Form DEF 14A Snowflake Inc. For: Jul 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: | ||||||||

| ☐ | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| ☒ | Definitive Proxy Statement | |||||||

| ☐ | Definitive Additional Materials | |||||||

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |||||||

SNOWFLAKE INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply) | ||||||||

| ☒ | No fee required. | |||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

NOTICE OF ANNUAL

MEETING OF STOCKHOLDERS

MEETING OF STOCKHOLDERS

To Be Held on July 7, 2022

Dear Stockholder:

We are pleased to invite you to virtually attend the 2022 Annual Meeting of Stockholders (including any adjournments, continuations, or postponements thereof, the Annual Meeting) of Snowflake Inc., a Delaware corporation (Snowflake). The Annual Meeting will be held virtually, via live webcast at www.virtualshareholdermeeting.com/SNOW2022 on Thursday, July 7, 2022 at 10:00 a.m., Mountain Time. The virtual format of the Annual Meeting allows us to preserve stockholder access while saving time and money for both us and our stockholders. You will be able to vote and submit questions during the Annual Meeting, and we encourage you to attend online and participate.

The Annual Meeting will be held for the following purposes, which are more fully described in the accompanying materials:

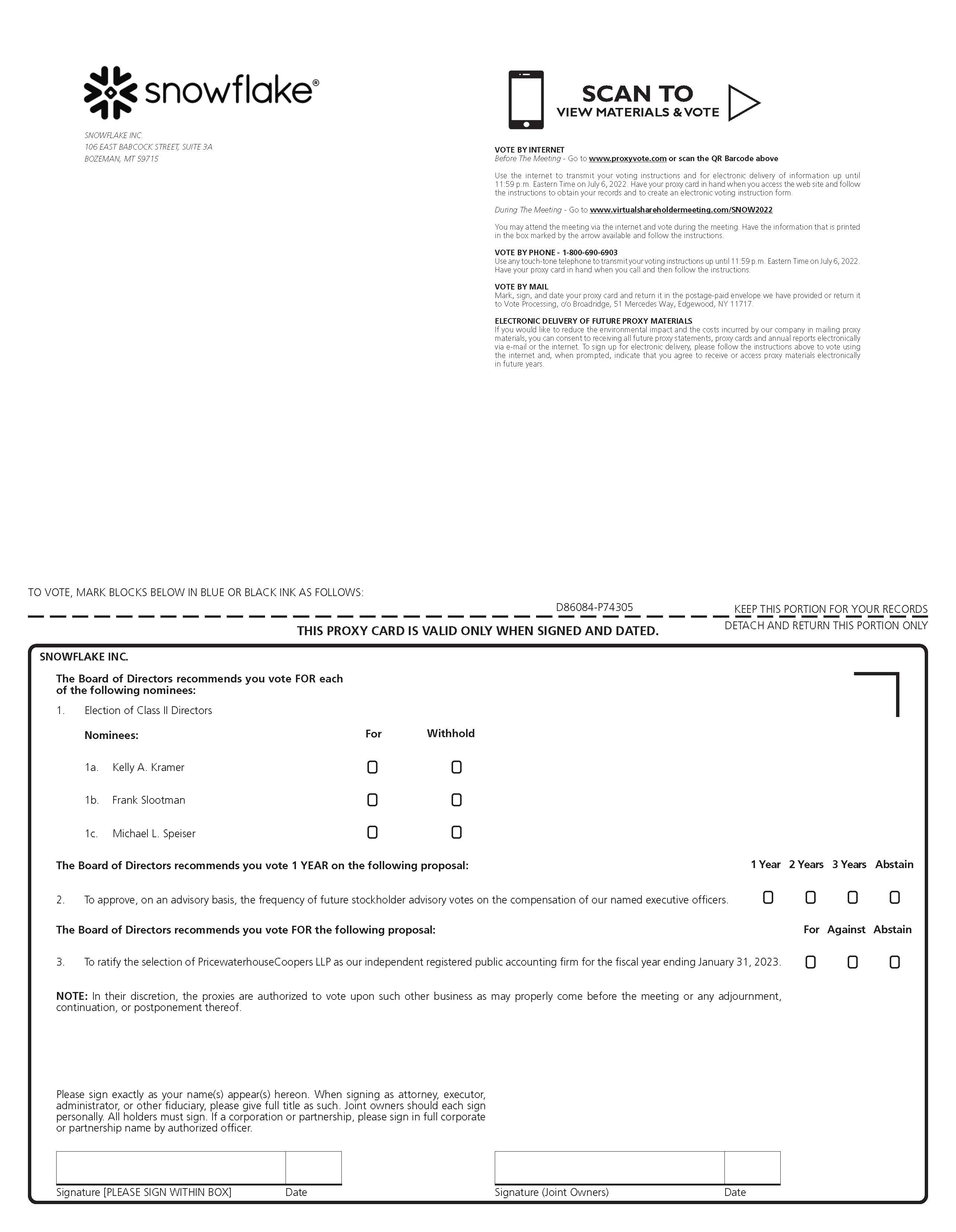

| 1 | To elect three Class II directors, Kelly A. Kramer, Frank Slootman, and Michael L. Speiser, each to hold office until our Annual Meeting of Stockholders in 2025 and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation, or removal; | ||||

| 2 | To conduct a non-binding advisory vote on the frequency of future stockholder advisory votes on the compensation of our named executive officers; | ||||

| 3 | To ratify the selection of PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for the fiscal year ending January 31, 2023; and | ||||

| 4 | To conduct any other business properly brought before the Annual Meeting. | ||||

We have elected to provide internet access to our proxy materials, which include the proxy statement for our Annual Meeting (Proxy Statement) accompanying this notice, in lieu of mailing printed copies. Providing our Annual Meeting materials via the internet reduces the costs associated with our Annual Meeting and lowers our environmental impact, all without negatively affecting our stockholders’ ability to timely access Annual Meeting materials.

On or about May 27, 2022, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (Notice) containing instructions on how to access the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended January 31, 2022 (2022 Annual Report). The Notice provides instructions on how to vote online or by telephone and how to receive a paper copy of proxy materials by mail. The Proxy Statement and our 2022 Annual Report can be accessed directly at the internet address www.proxyvote.com using the control number located on the Notice, on your proxy card, or in the instructions that accompanied your proxy materials.

Our board of directors has fixed the close of business on May 13, 2022 as the record date for the Annual Meeting. Only stockholders of record at the close of business on May 13, 2022 are entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors

Frank Slootman

Chief Executive Officer and Chairman

Your vote is important. Whether or not you plan to virtually attend the Annual Meeting, please ensure that your shares are voted during the Annual Meeting by signing and returning a proxy card or by using our internet or telephonic voting system. Even if you have voted by proxy, you may still vote online if you attend the Annual Meeting. Please note, however, that if your shares are held on your behalf by a brokerage firm, bank, or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that nominee. | ||||||||

OUR ADDRESS Suite 3A, 106 East Babcock Street, Bozeman, Montana 59715 | VIRTUAL MEETING If you held shares of our common stock at the close of business on May 13, 2022, you are invited to virtually attend the Meeting at www.virtualshareholdermeeting.com/SNOW2022 and vote on the proposals described in this Proxy Statement. | |||||||||||||||||||

TABLE OF

CONTENTS

| Page | |||||

PROXY

STATEMENT

For the 2022 Annual Meeting of Stockholders

GENERAL INFORMATION

Our board of directors is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders (including any adjournments, continuations, or postponements thereof, the Annual Meeting) of Snowflake Inc., for the purposes set forth in this proxy statement for our Annual Meeting (Proxy Statement). The Annual Meeting will be held virtually via a live webcast on the internet on July 7, 2022 at 10:00 a.m., Mountain Time. The Notice of Internet Availability of Proxy Materials (Notice) containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended January 31, 2022 (2022 Annual Report) is first being mailed on or about May 27, 2022 to all stockholders entitled to vote at the Annual Meeting. If you held shares of our common stock at the close of business on May 13, 2022, you are invited to virtually attend the Annual Meeting at www.virtualshareholdermeeting.com/SNOW2022 and vote on the proposals described in this Proxy Statement.

