Form DEF 14A MATERION Corp For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

MATERION CORPORATION

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

þ | No fee required |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4)Date Filed:

Materion Corporation

6070 Parkland Boulevard

Mayfield Heights, Ohio 44124

Notice of Annual Meeting of Shareholders

The annual meeting of shareholders of Materion Corporation will be held at The Westin Milwaukee in Milwaukee, Wisconsin on May 8, 2019 at 8:00 a.m. (CDT) for the following purposes:

(1) | To elect nine directors, each to serve for a term of one year and until a successor is elected and qualified; |

(2) | To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for Materion Corporation for the year 2019; |

(3) | To approve, by non-binding vote, named executive officer compensation; and |

(4) | To transact any other business that may properly come before the meeting. |

Shareholders of record as of the close of business on March 11, 2019 are entitled to notice of the meeting and to vote at the meeting or any adjournment or postponement of the meeting.

We are pleased to take advantage of the Securities and Exchange Commission rules allowing us to furnish proxy materials to shareholders on the Internet. We believe that these rules provide you with proxy materials more quickly and reduce the environmental impact of our meeting. Accordingly, we are mailing to shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review our proxy statement and Annual Report for the year ended December 31, 2018, and to vote online or by telephone. If you would like to receive a paper copy of our proxy materials, please follow the instructions for requesting these materials on the Notice of Internet Availability of Proxy Materials.

Gregory R. Chemnitz |

Secretary |

March 25, 2019

Important — your proxy is enclosed.

You are requested to cooperate in assuring a quorum by voting online at www.proxyvote.com or, if you received a paper copy of the proxy materials, by filling in, signing and dating the enclosed proxy and promptly mailing it in the return envelope.

MATERION CORPORATION

6070 Parkland Boulevard

Mayfield Heights, Ohio 44124

PROXY STATEMENT

March 25, 2019

GENERAL INFORMATION

Your Board of Directors (Board) is furnishing this proxy statement to you in connection with our solicitation of proxies to be used at our annual meeting of shareholders to be held on May 8, 2019. The proxy statement and other proxy materials are being sent to shareholders on March 25, 2019.

Registered Holders. If your shares are registered in your name, you may vote in person or by proxy. If you decide to vote by proxy, you may do so by telephone, over the Internet or by mail.

By telephone. After reading the proxy materials, you may call the toll-free number, 1-800-690-6903, using a touch-tone telephone. You will be prompted to enter your control number, which is a 16-digit number located in a box on your proxy card that you can also receive in the mail, if requested, then follow the simple instructions that will be given to you to record your vote.

Over the Internet. After reading the proxy materials, you may vote and submit your proxy online at www.proxyvote.com. Even if you request and receive a paper copy of the proxy materials, you may vote online by going to www.proxyvote.com and entering your control number, which is a 16-digit number located in a box on your proxy card that you can also receive in the mail, if requested, then follow the simple instructions that will be given to you to record your vote.

By mail. After reading the proxy materials, you may mark, sign and date your proxy card and return it in the enclosed prepaid and addressed envelope.

The Internet and telephone voting procedures have been set up for your convenience and have been designed to authenticate your identity, allow you to give voting instructions and confirm that those instructions have been recorded properly. Without affecting any vote previously taken, you may revoke your proxy by delivery to us of a new, later dated proxy with respect to the same shares, or giving written notice to us before or at the annual meeting. Your presence at the annual meeting will not, in and of itself, revoke your proxy.

Participants in the Materion Corporation Retirement Savings Plan and/or the Payroll Stock Ownership Plan (PAYSOP). If you participate in the Retirement Savings Plan and/or the PAYSOP, the independent trustee for each plan, Fidelity Management Trust Company, will vote your plan shares according to your voting directions. You may give your voting directions to the plan trustee in any one of the three ways set forth above. If you do not return your proxy card or do not vote over the Internet or by telephone, the trustee will not vote your plan shares. Each participant who gives the trustee voting directions acts as a named fiduciary for the applicable plan under the provisions of the Employee Retirement Income Security Act of 1974, as amended.

Nominee Shares. If your shares are held by a bank, broker, trustee or some other nominee, that entity will give you separate voting instructions.

In addition to the solicitation of proxies by mail, we may solicit the return of proxies in person, by telephone, facsimile or e-mail. We will request brokerage houses, banks and other custodians, nominees and fiduciaries to forward soliciting material to the beneficial owners of shares and will reimburse them for their expenses. We will bear the cost of the solicitation of proxies.

Voting. At the close of business on March 11, 2019, the record date for the determination of shareholders entitled to notice of, and to vote at, the annual meeting, we had outstanding and entitled to vote 20,317,148 shares of common stock. Each outstanding share of common stock entitles its holder to one vote on each matter brought before the meeting.

With respect to Proposal 1, the nominees receiving the greatest number of votes for their election will be elected as directors of Materion Corporation, subject to the Company's Majority Voting Policy (described below). The approval of each of Proposals 2 and 3 requires the affirmative vote of a majority of the votes cast, whether in person or by proxy, on such proposals at the annual meeting.

Abstentions and Broker Non-votes. At the annual meeting, the inspectors of election appointed for the meeting will tabulate the results of shareholder voting. Under Ohio law and our code of regulations, properly signed proxies that are marked “abstain” or are held in “street name” by brokers and not voted on one or more of the items (but otherwise voted on at least one item) before the meeting will be counted for purposes of determining whether a quorum has been achieved at the annual meeting.

If you do not provide directions to your broker, your broker or other nominee will not be able to vote your shares with respect to the election of directors (Proposal 1) or the non-binding vote to approve named executive officer compensation (Proposal 3).

Abstentions and broker non-votes will not affect the vote on the election of directors.

1

An abstention or broker non-vote with respect to the non-binding vote to approve named executive officer compensation (Proposal 3) will have no effect on the proposal as the abstention or broker non-vote will not be counted in determining the number of votes cast.

Because the vote to ratify the appointment of Ernst & Young LLP (Proposal 2) is considered to be routine, your broker or other nominee will be able to vote your shares with respect to this proposal without your instructions. An abstention will have no effect on this proposal as the abstention will not be counted in determining the number of votes cast.

* * *

We know of no other matters that will be presented at the meeting; however, if other matters do properly come before the meeting, the persons named in the proxy card will vote on these matters in accordance with their best judgment.

If you sign, date and return your proxy card but do not specify how you want to vote your shares, your shares will be voted as recommended by the Board as indicated on the proxy card.

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Articles of Incorporation and Code of Regulations establish the number of directors at no fewer than nine and no more than 18. There are currently nine directors on the Board. At the 2019 Annual Meeting, the Shareholders will consider the election of nine directors, each to serve a one-year term. Each of the nominees for election is a current Director, other than Mr. Prevost who was recommended by a third-party search firm.

William B. Lawrence, a current member of our Board, is retiring from the Board at the 2019 Annual Meeting. The Company thanks Mr. Lawrence for his valuable service and guidance provided to the Board.

Nominees for Director.

