical company. This broad experience from a diverse set of industries has provided Dr. Steineger with the opportunity to develop strong analytical and leadership skills which, along with her medical biochemistry background, allows her to provide valuable insight to our board of directors.

The Irish Companies Act provides for a minimum of two directors for public limited companies. Our Articles of Association provide for a minimum of two directors and a maximum of 13 directors. Our shareholders may from time to time increase or reduce the maximum number, or increase or reduce the minimum number (subject to the minimum requirements of the Irish Companies Act), of directors by special resolution (i.e., the affirmative vote of at least 75% of the votes cast at a shareholder meeting). Our board of directors determines the number of directors within the range of two to 13. Our board of directors currently consists of six directors.

Our Articles of Association divide our board of directors into three classes, with members of each class being elected to staggered three-year terms. At each annual general meeting, directors will be elected for a full term of three years to succeed those directors of the relevant class whose terms are expiring. A director nominee is elected to the board of directors by a plurality of votes cast.

Our Class III directors, Dr. Kong and Mr. Gill, have been nominated for election at our Annual Meeting for a term ending at the conclusion of the Company’s 2024 annual general meeting and until such time as their successors are duly elected and qualified.

Our Class II directors, Mr. Johnson and Dr. Sherman, were elected at our annual general meeting in May 2020 for a term ending at the conclusion of the Company’s 2023 annual general meeting and until such time as their successors are duly elected and qualified. Our Class I directors, Drs. Steen and Steineger, were elected at our annual general meeting in May 2019 for a term ending at the conclusion of the Company’s 2022 annual general meeting and until such time as their successors are duly elected and qualified.

Our governance structure separates the roles of principal executive officer and Chairman. Mr. Johnson serves as our Chief Executive Officer of the Company and Dr. Kong serves as our independent Chairman. Our board of directors believes maintaining separate roles allows our Chairman to devote his time and attention to matters of board oversight and governance and allows our Chief Executive Officer the opportunity to focus his time and energy on managing the business.

7

Our independent Chairman’s responsibilities include:

| · | Presiding at all meetings of the shareholders and the board of directors at which he is present; | |

| · | Setting the schedule and agenda for each meeting of the board of directors, to the extent foreseeable; | |

| · | Calling and preparing the agenda for, and presiding over, separate executive sessions of the independent directors; | |

| · | Acting as a liaison between the independent directors and the Company’s management; and | |

| · | Performing such other powers and duties as may from time to time be assigned by the board of directors or as may be prescribed by the Company’s Articles of Association. |

The board of directors periodically reviews its leadership structure to determine whether it continues to best serve our shareholders.

Based upon information requested from and provided by each of our directors concerning his or her background, employment and affiliations, including family relationships, our board of directors has determined that each of Mr. Gill and Drs. Kong, Sherman, Steen and Steineger, representing five of our six directors, is independent under the applicable rules and regulations of the Nasdaq Stock Market (“Nasdaq”). In making such determinations, the board of directors considered the relationships that each such non-employee director has with the Company and all other facts and circumstances the board of directors deemed relevant in determining their independence. As Chief Executive Officer, Mr. Johnson does not qualify as an independent director under the applicable rules and regulations of Nasdaq.

Committees of the Board of Directors

The standing committees of our board of directors consist of an audit committee, a compensation committee and a nomination and governance committee. Each committee operates under a charter. Copies of each committee’s charter are posted on the “Investors” tab of our website, which is located at www.strongbridgebio.com.

Audit Committee

The current members of our audit committee are Mr. Gill and Drs. Steineger and Sherman, with Mr. Gill serving as chairman. Our board of directors has determined that each member of our audit committee is independent under Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Irish Companies Act and the applicable listing requirements of Nasdaq, and that each member of our audit committee satisfies the other listing requirements of Nasdaq for audit committee membership. Our board of directors has also determined that two of the three members of our audit committee, Mr. Gill and Dr. Steineger, qualify as an “audit committee financial expert,” as such term is defined by the SEC and as a “person who has competence in accounting or auditing”, within the meaning of Section 167 of the Irish Companies Act, and that he or she has the requisite level of financial sophistication required by the continued listing standards of Nasdaq.

