Form DEF 14A R F INDUSTRIES LTD For: Sep 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Materials Under Rule 14a-12 |

|

RF INDUSTRIES, LTD. |

||

|

(Name of Registrant as Specified in its Charter)

|

||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: |

RF INDUSTRIES, LTD.

7610 Miramar Road

San Diego, California 92126

NOTICE IS HEREBY GIVEN THAT THE ANNUAL MEETING OF STOCKHOLDERS

WILL BE HELD ON SEPTEMBER 8, 2021

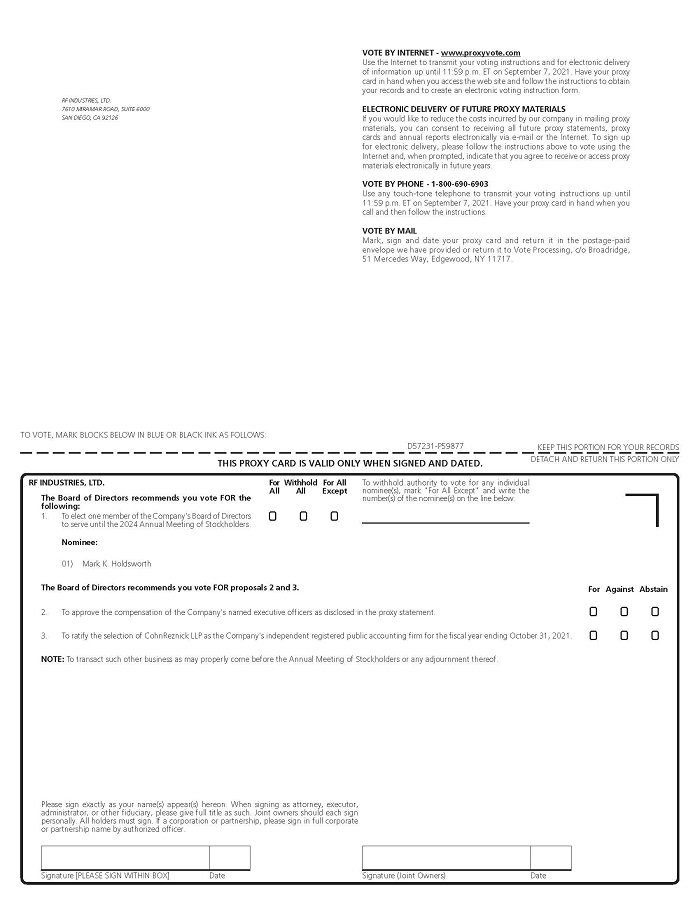

An Annual Meeting of Stockholders of RF Industries, Ltd., a Nevada corporation (the “Company”), will be held at the offices of RF Industries, Ltd., 7610 Miramar Road, Suite 6000, San Diego, California, 92126 on Wednesday, September 8, 2021, at 11:00 a.m., for the following purposes:

|

1. |

To elect one member of the Company’s Board of Directors to serve until the 2024 Annual Meeting of Stockholders. |

|

2. |

To conduct an advisory vote on the compensation of the Company’s named executive officers as disclosed in this proxy statement. |

|

3. |

To ratify the selection of CohnReznick LLP as the Company’s independent registered public accounting firm for the fiscal year ending October 31, 2021. |

|

4. |

To transact such other business as may properly come before the Annual Meeting of Stockholders or any adjournment thereof. |

The Board of Directors has fixed the close of business on July 12, 2021 as the record date for determination of stockholders entitled to notice of and to vote at the Annual Meeting of Stockholders or any adjournment thereof. Only stockholders of record on July 12, 2021 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

This proxy statement and our 2020 Annual Report can be accessed directly at the following internet address: https://materials.proxyvote.com/749552.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the internet, telephone, or mail.

I hope you will join us.

| By Order of the Board of Directors, | |

|

|

| Robert Dawson | |

| President and Chief Executive Officer | |

| San Diego, California | |

| July 27, 2021 |

RF INDUSTRIES, LTD.

7610 Miramar Road

San Diego, California 92126

PROXY STATEMENT

General

The enclosed proxy is solicited on behalf of the Board of Directors of RF Industries, Ltd., a Nevada corporation (“we,” “us” or the “Company”), for use at the Annual Meeting of Stockholders (“Annual Meeting”) to be held on Wednesday, September 8, 2021, at 11:00 a.m. local time, or at any adjournment or postponement thereof. The Annual Meeting will be held at the offices of RF Industries, Ltd., 7610 Miramar Road, Suite 6000, San Diego, California, 92126.

The Notice of Internet Availability is first being mailed to our stockholders on or about July 27, 2021.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON SEPTEMBER 8, 2021

The Company’s Notice of Annual Meeting, this proxy statement, the proxy card, and our Annual Report for the fiscal year ended October 31, 2020 are available on the Internet at https://materials.proxyvote.com/749552 and on our website at www.rfindustries.com under “Investor Information.”

Only stockholders of record at the close of business on July 12, 2021, will be entitled to notice of and to vote at the Annual Meeting. On July 12, 2021, there were 10,015,657 shares of common stock outstanding. The Company is incorporated in Nevada and is not required by Nevada corporation law or its Articles of Incorporation to permit cumulative voting in the election of directors.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

How can I attend the Annual Meeting?

You may attend the Annual Meeting if you are listed as a stockholder of record as of July 12, 2021, and bring proof of your identity. If you hold your shares in street name through a broker or other nominee, you will need to provide proof that you are the beneficial owner of the shares by bringing either a copy of a brokerage statement showing your share ownership as of July 12, 2021, or a legal proxy if you wish to vote your shares in person at the Annual Meeting.

How can I vote my shares in person at the Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to do so, please bring proof of your identity to the Annual Meeting. If your shares are held in a stock brokerage account or by a bank or other nominee, you have the right to direct your broker or nominee on how to vote these shares and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a proxy from your broker or nominee. Your broker or nominee has provided voting instructions for you to use. If you wish to attend the Annual Meeting and vote in person shares held in your brokerage account name, please contact your broker or nominee so that you can receive a legal proxy to present at the Annual Meeting. Even if you plan to attend the Annual Meeting, we urge you to vote in one of the ways described below so that your vote will be counted if you later decide not to attend the Annual Meeting or are unable to attend. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you change your proxy instructions as described above.

How can I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to the summary instructions below, the instructions included on the Notice of Internet Availability of the proxy materials, and if you request printed proxy materials, the instructions included on your proxy card or, for shares held in street name, the voting instruction card provided by your broker or nominee.

|

● |

By Internet — If you have Internet access, you may submit your proxy from any location in the world by following the Internet voting instructions on the proxy card or voting instruction card sent to you. |

|

● |

By Telephone — You may submit your proxy by following the telephone voting instructions on the proxy card or voting instruction card sent to you. |

|

● |

By Mail — You may do this by marking, dating, and signing the enclosed proxy or, for shares held in street name, the voting instruction card provided to you by your broker or nominee, and mailing it in the enclosed, self-addressed, postage prepaid envelope. No postage is required if mailed in the United States. Please note that you will be mailed a printed proxy or printed voting instruction card only if you request that such printed materials be sent to you by following the instructions in the Notice of Internet Availability for requesting paper copies of the proxy materials. |

What vote is required for the proposals?

The representation, in person or by proxy, of at least a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business. Shares represented by proxies pursuant to which votes have been withheld from any nominee for director, or which contain one or more abstentions or broker “non-votes,” are counted as present or represented for purposes of determining the presence or absence of a quorum for the Annual Meeting. A “non-vote” occurs when a broker or other nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the broker does not have discretionary voting power and has not received instructions from the beneficial owner.

