Form DEF 14A Kalera Public Ltd Co For: Nov 16

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Kalera Public Limited Company

(Name of Registrant as Specified In Its Charter)

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Kalera Public Limited Company

10 Earlsfort Terrace

Dublin 2, D02 T380, Ireland

November 16, 2022

Dear Shareholder:

You are cordially invited to attend an extraordinary general meeting of shareholders (the “EGM”) of Kalera Public Limited Company, to be held on December 15, 2022, beginning at 5:00 p.m., Irish time (12:00 p.m., Eastern Time), at Arthur Cox LLP, 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland.

Your vote is very important, regardless of the number of shares of our voting securities that you own. I encourage you to vote by telephone, over the internet, or by marking, signing, dating, and returning your proxy card so that your shares will be represented and voted at the EGM, whether or not you plan to attend. If you attend the EGM, you will have the right to revoke the proxy and vote your shares during the EGM.

If your shares are held in the name of a broker, bank, or other nominee, and you receive notice of the EGM through your broker or through another intermediary, please vote or return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the EGM and vote during the EGM. Failure to do so may result in your shares not being eligible to be voted by proxy at the EGM. On behalf of the Board of Directors, I urge you to submit your proxy as soon as possible, even if you currently plan to attend the EGM.

The accompanying notice of extraordinary general meeting of shareholders and proxy statement describe the business to be conducted at the EGM and specific instructions for voting. You are encouraged to read the accompanying materials carefully and vote in accordance with the recommendations of the Board of Directors.

Thank you for your ongoing support and continued interest in our company.

| By order of the Board of Directors, | ||

| By: | /s/ Curtis McWilliams | |

| Name: | Curtis McWilliams | |

| Title: | Chairman of the Board | |

This proxy statement is dated November 16, 2022, and is first being mailed to shareholders of Kalera Public Limited Company, together with the enclosed proxy card, on or about November 16, 2022.

Kalera

Public Limited Company

10 Earlsfort Terrace

Dublin

2, D02 T380, Ireland

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

To Be Held December 15, 2022

________________

November 16, 2022

Dear Shareholder:

You are cordially invited to attend an extraordinary general meeting of shareholders (the “EGM”) of Kalera Public Limited Company, an Irish public limited company (“Kalera” or the “Company”), to be held on December 15, 2022, beginning at 5:00 p.m., Irish time (12:00 p.m., Eastern Time), at Arthur Cox LLP, 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. The EGM will be held to consider and vote upon the following matters:

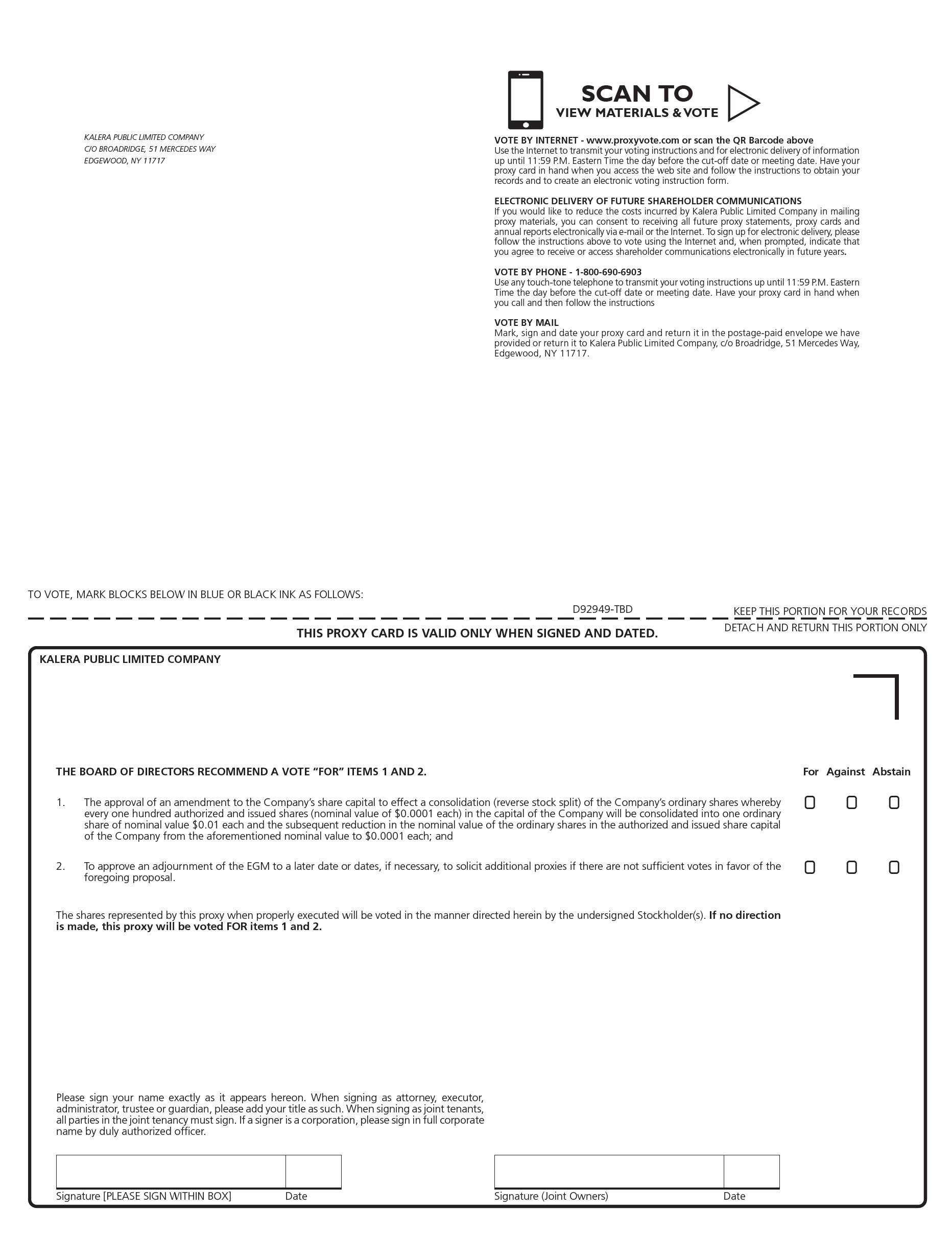

| 1. | the approval of an amendment to the Company’s share capital to effect a consolidation (reverse stock split) of the Company’s ordinary shares whereby every one hundred authorized and issued shares (nominal value of $0.0001 each) in the capital of the Company will be consolidated into one ordinary share of nominal value $0.01 each and the subsequent reduction in the nominal value of the ordinary shares in the authorized and issued share capital of the Company from the aforementioned nominal value to $0.0001 each; and | |

| 2. | to approve an adjournment of the EGM to a later date or dates, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposal. |

The proposals above are ordinary resolutions requiring a simple majority of the votes cast on the matter at the meeting to be approved.

Shareholders are referred to the Proxy Statement accompanying this notice for more detailed information with respect to the matters to be considered at the EGM. After careful consideration, the Board of Directors recommends a vote FOR the reverse stock split proposal (proposal 1, the “Reverse Stock Split Proposal”) and FOR the adjournment(s) proposal (proposal 2, the “Adjournment Proposal”) in order to help ensure that the share price of our ordinary shares meets the continued listing requirements of the Nasdaq Capital Market. Non-compliance with Nasdaq listing requirements will result in the delisting of our ordinary shares from Nasdaq, which would likely have very serious consequences for the Company and our shareholders.

The Board of Directors has fixed the close of business on November 8, 2022 as the record date. Only holders of record of shares of our ordinary shares on such date are entitled to vote at the EGM or at any postponement(s) or adjournment(s) of the EGM. Your vote is very important, regardless of the number of shares of our voting securities that you own.

On behalf of the Board and our management team, I extend our appreciation for your continued support.

| By order of the Board of Directors, | ||

| By: | /s/ Curtis McWilliams | |

| Name: | Curtis McWilliams | |

| Title: | Chairman of the Board | |

YOU MAY OBTAIN ADMISSION TO THE EGM BY IDENTIFYING YOURSELF AT THE EGM AS A SHAREHOLDER AS OF THE RECORD DATE. IF YOU ARE A RECORD OWNER, POSSESSION OF A COPY OF A PROXY CARD WILL BE ADEQUATE IDENTIFICATION. IF YOU ARE A BENEFICIAL (BUT NOT RECORD) OWNER, A COPY OF AN ACCOUNT STATEMENT FROM YOUR BANK, BROKER OR OTHER NOMINEE SHOWING SHARES HELD FOR YOUR BENEFIT ON NOVEMBER 8, 2022 WILL BE ADEQUATE IDENTIFICATION.

WHETHER OR NOT YOU EXPECT TO ATTEND THE EGM, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE TO HELP ENSURE REPRESENTATION OF YOUR SHARES AT THE EGM. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES. IF YOU RETURN YOUR PROXY AND VOTING CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, THIS WILL BE CONSIDERED AS AN INSTRUCTION TO THE PROXYHOLDER TO VOTE IN FAVOR OF EACH OF THE RESOLUTIONS.

ALTERNATIVELY, YOU MAY SUBMIT YOUR VOTE VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE ENCLOSED PROXY CARD. A SHAREHOLDER ENTITLED TO ATTEND AND VOTE AT THE EGM IS ENTITLED, USING THE PROXY CARD PROVIDED, TO APPOINT ONE OR MORE PROXIES TO ATTEND, SPEAK, VOTE AND TO DEMAND OR JOIN IN DEMANDING A POLL INSTEAD OF HIM OR HER AT THE EGM. A PROXY NEED NOT BE A SHAREHOLDER OF RECORD.