Under the Audit Committee Charter, our audit committee is authorized to take the following actions, among others:

| · | approve and retain the independent auditors to conduct the annual audit of our financial statements; | |

| · | review the proposed scope and results of the audit; | |

| · | review and pre-approve audit and non-audit fees and services; | |

| · | review accounting and financial controls with the independent auditors and our financial and accounting staff | |

| · | review and approve transactions between us and our directors, officers and affiliates; | |

| · | establish procedures for complaints received by us regarding accounting matters; and | |

| · | oversee internal audit functions, if any. |

8

Compensation Committee

The current members of our compensation committee are Dr. Kong and Mr. Gill, with Dr. Kong serving as chairman. Our board of directors has determined that both members of our compensation committee are independent under the applicable listing requirements of Nasdaq.

Under the Compensation Committee Charter, our compensation committee is authorized to take the following actions, among others:

| · | review at least annually the goals and objectives of the Company’s executive compensation plans, and amend, or recommend that the board of directors amend, these goals and objectives if the committee deems it appropriate; | |

| · | evaluate annually the performance of our Chief Executive Officer in light of the goals and objectives of the Company’s executive compensation plans and make recommendations to the board of directors with respect to the Chief Executive Officer’s compensation level based on this evaluation; | |

| · | evaluate annually the performance of the other executive officers of the Company in light of the goals and objectives of the Company’s executive compensation plans, and determine the compensation of such other executive officers; and | |

| · | review at least annually the Company’s general compensation plans and other employee benefit plans, including incentive compensation and equity-based plans, in light of the goals and objectives of these plans, and recommend that the board of directors amend these plans if the committee deems it appropriate. |

Nomination and Governance Committee

The current members of our nomination and governance committee are Drs. Steen and Kong, with Dr. Steen serving as chairman. Our board of directors has determined that each member of our nomination and governance committee is independent under the applicable listing requirements of Nasdaq.

Under the Nomination and Governance Committee Charter, our nomination and governance committee is authorized to take the following actions, among others:

| · | assist in identifying, recruiting and, if appropriate, interviewing candidates to fill positions on the board of directors; | |

| · | recommend the director nominees for election by the shareholders or appointment by the board of directors, as the case may be, pursuant to our Articles of Association; | |

| · | make recommendations to the board of directors regarding the size and composition for each standing committee of the board of directors and monitor the functioning of the various committees; and | |

| · | evaluate and determine at least annually the appropriate level of compensation for the board of directors and committee service by non-employee directors. |

Director nominees are considered by our nomination and governance committee on a case-by-case basis. Among the qualifications considered in the selection of candidates, the nomination and governance committee will consider the following attributes: experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors that the committee considers appropriate in the context of the needs of the board of directors. The nomination and governance committee will consider these criteria for nominees identified by the committee, the board of directors, by shareholders, or through other sources.

9

The nomination and governance committee will make a preliminary assessment of each proposed nominee based upon the résumé and biographical information, an indication of the individual’s willingness to serve, and other relevant information. This information will be evaluated against the criteria set forth above and the specific needs of the Company at that time. Based upon a preliminary assessment of the candidate(s), those who appear best suited to meet the needs of the Company may be invited to participate in a series of interviews, which are used as a further means of evaluating potential candidates. On the basis of information learned during this process, the nomination and governance committee will determine which nominee(s) to submit for election. The nomination and governance committee will use the same process for evaluating all nominees, regardless of the original source of the nomination.

When current directors are considered for nomination for re-election, the nomination and governance committee will take into consideration their prior contributions and performance as well as the composition of our board of directors as a whole, including whether the board of directors reflects the appropriate balance of independence, sound judgment, business specialization, technical skills, diversity, and other desired qualities.

It is our nomination and governance committee’s responsibility to consider shareholder proposals for nominees for election as directors that are nominated in accordance with our Articles of Association, and other applicable laws, including the rules and regulations of the SEC and any stock market on which our ordinary shares are listed for trading or quotation. Generally, a recommendation made by a shareholder entitled to notice of, and to vote at, the meeting at which a proposed nominee is to be considered must be in writing and received by the Secretary of the Company by no later than the close of business on the day that is no less than 120 days prior to the first anniversary of the day the Company’s proxy statement in respect of the preceding year’s annual general meeting is first released to shareholders, provided, however, that in the event that the date of the annual general meeting is changed by more than 30 days from the date contemplated at the time of the preceding year’s proxy statement, notice by the shareholder must be so delivered by close of business on the day that is not less than the later of (a) 150 days prior to the day of the contemplated annual general meeting or (b) ten days after the day on which public announcement of the date of the contemplated annual general meeting is first made by the Company. The notice must set forth all of the information required by the Company’s Articles of Association to be considered by the nomination and governance committee and the board of directors.

