Form DEF 14A Startek, Inc. For: May 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

| StarTek, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) |

Title of each class of securities to which transaction applies:

|

|

|

(2) |

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4) |

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

Total fee paid:

|

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

Amount Previously Paid:

|

|

|

(2) |

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

Filing Party:

|

|

|

(4) |

Date Filed:

|

Business Process Outsourcing

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS — May 26, 2021

PROXY STATEMENT

StarTek, Inc.

6200 South Syracuse Way, Suite 485

Greenwood Village, Colorado 80111

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 26, 2021

To the Stockholders of StarTek, Inc.:

The 2021 Annual Meeting of Stockholders of StarTek, Inc. (“StarTek”), a Delaware corporation, will be held at StarTek, Inc., 6200 South Syracuse Way, Suite 485, Greenwood Village CO 80111, on May 26, 2021, at 8:00 a.m. local time, for the following purposes:

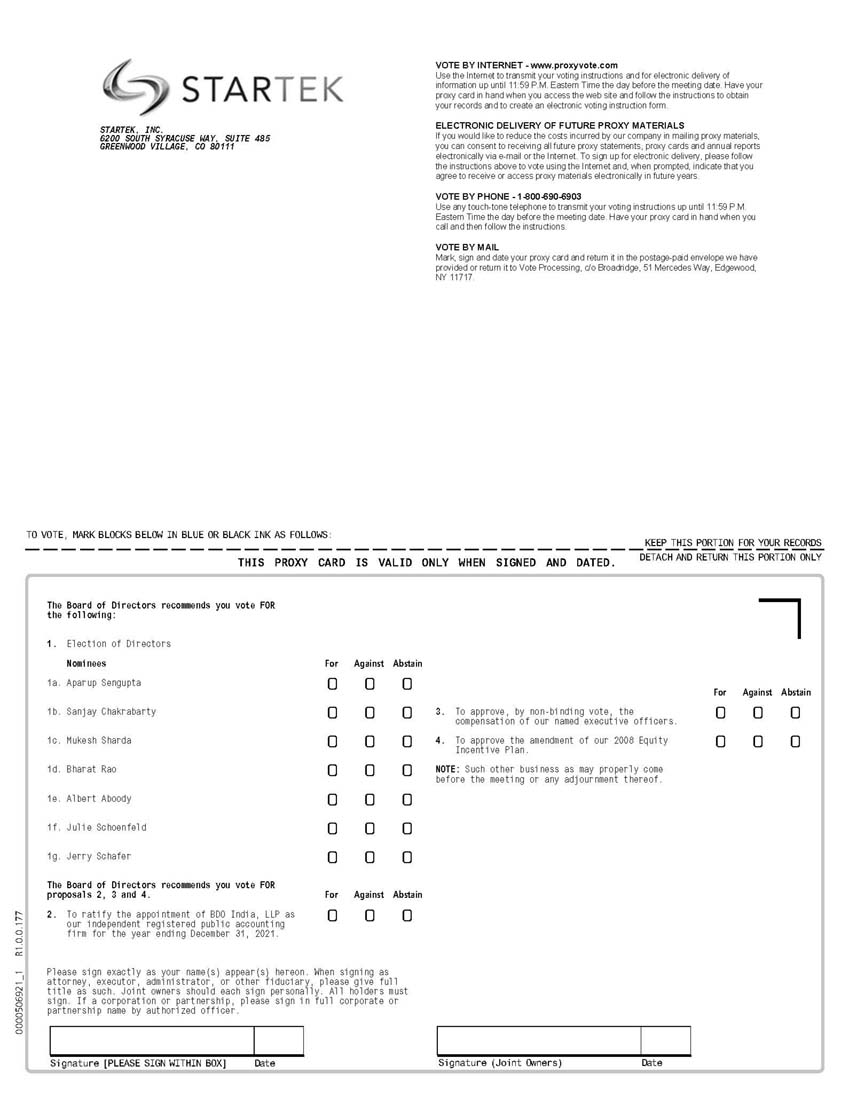

|

1. |

To elect seven directors to hold office for a term of one year until the 2022 Annual Meeting of Stockholders and until their successors are elected and qualified. |

|

2. |

To ratify the appointment of BDO India LLP as our independent registered public accounting firm for the year ending December 31, 2021. |

|

3. |

To hold a non-binding advisory vote to approve the compensation of our named executive officers. |

|

4. |

To approve the amendment of our 2008 Equity Incentive Plan to increase the maximum number of shares available for award under the plan by 1,550,000 shares of our common stock. |

|

5. |

To consider and act upon such other business as may properly come before the Annual Meeting. |

Only stockholders of record at the close of business on April 1, 2021 are entitled to notice of and to vote at the meeting and any adjournment thereof.

Stockholders may listen to (but not participate in) the Annual Meeting by telephone via the following dial-in, listen-only number: [+1 213-375-3254, Conference ID: 189 322 986#]. See “Special Note Regarding COVID-19 Guidelines” in the accompanying proxy materials for additional information on the listen-in option.

| By order of the Board of Directors, | |

|

|

| Aparup Sengupta | |

| Global Chief Executive Officer |

April 16, 2021

IMPORTANT

Whether or not you expect to attend the Annual Meeting in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares will save us the expense and extra work of additional solicitation. Please vote your shares, as instructed in the proxy materials, as promptly as possible. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Please also see the “Special Note Regarding COVID-19 Guidelines” in the accompanying proxy materials for certain limitations on your ability to physically attend the Annual Meeting.

STARTEK, INC.

TABLE OF CONTENTS

|

Page |

|

|

Notice of Annual Meeting of Stockholders |

|

|

Proxy Statement: |

|

|

Outstanding Stock and Voting Rights |

1 |

|

Beneficial Ownership of Common Stock by Directors, Executive Officers, and Principal Stockholders |

3 |

|

Proposal 1 — Election of Directors |

4 |

|

Corporate Governance |

6 |

|

Executive Officers |

8 |

|

Compensation Discussion and Analysis |

9 |

|

Compensation Committee Report |

10 |

|

Compensation of Executive Officers |

10 |

|

Summary Compensation Table |

10 |

|

Outstanding Equity Awards at 2020 Fiscal Year End |

11 |

|

Employment Agreements |

11 |

|

Compensation of Directors |

12 |

|

Certain Transactions |

13 |

|

Proposal 2 — Ratification of Appointment of Independent Registered Public Accounting Firm |

15 |

|

Audit and Non-Audit Fees |

15 |

|

Audit Committee Report |

15 |

|

Proposal 3 — Advisory Vote on Executive Compensation |

16 |

|

Proposal 4 — Approval of Amendment of 2008 Equity Incentive Plan |

16 |

|

Stockholder Proposals |

23 |

|

Stockholder Communication with the Board |

23 |

|

Equity Compensation Plans |

23 |

|

Miscellaneous |

24 |

|

Exhibit A |

25 |

PROXY STATEMENT

STARTEK, INC.

6200 SOUTH SYRACUSE WAY, SUITE 485

GREENWOOD VILLAGE, COLORADO 80111

(303) 262-4500

2021 ANNUAL MEETING OF STOCKHOLDERS

MAY 26, 2021

This Proxy Statement, or a Notice of Internet Availability of Proxy Materials, was first mailed to our stockholders on or about April 16, 2021. It is furnished in connection with the solicitation of proxies by the Board of Directors of StarTek, Inc., a Delaware corporation, to be voted at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at 6200 South Syracuse Way, Suite 485, Greenwood Village CO 80111, on May 26, 2021, at 8:00 a.m. local time.

SPECIAL NOTE REGARDING COVID-19 GUIDELINES

Stockholders may listen to the Annual Meeting by telephone via the following dial-in, listen-only number: [+1 213-375-3254, Conference ID: 189 322 986#]. Due to the ongoing public impact of COVID‑19 and to mitigate risks to the health and well-being of employees, stockholders, communities, and other stakeholders, StarTek discourages stockholders from physically attending the Annual Meeting. In light of the rapidly evolving news and guidelines relating to the COVID-19 pandemic, StarTek requests that all stockholders comply with guidelines and orders of local government and health officials.

The Annual Meeting agenda will be limited to the items of business in this Proxy Statement and no business update will be provided at the Annual Meeting.

