Form DEF 14A PNM RESOURCES INC For: Dec 31

| UNITED STATES | ||||||||||||||

| SECURITIES AND EXCHANGE COMMISSION | ||||||||||||||

| Washington, D.C. 20549 | ||||||||||||||

| SCHEDULE 14A | ||||||||||||||

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) | ||||||||||||||

Filed by the Registrant x | ||||||||||||||

Filed by a Party other than the Registrant o | ||||||||||||||

| Check the appropriate box: | ||||||||||||||

| o | Preliminary Proxy Statement | |||||||||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||||

| ý | Definitive Proxy Statement | |||||||||||||

| o | Definitive Additional Materials | |||||||||||||

| o | Soliciting Material Pursuant to §240.14a-12 | |||||||||||||

| PNM Resources, Inc. | ||||||||||||||

| (Name of Registrant as Specified In Its Charter) | ||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||||||||

| ý | No fee required. | |||||||||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| (5) | Total fee paid: | |||||||||||||

| o | Fee paid previously with preliminary materials. | |||||||||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| (1) | Amount Previously Paid: | |||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| (3) | Filing Party: | |||||||||||||

| (4) | Date Filed: | |||||||||||||

| PNM Resources, Inc. 414 Silver Ave. SW Albuquerque, NM 87102-3289 www.pnmresources.com | ||||

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders: The 2021 Annual Meeting of shareholders of PNM Resources, Inc. will be held as follows:

| DATE AND TIME: | Tuesday, May 11, 2021, at 9:00 a.m. Mountain Daylight Time | ||||

| PLACE: | Due to the public health impact of the ongoing coronavirus (COVID-19) pandemic and in accordance with Executive Order 2021-008 issued by the Governor of the State of New Mexico and to support the health and well-being of our shareholders, the Annual Meeting will be held only through a remote communication in a virtual meeting format and will not be held at a physical location. Therefore, you will not be able to attend the Annual Meeting in-person. To be admitted electronically to the annual meeting, you must go to the meeting website at www.virtualshareholdermeeting.com/PNM2021AM and enter the 16-digit control number found on your proxy card or your voting instruction form. We encourage you to access the annual meeting prior to its start time. | ||||

WHO CAN VOTE: | You may vote if you were a shareholder of record as of the close of business on March 22, 2021. | ||||

| ITEMS OF BUSINESS: | (1) Elect as directors the nine director nominees named in the proxy statement. (2) Ratify appointment of KPMG LLP as our independent registered public accounting firm for 2021. (3) Approve, on an advisory basis, the compensation of our named executive officers. (4) Consider one shareholder proposal described in the accompanying proxy statement, if presented. (5) Consider any other business properly presented at the meeting. | ||||

| VOTING: | On March 30, 2021, we began mailing to our shareholders either (1) a Notice of Internet Availability of Proxy Materials, which indicates how to access our proxy materials on the Internet or (2) a printed copy of our proxy materials. After reading the proxy statement, please promptly vote by telephone or internet or by signing and returning the proxy card so that we can be assured of having a quorum present at the meeting and your shares may be voted in accordance with your wishes. See the questions and answers beginning on page 74 of our proxy statement about the meeting (including how to participate in the meeting by webcast as described in Question 6, voting your shares, how to revoke a proxy, and how to vote shares via the internet. | ||||

| By Order of the Board of Directors Patricia K. Collawn Chairman, President and Chief Executive Officer | |||||

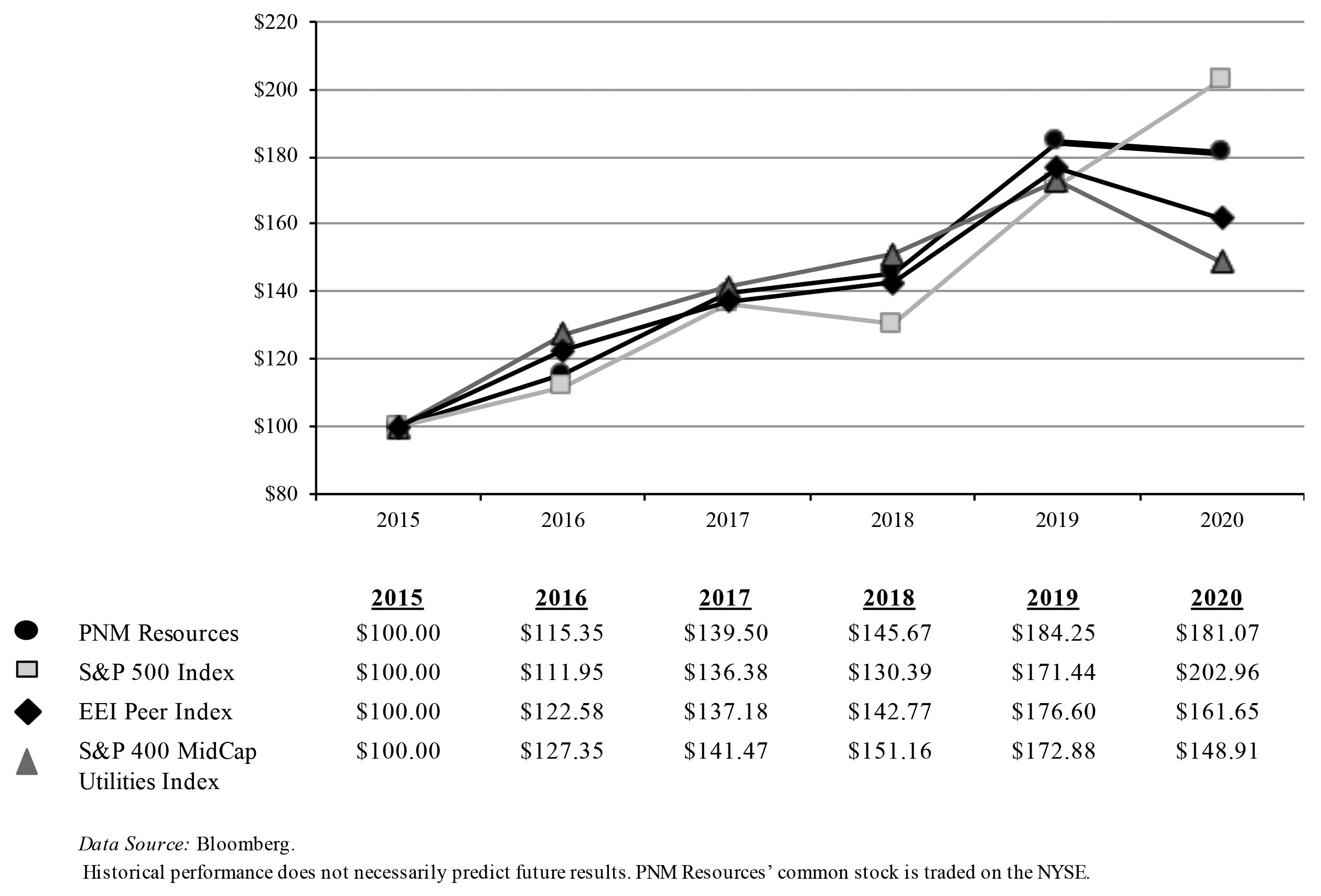

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 11, 2021: This Notice of Annual Meeting; our 2021 proxy statement; our 2020 Annual Report on Form 10-K; a shareholder letter from Patricia K. Collawn, our Chairman, President and CEO; and stock performance graph are available at www.proxyvote.com and www.pnmresources.com/asm/annual-proxy.cfm. You are receiving these proxy materials in connection with the solicitation by the Board of Directors of PNM Resources, Inc. of proxies to be voted on at PNM Resources’ 2021 Annual Meeting of Shareholders. Please vote on the proposals described in this proxy statement. Thank you for investing in PNM Resources, Inc. | |||||

TABLE OF CONTENTS

| ii | |||||

| 1 | |||||

| 7 | |||||

| 13 | |||||

| 17 | |||||

| 19 | |||||

| 21 | |||||

| 21 | |||||

| 22 | |||||

| 31 | |||||

| 32 | |||||

| 32 | |||||

| 34 | |||||

| 35 | |||||

| 36 | |||||

| 36 | |||||

| 36 | |||||

| 39 | |||||

| 41 | |||||

| 47 | |||||

| 48 | |||||

| 49 | |||||

| 51 | |||||

| 52 | |||||

| 70 | |||||

| 71 | |||||

| 74 | |||||

| A-1 | |||||

i

GLOSSARY OF TERMS USED IN THIS PROXY

| AIP or Annual Incentive Plan | PNM Resources, Inc. Officer Annual Incentive Plan, our annual cash incentive plan for Officers. Each AIP details measurements and metrics for a specific calendar year | ||||

| Annual Meeting | Annual Meeting of PNM Resources, Inc. shareholders, to be held on May 11, 2021 | ||||

| Audit Committee | Audit and Ethics Committee of the Board | ||||

| Avangrid | Avangrid, Inc., a New York corporation | ||||

| Board | Board of Directors of PNM Resources, Inc. | ||||

| CD&A | Compensation Discussion and Analysis beginning on page 36 | ||||

| CEO | Chief Executive Officer | ||||

| CFO | Chief Financial Officer | ||||

| Climate Change Report | A report available on our website (at www.pnmresources.com/esg-commitment/environment/climate-change-report.aspx) under the caption “Climate Change Report” describing the significant efforts we have made and are making to reduce our GHG emissions and for PNM to transition to a carbon-free generation portfolio | ||||

| Company, PNMR or PNM Resources | PNM Resources, Inc. | ||||

CO2 | Carbon Dioxide | ||||

| Compensation and HR Committee | Compensation and Human Resources Committee of the Board | ||||

