Form DEF 14A SPS COMMERCE INC For: May 19

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/17/2024

April 7, 2021 4:08 PM EDT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☑ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

SPS COMMERCE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

333 South Seventh Street, Suite 1000

Minneapolis, Minnesota 55402

(612) 435-9400

April 7, 2021

Dear Stockholders:

You are cordially invited to join us for our 2021 annual meeting of stockholders, which will be held on Wednesday, May 19, 2021, at 8:00 a.m., Central Time. The meeting will be virtual and can be accessed by visiting the following website and entering your control number: www.virtualshareholdermeeting.com/SPSC2021. Stockholders will have the same opportunities to participate in the meeting as you would at an in-person meeting, including having the opportunity to vote and to submit questions during the meeting using the directions on the meeting website. You will not be able to attend the annual meeting physically in person.

The notice of annual meeting of stockholders and the proxy statement that follow describe the business to be conducted at the meeting. Whether or not you plan to attend the virtual meeting, your vote is important and we encourage you to submit your proxy to vote your shares promptly. You may vote your shares by proxy by using a toll-free telephone number, using the internet or you may sign, date and mail a proxy card which can be requested and mailed to you free of charge. Instructions regarding these three methods of voting are contained in the proxy materials.

We are pleased to take advantage of Securities and Exchange Commission (“SEC”) rules that allow companies to furnish their proxy materials over the internet. We are mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of our proxy materials and our 2020 Annual Report to Stockholders (the “Annual Report”). The Notice contains instructions on how to access those documents and to cast your vote via the internet. The Notice also contains instructions on how to request a paper copy of our proxy materials and our Annual Report. All stockholders who do not receive a Notice will receive a paper copy of the proxy materials and the Annual Report by mail. This process allows us to provide our stockholders with the information they need on a more timely basis, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

We look forward to having you attend the annual meeting.

Sincerely,

|

|

|

|

Archie Black |

|

President and Chief Executive Officer |

SPS COMMERCE, INC.

SPS COMMERCE, INC.

SPS Commerce, Inc.

333 South Seventh Street

Minneapolis, Minnesota 55402

Notice of 2021 Annual Meeting of Stockholders

|

|

Time and Date Time and Date

8:00 a.m., Central Time

Wednesday, May 19, 2021 |

|

Access Access

The meeting is virtual only. Join us via:

www.virtualshareholdermeeting.com/SPSC2021 |

|

Items of Business |

|

1. |

Election of the seven directors identified in the Proxy Statement, each for a one-year term. |

|

2. |

Ratification of the selection of KPMG LLP as independent auditor of SPS Commerce, Inc. for the fiscal year ending December 31, 2021. |

|

3. |

An advisory vote to approve the compensation of our named executive officers as disclosed in the attached proxy statement. |

|

4. |

Any other business that may properly be considered at the meeting or any adjournment or postponement of the meeting. |

Record Date – You may vote at the meeting if you were a stockholder of record at the close of business on March 24, 2021.

Voting by Proxy – Whether or not you plan to attend the annual meeting virtually, please vote your shares by proxy to ensure they are represented at the meeting. To submit your proxy vote, you may follow the instructions for voting via telephone or the internet as described in the Notice of Internet Availability of Proxy Materials and the following proxy statement. If you received a paper copy of the proxy card by mail, you may sign, date, and mail the proxy card in the envelope provided. Our vote tabulator is Broadridge Financial Solutions, Inc., and no postage is required if the request for a paper copy of the proxy materials is mailed in the United States.

By Order of the Board of Directors,

|

|

|

|

Archie Black |

|

President and Chief Executive Officer |

|

Important Notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on May 19, 2021:

The Notice of Annual Meeting, Proxy Statement, and 2020 Annual Report are available at www.proxyvote.com. |

SPS COMMERCE, INC.

SPS COMMERCE, INC.

How to Vote

Whether or not you plan to attend the meeting virtually, please provide your proxy by either using the internet or telephone as further explained in this proxy statement or filling in, signing, dating, and promptly mailing a proxy card.

All references to the “Plan” are in reference to the SPS Commerce, Inc. 401(k) Retirement Savings Plan.

|

|

|

|

|

|

BY TELEPHONE |

|

|

• |

You will need to use a control number that was provided to you by our vote tabulator, Broadridge Financial Solutions. |

|

|

• |

Call the toll-free number on your Notice or proxy card, 24 hours a day, seven days a week, through 11:59 p.m. (ET) on May 18, 2021 for shares held directly, and through 11:59 p.m. (ET) on May 16, 2021 for shares held in the Plan. |

|

|

• |

Please have your Notice or proxy card available and follow the additional steps when prompted. |

|

|

|

|

|

|

BY INTERNET |

|

|

• |

Go to the web site at www.proxyvote.com, 24 hours a day, seven days a week, through 11:59 p.m. (ET) on May 18, 2021 for shares held directly, and through 11:59 p.m. (ET) on May 16, 2021 for shares held in the Plan. |

|

|

• |

Please have your Notice or proxy card available and follow the instructions provided to obtain your records and to create an electronic voting instruction form. |

|

|

|

|

|

|

BY MAIL |

|

|

• |

If you received a Notice, first request a paper copy of the proxy materials as directed in the Notice on or before May 5, 2021 to facilitate timely delivery. |

|

|

• |

Mark, sign, and date your proxy card. |

|

|

• |

Return it in the postage-paid envelope provided. |

If your shares are held in an account at a brokerage firm, bank, or similar organization, you will receive voting instructions from the organization holding your account and you must follow those instructions to vote your shares. You will receive a Notice Regarding the Availability of Proxy Materials that will tell you how to access our proxy materials on the internet and vote your shares over the internet. It will also tell you how to request a paper or e-mail copy of our proxy materials.

YOUR VOTE IS IMPORTANT. THANK YOU FOR VOTING.

SPS COMMERCE, INC.

SPS COMMERCE, INC.

|

Unless the context otherwise requires, the words “we,” “us,” “our,” the “Company,” “SPS,” and “SPS Commerce” refer to SPS Commerce, Inc. |

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

1 |

Proxy Statement for the Year Ended December 31, 2020 |

proxy summary

This summary highlights information contained elsewhere in this proxy statement. We encourage you to review the entire proxy statement. This proxy statement and our Annual Report for the year ended December 31, 2020 are first being mailed to our stockholders on or about April 7, 2021. Website addresses included throughout this proxy statement are for reference only. The information contained on our website is not incorporated by reference into this proxy statement.

Business Results

We are a technology company with revenue of $312.6 million in 2020. We are a leading provider of cloud-based supply chain management solutions, providing network-proven integrations and comprehensive retail performance analytics to tens of thousands of customers worldwide.