Please be advised that stockholders will not be deemed to be "present" for quorum purposes and will not be able to vote their shares, or revoke or change a previously submitted vote, by dialing into the Annual Meeting. As a result, StarTek strongly urges stockholders to submit their proxies or votes in advance of the Annual Meeting using one of the available methods described herein.

OUTSTANDING STOCK AND VOTING RIGHTS

The only outstanding securities entitled to vote at the Annual Meeting are shares of our common stock, $0.01 par value. Stockholders of record at the close of business on April 1, 2021 will be entitled to vote at the Annual Meeting on the basis of one vote for each share held. On April 1, 2021, there were 40,776,059 shares of common stock outstanding.

Under rules of the Securities and Exchange Commission (“SEC”), we are furnishing proxy materials to our stockholders on the Internet, rather than mailing printed copies to our stockholders. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials unless you request one as instructed in that notice. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy material on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials.

Proxies will be voted according to the instructions received either on the proxy card or online via the Internet or telephone. In the absence of specific instructions, proxies will be voted (i) FOR each of the nominees in proposal 1, (ii) FOR proposals 2, 3 and 4 and (iii) in the discretion of the proxy holders on any other matter which properly comes before the Annual Meeting.

Stockholders who execute proxies retain the right to revoke them at any time before the shares are voted by proxy at the Annual Meeting. A stockholder may revoke a proxy by delivering a signed statement to our Corporate Secretary at or prior to the Annual Meeting or by timely executing and delivering, by mail, Internet, telephone, or in person at the Annual Meeting, another proxy dated as of a later date. We will pay the cost of solicitation of proxies.

The quorum necessary to conduct business at the Annual Meeting consists of a majority of the outstanding shares of common stock as of the record date. Abstentions and broker non-votes (i.e., when a broker does not have or exercise authority to vote on a specific issue) are counted as present in determining whether the quorum requirement is satisfied. Each stockholder is entitled to cast one vote per share on each matter.

The election of the directors requires a majority (i.e., greater than 50%) of the shares of common stock present in person or represented by proxy at the Annual Meeting. If a nominee for director who is an incumbent director is not elected and no successor has been elected at the annual stockholder’s meeting, the director shall promptly tender his or her resignation to the Board of Directors. The Nominating and Governance Committee of the Board of Directors shall make a recommendation to the Board of Directors whether to accept or reject the resignation. If accepted, the Board of Directors, at its sole discretion, may fill any resulting vacancy pursuant to the provisions of our Bylaws. If the election of directors is contested, whereby the number of nominees for election exceeds the number of directors to be elected, then the directors shall be elected by the vote of a plurality of the votes cast. We do not expect the election of directors at the Annual Meeting to be contested and therefore directors will be elected by a majority of the votes represented at the Annual Meeting. Cumulative voting is not permitted in the election of directors.

The affirmative vote of the holders of a majority of the shares of our common stock present at the Annual Meeting, whether in person or by proxy, is required to approve the amendment of our 2008 Equity Incentive Plan and to ratify the appointment of our independent registered public accounting firm. The proposal to approve our executive compensation is advisory and not binding on us. However, we will consider our stockholders to have approved our executive compensation if the number of votes for this proposal exceeds the number of votes against this proposal.

For purposes of the proposals to elect directors, ratify the appointment of our independent registered public accounting firm, amend our 2008 Equity Incentive Plan, and any other matters properly brought before the Annual Meeting, abstentions and broker non-votes will have the effect of a vote against the director or the matter, as applicable. For purposes of the non-binding approval of our executive compensation, abstentions and broker non-votes will not affect the vote taken. Because brokers may not vote uninstructed shares on behalf of their customers for “non-routine” matters, which include the election of directors, approval of our executive compensation, and approval of the amendment of our 2008 Equity Incentive Plan it is critical that stockholders vote their shares.

The Board of Directors has selected Dixie Pepper and Aparup Sengupta, and each of them, to act as proxies with full power of substitution. Solicitation of proxies may be made by mail, personal interview, telephone and facsimile transmission by our officers and other management employees, none of whom will receive any additional compensation for their soliciting activities. The total expense of any solicitation will be borne by us and may include reimbursement paid to brokerage firms and others for their expenses in forwarding material regarding the Annual Meeting to beneficial owners. Unless otherwise noted in this definitive proxy statement, any description of “us,” “we,” “our,” “StarTek,” etc. refers to StarTek, Inc. and our subsidiaries.

BENEFICIAL OWNERSHIP OF COMMON STOCK BY

DIRECTORS, EXECUTIVE OFFICERS, AND PRINCIPAL STOCKHOLDERS

The table below presents information as of April 1, 2021, regarding the beneficial ownership of shares of our common stock by:

|

• |

Each of our directors and the executive officers named in the Summary Compensation Table set forth below; |

|

|

• |

Each person we know to have beneficially owned more than five percent of our common stock as of that date; and |

|

|

• |

All of our current executive officers and directors as a group. |

|

Beneficial |

||||||||

|

Ownership of Shares |

||||||||

|

Number of |

Percentage of |

|||||||

|

Name of Beneficial Owner |

Shares (1) |

Class |

||||||

|

CSP Management Ltd.(2) |

22,568,259 |

55.3 |

% |

|||||

|

A. Emmet Stephenson, Jr.(3)(4) |

2,914,382 |

7.1 |

% |

|||||

|

Steven D. Lebowitz(5) |

2,600,653 |

6.4 |

% |

|||||

|

Directors: |

||||||||

|

Albert Aboody(3)(6) |

48,964 |

* |

||||||

|

Sanjay Chakrabarty(3)(7) |

58,877 |

* |

||||||

|

Bharat Rao(3)(7)(8) |

539,755 |

1.3 |

% |

|||||

|

Julie Schoenfeld(3) |

33,403 |

* |

||||||

|

Aparup Sengupta(3)(7) |

261,008 |

* |

||||||

|

Mukesh Sharda(3)(7)(8) |

539,755 |

1.3 |

% |

|||||

|

Gerald Schafer(3)(6) |

48,964 |

* |

||||||

|

Named Executive Officers: |

||||||||

|

Lance Rosenzweig(3) |

15,024 |

* |

||||||

|

Rajiv Ahuja (3) |

- |

- |

||||||

|

Surender Mohan Gupta(3) |

- |

- |

||||||

|

All Current Directors and Executive Officers as a group (10 persons) |

1,530,726 |

3.7 |

% |

|||||

|

* |

Less than one percent. |

(1) Calculated pursuant to Rule 13d-3(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under Rule 13d-3(d), shares not outstanding that are subject to options, warrants, rights or conversion privileges exercisable within 60 days are deemed outstanding for the purpose of calculating the number and percentage owned by such person, but are not deemed outstanding for the purpose of calculating the percentage owned by each other person listed. Accordingly, share ownership in each case includes shares issuable upon exercise of outstanding options that are exercisable within 60 days after April 1, 2021.

Included in this table are all shares of restricted stock (vested and unvested) and deferred stock units (vested and unvested) as of April 1, 2021. Unless otherwise indicated in the footnotes and subject to community property laws where applicable, each of the named persons has sole voting and investment power with respect to the shares shown as beneficially owned.

(2) This disclosure is based on information provided to us in a questionnaire. The address of this stockholder is 160 Robinson Road, #10-01, SBF Center, Singapore, 068914. Includes 21,028,218 shares directly owned by CSP Alpha Holdings Parent Pte Ltd and 1,540,041 shares directly owned by CSP Victory Limited, each of which are indirectly controlled by CSP Management Ltd.

(3) The address of such person is c/o Startek, Inc., 6200 South Syracuse Way., Suite 485, Greenwood Village, Colorado 80111.

(4) This disclosure is based on information provided to us in a questionnaire.

(5) This disclosure is based on a Schedule 13G/A filed with the SEC by Steven D. Lebowitz on January 29, 2021. The address of this stockholder is 1333 Second Street, Suite 650, Santa Monica, California 90401.

(6) Includes 48,964 shares of common stock underlying vested stock options.

(7) Includes 58,877 shares of common stock underlying vested stock options.

(8) Includes 274,064 shares of common stock owned by Advance Crest Investments Limited and 206,814 shares of common stock owned by Tribus Capital Limited, each of which are controlled by Bharat Rao and Mukesh Sharda. Each of Messrs. Rao and Sharda disclaim beneficial ownership of all such shares held by Advance Crest Investments Limited and Tribus Capital Limited except to the extent of their proportionate pecuniary interests therein.

