Form DEF 14A Playtika Holding Corp. For: Jun 09

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

PLAYTIKA HOLDING CORP.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

April 28, 2021

Dear Stockholder:

You are cordially invited to attend our 2021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 9:00 a.m., Pacific Time on June 9, 2021. Due to the public health impact of the coronavirus outbreak (COVID-19), and to support the health and well-being of the Board, our employees and our stockholders, this year’s Annual Meeting will be a completely virtual meeting of stockholders, conducted via live audio webcast. You can attend the Annual Meeting via the Internet at www.proxydocs.com/PLTK by using the control number that appears on your proxy card (printed in the shaded box), and the instructions that accompanied your proxy materials. You will have the ability to submit questions in advance of and real-time during the Annual Meeting via the meeting website.

The matters expected to be acted upon at the Annual Meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the meeting, please cast your vote as soon as possible by Internet or by completing and returning the enclosed proxy card in the postage-prepaid envelope to ensure that your shares will be represented. Your vote by written proxy will ensure your representation at the Annual Meeting regardless of whether you attend the virtual meeting or not. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares at the virtual meeting.

We look forward to your attendance at our virtual Annual Meeting.

Sincerely,

/s/ Robert Antokol

Robert Antokol

Chief Executive Officer

Chairperson of the Board of Directors

Notice of the 2021

Annual Meeting of Stockholders

NOTICE IS HEREBY GIVEN that the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Playtika Holding Corp., a Delaware corporation, will be held as follows:

| MEETING DATE: | Wednesday, June 9, 2021 | |||||||

| MEETING TIME: | 9:00 a.m. Pacific Time | |||||||

| VIRTUAL MEETING ACCESS: | www.proxydocs.com/PLTK | |||||||

RECORD DATE: You may vote if you were a holder of record of shares of our common stock, par value $0.01 per share, at the close of business on April 12, 2021.

ITEMS OF BUSINESS:

| 1 | The election of five director nominees named in the proxy statement accompanying this notice to serve until the 2022 annual meeting of stockholders and until their respective successors are duly elected and qualify. | |||||||

| 2 | The ratification of the appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as our independent registered public accounting firm for the year ending December 31, 2021. | |||||||

| 3 | A non-binding advisory proposal to approve the compensation of our named executive officers as described in the accompanying proxy statement. | |||||||

| 4 | A non-binding advisory vote to approve the frequency of future non-binding advisory votes by stockholders on the compensation of our named executive officers. | |||||||

| 5 | The transaction of such other business as may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting. | |||||||

The proxy statement following this notice describes these matters in detail. We have not received notice of any other proposals to be presented at the Annual Meeting.

PROXY VOTING: Your vote is important. Whether or not you plan to participate in our Annual Meeting, we urge you to submit your proxy as soon as possible to ensure your shares are represented and voted at our Annual Meeting. You may authorize a proxy to vote your shares by telephone, via the Internet, or – if you have received and/or requested paper copies of our proxy materials by mail – by signing, dating and returning the proxy card in the envelope provided. If you participate in our virtual Annual Meeting, you may, if you wish, vote your shares (or withdraw your proxy) at www.proxydocs.com/PLTK.

You are encouraged to read this Proxy Statement in its entirety before voting or authorizing a proxy to vote on your behalf.

By Order of the Board of Directors,

/s/ Michael Cohen

Michael Cohen

Executive Vice President, General Counsel and Corporate Secretary

April 28, 2021

Table of Contents

Proxy Summary

| MEETING DATE: | Wednesday, June 9, 2021 | |||||||

| MEETING TIME: | 9:00 a.m. Pacific Time | |||||||

| VIRTUAL MEETING ACCESS: | www.proxydocs.com/PLTK | |||||||

| RECORD DATE: | April 12, 2021 | |||||||

The Board of Directors (the “Board”) of Playtika Holding Corp., a Delaware corporation (“we”, “us,” “Playtika,” or the “Company”), is soliciting proxies for the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) and any postponement or adjournment of the Annual Meeting. This Proxy Summary provides an overview of the proposals to be considered and voted on at the Annual Meeting and information contained in the Proxy Statement, but does not contain all of the information that should be considered before voting. We encourage you to read the Proxy Statement in its entirety before voting.

How to Vote

On or about April 28, 2021, we will mail or e‑mail a copy of our Notice of 2021 Annual Meeting of Stockholders, Proxy Statement, proxy card, and 2020 Annual Report (collectively “Proxy Materials”) to our stockholders according to their previously indicated preference. Some of our stockholders will be mailed a Notice of Availability of Proxy Materials, which contains instructions on how to request and receive a paper or e‑mailed copy of our Proxy Materials, and how to view these materials online. We encourage you to vote by telephone, over the Internet or by mail by completing your proxy card, even if you plan to participate in the virtual Annual Meeting. All methods of correspondence will provide stockholders with instructions on how to vote or authorize a proxy to vote using any of the following methods:

By Internet

Authorize a proxy to vote your shares via the website www.proxypush.com/PLTK, which is available 24 hours per day until the start of the Annual Meeting. In order to authorize your proxy, you will need to have available the control number that appears on the voting instructions included in the Proxy Materials that you received. If you authorize your proxy via the Internet, you do not need to return your proxy or voting instruction card.

By Telephone

Authorize a proxy to vote your shares by calling toll-free at 844-311-3915, 24 hours per day until the start of the Annual Meeting. When you call, please have the voting instructions in hand that accompanied the Proxy Materials you received, along with the control number that appears therein. Follow the series of prompts to instruct your proxy how to vote your shares. If you authorize your proxy by telephone, you do not need to return your proxy or voting instruction card.

By Mail

If you received and/or requested via the Notice a printed set of the Proxy Materials (including the Proxy Statement, proxy card, and Annual Report), authorize a proxy to vote your shares by completing, signing, and returning the proxy in the prepaid envelope provided.

Virtual Meeting Access

Vote your shares by logging onto and voting at the virtual Annual Meeting at www.proxydocs.com/PLTK by following the instructions provided to you via email after completing the registration procedures described on the website. Please note that you must register on the website in advance of the Annual Meeting to be able to attend and vote your shares. You may also be represented by another person at the Annual Meeting by executing a proper proxy

1

designating that person as your representative. If you are a beneficial owner of shares, you will need your unique control number, which appears on the instructions that accompanied the Proxy Materials.

Beneficial Stockholders: If your shares of common stock are held by a bank, broker or other holder of record, please follow the instructions you receive from your bank, broker or other holder of record on how to vote your shares of common stock at our Annual Meeting. Since a beneficial owner is not the stockholder of record, you may not vote these shares online at our Annual Meeting unless you obtain a “legal proxy” from the bank, broker or other holder of record that holds your shares, giving you the right to vote the shares at the Annual Meeting. You must also register at www.proxydocs.com/PLTK in advance of the Annual Meeting to be able to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on June 9, 2021: This Proxy Statement and our 2020 Annual Report are available in the investors section of our corporate website at www.playtika.com. You can also view these materials at www.proxydocs.com/PLTK. If you would like to request paper copies of the Proxy Statement or our 2020 Annual Report, please follow the instructions provided on the Notice of Availability of Proxy Materials. You are encouraged to access and review all of the information contained in the Proxy Materials before voting.

