Form DEF 14A SentinelOne, Inc. For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

SENTINELONE, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

SentinelOne, Inc.

Notice of 2022 Annual Meeting of Stockholders

To be held at 9:00 a.m. Pacific Time on Thursday, June 30, 2022

To Stockholders of SentinelOne, Inc.:

We are pleased to invite you to attend the virtual annual meeting of stockholders (the “Annual Meeting”) of SentinelOne, Inc., a Delaware corporation, to be held on Thursday, June 30, 2022 at 9:00 a.m., Pacific Time. The Annual Meeting will be a virtual meeting exclusively held over the Internet via a live webcast. You will be able to attend the Annual Meeting, vote your shares electronically, and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/S2022 and entering the control number located on your proxy card or notice. The virtual format of the Annual Meeting enables increased stockholder access while also saving time and money for both us and our stockholders and also is better for the environment.

We are holding the Annual Meeting for the following purposes, which are more fully described in the accompanying proxy statement:

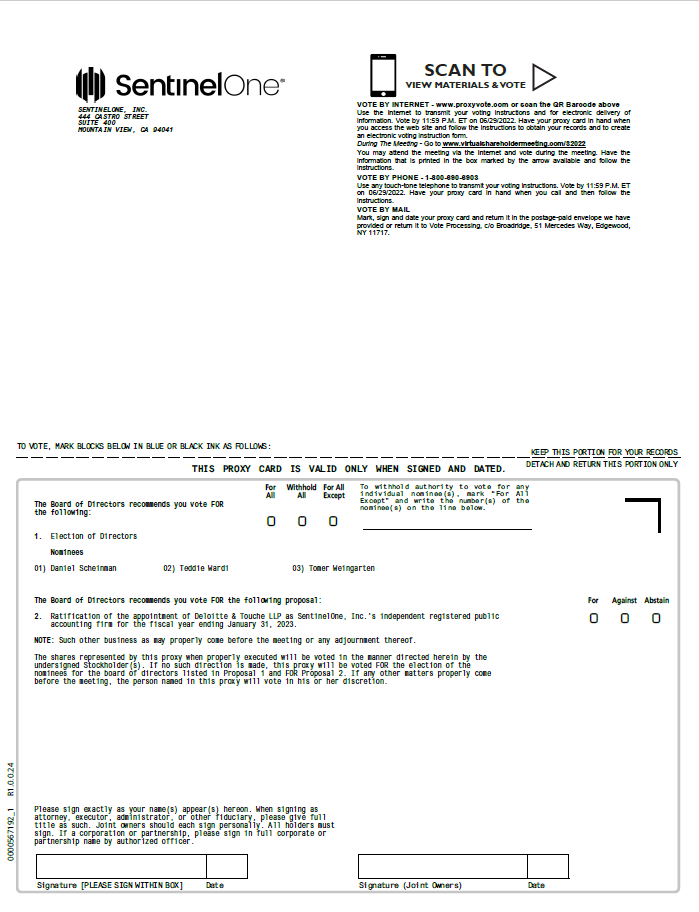

1.To elect as Class I directors the three nominees named in the proxy statement, to serve until the 2025 annual meeting of stockholders and until their successors are duly elected and qualified, subject to their earlier death, resignation, or removal;

2.To ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending January 31, 2023; and

3.To transact any other business that properly comes before the Annual Meeting.

Our Board of Directors (“Board”) recommends that you vote “FOR” the director nominees named in Proposal One and “FOR” the ratification of the appointment of Deloitte as our independent registered public accounting firm as described in Proposal Two.

Our Board has fixed the close of business on May 4, 2022 as the record date (the “Record Date”) for the Annual Meeting. Only stockholders of record at the close of business on May 4, 2022 are entitled to notice of, and to vote, during the Annual Meeting as set forth in the Proxy Statement. Our proxy statement contains further information regarding voting rights and the matters to be voted upon.

On or about May 17, 2022, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the proxy statement and our Annual Report on Form 10-K for the year ended January 31, 2022 (the “Annual Report”). The Notice provides instructions on how to vote and includes instructions on how to receive a paper copy of proxy materials and Annual Report by mail or email. The Notice, our proxy statement and our Annual Report can be accessed directly by visiting www.proxyvote.com and entering the control number located on your proxy card or Notice, or in the instructions that accompanied your proxy materials.

Your vote is important. Regardless of whether you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting, and we hope you will vote as soon as possible. We encourage you to submit your proxy or voting instructions via the Internet, which is convenient, helps reduce the environmental impact of our Annual Meeting and saves us significant postage and processing costs.

Thank you for your ongoing support of, and continued interest in, SentinelOne, Inc.

Sincerely,

Tomer Weingarten

Co-Founder, President, Chief Executive Officer and Chairman of the Board of Directors

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON THURSDAY, JUNE 30, 2022: THE PROXY STATEMENT AND ANNUAL REPORT ARE AVAILABLE AT WWW.PROXYVOTE.COM.

TABLE OF CONTENTS

| Page | |||||

SENTINELONE, INC.

444 Castro Street, Suite 100

Mountain View, CA 94041

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

To be held at 9:00 a.m., Pacific time, on Thursday, June 30, 2022

This Proxy Statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by the board of directors of SentinelOne, Inc., a Delaware corporation, for use at the annual meeting of stockholders of the Company (the “Annual Meeting”), and any postponements, adjournments or continuations thereof. The Annual Meeting will be held on Thursday, June 30, 2022, at 9:00 a.m. Pacific Time and will be conducted virtually via a live webcast on the Internet at www.virtualshareholdermeeting.com/S2022.

To participate at this year’s Annual Meeting, please log in to www.virtualshareholdermeeting.com/S2022. You will be asked to provide the control number located on your proxy card (the “Control Number”). The Control Number is located inside the shaded gray box on your notice or proxy card. You will not be able to attend the Annual Meeting physically. You will be able to listen to the Annual Meeting live, submit questions and vote online. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report is first being mailed on or about May 17, 2022 to all stockholders entitled to vote at the Annual Meeting.

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with U.S. Securities and Exchange Commission (“SEC”) rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and Annual Report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this rule makes the proxy distribution process more efficient, less costly and helps in conserving natural resources.

QUESTIONS AND ANSWERS

ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this Proxy Statement are inactive textual references only. In this Proxy Statement, we refer to SentinelOne, Inc. as “SentinelOne,” “we,” “us,” “our,” and the board of directors of SentinelOne, Inc. as our “Board.” Our fiscal year ends on January 31. References to fiscal 2022 are to our fiscal year ended January 31, 2022.

