Form DEF 14A PENN NATIONAL GAMING For: Jun 09

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

PENN NATIONAL GAMING, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. | |||

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

| (5) |

Total fee paid:

| |||

| ☐ |

Fee paid previously with preliminary materials. | |||

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid:

| |||

| (2) |

Form, Schedule or Registration Statement No.:

| |||

| (3) |

Filing Party:

| |||

| (4) |

Date Filed:

| |||

Table of Contents

2021 Notice of Annual Meeting and Proxy Statement

Table of Contents

825 Berkshire Boulevard, Suite 200

Wyomissing, Pennsylvania 19610

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on June 9, 2021

NOTICE IS HEREBY GIVEN that the 2021 Annual Meeting of Shareholders (the “Annual Meeting”) of Penn National Gaming, Inc. (the “Company”), a Pennsylvania corporation, will be held on Wednesday, June 9, 2021, at 10:00 a.m. Eastern time. This year, due to the continuing public health impact of the coronavirus (COVID-19) pandemic, the Annual Meeting will be online and a completely virtual meeting of shareholders. You may attend, vote and submit questions during the Annual Meeting via the live audio webcast on the Internet at www.virtualshareholdermeeting.com/PENN2021. You will not be able to attend the Annual Meeting in person nor will there be any physical location.

Only shareholders of record at the close of business on April 7, 2021 are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. We are committed to ensuring our shareholders have the same rights and opportunities to participate in the Annual Meeting as if it had been held in a physical location. As further described in the proxy materials for the Annual Meeting, you are entitled to attend the Annual Meeting via the live audio webcast on the Internet at www.virtualshareholdermeeting.com/PENN2021. While we encourage you to vote in advance of the Annual Meeting, you may also vote and submit questions relating to meeting matters during the Annual Meeting (subject to time restrictions). You may vote by telephone, Internet or mail prior to the Annual Meeting.

To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/PENN2021, you must enter the 16-digit control number found in the control number box included on your Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on June 9, 2021 (the “Notice”) or proxy card (if you receive a printed copy of the proxy materials).

The Annual Meeting will be held for the following purposes:

| 1. | To elect two Class I directors to serve until the 2024 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified; |

| 2. | To approve the Company’s Second Amended and Restated Articles of Incorporation to increase the number of authorized shares of common stock from 200,000,000 to 400,000,000; |

| 3. | To approve the Company’s Amended and Restated 2018 Long Term Incentive Compensation Plan; |

| 4. | To ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2021 fiscal year; |

| 5. | To approve, on an advisory basis, the compensation paid to the Company’s named executive officers; and |

| 6. | To consider and transact such other business as may properly come before the Annual Meeting. |

On or about April 23, 2021, we began mailing to certain shareholders the Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting of Shareholders to be held on June 9, 2021 (the “Notice of Annual Meeting”) containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “Annual Report”) and how to vote online. The Notice of Annual Meeting, Proxy Statement and Annual Report are available at www.proxyvote.com.

| Wyomissing, Pennsylvania |

By order of the Board of Directors, | |

| April 23, 2021 |

Harper Ko Executive Vice President, Chief Legal Officer and Secretary |

|

Your vote is very important. You may vote at the virtual meeting or by proxy. Whether or not you plan to virtually attend the Annual Meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. You may vote by proxy by telephone or Internet (instructions are on your proxy card, voter instruction form or the Notice, as applicable) or, if you received your materials by mail, by completing, signing and mailing the enclosed proxy card in the enclosed envelope. |

| 2 | PENN NATIONAL GAMING, INC. |

Table of Contents

| 2021 PROXY STATEMENT | 3 |

Table of Contents

| This Proxy Statement includes forward-looking statements. These statements are not historical facts, but instead represent beliefs of Penn National Gaming, Inc. (the “Company”) regarding future events, many of which, by their nature are inherently uncertain and outside the Company’s control. These statements can be identified by the use of forward-looking terminology such as “expects,” “believes,” “estimates,” “projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should,” or “anticipates” or the negative or other variations of these or similar words, or by discussions of future events, strategies or risks and uncertainties. Specifically, forward-looking statements include, but are not limited to, statements regarding: COVID-19; continued demand for our gaming properties and the possibility that our gaming properties may be required to close again in the future due to COVID-19; the impact of COVID-19 on general economic conditions, capital markets, unemployment, and the Company’s liquidity, operations, supply chain and personnel; future stock price performance; future margin improvements; stock-based compensation expense; the potential benefits and expected timing of the Perryville transaction with Gaming and Leisure Properties, Inc. (“GLPI”); the Company’s future results of operations, liquidity and revenue, including from our online sports betting and online casino games (“iGaming”) business in Pennsylvania, Michigan and Illinois and in additional states in the future; the expected benefits and potential challenges of the investment in Barstool Sports, including the anticipated benefits for the Company’s online and retail sports betting, iGaming and social casino products; the expected financial returns from the transaction with Barstool Sports; expected future launches of the Barstool-branded mobile sports betting product in additional states; the future revenue and profit contributions of the Barstool-branded mobile sports betting product; our expectations of future results of operations and financial condition, including margins; the purchase of the remaining equity in Barstool Sports; our expectations for our properties; our development projects; our expectations with regard to the impact of competition; the anticipated opening dates of our retail sportsbooks in future states and our proposed Pennsylvania Category 4 casinos in York and Berks Counties; our expectations with regard to acquisitions, potential divestitures and development opportunities, as well as the integration of and synergies related to any companies we have acquired or may acquire; the actions of regulatory, legislative, executive or judicial decisions at the federal, state or local level with regard to our business and the impact of any such actions; our ability to maintain regulatory approvals for our existing businesses and to receive regulatory approvals for our new business partners; the performance of our partners in online sports betting, iGaming and retail/mobile sportsbooks, including the risks associated with any new business, the actions of regulatory, legislative, executive or judicial decisions at the federal, state or local level with regard to online sports betting, iGaming and retail/mobile sportsbooks and the impact of any such actions; and our expectations regarding economic and consumer conditions. Accordingly, the Company cautions that the forward-looking statements contained herein are qualified by important factors that could cause actual results to differ materially from those reflected by such statements. Such factors include, but are not limited to: (a) COVID-19 and its effect on capital markets, general economic conditions, unemployment, consumer spending and the Company’s liquidity, financial condition, operations and personnel; (b) industry, market, economic, political, regulatory and health conditions; (c) disruptions in operations from data protection breaches, cyberattacks, extreme weather conditions, medical epidemics or pandemics, such as COVID-19, and other natural or manmade disasters or catastrophic events; (d) the reopening of the Company’s gaming properties are subject to various conditions, including numerous regulatory approvals and may be delayed, including for reasons beyond our control; (e) the consummation of the Perryville transaction with GLPI is subject to various conditions, including regulatory approvals, and accordingly may be delayed or may not occur at all, including for reasons beyond our control; (f) potential adverse reactions or changes to business or regulatory relationships resulting from the announcement or completion of the transactions with GLPI; (g) the outcome of any legal proceedings that may be instituted against the Company or its directors, officers or employees; (h) the impact of new or changes in current laws, regulations, rules or other industry standards; and (i) other risks, including those as may be detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). For more information on the potential factors that could affect the Company’s financial results and business, review the Company’s filings with the SEC, including, but not limited to, our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. We do not intend to update publicly any forward-looking statements except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Proxy Statement may not occur. |

| 4 | PENN NATIONAL GAMING, INC. |

Table of Contents

|

April 23, 2021

Dear Fellow Shareholder:

2020 was undoubtedly one of the most challenging times in any of our lives from a personal and professional standpoint. At Penn National Gaming, we endured unprecedented changes to our business, created and implemented comprehensive new COVID-19 health and safety protocols to help keep our team members and guests safe, and withstood a series of natural disasters that damaged several of our southern properties and left many of our team members displaced in the midst of the ongoing pandemic. Yet, despite all the challenges we faced, it was a year of

transformational growth for our Company. When the pandemic caused the temporary closure of our entire portfolio, we took decisive steps to preserve the long-term future of

the Company, including the sale of Tropicana Las Vegas and the successful completion of two capital raises. Meanwhile, we completely reimagined our |

