Form DEF 14A SHERWIN WILLIAMS CO For: Apr 17

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☑ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to 240.14a-12 | |||

|

| ||||

| (Name of Registrant as Specified In Its Charter) | ||||

|

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

|

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

The Sherwin-Williams Company

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held April 17, 2019

The Annual Meeting of Shareholders of THE SHERWIN-WILLIAMS COMPANY will be held in the Landmark Conference Center, 927 Midland Building, 101 West Prospect Avenue, Cleveland, Ohio on Wednesday, April 17, 2019 at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| 1. | To elect the 12 director nominees named in the attached Proxy Statement to hold office until the next Annual Meeting of Shareholders and until their successors are elected; |

| 2. | To approve, on an advisory basis, the compensation of the named executives; |

| 3. | To ratify the appointment of Ernst & Young LLP as Sherwin-Williams’ independent registered public accounting firm; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

Shareholders of record at the close of business on February 19, 2019, the record date for the Annual Meeting, are the only shareholders entitled to notice of and to vote at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please promptly vote on the Internet, by telephone or by completing and returning the enclosed proxy card. Voting early will help avoid additional solicitation costs and will not prevent you from voting in person at the Annual Meeting if you wish to do so.

MARY L. GARCEAU

Secretary

101 West Prospect Avenue

Cleveland, Ohio 44115-1075

March 6, 2019

ADMISSION TO THE 2019 ANNUAL MEETING.

You are entitled to attend the Annual Meeting only if you were a Sherwin-Williams shareholder at the close of business on February 19, 2019. We may ask you to present evidence of share ownership and valid photo identification to enter the Annual Meeting. Please refer to the section entitled “How can I attend the Annual Meeting?” for further information.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 17, 2019.

Sherwin-Williams’ Proxy Statement and 2018 Annual Report to Shareholders are available free of charge at http://proxymaterials.sherwin.com.

Table of Contents

| 1 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 9 | ||||

| 14 | ||||

| 21 | ||||

| Experiences, Qualifications, Attributes and Skills of Director Nominees |

22 | |||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 50 | ||||

| 54 | ||||

| 56 | ||||

| 58 | ||||

| 58 | ||||

| 60 | ||||

| Estimated Payments upon Termination or Change in Control Table |

65 | |||

| 66 | ||||

| 67 | ||||

| PROPOSAL 2 — Advisory Approval of the Compensation of the Named Executives |

68 | |||

| PROPOSAL 3 — Ratification of Appointment of the Independent Registered Public Accounting Firm |

69 | |||

| Matters Relating to the Independent Registered Public Accounting Firm |

70 | |||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| 72 | ||||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| 74 | ||||

| 74 | ||||

| A-1 | ||||

| B-1 | ||||

Table of Contents

This summary highlights information contained elsewhere in this Proxy Statement and does not contain all of the information you should consider. Please carefully read the entire Proxy Statement and our 2018 Annual Report to Shareholders before voting.

2019 Annual Meeting of Shareholders

|

Date and Time |

Place |

Record Date | ||||||||

| Wednesday, April 17, 2019 9:00 a.m., EDT |

Landmark Conference Center 927 Midland Building 101 West Prospect Avenue Cleveland, Ohio 44115

|

February 19, 2019 | ||||||||

Proposals and Board Recommendations

|

Proposal |

Board Recommendation | |

|

1. Election of 12 directors

|

✓ FOR each nominee

| |

|

2. Advisory approval of the compensation of the named executives

|

✓ FOR

| |

|

3. Ratification of Ernst & Young LLP as our independent registered public accounting firm

|

✓ FOR

| |

2018 Financial and Operating Highlights

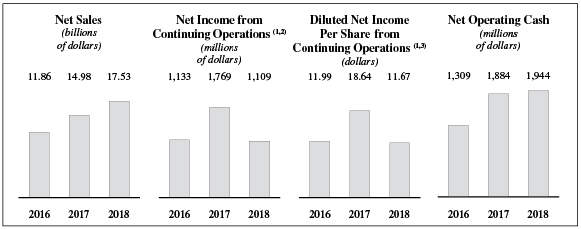

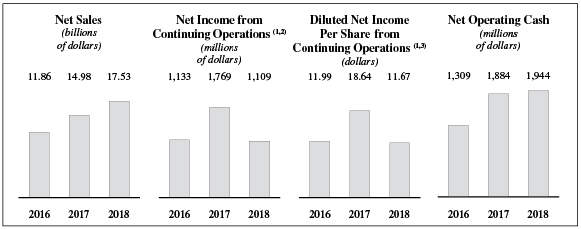

We delivered record performance across many measures in 2018. 2018 net sales increased to a record $17.53 billion. Diluted net income per share from continuing operations decreased to $11.67. Net income from continuing operations was $1.1 billion, and we generated record net operating cash of $1.94 billion. Since completing the acquisition of The Valspar Corporation in 2017 (the Valspar Transaction), we have continued to make significant progress on our integration efforts.

| 1 | 2017 has been adjusted for a voluntary inventory accounting change made in 2018. |

| 2 | 2018 includes after-tax acquisition-related costs of $394.4 million, after-tax environmental expense provisions of $126.1 million, after-tax California litigation expense of $102.5 million and after-tax pension settlement expense of $28.3 million. 2017 includes a one-time income tax benefit of $668.8 million from Deferred income tax reductions and after-tax acquisition-related costs of $329.4 million. 2016 includes after-tax acquisition-related costs of $81.5 million. |

1

Table of Contents

| 3 | 2018 includes charges of $4.15 per share for acquisition-related costs, $1.32 per share for environmental expense provisions, $1.09 per share for California litigation expense and $.30 per share for pension settlement expense. 2017 includes a one-time benefit of $7.04 per share from Deferred income tax reductions and a charge of $3.47 per share for acquisition-related costs. 2016 includes a charge of $.86 per share for acquisition-related costs. |

We continued our history of returning significant value to our shareholders in 2018, returning $936 million through dividends and repurchases of our stock. During 2018, we increased our annual dividend to $3.44 per share, extending our string of dividend increases to 40 consecutive years. In February 2019, the Board increased the quarterly cash dividend to $1.13 per share, an increase of 31% over the dividend paid in the same quarter in 2018.

Our Director Nominees

The following table provides summary information about each of our director nominees. This year we have included two new director nominees — Kerrii B. Anderson, Retired, Former Chief Executive Officer and President of Wendy’s International, Inc., and Jeff M. Fettig, Retired, Former Chairman of the Board and Chief Executive Officer of Whirlpool Corporation.

| Committee Memberships | ||||||||||||||||||||

|

Name |

Age | Director Since |

Principal Occupation |

Inde- pendent |

AC | CMDC | NCGC |

Other Public Company Boards | ||||||||||||

| Kerrii B. Anderson |

61 | N/A | Retired, Former CEO & President, Wendy’s International, Inc. | ✓ | 3 | |||||||||||||||

| Arthur F. Anton |

61 | 2006 | Chairman & CEO, Swagelok Company | ✓ | C, F | 1 | ||||||||||||||

| Jeff M. Fettig |

62 | N/A | Retired, Former Chairman & CEO, Whirlpool Corporation | ✓ | 1 | |||||||||||||||

| David F. Hodnik |

71 | 2005 | Retired, Former President & CEO, Ace Hardware Corporation | ✓ | ✓ | 0 | ||||||||||||||

| Richard J. Kramer |

55 | 2012 | Chairman, CEO & President, The Goodyear Tire & Rubber Company | ✓ | F | ✓ | 1 | |||||||||||||

| Susan J. Kropf |

70 | 2003 | Retired, Former President & COO, Avon Products, Inc. | ✓ | ✓ | ✓ | 3 | |||||||||||||

| John G. Morikis |

55 | 2015 | Chairman & CEO, Sherwin-Williams | 1 | ||||||||||||||||

| Christine A. Poon |

66 | 2014 | Executive in Residence, The Ohio State University | ✓ | F | C | 3 | |||||||||||||

| John M. Stropki |

68 | 2009 | Retired, Former Chairman, President & CEO, Lincoln Electric Holdings, Inc. |