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act | ||||

| Earnings Growth | Non-GAAP adjusted diluted earnings per share performance measure calculated for purposes of determining certain long-term awards under the outstanding LTIPs. Earnings Growth is calculated by measuring the growth rate in the Company’s adjusted annual diluted earnings per share during the performance period. Each of the applicable LTIPs sets forth (i) a definition of the adjusted diluted earnings per share performance measure used thereunder (which definitions are generally similar, but not identical, to the Incentive EPS performance measure used for purposes of determining awards under the AIP), and (ii) a detailed formula for calculating Earnings Growth thereunder. Earnings Growth levels are not necessarily identical to any earnings outlook or guidance that may be announced by the Company and are designed to ensure that award payments are not artificially inflated or deflated | ||||

| ECP | PNM Resources, Inc. Executive Choice Account Plan, formerly known as the PNM Resources, Inc. Executive Spending Account Plan, which allows Officers to receive reimbursement for income tax preparation, financial management and counseling services, estate planning, premiums for life and other insurance, and travel expenses related to medical or financial planning services | ||||

| EEI | Edison Electric Institute | ||||

| EPA | United States Environmental Protection Agency | ||||

| EPRI | Electric Power Research Institute, Inc. | ||||

| ERP | PNM Resources, Inc. Employees’ Retirement Plan | ||||

| ESG Commitment | A component to the PNM Resources, Inc. website that contains our commitment concerning environmental (including climate change), social, governance, and sustainability reporting as well as our disclosures relating thereto, which are available at www.pnmresources.com/esg-commitment.aspx | ||||

| ESP II | PNM Resources, Inc. Executive Savings Plan II, a non-qualified deferred compensation plan for Officers | ||||

| EVP | Executive Vice President | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| FASB ASC Topic 718 | Financial Accounting Standards Board Accounting Standards Codification Topic 718 (Compensation - Stock Compensation) | ||||

ii

| FFO/Debt Ratio | Non-GAAP performance measure calculated for the purpose of determining certain long-term equity awards, as described in the CD&A. For the 2018 LTIP, as amended, equals PNMR's funds from operations for the fiscal year ending December 31, 2020, divided by PNMR's total debt outstanding (including any long-term leases and unfunded pension plan obligations) as of December 31, 2020. Funds from operations are equal to the amount of PNMR's net cash flow from operating activities (as reflected on the Consolidated Statement of Cash Flows) as reported in the Company's Form 10-K for PNMR adjusted by the following items: (1) including amounts attributable to principal payments on imputed debt from long-term leases, (2) excluding changes in PNMR's working capital, including bad debt expense, (3) excluding the impacts of any consolidation required by the variable interest entities accounting rules and regulations, (4) subtracting the amount of capitalized interest, (5) excluding any contributions to the PNMR or TNMP qualified pension plans, and (6) excluding the impacts of acquisition activities. The calculation is intended to be consistent with Moody's calculation of FFO/Debt (which Moody's refers to as "CFO Pre-WC/Debt") and if Moody’s modifies its calculation methodology prior to December 31, 2020 and communicates such changes in writing to Company representatives or the general public prior to December 31, 2020, said changes in Moody’s methodology in effect as of December 31, 2020 will be incorporated into the calculation outlined above. For the 2020 LTIP, as amended, equals PNMR’s funds from operations for the fiscal year ending December 31, 2022, divided by PNMR’s total debt outstanding (including any long-term leases and unfunded pension plan obligations; excluding any outstanding debt associated with securitization) as of December 31, 2022. Funds from operations are equal to the amount of PNMR’s net cash flow from operating activities (as reflected on the Consolidated Statement of Cash Flows) as reported in the Company’s Form 10-K for PNMR adjusted by the following items: (1) including amounts attributable to principal payments on imputed debt from long-term leases, (2) excluding changes in PNMR’s working capital, including bad debt expense, (3) excluding the impacts of any consolidation required by the variable interest entities accounting rules and regulations, (4) subtracting the amount of capitalized interest, (5) excluding impacts on material changes to the federal and state tax rate, (6) excluding any contributions to the PNMR or TNMP qualified pension plans, (7) excluding cash invested in cloud computing projects that are treated as operating cash flows, (8) excluding impacts of securitization, and (9) excluding impacts of acquisition activities. The calculation is intended to be consistent with the Moody’s calculation of FFO/Debt (which Moody’s refers to as “CFO Pre-WC/Debt”) and includes any other adjustments to be consistent with Moody’s methodology as of February 21, 2020. The FFO/Debt Ratio levels are not necessarily identical to any earnings outlook or guidance that may be announced by the Company and are designed to ensure that award payments are not artificially inflated or deflated | ||||

| Finance Committee | Finance Committee of the Board | ||||

| FCPP or Four Corners coal plant | Four Corners Power Plant | ||||

| GAAP | Generally Accepted Accounting Principles | ||||

| GHG | Greenhouse Gas | ||||

| GPBA Table | Grants of Plan Based Awards Table beginning on page 57 | ||||

| Incentive EPS | Non-GAAP adjusted diluted earnings per share performance measure calculated for the purpose of determining awards under the AIP in accordance with the AIP for the applicable year. Incentive EPS is corporate diluted earnings per share, excluding certain terms that do not factor into ongoing earnings. Incentive EPS levels are not necessarily identical to any earnings outlook or guidance that may be announced by the Company and are designed to ensure that award payments are not artificially inflated or deflated. For 2020, Incentive EPS of $2.28 equals net earnings attributable to PNMR per common stock share (as reflected on the Consolidated Statement of Earnings) of $2.15 adjusted to exclude: (1) $(0.13) per share attributable to the net change in unrealized gains and losses on investment securities; (2) $0.03 per share attributable to regulatory disallowances and restructuring costs; (3) $0.04 per share attributable to pension expense related to previously disposed of gas distribution business; and (4) $0.19 per share attributable to merger related costs | ||||

| KPMG | KPMG LLP, the independent registered public accounting firm | ||||

iii

| LTIP or Long-Term Incentive Plan | PNM Resources, Inc. Long-Term Incentive Plan, the long-term equity incentive plan for our executives, adopted yearly to set forth three-year performance measurements and metrics for specific plan years within the scope of the governing PEP | ||||

Merger Agreement | Agreement and Plan of Merger, dated as of October 20, 2020, by and among Avangrid, Merger Sub and PNMR, pursuant to which Merger Sub will merger with and into PNMR, with PNMR surviving as a wholly-owned subsidiary of Avangrid | ||||

| Merger Sub | NM Green Holdings, Inc., a New Mexico corporation and wholly-owned subsidiary of Avangrid | ||||

| Moody’s | Moody’s Investors Service, Inc. | ||||

| NEO(s) or named executive officer(s) | Named Executive Officers of PNM Resources, Inc. consisting of (a) each individual who served as our CEO or CFO at any time during the previous fiscal year, (b) our three most highly compensated executive officers (other than our CEO and CFO) who were serving as executive officers as of the end of the previous fiscal year, and (c) up to two additional individuals for whom disclosure would be provided but for the fact they were not serving as an executive officer as of the end of the previous fiscal year | ||||

| NMPRC | New Mexico Public Regulation Commission | ||||

| Nominating Committee | Nominating and Governance Committee of the Board | ||||

| Notice | Notice of Internet Availability of Proxy Materials | ||||

| NYSE | New York Stock Exchange | ||||

| Officer(s) | PNM Resources, Inc. Officer(s) | ||||

| OSHA | Occupational Safety and Health Administration | ||||

| Pay Governance | Pay Governance LLC, the independent compensation consultant currently retained by the Compensation and HR Committee and the Nominating Committee | ||||

| PEP | A general reference to the applicable form of the Company’s performance equity plan, which covers incentive compensation awards to certain employees and non-employee directors | ||||

| PNM | Public Service Company of New Mexico, a regulated electric utility operating in New Mexico, and a subsidiary of PNM Resources, Inc. | ||||

| PNM Resources, PNMR or Company | PNM Resources, Inc., which trades on the NYSE under the symbol “PNM” | ||||

| PNMR Peer Group | Utility and energy companies comprising the PNMR director and executive compensation peer group listed on page 48 | ||||

| PS or PS awards | Performance share award | ||||

| Retention Plan | PNM Resources, Inc. Officer Retention Plan | ||||

| RSA | Time-vested restricted stock right award | ||||

| RSP | PNM Resources, Inc. Retirement Savings Plan, a 401(k) plan | ||||

| S&P | Standard & Poor’s Financial Services LLC | ||||

| SAIDI | System Average Interruption Duration Index. A reliability indicator that measures average outage duration in units of time | ||||

| SAR | Stock Appreciation Right | ||||

| Say-on-Pay | PNM Resources shareholders’ advisory vote on executive compensation | ||||

| SCT | Summary Compensation Table beginning on page 52 | ||||

| SEC | United States Securities and Exchange Commission | ||||

| Severance Plan | PNM Resources, Inc. Non-Union Severance Pay Plan | ||||

| SJGS or San Juan coal plant | San Juan Generating Station | ||||

| Sustainability Report | A report prepared annually that contains sustainability disclosures related to our environmental (including climate change), social and governance principles available at www.pnmresources.com/esg-commitment/esg-reporting-and-disclosures/esg-reporting-library.aspx | ||||

| SVP | Senior Vice President | ||||

| Tax Code | Internal Revenue Code of 1986, as amended | ||||

iv

| TCC or Total Cash Compensation | Total cash compensation, which consists of base salary and short-term cash incentives | ||||