|

operational norms and product offerings to create a more modern and efficient operating model at our properties. As a result, we finished the year with an improved balance sheet to help support our evolution into the nation’s best-in-class omni-channel provider of retail and online gaming and sports betting entertainment – all while creating significant shareholder value. I am immensely proud of the way our team members at all levels of our organization came together to weather the storm last year. Our impressive results in 2020 speak to the relentless focus and nimbleness of our corporate and property management teams and they reflect the power of our incredible partnership with our friends at Barstool Sports. What I am equally proud of in looking back on 2020 is how our Company rose to the occasion to support our team members and our communities in these times of great need and heightened social justice awareness. Our 41 properties in 19 states throughout the country donated more than 45 tons of food and PPE directly to area food banks and emergency relief organizations at the height of the pandemic. Many of our properties served as COVID-19 test sites and housed emergency personnel, in addition to organizing food drives and blood donations. While some companies temporarily suspended their charitable giving, we continued to support our charitable partners, contributing $6 million last year from our Penn National Gaming Foundation and our properties to worthwhile charities and civic organizations in our host communities. In addition, we generated more than $14 million in economic development funds for our host communities in Kansas, Indiana and Iowa. During the time our properties were temporarily closed, we extended health benefits to all furloughed team members and also provided $13 million in one-time holiday cash bonuses in December to our non-executive team members companywide to help with the financial impact to their families in 2020. Meanwhile, our executives took significant pay cuts early in 2020 when COVID-19 initially forced property closures and sacrificed end-of-year performance bonuses as well. Through our Penn National Gaming Foundation, we created a COVID-19 Emergency Relief Fund for our team members and raised over $4 million from our Board of Directors, senior management team and our Foundation. In addition, we created the Hurricane Laura Relief Fund and have contributed more than $6.5 million to assist L’Auberge Lake Charles and the community, which includes covering full wages and benefits for our team members while the property was closed. Most recently, we joined Barstool Sports Founder Dave Portnoy’s personal mission to help save and sustain small businesses who have been impacted by COVID-19, contributing more than $4.6 million and counting to the non-profit “Barstool Fund.” To date, the Fund has raised over $36 million and is actively supporting 288 small businesses around the country. |

| 2021 PROXY STATEMENT | 5 |

Table of Contents

Finally, on the social justice front, we formed a new Diversity Committee and launched a $1 million annual Penn Diversity Scholarship Program for the Children of Team Members. We also implemented a series of new inclusion-related initiatives to educate our team members across the organization, while continuing to foster a respectful and inclusive workplace.

Like most, we were eager to turn the page to 2021. As of March 5 of this year, all of our casino properties were operational for the first time since the pandemic struck. With the continued easing of capacity restraints and the rollout of COVID-19 vaccinations across the country, we have reason to feel a renewed sense of optimism here in 2021.

Our core business continues to experience stronger visitation, spend per visit and volumes. We are also seeing encouraging growth in the younger demographic tiers of our database as a steadier flow of guests in all age segments of our database have begun to return to our land-based facilities.

We are looking forward to introducing our guests to our new cashless, cardless and contactless technology (which we refer to as the “3 Cs”) later this year pending final regulatory approvals, which will improve efficiency and provide a guest experience in line with other industries frequented by younger demographics.

On the interactive front, 2020 was highlighted by the successful launch of the Barstool Sportsbook app in Pennsylvania last September. This was a meaningful milestone for our Company and I would like to thank our team at Penn Interactive and our partners at Barstool Sports for their tireless efforts and dedication in bringing this highly regarded product to market.

In January of this year, we introduced our Barstool Sportsbook mobile app and fully integrated iCasino in Michigan, and in March we launched our sports betting app in Illinois. By the end of 2021, we anticipate being live with our digital products in at least 10 states.

Despite limited external marketing spend, the Barstool Sportsbook app has consistently ranked in the top three or four in market share in the highly competitive Pennsylvania and Michigan sports betting markets and, while early, has delivered strong initial results in Illinois as well.

We believe our success in these markets demonstrates the benefits of our structural advantages in the space. Most significantly, our investment in Barstool Sports provides highly efficient customer acquisition and enhanced retention through a fully integrated and rapidly growing media partnership. In addition, our industry leading footprint provides us with a highly valuable casino database, as well as frictionless access to key states and sizable recurring revenue and equity value from our third-party skin partners. We believe these advantages will allow us to win sizable share in each of our markets while delivering best in class profitability.

We are also looking forward to continuing to introduce our Barstool-branded retail sportsbooks across our portfolio, including our two new properties opening in Pennsylvania later this year. We’re continuing to see very strong results from our retail sportsbooks, with our Indiana properties seeing meaningful increases in both gaming and non-gaming revenues following their rebranding as Barstool Sportsbooks.

Finally, we have continued to enhance our industry leading mychoice rewards program, which now connects all of our properties and digital products and is a key component of our omni-channel strategy. Our experience has shown that customers who play across multiple channels are more valuable, and our mychoice program offers its more than 20 million members a wide-range of compelling incentives to consolidate play across our various platforms.

Despite its challenges, 2020 was an exceptional year of growth and momentum for our Company and we believe the successful groundwork we laid over the year has positioned us for an exciting 2021 and beyond. As always, I’d like to thank all of our valued shareholders for your ongoing support and confidence.

Sincerely,

Jay A. Snowden

President, Chief Executive Officer and Director

| 6 | PENN NATIONAL GAMING, INC. |

Table of Contents

This summary contains highlights about our Company and the upcoming 2021 Annual Meeting of Shareholders. This summary does not contain all of the information that you may wish to consider in advance of the meeting, and we encourage you to read the entire proxy statement before voting.

2021 Annual Meeting of Shareholders

|

Date and Time: |

Wednesday, June 9, 2021 at 10:00 a.m., Eastern time | |

|

Location: |

Live audio webcast on the Internet at www.virtualshareholdermeeting.com/PENN2021* | |

|

Record Date: |

April 7, 2021 |

*This year’s Annual Meeting will be conducted via audio webcast online and a completely virtual meeting of shareholders due to the ongoing public health impact of the COVID-19 pandemic. You may attend, ask questions relating to meeting matters and vote during the Annual Meeting via the live audio webcast on the Internet at the link above. You will not be able to attend the Annual Meeting in person. There will be no physical location for shareholders to attend.

Voting Matters and Board Recommendations

| Proposal | Matter | Board Recommendation | ||

|

1 |

Election of Class I Directors (David A. Handler and John M. Jacquemin) | FOR each Nominee | ||

|

2 |

Approval of the Company’s Second Amended and Restated Articles of Incorporation to increase the number of authorized shares of common stock from 200,000,000 to 400,000,000 | FOR | ||

|

3 |

Approval of the Company’s Amended and Restated 2018 Long Term Incentive Compensation Plan | FOR | ||

|

4 |

Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2021 fiscal year | FOR | ||

|

5 |

Approval, on an advisory basis, of the compensation paid to the Company’s named executive officers | FOR | ||

Overview of Penn National Gaming

| • | Nation’s Leading Omni-Channel Gaming and Sports Betting Operator– Penn National Gaming, Inc. is the largest and most diversified regional operator of gaming and racing properties in the United States with 41 properties in 19 states. The Company continues to evolve into a highly innovative omni-channel provider of retail and online gaming and sports betting entertainment. The Company has consistently generated attractive returns for its shareholders. |

| • | Disciplined Operating Focus – In 2020, the Company continued to deploy disciplined operating strategies by managing existing properties with a focus on maximizing profitability and free cash flow, while delivering outstanding gaming and entertainment experiences for customers and supporting the local communities in which it operates. |

| 2021 PROXY STATEMENT | 7 |

Table of Contents

| ✓ | Decisive Actions in Response to COVID-19

In 2020, we were faced with the novel coronavirus (known as “COVID-19”) pandemic, which had a devastating impact on the gaming industry. To help combat the spread of COVID-19, we were required to temporarily suspend operations at all of our properties for single or multiple time periods during the year. Once re-opened, our properties operated with reduced gaming and hotel capacity and limited food and beverage offerings in order to accommodate social distancing and health and safety protocols.

In light of COVID-19, we took the following actions to strengthen our balance sheet and improve our liquidity:

• We entered into an agreement with our principal landlord, Gaming and Leisure Properties, Inc. (“GLPI”) and closed on the sale of the Tropicana Las Vegas real estate assets and a new ground lease for our planned Category 4 casino in Morgantown, Pennsylvania, in exchange for $337.5 million in rent credits and the ability to participate in additional upside from the eventual sale of Tropicana Las Vegas by GLPI;

• In April 2020, we entered into an amendment to our credit agreement to obtain relief from our financial covenants for a period up to one year.

• In May 2020, we completed a public offering of $330.5 million aggregate principal amount of 2.75% unsecured convertible notes due May 15, 2026;

• In May 2020, we completed a $345.0 million public offering of 19,166,667 shares of common stock; and

• In September 2020, we completed a $982.1 million public offering of 16,100,000 shares of common stock.

As a result of these actions, as of December 31, 2020, we had $1,853.8 million in cash on our balance sheet and no outstanding balance under our $700 million revolving credit facility.

|

✓ | Evolution as an Omni-Channel Provider of Retail and Online Gaming and Sports Betting Entertainment

In 2020 and early 2021, we undertook meaningful actions in our evolution from an owner and manager of gaming and racing properties into an omni-channel provider of retail and online gaming and sports betting entertainment.

Investment in Barstool Sports - In February 2020, we acquired 36% of the common stock of Barstool Sports, a leading digital sports, entertainment and media platform. In connection with the Barstool Sports investment, we became Barstool Sports’ exclusive gaming partner for up to 40 years and have the right to utilize the Barstool Sports brand for all of our online and retail sports betting and iCasino apps.