2020 was a year of continued execution for SPS Commerce, in an industry and customer base that has seen significant acceleration of transition. We achieved year-over-year recurring revenue growth, customer growth and wallet share growth while delivering strong revenue and Adjusted EBITDA growth. We also executed one strategic acquisition and continued to repurchase shares through our buyback program. Additional information regarding our performance is as follows.

|

|

• |

We had sequential revenue growth for all four quarters of 2020 and now have 80 consecutive quarters of sequential revenue growth. |

|

|

• |

Our revenues of $312.6 million for 2020, compared to $279.1 million for 2019, reflect 12% growth. Recurring revenue grew 13% from 2019. |

|

|

• |

Our average recurring revenue per recurring revenue customer increased 6% from 2019, and the number of recurring revenue customers grew 8% from 2019. |

|

|

• |

We achieved improvements in operational efficiency that produced Adjusted EBITDA of $87.0 million, compared to $69.8 million in 2019, and non-GAAP net income per diluted share of $1.53 compared to $1.28 in 2019.1 |

1 Adjusted EBITDA, Non-GAAP income and non-GAAP income per diluted share are non-GAAP financial measures. Refer to Appendix A in this proxy statement for a reconciliation of these non-GAAP financial measures to the corresponding GAAP measures.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

2 |

Proxy Statement for the Year Ended December 31, 2020 |

Voting Matters and Voting Recommendations

The following proposals are included in this proxy statement and are scheduled to be voted on at the meeting. Our board of directors recommends that you vote your shares as indicated below.

|

PROPOSALS: |

|

THE BOARD OF DIRECTOR’S

VOTING RECOMMENDATIONS: |

|

RATIONALE FOR SUPPORT: |

|

FOR FURTHER

DETAILS: |

|

1. |

Election of the seven directors identified in this Proxy Statement, each for a term of one year. |

|

“FOR” each nominee to the Board |

|

Our nominees are distinguished leaders who bring a mix of skills and qualifications to our board of directors and can represent the interests of all stockholders. |

|

Page 9 |

|

2. |

Ratification of the selection of KPMG LLP (“KPMG“) as independent auditor of SPS Commerce, Inc. for the fiscal year ending December 31, 2021. |

|

“FOR” |

|

Based on its assessment of the qualifications and performance of KPMG, the Audit Committee believes that it is in the best interests of the Company and its stockholders to retain KPMG. |

|

Page 38 |

|

3. |

An advisory vote to approve the compensation of our named executive officers. |

|

“FOR” |

|

Our executive compensation program is designed to attract and retain talented and highly experienced executives and to motivate our executives to achieve the goals that are important to the Company’s growth and stockholder value. |

|

Page 39 |

Other than the proposals described in this proxy statement, the board is not aware of any other matters to be presented for a vote at the annual meeting. If you grant a proxy by telephone, internet, or by signing and returning your proxy card, any of the persons appointed by the board as proxy holders will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If any of our nominees is unavailable as a candidate for director, the above-named proxy holders will vote your proxy for another candidate or candidates as may be nominated by the board of directors.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

3 |

Proxy Statement for the Year Ended December 31, 2020 |

Questions and Answers about the Annual meeting and Voting

The board of directors of SPS Commerce, Inc. is soliciting proxies for use at the annual meeting of stockholders to be held on May 19, 2021, and at any adjournment or postponement of the meeting.

|

Purpose of the Annual Meeting |

At our annual meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders, and management will report on matters of current interest to our stockholders and respond to questions from our stockholders. The matters outlined in the notice include the election of directors, the ratification of the selection of our independent auditor for 2021, and an advisory vote to approve the compensation of our named executive officers.

|

Annual Meeting Voting Rights and Attendance |

Who is entitled to vote at the meeting?

The board of directors has set March 24, 2021 as the record date for the annual meeting. If you were a stockholder of record at the close of business on March 24, 2021, you are entitled to vote at the meeting. As of the record date, 35,861,584 shares of common stock, representing all of our voting stock, were issued and outstanding and, therefore, eligible to vote at the meeting.

What are my voting rights?

Holders of our common stock are entitled to one vote per share. Therefore, a total of 35,861,584 votes are entitled to be cast at the meeting. There is no cumulative voting.

How many shares must be present to hold the meeting?

In accordance with our bylaws, shares equal to a majority of the voting power of the outstanding shares of common stock entitled to vote generally in the election of directors as of the record date must be present at the annual meeting in order to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the meeting if:

|

|

• |

you are present (virtually) and vote at the meeting; or |

|

|

• |

you have properly and timely submitted your proxy as described below under “How do I submit my proxy?” |

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares. If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the stockholder of record with respect to those shares, while you are considered the beneficial owner of those shares. In that case, your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust, or other nominee how to vote their shares using the method described below under “How do I submit my proxy?”

How can I attend the meeting?

All of our stockholders are invited to attend the annual meeting virtually. The meeting is not being held in person due to public health and travel impacts of the coronavirus (COVID-19) pandemic. In addition, we believe that hosting the meeting online enables increased attendance and participation from locations around the world. The meeting has been designed to provide the same rights to participate as you would have at an in-person meeting.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

4 |

Proxy Statement for the Year Ended December 31, 2020 |

What do I need to attend the meeting?

We will be hosting our meeting via live webcast. Stockholders can attend the meeting online at: www.virtualshareholdermeeting.com/SPSC2021. The webcast will begin at 8:00 a.m., Central Time. We encourage you to access the meeting prior to the start time. In order to participate in the meeting, you will need the 16-digit control number located on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. A replay of the meeting will be publicly available on the Investor Relations page of our website for at least 30 days after the meeting.

How can I submit a question at the meeting?

If you would like to submit a question at the meeting, you may type your question into the dialog box provided at any point during the virtual meeting (until the floor is closed to questions). In order to allow us to answer questions from as many stockholders as possible, we limit each stockholder to one question. Questions and answers may be grouped by topic and substantially similar questions may be answered at once. If we do not have time to answer all the appropriate questions that have been submitted, we expect to post any additional questions and our answers on the Investor Relations page of our website promptly following the meeting and retain them for 30 days after the meeting.

What if I have technical difficulties or trouble accessing the meeting?

If you encounter any technical difficulties with accessing the virtual meeting, please call the technical support number that will be posted on the meeting website log-in page.

|

Information about the Notice and Proxy Materials |

What is a proxy?

It is your designation of another person to vote stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. When you designate a proxy, you also may direct the proxy how to vote your shares. We refer to this as your “proxy vote.” Two executive officers have been designated as proxies for our 2021 annual meeting of stockholders. These executive officers are Archie Black and Kimberly Nelson.

If I received a one-page Notice of Internet Availability of Proxy Materials, how can I receive a full set of printed proxy materials?

As permitted by SEC rules, we have elected to provide access to our proxy materials over the internet to record owners and any beneficial owners of our stock who have not previously requested printed proxy materials, which reduces our costs and the environmental impact of our annual meeting. The Notice of Availability contains instructions on how to request a printed set of proxy materials, which we will provide to stockholders upon request at no cost to the requesting stockholder within three business days after receiving the request. If you would like to request a printed set of proxy materials, please make your request on or before May 5, 2021 to facilitate timely delivery.

How do I submit my proxy?