✓ L | ✓ | ✓ | 2 | |||||||||||||

| Michael H. Thaman |

55 | 2017 | Chairman & CEO, Owens Corning | ✓ | ✓ | 1 | ||||||||||||||

| Matthew Thornton III |

60 | 2014 | Executive VP & COO, FedEx Freight, FedEx Corporation | ✓ | ✓ | ✓ | 0 | |||||||||||||

| Steven H. Wunning |

67 | 2015 | Retired, Former Group President, Caterpillar Inc. | ✓ | C | 2 | ||||||||||||||

|

AC = Audit Committee |

C = Committee Chair | |||||||||||||||||||

| CMDC = Compensation and Management Development Committee | F = Financial Expert | |||||||||||||||||||

| NCGC = Nominating and Corporate Governance Committee | L = Lead Independent Director | |||||||||||||||||||

2

Table of Contents

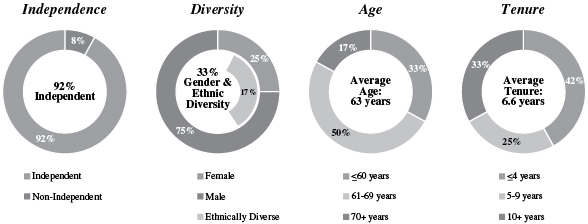

Board Refreshment. Our Board utilizes a thoughtful approach to board composition to ensure a proper balance between the addition of new directors who bring fresh and diverse perspectives and the stability of the Board as a whole. With the election of the 12 director nominees, we will have added 7 new independent directors to our Board over the past 5 years. Our director nominees reflect the Board’s efforts and commitment to achieving diversity in age, gender and ethnicity and the need for refreshment to maintain this commitment.

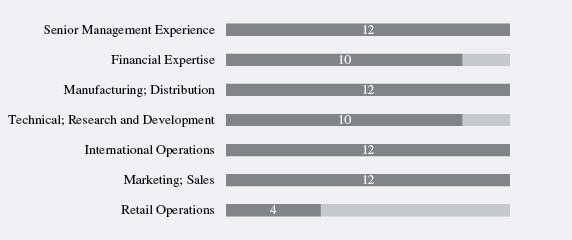

Balanced Mix of Skills and Experience. Our director nominees also reflect the Board’s efforts to ensure our directors have the variety of experiences, qualifications, attributes and skills necessary to make significant contributions to the Board, Sherwin-Williams and our shareholders. Our Board believes this mix contributes to a well-balanced Board and enables the Board to provide effective oversight of our management and business. These experiences, qualifications, attributes and skills are reviewed regularly in considering the composition of the full Board and each director nominee.

3

Table of Contents

Corporate Governance

Our Board and Committees. Under our Corporate Governance Guidelines, each director is expected to attend, absent unusual circumstances, all meetings of the Board and each committee on which he or she serves. Each director is also expected to attend, absent unusual circumstances, all annual and special meetings of shareholders.

|

Number of |

Independence |

Number of | ||||

| Board of Directors | 10 |

9 of 10 |

5 | |||

| Audit Committee | 4 | 100% | 5 | |||

| Compensation and Management Development Committee | 5 |

100% |

5 | |||

| Nominating and Corporate Governance Committee | 5 | 100% | 3 | |||

Each of our incumbent directors attended at least 75% of all of the 2018 meetings of the Board and the committees on which he or she served. All of our incumbent directors attended the 2018 Annual Meeting.

Sound Corporate Governance Practices. We believe good corporate governance is an important element for creating and maximizing long-term value for our shareholders. Our corporate governance practices are designed to enable the Board to set objectives and monitor performance and to strengthen the accountability of the Board and management. We actively monitor our corporate governance practices to ensure we continue to manage our business in accordance with high standards of ethics, business integrity and corporate governance. The following table highlights our corporate governance practices and policies that serve the long-term interests of Sherwin-Williams and our shareholders.

|

✓ Annual election of all directors ✓ Majority voting standard and resignation policy for directors in uncontested elections ✓ Proxy access rights available to 3 year, 3% shareholders for up to 20% of Board — NEW ✓ 11 of 12 director nominees are independent ✓ Independent lead director has significant governance responsibilities ✓ Board committees are comprised entirely of independent directors ✓ Mandatory retirement age of 72 for directors ✓ Orientation program for new directors

|

✓ Annual board and committee self-assessment evaluations (conducted by an outside, independent advisor in 2018) ✓ Executive sessions of independent directors are held with each regular board meeting ✓ Directors have complete access to management ✓ Board oversight of risk management ✓ Stringent restrictions on pledging and hedging of our stock ✓ Significant director and executive stock ownership guidelines

|

4

Table of Contents

Executive Compensation

Our Compensation Objectives. We design and manage our company-wide compensation programs to align with our overall business strategy and focus our employees on delivering sustained financial and operating results that drive long-term, superior shareholder returns. We believe it is important that our compensation programs: (a) be competitive; (b) maintain a performance and achievement-oriented culture; and (c) align the interests of our executives with those of our shareholders.

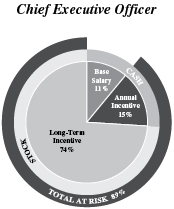

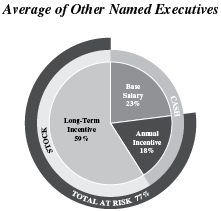

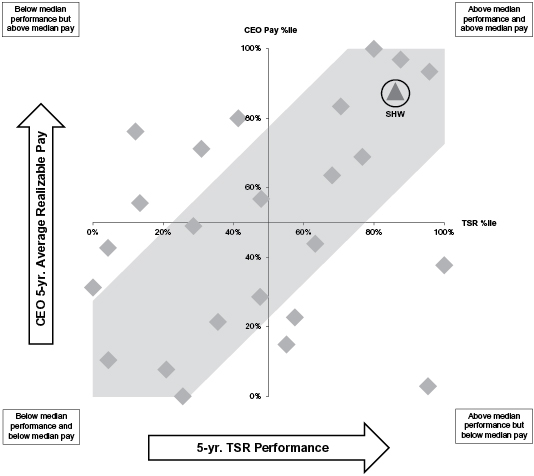

Our Compensation Mix. A significant percentage of the compensation opportunity of our executives is variable, at risk and tied to company or business unit performance, including stock price appreciation. For 2018, 89% of the standard principal compensation components for our CEO and an average of 77% for our other named executives were at risk and tied to performance.

|

|

Our Responsible Compensation Practices. Our compensation programs, practices and policies demonstrate our commitment to responsible pay and governance principles. We review and evaluate our compensation programs, practices and policies on an ongoing basis, and we modify them to address evolving best practices and changing regulatory requirements. The following table highlights some of the more significant best practices we have adopted, and the practices we have avoided, to best serve the long-term interests of our shareholders.

| ✓ | Annual say-on-pay votes | ✓ | No unnecessary or excessive risk-taking in compensation policies and practices | |||

| ✓ | Independent Compensation Committee | |||||

| ✓ | Independent compensation consultant | ✓ | No excessive perquisites | |||

| ✓ | Peer group benchmarking to median pay | ✓ ✓

✓

✓ ✓ |

No payment of dividend equivalents on unvested RSUs Double-trigger vesting of long-term equity incentive awards upon change in control No repricing or replacing of underwater stock options without shareholder approval No above-market earnings on deferred compensation No employment agreements with named executives (with the exception of Mr. Erter) | |||

| ✓ | Emphasis on performance-based pay | |||||

| ✓ | Responsibly administered incentive compensation programs | |||||

| ✓ | Balanced compensation structure | |||||

| ✓ | Diversified performance metrics tied to financial and operating performance | |||||

| ✓ | Clawback and recapture policy | |||||

| ✓ | Significant stock ownership by our directors and officers

|

5

Table of Contents

THE SHERWIN-WILLIAMS COMPANY

101 West Prospect Avenue

Cleveland, Ohio 44115-1075

March 6, 2019

We are providing the enclosed proxy materials to you in connection with the solicitation by the Board of Directors (the Board) of proxies to be voted at the Annual Meeting of Shareholders to be held on April 17, 2019 (the Annual Meeting). We began giving these proxy materials to our shareholders on March 6, 2019. The terms “we,” “us” and “our” throughout this Proxy Statement refer to Sherwin-Williams and/or its management.