| TCJA | Tax Cuts and Jobs Act of 2017 | ||||

| TDC or Total Direct Compensation | Total direct compensation, which consists of base salary, short-term cash incentives, and long-term incentives (equity grants, performance-based grants) | ||||

| TNMP | Texas-New Mexico Power Company, a regulated electric distribution and transmission utility operating in Texas and an indirect subsidiary of PNMR | ||||

| TSR or Total Shareholder Return | A comparison over a specified period of time of share price change and dividends paid to show the total return to the shareholder during such time period. TSR = (Priceend – Pricebegin + Dividends) / Pricebegin | ||||

| Willis Towers Watson | Willis Towers Watson Public Limited Company | ||||

| 2020 Benchmark Data | The compensation data from companies included in (i) the PNMR Peer Group and (ii) the Willis Towers Watson 2019 Executive CDB General Industry Survey Report - U.S. of general industry companies with data regressed to companies similarly sized to PNMR, weighted respectively at 75% and 25%, to derive weighted market compensation statistics. The two compensation databases provide information on TCC, the reported accounting value of long-term incentives and TDC. The companies in the 2020 Benchmark Data for the 2019 Willis Towers Watson U.S. CDB General Industry Executive Database are listed in Appendix A | ||||

| 2021 Benchmark Data | The compensation data from companies included in (i) the PNMR Peer Group and (ii) the Willis Towers Watson 2020 Executive CDB General Industry Survey Report - U.S. of general industry companies with data regressed to companies similarly sized to PNMR, weighted respectively at 75% and 25%, to derive weighted market compensation statistics. The two compensation databases provide information on TCC, the reported accounting value of long-term incentives and TDC. The companies in the 2021 Benchmark Data for the Willis Towers Watson 2020 Executive CDB General Industry Survey Report - U.S. will be listed in an appendix in the 2022 proxy statement | ||||

v

PROXY SUMMARY

We are an investor-owned energy holding company with two regulated utilities, PNM and TNMP, providing electricity and electric services in New Mexico and Texas. To assist you in reviewing the proposals to be acted upon at our Annual Meeting, we call your attention to the following information, which is only a summary. For more complete information about our corporate governance, the experience and composition of our Board and key executive compensation actions and decisions, please review this entire proxy statement. For more complete information about our financial and operational results, strategic direction and our environmental stewardship, community activities, and social initiatives, please review our 2020 Annual Report on Form 10-K (available on our website at www.pnmresources.com/investors/financial-information/sec-filings.aspx) and our Sustainability Report (available on our website at www.pnmresources.com/esg-commitment/esg-reporting-and-disclosures/esg-reporting-library.aspx). For a list of terms defined and used in this proxy statement, see the Glossary beginning on page ii. Information contained on www.pnmresources.com, www.pnm.com, or any third-party websites referenced in this proxy statement is not incorporated by reference or otherwise deemed to be part of this proxy statement. On March 30, 2021, we began mailing to our shareholders either the Notice of Internet Availability of Proxy Materials or a printed copy of our proxy materials.

Strategic Combination with Avangrid

On October 20, 2020, we entered into the Merger Agreement with Avangrid and Merger Sub, pursuant to which Merger Sub will merge with and into the Company, with the Company surviving as a wholly-owned subsidiary of Avangrid (the "Merger"). At a special meeting of shareholders held on February 12, 2021, our shareholders overwhelmingly approved the Merger Agreement. No further action by our shareholders is required with respect to the Merger Agreement. Accordingly, no action will be taken at this Annual Meeting with respect to, and no proxy is being solicited by this Proxy Statement in connection with, the Merger Agreement or any matters related thereto. This Proxy Summary, as well as certain compensation disclosures included in this Proxy Statement, are presented without regard to the terms of the proposed Merger.

Consummation of the Merger is subject to the satisfaction or waiver of certain customary closing conditions, including, without limitation, the absence of any material adverse effect on PNMR, the receipt of required regulatory approvals, the agreements relating to the divestiture of Four Corners being in full force and effect and all applicable regulatory filings associated therewith being made. The Merger is currently expected to close in the second half of 2021. Until the Merger closes, we remain a separate and independent company, focused on delivering our operational plan and business objectives. The foregoing description of the Merger Agreement is qualified in its entirety by reference to the full text of the Merger Agreement, which has been filed as Exhibit 2.1 to the Current Report on Form 8-K that we filed with the SEC on October 21, 2020. For more information regarding the Merger Agreement and the Merger, including the interests of certain persons under the proposed Merger, please see our Definitive Proxy Statement on DEFM14A filed with the SEC on January 5, 2021.

1

Annual Meeting of Shareholders

| Date and Time: | May 11, 2021, 9:00 a.m. Mountain Daylight Time | ||||

| Place: | Due to the public health impact of the ongoing coronavirus (COVID-19) pandemic and in accordance with Executive Order 2021-008 issued by the Governor of the State of New Mexico and to support the health and well-being of our shareholders, the Annual Meeting will be held only through a remote communication in a virtual meeting format and will not be held at a physical location. Therefore, you will not be able to attend the annual meeting in-person. To be admitted electronically to the Annual Meeting, you must go to the meeting website at www.virtualshareholdermeeting.com/PNM2021AM and enter the 16-digit control number found on your proxy card or your voting instruction form. We encourage you to access the annual meeting prior to its start time. | ||||

| Record Date: | March 22, 2021 | ||||

| How to Vote: | Shareholders as of the record date may vote as follows: | ||||

| By Internet: | Access www.pnmresources.com and follow the instructions. (You will need the control number on your Notice or on the requested paper proxy card to vote your shares.) | ||||

| By Telephone: | For automated telephone voting, call 1-800-690-6903 (toll free) from any touch-tone telephone and follow the instructions. (You will need the control number on your Notice or the requested paper proxy card to vote your shares.) | ||||

| By Mail: | If you received a full paper set of materials, date and sign your proxy card exactly as your name appears on your proxy card and mail it in the enclosed, postage-paid envelope. Otherwise, request delivery of the proxy statement and proxy card by following the instructions in your Notice. You do not need to mail the proxy card if you are voting by telephone or internet. | ||||

| During the Meeting: | If you are a registered shareholder, you will have the opportunity to vote your shares during the Annual Meeting by following the instructions available on the meeting website during the meeting. If you are a beneficial owner and your shares are held in “street name”, and you wish to participate electronically in the Annual Meeting, and vote via the internet, you must follow the instructions provided by your bank, broker or other nominee. | ||||

Your shares will be voted in the manner you indicate. The telephone and internet voting systems are available 24 hours a day. They will close at 11:59 p.m. Eastern Daylight Time on May 10, 2021. Please note that the voting deadline is earlier for voting shares held in our RSP, as described on page 78 under Question 17 (and that shares held in our RSP may not be voted during the Annual Meeting).

2

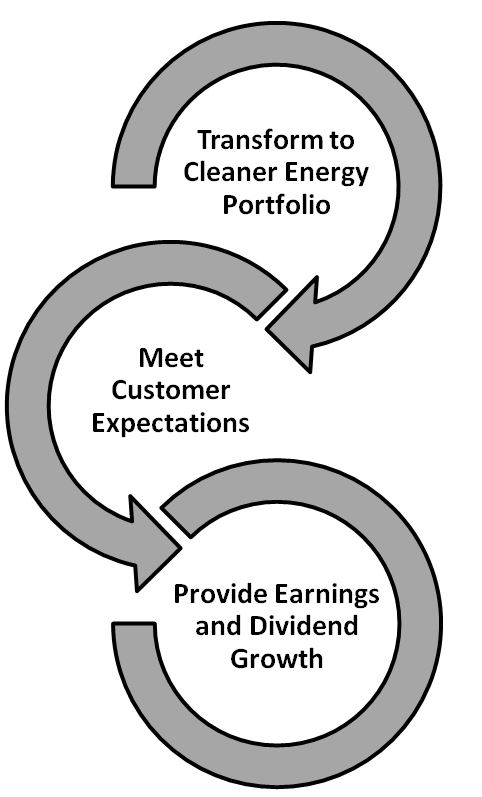

Our vision and values guide us in the pursuit of strategic and financial objectives. Success is demonstrated in achievements providing value to employees, customers, communities and shareholders.