In this Proxy Statement, we refer to Snowflake Inc. as “Snowflake,” “we,” “us,” or “our” and the board of directors of Snowflake as “our board of directors.” The 2022 Annual Report accompanies this Proxy Statement. You also may obtain a paper copy of the 2022 Annual Report without charge by following the instructions in the Notice.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this Proxy Statement and references to our website address in this Proxy Statement are inactive textual references only.

DATE & TIME July 7, 2022 10:00a.m. Mountain Time | VIRTUAL MEETING If you held shares of our common stock at the close of business on May 13, 2022, you are invited to virtually attend the Meeting at www.virtualshareholdermeeting.com/SNOW2022 and vote on the proposals described in this Proxy Statement. | |||||||||||||||||||

1 | ||||||||

QUESTIONS AND ANSWERS

WHAT AM I VOTING ON?

| PROPOSAL | BOARD RECOMMENDATION | PAGE REFERENCE | |||||||||

| 1 | Election of three Class II directors, Kelly A. Kramer, Frank Slootman, and Michael L. Speiser, each to hold office until our annual meeting of stockholders in 2025 and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation, or removal. | “FOR” the election of Kelly A. Kramer, Frank Slootman, and Michael L. Speiser as Class II directors. | |||||||||

| 2 | Non-binding advisory vote on the frequency of future stockholder advisory votes on the compensation of our named executive officers. | to hold future stockholder advisory votes on the compensation of our named executive officers every “ONE YEAR.” | |||||||||

| 3 | Ratification of the selection of PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for the fiscal year ending January 31, 2023. | “FOR” the ratification of the selection of PwC as our independent registered public accounting firm for the fiscal year ending January 31, 2023. | |||||||||

WHY DID I RECEIVE A NOTICE REGARDING THE

AVAILABILITY OF PROXY MATERIALS ON THE INTERNET?

AVAILABILITY OF PROXY MATERIALS ON THE INTERNET?

Pursuant to rules adopted by the Securities and Exchange Commission (SEC), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you the Notice because our board of directors is soliciting your proxy to vote at the Annual Meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about May 27, 2022 to all stockholders of record entitled to vote at the Annual Meeting.

WILL I RECEIVE ANY OTHER PROXY MATERIALS BY MAIL?

We may send you a proxy card, along with a second Notice, after ten calendar days have passed since our first mailing of the Notice.

WHO CAN VOTE AT THE ANNUAL MEETING?

Only stockholders of record at the close of business on May 13, 2022 (Record Date) will be entitled to vote at the Annual Meeting. On the Record Date, there were 318,083,513 shares of our common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, at the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote online during the

2 | ||||||||

Annual Meeting or by proxy in advance. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by proxy in advance of the Annual Meeting through the internet, by telephone, or by completing and returning a printed proxy card.

Beneficial Owner: Shares Held on Your Behalf by a Brokerage Firm, Bank, or Other Nominee

If, at the close of business on the Record Date, your shares were held not in your name, but on your behalf by a brokerage firm, bank, or other nominee, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that nominee. Those shares will be reported as being held by the nominee (e.g., your brokerage firm) in the system of record used for identifying stockholders. As a beneficial owner of the shares, you are invited to attend the Annual Meeting, and you have the right to direct your brokerage firm, bank, or other nominee how to vote the shares in your account. Please refer to the voting instructions provided by your broker, bank, or other nominee. Many brokers, banks, or other nominees enable beneficial owners to give voting instructions by telephone or over the internet as well as in writing. You are also welcome to attend the Annual Meeting and vote online during the meeting. However, because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy (sometimes referred to as a “legal proxy”) from your brokerage firm, bank, or other nominee. Follow the instructions from your brokerage firm, bank, or other nominee included with your proxy materials, or contact your brokerage firm, bank, or other nominee to request a proxy form. You may access the meeting and vote by logging in with your control number at www.virtualshareholdermeeting.com/SNOW2022.

WILL A LIST OF RECORD STOCKHOLDERS AS OF THE RECORD DATE BE AVAILABLE?

A list of our stockholders of record as of the close of business on the Record Date will be made available to stockholders online during the Annual Meeting for those that attend. In addition, for the ten days prior to the Annual Meeting, the stockholder list will be available upon request via IR@snowflake.com for examination by any stockholder for any purpose relating to the Annual Meeting.

HOW DO I ATTEND AND ASK QUESTIONS DURING THE ANNUAL MEETING?

We will be hosting the Annual Meeting via live webcast only. You can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/SNOW2022 by logging in with your control number. The meeting will start at 10:00 a.m., Mountain Time, on Thursday, July 7, 2022. We recommend that you log in a few minutes before 10:00 a.m., Mountain Time, to ensure you are logged in when the Annual Meeting starts. The webcast will open 15 minutes before the start of the Annual Meeting. Stockholders attending the Annual Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting.

In order to attend the Annual Meeting, you will need your control number, which is included in the Notice or on your proxy card if you are a stockholder of record. If you are the beneficial owner of your shares, your control number is included with your voting instruction card and voting instructions received from your brokerage firm, bank, or other nominee. Instructions on how to attend and participate are available at www.virtualshareholdermeeting.com/SNOW2022.

If you would like to submit a question during the Annual Meeting, you may log in at www.virtualshareholdermeeting.com/SNOW2022 using your control number, type your question into the “Ask a Question” field, and click “Submit.” To help ensure that we have a productive and efficient meeting, and in fairness to all stockholders in attendance, you will also find posted our rules of conduct for the Annual Meeting when you log in prior to its start. We will answer as many questions submitted in accordance with the rules of conduct as possible in the time allotted for the Annual Meeting. Only questions that are relevant to an agenda item to be voted on by stockholders at the Annual Meeting will be answered.

3 | ||||||||

HOW DO I VOTE?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote (i) online during the Annual Meeting or (ii) in advance of the Annual Meeting by proxy through the internet, by telephone, or by using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the meeting, you may still attend online and vote during the meeting. In such case, your previously submitted proxy will be disregarded. For more information, see the question below titled “Can I change my vote or revoke my proxy after submitting a proxy?”

•To vote in advance of the Annual Meeting (i) through the internet, go to www.proxyvote.com to complete an electronic proxy card, or (ii) by telephone, call 1-800-690-6903. You will be asked to provide the control number from the Notice, proxy card, or instructions that accompanied your proxy materials. Votes over the internet or by telephone must be received by 11:59 p.m., Eastern Time on July 6, 2022 to be counted.

•To vote in advance of the Annual Meeting using a printed proxy card, simply complete, sign, and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

•To vote online during the Annual Meeting, follow the provided instructions to join the Annual Meeting at www.virtualshareholdermeeting.com/SNOW2022, starting at 10:00 a.m., Mountain Time, on Thursday, July 7, 2022. You will need to enter the 16-digit control number located on the Notice, on your proxy card, or in the instructions that accompanied your proxy materials. The webcast will open 15 minutes before the start of the Annual Meeting.

Beneficial Owner: Shares Held on Your Behalf by a Brokerage Firm, Bank, or Other Nominee

If you are a beneficial owner of shares held on your behalf by a brokerage firm, bank, or other nominee, you should have received a Notice containing voting instructions from that nominee rather than from us. To vote online during the Annual Meeting, you must follow the instructions from such nominee.