The board of directors met nine times during 2020. During 2020, each board member attended at least 75% of the aggregate of the number of board meetings held during his or her term and the meetings held by all committees of the board on which he or she then served.

We have not adopted a formal policy regarding director attendance at the annual general meeting of shareholders and none of our directors attended our 2020 annual general meeting due to COVID-19 concerns.

Our board of directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our board of directors and its committees is to oversee the risk management activities of management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our board of directors oversees risk management activities relating to business strategy, acquisitions, capital raising and allocation, organizational structure and certain operational risks; our audit committee oversees risk management activities related to financial controls and legal and compliance risks; our compensation committee oversees risk management activities relating to our compensation policies and practices and management succession planning; our nomination and corporate governance committee oversees risk management activities relating to board composition. Each committee reports to the full board on a regular basis, including reports with respect to the committee’s risk oversight activities as appropriate. In addition, since risk issues often overlap, committees from time-to-time request that the full board discuss such risks.

10

Communications with Our Directors

Our board of directors will give appropriate attention to written communications that are submitted by shareholders and will respond if and as appropriate. The chairman of the board, or otherwise the chair of the nomination and governance committee, and the Company Secretary are primarily responsible for monitoring communications from shareholders and other interested parties and provide copies or summaries of such communications to the other directors as they consider appropriate. Shareholders who wish to communicate with our board of directors may do so by addressing such communications to Board of Directors, c/o Company Secretary, Strongbridge Biopharma plc, 900 Northbrook Drive, Suite 200, Trevose, Pennsylvania 19053. Communications will be forwarded to other directors if they relate to substantive matters that the chairman of the board or chair of the nomination and governance committee considers appropriate for attention by the other directors.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics is applicable to all of our directors, officers and employees and is posted on the Investors section of our website, which is located at www.strongbridgebio.com. Our Code of Business Conduct and Ethics provides that our directors, officers and employees are expected to avoid any action, position or interest that conflicts with the interests of our company or gives the appearance of a conflict. We expect that any amendment to the code, or any waivers of its requirements, will be disclosed on our website. Information contained on, or that can be accessed through, our website is not incorporated by reference into this document, and you should not consider information on our website to be part of this document.

Policies and Procedures for Related Party Transactions

We have adopted a policy that our executive officers, directors, nominees for election as a director, beneficial owners of more than 5% of any class of our voting securities and any members of the immediate family of any of the foregoing persons are not permitted to enter into a related person transaction with us without the prior consent of our audit committee. Any proposed transaction involving the Company and an executive officer, director, nominee for election as a director, beneficial owner of more than 5% of any class of our voting securities or any member of the immediate family of any of the foregoing persons, in which the amount involved exceeds $120,000 and such person would have a direct or indirect material interest, must first be presented to our audit committee for review, consideration and approval. In approving or rejecting any such proposal, our audit committee is to consider the material facts of the transaction, including, but not limited to: the benefits to the Company; the impact on a director’s independence in the event the transaction involves a director, an immediate family member of a director or an entity in which a director is a general partner, shareholder or executive officer; the availability of other sources for comparable products or services; the terms of the transaction; and the terms available to unrelated third parties or to employees generally.

Except as described below, there have been no related party transactions since January 1, 2019.

On September 21, 2020, we sold 11,111,111 ordinary shares in a public offering. One of our existing shareholders holding in excess of 5% of our outstanding shares prior to the public offering, Caxton Alternative Management LP, purchased shares in the public offering for $2.0 million.

11

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers as of the date of this proxy statement.

| NAME | AGE | POSITION | ||

| John H. Johnson | 63 | Chief Executive Officer and Director | ||

| Frederic Cohen, M.D. | 56 | Chief Medical Officer | ||

| Richard S. Kollender | 51 | President and Chief Financial Officer | ||

| Stephen Long | 55 | Chief Legal Officer | ||

| Scott Wilhoit | 58 | Chief Commercial Officer |

In addition to the biographical information for Mr. Johnson, which is set forth above under “Corporate Governance—Board of Directors,” set forth below is certain biographical information about our other executive officers.