Vinod M. Khilnani

Age: 66

Director Since: 2009

Mr. Khilnani was appointed our Non-Executive Chairman of the Board in January 2018. Now retired, Mr. Khilnani was the Executive Chairman of CTS Corporation (electronic components and accessories). Mr. Khilnani became Executive Chairman of CTS Corporation in January 2013 and served in that capacity until May 2013. He had served as Chairman, President and Chief Executive Officer of CTS from 2007 until 2013. Prior to that time, he served as Senior Vice President and Chief Financial Officer since 2001. Mr. Khilnani was appointed to the Board of Gibraltar Industries in October 2014 and to the Board of ESCO Technologies Inc. (filtration and fluid control products, RF shielding and test equipment, technical packaging, and electric utility solutions) in August 2014 and has served on the Board of Directors of 1st Source Corporation since 2013. As the former Executive Chairman and Chief Executive Officer and President of CTS (and its former Chief Financial Officer), Mr. Khilnani offers a wealth of management experience and business knowledge regarding operational, financial and corporate governance issues, as well as extensive international experience with global operations.

Robert J. Phillippy

Age: 58

Mr. Phillippy is an independent consultant, advising technology companies on a range of strategic, operational and organizational issues. From September 2007 until April 2016, he was the President, Chief Executive Officer and a director of Newport Corporation (lasers, optics and photonics technologies). Mr. Phillippy joined Newport in 1996 and served in various executive management positions prior to his appointment as Chief Executive Officer in 2007. In April 2016, Newport was acquired by MKS Instruments (instruments, components, subsystems, and process control solutions for advanced manufacturing applications), and from July 2016 until May 2018, Mr. Phillippy served on the board of directors of MKS Instruments. From April 2016 to September 2016, he also served as Executive Advisor to MKS Instruments. Mr. Phillippy has also served as a director of ESCO Technologies Inc. (filtration and fluid control products, RF shielding and test equipment, technical packaging, and electric utility solutions) since May 2014, and as a director of Kimball Electronics (engineering, manufacturing, and supply chain solutions) since November 2018. Mr. Phillippy's deep understanding of technology-related industries, extensive experience as the former Chief Executive Officer of a global technology company and significant knowledge of matters impactful to public company boards makes him a valuable contribution to the Board of Directors.

Patrick Prevost

Age: 63

Mr. Prevost served as the President and Chief Executive Officer of Cabot Corporation (global specialty chemical and performance materials company) from January 2008 until his retirement in March 2016. Prior to Cabot, Mr. Prevost served as President,

2

Performance Chemicals at BASF AG (international chemical company) from October 2005 to December 2007. Prior to that, he was responsible for BASF Corporation’s Chemicals and Plastics business in North America. Mr. Prevost previously held senior management positions with increasing responsibility at BP Plc from 1999 to 2003 and Amoco Chemicals from 1983 until 1999. Mr. Prevost serves on the Board of Directors of Southwestern Energy Company and Cabot Corporation and previously served on the Board of Directors of General Cable Corporation. Mr. Prevost brings to our Board of Directors substantial leadership experience in a variety of complex international businesses, a chemical engineering background with broad experience in material science and chemistry, which are important to our business, extensive experience involving acquisitions and strategic alliances and deep knowledge of international business, strategic planning, manufacturing and financial matters.

N. Mohan Reddy, Ph.D.

Age: 65

Director Since: 2000

Dr. Reddy is B. Charles Ames, Professor of Management at Case Western Reserve University. Dr. Reddy was appointed B. Charles Ames, Professor of Management in February 2014. Prior to that, he had served as the Albert J. Weatherhead III Professor of Management from 2007 until 2012 and as the Dean of the Weatherhead School of Management, Case Western Reserve University from 2006 until 2012. Dr. Reddy had been Associate Professor of Marketing since 1991 and Keithley Professor of Technology Management from 1996 to 2006 at the Weatherhead School of Management, Case Western Reserve University. Dr. Reddy had served on the Board of Directors of Keithley Instruments, Inc. from 2001 until December 2010, when Keithley Instruments was purchased by Danaher Corporation. Dr. Reddy had also served on the Board of Directors of Lubrizol Corporation from February 2011 until October 2011, when Lubrizol was purchased by Berkshire Hathaway Inc. Dr. Reddy also serves as a consultant to firms in the electronics and semiconductor industries, primarily in the areas of product and market development. Dr. Reddy’s knowledge of industrial marketing, technology development and extensive global knowledge in the electronics and semiconductor industries provides valuable insight to our Board of Directors.

Craig S. Shular

Age: 66

Director Since: 2008

Mr. Shular is Co-Founder of Global Graphite Group LLC (advanced materials company specializing in graphite products), which he co-founded in November 2017. Mr. Shular is the former Executive Chairman of the Board of GrafTech International Ltd. (electrical industrial apparatus). Mr. Shular was elected Chairman of the Board of GrafTech in 2007 and served in that capacity until December 2014. He had been a director of GrafTech from January 2003 until May 2014. Mr. Shular served as Chief Executive Officer of GrafTech from 2003 and as President from 2002 until he retired from both positions in January 2014. From 2001 until 2002, he served as Executive Vice President of GrafTech’s largest business, Graphite Electrodes. Mr. Shular joined GrafTech as its Vice President and Chief Financial Officer in 1999 and assumed the additional duties of Executive Vice President, Electrode Sales and Marketing in 2000 until 2001. As the former Chairman, Chief Executive Officer and President and former Chief Financial Officer of GrafTech, Mr. Shular brings a breadth of financial and operational management experience and provides our Board of Directors with a perspective of someone familiar with all facets of a global enterprise.

Darlene J. S. Solomon, Ph.D.

Age: 60

Director Since: 2011

Dr. Solomon is Senior Vice President and Chief Technology Officer of Agilent Technologies, Inc. (life sciences, diagnostics and applied chemical markets). Dr. Solomon has served as Senior Vice President and Chief Technology Officer of Agilent Technologies since 2006. Prior to that time, she served as Vice President and Director of Agilent Laboratories, Agilent's centralized advanced research organization. Dr. Solomon joined Agilent in 1999 and served in a dual capacity as the director of the Life Sciences Technologies Laboratory and as the senior director, research and development/technology for Agilent’s Life Sciences and Chemical Analysis business. She is a member of the National Academy of Engineering and serves on multiple academic and government advisory boards focused on science, technology and innovation. With extensive knowledge and experience in materials measurement and leading innovation in a diversified global technology enterprise, Dr. Solomon brings to our Board of Directors valuable insight on research and development and other operational issues faced by companies focused on innovations in technology.

Robert B. Toth

Age: 58

Director Since: 2013

Mr. Toth has been a Managing Director of CCMP Capital Advisors, LLC (global private equity investment firm) since January 2016. Mr. Toth also served as President, Chief Executive Officer and Director of Polypore International, Inc. (high technology

3

filtration products) from 2005 until 2015 and as Chairman of the Board from 2011 until 2015. Prior to Polypore, Mr. Toth served as President, Chief Executive Officer, and Director of CP Kelco ApS. Mr. Toth also spent 19 years at Monsanto Company, and its spin-off company, Solutia Inc., where he held a variety of executive and managerial roles. Mr. Toth also serves on the Board of Directors of PQ Corporation (producer of specialty inorganic performance chemicals and catalysts), SPX Corporation (a supplier of highly engineered products and technologies, holding leadership positions in the HVAC, detection and measurement, and engineered solutions markets), and Hayward Industries, Inc. (a leading global manufacturer of residential and commercial pool equipment and industrial flow control products). With extensive experience in leading corporations in the manufacturing and specialty materials sector, including his knowledge and skills in senior management, finance and operations, Mr. Toth brings to our Board of Directors significant insight into the strategic and operational issues facing companies in the advanced materials industry.