PROPOSAL 1.

ELECTION OF DIRECTORS

Introductory Note

As previously disclosed, on July 3, 2018, StarTek, Inc. (the “Company”) consummated a transaction, pursuant to which the Company acquired all of the outstanding capital stock of CSP Alpha Midco Pte Ltd, a Singapore private limited company (“Aegis”) from CSP Alpha Holdings Parent Pte Ltd, a Singapore private limited company (the “Aegis Stockholder”) in exchange for the issuance of 20,600,000 shares of the common stock of the Company, par value $.01 per share (the “Common Stock”) to the Aegis Stockholder and for certain other considerations (such transactions are referred to herein as the “Aegis Transactions”).

Stockholders’ Agreement

On July 20, 2018, in connection with the consummation of the Aegis Transactions, the Company and the Aegis Stockholder entered into a Stockholders' Agreement (the “Stockholders' Agreement”), pursuant to which the Company and the Aegis Stockholder agreed to, among other things: (i) certain rights, duties and obligations of the Aegis Stockholder and the Company as a result of the transactions contemplated by the Transaction Agreement and (ii) certain aspects of the management, operation and governance of the Company after consummation of the Aegis Transactions. As a result of the consummation of the Aegis Transactions, the Aegis Stockholder now owns approximately 56% of the common stock of the Company.

The Stockholders' Agreement outlines various corporate governance matters including board composition, director nomination rights and committees of the Company’s Board of Directors (the “Board”) after consummation of the Aegis Transactions. It provides that the Board shall consist of nine members comprised initially of (i) five directors (including the chairman), to be designated by the Aegis Stockholder (the “Aegis Stockholder Directors”), (ii) the Company’s chief executive officer, and (iii) three independent directors, reasonably acceptable to the Aegis Stockholder (the “Non-Stockholder Directors”) and that if the Aegis Stockholder does not initially designate all five of the Aegis Stockholder Directors, it shall have the right to fill any vacancy at any time. This Board composition shall continue so long as the Aegis Stockholder or its affiliates own 50% or more of the outstanding shares of the Company’s common stock. If the Aegis Stockholder and its affiliates beneficially own less than 50% of our common stock, the nomination rights are reduced pursuant to the Stockholders' Agreement.

Under the Stockholders’ Agreement, the Company shall avail itself of all “controlled company” exceptions to the corporate governance listing rules of the New York Stock Exchange (“NYSE”) for so long as the Aegis Stockholder owns more than 50% of the voting power for the election of directors, and thereafter the Company and the Aegis Stockholder shall take all necessary actions to comply with the corporate governance listing rules of the NYSE. The committees of the Board will include an Audit Committee consisting of three Non-Stockholder Directors, as well as a Compensation Committee and a Governance and Nominating Committee, each consisting of three directors, including at least one Non-Stockholder Director. The number of Non-Stockholder Directors on all other committees is required to be proportional to the number of Non-Stockholder Directors on the Board; provided that each such committee shall have at least one Non-Stockholder Director. See “Certain Transactions” for further information regarding the Stockholders’ Agreement.

Bylaws

Our Bylaws provide that our Board of Directors must consist of at least one but no more than nine directors. Each director serves a one-year term (and until his or her successor is elected and qualified). At the Annual Meeting, our stockholders will elect seven directors to serve until the 2022 Annual Meeting of Stockholders and until their successors are duly elected and qualified.

Nominees

The table below lists the persons being nominated to serve on the Board of Directors until their terms expire in 2022, along with the party who nominated each person, and any other position that such nominee holds with the Company:

|

Name |

Position |

Nominated By |

|

Aparup Sengupta |

Chairman of the Board and Chief Executive Officer |

Aegis Stockholder |

|

Sanjay Chakrabarty |

Director; Chairman of Governance and Nominating Committee |

Aegis Stockholder |

|

Mukesh Sharda |

Director; Chairman of Compensation Committee; member of Governance and Nominating Committee |

Aegis Stockholder |

|

Bharat Rao |

Director; member of Compensation Committee |

Aegis Stockholder |

|

Albert Aboody |

Director; Chairman of Audit Committee; member of Governance and Nominating Committee |

StarTek |

|

Julie Schoenfeld |

Director; member of Audit Committee; member of Compensation Committee |

StarTek |

|

Jerry Schafer |

Director; member of Audit Committee |

StarTek |

In the event any nominee declines or is unable to serve, proxies will be voted in the discretion of the proxy holders. We have no reason to anticipate that this will occur.

When considering whether directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Governance and Nominating Committee and the Board of Directors considered the information in the individual biographies set forth below as well as the record of service to the company of each director nominated for re-election.

Biographical information and qualifications regarding the Board of Director nominees seeking election is as follows:

Aparup Sengupta; age 56; Operating Partner, Capital Square Partners Management Pte Ltd.

Mr. Sengupta is the Operating Partner of Capital Square Partners Management Pte Ltd. (“CSP”) and is on the board of Aegis. Previously, he was the Executive Chairman of The Minacs Group (“Minacs”), a business solutions company, from 2014. Prior to joining Minacs, Mr. Sengupta was the Global CEO and Managing Director at Aegis from 2005 to 2012. Mr. Sengupta holds a Bachelor’s degree in Electrical Engineering from the Indian Institute of Engineering Science and Technology, formally known as the Bengal Engineering and Science University. Mr. Sengupta was appointed to serve as the Chief Executive Officer of the Company effective as of January 15, 2020.

The Board believes that Mr. Sengupta’s significant experience as a leader in the business process outsourcing industry brings valuable expertise to the Board and assists the Company with its global operational and strategic growth initiatives.

Sanjay Chakrabarty; age 52; Managing Partner, Capital Square Partners (Management) Pte Ltd.

Mr. Chakrabarty is a Managing Partner of CSP and has been serving on the board of ESM, since March 2018 and on the board of the Company since July 2018. In addition, he has been a director on the board of CSS Corp, since June 2013. Mr. Chakrabarty was previously a board member of Minacs and Indecomm Corporation. Prior to founding CSP, Mr. Chakrabarty served as the President of Columbia Capital’s India and SE Asia investments platform from late 2007 to December 2012. Before his investment role, Mr. Chakrabarty was the Founder & CEO of MobiApps Holdings, a technology company that built products and services based on a patent protected radio frequency semiconductor chip for satellite communications. Mr. Chakrabarty holds a dual B.S. degree in Computer Engineering and Mathematics from Pennsylvania State University at Slippery Rock and an M.B.A. from Carnegie Mellon University

The Board believes that Mr. Chakrabarty's substantial business and leadership experience, previous Board of Director experience, and specific experience within the business process outsourcing industry brings valuable expertise to the Board and assists the Company with its strategic growth initiatives.

Mukesh Sharda; age 49; Managing Partner, Capital Square Partners Management Pte Ltd.

Mr. Sharda is a Managing Partner of CSP and has been on the board of the Company since July 2018. Mr. Sharda was previously on the board of Minacs and Indecomm Corporation. Prior to co-founding CSP, Mr. Sharda was the Executive Director and Country Head for Avenue Capital Group from 2005 to 2012. The Avenue Capital Group, is a multi-strategy investment manager with over US$15 billion under management and had raised a dedicated fund raised to invest in Asia. Mr. Sharda covered investments in South East Asia and India. Prior to joining Avenue Capital Group, Mr. Sharda worked in investment banking (Structured Finance and M&A) from 1997 through 2004 in Singapore and Hong Kong at Deutsche Bank. Mr. Sharda also previously served on the board of directors at National Citizen Bank in Vietnam. Mr. Sharda is a Chartered Accountant from the Institute of Chartered Accountants in India and holds a Bachelor of Commerce degree from Gujarat University, India.

The Board believes that Mr. Sharda's financial expertise and substantial global business experience brings valuable expertise to the Board and assists the Company with its strategic growth initiatives.

Bharat Rao; age 56; Managing Partner, Capital Square Partners Management Pte Ltd.