Virtual Stockholder Meeting

Due to the ongoing public heath impact of the coronavirus outbreak (COVID-19), and to support the health and well-being of our Board, our employees and our stockholders, the Board has decided to hold a completely virtual Annual Meeting this year. The Board believes that the virtual format for the Annual Meeting will provide the opportunity for participation by a broader group of our stockholders, while reducing the costs associated with planning, holding, and arranging logistics for in-person meeting proceedings. The virtual meeting format enables stockholders to participate fully, and equally, from any location around the world, at little to no cost. It also reduces the environmental impact of our Annual Meeting. We designed the format of our Annual Meeting to ensure that our stockholders who attend our Annual Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting and to enhance stockholder access, participation and communication through online tools.

Date and Time: The Annual Meeting will be held virtually through a live audio webcast on June 9, 2021, at 9:00 a.m. Pacific Time. There will be no physical meeting location. The meeting will only be conducted via an audio webcast.

Access to the Audio Webcast of the Annual Meeting: The live audio webcast of the Annual Meeting will begin promptly at 9:00 a.m. Pacific Time. Online access to the audio webcast will open approximately fifteen minutes prior to the start of the Annual Meeting to allow time for you to log in and test the computer audio system. We encourage our stockholders to access the meeting prior to the start time.

Log in Instructions: To attend the virtual Annual Meeting, log in at www.proxydocs.com/PLTK and register in advance. Following registration, you will receive instructions regarding virtual attendance at the Annual Meeting and how to vote your shares at the Annual Meeting, along with your unique link to attend the Annual Meeting, via email. Stockholders will need their unique control number which appears on the Notice (printed in the shaded box) and the instructions that accompanied the Proxy Materials. If your shares of common stock are held by a bank, broker or other holder of record, and you do not have a control number, please contact your bank, broker or other holder of record as soon as possible, so that you can be provided with a control number and register to gain access to the Annual Meeting.

The Annual Meeting’s Rules of Conduct will be posted on www.proxydocs.com/PLTK approximately two weeks prior to the day of the Annual Meeting.

Technical Assistance: Beginning 30 minutes prior to the start of and during the virtual Annual Meeting, we will have a support team ready to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting.

2

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, you should call our support team at the toll free number that will be provided to you via email following registration.

Voting shares prior to and at the virtual Annual Meeting: Stockholders may vote their shares at www.proxypush.com/PLTK prior to the start of the virtual Annual Meeting. If your shares of common stock are held by a bank, broker or other holder of record, you may not vote these shares online at our Annual Meeting unless you obtain a “legal proxy” from the bank, broker or other holder of record that holds your shares, giving you the right to vote the shares at the Annual Meeting.

Availability of live webcast to our employees and other constituents: The live audio webcast will be available to not only our stockholders, but also our employees and other constituents.

Proposal Guide

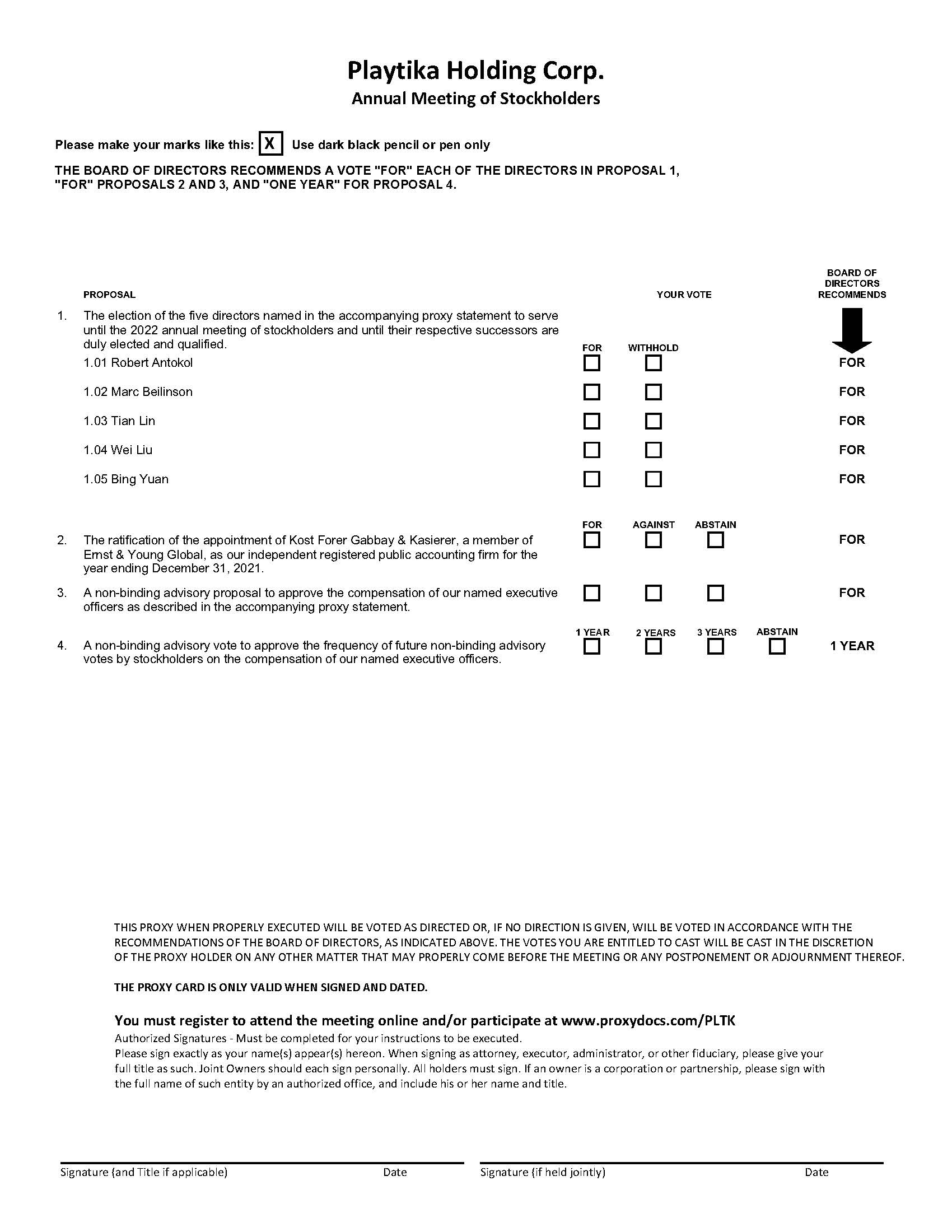

| PROPOSAL | PAGE | BOARD VOTE RECOMMENDATION | ||||||||||||

PROPOSAL 1 – ELECTION OF DIRECTORS The Board believes that the five director nominees named herein contribute the breadth and diversity of knowledge and experience needed for the advancement of our business strategies and objectives. | 4 | For | ||||||||||||

PROPOSAL 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Audit Committee of the Board has appointed Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as the independent registered public accounting firm for the year ending December 31, 2021 and requests stockholders to ratify the appointment. | 5 | For | ||||||||||||

PROPOSAL 3 – ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS The Board recommends that stockholders vote to approve the compensation of our named executive officers described in this proxy statement.. | 6 | For | ||||||||||||

PROPOSAL 4 – ADVISORY VOTE TO APPROVE THE FREQUENCY OF FUTURE ADVISORY VOTES BY STOCKHOLDERS ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS The Board recommends that future advisory votes by our stockholders to approve executive compensation occur every one year until the next advisory vote on the frequency of advisory votes by our stockholders to approve executive compensation. | 7 | One Year | ||||||||||||

3

Proposals

Proposal 1 - Election of Directors

The Board currently consists of five directors who we believe contribute the breadth of knowledge and experience necessary for the advancement of our business strategies and objectives. Based on the recommendation of our Nominating and Corporate Governance Committee, the Board has nominated the following current five directors, for re-election at the Annual Meeting, each to serve for a one‑year term expiring at our annual meeting of stockholders in 2022 and until their respective successors have been duly elected and qualify:

| Name | Age | Position | ||||||||||||

| Robert Antokol | 53 | Chief Executive Officer and Chairperson of the Board | ||||||||||||

| Marc Beilinson | 62 | Director | ||||||||||||

| Tian Lin | 41 | Director | ||||||||||||

| Wei Liu | 53 | Director | ||||||||||||

| Bing Yuan | 52 | Director | ||||||||||||

Each of the nominees for election currently serves as a director and has consented to serve for a new term if elected. Each nominated director was elected by our stockholders to his or her present term of office. Although it is anticipated that each nominee will be able to serve as a director, should any nominee become unavailable to serve, the shares of our common stock represented by the proxies will be voted for such other person or persons as may be designated by the Board, unless the Board reduces the number of directors accordingly. As of the date of this Proxy Statement, the Board is not aware of any nominee who is unable or will decline to serve as a director.