Fredric Cohen, M.D. has served as our Chief Medical Officer since November 2016. Dr. Cohen joined Strongbridge in August 2015 and held roles of increasing responsibility, including Senior Vice President, Global Research and Development, and Vice President, Clinical Research and Development, prior to his promotion to Chief Medical Officer. Fred is an endocrinologist by training with approximately 25 years of drug and business development experience, most recently focused in development and commercialization of rare disease and specialty products. Prior to joining Strongbridge, Fred provided strategic and operational counsel to life science companies, actively supporting their development and licensing functions. Prior to that, he served as Executive Director, Clinical Pipeline, at Aptalis Pharma, where he was responsible for innovation strategy as well as building and advancing the company’s specialty pharma pipeline. He has also held research and development positions with Johnson & Johnson and Eli Lilly & Company. Fred holds an M.D. from Pennsylvania State University College of Medicine and an A.B. in biology from Franklin and Marshall College.

Richard S. Kollender has served as our President and Chief Financial Officer since March 3, 2021. Previously, he served as our Chief Operating Officer since September 2019. He also previously served as a Class II director of our board of directors from March 2015 until September 2019, and was Chairman of the audit committee and a member of the compensation committee. Since January 2011, he has served as a Partner and Executive Manager of Quaker Partners Management, LP, a healthcare investment firm, which he initially joined in 2003, and was promoted to Partner in 2005. In addition, from August 2016 through September 2018, Mr. Kollender served as Chief Business Officer and Chief Financial Officer of Rapid Micro Biosystems, a Quaker Partners’ portfolio company, where he continues to serve on the board of directors. Mr. Kollender held positions in sales, marketing and worldwide business development at GlaxoSmithKline (“GSK”), and served as investment manager at S.R. One, the corporate venture capital arm of GSK. Mr. Kollender holds a B.A. in accounting from Franklin and Marshall College and an M.B.A. and a certificate degree in the Graduate Program in Health Administration and Policy, both from the University of Chicago, and practiced as a certified public accountant for six years at public accounting firms including KPMG.

Stephen Long has served as our Chief Legal Officer since March 2015 and as Company Secretary since September 2015. Prior to joining Strongbridge, Mr. Long served as Counsel at the law firm of Reed Smith LLP, from April 2013 to February 2015. He previously served at C.R. Bard, Inc., a medical device manufacturing company, from October 2000 to May 2012 in the roles of Vice President, General Counsel, as Vice President, and Secretary, and as Associate General Counsel. Mr. Long also served as Assistant General Counsel, Consumer Healthcare, at Warner-Lambert Company, and as Counsel for the company’s pharmaceutical division from February 1998 to September 2000. Mr. Long held positions earlier in his career at the law firm of Willkie Farr & Gallagher and Bankers Trust Company. Mr. Long received his B.S. from the School of Industrial and Labor Relations at Cornell University and his J.D. from Albany Law School of Union University.

Scott Wilhoit has served as our Chief Commercial Officer since May 2019. Mr. Wilhoit joined Strongbridge in January 2017 and held roles of increasing responsibility, including Senior Vice President, Global Market Access, Patient Services and Advocacy, prior to his promotion to Chief Commercial Officer. Mr. Wilhoit has over 30 years of industry experience, much of which has been focused on commercializing products in a variety of rare disease categories. Most recently, Mr. Wilhoit served as Vice President, Market Access and Patient Services at Marathon Pharmaceuticals, where he designed and developed the access strategy for the company’s first commercial rare disease product. Previously, Mr. Wilhoit served as Vice President, Market Access and Health Services at PTC Therapeutics leading pre-launch market access strategic planning for the company’s Duchenne Muscular Dystrophy treatment. Prior to that, he served as Vice President, Pricing, Access and Patient Services at NPS Pharmaceuticals (acquired by Shire). Mr. Wilhoit has also served in a variety of positions with increasing responsibility with Clarus Therapeutics, Auxilium Pharmaceuticals, Biovail Corporation and Johnson & Johnson. Mr. Wilhoit served as a Field Artillery Officer in the U.S. Army and holds a BS in Criminology from Missouri Western State University.