We are enclosing our Annual Report to Shareholders for the year ended December 31, 2018 with these proxy materials.

QUESTIONS AND ANSWERS ABOUT THE MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act upon the proposals outlined in the Notice of Annual Meeting of Shareholders. The agenda includes the following proposals:

|

Proposal |

Board Recommendation | |

| 1. Election of 12 directors |

✓ FOR each nominee | |

| 2. Advisory approval of the compensation of the named executives |

✓ FOR | |

|

3. Ratification of Ernst & Young LLP as our independent registered public accounting firm |

✓ FOR | |

In addition, our management will report on Sherwin-Williams’ financial and operating performance and respond to questions from shareholders. We are not aware of any other matters that will be brought before the Annual Meeting for action.

Who is entitled to vote at the Annual Meeting?

You are entitled to vote at the Annual Meeting only if you were a record holder of our common stock at the close of business on the record date, February 19, 2019. At the close of business on the record date, 92,680,611 shares of common stock were outstanding. Each share owned on the record date is entitled to one vote.

What is the difference between a shareholder of record and a beneficial owner of shares held in street name?

Shareholder of Record. If your shares are registered directly in your name with our transfer agent, EQ Shareowner Services, you are considered the shareholder of record with respect to those shares.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a broker, bank or other similar organization, you are the beneficial owner of shares held in “street name.” The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account.

6

Table of Contents

How do I vote?

Most shareholders have a choice of voting by mail, on the Internet, by telephone or in person at the Annual Meeting. We encourage you to vote in advance to ensure your vote will be represented at the Annual Meeting.

Voting by Mail. If you are a shareholder of record, you may vote by signing, dating and returning your proxy card in the enclosed prepaid envelope. The proxy holders will vote your shares in accordance with your directions. If you sign and return your proxy card, but do not properly direct how your shares should be voted on a proposal, the proxy holders will vote your shares “for” the election of each director nominee on Proposal 1 and “for” Proposals 2 and 3. If you sign and return your proxy card, the proxy holders will vote your shares according to their discretion on any other proposals and other matters that may be brought before the Annual Meeting.

If you hold shares in street name, you should complete, sign and date the voting instruction card provided to you by your broker or nominee.

Voting on the Internet or by Telephone. If you are a shareholder of record, detailed instructions for Internet and telephone voting are attached to your proxy card. Your Internet or telephone vote authorizes the proxy holders to vote your shares in the same manner as if you signed and returned your proxy card by mail. If you are a shareholder of record and you vote on the Internet or by telephone, your vote must be received by 11:59 p.m. EDT on April 16, 2019; you should not return your proxy card.

If you hold shares in street name, you may be able to vote on the Internet or by telephone as permitted by your broker or nominee.

Voting in Person. All shareholders may vote in person at the Annual Meeting. Shareholders of record also may be represented by another person present at the Annual Meeting by signing a proxy designating such person to act on your behalf. If you hold shares in street name, you may vote in person at the Annual Meeting only if you have obtained a signed proxy from your broker or nominee giving you the right to vote your shares.

What happens if I hold shares in street name and I do not give voting instructions?

If you hold shares in street name and do not provide your broker with specific voting instructions, under the rules of the New York Stock Exchange (NYSE), your broker may generally vote on routine matters but cannot vote on non-routine matters. Proposals 1 and 2 are considered non-routine matters. Therefore, if you do not instruct your broker how to vote on Proposals 1 and 2, your broker does not have the authority to vote on those proposals. This is generally referred to as a “broker non-vote.” Proposal 3 is considered a routine matter and, therefore, your broker may vote your shares on this proposal according to your broker’s discretion.

Who tabulates the votes?

Representatives of EQ Shareowner Services will tabulate the votes and act as inspectors of election at the Annual Meeting.

How do I vote if I am a participant in the Dividend Reinvestment Plan or the Employee Stock Purchase and Savings Plan?

If you are a participant in one of these plans, your proxy card also serves as voting instructions for the number of shares for which you are entitled to direct the vote under each plan. You may vote your shares in the same manner outlined above for shareholders of record. If you are a participant in our Employee Stock Purchase and Savings Plan (ESPP), your voting instructions must be received by the close of business on April 12, 2019 in order to allow the trustee sufficient time for voting.

7

Table of Contents

If you are a participant in our ESPP and you do not timely provide your voting instructions, the trustee will vote your shares in the same proportion as the trustee votes those shares for which it receives proper instructions.

What constitutes a quorum for the Annual Meeting?

A “quorum” of shareholders is necessary for us to hold a valid Annual Meeting. For a quorum, there must be present, in person or by proxy, or by use of communications equipment, shareholders of record entitled to exercise not less than fifty percent of the voting power of Sherwin-Williams. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

What vote is required to approve each proposal?

Election of Directors (Proposal 1). As provided in our Amended and Restated Articles of Incorporation, each of the 12 director nominees who receives a majority of the votes cast will be elected as a member of the Board. A “majority of the votes cast” means that the number of shares voted “for” a nominee’s election exceeds the number of shares voted “against” the nominee’s election. Abstentions and broker non-votes with respect to the election of one or more directors will not be counted as a vote cast and, therefore, will have no effect on the vote.

Any incumbent nominee who receives a greater number of “against” votes than “for” votes shall continue to serve on the Board pursuant to Ohio law, but is required to promptly tender his or her resignation for consideration by the Nominating and Corporate Governance Committee (the Nominating Committee) of the Board. We provide more information about majority voting for directors under the heading “Corporate Governance — Majority Voting for Directors.”

Advisory Approval of the Compensation of the Named Executives (Proposal 2). The approval, on an advisory basis, of the compensation of the named executives requires the affirmative vote of a majority of the votes cast. Abstentions and broker non-votes with respect to this proposal will not be counted as a vote cast and, therefore, will have no effect on the vote.

Ratification of Independent Registered Public Accounting Firm (Proposal 3). The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast. Abstentions with respect to this proposal will not be counted as a vote cast and, therefore, will have no effect on the vote. Broker non-votes are not expected to exist with respect to this proposal.

Other Items. All other proposals and other business as may properly come before the Annual Meeting require the affirmative vote of a majority of the votes cast, except as otherwise required by statute or our Amended and Restated Articles of Incorporation or Regulations.

Can I revoke or change my vote after I submit my proxy?

Yes. You can revoke or change your vote before the proxy holders vote your shares by timely:

| • | giving a revocation to our Corporate Secretary in writing, in a verifiable communication or at the Annual Meeting; |

| • | returning a later signed and dated proxy card; |

| • | entering a new vote on the Internet or by telephone; or |

| • | voting in person at the Annual Meeting. |

How can I attend the Annual Meeting?

You are entitled to attend the Annual Meeting only if you were a shareholder at the close of business on the record date, February 19, 2019. We may ask you to present evidence of share ownership

8

Table of Contents

as of the record date, such as an account statement indicating ownership on that date, and valid photo identification, such as a driver’s license or passport, to enter the Annual Meeting.

Even if you plan to attend the Annual Meeting in person, we encourage you to vote your shares in advance using one of the methods outlined in this Proxy Statement to ensure that your vote will be represented at the Annual Meeting. If you require directions to the Annual Meeting, please contact Investor Relations at (216) 566-2000.

Where will I be able to find voting results of the Annual Meeting?

We intend to announce preliminary voting results at the Annual Meeting and publish final voting results in a Current Report on Form 8-K to be filed with the SEC within four business days of the Annual Meeting.

Who pays the cost of this proxy solicitation?