Mr. Rao is a Managing Partner of CSP and has been serving on the board of ESM, since March 2018 and on the board of Startek since July 2018. Prior to CSP, Mr. Rao was a Managing Director with the investment banking arm of Credit Suisse in Asia from November 2012 to June 2016 and focused on Financial sponsors and structured solutions. Prior to joining Credit Suisse Mr. Rao was a Managing Director and managed client relationships, origination and financial sponsors group for ING Bank in South East Asia from August 2010 to November 2012. Before transitioning to investment banking, Mr. Rao served as the Country Manager (Indonesia) and head of Financials Services for South East Asia for Actis Capital from August 2006 to March 2009. Actis Capital is a leading emerging market focused growth and buyout fund. Prior to this role in private equity, Mr. Rao was a Partner with the Australasian practice of PricewaterhouseCoopers and focused on providing transactions advisory services from February 1999 to July 2006. Mr. Rao holds a Bachelor’s degree with honors in Electrical Engineering from the Indian Institute of Technology and an M.B.A. from the Indian Institute of Management.

The Board believes that Mr. Rao's financial expertise and varied business experience brings valuable expertise to the Board and assists the Company with its strategic growth initiatives.

Jerry Schafer; age 67; Retired

Mr. Schafer brings more than three decades of executive experience overseeing business development efforts, managing operations and leading finance teams for global corporations. Prior to his retirement, Schafer most recently served as the vice president of worldwide development for McDonald’s Corporation, where he was responsible for the company’s global expansion initiatives. Schafer also served as chief operations officer and executive officer of development for McDonald’s China. Prior to McDonald’s, Schafer was the chief financial officer of Chipotle Mexican Grill, where he implemented multiple finance and accounting functions to support company’s early stages of growth. Prior to his CFO role, Schafer led Chipotle’s initial expansion efforts outside the city of Denver, launching 25 new restaurants in three cities. Mr Schafer holds a Bachelor of Arts in accounting from Walsh College. He currently serves on the board of trustees for Walsh College and the board of trustees for the Ronald McDonald House of North Carolina, including locations in the city of Durham and Wake County. Schafer is also a consultant to Salad and Go, a start-up restaurant concept in the Phoenix area.

The Board believes that Mr. Schafer’s experience, background and financial expertise, including extensive accounting experience, as well as operational and development responsibilities for global corporations, allows Mr. Schafer to bring valuable expertise to the Board and assists the Company with its global growth and operational improvement initiatives.

Albert Aboody; age 73; Retired

Mr. Aboody is a retired KPMG -US audit partner with 33 years of experience with public companies. He was also seconded to KPMG India where he led its audit practice and served as Deputy Chairman and as a member of its Advisory Board. Following his retirement, Mr. Aboody joined the Board of WNS Global Services in 2010 as chair of its audit committee until his retirement in 2017. During the period from 2011 to 2015 Mr. Aboody was the Independent Monitor for Price Waterhouse in connection with its compliance with SEC and PCAOB Orders. Mr. Aboody also co-authored the chapter on SEC Reporting Requirements in the 2001- 2008 editions of the Corporate Controller Manual. Mr. Aboody holds a Bachelor’s Degree from Princeton University’s Woodrow Wilson School of Public and International Affairs and did graduate study in philosophy at Cambridge University.

The Board believes that Mr. Aboody’s experience, background and accounting expertise, including extensive involvement with public company accounting, allows Mr. Aboody to bring valuable expertise to the Board.

Julie Schoenfeld; age 63; Vice President, Entrepreneur in Residence California Institute of Technology

Ms. Schoenfeld is a serial entrepreneur who has led four venture-backed startups. Her most recent company, Strobe Inc., (founded in 2014) was acquired by General Motors Cruise Automation in 2017. She has been Vice President at GM Autonomous Vehicle Subsidiary, Cruise Automation. From 2007 to 2014 Julie was CEO of Perfect Market, Inc., a digital publishing software company backed by Trinity Ventures, Idealab and Comcast. Perfect Market was acquired by Taboola in July 2104. Julie also served as CEO and founder for two other venture-backed start-ups. In 1999 she led the sale of Net Effect, Inc., for over $300M to Ask. Ms. Schoenfeld was also Vice President worldwide sales for Stream International from 1995 to 1998. Julie holds a B.S. in engineering from Tufts University and an M.B.A. from Harvard Business School.

The Board believes that Ms. Schoenfeld’s experience, background and financial expertise, including extensive experience founding, developing and managing technology companies, allows Ms. Schoenfeld to bring valuable expertise to the Board and assists the Company with its global growth and operational improvement initiatives. Ms. Schoenfeld’s also serves on the Company’s Compensation Committee.

CORPORATE GOVERNANCE

The Board of Directors

The Board of Directors is comprised of Mr. Aparup Sengupta, Mr. Sanjay Chakrabarty, Mr. Mukesh Sharda, Mr. Bharat Rao, Mr. Albert Aboody, Ms. Julie Schoenfeld and Mr. Jerry Schafer.

During 2020, the Board of Directors held [four] meetings, our Audit Committee met [four] times, our Compensation Committee met [one] time and our Governance and Nominating Committee met [one] time. Each incumbent director attended at least 75% of the meetings of the Board and the committees on which they serve for the period during 2020 when they served as a director. We do not require that our directors attend our annual meetings of stockholders.

The Board has nominated all incumbent directors to stand for re-election to the Board. All of such incumbent directors are being nominated by the Board and the Aegis Stockholder pursuant to the terms and conditions of the Stockholders’ Agreement described above under “Election of Directors”.

Our Board of Directors has determined that each of Mr. Aboody, Ms. Schoenfeld and Mr. Schafer are “independent” under the regulations of the NYSE. None of these directors has any relationship or has been party to any transactions that the Board believes could impair the independent judgment of these directors in considering matters relating to us. As allowed by the “controlled company” exemption from the NYSE Corporate Governance Standards, our Board of Directors is not comprised of a majority of independent directors; four members, Messrs. Sengupta, Chakrabarty, Sharda and Rao, have not been determined by our Board of Directors to be independent directors.

Leadership Structure of our Board

Mr. Sengupta served as our non-executive Chairman from July 2018 following the closing of the Aegis Transactions until his appointment as Global Chief Executive Officer on January 15, 2020. Mr. Sengupta now serves as our executive Chairman. We maintained a leadership structure from 2006 until Mr. Sengupta’s appointment as Global Chief Executive Officer with the non-executive Chairman separate from the Chief Executive Officer, although the Board has no formal policy with respect to the separation of such offices. The independent directors have always and continue to meet regularly without management present.

Our Board of Directors believes that it is the proper responsibility of the Board to determine who should serve as Chairman and/or Chief Executive Officer and whether the offices should be combined or separated. The Board members have considerable experience and knowledge about the challenges and opportunities we face. The Board, therefore, is in the best position to evaluate our current and future needs and to judge how the capabilities of our directors and senior management from time to time can be most effectively organized to meet those needs. The Board believes that the combined offices of the Chairman and Chief Executive Officer currently functions well and is the optimal leadership structure for us going forward. While the Board may separate these offices in the future if it considers such a separation to be in our best interests, it currently intends to retain this structure.

The Board has three standing committees: the Audit Committee, Compensation Committee and Governance and Nominating Committee, as described below. The charters for our Audit Committee, Compensation Committee and Governance and Nominating Committee are available on the Investor Relations - Corporate Governance page on our website at www.startek.com.

Audit Committee

Our Board of Directors has an Audit Committee that assists the Board of Directors in fulfilling its oversight responsibility relating to our financial statements and financial reporting process and our systems of internal accounting and financial controls. The Audit Committee is also responsible for the selection and retention of our independent auditors, reviewing the scope of the audit function of the independent auditors and approving non-audit services provided to us by our auditors, and reviewing audit reports rendered by our independent auditors. The members of the Audit Committee are Mr. Aboody, Chairman, Ms. Schoenfeld, and Mr. Schafer, each of whom is an “independent director” as defined by the New York Stock Exchange’s (“NYSE”) listing standards and is financially literate. Our Board of Directors has determined that Mr. Aboody qualifies as an “audit committee financial expert” under SEC rules.