Vision: Create a clean and bright energy future Values: Safety for ourselves, our co-workers, our customers and communities Caring about the welfare of others is a company tradition. It fosters a positive workplace, a focus on customers and dedicated community service Integrity and honest communications guide our dealings and keep us accountable to our stakeholders and each other Strategic and Financial Objectives: Create an environment where employees can succeed; engage and earn the trust of our customers and stakeholders; always strive for operational excellence; create value for our shareholders; transform our portfolio for a sustainable future. In conjunction, we remain focused on three key financial objectives: •Earning authorized returns on our regulated businesses •Delivering at or above industry-average earnings and dividend growth •Maintaining investment grade metrics |  | |||||||

2020 Business Highlights

Merger with Avangrid

•Entered into Merger Agreement with Avangrid, expected to close in the second half of 2021, providing for:

–$50.30 per share to PNM Resources shareholders in an all-cash transaction reflecting a 19.3% premium to the 30-day volume weighted average price of the common stock as of October 20, 2020

–Combination of two strategically aligned, premier companies to create a large, diversified national regulated utility and renewable energy platform with approximately $14 billion of rate base, more than 4 million electric and natural gas utility customers and more than 7.4 gigawatts of renewable energy assets

–Strong financial profile, a solid investment grade balance sheet and robust cash flow profile, supported by the unparalleled global resources of the combined company’s largest shareholder, Iberdrola, S.A., the third largest electricity company in the world and a leading global renewable energy company

–Facilitation of PNM Resources’ continued commitment to exit coal with the approved abandonment of the San Juan coal plant in 2022 and continued efforts to exit Four Corners coal plant prior to the expiration of ownership and coal supply agreements in 2031

•Secured overwhelming approval of the Merger Agreement from PNM Resources shareholders in 2021

Financial Performance and Investment Highlights

•Delivered ongoing earnings per share growth of 5.6% and annual dividend growth of 6.5% over 2019, demonstrating adaptability and resilience during the COVID-19 pandemic

•Transacted over $2.0 billion of financing, including a successful forward equity offering, to support business needs, strengthen credit metrics and reduce borrowing costs

•Completed the most significant capital investment year in TNMP’s history with transmission line upgrades to support ERCOT and relieve congestion, distribution substation and feeder expansion programs, and new service delivery to subdivisions and small commercial areas across the service territory

•Launched PNM Wired for the Future initiative highlighting transmission and distribution investments designed to deliver clean energy, enhance customer satisfaction and increase grid resilience

•Maintained investment grade credit ratings

3

Corporate Responsibility and ESG Commitment

•Moved swiftly in response to the COVID-19 pandemic to ensure employee safety and customer support:

–Utilized business continuity plans and pandemic protocol to ensure safety and continuation of electricity services through the modification of workplace practices and workspaces for critical functions, staging of backup implementation of additional technology solutions to enable work-from-home capabilities for remaining services

–Suspended PNM customer disconnects and waived late fees temporarily, expanded flexible payment plans and established COVID Customer Relief Programs to assist residential and small commercial customers, with shareholder funding subsequently matched by a local non-profit

–Undertook key role in developing Texas COVID-19 Electricity Relief Program to establish and fund customer protections for end-users of TNMP and other utilities across ERCOT

•Progressed on our transition to clean energy:

–Supplemented industry-leading goal for PNM-owned generation to achieve 100% emission free energy by 2040, five years earlier than New Mexico carbon-free mandate, with increasing intermediate goals for reductions to CO2, NOx and SO2 emissions and a 90% reduction in freshwater usage by 2040, when compared to 2005 levels

–Accelerated PNM’s full exit of coal to 2024 with approval for the abandonment of the coal-fired San Juan Generating Station in 2022 and an agreement to exit PNM’s 13% ownership share of the Four Corners Power Plant at the end of 2024, with considerations for customer savings and support for impacted employees and communities

–Developed and received approval for PNM’s Energy Efficiency and Load Management programs for 2021, 2022 and 2023 designed to generate at least 403 gigawatt-hours of cumulative energy savings, or 5% of PNM’s 2020 sales

•Employed a workforce comprised of 50% minorities, 26% women and 8% veterans

•Demonstrated commitment to actively recruiting and developing our workforce:

–Implemented an enterprise-wide leadership development program to develop skills and abilities to become inspiring and results-focused leaders who foster high-performing teams

–Embarked on a company-wide culture alignment that creates a shift in behavior and mindset to accentuate shared purpose, transparency and collaboration creating both individual and organizational accountability for achieving key results

•Championed our employees, customers, communities and industry:

–Contributed $4.5 million to non-profits and community partners, including $1.2 million from the PNM Resources Foundation, $2.0 million through COVID Customer Relief Programs and customer payment assistance for nearly 3,500 families through the Good Neighbor Fund

–Supplemented financial contributions with donations of personal protective equipment, technology and in-kind donations procured from local businesses to support those most impacted by the pandemic, including tribal communities, first responders and front-line workers

–Continued to provide leadership, sponsorship and membership in local New Mexico and Texas commerce organizations and industry-focused organizations, highlighted by our CEO’s leadership positions with EEI and EPRI

–Supported employee and retiree volunteers who continued to dedicate over 6,200 virtual and in-person hours to benefit over 250 organizations in our communities amidst pandemic limitations

•Received recognition for these efforts:

–PNM achieved new all-time high J.D. Power customer satisfaction scores through continued delivery of new customer solutions and focused communications along with recognition as a top performer in the United States electric utility industry for improved customer impression based on COVID-19 response

–TNMP honored for the fifth consecutive year by the Environmental Protection Agency’s ENERGY STAR program, earning recognition with a third consecutive Partner of the Year Sustained Excellence Award for its High-Performance Homes program

–PNM Resources named to Newsweek’s 2021 list of America’s Most Responsible Companies

4

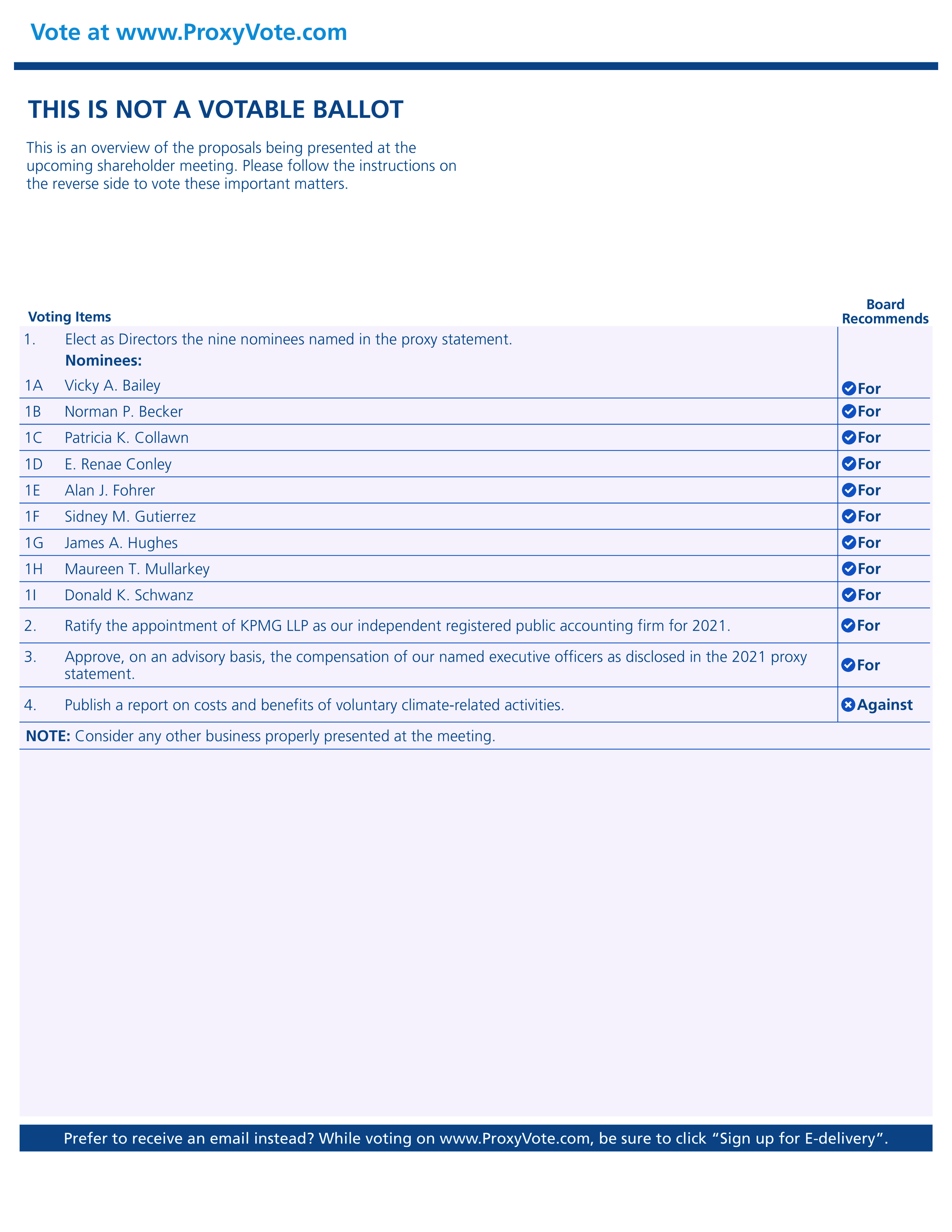

Voting Matters and Board Recommendations

This year shareholders will be asked to vote on four proposals. These proposals and the Board’s vote recommendations are listed below:

| Board vote recommendation | Page References (for more detail) | |||||||

Proposal 1: Elect as directors the nine director nominees named in this proxy statement | FOR each nominee | 21 - 31 | ||||||

| Nominees provide the needed experience and expertise to direct the management of the business and affairs of the Company and ensure strong independent oversight. | ||||||||

Proposal 2: Ratify appointment of KPMG as our independent registered public accounting firm for 2021 | FOR | 32 | ||||||

| All independence standards have been met and sound practices are used to ensure high quality audits. | ||||||||

Proposal 3: Approve, on an advisory basis, the compensation of our named executive officers | FOR | 35 | ||||||

| Our executive compensation is market-based, performance-driven, and aligned with shareholder interests. | ||||||||

Proposal 4: Shareholder proposal to publish a report on costs and benefits of our voluntary climate-related activities | AGAINST | 71-74 | ||||||

We currently provide extensive disclosure on the costs and benefits of our investment strategy and environmental activities. | ||||||||

Governance Highlights

We believe that good governance and transparency are integral to achieving long-term shareholder value and our strategic goals, including delivering at or above industry-average earnings and dividend growth, maintaining strong employee safety and operational performance, transforming to a cleaner energy portfolio and supporting our communities. Our commitment to governance policies and practices that serve the interests of the Company and our shareholders, customers and communities is underscored by the following corporate governance practices and facts for PNM Resources that are described further beginning on page 7:

ü Gender, ethnic and experience-diverse Board | ü Lead independent director with specified duties to ensure strong independent oversight | ||||

ü Annual election of all directors and Board refreshment/service policy | ü Independent directors meeting regularly in executive sessions | ||||

ü Majority voting for all directors | ü Board committees comprised entirely of independent directors with relevant expertise | ||||

ü Annual Board and committee self-evaluation process | ü Prohibition of hedging Company securities | ||||

ü Proxy access bylaws | ü Prohibition of pledging of Company securities by directors and executive officers, including the NEOs | ||||

ü Sustainability reporting and oversight | ü Incentive compensation awards subject to forfeiture and clawback | ||||

ü Political contributions, lobbying and governmental communications policies, including voluntary reporting of these activities | ü Stock ownership guidelines for executive officers and directors | ||||

5

2021 Nominees for the Board of Directors

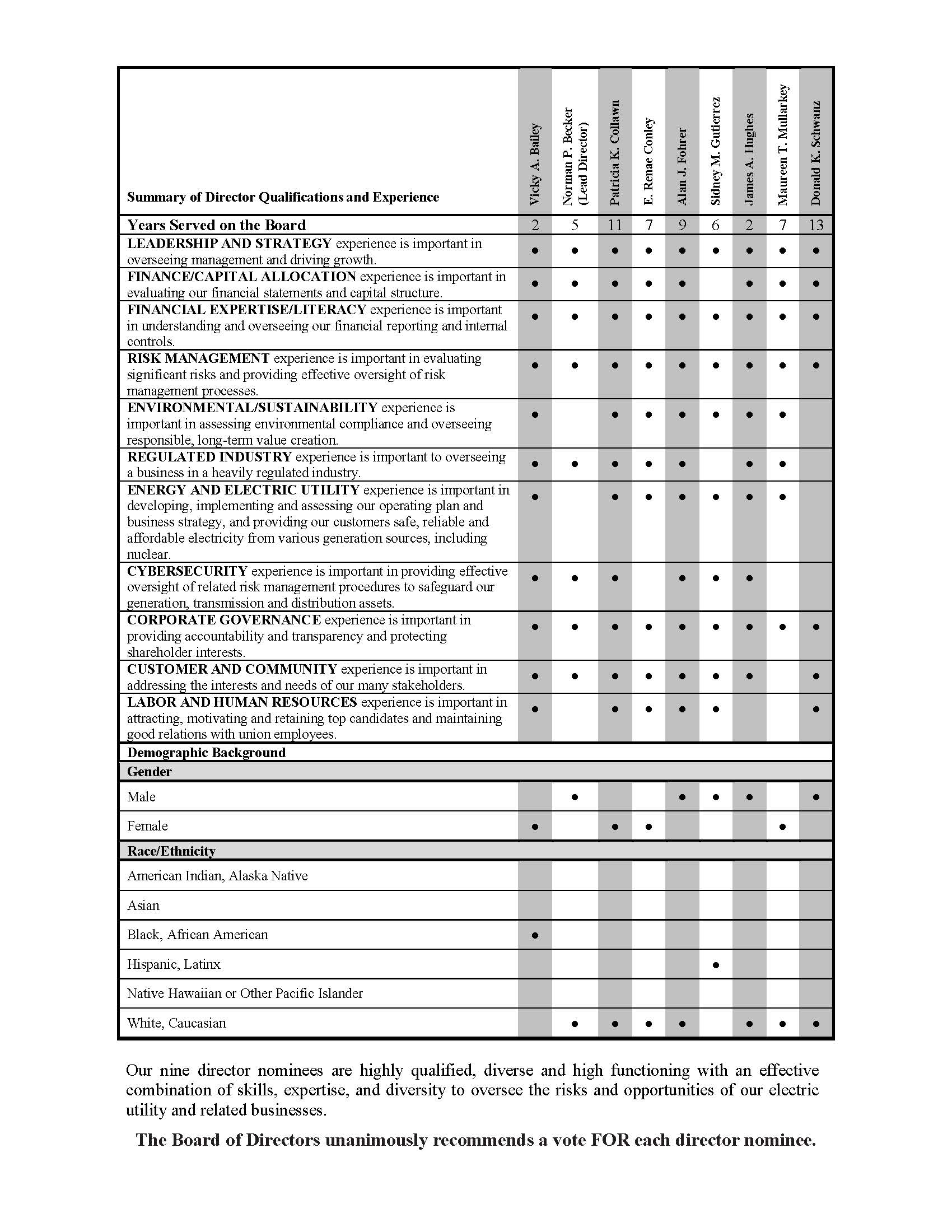

We have highly qualified, diverse, high-functioning and experienced directors that position the Board to provide effective oversight. The Board has a good mix of new and long-standing directors and the Board’s gender diversity has been recognized by the 2020 Women on Boards campaign for the past ten years. Detailed background and other skills and experience information about our nine director nominees can be found beginning on page 22.

Board Highlights:

7 Years Average Tenure | 8 of 9 Members Are Independent | 44.4% Are Female and 22.2% are Minority | 100% Have C-Suite Experience and Financial Expertise | 77.7% Have Environmental/Sustainability Expertise | ||||||||||

2021 Nominees:

| Name | Age | Director Since | Occupation / Experience | Independent | PNMR Committees | Other Public Company Boards | ||||||||||||||

| Vicky A. Bailey | 68 | 2019 | Founder and President, Anderson Stratton International, LLC | ü | Audit Nominating (Chair) | Cheniere Energy Equitrans Midstream Corporation | ||||||||||||||

| Norman P. Becker (Lead Director) | 65 | 2016 | President and CEO, New Mexico Mutual Casualty Company | ü | Compensation Finance | |||||||||||||||

| Patricia K. Collawn | 62 | 2010 | Chairman, President and CEO, PNM Resources, Inc. | CTS Corporation1 Equitrans Midstream Corporation | ||||||||||||||||

| E. Renae Conley | 63 | 2014 | CEO, ER Solutions, LLC | ü | Audit Compensation (Chair) | US Ecology, Inc. | ||||||||||||||

| Alan J. Fohrer | 70 | 2012 | Retired Chairman and CEO, Southern California Edison | ü | Audit (Chair) Nominating | TransAlta Corporation | ||||||||||||||

| Sidney M. Gutierrez | 69 | 2015 | Chairman, Vaya Space | ü | Audit Finance | |||||||||||||||

| James A. Hughes | 58 | 2019 | Managing Partner, Encap Investments, L.P. | ü | Finance Nominating | Alcoa Corp. TPI Composites, Inc. | ||||||||||||||

| Maureen T. Mullarkey | 61 | 2014 | Former EVP and CFO, International Game Technology | ü | Compensation Finance (Chair) | Everi Holdings, Inc. | ||||||||||||||

| Donald K. Schwanz | 76 | 2008 | Retired Chairman and CEO, CTS Corporation | ü | Audit Nominating | |||||||||||||||

1 Ms. Collawn will serve her remaining term as a director of CTS Corporation through May 13, 2021 and not stand for re-election.

Annual Advisory Vote On Our Executive Compensation Programs

The compensation programs for our named executive officers are performance-based and market competitive, aligning incentive opportunities with the performance expected of us by our shareholders and customers. In 2020, shareholders continued their strong support of our executive compensation programs with 87.5% of the votes cast for approval of the Say-on-Pay proposal at the 2020 annual meeting of shareholders. The Compensation and HR Committee continues to examine our executive compensation program to ensure continued alignment between the interests of our executives and our shareholders and customers. We ask that our shareholders approve, on an advisory basis, the compensation of our NEOs as described in the Executive Compensation section (including the CD&A and compensation tables) of this proxy statement beginning on page 36.

6

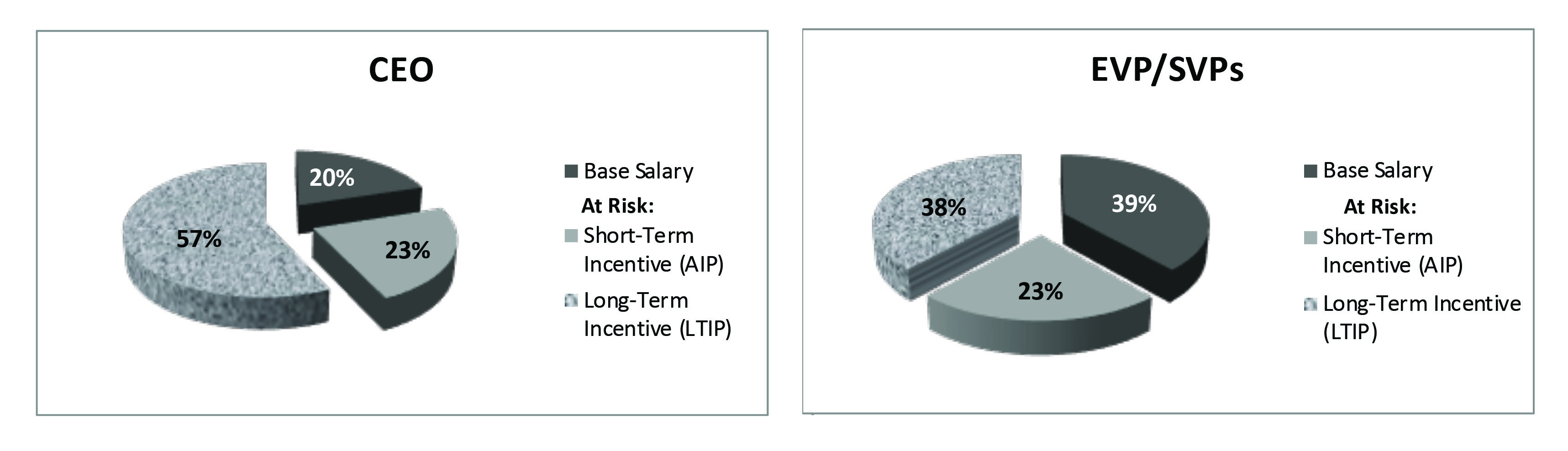

ü Performance-based: 80% of CEO and 61% of NEO Officer 2020 pay opportunity is at risk

ü Performance metrics align with business strategy:

| Annual Incentive Pay under 2020 AIP | ||||||||

| 60% Incentive EPS | 20% Customer Satisfaction | 20% Reliability | ||||||

| Long-Term Incentive Performance Shares under 2020 LTIP | ||||||||

| 50% Earnings Growth | 25% Relative TSR | 25% FFO/Debt | ||||||

ü Market competitive pay mix of equity and cash:

• Designed to attract and retain talented executives

• Targets the median of 2020 Benchmark Data

• Share ownership guidelines align with long-term shareholder value

Forward-Looking Statements

Statements made in this Proxy Statement that relate to future events or our expectations, projections, estimates, intentions, goals, targets, and strategies are made pursuant to the Private Securities Litigation Reform Act of 1995. Readers are cautioned that all forward-looking statements are based upon current expectations and estimates. We assume no obligation to update this information.