If you are a stockholder of record, you can submit a proxy to be voted at the meeting in any of the following ways:

|

|

• |

over the internet using www.proxyvote.com, |

|

|

• |

over the telephone by calling a toll-free number; or |

|

|

• |

signing, dating, and mailing the proxy card in the envelope provided. |

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

5 |

Proxy Statement for the Year Ended December 31, 2020 |

To vote by telephone or the internet, you will need to use a control number that was provided to you by our vote tabulator, Broadridge Financial Solutions, and then follow the additional steps when prompted. The steps have been designed to authenticate your identity, allow you to give voting instructions, and confirm that those instructions have been recorded properly. If you hold your shares in street name, you must vote your shares in the manner prescribed by your broker, bank, trust, or other nominee, which is similar to the voting procedures for stockholders of record. If you request the proxy materials by mail after receiving a Notice of Internet Availability of Proxy Material, you will receive a voting instruction form (not a proxy card) to use in directing the broker, bank, trust, or other nominee how to vote your shares.

What does it mean if I receive more than one printed set of proxy materials?

If you receive more than one Notice of Internet Availability of Proxy Materials or printed set of proxy materials, it means that you hold shares registered in more than one account. To ensure that all of your shares are voted, vote once for each control number you receive as described above under “How do I submit my proxy?”

Who pays for the cost of proxy preparation and solicitation?

SPS Commerce pays for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks, trusts or other nominees for forwarding proxy materials to street name holders. We are soliciting proxies by mail. In addition, our directors, officers, and regular employees may solicit proxies personally, telephonically, electronically or by other means of communication. Our directors, officers and regular employees will receive no additional compensation for their services other than their regular compensation.

How do I vote?

See the “How to Vote” section earlier in this document for instructions on the different options on how to vote.

How does the board of directors recommend that I vote?

The board of directors recommends a vote:

|

|

• |

FOR the election of each of the nominees for director; |

|

|

• |

FOR the ratification of the selection of KPMG as the independent auditor of SPS Commerce, Inc. for the year ending December 31, 2021; and |

|

|

• |

FOR advisory approval of the compensation of our named executive officers. |

What if I do not specify how I want my shares voted?

If you are a stockholder of record and submit a signed proxy card or submit your proxy by internet or telephone but do not specify how you want to vote your shares on a particular matter, we will vote your shares as follows:

|

|

• |

FOR the election of each of the nominees for director; |

|

|

• |

FOR the ratification of the selection of KPMG as the independent auditor of SPS Commerce, Inc. for the year ending December 31, 2021; and |

|

|

• |

FOR advisory approval of the compensation of our named executive officers. |

Your vote is important. We urge you to vote, or to instruct your broker, bank, trust, or other nominee how to vote, on all matters before the annual meeting. If you are a street name holder and fail to instruct the stockholder of record how you want to vote your shares on a particular matter, those shares are considered to be “uninstructed.” New York Stock Exchange rules determine the circumstances under which member brokers of the New York Stock Exchange may exercise discretion to vote “uninstructed” shares held by them on behalf of their clients who are

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

6 |

Proxy Statement for the Year Ended December 31, 2020 |

street name holders. Other than the ratification of the selection of KPMG as our independent auditor for the year ending December 31, 2021, the rules do not permit member brokers to exercise voting discretion as to the uninstructed shares on any matter included in the notice of meeting. With respect to the ratification of the selection of KPMG as our independent auditor for the year ending December 31, 2021, the rules permit member brokers to exercise voting discretion as to the uninstructed shares. For matters with respect to which the broker, bank or other nominee does not have voting discretion or has, but does not exercise, voting discretion, the uninstructed shares will be referred to as a “broker non-vote.” For more information regarding the effect of broker non-votes on the outcome of the vote, see below under “How are votes counted?”

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before your proxy is voted at the annual meeting, in any of the following ways:

|

|

• |

by submitting a later-dated proxy by telephone or the internet before 11:59 p.m. Eastern Time on May 18, 2021 for shares held directly and before 11:59 p.m. Eastern Time on May 16, 2021 for shares held in a Plan; |

|

|

• |

by submitting a later-dated proxy to the Chief Financial Officer of SPS Commerce, Inc., which must be received by us before the time of the annual meeting; |

|

|

• |

by sending a written notice of revocation to the Chief Financial Officer of SPS Commerce, Inc., which must be received by us before the time of the annual meeting; or |

|

|

• |

by voting at the virtual meeting. |

Can I vote my shares at the meeting?

If you are a stockholder of record or beneficial owner of common stock as of the close of business on the record date, you may vote your shares during the virtual meeting by using the 16-digit control number on your Notice, your proxy card, or your voting instruction form, as applicable, on www.virtualshareholdermeeting.com/SPSC2021. Even if you currently plan to attend the meeting, we recommend that you submit your proxy as described above so your vote will be counted if you later decide not to attend the meeting. If you submit your vote by proxy and later decide to vote at the annual meeting, the vote you submit at the meeting will override your proxy vote.

What vote is required to approve each item of business included in the notice of meeting?

A director nominee will be elected if the number of votes cast “FOR” the nominee exceeds the number of votes cast “AGAINST” the nominee. Any incumbent director who does not receive a greater number of votes “FOR” than “AGAINST” his or her reelection in an uncontested election shall tender his or her resignation to the board of directors, subject to acceptance by the board of directors. The board of directors will determine whether to accept or reject the offer to resign within 90 days of certification of the stockholder vote.

The affirmative vote of the holders of a majority of the outstanding shares of common stock present at the meeting or represented by proxy and entitled to vote at the annual meeting is required to ratify the selection of our independent auditor.

For the advisory vote to approve the executive compensation of our named executive officers, there is no minimum approval necessary for the proposal since it is an advisory vote; however, the board of directors will consider the results of the advisory vote when considering future decisions related to such proposals.

How are votes counted?

You may vote “FOR,” “AGAINST” OR “ABSTAIN” for each director nominee and on the other proposals. If you properly submit your proxy but abstain from voting for a director nominee or on these other proposals, your shares will be counted as present at the meeting for the purpose of determining a quorum and for the purpose of calculating the vote on the particular matter(s) with respect to which you abstained from voting. If you do not submit

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

7 |

Proxy Statement for the Year Ended December 31, 2020 |

your proxy or voting instructions and also do not vote by ballot at the annual meeting, your shares will not be counted as present at the meeting for the purpose of determining a quorum unless you hold your shares in street name and the broker, bank, trust or other nominee has discretion to vote your shares and does so. For more information regarding discretionary voting, see the information above under “What if I do not specify how I want my shares voted?”