Interactive – In 2020, we launched our Barstool Sportsbook app in Pennsylvania with over 72,000 registered customers. On January 22, 2021, we launched the Barstool Sportsbook app in Michigan with over 48,000 registered customers. Further, on March 10, 2021, we successfully launched the Barstool Sportsbook app in Illinois. We expect to have our Barstool Sportsbook app live in at least 10 states by the end of 2021.

We currently operate online casino games in Pennsylvania through our HollywoodCasino.com gaming platform. We also launched our online casino games in Michigan in 2021. We currently operate a number of our retail sports books in Colorado, Illinois, Indiana, Iowa, Michigan, Mississippi, Pennsylvania and West Virginia. In addition, we continued to enter into long-term market access agreements with leading sports betting operators (BetMGM, Unibet and Rush Street), which we expect to fund our own online sports betting and iCasino business.

Further, we have entered into long-term market access agreements with third parties (Rush Street and Resorts) to gain access to new states, including sports betting in New York (Rush Street) and iCasino in New Jersey (Resorts).

| |||

| ✓ | Team Member Assistance

In response to COVID-19, we created a COVID-19 Emergency Relief Fund for our team members and raised over $4 million in contributions from our Board of Directors, senior management team and from our Penn National Gaming Foundation. We also extended health benefits to all furloughed team members and provided $13 million in one-time holiday cash bonuses to our non-executive team members companywide to help with the financial impact to their families. Further, in response to Hurricane Laura, we contributed more than $6.5 million to L’Auberge Lake Charles and the surrounding community, including payment of full wages and benefits for our team members.

|

✓ | Diversity

In 2020, we formed a new Diversity Committee and established a $1 million annual diversity scholarship program to support the children of our team members. We also implemented a series of new inclusion-related initiatives to educate our team members across the organization, while continuing to foster a respectful and inclusive workplace. We continue to strive to find the best and most talented executives and Board members. Currently, we are well represented from a gender diversity perspective; 50% of our executive officers and 38% of our Board of Directors are women. | |||

|

✓ |

Growth by Acquisitions and Development

We entered into an agreement with GLPI to acquire the operations of Hollywood Casino Perryville for $31.1 million, which is expected to close in the second or third quarter of 2021, subject to regulatory approval. Upon completion of this transaction, we will be in our 20th state. We expect to open our Category 4 Casinos in Morgantown and York, Pennsylvania in 2021, subject to regulatory approval. |

|||||

| 8 | PENN NATIONAL GAMING, INC. |

Table of Contents

825 Berkshire Boulevard, Suite 200

Wyomissing, Pennsylvania 19610

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

June 9, 2021

This Proxy Statement is being furnished to the shareholders of Penn National Gaming, Inc. (the “Company,” “Penn National” or “PENN”) in connection with the solicitation of proxies for the Company’s 2021 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on June 9, 2021 at 10:00 a.m., Eastern time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held via live audio webcast on the Internet at www.virtualshareholdermeeting.com/PENN2021. This solicitation is being made by the Company. This Proxy Statement, the accompanying Proxy Card, and the Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “Annual Report”) are first being made available to our shareholders on or about April 23, 2021.

Corporate Governance Highlights

|

Independence |

Board Leadership |

Gender Diversity |

Board Tenure |

Overboarding |

Director Skills and Experience | |||||

| 7 of 8 independent directors

Fully independent Compensation, Audit, Nominating and Corporate Governance Committees |

Separate Chairman and CEO (for over seven years)

Independent Chairman

Lead Independent Director |

3 of 8 board members, or 38%, are female (two of whom hold board leadership positions) | 4 directors have tenure of less than 7 years | No overboarded directors | Extensive experience in gaming, hospitality, capital markets, accounting, tax, technology, risk management, marketing, media and governmental affairs |

| 2021 PROXY STATEMENT | 9 |

Table of Contents

Commitment to Shareholder Value

We have continued to pursue innovative transactions to create value for our shareholders and to undertake new avenues of growth over the last several years:

| • | On November 1, 2013, we created the gaming industry’s first real estate investment trust, Gaming and Leisure Properties, Inc. (“GLPI”), through a tax free spin-off (the “Spin-Off”). The Company was an industry pioneer in this regard, as several of its peers have since completed similar transactions. |

| • | On October 15, 2018, we acquired Pinnacle Entertainment, Inc. in a stock/cash transaction that significantly expanded the Company’s position as the nation’s leading regional gaming operator. |

| • | In 2019, we pursued online opportunities through Penn Interactive, including the launch of Hollywoodcasino.com, an online real money gaming operation, in Pennsylvania. |

| • | We completed a significant investment in the first quarter of 2020 in Barstool Sports, Inc., a leading digital sports, entertainment and media platform and have the right to utilize the Barstool Sports brand for all of our online and retail sports betting and iCasino apps. |

| • | In 2020, we launched the Barstool Sportsbook app in Pennsylvania. In 2021, we launched our Barstool Sportsbook app in Michigan and Illinois. We continue to evolve into an omni-channel provider of retail and interactive gaming, sports betting and entertainment. We expect to have our Barstool Sportsbook app live in ten states by the end of 2021. |

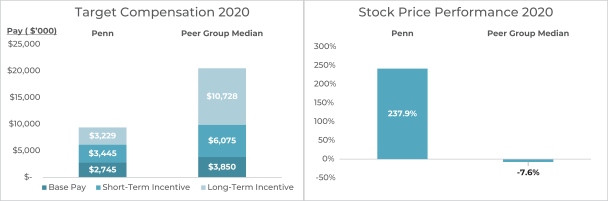

| • | On March 22, 2021, the Company was added to the S&P 500 Index and we have created value for our shareholders with Total Shareholder Returns (TSR) of 237.9% on a one year basis, 439% on a five year basis, and 987% on a ten year basis. |

The Board was highly instrumental in providing leadership to the Company during the evolution of these notable developments.

| Board Overview

The Company operates in a highly specialized and rigorously regulated industry. This environment demands a high level of integrity and accountability in all key aspects of its operations, its management team and its Board of Directors. The Board believes that its structure and composition have been important elements of the Company’s development activity, growth and success in the gaming industry over the years. The Board is comprised of individuals who bring unique talents and perspectives to their service on the Board and, as a group, strike a balance between those who have a proven record of effectively working together to responsibly oversee management’s operation of the Company and those who bring fresh perspectives and unique insights to the Board. In fact, over the last seven years, the Company has added four talented new directors and looks forward to the long-term benefits of the diversity of their experiences and views. In November 2020, we added a new independent board member, Marla Kaplowitz, to our Board. In addition, no member of the Board serves on the board of more than one other public company, which helps to ensure that each member is fully engaged in his or her duties to the Company. |

To maximize shareholder value, the Board strives to maintain a governance environment where (i) entrepreneurship and prudent risk taking are encouraged, with a focus on both long- and short-term value creation, (ii) shareholder perspectives are understood and long-term relationships with shareholders are fostered through frequent, candid and comprehensive engagement with and disclosure to the Company’s shareholders and the investment community, (iii) integrity and accountability are integrated into the Company’s management philosophy and operations and (iv) the Company is able to attract, develop and retain industry-leading executive talent to manage the Company’s increasingly complex operations.

The Board regularly evaluates the governance environment to enable the Company to respond appropriately to changes, practices and market conditions, as well as suggestions from shareholders and other stakeholders, all in a manner that we believe will continue the Company’s long-term record of increasing shareholder value. |

| 10 | PENN NATIONAL GAMING, INC. |

Table of Contents

| 2021 PROXY STATEMENT | 11 |

Table of Contents

| 12 | PENN NATIONAL GAMING, INC. |

Table of Contents

| 2021 PROXY STATEMENT | 13 |

Table of Contents

The Board maintains four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Compliance Committee. The specific duties and operation of each committee are described in more detail below. The Board has determined that each director serving on the Audit Committee, the Compensation Committee or the Nominating and Corporate Governance Committee is independent under the NASDAQ Rules and the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”). The Compliance Committee also includes subject matter experts who are not directors. Each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee operates under a written charter adopted by the Board of Directors that is reviewed annually and is available at www.pngaming.com/about-us.

Committee Membership

| Audit Committee Members |

Compensation Committee Members |

Nominating and Corporate Governance Committee Members |

Compliance Committee Members | |||

| Jane Scaccetti, Chair

John M. Jacquemin

Barbara Shattuck Kohn |

Barbara Shattuck Kohn, Chair

John M. Jacquemin

Ronald J. Naples

Marla Kaplowitz |

Barbara Shattuck Kohn, Chair

John M. Jacquemin

Ronald J. Naples |

Thomas A. Auriemma, Chair (non-director)

Ronald J. Naples

Saul V. Reibstein

Marla Kaplowitz

| |||

| Audit Committee

In addition to being independent as noted above, the Board has determined that each member of the Audit Committee also meets the financial literacy requirements under the NASDAQ Rules and is an “audit committee financial expert” within the meaning of the rules and regulations of the SEC. In addition, Ms. Scaccetti has practiced as a certified public accountant since 1977, which makes her particularly well-qualified to serve as Chair of the Audit Committee.

