Form DEF 14A RED HAT INC For: Aug 09

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant: ☒

Filed by a Party other than the Registrant: ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

RED HAT, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

Table of Contents

June 22, 2017

Dear Red Hat Stockholders,

It is my pleasure to invite you to Red Hat’s 2017 Annual Meeting of Stockholders. This year’s meeting will be held on Thursday, August 10, 2017, at 8:30 a.m.

Eastern time, at our corporate headquarters, located at 100 East Davie Street, Raleigh, North Carolina 27601. I hope you will be able to attend.

This year we are again

pleased to furnish our proxy materials via the Internet. Providing our materials to stockholders electronically allows us to conserve natural resources and reduce our printing and mailing costs for the distribution of the proxy materials. We will

mail to stockholders a Notice of Internet Availability of Proxy Materials for the 2017 Annual Meeting which contains instructions on how to access those documents over the Internet. Stockholders who wish to receive paper copies of the proxy

materials may do so by following the instructions on the Notice of Internet Availability of Proxy Materials.

Your vote is important to us. Whether or not you plan to attend

the 2017 Annual Meeting, we hope you will vote as soon as possible. You may vote in person, by telephone, over the Internet or, if you received paper copies of the proxy materials, by mail.

Thank you for your ongoing support of Red Hat.

Sincerely,

James M. Whitehurst

President and Chief Executive Officer

Table of Contents

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE: |

8:30 a.m. Eastern time on Thursday, August 9, 2018 | |||

| PLACE: |

Red Hat’s corporate headquarters located at 100 East Davie Street, Raleigh, North Carolina 27601 | |||

| ITEMS OF BUSINESS: |

1. To elect eight members to the Board of Directors, each to serve for a one-year term | |||

| 2. To approve, on an advisory basis, a resolution relating to Red Hat’s executive compensation | ||||

| 3. To ratify the selection of PricewaterhouseCoopers LLP as Red Hat’s independent registered public accounting firm for the fiscal year ending February 28, 2019 | ||||

| 4. To transact such other business as may properly come before the 2018 Annual Meeting and any adjournments thereof | ||||

| ADJOURNMENTS AND POSTPONEMENTS: |

Any action on the items of business described above may be considered at the 2018 Annual Meeting or at any time and date to which the 2018 Annual Meeting may be properly adjourned or postponed. | |||

| RECORD DATE: |

Stockholders of record at the close of business on June 15, 2018 are entitled to notice of, and to vote at, the 2018 Annual Meeting and at any adjournments or postponements thereof. | |||

| INSPECTION OF LIST OF STOCKHOLDERS OF RECORD: |

A list of stockholders of record will be available for inspection at our corporate headquarters located at 100 East Davie Street, Raleigh, North Carolina 27601, during ordinary business hours during the ten-day period before the 2018 Annual Meeting. | |||

| VOTING: |

Whether or not you plan to attend the 2018 Annual Meeting, we urge you to vote your shares via the toll-free telephone number or over the Internet as described in the proxy materials. If you received a copy of the proxy card by mail you may sign, date and mail the proxy card in the pre-paid envelope provided.

|

|||

| Raleigh, North Carolina June 25, 2018

|

By Order of the Board of Directors,

Michael R. Cunningham Secretary | |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2018 ANNUAL MEETING TO BE HELD ON AUGUST 9, 2018: THIS PROXY STATEMENT AND RED HAT’S 2018 ANNUAL REPORT TO STOCKHOLDERS ARE AVAILABLE AT WWW.EDOCUMENTVIEW.COM/RHT

| ||

Table of Contents

Table of Contents

June 25, 2018

Thank you for choosing to invest in Red Hat.

This year, Red Hat celebrates its 25th anniversary. From the outset, the Company saw how open source development and licensing unlocked the potential to create better software, and its culture was rooted in open source principles. Today, Red Hat is the world’s leading provider of open source solutions for the enterprise.

As we look ahead to the next 25 years, Red Hat’s commitment to being the open source leader means that it must attract people who will help to sustain and scale this culture and remain focused on transparency, sharing and collaboration. As the Company’s directors, we remain focused on working with management to build upon this open source leadership to provide long-term, sustainable value for stockholders.

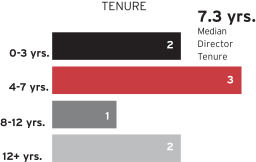

We continue to review the composition of the Board in an effort to provide a thoughtful balance of skills, tenure and experience that best serves the Company and its stockholders. Over the past four years, we have added three new directors, deepening our diversity of composition, thought and experience with fresh perspectives.

To enhance the Board’s effectiveness, we look for opportunities to hear from customers about their use of Red Hat solutions and from a broad range of Company employees. During this past year, members of the Board visited Red Hat’s engineering facility in Brno, Czech Republic, participated in a regional sales kick-off conference, attended Red Hat Summit, our annual customer conference, and met informally with Red Hat employees in a number of settings. These interactions deepen our understanding of the Company, its business and its culture, in addition to supporting our oversight of management’s employee development and succession planning efforts.

We also believe that stockholder engagement is an important part of a robust corporate governance program. Red Hat regularly meets with stockholders at conferences and one-on-one meetings to discuss the Company’s financial performance, corporate governance practices, executive compensation programs and other matters. These conversations with stockholders provide us with important perspective and we encourage you to share your viewpoints and suggestions with us. You can contact us at Investor Relations, Red Hat, Inc., 100 E. Davie Street, Raleigh, NC 27601, United States.

We appreciate your support as Red Hat continues on its journey to drive innovation with open source-based technologies.

Respectfully submitted,

Red Hat, Inc. Board of Directors

|

|

1

|

Table of Contents

This Proxy Summary provides general information about Red Hat, Inc., referred to as “Red Hat,” “the Company,” “we,” “us,” and “our” in this Proxy Statement, and highlights certain information contained elsewhere in this Proxy Statement. As it is only a summary, please refer to the entire Proxy Statement and the 2018 Annual Report to Stockholders before you vote. Our fiscal year ends on the last day of February, and we identify our fiscal years by the calendar years in which they end. For example, we refer to the fiscal year ended February 28, 2018 as “Fiscal 2018.” “GAAP” means U.S. generally accepted accounting principles.

| 2018 ANNUAL MEETING OF STOCKHOLDERS

| ||||

|

WHERE? Red Hat’s Corporate HQ: 100 East Davie Street Raleigh, North Carolina 27601 |

WHEN? Thursday August 9, 2018 8:30 a.m. Eastern |

WHO MAY ATTEND & VOTE? Stockholders of record at the close of business on June 15, 2018 | ||

| AGENDA ITEMS AND BOARD RECOMMENDATIONS

|

||||

| ITEM | RECOMMENDATION | |||

| 1. | Elect Sohaib Abbasi, W. Steve Albrecht, Charlene T. Begley, Narendra K. Gupta, Kimberly L. Hammonds, William S. Kaiser, James M. Whitehurst and Alfred W. Zollar to the Board of Directors, each to serve for a one-year term | FOR | ||

| 2. | Approve, on an advisory basis, a resolution relating to Red Hat’s executive compensation | FOR | ||

| 3. | Ratify the selection of PricewaterhouseCoopers LLP as Red Hat’s independent registered public accounting firm for the fiscal year ending February 28, 2019 |

FOR | ||

|

ELECTRONIC VERSIONS This Proxy Statement and Red Hat’s 2018 Annual Report to stockholders are available at: www.edocumentview.com/RHT.