12

EXECUTIVE AND DIRECTOR COMPENSATION

Summary Compensation Table – 2020 and 2019

The following table sets forth information concerning cash and non-cash compensation paid for 2020 and 2019 to certain of our executive officers (referred to herein as “our named executive officers”).

| Stock | Option | All Other | ||||||||||||||||||||||||

| Salary | Bonus | Awards | Awards | Compensation | ||||||||||||||||||||||

| Name and position | Year | ($) | ($)(1) | ($)(2) | ($)(2) | ($)(3) | Total | |||||||||||||||||||

| John H. Johnson(4) | 2020 | $ | 659,128 | $ | 472,500 | $ | 166,250 | $ | 1,509,100 | $ | 1,365 | $ | 2,808,343 | |||||||||||||

| Chief Executive Officer | 2019 | 114,400 | - | - | 274,411 | 202,388 | 591,199 | |||||||||||||||||||

| Fredric Cohen, M.D. | 2020 | 442,834 | 321,417 | 606,977 | - | 19,863 | 1,391,091 | |||||||||||||||||||

| Chief Medical Officer | 2019 | 427,859 | 145,472 | 114,415 | 385,518 | 20,563 | 1,093,827 | |||||||||||||||||||

| Robert Lutz(5) | 2020 | 404,250 | 190,040 | 556,396 | - | 23,115 | 1,173,801 | |||||||||||||||||||

| Chief Financial Officer | 2019 | 373,298 | 144,375 | 114,415 | 359,381 | 25,458 | 1,016,927 | |||||||||||||||||||

| (1) | The amounts in this column represent the discretionary bonuses paid with respect to 2020 and 2019 performance. |

| (2) | The fair value of all stock options granted during the periods covered by the table are calculated on the grant date in accordance with ASC 718-10-30-3 which represented the grant date fair value. |

| (3) | All other compensation received that does not properly report in any other column of the table including insurance premiums paid by Strongbridge with respect to term life insurance, company match on employee’s 401(k) contributions and club membership fees. |

| (4) | Mr. Johnson was appointed Chief Executive Officer effective July 2, 2020. He served as our Executive Chairman from November 2019 through his appointment as Chief Executive Officer. |

| (5) | Mr. Lutz resigned as Chief Financial Officer effective March 3, 2021. |

Narrative to Summary Compensation Table

We have entered into employment agreements with Mr. Johnson and Dr. Cohen, as well as with Mr. Lutz prior to his resignation. These agreements outline the terms of the employment relationship, including any potential severance benefits. We believe that these agreements provide certainty to our management team and help to retain the leadership necessary for our company to succeed.

Employment Agreements

We entered into employment agreements with each of Mr. Johnson, Dr. Cohen and Mr. Lutz for their service as Chief Executive Officer, Chief Medical Officer and Chief Financial Officer, respectively. The agreements are effective until terminated by either the Company or the executive officer, in either case in accordance with the terms of the agreement. As noted above, Mr. Lutz resigned as Chief Financial Officer of the Company effective March 3, 2021.

Under the terms of the employment agreements, Mr. Johnson is entitled to receive an annual base salary of $648,900, Dr. Cohen is entitled to receive an annual base salary of $464,976 and Mr. Lutz was entitled to receive an annual base salary of $424,463 prior to his resignation. Pursuant to the terms of these agreements, the annual incentive bonus target (which is calculated as a percentage of annual base salary) is 60% for Mr. Johnson, 40% for Dr. Cohen and was 40% for Mr. Lutz. Our executive officers are also entitled to participate in benefits offered by us for similarly situated employees, including the Company’s paid time-off policy.

Executive Chairman Agreement

On November 18, 2019, we entered into an Executive Chairman Agreement with Mr. Johnson in connection with his appointment as Executive Chairman on November 1, 2019. This agreement was terminated in connection with his appointment as Chief Executive Officer in July 2020 and superseded by the employment agreement we entered into with Mr. Johnson on July 2, 2020.