WHAT IF I HAVE TECHNICAL DIFFICULTIES OR TROUBLE ACCESSING THE ANNUAL MEETING?

We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/SNOW2022.

HOW MANY VOTES DO I HAVE?

On each matter to be voted upon, each holder of shares of our common stock will have one vote per share held as of the close of business on the Record Date.

WHAT IF ANOTHER MATTER IS PROPERLY BROUGHT BEFORE THE ANNUAL MEETING?

Our board of directors does not intend to bring any other matters to be voted on at the Annual Meeting, and currently knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

4 | ||||||||

CAN I VOTE MY SHARES BY FILLING OUT AND RETURNING THE NOTICE?

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by proxy in advance of the Annual Meeting through the internet, by telephone, using a printed proxy card, or online during the Annual Meeting.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE NOTICE?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

CAN I CHANGE MY VOTE OR REVOKE MY PROXY AFTER SUBMITTING A PROXY?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy at any time before the final vote at the Annual Meeting in any one of the following ways:

•Submit another properly completed proxy card with a later date;

•Grant a subsequent proxy by telephone or through the internet;

•Send a timely written notice that you are revoking your proxy to our Secretary via email at generalcounsel@snowflake.com; or

•Attend the Annual Meeting and vote online during the meeting. Simply attending the Annual Meeting will not, by itself, change your vote or revoke your proxy. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions or vote in advance of the Annual Meeting by telephone or through the internet so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you are a beneficial owner and your shares are held in “street name” on your behalf by a brokerage firm, bank, or other nominee, you should follow the instructions provided by that nominee. Your most current proxy card or telephone or internet proxy is the one that will be counted.

IF I AM A STOCKHOLDER OF RECORD AND I DO NOT VOTE, OR IF I RETURN A PROXY CARD

OR OTHERWISE VOTE WITHOUT GIVING SPECIFIC VOTING INSTRUCTIONS, WHAT HAPPENS?

OR OTHERWISE VOTE WITHOUT GIVING SPECIFIC VOTING INSTRUCTIONS, WHAT HAPPENS?

If you are a stockholder of record and do not vote through the internet, by telephone, by completing a proxy card, or online during the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted in accordance with the recommendations of our board of directors:

•“FOR” the election of Kelly A. Kramer, Frank Slootman, and Michael L. Speiser as Class II directors;

•to hold future stockholder advisory votes on the compensation of our named executive officers every “ONE YEAR;” and

•“FOR” the ratification of the selection of PwC as our independent registered public accounting firm for the fiscal year ending January 31, 2023.

If any other matter is properly presented at the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

5 | ||||||||

IF I AM A BENEFICIAL OWNER OF SHARES HELD IN “STREET NAME” AND I DO NOT PROVIDE

MY BROKERAGE FIRM, BANK, OR OTHER NOMINEE WITH VOTING INSTRUCTIONS, WHAT HAPPENS?

MY BROKERAGE FIRM, BANK, OR OTHER NOMINEE WITH VOTING INSTRUCTIONS, WHAT HAPPENS?

If you are a beneficial owner and do not instruct your brokerage firm, bank, or other nominee how to vote your shares, your shares will be considered “uninstructed” and the question of whether your nominee will still be able to vote your shares depends on whether, pursuant to stock exchange rules, the particular proposal is deemed to be a “routine” matter. Brokerage firms, banks, and other nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under applicable rules and interpretations, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as elections of directors (even if not contested), mergers, stockholder proposals, executive compensation, and certain corporate governance proposals, even if management-supported.

Proposals One and Two are considered to be “non-routine,” meaning that your brokerage firm, bank, or other nominee may not vote your shares on those proposals in the absence of your voting instructions, which would result in a “broker non-vote,” and your shares would not be counted as having been voted. Proposal Three is considered to be “routine,” meaning that if you do not return voting instructions to your brokerage firm, bank, or other nominee by its deadline, your shares may be voted on Proposal Three by your brokerage firm, bank, or nominee in its discretion. Please instruct your brokerage firm, bank, or other nominee to ensure that your vote will be counted.

| If you are a beneficial owner of shares held in street name, and you do not plan to attend the Annual Meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your brokerage firm, bank, or other nominee by the deadline provided in the materials you receive from your nominee. | ||||||||

WHAT ARE “BROKER NON-VOTES”?

As discussed above, when a beneficial owner of shares held in “street name” does not give voting instructions to the brokerage firm, bank, or other nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the brokerage firm, bank, or other nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.” Proposals One and Two are considered to be “non-routine” and, therefore, broker non-votes may exist in connection with these proposals.

HOW ARE VOTES COUNTED?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count:

•For the proposal to elect three Class II directors, votes “FOR,” “WITHHOLD,” and broker non-votes;

•For the proposal on the frequency of future stockholder advisory votes on the compensation of our named executive officers, votes “ONE YEAR,” “TWO YEARS,” “THREE YEARS,” and abstentions and broker non-votes; and

•For the proposal to ratify the selection of PwC as our independent registered public accounting firm for the fiscal year ending January 31, 2023, votes “FOR,” “AGAINST,” and abstentions.

6 | ||||||||

HOW MANY VOTES ARE NEEDED TO APPROVE EACH PROPOSAL?

Proposal One

Directors are elected by a plurality vote. “Plurality” means that the three director nominees for Class II who receive the largest number of votes cast “FOR” such nominees will be elected as directors. As a result, any shares not voted “FOR” a particular nominee, whether as a result of a “WITHHOLD” vote or a broker non-vote (in other words, where a brokerage firm has not received voting instructions from the beneficial owner and for which the brokerage firm does not have discretionary power to vote on a particular matter), will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote “FOR” or “WITHHOLD” on each of the nominees for election as a director.

Proposal Two

Approving the frequency of future stockholder advisory votes on the compensation of our named executive officers on a non-binding, advisory basis requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or by proxy during the Annual Meeting and entitled to vote thereon. Abstentions are considered shares present and entitled to vote on this proposal and, thus, will have the same effect as a vote “AGAINST” each of the proposed voting frequencies. Broker non-votes will have no effect on the outcome of this proposal. Because this proposal is an advisory vote, the result will not be binding on our board of directors or our company. Our board of directors and our compensation committee, however, will consider the outcome of the vote when determining how often we should submit to our stockholders an advisory vote to approve the compensation of our named executive officers.

Proposal Three

The ratification of the selection of PwC as our independent registered public accounting firm for the fiscal year ending January 31, 2023 requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or by proxy during the Annual Meeting and entitled to vote thereon to be approved. Abstentions are considered shares present and entitled to vote on this proposal and, thus, will have the same effect as a vote “AGAINST” this proposal. Broker non-votes will have no effect on the outcome of this proposal.

WHAT IS THE QUORUM REQUIREMENT?

A quorum of stockholders is necessary to hold a valid Annual Meeting. A quorum will be present if stockholders holding at least a majority of the voting power of the outstanding shares entitled to vote at the Annual Meeting are present at the Annual Meeting either by virtual attendance or by proxy. On the Record Date, there were 318,083,513 shares of our common stock outstanding and entitled to vote.

Your shares will be counted as present only if you submit a valid proxy (or one is submitted on your behalf by your brokerage, bank, or other nominee) or if you vote online during the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairperson of the Annual Meeting or holders of a majority of the voting power of the shares present at the Annual Meeting may adjourn the Annual Meeting to another date.

HOW CAN I FIND OUT THE RESULTS OF THE VOTING AT THE ANNUAL MEETING?

We expect that preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amendment to the Form 8-K to publish the final results.

7 | ||||||||

WHEN ARE STOCKHOLDER PROPOSALS DUE FOR NEXT YEAR’S ANNUAL MEETING?