Election of Directors (Proposal No. 1). Directors are elected by a plurality of the votes cast, in person or by proxy, at the Annual Meeting. The nominee who receives the highest number of affirmative votes of the shares present or represented and voting on the election of directors at the Annual Meeting will be elected to our Board of Directors. Shares present or represented and not so marked as to withhold authority to vote for a particular nominee will be voted in favor of a particular nominee and will be counted toward such nominee’s achievement of a plurality. Shares present at the meeting or represented by proxy where the stockholder properly withholds authority to vote for such nominee in accordance with the proxy instructions and broker “non-votes” will not be counted toward such nominee’s achievement of plurality.

Advisory Vote on the Compensation of our Named Executive Officers (Proposal No. 2). For the advisory vote on the compensation of our named executive officers, the affirmative vote of the majority of shares present, in person or represented by proxy, and voting on that matter is required for approval. Shares voted to abstain are included in the number of shares present or represented and voting on each matter. Shares subject to broker “non-votes” are considered to be not entitled to vote for the particular matter and have the practical effect of reducing the number of affirmative votes required to achieve a majority for such matter by reducing the total number of shares from which the majority is calculated.

Ratification of Independent Accountants (Proposal No. 3). For the ratification of the appointment of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2021, an affirmative vote of a majority of the shares present, in person or represented by proxy, and voting on such matter is required for approval. Shares voted to abstain are included in the number of shares present or represented and voting. Brokers are entitled to vote on this matter without direction from you, and therefore are included in the number of affirmative votes required to achieve a majority.

Other Matters. The Board of Directors knows of no other matters to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote properly may be taken, the persons named on the enclosed proxy will have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment.

Revocability of Proxies

Any person giving a Proxy in the form accompanying this Proxy Statement has the power to revoke it any time before its exercise. To revoke a proxy previously submitted by telephone or through the Internet, you may simply vote again at a later date, using the same procedures, in which case your later submitted vote will be recorded and your earlier vote revoked. A proxy may also be revoked by filing with the Secretary of the Company’s principal executive office, 7610 Miramar Road, San Diego, California 92126-4202, an instrument of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the Annual Meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote in person at the Annual Meeting, you must obtain from the record holder a proxy issued in your name.

If I am a beneficial owner of shares, can my brokerage firm vote my shares?

If you are a beneficial owner and do not vote via the Internet, telephone, or by returning a signed voting instruction card to your broker, your shares may be voted only with respect to so-called routine matters where your broker has discretionary voting authority over your shares. Brokers will have such discretionary authority to vote on Proposal 3 regarding the ratification of the selection of our independent registered public accounting firm for 2021, but not on any of the other proposals.

We encourage you to provide instructions to your brokerage firm by returning your voting instruction card. This ensures that your shares will be voted at the Annual Meeting with respect to all of the proposals described in this proxy statement.

Solicitation

The Company will bear the entire cost of solicitation of proxies, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any additional material furnished to stockholders. Copies of solicitation material will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others to forward to such beneficial owners. In addition, the Company may reimburse such persons for their cost of forwarding the solicitation material to such beneficial owners. The solicitation of proxies by mail may be supplemented by telephone, facsimile, or email, and/or personal solicitation by directors, officers, or employees of the Company. No additional compensation will be paid for any such services. Except as described above, the Company does not intend to solicit proxies.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published by the Company on Form 8-K within four business days following the Annual Meeting.

PROPOSAL 1:

NOMINATION AND ELECTION OF DIRECTORS

The Company’s Amended and Restated Bylaws (the “Bylaws”) provide for the classification of our Board of Directors into three classes of directors, with each class as nearly equal in number as possible, with staggered terms of office. At each annual meeting of stockholders, the successors to the class of directors whose terms expire at that meeting will be elected for a term of office to expire at the third succeeding annual meeting of stockholders after their election and until their successors have been duly elected and qualified.

Our Board of Directors is currently composed of the following members: Marvin H. Fink, Joseph Benoit, Gerald T. Garland, Sheryl Cefali, Mark K. Holdsworth, and Robert Dawson. Directors elected at each annual meeting hold office until their terms expire and until their successors are elected and qualified, or until their death, resignation, or removal. At the Annual Meeting, directors for Class II will be elected. Currently, Joseph Benoit and Mark K. Holdsworth are the two Class II directors. Mr. Benoit has informed the Board that he will not stand for re-election at the Annual Meeting. Therefore, the Board has reduced the number of directors from six to five, and the Company’s only nominee for election at the Annual Meeting is Mr. Holdsworth.

The nominee receiving the highest number of affirmative votes cast at the Annual Meeting shall be elected as director of the Company. Mr. Holdsworth has agreed to serve if elected. If for any reason Mr. Holdsworth is not a candidate when the election occurs, we intend to vote proxies for the election of a substitute nominee or, in lieu thereof, our Board of Directors may reduce the number of directors in accordance with our Bylaws. Unless otherwise instructed, the proxy holders will vote the proxies received by them in favor of the election of Mr. Holdworth.

A majority of the Directors are “independent directors” as defined by the listing standards of The Nasdaq Stock Market, and the Board of Directors has determined that such independent directors have no relationship with the Company that would interfere with the exercise of their independent judgment in carrying out the responsibilities of a director.

Set forth below is information regarding the nominees and the other current Board members, including information furnished by them as to their principal occupations and their ages:

|

Name |

Age |

Director Since |

||||

|

Marvin H. Fink |

85 | 2001 | ||||

|

Gerald T. Garland |

71 | 2017 | ||||

|

Joseph Benoit (1) |

67 | 2013 | ||||

|

Sheryl Cefali |

59 | 2019 | ||||

|

Mark K. Holdsworth |

55 | 2020 | ||||

|

Robert Dawson |

47 | 2018 |

|

(1) |

Mr. Benoit’s term will expire, and he will leave the Board at the Annual Meeting. |

Class II - Nominee for Election for a Three-Year Term Expiring at the 2024 Annual Meeting

Mark K. Holdsworth was appointed to the Board on December 31, 2020. Mr. Holdsworth is the Managing Partner of The Holdsworth Group, LLC (“THG”), which he founded in 2019. THG is a capital partner, advisor, and curator of alternative investments for family offices and corporations worldwide. From 1999-2018, Mr. Holdsworth was a Co-Founder, Managing Partner and Operating Partner of Tennenbaum Capital Partners, LLC (“TCP”), a Los Angeles-based private multi-strategy investment firm that was acquired by BlackRock, Inc. in August 2018, and was a Managing Director of BlackRock until April 2019. Mr. Holdsworth is currently a director of Parsons Corporation (NYSE: PSN), where he serves as Chairman of the Corporate Governance and Responsibility Committee, and as a member of the Executive Committee. Mr. Holdsworth earned a Bachelor of Arts degree from Pomona College, a Bachelor of Science degree (with Honors) from the California Institute of Technology and a Master of Business Administration degree from Harvard Business School.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” ELECTION OF THE FOREGOING NOMINATED DIRECTOR.

Continuing Directors

The following is a description of the incumbent Class II and III directors whose terms of office will continue after the Annual Meeting:

Class III - Directors Continuing in Office Until the 2022 Annual Meeting

Robert Dawson has been the Company’s current President and Chief Executive Officer since July 17, 2017. Effective July 21, 2018, Mr. Dawson was appointed to the Board to also serve as a director. Prior to joining RF Industries on July 17, 2017, Mr. Dawson was President and CEO of Vision Technology Services, an information technology consulting and project management company that was acquired by BG Staffing. He spent 2007-2013 at TESSCO Technologies, a publicly traded distributor of wireless products and services. At TESSCO Mr. Dawson held multiple executive roles in sales, marketing, product management and strategy culminating with being Vice President of Sales, responsible for TESSCO’s sales organization and leading a team delivering more than $700 million in sales. He joined TESSCO through the 2007 acquisition of NetForce Solutions, a technology training and consulting firm that he co-founded in 2000 and led as the Chief Executive Officer through seven years of growth before being acquired by TESSCO. Mr. Dawson received his Bachelor's degree in Business Administration from Hillsdale College.