Why am I receiving these materials?

This Proxy Statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our Board for use at the 2022 Annual Meeting and any postponements or adjournments thereof. The Annual Meeting will be held virtually on Thursday, June 30, 2022, at 9:00 a.m., Pacific Time. You will be able to attend the virtual Annual Meeting, vote your shares electronically and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/S2022 and entering the Control Number located on your proxy card or Notice.

Stockholders are invited to attend the virtual Annual Meeting and are requested to vote on the items of business described in this Proxy Statement. The Notice, which contains instructions on how to access the proxy materials and our Annual Report, is first being sent or given on or about May 17, 2022 to all stockholders entitled to notice of and to vote at the virtual Annual Meeting. The proxy materials and our Annual Report can be accessed by following the instructions in the Notice as well as online at our Investor Relations website at https://investors.sentinelone.com.

What proposals am I voting on?

You will be voting on:

•The election of the three nominees for Class I director named in this proxy statement to hold office until our 2025 annual meeting of stockholders and until their respective successors are duly elected and qualified;

•The ratification of the appointment of Deloitte & Touche LLP (“Deloitte”), as our independent registered public accounting firm for our fiscal year ending January 31, 2023; and

•Any other business as may be properly come before the Annual Meeting.

What other matters may be brought before the Annual Meeting?

As of the date of this Proxy Statement, we are not aware of any other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

How does the Board recommend that I vote?

Our Board recommends that you vote your shares:

•“For” each of the three nominees for Class I director named in this Proxy Statement; and

•“For” the ratification of the appointment of Deloitte as our independent registered public accounting firm for our fiscal year ending January 31, 2023.

Who is entitled to vote at the Annual Meeting?

Holders of our common stock as of the close of business on May 4, 2022, the Record Date for the Annual Meeting, are entitled to vote at the Annual Meeting. As of the Record Date, there were 196,880,332 shares of our Class A common stock and 81, 747, 465 shares of our Class B common stock issued and outstanding. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this Proxy Statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors.

Each share of Class A common stock is entitled to one vote on each proposal properly brought before the Annual Meeting and each share of Class B common stock is entitled to 20 votes on each proposal properly brought before the Annual Meeting. Our Class A common stock and Class B common stock are collectively referred to in this Proxy Statement as our “common stock.”

Stockholder of Record: Shares Registered in Your Name. If, at the close of business on the Record Date for the Annual Meeting, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), then you are the stockholder of record with respect to those shares. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card, to vote electronically at the virtual Annual Meeting, or by Internet or by telephone, or, if you received paper copies of the proxy materials by mail, to vote by mail by following the instructions on the proxy card or voting instruction card.

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. If, at the close of business on the Record Date, your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other nominee, then you are the beneficial owner of those shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote the shares in your account by following the voting instructions your broker, bank or other nominee provides. You are also invited to attend the virtual Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares electronically at the virtual Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

How can I vote my shares?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in one of the following ways:

•You may vote electronically at the Annual Meeting. If you plan to attend the virtual Annual Meeting, you may vote at the Annual Meeting.

•You may vote by mail. To vote by mail, complete, sign and date the proxy card that accompanies this Proxy Statement and return it promptly in the postage-prepaid envelope provided (if you received printed proxy materials). Your completed, signed and dated proxy card must be received prior to the Annual Meeting.

•You may vote by telephone. To vote over the telephone, call toll-free 1-800-690-6903 from any touch-tone telephone and follow the instructions. Have your Notice or proxy card available when you call. You will be asked to provide the Control Number from your Notice or proxy card. Telephone voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on June 29, 2022.

•You may vote via the Internet. To vote via the Internet, go to www.proxyvote.com to complete an electronic proxy card (have your Notice or proxy card in hand when you visit the website). You will be asked to provide the Control Number from your Notice or proxy card. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on June 29, 2022.

Beneficial Owner of Shares Held in “Street Name”

If you are a beneficial owner of shares held in Street Name, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Beneficial owners of shares should generally be able to vote by returning the voting instruction card to their broker, bank or other nominee, or by telephone or via the Internet. However, the availability of telephone or Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a beneficial owner, you may only vote your shares electronically at the Annual Meeting if you obtain a legal proxy from your broker, bank or other nominee.

Can I change my vote or revoke my proxy?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you can change your vote or revoke your proxy by:

•entering a new vote by telephone or via the Internet (until the applicable deadline for each method as set forth above);

•returning a later-dated proxy card (which automatically revokes the earlier proxy);

•providing a written notice of revocation prior to the Annual Meeting to our corporate secretary at our principal executive offices as follows: SentinelOne, Inc., 444 Castro Street, Suite 400, Mountain View, CA 94041, Attn: Corporate Secretary; or

•attending the virtual Annual Meeting and voting electronically. Attendance at the virtual Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or cast your vote electronically at the virtual Annual Meeting.

Beneficial Owner of Shares Held in “Street Name”. If you are the beneficial owner of your shares in Street Name, you must contact the broker, bank or other nominee holding your shares and follow their instructions to change your vote or revoke your proxy.

Why is this Annual Meeting being held virtually?

We are continuously exploring technologies and services that will best permit our stockholders to engage with us from any location around the world and exercise their vote. We have decided to conduct the Annual Meeting on a virtual basis because we believe it provides expanded access, improves communication, and enables increased stockholder attendance and participation. It also is better for the environment.

We believe that by hosting our Annual Meeting virtually, our stockholders will be provided comparable rights and opportunities to participate as they would at an in-person meeting, while offering a greater level of flexibility for many of our stockholders who may not be able to attend an annual meeting of stockholders in person, particularly in light of the continuing ongoing COVID-19 pandemic.

How can I submit a question before or during the Annual Meeting?

If you want to submit a question during the Annual Meeting, log into www.virtualshareholdermeeting.com/S2022 type your question into the “Ask a Question” field and click “Submit.” Stockholders are permitted to submit questions before and during the Annual Meeting via the website and the virtual meeting website, respectively, that are in compliance with the meeting rules of conduct that will be available on the virtual meeting website and with a limit of one question per stockholder. We will answer as many questions submitted in accordance with the meeting rules of conduct as possible in the time allotted for the meeting. Only questions that are relevant to an agenda item to be voted on by stockholders will be answered and we reserve the right to exclude questions that are irrelevant to meeting matters, irrelevant to our business, or derogatory or in bad taste; that relate to pending or threatened litigation; that are personal grievances; or that are otherwise inappropriate (as determined by the chair of the Annual Meeting).

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the full set of proxy materials?