Compensation Committee

Our Board of Directors also has a Compensation Committee, which reviews our compensation programs and exercises authority with respect to payment of direct salaries and incentive compensation to our executive officers. In addition, the committee is responsible for oversight of our equity incentive plans. The members of the Compensation Committee are Mr. Sharda, Chairman, Mr. Rao and Ms. Schoenfeld. As allowed by the “controlled company” exemption from the NYSE Corporate Governance Standards, our Compensation Committee is not comprised entirely of independent directors; two member, Mr. Rao and Mr. Sharda, have not been determined by our Board of Directors to be independent directors.

Governance and Nominating Committee

The Governance and Nominating Committee of our Board of Directors is responsible for the nomination of candidates for election to our Board, including identification of suitable candidates, and also oversees our corporate governance principles and recommends the form and amount of compensation for directors to the Board for approval. The members of the Governance and Nominating Committee are Mr. Chakrabarty, Chairman, Mr. Aboody and Mr. Sharda. As allowed by the “controlled company” exemption from the NYSE Corporate Governance Standards, our Governance and Nominating Committee does not have to be comprised entirely of independent directors. Notwithstanding the Governance and Nominating Committee, certain of the nominees to our Board of Directors have been nominated by the Aegis Stockholder pursuant to the terms of the Stockholders’ Agreement. See “Election of Directors”.

Director Nominations

The Governance and Nominating Committee does not have an express policy with regard to the consideration of any director candidates recommended by our stockholders because our Bylaws permit any stockholder to nominate director candidates, and the committee believes that it can adequately evaluate any such nominees on a case-by-case basis. The committee will consider director candidates proposed in accordance with the procedures set forth below under “Stockholder Proposals” and will evaluate stockholder-recommended candidates under the same criteria as other candidates (subject in all cases to the terms and conditions of the Stockholders’ Agreement).

Although the committee does not currently have formal minimum criteria for director nominees, it considers a variety of factors such as a nominee’s independence, prior board experience, relevant business and industry experience, leadership experience, ability to attend and prepare for Board and committee meetings, ethical standards and integrity, cultural fit with the Company’s existing Board and management, and how the candidate would add to the diversity in backgrounds and skills of the Board. The Governance and Nominating Committee takes into account diversity considerations in determining our director nominees and believes that, as a group, the nominees bring a diverse range of perspectives to the Board’s deliberations; however, we do not have a formal policy on Board diversity. Any candidate must state in advance his or her willingness and interest in serving on our Board. In identifying prospective director candidates, the Governance and Nominating Committee seeks referrals from other members of the Board, management, stockholders and other sources. The Governance and Nominating Committee also may, but need not, retain a professional search firm in order to assist it in these efforts. The Governance and Nominating Committee utilizes the same criteria for evaluating candidates regardless of the source of the referral. When considering director candidates, the Governance and Nominating Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance the Board’s effectiveness.

Board’s Role in Risk Oversight

The Board of Directors takes an active role in risk oversight of our Company, both as a full Board and through its committees. The agendas for the Board and committee meetings are specifically designed to include an assessment of opportunities and risks inherent in our Company’s strategies and compensation plans. In 2020, at each regularly scheduled Audit Committee meeting, management presented a summary of enterprise risks, mitigation strategies and progress on previously identified risks and mitigation steps. The Audit Committee then determined whether the mitigation activities were sufficient and whether our Company’s overall risk management process or control procedures required modification or enhancement. The objectives for the risk assessment included (i) facilitating the NYSE governance requirement that the Audit Committee discuss policies around risk assessment and risk management; (ii) developing a defined list of key risks to be shared with the Audit Committee, Board and senior management; and (iii) determining whether there are risks that require additional or higher priority mitigation efforts. We plan on continuing this iterative process in 2021.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines, in accordance with applicable rules and regulations of the SEC and NYSE, to govern the responsibilities and requirements of the Board of Directors. A current copy of our Corporate Governance Guidelines is available on the Investor Relations - Corporate Governance page on our website at www.startek.com.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our directors and employees, including our principal executive officer, principal financial officer, and principal accounting officer. The Code of Business Conduct and Ethics is available on the Investor Relations - Corporate Governance page on our website at www.startek.com. We intend to disclose on our website any amendments to or waivers of the code applicable to our directors, principal executive officer, principal financial officer, chief accounting officer, controller, treasurer and other persons performing similar functions within four business days following the date of such amendment or waiver.

Section 16(A) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers and beneficial owners of more than 10% of our outstanding common stock (collectively, “Insiders”) to file reports with the SEC disclosing direct and indirect ownership of our common stock and changes in such ownership. The rules of the SEC require Insiders to provide us with copies of all Section 16(a) reports filed with the SEC. Based solely upon a review of copies of Section 16(a) reports received by us, and written representations that no additional reports were required to be filed with the SEC, we believe that our Insiders have timely filed all Section 16(a) reports during the 2020 fiscal year, except that the following Form 4 filings were made late: (i) filing of each of Bharat Rao, Mukesh Sharda and CSP Management Ltd, reporting transactions that occurred on November 16, 2020; (ii) filing of Aparup Sengupta, reporting transactions that occurred on July 1, 2020; and (iii) filing of CSP Alpha Holdings Parent PTE LTD, reporting transactions that occurred on December 13, 2018 and May 17, 2019.

Available Information

Copies of our key corporate governance documents, including the committee charters, described previously, are available on the Investor Relations - Corporate Governance page on our website at www.startek.com. Any stockholder that wishes to obtain a hard copy of any of these corporate governance documents may do so without charge by writing to: Corporate Secretary, 6200 South Syracuse Way, Suite 485, Greenwood Village, Colorado, 80111.

EXECUTIVE OFFICERS

Current Executive Officers

Set forth below is information regarding our executive officers as of April 1, 2021: [NTD: Update for any officer changes since beginning of year.]

|

Officer Name |

Age |

Position |

Joined StarTek |

|||

|

Aparup Sengupta |

56 |

Global Chief Executive Officer |

2018*† |

|||

|

Vikesh Sureka |

46 |

Chief Financial Officer |

2021 |

|||

|

Surender Mohan Gupta |

55 |

Global Chief People Officer |

2018* |

* Indicates executive officer who joined the Company in connection with the closing of the Aegis Transactions.

† Aparup Sengupta was appointed to serve on the Board of Directors in connection with the closing of the Aegis Transactions, but did not become the Chief Executive Officer of the Company until January 15, 2020. Mr. Sengupta’s biography appears under the heading “Board of Directors”.

Vikesh Sureka, age 46; Global Chief Financial Officer

Mr. Sureka joined Startek in February 2021. Mr. Sureka comes with 25 years of rich and extensive finance experience. He previously served as the Chief Financial Officer at IBS Software (IBS), a SaaS-enabled software solutions company for the travel industry. At IBS, Mr. Sureka was responsible for driving key improvements across multiple finance functions, including accounting, risk management, value creation, strategic planning, financing & fund raising, board reporting and governance, and direct taxation. Before IBS, Mr. Sureka also held finance leadership positions at Wipro Limited and App Labs Technologies (a CSC company).

Surender Mohan (SM) Gupta; age 55; Global Chief People Officer

Mr. Gupta joined StarTek in July 2018. Previously, SM served as Chief People Officer at Aegis, where he joined in 2008. SM brings over 30 years of HR experience across a variety of industries, including IT, ITES, Telecom, Retail, Oil and FMCG. Throughout his career, he has executed innovative, forward-thinking strategies to attract, develop, reward, and retain top talent. Under SM’s leadership, his organization has been instrumental in winning numerous distinct HR awards from industry bodies such as Aon, Great Place to Work, National Award from Govt. of India, NASSCOM, CII, SHRM, People Matters, NCPEDP, Businessworld and BPeSA among others.A distinguished speaker and thought leader at various forums and associations, he is committed to creating a progressive workplace where employees thrive in a culture of empowerment, inclusion, and diversity. SM has also served as board director for Contact Center Company (CCC), the joint venture company of STC and Aegis in Saudi Arabia, and is a governing board member for the National Abilympic Association of India. He is also a member of CII National Committee on Special Abilities and member of IBDN (India Business and Disability Network) for mainstreaming Persons with Disabilities (PwDs) into the workforce. He holds a Bachelor's degree in Science, Master in Business Administration (MBA) from Kurukshetra University and a Doctorate degree (Ph.D.) in Commerce & Management Studies from Andhra University.