Because actual results may differ materially from those expressed or implied by these forward-looking statements, we caution readers not to place undue reliance on these statements. Our business, financial condition, cash flows, and operating results are influenced by many factors, which are often beyond our control, that can cause actual results to differ from those expressed or implied by the forward-looking statements. Additionally, there are risks and uncertainties in connection with the proposed acquisition of us by Avangrid which may adversely affect our business, future opportunities, employees and common stock, including without limitation, (i) the expected timing and likelihood of completion of the pending Merger, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending Merger that could reduce anticipated benefits or cause the parties to abandon the transaction, (ii) the failure by Avangrid to obtain the necessary financing arrangement set forth in the commitment letter received in connection with the Merger, (iii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (iv) the risk that the parties may not be able to satisfy the conditions to the proposed Merger in a timely manner or at all, and (v) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of PNM Resources to retain and hire key personnel and maintain relationships with its customers and suppliers, and on its operating results and businesses generally. We describe risks and uncertainties that can cause actual results and events to differ materially in the “Risk Factors,” “Quantitative and Qualitative Disclosures about Market Risk,” and “Management’s Discussion and Analysis” sections of our Forms 10-K and 10-Q filed with the SEC.

INFORMATION ABOUT OUR CORPORATE GOVERNANCE

Corporate Governance Principles

Our Board is elected by shareholders to oversee management to assure we optimize long-term shareholder value by operating in an ethical and forthright manner and responsibly addressing the concerns of our various constituencies. In recognition of the importance of governance to the proper management of the Company, the Board adopted a consolidated Corporate Governance Principles document so that investors, employees, customers, regulators, and the community may be aware of the policies followed by the Company. These principles have been approved by the full Board after analysis of policy considerations and peer benchmarks. With the goal of incorporating evolving best corporate governance principles, the Board requires the Nominating Committee to review the principles at least annually and recommend changes from time to time for consideration and adoption by the full Board. The Corporate Governance Principles document can be found on PNM Resources’ website at www.pnmresources.com/esg-commitment/governance.aspx.

7

Code of Ethics

We have adopted a code of ethics, Do the Right Thing: Principles of Business Conduct, which applies to all directors, officers (including the principal executive officer, principal financial officer, and principal accounting officer), and employees. Do the Right Thing is available in print to any shareholder who requests it by writing to the Ethics and Governance Department, PNM Resources, Inc., 414 Silver Avenue SW, MS-1285, Albuquerque, NM 87102-3289. Do the Right Thing is also available on our website at www.pnmresources.com/esg-commitment/governance.aspx. We will post any amendments to or waivers from our code of ethics (to the extent applicable to the Company’s executive officers and directors) at this location on our website.

Concerns relating to financial statement disclosures, accounting, internal accounting controls, auditing matters, or other matters involving violations of law are handled in accordance with the complaint procedures adopted by the Audit Committee that are posted on our website at www.pnmresources.com/esg-commitment/governance.aspx. We have established an anonymous, confidential hotline through which employees and others may report concerns about our business practices.

Director Independence

In accordance with our Corporate Governance Principles, the Board has affirmatively determined that all current directors and the director nominees are independent of PNM Resources and its management (with the exception of Patricia K. Collawn). Ms. Collawn is considered an inside director because of her employment as the President and CEO of the Company.

In determining the independence of the non-employee members of the Board, the Board examined all direct and indirect relationships of these non-employee directors with the Company and determined that all such relationships complied with the specific independence criteria under applicable law and regulations, including the NYSE listing standards. In addition, the only direct or indirect relationships between PNM Resources and each current non-employee director nominee consist of service on the Board or a Board committee and being a shareholder or a retail utility customer of the Company.

Majority Voting for Directors

Our articles of incorporation and bylaws provide for the annual election of directors. As discussed under Question 14 on page 77, each director must receive the affirmative vote of a majority of our shares of common stock represented at the meeting and entitled to vote on the election.

Our Corporate Governance Principles also provide that any nominee in an uncontested election who does not receive the required affirmative majority vote must promptly submit his or her resignation for consideration by the Nominating Committee which shall make a recommendation to the full Board within a reasonable period of time. The director whose resignation is under consideration will abstain from participating in the Nominating Committee’s recommendation and the Board’s decision on this matter. If a resignation is not accepted by the Board, the director may continue to serve. Directors added to the Board during the course of the year will stand for election at the next annual meeting of shareholders.

In addition to the annual election of directors, the Board’s accountability to shareholders is enhanced by:

•the rigorous nomination process conducted by the Nominating Committee (which includes consideration of director candidates proposed by shareholders as described further on page 16); and

•the Board’s policy that a substantial majority of the Board be independent and that the Audit, Compensation and HR and Nominating Committees consist entirely of independent directors and the Finance Committee consist of non-employee directors, a majority of whom are independent.

Director Service Policy

Our Director Service Policy provides that directors will not serve more than 12 years on the Board absent certain conditions. The policy requires directors serving more than 12 years, employee directors who leave the Company and directors who undergo a significant change in their business or professional career to submit resignations to the Board for acceptance at such time as the Board deems appropriate. Term limits for Directors can be found on page 7 of the Corporate Governance Principles, available on our website at www.pnmresources.com/esg-commitment/governance.aspx.

Succession Planning

Our Nominating Committee regularly assesses whether the composition of the Board reflects the knowledge, skills, expertise, and diversity appropriate to oversee the management of our company. Since 2014, six new members have joined the Board. In

8

addition, effective January 1, 2019, the Board increased its size from eight to ten members to permit the addition of two highly qualified members and to facilitate Board refreshment and transition. The Board fixed the number at nine effective May 11, 2021.

Nominations Policy for Directors

Our Board recognizes that the contribution of the Board depends not only on the character and capabilities of the directors individually, but also on their collective strengths. Our Nominating Committee recognizes the importance of recruiting a well-balanced board, which reflects the interests of our shareholders, customers, employees, regulators and the communities we serve. The Nominating Committee does consider the diversity of the Board (including age, ethnicity, geographic representation, gender, experience, and education) in identifying nominees for a balanced board with varied expertise relevant to our electric energy business. For example, our current members reflect the Board’s successful efforts to recruit female (4), African-American (1) and Hispanic (1) nominees, as well as candidates from Texas (2) and New Mexico (2) (to reflect the geographic market of our utility subsidiaries, PNM and TNMP). Two candidates joined the Board in 2019 with significant environmental, climate change and sustainability expertise highly relevant to transforming to a cleaner energy portfolio and enhancing the reliability and resiliency of the grid. The Board’s gender diversity has been recognized by the 2020 Women on Board’s campaign for the past ten years.

Shareholder Recommendations of Directors

Any shareholder may recommend potential nominees to the Nominating Committee for consideration for membership on the Board. Recommendations can be made by sending a written statement of the qualifications of the recommended individual to the Corporate Secretary, PNM Resources, Inc., 414 Silver Ave. SW, MS-1245, Albuquerque, NM 87102-3289. As discussed on page 16, the Nominating Committee will evaluate candidates recommended by shareholders on the same basis as it evaluates other candidates.

Proxy Access

Our bylaws permit any shareholder (or group of no more than 20 shareholders) owning three percent or more of our common stock continuously for at least three years to nominate up to an aggregate limit of one candidate or 20 percent of our board (whichever is greater) for inclusion in the proxy statement. For the 2022 annual meeting of shareholders notice of such nominee must be received no earlier than October 31, 2021 and no later than the close of business on November 30, 2021. Notice should be addressed to the Corporate Secretary, PNM Resources, Inc., 414 Silver Ave. SW, MS-1245, Albuquerque, NM 87102-3289. Requirements for such nominations and nominees are detailed in our bylaws, which are available on our website at www.pnmresources.com/esg-commitment/governance.aspx.

Board Leadership Structure and Lead Director

We believe the Company and our shareholders are best served by a Board that has the flexibility to establish a leadership structure that fits the needs of the Company at a particular point in time. Under our Corporate Governance Principles and bylaws, the Board has the authority to combine or separate the positions of Chairman and CEO, as well as to determine whether, if the positions are separated, the Chairman should be an employee, non-employee, or an independent director. The Board has separated the two offices on four occasions since the 1980s.

