Form DEF 14A MARLIN BUSINESS SERVICES For: Jun 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

MARLIN BUSINESS SERVICES CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ Fee paid previously with preliminary materials.

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

MARLIN BUSINESS SERVICES CORP.

300 Fellowship Road

Mount Laurel, NJ 08054

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On June 2, 2021

To the Shareholders of Marlin Business Services Corp.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of Marlin Business Services Corp. (the “Corporation”), a Pennsylvania corporation, will be held on Wednesday, June 2, 2021, at 9:00 a.m. virtually via the internet for the following purposes:

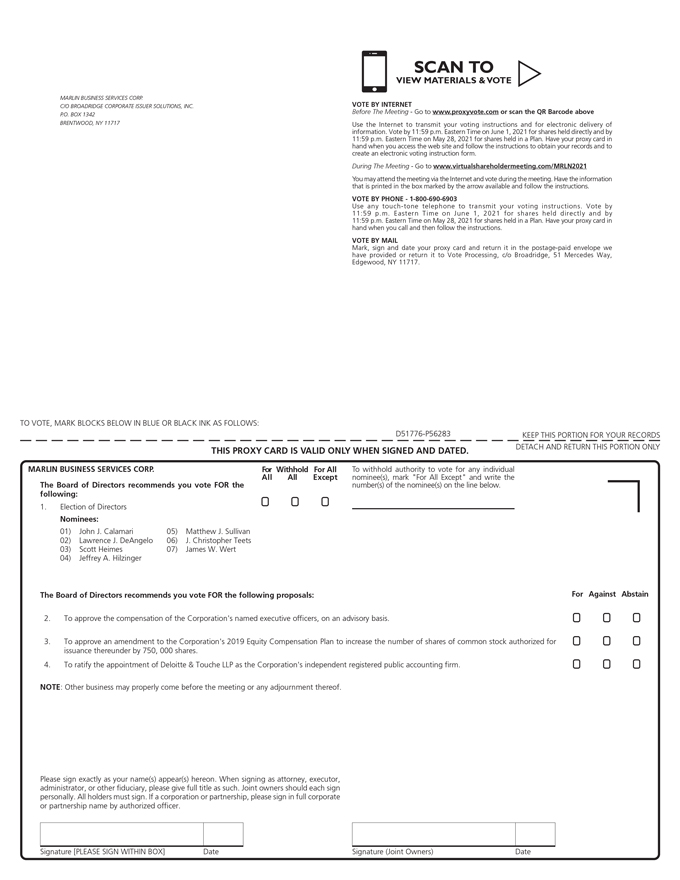

| 1. | To elect a Board of Directors of seven (7) directors to serve until the next annual meeting of shareholders of the Corporation and until their successors are elected and qualified; |

| 2. | To approve the compensation of the Corporation’s named executive officers on an advisory basis; |

| 3. | To approve an amendment to the Corporation’s 2019 Equity Compensation Plan to increase the number of shares of common stock authorized for issuance thereunder by 750,000 shares; and |

| 4. | To ratify the appointment of Deloitte & Touche LLP as the Corporation’s independent registered public accounting firm. |

In the proxyholder’s discretion, the proxyholder is authorized to vote upon such other business as may properly be presented at the Annual Meeting or any adjournments or postponements thereof.

The Annual Meeting can be accessed virtually at: www.virtualshareholdermeeting.com/MRLN2021.

The Board of Directors has fixed April 15, 2021, as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

| By order of the Board of Directors |

|

|

| Ryan Melcher Senior Vice President, General Counsel and Corporate Secretary |

Your vote is important, regardless of the number of shares you own. Even if you plan to attend the meeting, please date and sign the enclosed proxy form, indicate your choice with respect to the matters to be voted upon, and return it promptly in the enclosed envelope. A proxy may be revoked before exercise by notifying the Secretary of the Corporation in writing or in open meeting, by submitting a proxy of a later date or by attending the meeting and voting.

Dated: April 28, 2021

Important Notice Regarding Availability of Proxy Materials for the

Annual Meeting to be Held on June 2, 2021.

The Proxy Statement and Annual Report to Shareholders are available at

https://materials.proxyvote.com/571157

PROXY STATEMENT FOR THE

2021 ANNUAL MEETING OF SHAREHOLDERS

MARLIN BUSINESS SERVICES CORP.

300 Fellowship Road

Mount Laurel, NJ 08054

This Proxy Statement and the enclosed proxy card are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of Marlin Business Services Corp. (the “Corporation” or “Marlin”), a Pennsylvania corporation, to be voted at the Annual Meeting of Shareholders (the “Annual Meeting”) of the Corporation to be held on Wednesday, June 2, 2021, at 9:00 a.m., to be held virtually via the internet, or at any adjournment or postponement thereof, for the purposes set forth below:

| 1. | To elect to the Board seven (7) directors to serve until the next annual meeting of shareholders of the Corporation and until their successors are elected and qualified; |

| 2. | To approve the compensation of the Corporation’s named executive officers on an advisory basis; |

| 3. | To approve an amendment to the Corporation’s 2019 Equity Compensation Plan to increase the number of shares of common stock authorized for issuance thereunder by 750,000 shares; and |

| 3. | To ratify the appointment of Deloitte & Touche LLP as the Corporation’s independent registered public accounting firm. |

In the proxyholder’s discretion, the proxyholder is authorized to vote upon such other business as may properly be presented at the Annual Meeting or any adjournments or postponements thereof.

The Annual Meeting can be accessed virtually at: www.virtualshareholdermeeting.com/MRLN2021.

This Proxy Statement and related proxy card have been mailed on or about April 28, 2021, to all holders of record of common stock of the Corporation as of the record date. The Corporation will bear the expense of soliciting proxies. The Board of Directors of the Corporation has fixed the close of business on April 15, 2021, as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. The Corporation has only one class of common stock, of which there were 12,013,245 shares outstanding as of April 15, 2021.

At the Annual Meeting, the Board of Directors recommends that the shareholders vote:

| • | “FOR” Proposal 1: the election of John J. Calamari, Lawrence J. DeAngelo, Scott A. Heimes, Jeffrey A. Hilzinger, Matthew J. Sullivan, J. Christopher Teets and James W. Wert to serve on the Board of Directors until the next annual meeting of shareholders and until their successors are elected and qualified; |

| • | “FOR” Proposal 2: the adoption of the resolution indicating approval, on an advisory basis, of the compensation of the Corporation’s named executive officers; |

| • | “FOR” Proposal 3: the approval of an amendment to the Corporation’s 2019 Equity Compensation Plan to increase the number of shares of common stock authorized for issuance thereunder by 750,000 shares; and |

| • | “FOR” Proposal 4: the ratification of the appointment of Deloitte & Touche LLP as the Corporation’s independent registered public accounting firm for 2021. |

GENERAL INFORMATION ABOUT THE 2021 ANNUAL MEETING

Please take note that in light of the Covid-19 pandemic and in order to protect the health and safety of Marlin’s shareholders, directors, management and other stakeholders, the Annual Meeting will be a completely “virtual

1

meeting” of shareholders. There will not be a physical meeting location. Marlin believes that hosting a virtual meeting will facilitate shareholder attendance and participation at the Annual Meeting by enabling shareholders to participate remotely from any location. Marlin has designed the Annual Meeting to provide the same rights and opportunities to participate to shareholders as they would have at an in-person meeting. Marlin is permitted to hold the meeting in this format pursuant to the Corporation’s bylaws (the “Bylaws”) and the laws of the Commonwealth of Pennsylvania, the jurisdiction in which the Corporation is incorporated.

Authorized shareholders will be able to attend the Annual Meeting, vote and submit questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/MRLN2021. Prior to the Annual Meeting, authorized shareholders will be able to vote by proxy in the manner and upon the matters described herein.