In accordance with the rules of the SEC, we have elected to distribute our proxy materials, including the Notice, this Proxy Statement and our Annual Report, primarily via the Internet. As a result, we are mailing to our stockholders a Notice instead of a paper copy of the proxy materials. The Notice contains instructions on how to access our proxy materials on the Internet, how to vote on the proposals, how to request printed copies of the proxy materials and Annual Report, and how to request to receive all future proxy materials in printed form by mail or electronically by email. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

How can I sign up for electronic proxy delivery service?

The Notice and proxy card or voting instruction form included with the Proxy Materials will contain instructions on how to request electronic delivery of future proxy materials. Choosing to receive your future proxy materials by email will eliminate the cost of printing and mailing documents and will reduce the associated environmental impact. If you choose to receive future proxy materials by email, you will receive an email next year containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board. The persons named in the proxy, Tomer Weingarten, our Co-Founder, President, Chief Executive Officer and Chairman of our Board and Keenan Conder, our Chief Legal Officer & Secretary have been designated as proxies for the Annual Meeting by our Board. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted electronically at the virtual Annual Meeting in accordance with the instruction of the stockholder on such proxy. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board on the proposals as described above and, if any other matters are properly brought before the Annual Meeting, the shares will be voted in accordance with the proxies’ judgment.

What is the quorum requirement for the Annual Meeting?

A quorum is the minimum number of shares required to be present or represented at the Annual Meeting for the meeting to be properly held under our restated bylaws and Delaware law. The presence, virtually or represented by proxy, of a majority of the voting power of our stock issued and outstanding and entitled to vote at the Annual Meeting will constitute a quorum to transact business at the Annual Meeting. Abstentions, “WITHHOLD” votes, and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chairman of the meeting may adjourn the meeting to another time or place.

How are broker non-votes and abstentions counted?

A broker non-vote occurs when shares held by a broker in street name are not voted with respect to a particular proposal because the broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. If your broker holds your shares in its name, or in “street name” and you do not instruct your broker how to vote, your broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a broker who has not received instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal. The ratification of the appointment of Deloitte as our independent registered public accounting firm for our fiscal year ending January 31, 2023 (Proposal No. 2) is considered

“routine” under applicable rules. The election of Class I directors (Proposal No. 1) is considered “non-routine” under applicable rules.

Broker non-votes and abstentions by stockholders from voting (including brokers holding their clients’ shares of record who cause abstentions to be recorded) will be counted towards determining whether or not a quorum is present. However, because broker non-votes and abstentions are not voted affirmatively or negatively, they will have no effect on the approval of any of the proposals.

How many votes are needed for approval of each proposal?

Proposal No. 1: Election of Class I Directors. The election of Class I directors requires a plurality of the voting power of the shares present virtually or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. This means that the three nominees for Class I director receiving the highest number of “FOR” votes will be elected as Class I directors. You may vote (i) “FOR” for each director nominee or (ii) “WITHHOLD” for each director nominee. Because the outcome of this proposal will be determined by a plurality vote, shares voted “WITHHOLD” will not prevent a director nominee from being elected as a director. Broker non-votes will not affect the outcome of voting on this proposal.

Proposal No. 2: Ratification of Appointment of Deloitte. The ratification of the appointment of Deloitte requires the affirmative vote of a majority of the voting power of the shares present virtually or represented by proxy at the Annual Meeting and entitled to vote and voted “for” or “against” the matter. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions will count towards the quorum requirement for the Annual Meeting and will have the same effect as a vote against the proposal. Broker non-votes will not affect the outcome of voting on this proposal.

Who will count the votes?

A representative of Broadridge Financial Solutions will tabulate the votes and act as inspector of elections.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

•“FOR” each of the three nominees for Class I director named in this Proxy Statement; and

•“FOR” the ratification of the appointment of Deloitte as our independent registered public accounting firm for our fiscal year ending January 31, 2023.

In addition, if any other matters are properly brought before the Annual Meeting or any adjournments or postponements thereof, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. Brokers, banks and other nominees holding shares of common stock in “street name” for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole “routine” matter-Proposal No. 2 (ratification of the appointment of Deloitte). Absent direction from you, however, your broker, bank or other nominee will not have the discretion to vote on Proposal No. 1 relating to the election of directors.

How can I attend the Annual Meeting?

The Annual Meeting will be a virtual meeting held over the Internet. You will be able to attend the virtual Annual Meeting, vote your shares electronically and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/S2022 and entering the sixteen-digit Control Number located on your proxy card. The Annual Meeting webcast will begin promptly at 9:00 a.m., Pacific time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:45 a.m., Pacific time, and you should allow ample time for the check-in procedures. You will have the same rights and opportunities that would be afforded by an in-person meeting.

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you were a beneficial owner of shares that are held in “street name” at the close of business on the Record Date, you may not vote your shares electronically at the virtual Annual Meeting unless you obtain a “legal proxy” from your broker, bank or other nominee who is the stockholder of record with respect to your shares. You may still attend the virtual Annual Meeting even if you do not have a legal proxy. For admission to the virtual Annual Meeting, visit www.virtualshareholdermeeting.com/S2022 and enter the sixteen-digit Control Number located on your proxy card.

What if I have technical difficulties or trouble accessing the Annual Meeting?

If we experience technical difficulties during the meeting (e.g., a temporary or prolonged power outage), we will determine whether the meeting can be promptly reconvened (if the technical difficulty is temporary) or whether the meeting will need to be reconvened on a later day (if the technical difficulty is more prolonged). In any such situation, we will promptly notify stockholders of the decision via www.virtualshareholdermeeting.com/S2022.

If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the login page. Technical support will be available starting at 8:45 a.m. Pacific Time on Thursday, June 30, 2022 and will remain available until the Annual Meeting has ended.

We encourage you to log in prior to the start time of the Annual Meeting to allow reasonable time for log in procedures.

How are proxies solicited for the Annual Meeting and who is paying for such solicitation?

Our Board is soliciting proxies for use at the Annual Meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communication, or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation. We do not plan to retain a proxy solicitor to assist in the solicitation of proxies.

If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and, within four business days after final results are known, file an additional Current Report on Form 8-K to publish the final results.

What does it mean if I receive more than one Notice or more than one set of printed materials?