The principal functions of the Audit Committee are to:

• serve as an independent and objective party to monitor the integrity of the Company’s financial reporting process and internal control system;

• engage the independent registered public accounting firm, review and appraise the audit efforts of the Company’s independent registered public accounting firm and internal auditors and monitor the registered public accounting firm’s independence; and

• maintain free and open communication with and among the independent registered public accounting firm, the internal auditors, the Company’s finance department, senior management and the Board of Directors.

The Audit Committee is also responsible for reviewing and pre-approving all conflicts of interest and related |

person transactions involving the Board or the Company’s executive officers. In discharging its oversight role, the Audit Committee is empowered to investigate any matter brought to its attention and any other matters that the Audit Committee believes should be investigated. The Audit Committee may at any time engage, at the expense of the Company, independent counsel or other advisors, as it deems necessary to carry out its duties.

Compensation Committee

In addition to being independent as noted above, each member of the Compensation Committee is also a non-employee director, as defined under Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and an outside director, as defined under Section 162(m) of the Internal Revenue Code of 1986, as amended.

The Compensation Committee’s authority and responsibilities include:

• evaluating the annual performance of the CEO and recommending to the Board for approval all CEO compensation and employment agreements and separation agreements;

• evaluating and approving for the other executive officers (other than the CEO) salary, annual short-term incentive opportunities, long-term equity based incentives and other benefits; |

| 14 | PENN NATIONAL GAMING, INC. |

Table of Contents

| 2021 PROXY STATEMENT | 15 |

Table of Contents

| 16 | PENN NATIONAL GAMING, INC. |

Table of Contents

The Company pays fees to each director who is not an employee of the Company. During the year ended December 31, 2020, the annual compensation for each non-employee director (other than Marla Kaplowitz who joined in November 2020) consisted of an annual cash fee of $50,000, plus an additional $10,000 for service on each of the Audit Committee, the Compensation Committee and the Compliance Committee, as applicable. In addition, the Chair of the Audit Committee receives a $15,000 annual retainer, the Chair of the Compensation Committee receives a $10,000 annual retainer, and the Chair of the Nominating and Corporate Governance Committee receives a $5,000 annual retainer. Each non-employee director had the opportunity to elect to receive his or her annual fees in the form of shares of restricted stock with forfeiture restrictions lapsing on the first anniversary of the date of grant. In 2020, each non-employee director (who elected to receive cash compensation in lieu of shares of restricted stock) elected to forgo any of their cash compensation from April 1, 2020 until October 1, 2020.

In 2020, each non-employee director (other than Marla Kaplowitz) received a grant of phantom stock units or restricted stock at his or her election with a value of $250,000 and the Chairman of the Board received a grant of phantom stock units or restricted stock at his election with a value of $375,000. Each award of phantom stock units or shares of restricted stock vests in three equal annual installments from the date of grant. Ms. Kaplowitz joined the Board of Directors on November 23, 2020 and did not receive any compensation in 2020.

2020 Director Compensation Table

The following table sets forth information with respect to all compensation awarded to the Company’s non-employee directors for 2020.

| Name |

Fees |

Stock Awards ($)(3)(4) |

Total ($) | |||

| David A. Handler |

50,000 | 375,004 | 425,004 | |||

|

John M. Jacquemin |

70,000 | 250,003 | 320,003 | |||

| Marla Kaplowitz(1) |

0 | 0 | 0 | |||

|

Barbara Shattuck Kohn |

42,500 | 250,003 | 292,503 | |||

| Ronald J. Naples |

35,000 | 250,003 | 285,003 | |||

|

Saul V. Reibstein |

60,000 | 250,003 | 310,003 | |||

|

Jane Scaccetti |

37,500 | 250,003 | 287,503 |

| (1) | Ms. Kaplowitz joined the Company’s Board of Directors on November 23, 2020. During 2020, Ms. Kaplowitz did not receive any compensation for her service as director, including any cash compensation or stock awards. |

| (2) | In 2020, each non-employee director was permitted to elect to receive his or her fees in shares of restricted stock, which vest on the first anniversary of the date of grant. In 2020, Messrs. Handler, Jacquemin, and Reibstein elected to receive shares of restricted stock in lieu of cash. In 2020, Mr. Naples and Messes. Kohn and Scaccetti (who elected to receive his or her fees in cash) forwent these payments from April 1, 2020 to October 1, 2020. |

| (3) | The amounts listed are calculated based on the closing price on the day prior to grant date computed in accordance with FASB ASC Topic 718. |

| (4) | As of December 31, 2020, the following stock awards were outstanding: (i) for Mr. Handler, 8,498 phantom stock units and 27,448 shares of restricted stock; (ii) for Mr. Jacquemin, 8,498 phantom stock units and 20,810 shares of restricted stock; (iii) for Ms. Kaplowitz, there were no outstanding stock awards; (iv) for Ms. Kohn, 8,498 phantom stock units and 18,132 shares of restricted stock; (v) for Mr. Naples, 17,066 phantom stock units and 9,564 shares of restricted stock; (vi) for Mr. Reibstein, 14,331 phantom stock units and 10,863 shares of restricted stock; and (vii) for Ms. Scaccetti, 18,062 phantom stock units and 8,568 shares of restricted stock. As of December 31, 2020, Mr. Reibstein also had 54,543 stock options outstanding related to his previous service as Chief Financial Officer of the Company. |

| 2021 PROXY STATEMENT | 17 |

Table of Contents

Table of Contents

At Penn National Gaming, as we continue our evolution from what began as a single racetrack operator into what is today the nation’s leading omni-channel provider of retail and online gaming and sports betting entertainment, our Board of Directors and Management Team remain deeply committed to fostering a culture that helps to attract and retain a diverse, talented pool of dedicated team members.

In addition, as a longstanding good corporate citizen, we’re committed to being a trusted and valued member of our communities and a responsible steward of our finite natural resources.

Penn National’s Environmental, Social and Governance (“ESG”) Committee, which reports directly to our President & CEO Jay Snowden and our Nominating and Corporate Governance Committee and the Board of Directors, is comprised of:

| Todd George Executive Vice President of Operations

Felicia Hendrix Executive Vice President and Chief Financial Officer

Harper Ko Executive Vice President, Chief Legal Officer and

D. Eric Schippers Senior Vice President, Public Affairs and |

Justin Carter Senior Vice President of Regional

Operations and

Wendy Hamilton Senior Vice President,

Justin Sebastiano Senior Vice President, Finance & Treasurer

Richard Primus Senior Vice President and Chief Information Officer | |

| 2021 PROXY STATEMENT | 19 |

Table of Contents

| 20 | PENN NATIONAL GAMING, INC. |

Table of Contents

| amenity bottles. For example, at Hollywood Casino St. Louis, which features a 502-room hotel, we’ve reduced plastic bottle use by 91% — or 550 pounds annually — which translates to nearly $50,000 in annual savings for that hotel alone. In addition, replacing paper towels with electric hand dryers and using coreless toilet paper rolls at the casino has led to a reduction of 22,000 pounds of paper waste annually.

In an effort to conserve water, most of our hotel locations encourage guests to participate in linen and towel reuse programs. Behind the scenes, low-flow plumbing fixtures and efficient use of laundry facilities help further curb water waste.

We currently have robust recycling programs in place at most of our properties nationwide (with plans to further expand the program), diverting recyclable materials produced by the casino and hotel operations away from landfills. Composting facilities, currently implemented at five locations, allow even more waste |

to be redirected. Additional waste reduction efforts at select properties — such as the use of plant-based and paper straws, the replacement of paper towels with electric hand dryers, and the elimination of Styrofoam — help further reduce waste directly at the source. These types of broad sustainability programs are designed to eliminate over 25,000 pounds of waste annually at each property.