Jugal K. Vijayvargiya

Age: 51

Director Since: 2017

Mr. Vijayvargiya is President and Chief Executive Officer, and member of the Board of Materion Corporation. He joined Materion as President and Chief Executive Officer in March 2017. Prior to joining Materion, Mr. Vijayvargiya had an extensive 26-year international career with Delphi Automotive PLC (leading global technology solutions provider to the automotive and transportation sectors). He most recently led Delphi's Automotive Electronics and Safety segment, a $3 billion global business based in Germany. In this role, Mr. Vijayvargiya served as an officer of Delphi and a member of its Executive Committee. Previously, he attained progressively responsible positions in Europe and North America in product and manufacturing engineering, sales, product line management, acquisition integration and general management. Mr. Vijayvargiya’s broad and diverse experience at Delphi provides significant value to our Board of Directors.

Geoffrey Wild

Age: 62

Director Since: 2011

Mr. Wild is currently the Chief Executive Officer of Atotech (specialty plating chemicals, equipment and services company). Mr. Wild was appointed Chief Executive Officer of Atotech on March 13, 2017. Previously, Mr. Wild had served as Chief Executive Officer and a director of AZ Electronic Materials (specialty chemicals and materials) from 2010 until April 2015 which was acquired by Merck KgAa of Germany in May 2014. From 2008 to 2009, Mr. Wild was President and Chief Executive Officer of Cascade Microtech, Inc. (precision electrical measurement products and services). From 2002 to 2007, Mr. Wild served as Chief Executive Officer of Nikon Precision Inc. He was elected to the Board of Directors of Cabot Microelectronics (polishing slurries and pad supplier to the semiconductor industry) in September 2015 and served on the Board of Directors of Axcelis Technologies, Inc. from 2006 until 2011. Mr. Wild’s substantial knowledge and management experience in the global semiconductor industry, including the role of a supplier of equipment and materials to international customers, deepens our Board of Directors’ insight into the operational issues that global companies face. Additionally, Mr. Wild’s role as a chief executive officer exposes him to international financial and accounting issues.

Your Board of Directors unanimously recommends a vote for each of Vinod M. Khilnani, Robert J. Phillippy, Patrick Prevost, N. Mohan Reddy, Ph.D., Craig S. Shular, Darlene J. S. Solomon, Ph.D., Robert B. Toth, Jugal K. Vijayvargiya, and Geoffrey Wild.

If any of these nominees becomes unavailable, it is intended that the proxies will be voted as the Board of Directors determines. We have no reason to believe that any of the nominees will be unavailable. The nominees receiving the greatest number of votes for their election will be elected as directors of Materion Corporation. However, our Board of Directors has adopted a Majority Voting Policy whereby, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election is expected to tender his or her resignation following certification of the shareholder vote, subject to a 90-day review process by our Governance and Organization Committee and Board of Directors to consider whether the tendered resignation should be accepted. An abstention or broker non-vote is not treated as a vote “withheld” under our Majority Voting Policy. For additional details on the Majority Voting Policy, see page 9 of this proxy statement.

4

CORPORATE GOVERNANCE; COMMITTEES OF THE BOARD OF DIRECTORS

We have adopted a Policy Statement on Significant Corporate Governance Issues and a Code of Conduct Policy in compliance with the New York Stock Exchange (NYSE) and Securities and Exchange Commission (SEC) requirements. These materials, along with the charters of the Audit, Compensation and Governance and Organization Committees of our Board, which also comply with applicable requirements, are available on our website at https://materion.com, or upon request by any shareholder to: Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124. We also make our reports on Forms 10-K, 10-Q and 8-K available on our website, free of charge, as soon as reasonably practicable after these reports are filed with the SEC. Any amendments or waivers to our Code of Conduct Policy, Committee Charters and Policy Statement on Significant Corporate Governance Issues will also be made available on our website. The information on our website is not incorporated by reference into this proxy statement or any of our periodic reports.

Director Independence

The NYSE listing standards require that all listed companies have a majority of independent directors. For a director to be “independent” under the NYSE listing standards, the board of directors of a listed company must affirmatively determine that the director has no material relationship with the Company, or its subsidiaries or affiliates, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company, or its subsidiaries or affiliates. Our Board has adopted the following standards, which are identical to those of the NYSE listing standards, to assist in its determination of director independence. A director will be determined not to be independent under the following circumstances:

• | the director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company; |

• | the director has received, or has an immediate family member who has received, during any 12-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

• | the director (a) is a current partner or employee of a firm that is the Company’s internal or external auditor; (b) has an immediate family member who is a current partner of such a firm; (c) has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit; or (d) was or has an immediate family member who was within the last three years a partner or employee of such a firm and personally worked on the Company’s audit within that time; |

• | the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serve or served on that company’s compensation committee; or |

• | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1,000,000 or two percent of such other company’s consolidated gross revenues. |

Additionally, for purposes of determining whether a director has a material relationship with the Company apart from his or her service as a director, our Board has deemed the following relationships as categorically immaterial:

• | the director, or an immediate family member, is a current employee, director or trustee of a tax-exempt organization and the Company’s contributions to the organization (excluding Company matching of employee contributions) in any fiscal year are less than $120,000; or |

• | the director is a director of a company that has made payments to, or received payments or deposits from, the Company for property, goods or services in the ordinary course of business in an amount which, in any fiscal year, is less than the greater of $1,000,000, or two percent of such other company’s consolidated gross revenues. |

Our Board has affirmatively determined that each of our current directors, and director nominees, other than Mr. Vijayvargiya, are “independent” within the meaning of that term as defined in the NYSE listing standards; a “non-employee director” within the meaning of that term as defined in Rule 16b-3(b)(3) promulgated under the Securities Exchange Act of 1934 (Exchange Act); and an “outside director” within the meaning of that term as defined in the regulations promulgated under Section 162(m) of the Internal Revenue Code (Code). Additionally, Joseph P. Keithley, who served as a director during 2018, was "independent" as defined in the NYSE listing standards.

Charitable Contributions

Within the preceding three years, we have not made a contribution to any charitable organization in which any of our directors serves as a director, trustee, or executive officer.

5

Non-management Directors and Non-Executive Chairman

Our Policy Statement on Significant Corporate Governance Issues provides that the non-management members of the Board will meet during each regularly scheduled meeting of the Board of Directors in executive session. Additional executive sessions may be scheduled by the Non-Executive Chairman or other non-management directors. The Non-Executive Chairman will chair these sessions. Mr. Khilnani was appointed our Non-Executive Chairman in January 2018.

The non-management directors have access to our management as they deem necessary or appropriate. In addition, the Chair of each of the Audit Committee, Governance and Organization Committee and Compensation Committee meets periodically with members of senior management.