Proxies and Voting Procedures

Each outstanding share of common stock of the Corporation will entitle the holder thereof to one vote on each separate matter presented for vote at the Annual Meeting. Votes cast at the meeting and submitted by proxy are counted by the inspectors of the meeting who are appointed by the Corporation. The shares represented by such proxy will be voted at the Annual Meeting and any adjournment or postponement thereof. If you specify a choice, the proxy will be voted as specified. If no choice is specified, the shares represented by the proxy will be voted for the election of all of the director nominees named in the Proxy Statement; for the adoption, on an advisory basis, of the resolution approving the compensation of the Corporation’s named executive officers, as described in the Proxy Statement under “Executive Compensation – Compensation Discussion and Analysis”; for the approval of an amendment to the Corporation’s 2019 Equity Compensation Plan to increase the number of shares of common stock authorized for issuance thereunder by 750,000 shares, as described under Proposal 3; for the ratification of Deloitte & Touche LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2021; and in accordance with the judgment of the persons named as proxies with respect to any other matter which may come before the meeting. If you are the shareholder of record, you can also choose to vote your shares electronically at the Annual Meeting.

A proxy may be revoked before exercise by notifying the Secretary of the Corporation in writing or in open meeting, by submitting a proxy of a later date or attending the meeting and voting. You are encouraged to date and sign the enclosed proxy form, indicate your choice with respect to the matters to be voted upon and promptly return it to the Corporation.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee, who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct how your broker votes your shares. You are also invited to attend the Annual Meeting. However, because you are not the shareholder of record, you may not vote your street name shares at the Annual Meeting unless you obtain a proxy executed in your favor from the holder of record. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee to vote your shares.

2

Voting of Shares Prior to the Annual Meeting. You can vote prior to the Annual Meeting by valid proxy received by telephone, via the internet or by mail. We urge you to vote by doing one of the following:

| Vote by Telephone |

Vote by Internet |

Vote by Mail | ||

| You can vote your shares by calling the toll free number indicated on your proxy card using a touch tone telephone 24 hours a day. Easy to follow voice prompts enable you to vote your shares and confirm that your voting instructions have been properly recorded. If you are a beneficial owner, or you hold your shares in “street name,” please check your vote instruction form or contact your bank, broker or other nominee to determine whether you will be able to vote by telephone. |

You can also vote via the Internet by following the instructions on your proxy card. The website address for Internet voting is indicated on your proxy card. Internet voting is also available 24 hours per day. If you are a beneficial owner, or you hold your shares in “street name,” please check your vote instruction form or contact your bank, broker or other nominee to determine whether you will be able to vote via the Internet. |

If you choose to vote by mail, complete, sign, date and return your proxy card in the postage paid envelope provided. Please promptly mail your proxy card to ensure that it is received on or before June 1, 2021. |

The deadline for voting by telephone or electronically through the Internet is set forth on your proxy card.

Voting of Shares at the Annual Meeting. The Annual Meeting will be held entirely online to allow greater participation. Shareholders may participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/MRLN2021. To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the shareholder of record may be voted electronically during the Annual Meeting. Shares for which you are the beneficial owner but not the shareholder of record also may be voted electronically during the Annual Meeting. However, even if you plan to attend the Annual Meeting, the Corporation recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting. You are entitled to attend the virtual Annual Meeting only if you were a shareholder of record as of April 15, 2021, the record date for the Annual Meeting, or you hold a valid proxy for the Annual Meeting. If you are not a shareholder of record but hold shares as a beneficial owner in street name, you may be required to provide proof of beneficial ownership, such as your most recent account statement as of the record date, a copy of the voting instruction form provided by your broker, bank, trustee, or nominee, or other similar evidence of ownership. If you do not comply with the procedures outlined above, you will not be admitted to the virtual Annual Meeting.

Quorum and Voting Requirements

The presence, via webcast or by proxy, of shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast on a particular matter to be voted upon at the meeting will constitute a quorum for the meeting. If, however, the Annual Meeting cannot be organized because a quorum is not present, the shareholders entitled to vote and present at the Annual Meeting will have the power, except as otherwise provided by statute, to adjourn the meeting to such time and place as they may determine. Those who attend or participate at a meeting that has been previously adjourned for lack of a quorum, although less than a quorum, shall nevertheless constitute a quorum for the purpose of electing directors.

3

The following chart shows the proposals to be acted upon at the Annual Meeting, and the votes needed for the proposals to be adopted.

| Proposal |

Vote Required for Approval |

Effect of Abstentions* |

Broker Discretionary |

Effect of Broker | ||||||

| 1 | Election of directors | Plurality. But if votes “withheld” exceed votes “for” a nominee, then nominee must tender resignation to the Board (as described below) | Not applicable | No | No effect | |||||

| 2 | Advisory vote on compensation of named executive officers | Majority of votes cast | No effect | No | No effect | |||||

| 3 | Approval of amendment to the Corporation’s 2019 Equity Compensation Plan | Majority of votes cast | No effect | No | No effect | |||||

| 4 | Ratification of appointment of independent registered public accounting firm | Majority of votes cast | No effect | Yes | No effect | |||||

| * | Note: Abstentions are counted as present for determining whether a quorum is present for each proposal, where applicable. |

At the Annual Meeting, in connection with Proposal 1 to elect directors, you will be entitled to cast one vote for each share held by you for each candidate nominated but will not be entitled to cumulate your votes. Votes may be cast “for” or “withheld” with respect to each candidate nominated. Directors shall be elected by a plurality of the votes cast, which means that seven (7) director nominees receiving the highest number of votes “for” their election will be elected to the Board of Directors. Votes that are withheld will be excluded entirely from the vote and will have no effect, other than for purposes of determining the presence of a quorum. However, the Board has adopted a director resignation policy, pursuant to which, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election will, promptly following certification of the shareholder vote, tender his or her resignation to the Board with such resignation expressly stating that it is contingent upon the acceptance of the resignation by the Board. See “Governance of the Corporation—Majority Voting in Director Elections/Director Resignation Policy.”

With respect to Proposal 2 regarding the advisory vote on executive compensation (“say-on-pay” vote), while the Corporation intends to carefully consider the voting results of this proposal, the final vote is advisory in nature and therefore not binding on the Corporation, the Board or the Compensation Committee. The Board and Compensation Committee value the opinions of all of the Corporation’s shareholders and will consider the outcome of this vote when making future compensation decisions for the Corporation’s named executive officers.

Proposal 3 regarding the approval of the proposed amendment to the Corporation’s 2019 Equity Compensation Plan requires, under the Corporation’s Bylaws, the affirmative vote of a majority of the votes cast by those shareholders present or by proxy at the Annual Meeting. Any abstentions and broker non-votes will not be considered votes cast on Proposal 3 and, therefore, will have no effect.

4

Proposal 4 considers ratification of the appointment of Deloitte & Touche LLP as the Corporation’s independent registered public accounting firm. While shareholder approval of this appointment is not required by law, the Bylaws or otherwise, nor binding on the Corporation, the Corporation intends to carefully consider the voting results of this proposal. The Corporation believes that its shareholders should be given the opportunity to express their views on the Corporation’s external financial accounting firm and therefore is submitting this matter to shareholder vote as a matter of good corporate practice. If the shareholders do not ratify the appointment of Deloitte & Touche LLP as the Corporation’s independent auditor, the Audit and Risk Committee of the Board (the “Audit and Risk Committee”) will consider the same in determining whether to continue the engagement of Deloitte & Touche LLP as its independent auditor.