Additionally, our operations and IT teams have laid the groundwork for implementing a new generation of cashless, cardless, and contactless technology at our casinos, which we refer to as the 3Cs, that will help to eliminate a significant amount of plastic and paper waste from membership cards and printed tickets from our slot machines, self-serve kiosks and ATMs. It will also lead to an ongoing reduction of direct mail to consumers. We intend to launch this technology initially at our Pennsylvania casinos in the first half of 2021, subject to regulatory approval, and plan to continue rolling it out to other regions in 2021.

|

Penn National Gaming Casino and Hotel — Energy Efficieny Projects

ESG — KWH Reduction, Green House Gas Emissions and Carbon Footprint Reduction Annually

| Locations | Total KWH Annually - 2019 |

LED Lighting Retrofits and Total KWH Reduction |

Annual Percentage of KWH Reduction |

Greenhouse Gas Emissions Reduction (Tons)1 |

Equivalent from switching to LED from incandescent light bulbs1 |

Carbon Free Power Generation w/ Constellation Energy |

||||||||||||||||||

| Charles Town |

32,063,541 | 4,910,806 | 15 | % | 3,827 | 131,905 | ||||||||||||||||||

| Aurora |

10,873,000 | 1,555,303 | 14 | % | 1,212 | 41,776 | 10,873,000 | |||||||||||||||||

| Grantville |

25,368,000 | 1,053,204 | 4 | % | 821 | 28,289 | 25,368,000 | |||||||||||||||||

| Tunica |

15,054,000 | 2,350,355 | 16 | % | 1,832 | 63,131 | ||||||||||||||||||

| Riverside |

15,429,999 | 3,814,101 | 25 | % | 2,973 | 102,447 | ||||||||||||||||||

| Joliet |

17,819,000 | 3,041,119 | 17 | % | 2,370 | 81,685 | 17,819,000 | |||||||||||||||||

| Dayton |

8,705,000 | 508,560 | 6 | % | 396 | 13,660 | 8,705,000 | |||||||||||||||||

| Tropicana |

26,589,948 | 5,383,320 | 20 | % | 4,196 | 144,597 | ||||||||||||||||||

| Zia Park |

5,779,145 | 64,743 | 1 | % | 51 | 1,739 | ||||||||||||||||||

| Columbus |

19,404,000 | 2,174,040 | 11 | % | 1,694 | 58,395 | 19,404,000 | |||||||||||||||||

| Youngstown |

9,025,000 | 421,497 | 5 | % | 329 | 11,321 | 9,025,000 | |||||||||||||||||

| Lawrenceburg |

15,624,000 | 2,229,072 | 14 | % | 1,737 | 59,873 | ||||||||||||||||||

| KC Speedway |

17,652,900 | 1,510,210 | 9 | % | 1,177 | 40,564 | ||||||||||||||||||

|

1st Jackpot |

6,894,000 | 727,032 | 11 | % | 567 | 19,528 | ||||||||||||||||||

| Boomtown Bilioxi |

11,879,764 | 1,142,208 | 10 | % | 890 | 30,680 | ||||||||||||||||||

| M Resort |

26,023,496 | 1,719,828 | 7 | % | 1,340 | 46,195 | ||||||||||||||||||

| Plainridge |

9,812,000 | 1,459,476 | 15 | % | 1,137 | 39,202 | 9,812,000 | |||||||||||||||||

| L’Auberge Baton Rouge |

24,435,629 | 1,130,776 | 5 | % | 881 | 30,373 | ||||||||||||||||||

| Bay St. Louis |

14,500,000 | 2,631,420 | 18 | % | 2,051 | 70,680 | 14,500,000 | |||||||||||||||||

| St. Louis |

27,926,410 | 1,242,445 | 4 | % | 968 | 33,372 | ||||||||||||||||||

| Bangor |

9,471,000 | 2,423,952 | 26 | % | 1,889 | 65,108 | 9,471,000 | |||||||||||||||||

| Toledo |

20,875,000 | 1,737,845 | 8 | % | 1,354 | 46,679 | 20,875,000 | |||||||||||||||||

| Council Bluffs-Iowa |

17,936,825 | 1,043,700 | 6 | % | 813 | 28,034 | ||||||||||||||||||

| Ameristar-East Chicago |

23,696,400 | 2,376,590 | 10 | % | 1,852 | 63,836 | ||||||||||||||||||

| L’Auberge Lake Charles |

39,873,314 | 2,171,115 | 5 | % | 1,692 | 58,316 | ||||||||||||||||||

| Boomtown New Orleans |

14,687,859 | 1,142,892 | 8 | % | 891 | 30,698 | ||||||||||||||||||

| Black Hawk-Colorado |

19,412,028 | 2,412,270 | 12 | % | 1,880 | 64,794 | ||||||||||||||||||

| Total |

486,811,258 | 52,377,879 | 11 | % | 40,820 | 1,406,877 | 145,852,000 | 2 | ||||||||||||||||

Notes:

1. Information from the EPA website listed below:

Greenhouse Gas Equivalencies Calculator | Energy and the Environment | US EPA

https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator

2. Completely Carbon Free Power Generation

| 2021 PROXY STATEMENT | 21 |

Table of Contents

| 22 | PENN NATIONAL GAMING, INC. |

Table of Contents

| Diversity Procurement

In 2019, following our acquisition of Pinnacle Entertainment, we formally established a committee to implement a corporate-wide Supplier Diversity Initiative to coordinate efforts across all properties regardless of jurisdictional requirements, with the goal of developing new opportunities for diversity businesses. This initial effort resulted in us more than doubling our diversity spend to $104 million in 2019 with businesses-owned by minorities, women, disabled individuals and veterans. In 2020, we’ve enhanced our efforts through a membership in the National Minority Supplier Diversity Council (NMSDC). Our head of procurement, Drew Misher, serves on its Corporate Advisory Board, and we were honored last year to sponsor and attend their annual national vendor fair, which was held virtually. We also held a regional networking event in conjunction with the Chicago Minority Supplier Diversity Council last December.

In addition, we are in the process of creating a Penn Small Business Incubator program that will help to onboard minority businesses as suppliers with Penn National. It will also assist them in growing from local to regional and ultimately national suppliers with our Company. |

Penn National is proud to partner with the All-in

Diversity Project, an industry-driven initiative supporting diversity, equality and inclusion in business. Recently we sponsored their #OpenDoors 2021 social media campaign. Spanning Black History Month and International Women’s Day, the #OpenDoors campaign is designed to raise awareness of how others affect our professional development and recognize that people do not progress in their careers without the help of someone along the way. The campaign asked contributors to thank someone who opened a door for them, and then pledge to pay it forward and hold the door open for someone else. | |||

|

Category

|

2019 actual

|

2021 target

| ||

|

Qualified Diversity Spend |

18%—property spend 14%—corporate spend WBE—8.3% MBE—2.2% WMBE—3.7%

|

22%—property spend 16%—corporate spend WBE—10% MBE—4% Other—1%

| ||

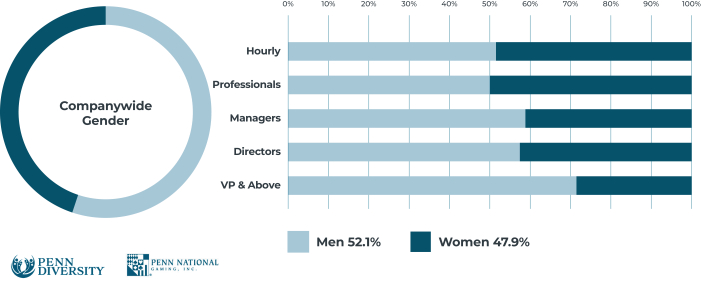

| Diversity Recruitment

Building a diverse workforce is critical to helping us attract and retain the talent needed to advance our business and create outstanding guest experiences at our properties across the country. We welcome and value customers and team members of all backgrounds and are committed to creating both a work force reflective of the local markets and a supplier base that promotes an environment of diversity, equity, inclusion and empowerment. We are proud that 48% of our team members identify as female and 47% identify as minority across the entire enterprise. We also fully support our LGBTQ+ team members and guests. In 2019, we developed standards at each of our properties to ensure accessibility of facilities and training and communication to team members regarding LGBTQ+ rights. In addition, we support local community organizations, such as |

The LGBTQ Center in Las Vegas, which fights to “protect the well-being, positive image, and human rights of the lesbian, gay, bisexual, transgender, and queer community, its allies, and low to moderate income residents in Southern Nevada.”

• Ethnic Diversity:

• 25% of all Penn National team members self-identify as African American

• 18% of all Penn National managers self-identify as African American

• 8% of all Penn National team members self-identify as Asian Americans

• 10% of all Penn National team members self-identify as Latino/Hispanic | |||

| 2021 PROXY STATEMENT | 23 |

Table of Contents

| We are committed to supporting the well-being and professional development of all of our team members, including tuition reimbursement and other certification programs, with a particular focus on minority and female leadership development. For example, our Women Leading at Penn (“WLP”) program continued to grow in its third year of operations. The goal of WLP is to network, inspire, and encourage women to pursue leadership roles

and to have female executives champion growth and development at the property and corporate levels. As a result, women held 34% of the leadership positions at the Company in 2019 and we’ve seen continued growth since then. Today, our Corporate Senior Management Team is 35% female and our Executive Team is 37.5% female, including our new Executive Vice President and Chief Financial Officer; Executive Vice President, Chief Legal Officer and Secretary; and our Senior Vice President, Chief Human Resources Officer.

In addition, we are very proud of the fact that two members of our Board of Directors – Barbara Shattuck Kohn and Jane Scaccetti – were named to Women Inc.’s list of “2019 Most Influential Corporate Directors.” The Women Inc.’s list features a comprehensive directory of influential female directors, executives, influencers and achievers who are currently serving on the boards of S&P 500/Large-Cap publicly-held companies and making impacts through their leadership. We also welcomed the addition of Marla Kaplowitz to our Board at the end of last year. Ms. Kaplowitz is President and Chief Executive Officer of the American Association of Advertising Agencies (4A’s), a trade association serving more than 600 member agencies across 1,200 offices |

throughout the U.S., who are responsible for more than 85% of total domestic advertising spend. With the addition of Ms. Kaplowitz, our Board of Directors is now 38% female.