MAILING OF NOTICE A Notice of Internet Availability of Proxy Materials (or this Proxy Statement and the accompanying materials) are being mailed on or about June 28, 2018 to stockholders of record as of the close of business on June 15, 2018.

|

|

2

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

PROXY SUMMARY OUR BOARD

| FAST FACTS

| ||

| ANNUAL DIRECTOR ELECTIONS |

MAJORITY VOTING STANDARD | |

INDEPENDENT

BOARD CHAIR AND COMMITTEE MEMBERS

| DIRECTOR NOMINEES

| ||||||||||

| NAME | AGE | PRIMARY OCCUPATION |

COMMITTEE MEMBERSHIP |

EXPERIENCE & EXPERTISE |

INDEPENDENT | |||||

| Sohaib Abbasi |

61 | Chairman, Chief Executive Officer and President (Retired), Informatica Corporation | Compensation (Chair), Audit |

|

| |||||

| W. Steve Albrecht |

71 | Professor of Accounting (Retired), Brigham Young University, Marriott School of Management | Audit (Chair), Nominating and Corporate Governance |

|

| |||||

| Charlene T. Begley |

51 | Senior Vice President and Chief Information Officer (Retired), General Electric Company | Audit, Nominating and Corporate Governance |

|

| |||||

| Narendra K. Gupta (Board Chair) |

69 | Managing Director, Nexus Venture Partners | Compensation |

|

| |||||

| Kimberly L. Hammonds |

51 | Former Group Chief Operating Officer, Deutsche Bank AG | Compensation, Nominating and Corporate Governance |

|

| |||||

| William S. Kaiser |

62 | Partner, Greylock Partners |

Nominating and Corporate Governance (Chair) |

|

| |||||

| James M. Whitehurst |

50 | President and CEO, Red Hat, Inc. |

|

|||||||

| Alfred W. Zollar |

64 | Executive Partner, Siris Capital Group, LLC |

|

| ||||||

|

| ||||||||||

|

|

3

|

Table of Contents

OUR BOARD PROXY SUMMARY

DIRECTOR NOMINEES

|

| |

|

| |

GOVERNANCE HIGHLIGHTS

| • | Separate Board Chair and CEO since 2008 |

| • | Added three new directors in past four years |

| • | Regular focus on Board composition |

| • | Annual Board and committee self-evaluations |

| • | Board orientation and director education programs |

| • | Stock ownership guidelines for directors and named executive officers based on target multiples of annual cash retainer for non-employee directors and annual base salary for CEO and other named executive officers |

| • | Prohibition on hedging or pledging Red Hat stock |

| • | Annual advisory say-on-pay vote |

|

4

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

PROXY SUMMARY PERFORMANCE

| FAST FACTS | ||||

| 25th Anniversary CELEBRATED ON MARCH 26, 2018 |

64 | CONSECUTIVE QUARTERS OF REVENUE GROWTH AS OF THE END OF FISCAL 2018 | ||

| $3.4 BILLION OF TOTAL BACKLOG AT END OF FISCAL 2018 |

21% |

YEAR-OVER-YEAR TOTAL REVENUE GROWTH IN FISCAL 2018 |

Red Hat Performance and Executive Compensation

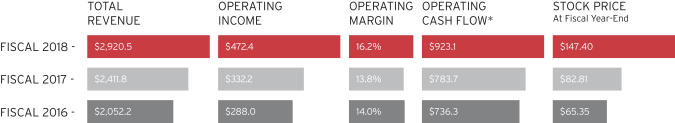

FINANCIAL PERFORMANCE (U.S. DOLLARS IN MILLIONS, EXCEPT STOCK PRICE)

In Fiscal 2018, Red Hat achieved over $2.9 billion in total revenue and delivered growth in revenue, operating income, operating margin, operating cash flow and stock price at fiscal year end.

| * | In March 2016, Red Hat elected to adopt Accounting Standards Update 2016-09 on a retrospective basis which increased operating cash flow by $20.2 million for Fiscal 2016. |

PAY AND PERFORMANCE AT A GLANCE

Red Hat’s Fiscal 2018 financial and stock price performance drove over 80% of the compensation earned by our executives during Fiscal 2018, reflecting the linkage between pay and performance built into our executive compensation program design. Payouts for Fiscal 2018 performance reflect:

| • | strong financial results that outperformed the majority of our compensation peer companies over the applicable performance periods under our operating performance share units, and yielded above target payouts earned under our annual cash bonus plan; and |

| • | stock price growth over a three-year period that outperformed the majority of our compensation peer companies under our total stockholder return (“TSR”) performance share units. |

| COMPONENT | PERFORMANCE AGAINST INCENTIVE METRICS | PAYOUT % | ||

| Annual Cash Bonus Plan | Company financial performance on total revenue, non-GAAP operating income and non-GAAP operating cash flow: 167% of target | 167% of target (average for all Named Officers) | ||

| Individual performance objectives (average of all Named Officers): 166% of target | ||||

| Operating Performance Share Units | Revenue and operating income growth relative to compensation peer companies for operating performance share units granted in Fiscal 2016 (over three years) and Fiscal 2017 (over two years) | 200% of target (average) | ||

| TSR Performance Share Units | TSR growth relative to compensation peer companies over three years (Fiscal 2016 – Fiscal 2018) | 200% of target | ||

|

|

5

|

Table of Contents

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

Our Board of Directors (the “Board”) currently consists of nine directors. All of our incumbent directors except Donald H. Livingstone, who has reached the mandatory retirement age set forth in our Corporate Governance Guidelines and will not stand for re-election at the 2018 Annual Meeting of Stockholders (“Annual Meeting”), are nominees for re-election to the Board. Mr. Livingstone will continue to serve as a director until his term expires at the Annual Meeting. We believe that our director nominees, individually and together as a whole, possess the requisite skills, experience and qualifications necessary to maintain an effective Board to serve the best interests of the Company and its stockholders.

Set forth below is a brief biography for each nominee and a description of certain key attributes that the Board considered in recommending each nominee for re-election.

|

SOHAIB ABBASI Age: 61 Director Since: March 2011 Committees: • Audit • Compensation (Chair) |

Mr. Abbasi served as the Chief Executive Officer and President of Informatica Corporation, a provider of enterprise data integration software and services, from July 2004 through August 2015 and as Chairman of its board of directors from March 2005 through August 2015. Mr. Abbasi also served as the Chairman of Informatica LLC from August 2015 through January 2016. From 2001 to 2003, Mr. Abbasi was Senior Vice President, Oracle Tools Division and Oracle Education at Oracle Corporation, which he joined in 1982. From 1994 to 2000, he was Senior Vice President, Oracle Tools Product Division. Mr. Abbasi currently serves on the board of directors of New Relic, Inc., a software analytics provider to enterprises.

Skills and Qualifications: With his experience as President, Chief Executive Officer and Chairman of a technology-related company, Mr. Abbasi brings to our Board IT industry expertise as well as public company board and senior leadership experience. | |

|

W. STEVE ALBRECHT Age: 71 Director Since: March 2011 Committees: • Audit (Chair) • Nominating and Corporate Governance |

Dr. Albrecht, who previously served on our Board from April 2003 through June 2009, served as the Gunnell Endowed Professor and a Wheatley Fellow at Brigham Young University’s (“BYU”) Marriott School of Management (“Marriott School”) from July 2012 until August 2017. Dr. Albrecht also served as a mission president in Japan for his church from July 2009 through July 2012. Dr. Albrecht, a certified public accountant, certified internal auditor and certified fraud examiner, joined BYU in 1977 after teaching at Stanford University and the University of Illinois and served as Associate Dean of the Marriott School at BYU from 1998 until July 2008. Prior to becoming a professor, he worked as an accountant for Deloitte & Touche. Dr. Albrecht currently serves on the board of directors of Cypress Semiconductor Corporation (“Cypress”), a semiconductor design and manufacturing company, and SkyWest, Inc., the holding company of SkyWest Airlines and ExpressJet, a regional airline company. Dr. Albrecht was appointed Chairman of the board of directors of Cypress in June 2017. He is the past president of the American Accounting Association and the Association of Certified Fraud Examiners and is a former trustee of the Financial Accounting Foundation that oversees the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB) and a former trustee of the Committee of Sponsoring Organizations (COSO), the organization that designed the internal control framework used by nearly all public companies and other organizations.