If you abstain from voting for one or more of the director nominees or you do not vote your shares on this matter (whether by broker non-vote or otherwise), this will have no effect on the outcome of the vote. With respect to the proposal to ratify the selection of KPMG as our independent auditor, if you abstain from voting, doing so will have the same effect as a vote against the proposal, but if you do not vote your shares (or, for shares held in street name, if you do not submit voting instructions and your broker, bank, trust or other nominee does not or may not vote your shares), this will have no effect on the outcome of the vote. Abstentions and broker non-votes will have no effect on the advisory vote to approve the compensation of our named executive officers.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

8 |

Proxy Statement for the Year Ended December 31, 2020 |

|

ITEM 1 – ELECTION OF DIRECTORS |

The board of directors currently consists of eight directors and the board has set the number of directors that will constitute the board as of the annual meeting at seven. Our Amended and Restated Bylaws provide that each member of our board is elected annually by a majority of votes cast if the election is uncontested. All of our directors were elected by our stockholders at our 2020 annual meeting of stockholders, with the exception of Ms. Ward who was elected by the board to serve as a director in November 2020. Ms. Ward was initially identified as a potential candidate for the board by the Company’s Chief Financial Officer and referred to the Governance & Nominating Committee for consideration as part of the committee’s search for a new director.

The following are directors who currently serve on our board of directors and those directors nominated for election.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Age(1) |

|

|

Position |

|

Director Since |

|

Independent |

|

Nominated for Election(2) |

|

|

Archie Black |

|

|

59 |

|

|

Chief Executive Officer |

|

2001 |

|

No |

|

Yes |

|

|

James Ramsey |

|

|

48 |

|

|

Director |

|

2014 |

|

Yes |

|

Yes |

|

|

Marty Reaume |

|

|

55 |

|

|

Director |

|

2018 |

|

Yes |

|

Yes |

|

|

Tami Reller |

|

|

56 |

|

|

Chair of the Board |

|

2016 |

|

Yes |

|

Yes |

|

|

Philip Soran |

|

|

64 |

|

|

Director |

|

2010 |

|

Yes |

|

Yes |

|

|

Anne Sempowski Ward |

|

|

49 |

|

|

Director |

|

2020 |

|

Yes |

|

Yes |

|

|

Sven Wehrwein |

|

|

70 |

|

|

Director |

|

2008 |

|

Yes |

|

Yes |

|

|

Martin Leestma |

|

|

62 |

|

|

Director |

|

2006 |

|

Yes |

|

No |

(3) |

|

|

(1) |

Age as of April 7, 2021 |

|

|

(2) |

Nominated for election at the 2021 annual meeting for continued service on the board upon the recommendation of the Governance & Nominating committee |

|

|

(3) |

Mr. Leestma has informed the board of directors of his intention to resign from the board effective the date of the 2021 annual meeting, May 19, 2021, and thus, is not nominated for election |

All nominated board members have agreed to serve as directors if elected. If, for any reason, any nominee becomes unable to serve before the annual meeting occurs, the persons named as proxies may vote your shares for a substitute nominee selected by our board of directors. The director nominees, if reelected, will serve until our 2022 annual meeting of stockholders or until their successors are elected and qualified.

The board of directors recommends a vote FOR the election of each of the director nominees. Proxies will be voted FOR the election of each of the nominees unless otherwise specified.

Set forth below is biographical information for each of the current and nominated directors. The following includes certain information regarding our directors’ individual experience, qualifications, attributes, and skills that led the board of directors to conclude that they should serve as directors.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

9 |

Proxy Statement for the Year Ended December 31, 2020 |

Nominees for Directors

Archie Black

Professional Highlights

|

|

• |

SPS Commerce, Inc., President and Chief Executive Officer, 2001 – present, Senior Vice President and Chief Financial Officer, 1998 – 2001 |

|

|

• |

Investment Advisors, Inc., Senior Vice President and Chief Financial Officer, 1987 – 1998 |

International asset management firm

|

|

• |

Price Waterhouse, Auditor, 1984 – 1987 |

International audit, tax, and consulting firm

|

|

• |

Chair of the Board, Proto Labs, Inc. |

Publicly traded internet-enabled manufacturer of custom parts

|

|

• |

Director on the Minnesota Business Partnership |

Group of over 100 senior executives of Minnesota’s largest employers that works on a range of Minnesota based policy issues

Primary Nominee Qualifications

Extensive management, financial, and operational experience as well as his experience with our Company.

James Ramsey

Professional Highlights

|

|

• |

Vlocity Inc., Director, 2014 – 2020 |

Co-founder of the industry-specific cloud CRM application provider

|

|

• |

NetSuite Inc., 2003 – 2013, Executive Vice President of Worldwide Sales and Distribution |

Publicly traded provider of cloud-based business management software

|

|

• |

Oracle Corporation, Various sales management roles, 1995 – 2003 |

Publicly traded software and technology provider

|

|

• |

Director of Ambra Health (formerly DicomGrid) |

Medical software company

|

|

• |

Served as a director of Flipgrid, Inc. |

Education technology software company

Primary Nominee Qualifications

Experience in software sales and in rapidly scaling sales organizations.

Marty Reaume

Professional Highlights

|

|

• |

SemperVirens Venture Capital, HR Venture Advisor, 2020 – present |

Early stage venture capital fund

|

|

• |

Twilio Inc., Chief People Officer, 2017 – 2019 |

Publicly traded developer and provider of a communication cloud-based platform

|

|

• |

Fitbit, Inc., Chief People Officer, 2015 – 2017 |

Publicly traded health solution technology provider

|

|

• |

NetSuite, Inc., Chief People Officer and Head of Human Resources, 2006 – 2014 |

Publicly traded provider of cloud-based business management software

|

|

• |

Director of Ambra Health (formerly DicomGrid) |

Medical software company

Primary Nominee Qualifications

Strong human resources, talent acquisition and talent development expertise.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

10 |

Proxy Statement for the Year Ended December 31, 2020 |

Tami Reller

Professional Highlights

|

|

• |

UnitedHealth Group, Executive Vice President and Chief Marketing and Experience Officer, 2017 – present |

Publicly traded health benefits and service platform

|

|

• |

Optum, Chief Growth Officer, Chief Financial Officer, 2016 – 2017; Chief Marketing Officer, 2014 – 2016 |

Part of UnitedHealth Group, pharmacy benefit manager

|

|

• |

Microsoft Corporation, 2001 – 2014, several executive roles including Executive Vice President of Marketing, Divisional Chief Financial Officer and Divisional Chief Marketing Officer |

Publicly traded software and technology company

|

|

• |

Great Plains Software, Chief Financial Officer, 1999 – 2001 |

Publicly traded accounting and ERP software provider

Publicly traded automated tax compliance software company

|

|

• |

Chair of our board, 2018 – present |

Primary Nominee Qualifications

Extensive experience managing software companies, financial understanding and auditing review, and general business knowledge.