In addition to the other duties of a director under our Policy Statement on Significant Corporate Governance Issues, the Non-Executive Chairman, in collaboration with the other independent directors, is responsible for coordinating the activities of the independent directors and in that role will:

• | chair the executive sessions of the independent directors at each regularly scheduled meeting; |

• | determine the timing and structuring of Board meetings; |

• | establish the agenda for Board meetings, including allocation of time as well as subject matter; |

• | determine the quality, quantity and timeliness of the flow of information from management to the Board; |

• | serve as the independent point of contact for shareholders wishing to communicate with the Board other than through management; |

• | interview all Board candidates and provide the Governance and Organization Committee with recommendations on each candidate; |

• | maintain close contact with the Chairman of each standing committee and assist in ensuring communications between each committee and the Board; |

• | lead the Chief Executive Officer annual evaluation process; and |

• | be the ombudsman for the Chief Executive Officer to provide two-way communication with the Board. |

Board Communications

Shareholders or other interested parties may communicate with the Board as a whole, the non-executive chairman or the non-management directors as a group, by forwarding relevant information in writing to: Non-Executive Chairman, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124. Any other communication to individual directors or committees of the Board of Directors may be similarly addressed to the appropriate recipients, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

Board Leadership

The Board does not have a policy as to whether the role of Chief Executive Officer and Chairman of the Board should be separate or combined, or whether the Chairman should be a management or non-management director. Mr. Khilnani was appointed Non-Executive Chairman of the Board effective January 2018, eliminating the need for a Lead Director. During 2018, Mr. Vijayvargiya was the only member of our Board who was not independent.

Unless the Chairman of the Board is an independent director, our Lead Director is elected solely by the independent members of our Board of Directors. The Lead Director works with the Chairman of the Board and other Board members to provide strong, independent oversight of the Company’s management and affairs as described above under "Non-management Directors and Non-Executive Chairman".

Risk Oversight

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the full Board in setting the Company’s business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and receives an annual risk assessment report from the Company’s internal auditors. In addition, management provides a risk management report, including a financial risk assessment and enterprise risk management update and information technology contingency plan to the Audit Committee. In setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking consistent with the Company’s business strategy. Finally, the Company’s Governance and Organization Committee conducts an annual assessment of the Board for compliance with corporate governance and risk

6

management best practices. The Company believes that the Board’s role in risk oversight is consistent with the Company’s leadership structure, with management having day-to-day responsibility for assessing and managing the Company’s risk exposure and the Board and its committees providing oversight in connection with those efforts, with particular focus on the most significant risks facing the Company.

Audit Committee

The Audit Committee held six meetings in 2018. The Audit Committee membership consists of Mr. Wild, as Chairman, and Messrs. Phillippy and Shular and Dr. Reddy. Under the Audit Committee charter, the Audit Committee’s principal functions include assisting our Board in fulfilling its oversight responsibilities with respect to:

• | the integrity of our financial statements and our financial reporting process; |

• | compliance with ethics policies and legal and other regulatory requirements; |

• | our independent registered public accounting firm’s qualifications and independence; |

• | our systems of internal accounting and financial controls; and |

• | the performance of our independent registered public accounting firm and of our internal audit functions. |

No member of our Audit Committee serves on the audit committee of three or more public companies in addition to ours unless the Board determines that such services would not impair the member's ability to serve on our Audit Committee. The Audit Committee also prepared the Audit Committee report included under the heading “Audit Committee Report” in this proxy statement.

Audit Committee Expert, Financial Literacy and Independence

Our Board has determined that Messrs. Phillippy and Shular are Audit Committee financial experts, as defined by the SEC. Each member of the Audit Committee is financially literate and satisfies the independence requirements as set forth in the NYSE listing standards.

Compensation Committee

The Compensation Committee held six meetings in 2018. Its membership consists of Dr. Solomon, as Chairman, and Messrs. Khilnani, Lawrence and Toth. Each member of the Compensation Committee has been determined by the Board to be independent in accordance with NYSE listing standards. The Compensation Committee may, at its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee, provided that such subcommittee has a published charter in accordance with NYSE rules. The Compensation Committee’s principal functions include:

• | reviewing and approving executive compensation, including severance payments; |

• | overseeing and recommending equity and non-equity incentive plans; |

• | overseeing regulatory compliance with respect to compensation matters; |

• | advising on senior management compensation; and |

• | reviewing and discussing the Compensation Discussion and Analysis (CD&A) and Compensation Committee Report. |

For additional information regarding the operation of the Compensation Committee, see the “Compensation Discussion and Analysis” in this proxy statement.

Governance and Organization Committee

The Governance and Organization Committee held three meetings in 2018. The Governance and Organization Committee membership consists of Mr. Khilnani, as Chairman, and Messrs. Lawrence, Phillippy, Shular, Toth and Wild and Drs. Reddy and Solomon. All of the members are independent in accordance with the NYSE listing requirements. The Governance and Organization Committee’s principal functions include:

• | evaluating candidates for Board membership, including any nominations of qualified candidates submitted in writing by shareholders to our Secretary; |

• | making recommendations to the full Board regarding director compensation; |

• | making recommendations to the full Board regarding governance matters; |

• | overseeing the evaluation of the Board and management of the Company; |

• | evaluating potential successors to the Chief Executive Officer for recommendation to the Board and assisting in management succession planning; and |

• | reviewing related party transactions. |

As noted above, the Governance and Organization Committee is involved in determining compensation for our directors. The Governance and Organization Committee administers our equity incentive plans with respect to our directors, including approval of grants of stock options and other equity or equity-based awards, and makes recommendations to the Board with respect to incentive compensation plans and equity-based plans for directors. The Governance and Organization Committee periodically reviews director compensation in relation to comparable companies and other relevant factors. Any change in director compensation must be approved by the Board. No executive officer other than the Chief Executive Officer in his capacity as director participates

7

in setting director compensation. From time to time, the Governance and Organization Committee or the Board may engage the services of a compensation consultant to provide information regarding director compensation at comparable companies.

Annual Board Self-assessments

The Board has instituted annual self-assessments of the Board, as well as of the Audit Committee, the Compensation Committee and the Governance and Organization Committee, to assist in determining whether the Board and its committees are functioning effectively. Annually, each of the members of the Board completes a detailed survey regarding the Board and its committees that provides for quantitative ratings in key areas and seeks subjective comments. The results of the survey are compiled and discussed at the Board level and in each committee. Any matters requiring follow-up are identified by the Governance and Organization Committee, which is responsible for any action items. Each of the committees also reviews its charter on an annual basis for any changes.

Also annually, each member of the Board completes a confidential evaluation of each other director that, among other things, seeks subjective comments in certain key areas. The responses to the evaluation are collected by a third party and a summary of the responses are conveyed to the Non-Executive Chairman. The Non-Executive Chairman uses the results of the evaluation as part of the process the Governance and Organization Committee undertakes in determining whether to recommend that those directors be nominated for re-election.