Skills and Qualifications: Dr. Albrecht’s career in public accounting and as a professor and associate dean, as well as his service as a director of a number of public companies, brings to our Board financial expertise as well as public company board and senior leadership experience. | |

|

6

|

RED HAT, INC. 2018 PROXY STATEMENT

|

|

Table of Contents

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

|

CHARLENE T. BEGLEY Age: 51 Director Since: November 2014 Committees: • Audit • Nominating and Corporate Governance |

Ms. Begley served in various capacities at General Electric Company (“GE”) from 1988 through December 2013. Most recently, she served in a dual role as Senior Vice President and Chief Information Officer, as well as the President and Chief Executive Officer of GE’s Home and Business Solutions business, from January 2010 through December 2013. Ms. Begley served as President and Chief Executive Officer of GE Enterprise Solutions from August 2007 through December 2009. During her career at GE, she served as President and Chief Executive Officer of GE Plastics and GE Transportation, led GE’s Corporate Audit staff and served as the Chief Financial Officer for GE Transportation and GE Plastics Europe and India. Ms. Begley currently serves on the board of directors of Nasdaq, Inc., a global exchange group that delivers trading, clearing, exchange technology, regulatory, securities listing, and public company services, and Hilton Worldwide Holdings Inc., a provider of hospitality services through hotels, resorts and timeshare properties. Ms. Begley served on the board of directors of WPP, plc, a provider of marketing communications services globally, from December 2013 until June 2017.

Skills and Qualifications: With her experience leading various divisions of a complex global industrial and financial services company, Ms. Begley brings to our Board financial and global expertise as well as public company board and senior leadership experience. | |

|

NARENDRA K. GUPTA Age: 69 Director Since: November 2005; Board Chair since August 2017 Committees: • Compensation |

Dr. Gupta co-founded and has served as Managing Director of Nexus Venture Partners, a U.S./India venture capital fund, since December 2006. In 1980, Dr. Gupta co-founded Integrated Systems Inc., a provider of products for embedded software development, which went public in 1990. Dr. Gupta served as Integrated System’s President and CEO from founding until 1994 and as Chairman until 2000 when Integrated Systems merged with Wind River Systems, Inc., a provider of device software optimization solutions. Dr. Gupta served as Wind River’s Vice Chairman from 2000 until its acquisition by Intel Corporation in 2009. Dr. Gupta served on the board of directors of Tibco Software Inc., a provider of service-oriented architecture and business process management enterprise software, from 2002 until April 2014. Dr. Gupta has served on the board of trustees of California Institute of Technology since 2010.

Skills and Qualifications: As a former executive and current and former board member of a number of technology-related public and private companies and as an investor in global companies, Dr. Gupta provides our Board with global and IT industry expertise and public company board and technology and innovation experience. | |

|

KIMBERLY L. HAMMONDS Age: 51 Director Since: August 2015 Committees: • Compensation • Nominating and Corporate Governance |

Ms. Hammonds served as the Group Chief Operating Officer at Deutsche Bank AG, a global financial services company, from January 2016 to May 2018 and as a member of the Deutsche Bank Management Board from August 2016 to May 2018. She joined Deutsche Bank as Chief Information Officer and Global Co-Head Technology and Operations in November 2013 from The Boeing Company, a global aerospace company. Ms. Hammonds joined Boeing in 2008 and served in a number of capacities, including most recently as Chief Information Officer/Vice President, Global Infrastructure, Global Business Systems from January 2011 to November 2013. Ms. Hammonds joined Boeing from Dell Incorporated, where she led IT systems development for manufacturing operations in the Americas, and directed global IT reliability and factory systems. Ms. Hammonds currently serves on the board of directors of Cloudera, Inc., a data management, machine learning and advance analytics platform provider.

Skills and Qualifications: Ms. Hammonds’ experience as an executive spans both technology and operations for some of the world’s largest companies and brings to our Board global expertise as well as public company board, senior leadership and technology and innovation experience. | |

|

|

|

7

|

Table of Contents

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

|

WILLIAM S. KAISER Age: 62 Director Since: September 1998 Committees: • Nominating and Corporate Governance (Chair) |

Mr. Kaiser has been employed by Greylock Management Corporation, a venture capital firm, since May 1986 and has been a general partner of several limited partnerships affiliated with Greylock Partners since January 1988. Mr. Kaiser served on the board of directors of Constant Contact, Inc., a provider of products and services that help small organizations create and grow customer relationships, from May 2006 to February 2016 in addition to serving or having served on the boards of directors of a number of public and private companies.

Skills and Qualifications: Having a background in venture capital investment focused on technology-related entities, Mr. Kaiser brings to our Board financial and IT industry expertise and technology and innovation experience. | |

|

JAMES M. WHITEHURST Age: 50 Director Since: January 2008 |

Mr. Whitehurst has served as the President and CEO of Red Hat and as a member of the Board since January 2008. Prior to joining Red Hat, Mr. Whitehurst served at Delta Air Lines, Inc. as Chief Operating Officer from July 2005 to August 2007, as Senior Vice President and Chief Network and Planning Officer from May 2004 to July 2005 and as Senior Vice President—Finance, Treasury & Business Development from January 2002 to May 2004. Prior to joining Delta, he was a partner and managing director at The Boston Consulting Group. Mr. Whitehurst was appointed to the board of directors of United Continental Holdings, Inc., the holding company of United Airlines, Inc., a global airline company, in March 2016 and to the board of directors of SecureWorks Corp., a provider of information security solutions, in April 2016. Mr. Whitehurst served on the board of directors of DigitalGlobe, Inc., a builder and operator of satellites for digital imaging, from 2009 through May 2016.

Skills and Qualifications: Mr. Whitehurst’s service as our CEO as well as his experience as a senior executive at a global corporation brings financial and global expertise as well as senior leadership and technology and innovation experience to our Board. | |

|

ALFRED W. ZOLLAR Age: 64 Director Since: May 2018 |

Mr. Zollar has been employed as an Executive Partner at Siris Capital Group, LLC, a private equity firm, since February 2014. Mr. Zollar served as General Manager-Tivoli Software division of International Business Machines Corporation, a provider of information technology, products and services, from July 2004 to January 2011, General Manager-eServer iSeries from January 2003 to July 2004, President and Chief Executive Officer-Lotus Software division from January 2000 to December 2003, and Division General Manager-Network Computer Software division from 1996 to 2000. Mr. Zollar has served on the board of directors of Public Service Enterprise Group Incorporated, an energy company operating primarily in the Northeastern and Mid-Atlantic states, since 2012. Mr. Zollar served as a director of the Chubb Corporation, a property and casualty insurance company, from 2001 until 2016, in addition to serving or having served on the boards of directors of a number of public and private companies.

Skills and Qualifications: With his experience as an executive at a global technology-related company, Mr. Zollar provides our Board with IT industry expertise as well as senior leadership and technology and innovation experience. | |

|

8

|

RED HAT, INC. 2018 PROXY STATEMENT

|

|

Table of Contents

BOARD COMPOSITION

CRITERIA FOR EVALUATING CANDIDATES FOR SERVICE ON OUR BOARD

The Nominating and Corporate Governance Committee of our Board is responsible for identifying and evaluating candidates for service on our Board and recommending proposed director nominees to the full Board for consideration. Our Corporate Governance Guidelines describe the criteria used to select candidates for service on our Board. These include:

| DIRECTOR SELECTION CRITERIA

|

||||

|

• Reputation for integrity, honesty and adherence to high ethical standards

• Demonstrated business acumen, experience and ability to exercise sound judgment in matters that relate to the current and long-term objectives of the Company and should be willing and able to contribute positively to the decision-making process of the Company

• Commitment to understand the Company and its industry

• Commitment to regularly attend and participate in meetings of the Board and its committees

• Interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company

• No conflict of interest, or appearance of a conflict of interest, that would impair the nominee’s ability to represent the interests of all the Company’s stockholders and to fulfill the responsibilities of a director

• Ability to serve for at least five years before reaching the age of 75 for new directors

| ||||

In addition, the Nominating and Corporate Governance Committee believes it is important to select directors from various backgrounds and professions in an effort to ensure that the Board as a group has a broad range of experiences to enrich discussion and inform its decisions. Consistent with this philosophy, the Nominating and Corporate Governance Committee believes that each director should possess at least two of the following attributes:

| DIRECTOR ATTRIBUTES

|

||||

|

| ||||

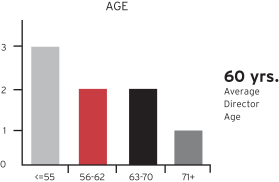

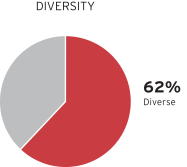

DIVERSITY

As stated in our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee’s review of a nominee’s qualifications includes consideration of diversity, age, skills and professional experience in the context of the needs of the Board, and nominees shall not be discriminated against on the basis of race, religion, national origin, gender, sexual orientation, disability or other basis proscribed by law. While the Company has no formal diversity policy that applies to the consideration of director candidates, the Nominating and Corporate Governance Committee believes that diversity includes not just race and gender but differences of viewpoint, experience, education, skill and other qualities or attributes that contribute to Board heterogeneity.