The enclosed proxy is solicited by the Board, and Sherwin-Williams will pay the entire cost of solicitation. We retained Georgeson LLC to aid in the solicitation of proxies, for which it will receive a fee estimated at $15,500, plus reasonable expenses.

In addition, we may reimburse banks, brokers and other nominees for costs reasonably incurred by them in forwarding proxy materials to beneficial owners of our common stock. Our officers and other employees may also solicit the return of proxies. Proxies will be solicited by personal contact, mail, telephone and electronic means.

Are the Proxy Statement and the 2018 Annual Report to Shareholders available on the Internet?

Yes. This Proxy Statement and our 2018 Annual Report are available at http://proxymaterials.sherwin.com.

You may help us save money in the future by accessing your proxy materials online, instead of receiving paper copies in the mail. If you would like to access proxy materials online beginning next year, please follow the instructions located in the “Access Proxy Materials Online” section of our Investor Relations website at www.sherwin.com.

The Board and management have recognized for many years the importance of sound corporate governance practices in fulfilling their respective duties and responsibilities to shareholders. We describe below our key corporate governance policies that enable us to manage our business in accordance with high ethical standards and in the best interests of our shareholders.

Corporate Governance Guidelines.

The Board has adopted Corporate Governance Guidelines, which provide the framework for the governance of our company. The Board reviews our Corporate Governance Guidelines at least annually. From time to time, the Board may revise our Corporate Governance Guidelines to reflect new regulatory requirements and evolving corporate governance practices.

Leadership Structure and Lead Director.

Combined Chairman and Chief Executive Officer Role. Our Corporate Governance Guidelines provide that the same person should hold the positions of Chairman and CEO, except in unusual circumstances such as during a period of transition in the office of the chief executive officer. The

9

Table of Contents

Board believes this structure provides the most efficient and effective leadership model. A combined Chairman and CEO role provides clear insight and direction of business strategies and plans to both the Board and management, which facilitates the efficient and effective functioning of the Board and our company. The Board also believes we can most effectively execute our business strategies and plans if our Chairman is also a member of our management team. A single person acting in the capacities of Chairman and CEO also provides unified leadership and focus.

Lead Director. Under our Corporate Governance Guidelines, if the Chairman is not an independent director, the independent directors of the Board will annually elect an independent director to serve as Lead Director. John M. Stropki is currently the Lead Director. The Board believes a Lead Director improves the Board’s overall performance by enhancing the efficiency of the Board’s oversight and governance responsibilities and by supporting the relationship between the CEO and the independent directors.

The Lead Director has a significant role, with comprehensive governance responsibilities that are clearly described in our Corporate Governance Guidelines. These responsibilities are as follows:

| • | Chair meetings of the Board at which the Chairman is not present. |

| • | Chair executive sessions of the non-management directors. Meet separately with the Chairman after executive sessions to review the matters discussed during the executive sessions. |

| • | Review with the Chairman the schedule for meetings of the non-management directors and set the agenda for such meetings. |

| • | Facilitate communications and serve as the principal liaison on Board-related issues between the Chairman and the non-management directors. Each director, however, is free to communicate directly with the Chairman. |

| • | Review with the Chairman the schedule for meetings of the Board to help assure that there is sufficient time allocated for discussion of all agenda items. |

| • | Suggest agenda items to the Chairman for meetings of the Board and approve the agenda, as well as the substance and timeliness of information sent to the Board. |

| • | Authorize the retention of independent legal advisors, or other independent consultants and advisors, as necessary, who report directly to the Board on Board-related issues. |

| • | Act as a resource for, and counsel to, the Chairman. |

Other Leadership Components. Another key component of our leadership structure is our strong governance practices, which ensure the Board effectively carries out its responsibility to oversee management. All Board committees are entirely comprised of independent directors. Non-management directors meet in executive session following every regularly scheduled Board meeting. The Lead Director may schedule additional executive sessions, as appropriate. The Board has full access to our management team at all times. In addition, the Board or any committee may retain independent legal, financial, compensation or other consultants and advisors to advise and assist the Board or committee in discharging its responsibilities.

Code of Conduct.

Our Code of Conduct applies to all directors, officers and employees of Sherwin-Williams and our subsidiaries, wherever located. It contains the general guidelines and principles for conducting Sherwin-Williams’ business, consistent with the highest standards of business ethics. Our Code of Conduct also embodies our seven guiding values, which form the foundation of our company: Integrity, People, Service, Quality, Performance, Innovation and Growth. We encourage our employees to report all violations of company policies and applicable law, including incidents of harassment or discrimination.

10

Table of Contents

We will take appropriate steps to investigate all such reports and take appropriate action. Under no circumstances will employees be subject to any disciplinary or retaliatory action for reporting, in good faith, a possible violation of our Code of Conduct or applicable law, or for cooperating in any investigation of such a possible violation.

Under our Code of Ethics for Senior Financial Management, our CEO, CFO and senior financial management are responsible for creating and maintaining a culture of high ethical standards and commitment to compliance throughout our company to ensure the fair and timely reporting of Sherwin-Williams’ financial results and condition. Senior financial management includes the controller, treasurer, principal financial/accounting personnel in our operating groups and divisions, and all other financial/accounting personnel with staff supervision responsibilities in our corporate departments and operating groups and divisions.

Risk Management and Oversight.

While management is responsible for assessing and managing our exposure to various risks, the Board has responsibility for the oversight of risk management. We have an enterprise risk management process to identify, assess and manage the most significant risks facing us, including financial, strategic, operational, litigation, compliance, reputational and cybersecurity risks. Management reviews various significant risks with the Board throughout the year, as necessary and/or appropriate, and conducts a formal review of its assessment and management of the most significant risks with the Board on an annual basis.

Certain Board committees review specific risk areas to assist the Board with its overall risk management oversight responsibility. The Audit Committee has oversight responsibility to review management’s enterprise risk management process, including the policies and guidelines used by management to identify, assess and manage our exposure to various risks. Consistent with this responsibility for the enterprise risk management process generally, the Audit Committee retains primary oversight of management’s policies with respect to cybersecurity risks and the controls and procedures implemented to monitor and mitigate these risks. Management periodically reviews such cybersecurity policies, controls and procedures with the Audit Committee. The Audit Committee also has oversight responsibility for financial risks. Management reviews financial risks with the Audit Committee at least quarterly and reviews its risk management process with the Audit Committee on an ongoing basis. The Compensation Committee has oversight responsibility for the risks related to our compensation policies and practices. We include additional information about the Compensation Committee’s annual risk assessment of such policies and practices under the heading “Compensation Risk Assessment.”

Management’s role in identifying, assessing and managing risk and the Board’s role in risk oversight have been well defined for many years. The Board’s role in risk oversight has not significantly impacted the Board’s leadership structure. We believe our current leadership structure, with Mr. Morikis serving as Chairman and CEO, enhances the Board’s effectiveness in risk oversight due to his extensive knowledge of our operations and the paint and coatings industry.

How You May Communicate with Directors.

The Board has adopted a process by which shareholders and all other interested parties may communicate with the non-management directors, Lead Director or chairperson of any of the committees of the Board. You may send communications by regular mail to the attention of the: Lead Director; Chair, Audit Committee; Chair, Compensation and Management Development Committee; Chair, Nominating and Corporate Governance Committee; or non-management directors as a group to the Non-Management Directors; each, c/o Corporate Secretary, The Sherwin-Williams Company, 101 West Prospect Avenue, 12th Floor, Midland Building, Cleveland, Ohio 44115.

11

Table of Contents

Sherwin-Williams’ management will review all communications received to determine whether the communication requires immediate action. Management will pass on all appropriate and applicable communications received, or a summary of such communications, to the appropriate director or directors.

Complaint Procedures for Accounting, Auditing and Financial Related Matters.

The Audit Committee has established procedures for receiving, retaining and treating complaints from any source regarding accounting, internal accounting controls and auditing matters. The Audit Committee has also established procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. Interested parties may communicate such complaints by following the procedures described above under the heading “How You May Communicate with Directors.” Employees may report such complaints by following the procedures outlined in our Code of Conduct. We do not permit any disciplinary or retaliatory action against any person who, in good faith, submits a complaint or concern under these procedures.