The Board believes the most effective leadership structure for the Company at this time is one with a combined Chairman and CEO coupled with an independent lead director. The Chairman is Patricia K. Collawn, our President and CEO. Combining the roles of Chairman and CEO: (1) enhances the Board’s ability to provide strategic direction and communicate clearly and effectively with management; and (2) avoids creating a structure that would effectively duplicate the work of our lead director. Ms. Collawn’s knowledge of our utilities and of the significant risks, challenges, and opportunities for our industry, including climate change, technological innovation, cybersecurity, and regulatory outcomes, make her best suited to serve as Chairman and CEO and provide strong unified leadership for PNM Resources. As Chairman, Ms. Collawn also brings contemporary industry insights to the Board as a result of her leadership role in leading industry organizations, such as EPRI and EEI, both of which are instrumental in addressing policy, operational, and technological issues facing the utility industry.

The position of lead director and role of our Board committees (comprised entirely of independent directors) are designed to promote strong, independent oversight of our management and affairs. Our lead director, Norman P. Becker, performs the following functions:

9

•approves Board meeting agendas and information sent to the Board;

•approves meeting schedules to ensure sufficient time for discussion of all agenda items;

•chairs all meetings of the independent directors, including executive sessions of the independent directors, and presides at all meetings of the Board in the absence of the Chairman;

•works with committee chairs to ensure coordinated coverage of Board responsibilities;

•ensures the Board is organized properly and functions effectively, independent of management;

•in consultation with the Board, is authorized to retain independent advisors and consultants on behalf of the Board;

•facilitates the annual self-evaluation of the Board and Board committees;

•serves as a liaison for communications between (1) management and the independent directors, and (2) the Board and our shareholders and other interested parties; and

•performs such other duties as the Board may from time to time delegate.

The lead director is elected by the independent directors, who review the role and functions of the lead director on an annual basis. The lead independent director receives an annual retainer of $25,000, in addition to his ordinary director compensation, for the additional services the lead director provides.

The lead director, with the above described duties, facilitates independent oversight of management. The balance of the lead director and combined Chairman and CEO positions ensures that the Board receives the information, experience and direction to effectively govern. The Board established this leadership structure because the Board believes it is effective, efficient, appropriate to PNM Resources’ size and complexity, and represents a cost-effective allocation of responsibilities.

The Board has also determined that the cost and efficiency benefits of its leadership structure do not result in control over both management and corporate governance being overly invested in one person. The Board is confident that, as currently constituted, it will provide ample counterbalance to a combined Chairman and CEO and that it continues to provide suitable independent oversight of management. The independent directors on the Board are all accomplished professionals possessing substantial relevant experience to oversee our regulated utility businesses. The independent directors meet in separate session, excluding management, at each regular meeting of the Board. Any director has the right to submit items to be heard at any Board meeting. Finally, the independent directors outnumber the one non-independent director, the combined Chairman and CEO, by a large majority.

Board’s Role in Risk Oversight

Our management is responsible for managing risk and bringing to the Board’s attention the most significant risks facing the Company. The Board has oversight responsibility for the processes established to identify, assess, mitigate, and monitor these risks. In addition, the Board integrates these processes with its ongoing strategic oversight responsibilities. Board oversight includes consideration of the various challenges and opportunities presented by the Company’s risks, plans to mitigate the risks, and the impact these risks may have on our strategy.

Throughout the year, the Board reviews information regarding the potential significant risks facing the Company. Each significant strategic risk is overseen by the full Board in order to facilitate more effective integrated risk and strategy oversight. For many years, management has identified and reported to the full Board on multiple risks and opportunities related to climate change, including potential environmental regulation, transformation of PNM’s generation portfolio, technological innovation, and the wider power sector transformation. In addition, the full Board approves certain Company investments in environmental equipment and grid modernization technologies. In contemplating new investments and against a backdrop of a transforming and increasingly interconnected industry, the Board also considers risks related to cybersecurity. Other significant risks overseen by the full Board include safety, New Mexico stakeholder relationships, and personnel and infrastructure security.

The Board also allocates responsibility for oversight of other risks among the committees of the Board. For example, the Finance Committee reviews and recommends to the full Board decisions regarding capital structure and oversees our management of risks associated with capital availability, liquidity, and costs thereof. In addition, the Finance Committee monitors the execution of our energy supply, sales, and hedging programs. The Audit Committee plays a central role in overseeing the integrity of our financial statements and reviewing and approving the performance of our internal audit function and independent auditors. While the full Board annually reviews the CEO succession planning process, the Nominating Committee oversees risks related to succession planning for the Board, and the Compensation and HR Committee oversees risks related to succession planning for Company officers. In addition, the Compensation and HR Committee considers risks related to the attraction and retention of talent and to the design of compensation programs and arrangements. In doing so, the Compensation and HR Committee monitors the design and administration of our overall incentive programs to ensure that they incentivize strong individual and group performance and include appropriate safeguards to avoid unintended or excessive risk-taking by our employees.

10

In executing its risk oversight duties, the Board can and does access extensive internal and external expertise regarding our challenges and opportunities, including those related to climate change and cybersecurity. For instance, the Board’s Chairman, Ms. Collawn, also serves on the board of EPRI, a non-profit research institute engaged in researching innovative technologies and policy matters for the power industry. We are actively involved in multiple EPRI programs and have representatives on various committees of EEI focused on environmental risks and technological innovation. Such active participation in industry groups and programs has supported the development of a robust internal Environmental Management System within our Environmental Services department. The foundation of the Environmental Management System is a screening process that allows for the review of PNM and TNMP jobs and projects before work begins to ensure protection and preservation of the environment. The Environmental Management System is supported by the Environmental Services Department’s environmental engineers, air quality and natural scientists, biologists and archaeologists who prepare and oversee implementation of measures that minimize and mitigate the environmental impacts of electric utility works.

The Board does not believe that its leadership structure (i.e., combining the Chairman and CEO roles, coupled with an independent lead director) detracts from its ability to effectively oversee risk management because a substantial majority of the Board is comprised of independent directors, each committee is comprised entirely of non-management independent directors, and the roles of the lead director and committees are designed to provide effective oversight of management.

Communication with the Board

Shareholders wishing to communicate with the Board or with a specific director may do so by writing to the Board or to the particular director and delivering the communication in person or mailing it to: Board of Directors, c/o Corporate Secretary, PNM Resources, Inc., 414 Silver Avenue SW, MS-1245, Albuquerque, NM 87102-3289. All shareholder communications will be relayed to the Board or an appropriate committee of the Board. If the shareholder desires to communicate a concern directly with the Board without initial review by the Corporate Secretary, the concern should be submitted in writing, in a sealed envelope addressed to the Board, in care of the Corporate Secretary, with a notation indicating that it is to be opened only by the Board. The Corporate Secretary shall promptly forward the unopened envelope to the Board. From time to time, the Board may change the process for shareholder communications with the Board or its members. Please refer to our website www.pnmresources.com/esg-commitment/governance.aspx for any changes in this process.

Shareholders and other interested parties wishing to communicate directly with the lead independent director or with the non-management or independent directors as a group may do so by writing to Lead Independent Director, c/o Corporate Secretary, PNM Resources, Inc., 414 Silver Avenue SW, MS-1245, Albuquerque, NM 87102-3289.

Director Education

Our Corporate Governance Principles encourage all directors to participate in director continuing education programs. In addition, management monitors and reports to the directors significant corporate governance initiatives. The directors also receive a presentation on developments in corporate governance at least annually.

Related Person Transaction Policy

Our “Policy and Procedures Governing Related Party Transactions” is posted on our website at www.pnmresources.com/esg-commitment/governance.aspx. The policy provides that all transactions with executive officers, directors or greater than 5% shareholders or any immediate family member of any of the foregoing (collectively referred to as “related persons”), where the aggregate amount involved is expected to exceed $120,000 per year, are subject to pre-approval or ratification by the Nominating Committee, or by the Board or another committee in the normal fulfillment of their respective charters and responsibilities. In determining whether to approve such transactions, the Nominating Committee will consider, among other factors, the extent of the related person’s interest in the transaction; the availability of other sources of comparable products or services; whether the terms are no less favorable than terms generally available in unaffiliated transactions under like circumstances; the benefit to the Company; and the aggregate value of the transaction at issue. Since January 1, 2020, we have not participated, and have no current plans to participate, in any transactions in which any related person has a material interest that would be subject to pre-approval under this policy or otherwise be reportable under applicable SEC Rules.

11

Equity Compensation Awards Policy

The Board adopted the Equity Compensation Awards Policy to govern the granting of all forms of equity compensation. The policy provides that equity compensation awards shall only be made in compliance with the PEP and applicable laws and regulations. The PEP prohibits option repricing, incorporates, as a general rule, a “double trigger” vesting rule in connection with a change in control, and contains a “clawback” provision subjecting all awards issued under the PEP to potential forfeiture or recovery to the fullest extent called for by any clawback policy that may be adopted by the Company. For additional information on the Clawback Policy that was adopted in 2019, see Clawback Policy on page 50. The Equity Compensation Awards Policy provides that equity compensation awards are prospective only and sets forth additional good governance procedures for making equity awards when the regular schedule for the grant of equity compensation falls within a black-out period for trading in our securities under PNM Resources’ Insider Trading Policy. The Equity Compensation Awards Policy is available on our website at www.pnmresources.com/esg-commitment/governance.aspx.