|

|

9

|

Table of Contents

BOARD COMPOSITION

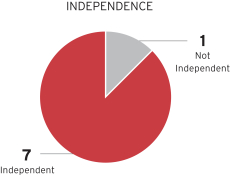

BOARD INDEPENDENCE

The Board affirmatively determined that all of our directors, except for Mr. Whitehurst, our President and CEO, are independent according to the criteria of the New York Stock Exchange (“NYSE”) and our Corporate Governance Guidelines and in the judgment of our Board. The Board makes its independence determination on an annual basis at the time it approves director nominees for inclusion in the annual proxy statement and, if a director joins the Board in the interim, at such time as the director joins the Board. For a director to be considered independent under the NYSE rules, the Board must determine that a director does not have a direct or indirect material relationship with Red Hat (other than as a director) that would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities. On an annual basis, we require each member of our Board to complete a questionnaire designed to provide information to assist the Board in determining whether the director is independent. The Board makes independence determinations on a case-by-case basis in light of all relevant facts and circumstances. The Board had previously determined that General H. Hugh Shelton (U.S. Army Retired), a former director who served on our Board for a portion of Fiscal 2018, was independent.

ELECTION OF DIRECTORS

At all meetings of stockholders for the election of directors at which a quorum is present, each director nominee shall be elected to the Board by the vote of the majority of the votes cast with respect to the director nominee; provided, however, that if, as of a date that is five business days in advance of the date that the Company files its definitive proxy statement (regardless of whether or not thereafter revised or supplemented) with the U.S. Securities and Exchange Commission (“SEC”), the number of director nominees exceeds the number of directors to be elected, the directors (not exceeding the authorized number of directors as fixed by the Board in accordance with the Company’s Certificate of Incorporation) shall be elected by a plurality of the voting power of the shares of stock entitled to vote who are present, in person or by proxy at any such meeting and entitled to vote on the election of directors. For purposes of the election of directors, a “majority of the votes cast” means that the number of shares voted “For” a director nominee must exceed the number of shares voted “Against” that director nominee. Abstentions and broker non-votes are not considered votes cast for this purpose and will have no effect on the election of director nominees.

PROCESS FOR NOMINATING CANDIDATES FOR SERVICE ON OUR BOARD

The Nominating and Corporate Governance Committee will consider candidates proposed or suggested by other members of the Board, members of executive management and stockholders and candidates identified by third-party search firms retained by the Nominating and Corporate Governance Committee. Mr. Zollar was identified as a potential director nominee by a third-party search firm.

Stockholders who wish to recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates may do so by submitting candidate names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation beneficially owned more than 5% of our common stock for at least one year as of the date the recommendation is made, to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Red Hat, Inc., 100 East Davie Street, Raleigh, North Carolina 27601. Assuming the appropriate biographical information and background materials have been provided on a timely basis, the Committee will evaluate any such stockholder-recommended candidates by following the same process, and applying the same criteria, as it follows for candidates submitted by others.

By following the procedures set forth under “Other Matters—Stockholder Proposals and Nominations,” stockholders also have the right under our By-Laws to nominate director candidates.

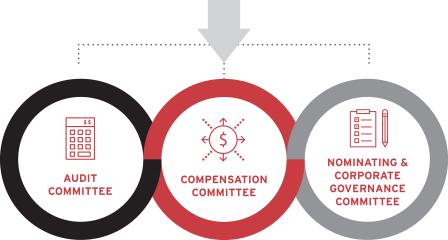

Our Board has established three standing committees—Audit, Compensation and Nominating and Corporate Governance—each of which operates under a written charter approved by the Board and available on our website at www.redhat.com under “About Red Hat—Investor Relations—Corporate Governance.” Our Board delegates substantial responsibilities to the committees, which then report their activities and actions back to the full Board. Each committee may form one or more subcommittees and delegate its authority to such subcommittees. The Board has determined that all of the members of the Audit, Compensation and Nominating and Corporate Governance Committees, including committee chairpersons, are independent in accordance with the standards set forth in our Corporate Governance Guidelines and applicable SEC and NYSE rules.

|

10

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

COMMITTEES OF THE BOARD

|

AUDIT COMMITTEE

8 Number of Meetings in Fiscal 2018

Members: • Dr. Albrecht (Chair) • Mr. Abbasi • Ms. Begley • Mr. Livingstone |

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee’s responsibilities include:

• appointing, setting the compensation of, and assessing the independence of the Company’s independent registered public accounting firm;

• overseeing the work of the Company’s independent registered public accounting firm, including through the receipt and consideration of certain reports from the independent registered public accounting firm;

• discussing the scope of and plans for the audit with the Company’s independent registered public accounting firm, including through the receipt and consideration of certain reports from the independent registered public accounting firm;

• reviewing and discussing with management and the Company’s independent registered public accounting firm our annual and quarterly financial statements and related disclosures and reviewing and discussing quarterly earnings press releases;

• monitoring internal controls over financial reporting, disclosure controls and procedures and the Code of Business Conduct and Ethics;

• providing oversight over the Company’s risk management policies;

• establishing policies regarding hiring of present or former employees of the independent registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns;

• meeting independently with the Company’s internal auditing staff, independent registered public accounting firm and management; and

• preparing the audit committee report required by SEC rules (which is included in the section entitled “Audit Matters–Audit Committee Report”).

While our Board has designated Dr. Albrecht as the “audit committee financial expert” in accordance with applicable SEC rules, management believes that all of the members of the Audit Committee meet the qualifications for an audit committee financial expert.

The Audit Committee’s Charter limits a director to service on the audit committees of no more than two other public companies (in addition to Red Hat’s) without the approval of our Board. None of the current members of our Audit Committee serve on the audit committees of more than two other public companies.

|

|

COMPENSATION COMMITTEE

10 Number of Meetings in Fiscal 2018

Members: • Mr. Abbasi (Chair) • Dr. Gupta • Ms. Hammonds • Mr. Livingstone |

The Compensation Committee’s responsibilities include:

• annually reviewing and approving corporate goals and objectives relevant to CEO compensation;

• determining the CEO’s compensation;

• reviewing and approving, or making recommendations to the Board with respect to, the compensation of the Company’s other executive officers;

• evaluating the Company’s management;

• overseeing an annual assessment of the material risks, if any, posed by the Company’s compensation policies and practices;

• reviewing and making recommendations to the Board with respect to director compensation; and

• overseeing and administering the Company’s equity incentive plans. | |||||

|

|

11

|

Table of Contents

COMMITTEES OF THE BOARD

|

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

4 Number of Meetings in Fiscal 2018

Members: • Mr. Kaiser (Chair) • Dr. Albrecht • Ms. Begley • Ms. Hammonds

|

The Nominating and Corporate Governance Committee’s responsibilities include:

• identifying individuals qualified to become Board members;

• recommending to the Board the persons to be nominated for election as directors and appointment to each of the Board’s committees;

• reviewing and making recommendations to the Board with respect to management succession planning;

• developing and recommending corporate governance principles to the Board; and

• overseeing an annual evaluation of the Board. |

During Fiscal 2018, Mr. Abbasi joined the Audit Committee in August 2017, Dr. Gupta served on the Nominating and Corporate Governance Committee until August 2017, and General Shelton served on the Compensation Committee until his term ended at the 2017 Annual Meeting of Stockholders (“2017 Annual Meeting”). General Shelton did not stand for re-election to the Board at the 2017 Annual Meeting.