For more information regarding our nominees, please see the “Board of Directors and Corporate Governance” section of this Proxy Statement beginning on page 8.

| OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE. | ||

4

Proposal 2 - Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee of the Board has appointed Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as the independent registered public accounting firm to audit our consolidated financial statements and internal control over financial reporting for the year ending December 31, 2021. Representatives of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, are expected to be present at the Annual Meeting and will be provided an opportunity to make a statement if the representatives desire to do so. The representatives are also expected to be available to respond to appropriate questions.

Although ratification by our stockholders is not a prerequisite to the power of the Audit Committee to appoint Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as our independent registered public accounting firm, the Board and the Audit Committee believe such ratification to be advisable and in the best interests of the company. Accordingly, stockholders are being requested to ratify, confirm, and approve the appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as our independent registered public accounting firm to conduct the annual audit of our consolidated financial statements and internal control over financial reporting for the year ending December 31, 2021. If the stockholders do not ratify the appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, the appointment of an independent registered public accounting firm will be reconsidered by the Audit Committee; however, the Audit Committee has no obligation to change its appointment based on stockholder ratification. If the appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, is ratified, the Audit Committee will continue to conduct an ongoing review of its scope of engagement, pricing and work quality, among other factors, and will retain the right to replace Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, at any time.

| OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KOST FORER GABBAY & KASIERER, A MEMBER OF ERNST & YOUNG GLOBAL, FOR THE YEAR ENDING DECEMBER 31, 2021. | ||

5

Proposal 3 - Advisory Vote to Approve the Compensation of Our Named Executive Officers (“Say-on-Pay” Proposal)

As required by Section 14A(a)(1) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), we are asking our stockholders to vote, on a non-binding, advisory basis, to approve the compensation paid to our named executive officers, as described in the Compensation Discussion and Analysis and the executive compensation tables narrative that follow (the “Say-on-Pay Proposal”).

As described in further detail under Proposal No. 4 of this Proxy Statement, at the 2021 annual meeting, our stockholders are being asked to indicate how frequently they believe we should seek an advisory vote on the compensation of our named executive officers (the “Frequency Proposal”). Our Board has recommended that our stockholders vote for a frequency of one year. We currently expect our next vote on a say-on-pay proposal (after the vote on this Proposal 3 at the 2021 annual meeting) will be held at our 2022 annual meeting, although our Board may decide to modify this expectation, particularly in light of the results of the Frequency Proposal.

We encourage our stockholders to review the “Executive Compensation” section of this Proxy Statement for more information.

Because this vote is advisory, it is not binding on us or the Board. Nevertheless, the views expressed by stockholders, whether through this vote or otherwise, are important to management and the Board and, accordingly, the Board and the Compensation Committee of the Board (the “Compensation Committee”) will consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

| OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL ON A NON-BINDING ADVISORY BASIS OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020, AS MORE FULLY DISCLOSED IN THIS PROXY STATEMENT. | ||

6

Proposal 4 - Advisory Approval of the Frequency of Future Advisory Votes by Stockholders on the Compensation of Our Named Executive Officers (“Frequency Proposal”)

As required by Section 14A(a)(1) of the Exchange Act, our stockholders may indicate how frequently they believe we should seek an advisory vote on the compensation of our named executive officers. We are seeking an advisory, non-binding determination from our stockholders as to the frequency with which our stockholders have an opportunity to provide an advisory approval of the compensation of our named executive officers. Stockholders are not being asked to approve or disapprove our Board’s recommendation, but rather vote for a frequency of one, two or three years, or abstain from voting.

We recommend that our stockholders select a frequency of one year, or an annual vote. We believe that this frequency is appropriate because it will continue to enable our stockholders to vote, on an advisory basis, on the most recent executive compensation information that is presented in our Proxy Statement, leading to a more meaningful and coherent communication between the Company and our stockholders on the compensation of our named executive officers. An annual advisory vote on executive compensation is consistent with our policy of seeking regular input from, and engaging in discussions with, our stockholders on corporate governance matters and our executive compensation philosophy, policies and practices.

This vote is advisory, and therefore not binding on us, the Compensation Committee or the Board. However, we value the opinions of our stockholders and will take into account the outcome of the vote when considering the frequency of submitting to stockholders a resolution to afford stockholders the opportunity to vote on executive compensation.

| OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE ON A NON-BINDING ADVISORY BASIS FOR A FREQUENCY OF “ONE YEAR” ON FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS. | ||

7

Board of Directors and Corporate Governance

Director Nominees

The Board has nominated the following five current directors, identified below, for re-election at the Annual Meeting, each to serve for a one‑year term expiring at our annual meeting of stockholders in 2022, and until their respective successors are duly elected and qualify. The information presented below highlights each director nominee’s specific experience, qualifications, attributes, and skills that led the Board to the conclusion that he or she should serve as a director. We believe that all of our director nominees have a reputation for integrity, honesty, and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Playtika and the Board. We also value the additional perspective that comes from serving on other companies’ boards of directors and board committees. We continue to review the composition of the Board in an effort to assemble a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in various areas.

Robert Antokol co-founded the Playtika business in 2010, with our subsidiary, Playtika Ltd., and has served as its Chief Executive Officer since its founding. Mr. Antokol also served as our Chief Executive Officer since October 2019 and as Chairperson of the Board since June 2020. In these roles, Mr. Antokol has overseen the expansion of our games portfolio, the successful transition to mobile, and an employee base that grew from less than 50 to more than 3,700 employees. In 2011, only 13 months after founding Playtika, he successfully oversaw the sale of Playtika to Caesars Interactive Entertainment, Inc. (“CIE”), and in 2016, Mr. Antokol oversaw the sale of Playtika from CIE to a consortium of investors led by Giant Network Group Co, Ltd. Mr. Antokol also serves on the board of directors of several private companies. Mr. Antokol received his Practical Engineering degree, with an emphasis on Electricity, from Ort Braude College.

We believe Mr. Antokol’s operational expertise, leadership, historical knowledge and the continuity that he brings to the Board as our founder, Chief Executive Officer and Chairperson of the Board qualify him to continue to serve on the Board.