Sheryl Cefali was appointed to the Board of Directors on June 7, 2019. Ms. Cefali is a Managing Director in the transactions opinions practice at Duff & Phelps and head of the firm's Los Angeles office. Ms. Cefali has over 25 years of experience rendering fairness and solvency opinions and determining valuations of companies and securities. She is a member of the Fairness and Solvency Opinion Senior Review Committee at Duff & Phelps. Prior to joining Duff & Phelps in 1990, she was a Vice President with Houlihan Lokey. Ms. Cefali received her M.B.A. from the University of Southern California and her B.A. from the University of California at Santa Barbara. Ms. Cefali holds the FINRA Series 7 and 63 licenses. Ms. Cefali also serves as an officer and a director on the board of the Women’s Leadership Council. In January 2019, the Los Angeles Business Journal named Ms. Cefali as one of the Top Women in Banking.

Class I - Directors Continuing in Office Until the 2023 Annual Meeting

Marvin H. Fink is a retired executive. Mr. Fink most recently served as the Chief Executive Officer, President and Chairman of the Board of Recom Managed Systems, Inc. from October 2002 to March 2005. Prior thereto, Mr. Fink was President of Teledyne’s Electronics Group. Mr. Fink was employed at Teledyne for 39 years. He holds a B.E.E. degree from the City College of New York, an M.S.E.E. degree from the University of Southern California and a J.D. degree from the University of San Fernando Valley. He is an inactive member of the California Bar.

Gerald T. Garland was most recently Senior Vice President of Solutions Development and Product Management for TESSCO Technologies, a publicly-traded value-added distributor and solutions provider for the wireless industry. Mr. Garland also served as Senior Vice President of the Commercial Division at TESSCO, where he was responsible for sales, business and product development and product management at the Company’s core wireless communications business. He was previously Director of Business Development at American Express Tax and Business Services from 2002 to 2003, where he was involved in an expanded asset recovery capability for Fortune 1000 corporations. From 2000 to 2001, he was Chief Financial Officer at Mentor Technologies, a developer of on-line, Cisco certification training products. Mr. Garland was Chief Financial Officer and Treasurer at TESSCO Technologies from 1993 to 1999 during the Company’s successful Initial Public Offering and oversaw TESSCO’s annual sales expansion from $50 million to over $160 million. Prior to joining TESSCO, Mr. Garland held leadership positions at Bank of America and Stanley Black & Decker. Mr. Garland received his MBA, with a concentration in Finance, from Loyola University and his Bachelor of Science in Business Management and Accounting from Towson University. He is currently the Managing Director at Inscite Consulting, on the Board of Directors and Chief Adviser to the World Trade Center Institute and on the Executive Advisory Board of Patriot Capital. He is also on the Executive Committee of Communications Electronics, Inc., and the Board of SOZO Children.

In determining whether the nomination of each current director was appropriate and that each current director is qualified to serve on the Board of Directors, the Board considered the following:

Marvin H. Fink: Mr. Fink has significant experience in a variety of areas important to overseeing the management and operations of this Company, including experience as an executive officer, an engineer, and a lawyer. Mr. Fink has been the principal executive officer of a public company as well as the President of Teledyne’s Electronics Group. He has degrees in engineering and law and was involved in the electronics industry for over 40 years.

Gerald T. Garland: Mr. Garland has significant leadership experience in product management, sales management, corporate strategy, solutions development, global sourcing, and financial management. Mr. Garland served as a Chief Financial Officer and Senior Vice President for a leading distributor and solutions provider to the wireless industry for over 18 years. Mr. Garland has also held senior leadership positions with Bank of America, Stanley Black & Decker, American Express and TESSCO Technologies.

Sheryl Cefali: Ms. Cefali has over 30 years of experience rendering fairness and solvency opinions and determining valuations of companies and securities. Ms. Cefali is currently a Managing Director at Duff & Phelps, is the head of that firm’s Los Angeles office, and is a member of that firm’s Fairness and Solvency Opinion Senior Review Committee. Prior to joining Duff & Phelps in 1990, she was a Vice President with Houlihan Lokey.

Mark K. Holdsworth: Mr. Holdsworth has significant experience in investment banking and investment management. In addition, Mr. Holdsworth has experience in serving on the Boards of Directors of major public companies, and as the Chairman of a Corporate Governance and Responsibility Committee.

Robert Dawson: Mr. Dawson has significant leadership experience in sales, marketing, product management and strategy for a leading publicly traded distributor of wireless products and services. Mr. Dawson also served as President and CEO of an information technology consulting and project management company and was a co-founder of a successful telecom and wireless technology training and consulting firm that he co-founded and led for seven years of growth until it was acquired.

Terms of Service

The director to be elected at the Annual Meeting will hold office until his/her three-year term expires and until his/her successor is elected and has qualified, or until his/her death, resignation, or removal.

Board Leadership Structure

Currently, the positions of Chairman of the Board of Directors and Chief Executive Officer of the Company are held by separate individuals, with Mr. Holdsworth serving as Chairman of the Board and Robert Dawson serving as Chief Executive Officer and as a director on the Board. Mr. Holdsworth, an independent director, was appointed as the Chairman of the Board in June 2021. The Company has continuously had a separate Chairman of the Board and Chief Executive Officer since 2007. The Chairman of the Board is appointed by our Board of Directors.

The Board of Directors currently believes that this structure is best for the Company, as it allows Mr. Dawson to focus on the Company’s strategy, business and operations while serving as a liaison between the Board and the Company’s senior management. The Board currently believes the separation of offices is beneficial because a separate Chairman can provide the Chief Executive Officer with guidance and feedback on his performance and the Chairman provides a more effective channel for the Board to express its views on management. This structure can also enable Mr. Holdsworth and the other members of the Board to be better informed and to communicate more effectively on issues, including with respect to risk oversight matters.

The Board does not believe that a formal policy separating the positions of Chairman of the Board and Chief Executive Officer is necessary. The Board continually evaluates our leadership structure and could in the future decide to combine the Chairman and Chief Executive Officer positions if it believes that doing so would serve the best interests of the Company and our stockholders.

Management

Robert Dawson has served as our President and Chief Executive Officer since July 17, 2017. See, “Proposal No. 1: Class III - Directors Continuing in Office Until the 2022 Annual Meeting,” above.

Peter Yin, age 38, was appointed as the Company’s Interim Chief Financial Officer and new Corporate Secretary effective as of July 11, 2020, and promoted to Chief Financial Officer on January 12, 2021. Mr. Yin, who is a Certified Public Accountant and a Certified Fraud Examiner, joined the Company in September 2014 and served as the Company’s Senior Vice President, Finance & Operations since November 2019. Prior to joining the Company, Mr. Yin worked at Sony Corporation of America in Corporate Audit from 2010 to 2014, and at Grant Thornton in the Assurance practice from 2006 to 2010. Mr. Yin received a Bachelor’s degree from the University of San Diego.

Board of Director Meetings

During the fiscal year ended October 31, 2020, the Board of Directors met eleven times, and each member of the Board of Directors attended at least 75% of the meetings of the Board of Directors and of the Board committees on which they served.

Board Committees

During fiscal 2020, the Board of Directors maintained three committees, the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee.