Philip Soran

Professional Highlights

|

|

• |

Piper Sandler Companies, Lead Director, 2013 – present |

Publicly traded investment bank and asset management firm

|

|

• |

Flipgrid, Inc., Executive Chairman, 2015 – 2018 |

Co-founded education technology software company

|

|

• |

Compellent Technologies, Inc., President/Chief Executive Officer, 2002 – 2012 |

Co-founded publicly traded software company

|

|

• |

Xiotech, President/Chief Executive Officer, 1995 – 2001 |

Co-founded network storage business

|

|

o |

Claros Technologies, Inc., an advanced materials and environmental company |

|

|

o |

Foodsby, a food delivery service |

|

|

o |

Spineology Inc., a medical technology company |

|

|

• |

Served as a director of Hutchinson Technology Inc. |

Manufacturing company; publicly traded at the time of director role

|

|

• |

Served as Chair of our board, 2014 – 2017 |

Primary Nominee Qualifications

Experience as a chief executive officer of a publicly traded company, service on a variety of public and private technology-related company boards, and experience in founding and building technology companies as well as corporate vision and operational knowledge.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

11 |

Proxy Statement for the Year Ended December 31, 2020 |

Anne Sempowski Ward

Professional Highlights

|

|

• |

CURiO Brands, Chief Executive Officer, 2012 – present |

Consumer goods provider

|

|

• |

The FORWARD Group, Chief Executive Officer, 2010 – 2012 |

Co-founded business consulting group

|

|

• |

Johnson Publishing Company, President & Chief Operating Officer, 2007 – 2010 |

Media and beauty company

|

|

• |

The Coca-Cola Company, Assistant Vice President, 2006 – 2007 |

Publicly traded multinational consumer goods provider

|

|

• |

Procter & Gamble, Associate Marking Director, 1994 – 2006 |

Publicly traded multinational consumer goods provider

|

|

o |

Spectrum Brands, publicly traded consumer goods provider |

|

|

o |

Vanda Pharmaceuticals, publicly traded biopharma company |

Primary Nominee Qualifications

Experience as a chief executive officer and brand builder in the high-growth consumer and retail environment.

Sven Wehrwein

Professional Highlights

|

|

• |

Independent financial consultant to emerging companies, 1999 – present |

|

|

• |

Over 35 years in accounting and finance roles as a certified public accountant (inactive), investment banker to emerging growth companies, chief financial officer, and audit committee chair |

|

|

o |

Atricure, Inc., publicly traded medical device company |

|

|

o |

Proto Labs, Inc., publicly traded internet-enabled manufacturer of custom parts |

|

|

• |

Served as a director of the following publicly traded companies: |

|

|

o |

Cogentix Medical, Inc., 2006 – 2016 |

|

|

o |

Compellent Technologies, Inc., 2007 – 2011 |

|

|

o |

Image Sensing Systems, Inc., 2006 – 2012 |

|

|

o |

Synovis Life Technologies, Inc., 2004 – 2012 |

|

|

o |

Vital Images, Inc., 1997 – 2011 |

Primary Nominee Qualifications

Capabilities in financial understanding, strategic planning, and auditing expertise, given his experiences in investment banking and in financial leadership positions.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

12 |

Proxy Statement for the Year Ended December 31, 2020 |

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

The board of directors conducts its business through meetings of the board established standing committees. Each of the standing committees has adopted and operates under a written charter, all of which are available on our website at www.spscommerce.com. We have adopted a code of business conduct and ethics relating to the conduct of our business by our directors, officers, and employees, which is posted on our website at www.spscommerce.com. Our Corporate Governance Guidelines are also available on our website.

Board Leadership Structure

Tami Reller, a non-employee independent director, has served as chair of our board of directors since 2018, while Archie Black serves as our President and Chief Executive Officer. Separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the chair of the board to lead the board in its fundamental role of providing advice to, and independent oversight of, management. The board of directors recognizes the time, effort, and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our board chair. Our Corporate Governance Guidelines require our board chair and Chief Executive Officer positions to be separate because the board of directors believes that having separate positions and having an independent director serve as chair of the board is the appropriate leadership structure for us and demonstrates our commitment to good corporate governance.

Board Committees

The board of directors has established an Audit Committee, a Compensation & Talent Committee, a Governance & Nominating Committee and a Finance & Strategy Committee. The following sets forth the membership of each of our committees as of March 24, 2021.

|

DIRECTOR(1) |

COMMITTEES |

|

Audit |

Compensation & Talent |

Governance & Nominating |

Finance &

Strategy |

|

Archie Black |

|

|

|

|

|

(2) (2)

|

|

Martin Leestma(3) |

|

|

|

|

|

|

|

James Ramsey |

|

|

|

|

|

|

|

Marty Reaume |

|

|

|

|

|

|

|

Tami Reller |

|

|

|

|

|

|

|

Philip Soran |

|

|

|

|

|

|

|

Sven Wehrwein |

|

|

|

|

|

|

|

Chair Chair  Member Member

|

|

|

|

|

|

|

|

|

(1) |

Ms. Ward is not a member of any committees as of March 24, 2021. Pending election at the 2021 annual meeting, she will become a member on the Audit and Governance & Nominating Committees. |

|

|

(2) |

Mr. Black is an ex-officio member of the Finance & Strategy Committee. As an ex-officio member, Mr. Black has a standing invitation to attend each committee meeting but does not count for quorum purposes or vote on committee matters. |

|

|

(3) |

Mr. Leestma has informed the board of directors of his intention to resign from the board effective the date of the 2021 annual meeting, May 19, 2021, and therefore will also resign from his membership on both the Finance & Strategy and Audit Committees at that time. |

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

13 |

Proxy Statement for the Year Ended December 31, 2020 |

The primary responsibilities of each board committee are discussed in turn below.

Audit Committee

Among other matters, our Audit Committee:

|

|

• |

evaluates the qualifications, performance and independence of our independent auditor and reviews and approves both audit and non-audit services to be provided by the independent auditor; |

|

|

• |

discusses with management and our independent auditors any major issues as to the adequacy of our internal controls, any actions to be taken in light of significant or material control deficiencies and the adequacy of disclosures about changes in internal control over financial reporting; |

|

|

• |

establishes procedures for the receipt, retention, and treatment of complaints regarding accounting, internal accounting controls or auditing matters, including the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters; |

|

|

• |

oversees our investment policy; and |

|

|

• |

prepares the Audit Committee report that SEC rules require to be included in our annual proxy statement. |

Each of the members of our Audit Committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the Nasdaq Global Market. Our board of directors has determined that Mr. Wehrwein is an Audit Committee financial expert, as defined under the applicable rules of the SEC. Each member of our Audit Committee satisfies the Nasdaq Global Market independence standards and the independence standards of Rule 10A-3(b)(1) of the Securities Exchange Act.

Compensation & Talent Committee

Among other matters, our Compensation & Talent Committee:

|

|

• |

reviews and approves, on an annual basis, the goals, and objectives relevant to our executive officer’s compensation; |

|

|

• |

assess and approves our Chief Executive Officer and other executive officers’ annual compensation, including salary, bonus, incentive and equity-based compensation, based on a review of executive officer performance evaluations, a review of peer company compensation programs, and external consultations; |

|

|

• |

administers the issuance of stock options and other awards under our 2010 Equity Incentive Plan; and |

|

|

• |

periodically reviews the compensation paid to our non-employee directors and recommends any adjustments in director compensation to our board of directors. |

In 2021, the committee expanded its responsibilities to include its oversight of the talent programs and initiatives impacting our people.