Political Contributions, Lobbying and Governmental Communication Policies

We support an open and transparent political process and are committed to ensuring our actions reflect the Company’s strong ethical standards. We voluntarily report information related to our efforts in the “Public Policy” section of our Sustainability Report available at www.pnmresources.com/esg-commitment/esg-reporting-and-disclosures/esg-reporting-library.aspx. In addition, our policies on communications with regulatory agencies are set forth in our Do The Right Thing: Principles of Business Conduct available at www.pnmresources.com/esg-commitment/governance.aspx.

Insider Trading Policy Includes No Hedging or Pledging

The Company’s Insider Trading Policy prohibits all employees, officers, and directors from engaging in short sales of Company securities and states that speculative trading in Company stock is considered to be improper and inappropriate. In addition, the policy prohibits all directors, officers, and employees from engaging in hedging or monetization transactions, such as zero-cost collars and forward sales contracts, or transactions that allow a person to lock in much of the value of his or her Company securities. Further, our Insider Trading Policy prohibits all directors and executive officers including our NEOs, from pledging Company securities as collateral for a loan.

Clawback Policy

Under the Clawback Policy adopted in February 2019 and described more fully on page 50 of this proxy statement, incentive compensation awarded to all PNMR officers is subject to recoupment if (1) any future SEC or NYSE rules require the Company to seek recovery, (2) an accounting restatement occurs due to material non-compliance by the Company with any financial requirement as a result of PNMR officer misconduct, or (3) any improper conduct by a PNMR officer. In addition, (1) the PEP provides that all unvested and unpaid awards are subject to forfeiture for conduct which is demonstrably and materially injurious to the Company, and (2) the LTIPs and AIPs provide that a recipient will forfeit unvested and unpaid incentive compensation awards issued under the PEP for any manipulation or attempted manipulation of the performance results for personal gain at the expense of customers, shareholders, other employees or the Company.

Sustainability

We are committed to integrating sustainability into our everyday actions to help create enduring value for our shareholders, our customers, our employees and the communities we serve. At PNM Resources, the term “sustainability” encompasses a broad range of important actions. It starts with our responsibility to deliver safe, reliable, affordable, and environmentally responsible energy to our customers and focuses on the following areas: advancement of cleaner sources of energy, including renewable energy, resulting in the significant reduction of CO2 emissions; natural resource conservation and protection; energy efficiency; economic development and improving the quality of life in our communities; and corporate governance. Information about these activities, including details on the significant efforts PNM has made and continues to make to reduce its GHG emissions and water usage, and transform its generation portfolio to a carbon-free portfolio in accordance with the ETA, is available in our Sustainability Report available at www.pnmresources.com/esg-commitment/esg-reporting-and-disclosures/esg-reporting-library.aspx.

12

ADDITIONAL INFORMATION ABOUT OUR BOARD AND BOARD COMMITTEES

Board Meetings

The Chairman of the Board presides at all meetings of the shareholders and of the full Board. As discussed on page 9 under “Board Leadership Structure and Lead Director,” the lead independent director chairs meetings of the independent directors and assumes other duties designed to support the Board’s independent oversight of management. The lead independent director is nominated and approved by the independent directors annually. The independent directors meet at each regular Board meeting without management present and will meet more often as the need arises. Norman P. Becker has served as the lead independent director since January 1, 2021. Previously, Bruce W. Wilkinson served as the lead independent director from May 15, 2015 to December 31, 2020.

In 2020, the full Board met 16 times and acted twice by unanimous written consent. The independent directors held five regularly scheduled meetings and 11 specially called meetings in 2020. During 2020, all incumbent directors attended at least 75% of the total number of meetings of the Board and of the committees of the Board on which they served.

Directors are expected to attend the Annual Meeting and, as stated in the Corporate Governance Principles, are responsible for attending all director meetings and for reviewing materials provided in advance of each meeting. Directors are expected to actively participate in Board and committee meetings. All directors attended the 2020 annual meeting held on May 12, 2020 in a virtual format due to the COVID-19 pandemic.

Board Committees and their Functions

The Board has four current standing committees: the Audit Committee, the Compensation and HR Committee, the Finance Committee, and the Nominating Committee. All committee members are independent directors.

Each committee has a written charter that addresses the committee’s purpose and responsibilities. All current committee charters can be found at www.pnmresources.com/esg-commitment/governance.aspx and are available in print without charge to any shareholder who requests them. The charters comply with applicable NYSE Listing Standards.

The following table provides 2020 membership and meeting information for each of the four Board committees.

| Name | Audit Committee | Nominating Committee | Finance Committee | Compensation and HR Committee | ||||||||||

| V. A. Bailey | x | x* | ||||||||||||

| N. P. Becker | x* | x | ||||||||||||

| E. R. Conley | x | x* | ||||||||||||

| A. J. Fohrer | x* | x | ||||||||||||

| S. M. Gutierrez | x | x | ||||||||||||

| J. A. Hughes | x | x | ||||||||||||

| M. T. Mullarkey | x | x | ||||||||||||

| D. K. Schwanz | x | x | ||||||||||||

| B. W. Wilkinson** | x | x | ||||||||||||

| # Meetings in 2020 | 5 | 3 | 3 | 3 | ||||||||||

| # Executive Sessions in 2020 | 3 | — | — | 2 | ||||||||||

| *Committee Chair **Lead Independent Director | ||||||||||||||

13

Effective January 1, 2021, the membership of each of the four standing committees in 2021 is as follows:

| Audit Committee | Finance Committee | ||||

| V. A. Bailey E. R. Conley A. J. Fohrer* S. M. Gutierrez D. K. Schwanz | N. P. Becker** S. M. Gutierrez J. A. Hughes M. T. Mullarkey* | ||||

| Compensation and HR Committee | Nominating Committee | ||||

| N. P. Becker E. R. Conley* M. T. Mullarkey B. W. Wilkinson*** | V. A. Bailey* A. J. Fohrer J. A. Hughes D. K. Schwanz B. W. Wilkinson*** | ||||

| *Committee Chairs elected on March 4, 2021 ** Lead Independent Director ***Mr. Wilkinson is not standing for re-election and will serve on these committees until he retires from the Board on May 11, 2021. | |||||

14

A summary of each current standing committee’s responsibilities is included below:

Audit and Ethics Committee

| Membership: | Five independent, non-employee directors in 2020 | ||||

| Functions: | Oversees the integrity of our financial statements, system of disclosure and internal controls regarding finance, accounting, legal, compliance, and ethics that management and the Board have established. Ensures compliance with our legal and regulatory requirements. Assesses and ensures the independent accountant’s qualifications and independence. Reviews and approves the performance of our internal audit function and independent accountants. Approves independent accountant services and fees for audit and non-audit services. Oversees our management of risks as assigned by the Board. | ||||

| Charter: | A current copy of the Audit Committee Charter may be found on our website at www.pnmresources.com/esg-commitment/governance.aspx. The Audit Committee Charter prohibits any committee member from serving on the audit committees of more than two other publicly traded companies. | ||||

| Evaluation: | The Audit Committee evaluated its 2020 performance and confirmed that it fulfilled all of the responsibilities described in its Charter. | ||||

| Financial Expert: | The Board has unanimously determined that all Audit Committee members are financially literate and that E. R. Conley, A. J. Fohrer, and D. K. Schwanz qualify as “audit committee financial experts” within the meaning of SEC regulations. | ||||

Compensation and Human Resources Committee

| Membership: | Four independent, non-employee directors in 2020 | ||||

| Functions: | Recommends the compensation philosophy, guidelines, and equity-based compensation for officers (emphasizing rewarding long-term results and maximizing shareholder value). Establishes an appropriate compensation program for the CEO and reviews and approves corporate goals and objectives relevant to CEO compensation. Evaluates CEO performance in light of corporate goals and objectives. Reviews and recommends to the independent directors, the CEO’s annual compensation level and components. Reviews and approves all components of compensation and stock ownership guidelines for all senior officers, giving due consideration to the CEO’s recommendations. Monitors our affirmative action program. Oversees our annual compensation risk assessment. | ||||

| Charter: | A current copy of the Compensation and HR Committee Charter may be found on our website at www.pnmresources.com/corporate-governance.aspx. | ||||

| Evaluation: | The Compensation and HR Committee evaluated its 2020 performance and confirmed that it fulfilled all of the responsibilities described in its Charter. | ||||

Finance Committee

| Membership: | Four independent, non-employee directors in 2020 | ||||

| Functions: | Reviews and recommends to the Board decisions regarding our capital structure and financial strategy, including dividend policy. Oversees our financial performance, capital expenditures, and investment procedures and policies. Oversees our investments in subsidiaries, investment trusts and other corporate investments. Oversees our management of risks as assigned by the Board. | ||||

| Charter: | A current copy of the Finance Committee Charter may be found at www.pnmresources.com/esg-commitment/governance.aspx. | ||||

| Evaluation: | The Finance Committee evaluated its 2020 performance and confirmed that it fulfilled all of the responsibilities described in its Charter. | ||||

15

Nominating & Governance Committee

| Membership: | Five independent, non-employee directors in 2020 | ||||

| Functions: | Recommends candidates for election to the Board. Develops policy on composition and size of the Board, as well as director tenure. Develops director independence standards consistent with applicable laws or regulations. Oversees the performance evaluation of the Board. Recommends applicable revisions to the corporate governance principles. Recommends Board compensation levels and stock ownership guidelines. Oversees the Policy and Procedure Governing Related Party Transactions. Oversees the Company’s management of risks as assigned by the Board. | ||||

| Charter: | A current copy of the Nominating Committee Charter may be found at www.pnmresources.com/esg-commitment/governance.aspx. | ||||

| Evaluation: | The Nominating Committee evaluated its 2020 performance and confirmed that it fulfilled all of the responsibilities described in its Charter. | ||||