13

Under the terms of the Executive Chairman Agreement, Mr. Johnson was paid a monthly salary of not less than $57,200 and was eligible to participate in and receive benefits under our employee benefit plans that are generally made available to our executive officers. Mr. Johnson was granted an option to purchase 275,000 shares of common stock (the “Johnson Option”) under the Company’s 2015 Equity Compensation Plan (the “2015 Plan”), at an exercise price equal to the closing price per share of the Company’s common stock as reported on Nasdaq on the grant date. The Johnson Option will vest and become exercisable over a period of four years from the grant date, with 6.25% of the grant vesting on each of the 16 quarterly anniversaries of the grant date.

Other Benefits

Our executive officers (including the named executive officers) are eligible to participate in our employee benefit plans on the same basis as our other employees, including our health and welfare plans and our 401(k) plan. Under our 401(k) plan, participants may elect to make both pre- and post-tax contributions to their accounts in the plan, and we match 100% of those contributions up to 4% of compensation. Our executive officers are not eligible for retirement benefits other than under our 401(k) plan. We are not required to, and have not, set aside any amounts relating to pension or retirements.

Outstanding Equity Awards as of December 31, 2020

The following table includes certain information with respect to option that were outstanding as of December 31, 2020 for our executive officers.

| Option Awards | Stock Awards | |||||||||||||||

| Number of | Number of | Market | ||||||||||||||

| Securities | Securities | Number of | Value of | |||||||||||||

| Underlying | Underlying | Shares or | Shares or | |||||||||||||

| Unexercised | Unexercised | Option | Units of | Units of | ||||||||||||

| Options | Options | Exercise | Option | Stock That | Stock That | |||||||||||

| (#) | (#) | Price | Grant | Expiration | Have Not | Have not | ||||||||||

| Name | Exercisable | Unexercisable | ($) | Date | Date | Vested (#) | Vested ($)(1) | |||||||||

| John Johnson | 13,224 | — | $ | 17.55 | 10/16/2015 | 10/16/2025 | ||||||||||

| 40,000 | — | $ | 5.50 | 5/12/2016 | 5/12/2026 | |||||||||||

| 40,000 | — | $ | 4.40 | 5/11/2017 | 5/11/2027 | |||||||||||

| 40,000 | — | $ | 7.75 | 5/15/2018 | 5/15/2028 | |||||||||||

| 68,750 | 206,250 | (2) | $ | 1.56 | 11/14/2019 | 11/14/2029 | ||||||||||

| 10,938 | 76,562 | (2) | $ | 1.90 | 4/8/2020 | 4/8/2030 | ||||||||||

| 182,500 | $ | 443,475 | (3) | |||||||||||||

| 315,000 | $ | 765,450 | (4) | |||||||||||||

| Fredric Cohen, M.D. | 81,818 | — | $ | 18.12 | 8/5/2015 | 8/5/2025 | ||||||||||

| 30,000 | — | $ | 3.94 | 2/26/2016 | 2/26/2026 | |||||||||||

| 40,000 | — | $ | 4.16 | 6/13/2016 | 6/13/2026 | |||||||||||

| 10,000 | — | $ | 3.90 | 11/23/2016 | 11/23/2026 | |||||||||||

| 162,188 | 10,812 | (2) | $ | 2.90 | 2/23/2017 | 2/23/2027 | ||||||||||

| 79,750 | 36,250 | (2) | $ | 6.65 | 2/5/2018 | 2/5/2028 | ||||||||||

| 51,625 | 66,375 | (2) | $ | 4.67 | 2/20/2019 | 2/20/2029 | ||||||||||

| 56,250 | 243,750 | (2) | $ | 2.98 | 1/27/2020 | 1/27/2030 | ||||||||||

| 24,500 | $ | 59,535 | (5) | |||||||||||||

| Robert Lutz | 15,150 | — | $ | 14.37 | 6/25/2015 | 6/25/2025 | ||||||||||

| 63,000 | — | $ | 3.94 | 2/26/2016 | 2/26/2026 | |||||||||||

| 164,063 | 10,937 | (2) | $ | 2.90 | 2/23/2017 | 2/23/2027 | ||||||||||

| 78,375 | 35,625 | (2) | $ | 6.65 | 2/5/2018 | 2/5/2028 | ||||||||||

| 48,125 | 61,875 | (2) | $ | 4.67 | 2/20/2019 | 2/20/2029 | ||||||||||

| 51,563 | 223,437 | (2) | $ | 2.98 | 1/27/2020 | 1/27/2030 | ||||||||||

| 24,500 | $ | 59,535 | (5) | |||||||||||||

| (1) | The market value of shares of stock that have not vested is based on the closing price of our common stock on December 31, 2020, or $2.43 per share. |