Generally, broker non-votes occur when shares held by a broker, bank or other nominee in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker, bank or other nominee (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares with respect to that particular proposal. A broker is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares, such as Proposal 4. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters, such as the election of directors (Proposal 1), the advisory vote on executive compensation (Proposal 2), or the approval of the proposed amendment to the Corporation’s 2019 Equity Compensation Plan (Proposal 3)

If you hold your shares in street name and you do not indicate how you want your shares voted in the election of directors, then your broker, bank or other nominee is not allowed to vote those shares on your behalf in the election of directors or other “non-routine” matters as they felt appropriate. Thus, if you hold your shares in street name and you do not instruct your broker, bank or other nominee how to vote in the election of directors or other “non-routine” matters, no votes will be cast on your behalf. Such broker non-votes are counted for purposes of determining whether or not a quorum exists for the transaction of business, but will not be counted for purposes of determining the number of shares represented and voted with respect to an individual “non-routine” proposal, and therefore will have no effect on the outcome of the vote on an individual “non-routine” proposal.

As to all other matters properly brought before the Annual Meeting, the majority of the votes cast at the meeting, via webcast or by proxy, by shareholders entitled to vote thereon will decide any question brought before the Annual Meeting, unless the question is one for which, by express provision of statute or of the Corporation’s Articles of Incorporation or Bylaws, a different vote is required. Generally, abstentions and broker non-votes on these matters will have no effect on the vote because under Pennsylvania law abstentions and broker non-votes are not considered votes cast. Broker non-votes and abstentions will be counted, however, for purposes of determining whether a quorum is present.

RECENT DEVELOPMENTS

On April 18, 2021, we entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among the Corporation, Madeira Holdings, LLC and Madeira Merger Subsidiary, Inc. (“Merger Sub”) pursuant to which all outstanding shares of the Corporation’s common stock will, subject to the terms and conditions of the Merger Agreement, be acquired by funds managed by HPS Investment Partners, LLC in a merger of the Corporation with and into Merger Sub, with the Corporation surviving.

5

Proposal 1:

ELECTION OF DIRECTORS

PROPOSAL SUMMARY AND RECOMMENDATION

The Board has nominated for election as directors at the Annual Meeting John J. Calamari, Lawrence J. DeAngelo, Scott A. Heimes, Jeffrey A. Hilzinger, Matthew J. Sullivan, J. Christopher Teets and James W. Wert, each to serve until the 2022 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified, or until their earlier death, retirement or resignation.

Each nominee has consented to being named in this Proxy Statement and to serve if elected. Except to the extent that authority to vote for any directors is withheld in a proxy, shares represented by proxies will be voted for such nominees. In the event that any of the nominees for director should, before the Annual Meeting, become unable to serve if elected, shares represented by proxies will be voted for such substitute nominees as may be recommended by the Corporation’s existing Board, unless other directions are given in the proxies. To the best of the Corporation’s knowledge, all of the nominees will be able to serve.

Recommendation: The Board recommends that the shareholders vote “FOR” the seven (7) nominees listed above. Proxies received will be so voted unless shareholders specify otherwise in the proxy.

BOARD OF DIRECTORS

Currently, the Board has seven (7) members. From January 1, 2020 through December 31, 2020, there were eleven (11) meetings of the Board of Directors, six (6) meetings of the Audit and Risk Committee, eight (8) meetings of the Compensation Committee and three (3) meetings of the Nominating and Governance Committee. All of our directors attended at least 75% of the meetings of each of our Board and each Board committee on which they served.

Directors are encouraged, but not required, to attend annual meetings of the Corporation’s shareholders. Each director attended the Corporation’s 2020 Annual Meeting of Shareholders (the “2020 Annual Meeting”) virtually via the internet.

Nominees to Serve as Directors – Term Expires 2022

In general, the Corporation’s directors are elected at each annual meeting of shareholders. Currently, the number of directors of the Corporation is seven (7) with one vacancy.

Consequently, at the Annual Meeting, the Corporation’s shareholders are being asked to elect seven (7) directors to serve until the next annual meeting of shareholders and until their successors are elected and qualified, or until their earlier death, resignation or removal. The nominees receiving the greatest number of votes at the Annual Meeting, up to the number of authorized directors, will be elected.

After the Annual Meeting, there will remain one vacancy on the Board of Directors as the Nominating and Governance Committee has not identified a candidate to fill the remaining independent board member vacancy, but continually searches for candidates. Under the terms of our Amended and Restated Articles of Incorporation and Bylaws, the Board of Directors may fill a board of director vacancy at any time.

All seven (7) of the nominees for election as directors at the Annual Meeting as set forth in the following table are incumbent directors previously elected as directors by the Corporation’s shareholders. For each such nominee, set forth below is biographical and other information as of April 28, 2021, as to each nominee’s positions and offices held with the Corporation, principal occupations during the past five years, directorships of

6

public companies and other organizations held during the past five years and the specific experience, qualifications, attributes or skills that, in the opinions of the Nominating and Governance Committee and the Board of Directors, make each nominee qualified to serve as a director of the Corporation:

| Name |

Age | Principal Occupation | Director Since |

|||||||

| John J. Calamari | 66 | Former Executive Vice President and Chief Financial Officer of J.G. Wentworth |

2003 | |||||||

| Lawrence J. DeAngelo (Chairman) | 55 | Managing Director of Houlihan Lokey, Inc. | 2001 | |||||||

| Scott A. Heimes |

52 | Chief Marketing Officer of Zipwhip | 2015 | |||||||

| Jeffrey A. Hilzinger |

63 | President and Chief Executive Officer of the Corporation |

2016 | |||||||

| Matthew J. Sullivan |

63 | Partner with Peachtree Equity Management | 2008 | |||||||

| J. Christopher Teets |

48 | Partner of Red Mountain Capital Partners LLC | 2010 | |||||||

| James W. Wert |

74 | Managing Member & CEO of CM Wealth Advisors LLC |

1998 | |||||||

John J. Calamari:

Biography. Mr. Calamari has been a director since November 2003. Since November 2009, Mr. Calamari has served as an independent consultant in accounting and financial matters for various clients in diverse industries. Mr. Calamari served as the Executive Vice President and Chief Financial Officer of J.G. Wentworth from March 2007 until November 2009. Prior to that time, Mr. Calamari was Senior Vice President, Corporate Controller of Radian Group Inc., where he oversaw Radian’s global controllership functions, a position he held after joining Radian in September 2001. From 1999 to August 2001, Mr. Calamari was a consultant to the financial services industry, where he structured new products and strategic alliances, established financial and administrative functions and engaged in private equity financing for startup enterprises. Mr. Calamari served as Chief Accountant of Advanta from 1988 to 1998, as Chief Financial Officer of Chase Manhattan Bank Maryland and Controller of Chase Manhattan Bank (USA) from 1985 to 1988 and as Senior Manager at Peat, Marwick, Mitchell & Co. (now KPMG LLP) prior to 1985 where he earned his certified public accountant license (currently non-active status). In addition, Mr. Calamari served as a director of Advanta National Bank, Advanta Bank USA and Credit One Bank. Mr. Calamari received his undergraduate degree in accounting from St. John’s University in 1976.

Qualifications. Mr. Calamari has over 40 years of banking and financial experience, including five years serving in the role of Chief Financial Officer for a bank and a financial services company. Mr. Calamari achieved the level of certified public accountant, and he has served as Chairman of the Corporation’s Audit and Risk Committee since July 2004. He has seven years of past service as a director of several non-public banks and financial services companies. Mr. Calamari currently serves on the Nominating and Governance Committee of the Corporation. Mr. Calamari has also had leadership positions with various community organizations. The Board has determined that Mr. Calamari is an independent director and is financially literate and an audit committee financial expert within the meaning of applicable United States Securities and Exchange Commission (“SEC”) rules. The Board views Mr. Calamari’s independence, his banking and financial experience, his experience as a director of other companies and his demonstrated leadership roles in business and community activities as important qualifications, skills and experience for the Board’s conclusion that Mr. Calamari should serve as a director of the Corporation.