If you receive more than one Notice or more than one set of printed materials, your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice or each set of printed materials, as applicable, to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted an SEC-approved procedure called “householding,” under which we can deliver a single copy of the Notice and, if applicable, the proxy materials and Annual Report, to multiple stockholders who share the same address unless we receive contrary instructions from one or more of the stockholders. Once you have received notice from your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. Stockholders may revoke their consent at any time by contacting Broadridge by calling 1-866-540-7095 or writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York, 11717. This procedure reduces our printing and mailing costs and is better for the environment. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, the proxy materials and Annual Report, to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of next year’s proxy materials and Annual Report, you may contact us as follows:

SentinelOne, Inc.

Attention: Investor Relations

444 Castro Street, Suite 400

Mountain View, CA 91367

Tel: (855) 868-3733

Stockholders who hold shares in street name may contact their broker, bank or other nominee to request information about householding.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting will be available for review during regular business hours from our Corporate Secretary for ten days prior to the Annual Meeting for any purpose germane to the Annual Meeting at our corporate headquarters located at 444 Castro Street, Suite 400, Mountain View, CA 94041. Please contact our Corporate Secretary a reasonable time in advance to make appropriate arrangements, but in no event less than 48 hours in advance of your desired visiting time. The list of stockholders will also be available during the Annual Meeting through the meeting website at www.virtualshareholdermeeting.com/S2022.

When are stockholder proposals due for next year’s Annual Meeting?

Please see the section entitled Stockholder Proposal Deadlines for 2023 Annual Meeting in this Proxy Statement for more information regarding the deadlines for the submission of stockholder proposals for our 2023 annual meeting.

What does being an “emerging growth company” mean?

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise generally applicable to public companies. These provisions include:

•an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting;

•an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements;

•reduced disclosure about our executive compensation arrangements;

•extended transition periods for complying with new or revised accounting standards; and

•exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangement.

We will remain an emerging growth company until the earliest to occur of the following:

•the last day of the fiscal year in which we have total gross revenue of $1.07 billion or more;

•the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities;

•the last day of the fiscal year ending after the fifth anniversary of the completion of our initial public offering (“IPO”); and

•the date on which we are deemed to be a “large accelerated filer,” as defined in Rule 12b-2 under the Exchange Act.

We intend to take advantage of certain of the available benefits under the JOBS Act. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Composition of the Board

Our Board is currently comprised of eight members. Our Board consists of three classes of directors, each serving staggered three-year terms. Upon expiration of the term of a class of directors, directors in that class will be elected for a three-year term at the annual meeting of stockholders in the year in which that term expires. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

The following table sets forth the names, ages, and certain other information for each of the directors with terms expiring at the Annual Meeting (including those who are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our Board. All information is as of April 30, 2022.

| Name | Class | Age | Position | Director Since | Current Term Expires | Expiration of Term for Which Nominated | ||||||||||||||||||||||||||||||||

| Nominees for Director | ||||||||||||||||||||||||||||||||||||||

| Tomer Weingarten | I | 39 | Co-Founder, President and Chief Executive Officer and Director | 2013 | 2022 | 2025 | ||||||||||||||||||||||||||||||||

Daniel Scheinman(2)(3) | I | 59 | Lead Independent Director | 2019 | 2022 | 2025 | ||||||||||||||||||||||||||||||||

Teddie Wardi(2) | I | 37 | Director | 2015 | 2022 | 2025 | ||||||||||||||||||||||||||||||||

| Continuing Directors | ||||||||||||||||||||||||||||||||||||||

Robert Schwartz(3) | II | 60 | Director | 2015 | 2023 | — | ||||||||||||||||||||||||||||||||

Jeffery W. Yabuki(3) | II | 62 | Director | 2021 | 2023 | — | ||||||||||||||||||||||||||||||||

Charlene T. Begley(1) | III | 55 | Director | 2021 | 2024 | — | ||||||||||||||||||||||||||||||||

Aaron Hughes(1) | III | 46 | Director | 2021 | 2024 | — | ||||||||||||||||||||||||||||||||

Mark S. Peek(1)(2) | III | 64 | Director | 2021 | 2024 | — | ||||||||||||||||||||||||||||||||

(1)Member of audit committee.

(2)Member of compensation committee.

(3)Member of nominating and corporate governance committee (“Nominating Committee”).

Nominees for Director

Tomer Weingarten is our co-founder and has served as our Chief Executive Officer and a member of our Board since our inception in January 2013, as our President since November 2018, and as our Chairman of the Board since March 2021. Before our founding, Mr. Weingarten held various positions, including Vice President of Products, at Toluna Holdings Limited, a technology company that delivers real-time consumer insights, from May 2007 to December 2012, which he joined following the acquisition of Dpolls, a startup he had previously co-founded. Prior to that, Mr. Weingarten co-founded Carambola Media Ltd., a publisher focused platform that creates new ad revenue streams through engaging content formats, where he served as Chief Technology Officer from May 2011 to May 2012. Mr. Weingarten also previously served in various roles at Mckit Systems Ltd., a provider of information and knowledge management systems in Israel, from March 2005 to April 2007. We believe Mr. Weingarten is qualified to serve as a member of our Board because of the historical knowledge, operational expertise, leadership, and continuity that he brings to our Board as our co-founder and Chief Executive Officer.

Daniel Scheinman has served as a member of our Board since September 2015. Since April 2011, Mr. Scheinman has been an angel investor. From September 1993 to April 2011, Mr. Scheinman served in various roles at Cisco Systems, Inc., a technology and networking company, most recently as Senior Vice President, Cisco Media Solutions Group. He has served as a member of the boards of directors of Arista Networks, Inc., a cloud networking company, since October 2011, and of Zoom Video Communications Inc., a cloud-based video communication company, since January 2013, and currently serves on the boards of directors of several private companies. Mr. Scheinman holds a B.A. in Politics from Brandeis University and a J.D. from the Duke University School of Law. We believe that Mr. Scheinman is qualified to serve as a member of our Board because of his extensive leadership and business experience with technology companies, as well as his service on the boards of directors of other privately and publicly-held companies.

Teddie Wardi has served as a member of our Board since May 2019. Since October 2017, Mr. Wardi has served as a Managing Director at Insight Venture Management, L.L.C., a private investment firm. Prior to joining Insight, Mr. Wardi served as a Partner at Atomico (UK) Partners LLP, an international investment firm, from March 2016 to October 2017. Previously, Mr. Wardi served as Vice President at Dawn Capital LLP, a private investment firm, from March 2014 to March 2016. Mr. Wardi co-founded Nervogrid Oy, a software provider acquired by ALSO Holding Ag, and served as Chief Technology Officer from March 2006 to August 2012. Mr. Wardi holds a B.S.c. Business Technology and Finance from Aalto University in Finland and an M.B.A. from Harvard Business School. We believe that Mr. Wardi is qualified to serve as a member of our Board because of his extensive leadership and business experience with the venture capital and technology industries.