Supporting our Veterans

Later this year we’ll be launching the U.S. Chamber of Commerce Foundation’s Hiring Our Heroes initiative, which connects veterans, service members, and military spouses with meaningful employment opportunities. We are committed to identifying and hiring full-time team members through this program to further unite the military community with our company in order to create economic opportunity and a stronger, more diversified workforce.

• Program Overview:

• 12-week intern fellowship program for exiting military personnel to gain hands-on, practical experiences in one functional area (e.g., F&B, HR, IT, etc.)

• Fellows are placed in exempt roles and report to their properties Monday-Thursday, and to their military base on Fridays for training |

| 24 | PENN NATIONAL GAMING, INC. |

Table of Contents

| 2021 PROXY STATEMENT | 25 |

Table of Contents

| 26 | PENN NATIONAL GAMING, INC. |

Table of Contents

|

|

||||

| At Metanoia Gala, from left: Michelle and State Senator Ronnie Johns, Donna and Governor John Bel Edwards, Reverend Jeff Bayh, Mary Kadair, and Eric Schippers, Sr. Vice President, Penn National Gaming.

|

| COVID-19 Response

Our team members are the life blood of our Company. During the time our properties were temporarily closed as a result of the COVID-19 outbreak, we extended health benefits to all furloughed team members and provided $13 million in holiday cash bonuses to our non-executive team members companywide to help with the financial impact to their families. Meanwhile, our executives took significant pay cuts and sacrificed end-of-year performance bonuses.

Through our Penn National Gaming Foundation, we created a COVID-19 Emergency Relief Fund for our team members and raised over $4 million through personal donations from our CEO, Senior Management team, Corporate Board of Directors and property general managers, in addition to contributions from our Foundation and property employee assistance funds.

Most recently, we joined Barstool Sports Founder Dave Portnoy’s personal mission to help save and sustain small businesses which have been impacted by COVID-19, contributing more than $4.6 million, and counting, to the non-profit “Barstool Fund.” To date, the Fund has raised over $36 million and is actively supporting 288 small businesses around the country. |

This initiative is in addition to our collective effort in October to save the historic Reading Terminal Market in Philadelphia, which was suffering from decreased business as a result of COVID-19 and launched an online fundraising campaign to assist with its survival. Within 24 hours, Penn National and Barstool raised enough money to meet and exceed their fundraising goal. Our effort ensured the survival of an organization that supports family businesses, educational opportunities for low-income Philadelphia youth, and is one of the largest sites for the redemption of SNAP benefits in Pennsylvania.

Meanwhile, during the mandatory COVID-19 temporary closures, our 41 properties in 19 states throughout the country donated more than 45 tons of food to local food banks and homeless shelters in our communities, ensuring our perishable food items could help those in need at the height of the pandemic. In addition, our properties donated thousands of unused masks and surgical gloves to first responders and health care providers. Many of our properties served as COVID-19 test sites and housed emergency personnel, in addition to organizing food drives and blood donations.

| |||

| 2021 PROXY STATEMENT | 27 |

Table of Contents

Charitable Efforts

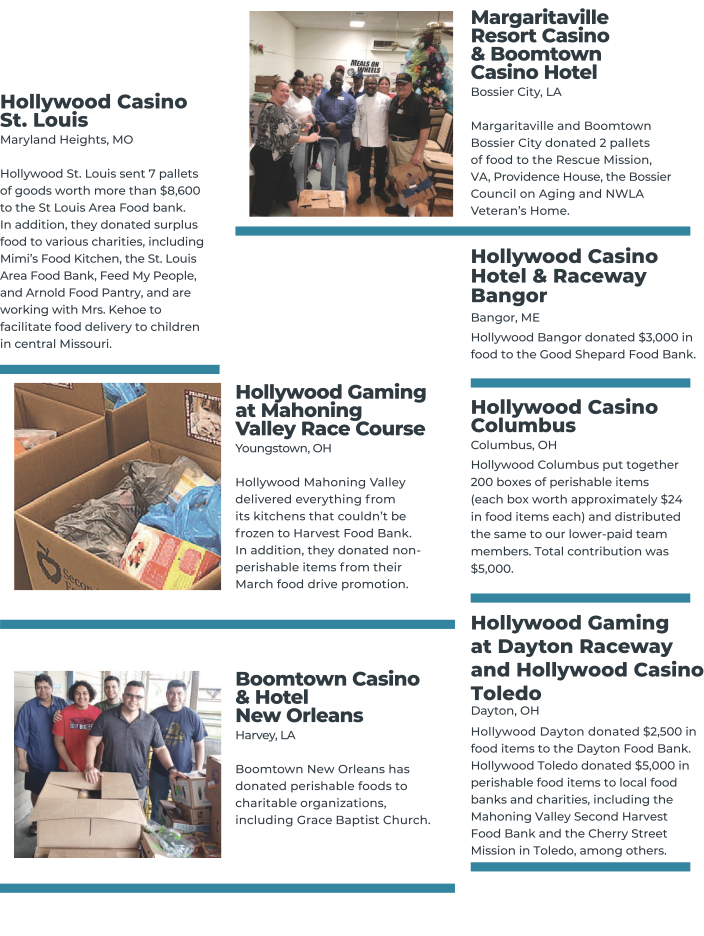

At the onset of the COVID-19 pandemic, our properties across the country stepped up to donate food items to

our local communities, ensuring our perishables would go to the homes of our neighbors in need. In times of crisis, we come together. We support the communities in which we live and work.

River City Casino & Hotel

St. Louis, MO

River

City Casino & Hotel has donated $7,000 in produce and dairy to a variety of charities, including Feed My People, Arnold Food Pantry, Aging Ahead and St. Louis Area Food Bank. These are the organizations River City supports

regularly.

Hollywood Casino Aurora & Hollywood Casino Joliet

Aurora & Joliet, IL

Hollywood Casino Joliet recently donated more than $8,000 of food to Catholic Charities Homeless Shelter in Joliet, and Hollywood Casino Aurora donated

perishables to Aurora Interfaith Food Pantry, with its executive team staying to help with pantry bag items.

Greektown Casino

Detroit, MI

Greektown donated perishable food items, water, gloves and toilet paper to Gleaners Community Food

Bank, Wayne County Meals on Wheels, Mariners Inn (housing for displaced veterans) and Veterans Solutions. Greektown is also working with the city of Detroit and local medical facilities to offer their facilities as a makeshift hospital and drive

through testing center.

Zia Park Casino Hotel

& Racetrack

Hobbs, NM

Zia Park donated $6,000 in food to Hearts Desire Inc., Hobbs Guidance Center, Isaiah's Soup Kitchen and Options Inc. woman's shelter.

| 28 | PENN NATIONAL GAMING, INC. |

Table of Contents

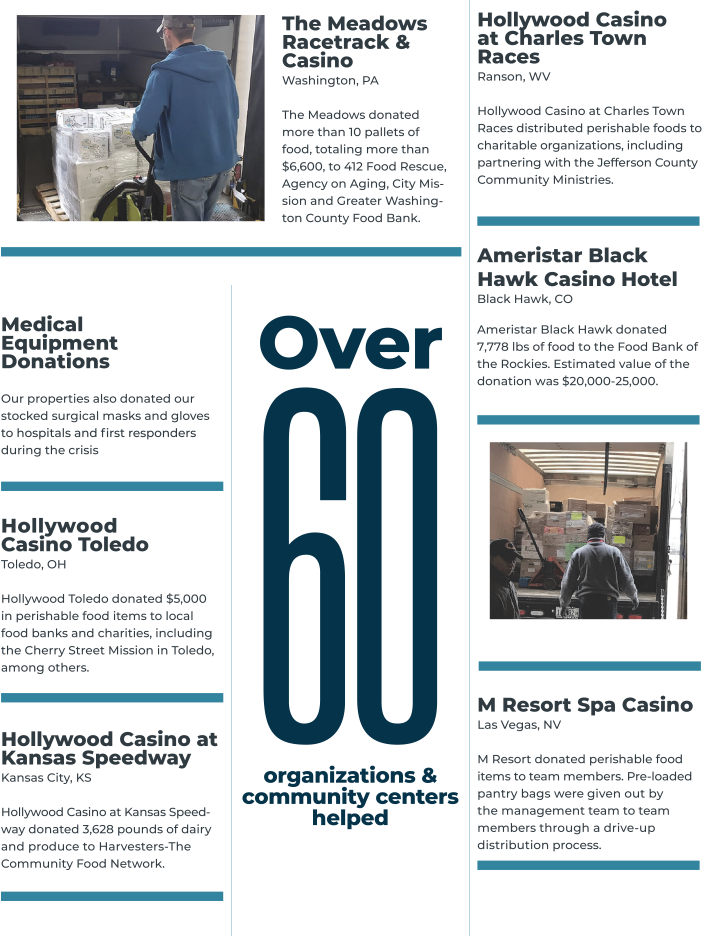

The Meadows Racetrack & Casino

Washington, PA

The Meadows donated more than 10 pallets of food, totaling more than

$6,600, to 412 Food Rescue, Agency on Aging, City Mission and Greater Washington County Food Bank.