Marc Beilinson has served as a member of the Board since June 2020 and also serves as chairperson of our Audit Committee. Since 2013, he has served as a director of Athene Holding Ltd., a retirement services company, where he also serves as the lead independent director, the chair of its compensation committee and a member of its conflicts committee and legal and regulatory committee. Since August 2011, Mr. Beilinson has been the Managing Partner of Beilinson Advisory Group, a financial restructuring and hospitality advisory group that specializes in assisting distressed companies. Most recently, Mr. Beilinson served as Chief Restructuring Officer of Newbury Common Associates LLC (and certain affiliates) from December 2016 to June 2017. Mr. Beilinson previously served as Chief Restructuring Officer of Fisker Automotive from November 2013 to August 2014 and as Chief Restructuring Officer and Chief Executive Officer of Eagle Hospitality Properties Trust, Inc. from August 2011 to December 2014 and Innkeepers USA Trust from November 2008 to March 2012. Mr. Beilinson currently serves on the boards of directors of Exela Technologies, 24 Holdings II, LLC, Mallinckrodt, LLC, MMR Advisory Holdings, LLC, Rentpath Holdings, Inc. and KB US, Inc, as well as the audit committee of Exela Technologies. Mr. Beilinson has previously served on the boards of directors and/or audit committees of a number of public and privately held companies, including, but not limited to, Westinghouse Electric, CAC, Wyndham International, Inc., Apollo Commercial Real Estate Finance, Inc., Innkeepers USA Trust, Gastar Inc., Acosta, Inc., American Tire, Haggen Stores and Monitronics. Mr. Beilinson has a Bachelor of Arts in political science from the University of California, Los Angeles and a Juris Doctor from the University of California Davis Law School.

We believe Mr. Beilinson’s over thirty years of service on the boards of both public and private companies, and his extensive knowledge of legal and compliance issues, including the Sarbanes-Oxley Act of 2002, qualify him to continue to serve on the Board.

8

Tian Lin has served as a member of the Board since September 2016. Mr. Lin served as our Chief Executive Officer, President and Chief Financial Officer from September 2016 to October 2019 and as our Secretary from September 2016 to October 2020, although Mr. Lin has never had an operational role within the Company. Mr. Lin has also served on the boards of certain of our subsidiaries since 2016, including Playtika Ltd. Since December 2017, Mr. Lin also served as a managing director of M31 Capital, a multi-strategy investment platform based in China. Mr. Lin has extensive experience in the technology and online gaming industries, having served as the head of investment at Giant Network Group Co., Ltd. since January 2016, leading Giant’s acquisition of Playtika in 2016. Mr. Lin received his bachelor of science degree in computer science from Carnegie Mellon and his M.B.A. from Peking University.

We believe Mr. Lin’s extensive experience in the gaming and technology industries, as well as the continuity that he brings to the Board through his prior roles at Playtika and his service on the board of directors of our subsidiaries, qualify him to continue to serve on the Board.

Wei Liu has served as a member of the Board since June 2020. Since May 2016, Ms. Liu has served as a director of Giant Network Group Co., Ltd., where she has also served as a member of the Nominating Committee and as the General Manager of the company’s routine operations. Ms. Liu also served as the Chief Executive Officer and a director for Giant Interactive Group Inc. from 2006 to 2014. Ms. Liu holds a Bachelor’s degree from Nankai University and a Master’s degree from China Europe International Business School.

We believe Ms. Liu’s experience in the gaming and technology industries as well has her extensive experience of service to the boards of both public and private companies qualifies her to continue to serve on the Board.

Bing Yuan has served as a member of the Board since June 2020 and also serves on the Audit Committee. Since April 2020, Mr. Yuan has served on the board of directors for I-Mab, a clinical stage biopharmaceutical company, where he also serves as a member of the audit committee. Mr. Yuan also currently serves as a director for Haichang Ocean Park Holdings Ltd and PizzaExpress. Additionally, Mr. Yuan is a managing director and the Chief Operating Officer of Hony Capital, responsible for its equity investment operations. Mr. Yuan joined Hony Capital in April 2009 and has served as a managing director of the private equity department since January 2010. Prior to joining Hony Capital, Mr. Yuan served as a managing director of the direct investment department of Morgan Stanley Asia Limited from 2008 to 2009. Mr. Yuan has previously served as a director at other private and public companies, including Biosensors International Group, Ltd. from May 2016 to July 2017 and Hydoo International Holding Ltd. from July 2011 to September 2019. Mr. Yuan received his bachelor’s degree in English from Nanjing University and received his master’s degree in international relations and his Juris Doctor from Yale University.

We believe Mr. Yuan’s extensive experience in corporate finance, investment banking and service on various companies’ boards of directors qualifies him to continue to serve on the Board.

Corporate Governance

Board Composition

We believe the Board should be composed of individuals with sophistication and experience in many substantive areas that impact our business. We believe that all of our current Board members possess the professional and personal qualifications necessary for Board service, and have highlighted particularly noteworthy attributes for each Board member in the individual biographies above.

The Board is currently composed of five members with no vacancies.

Our amended and restated certificate of incorporation (our “Certificate of Incorporation”) provides that the authorized number of directors may be changed only by resolution of the Board. Until the date on which Playtika Holding UK II Limited and its affiliates cease to beneficially own, in the aggregate, more than 50% in voting power of our stock entitled to vote generally in the election of directors (a “Triggering Event”), the Board shall be elected annually to serve from the time of election and qualification until the next annual meeting following their election or

9

until their earlier death, resignation and removal. In addition, until a Triggering Event, our stockholders will have the right to remove any of our directors with or without cause by a majority vote of the stockholders. Following a Triggering Event, the Board will be divided into three classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose terms are then expiring, to serve from the time of election and qualification until the third annual meeting following their election or until their earlier death, resignation or removal. In addition, following a Triggering Event, our stockholders will have the right to remove any of our directors only for cause by a majority vote of the stockholders.

Our Certificate of Incorporation provides that the authorized number of directors may be changed only by resolution of the Board. Following a Triggering Event, any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of the Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

Playtika Holding UK II Limited beneficially owns shares representing more than 50% of the voting power of our shares eligible to vote in the election of directors. As a result, we are a “controlled company” within the meaning of the corporate governance standards of the Nasdaq Stock Market (“Nasdaq”). Under these corporate governance standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance standards, including the requirements (1) that a majority of the Board consist of independent directors, (2) that the Board have a compensation committee that is comprised entirely of independent directors and (3) that the Board have a nominating and governance committee that is comprised entirely of independent directors. We do not plan to utilize the exemptions available for controlled companies at this time.

Board Leadership Structure

The Board does not have a policy with respect to whether the role of the Chairperson and the Chief Executive Officer should be separate and, if it is to be separate, whether the Chairperson should be selected from the non-employee directors or be an employee. Mr. Antokol, our Chief Executive Officer, currently serves as Chairperson of the Board. The Board has determined that, like many U.S. companies, this is the appropriate leadership structure for the Company at this time because Mr. Antokol is uniquely positioned to serve as our Chairperson as our Chief Executive Officer with significant industry experience and depth of knowledge about our operations. We do not have a formally designated “lead director.” The Board acknowledges that no single leadership model is right for all companies at all times. As such, the Board periodically reviews its leadership structure and may, depending on the circumstances, choose a different leadership structure in the future.

Director Independence

The Board determined that each of Mr. Beilinson, Ms. Liu and Mr. Yuan is an “independent director” as defined under the applicable rules and regulations of the SEC and the listing requirements and rules of Nasdaq, representing 60% of our five directors. In making these determinations, the Board reviewed information provided by the directors and us with regard to each director’s business and personal activities and current and prior relationships as they may relate to us and our management, including the beneficial ownership of our capital stock by each non-employee director and any transactions involving them described in the section titled “Related Party Transactions.”

Board Meetings and Attendance

The Board met three times during 2020. All directors attended at least 75% of the aggregate of (i) the total number of meetings of the Board while they were members of the Board, and (ii) the total number of meetings of the committees of the Board on which such directors served during the period he or she served.