| (2) | These options vest in 16 equal quarterly installments commencing with the first quarter subsequent to the grant date. These options will fully vest and become exercisable upon a change of control provided that the executive is employed on the date of such change of control. |

| (3) | The restricted stock units vest in one-third installments annually, starting April 8, 2021. These restricted stock units will fully vest and become exercisable upon a change of control provided that the executive is employed on the date of such change of control. |

| (4) | The restricted stock units vest in one-half installments annually, starting July 2, 2021. These restricted stock units will fully vest and become exercisable upon a change of control provided that the executive is employed on the date of such change of control. |

| (5) | The restricted stock units vested on February 20, 2021. |

14

Prior to September 3, 2015, we did not have an equity compensation plan. Grants of stock options to the executive officers and other individuals were made through individual grant agreements.

On January 7, 2021, our board of directors granted restricted stock units to each of Mr. Johnson, Dr. Cohen and Mr. Lutz for 491,000, 181,000 and 147,500 ordinary shares, respectively. These restricted stock units vest 24 months from grant date, provided the executive officer is employed by the Company on such date. All restricted stock units will fully vest upon a change of control of our company. Mr. Lutz forfeited his restricted stock units upon his resignation.

Potential Payments Upon Terminations of Employment or Following a Change of Control

Employment Agreements

The employment agreements with our executive officers provide that if the executive’s employment is terminated (a) by the executive without “good reason”; (b) by our company for “cause”; or (c) due to the executive’s disability, the executive will not be entitled to any amounts above those that have already been earned and/or accrued. Mr. Lutz did not receive any additional compensation above the amounts already earned and accrued to him in connection with his resignation on March 3, 2021.

The employment agreements also provide that, upon a termination of employment by our company without cause, or by the executive for good reason, or due to the executive’s death, subject to the execution of a release of claims, he or she will be entitled to (1) an amount equal to the sum of 12 months of base salary and the target bonus, paid in installments over the 12-month period following termination, (2) a pro rata portion of the annual bonus that he would have been entitled to receive for the calendar year that includes the termination date, based on the actual achievement of the applicable performance goals, and (3) medical and dental benefits provided by us that are at least equal to the level of benefits provided to other similarly situated active employees until the earlier of (a) 18 months for Mr. Johnson and 12 months for Dr. Cohen following the termination date and (b) the date the executive becomes covered under a subsequent employer’s medical and dental plans.

In the event there is a change of control of our company and, during the 24-month period following the change of control, any of our executive officers is terminated by us without cause, by the executive for good reason, or due to the executive’s death or, he or she will be entitled to the severance benefits detailed below and all unvested equity or equity-based awards held by the executive will accelerate and vest. The severance benefits include (1) an amount equal to the sum of 24 months base salary and target bonus for Mr. Johnson and 18 months base salary and target bonus for Dr. Cohen, paid in installments over the 24-month period following termination for Mr. Johnson and 18-month period following termination for Dr. Cohen; and (2) the medical and dental benefits provided by us until the earlier of (a) two years following the termination date for Mr. Johnson and one year following the termination date for Dr. Cohen and (b) the date the executive becomes covered under a subsequent employer’s medical and dental plans.