Requirements for stockholder proposals to be considered for inclusion in our proxy materials

To be considered for inclusion in next year’s proxy materials, stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (Exchange Act), must be submitted in writing by January 27, 2023, to our Secretary at Suite 3A, 106 East Babcock Street, Bozeman, Montana 59715, Attention: Secretary.

Requirements for stockholder proposals to be brought before the annual meeting

Our amended and restated bylaws provide that, for stockholder proposals that are not to be included in next year’s proxy materials to be considered at an annual meeting, stockholders must give timely advance written notice thereof to our Secretary at Suite 3A, 106 East Babcock Street, Bozeman, Montana 59715, Attention: Secretary. In order to be considered timely, notice of a proposal (including a director nomination) for consideration at the 2023 annual meeting of stockholders that is not to be included in next year’s proxy materials must be received by our Secretary in writing not later than the close of business on April 8, 2023 nor earlier than the close of business on March 9, 2023. However, if our 2023 annual meeting of stockholders is not held between June 7, 2023 and August 6, 2023, the notice must be received (A) not earlier than the close of business on the 120th day prior to the 2023 annual meeting of stockholders, and (B) not later than the close of business on the later of the 90th day prior to the 2023 annual meeting of stockholders or, if later than the 90th day prior to the 2023 annual meeting of stockholders, the 10th day following the day on which public announcement of the date of the 2023 annual meeting is first made. Any such notice to the Secretary must include the information required by our amended and restated bylaws.

In addition to satisfying the foregoing requirements under our amended and restated bylaws, to comply with the universal proxy rules (which will apply to the 2023 annual meeting of stockholders), stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than May 8, 2023.

WHO IS PAYING FOR THIS PROXY SOLICITATION?

We will pay for the cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid additional compensation for soliciting proxies. We may reimburse brokerage firms, banks, and other nominees for the cost of forwarding proxy materials to beneficial owners. If you choose to access the proxy materials and/or vote over the internet, you are responsible for any internet access charges you may incur.

8 | ||||||||

THE BOARD OF DIRECTORS

AND CORPORATE GOVERNANCE

The following table presents, for the Class II nominees for election at the Annual Meeting and our other directors who will continue in office after the Annual Meeting, their ages, independence, and position or office held with us as of April 30, 2022:

| NAME | AGE | INDEPENDENT | TITLE | |||||||||||||||||

Class I directors(1) | ||||||||||||||||||||

| Benoit Dageville | 55 | President of Products and Director | ||||||||||||||||||

Mark S. Garrett(2)(4) | 64 | Director | ||||||||||||||||||

Jayshree V. Ullal(3) | 61 | Director | ||||||||||||||||||

Class II director nominees(1) | ||||||||||||||||||||

Kelly A. Kramer(2) | 54 | Director | ||||||||||||||||||

| Frank Slootman | 63 | Chief Executive Officer and Chairman | ||||||||||||||||||

Michael L. Speiser(3)(4)* | 51 | Director | ||||||||||||||||||

Class III directors(1) | ||||||||||||||||||||

Teresa Briggs(2) | 61 | Director | ||||||||||||||||||

Jeremy Burton | 54 | Director | ||||||||||||||||||

Carl M. Eschenbach(3) | 55 | Director | ||||||||||||||||||

John D. McMahon(3)(4) | 66 | Director | ||||||||||||||||||

* Lead independent director.

(1)Class II director nominees are up for election at the Annual Meeting and will continue in office until the 2025 annual meeting of stockholders. Class I directors will continue in office until the 2024 annual meeting of stockholders. Class III directors will continue in office until the 2023 annual meeting of stockholders.

(2)Member of the audit committee.

(3)Member of the compensation committee.

(4)Member of the nominating and governance committee.

9 | ||||||||

Set forth below is biographical information for the Class II director nominees and each person whose term of office as a director will continue after the Annual Meeting. This includes information regarding each director’s experience, qualifications, attributes, or skills that led our board of directors to recommend them for board service.

NOMINEES FOR ELECTION AT THE ANNUAL MEETING

| KELLY A. KRAMER |  | |||||||

Kelly A. Kramer has served as a member of our board of directors since January 2020. From January 2015 to December 2020, Ms. Kramer served as Executive Vice President and Chief Financial Officer of Cisco Systems, Inc., a worldwide technology company. From January 2012 to January 2015, Ms. Kramer served in various finance roles at Cisco, including Senior Vice President, Corporate Finance and Senior Vice President, Business Technology and Operations Finance. Prior to Cisco, she served in various finance roles at GE Healthcare Systems, GE Healthcare Diagnostic Imaging, and GE Healthcare Biosciences. Ms. Kramer currently serves on the board of directors of Gilead Sciences, Inc. and Coinbase Global, Inc. Ms. Kramer holds a B.S. degree in Mathematics from Purdue University. Ms. Kramer is qualified to serve on our board of directors because of her financial expertise and management experience. | ||||||||

| FRANK SLOOTMAN |  | |||||||

Frank Slootman has served as our Chief Executive Officer and as a member of our board of directors since April 2019 and as Chairman of our board of directors since December 2019. Before joining us, Mr. Slootman served as Chairman of the board of directors of ServiceNow, Inc., an enterprise IT cloud company, from October 2016 to June 2018. From May 2011 to April 2017, Mr. Slootman served as President and Chief Executive Officer and as a member of the board of directors of ServiceNow, Inc. From January 2011 to April 2011, Mr. Slootman served as a Partner of Greylock Partners, a venture capital firm. From July 2009 to January 2011, Mr. Slootman served as President of the Backup Recovery Systems Division at EMC Corporation, a computer data storage company, and as an advisor from January 2011 to February 2012. From July 2003 until its acquisition by EMC in July 2009, Mr. Slootman served as President and Chief Executive Officer of Data Domain Corporation, an electronic storage solution company. Mr. Slootman previously served as a member of the board of directors of Pure Storage, Inc. from May 2014 to February 2020, and Imperva, Inc., from August 2011 to March 2016. Mr. Slootman holds undergraduate and graduate degrees in Economics from the Netherlands School of Economics, Erasmus University Rotterdam. Mr. Slootman is qualified to serve on our board of directors because of his management experience and business expertise, including his prior executive-level leadership and experience scaling companies, as well as his past board service at a number of other publicly traded companies. | ||||||||

10 | ||||||||

| MICHAEL L. SPEISER |  | |||||||

Michael L. Speiser has served as a member of our board of directors since our inception in July 2012, and as our lead independent director since December 2019. Mr. Speiser also served as our Chief Executive Officer and Chief Financial Officer from August 2012 to June 2014. Since 2008, Mr. Speiser has served as a Managing Director at Sutter Hill Ventures, a venture capital firm. Mr. Speiser previously served on the board of directors of Pure Storage, Inc., ending in 2019, and currently serves on the board of several private companies. Mr. Speiser holds a B.A. in Political Science from the University of Arizona and an M.B.A. from Harvard Business School. Mr. Speiser is qualified to serve on our board of directors because of his leadership and operational experience in the technology industry and knowledge of high-growth companies. | ||||||||