10

Role of the Board in Risk Oversight

The Board has an active role, as a whole and also at the committee level, in overseeing the management of our risks. The Board is responsible for general oversight of risks and regular review of information regarding our risks, including credit risks, cybersecurity risks, liquidity risks and operational risks. The Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. The Audit Committee is responsible for overseeing the management of risks relating to accounting matters and financial reporting. The Audit Committee is also responsible for overseeing the management of risks associated with the independence of the Board and potential conflicts of interest. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through discussions from committee members about such risks. The Board believes its administration of its risk oversight function has not negatively affected the Board’s leadership structure.

Code of Business Conduct and Ethics

We adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of our code of business conduct and ethics is available in the investors section of our corporate website at www.playtika.com.

Corporate Governance Guidelines

We adopted corporate governance guidelines that promote the functioning of the Board and its committees and set forth expectations as to how the Board should operate. The guidelines include information about the composition of the Board, orientation and continuing education, director compensation, Board meetings, Board committees, management succession, expectations of directors, and information regarding the performance evaluation of the Board. A current copy of our corporate governance guidelines is available in the investors section of our corporate website at www.playtika.com.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is an officer or one of our employees. None of our executive officers currently serves, or in the past year has served, as a member of the Board or Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of any entity that has one or more executive officers serving on the Board or Compensation Committee.

Anti-Hedging and Anti-Pledging Policies

To ensure proper alignment with our stockholders, we have established policies that prohibit our directors, officers, employees, and their family members from engaging in any transaction that might allow them to realize gains from declines in our securities. Specifically, we prohibit our directors, officers, employees, and their family members from engaging in transactions using derivative securities, short selling our securities, trading in any puts, calls or covered calls, writing purchase or call options and short sales, or otherwise participating in hedging, “stop loss,” or other speculative transactions involving our securities. In addition, margin purchases of our securities and pledging any of our securities as collateral to secure loans is prohibited.

Board Committees

The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which has the composition and the responsibilities described below. In addition, from time to time, special committees may be established under the direction of the Board when necessary to address specific issues.

11

Each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee operate under a written charter that was approved by the Board. A copy of each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee charters are available in the investors section of our corporate website at www.playtika.com.

Audit Committee

Our Audit Committee oversees our corporate accounting and financial reporting process and assists the Board in monitoring our financial systems. Our Audit Committee is responsible for, among other things:

•appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm;

•discussing with our independent registered public accounting firm their independence from management;

•reviewing with our independent registered public accounting firm the scope and results of their audit;

•approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

•overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC;

•reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; and

•establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters.

Our Audit Committee consists of Messrs. Beilinson, Lin and Yuan, with Mr. Beilinson serving as chair. The Board has affirmatively determined that Mr. Beilinson and Mr. Yuan each meet the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. Under applicable Nasdaq listing standards and SEC rules and regulations, we are permitted to phase in our compliance with the audit committee independence requirements as follows: (1) one independent member at the time of listing, (2) a majority of independent members within 90 days of listing and (3) all independent members within one year of listing. Within one year of our listing on Nasdaq, we intend to ensure that all members of our Audit Committee will meet the applicable independence requirements under Nasdaq listing rules and Rule 10A-3 of the Exchange Act.

In addition, the Board has determined that each member of our Audit Committee is financially literate, and that each of Mr. Beilinson and Mr. Yuan is an “audit committee financial expert” as defined in Item 407(d) of Regulation S-K promulgated under the Securities Act.

Our Audit Committee met three times during the fiscal year ended December 31, 2020.

Compensation Committee

Our Compensation Committee oversees our compensation policies, plans and benefits programs. Our Compensation Committee is responsible for, among other things:

•reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating our Chief Executive Officer’s performance in light of these goals and objectives and setting compensation;

•reviewing and setting or making recommendations to the Board regarding the compensation of our other executive officers;

•reviewing and approving or making recommendations to the Board regarding our incentive compensation and equity-based plans and arrangements; and

•appointing and overseeing any compensation consultants.

Our Compensation Committee consists of Mr. Lin, Ms. Liu and Mr. Yuan, with Mr. Lin serving as chair. The Board has affirmatively determined that each of Ms. Liu and Mr. Yuan meets the requirements for independence under the

12

current Nasdaq listing standards and that each is a non-employee director, as defined in Section 16b-3 of the Exchange Act. Under applicable Nasdaq listing standards, we are permitted to phase in our compliance with the Compensation Committee independence as follows: (1) one independent member at the time of listing, (2) a majority of independent members within 90 days of listing and (3) all independent members within one year of listing. Within one year of our listing on Nasdaq, we intend to ensure that each member of the Compensation Committee will meet the applicable requirements for independence under the Nasdaq listing standards.

Our Compensation Committee was formed in connection with our initial public offering in January 2021, and thus did not meet during the fiscal year ended December 31, 2020.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee oversees and assists the Board in reviewing and recommending nominees for election as directors. Our Nominating and Corporate Governance Committee is responsible for, among other things:

•identifying individuals qualified to become members of the Board, consistent with criteria approved by the Board;

•recommending to the Board the nominees for election to the Board at annual meetings of our stockholders;

•evaluating the overall effectiveness of the Board; and

•developing and recommending to the Board a set of corporate governance guidelines and principles.

Our Nominating and Corporate Governance Committee consists of Mr. Beilinson, Ms. Liu and Mr. Yuan, with Mr. Yuan serving as chair. The Board has affirmatively determined that each of Mr. Beilinson, Ms. Liu and Mr. Yuan meet the requirements for independence under the current Nasdaq listing standards, and the composition of our Nominating and Corporate Governance Committee meets the applicable requirements under Nasdaq listing standards.

Our Nominating and Corporate Governance Committee was formed in connection with our initial public offering in January 2021, and thus did not meet during the fiscal year ended December 31, 2020.

While the Nominating and Corporate Governance Committee does not have any specific, minimum qualifications for Board nominees, in considering possible candidates for election as a director, the committee strives to compose the Board with a collection of complementary skills and which, as a group, will possess the appropriate skills and experience to effectively oversee the Company’s business. In evaluating a potential candidate for the Board, our Nominating and Corporate Governance Committee takes into account a number of factors, including: personal and professional integrity; ethics and values; experience in corporate management, such as current or past service as an officer of a publicly held company; and a general understanding of marketing, finance, and other elements relevant to the success of a publicly traded company; experience in the Company’s industry; experience as a board member of another publicly held company; academic expertise in an area of the Company’s operations; and practical and mature business judgment, including the ability to make independent analytical inquiries. Although diversity may be a consideration in the Nominating and Corporate Governance Committee’s process, the committee does not have a formal policy regarding the consideration of diversity in identifying director nominees. The Nominating and Corporate Governance Committee will review the qualifications and backgrounds of directors and nominees (without regard to whether a nominee has been recommended by a stockholder), as well as the overall composition of the Board, and recommend the slate of directors to be nominated for election at the next annual meeting of stockholders. The Nominating and Corporate Governance Committee does not currently employ or pay a fee to any third party to identify or evaluate, or assist in identifying or evaluating, potential director nominees.

If the Board determines to seek additional directors for nomination, the Nominating and Corporate Governance Committee will consider as potential director nominees candidates recommended by various sources, including any member of the Board or senior management. The Nominating and Corporate Governance Committee may also retain a third-party search firm to identify candidates. The committee also considers recommendations for nominees that are timely submitted by stockholders if such recommendations are delivered in the manner prescribed by the

13

advance notice provisions contained in our bylaws. In addition to satisfying the timing, ownership and other requirements specified in our bylaws, a stockholder’s notice must set forth as to each person whom the stockholder proposes to recommend all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, pursuant to Regulation 14A under the Exchange Act and our bylaws (including such person’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected). Properly communicated stockholder recommendations will be considered in the same manner as recommendations received from other sources.