The Audit Committee meets periodically with the Company’s management and independent registered public accounting firm to, among other things, review the results of the annual audit and quarterly reviews and discuss the financial statements. The Audit Committee also hires the independent registered public accounting firm, and receives and considers the accountant’s comments as to controls, adequacy of staff and management performance and procedures. The Audit Committee is also authorized to review related party transactions for potential conflicts of interest and to conduct internal investigations into whistleblower complaints. During fiscal 2020, the Audit Committee was composed of Mr. Garland (Chair), Mr. Benoit, and Ms. Cefali, each of whom still serves on the Audit Committee. Each of the current members of the Audit Committee is a non-employee director and is independent as defined under the NASDAQ Stock Market’s listing standards. In addition, each of the members of the Audit Committee has significant knowledge of financial matters, and Mr. Garland is an “audit committee financial expert”. The Audit Committee met four times during fiscal 2020.

During fiscal 2020 and continuing through the date of this Proxy Statement, the Compensation Committee consisted of Ms. Cefali (Chair), Mr. Fink, Mr. Garland, and Mr. Benoit each of whom is a non-employee director and is independent as defined under the NASDAQ Stock Market’s listing standards. Mr. Benoit’s term on the Compensation Committee will end when his term as a director ends on September 8, 2021. The Compensation Committee is responsible for considering and recommending to the Board the compensation arrangements for senior management. As part of its other responsibilities, the Compensation Committee provides general oversight of our compensation structure, and, if deemed necessary, retains, and approves the terms of the retention of compensation consultants and other compensation experts. Other specific duties and responsibilities of the Compensation Committee include reviewing the performance of executive officers; reviewing and approving objectives relevant to executive officer compensation; recommending equity-based and incentive compensation plans; and recommending compensation policies and practices for service on our Board of Directors and its committees and for the Chairman of our Board of Directors. The Compensation Committee held five meetings during fiscal 2020, which were attended by all committee members.

The Nominating and Corporate Governance Committee is responsible for developing and recommending corporate governance guidelines to the Board, identifying qualified individuals to become directors, recommending selected nominees to serve on the Board, and overseeing the evaluation of the Board and its committees. During fiscal 2020 and continuing through the date of this Proxy Statement, the Nominating and Corporate Governance Committee consisted of Mr. Benoit (Chair), Mr. Fink, Ms. Cefali, Mr. Holdsworth and Mr. Garland, each of whom is a non-employee director and is independent as defined under the NASDAQ Stock Market’s listing standards. Mr. Benoit’s term on the Nominating and Corporate Governance Committee will end when his term as a director ends on September 8, 2021. The Nominating and Corporate Governance Committee held five meetings during fiscal 2020, which were attended by all committee members.

The Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee each operate pursuant to a written charter, which charters are available on our website at www.rfindustries.com.

In April 2021, the Board established a The Strategic Planning and Capital Allocation Committee. The members of the new committee are Mark Holdsworth (Chair), Gerald Garland, and Robert Dawson. The responsibilities and duties of the new committee include assisting the Board in carrying out its oversight responsibilities relating to potential mergers, acquisitions, divestitures, and other key strategic transactions outside the ordinary course of the Company’s business.

Nominating Directors

The Nominating and Corporate Governance Committee believes that Board membership should reflect diversity in its broadest sense, but should not be chosen nor excluded based on race, color, gender, national origin, or sexual orientation. In this context, the Nominating and Corporate Governance Committee does consider a candidate’s experience, education, industry knowledge, history with the Company, if any, and differences of viewpoint when evaluating his or her qualifications for election to the Board.

The Nominating and Corporate Governance Committee believes that the Board of Directors should consist of individuals who possess the integrity, education, work ethic, experience, and ability to work with others necessary to oversee our business effectively and to represent the interests of all of the Company’s stockholders. The Nominating and Corporate Governance Committee also believes that it is desirable for directors to own an equity interest in the Company in order to better align their interests with those of the stockholders. The standards that the Nominating and Corporate Governance Committee considers in selecting candidates (although candidates need not possess all of the following characteristics, and not all factors are weighted equally) include, among other factors determined to be relevant by the Board, each director’s or nominee’s:

|

● |

business experience; |

|

● |

industry experience; |

|

● |

financial background; |

|

● |

breadth of knowledge about issues affecting the Company; and |

|

● |

time available for meetings and consultation regarding Company matters and other particular skills and experience possessed by the individual. |

Stockholder Recommendations of Director Candidates Stockholders wishing to nominate a candidate for director at an annual meeting may do in the manner provided in Article III, Section 2 of the Company’s Amended and Restated Bylaws. Among other steps, in order to nominate a candidate a stockholder must (a) provide timely notice to the Secretary of the Company, (b) provide the information, agreements and questionnaires with respect to such stockholder and its candidate for nomination, and (c) provide any updates and supplemental information as required by the Amended and Restated Bylaws.

Stockholder Communications with Board Members Stockholders who wish to communicate with our Board members may contact us at our principal executive office at 7610 Miramar Road, Suite 6000, San Diego, California 92126-4202. In general, any stockholder communication delivered to our Corporate Secretary for forwarding to the Board, the Chairman or a specified group of Board members will be forwarded in accordance with the stockholder’s instructions. However, our Corporate Secretary reserves the right not to forward to Board members any marketing, abusive, or otherwise inappropriate materials.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers, and employees, including our principal executive officer and principal financial officer. The Code of Business Conduct and Ethics is posted on our website at www.rfindustries.com. We intend to disclose any amendments to the Code by posting such amendments on our website. In addition, any waivers of the Code of Business Conduct and Ethics for directors or executive officers of the Company will be disclosed in a report on Form 8-K.

COMPENSATION OF EXECUTIVES AND DIRECTORS

Summary Compensation Discussion and Analysis

Our compensation program is currently designed to recruit and retain as executive officers individuals with the highest capacity to develop, grow and manage our business, and to align their compensation with the Company’s short-term and long-term goals. To do this, the compensation program for executive officers is made up of the following main components: (i) base salary, designed to compensate our executive officers for work performed during the fiscal year; (ii) year-end cash incentive programs, designed to reward the executive officers for achieving yearly performance goals and for their individual performances during the fiscal year; and (iii) equity-based awards, meant to align the executive officers’ interests with the interests of our stockholders.

The Board has appointed a Compensation Committee to assist the Board in discharging its responsibilities relating to compensation matters, including matters relating to compensation programs for directors and executive officers. The Compensation Committee currently consists of Ms. Cefali (Chair), Mr. Fink, Mr. Garland, and Mr. Benoit. Mr. Benoit’s term as a member of the Compensation Committee will terminate when he steps down as a director on September 8, 2021. The Board of Directors believes that each member of the Compensation Committee is an “independent” director as defined by the listing standards of The Nasdaq Stock Market. The Compensation Committee has overall responsibility for evaluating and recommending compensation plans, policies and programs, and compensation and benefits of the Named Executive Officers.

The Compensation Committee attempts to structure the total compensation for the Named Executive Officers to provide a guaranteed amount of cash compensation in the form of competitive base salaries, while also providing a meaningful amount of annual cash compensation in the form of annual bonuses that is at risk and dependent on both the Company’s performance and on the individual performance of the executives. We also seek to provide a portion of total compensation in the form of equity-based awards under our stock option plan in order to align the long-term interests of executives with those of our stockholders and for retention purposes. Historically, we have made larger grants of stock options to our Named Executive Officers and other key officers and employees at the time that the officers/key employees first join the Company, which options vest over a longer period of time (often up to nine years). These option grants are supplemented by smaller, annual options grants that are similar to the option grants made to other officers and key employees.

Base salaries for our executive officers are determined by an assessment of the Company’s overall financial and operating performance, each executive officer's experience, duties, responsibilities, performance evaluation and changes in his or her responsibilities. We seek to establish annual base salaries that the Compensation Committee believes are fair and competitive with salaries for executive officers in similar positions and with similar responsibilities in the Company’s marketplace. Periodically, the Compensation Committee engages a compensation consultant to advise the Compensation Committee regarding the components and levels of the executive compensation program, including our incentive and equity-based compensation plans.