LEADERSHIP STRUCTURE

Currently, the roles of Board Chair and Chief Executive Officer are held by two different individuals. We believe this structure represents an appropriate allocation of roles and responsibilities for the Company at this time. This arrangement allows our Board Chair, who is an independent director, to lead the Board in its fundamental role of providing independent advice to and oversight of management, and allows our CEO to focus on our day-to-day business and strategy and convey the management perspective to other directors.

|

12

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

BOARD OPERATIONS

RISK OVERSIGHT

Management is responsible for the day-to-day management of the risks the Company faces and our Board has responsibility for the oversight of risk management, including strategic risk, risk to our brand and reputation and cybersecurity risk. The Board and its committees regularly receive information and reports from members of senior management on areas of material risk. In addition, the Board regularly discusses our strategic direction and the risks and opportunities facing the Company in light of trends and developments in the software industry and general business environment.

BOARD OF DIRECTORS

PRIMARY RISK OVERSIGHT

| Financial and Legal | Compensation Plans and Arrangements |

Executive Succession Planning and Board Composition |

RED HAT AND ITS STOCKHOLDERS

Our Board and management focus on creating long-term, sustainable stockholder value. Key to this goal is regular stockholder engagement through meetings with stockholders at conferences and in one-on-one meetings to discuss our financial performance, corporate governance practices, executive compensation programs and other matters. Additionally, from time to time, we invite investors to attend roadshows and visit Red Hat facilities and provide periodic e-mail communications about developments of interest, such as acquisitions. A variety of financial, investor and corporate governance information is available on our website.

Our conversations with stockholders allow us to better understand our stockholders’ perspectives and provide us with useful feedback to calibrate our priorities. Stockholders and other interested parties who wish to communicate with the Board, the Board Chair, independent members of the Board as a group, or any committee chair may do so by following the process set forth on our website at www.redhat.com under “About Red Hat—Investor Relations—Corporate Governance—Contact the Board.”

BOARD MEETINGS AND ATTENDANCE

Directors are responsible for attending all meetings of the Board, the Board committees on which they serve and the annual meeting of stockholders. The Board met 11 times during Fiscal 2018, either in person or by teleconference. During Fiscal 2018, each member of our Board attended at least 75% of the aggregate of the meetings of the Board and the committees on which he or she served. All of the then-serving members of our Board attended our 2017 Annual Meeting.

EXECUTIVE SESSIONS

Our independent directors meet in separate regularly scheduled executive sessions, without management. Our practice is for our Board Chair or the applicable committee chair to preside over any executive session.

|

|

13

|

Table of Contents

KEY BOARD PRACTICES

SUCCESSION PLANNING

On an annual basis, the Nominating and Corporate Governance Committee, the Board and our CEO review the Company’s long-term plan for developing, retaining and replacing senior management and assess Board composition.

Copies of our current corporate governance documents and policies, including our Code of Business Conduct and Ethics, Corporate Governance Guidelines, and committee charters, are available at www.redhat.com under “About Red Hat—Investor Relations—Corporate Governance.”

CODE OF BUSINESS CONDUCT AND ETHICS

The Board has adopted a written Code of Business Conduct and Ethics that applies to our directors, officers and employees. Our Code of Business Conduct and Ethics is posted on our website www.redhat.com under “About Red Hat—Investor Relations—Corporate Governance.” In addition, we intend to post on our website all disclosures that are required by law or by NYSE listing standards with respect to amendments to, or waivers from, any provision of the Code of Business Conduct and Ethics.

CORPORATE GOVERNANCE GUIDELINES

The Board has adopted written Corporate Governance Guidelines, which provide a framework for the conduct of the Board’s business.

| CORPORATE GOVERNANCE GUIDELINES HIGHLIGHTS

|

||||

|

• Principal responsibility of the directors is to oversee and advise the management of the Company

• Majority of the members of the Board must be independent directors

• Independent directors are each to meet regularly in executive session

• Directors have full and free access to management and, as necessary, independent advisors

• Any director who reaches the age of 75 will retire from the Board effective at the end of then current term

• Orientation program for new directors and directors expected to participate in continuing director education on an ongoing basis

• Board and its committees will annually conduct a self-evaluation to determine whether they are functioning effectively

| ||||

POLICIES AND PROCEDURES FOR RELATED PERSON TRANSACTIONS

We have a written Related Person Transaction Policy that provides for the review of certain transactions, arrangements or relationships between Red Hat and parties including our directors, director nominees, executive officers and 5% stockholders (or their immediate family members), who we refer to as “related persons,” in which the amount involved exceeds $120,000 and such related person has or will have a direct or indirect material interest. Any related person transaction proposed to be entered into by the Company must be reported to the Company’s General Counsel and shall be reviewed and approved by our Audit Committee. If review and approval is not practicable prior to entry into the transaction, the Audit Committee will review, and in its discretion, may ratify the related person transaction.

In reviewing the proposed transactions, the Audit Committee shall review and consider, as appropriate:

| • | the related person’s interest in the related person transaction; |

| • | the approximate dollar value of the amount involved in the related person transaction; |

| • | the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss; |

| • | whether the transaction was undertaken in the ordinary course of business of the Company; |

| • | whether the terms of the transaction are, in the aggregate, no less favorable to the Company than terms that could have been reached with an unrelated third party; |

| • | the purpose of, and the potential benefits to the Company of, the transaction; and |

| • | any other information regarding the related person transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

|

14

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

KEY GOVERNANCE POLICIES

The Audit Committee may approve or ratify the transaction if it determines that, under all of the circumstances, the transaction is in, or is not inconsistent with, the Company’s best interests. The Audit Committee may impose any conditions on the related person transaction that it deems appropriate. The Related Person Transaction Policy provides that transactions involving compensation of executive officers will be reviewed and approved by the Compensation Committee of the Board in accordance with its charter.

RELATED PERSON TRANSACTIONS FOR FISCAL 2018

Since March 1, 2017, there has not been, nor is there currently proposed, any transaction, arrangement or relationship in which Red Hat is a party, the amount involved exceeds $120,000 and any related person had or will have a direct or indirect material interest, except for Red Hat’s employment of M. W. Vincent, the brother-in-law of DeLisa K. Alexander, our Executive Vice President and Chief People Officer. In Fiscal 2018, Mr. Vincent’s total compensation, including salary, commissions and stock awards, was $233,874.

OVERVIEW

Our Non-Employee Director Compensation Plan (the “Director Compensation Plan”) provides for a combination of cash and equity compensation for our non-employee directors. The Compensation Committee believes that a combination of cash and equity is the best way to attract and retain directors with the attributes, experience and skills necessary for a company such as Red Hat. Due to the unique nature of our open source development model and the constantly evolving environment in which we operate, the Company needs directors who are knowledgeable about the Company’s business environment and are willing to make a significant commitment to the Company and its stockholders for the long term.

In Fiscal 2018, the Board approved a $10,000 increase to the annual cash retainers for Board service and service as Board Chair. The cash retainer for board service had not been increased since 2008, and the cash retainer for service as board chair was last increased in 2011. Peer company benchmarking data provided by FW Cook, the Compensation Committee’s independent compensation consultant (the “Consultant”), indicated that these cash retainer amounts were no longer competitive. No other elements of our non-employee director compensation program were changed.

Our current compensation program for non-employee directors includes:

| • | a cash retainer for service on our Board; |

| • | additional cash retainers for service as Board Chair, Lead Director, committee chairs and committee members; |

| • | an initial Restricted Stock Award (“RSA”) granted in connection with joining our Board; and |

| • | an annual RSA grant. |

The cash retainer and annual RSA for any new director who serves only a portion of a year will be pro-rated.