Communications with the Board

Stockholders and other interested parties may communicate with the Chairperson of the Board or with the non-employee directors, as a group, by sending such written communication to our Corporate Secretary at c/o Playtika Ltd., HaChoshlim St 8, Herzliya Pituarch, Israel, Attn: Corporate Secretary.

All appropriate correspondence will be promptly forwarded by the Corporate Secretary to the Chairperson or the relevant directors. The Corporate Secretary may analyze and prepare a response to the information contained in communications received and may deliver a copy of the communication to other Company staff members or agents who are responsible for analyzing or responding to complaints or requests.

14

Director Compensation

The following table sets forth information for the year ended December 31, 2020 regarding the compensation awarded to, earned by or paid to our non-employee directors who served on the Board during 2020. Mr. Antokol, the Chairperson of the Board, who also served as our Chief Executive Officer, during the year ended December 31, 2020, and continues to serve in that capacity, does not receive any additional compensation for his board service and therefore is not included in the Director Compensation table below. All compensation paid to Mr. Antokol is reported below in the “2020 Summary Compensation Table.”

| Name | Fees Earned or Paid in Cash ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||

Marc Beilinson(1) | 100,000 | (2) | — | 100,000 | ||||||||||||||||

| Tian Lin | — | — | — | |||||||||||||||||

Wei Liu(1) | — | — | — | |||||||||||||||||

Bing Yuan(1) | 85,000 | (2) | — | 85,000 | ||||||||||||||||

____________

(1) Messrs. Beilinson and Yuan, and Ms. Liu were appointed to the Board on June 27, 2020.

(2) Amounts reflect fees paid to Messrs. Beilinson and Yuan pursuant to an annual cash retainer of $150,000 for their service on the board and an additional retainer of $50,000 and $20,000 for their service as chair and member of the Audit Committee, respectively. Mr. Lin and Ms. Liu did not receive any cash compensation for their service on the Board in 2020. No non-employee members of the Board held outstanding awards as of December 31, 2020.

Effective as of January 1, 2021, (i) Mr. Beilinson is entitled to an annual cash retainer of $50,000 for his service on the board and an additional retainer of $50,000 and $10,000 for his service as chair and member of the Audit Committee and member of the Nominating and Corporate Governance Committee, respectively and (ii) Mr. Yuan is entitled to an annual cash retainer of $50,000 for his service on the board and an additional retainer of $25,000, $10,000 and $10,000 for his service as member of the Audit Committee, a member of the Nominating and Corporate Governance Committee and a member of the Compensation Committee, respectively. Also, in February 2021, each of Messrs. Beilinson and Yuan were granted 9,259 fully vested RSUs grants under the 2020 Plan.

15

Information about our Executive Officers

The following table sets forth certain information about the executive officers as of April 12, 2021.

| Name | Age | Position(s) | ||||||||||||

| Executive Officers | ||||||||||||||

| Robert Antokol | 53 | Chief Executive Officer and Chairperson of the Board | ||||||||||||

| Craig Abrahams | 44 | President and Chief Financial Officer | ||||||||||||

| Ofer Kinberg | 41 | Executive General Manager, Social Casino Division | ||||||||||||

| Shlomi Aizenberg | 41 | Executive General Manager, Casual Games Division | ||||||||||||

| Michael Cohen | 50 | Executive Vice President, General Counsel and Corporate Secretary | ||||||||||||

| Ira Holtzer | 44 | Chief Technology Officer | ||||||||||||

| Nir Korczak | 41 | Chief Marketing Officer | ||||||||||||

| Yael Yehudai | 41 | Senior Vice President Global Human Resources | ||||||||||||

Robert Antokol co-founded the Playtika business in 2010, with our subsidiary, Playtika Ltd., and has served as its Chief Executive Officer since its founding. Mr. Antokol also served as our Chief Executive Officer since October 2019 and as Chairperson of the Board since June 2020. For Mr. Antokol’s biographical information, see “Board of Directors and Corporate Governance—Director Nominees” above.

Craig Abrahams has served as our President and Chief Financial Officer since October 2019, overseeing our corporate and financial strategy, inorganic growth, and capital markets initiatives. Prior to that, he also served as our President of Global Development from October 2016 to September 2019. While serving in these capacities at our company, Mr. Abrahams has overseen more than ten acquisitions, including the purchase of Buffalo Studios (makers of Bingo Blitz, in 2012), EA Mobile Montreal (makers of World Series of Poker, in 2013) and Pacific Interactive (makers of House of Fun, in 2014). Previously, Mr. Abrahams served as Chief Financial Officer of Caesars Acquisition Company, or CAC, from October 2013 to October 2017. From January 2011 to September 2016, Mr. Abrahams served as Co-founder, President and Chief Financial Officer of CIE, where he helped lead CIE’s purchase of Playtika in 2011. His previous experience includes strategic planning and investment banking roles at The Walt Disney Company and Bear, Stearns & Co. Inc., respectively. He serves on the board of directors and audit committee of Redwood Holdco LLC, an affiliate of Redbox Automated Retail, LLC, a movie and video game rental company, since December 2016, and served on the board of directors of CareerBuilder, LLC, a human capital solutions company and jobs marketplace, from August 2017 to February 2021. Mr. Abrahams holds a bachelor’s degree in finance from Indiana University with High Distinction and an M.B.A. from Harvard Business School with Distinction.

Ofer Kinberg has served as our Executive General Manager, Social Casino Division, overseeing the development of our portfolio of social casino games, since January 2019. Previously, Mr. Kinberg served as our General Manager of Slotomania from January 2015 to January 2019, where he was responsible for managing the strategy, tactics and continued development of Slotomania, our largest game. Previously, Mr. Kinberg served as our Vice President, Marketing and Monetization and Vice President, Customer Relationship Management and Analytics. Prior to joining Playtika, Mr. Kinberg served as the Director of Customer Relationship Management at Neogames, and in the elite Israeli military unit 8200. Mr. Kinberg holds a bachelor of science degree in statistics from Tel Aviv University.

Shlomi Aizenberg has served as our Executive General Manager, Casual Games Division, since January 2019. In that role, Mr. Aizenberg oversees the development of our portfolio of casual games. Previously, Mr. Aizenberg served as the General Manager of the Bingo Blitz business unit from April 2015 to January 2019, managing the strategy, tactics and continued development of the game during a period of rapid growth for the game. Prior to joining Playtika, Mr. Aizenberg served as Vice President of Marketing and SaaS Strategy of easy2comply from January 2011 to November 2011, and Vice President of Marketing at Give2gether.com from July 2010 to January

16

2011, as well as serving in multiple roles, including as Director of Pre-Sales at Serpia from July 2006 to June 2010. Mr. Aizenberg holds a bachelor of science degree in political science and international relations from Interdisciplinary Center Herzliya and an M.B.A. from the College of Management Academic Studies in Rishon LeZion, Israel.

Michael Cohen has served as our Executive Vice President and General Counsel since October 2016 and as our Corporate Secretary since October 2020. Prior to these roles, Mr. Cohen served as Senior Vice President, Corporate Development, General Counsel and Corporate Secretary of CAC from April 2014 to October 2017. Mr. Cohen also served as Senior Vice President, General Counsel and Secretary of CIE until September 30, 2016, a position he held since 2012. Mr. Cohen joined Caesars Entertainment Corporation (“CEC”) in February 2006 as Vice President and Corporate Secretary, a position he held until November 2011. He served as Senior Vice President, Deputy General Counsel and Corporate Secretary of CEC from November 2011 until April 2014. Mr. Cohen previously worked at Latham & Watkins LLP in Costa Mesa, California and holds a bachelor of business administration degree from the University of Wisconsin-Madison and a Juris Doctor from Northwestern University School of Law.