The Named Executive Officers for the fiscal year ended October 31, 2020 were (i) Robert D. Dawson, who was hired to serve as the President and Chief Executive Officer of the Company in July 2017, (ii) Mark Turfler, who served as Chief Financial Officer since January 2014 until his departure from the Company in July 2020, (iii) Ray Bibisi, who was hired to serve as Chief Revenue Officer in January 2020, and (iv) Peter Yin, who was appointed Interim Chief Financial Officer in July 2020 and promoted to Chief Financial Officer in January 2021.

|

● |

As of November 1, 2019 (the beginning of the 2020 fiscal year), Mr. Dawson’s salary was $300,000, which salary was then increased to $400,000 on July 17, 2019. In January 2020, Mr. Dawson received a cash bonus of $130,800 for his services in the fiscal year ended October 31, 2019, but did not receive a cash bonus for the fiscal year ended October 31, 2020. |

|

● |

In fiscal 2020, Mr. Turfler’s base salary was $187,000. In January 2020, Mr. Turfler received a cash bonus of $55,500 for his services in the fiscal year ended October 31, 2019. Effective July 10, 2020, Mr. Turfler departed from the Company and received severance payments totaling $93,500. Since Mr. Turfler was not an employee at the end of the 2020 fiscal year, he did not earn any incentive bonuses for the fiscal year ended October 31, 2020. |

|

● |

Mr. Bibisi’s annual base salary upon joining the Company in January 2020 was $200,000. Mr. Bibisi received a bonus of $7,500 in January 2021 for his personal performance in fiscal 2020. |

|

● |

Mr. Yin’s annual base salary for fiscal 2019 was $175,000. Effective July 11, 2020, Mr. Yin’s annual base salary increased to $187,000. In January 2020, Mr. Yin received a cash bonus of $59,316 for his services in the fiscal year ended October 31, 2019. Mr. Yin received a bonus of $10,000 in January 2021 for his personal performance in fiscal 2020. |

Fiscal Year 2020 Management Incentive Equity and Cash Compensation Plan

On January 9, 2020, the Board adopted an incentive compensation plan for the fiscal year ending October 31, 2020. The plan covers executive officers (including the Named Executive Officers) and senior managers of the Company and its subsidiaries. Under the plan, each participant (i) is eligible to receive a cash payment after the end of the fiscal year as a short-term incentive bonus, and (ii) received an equity award as a long-term incentive award.

Cash Bonuses. Under the plan, cash incentive bonuses, if any, are determined based upon (i) the Company’s achievement of specified corporate goals and (ii) the satisfaction of subjective personal performance and contribution goals established for that participant. The corporate goals will apply equally to all participating officers and managers. The subjective performance of each officer are to be evaluated and determined by the Compensation Committee, in its sole discretion, after consultation with the Company’s Chief Executive Officer.

The maximum target cash bonus payable to participants if all of the goals for fiscal 2020 are achieved range from 15% to 50% of the recipient’s fiscal 2020 base salary. Bonuses are to be weighted and based on (i) the Company’s achievement of certain fiscal 2020 revenues (weighted 30%), (ii) earnings before interest, taxes, depreciation, and amortization (EBITDA) (weighted 60%), and (iii) individual subjective performance criteria (weighted 10%). The 2020 bonuses were required to be paid within 75 days after the end of the fiscal year to participating officers and managers who are employed with the Company or its subsidiaries on the date of payment.

In January 2021, the Compensation Committee determined that none of the corporate goals were achieved and, therefore, that no bonuses were payable based on the Company’s performance. The Compensation Committee and the Board did, however, determine that Mr. Dawson, Mr. Yin, and certain of senior managers achieved some or all of their personal subjective goals. Mr. Dawson informed the Compensation Committee that he would not accept any cash bonuses for fiscal 2020. Mr. Yin was, however, granted a year-end cash bonus of $10,000, and certain other senior managers received cash bonuses based on their achievement of subjective performance criteria.

Equity Awards. In order to provide long term incentives to the Company’s officers and managers, on January 9, 2020, the Board granted participating officers and managers shares of restricted stock and/or options to purchase the Company’s common stock. Provided the participating officer or manager is still employed with the Company or its subsidiaries on the following dates, the shares of restricted stock and the options vest over four years as follows: (i) one-quarter of the restricted shares and options vested on January 9, 2021; and (ii) the remaining restricted shares and options shall vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following January 9, 2021. The options have a ten-year term and an exercise price of $6.46 per share (which was the closing price of the Company’s common stock on the date of grant).

Mr. Dawson, the Company’s President and Chief Executive Officer, was a participant in the fiscal 2020 plan and, therefore, on January 9, 2020, was granted 21,000 shares of restricted stock, and options to purchase 42,000 shares of common stock at an exercise price of $6.46 (the closing price of the Company’s common stock on the date of grant). Mr. Dawson’s shares of restricted stock and the options have the same terms, vesting schedule and price as the equity awards granted to other officers and managers under the equity awards plan. Mr. Dawson was also awarded 5,062 fully-vested shares valued at $32,700. On January 9, 2020, the Compensation Committee and the Board also granted Mr. Yin 3,750 shares of restricted stock, options to purchase 7,500 shares of common stock at an exercise price of $6.40, and 2,289 fully-vested shares.

Fiscal Year 2021 Management Incentive Equity and Cash Compensation Plan

On January 12, 2021, the Board adopted an annual incentive compensation plan for officers (including the Company’s named executive officers) and certain senior managers of the Company and its subsidiaries for the fiscal year ending October 31, 2021 (the “2021 Compensation Plan”). Under the 2021 Compensation Plan, each participant (i) received an equity award as a long-term incentive, and (ii) is eligible to receive a cash payment after the end of the fiscal year as a short-term incentive.

Equity Awards. In order to provide long-term incentives to the Company’s officers and managers, on January 12, 2021, the Board granted participating officers and managers shares of restricted stock and options to purchase the Company’s common stock. Provided the participating officer or manager is still employed with the Company or its subsidiaries on the following dates, the shares of restricted stock and the options shall vest over four years as follows: (i) one-quarter of the restricted shares and options shall vest on January 12, 2022; and (ii) the remaining restricted shares and options shall vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following January 12, 2022. The options have a ten-year term and an exercise price of $4.98 per share (which was the closing price of the Company’s common stock on the date of grant).

Mr. Dawson, the Company’s President and Chief Executive Officer, also is a participant in the 2021 Compensation Plan and was granted 21,000 shares of restricted stock and options to purchase 42,000 shares of common stock at an exercise price of $4.98 (the closing price of the Company’s common stock on the date of grant), and Mr. Yin, the Company’s Chief Financial Officer, was granted 5,000 shares of restricted stock and options to purchase 10,000 shares of common stock at an exercise price of $4.98.

Cash Incentives. Under the 2021 Compensation Plan, cash incentive bonuses, if any, will be paid to certain officers and senior managers based upon (i) the Company’s achievement of specified financial goals and (ii) on the Board’s discretionary review of each participant’s performance during the fiscal year that ends on October 31, 2021. The corporate goals will apply equally to all participating officers and managers. The subjective performance of each officer will be evaluated and determined by the Compensation Committee, in its sole discretion, after consultation with the Company’s Chief Executive Officer.

The maximum target cash bonus payable to participants if all of the goals are achieved range from 15% to 50% of the recipient’s fiscal 2021 annual base salary. Bonuses will be weighted and based on (i) the Company’s achievement of certain fiscal 2021 revenues (weighted 30%), (ii) fiscal 2021 adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) (weighted 60%), and (iii) a subjective evaluation of each individual’s performance (weighted 10%). The calculation of adjusted EBITDA will exclude the impact of any business acquisitions or dispositions effected during the year, the impact of the Federal Paycheck Protection Program loans the Company has received, and equity compensation expenses accrued to management. The Board and the Compensation Committee reserve the right to modify these goals, criteria, and target percentage at any time, and to grant bonuses to the participants even if the performance goals are not met. In addition, the Board and Compensation Committee may modify the bonus plan targets to reflect significant changes in the Company’s business, including changes due to acquisitions or dispositions of businesses or product lines. The 2021 bonuses will be paid by January 15, 2022 to participating officers and managers who are employed with the Company or its subsidiaries on the date of payment.