DIRECTORS CONTINUING IN OFFICE UNTIL

THE 2023 ANNUAL MEETING OF STOCKHOLDERS

THE 2023 ANNUAL MEETING OF STOCKHOLDERS

| TERESA BRIGGS |  | |||||||

Teresa Briggs has served as a member of our board of directors since December 2019. Ms. Briggs served as Vice Chair & West Region and San Francisco Managing Partner of Deloitte LLP, a global professional services firm, from June 2011 to April 2019, and as Managing Partner, Silicon Valley from June 2006 to June 2011. Ms. Briggs also served on the board of directors of Deloitte USA LLP from January 2016 to March 2019. Ms. Briggs currently serves on the board of directors and the audit committees of ServiceNow, Inc., DocuSign, Inc., and Warby Parker. Ms. Briggs previously served on the board of directors of VG Acquisition Corp. Ms. Briggs also served as an adjunct member of Deloitte’s Center for Board Effectiveness. In 2019, she was a Distinguished Careers Fellow at Stanford University. Ms. Briggs holds a B.S. degree in Accounting from the University of Arizona, Eller College of Management. Ms. Briggs is qualified to serve on our board of directors because of her financial expertise and management experience. | ||||||||

| JEREMY BURTON |  | |||||||

Jeremy Burton has served as a member of our board of directors since March 2016. Since November 2018, Mr. Burton has served as the Chief Executive Officer of Observe, Inc., an information technology and services company. Prior to Observe, Mr. Burton served as Executive Vice President, Marketing & Corporate Development of Dell Technologies, a worldwide technology company, from September 2016 to April 2018, and in various roles at EMC Corporation, including as President of Products from April 2014 to September 2016 and Executive Vice President and Chief Marketing Officer from March 2010 to March 2014. Mr. Burton holds a B.Eng. (Hons) degree in Information Systems Engineering from the University of Surrey. Mr. Burton is qualified to serve on our board of directors because of his operational and marketing expertise. | ||||||||

11 | ||||||||

| CARL M. ESCHENBACH |  | |||||||

Carl M. Eschenbach has served as a member of our board of directors since May 2019. Since April 2016, Mr. Eschenbach has been a managing member at Sequoia Capital Operations, LLC, a venture capital firm. Prior to joining Sequoia Capital, Mr. Eschenbach spent 14 years at VMware, Inc., a global virtual infrastructure software provider, most recently as its President and Chief Operating Officer, a role he held from December 2012 to March 2016. Mr. Eschenbach served as VMware’s Co-President and Chief Operating Officer from April 2012 to December 2012, as Co-President, Customer Operations from January 2011 to April 2012, and as Executive Vice President of Worldwide Field Operations from May 2005 to January 2011. Mr. Eschenbach currently serves on the board of directors of UiPath, Inc., Zoom Video Communications, Inc., Workday, Inc., Palo Alto Networks, Inc., and Aurora Innovation, Inc., as well as several private companies. Mr. Eschenbach holds an Electronics Technician diploma from DeVry University. Mr. Eschenbach is qualified to serve on our board of directors because of his operational and sales experience in the technology industry and knowledge of high-growth companies. | ||||||||

| JOHN D. MCMAHON |  | |||||||

John D. McMahon has served as a member of our board of directors since September 2013. From April 2008 to September 2011, Mr. McMahon served as Senior Vice President, Worldwide Sales and Services at BMC Software, Inc., a computer software company, after BMC’s acquisition of BladeLogic, Inc., a computer software company, where he served as Chief Operating Officer from August 2005 to April 2008. Prior to BladeLogic, Mr. McMahon was Senior VP-Worldwide Sales at Ariba, Inc. Preceding Ariba, Mr. McMahon served as Executive VP-Worldwide Sales at GeoTel Communications, LLC, which was acquired by Cisco Systems, Inc., and earlier as Executive VP-Worldwide Sales at Parametric Technology Corporation. Mr. McMahon serves on the board of directors of MongoDB, Inc., as well as several private companies. Mr. McMahon holds a B.S.E.E. degree in Electrical Engineering from the New Jersey Institute of Technology. Mr. McMahon is qualified to serve on our board of directors because of his software sales experience. | ||||||||

DIRECTORS CONTINUING IN OFFICE UNTIL

THE 2024 ANNUAL MEETING OF STOCKHOLDERS

THE 2024 ANNUAL MEETING OF STOCKHOLDERS

| BENOIT DAGEVILLE |  | |||||||

Benoit Dageville is one of our co-founders and has served as a member of our board of directors since August 2012. Dr. Dageville currently serves as our President of Products, and previously served as our Chief Technology Officer from August 2012 to May 2019. Before our founding, Dr. Dageville served in various engineering roles at Oracle Corporation, a software and technology company, including as Architect in the Manageability Group from January 2002 to July 2012. Dr. Dageville holds B.S., M.S., and Ph.D. degrees in Computer Science from Jussieu University. Dr. Dageville is qualified to serve on our board of directors because of his experience and perspective as one of our co-founders as well as his extensive experience driving product innovation. | ||||||||

12 | ||||||||

| MARK S. GARRETT |  | |||||||

Mark S. Garrett has served as a member of our board of directors since April 2018. Mr. Garrett served as Executive Vice President and Chief Financial Officer of Adobe Systems Incorporated, a global software company, from February 2007 to April 2018. From June 2004 to February 2007, Mr. Garrett served as Senior Vice President and Chief Financial Officer of the Software Group of EMC Corporation, a computer data storage company. Mr. Garrett currently serves on the board of directors of GoDaddy Inc., Cisco Systems, Inc., and NightDragon Acquisition Corp. He previously served on the board of directors of Informatica Corporation, from October 2008 to August 2015, Model N, Inc., from January 2008 to May 2016, and Pure Storage, Inc. from July 2015 to December 2021. Mr. Garrett holds a B.S. degree in Accounting and Marketing from Boston University and an M.B.A. degree from Marist College. Mr. Garrett is qualified to serve on our board of directors because of his financial expertise and management experience. | ||||||||

| JAYSHREE V. ULLAL |  | |||||||

Jayshree V. Ullal has served on our board of directors since June 2020. Since October 2008, Ms. Ullal has served as President, Chief Executive Officer, and director of Arista Networks, Inc., a cloud networking company. From September 1993 to May 2008, Ms. Ullal served in various positions at Cisco Systems, Inc., a worldwide technology company, with her last position as senior vice president of the data center, switching and services group. Ms. Ullal holds a B.S. degree in Engineering (Electrical) from San Francisco State University and an M.S. degree in Engineering Management from Santa Clara University. She is a 2013 recipient of the Santa Clara University School of Engineering Distinguished Engineering Alumni Award. Ms. Ullal is qualified to serve on our board of directors because of her extensive experience as a senior executive and chief executive officer in the cloud computing industry. | ||||||||

INDEPENDENCE OF OUR BOARD OF DIRECTORS

Our Class A common stock is listed on the New York Stock Exchange (NYSE). Under the listing standards of the NYSE, independent directors must comprise a majority of a listed company's board of directors. In addition, the listing standards of the NYSE require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and governance committees be independent. Under the listing standards of the NYSE, a director will only qualify as an “independent director” if the listed company’s board of directors affirmatively determines that the director does not have a material relationship with the company (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the company) that, in the opinion of the listed company’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Exchange Act and the listing standards of the NYSE. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the listing standards of the NYSE.

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment, and affiliations, our board of directors has affirmatively determined that each of our directors, other than Mr. Burton, Mr. Slootman, and Dr. Dageville, is “independent” as that term is defined under the listing standards of the NYSE and the applicable rules and regulations of the SEC. In making these affirmative determinations, our board of directors

13 | ||||||||

considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Transactions with Related Persons.”

BOARD LEADERSHIP

Our nominating and governance committee periodically considers the leadership structure of our board of directors and makes such recommendations to our board of directors as our nominating and governance committee deems appropriate. Our corporate governance guidelines also provide that, when the positions of chairperson and chief executive officer are held by the same person, the independent members of our board of directors may designate a “lead independent director.”