Certain Former Executive Officer

Set forth below is information regarding certain persons who were executive officers during a portion of 2020, which resulted in such persons being included below in “Item 11 - Summary Compensation Table”:

Lance Rosenzweig; age 58; Former Global Chief Executive Officer

Mr. Rosenzweig served as our Global Chief Executive Officer from July 2018 to January 15, 2020. From 2015 through 2016, Mr. Rosenzweig was an Operating Executive of Marlin Operations Group, working with Marlin Equity Partners, a global investment firm, where he served as Chairman of the board of Duncan Solutions and GiftCertificates.com and Chairman of the board and interim Chief Executive Officer of Domo Tactical Communications. Mr. Rosenzweig received a B.S. in Industrial Engineering from Northwestern University and an M.B.A. from Northwestern University Kellogg School of Management. Mr. Rosenzweig resigned as a member of the Board of Directors and Chief Executive Officer effective as of January 15, 2020.

Ramesh Kamath; age 63; Former Chief Financial Officer

Mr. Kamath currently serves as our Chief Financial Officer. He previously served as CFO of Aegis Global, which was combined with StarTek on July 20, 2018. At Aegis, Ramesh helped manage more than 40,000 employees, implemented various internal controls, and centralized the company’s treasury management system to improve working capital and cash flow management. Prior to Aegis, he also led the finance organization of prominent BPOs, including serving as CFO of The Minacs Group and Progeon (now Infosys BPO). In February 2021 Mr. Kamath transitioned to a new role as Senior Advisor, M&A and Strategy.

Rajiv Ahuja; age 57; Former President

Mr Ahuja joined Startek in July 2019 and served as our President from March 2020 to April 2021. He previously served as the SVP & Country Manager India, China, Malaysia and Japan at Convergys. Prior to Convergys, Rajiv was associated with Aegis for 12 years in various leadership roles, most recently as President, ASEAN & ANZ. Earlier, Rajiv headed AOL’s captive center in Bangalore, headed Dell's US Consumer Care Division in India and served as the India COO of VCustomer.

COMPENSATION DISCUSSION AND ANALYSIS

As a “smaller reporting company”, the Company has elected to follow the scaled disclosure requirements for smaller reporting companies with respect to the disclosures required by Item 402 of Regulation S-K. Under such scaled disclosure, the Company is not required to provide a Compensation, Discussion and Analysis, Compensation Committee Report and certain other tabular and narrative disclosures relating to executive compensation.

COMPENSATION COMMITTEE REPORT

As a “smaller reporting company”, the Company has elected to follow the scaled disclosure requirements for smaller reporting companies with respect to the disclosures required by Item 402 of Regulation S-K. Under such scaled disclosure, the Company is not required to provide a Compensation, Discussion and Analysis, Compensation Committee Report and certain other tabular and narrative disclosures relating to executive compensation.

COMPENSATION OF EXECUTIVE OFFICERS

The following table sets forth certain information concerning the compensation earned in 2020 and 2019 by each of the individuals who served as Chief Executive Officer, and the next two most highly compensated executive officers, other than the Chief Executive Officer, who were serving as executive officers at the end of 2020 (collectively referred to as the “named executive officers”):

SUMMARY COMPENSATION TABLE

|

Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation |

All Other Compensation ($) (d) |

Total ($) |

|||||||||||||||||||

|

Aparup Sengupta, Global Chief Executive Officer |

(e) |

2020 |

611,375 | — | 337,370 | 605,851 | — | 1,554,596 | ||||||||||||||||||

|

Lance Rosenzweig, Former Global Chief Executive Officer |

2020 |

25,385 | — | — | 1,152,287 | 1,177,672 | ||||||||||||||||||||

|

2019 |

602,308 | 271,233 | — | — | 4,304 | 877,845 | ||||||||||||||||||||

|

Rajiv Ahuja, Former President |

2020 |

432,194 | 110,829 | — | — | 35,010 | 578,033 | |||||||||||||||||||

|

SM Gupta, Global Chief People Officer |

2020 |

281,447 | 46,133 | — | — | 37,569 | 365,149 | |||||||||||||||||||

|

2019 |

270,888 | 51,001 | — | — | 33,764 | 355,653 | ||||||||||||||||||||

|

(a) |

All amounts in this table are presented for the full calendar years that are indicated. |

|

(b) |

The amounts shown in this column reflect the aggregate grant date fair value of stock awards and options granted to each named executive officer during 2020 and 2019, respectively. This does not reflect amounts paid to or realized by the named executive officers. See Note 10 to our consolidated financial statements for the twelve months ended December 31, 2020 for information on the assumptions used in accounting for equity awards. |

|

(c) |

The amounts disclosed under Non-Equity Incentive Plan Compensation reflect payouts under the Company’s annual Executive Incentive Plan. Under the terms of such plan, participants have the option to have their incentive bonus award paid out in stock options or a combination of stock options and/or cash. The election as to form of payout shall be at the time that payouts are certified, which is expected to be complete by the end of the first quarter in 2021. |

|

(d) |

Included in All Other Compensation for 2019 are Provident fund (Mr. Gupta $15,334), premiums for health insurance (Mr. Rosenzweig, $1,719); premiums for group short term disability insurance (Mr. Rosenzweig, $2,585); and paid holiday leave (Mr. Gupta $18,430). Included in All Other Compensation for 2020 are Provident fund (Mr. Ahuja $20,465; Mr. Gupta $13,953); paid holiday leave (Mr. Ajuja $14,545; Mr. Gupta $23,625); and severance payments made to Mr. Rosenzweig upon the termination of his employment with the Company ($1,152,000). |

|

(e) |

Pursuant to the terms of the employment agreement between the Company and Mr. Sengupta, all base compensation paid to Mr. Sengupta was paid in fully vested shares of common stock of the Company. See “Employment Agreements – Aparup Sengupta” for additional information. The transaction bonus paid to Mr. Sengupta in 2020 relating to the closing of the Aegis Transactions is not included in Mr. Sengupta’s compensation, as such bonus was earned during 2018 following the closing of the Aegis Transactions. Mr. Sengupta did not become an executive officer of the Company until his appointment as Chief Executive Officer on January 15, 2020. See “Certain Transactions” below for additional information. |

OUTSTANDING EQUITY AWARDS AT 2020 FISCAL YEAR END

The following table identifies the exercisable and unexercisable option awards for each of the named executive officers as of December 31, 2020.

|

Option Awards |

||||||||||||||||

|

Name |

Grant Date |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

|||||||||||

|

Aparup Sengupta |

1/10/2018 |

4,847 |

- |

6.44 |

1/10/2028 |

|||||||||||

|

2/1/2019 |

5,066 |

- |

6.54 |

2/1/2029 |

||||||||||||

|

1/4/2019 |

4,333 |

- |

8.02 |

1/4/2029 |

||||||||||||

|

1/7/2019 |

4,387 |

- |

8.39 |

1/7/2029 |

||||||||||||

|

10/1/2019 |

5,925 |

- |

6.39 |

10/1/2029 |

||||||||||||

|

2/1/2020 |

4,642 |

- |

8.14 |

2/1/2030 |

||||||||||||

|

1/4/2020 |

11,138 |

- |

3.31 |

1/4/2030 |

||||||||||||

|

1/7/2020 |

68,056 |

281,944 |

5.06 |

1/7/2030 |

(a) |

|||||||||||

|

10/11/2020 |

38,889 |

161,111 |

6.68 |

10/11/2030 |

(a) |

|||||||||||

|

(a) |

Options scheduled to vest in 36 equal monthly installments beginning on July 1, 2020. |

EMPLOYMENT AGREEMENTS

Lance Rosenzweig

In connection with his appointment as President and Global Chief Executive Officer upon closing of the Aegis Transactions, Mr. Rosenzweig entered into a letter agreement that provides an annual base salary of $600,000, a target annual bonus opportunity of 100% of his base salary, and eligibility to participate in the Company’s employee benefit plans on generally the same terms as the Company’s other executives. As an inducement to join the Company, he was also granted an option to purchase 584,000 shares of the Company’s common stock (vesting in quarterly installments over a period of three years). In general, if Mr. Rosenzweig’s employment is terminated by the Company without cause or by him for good reason (as such terms are defined in the letter agreement), he would be entitled to 6 months’ base salary, 50% of the target bonus for the year in which the qualifying termination occurs and reimbursement by the Company of his COBRA premiums for up to 6 months. The Company has the right but not the obligation to extend such payments for up to an additional 12 months, in two 6-month periods, in exchange for continued enforcement of certain restrictive covenants post-termination (with the 50% target bonus substituted for a pro-rated bonus based on actual results). Upon any termination of employment, Mr. Rosenzweig will forfeit all unvested stock option awards except if Mr. Rosenzweig’s employment is terminated by the Company without cause or by him for good reason within 90 days before, or within 12 months after, a change in control of the Company, all outstanding and unvested options shall immediately vest in full on the later of the termination date or the date of the change in control. Mr. Rosenzweig’s employment with the Company is at-will, and his offer letter does not include any specified term.