Continuing Directors

Robert Schwartz has served as a member of our Board since September 2015. Since June 2000, Mr. Schwartz has served as Managing Partner at Third Point Ventures, a private investment firm. Mr. Schwartz served as a member of the board of directors of Upstart Holdings Inc., an online lending platform, from 2015 until November 2021, and currently serves on the board of directors of several privately-held companies. Mr. Schwartz also served as a member of the board of directors from 2008 to 2016 of Apigee Corp., an API management and predictive analytics software provider that was acquired by Alphabet Inc. in September 2016, and Enphase Energy, Inc., a publicly traded energy technology company, from 2006 to 2016. Mr. Schwartz holds a B.S. in multi-discipline engineering from the University of California, Berkeley. We believe Mr. Schwartz is qualified to serve as a member of our Board because of his extensive experience in the venture capital industry, his knowledge of technology companies, and his deep understanding of our business and operations as one of our early investors.

Jeffery W. Yabuki has served as a member of our Board since May 2021. Since January 2021, Mr. Yabuki has served as the Chairman of the board of directors of Sportradar Holding AG, a leading global provider of sports betting and sports entertainment products and services. From December 2005 to December 2020, Mr. Yabuki served as the Chief Executive Officer of Fiserv, Inc., a global leader in financial services and payments technology. From 2005 to June 2020, Mr. Yabuki served as a member of board of directors of Fiserv and from July 2019 to December 2020 as the Chairman of the board of directors. Before joining Fiserv, Mr. Yabuki served as Executive Vice President and Chief Operating Officer for H&R Block, Inc., a financial services firm, from 2002 to 2005. From 2001 to 2002, he served as Executive Vice President of H&R Block and from 1999 to 2001, he served as the President of H&R Block International. From 1987 to 1999, Mr. Yabuki held various executive positions with American Express Company, a financial services firm, including President and Chief Executive Officer of American Express Tax and Business Services, Inc. Mr. Yabuki currently serves as a director at Royal Bank of Canada, a publicly traded financial institution and as a director at Ixonia Bancshares, Inc., a privately held bank holding company. Mr. Yabuki received a B.S. in accounting from California State University, Los Angeles. We believe that Mr. Yabuki is qualified to serve as a member our Board because of his leadership experience as a chief executive officer and board member.

Charlene T. Begley has served as a member of our Board since January 2021. Ms. Begley has served as an independent director and member of the Audit Committee of Nasdaq, Inc., a global technology and financial services company, since April 2014, and as chair of its Nominating and ESG committee since June 2021. Since April 2017, she has served as an independent director, chairperson of the audit committee, and member of the nomination and Environmental, Social and Governance committee at Hilton Worldwide Holdings Inc., a multinational hospitality company. Earlier in her career, Ms. Begley served in various roles at the General Electric Company, or GE, a diversified infrastructure and financial services company, from June 1988 to December 2013. Ms. Begley served in a dual role as Senior Vice President and Chief Information Officer, as well as President and Chief Executive Officer of GE’s Home and Business Solutions Office, from January 2010 to December 2012. Previously, Ms. Begley served as President and Chief Executive Officer of GE’s Enterprise Solutions group from 2007 to 2009. In addition, Ms. Begley served as President and Chief Executive Officer of GE Plastics and GE Transportation and prior to that led GE’s Corporate Audit staff and served as Chief Financial Officer for GE Transportation and GE Plastics Europe and India. Ms. Begley served as a director at Red Hat, Inc., a software development company, from November 2014 to June 2019 and at WPP plc, a multinational communications, commerce and technology company, from December 2013 to June 2017. Ms. Begley holds a B.S. in Finance from the University of Vermont. We believe Ms. Begley is qualified to serve as a member of our Board because of her knowledge of technology and information security companies, and her expertise and experience both in operational management roles and board leadership positions at large, public organizations.

Aaron Hughes has served as a member of our Board since May 2021. Since November 2020, Mr. Hughes has served as Group Vice President and Chief Information Security Officer at Albertsons Companies, Inc., a grocery and drugstore company. From June 2017 to November 2020, Mr. Hughes served as Vice President for Information Security and Deputy Chief Information Security Officer at Capital One Financial Corporation, a financial services company. Prior to Capital One, Mr. Hughes served as Deputy Assistant Secretary of Defense for Cyber Policy at the United States Department of Defense from May 2015 to January 2017. From July 2008 to May 2015, Mr. Hughes served as Vice President at In-Q-Tel, Inc., a venture capital firm. Mr. Hughes holds a B.S. in Mechanical Engineering from the University of Virginia, a M.S. in Telecommunication and Computers from George Washington University, and an M.B.A. from the Stanford Graduate School of Business. We believe that Mr. Hughes is qualified to serve as a member of our Board because of his extensive leadership, business and policy experience in the technology and cybersecurity industries.

Mark S. Peek has served as a member of our Board since May 2021. Since February 2018, Mr. Peek has served as Executive Vice President, Managing Director and head of Workday Ventures, the strategic investment arm of Workday, Inc., or Workday, a provider of enterprise cloud applications for finance and human resources. From June 2015 to February 2018, Mr. Peek served as Co-President of Workday, and from June 2012 to April 2016, as Workday’s Chief Financial Officer. Prior to joining Workday, Mr. Peek served as President, Business Operations and Chief Financial Officer of VMware, Inc., a provider of business infrastructure virtualization solutions from April 2007 to January 2011. From March 2000 to April 2007, Mr. Peek served as Senior Vice President and Chief Accounting Officer at Amazon.com, Inc., a technology company. Prior to joining Amazon, Mr. Peek spent 19 years at Deloitte, and as a partner for the last ten of those years. Mr. Peek serves on the Advisory Board of the Foster School of Business at the University of Washington. From December 2011 to June 2012, Mr. Peek served on the board of directors of Workday. Mr. Peek has served as a member of the board of directors of Trimble Inc. since May 2010. Mr. Peek received a B.S. in Accounting and International Finance from Minnesota State University. We believe that Mr. Peek is qualified to serve as a member of our Board because of his extensive leadership and business experience with technology companies.

Director Independence

Our Class A common stock is listed on the NYSE. Under the listing standards of the NYSE, independent directors must compromise a majority of a listed company’s board of directors. The NYSE listing standards also require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committee be independent. Under the listing standards of the NYSE, a director will only qualify as an “independent director” if, in the opinion of that listed company’s board of directors, that director has no material relationship with the listed company (either directly as a partner, stockholder or officer of an organization that has a relationship with the company) and such director does not have specified relationships with the company.