Currently, our board of directors believes that it is in the best interests of our company and our stockholders for our Chief Executive Officer, Mr. Slootman, to serve as both Chief Executive Officer and Chairman given his knowledge of our company and industry and his strategic vision. Because Mr. Slootman has served and continues to serve in both these roles, and in accordance with our corporate governance guidelines, our board of directors has appointed a lead independent director, Michael L. Speiser. As lead independent director, Mr. Speiser provides leadership to our board of directors if circumstances arise in which the role of Chief Executive Officer and Chairman of our board of directors may be, or may be perceived to be, in conflict, and performs such additional duties as our board of directors may otherwise determine and delegate, including, among other things, (i) presiding at meetings of our board of directors at which the Chairman is not present, (ii) convening meetings of the independent members of our board of directors, and (iii) serving as liaison between our Chairman and our independent directors. Our board of directors believes that its independence and oversight of management is maintained effectively through this leadership structure, the composition of our board of directors, and sound corporate governance policies and practices.

ROLE OF THE BOARD IN RISK OVERSIGHT

Our board of directors oversees our risk management processes, which are designed to support the achievement of organizational objectives, improve long-term organizational performance, and enhance stockholder value while mitigating and managing identified risks. A fundamental part of our approach to risk management is not only understanding the most significant risks we face as a company and the necessary steps to manage those risks, but also deciding what level of risk is appropriate for our company. Our board of directors plays an integral role in guiding management’s risk tolerance and determining an appropriate level of risk.

While our full board of directors has overall responsibility for evaluating key business risks, its committees monitor and report to our board of directors on certain risks. Our audit committee monitors our major financial, reporting, and cybersecurity risks, and the steps our management has taken to identify and control these exposures, including by reviewing and setting guidelines, internal controls, and policies that govern the process by which risk assessment and management is undertaken. Our audit committee also monitors compliance with legal and regulatory requirements, and directly supervises our internal audit function. Our compensation committee assesses and monitors whether any of our compensation policies and programs have the potential to encourage excessive risk-taking, and also plans for leadership succession. Our nominating and governance committee oversees risks associated with director independence and the composition and organization of our board of directors, monitors the effectiveness of our corporate governance guidelines, and provides general oversight of our other corporate governance policies and practices.

In connection with its reviews of the operations of our business, our full board of directors addresses holistically the primary risks associated with our business, as well as the key risk areas monitored by its committees, including cybersecurity risks. Our board of directors appreciates the evolving nature of our business and industry and is actively involved in monitoring new threats and risks as they emerge. In particular, our board of directors is committed to the prevention, timely detection, and mitigation of the effects of cybersecurity threats or incidents.

At periodic meetings of our board of directors and its committees, management reports to and seeks guidance from our board and its committees with respect to the most significant risks that could affect our business, such as legal risks, competition risks, cybersecurity and privacy risks, and financial, tax, and audit-related risks. In addition, among other matters, management provides our audit committee periodic reports on our compliance programs and investment policy and practices.

14 | ||||||||

BOARD MEETINGS AND COMMITTEES

Our board of directors is responsible for the oversight of management and the strategy of our company and for establishing corporate policies. Our board of directors meets periodically during the year to review significant developments affecting us and to act on matters requiring the approval of our board of directors. Our board of directors met five times during our last fiscal year. Our board of directors has established an audit committee, a compensation committee, and a nominating and governance committee. The audit committee met seven times during our last fiscal year. The compensation committee met four times during our last fiscal year. The nominating and governance committee met four times during our last fiscal year. During our last fiscal year, each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she had been a director and (ii) the total number of meetings held by all committees of our board of directors on which he or she served during the periods that he or she served. We encourage our directors and nominees for director to attend our Annual Meeting. Six of our then-current directors attended our 2021 annual meeting of stockholders.

As required under applicable NYSE listing standards, our non-management directors met four times during our last fiscal year in regularly scheduled executive sessions at which only non-management directors were present. Mr. Speiser, our lead independent director, presided over these executive sessions.

The composition and responsibilities of each of the standing committees of our board of directors are described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors. Our board of directors may establish other committees as it deems necessary or appropriate from time to time.

15 | ||||||||

Audit Committee

| MEMBERS: TERESA BRIGGS, KELLY A. KRAMER, AND MARK S. GARRETT (CHAIR) |  | |||||||||||||||||||

RESPONSIBILITIES The principal duties and responsibilities of our audit committee include, among other things: •selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; •helping to ensure the independence and performance of the independent registered public accounting firm; •helping to maintain and foster an open avenue of communication between management and the independent registered public accounting firm; •discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accounting firm, our interim and year-end operating results; •developing and overseeing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; •helping to oversee legal and regulatory compliance; •reviewing our policies on risk assessment and risk management, including information security policies and practices; •overseeing the organization and performance of our internal audit function; •establishing our investment policy to govern our cash investment program; •reviewing related party transactions; •obtaining and reviewing a report by the independent registered public accounting firm at least annually that describes its internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and •approving (or, as permitted, pre-approving) all audit and all permissible non-audit services to be performed by the independent registered public accounting firm. | ||||||||||||||||||||

QUALIFICATIONS Our board of directors has determined that each of our audit committee members satisfies the independence requirements under the NYSE listing standards and Rule 10A-3(b)(1) of the Exchange Act. Each member of our audit committee can read and understand fundamental financial statements in accordance with applicable requirements, and our board of directors has determined that each of Ms. Briggs, Mr. Garrett, and Ms. Kramer is an “audit committee financial expert” within the meaning of SEC regulations. | ||||||||||||||||||||

Our board of directors has determined that the simultaneous service by Ms. Briggs and Mr. Garrett on the audit committee of more than three public companies does not impair her or his ability to effectively serve on our audit committee. In arriving at these determinations, our board of directors has examined each audit committee member’s scope of experience, the time commitment associated with service on other audit committees, and other relevant factors. Our audit committee operates under a written charter that satisfies the applicable listing standards of the NYSE and is available to stockholders on our website at www.investors.snowflake.com.

16 | ||||||||

Compensation Committee

| MEMBERS: CARL M. ESCHENBACH, JOHN D. MCMAHON, MICHAEL L. SPEISER, AND JAYSHREE V. ULLAL (CHAIR) |  | |||||||||||||||||||

RESPONSIBILITIES The principal duties and responsibilities of our compensation committee include, among other things: •approving the retention of compensation consultants and outside service providers and advisors to the committee; •reviewing and approving, or recommending that our board of directors approve, the compensation, individual and corporate performance goals and objectives and other terms of employment of our executive officers, including evaluating the performance of our Chief Executive Officer and, with his assistance, that of our other executive officers; •reviewing and recommending to our board of directors the compensation of our directors; •administering our equity and non-equity incentive plans; •reviewing our practices and policies of employee compensation as they relate to risk management and risk-taking incentives; •reviewing and evaluating succession plans for our executive officers and making recommendations to our board of directors with respect to the selection of appropriate individuals to succeed these positions; •preparing the compensation committee report required to be included in our proxy statement under the rules and regulations of the SEC; •reviewing and approving, or recommending that our board of directors approve, incentive compensation and equity plans; and •reviewing and establishing general policies relating to compensation and benefits of our employees and reviewing our overall compensation philosophy. | ||||||||||||||||||||

QUALIFICATIONS Our board of directors has determined that each of our compensation committee members is independent under NYSE listing standards. The compensation committee has a compensation subcommittee, consisting of Mr. Eschenbach, Ms. Ullal, and Mr. McMahon, to which our board of directors has delegated the responsibility for approving transactions between us and our officers and directors that are within the scope of Rule 16b-3 promulgated under the Exchange Act. | ||||||||||||||||||||

Each of Mr. Eschenbach, Ms. Ullal, and Mr. McMahon is a “non-employee director” as defined in Rule 16b-3 under the Exchange Act.

Our compensation committee operates under a written charter that satisfies the applicable listing standards of the NYSE and is available to stockholders on our website at www.investors.snowflake.com.

17 | ||||||||

PROCESSES AND PROCEDURES FOR COMPENSATION DECISIONS

Our compensation committee is primarily responsible for establishing and reviewing our overall compensation strategy. In addition, our compensation committee oversees our compensation and benefit plans and policies, administers our equity incentive plans, and reviews and approves all compensation decisions relating to our executive officers, including our Chief Executive Officer. Our compensation committee considers recommendations from our Chief Executive Officer regarding the compensation of our executive officers other than himself.