Executive Compensation

Summary of Cash and Other Compensation. The following table sets forth compensation for services rendered in all capacities to the Company (i) for each person who served as the Company’s Chief Executive Officer at any time during the past fiscal year, (ii) for the two most highly compensated executive officers, other than our Chief Executive Officer, who was employed with the Company on October 31, 2020 and who earned over $100,000 during the fiscal year ended October 31, 2020, and (iii) for up to two other executive officers who earned over $100,000 during the October 31, 2020 fiscal year but were no longer employed with the Company on October 31, 2020 (the foregoing executives are herein collectively referred to as the “Named Executive Officers”). Except for the persons listed below, no other executive officer of the Company received total salary and bonus, which exceeded $100,000 in the aggregate, during the fiscal year ended October 31, 2020.

|

Nonqualified |

||||||||||||||||||||||||||||||||||||||||||||

|

Non-Equity |

Deferred |

|||||||||||||||||||||||||||||||||||||||||||

|

Stock |

Option |

Incentive Plan |

Compensation |

All Other |

||||||||||||||||||||||||||||||||||||||||

|

Salary |

Severance |

Bonus |

Awards |

Awards |

Compensation |

Earnings |

Compensation |

Total |

||||||||||||||||||||||||||||||||||||

|

Name and Principal Position |

Year |

($) |

($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||||||||||||

|

Robert D. Dawson |

||||||||||||||||||||||||||||||||||||||||||||

|

President and Chief Executive Officer and Director (1) |

2020 |

400,000 | - | - | 167,100 | (2) | 127,844 | (2) | - | (12) | - | 46,154 | (3) | 741,098 | ||||||||||||||||||||||||||||||

|

2019 |

327,000 | - | - | - | - | 130,800 | (13) | - | 34,946 | (3) | 492,746 | |||||||||||||||||||||||||||||||||

|

Mark Turfler |

||||||||||||||||||||||||||||||||||||||||||||

|

SVP, Chief Financial Officer (4) |

2020 |

135,934 | (4) | 93,500 | (4) | - | - | - | - | - | 14,546 | (5) | 243,981 | |||||||||||||||||||||||||||||||

|

2019 |

187,000 | - | - | - | - | 55,500 | (13) | - | 6,862 | (5) | 249,362 | |||||||||||||||||||||||||||||||||

|

Ray Bibisi |

||||||||||||||||||||||||||||||||||||||||||||

|

Chief Revenue Officer (6) |

2020 |

161,538 | (6) | - | 7,500 | (12) | 32,000 | (7) | 193,276 | (6)(7) | - | - | 6,071 | (8) | 400,385 | |||||||||||||||||||||||||||||

|

Peter Yin |

||||||||||||||||||||||||||||||||||||||||||||

|

Interim Chief Financial Officer (9) |

2020 |

181,827 | (9) | - | 10,000 | (12) | 38,787 | (10) | 22,829 | (10) | - | (12) | - | 26,625 | (11) | 280,068 | ||||||||||||||||||||||||||||

|

2019 |

175,000 | - | - | - | - | 59,316 | (13) | - | 12,638 | (11) | 246,954 | |||||||||||||||||||||||||||||||||

(1) As of January 2, 2019, Mr. Dawson’s salary was increased from $275,000 to $300,000, and then to $400,000 on July 17, 2019.

(2) On January 9, 2020, Mr. Dawson was granted 21,000 shares of restricted stock valued at $134,400 and options to purchase 42,000 shares of common stock at an exercise price of $6.40 (the closing price of the Company’s common stock on the date of grant) valued at $127,844. Mr. Dawson was also awarded 5,062 fully-vest shares valued at $32,397.

(3) Mr. Dawson’s other compensation for the fiscal 2020 and 2019 years consisted of $46,154 and $34,946, respectively, of accrued vacation.

(4) Effective July 10, 2020, Mr. Turfler departed from the Company as its Senior Vice President—Chief Financial Officer and Corporate Secretary. Mr. Turfler will receive a severance payment of $93,500.

(5) Mr. Turfler’s other compensation for the fiscal 2020 and 2019 years consisted of $14,546 and $6,862, respectively, of accrued vacation. Mr. Turfler’s fiscal 2020 accrued vacation balance was paid out to him upon his termination.

(6) Mr. Bibisi joined the Company as Chief Revenue Officer as of January 6, 2020 at an annual salary of $200,000. As part of his offer letter, Mr. Bibisi was also granted options to purchase 50,000 shares of common stock at an exercise price of $6.74 (the closing price of the Company’s common stock on the date of grant) valued at $162,837.

(7) On January 9, 2020, Mr. Bibisi was granted 5,000 shares of restricted stock valued at $32,000 and options to purchase 10,000 shares of common stock at an exercise price of $6.40 (the closing price of the Company’s common stock on the date of grant) valued at $30,439.

(8) Mr. Bibisi’s other compensation for the fiscal 2020 year also includes $6,071 of accrued vacation.

(9) Effective July 11, 2020, Mr. Yin was appointed Interim Chief Financial Officer and new Corporate Secretary. Effective July 11, 2020, Mr. Yin’s annual base salary increased from $175,000 to $187,000.

(10) On January 9, 2020, Mr. Yin was granted 3,750 shares of restricted stock valued at $24,000 and options to purchase 7,500 shares of common stock at an exercise price of $6.40 (the closing price of the Company’s common stock on the date of grant) valued at $22,829. Mr. Yin was also awarded 2,289 fully-vest shares valued at $14,650.

(11) Mr. Yin’s other compensation for the fiscal 2020 and 2019 years consisted of $26,625 and $12,638, respectively, of accrued vacation.

(12) These cash payments were paid in January 2021 under the Company’s incentive compensation plan for the Company’s officers (including the named executive officers) and senior managers. Mr. Dawson declined to receive a cash bonus for his individual performance for the fiscal year ended October 31, 2020.

(13) For the fiscal year ended October 31, 2019, the Company adopted a cash incentive compensation plan for cash bonuses that can be earned by the Company’s officers and senior managers, which bonuses are based upon (i) the Company’s achievement of specified corporate goals and (ii) the satisfaction of subjective personal performance goals. Under the cash incentive plan, Mr. Dawson’s and Mr. Turfler’s cash bonus targets were 40% of their respective base salaries, and Mr. Yin’s target for his cash bonus was 32% of his base salary. The Company’s Compensation Committee determined that Mr. Dawson met all of his corporate and personal goals, Mr. Turfler met 60% of his personal targets, and Mr. Yin exceeded his personal targets. Based on the foregoing evaluation, their cash bonuses were adjusted accordingly.

2020 Option Grants

On January 6, 2020, Ray Bibisi was granted 50,000 incentive stock options. These options vested 10,000 on the date of grant, and the balance vests as to 10,000 shares per year thereafter on each of the next four anniversaries of January 6, 2020, and expire ten years from the date of grant.

On January 9, 2020, we granted a total of 59,500 incentive stock options to Messrs. Dawson, Yin, and Bibisi. The options vest over four years as follows: (i) one-quarter of the options shall vest on January 9, 2021; and (ii) the remaining options shall vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following January 9, 2021. All incentive stock options expire ten years from the date of grant.

No other options were granted to the Named Executive Officers during the year ended October 31, 2020.