In addition, audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or be an affiliated person of the listed company or any of its subsidiaries. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the listing standards of the NYSE.

Our Board has undertaken a review of the independence of each director and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board determined that Charlene T. Begley, Aaron Hughes, Mark S. Peek, Daniel Scheinman, Robert Schwartz, Teddie Wardi, and Jeffery W. Yabuki are “independent directors” as defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE. In making these determinations, our Board reviewed and discussed information provided by the directors and by us with regard to each director’s background, business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our common stock by each outside director and the transactions involving them described in the section titled “Related Person Transactions.”

In evaluating the independence of Mr. Peek, our Board considered that Mr. Peek serves as Executive Vice President, Managing Director, and head of Workday Ventures, the strategic investment arm of Workday, which is both a customer and a vendor of our company. Arms-length sales to and purchases from Workday were significantly less than 2% of the recipient company’s gross revenue during its most recent fiscal year and were made in the ordinary course of business.

There are no family relationships among any of our directors or executive officers.

Board Leadership Structure

Our Board has adopted corporate governance guidelines that provide that one of our independent directors will serve as our lead independent director when the chairperson of our Board and the Chief Executive Officer are the same person. Our Board has appointed Daniel Scheinman to serve as our lead independent director. As lead independent director, Mr. Scheinman provides leadership to our Board if circumstances arise in which the role of Chief Executive Officer and chairperson of our Board may be, or may be perceived to be, in conflict, and perform such additional duties as our Board may otherwise determine and delegate. Our Corporate Governance Guidelines are available on the “Investor Relations” section of our website, which is located at https://investors.sentinelone.com, by clicking “Governance Documents” in the “Governance” section of our website. Our Corporate Governance Guidelines enumerate specific responsibilities for our lead independent director as follows:

•calling separate meetings of the independent directors;

•facilitating discussion and open dialogue among the independent directors during meetings of the Board, executive sessions and outside of meetings of the Board;

•serving as the principal liaison between the Chairperson and the independent directors;

•communicating to the Chairperson and management, as appropriate, any decisions reached, suggestions, views or concerns expressed by the independent directors in executive sessions or outside of meetings of the Board;

•providing the Chairperson with feedback and counsel concerning the Chairperson’s interactions with the Board;

•coordinating with the Chairperson to set the agenda for meetings of the Board, taking into account input from other independent directors;

•providing the Chairperson and management with feedback on meeting schedules and the appropriateness, including the quality and quantity, and timeliness of information provided to the Board;

•recommending the retention of advisors and consultants who report directly to the Board when appropriate;

•providing leadership to the Board if circumstances arise in which the role of the Chairperson may be, or may be perceived to be, in conflict;

•if appropriate, and in coordination with management, being available for consultation and direct communication with major stockholders; and

•performing such other functions and responsibilities as requested by the Board from time to time.

Role of Board in Risk Oversight Process

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces. Our Board as a whole has responsibility for overseeing our risk management process, although the committees of our Board oversee and review risk areas that are particularly relevant to them. Our Board reviews strategic and operational risk in the context of discussions, question and answer sessions, and reports from the management team at each regular

Board meeting, receives reports on all significant committee activities at each regular Board meeting, and evaluates the risks inherent in significant transactions. Our audit committee assists our Board in fulfilling its oversight responsibilities with respect to oversight of risk assessment and risk management generally, and specifically in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance, cyber risk, and also, among other things, discusses guidelines with management and the independent auditor. Our nominating committee assists our Board in fulfilling its oversight responsibilities with respect to risks relating to our corporate governance practices, the independence of the Board and potential conflicts of interest, as well as our policies and practices with regard to environmental, social and governance matters. Our compensation committee assesses risks relating to our executive compensation plans and arrangements, and whether our compensation policies and programs have the potential to encourage excessive risk taking.

Our Board believes its current leadership structure supports the risk oversight function of the Board. In particular, our Board believes that our lead independent director and our majority of independent directors provide a well-functioning and effective balance to the members of executive management on our Board. Further, our Board and nominating committee review and discuss with management matters related to human capital management, including SentinelOne’s commitments and progress on inclusion and diversity, employee engagement, business conduct and compliance, and executive succession planning. During fiscal 2022, the Board and its committees also reviewed and discussed with management on a regular basis the continuing impact of the COVID-19 pandemic on SentinelOne’s employees and business, as well as management’s strategies and initiatives to respond to and mitigate adverse impacts, such as risks related to increased remote work by us and our customers, economic risk, and the impacts of virtual customer events and sales activities.

Management Succession Planning

Our Board has delegated primary oversight responsibility for succession planning for our senior management positions, including our Chief Executive Officer, to the nominating and governance committee.

Oversight of Corporate Strategy

Our Board actively oversees management’s establishment and execution of corporate strategy, including major business and organizational initiatives, annual budget and long-term strategic plans, capital allocation priorities, potential corporate development opportunities, and risk management. At its regularly scheduled meetings and throughout the year, our Board receives information and formal updates from our management and actively engages with the senior leadership team with respect to our corporate strategy. Our Boards’ diverse skill set and experience enhances our Boards’ ability to support management in the execution and evaluation of our corporate strategy. The independent members of our Board also hold regularly scheduled executive sessions at which strategy is discussed.

Cybersecurity Risk Oversight

Securing the information of our customers, employees, partners, and other third parties is important to us. We have adopted physical, technological, and administrative controls on data security, and have a defined procedure for data incident detection, containment, response, and remediation. While everyone at our company plays a part in managing these risks, oversight responsibility is shared by our board of directors, our audit committee, and management.

Our management team provides regular cybersecurity updates in the form of reports and presentations to our audit committee. Our audit committee also reviews metrics about cyber threat response preparedness, program maturity milestones, risk mitigation status, and the current and emerging threat landscape. We also maintain information security risk insurance coverage.

Board Meetings and Committees

During fiscal 2022, our Board held 10 meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our Board on which he or she served during the periods that he or she served. We do not have a formal policy regarding attendance by members of our Board at annual meetings of stockholders, but we strongly encourage our directors to attend.

Our Board has established a standing audit committee, a standing compensation committee, and a standing Nominating Committee. Each of the committees has the composition and the responsibilities described below.

Each of these committees has a written charter approved by our Board. Copies of the charters for each committee are available, without charge, upon request in writing to SentinelOne, Inc., 444 Castro Street, Mountain View, California 94041 Attn: Corporate Secretary, or the “Investor Relations” section of our website, which is located at https://investors.sentinelone.com, by clicking “Governance Documents” in the “Governance” section of our website.