Governance & Nominating Committee

Our Governance & Nominating Committee identifies individuals qualified to become members of the board of directors, recommends individuals to the board for nomination as members of the board and board committees and oversees the evaluation of our board of directors.

Finance & Strategy Committee

Our Finance & Strategy Committee assists the board of directors in matters involving certain finance and strategic matters, including reviewing and monitoring the management of capital, reviewing dividend and share repurchase policies and practices, and reviewing proposed merger, recapitalization, financing and other similar transactions.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

14 |

Proxy Statement for the Year Ended December 31, 2020 |

Meeting Attendance

Our Corporate Governance Guidelines provide that our directors are expected to attend meetings of the board of directors and of the committees on which they serve, as well as our annual meeting of stockholders. Our board of directors held the following meetings during 2020.

|

Committee |

|

Meetings (#) |

|

|

Audit |

|

|

8 |

|

|

Compensation & Talent |

|

|

8 |

|

|

Governance & Nominating |

|

|

11 |

|

|

Finance & Strategy |

|

|

7 |

|

|

Full Board of Directors |

|

|

10 |

|

Each of our directors attended at least 75% of the meetings of the board of directors and the committees on which he or she served during 2020, and each of our directors whose service would be continuing after the meeting, attended our 2020 annual meeting.

Board Involvement in Risk Oversight

Our management is responsible for identifying the various risks facing us, formulating risk management policies and procedures, and managing our risk exposures on a day-to-day basis. The board of directors’ responsibility is to monitor our risk management processes by informing itself concerning our material risks and evaluating whether management has reasonable controls in place to address the material risks; the board is not responsible, however, for identifying or managing our various risks. The Audit Committee is primarily responsible for monitoring management’s responsibility in the area of financial risk oversight and the board of directors is primarily responsible for monitoring management’s responsibility in our other areas of risk management. Accordingly, management regularly reported to the Audit Committee and the board of directors on risk management during 2020. The Audit Committee, in turn, reports on the matters discussed at the committee level to the full board. The Audit Committee and the full board focus on the material risks facing us, including financial, operational, market, credit, liquidity, legal and regulatory risks, to assess whether management has reasonable controls in place to address these risks. In addition, the Compensation & Talent Committee is charged with reviewing and discussing with management whether our compensation arrangements are administered consistent with effective internal controls and sound risk management. The board of directors believes this division of responsibilities provides an effective and efficient approach for addressing risk management.

Procedures for Contacting the Company, including the Board of Directors

Throughout this proxy statement, we identify reasons stockholders may need or wish to contact the Company. All of those communications should be directed to the title of the person indicated at the address below.

Stockholders who wish to communicate with the board of directors may do so by writing to the board or a particular director in care of the Secretary of the Company. Communications should be addressed to:

SPS Commerce, Inc.

Attention: Secretary

333 South Seventh Street, Suite 1000

Minneapolis, Minnesota 55402

All communications addressed to the board will initially be received and processed by the Secretary of the Company, who will then refer the communication to the appropriate board member (either the director named in the communication, the chairperson of the board committee having authority over the matter raised in the communication, or the chairperson of the board in all other cases). The director to whom a communication is referred will determine, in consultation with our counsel, whether a copy or summary of the communication will be provided to the other directors. The board of directors will respond to communications if and as appropriate.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

15 |

Proxy Statement for the Year Ended December 31, 2020 |

Director Independence

As required under the Nasdaq Global Market rules and regulations, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board. The board of directors consults with our counsel to ensure that the board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the Nasdaq Global Market, as in effect from time to time.

In assessing Ms. Ward’s independence, the board of directors considered that Ms. Ward is the Chief Executive Officer of a company that purchases services in the ordinary course of business from our Company. The board considered that Ms. Ward is not personally involved in the relationship between her employer and our Company, the contract was at terms commensurate with other customers, and contract amount is overall insignificant for each company, including representing less than 1% of our revenue.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and our Company, our management and our independent registered public accounting firm, the board of directors has affirmatively determined that all of our Company’s directors are independent directors within the meaning of the applicable listing standards of the Nasdaq Global Market, except for Mr. Black, our current President and Chief Executive Officer.

As required under the Nasdaq Global Market rules and regulations, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present. All of the committees of our board of directors are comprised entirely of directors determined by the board to be independent within the meaning of the Nasdaq Global Market rules and regulations.

Hedging, Pledging and Other Restricted Transactions

Our directors, consistent with all of our employees and Section 16 officers, are prohibited from engaging in the following transactions with respect to our securities:

|

|

• |

Purchasing our securities on margin, or otherwise pledging our securities; |

|

|

• |

Short sales of our securities (selling securities not owned at the time of sale); |

|

|

• |

Buying or selling put or call options or other derivative securities based on our securities; |

|

|

• |

Purchasing any financial instruments (including prepaid variable forward contracts, equity swaps, zero cost collars and exchange funds) that are designed to hedge or offset any decrease in the market value of our securities; and |

|

|

• |

Engaging in limit orders or other pre-arranged transactions that execute automatically, except for “same-day” limit orders and approved 10b5-1 plans. |

Procedures for Selecting and Nominating Director Candidates

Stockholders may directly nominate a person for election to our board of directors by complying with the procedures set forth in Article II, Section 2.4(a)(2) of our bylaws, and with the rules and regulations of the SEC. Under our bylaws, only persons nominated in accordance with the procedures set forth in the bylaws will be eligible to serve as directors. In order to nominate a candidate for service as a director, you must be a stockholder at the time you give the board notice of your nomination, and you must be entitled to vote for the election of directors at the meeting at which your nominee will be considered. In accordance with our bylaws, director nominations generally must be made pursuant to notice delivered to, or mailed and received at, our principal executive offices at the address above, not later than the 90th day (February 18, 2022), nor earlier than the 120th day (January 19, 2022), prior to the first anniversary of the prior year’s annual meeting of stockholders. Your notice must set forth all information relating to the nominee that is required to be disclosed in solicitations of proxies for the election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including the nominee’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected).

Your notice also must set forth the following information for you and any beneficial owner on whose behalf you make a nomination: (i) the name and address of the stockholder, as they appear on our books; (ii) the class and

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

16 |

Proxy Statement for the Year Ended December 31, 2020 |

number of shares of our capital stock which are owned beneficially and of record, as well as a description of all securities or contracts, with a value derived in whole or in part from the value of any shares of our capital stock, held by you and such beneficial owner or to which either is a party; (iii) a description of all arrangements or understandings between you and any such beneficial owner and any other person or persons (including their names) regarding the nomination; (iv) a representation that you intend to appear at the meeting, or by proxy thereto, to nominate the persons named in your notice; and (v) a description of any other information relating to you and any such beneficial owner that would be required to be disclosed in a proxy statement or other filing required to be made in connection with the solicitation of proxies pursuant to Regulation 14A under the Securities Exchange Act of 1934.