CASH COMPENSATION

Each non-employee director receives cash payments, paid in equal quarterly amounts, as compensation for the time and effort spent in connection with service on the Board and its committees. We do not pay meeting fees. A director may elect to receive all or a portion of the quarterly cash payments in the form of deferred stock units (“DSUs”).

| • | DSUs represent the right to receive shares of our common stock that are paid to the director only at the time the director’s Board service ends. |

| • | DSUs granted in lieu of cash compensation are fully vested. |

| • | The number of DSUs granted is determined by dividing the portion of the cash compensation with respect to which the election is made by the closing stock price on the date the cash compensation is due to be paid, rounded up to the nearest share. |

|

|

15

|

Table of Contents

BOARD COMPENSATION

The following table sets out annual cash compensation amounts for Board and committee service during Fiscal 2018:

| CASH COMPENSATION PAYABLE ($) |

||||||||

| TYPE OF CASH COMPENSATION |

(IN EFFECT MARCH 1, 2017 – DECEMBER 2017) |

(EFFECTIVE JANUARY 1, 2018) |

||||||

| Board Member |

50,000 | 60,000 | ||||||

| Board Chair (1) |

50,000 | 60,000 | ||||||

| Lead Director (1) |

30,000 | 30,000 | ||||||

| Audit Committee Chair (2) |

40,000 | 40,000 | ||||||

| Audit Committee Member |

20,000 | 20,000 | ||||||

| Compensation Committee Chair (2) |

30,000 | 30,000 | ||||||

| Compensation Committee Member |

15,000 | 15,000 | ||||||

| Nominating and Corporate Governance Committee Chair (2) |

15,000 | 15,000 | ||||||

| Nominating and Corporate Governance Committee Member |

7,500 | 7,500 | ||||||

(1) A Board Chair or Lead Director who also serves as a committee chair receives both the Board Chair or Lead Director retainer, as applicable, and the retainer payable for service on the committee rather than the applicable committee chair retainer.

(2) Committee chairs receive the applicable committee chair retainer in lieu of the retainer payable for service on the committee.

EQUITY COMPENSATION

In Fiscal 2018, our non-employee directors were entitled to receive equity compensation in order to align their interests with stockholder interests.

| EQUITY COMPENSATION

|

||||||||

| Initial RSA |

• Value of $300,000 converted into shares by using closing stock price on grant date, rounded up to nearest share

• New non-employee directors eligible upon election or appointment

• Vests on anniversary of grant date in equal annual installments over a three-year period

| |||||||

| Annual RSA |

• Value of $250,000 converted into shares by using closing stock price on grant date, rounded up to nearest share

• Vests on first anniversary of grant date

| |||||||

| Each director may elect to receive DSUs on a one-for-one basis in lieu of annual

RSA

• Vests on same basis as RSA

• Paid out in shares at time Board service ends

| ||||||||

ADDITIONAL COMPENSATION

Directors are reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of the Board and meetings of any committee on which they serve, Company business meetings and approved educational seminars. The Company funds no retirement or pension plan for non-employee directors.

| DIRECTOR COMPENSATION LIMIT

|

||||

|

Limit of $600,000 on aggregate value of cash payments and annual RSA that can be awarded to a non-employee director for service on the Board in a single year

• Board agreed not to change this limit unilaterally until the next time the Company submits its long-term incentive plan to a stockholder vote

| ||||

|

16

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

BOARD COMPENSATION

SUMMARY COMPENSATION TABLE FOR NON-EMPLOYEE DIRECTORS

The following table summarizes the compensation awarded to our directors other than Mr. Whitehurst during Fiscal 2018:

| NAME (1) |

FEES EARNED OR PAID IN CASH ($) (2) |

STOCK AWARDS ($) (3)(4) |

ALL OTHER COMPENSATION ($) |

TOTAL ($) | ||||

| Sohaib Abbasi (5) |

— | 335,291 | — | 335,291 | ||||

| W. Steve Albrecht (6) |

100,000 | 250,069 | — | 350,069 | ||||

| Charlene T. Begley (7) |

80,000 | 250,069 | — | 330,069 | ||||

| Narendra K. Gupta (8) |

99,429 | 250,069 | — | 349,498 | ||||

| Kimberly L. Hammonds (9) |

75,000 | 250,069 | — | 325,069 | ||||

| William S. Kaiser (10) |

67,500 | 250,069 | — | 317,569 | ||||

| Donald H. Livingstone (11) |

87,500 | 250,069 | — | 337,569 | ||||

| General H. Hugh Shelton (U.S. Army Retired) (12) |

55,938 | 250,069 | — | 306,007 | ||||

(1) Compensation paid to Mr. Whitehurst, our President and CEO, is described in the section entitled “Executive Compensation.” Mr. Zollar was elected to our Board in May 2018 and received no compensation from Red Hat in Fiscal 2018.

(2) This column reflects the amount of cash compensation paid to each director for Board and committee service after accounting for DSU elections. As described in the section entitled “Cash Compensation” above, non-employee directors may elect to receive fully vested DSUs in lieu of all or a portion of their cash compensation.

(3) Amounts in this column represent the aggregate grant date fair value of equity compensation issued to directors determined in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. For the assumptions made in determining these values, see Notes 2 and 17 to the Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for Fiscal 2018. Equity compensation that our non-employee directors are eligible to receive is described in the section entitled “Equity Compensation” above.

(4) As of February 28, 2018, our non-employee directors had DSUs and unvested RSAs representing the right to receive the following number of shares of common stock: Mr. Abbasi—29,435, Dr. Albrecht—16,220, Ms. Begley—2,538, Dr. Gupta—44,574, Ms. Hammonds—3,827, Mr. Kaiser—9,728, Mr. Livingstone—31,210 and General Shelton—0.

(5) During Fiscal 2018, Mr. Abbasi was eligible to receive $85,000 in cash compensation and an annual RSA valued at $250,000. Mr. Abbasi elected to receive DSUs in lieu of his cash compensation and annual RSA. The stock awards total in the table includes $291 of value realized as a result of issuing grants rounded up to the nearest whole share.

(6) During Fiscal 2018, Dr. Albrecht received $100,000 in cash compensation and an annual RSA valued at $250,000. The stock awards total in the table includes $69 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(7) During Fiscal 2018, Ms. Begley received $80,000 in cash compensation and an annual RSA valued at $250,000. The stock awards total in the table includes $69 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(8) During Fiscal 2018, Dr. Gupta received $99,429 in cash compensation and an annual RSA valued at $250,000. Dr. Gupta elected to receive DSUs in lieu of his annual RSA. The stock awards total in the table includes $69 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(9) During Fiscal 2018, Ms. Hammonds received $75,000 in cash compensation and an annual RSA valued at $250,000. The stock awards total in the table includes $69 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(10) During Fiscal 2018, Mr. Kaiser received $67,500 in cash compensation and an annual RSA valued at $250,000. The stock awards total in the table includes $69 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(11) During Fiscal 2018, Mr. Livingstone received $87,500 in cash compensation and an annual RSA valued at $250,000. Mr. Livingstone elected to receive DSUs in lieu of his annual RSA. The stock awards total in the table includes $69 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(12) During Fiscal 2018, General Shelton received $55,938 in cash compensation and an annual RSA valued at $250,000. The stock awards total in the table includes $69 of value realized as a result of issuing a grant rounded up to the nearest whole share. General Shelton’s annual RSA was forfeited when his term on the Board ended in August 2017.

PROCESS FOR SETTING DIRECTOR COMPENSATION

The Compensation Committee reviews our non-employee director compensation program annually and works with the Consultant to design and update the Director Compensation Plan to keep our compensation levels competitive so that the Company may attract and retain directors with the combination of attributes, experience and skills needed for the Board to operate effectively. In making decisions regarding non-employee director compensation, the Compensation Committee considers data provided by the Consultant about non-employee director compensation at the companies in our compensation peer group (the composition of our compensation peer group is described in “Executive Compensation-Compensation Discussion and Analysis-Process for Determining Named Officers’ Compensation-Compensation Peer Group”).

The Compensation Committee adopted a new Director Compensation Plan in December 2017. The mix of cash and equity provided under the plan is consistent with the mix provided by our compensation peer group companies.

INDEMNIFICATION

Each director has entered into an indemnification agreement with the Company. The indemnification agreements are on substantially the same terms as the indemnification agreements that the Company has entered into with the Named Officers, as described in the section entitled “Executive Compensation—Employment and Indemnification Arrangements with Named Officers—Indemnification.”

|

|

17

|

Table of Contents

BOARD COMPENSATION

DIRECTOR STOCK OWNERSHIP REQUIREMENTS

We have a Stock Ownership Policy that applies to our non-employee directors. During Fiscal 2018 this Stock Ownership Policy set the stock ownership level for each non-employee director at 4,000 shares, an ownership level based on a multiple of the cash retainer for service as a Board member in place at the beginning of Fiscal 2018. As of the end of Fiscal 2018, each of our non-employee directors was in compliance with the Stock Ownership Policy. Our Stock Ownership Policy is described in the section entitled “Executive Compensation—Compensation Discussion and Analysis—Compensation Policies and Practices—Stock Ownership Requirements.”