Independence of Directors.

Under our Director Independence Standards (a copy of which is attached as Appendix A), 9 of our 10 current directors and 11 of our 12 director nominees are independent. All members of the Audit Committee, Compensation Committee and Nominating Committee are independent.

Majority Voting for Directors.

As provided in our Amended and Restated Articles of Incorporation, for an individual to be elected to the Board of Directors in an uncontested election of directors, the number of votes cast in favor of the individual’s election must exceed the number of votes cast against the individual’s election.

Any incumbent nominee for director in an uncontested election who receives a greater number of “against” votes than “for” votes shall continue to serve on the Board pursuant to Ohio law, but is required to promptly tender his or her resignation to the Board under our Corporate Governance Guidelines. The Nominating Committee will promptly consider the tendered resignation and will recommend to the Board whether to accept the tendered resignation or to take some other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the majority against vote.

In making this recommendation, the Nominating Committee will consider all factors deemed relevant by its members. These factors may include the underlying reasons why shareholders voted against the director (if ascertainable), the length of service and qualifications of the director whose resignation has been tendered, the director’s contributions to Sherwin-Williams, whether by accepting the resignation Sherwin-Williams will no longer be in compliance with any applicable law, rule, regulation or governing document, and whether or not accepting the resignation is in the best interest of Sherwin-Williams and our shareholders. In considering the Nominating Committee’s recommendation, the Board will consider the factors considered by the Nominating Committee and such additional information and factors the Board believes to be relevant. We will promptly and publicly disclose the Board’s decision and process in a report filed with or furnished to the SEC.

Executive Sessions of Non-Management Directors.

The non-management members of the Board meet in executive session in connection with regularly scheduled Board meetings. Additional executive sessions may be scheduled by the Lead Director or the non-management directors. The Lead Director will chair these sessions.

Annual Board Self-Assessments.

The Board has instituted annual self-assessments of the Board, as well as the Audit Committee, Compensation Committee and Nominating Committee, to assist in determining whether the Board and its committees are functioning effectively. The Nominating Committee oversees this process.

12

Table of Contents

During 2018, the Board engaged an independent third-party advisor experienced in corporate governance matters to facilitate, and bring an outside perspective to, the Board’s annual self-assessment process. The advisor conducted one-on-one, open-ended interviews with all Board members to provide each director with the opportunity to openly discuss the performance and effectiveness of the Board as a whole and its committees. The interviews also provided each director with an opportunity to identify areas for improvement. In addition to the director interviews, the advisor conducted interviews with the members of senior management who regularly attend Board meetings to solicit their perspectives on the relationship between the Board and management. The advisor’s process was developed in consultation with the Lead Director and chair of the Nominating Committee, as well as our Chairman and CEO and our Senior Vice President, General Counsel and Secretary. The advisor gathered and analyzed the data and presented its findings and recommendations to the full Board.

Board Committee Charters.

The Audit Committee, Compensation Committee and Nominating Committee each have adopted written charters. Each committee reviews and evaluates the adequacy of its charter at least annually.

Stock Ownership Guidelines.

The Board believes our directors and executives should have meaningful share ownership in Sherwin-Williams. Accordingly, the Board has established minimum share ownership requirements. More information is set forth under the heading “Stock Ownership Guidelines” in the CD&A.

Clawback and Recapture Policy.

The Board has adopted a policy regarding the adjustment and recapture of compensation paid or payable to executives and key employees. Under this clawback and recapture policy, employees who participate in our 2007 Executive Annual Performance Bonus Plan are required to reimburse Sherwin-Williams for any award paid under this plan in the event:

| • | the award was based upon the achievement of financial results that were subsequently the subject of an accounting restatement due to the material noncompliance with any financial reporting requirement under federal securities laws; and |

| • | the Board determines the employee engaged in knowing or intentional fraudulent or illegal conduct that caused or partially caused the need for the restatement; and |

| • | a lower amount would have been paid to the employee based upon the restated financial results. |

The reimbursement will be equal to the difference in the amount of the award prior to the restatement and the amount of the award determined using the restated financial results.

In addition, (a) all outstanding stock awards will be cancelled and (b) the employee will be required to reimburse Sherwin-Williams for any economic gains received by the employee pursuant to a stock award during the one-year period preceding the Board’s determination that the employee engaged in the conduct described above.

Availability of Corporate Governance Materials.

You may access all committee charters and our Corporate Governance Guidelines, Director Independence Standards, Code of Conduct and other corporate governance materials in the “Corporate Governance” section of our Investor Relations website at www.sherwin.com.

13

Table of Contents

PROPOSAL 1 — ELECTION OF DIRECTORS

Our Board has nominated the following 12 director nominees for election at the 2019 Annual Meeting to hold office until the next Annual Meeting and until their successors are elected. Our Board currently has 10 members, and all are standing for re-election as nominees. Each nominee was elected by our shareholders at the 2018 Annual Meeting, except for our two new nominees, Ms. Anderson and Mr. Fettig, who were nominated to be elected as directors by unanimous action of the Board on February 13, 2019.

All of the nominees are independent, except for Mr. Morikis. Mr. Morikis is not considered to be independent because of his position as our Chairman and CEO. There are no family relationships among any of the directors, director nominees and executive officers.

Each nominee has agreed to serve, if elected. If any nominee declines or is unable to accept such nomination or is unable to serve, an event which we do not expect, the Board reserves the right in its discretion to substitute another person as a nominee or to reduce the number of nominees. In this event, the proxy holders may vote, in their discretion, for any substitute nominee proposed by the Board.

We have presented biographical information regarding each nominee below. This biographical information is supplemented with the particular experiences, qualifications, attributes and skills that led the Board to conclude each nominee should serve on the Board. Please also refer to the additional information set forth under the heading “Experiences, Qualifications, Attributes and Skills of Director Nominees.”

KERRII B. ANDERSON

Retired, Former Chief Executive Officer and President

Wendy’s International, Inc.

Age: 61

Business Experience. Kerrii B. Anderson served as Chief Executive Officer and President of Wendy’s International, Inc. (restaurant operating and franchising company n/k/a The Wendy’s Company) from November 2006 until September 2008 when Wendy’s merged with a subsidiary of Triarc Companies, Inc. to form Wendy’s/Arby’s Group, Inc. Ms. Anderson joined Wendy’s in September 2000, serving as Interim Chief Executive Officer and President from April 2006 to November 2006 and Executive Vice President and Chief Financial Officer from September 2000 to April 2006. Prior to joining Wendy’s, Ms. Anderson served as Senior Vice President and Chief Financial Officer of M/I Schottenstein Homes, Inc. (n/k/a M/I Homes, Inc.) from September 1987 to September 2000. Ms. Anderson has been a private investor and board advisor since 2008. Ms. Anderson is a director of Laboratory Corporation of America Holdings (NYSE: LH), Worthington Industries, Inc. (NYSE: WOR) and Abercrombie & Fitch Co. (NYSE: ANF). Ms. Anderson is a former director of Chiquita Brands International, Inc., for which she served as Chairwoman of the Board.

Key Qualifications, Attributes and Skills. Ms. Anderson has a strong record of leadership in operations, strategy, finance and talent management as a result of her experience serving as Chief Executive Officer and President and Chief Financial Officer of Wendy’s. Ms. Anderson also has significant expertise in the areas of accounting and financial reporting, corporate finance, corporate governance and executive compensation through her service on other large public company boards. This breadth of experience will enable Ms. Anderson to advise our Board on a variety of matters relevant to Sherwin-Williams’ global operations and business strategy.