Ira Holtzer has served as our Chief Technology Officer since 2010. He is responsible for our company-wide technical strategy and vision. Prior to joining Playtika, Mr. Holtzer was Chief Technology Officer at UMOO, a virtual online trading platform for financial entertainment from 2007 to 2010, and System Architect at 888 Holdings PLC, an online gaming operator from 2000 to 2007. Mr. Holtzer holds a bachelor of science degree in computer sciences from the Interdisciplinary Center Herzliya.

Nir Korczak has served as our Chief Marketing Officer since March 2017, overseeing the establishment of our centralized marketing function. He is responsible for developing and executing our comprehensive marketing plan, including strategy, recruitment and processes to facilitate our growth and increase our revenues. Previously, Mr. Korczak served as Chief Executive Officer of Aditor LTD, a mobile advertising company that we acquired in March 2017, from 2015 to March 2017, where he managed and oversaw the development of Aditor’s innovative advertising solutions and technologies. Prior to serving as Chief Executive Officer of Aditor, Mr. Korczak has also served as Head of Exports Sectors at Google Israel from 2006 to 2015. Mr. Korczak holds a bachelor of science degree in industrial engineering management and information systems from Ben Gurion University and an M.B.A. from Tel Aviv University.

Yael Yehudai has served as our Senior Vice President Global Human Resources, since January 2019. She is responsible for developing and overseeing our worldwide human resources policies, procedures and practices. Previously, she served as our Head of Human Resources from March 2018 to January 2019 and as Human Resources Director from October 2015 to March 2018, in which roles she helped us through our rapid expansion of operations into multiple counties. Prior to joining Playtika, Ms. Yehudai was Head of Human Resources at Cosmec Ltd., a cybersecurity firm, from 2010 until October 2015. Ms. Yehudai received a bachelor of science degree in economics and management from Hebrew University and a M.A. from Hebrew University. She also attended the Workplace Development and Talent Management program at Harvard University and the Instructional Design program at Suffolk University.

17

Executive Compensation

Compensation Discussion and Analysis

This compensation discussion and analysis provides information about the material components of our executive compensation program for 2020 for our “named executive officers.” For 2020, our named executive officers are:

• Robert Antokol, Chairperson of the Board and Chief Executive Officer;

• Craig Abrahams, President and Chief Financial Officer;

• Ofer Kinberg, Executive General Manager, Social Casino Division;

• Shlomi Aizenberg, Executive General Manager, Casual Games Division; and

• Michael Cohen, Executive Vice President, General Counsel and Corporate Secretary.

Executive Compensation Philosophy and Objectives

We believe that for us to be successful we must hire and retain people who can continue to develop our strategy and innovate our products and services. To achieve these objectives, our executive compensation program has been designed to motivate, reward, attract and retain high caliber management and seeks to align compensation with our short- and long-term business objectives, business strategy and financial performance.

Our compensation programs for our named executive officers are built to support the following objectives:

•attract top talent in our leadership positions and motivate our executives to deliver the highest level of individual and team impact and results;

•ensure each one of our named executive officers receives a total compensation package that encourages the executive’s long-term retention;

•reward high levels of performance with commensurate levels of compensation; and

•align the interests of our executives with those of our stockholders by emphasizing long-term incentives.

Determination of Compensation

Role of the Board. The Board is responsible for overseeing all aspects of our executive compensation programs, including executive salaries, annual and long-term incentives and any executive perquisites for our named executive officers. The Board considers such factors as it determines are appropriate in setting executive compensation, including the recommendations of our Chief Executive Officer (other than with respect to himself), current and past total compensation, company performance and each executive’s impact on performance, each executive’s relative scope of responsibility and potential, each executive’s individual performance and demonstrated leadership and internal equity pay considerations.

Role of Compensation Consultant. The Board has the authority to engage its own advisors to assist in carrying out its responsibilities. To date, we have not engaged the services of any outside compensation advisor for purposes of setting executive or director compensation.

Role of Management. In setting compensation for 2020, our Chief Executive Officer worked closely with the Board in managing our executive compensation program. Our Chief Executive Officer made recommendations to the Board regarding compensation for our executive officers other than himself because of his daily involvement with

18

our executive team. No executive officer participated directly in the final deliberations or determinations regarding his or her own compensation package.

Elements of Our Executive Compensation Program

The primary elements of our named executive officers’ compensation and the main objectives of each are:

•Base Salary: Base salary attracts and retains talented executives, recognizes individual roles and responsibilities and provides stable income;

•Annual Bonus Plan: Annual performance bonuses help to incentivize executives to work towards key corporate performance objectives on an annual basis;

•Equity-Based Long-Term Incentive Compensation: Equity compensation, provided in the form of stock options and restricted stock units, aligns executives’ interests with our stockholders’ interests, emphasizes long-term financial performance and helps retain executive talent;

•Retention Plan Awards:

◦Appreciation Unit Awards. Annual performance-based payments promote the achievement of key financial performance objectives and reward executives for their contributions toward achieving those objectives;

◦Retention Awards: Retention awards provide for annual payments and help retain executive talent; and

•Other Benefits and Perquisites: Our named executive officers are eligible to participate in our health and welfare programs and our retirement programs. Our Israel-based named executive officers also receive other customary or mandatory social benefits in Israel on the same basis as our other full-time Israel-based employees. We also provide certain perquisites, which aid in attracting and retaining executive talent.

Each of these elements of compensation is described further below.

Base Salaries

Base salary is a stable fixed component of our compensation program. Our executive compensation program emphasizes performance-based and retention-based compensation over fixed compensation, and our executive base salaries are set at levels intended to provide a reasonable baseline level of compensation that is relatively low compared to comparable companies. On a prospective basis, we intend to continue to evaluate the mix of base salary, short-term incentive compensation and long-term incentive compensation to appropriately align the interests of our named executive officers with those of our stockholders. Our named executive officers did not receive base salary increases during 2020. Our named executive officers’ base salaries for the fiscal year ended December 31, 2020 are reflected in the “2020 Summary Compensation Table” below.

Annual Bonus Plan

We adopted a bonus plan for 2020 pursuant to which annual bonuses will be paid to our executive officers, other than our Chief Executive Officer, based on a pool that is established by the Board upon consideration of “Bonus Plan Adjusted EBITDA” for 2020. The annual bonus pool is determined by the Board based on its consideration of our results for the applicable year, which bonus pool is then allocated by our Chief Executive Officer in his discretion. The Board determines the bonus for our Chief Executive Officer separately based on its evaluation of overall company and individual performance, which determination is separate from the bonus pool calculations for other employees.

19

“Bonus Plan Adjusted EBITDA,” as used herein, is a non-GAAP financial measure which means the Adjusted EBITDA of our company and its subsidiaries for the applicable calendar year, increased by the payments in respect of awards under the Playtika Holding Corp. Retention Plan for the applicable year, the amount of retention awards to key individuals associated with acquired companies and certain other adjustments.