Mr. Rosenzweig resigned as the President and Chief Executive Officer and as a member of the Board of Directors of the Company, effective as January 15, 2020. In connection with Mr. Rosenzweig’s resignation, the Company entered into a separation agreement with Mr. Rosenzweig, dated January 13, 2020 (the “Separation Agreement”), that provides for post-separation payments that are generally consistent with the post-separation payments that would be provided upon an eligible separation under Mr. Rosenzweig’s letter of employment with the Company. The Separation Agreement provides for (i) cash severance payments equal to six months of Mr. Rosenzweig’s base salary and six months of health care continuation coverage, (ii) a lump-sum payment equal to Mr. Rosenzweig’s actual 2019 annual bonus and (iii) a lump-sum payment equal to 50% of Mr. Rosenzweig’s target annual bonus, in each case subject to execution of a mutual general release of claims between the Company and Mr. Rosenzweig and Mr. Rosenzweig’s compliance with certain restrictive covenants, including non-competition and non-solicitation for 6 months. The Separation Agreement also provides for accelerated vesting of certain of Mr. Rosenzweig’s options to purchase Company common stock, which would have otherwise vested through January 31, 2020.

Aparup Sengupta

Following the resignation of Mr. Rosenzweig, Mr. Sengupta was appointed to the post of Global Chief Executive Officer in addition to his role as Executive Chairman of the Board of Directors pursuant to an Employment Agreement that provides for compensation in four parts. First, in 2020, Mr. Sengupta’s employment agreement provides for $600,000, to be paid in fully vested shares of the Company’s common stock, with subsequent years to be paid in a mix of cash and Company common stock at the election of the Board of Directors. The second component of Mr. Sengupta’s compensation is the grant of an option to purchase 350,000 shares of the Company’s common stock, vesting in 36 equal monthly installments that began on July 1, 2020. The third component is an additional grant of an option to purchase 200,000 shares of the Company’s common stock if the Company’s stock price exceeded $6.00 per share, which options retroactive vest back to July 1, 2020 upon reaching this target stock price. The Company’s stock price reached $6.00 per share on November 10, 2020, and the applicable vested options were granted to Mr. Sengupta at that time. The final component of Mr. Sengupta’s compensation is an annual target bonus opportunity of $600,000. Mr. Sengupta may be removed for events of breach and misconduct (as such terms are defined in Mr. Sengupta’s employment agreement) by the Company that are attributable to Mr. Sengupta, as well as for acts involving moral turpitude, indiscipline, loss of confidence, violation of Company policy, breach of the terms and conditions of Mr. Sengupta’s employment agreement, or for any acts or omissions that may adversely affect the Company. Mr. Sengupta is not entitled to severance upon termination as Global Chief Executive Officer, and he will forfeit any unvested stock options upon termination of his employment. Additionally, any vested stock options will expire 90 days following his tenure on the Board of Directors.

Other Named Executive Officers

We are parties to Employment Agreements with certain of the other named executive officers that provide for the executive’s initial base salary and annual incentive bonus plan, expressed as a percentage of base salary. The Employment Agreements also provide for any initial equity grants.

Each named executive officer’s employment with the Company can be terminated at any time for any reason by the Company or the executive. However, if the executive’s employment is terminated without cause, he will be entitled to receive six or twelve months of his then-current annual base salary payable on the same basis and at the same time as previously paid, commencing on the first regularly scheduled pay date following termination.

The Employment Agreements also provides for non-disclosure by the executives of the Company’s confidential or proprietary information and includes covenants by the executives not to compete with the Company or hire or solicit its employees, suppliers and customers, in each case for a restricted period equal to twelve months following termination of employment.

Acceleration of Equity Awards upon Change of Control

The options that have been granted to each of the named executive officers have been granted under the 2008 Equity Incentive Plan, as amended (“2008 EIP”). Unless otherwise provided in an award agreement, if a change of control (generally defined as a transaction involving a merger or consolidation of the Company or a sale of substantially all of the Company’s assets) occurs, then each outstanding award under the 2008 EIP that is not yet vested will immediately vest with respect to 50% of the shares that were unvested immediately before the change of control. If, in connection with a change of control, the awards under the 2008 EIP were either continued in effect or assumed or replaced by the surviving corporation, and within two years after the change of control, a participant is involuntarily terminated other than for cause (or, for certain awards, termination with good reason), then each such outstanding award will immediately become vested and exercisable in full and will remain exercisable for twenty-four months. In the event that awards will be cancelled because they are not assumed or replaced by the surviving corporation, they will immediately vest.

In connection with the Aegis Transactions, each outstanding award under the 2008 EIP immediately vested with respect to 50% of the shares that were unvested immediately before the Aegis Transactions. For those executives that were terminated within two years after the consummation of the Aegis Transactions, all remaining shares that were unvested immediately following the Aegis Transactions became vested upon the occurrence of the termination event.

COMPENSATION OF DIRECTORS

The following table presents the total compensation for each non-employee director who served as a member of our Board of Directors during 2020. In 2020, we did not pay any other compensation to the members of our Board of Directors.

|

Name |

Stock Awards(a) ($) |

Option Awards(a) ($) |

Total ($) |

|||||||||

|

Albert Aboody |

0 | 90,000 | 90,000 | |||||||||

|

Sanjay Chakrabarty |

0 | 90,000 | 90,000 | |||||||||

|

Bharat Rao |

0 | 90,000 | 90,000 | |||||||||

|

Julie Schoenfeld |

90,000 | 0 | 90,000 | |||||||||

|

Aparup Sengupta |

0 | 90,000 | 90,000 | |||||||||

|

Mukesh Sharda |

0 | 90,000 | 90,000 | |||||||||

|

Jerry Schafer |

0 | 90,000 | 90,000 | |||||||||

|

(a) |

The amounts shown in these columns reflect the aggregate grant date fair value of stock awards and options granted to each director during 2020. This does not reflect amounts paid to or realized by the directors. See Note 10 to our consolidated financial statements for the twelve months ended December 31, 2020 for information on the assumptions used in accounting for equity awards. |

Members of the Board of Directors are compensated entirely with equity awards. At the start of each quarter, members of the Board of Directors, at their option, may elect to receive (1) stock options to purchase shares of common stock with a fair value equivalent to $22,500 (calculated using the Black-Scholes pricing model), (2) common stock with a grant date fair value of $22,500, (3) deferred stock units with a fair value equivalent to $22,500 or (4) any combination of options, stock and deferred stock units. Upon the date of grant, the members of the Board of Directors are immediately vested in the stock options or stock.

As of December 31, 2020, our current non-employee directors had the following outstanding equity awards:

|

Aggregate number of |

Aggregate number of |

|||||||

|

Name |

stock options |

deferred stock units |

||||||

|

Albert Aboody |

48,964 | 0 | ||||||

|

Sanjay Chakrabarty |

58,877 | 0 | ||||||

|

Bharat Rao |

58,877 | 0 | ||||||

|

Julie Schoenfeld |

0 | 33,403 | ||||||

|

Aparup Sengupta |

590,338 | 0 | ||||||

|

Mukesh Sharda |

58,877 | 0 | ||||||

|

Jerry Schafer |

48,964 | 0 | ||||||

CERTAIN TRANSACTIONS

As a “smaller reporting company”, the Company has elected to follow the scaled disclosure requirements for smaller reporting companies with respect to the disclosures required by Item 404 of Regulation S-K. Under such scaled disclosure, the Company is not required to provide information regarding the Company’s policies and procedures for the review, approval or ratification of transactions with related persons.