Audit Committee

Our audit committee is composed of Charlene T. Begley, Aaron Hughes and Mark S. Peek. Ms. Begley is the chair of our audit committee. The members of our audit committee meet the independence requirements under NYSE and SEC rules. Each member of our audit committee is financially literate. In addition, our Board has determined that each of Ms. Begley and Mr. Peek is an “audit committee financial expert” as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act of 1933, as amended. This designation does not, however, impose on her or him any supplemental duties, obligations or liabilities beyond those that are generally applicable to the other members of our audit committee and Board. Our audit committee’s principal functions are to assist our Board in its oversight of:

•selecting a firm to serve as our independent registered public accounting firm to audit our financial statements;

•ensuring the independence of the independent registered public accounting firm, reviewing the qualifications and performance of the independent registered public accounting firm, and overseeing the rotation of the independent registered public accounting firm’s audit partners;

•discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and that firm, our interim and year-end operating results;

•establishing procedures for employees to anonymously submit concerns about questionable accounting or audit matters;

•considering the adequacy of our internal controls and the design, implementation, and performance of our internal audit function;

•risk assessment and management;

•our compliance with legal and regulatory requirements;

•reviewing related party transactions that are material or otherwise implicate disclosure requirements; and

•approving, or as permitted, pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm.

During fiscal 2022, our audit committee met seven times.

Compensation Committee

Our compensation committee is comprised of Messrs. Peek, Scheinman and Wardi. Mr. Peek is the chair of our compensation committee. The members of our compensation committee meet the independence requirements under NYSE and SEC rules. All the members of this committee are also “non-employee directors” within the meaning of Rule 16b-3 under the Exchange Act. Our compensation committee is responsible for, among other things:

•evaluating, recommending to our Board, approving and reviewing our executive officer and director compensation arrangements, plans, policies, and programs;

•reviewing and recommending to our Board the form and amount of our compensation of our non-employee directors;

•reviewing, at least annually, the goals and objectives to be considered in determining the compensation of our chief executive officer and other executive officers;

•reviewing with our management our organization and people activities;

•administering and interpreting our cash and equity incentive compensation plans;

•reviewing and approving, or making recommendations to our Board with respect to, our cash and equity incentive compensation plans; and

•establishing our overall compensation philosophy.

During fiscal 2022, our compensation committee met eight times.

Nominating and Corporate Governance Committee

Our Nominating Committee is composed of Daniel Scheinman, Robert Schwartz, and Jeffrey W. Yabuki. Mr. Scheinman is the chair of our Nominating Committee. The members of our Nominating Committee meet the independence requirements under NYSE and SEC rules. Our Nominating Committee’s principal functions include:

•identifying, considering, and recommending candidates for membership on our Board, and recommending to our Board the desired qualifications, expertise, and characteristics of members of our Board;

•developing and recommending our corporate governance guidelines and policies;

•periodically consider and make recommendations to our Board regarding the size, structure and composition of our Board and its committees

•reviewing and recommending to our Board any changes to our corporate governance guidelines;

•reviewing any corporate governance related matters required by the federal securities laws;

•reviewing proposed waivers of the code of conduct for directors and executive officers;

•assisting our Board in overseeing our programs related to corporate responsibility and sustainability;

•overseeing the process of evaluating the performance of our Board and its committees; and

•advising our Board on corporate governance matters.

During fiscal 2022, our Nominating Committee met once.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee was at any time during fiscal 2022, or at any other time, an officer or employee of our company or any of our subsidiaries. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or compensation committee. Please see the section entitled Related Party Transactions in this Proxy Statement.

Considerations in Evaluating Director Nominees

In its evaluation of director candidates, including the members of the Board eligible for re-election, our nominating committee considers the current size, structure, and composition of the Board, the needs of the Board and its respective committees, and the desired Board qualifications, expertise and characteristics, including such factors as judgment, business acumen, and diversity. While we do not have a formal policy with respect to diversity, our nominating committee may consider such factors as differences in professional background, education, race, ethnicity, gender, age, geography, and other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board. Our Board is committed to seeking out highly qualified women and individuals from minority groups and diverse backgrounds. Our nominating committee has engaged an executive search firm to assist in identifying and recruiting potential candidates for membership on our Board.

Our Nominating Committee evaluates each individual in the context of the membership of the Board as a group, with the objective of having a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of background and experience in the various areas. Each director should be an individual of high character and integrity. The Board annually evaluates the performance of the Board and its committees. Our nominating committee reviews self-assessment questionnaires to evaluate the performance of individual members. In determining whether to recommend a director for re-election, our nominating committee also considers the director’s past attendance at meetings, participation in and contributions to the activities of the Board and the company, and other qualifications and characteristics determined by the Board. Each director must ensure that other existing and anticipated future commitments do not materially interfere with his or her service as a director.

After completing their review and evaluation of director candidates, in accordance with the rules of the NYSE our nominating committee will recommend a director nominee for selection by our Board. Our Board has the final authority in determining the selection of director candidates for nomination to our Board.

Stockholder Recommendations for Nominations to Our Board

A stockholder that wants to recommend a candidate for election to the Board should direct the recommendation in writing by letter to the company, attention of our Chief Legal Officer at SentinelOne, Inc., 444 Castro Street, Suite 400, Mountain View, CA 94041. Such recommendation should include the candidate’s name, home and business contact information, detailed biographical data and relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between us and the candidate, and evidence of the recommending stockholder’s ownership of our stock. Such recommendation should also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for board membership. We do not have a formal policy regarding the consideration of director candidates recommended by stockholders, but subject to the foregoing, our independent directors will consider candidates recommended by stockholders in the same manner as candidates recommended from other sources. Nominating Committee has discretion to decide which individuals to recommend to our Board for nomination as directors. Our Board has the final authority in determining the selection of director candidates for nomination to our Board. A stockholder that wants to nominate a person directly for election to the Board at an annual meeting of the stockholders must meet the deadlines and other requirements set forth in our restated bylaws and the rules and regulations of the SEC. Any nomination should be sent in writing to SentinelOne, Inc., 444 Castro Street, Suite 400, Mountain View, CA 94041, Attention: Corporate Secretary. To be timely for our 2023 annual meeting of stockholders, our corporate secretary must receive the nomination no earlier than March 2, 2023 and no later than April 1, 2023. Please see the section titled “Stockholder Proposal Deadlines for 2023 Annual Meeting” in this Proxy Statement for more information.