Nomination of Director Candidates

The Governance and Organization Committee will consider candidates recommended by shareholders for nomination as directors of Materion Corporation. Any shareholder desiring to submit a candidate for consideration by the Governance and Organization Committee should send the name of the proposed candidate, together with biographical data and background information concerning the candidate, to the Governance and Organization Committee, c/o Secretary, Materion Corporation, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

In recommending candidates to the Board for nomination as directors, the Governance and Organization Committee’s charter requires it to consider such factors as it deems appropriate, consistent with our Policy Statement on Significant Corporate Governance Issues. These factors are as follows:

• | broad-based business, governmental, non-profit, or professional skills and experiences that indicate whether the candidate will be able to make a significant and immediate contribution to the Board’s discussion and decision-making in the array of complex issues facing the Company; |

• | exhibited behavior that indicates he or she is committed to the highest ethical standards and the values of the Company; |

• | special skills, expertise and background that add to and complement the range of skills, expertise and background of the existing directors; |

• | whether the candidate will effectively, consistently and appropriately take into account and balance the legitimate interests and concerns of all our shareholders and other stakeholders in reaching decisions; |

• | a global business and social perspective, personal integrity and sound judgment; and |

• | time available to devote to Board activities and to enhance their knowledge of the Company. |

Although the Company does not have a formal policy regarding diversity, as part of the analysis of the foregoing factors, the Governance and Organization Committee considers whether the candidate enhances the diversity of the Board. Such diversity includes professional background and capabilities, knowledge of specific industries and geographic experience, as well as the more traditional diversity concepts of race, gender and national origin.

The Governance and Organization Committee’s evaluation of candidates recommended by shareholders does not differ materially from its evaluation of candidates recommended from other sources.

The Governance and Organization Committee utilizes a variety of methods for identifying and evaluating director candidates. The Governance and Organization Committee regularly reviews the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Governance and Organization Committee considers various potential candidates for director. Candidates may come to the attention of the Governance and Organization Committee through current Board members, professional search firms, shareholders or other persons. Additionally, from time to time, the Governance and Organization Committee has used the services of an executive search firm to help identify potential director candidates who possess the characteristics described above. In such instance, the search firm has prepared a biography of each candidate, conducted reference checks and screened candidates.

A shareholder of record entitled to vote in an election of directors who timely complies with the procedures set forth in our code of regulations and with all applicable requirements of the Exchange Act and the rules and regulations thereunder, may also directly nominate individuals for election as directors at a shareholders’ meeting. Copies of our code of regulations are available by a request addressed to Materion Corporation, c/o Secretary, 6070 Parkland Boulevard, Mayfield Heights, Ohio 44124.

8

To be timely, notice of a shareholder nomination for an annual meeting must be received at our principal executive offices not fewer than 60 nor more than 90 days prior to the date of the annual meeting. However, if the date of the meeting is more than one week before or after the first anniversary of the previous year’s meeting and we do not give notice of the meeting at least 75 days in advance, nominations must be received within ten days from the date of our notice.

Majority Voting Policy

Our Board adopted a Majority Voting Policy whereby, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” election, which we refer to as a Majority Withheld Vote, is expected to tender his or her resignation following certification of the shareholder vote. In such an event, the Governance and Organization Committee will consider the tendered resignation and make a recommendation to the Board. The Board will act on the Governance and Organization Committee’s recommendation within 90 days following certification of the shareholder vote. Any director who tenders his or her resignation pursuant to this policy will not participate in the Governance and Organization Committee’s recommendation or Board’s action regarding whether to accept or reject the tendered resignation.

However, if each member of the Governance and Organization Committee received a Majority Withheld Vote in the same election, then the Board would appoint a committee comprised solely of independent directors who did not receive a Majority Withheld Vote at that election to consider each tendered resignation offer and recommend to the Board of Directors whether to accept or reject each resignation. Further, if all of the director nominees received a Majority Withheld Vote in the same election, the Board would appoint a committee comprised solely of independent directors to consider each tendered resignation offer and recommend to the Board of Directors whether to accept or reject each resignation.

Director Attendance

Our Board held six meetings in 2018. All of the current directors who were directors in 2018 attended at least 75% of the Board and assigned committee meetings during 2018. Our policy is that directors are expected to attend all meetings, including the annual meeting of shareholders. All of our directors attended last year’s annual meeting of shareholders.

Use of Blank Check Preferred Stock

Our Board has adopted a resolution that it will not, without prior shareholder approval, authorize the issuance of any series of preferred stock for any defensive or anti-takeover purpose, for the purpose of implementing any shareholder rights plan or with features specifically intended to make any attempted acquisition of the Company more difficult or costly; provided that, within the limits described above, the Board may authorize the issuance of preferred stock for capital raising transactions, acquisitions, joint ventures or other corporate purposes.

Position Statement on Shareholder Rights Plans

Our Board has adopted a Position Statement on Shareholder Rights Plans. The Position Statement provides that, if the Board adopts a shareholder rights plan, it will do so by action of the majority of its independent directors after careful deliberation and in the exercise of its fiduciary duties, and the Board will seek prior shareholder approval of the plan unless, due to time constraints or other considerations, the majority of the independent directors determine that it would be in the best interest of the Company and its shareholders to adopt the rights plan without first obtaining shareholder approval. The Position Statement also provides that if the Board adopts a rights plan without prior shareholder approval, the plan will expire on the first anniversary of its effective date unless prior to such time the plan has been ratified by a vote of the Company’s shareholders, which vote may exclude shares held by any potential acquiring shareholders.

Opt Out of the Ohio Control Shareholder Act

At our annual meeting of shareholders held in May 2014, our shareholders approved a management-sponsored proposal to amend our Amended and Restated Code of Regulations to opt out of Section 1701.831 of the Ohio Revised Code, which is commonly referred to as the Ohio Control Share Acquisition Act. The Ohio Control Share Acquisition Act generally applies to Ohio public corporations unless a corporation specifically opts out of the statute's application. The Ohio Control Share Acquisition Act generally requires that any "control share acquisition" of an Ohio public corporation can only be made with the prior authorization of shareholders. "Control share acquisitions" are defined to be acquisitions of shares entitling a person to exercise or direct the voting power in the election of directors within any of three separate ranges: (1) one-fifth or more but less than one-third of such voting power, (2) one-third or more but less than a majority of such voting power, or (3) a majority or more of such voting power. A person desiring to make a control share acquisition must first deliver notice to the corporation and provide certain information about the acquirer and the proposed acquisition, and the corporation's board of directors must call a special meeting of shareholders to vote on the proposed acquisition. Because of the amendment to our Amended and Restated Code of Regulations approved by our shareholders, the Ohio Control Share Acquisition Act no longer applies to us.

9

2018 Compensation of Non-Employee Directors

Total compensation of our non-employee directors for the year ended December 31, 2018, was as follows:

Name | Fees Earned or Paid in Cash ($) | Stock Awards(1) ($) | Total ($) | |||||

Joseph P. Keithley(2) | 35,000 | — | 35,000 | |||||

Vinod M. Khilnani | 138,333 | 94,996 | 233,329 | |||||

William B. Lawrence | 70,000 | 94,996 | 164,996 | |||||

Robert J. Phillippy(3),(4) | 52,452 | 169,970 | 222,422 | |||||

N. Mohan Reddy | 70,000 | 94,996 | 164,996 | |||||

Craig S. Shular(5) | 69,869 | 94,996 | 164,865 | |||||

Darlene J. S. Solomon | 78,333 | 94,996 | 173,329 | |||||

Robert B. Toth | 70,000 | 94,996 | 164,996 | |||||

Geoffrey Wild | 83,333 | 94,996 | 178,329 | |||||

(1) The amounts in this column reflect the grant date fair value of time-based restricted stock unit (RSU) awards as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (FASB ASC) Topic 718.

(2) Mr. Keithley did not stand for re-election at the 2018 annual meeting and is no longer a member of our Board.