14

Table of Contents

ARTHUR F. ANTON

Chairman and Chief Executive Officer

Swagelok Company

Director of Sherwin-Williams since 2006

Age: 61

Business Experience. Arthur F. Anton has served as Chief Executive Officer of Swagelok Company (manufacturer and provider of fluid system products and services) since January 2004 and Chairman of Swagelok since October 2017. Mr. Anton served as President of Swagelok from January 2001 to October 2017, Chief Operating Officer of Swagelok from January 2001 to January 2004, Executive Vice President of Swagelok from July 2000 to January 2001, and Chief Financial Officer of Swagelok from August 1998 to July 2000. Mr. Anton is also a director of Olympic Steel, Inc. (Nasdaq: ZEUS) and is Vice Chairman and a director of University Hospitals Health System, Inc. Mr. Anton is a former director of Forest City Realty Trust, Inc.

Key Qualifications, Attributes and Skills. Mr. Anton brings significant domestic and international manufacturing and distribution experience to the Board. In addition, as a former partner of Ernst & Young LLP and the former Chief Financial Officer of Swagelok, Mr. Anton has financial expertise and extensive financial experience in a manufacturing and distribution setting that provide him with a unique perspective on Sherwin-Williams’ business and operations.

JEFF M. FETTIG

Retired, Former Chairman of the Board and Chief Executive Officer

Whirlpool Corporation

Age: 62

Business Experience. Jeff M. Fettig served as Executive Chairman of the Board of Whirlpool Corporation (world’s leading major home appliance company) from October 2017 until his retirement in December 2018. Mr. Fettig served as Chairman of the Board and Chief Executive Officer of Whirlpool from July 2004 to October 2017. Mr. Fettig joined Whirlpool in June 1981 and held numerous leadership positions of increasing responsibility, including President and Chief Operating Officer from June 1999 to July 2004 and Executive Vice President, Whirlpool and President, Whirlpool Europe and Asia from 1994 to June 1999. Mr. Fettig is a director and non-employee Executive Chairman of DowDuPoint Inc. (NYSE: DWDP) and a director of Kohler Company. Mr. Fettig also serves as a director of the Indiana University Foundation and a trustee of PGA REACH. Mr. Fettig is a former director of The Dow Chemical Company and Whirlpool Corporation.

Key Qualifications, Attributes and Skills. Through his long tenure as Chairman and Chief Executive Officer and his experience in various other key leadership positions with Whirlpool over 37 years, Mr. Fettig gained significant knowledge of global business operations and end markets and the manufacturing, marketing, sales and distribution of consumer products worldwide. This extensive experience and breadth of knowledge will enable him to provide our Board with a unique, independent perspective on Sherwin-Williams’ business strategy, growth and operations and the issues and opportunities facing complex, global companies.

15

Table of Contents

DAVID F. HODNIK

Retired, Former President and Chief Executive Officer

Ace Hardware Corporation

Director of Sherwin-Williams since 2005

Age: 71

Business Experience. David F. Hodnik served as Chief Executive Officer of Ace Hardware Corporation (cooperative of independent hardware retail stores) from January 1997 until his retirement in April 2005. Mr. Hodnik also served as President of Ace Hardware from January 1996 through December 2004. Mr. Hodnik joined Ace Hardware in October 1972 and held various financial, accounting and operating positions at Ace Hardware.

Key Qualifications, Attributes and Skills. Mr. Hodnik has valuable management and leadership skills supporting a large retail operation. Mr. Hodnik brings to the Board more than 30 years of relevant experience at Ace Hardware in various financial, accounting and operating positions, including as Ace Hardware’s principal accounting officer, allowing him to add important financial expertise and business insights to the Board.

RICHARD J. KRAMER

Chairman of the Board, Chief Executive Officer and President

The Goodyear Tire & Rubber Company

Director of Sherwin-Williams since 2012

Age: 55

Business Experience. Richard J. Kramer has served as Chief Executive Officer and President of The Goodyear Tire & Rubber Company (global manufacturer, marketer and distributor of tires) since April 2010 and Chairman of the Board of Goodyear since October 2010. Mr. Kramer joined Goodyear in March 2000 and has held various positions at Goodyear, including Chief Operating Officer from June 2009 to April 2010, President, North American Tire from March 2007 to February 2010, Executive Vice President and Chief Financial Officer from June 2004 to August 2007, Senior Vice President, Strategic Planning and Restructuring from August 2003 to June 2004, Vice President, Finance – North American Tire from August 2002 to August 2003, and Vice President – Corporate Finance from March 2000 to August 2002. Prior to joining Goodyear, Mr. Kramer was with PricewaterhouseCoopers LLP for 13 years, including two years as a partner. Mr. Kramer is also a director of Goodyear (Nasdaq: GT) and John Carroll University and serves on the Executive Committee of the National Association of Manufacturers.

Key Qualifications, Attributes and Skills. Mr. Kramer has significant experience leading and managing a large multinational industrial company. As the former Chief Financial Officer of Goodyear, he brings extensive financial and risk management experience to our Board. Mr. Kramer’s diverse range of positions at Goodyear for over 19 years provides him with significant knowledge of global markets, manufacturing, distribution, retail, finance and technology, which enables him to advise our Board on a variety of strategic and business matters.

16

Table of Contents

SUSAN J. KROPF

Retired, Former President and Chief Operating Officer

Avon Products, Inc.

Director of Sherwin-Williams since 2003

Age: 70

Business Experience. Susan J. Kropf served as President and Chief Operating Officer of Avon Products, Inc. (global manufacturer and marketer of beauty and related products) from January 2001 until her retirement in January 2007. Mrs. Kropf served as Executive Vice President and Chief Operating Officer, North America and Global Business Operations of Avon from December 1999 to January 2001 and Executive Vice President and President, North America of Avon from March 1997 to December 1999. Mrs. Kropf is also a director of Avon Products, Inc. (NYSE: AVP), Tapestry, Inc. (NYSE: TPR) (f/k/a Coach, Inc.) and The Kroger Co. (NYSE: KR) and serves on the Board of Managers of New Avon LLC. Mrs. Kropf is a former director of MeadWestvaco Corporation.

Key Qualifications, Attributes and Skills. Mrs. Kropf has a significant amount of manufacturing and operating experience at a large consumer products company. Mrs. Kropf joined Avon in 1970, holding various positions in manufacturing, marketing and product development, and brings a meaningful global business perspective to the Board. Mrs. Kropf has extensive board experience through her service on the boards of four public companies, including Sherwin-Williams. Mrs. Kropf also has a strong understanding of executive compensation and related areas.

JOHN G. MORIKIS

Chairman and Chief Executive Officer

Sherwin-Williams

Director of Sherwin-Williams since 2015

Age: 55

Business Experience. John G. Morikis has served as Chief Executive Officer of Sherwin-Williams since January 2016 and Chairman of Sherwin-Williams since January 2017. Mr. Morikis served as President of Sherwin-Williams from October 2006 to March 2019, Chief Operating Officer of Sherwin-Williams from October 2006 to January 2016 and President, Paint Stores Group of Sherwin-Williams from October 1999 to October 2006. Mr. Morikis joined Sherwin-Williams in 1984 as a management trainee in the Paint Stores Group and has held roles of increasing responsibility throughout his career. Mr. Morikis is also a director of Fortune Brands Home & Security, Inc. (NYSE: FBHS). Mr. Morikis serves on the Policy Advisory Board of the Joint Center for Housing Studies of Harvard University and on the Board of Directors of the University Hospitals Health System, Inc.

Key Qualifications, Attributes and Skills. Mr. Morikis has been with Sherwin-Williams for over 34 years, including over nine years as Chief Operating Officer. He currently serves as Sherwin-Williams’ Chairman and Chief Executive Officer. His vast operating and leadership experience with Sherwin-Williams has provided him with significant, in-depth knowledge of the paint and coatings industry, as well as unique insight into the opportunities and challenges facing Sherwin-Williams. The Board benefits from his broad operating, manufacturing, retail, marketing, strategic planning and international experience.