Lawrence J. DeAngelo:

Biography. Mr. DeAngelo has been a director since July 2001 and has served as the Chairman of the Board since June 2014. Mr. DeAngelo is a Managing Director with Houlihan Lokey Inc., an investment bank, and is based in Atlanta, Georgia. From 2010 to 2016, Mr. DeAngelo was a Managing Director with Sun Trust Robinson

7

Humphrey, an investment bank based in Atlanta, Georgia. Mr. DeAngelo served as a Managing Director with Roark Capital Group, a private equity firm based in Atlanta, Georgia from 2005 until January 2010. Prior to joining Roark in 2005, Mr. DeAngelo was a Managing Director of Peachtree Equity Partners, a private equity firm based in Atlanta, Georgia. Prior to co-founding Peachtree in April 2002, Mr. DeAngelo held numerous positions at Wachovia Capital Associates, the private equity investment group of Wachovia Bank, from 1996 to April 2002, the most recent of which was Managing Director. From 1995 to 1996, Mr. DeAngelo worked at Seneca Financial Group, and from 1992 to 1995, Mr. DeAngelo worked in the Corporate Finance Department at Kidder, Peabody & Co. From 1990 to 1992, Mr. DeAngelo attended business school. From 1988 to 1990, Mr. DeAngelo was a management consultant with Peterson & Co. Consulting. Mr. DeAngelo received his undergraduate degree in economics from Colgate University and his MBA from the Yale School of Management.

Qualifications. Mr. DeAngelo has over 28 years of experience as an investment banker and private equity professional, including 19 years serving in the role of Managing Director for a variety of private equity firms. He served as Chairman of the Corporation’s Nominating and Governance Committee from November 2003 to March 2009 and as Chairman of the Corporation’s Compensation Committee from March 2009 to June 2014. He currently serves on the Corporation’s Nominating and Governance Committee (as Chairman) and on the Compensation Committee. He has served as a director of over a dozen privately held companies. The Board has determined that Mr. DeAngelo is an independent director and is financially literate within the meaning of applicable SEC rules. The Board views Mr. DeAngelo’s independence, his investment banking and private equity experience, his experience as a director of other companies and his demonstrated leadership roles in business as important qualifications, skills and experience for the Board’s conclusion that Mr. DeAngelo should serve as a director of the Corporation.

Scott A. Heimes:

Biography. Mr. Heimes has been a director of the Corporation since April 2015. Since April 2018, Mr. Heimes has served as the Chief Marketing Officer of Zipwhip, a business-texting software and API provider. From 2015 to 2018, Mr. Heimes was the Chief Marketing Officer for SendGrid, Inc., a global digital communication platform, and from 2012 to 2015, he was the Chief Marketing Officer for Digital River, Inc., a global ecommerce, payments, and marketing services provider. From 2009 to 2012, Mr. Heimes worked as a Chief Marketing Officer for WebMD Health Corp. and from 2006 to 2009, Mr. Heimes worked with UnitedHealth Group in a variety of senior marketing roles. Mr. Heimes has worked in various other executive management positions between 1998 and 2006 with most of that time was spent in marketing roles. In 1991, Mr. Heimes received his undergraduate degree in English literature with a minor in French and Business Administration from the University of St. Thomas in St. Paul, Minnesota.

Qualifications. The Board has determined that Mr. Heimes is an independent director. The Board views Mr. Heimes’ independence, his business and marketing experience, and his demonstrated leadership roles in business activities as important qualifications, skills and experience for the Board’s conclusion that Mr. Heimes should serve as a director of the Corporation.

Jeffrey A. Hilzinger:

Biography. Mr. Hilzinger has been the Corporation’s Chief Executive Officer, President and Director since June 2016. Mr. Hilzinger was most recently President of EverBank Commercial Finance, Inc. From 2010 until 2013, Mr. Hilzinger served as Chief Operating Officer of EverBank Commercial Finance, Inc. From 2008 until 2010, Mr. Hilzinger served as Chief Financial Officer of Tygris Vendor Finance. In 2004, Mr. Hilzinger co-founded US Express Leasing, Inc. and served as Chief Financial Officer from 2004 until 2008. In 2002, Mr. Hilzinger co-founded Aternus Partners, LLC, a management consulting firm, and served as a Managing Director until 2004. From 1979 until 2002, Mr. Hilzinger served in various regional and global leadership roles with Heller Financial, Inc. and certain of its subsidiaries and affiliates. Since September 2019, Mr. Hilzinger has served on the board of directors of Encore Capital Group, Inc. (NASDAQ: ECPG), an international specialty

8

finance company providing debt recovery solutions and other related services for consumers. Mr. Hilzinger earned a bachelor’s degree in Economics from the University of Michigan in 1979.

Qualifications. Mr. Hilzinger has over 40 years of experience in financial services, including over 15 years in the equipment leasing industry. Mr. Hilzinger is the Corporation’s President and Chief Executive Officer, and has served as Director of the Corporation since joining the Corporation in June 2016. The Board views Mr. Hilzinger’s leadership ability along with his significant industry knowledge and broad financial services expertise as important qualifications, skills and experience for the Board’s conclusion that Mr. Hilzinger should serve as director of the Corporation.

Matthew J. Sullivan:

Biography. Mr. Sullivan has been a director since April 2008. Mr. Sullivan is a Partner with Peachtree Equity Management (“Peachtree”), a private equity investment firm. Mr. Sullivan co-founded Peachtree in 2002. From 1994 to 2002, Mr. Sullivan held numerous positions at Wachovia Capital Associates, the private equity investment group of Wachovia Bank, the most recent of which was Managing Director. From 1983 to 1994, Mr. Sullivan worked in the Corporate Finance Department at Kidder, Peabody & Co. and previously with Arthur Andersen & Company where he earned his certified public accountant license (currently non-active status). Mr. Sullivan received his undergraduate degree in finance from the University of Pennsylvania and his MBA from Harvard Business School.

Qualifications. Mr. Sullivan has over 30 years of experience as an investment banker and private equity professional, including over 20 years serving in the role of Managing Director for a variety of private equity firms. He has over ten years of past service as a director of privately held companies. Mr. Sullivan currently serves on the Corporation’s Audit and Risk Committee, Compensation Committee and Nominating and Governance Committee. Mr. Sullivan has also had leadership positions with various cultural and community organizations. The Board has determined that Mr. Sullivan is an independent director and is financially literate and an audit committee financial expert within the meaning of applicable SEC rules. The Board views Mr. Sullivan’s independence, his investment banking and private equity experience, his experience as a director of other companies and his demonstrated leadership roles in business and community activities as important qualifications, skills and experience for the Board’s conclusion that Mr. Sullivan should serve as a director of the Corporation.

J. Christopher Teets:

Biography. Mr. Teets has been a director since May 2010. Mr. Teets has served as a Partner of Red Mountain Capital Partners LLC (“Red Mountain”), an investment firm, since February 2005. Before joining Red Mountain in 2005, Mr. Teets was an investment banker at Goldman Sachs & Co. Prior joining Goldman Sachs in 2000, Mr. Teets worked in the investment banking division of Citigroup. Mr. Teets currently serves on the boards of directors of Air Transport Services Group, Inc., Nature’s Sunshine Products, Inc. and Intrinsic LLC and previously served on the board of directors of Affirmative Insurance Holdings, Inc., Encore Capital Group, Inc. and Yuma Energy, Inc. Mr. Teets holds a bachelor’s degree from Occidental College and an MSc degree from the London School of Economics.