(3) Mr. Phillippy's stock award includes 1,453 shares of common stock, with a grant date fair value of $51.60 per share, granted upon appointment to the Board of Directors on May 3, 2018, as described below under Equity Compensation.

(4) Mr. Phillippy elected to defer 100% of his compensation in the form of deferred stock units beginning in the third quarter of 2018, as described below under Deferred Compensation. Mr. Phillippy received his second quarter 2018 compensation in the form of cash.

(5) Mr. Shular elected to defer 100% of his compensation in the form of deferred stock units in 2018, as described below under Deferred Compensation.

The following table presents the RSU awards granted to non-employee directors in 2018. Awards were made on May 3, 2018 and valued based on the preceding day's closing price of $51.60. These awards in general will vest May 3, 2019, if the individual remains as a director until that date. As of December 31, 2018, no other stock or option awards were outstanding for our non-employee directors.

Name | Restricted Stock Units | |

Vinod M. Khilnani | 1,841 | |

William B. Lawrence | 1,841 | |

Robert J. Phillippy | 1,841 | |

N. Mohan Reddy | 1,841 | |

Craig S. Shular | 1,841 | |

Darlene J. S. Solomon | 1,841 | |

Robert B. Toth | 1,841 | |

Geoffrey Wild | 1,841 | |

Annual Retainer Fees

In 2018, non-employee directors received an annual retainer fee in the amount of $65,000. Non-employee directors received an additional $5,000 for being a member of a committee, with the exception of the Chairman of the Compensation Committee (Dr. Solomon), who received an additional $10,000, and the Chairman of the Audit Committee (Mr. Wild), who received an additional $15,000. The Non-Executive Chairman (Mr. Khilnani) received an additional $70,000.

Equity Compensation

Under the 2006 Non-Employee Director Equity Plan (Director Equity Plan), non-employee directors who continued to serve as directors following the 2018 annual meeting of shareholders received $95,000 worth of RSUs (subject to rounding) which will generally be paid out in common stock at the end of a one-year restriction period. These RSUs were granted on the day following the annual meeting. The number of RSUs granted is equal to $95,000 divided by the closing price of our common stock on the day of the annual meeting (subject to rounding).

In the event a new director is elected or appointed, common stock may be granted, at the Board's discretion, usually on the first business day following the election or appointment to the Board of Directors. This grant of common stock has typically been equal

10

to $100,000 divided by the closing price of our common stock on the day the director is elected or appointed to the Board of Directors. The grant is expected to be prorated by multiplying such number of shares of common stock by a fraction (in no case greater than one), (1) the numerator of which is one plus the number of full quarters remaining in the calendar year in which such election or appointment occurs after the date such election or appointment occurs, and (2) the denominator of which is four. The Company does not issue any fractional shares.

Deferred Compensation

Non-employee directors may defer all or a part of their annual retainer fees in the form of deferred stock units under the Director Equity Plan until ceasing to be a member of the Board of Directors or a date specified by the participant. A director may also elect to have RSUs or other stock awards granted under the Director Equity Plan deferred in the form of deferred stock units.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following information is set forth with respect to persons known to management to be the beneficial owners of more than 5% of Materion’s common shares as of December 31, 2018.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Class | |||

BlackRock, Inc. | 3,091,415 | (2) | 15.3 | % | |

55 East 52nd Street | |||||

New York, NY 10055 | |||||

The Vanguard Group | 2,166,772 | (3) | 10.7 | % | |

100 Vanguard Blvd. | |||||

Malvern, PA 19355 | |||||

Dimensional Fund Advisors LP | 1,673,063 | (4) | 8.3 | % | |

6300 Bee Cave Road, Building One | |||||

Austin, TX 78746 | |||||

GAMCO Investors, Inc. | 1,140,600 | (5) | 5.6 | % | |

One Corporate Center | |||||

Rye, NY 10580 | |||||

(1) The information contained in this table, including related footnotes, is based on the Schedule 13G and Schedule 13D filings made by the beneficial owners identified herein.

(2) BlackRock, Inc. has sole investment power over 3,091,415 shares and sole voting power over 3,007,538 shares.

(3) The Vanguard Group has sole voting power over 19,614 shares, shared voting power of 1,800 shares, sole dispositive power over 2,147,358 shares and shared dispositive power over 19,414 shares. The amount beneficially owned totals 2,166,772 shares.

(4) Dimensional Fund Advisors LP has sole investment power over 1,673,063 shares and sole voting power over 1,612,612 shares.

(5) A Schedule 13D/A filed with the SEC on May 7, 2018 indicates that, as of May 4, 2018: (a) Gabelli Funds, LLC had sole voting and dispositive power with respect to 326,300 shares; (b) GAMCO Asset Management Inc. had sole voting and dispositive power with respect to 591,000 shares and sole dispositive power with respect to 643,500 shares; and (c) Teton Advisors, Inc. had sole voting and dispositive power with respect to 170,800 shares. The Schedule 13D/A further indicates that it was being filed by Mario J. Gabelli and various entities which he directly or indirectly controls or for which he acts as chief investment officer and that he, GSI and certain other entities named therein may be deemed to have beneficial ownership of the shares owned beneficially by each of the foregoing entities as well as certain other persons or entities named therein.

12

Security Ownership of Directors and Named Executive Officers

The following table sets forth information with respect to the beneficial ownership of Materion Corporation’s common stock by each director and director nominee for election as a director of Materion, each of the named executive officers and all directors and executive officers as a group, as of January 31, 2019, unless otherwise indicated. The shareholders listed in the table have sole voting and investment power with respect to shares beneficially owned by them, unless otherwise indicated. Shares that are subject to stock appreciation rights (SARs) that may be exercised within 60 days of January 31, 2019 are reflected in the number of shares shown and in computing the percentage of Materion’s common stock beneficially owned by the person who owns those SARs.

Name | Number of Shares | Percent of Class | ||

Gregory R. Chemnitz | 29,559 | (2) | * | |

Joseph P. Kelley | 20,822 | (2) | * | |

Vinod M. Khilnani | 32,528 | (1) | * | |

William B. Lawrence | 38,871 | (1) | * | |

Robert J. Phillippy | 2,430 | (1) | * | |

Patrick Prevost | — | * | ||

N. Mohan Reddy | 34,372 | (1) | * | |

Craig S. Shular | 45,697 | (1) | * | |

Darlene J. S. Solomon | 18,208 | * | ||

Robert B. Toth | 16,617 | * | ||

Geoffrey Wild | 21,279 | (1) | * | |

Jugal K. Vijayvargiya | 32,015 | (2) | * | |

All Directors, Director Nominees and Executive Officers as a group (including the Named Executive Officers (12 persons)) | 292,398 | (3) | 1.4% | |

*Less than 1% of Materion's outstanding common stock | ||||

(1) | Includes deferred shares under the Director Plan as follows: Mr. Khilnani 16,062, Mr. Lawrence 32,826, Mr. Phillippy 977, Dr. Reddy 34,372, Mr. Shular 41,570 and Mr. Wild 21,279. |

(2) | Includes shares covered by SARs exercisable within 60 days of January 31, 2019 as follows: Mr. Vijayvargiya 29,479, Mr. Kelley 17,378 and Mr. Chemnitz 15,916. |

(3) | Includes an aggregate of 62,773 shares subject to SARs held by executive officers exercisable within 60 days of January 31, 2019 and an aggregate of 147,086 deferred shares held by directors. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, officers and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC. Directors, officers and greater than 10% shareholders are required by SEC regulations to furnish us with copies of all Forms 3, 4 and 5 they file.