17

Table of Contents

CHRISTINE A. POON

Executive in Residence

The Max M. Fisher College of Business

The Ohio State University

Director of Sherwin-Williams since 2014

Age: 66

Business Experience. Christine A. Poon has served as Executive in Residence at The Max M. Fisher College of Business at The Ohio State University since September 2015. Ms. Poon served as Professor of Management and Human Resources at The Max M. Fisher College of Business from October 2014 to September 2015 and Dean and John W. Berry, Sr. Chair in Business at The Max M. Fisher College of Business from April 2009 to October 2014. Prior to joining Ohio State, Ms. Poon spent eight years at Johnson & Johnson until her retirement in March 2009, most recently as Vice Chairman of the Board of Directors beginning January 2005 and Worldwide Chairman, Pharmaceuticals Group beginning August 2001. Prior to joining Johnson & Johnson, Ms. Poon held various senior leadership positions at Bristol-Myers Squibb Company over a period of 15 years, most recently as President, International Medicines Group, and President, Medical Devices Group. Ms. Poon is also a director of Prudential Financial, Inc. (NYSE: PRU) and Regeneron Pharmaceuticals, Inc. (Nasdaq: REGN) and serves on the Supervisory Board of Koninklijke Philips N.V. (OTCMKTS: RYLPF).

Key Qualifications, Attributes and Skills. Ms. Poon has extensive strategic and operational leadership skills due to her over 20 years of experience at Johnson & Johnson and Bristol-Myers Squibb. Ms. Poon brings significant sales and marketing expertise in domestic and international markets to the Board, providing a valuable perspective on Sherwin-Williams’ worldwide commercial operations.

JOHN M. STROPKI

Retired, Former Chairman, President and Chief Executive Officer

Lincoln Electric Holdings, Inc.

Director of Sherwin-Williams since 2009

Lead Director since 2015

Age: 68

Business Experience. John M. Stropki served as Executive Chairman of Lincoln Electric Holdings, Inc. (manufacturer and reseller of welding and cutting products) from December 2012 until his retirement in December 2013. Mr. Stropki served as President and Chief Executive Officer of Lincoln Electric Holdings from June 2004 to December 2012 and Chairman of Lincoln Electric Holdings from October 2004 to December 2012. Mr. Stropki also served as Executive Vice President and Chief Operating Officer of Lincoln Electric Holdings from May 2003 to June 2004 and Executive Vice President of Lincoln Electric Holdings and President, North America of The Lincoln Electric Company from May 1996 to May 2003. Mr. Stropki is also a director of Hyster-Yale Materials Handling, Inc. (NYSE: HY) and Rexnord Corporation (NYSE: RXN).

Key Qualifications, Attributes and Skills. Mr. Stropki has vast management, technical, manufacturing and leadership skills at an industrial company with a long history of financial improvement. His 41 years of experience at Lincoln Electric Holdings provided him with extensive knowledge of employee development and engagement, as well as important perspectives in operating a business in global markets that are relevant to Sherwin-Williams’ business.

18

Table of Contents

MICHAEL H. THAMAN

Chairman and Chief Executive Officer

Owens Corning

Director of Sherwin-Williams since 2017

Age: 55

Business Experience. Michael H. Thaman has served as Chief Executive Officer of Owens Corning (developer, manufacturer and marketer of insulation, roofing and fiberglass composites) since December 2007 and Chairman of Owens Corning since April 2002. Mr. Thaman also served as President of Owens Corning from December 2007 to August 2018. In early 2019, Owens Corning announced that Mr. Thaman will be retiring as Chief Executive Officer of Owens Corning on April 18, 2019 and remain in the role of Executive Chairman. Mr. Thaman joined Owens Corning in 1992 and, before assuming his current role, held a variety of senior leadership positions, including Chief Financial Officer from April 2000 to September 2007, President of Exterior Systems from January 1999 to April 2000 and President of Engineered Pipe Solutions from January 1997 to December 1998. Mr. Thaman is a director of Owens Corning (NYSE: OC) and Kohler Company. Mr. Thaman is also a member of the Business Roundtable and serves on the Policy Advisory Board of the Joint Center for Housing Studies of Harvard University. Mr. Thaman is a former director of NextEra Energy, Inc.

Key Qualifications, Attributes and Skills. Mr. Thaman brings relevant operational experience leading and managing a global manufacturing company to the Board. The Board benefits from Mr. Thaman’s deep and unique understanding of the residential, construction and industrial markets. Through serving in a variety of leadership roles at Owens Corning during a 27-year career, Mr. Thaman has gained significant knowledge of global markets, operations, finance and business strategy, which enables him to advise our Board on a variety of matters relevant to Sherwin-Williams’ operations and business strategy.

MATTHEW THORNTON III

Executive Vice President and Chief Operating Officer

FedEx Freight

FedEx Corporation

Director of Sherwin-Williams since 2014

Age: 60

Business Experience. Matthew Thornton III has served as Executive Vice President and Chief Operating Officer of FedEx Freight, a subsidiary of FedEx Corporation (global transportation, business services and logistics company), since May 2018. Mr. Thornton joined FedEx Corporation in November 1978 and has held various management positions of increasing responsibility with the company, including Senior Vice President, US Operations, FedEx Express from September 2006 to May 2018, Senior Vice President – Air, Ground & Freight Services, FedEx Express from July 2004 to September 2006 and Vice President – Regional Operations (Central Region), FedEx Express from April 1998 to July 2004. Mr. Thornton also serves on the Board of Directors of Safe Kids Worldwide and is a member of The Executive Leadership Council.

Key Qualifications, Attributes and Skills. Mr. Thornton brings extensive management and leadership experience from a large multinational company to the Board. Through his broad range of positions at FedEx Corporation during a career exceeding 40 years, Mr. Thornton has gained significant strategic operations expertise and logistics management experience that allows him to provide the Board with a meaningful perspective on Sherwin-Williams’ operations and business matters.

19

Table of Contents

STEVEN H. WUNNING

Retired, Former Group President

Caterpillar Inc.

Director of Sherwin-Williams since 2015

Age: 67

Business Experience. Steven H. Wunning served as Group President and member of the Executive Office of Caterpillar Inc. (world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives) from January 2004 until his retirement in February 2015. Mr. Wunning joined Caterpillar in 1973 and held a variety of positions with increasing responsibility, including Vice President, Logistics Division from January 2000 to January 2004 and Vice President, Logistics & Product Services Division from November 1998 to January 2000. Mr. Wunning is also a director of Kennametal Inc. (NYSE: KMT), Neovia Logistics Holdings Ltd., Summit Materials, Inc. (NYSE: SUM) and Black & Veatch Holding Company. Mr. Wunning serves on the Board of Trustees of Missouri University of Science and Technology.

Key Qualifications, Attributes and Skills. Through his broad range of assignments and experience gained during 41 years of service at Caterpillar, Mr. Wunning developed an in-depth understanding of manufacturing, quality, product support and logistics at a leading global manufacturing company. Mr. Wunning’s extensive management experience provides the Board with a valuable, independent perspective on Sherwin-Williams’ global manufacturing and supply chain operations.

The Board of Directors unanimously recommends that

you vote “FOR” the election of each of the nominees listed.

20

Table of Contents

ADDITIONAL INFORMATION ABOUT OUR DIRECTORS

The Board has adopted categorical Director Independence Standards to assist the Board in determining the independence of each director. To be considered independent, the Board must affirmatively determine that the director has no material relationship with Sherwin-Williams. In each case, the Board broadly considers all relevant facts and circumstances, including the director’s commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, and such other criteria as the Board may determine from time to time. Our Director Independence Standards also include additional independence requirements for members of the Audit Committee and Compensation Committee. A complete copy of our Director Independence Standards is attached as Appendix A.