Medical Equipment Donations

Our properties also donated our stocked surgical masks and gloves to hospitals and first responders during the

crisis

Hollywood Casino Toledo

Toledo, OH

Hollywood Toledo donated $5,000 in perishable food items to local food banks and charities, including the Cherry Street Mission in Toledo, among others.

Over 60 organizations & community

centers helped

Hollywood Casino at Kansas Speedway

Kansas City, KS

Hollywood Casino at Kansas Speedway donated 3,628 pounds of dairy and produce to Harvesters-The Community Food Network.

Hollywood Casino at Charles Town Races

Ranson, WV

Hollywood Casino at Charles Town Races is distributed perishable foods to charitable organizations, including partnering with the Jefferson County Community Ministries.

Ameristar Black Hawk Casino Hotel

Black Hawk,

CO

Ameristar Black Hawk donated 7,778 lbs of food to the Food Bank of the Rockies. Estimated value of the donation was $20,000-25,000.

M Resort Spa Casino

Las Vegas, NV

M Resort donated perishable food items to team members. Pre-loaded

pantry bags were given out by the management team to team members through a drive-up distribution process.

| 2021 PROXY STATEMENT | 29 |

Table of Contents

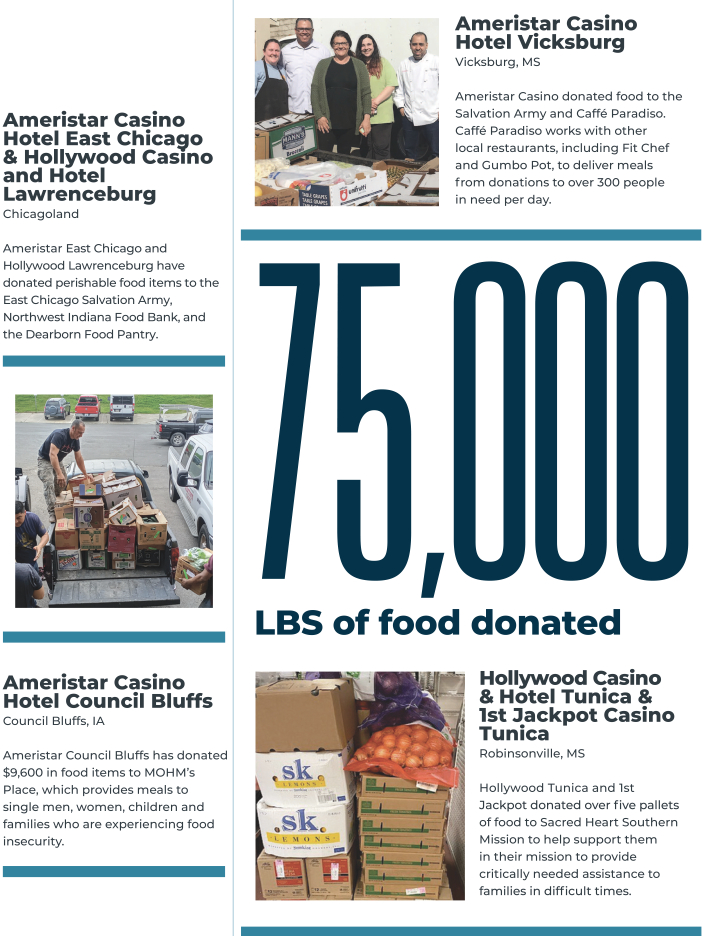

Ameristar Casino Hotel East Chicago & Hollywood Casino and Hotel Lawrenceburg

Chicagoland

Ameristar East Chicago and

Hollywood Lawrenceburg have donated perishable food items to the East Chicago Salvation Army, Northwest Indiana Food Bank, and the Dearborn Food Pantry.

Ameristar Casino Hotel Council Bluffs

Council Bluffs, IA

Ameristar Council Bluffs has

donated $9,600 in food items to MOHM's Place, which provides meals to single men, women, children and families who are experiencing food insecurity.

Ameristar Casino Hotel Vicksburg

Vicksburg, MS

Ameristar Casino donated food to the

Salvation Army and Caffe Paradiso. Caffe Paradiso works with other local restaurants, including Fit Chef and Gumbo Pot, to deliver meals from donations to over 300 people in need per day.

75,000 LBS of food donated

Hollywood Casino &

Hotel Tunica & 1st Jackpot Casino Tunica

Robinsonville, MS

Hollywood Tunica and 1st Jackprt donated over five pallets of food to Sacred Heart Southern Mission to help support them in their mission to provide critically needed assistance to

families in difficult times.

| 30 | PENN NATIONAL GAMING, INC. |

Table of Contents

Hollywood Casino St. Louis Maryland Heights, MO Hollywood St. Louis sent 7 pallets of goods worth more than $8,600 to the St Louis

Area Food-bank. In addition, they donated surplus food to various charities, including Mimi's Food Kitchen, the St. Louis Area Food Bank, Feed My People, and Arnold Food Pantry, and are working with Mrs. Kehoe to facilitate food delivery to children

in central Missouri. Hollywood Gaming at Mahoning Valley Race Course Youngstown, OH Hollywood Mahoning Valley delivered everything from its kitchens that couldn't be frozen to Harvest Food Bank. In addition, they donated non-perishable items from

their March food drive promotion. Boomtown Casino & Hotel New OrleansHarvey, LA Boomtown New Orleans has donated perishable foods to charitable organizations, including Grace Baptist Church. Margaritaville Resort Casino& Boomtown Casino

HotelBossier City, LAMargaritaville and Boomtown Bossier City donated 2 pallets of food to the Rescue Mission, VA, Providence House, the Bossier Council on Aging and NWLA Veterans Home. Hollywood Casino Hotel & Raceway Bangor

Bangor,

ME

Hollywood Bangor donated $3,000 in food to the Good Shepard Food Bank.

Hollywood Casino Columbus

Columbus, OH

Hollywood Columbus put together 200 boxes of perishable items (each box worth approximately $24 in food items each) and

distributed the same to our lower-paid team members. Total contribution was $5,000.

Hollywood Gaming at Dayton Raceway and Hollywood Casino Toledo

Dayton, OH

Hollywood Dayton donated $2,500 in food items to the Dayton Food Bank. Hollywood

Toledo donated $5,000 in perishable food items to local food banks and charities, including the Mahoning Valley Second Harvest Food Bank and the Cherry Street Mission in Toledo, among others.

| 2021 PROXY STATEMENT | 31 |

Table of Contents

| 32 | PENN NATIONAL GAMING, INC. |

Table of Contents

| 2021 PROXY STATEMENT | 33 |

Table of Contents

ELECTION OF CLASS I DIRECTORS

Information about Nominees and Other Directors

The Board of Directors currently consists of eight members: David A. Handler (Chairman), John M. Jacquemin, Marla Kaplowitz, Barbara Shattuck Kohn, Ronald J. Naples, Saul V. Reibstein, Jane Scaccetti and Jay A. Snowden. The directors are organized into three classes, with each class elected to serve a three year term. Two Class I directors will be elected at the Annual Meeting to hold office, subject to the provisions of the Company’s bylaws, until the annual meeting of shareholders of the Company to be held in 2024 and until their respective successors are duly elected and qualified.

Class I Nominees

The following table sets forth the name, independence status, number of other public company boards, principal occupation and term of service of each person who has been nominated to be a director of the Company. Each nominee has consented to be named as a nominee and, to the knowledge of the Company, is willing to serve as a director, if elected. Should either of the nominees not remain a nominee at the end of the meeting (a situation which is not anticipated), solicited proxies may be voted by the holders of the proxies for a substitute nominee (unless a proxy contains instructions to the contrary).

| Name of Nominee | Independent | Other Public Company Boards |

Principal Occupation | Term (if elected) | ||||

| David A. Handler |

Yes | None |

Partner, Centerview |

2024 | ||||

| John M. Jacquemin |

Yes | None |

President, Mooring |

2024 | ||||

| 34 | PENN NATIONAL GAMING, INC. |

Table of Contents

Nominee Qualifications

|

David A. Handler

Class I Director

Age: 56

Director Since: 1994 |

Business Experience: Mr. Handler has served as the Company’s Chairman of the Board since June 2019 and as a director since 1994. In August 2008, Mr. Handler joined Centerview Partners as a Partner. Centerview Partners is an independent financial advisory and private equity firm. From April 2006 to August 2008, he was a Managing Director at UBS Investment Bank.

Other Public Company Boards: None.