Qualifications. Mr. Teets has 23 years of experience as an investment banker and investment professional, which includes advising and investing in financial institutions. Mr. Teets’ experience also includes over 16 years serving as a Partner for an investment firm. He has 14 years of service as a director of other public companies and currently sits on the boards of two other such companies. Mr. Teets currently serves on both the Corporation’s Audit and Risk Committee and Compensation Committee. In considering the independence of Mr. Teets, the Board considered the fact that he is a Partner of Red Mountain, the beneficial owner (via certain affiliates) of approximately 24.62% of the Corporation’s outstanding shares (reported as of June 10, 2020) as of April 1, 2021, and concluded that his relationship with Red Mountain does not impact his independence as a

9

director of the Corporation. In reaching this conclusion, the Board took into account that while Red Mountain and certain of its affiliates received relief in December 2020 from the passivity commitments it had made to the Federal Reserve Board in 2014, Red Mountain and such affiliates remain subject to Federal Reserve Board rules regarding the exercise of “control” over a bank holding company such as the Corporation. The Board has determined that Mr. Teets is an independent director and is financially literate and an audit committee financial expert within the meaning of applicable SEC rules. The Board views Mr. Teets’ independence, his investment banking and public and private investing experience, his experience with financial institutions, his experience as a director of other public companies and his demonstrated leadership roles in business as important qualifications, skills and experience for the Board’s conclusion that Mr. Teets should serve as a director of the Corporation.

James W. Wert:

Biography. Mr. Wert has been a director since February 1998. Mr. Wert is Managing Member and CEO of CM Wealth Advisors LLC f/k/a Clanco Management Corp., which is a wealth management and investment advisory firm headquartered in Cleveland, Ohio. Prior to joining Clanco in May 2000, Mr. Wert served as Chief Financial Officer and then Chief Investment Officer of KeyCorp, a financial services company based in Cleveland, Ohio, and its predecessor, Society Corporation, until 1996, holding a variety of capital markets and corporate banking leadership positions. Mr. Wert received his undergraduate degree in finance from Michigan State University in 1971 and completed the Stanford University Executive Program in 1982. Mr. Wert also serves as lead Director of Park-Ohio Holdings Corp.

Qualifications. Mr. Wert has over 30 years of experience in the banking and financial services industries, including over 20 years as a senior officer of a bank. He served as Chairman of the Corporation’s Audit and Risk Committee from November 2003 to July 2004. Mr. Wert presently serves as Chairman of the Corporation’s Compensation Committee and on the Corporation’s Audit and Risk Committee and Nominating and Governance Committee. He has over 23 years of service as a director of public companies, and has also spent over 20 years serving on the boards of several non-public entities. Mr. Wert has also had leadership positions with various cultural and community organizations. The Board has determined that Mr. Wert is an independent director and is financially literate and an audit committee financial expert within the meaning of applicable SEC rules. The Board views Mr. Wert’s independence, his banking and financial services experience, his experience as a director of other companies and his demonstrated leadership roles in business and community activities as important qualifications, skills and experience for the Board’s conclusion that Mr. Wert should serve as a director of the Corporation.

Independence of the Board of Directors

The Board has affirmatively determined that John J. Calamari, Lawrence J. DeAngelo, Scott A. Heimes, Matthew J. Sullivan, J. Christopher Teets and James W. Wert are each independent directors. Our Board has also determined that Mr. Hilzinger, who serves as a director and our President and Chief Executive Officer, is not an independent director. Accordingly, 86% of our current incumbent directors, who also constitute our director nominees, are independent. The standards applied by the Board in affirmatively determining whether a director is “independent” are those objective standards set forth in the listing standards of the NASDAQ Global Select Market (“NASDAQ”).

Only independent directors serve on our Audit and Risk Committee, Compensation Committee and Nominating and Governance Committee. Mr. DeAngelo, a non-employee independent director, serves as the Chairman of the Board. He was elected to that position in June 2014. The Board is responsible for ensuring that independent directors do not have a material relationship with the Corporation or any of the Corporation’s affiliates or any of our executive officers or their affiliates.

10

It is the policy of the Board and NASDAQ’s rules require listed companies to have a board of directors with at least a majority of independent directors, as defined under NASDAQ’s Marketplace Rules. The Board has affirmatively determined that each member of our Board (other than the Corporation’s President and Chief Executive Officer, Jeffrey A. Hilzinger), is an independent director, and all standing committees of the Board are composed entirely of independent directors, in each case under NASDAQ’s independence definition. The NASDAQ independence definition includes a series of objective tests, such as that the director is not an employee of the Corporation and has not engaged in various types of business dealings with the Corporation. In addition, the Board has made a subjective determination as to each independent director that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors and the Corporation with regard to each director’s business and other activities as they may relate to the Corporation and the Corporation’s management.

COMMITTEES OF THE BOARD

The Corporation has three standing committees: the Audit and Risk Committee, the Compensation Committee and the Nominating and Governance Committee.

Audit and Risk Committee

The Audit and Risk Committee currently consists of four independent directors: Messrs. Calamari (chairman), Sullivan, Teets and Wert. The Board has determined that Messrs. Calamari, Sullivan, Teets and Wert each qualify as an audit committee financial expert as defined under current rules and regulations of the SEC and under NASDAQ listing standards, and that all the members of the Audit and Risk Committee satisfy the independence and other requirements for audit committee members under such rules, regulations and listing standards.

The Audit and Risk Committee’s primary purpose is to assist the Board in overseeing and reviewing:

(1) the integrity of the Corporation’s financial reports and financial information provided to the public and to governmental and regulatory agencies;

(2) the adequacy of the Corporation’s internal accounting systems and financial controls;

(3) the annual independent audit of the Corporation’s financial statements, including the independent registered public accountant’s qualifications and independence; and

(4) the Corporation’s compliance with law and ethics programs as established by management and the Board.

In this regard, the Audit and Risk Committee, among other things, (a) has sole authority to select, evaluate, terminate and replace the Corporation’s independent registered public accountants; (b) has sole authority to approve in advance all audit and non-audit engagement fees and terms with the Corporation’s independent registered public accountants; and (c) reviews the Corporation’s audited financial statements, interim financial results, public filings and earnings press releases prior to issuance, filing or publication.

The Board has adopted a written charter for the Audit and Risk Committee, which is accessible in the Investors section of the Corporation’s website at www.marlincapitalsolutions.com. The Corporation’s website is not part of this Proxy Statement and references to the Corporation’s website address are intended to be inactive textual references only.

11

Compensation Committee

The Compensation Committee of the Board (the “Compensation Committee”) currently consists of four independent directors: Messrs. Wert (chairman), DeAngelo, Sullivan and Teets.

The functions of the Compensation Committee include:

| • | evaluating the performance of the Corporation’s named executive officers and approving their compensation; |

| • | preparing an annual report on executive compensation for inclusion in the Corporation’s proxy statement; |

| • | reviewing and approving compensation plans, policies and programs and considering their design and competitiveness; and |

| • | reviewing the Corporation’s non-employee independent director compensation levels and practices and recommending changes as appropriate. |

The Compensation Committee reviews and approves corporate goals and objectives relevant to chief executive officer compensation, evaluates the chief executive officer’s performance in light of those goals and objectives, and recommends to the Board the chief executive officer’s compensation levels based on its evaluation. The Compensation Committee also administers the Corporation’s 2003 Equity Compensation Plan, as amended (the “2003 Equity Plan”), 2014 Equity Compensation Plan (the “2014 Equity Plan”), 2019 Equity Compensation Plan (the “2019 Equity Plan”) and 2012 Employee Stock Purchase Plan. The Compensation Committee is governed by a written charter that is accessible on the Investors page of the Corporation’s website at www.marlincapitalsolutions.com.