15

Under the employment agreements, “cause” is defined as (1) the conviction of, or plea of guilty or nolo contendere to, any felony or any crime involving theft, embezzlement, dishonesty or moral turpitude, (2) any act constituting willful misconduct, deliberate malfeasance, dishonesty, or gross negligence in the performance of the individual’s duties, (3) the willful and continued failure to perform any of the individual’s duties, which has not been cured within 30 days following written notice from us, or (4) any material breach by the individual of the employment agreement or any other agreement with us, which has not been cured within 30 days following written notice from us. “Good reason” is defined as any of the following reasons unless cured by us within a specified period: (1) a material reduction of the individual’s base salary, other than a reduction that is applicable to other senior executives in the same manner and proportion, (2) the assignment of duties or responsibilities which are materially inconsistent with the individual’s position, (3) a change in the principal location at which the individual performs his or her duties to a new location that is more than 50 miles from the prior location or (4) a material breach of the employment agreement by us. “Change of control ” is defined as the occurrence of any of the following: (a) any person or group of persons becomes the beneficial owner, directly or indirectly, of securities of the Company representing more than 50% of the combined voting power of the Company’s then outstanding securities; provided that if the person or group of persons is already deemed to own more than 50% of the total fair market value or total voting power, then the acquisition of additional stock by such person or group of persons shall not constitute an additional change of control; (b) the shareholders of the Company approve a plan of complete liquidation of the Company; (c) the sale or disposition of all or substantially all of the Company’s assets; or (d) a merger, consolidation or reorganization of the Company with or involving any other entity, other than a merger, consolidation or reorganization that would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least 50% of the combined voting power of the Company (or such surviving entity) outstanding immediately after such merger, consolidation or reorganization owned in approximately the same proportion of such ownership by each of the prior shareholders as prior to the transaction. The following acquisitions are not considered to be a change of control of the Company: (A) an acquisition by the Company or entity controlled by the Company, or (B) an acquisition by an employee benefit plan (or related trust) sponsored or maintained by the Company.

The employment agreements also provide that, in the event that any of our other executive officers is subject to the excise tax under Section 4999 of the Code, the payments that would be subject to the excise tax will be reduced to the level at which the excise tax will not be applied unless such executive would be in a better net after-tax position by receiving the full payments and paying the excise tax.

Our board of directors’ compensation program for fiscal year 2020 provided for the following:

| · | Annual Cash Retainer—$40,000 |

| · | Additional Annual Cash Retainers |

| · | Non-Executive Chairman of the Board Retainer—$40,000 |

| · | Audit Committee Chair Retainer—$20,000 |

| · | Compensation Committee Chair Retainer—$15,000 |

| · | Nomination and Governance Committee Chair Retainer—$10,000 |

16

| · | Audit Committee Member (other than Chairman) Retainer—$10,000 |

| · | Compensation Committee Member (other than Chairman) Retainer—$7,500 |

| · | Nomination and Governance Committee Member (other than Chairman) Retainer—$5,000 |

| · | Transaction Committee Member Retainer—$8,000 |

| · | Equity Compensation |

| · | Initial Equity Grant—50,000 restricted stock units, vesting in full on the first anniversary of the date of grant, provided that the director continues to provide services as a member of our board of directors continuously from the date of grant through the applicable vesting date |

| · | Annual Equity Grant—40,000 restricted stock units, vesting in full on the first anniversary of the date of grant, as determined by our board of directors, provided that the director continues to provide services as a member of our board of directors continuously from the date of grant through the vesting date |

Our directors earned compensation in 2020 for their service on the board as summarized below:

| Fees earned | Stock Awards (1) | Total | ||||||||||||

| Name | Year | ($) | ($) | ($) | ||||||||||

| David Gill | 2020 | 67,316 | 116,400 | 183,716 | ||||||||||

| Garheng Kong, M.D., Ph.D. | 2020 | 84,960 | 116,400 | 201,360 | ||||||||||

| Jeffrey W. Sherman, M.D., FACP | 2020 | 50,000 | 116,400 | 166,400 | ||||||||||

| Mårten Steen, M.D., Ph.D. | 2020 | 58,000 | 116,400 | 174,400 | ||||||||||

| Hilde H. Steineger, Ph.D. | 2020 | 50,000 | 116,400 | 166,400 | ||||||||||

| (1) | Amounts shown represent the aggregate grant date fair value of the restricted stock unit awards, computed in accordance with FASB ASC Topic 718. |

The following table includes a summary of outstanding stock options and restricted stock unit grants as of December 31, 2020 for those individuals serving as directors in fiscal year 2020. See “Outstanding Equity Awards as of December 31, 2020” for Mr. Johnson’s outstanding equity awards as of December 31, 2020.

| Restricted Stock Units | Options | |||||||

| Name | Outstanding | Outstanding | ||||||

| David Gill | 40,000 | — | ||||||

| Garheng Kong, M.D., Ph.D. | 40,000 | 154,385 | ||||||

| Jeffrey W. Sherman, M.D., FACP | 40,000 | 140,000 | ||||||