The Board established threshold, target and maximum achievement levels relative to Bonus Plan Adjusted EBITDA for 2020, which will result in an annual bonus pool to be allocated to management employees, including the executive officers, by our Chief Executive Officer. Our “target” 2020 Bonus Plan Adjusted EBITDA was $721,200,000, which would equate to a bonus pool equal to 6.5% of 2020 Bonus Plan Adjusted EBITDA. Our “threshold” 2020 Bonus Plan Adjusted EBITDA was set at 85% of “target,” which would result in a total bonus pool equal to 5% of 2020 Bonus Plan Adjusted EBITDA. Our “maximum” 2020 Bonus Plan Adjusted EBITDA objective was set at 125% of target, which would result in a total bonus pool equal to 9% of 2020 Bonus Plan Adjusted EBITDA.

Our 2020 Bonus Plan Adjusted EBITDA for 2020 was $941.6 million, which resulted in an annual bonus pool equal to $85 million. The Board elected to reduce the annual bonus pool to $54 million and award Mr. Antokol a $6 million discretionary bonus. Accordingly, in February 2021, our Chief Executive Officer approved the following 2020 bonuses to our named executive officers: Mr. Abrahams, $319,000; Mr. Kinberg, $729,500; Mr. Aizenberg, $729,500 and Mr. Cohen, $385,000. Additionally, in February 2021, our Board approved an annual bonus payment for Mr. Antokol of $6,000,000 based on its evaluation of overall company performance and Mr. Antokol’s individual performance, in each case, for 2020.

We have adopted a bonus plan for 2021 pursuant to which annual bonuses to our employees, including our named executive officers other than our Chief Executive Officer, will be paid as determined by our Chief Executive Officer from a bonus pool determined by the Board.

Retention Plans

Playtika Holding Corp. 2017-2020 Retention Plan

We maintained the Playtika Holding Corp. Amended and Restated Retention Plan (the “2017-2020 Retention Plan”), to provide certain key employees and consultants of the company and its subsidiaries the right to receive annual cash retention awards and awards providing an opportunity to participate in the appreciation of the company’s value and in order to retain these key employees and consultants and reward them for contributing to the success of the company and its subsidiaries. The 2017-2020 Retention Plan was in effect for calendar years 2017 through 2020, and the final performance period ended on December 31, 2020. The 2017-2020 Retention Plan was administered by our Chief Executive Officer, who generally had the authority to approve awards under the plan and generally administer the plan. Initial awards were granted under the 2017-2020 Retention Plan in December 2016, with subsequent awards to employees or consultants hired or retained after such date granted at the discretion of the administrator.

•Appreciation Unit Awards. Participants in the 2017-2020 Retention Plan were granted a number of notional interests, or “Appreciation Units,” representing a right to receive payment of a proportionate interest of the appreciation pool for each calendar year during the term of the plan. Appreciation Units vested on December 31 of each calendar year during the term of the plan for the applicable one-year performance periods, subject to the participant’s continued service through such vesting date. Upon vesting, a participant received a cash payment in respect of his or her proportionate share of the annual appreciation pool (based on the total number of Appreciation Units outstanding and eligible for payment as of such date), which payment was made no later than March 15 following the applicable vesting date. For certain participants, including the named executive officers, 50% of the estimated annual payment was paid to the participant in July of each calendar year based on the estimated total annual appreciation pool for such year, with the remaining portion of the payment due to the participant in respect of his Appreciation Units for the calendar year paid following the end of the year as described above. The 2017-2020 Retention Plan provided that a

20

maximum of 200,000 Appreciation Units may be awarded, of which no more than 50% may be awarded to the Chief Executive Officer.

For 2020, the appreciation pool under the 2017-2020 Retention Plan was equal to 1.5% multiplied by the amount by which (1) 12.0x our Adjusted EBITDA for such calendar year, exceeded (2) $4,400,000,000. Adjusted EBITDA for purposes of the 2017-2020 Retention Plan, or “2017-2020 Retention Plan Adjusted EBITDA” means the Adjusted EBITDA of our company and its subsidiaries for the applicable calendar year, increased by the payments in respect of awards under the 2017-2020 Retention Plan for the applicable year, the amount of retention awards to key individuals associated with acquired companies and certain other adjustments.

In the event a change in control occurred prior to December 31, 2020, subject to a participant’s continued service on the date of such change in control (except as described below), a participant would have received a cash payment in respect of his or her proportionate share of the change in control appreciation pool (as described below) (based on the number of Appreciation Units outstanding and eligible for payment in respect of such change in control), which amount would have been paid in cash within 30 days of the closing of the change in control. The change in control appreciation pool would have generally been equal to 1.5% multiplied by the amount by which (1) the transaction valuation of the company (taking into account all transaction costs) exceeded (2) $4,400,000,000. However, in the event of any other transaction that constituted a change in control but involved an entity that controls, directly or indirectly, the company, the change in control appreciation pool would have been equal to 1.5% multiplied by the amount by which (1) 12.0x the company’s 2017-2020 Retention Plan Adjusted EBITDA for the trailing 12 month period ended on the last day of the calendar month preceding the calendar month in which the change in control occurred, calculated in a manner consistent with past practice, exceeded (2) $4,400,000,000.

Our 2017-2020 Retention Plan Adjusted EBITDA for 2020 was $941.6 million which resulted in a total appreciation pool for 2020 of $103.5 million.

•Retention Awards. Retention Awards were provided to eligible employees and consultants as an incentive to remain in service with the company during the four-year term of the 2017-2020 Retention Plan. Each participant may have been awarded a number of notional interests, each, a Retention Unit, with each Retention Unit representing a right to receive payment of his or her proportionate interest of the annual retention pool for each such calendar year. The sum of the retention pools for the term of the 2017-2020 Retention Plan was $100,000,000, although each annual retention pool was determined by the Chief Executive Officer. The retention pool for 2020 was $25,000,000. The 2017-2020 Retention Plan provided that a maximum of 100,000 Retention Units could have been awarded, of which no more than 50% may have been awarded to the Chief Executive Officer.

Retention Units vested on December 31 of each calendar year during the term of the plan, subject to a participant’s continued service through such vesting date. Upon vesting, a participant received a cash payment in respect of his or her proportionate share of the annual retention pool (based on the number of Retention Units outstanding and eligible for payment as of such date), which payment was made no later than the last day of the calendar month following the applicable vesting date. For certain participants, including the named executive officers, 50% of the estimated annual payment was paid to the participant in July of each calendar year based on the annual retention pool, with the remaining portion of the payment due to a participant in respect of his Retention Units for the calendar year paid following the end of the year as described above.

In the event a change in control occurred prior to December 31, 2020, subject to a participant’s continued service on the date of such change in control (except as described below), a participant would have received a payment in respect of his or her proportionate share of the unpaid portion of the total retention pool for the remaining term of the 2017-2020 Retention Plan as of the date of such change in control (less any deductions for prior payouts to terminated participants) (based on the number of Retention Units

21

outstanding and eligible for payment as of such date), which amount would have been paid in cash within 30 days of the closing of such change in control.

•Effect of Termination of Service. For certain participants, including the named executive officers, in the event of a participant’s termination without cause or resignation for good reason, or termination by reason of death or disability (each, as defined in the 2017-2020 Retention Plan), he or she would have been eligible to receive a lump sum cash payment equal to 50% of his proportionate share of the unpaid portion of the total retention pool for the remaining term of the 2017-2020 Retention Plan as of the date of termination (based on the number of Retention Units outstanding and eligible for payment as of such date), which amount would have been paid in cash within 60 days following the date of termination. In the event of such a termination, such participant would also have remained eligible to receive payments in respect of 50% of his or her Appreciation Units for all vesting dates that had not yet occurred prior to the date of such termination, which payments would have been made as and when such payments are made to other Appreciation Unit holders.