Nominating and Governance Committee

The Nominating and Governance Committee of the Board (the “Nominating and Governance Committee”) currently consists of four independent directors: Messrs. DeAngelo (chairman), Calamari, Sullivan and Wert. The Nominating and Governance Committee is responsible for seeking, considering and recommending to the Board qualified candidates for election as directors and proposing a slate of nominees for election as directors at the Corporation’s Annual Meeting of Shareholders. The Nominating and Governance Committee is responsible for reviewing and making recommendations on matters involving general operation of the Board and its committees and will annually recommend to the Board nominees for each committee of the Board. The Nominating and Governance Committee is governed by a written charter that is accessible on the Investors page of the Corporation’s website at www.marlincapitalsolutions.com.

The Nominating and Governance Committee has determined that no one single criterion should be given more weight than any other criteria when it considers the qualifications of a potential nominee to the Board. Instead, it believes that it should consider the total “skill set” of an individual. In considering potential nominees for director, the Nominating and Governance Committee will consider each potential nominee’s personal abilities and qualifications, independence, knowledge, judgment, character, leadership skills, education and the diversity of such nominee’s background, expertise and experience in fields and disciplines relevant to the Corporation, including financial literacy or expertise. In addition, potential nominees should have experience in positions with a high degree of responsibility, be leaders in the companies or institutions with which they are affiliated and be selected based upon contributions that they can make to the Corporation. The Nominating and Governance Committee considers all of these qualities when selecting, subject to ratification by the Board, potential nominees for director.

The Board views both demographic and geographic diversity among the directors as desirable. The Board does not have a formal diversity policy, but the Nominating and Governance Committee takes into account a

12

candidate’s ability to contribute to the cognitive diversity of backgrounds on the Board. To this end, we consider attributes such as race, ethnicity, gender, age, cultural background and professional experience. The Nominating and Governance Committee reviews its effectiveness in balancing these considerations when assessing the composition of the Board.

Recognizing the significant added value diversity can provide to the functionality of a boardroom, the Nominating & Governance Committee continually evaluates opportunities to appoint female and racially or ethnically diverse directors to the Board. Without limiting additional actions it may choose to take, the Nominating & Governance Committee and the Board have committed to appointing at least one female director to the Board at or prior to the Corporation’s 2022 Annual Meeting of Shareholders. The Board has retained a leading global recruiting firm to assist the Nominating & Governance Committee in identifying female director candidates.

The Nominating and Governance Committee’s typical process for identifying and evaluating potential nominees includes soliciting recommendations from existing directors and officers of the Corporation, reviewing the Board and Committee assessments completed by the directors and, when deemed advisable by the Nominating and Governance Committee, engaging third parties to assist in identifying and evaluating potential nominees.

The Nominating and Governance Committee will also consider recommendations from shareholders regarding potential director candidates provided that such recommendations are made in compliance with the nomination procedures set forth in the Corporation’s Bylaws. The procedures in the Corporation’s Bylaws require the shareholder to submit written notice of the proposed nominee to the Secretary of the Corporation no less than 90 days prior to the anniversary date of the immediately preceding annual meeting of shareholders. To be in proper form, such written notice must include, among other things, (i) the name, age, business address and residence of the proposed nominee, (ii) the principal occupation or employment of such nominee, (iii) the class and number of shares of capital stock of the Corporation owned beneficially or of record by such nominee and (iv) any other information relating to the proposed nominee that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for the election of directors. In addition, as to the shareholder giving the notice, the notice must also provide (a) such shareholder’s name and record address, (b) the class and number of shares of capital stock of the Corporation owned beneficially or of record by such shareholder, (c) a description of all arrangements or understandings between such shareholder and each proposed nominee and any other persons (including their names) pursuant to which the nominations are to be made by such shareholder, (d) a representation that such shareholder (or his or her authorized representative) intends to attend the meeting, or have the shareholder’s proxy attend the meeting, to nominate the persons named in the notice and (e) any other information relating to the shareholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for the election of directors. If the shareholder of record is not the beneficial owner of the shares, then the notice to the Secretary of the Corporation must include the name and address of the beneficial owner and the information referred to in clauses (c) and (e) above (substituting the beneficial owner for such shareholder).

13

GOVERNANCE OF THE CORPORATION

Governance Highlights

|

• Six out of seven of our directors are independent |

• The Corporation has implemented proxy access | |

|

• Our Audit and Risk, Compensation, and Nominating and Governance Committees are 100% independent |

• Shareholders have the same voting rights—one vote per share | |

|

• Our Chairman of the Board is an independent director who fosters effective collaboration among our independent directors and our CEO |

• Director compensation is reviewed annually by our Compensation Committee to ensure competitiveness relative to our peers. | |

|

• Our Board and management are subject to a Code of Ethics and Business Conduct |

• Our internal Disclosure Committee oversees the Corporation’s disclosure obligations to ensure timely and accurate reporting and support our disclosure controls and procedures processes | |

|

• All of our directors attended at least 75% of the aggregate number of meetings of our Board and Board committees on which they served |

• The Corporation has established a Management Risk Committee to oversee the risk profile and risk strategy of the Corporation | |

|

• Independent Board members meet regularly in Executive Session without management present |

• The Corporation has adopted a director resignation policy applicable if the votes “withheld” exceed the votes “for” a nominee in an uncontested election | |

Board Leadership Structure

The Board believes that separating the roles of Chairman of the Board and Chief Executive Officer strengthens the independence of each role and enhances overall corporate governance. As a result, in June 2014, the Board elected an independent director, Lawrence J. DeAngelo, to serve as the Board’s second non-executive Chairman of the Board. In his capacity as non-executive Chairman of the Board, Mr. DeAngelo leads all meetings of our Board at which he is present but does not serve as an employee or corporate officer. The non-executive Chairman of the Board serves on appropriate committees as requested by the Board, sets meeting schedules and agendas and manages information flow to the Board to assure appropriate understanding of, and discussion regarding matters of interest or concern to the Board. The Board believes that it is appropriate for the Chairman of the Board to be an independent, non-employee director to ensure that the Board operates independently of management in the fulfillment of its oversight function and that the matters presented for consideration by the Board and its committees reflect matters of key importance to the Corporation and its’ shareholders as determined by the independent directors.

Majority Voting in Director Elections/Director Resignation Policy

Pursuant to the Board’s director resignation policy, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election will, promptly following certification of the shareholder vote, tender his or her resignation to the Board with such resignation expressly stating that it is contingent upon the acceptance of the resignation by the Board. The Nominating and Governance Committee will consider such tendered resignation and recommend to the Board whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation, taking into account the Nominating and Governance Committee’s recommendation, and publicly disclose its decision regarding the tendered resignation and, if such tendered resignation is rejected, the rationale behind the decision, within 90 days following certification of the shareholder vote. The Nominating and Governance Committee in making its recommendation, and the Board in making its decision, each may consider any factors and other information that they consider appropriate and relevant, including as a principal factor whether the issue(s) that caused the high withhold/against vote have been or will be addressed.

14

Notwithstanding the foregoing, to the extent a director has received a greater number of votes “withheld” from his or her election than votes “for” such election in an uncontested election in two consecutive elections, the Board will accept such tendered resignation.

The director who has tendered his or her resignation will not participate in the Nominating and Governance Committee’s or the Board’s deliberations or decision with respect to the tendered resignation, but shall remain active and engaged in all other committee deliberations and decisions pending completion of the Nominating and Governance Committee and Board process. If a majority of the members of the Nominating and Governance Committee are required to tender resignations pursuant to our director resignation policy following any election, then the independent directors that are not required to tender their resignations will appoint a Board committee amongst themselves solely for the purpose of considering the tendered resignations and making a recommendation to the Board. In addition, if the only directors who are not required to tender resignations pursuant to the policy following any election constitute three or fewer directors, then all directors may participate in the Board action regarding whether to accept the tendered resignations.