As required by our Corporate Governance Guidelines, when evaluating the appropriate characteristics of candidates for service as a director, the Governance & Nominating Committee takes into account many factors. The board of directors selects and recommends to stockholders qualified individuals who, if added to the board, would provide the mix of director characteristics and diverse experiences, perspectives and skills appropriate for us. Board candidates are considered based on various criteria, including breadth and depth of relevant business and board skills and experiences, judgment and integrity, reputation in their profession, diversity of background, education, leadership ability, concern for the interests of stockholders and relevant regulatory guidelines. These considerations are made in the context of an assessment of the perceived needs of the board of directors at the particular point in time. We do not have a formal policy with respect to diversity, however, the board of directors seeks to have a board that represents diversity as to gender, race, ethnicity, and background experiences. We are committed to inclusiveness and as such, when searching for director nominees, the Governance & Nominating Committee endeavors to include highly qualified diverse candidates (including gender, race, and ethnicity) in the pool from which nominees are chosen. Directors must be willing and able to devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serving on the board for an extended period of time.

The Governance & Nominating Committee will consider director candidates recommended by stockholders in the same manner that it considers all director candidates. Stockholders who wish to suggest qualified candidates should write to the Company at the address listed above, to the attention of our Chief Financial Officer, stating in detail the characteristics that make the candidate a suitable person to serve on our board of directors in light of our Corporate Governance Guidelines.

Director Compensation

Our director compensation program is designed to compensate our non-employee directors fairly for work required for a company of our size and scope and to align their interests with the long-term interests of our stockholders. Director compensation reflects our desire to attract, retain and use the expertise of highly qualified individuals serving on our board of directors. The Compensation & Talent Committee periodically reviews the compensation arrangements for our non-employee directors and makes recommendations to our board of directors. In May 2020, the Compensation & Talent Committee, with the advice of its compensation consultant, conducted a review of our director compensation program. This review analyzed the structure and the overall level and mix of compensation delivered by our director compensation program as compared to our peer group. Following this review, the compensation & talent committee recommended, and the board approved, changes to our director compensation program as described below.

For 2020, our director compensation program provided that each non-employee director receives a total grant of $170,000 (consistent with the 2019 program). The compensation is split equally ($85,000) between stock options and at the election of the director, restricted stock and/or deferred stock units. The components are granted on the date of the annual meeting of stockholders, calculated as the grant date fair value of the option computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Stock Compensation (“ASC Topic 718”). All grants vest in four equal installments on the last day of each fiscal quarter with the first vesting date occurring on June 30, 2020, provided the recipient remains a member of the board as of the vesting date. Stock options have an exercise price equal to the fair market value of our common stock on the date of grant. Deferred stock units must be retained until completion of the director’s service on the board, and upon completion of such service, convert into an equal number of shares of our common stock. A director may defer receipt of the shares for up to ten years after completion of service.

Additionally, each new non-employee director also receives an initial stock option grant to purchase up to $170,000 of shares of our common stock in connection with initial appointment to the board, to be granted following the release of earnings for the quarter in which appointment occurs.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

17 |

Proxy Statement for the Year Ended December 31, 2020 |

Non-employee directors receive cash fees in addition to the equity awards described above. In 2020, each non-employee director was paid the following cash retainers for roles served:

|

Membership |

|

Chairperson Annual Cash Fee(1) |

|

|

Non-Chair Member Annual Cash Fee(1) |

|

|

Board of Directors |

|

$ |

|

61,000 |

|

|

$ |

|

31,000 |

|

|

Audit Committee |

|

$ |

|

20,000 |

|

|

$ |

|

8,000 |

|

|

Compensation & Talent Committee |

|

$ |

|

12,000 |

|

|

$ |

|

5,000 |

|

|

Governance & Nominating Committee |

|

$ |

|

7,500 |

|

|

$ |

|

4,000 |

|

|

Finance & Strategy Committee |

|

$ |

|

10,000 |

|

|

$ |

|

5,000 |

|

|

|

(1) |

Directors receive pro-rata cash compensation for partial year membership(s) |

We also reimbursed our non-employee directors for out-of-pocket expenses incurred in connection with attending our board and committee meetings.

The table below sets forth the compensation provided to our non-employee directors during 2020.

2020 Director Compensation Table

|

|

|

Fees Earned or Paid in Cash |

|

|

Stock Awards |

|

|

Option Awards |

|

|

Total |

|

|

Name(1) |

|

($) |

|

|

($)(2) |

|

|

($)(2) |

|

|

($) |

|

|

Martin Leestma |

|

|

49,000 |

|

|

|

84,960 |

|

|

|

84,997 |

|

|

|

218,957 |

|

|

James Ramsey |

|

|

43,500 |

|

|

|

84,960 |

|

|

|

84,997 |

|

|

|

213,457 |

|

|

Marty Reaume |

|

|

42,962 |

|

|

|

84,960 |

|

|

|

84,997 |

|

|

|

212,919 |

|

|

Tami Reller |

|

|

66,000 |

|

|

|

84,960 |

|

|

|

84,997 |

|

|

|

235,957 |

|

|

Philip Soran |

|

|

53,038 |

|

|

|

84,960 |

|

|

|

84,997 |

|

|

|

222,995 |

|

|

Anne Sempowski Ward |

|

|

4,854 |

|

|

|

- |

|

|

|

- |

|

|

|

4,854 |

|

|

Sven Wehrwein |

|

|

55,000 |

|

|

|

84,960 |

|

|

|

84,997 |

|

|

|

224,957 |

|

|

|

(1) |

Mr. Black did not receive any separate compensation for his service as a director. His compensation for serving as our President and Chief Executive Officer is set forth under the “2020 Summary Compensation Table.” |

|

|

(2) |

Represents the grant date fair value of the stock and option awards granted during the year computed in accordance with ASC Topic 718. For a discussion of the relevant assumptions used to determine the valuation of our option awards for financial reporting purposes, refer to Note L to the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K filed with the SEC on February 23, 2021. |

Under our stock ownership guidelines, we require our non-employee directors to own shares of our common stock (excluding unvested equity awards but including vested in-the-money options and vested restricted stock units) having a fair market value equal to five times the directors’ annual base cash retainer ($155,000 for 2020). Non-employee directors must comply with the stock ownership guidelines within five years of their appointment to the board of directors. Until a non-employee director has achieved compliance with the ownership guidelines, the director must retain 50% of the net shares acquired upon exercise, vesting or settlement of any equity award. As of March 24, 2021, all of our non-employee directors had met the stock ownership requirement or had served as a director for less than five years since the ownership guidelines took effect.