In connection with our initial public offering (IPO), our compensation committee adopted an Equity Award Policy, pursuant to which it delegated authority to our Chief Executive Officer, in his capacity as a member of our board of directors, to grant, without any further action required by our board of directors or compensation committee, certain stock options, restricted stock units, and other equity incentive awards to our employees and other service providers who are neither executive officers nor certain other members of management. As part of its oversight function, our compensation committee reviews on a quarterly basis the grants awarded under the Equity Award Policy. The delegation of authority under the Equity Award Policy is not exclusive, and both our board of directors and our compensation committee retain the right to grant equity awards.

Under its charter, our compensation committee has the right to retain or obtain the advice of compensation consultants, independent legal counsel, and other advisers. For the fiscal year ended January 31, 2022 and for prior fiscal years, our compensation committee retained Compensia, Inc. (Compensia), a compensation consulting firm with compensation expertise relating to technology companies, to provide it with market information, analysis, and other advice relating to executive compensation on an ongoing basis. Compensia was engaged directly by our compensation committee to, among other things, assist in developing an appropriate group of peer companies to help us determine the appropriate level of overall compensation for our executive officers and non-employee directors, as well as to assess each separate element of executive officer and non-employee director compensation, with a goal of ensuring that the compensation we offer to our executive officers and non-employee directors is competitive, fair, and appropriately structured. Compensia does not provide any non-compensation related services to us, and maintains a policy that is specifically designed to prevent any conflicts of interest. In addition, our compensation committee has assessed the independence of Compensia, taking into account, among other things, the factors set forth in Exchange Act Rule 10C-1 and the listing standards of the NYSE, and concluded that no conflict of interest exists with respect to the work that Compensia performs for our compensation committee.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the compensation committee are currently, or have been at any time, one of our officers or employees, except Michael L. Speiser who served as our Chief Executive Officer and Chief Financial Officer from August 2012 to June 2014. None of our executive officers currently serve, or have served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

18 | ||||||||

Nominating and Governance Committee

| MEMBERS: MARK S. GARRETT, JOHN D. MCMAHON, AND MICHAEL L. SPEISER (CHAIR) |  | |||||||||||||||||||

RESPONSIBILITIES The nominating and governance committee’s responsibilities include, among other things: •identifying, evaluating, and recommending that our board of directors approve, nominees for election to our board of directors and its committees; •approving the retention of director search firms; •evaluating the performance of our board of directors, committees of our board of directors, and of individual directors; •considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees; and •evaluating the adequacy of our corporate governance practices and reporting. | ||||||||||||||||||||

QUALIFICATIONS Our board of directors has determined that each member of the nominating and governance committee is independent under the NYSE listing standards. | ||||||||||||||||||||

Due to Snowflake's commercial relationship with Observe, Inc., of which Mr. Burton is the Chief Executive Officer, Mr. Burton was no longer considered an independent director under NYSE listing standards effective as of February 1, 2022. In August 2021, our board of directors (i) accepted Mr. Burton's resignation as a member of the nominating and governance committee and (ii) appointed Mr. McMahon as a member of the nominating and governance committee.

Our nominating and governance committee operates under a written charter that satisfies the applicable listing standards of the NYSE and is available to stockholders on our website at www.investors.snowflake.com.

NOMINATION TO THE BOARD OF DIRECTORS

Candidates for nomination to our board of directors are selected by our board of directors based on the recommendation of the nominating and governance committee in accordance with the committee’s charter, our policies, our amended and restated certificate of incorporation and amended and restated bylaws, our corporate governance guidelines, and the requirements of applicable law. In recommending candidates for nomination, the nominating and governance committee considers candidates recommended by directors, officers, and employees, as well as candidates that are properly submitted by stockholders in accordance with our policies and amended and restated bylaws, using the same criteria to evaluate all such candidates.

A stockholder that wishes to recommend a candidate for election to the board of directors may send a letter directed to our Secretary at Suite 3A, 106 East Babcock Street, Bozeman, Montana 59715. The letter must include, among other things, the candidate's name, business and residence address, biographical data, and the number of Snowflake shares held by the nominee. Additional information regarding the process and required information to properly and timely submit stockholder nominations for candidates for membership on our board of directors is set forth in our amended and restated bylaws and corporate governance guidelines.

Evaluations of candidates generally involve a review of background materials, internal discussions, and interviews with selected candidates as appropriate and, in addition, the nominating and governance committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

19 | ||||||||

DIRECTOR QUALIFICATIONS

In addition to the qualifications, qualities, and skills that are necessary to meet U.S. state and federal legal, regulatory and NYSE listing requirements and the provisions of our amended and restated certificate of incorporation, amended and restated bylaws, corporate governance guidelines, and charters of the board committees, our board of directors will consider the following factors in considering director candidates: (i) relevant expertise to offer advice and guidance to management, (ii) sufficient time to devote to Snowflake’s affairs, (iii) excellence in his or her field, (iv) the ability to exercise sound business judgment, (v) diversity of background and experience, and (vi) commitment to rigorously represent the long-term interests of Snowflake’s stockholders.

When considering nominees, our board of directors and nominating and governance committee may take into consideration other factors including, but not limited to, the current composition of our board of directors, Snowflake’s current operating requirements, the candidates’ character, integrity, judgment, independence, areas of expertise, corporate experience, length of service, and potential conflicts of interest, the candidates’ other commitments, and the long-term interests of our stockholders. Our board of directors and nominating and governance committee evaluates the foregoing factors, among others, and does not assign any particular weighting or priority to any of the factors.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Stockholders or interested parties who wish to communicate with our board of directors or with an individual director may do so by mail to our board of directors or the individual director, care of our Secretary at Suite 3A, 106 East Babcock Street, Bozeman, Montana 59715. In accordance with our corporate governance guidelines, our General Counsel or legal department, in consultation with appropriate directors as deemed necessary by the General Counsel, will review all incoming stockholder communications (except for mass mailings, product complaints or inquiries, job inquiries, business solicitations, and patently offensive or otherwise inappropriate material) and, if appropriate, will route such communications to the appropriate director(s) or, if none is specified, to the chairperson of the board of directors or the lead independent director.

CORPORATE GOVERNANCE GUIDELINES

Our board of directors has adopted corporate governance guidelines to ensure that our board of directors has the necessary practices in place to review and evaluate Snowflake’s business operations and make decisions that are independent of our management. The corporate governance guidelines set forth the practices our board of directors follows with respect to board composition and selection, board meetings and involvement of senior management, executive officer performance evaluation and succession planning, board compensation, director education, and conflicts of interest. The corporate governance guidelines, as well as the charters for each committee of our board of directors, are posted on our website at www.investors.snowflake.com.

GLOBAL CODE OF CONDUCT AND ETHICS

We have adopted a Global Code of Conduct and Ethics that applies to all our employees, officers, contractors, and directors, including our principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions. The full text of our Global Code of Conduct and Ethics is posted on our website at www.investors.snowflake.com. We intend to disclose on our website any future amendments of our Global Code of Conduct and Ethics or waivers that exempt any principal executive officer, principal financial officer, principal accounting officer or controller, persons performing similar functions, or our directors from provisions in the Global Code of Conduct and Ethics. Information contained on, or that can be accessed through, our website is not incorporated by reference into this Proxy Statement, and you should not consider information on our website to be part of this Proxy Statement.