Shareholder Nominations

Our Bylaws permit shareholders to submit director nominations for consideration at an annual meeting. Such nominations are subject to certain eligibility, procedural and disclosure requirements set forth in Article II Section 2.3 of the Bylaws, including the requirement that the notice of such nominations to the Corporate Secretary of the Corporation must be delivered to, or mailed and received at, the principal executive offices of the Corporation not less than ninety (90) days prior to the anniversary date of the previous year’s annual meeting; provided, however, that in the event that the annual meeting is called for a date that is not within thirty (30) days before or after such anniversary date, then notice by the shareholder to be timely must be so received not later than the close of business on the tenth (10th) day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure of the date of the annual meeting was made, whichever first occurs; and in the case of a special meeting of shareholders called for the purpose of electing directors, not later than the close of business on the tenth (10th) day following the day on which notice of the date of the special meeting was mailed or public disclosure of the date of the special meeting was made, whichever first occurs. A copy of the Bylaws can be obtained from the Corporation’s Corporate Secretary at 300 Fellowship Road, Mount Laurel, NJ 08054.

In addition, our Bylaws provide for proxy access for properly nominated directors under certain circumstances. Article II Section 2.15 of the Bylaws permits a shareholder who has owned shares of the Corporation, or a group of up to 20 shareholders, representing an aggregate of at least three percent of the voting power entitled to vote in the election of directors continuously for at least three years (an “Eligible Shareholder”) to nominate and include in the Corporation’s annual meeting proxy materials director nominees in a number up to 25 percent of the Board of the Directors in office as of the last day on which a proxy access notice may be delivered under the Bylaws, provided the nominating shareholder(s) and the director nominee(s) satisfy all of the specified eligibility and other requirements in Section 2.15 of the Bylaws. The proxy access provision may only be used in connection with an annual meeting of shareholders. To use the proxy access provision, a shareholder must provide the Corporation with a notice of proxy access nomination and other important information, which must include certain representations and agreements by the shareholder, no earlier than one hundred and fifty (150) and no later than one hundred and twenty (120) days before the first anniversary of the date the Corporation mailed its proxy statement for the prior year’s annual meeting of shareholders; provided, however, that in the event that the annual meeting is not scheduled to be held within a period that commences thirty (30) days before and ends sixty (60) days after the first anniversary date of the previous year’s annual meeting, then the proxy access notice must be so delivered to, and received by, the Corporate Secretary of the Corporation no earlier than one hundred and eighty (180) days and no later than the tenth (10th) day following the date such annual meeting is first publicly announced or disclosed. The required information includes, but is not limited to, shareholder statements verifying qualifying stock ownership as of the date of the notice of proxy access nomination and a copy of the shareholder’s Schedule 14N as filed with the SEC. The required representations and agreement include, but are

15

not limited to, the shareholder’s lack of intent to change or influence control at the Corporation and intent to maintain qualifying stock ownership through the date of the annual meeting. The Corporation may also require each shareholder nominee to provide any additional information that may be reasonably requested to determine if such nominee is independent or that may be reasonably required to determine the eligibility of such nominee to serve as a director of the Corporation.

Shareholder Proposals

Our Bylaws permit shareholders to submit proposals for consideration at future shareholder meeting. Such proposals are subject to certain eligibility, procedural and disclosure requirements set forth in Article II Section 2.3 of the Bylaws, including the requirement that the notice of such proposals to Corporate Secretary of the Corporation must delivered to or mailed and received at the principal executive offices of the Corporation not less than one hundred and twenty (120) days prior to the date of the Corporation’s proxy statement released to shareholders in connection with the previous year’s annual meeting; provided, however, that in the event that the current year’s annual meeting has been changed by more than thirty (30) days from the date of the previous year’s meeting, then notice by the shareholder to be timely must be so received within a reasonable time before the Corporation begins to print and mail its proxy materials.

Risk Management Oversight

The Corporation is subject to a variety of risks, including credit risk, liquidity risk, operational risk, regulatory risk, reputational risk and market risk. The Board oversees risk management through a combination of processes.

The Audit and Risk Committee, in conjunction with the Corporation’s management team, has developed risk management processes intended to:

| • | timely identify the material risks that the Corporation faces; |

| • | communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee; |

| • | implement appropriate and responsive risk management strategies consistent with Corporation’s risk profile; and |

| • | integrate risk management into the Corporation’s decision-making. |

The Board regularly reviews information regarding the Corporation’s credit, liquidity and operations, as well as the risks associated with each, during the Board meetings scheduled throughout the year.

The Corporation has established a Management Risk Committee (“Management Risk Committee”) comprised of the following voting members: the Corporation’s Chief Executive Officer; Chief Risk Officer; Chief Financial Officer; Chief Sales Officer; General Counsel; and Chief Operations Officer, and the President of the Corporation’s wholly owned bank subsidiary, Marlin Business Bank. In addition, the Management Risk Committee includes non-voting members comprised of senior and other management throughout the organization. The Management Risk Committee’s main task is to manage the risk profile and risk strategy of the Corporation by defining the risk appetite, defining the risk strategy, and actively monitoring the risk performance against the risk appetite and strategy as defined by the Management Risk Committee’s Charter, in each case ultimately subject to oversight by the Audit and Risk Committee. The Management Risk Committee Charter is subject to approval by the Board.

The Audit and Risk Committee, in consultation with management and the Corporation’s internal auditors, also discusses the Corporation’s policies and guidelines regarding risk assessment and risk management, as well as the Corporation’s significant financial risk and cybersecurity and information security risk exposures and the steps management has taken to monitor, control and report such exposures. The Compensation Committee

16

considers the risks that may be presented by the structure of the Corporation’s compensation programs and the metrics used to determine individual compensation under that program. Among its other duties, the Nominating and Governance Committee develops corporate governance guidelines applicable to the Corporation and recommends such guidelines or revisions of such guidelines to the Board. The Nominating and Governance Committee reviews such guidelines at least annually and, when necessary or appropriate, recommends changes to the Board. The Board believes that the present leadership structure, along with the Corporation’s corporate governance policies and procedures, permits the Board to effectively perform its role in the risk oversight of the Corporation.

Whistleblower Procedures

The Corporation has established procedures that provide employees with the ability to make anonymous submissions directly to the Audit and Risk Committee regarding concerns about accounting or auditing matters. The independent directors that comprise the Audit and Risk Committee will review, investigate and, if appropriate, respond to each submission made. Additionally, the Corporation has reminded employees of its policy to not retaliate or take any other detrimental action against employees who make submissions in good faith.

Code of Ethics and Business Conduct

All of the Corporation’s directors, officers and employees (including its senior executive, financial and accounting officers) are held accountable for adherence to the Corporation’s Code of Ethics and Business Conduct (the “Code”). The Code is posted in the Investors section of the Corporation’s website at www.marlincapitalsolutions.com. The purpose of the Code is to establish standards to deter wrongdoing and to promote honest and ethical behavior. The Code covers many areas of professional conduct, including compliance with laws, conflicts of interest, fair dealing, financial reporting and disclosure, confidential information and proper use of the Corporation’s assets. Employees are obligated to promptly report any known or suspected violation of the Code through a variety of mechanisms made available by the Corporation. Waiver of any provision of the Code for a director or executive officer (including our principal executive, financial and accounting officers) may only be granted by the Board of Directors or the Audit and Risk Committee. The Code is available free of charge in the Investors section of our website at www.marlincapitalsolutions.com. We intend to post on our website any amendments and waivers to the Code that are required to be disclosed by SEC rules, or file a Form 8-K, Item 5.05, to the extent required by NASDAQ listing standards.