Communications with the Board

In cases where stockholders wish to communicate directly with our Board, messages can be sent to our Corporate Secretary at corporate@sentinelone.com. We will initially receive and process communications before forwarding them to the addressee. We generally will not forward to the directors a communication that we determine to be primarily commercial in nature or related to an improper or irrelevant topic, or that requests general information about our company, our products or our services.

This procedure does not apply to stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are discussed further in the section titled “Stockholder Proposal Deadlines for 2023 Annual Meeting” in this Proxy Statement.

Code of Business Conduct and Ethics

Our Board has adopted a written code of business conduct and ethics that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer, and other executive and senior financial officers. The full text of our code of business conduct and ethics is available on the corporate governance section of our website, which is located at https://investors.sentinelone.com. We intend to disclose any amendments to our code of business conduct and ethics, or waivers of its requirements, on our website or in filings under the Exchange Act.

CORPORATE RESPONSIBILITY AND SUSTAINABILITY

SentinelOne recognizes the importance of a thoughtful approach to corporate citizenship, and our nominating committee is responsible for overseeing our programs relating to corporate responsibility and sustainability, including environmental, social, and corporate governance matters. As we continue to develop our strategies and practices in these areas, we are also committed to growing our programs to best meet the needs of the stakeholders we serve. Our current programs include:

•Community Involvement. We drive social good through our commitment to responsible corporate citizenship across the communities where we operate.

◦SentinelOne Foundation: In response to the armed conflict in Ukraine in March 2022 the SentinelOne Foundation, our charitable arm, announced it would match up to $100,000 in donations to the UN Crisis Relief run by the United Nations Office for the Coordination of Humanitarian Affairs.

•Environmental Responsibility. We work to reduce the environmental impact of our operations through our sustainability initiatives by reducing air travel and encouraging teleconferencing.

•Diversity, Equity, and Inclusion. At SentinelOne, we cultivate and foster an inclusive workplace for all Sentinels through key initiatives and programs including:

◦Strategic partnership with the Organization Women in Cybersecurity (WiCys), including an apprenticeship program;

◦University recruiting for internships targeting underrepresented minorities;

◦Monthly internal celebrations including Black History Month, Women’s History Month, Pride, and Hispanic Heritage Month; and

◦Inclusive recruitment and hiring practices to source diverse talent.

•Compliance with Laws. SentinelOne is committed to complying with all applicable laws in all jurisdictions where it does business, including employment, human rights, and environmental laws and regulations.

•COVID-19 Response. SentinelOne has taken a proactive and supportive approach to helping our employees remain healthy and productive through the COVID-19 pandemic. At the beginning of the pandemic we required the vast majority of our employees to work from home, using virtual collaboration tools to maintain productivity and to remain in contact with one another and our customers and channel partners. To support and protect our employees, we also instituted travel bans and restrictions and have taken precautions in accordance with local laws and guidelines to protect the health and safety of the small number of employees who need to be in our offices to perform their roles. As local guidelines have been lifted we have permitted employees to return to the office. In response to the COVID-19 pandemic, we have worked to globally realign our benefits to focus on business and continuity and employee well-being.

•Retention and Talent Development We believe that motivating and retaining talent at all levels is vital to our success. Our compensation and benefits program is intended to anticipate and meet the needs of our employees. In addition to base salary, these programs, which vary by country and region, include annual bonuses, equity awards, an employee stock purchase plan, a 401(k) plan, including a recently announced 401(k) match in the United States, healthcare and insurance benefits, health savings and flexible spending accounts, unlimited vacation, wellness reimbursement, and more. We have increased our investment in training and development and have rolled out several key programs as well as enabling our employees to access over 1,000 on demand webinars in technical and soft skills areas.

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Outside Director Compensation Policy

Our Board initially adopted an Outside Director Program in connection with our IPO, which was amended in December 2021. Members of our Board who are not employees are eligible for compensation under our Outside Director Program. Accordingly, Mr. Weingarten an executive officer of SentinelOne, is not eligible for awards under our Outside Director Program.

The Outside Director Program was developed in consultation with Aon, Radford, our compensation committee’s independent compensation consulting firm (“Radford”). Radford provided recommendations and competitive non-employee director compensation data and analyses. Our Board considered and discussed these recommendations and data, and considered the specific duties and committee responsibilities of particular directors. Our Board believes our Outside Director Compensation Policy provides our non-employee directors with reasonable and appropriate compensation that is commensurate with the services they provide and competitive with compensation paid by our peer group companies to their non-employee directors.

The Compensation Committee periodically reviews the type and form of compensation paid to our outside directors, which includes a market assessment and analysis by Radford. As part of this analysis, Radford reviews non-employee director compensation trends and data from companies comprising the same executive compensation peer group used by the compensation committee in connection with its review of executive compensation.

Under our Outside Director Program as in effect for fiscal 2022, non-employee directors received compensation in the form of equity and cash, as described below:

Cash Compensation

During fiscal 2022, each non-employee director was eligible to receive the following annual cash retainers for certain board and/or committee service according to our Outside Director Compensation Policy:

| Board/Committee | Chair ($) | Member ($) | |||||||||

| Lead Independent Director | — | 20,000 | |||||||||

| Board | — | 50,000 | |||||||||

| Audit Committee | 20,000 | 10,000 | |||||||||

| Compensation Committee | 12,000 | 6,000 | |||||||||

| Nominating Committee | 12,000 | 6,000 | |||||||||

All cash payments to non-employee directors are paid quarterly in arrears on a prorated basis, on the 15th of each of March, June, September and December, so long as the non-employee director continues to provide services in the applicable capacity to the company through each such date. Alternatively, each of our non-employee directors may elect to receive his or her cash fees in the form of deferred share units, pursuant to a prior written election. The RSUs granted as deferred share units will vest in equal quarterly installments so long as the non-employee director provides continuous service to the company through each vesting date, with the final installment vesting on the earliest of (i) the date of the next annual meeting of our stockholders, (ii) the date immediately prior to the next annual meeting of our stockholders if the non-employee director’s service as a director ends at such meeting due to his or her failure to be re-elected or his or her not standing for re-election, and (iii) the originally scheduled vesting date of such installment.

The RSUs granted as deferred share units will settle on the earliest to occur of (i) the 5th anniversary of the grant date, (ii) the non-employee director’s separation from service from the company, (iii) the non-employee director’s disability, (iv) the non-employee director’s death, and (v) a corporate transaction.

The annual fees, regardless of the form of payment, will become payable in full immediately prior to a corporate transaction.

Equity Compensation