Holdings of Previously Awarded Equity

Equity awards held as of October 31, 2020 by each of our Named Executive Officers were issued under our 2020 Equity Incentive Plan and our 2010 Stock Incentive Plan. The following table sets forth outstanding equity awards held by our Named Executive Officers as of October 31, 2020:

Outstanding Equity Awards As Of October 31, 2020

|

Option Awards |

|||||||||||||||||||

|

Name |

Number of |

Number of |

Equity Incentive Plan |

Option |

Option |

||||||||||||||

|

Mark Turfler |

100,000 | (1) | 5.88 |

01/31/21 |

|||||||||||||||

|

Robert D. Dawson |

10,000 | 60,000 | (2) | 1.90 |

07/17/27 |

||||||||||||||

| 42,000 | (5) | 6.40 |

01/09/30 |

||||||||||||||||

|

Peter Yin |

56,000 | (3) | 2.40 |

12/13/27 |

|||||||||||||||

| 7,500 | (5) | 6.40 |

01/09/30 |

||||||||||||||||

|

Ray Bibisi |

10,000 | 40,000 | (4) | 6.74 |

01/06/30 |

||||||||||||||

| 10,000 | (5) | 6.40 |

01/09/30 |

||||||||||||||||

|

(1) |

Effective July 10, 2020, the Board accelerated the vesting period of stock options held by Mr. Turfler for the purchase of 30,000 shares of common stock, and agreed to extend the period during which Mr. Turfler can exercise his stock options to January 31, 2021. |

|

(2) (3) (4) (5) |

Vests as to 10,000 shares annually following grant on July 17, 2017. Vests as to 8,000 shares annually following grant on December 13, 2017. Vests as to 10,000 shares annually following grant on January 6, 2020. Vests over four years as follows: i) one-quarter shall vest on January 9, 2021; and (ii) the remaining options shall vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following January 9, 2021. |

During the fiscal year ended October 31, 2020, we did not adjust or amend the exercise price of stock options awarded to the Named Executive Officers.

Employment Agreements; Incentive Plan; Change of Control Arrangements

Employment Agreements

Robert Dawson. On July 17, 2019, RF Industries, Ltd. entered into a two-year employment letter agreement (the “2019 Agreement”) with Mr. Dawson. Under the 2019 Agreement, the Company agreed to pay Mr. Dawson an annual base salary of $400,000. Mr. Dawson was also eligible to participate in the Company’s annual bonus plan, pursuant to which he will have the opportunity to earn a year-end bonus equal to fifty percent (50%) of his annual base salary

On July 17, 2017, Mr. Dawson received stock options to purchase 100,000 shares of the Company’s common stock (the “2017 Option”). The 2017 Option has an exercise price of $1.90 and vests as to 10,000 shares per year on each anniversary of July 17, 2017 (with 10,000 shares having vested on July 17, 2017) while he is employed by the Company.

On July 16, 2021, the Company entered into a new employment agreement (the “New Agreement”) with Robert D. Dawson, pursuant to which he will continue to serve as the Company’s President and Chief Executive Officer. The New Agreement became effective on July 17, 2021 and replaced Mr. Dawson’s prior employment agreement that expired on July 17, 2021. The initial term of the New Agreement ends on January 31, 2023, after which the New Agreement shall automatically renew for additional one (1) year periods, unless either Mr. Dawson or the Company provides the other party with written notice of non-renewal at least ninety (90) days prior to the date of automatic renewal.

Under the New Agreement, the Corporation agreed to pay Mr. Dawson an annual base salary of $425,000. Mr. Dawson will also be eligible to participate in the Company’s annual bonus plan, pursuant to which he will have the opportunity to earn a year-end bonus equal to fifty percent (50%) of his annual base salary. Under the New Agreement, if Mr. Dawson’s employment is terminated by the Company for any reason other than for “cause”, the Company is obligated to Mr. Dawson (x) an amount equal to one year’s base salary as in effect at such time, and (y) the estimated pro rata portion of his target bonus that was earned through the date of termination, and the vesting period of all of Mr. Dawson’s unvested stock options and all unvested time-based restricted stock grants will automatically be fully accelerated as of the termination date. The foregoing provisions will not apply if Mr. Dawson voluntarily terminates his employment with the Company or is terminated for cause.

Also, effective July 17, 2021, Mr. Dawson received a fully vested, ten-year immediately exercisable stock option to purchase 50,000 shares of the Company’s common stock. The exercise price of this option is $8.69, which was the closing price on the date of the New Agreement. The New Agreement also provided that the vesting schedule of the remaining portion of the 2017 Option was revised. As of the date of the New Agreement, Mr. Dawson’s 50,000 shares of the 2017 Option were still unvested. Under the revised vesting schedule, provided that Mr. Dawson is still employed by the Company, 25,000 shares of those unvested options under the 2017 Option will vest on July 17, 2022, and the remaining 25,000 shares will vest on July 17, 2023.

Upon a Change of Control Transaction (as defined in the New Agreement), all of Mr. Dawson’s time based stock options and shares of restricted stock shall immediately vest, whether or not his employment is terminated. If, at the time of a Change of Control Transaction, Mr. Dawson’s employment is terminated by the Company for any reason other than cause (as defined in the New Agreement), Mr. Dawson will be entitled to receive a change of control cash payment in an amount equal to 12 months of his base salary.

Peter Yin. Mr. Yin was appointed as the Company’s new Interim Chief Financial Officer effective July 11, 2020. Mr. Yin is currently employed on an at-will basis pursuant to an unwritten employment agreement. Mr. Yin’s annual base salary was $175,000 prior to his promotion to Interim Chief Financial Officer. Upon his promotion, Mr. Yin’s annual base salary was increased to $187,000. On January 12, 2021, the Board promoted Mr. Yin to Chief Financial Officer and concurrently, also increased Mr. Yin’s annual base salary to $200,000. Mr. Yin is entitled to participate in the Company’s pension, retirement, disability, insurance, medical service, and other employee benefit plans that are generally available to all employees of the Company.

Adoption of Fiscal Year 2020 Management Incentive Equity and Cash Compensation Plan

On January 9, 2020, the Board adopted an incentive compensation plan for officers (including the named executive officers) and senior managers of the Company and its subsidiaries for the fiscal year ending October 31, 2020. Under the 2021 incentive plan, each participant (i) is eligible to receive a cash payment after the end of the fiscal year as a short-term incentive bonus, and (ii) received an equity award as a long-term incentive award. See “Summary Compensation Discussion and Analysis” above.

Change of Control Arrangements

The outstanding stock options currently owned by the Company’s principal officers (including Messrs. Dawson and Yin) and division managers provide that, immediately prior to a change of control (as defined in the 2010 Stock Option Plan and the 2020 Equity Incentive Plan), all unvested stock options will become fully vested and exercisable. In addition, the shares of restricted stock granted to the non-executive directors for his/her services to be rendered during the current year, shall also become fully vested upon a change of control event.

The Company has no other change of control payment agreements that are currently in effect other than the provision in Mr. Dawson’s employment agreement described above.

2020 Equity Incentive Plan

On March 5, 2020, the Board adopted the 2020 Equity Incentive Plan (the “2020 Plan”), which plan was approved by our stockholders at the 2020 annual meeting of the stockholders. The 2020 Plan was adopted to replace the RF Industries, Ltd. 2010 Stock Incentive Plan that expired earlier in 2020.

As of April 30, 2021, we have awarded or granted under the 2020 Plan options to purchase a total of 77,000 shares of our common stock and restricted shares covering a total of 79,435 shares of our common stock. Accordingly, 1,191,955 shares of our common stock remain available for issuance under the 2020 Plan.

Types of Awards. The 2020 Plan provides for the following types of awards: incentive stock options, nonstatutory stock options, restricted stock awards, restricted stock unit awards, stock appreciation rights, performance stock awards, performance cash awards, and other stock-based awards (collectively, the “stock awards” or “awards”).