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee is composed entirely of independent directors, as was the case at all times during Fiscal 2018. At the beginning of Fiscal 2018, Mr. Abbasi, Dr. Gupta, Ms. Hammonds, Mr. Livingstone and General Shelton were members of the Compensation Committee. General Shelton did not stand for re-election at the 2017 Annual Meeting and left the committee when his term ended in August 2017. No member of the Compensation Committee (i) was during Fiscal 2018 or is currently an employee of the Company, (ii) has ever been an officer of the Company, (iii) is or was a participant in a “related person” transaction as described in the section entitled “Key Governance Policies—Policies and Procedures for Related Person Transactions—Related Person Transactions for Fiscal 2018” or (iv) is an executive officer of another entity, at which one of our executive officers serves on the compensation committee or the board of directors. None of our executive officers serves as a member of the board of directors or on the compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our Board or our Compensation Committee.

ITEM NO. 1—ELECTION OF DIRECTORS

The Board has nominated eight directors for one-year terms expiring at the 2019 Annual Meeting of Stockholders. Each nominee has indicated an intention to serve if elected and will hold office for his or her term and until a successor has been elected and qualified or until his or her earlier resignation or removal. In the event that any of the nominees should be unable or unwilling to serve, proxies may be voted for the election of some other person or for fixing the number of directors at a lesser number. Proxies cannot be voted for a greater number of persons than the number of nominees named.

|

RECOMMENDS A VOTE FOR THE ELECTION OF:

| ||

|

SOHAIB ABBASI

W. STEVE ALBRECHT

CHARLENE T. BEGLEY

NARENDRA K. GUPTA

|

KIMBERLY L. HAMMONDS

WILLIAM S. KAISER

JAMES M. WHITEHURST

ALFRED W. ZOLLAR | |

| TO THE COMPANY’S BOARD OF DIRECTORS

| ||

|

18

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

EXECUTIVE SUMMARY OF COMPENSATION DISCUSSION AND ANALYSIS

This executive summary is only a summary. You should refer to the more detailed information about our compensation program in the section of this Proxy Statement entitled “Compensation Discussion and Analysis” and in the Summary Compensation Table and other related compensation tables before you vote.

The Compensation Discussion and Analysis focuses on the Named Officers listed below.

|

|

|

|

| ||||

| JAMES M. WHITEHURST | ERIC R. SHANDER | PAUL J. CORMIER | ARUN OBEROI | MICHAEL R. CUNNINGHAM | ||||

| President and Chief Executive Officer |

Executive Vice President and Chief Financial Officer |

Executive Vice President and President, Products and Technologies |

Executive Vice President, Global Sales and Services |

Executive Vice President and General Counsel |

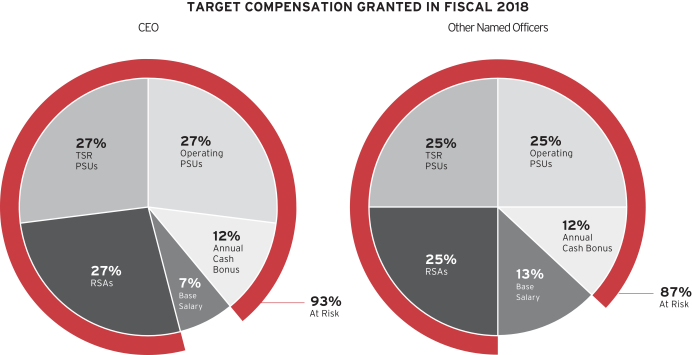

In Fiscal 2018, the Compensation Committee approved an executive compensation program designed to focus our executive team on growing our business and building long-term stockholder value. Our program provided compensation opportunities based on achievement against revenue, non-GAAP operating margin, non-GAAP cash flow from operations and TSR metrics, which the Compensation Committee believes are key contributors to our long-term profitability and growth, and the executive team’s ability to develop and implement strategies to drive Red Hat’s evolution beyond our traditional core infrastructure products.

Consistent with our long-standing practice, our executive compensation program was weighted heavily toward equity compensation (which represented approximately 75% of target compensation opportunities) because the committee believes performance-based, long-term equity compensation aligns the interests of our executives with stockholder interests, rewards executives for delivering long-term value and performance, serves as an important retention tool and provides a meaningful way to align executives’ contributions with the Company’s future success. Additionally, approximately 90% of target compensation opportunities included one or more performance elements in order to maintain a clear link between executive and Company performance and compensation received.

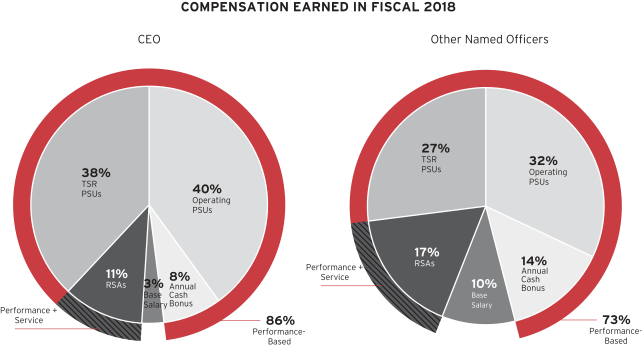

Payouts earned in Fiscal 2018 under the incentive compensation elements of our program reflected this pay and performance link. Our Named Officers’ contribution to the Company’s strong operating performance led to above-target payouts under our annual cash bonus plan and operating performance share units (“Operating PSUs”), while strong stock price growth over the past three fiscal years relative to our compensation peer companies yielded an above-target payout under the TSR performance share units (“TSR PSUs”). After evaluating the performance of the Company and the individual executives under our standard executive compensation program, the Compensation Committee approved:

| • | payouts earned under our annual cash bonus plan averaging 167% of target, based on corporate financial goal achievement of 167% and average individual goal achievement of 166%; |

| • | payouts earned based on growth in revenue and operating income relative to compensation peer group companies for each of the Operating PSUs granted in Fiscal 2016 and Fiscal 2017 at 200% of target; and |

| • | payouts earned based on TSR growth over a three-year period relative to compensation peer group companies under the TSR PSUs granted in Fiscal 2016 at 200% of target. |

|

|

19

|

Table of Contents

EXECUTIVE SUMMARY OF COMPENSATION DISCUSSION AND ANALYSIS

Performance-based compensation payouts earned by our Named Officers in respect of performance in Fiscal 2018, as approved by the Compensation Committee, and the percentage change from payouts earned in Fiscal 2017, are presented below. Shares delivered are based on target award amounts granted in Fiscal 2016 and Fiscal 2017 (Operating PSUs) and Fiscal 2016 (TSR PSUs).

| ANNUAL CASH BONUS | OPERATING PSUs | TSR PSUs | ||||||||||||||||||

| NAMED OFFICER |

PAYOUT EARNED FOR FISCAL 2018 |

% CHANGE FROM FISCAL 2017 |

# OF SHARES EARNED FOR FISCAL 2018 |

% CHANGE FROM FISCAL 2017 |

# OF SHARES EARNED FOR FISCAL 2018 |

% CHANGE FROM FISCAL 2017 |

||||||||||||||

| James M. Whitehurst |

$2,487,500 | 149% | 76,099 | (16)% | 72,196 | 44% | ||||||||||||||

| Eric R. Shander (1) |

$602,850 | 153% | — | — | — | — | ||||||||||||||

| Paul J. Cormier |

$1,169,292 | 144% | 40,288 | (19)% | 38,222 | 36% | ||||||||||||||

| Arun Oberoi |

$890,179 | 149% | 45,034 | 27% | 29,728 | 58% | ||||||||||||||

| Michael R. Cunningham |

$646,800 | 144% | 20,592 | (12)% | 19,536 | 56% | ||||||||||||||

(1) Mr. Shander began participating in our standard executive compensation program in Fiscal 2018, and as a result he will be eligible to receive a PSU payout for the first time in Fiscal 2019.