The Board of Directors

Our Board of Directors has determined that each of Ms. Schoenfeld, Mr. Aboody and Mr. Schafer are “independent” under the regulations of the NYSE. None of these directors has any relationship or has been party to any transactions that the Board believes could impair the independent judgment of these directors in considering matters relating to us. As allowed by the “controlled company” exemption from the NYSE Corporate Governance Standards, our Board of Directors is not comprised of a majority of independent directors; five members, Messrs. Sengupta, Chakrabarty, Sharda, Rao, have not been determined by our Board of Directors to be independent directors.

Transaction Bonus

In 2018, a transaction bonus of $850,000 became payable from CSP Alpha Holdings Pte Ltd (which became an indirect subsidiary of the Company following the completion of the Aegis Transactions) to Mr. Aparup Sengupta (Chairman & Global CEO) for the successful completion of the Aegis Transactions. Such transaction bonus was accrued in the Company’s financial statements for the year ended December 31, 2018 as an “Acquisition related cost”. An amount of $500,000 was paid to Mr. Sengupta during the 2020 fiscal year to Mr. Aparup Sengupta. We anticipate that the remainder of such transaction bonus will be paid to Mr. Sengupta [in 2021], depending on [the available cash flow of the Company in light of its other liabilities, obligations and contingencies].

Stock Purchase Agreement

On June 29, 2020, the Company entered into a Stock Purchase Agreement (the “Purchase Agreement”) with CSP Victory Limited, an exempted company incorporated in the Cayman Islands (“CSP Victory”) to sell 1,540,041 shares of its common stock (the “Shares”) to CSP Victory in a private placement at a price of $4.87 per share for aggregate gross proceeds to the Company of $7,500,000, before offering expenses. CSP Victory is indirectly controlled by the same manager that controls CSP Alpha Holdings Parent Pte Ltd, a Singapore private limited company (which owned approximately 55% of the Company’s outstanding common stock before the transactions contemplated by the Purchase Agreement). The closing of the private placement took place on June 29, 2020.

Management Services Agreement

In connection with the Aegis Transactions, the Aegis Stockholder entered into a Management Services Agreement with Aegis, pursuant to which the Aegis Stockholder provides Aegis with specified services, including:

|

• |

Analysis, evaluation and structuring of potential investments and divestments; |

|

• |

Identification and arrangement of sources of financing; and |

|

• |

Monitoring performance and providing management advice. |

Aegis pays the Aegis Stockholder an annual management fee of $400,000 per year. Aegis also reimburses the Aegis Stockholder for all costs and expenses reasonably incurred by the Aegis Stockholder in connection with the provision of the management services. The Management Services Agreement will continue in effect until the termination of the agreement by mutual agreement of the Aegis Stockholder and Aegis.

Stockholders Agreement

On July 20, 2018, in connection with the consummation of the Aegis Transactions, the Company and the Aegis Stockholder entered into a Stockholders Agreement (the “Stockholders Agreement”), pursuant to which the Company and the Aegis Stockholder agreed to, among other things: (i) certain rights, duties and obligations of the Aegis Stockholder and the Company as a result of the transactions contemplated by the Transaction Agreement and (ii) certain aspects of the management, operation and governance of the Company after consummation of the Aegis Transactions. As a result of the consummation of the Aegis Transactions, the Aegis Stockholder now owns approximately 55% of the common stock of the Company.

The Stockholders Agreement outlines various corporate governance matters including board composition, director nomination rights and committees of the Company’s Board of Directors (the “Board”) after consummation of the Aegis Transactions. It provides that the Board shall consist of nine members comprised initially of (i) five directors (including the chairman), to be designated by the Aegis Stockholder (the “Aegis Stockholder Directors”), (ii) the Company’s chief executive officer, and (iii) three independent directors, reasonably acceptable to the Aegis Stockholder (the “Non-Stockholder Directors”) and that if the Aegis Stockholder does not initially designate all five of the Aegis Stockholder Directors, it shall have the right to fill any vacancy at any time. This Board composition shall continue so long as the Aegis Stockholder or its affiliates own 50% or more of the outstanding shares of the Company’s common stock. If the Aegis Stockholder’s ownership falls below 50%, the Aegis Stockholder shall designate (i) four directors so long as it owns 35% or more, but less than 50%, (ii) three directors, so long as it owns 25% or more, but less than 35%; (iii) two directors, so long as it owns 15% or more, but less than 25%; and (v) one director, so long as it owns 10% or more, but less than 15%. If the Aegis Stockholder ceases to beneficially own the minimum percentage of outstanding shares of the Company’s common stock necessary to nominate the corresponding number of Aegis Stockholder Directors, the Aegis Stockholder shall cause the necessary number of the Aegis Stockholder Directors to offer to resign from the Board, so that the number of the Aegis Stockholder Directors is consistent with the Aegis Stockholder’s ownership percentage.

If the size of the Board is increased or decreased, the Aegis Stockholder shall have the right to designate one or more directors to the Board such that the total number of Aegis Stockholder Directors shall be proportional to the number set forth in the preceding paragraph. In the event of a vacancy on the Board for a Non-Stockholder Director, the Governance and Nominating Committee shall have the sole right to fill such vacancy or designate a person for nomination, such person to be reasonably acceptable to the Aegis Stockholder. In the event of a vacancy on the Board for an Aegis Stockholder Director, the vacancy of which was not caused by the resignation of a director pursuant to the Aegis Stockholder’s change in ownership, the Board is to fill the vacancy with a substitute Aegis Stockholder Director.

The Company shall avail itself of all “controlled company” exceptions to the corporate governance listing rules of the NYSE for so long as the Aegis Stockholder owns more than 50% of the voting power for the election of directors, and thereafter the Company and the Aegis Stockholder shall take all necessary actions to comply with the corporate governance listing rules of the NYSE. The committees of the Board will include an Audit Committee consisting of three Non-Stockholder Directors, as well as a Compensation Committee and a Governance and Nominating Committee, each consisting of three directors, including at least one Non-Stockholder Director. The number of Non-Stockholder Directors on all other committees is required to be proportional to the number of Non-Stockholder Directors on the Board; provided that each such committee shall have at least one Non-Stockholder Director.

Pursuant to the Stockholders Agreement, the Company renounces the expectation of corporate opportunities other than those expressly offered to a Aegis Stockholder Director or their affiliates solely in, and as a direct result of, their capacity as director of the Company. The Aegis Stockholder is required to (and will cause its affiliates to) maintain the confidentiality of and not use or otherwise exploit for its own or any third party’s benefit, any of the Company’s confidential information. To the extent permitted by NYSE rules, and for so long as the Aegis Stockholder owns 50% or more of the Company’s outstanding common stock, the Aegis Stockholder shall have a right to purchase its pro rata portion of any securities the Company may propose to issue apart from any Excluded Securities (as defined in the Stockholders’ Agreement).

The Company agrees to keep accurate books, records and accounts and for so long as the Aegis Stockholder owns 10% or more of the outstanding shares of the Company’s common stock, (a) permit the Aegis Stockholder and its designated representatives reasonable access to the books and records of the Company and to discuss the affairs, finances and condition of the Company with the Company’s officers and (b) provide reasonable access to (i) the Company’s auditors and officers, (ii) copies of all materials provided to the Board, (iii) the Company’s appropriate officers and directors and (iv) operating and capital expenditure budgets and periodic information packages relating to the operations and cash flows of the Company and its subsidiaries.

The Stockholders Agreement also includes provisions regarding registration rights. The Company has agreed that the Aegis Stockholder and any subsidiary of the Aegis Stockholder that holds registrable securities shall have the right to make no more than four demands for the registration of registrable securities then held by such stockholders. The Company has also agreed to provide customary piggyback registration rights to the Aegis Stockholder. The Aegis Stockholder and any subsidiary of the Aegis Stockholder that holds registrable securities may require the Company to file a Form S-3 relating to the offer and sale of registrable securities then held by such stockholders. The Stockholders Agreement requires the Aegis Stockholder and any subsidiary of the Aegis Stockholder that holds registrable securities to enter into customary agreements restricting the sale or distribution of certain company securities to the extent required by the lead managing underwriter(s) with respect to certain underwritten securities offerings in which the Aegis Stockholder or such subsidiary participates.

PROPOSAL 2.

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

General