Communications with the Board

Shareholders may communicate with the Board or any of the directors by sending written communications addressed to the Board or any of the directors, c/o Corporate Secretary, Marlin Business Services Corp., 300 Fellowship Road, Mount Laurel, New Jersey 08054. All communications are compiled by the Corporate Secretary and forwarded to the Board or the individual director(s) accordingly.

CERTAIN RELATED PERSON TRANSACTIONS

Under the Code, the Audit and Risk Committee must review and approve transactions with “related persons” (directors, director nominees and executive officers or their immediate family members, or shareholders owning 5% or greater of the Corporation’s outstanding common stock) in which the amount exceeds $120,000 and in which the related person has a direct or indirect material interest. Under this policy, full written disclosure must be submitted in writing to the Corporation’s General Counsel, who will submit it to the Audit and Risk Committee for review. The transaction must receive Audit and Risk Committee approval prior to the consummation of the transaction.

The March 20, 2007 (the “Order”) of the Federal Deposit Insurance Company (“FDIC”) originally approving the application for federal deposit insurance for the Corporation’s wholly-owned subsidiary, Marlin Business Bank,

17

an industrial bank chartered by the State of Utah (the “Bank”) is subject to certain conditions set forth in the Order. The Order provided that the approval was conditioned on, among other things, Peachtree Equity Investment Management, Inc. (“Peachtree”) and WCI (Private Equity) LLC (“WCI”), whose sole manager is Peachtree, executing a passivity agreement with the FDIC to eliminate Peachtree’s and WCI’s ability to control the Bank. As a result, on June 18, 2007, Peachtree, WCI and the FDIC entered into a Passivity Agreement (the “Passivity Agreement”) and Peachtree, WCI and the Corporation entered into a related Letter Agreement (the “Letter Agreement”). On March 11, 2008, the Corporation received approval from the FDIC for federal deposit insurance for the Bank, and approved the Bank to commence operations effective March 12, 2008. As a result of the approval, the Corporation became subject to the Letter Agreement, pursuant to which the Corporation agreed to create one vacancy on the Board by increasing the size of the Board. The Corporation also agreed to take all necessary action to appoint one individual proposed by Peachtree and WCI as a member of the Board to serve as a director. On April 17, 2008, Matthew J. Sullivan was appointed to the Board under the terms of the Letter Agreement, and Mr. Sullivan has continued to serve as a Board member under the provisions of the Letter Agreement that requires the Corporation to include an individual proposed by Peachtree and WCI on the Board’s slate of nominees for election as a director of the Corporation and to use its best efforts to cause the election of such individual so long as Peachtree and WCI are subject to the terms and conditions of the Passivity Agreement. While on March 24, 2020, the FDIC issued an amended order that eliminated many of the conditions in the Order, the amended order specifically requires Peachtree and WCI to keep the Passivity Agreement in place.

NON-EMPLOYEE DIRECTORS’ COMPENSATION

Members of the Board who are not employees are eligible for compensation in the form of cash and equity as described below. Frederic W. Cook & Co., Inc. (“FW Cook”) conducted a comprehensive evaluation of the compensation programs for non-employee independent members of the Board of Directors, which resulted in updates to the program in 2017. No subsequent refinements have been made to the program since 2017.

Cash Compensation

Annual Retainer. Each outside (non-employee independent) director receives an annual cash retainer of $50,000 for serving on the Board of Directors. The cash retainers are paid quarterly and prorated for fractional periods.

Chairman of the Board Retainer. In addition to the compensation described above, the non-employee Chairman of the Board of the Corporation receives and additional $50,000 annual retainer (payable in quarterly installments).

Committee and Chair Retainers. The chairpersons and non-chair members of the Board’s three standing committees are entitled to the following additional cash retainers each year (paid quarterly and prorated for fractional periods):

| Board Committee | Chairperson Retainer | Non-Chair Member Retainer | ||||||||

|

Audit and Risk Committee |

$21,000 | $9,000 | ||||||||

|

Compensation Committee |

$14,000 | $6,500 | ||||||||

|

Nominating and Governance Committee |

$10,000 | $4,000 | ||||||||

None of the above-described cash retainers have changed since 2017. However, following the onset of the Covid-19 pandemic, our independent directors voluntarily agreed to temporarily reduce their cash retainer by 25% from April 13, 2020 through May 31, 2020.

Equity Compensation

Annual Equity Award. In 2020, independent members of the Board of Directors received annual grants under the Corporation’s 2019 Equity Plan of restricted stock yielding a fair market value of $60,000 at the stock award

18

grant date. The transfer restrictions on restricted stock granted pursuant to the annual equity awards lapse at the earlier of (a) seven years from the grant date and (b) six months following the non-employee independent director’s termination of Board service.

Total 2020 Director Compensation

The following table sets forth compensation from the Corporation for the non-employee independent members of the Board of Directors in 2020. The table does not include reimbursement of travel expenses related to attending Board, Committee and Corporation business meetings.

Director Compensation Table

| Name |

Fees Earned or Paid In Cash |

Stock Awards(1) |

Total | |||||||||

| Lawrence J. DeAngelo |

$ | 112,579 | $ | 59,996 | $ | 172,575 | ||||||

| John J. Calamari |

$ | 72,476 | $ | 59,996 | $ | 132,472 | ||||||

| Scott A. Heimes |

$ | 48,317 | $ | 59,996 | $ | 108,313 | ||||||

| Matthew J. Sullivan |

$ | 67,161 | $ | 59,996 | $ | 127,157 | ||||||

| J. Christopher Teets |

$ | 63,296 | $ | 59,996 | $ | 123,292 | ||||||

| James W. Wert |

$ | 74,409 | $ | 59,996 | $ | 134,405 | ||||||

| (1) | Represents the grant date fair value of stock awards granted to the Directors of the Corporation in 2020 in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Stock Compensation (“FASB ASC Topic 718”). Please refer to Note 2 under “Summary of Significant Account Policies” subtitled “Stock-Based Compensation” included in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2020 for a discussion of the assumptions used to calculate these amounts. The fair value of the awards is based on the grant date of each Director’s equity award. |

The following table sets forth information with respect to the beneficial ownership of our common stock held by our independent directors as of April 1, 2021.

Security Ownership of Directors Table

| Name |

Number of Shares of Common Stock Owned (#) |

Number of Shares of Common Stock that have not yet Vested (#) |

Total Number of Shares Beneficially Owned (#) |

|||||||||

| John J. Calamari |

30,049 | 22,328 | 52,377 | |||||||||

| Lawrence J. DeAngelo |

286,506 | 22,328 | 308,834 | |||||||||

| Scott A. Heimes |

0 | 19,840 | 19,840 | |||||||||

| Matthew J. Sullivan(1) |

272,584 | 22,328 | 294,912 | |||||||||

| J. Christopher Teets(2) |

15,065 | 22,328 | 37,393 | |||||||||

| James W. Wert |

58,343 | 22,328 | 80,671 | |||||||||

| (1) | Includes 234,483 reported shares owned by Peachtree CIP, L.P., whose general partner is Peachtree Equity Management, LLC (the “General Partner”). Mr. Sullivan is the Managing Director of the General Partner and could be deemed to be an indirect holder of the shares. Mr. Sullivan disclaims beneficial ownership of these shares, except to the extent of his pecuniary interest therein. |

| (2) | The information for Mr. Teets does not include shares beneficially owned by Red Mountain Capital Partners LLC (“Red Mountain”). Mr. Teets, a Partner of Red Mountain, disclaims beneficial ownership of the shares of the Corporation beneficially owned by Red Mountain. |

19

Director Ownership Guidelines