The Compensation Committee made no changes to our executive compensation program design or compensation mix for Fiscal 2019 because the committee believes that the current program continues to pay for performance, align management interests with our stockholders’ interests and motivate, attract and retain the key executive talent needed to succeed in the technology industry. More detail about the Fiscal 2019 executive compensation program is provided in the section entitled “Executive Compensation—Compensation Discussion and Analysis—Fiscal 2019 Key Compensation Decisions.”

We have adopted a number of practices that we believe benefit our stockholders by helping to align the interests of our management team with the interests of our stockholders, mitigate potential risks and promote effective oversight of our compensation program. These practices include:

| • Stock ownership policy for Named Officers and directors; all Named Officers and directors in compliance at end of Fiscal 2018 |

• Prohibition on new excise tax gross-up payments to our executives; no new or modified provisions since December 2007 | |

| • Clawback policy covering Named Officers’ incentive compensation |

• Termination of employment required following change in control event (“double trigger”) before benefits payable | |

| • Prohibition on the following transactions with respect to Company securities: short sales, buying or selling options (puts and calls), hedging or monetization transactions (such as collars and forward sales contracts), purchases on margin and pledging |

• Named Officers receive the same benefits provided to all full-time employees. | |

| • Regular stockholder engagement on various aspects of Company performance, including executive compensation program

| ||

|

20

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

EXECUTIVE SUMMARY OF COMPENSATION DISCUSSION AND ANALYSIS

The following table summarizes the principal components of our standard executive compensation program in Fiscal 2018.

| COMPENSATION ELEMENT |

PRINCIPLE OBJECTIVE AND LINK TO BUSINESS STRATEGY |

PERFORMANCE METRICS |

KEY FEATURES | MORE DETAILS | ||||||

| FIXED |

Base Salary |

To attract and retain key executive talent | Not applicable | No automatic or guaranteed increases

Reviewed annually |

P. 26 | |||||

| FIXED WITH AT RISK COMPONENT |

Restricted Stock Awards | To attract and retain key executive talent

Align executives’ interests with those of stockholders |

Service-based vesting over four-year period subject to achievement of revenue target | 25% of shares vest after first year; remainder vest ratably on a quarterly basis over subsequent three years | P. 30 | |||||

| ALL AT RISK |

Annual Cash Bonus | To encourage and reward performance that contributes to creating stockholder value

To focus executives on growing key metrics that contribute to overall profitability and ability to grow our business |

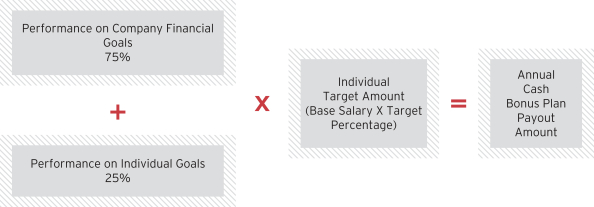

Revenue, non-GAAP operating margin, non-GAAP operating cash flow and individual performance goals over one-year performance period |

Payout based on absolute performance against financial targets and achievement of individual goals with payout capped at 200% of target | P. 26 | |||||

| Operating PSUs | To encourage and reward financial performance that contributes to creating long-term stockholder value

Align executives’ interests with those of stockholders |

Revenue and operating income growth relative to peer group over three-year performance period | 2 payouts based on performance relative to peer group, capped at 200% of target, after two and three years | P. 29 | ||||||

| TSR PSUs | To encourage and reward financial performance that contributes to creating long-term stockholder value

Align executives’ interests with those of stockholders |

Growth in stock price plus dividends relative to peer group over three-year performance period | Single payout based on performance relative to peer group, capped at 200% of target | |||||||

| SEVERANCE |

Change in Control (“CIC”) |

To focus management on acting in the best interests of our stockholders in a CIC context | Not applicable | Double trigger-benefits paid only upon occurrence of CIC and termination without good cause or with good reason | P. 41 | |||||

| Non-Change in Control | To attract and retain key executive talent | Not applicable | Paid upon termination without good cause or with good reason Requires execution of non-compete/non-solicit |

|||||||

| BENEFITS |

Benefits | To provide competitive benefits package to attract and retain talent | Not applicable | Same benefits as are provided to all of Company’s full-time employees

• 401(k) Plan with company match

• Medical, dental and vision plan

• Life insurance benefit

• Company charitable match |

|

|

21

|

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

COMPENSATION DISCUSSION AND ANALYSIS

OUR COMPENSATION PHILOSOPHY

Our executive compensation program is designed to:

| • | pay for performance by linking the majority of compensation to measures of Company performance and to Company and individual goals that contribute to the growth of our business and build long-term stockholder value; |

| • | align executive interests with those of our stockholders; and |

| • | attract and retain the talent needed to lead our Company in the evolving and highly competitive technology industry in which we operate. |

Our program emphasizes long-term equity awards and annual performance-based cash bonuses so that a substantial portion of the value of each executive’s total compensation opportunity is derived from Company business and stock price performance and the achievement of Company and individual performance goals established by the Compensation Committee. The selected performance metrics emphasize overall Company performance, reflecting the Compensation Committee’s belief that the Named Officers, led by our CEO, are a team, sharing responsibility for Company performance and for execution of Company strategies. The relatively uniform compensation mix for each Named Officer reinforces this view, and in the committee’s view also promotes team cohesion and internal equity. However, the Compensation Committee considers it appropriate for the CEO, who is responsible for developing the overall strategy and direction for the Company, to receive a greater portion of his compensation (in comparison to the other Named Officers) in performance-based compensation. Goals are derived from the Company’s operating plan and business strategy. Performance levels are intended to be challenging and require effective execution in order to obtain a target level payout. The program is designed to have the flexibility to reward superior performance by providing for total earned compensation substantially above the target level and to provide compensation below the target level if performance goals are not met. In making its compensation decisions for individual executives, the Compensation Committee seeks to provide a competitive level of compensation for a position.

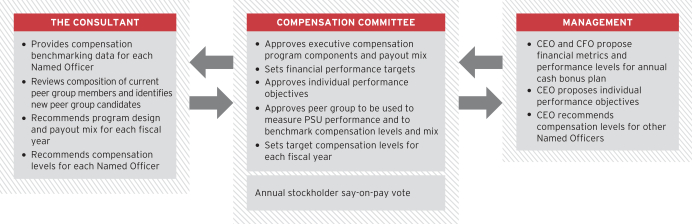

PROCESS FOR DETERMINING NAMED OFFICERS’ COMPENSATION

The process for determining the Named Officers’ compensation is outlined below along with a description of the role in the process of each of the Compensation Committee, our annual stockholder say-on-pay vote, the Consultant, our management and our compensation peer group.

ROLE OF THE COMPENSATION COMMITTEE

The Compensation Committee oversees and approves all compensation arrangements for the Named Officers. Each year, the Compensation Committee:

| • | makes compensation decisions for Named Officers, both to certify achievement of performance goals and determine the payouts for the previous fiscal year, and to set compensation levels and goals for the performance-based elements of our program for the current fiscal year; |

| • | reviews our executive compensation program design and effectiveness and adjusts as needed to support our business, taking into consideration compensation peer group company data, recommendations by the CEO and the Consultant, market trends, retention and succession considerations, legal and regulatory developments and the needs of our business; |

|

22

|

RED HAT, INC. 2018 PROXY STATEMENT

|

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| • | addresses executive compensation matters that arise during the fiscal year due to a change in status, retention and succession considerations or personnel changes; |

| • | assesses the performance of our CEO (together with the independent members of the Board) and senior management team; and |

| • | evaluates the effectiveness of our executive compensation program, including whether the program encourages excessive risk-taking. |

In determining the appropriate level and compensation mix for each Named Officer, the Compensation Committee takes into account:

| • | Named Officer’s experience and scope of responsibility, individual performance and retention prospects; |

| • | the Consultant’s annual review of publicly available compensation data from our compensation peer group companies and market information for certain positions from industry compensation surveys such as the Equilar Top 25 survey; |

| • | management input; |

| • | data prepared by the Consultant reflecting (i) cash payments, (ii) equity compensation grant values, (iii) internal equity and (iv) potential severance payments; and |

| • | other information as it deems necessary and appropriate. |