Eligibility. Stock awards may be granted under the 2020 Plan to employees (including officers) and consultants of RF Industries and its subsidiaries, and to members of our Board of Directors. Pursuant to applicable tax laws, we may grant incentive stock options only to our employees (including officers) and employees of our affiliates.

Annual Compensation to Non-Employee Directors; Limitation on Annual Stock Awards to Participants. The 2020 Plan provides that the compensation payable by us to a non-employee director for services performed as a non-employee director, including, without limitation, the grant date value (determined under U.S. generally accepted accounting principles) of awards, cash retainers, committee fees and other compensation, shall not exceed $500,000 in the aggregate during any calendar year. Furthermore, the 2020 Plan provides that a maximum of 100,000 shares of our common stock subject to options and other stock awards may be granted to any non-employee director during any calendar year. The 2020 Plan also provides that no officer, employee, or consultant may be granted stock awards covering more than 500,000 shares of our common stock during any calendar year pursuant to stock options, stock appreciation rights, and other stock awards.

Administration. The 2020 Plan is administered by our Board of Directors, which may in turn delegate authority to administer the 2020 Plan to a committee. Subject to the terms of the 2020 Plan, the Compensation Committee may determine the recipients, numbers, and types of stock awards to be granted, and terms and conditions of the stock awards, including the period of their exercisability and vesting. Subject to the limitations set forth below, the Board of Directors or Compensation Committee also determines the fair market value applicable to a stock award and the exercise price of stock options and stock appreciation rights granted under the 2020 Plan.

Unless otherwise determined by the Board of Directors, the Compensation Committee shall be comprised of at least two directors, each of whom is (1) a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and (2) an “independent director” under applicable rules of The NASDAQ Stock Market LLC, including the independence rules of such stock exchange relating to compensation committee members. The Compensation Committee has the authority to delegate its administrative powers under the 2020 Plan to a subcommittee consisting of members of the Compensation Committee. The 2020 Plan also permits delegation to one or more officers of the ability to determine the recipients, number of shares, and types of stock awards (to the extent permitted by law) to be granted to employees other than our officers, subject to a maximum limit on the aggregate number of shares subject to stock awards that may be granted by such officers.

Stock Available for Awards. If this Proposal 2 is approved, the total number of shares of our common stock reserved for issuance under the 2020 Plan will consist of 1,250,000 shares (the “Share Reserve”).

The shares of common stock subject to stock awards granted under the 2020 Plan that expire, are forfeited because of failure to vest, or otherwise terminate without being exercised in full will return to the Share Reserve and be available for issuance under the 2020 Plan. However, any shares that are withheld to satisfy tax requirements or that are used to pay the exercise or purchase price of a stock award will not return to the 2020 Plan.

Appropriate adjustments will be made to the Share Reserve, to the limit on the number of shares that may be issued as incentive stock options, to the limit on the number of shares that may be awarded to any one person in any calendar year, and to outstanding awards in the event of any change in our common stock without the receipt of consideration by the Company through reorganization, recapitalization, reincorporation, stock dividend, dividend in property other than cash, large nonrecurring cash dividend, stock split, reverse stock split, spin-off, split-off, liquidating dividend, combination of shares, exchange of shares, change in corporate structure or any similar equity restructuring transaction, other than the conversion of convertible securities.

Repricing. The 2020 Plan expressly provides that, without the approval of our stockholders, the Board of Directors or the Compensation Committee may not provide for either the cancellation of underwater stock options or stock appreciation rights outstanding under the 2020 Plan in exchange for the grant of new awards, or the amendment of outstanding stock options or stock appreciation rights to reduce their exercise price.

Dividends and Dividend Equivalents. The 2020 Plan provides that (1) no dividends or dividend equivalents may be paid with respect to any shares of our common stock subject to an award before the date that such shares have vested, (2) any dividends or dividend equivalents that are credited with respect to any such shares will be subject to all of the terms and conditions applicable to such shares under the terms of the applicable award agreement (including, without limitation, any vesting conditions), and (3) any dividends or dividend equivalents that are credited with respect to any such shares will be forfeited to use on the date, if any, such shares are forfeited to or repurchased by us due to a failure to meet any vesting conditions under the terms of the applicable award agreement.

Terms of Options. A stock option is the right to purchase shares or our common stock at a fixed exercise price during a specified period of time. Stock option grants may be incentive stock options or nonstatutory stock options. Each option is evidenced by a stock option agreement. The Board or Compensation Committee determines the terms of a stock option including the exercise price, the form of consideration paid on exercise, the vesting schedule, restrictions on transfer, and the term of the option.

Generally, the exercise price of a stock option may not be less than 100% of the fair market value of the stock subject to the option on the date of grant. Options granted under the 2020 Plan will vest at the rate specified in the option agreement.

The term of an option granted under the 2020 Plan will be determined by the Board of the Compensation Committee, but may not exceed ten years. The Board or Compensation Committee will determine the time period, including the time period following a termination of an optionholder’s continuous service relationship with us or any of our affiliates, during which an optionholder has the right to exercise a vested option. Unless the terms of an optionholder’s stock option agreement provide otherwise, if an optionholder’s continuous service relationship with us, or any of our affiliates, ceases for any reason other than disability or death, the optionholder may generally exercise any vested options for a period of three months following the cessation of service. Unless otherwise provided in the option agreement, if an optionholder’s service relationship with us, or any of our affiliates, ceases due to disability or detah, or an optionholder dies within a certain period following cessation of service, the optionholder or a beneficiary may generally exercise any vested options for a period of eighteen months in the event of disability and eighteen months in the event of death. The Board and the Compensation Committee has discretion to extend the term of any outstanding option and to extend the time period during which a vested option may be exercised following a termination of continuous service. The Compensation Committee may only accelerate the time at which an award may first be exercised or the time during which an award will vest (i) following a participant’s death or disability, or (ii) in connection with the consummation of a Change in Control or a Corporate Transaction.

Acceptable forms of consideration for the purchase of our common stock issued under the 2020 Plan may include cash, payment pursuant to a “cashless” exercise program developed under Regulation T as promulgated by the Federal Reserve Board, common stock owned by the participant, payment through a net exercise feature, or other approved forms of legal consideration.

Generally, an optionholder may not transfer a stock option other than by will or the laws of descent and distribution or pursuant to a domestic relations order. However, to the extent permitted under the terms of the applicable stock option agreement, an optionholder may designate a beneficiary who may exercise the option following the optionholder’s death.

Tax Limitations on Incentive Stock Options. The aggregate fair market value, determined at the time of grant, or shares of our common stock with respect to incentive stock options that are exercisable for the first time by an optionholder during any calendar year under all of our stock plans may not exceed $100,000. The options or portions of options that exceed this limit are generally treated as nonstatutory stock options. In addition, the maximum number of shares that may be issued pursuant to the exercise of incentive stock options under the 2020 Plan is 1,250,000 shares. No incentive stock option may be granted to any person who, at the time of the grant, owns or is deemed to own stock possessing more than 10% of our total combined voting power or that of any affiliate unless the following conditions are satisfied:

|

● |

The option exercise price must be at least 110% of the fair market value of the stock subject to the option on the date of grant; and |

|

● |

The term of any incentive stock option award must not exceed five years from the date of grant. |

Terms of Restricted Stock Awards. Restricted stock awards are awards of shares of our common stock. Each restricted stock award is evidenced by an award agreement that sets forth the terms and conditions of the award. A restricted stock award may be granted in consideration for cash, the recipient’s services performed, or to be performed, for us or an affiliate of ours, or other form of legal consideration. Shares of our common stock acquired under a restricted stock award may be subject to forfeiture in accordance with the vesting schedule determined at the time of grant. Rights to acquire shares of our common stock under a restricted stock award may be transferred only upon such terms and conditions as are set forth in the restricted stock award agreement.