Based solely on our review of copies of forms that we have received, and written representations by our directors, officers and greater than 10% shareholders, all of our directors, officers and greater than 10% shareholders complied with all filing requirements applicable to them with respect to transactions in our equity securities during the fiscal year ended December 31, 2018.

13

RELATED PARTY TRANSACTIONS

We recognize that transactions between any of our directors or executive officers and us can present potential or actual conflicts of interest and create the appearance that our decisions are based on considerations other than the best interests of our shareholders. Pursuant to its charter, the Governance and Organization Committee considers and makes recommendations to the Board with regard to possible conflicts of interest of Board members or management. The Board then makes a determination as to whether to approve the transaction.

The Governance and Organization Committee reviews all relationships and transactions in which Materion Corporation and its directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. Our Secretary is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related person transactions in order to enable the Governance and Organization Committee to determine, based on the facts and circumstances, whether Materion or a related person has a direct or indirect material interest in the transaction. As set forth in the Governance and Organization Committee’s charter, in the course of the review of a potentially material-related person transaction, the Governance and Organization Committee considers:

• | the nature of the related person’s interest in the transaction; |

• | the material terms of the transaction, including, without limitation, the amount and type of transaction; |

• | the importance of the transaction to the related person; |

• | the importance of the transaction to Materion; |

• | whether the transaction would impair the judgment of a director or executive officer to act in the best interest of Materion; and |

• | any other matters the Governance and Organization Committee deems appropriate. |

Based on this review, the Governance and Organization Committee will determine whether to approve or ratify any transaction which is directly or indirectly material to Materion or a related person.

Any member of the Governance and Organization Committee who is a related person with respect to a transaction under review may not participate in the deliberations or vote with respect to the approval or ratification of the transaction; however, such director may be counted in determining the presence of a quorum at a meeting of the Governance and Organization Committee that considers the transaction.

14

AUDIT COMMITTEE REPORT

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the Company’s systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the annual report with management, and discussed the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the statement of Auditing Standard 1301: Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board. The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm such firm’s independence.

The Audit Committee discussed with the Company’s internal auditors and the independent registered public accounting firm the overall scope and plans for the respective audits. The Audit Committee meets with the internal auditors and the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The Audit Committee held six meetings during 2018.

In reliance on these reviews and discussions, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2018 for filing with the SEC.

The current Audit Committee charter is available on our website at https://materion.com.

Geoffrey Wild (Chairman)

Robert J. Phillippy

N. Mohan Reddy

Craig S. Shular

15

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (CD&A) provides an overview of our executive compensation program and 2018 pay determinations for our named executive officers (NEOs), as shown below:

Named Executive Officers

Jugal K. Vijayvargiya, President and Chief Executive Officer

Joseph P. Kelley, Vice President, Finance and Chief Financial Officer

Gregory R. Chemnitz, Vice President, General Counsel and Secretary

This CD&A consists of the following three sections:

Section I: Executive Summary - 2018 in Review

Section II: Executive Compensation Program Overview

Section III: Details and Analysis of the 2018 Executive Compensation Program

Section I: Executive Summary - 2018 in Review

Materion Corporation has a long-standing and strong commitment toward pay-for-performance in its executive compensation programs. We maintain this orientation throughout economic cycles that may cause fluctuation in our operating results.

We believe the decisions regarding our NEO compensation program in 2018 described in the CD&A below reflect our ongoing commitment to sustaining our pay-for-performance philosophy.

2018 Company Performance Overview

The Company delivered strong sales and profit growth in 2018 primarily led by performance improvements in our Performance Alloys and Composites and Precision Coatings segments. Net sales of $1,207.8 million in 2018 increased 6% compared to $1,139.4 million in 2017. Value-added sales, an important measure to the company, (reconciled with generally accepted accounting principles (GAAP)(1) in Appendix A), was $739.0 million in 2018, an increase of 9%, versus $677.7 million in 2017. Excluding value-added sales related to the acquisition of Heraeus’ high-performance target materials business (HTB) which was acquired in February 2017, the base business grew at a robust rate of 8% compared to 2017 due to improvements in commercial execution and strong end market demand.

The Company reported operating profit of $61.5 million in 2018 compared to $40.0 million in 2017. Excluding special items related to cost reduction initiatives, legacy legal and environmental costs, and other items, adjusted operating profit(1) totaled $61.8 million in 2018, an increase of 30% compared to $47.4 million in 2017. Commercial and operational improvements drove the year-over-year increase in operating profit.

The Company also generated strong cash flow from operations of $76.4 million in 2018 and ended the year with $70.6 million of cash and only $3.0 million of total debt.

(1) See Appendix A for a definition of value-added sales and a reconciliation of non-GAAP to GAAP financial measures.

16

Key Financial and Strategic Highlights for 2018

Ÿ | Value-added sales of $739.0 million in 2018 an increase of 9% compared to $677.7 million in 2017 |

Ÿ | Adjusted operating profit was an all-time record of $61.8 million, up 30% from the prior year |

Ÿ | Adjusted net income for 2018 was an all-time record of $49.0 million, or $2.38 per share, diluted, as compared to $35.2 million, or $1.72 per share, for the prior year |

Ÿ | Strong operating cash flow of $76.4 million for 2018 and ended the year with $70.6 million in cash and only $3.0 million in total debt |

Ÿ | Increased quarterly dividend for a sixth consecutive year to $0.42 per share on an annual basis and returned $8.8 million to shareholders in the form of dividends and common share repurchases |

Summary NEO Compensation Decisions and Actions in 2018

Factors Guiding NEO Compensation Decisions | Ÿ | Market compensation rates, including within Materion's compensation peer group, for each position |

Ÿ | Company's performance against pre-established goals | |

Ÿ | Experience, skills and expected future contributions and leadership | |

Ÿ | Contributions and performance of each individual | |

2018 NEO Compensation Decisions (see below for details) | Ÿ | Target Total Direct Compensation: The target total direct compensation for Messrs. Vijayvargiya, Chemnitz, and Kelley in 2018 was managed within 20% of the market median. |

Ÿ | Base Pay: NEO salary increases were 3.57% for Mr. Vijayvargiya, 0% for Mr. Kelley and 0% for Mr. Chemnitz. | |

Ÿ | Management Incentive Plan (MIP): Payout under the MIP was based on Company adjusted operating profit, value-added sales growth, and simplified free cash flow performance versus goals. The Company achieved 121% of its adjusted operating profit target, 220% of its value-added sales growth target and 150% of its simplified free cash flow target, resulting in MIP awards at 200% of target for our NEOs. | |

Ÿ | Long-term Incentives (LTI): The Committee determined 2018 equity grants after carefully considering (1) the Company's 2017 performance, (2) comparative market pay practices and (3) our performance-driven compensation philosophy. In 2018, performance-based grants represented about 75% of the overall target equity opportunities for Mr. Vijayvargiya, and 60% of the overall target equity opportunities for each of Messrs. Kelley and Chemnitz. The target equity opportunity (as a percent of base salary) for Mr. Chemnitz was increased by 12% and for Mr. Kelley by 26%. | |