20 | ||||||||

PROHIBITION ON HEDGING, SHORT SALES, AND PLEDGING

Our board of directors has adopted an insider trading policy that applies to all of our employees, officers, contractors, and directors. This policy prohibits hedging or monetization transactions with respect to our common stock, including through the use of financial instruments such as prepaid variable forwards, equity swaps, and collars. In addition, our insider trading policy prohibits trading in derivative securities related to our common stock, which include publicly traded call and put options, engaging in short selling of our common stock, purchasing our common stock on margin or holding it in a margin account, and pledging our shares as collateral for a loan.

21 | ||||||||

DIRECTOR

COMPENSATION

The following table presents information regarding compensation earned by or paid to our directors for the fiscal year ended January 31, 2022, other than Frank Slootman, our Chief Executive Officer and Chairman, and Benoit Dageville, our President of Products, each of whom is also a member of our board of directors but did not receive any additional compensation for service as a director. The compensation of Mr. Slootman and Dr. Dageville as named executive officers is set forth below under “Executive Compensation—Fiscal Year 2022 Summary Compensation.”

| NAME | FEES EARNED OR PAID IN CASH ($) | STOCK AWARDS ($)(1) | TOTAL ($)(2) | ||||||||||||||||||||

Teresa Briggs | 40,000 | 306,367 | 346,367 | ||||||||||||||||||||

| Jeremy Burton | 32,261 | 306,367 | 338,628 | ||||||||||||||||||||

Carl M. Eschenbach | 36,000 | 306,367 | 342,367 | ||||||||||||||||||||

Mark S. Garrett | 54,000 | 306,367 | 360,367 | ||||||||||||||||||||

Kelly A. Kramer | 40,000 | 306,367 | 346,367 | ||||||||||||||||||||

John D. McMahon | 37,739 | 306,367 | 344,106 | ||||||||||||||||||||

Michael L. Speiser | 58,500 | 306,367 | 364,867 | ||||||||||||||||||||

Jayshree V. Ullal | 43,500 | 306,367 | 349,867 | ||||||||||||||||||||

(1)The amounts reported represent the aggregate grant date fair value of the Restricted Stock Units (RSUs) awarded under our 2020 Equity Incentive Plan (2020 Plan) to our non-employee directors in accordance with our non-employee director compensation policy, calculated in accordance with FASB ASC Topic 718. Such grant date fair value does not take into account any estimated forfeitures related to service-vesting conditions. These amounts do not necessarily correspond to the actual value recognized or that may be recognized by the directors.

(2)The following table presents the aggregate number of shares of our common stock underlying outstanding stock options and RSUs held by our non-employee directors as of January 31, 2022:

22 | ||||||||

| NAME | NUMBER OF SHARES UNDERLYING STOCK OPTIONS (#) | NUMBER OF SHARES UNDERLYING RSUs (#) | |||||||||||||||

Teresa Briggs | 30,000(1) | 1,224 | |||||||||||||||

| Jeremy Burton | 36,459 | 1,224 | |||||||||||||||

Carl M. Eschenbach | — | 1,224 | |||||||||||||||

Mark S. Garrett | 567,000 | 1,224 | |||||||||||||||

Kelly A. Kramer | 50,000 | 1,224 | |||||||||||||||

John D. McMahon | 560,296 | 1,224 | |||||||||||||||

Michael L. Speiser | — | 1,224 | |||||||||||||||

Jayshree V. Ullal | 50,000 | 1,224 | |||||||||||||||

(1)Held by The Teresa Briggs Trust, of which Ms. Briggs is a trustee.

NON-EMPLOYEE DIRECTOR COMPENSATION

We have adopted a Non-Employee Director Compensation Policy, pursuant to which our non-employee directors receive the following compensation.

EQUITY COMPENSATION

Each new non-employee director who joins our board of directors will automatically receive an RSU award for common stock having a value of $500,000 based on the average fair market value of the underlying common stock for the 20 trading days prior to and ending on the date of grant (Initial RSU Award). Each Initial RSU Award will vest over three years, with one-third of the Initial RSU Award vesting on the first, second, and third anniversary of the date of grant. Subject to any limitations provided in the 2020 Plan, our board of directors may (i) increase the value of the Initial RSU Award as it deems necessary or appropriate in order to attract a new non-employee director, and/or (ii) grant an equity award under the 2020 Plan that is in addition to the Initial RSU Award to a non-employee director on appointment, subject to the terms the board of directors deems appropriate.

On the date of each annual meeting of our stockholders, each person who is then a non-employee director will automatically receive an RSU award for common stock having a value of $300,000 based on the average fair market value of the underlying common stock for the 20 trading days prior to and ending on the date of grant (Annual RSU Award); provided, that, for a non-employee director who was appointed to the board less than 365 days prior to the annual meeting of our stockholders, the $300,000 will be pro-rated based on the number of days from the date of appointment until such annual meeting. Each Annual RSU Award will vest on the earlier of (i) the date of the following year’s annual meeting of our stockholders (or the date immediately prior to the next annual meeting of our stockholders if the non-employee director’s service as a director ends at such meeting due to the director’s failure to be re-elected or the director not standing for re-election); or (ii) the first anniversary of the date of grant.

23 | ||||||||

All outstanding awards held by each non-employee director who is in service as of immediately prior to a “Corporate Transaction” (as defined in the Non-Employee Director Compensation Policy) will become fully vested as of immediately prior to the closing of such Corporate Transaction.

CASH COMPENSATION

In addition, each non-employee director is entitled to receive the following cash compensation for services on our board of directors and its committees as follows:

•$30,000 (increased to $33,000 effective May 1, 2022) annual cash retainer for service as a board member and an additional annual cash retainer of $15,000 (increased to $20,000 effective May 1, 2022) for service as lead independent director of our board of directors, if any;

•$10,000 annual cash retainer for service as a member of the audit committee and $20,000 (increased to $21,000 effective May 1, 2022) annual cash retainer for service as chair of the audit committee (in lieu of the committee member service retainer);

•$6,000 annual cash retainer for service as a member of the compensation committee and $13,500 (increased to $15,000 effective May 1, 2022) annual cash retainer for service as chair of the compensation committee (in lieu of the committee member service retainer); and

•$4,000 annual cash retainer for service as a member of the nominating and governance committee and $7,500 (increased to $9,000 effective May 1, 2022) annual cash retainer for service as chair of the nominating and governance committee (in lieu of the committee member service retainer).

The annual cash compensation amounts are payable in equal quarterly installments, in arrears following the end of each quarter in which the service occurred, pro-rated for any partial quarters.

EXPENSES

We will reimburse each eligible non-employee director for ordinary, necessary, and reasonable out-of-pocket travel expenses to cover in-person attendance at meetings of our board of directors and any committee of the board. Our directors are also encouraged and provided with opportunities to participate in educational programs that would assist them in discharging their duties as a member of our board of directors. Pursuant to our corporate governance guidelines, we will reimburse each of our non-employee directors up to $10,000 each fiscal year in connection with their participation in such programs.

STOCK OWNERSHIP GUIDELINES

In an effort to align our directors’ and executive officers’ interests with those of our stockholders, we have adopted stock ownership guidelines. Within five years of becoming subject to the guidelines, our non-employee directors are expected to hold Snowflake stock valued at not less than five times their total annual cash retainer for board and committee service. Within five years of becoming subject to the guidelines, our executive officers are expected to hold Snowflake stock valued at not less than a multiple of their annual base salaries, consisting of five times annual base salary for our Chief Executive Officer and Chief Financial Officer, and two times annual base salary for our other executive officers. Stock ownership for purposes of the stock ownership guidelines include the following: (i) shares of stock owned directly, (ii) shares underlying vested, “in-the-money” stock options to purchase shares of common stock, and (iii) shares of common stock beneficially owned indirectly. Stock ownership will not include shares underlying unvested stock options, restricted stock units, or unvested shares of common stock issued upon early exercise of stock options.