Mr. Handler has considerable investment banking and capital markets experience, which includes a focus on mergers and acquisitions and other significant transactions (including many in the technology space), which compliments his long-term exposure to the gaming industry. Mr. Handler’s background has been an invaluable asset to the Company over the years, particularly in connection with evaluating potential acquisitions and financing opportunities.

| |

|

John M. Jacquemin

Class I Director

Age: 74

Director Since: 1995 |

Business Experience: Mr. Jacquemin is President of Mooring Financial Corporation, a group of financial services companies founded by Mr. Jacquemin in 1982 that specializes in the purchase and administration of commercial loan portfolios.

Other Public Company Boards: None.

Mr. Jacquemin has significant experience with private equity funds specializing in restructurings, workouts and the valuation of distressed debt. The nature of these investments requires a sophisticated understanding of financial statements to enable the identification of growth opportunities in troubled companies, as well as valuation expertise. This experience brings unique perspective to the Board and is enhanced by Mr. Jacquemin’s financial sophistication and financial statement expertise and long-term exposure to the gaming industry.

|

In addition to the qualifications of each nominee for director described above, David A. Handler and John M. Jacquemin are standing for re-election based upon the judgment, financial acumen and skill they have demonstrated as Board members, as well as their demonstrated commitment to serve on the Board.

The Board of Directors unanimously recommends that the shareholders vote “FOR” each of the nominees.

| 2021 PROXY STATEMENT | 35 |

Table of Contents

Continuing Directors

The following table sets forth the name, independence status, number of other public company boards, principal occupation and term of service of each person who will continue as a director after the Annual Meeting.

| Name | Independent |

Other Public |

Principal Occupation | Term Expires | ||||

|

Class II Directors:

| ||||||||

| Barbara Shattuck Kohn | Yes | 1 | Director of Fluent, Inc. and former Principal of Hammond Hanlon Camp LLC | 2022 | ||||

|

Ronald J. Naples |

Yes | 1 | Director of P.H. Glatfelter Company, Glenmede Trust Company and the Philadelphia Contributionship | 2022 | ||||

| Saul V. Reibstein | Yes | 1 | Director of Vishay Precision Group, Inc. and former Executive Vice President, Chief Financial Officer and Treasurer of Penn National Gaming, Inc. | 2022 | ||||

|

Class III Directors:

| ||||||||

| Marla Kaplowitz | Yes | None | President and Chief Executive Officer of the American Association of Advertising Agencies | 2023 | ||||

|

Jane Scaccetti |

Yes | 1 | Chief Executive Officer of Drucker & Scaccetti, P.C. and Director of Myer Industries, Inc. | 2023 | ||||

| Jay A. Snowden | No | None | President and Chief Executive Officer of Penn National Gaming, Inc. | 2023 | ||||

| 36 | PENN NATIONAL GAMING, INC. |

Table of Contents

Continuing Directors’ Qualifications

|

Barbara Shattuck Kohn

Class II Director

Age: 70

Director Since: 2004 |

Business Experience: Ms. Kohn serves as a director of Fluent, Inc. Ms. Kohn was a Principal at Hammond Hanlon Camp LLC, a strategic advisory and investment banking firm from 2012 to 2018. Ms. Kohn also serves as a director of Emblem Health, one of the nation’s largest nonprofit health plans. She has previously served as a director of Computer Task Group and a division of Sunlife Financial Corporation. Prior to joining Hammond Hanlon Camp LLC in 2012, Ms. Kohn was a Managing Director of Morgan Keegan – Raymond James. Morgan Keegan & Company, Inc. was acquired by Raymond James Financial from Regions Financial Corp. and was the successor to Shattuck Hammond Partners, an investment banking firm Ms. Kohn co-founded in 1993. Prior to 1993, she spent 11 years at Cain Brothers, Shattuck & Company, Inc., an investment banking firm she also co-founded. From 1976 to 1982, she was a Vice President of Goldman, Sachs & Co. Ms. Kohn began her career as a municipal bond analyst at Standard & Poor’s Corporation. Ms. Kohn was named to Women Inc.’s list of “2019 Most Influential Corporate Directors.”

Other Public Company Boards: Fluent, Inc.

Ms. Kohn has substantial experience in investment banking, capital markets and project finance. Further, she possesses the experience, financial sophistication and financial statement expertise necessary to evaluate potential acquisition and financing opportunities for the Company, and she was instrumental in evaluating both the preferred equity investment in the Company by Fortress Investment Group, LLC in 2008 and the spin-off of the Company’s real estate in 2013. This financial background is ideally suited for Ms. Kohn’s service on the Audit and Compensation Committees, and her reputation, integrity, judgment and proven leadership ability meets both the Board’s high standards and the rigorous requirements of the various regulatory agencies with jurisdiction over the Company.

| |

|

Ronald J. Naples

Class II Director

Age: 75

Director Since: 2013 |

Business Experience: Mr. Naples serves as a director of P.H. Glatfelter Company, Glenmede Trust Company and the Philadelphia Contributionship. Mr. Naples served as Chairman of the Pennsylvania Stimulus Oversight Commission and Chief Accountability Officer for the Commonwealth of Pennsylvania, having been appointed to that position by the Governor of Pennsylvania, from April 2009 until February 2011. From 1997 until May 2009, Mr. Naples was the Chairman of Quaker Chemical Corporation, a public specialty chemical company serving the metalworking and manufacturing industries worldwide, and served as Quaker’s Chief Executive Officer from 1995 to 2008. Previously, Mr. Naples was Chairman and Chief Executive Officer of Hunt Manufacturing Company, a public company, from 1981 to 1995. He also served as Chairman of the Federal Reserve Bank of Philadelphia.

Other Public Company Boards: P.H. Glatfelter Company

Mr. Naples has significant business experience as a chief executive officer and director of large, publicly traded corporations. Mr. Naples has significant government and regulatory experience as Chairman of the Pennsylvania Stimulus Oversight Commission and Chief Accountability Officer for the Commonwealth of Pennsylvania and as Chairman of the Federal Reserve Bank of Philadelphia. Mr. Naples’ impressive educational background and distinguished military career as well as his reputation, integrity, judgment and proven leadership ability meets both the Board’s high standards and the rigorous requirements of the various regulatory agencies with jurisdiction over the Company. In addition, Mr. Naples’ military, leadership and regulated company experience is invaluable in the context of his service on the Compliance Committee.

|

| 2021 PROXY STATEMENT | 37 |

Table of Contents

|

Saul V. Reibstein

Class II Director

Age: 72

Director Since: 2018

(and previously a director from 2011 to 2014) |

Business Experience: Mr. Reibstein served on the Company’s board of directors and was Chairman of the Audit Committee from June 2011 until his appointment as Senior Vice President and Chief Financial Officer in November 2013. Mr. Reibstein retired as the Company’s Executive Vice President, Chief Financial Officer and Treasurer on December 31, 2016 and was employed by the Company as an executive advisor from January 1, 2017 through December 31, 2017. From 2004 until joining the Company as an executive, Mr. Reibstein served as a member of the senior management team of CBIZ, Inc., a New York Stock Exchange-listed professional services company, where, as Executive Managing Director, he was responsible for the management of the CBIZ New York City Financial Services office operations and the overall international activities of the Financial Services Group. Mr. Reibstein has over 40 years of public accounting experience, including 11 years serving as a partner in BDO Seidman, a national accounting services firm, where he was the partner in charge of the Philadelphia office from June 1997 to December 2001 and Regional Business Line Leader from December 2001 until September 2004. In addition, since July 2010, Mr. Reibstein has served as a member of the Board of Directors of Vishay Precision Group, Inc., a publicly traded company, where he is Chairman of the Audit Committee and a member of both of its Compensation and Nominating and Corporate Governance Committees. Mr. Reibstein is a licensed CPA in Pennsylvania and received a Bachelor of Business Administration from Temple University.

Other Public Company Boards: Vishay Precision Group, Inc.

Mr. Reibstein brings to our Board extensive familiarity with the Company and the gaming industry, having previously served as the Company’s Executive Vice President, Chief Financial Officer and Treasurer, as well as accounting, finance, risk management and strategic management expertise for both public and private companies, including gaming companies.

| |

|

Marla Kaplowitz

Class III Director

Age: 55

Director Since: 2020 |

Business Experience: Ms. Kaplowitz has served as President and Chief Executive Officer of the American Association of Advertising Agencies (4A’s), a trade association serving more than 600 member agencies throughout the United States since 2017. From 2011 to 2017, Ms. Kaplowitz served as Chief Executive Officer of North America of MEC Global (now Wavemaker Global), a global media agency. Ms. Kaplowitz also spent 12 years at MediaVest, where she led Procter & Gamble’s communications planning for North America and worked with brands including Avon, Denny’s, Heineken and Norelco. She began her career at DMB&B and later joined Ammirati Puris Lintas, where she managed the agency’s Labatt, Nickelodeon Networks and Unilever accounts.

Other Public Company Boards: None

Ms. Kaplowitz brings marketing and digital transformation expertise to the Board as President and Chief Executive Officer of the American Association of Advertising Agencies (4A’s) and other senior management positions. Her experience brings to our Board significant marketing and digital experience, which is invaluable in the context of the Company evolving into a leading ominichannel provider of retail and interactive gaming, sports betting and entertainment.