2018 NEO Compensation Program Design Changes | Ÿ | We introduced a simplified free cash flow (SFCF) metric in addition to the existing operating profit and value-added sales growth metrics to the annual MIP to provide more focus on continually improving the Company's return on invested capital. SFCF is the amount equal to operating profit plus depreciation and amortization minus the change in working capital and capital investments. |

Ÿ | To align with market and peer company practices, vesting of Stock Appreciation Rights (SARs) was changed from 100% "cliff" vesting three years from the date of grant to ratably vesting one-third on each anniversary of the grant date. | |

Ÿ | Also, to align with market competitive best practices, any earned payout under the Company's Performance Restricted Stock Unit (PRSU) plans are 100% payable in shares versus our former practice of PRSUs being paid in shares for payouts up to target performance and in cash for payouts above target. | |

Shareholder Advisory Vote Consideration | Ÿ | At our 2018 annual meeting of shareholders, we received approximately 97% approval from our shareholders, based on the total votes counted, for our annual advisory "Say-on-Pay" proposal to approve the compensation of our NEOs. The Committee considered these voting results at its meetings after the vote, and while it believes the voting results demonstrate significant support for our overall executive compensation program, the Committee remains dedicated to continuously improving the existing executive compensation program and the governance environment surrounding the overall program. |

Other Changes in Prior Years

In addition to the above compensation program design changes made in 2018, the Committee has made a number of executive pay and related corporate governance changes over the past several years to further align our executive compensation program with market competitive best practices. Specifically, the Committee:

17

Compensation Program Design | Ÿ | Established stock ownership and retention guidelines for the NEOs and non-employee directors to further promote long-term equity ownership. |

Ÿ | Introduced a value-added sales metric (defined as sales less the cost of gold, silver, platinum, palladium and copper), in addition to the existing operating profit measure, within our annual MIP to allow for a more meaningful assessment of our performance. | |

Ÿ | Put more stock and compensation at risk by increasing the weighting on the PRSUs to between 40% and 50% (from 33% in 2012) of the total target LTI award mix for our NEOs. The LTI program for 2018 had four components, comprised of stock appreciation rights (SARs), PRSUs tied to our Relative Total Shareholder Return (RTSR) (RTSR PRSUs), PRSUs tied to our absolute Return On Invested Capital (ROIC) (ROIC PRSUs) and time-based restricted stock units (RSUs). Including all PRSUs and SARs, 60% or 75% of the total target LTI award mix for our NEOs is “at risk.” | |

Ÿ | Eliminated all executive perquisite programs, other than periodic executive physicals, for the NEOs. | |

Ÿ | Moved timing of annual base salary increase reviews for NEOs from January 1 to late March to align the Company’s annual merit review process for all other U.S.-based employees. | |

Corporate Governance | Ÿ | Eliminated the "modified single trigger" provision from all future severance agreements with new executives. |

Ÿ | Allowed the excise tax gross-up provisions in existing severance agreements to expire in 2012 and exclude gross-up provisions from any new agreements. | |

Ÿ | Implemented a "double trigger" change in control vesting provision for all new equity grants beginning in 2011, which provides that outstanding equity grants will vest on an accelerated basis either if the awards are not continued, assumed or replaced upon the occurrence of a change in control or if the executive experiences a subsequent qualifying termination of employment. The change in control beneficial ownership percentage trigger was also increased to 30%. | |

Ÿ | Implemented a formal clawback policy that goes beyond the existing provisions contained in our equity award agreements and mandates of The Sarbanes-Oxley Act of 2002. If and when final regulations for clawbacks are promulgated by the SEC and the NYSE under the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), we will modify our policy accordingly to ensure compliance with such new regulations. | |

18

Section II: Executive Compensation Program Overview

Compensation Philosophy and Objectives

Our long-standing compensation philosophy has three key objectives:

• | Attract, motivate and help retain key executives with the ability to profitably grow our business portfolio; |

• | Build a pay-for-performance environment with total pay levels targeted at the competitive market median; and |

• | Provide opportunities for share ownership to align the interests of our executives with our shareholders. |

Primary Components of the NEO Compensation Program for 2018

To achieve these objectives, our NEO compensation program includes the following primary components:

Component | Purpose / Objective | Performance Linkage | Form of Payout | |||

Base Salaries | Provide a fixed, competitive level of pay based on responsibility, qualifications, experience and performance | Moderate: merit increases are based on individual performance | Cash | |||

Short-term Cash Incentives (MIP) | Align variable pay with short-term performance in support of our annual business plan and strategic objectives | Strong: awards are tied to pre-established financial goals | Cash | |||

Long-term Incentives (LTI) including: SARs, PRSUs and RSUs | Align variable pay with longer term, sustained performance and shareholder value creation; enhance executive retention and provide an equity stake to further align with shareholder interests | Strong: PRSUs represent about 40% - 50% of the total target award opportunity, and, including SARs (the value of which is tied to stock price appreciation), about 60 - 75% of total target LTI is “at risk” | SARs, RSUs and PRSUs are payable in shares | |||

Health, Welfare and Retirement Benefits | Provide for competitive health, welfare and retirement needs and enhance executive retention. NEOs are also eligible for periodic executive physicals, but no other perquisites are provided | None | Retirement benefits are payable in cash following qualifying separation from service | |||

Target Total Pay Mix

Due to our pay-for-performance philosophy, the Committee has set base salaries as a relatively small part of target total pay for the NEOs and has provided a significant portion of target total pay for the NEOs in the form of equity-based LTI, consisting of grants of SARs, PRSUs and RSUs that align NEOs' interests with those of our shareholders. In 2018, performance-based LTI grants represented approximately 75% of the total target equity opportunity offered to Mr. Vijayvargiya and approximately 60% for Messrs. Chemnitz and Kelley.

19

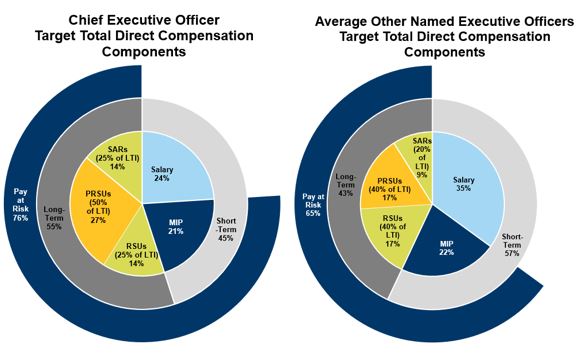

The following charts summarize the target total pay mix for our CEO and the average target total pay mix for our other NEOs:

As shown above, the majority of the target total pay mix is tied to variable, performance-based incentives, with considerable emphasis on equity-based LTI. Overall, the charts illustrate the following:

• | Long-term incentives represent 55% of the target total pay mix for our CEO, with 45% of the target total pay mix provided in the form of cash-based, short-term pay (the combination of salary and target MIP); |

• | Long-term incentives represent 43% of the average target total pay mix for our other two NEOs, with the remaining 57% provided in the form of cash-based short-term pay; and |

• | Performance-based pay (the combination of target MIP, SARs and PRSUs) is approximately 62% of target total pay for our CEO and averages 48% of target total pay for our other two NEOs, versus fixed pay (salary and time-based vesting RSUs) of about 38% and 52%, respectively. |

Our Commitment to Sound Corporate Governance