As of December 31, 2020, the directors held shares of unvested restricted stock, options to purchase shares of our common stock, and vested options as follows:

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

18 |

Proxy Statement for the Year Ended December 31, 2020 |

|

|

|

|

|

|

|

Options |

|

|

|

|

Unvested Restricted Stock |

|

|

Total Outstanding |

|

|

Number of Outstanding Options that Were Exercisable |

|

|

Name |

|

(#) |

|

|

(#) |

|

|

(#) |

|

|

Martin Leestma |

|

|

360 |

|

|

|

29,682 |

|

|

|

28,548 |

|

|

James Ramsey |

|

|

360 |

|

|

|

51,610 |

|

|

|

50,476 |

|

|

Marty Reaume |

|

|

360 |

|

|

|

26,660 |

|

|

|

24,160 |

|

|

Tami Reller |

|

|

360 |

|

|

|

42,824 |

|

|

|

41,690 |

|

|

Philip Soran |

|

|

360 |

|

|

|

34,188 |

|

|

|

33,054 |

|

|

Anne Sempowski Ward |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Sven Wehrwein |

|

|

360 |

|

|

|

23,682 |

|

|

|

22,548 |

|

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

19 |

Proxy Statement for the Year Ended December 31, 2020 |

|

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis |

Named Executive Officers

Our named executive officers for 2020 were the following (unchanged from 2019):

|

Name |

|

Role |

|

Archie Black |

|

President and Chief Executive Officer |

|

Kimberly Nelson |

|

Executive Vice President and Chief Financial Officer |

|

James Frome |

|

Executive Vice President and Chief Operating Officer |

Executive Summary

In 2020, the Compensation & Talent Committee took the following actions with respect to the compensation of our named executive officers:

|

|

• |

increased base salary by an average of 6% in comparison to 2019; |

|

|

• |

increased the formula-based target incentive plan bonus opportunity by an average of 21% in comparison to 2019; and |

|

|

• |

approved equity award packages comprised of the following components: |

|

|

o |

performance stock unit awards (“PSUs”) that are earned and vest over a three-year period based on a comparison of our stock performance relative to that of the Russell 2000; and |

|

|

o |

restricted stock unit (“RSUs”) that generally vest over a four-year period |

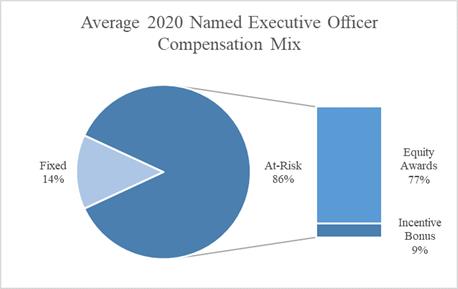

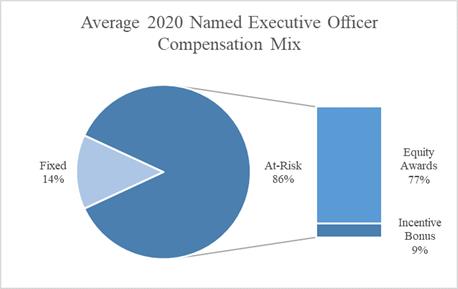

Each of the primary elements of our executive compensation program is discussed in more detail below. See the chart below for the proportion of fixed and at-risk components of named executive officer compensation during 2020, including a further breakout of what components made up at-risk compensation.

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

20 |

Proxy Statement for the Year Ended December 31, 2020 |

Compensation Objectives and Process

Historically and in 2020, our Compensation & Talent Committee (referred to in this Compensation Discussion and Analysis section as the “Committee”) has determined all elements of compensation for our named executive officers. Generally, prior to making its compensation determinations, our Chief Executive Officer provides his review of our other named executive officers to the Committee. Our Committee engages Compensia, Inc., a national independent compensation consultant, to help evaluate our compensation philosophy and provide guidance in administering our compensation program. Our Committee has determined that Compensia is independent and the services provided by Compensia do not raise any conflict of interests.

We set the compensation of our executive officers, including our named executive officers, based on their ability to create sustainable long-term stockholder value in a cost-effective manner. Our executive compensation philosophy is to align executive compensation decisions with our desired business direction, strategy, and performance. The primary objectives and priorities of our executive compensation program are the following:

|

|

• |

Pay for Performance: Emphasize at-risk (variable) compensation that is tied to our financial and stock price performance in an effort to generate and reward superior individual and collective performance; |

|

|

• |

Stockholder Alignment: Link our executives’ incentive goals with the interests of our stockholders, provide equity-based forms of compensation and establish specific stock ownership guidelines for employees in key management positions throughout our Company; |

|

|

• |

Long-Term Success: Support and reward our executives for consistent performance over time and achievement of our long-term strategic goals; and |

|

|

• |

Attraction and Retention: Attract and retain highly qualified executives whose abilities are critical to our success and competitive advantage. |

To achieve these objectives, we have designed an executive compensation program that is significantly weighted towards long-term goals. This approach aids us in the retention of executive officers and assures that the interests of our executive officers and stockholders are aligned. We provide compensation to our named executive officers through a combination of base salary, incentive compensation and equity awards (RSUs and PSUs under our 2010 Equity Incentive Plan).While our program emphasizes at-risk, performance and equity-based compensation as compared to fixed compensation (base salary), we do not have specific policies governing the allocation of the target total direct compensation opportunity among its various components or overall amounts.

While we have identified particular compensation objectives that each element of executive compensation serves, our compensation program is designed to be flexible and complementary and to collectively serve all of the executive compensation objectives described above. Accordingly, we believe that as a part of our overall executive compensation policy, each individual element, to a greater or lesser extent, serves each of our objectives.

Say-on-Pay

Our Committee considers the results of the stockholders’ advisory vote on the compensation of our named executive officers. At our 2020 Annual Meeting of Stockholders, our say-on-pay proposal received “FOR” votes that represented approximately 94.6% of the shares voted on this proposal. The Committee considered the results of the say-on-pay vote when evaluating our compensation practices and policies and when setting the compensation of our named executive officers for 2020 and decided not to make any significant changes to our executive compensation program. The Committee believes that the significant support for the prior year say-on-pay proposal demonstrates stockholders’ support of our compensation program, policies, and practices.

Policies and Practices

We maintained the following compensation policies and practices in 2020:

|

|

• |

No Tax Gross-Up Provisions. Our named executive officers are not entitled to any tax gross-up treatment on any severance or change in control benefits. |

|

|

• |

Compensation Programs Create No Excessive Risk. Our compensation programs are reviewed regularly by our Committee, which has determined that our compensation programs do not create inappropriate or excessive risk that is likely to have a material adverse effect on our Company. |

|

SPS COMMERCE, INC. SPS COMMERCE, INC.

|

21 |

Proxy Statement for the Year Ended December 31, 2020 |

|

|

• |

Independent Compensation Consultant Engaged. Our Committee engaged an independent compensation consultant, Compensia, to assist the committee with determining compensation for our named executive officers as well as provide the committee with market data and guidance on best practices. |

|

|

• |

Hedging Transactions Prohibited. Our insider trading policy prohibits our employees, including directors and executive officers, from participating in the following with respect to our securities: purchasing on margin, pledging or hedging, short sales, buying or selling put or call options or other derivative securities, purchasing financial instruments that are designed to hedge or offset any decrease in market value or engage in limit orders or other pre-arranged transactions that execute automatically except for ‘same-day’ limit orders and approved 10b5-1 plans. |

|

|

• |