During the Board’s annual review of director independence, the Board considers transactions, relationships and arrangements between each director or an immediate family member of the director and Sherwin-Williams. The Board also considers transactions, relationships and arrangements between each director or an immediate family member of the director and our senior management. Under our Director Independence Standards, the following relationships are not considered to be material relationships that would impair a director’s independence:

| • | if the director is a current employee, or an immediate family member of the director is a current executive officer, of another company that has made payments to, or received payments from, Sherwin-Williams for property or services in an amount which, in any of the last three fiscal years, is less than $1 million or two percent, whichever is greater, of such other company’s annual gross revenues; |

| • | if the director, or an immediate family member of the director, is an executive officer of another company which is indebted to Sherwin-Williams, or to which Sherwin-Williams is indebted, in an amount which is less than five percent of such other company’s total assets; |

| • | if the director, or an immediate family member of the director, serves as an officer, director or trustee of a not-for-profit organization, and Sherwin-Williams’ discretionary charitable contributions (excluding matching contributions) to the organization are less than $500,000 or five percent, whichever is greater, of that organization’s annual gross revenues; |

| • | if the director serves as a director or executive officer of another company that also uses Sherwin-Williams’ independent auditor; |

| • | if the director is a member of, or associated with, the same professional association, or social, educational, civic, charitable, fraternal or religious organization or club as another Sherwin-Williams director or executive officer; or |

| • | if the director serves on the board of directors of another company at which another Sherwin-Williams director or executive officer also serves on the board of directors (except for compensation committee interlocks). |

Early this year, the Board performed its independence review for 2019. As a result of this review, the Board determined that 9 of our 10 current directors and 11 of our 12 director nominees are independent. All members of the Audit Committee, Compensation Committee and Nominating Committee are independent. The Board determined that Mrs. Kropf, Ms. Anderson, Ms. Poon and Messrs. Anton, Fettig, Hodnik, Kramer, Stropki, Thaman, Thornton and Wunning meet these standards and are independent and, in addition, satisfy the independence requirements of the NYSE. Mr. Morikis is not considered to be independent because of his employment with Sherwin-Williams.

21

Table of Contents

Experiences, Qualifications, Attributes and Skills of Director Nominees.

In considering each director nominee and the composition of the Board as a whole, the Nominating Committee utilizes a director matrix consisting of a diverse set of experiences, qualifications, attributes and skills, including diversity in gender, ethnicity and race, that it believes enables a director nominee to make significant contributions to the Board, Sherwin-Williams and our shareholders. These experiences, qualifications, attributes and skills are more fully described below. The Nominating Committee regularly reviews the director matrix as part of its annual Board composition review, which includes a review of potential director candidates. The Nominating Committee may also consider such other experiences, qualifications, attributes and skills, as it deems appropriate, given the then-current needs of the Board and Sherwin-Williams.

| K. B. Anderson |

A. F. Anton |

J. M. Fettig |

D. F. Hodnik |

R. J. Kramer |

S. J. Kropf |

J. G. Morikis |

C. A. Poon |

J. M. Stropki |

M. H. Thaman |

M. Thornton III |

S. H. Wunning | |||||||||||||

| Senior Management Experience Experience as a CEO, COO, President or Senior VP of a company or a significant subsidiary, operating division or business unit. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

| Independence Satisfy the independence requirements of the NYSE. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| Financial Expertise Possess the knowledge and experience to be qualified as an “audit committee financial expert.” |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

| Manufacturing; Distribution Experience in, or experience in a senior management position responsible for, managing significant manufacturing and distribution operations. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

| Technical; Research and Development Experience in, or experience in a senior management position responsible for, managing a significant technical or research and development function. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

| International Operations Experience working in a major organization with global operations with a thorough understanding of different cultural, political and regulatory requirements. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

| Marketing; Sales Experience in, or experience in a senior management position responsible for, managing a marketing and/or sales function. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

| Retail Operations Experience in, or experience in a senior management position responsible for, managing retail operations. |

✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||

| Diversity Add perspective through diversity in gender, ethnic background, race, etc. |

✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||

22

Table of Contents

2018 DIRECTOR COMPENSATION TABLE

The following table sets forth information regarding the compensation of our non-management directors for 2018.

|

Name |

Fees Earned or Paid in Cash ($)(1,2) |

Stock Awards ($)(3,4) |

All Other Compensation ($)(5) |

Total ($) | ||||||||

| A. F. Anton |

136,000 | 145,797 | -0- | 281,797 | ||||||||

| D. F. Hodnik |

115,000 | 145,797 | -0- | 260,797 | ||||||||

| R. J. Kramer |

115,000 | 145,797 | -0- | 260,797 | ||||||||

| S. J. Kropf |

115,000 | 145,797 | 3,000 | 263,797 | ||||||||

| C. A. Poon |

130,000 | 145,797 | 3,513 | 279,310 | ||||||||

| J. M. Stropki |

140,000 | 145,797 | 3,513 | 289,310 | ||||||||

| M. H. Thaman |

115,000 | 145,797 | 6,000 | 266,797 | ||||||||

| M. Thornton III |

115,000 | 145,797 | -0- | 260,797 | ||||||||

| S. H. Wunning |

136,000 | 145,797 | 3,622 | 285,419 | ||||||||

| 1 | These amounts reflect the annual retainer, the annual retainer for the Lead Director and the annual retainers for committee chairs. |

| 2 | Mrs. Kropf, Ms. Poon and Messrs. Kramer, Thaman and Wunning deferred payments of fees under our Director Deferred Fee Plan. Cash amounts deferred into vested stock units under our Director Deferred Fee Plan during 2018 were as follows: Mrs. Kropf ($115,000), Ms. Poon ($32,500), Mr. Kramer ($115,000), Mr. Thaman ($115,000) and Mr. Wunning ($136,000). These amounts were credited to either a common stock unit account or a shadow stock unit account under our Director Deferred Fee Plan. |

| 3 | These values reflect 361 restricted stock units (RSUs) granted during 2018 to each of our non-management directors under our 2006 Stock Plan for Nonemployee Directors. The value of RSUs is equal to the aggregate grant date fair value computed in accordance with stock-based accounting rules (Stock Compensation Topic 718 of the Accounting Standards Codification (ASC)), excluding the effect of estimated forfeitures. The grant date fair value of RSUs is based on the fair market value of our common stock (the average of the highest and lowest reported sale prices) on the grant date. |

| 4 | The number of RSUs held by each of our non-management directors at December 31, 2018 was as follows: 671 for Mr. Thaman and 875 for each of Mrs. Kropf, Ms. Poon and Messrs. Anton, Hodnik, Kramer, Stropki, Thornton and Wunning. Dividend equivalents are paid on RSUs at the same rate as dividends are paid on our common stock. |

| None of our non-management directors held any stock options at December 31, 2018. Stock options are not part of our director compensation program. |

| 5 | Amounts for Mrs. Kropf, Ms. Poon and Messrs. Stropki, Thaman and Wunning include charitable matching gifts under our matching gifts and grants for volunteers program, which is described on the next page. Amounts for Ms. Poon and Messrs. Stropki and Wunning also include the aggregate incremental cost for personal use of corporate aircraft. The method used to calculate this cost is set forth in a footnote to the Summary Compensation Table. |

23

Table of Contents

The Compensation Committee is responsible for reviewing and approving the compensation for our non-management directors. All of our non-management directors are paid under the same compensation program. Any officer of Sherwin-Williams who also serves as a director does not receive any additional compensation for serving as a director.

Director Fees.

During 2018, the cash and equity compensation program for our non-management directors consisted of the following:

| • | an annual cash retainer of $115,000; |

| • | an additional annual cash retainer of $25,000 for the Lead Director, $21,000 for the chair of the Audit Committee, $21,000 for the chair of the Compensation Committee and $15,000 for the chair of the Nominating Committee; |

| • | a meeting fee of $1,750 for each Board or committee meeting attended in excess of twelve meetings during the calendar year. For purposes of calculating the number of meetings, any Board and committee meetings held within 24 hours constitute one meeting; and |

| • | an annual grant of RSUs of approximately $145,000, valued over a prior 30-day period, under our 2006 Stock Plan for Nonemployee Directors. One RSU is equivalent in value to one share of Sherwin-Williams common stock. RSUs generally are paid out in common stock upon vesting and vest in annual increments of one-third over a period of three years. RSUs will immediately vest in the event of the death or disability of the director or in the event of a change in control of Sherwin-Williams. In the event of the retirement of the director, RSUs will continue to vest in accordance with the original three-year vesting schedule. |

We reimburse all directors for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of the Board and its committees. We do not provide retirement benefits to our non-management directors.