PURSUANT TO THE COMPANY’S CONSTITUTION, THE EGM MAY BE ADJOURNED IN CERTAIN CIRCUMSTANCES AT THE DISCRETION OF THE DULY ELECTED CHAIRPERSON OF THE EGM WHERE HE OR SHE DECIDES THAT IT IS NECESSARY OR APPROPRIATE TO DO SO, INCLUDING TO GIVE ALL PERSONS ENTITLED TO DO SO A REASONABLE OPPORTUNITY OF VOTING AT THE EGM.

This proxy statement is dated November 16, 2022, and is first being mailed to shareholders of Kalera Public Limited Company, together with the enclosed proxy card, on or about November 16, 2022.

Table of Contents

Kalera

Public Limited Company

10 Earlsfort Terrace

Dublin

2, D02 T380, Ireland

PROXY STATEMENT

FOR

EXTRAORDINARY

GENERAL MEETING OF SHAREHOLDERS

To Be Held December 15, 2022

________________

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a street name holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the extraordinary general meeting of shareholders (the “EGM”).

What is a proxy statement?

A proxy statement is a document that regulations of the U.S. Securities and Exchange Commission (the “SEC”) require that we give to you when we ask you to sign a proxy card to vote your stock at a shareholders meeting.

Why am I receiving this proxy statement?

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of Kalera Public Limited Company, for use at the EGM, to be held on December 15, 2022, at the time and place and for the purposes set forth in the accompanying Notice of Extraordinary General Meeting of Shareholders (the “Notice” and, together with this proxy statement, the “Proxy Materials”) and at any adjournments or postponements of that meeting.

In this Proxy Statement, “Kalera”, the “Company”, “we”, “us” and “our” refer to Kalera Public Limited Company. Where the context requires, these references also include our consolidated subsidiaries and predecessors. The Company’s principal executive offices are located at 7455 Emerald Dunes Dr., Suite 2100, Orlando, FL, 32822.

Who is entitled to vote at the EGM?

Holders of Kalera ordinary shares at the close of business on the Record Date (as defined below) may vote at the EGM. We intend to mail the Proxy Materials to all shareholders of record entitled to vote at the EGM on or about November 16, 2022.

What is the record date and what does it mean?

The record date to determine the shareholders entitled to notice of and to vote at the EGM is the close of business on November 8, 2022 (the “Record Date”). The record date was established by the Board in their discretion in accordance with the Constitution of Kalera.

| 1 |

What is “householding” and how does it affect me?

The SEC permits a single set of Proxy Materials to be sent to any household at which two or more shareholders reside if they appear to be members of the same family. Each shareholder continues to receive a separate proxy card or voting instructions. This procedure, referred to as householding, reduces the volume of duplicate information shareholders receive and reduces mailing and printing expenses. A number of brokerage firms have instituted householding. As a result, if a shareholder holds shares through a broker and resides at an address at which two or more shareholders reside, that residence may receive only one set of Proxy Materials, unless any shareholder at that address has given the broker contrary instructions. However, if any such shareholder residing at such an address wishes to receive a separate set of Proxy Materials in the future, or if any such shareholder that elected to continue to receive such materials wishes to receive a single set of materials in the future, that shareholder should contact their bank, broker, or other nominee record holder.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of Proxy Materials, including multiple copies of the Notice or this Proxy Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a shareholder of record and hold shares in a brokerage account, you will receive a Notice for shares held in your name and a notice or voting instruction card for shares held in street name. Please follow the directions provided in the Notice and each additional notice or voting instruction card you receive to ensure that all your shares are voted.

How many votes do I have?

On each matter to be voted upon, you have one vote for each Kalera ordinary share you own as of the Record Date.

What is the quorum requirement?

Two members (as defined in the Company’s constitution) present in person or by proxy and having the right to attend and vote at the meeting and together holding shares representing more than 50% of the votes that may be cast by all members at the relevant time shall be a quorum at the EGM. Ordinary shares represented in person or by proxy (including “broker non-votes” (as described below) and shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum is present at the EGM.

What is the difference between a shareholder of record and a “street name” holder?

If your shares are registered directly in your name with Computershare Trust Company, N.A., our stock transfer agent, you are considered the shareholder of record with respect to those shares. The Proxy Statement has been sent directly to you by us. If your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” A Proxy Statement and voting instruction card have been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning how to vote your shares by using the voting instructions they included in the mailing or by following their instructions for voting by telephone or the internet. To vote by proxy or to instruct your broker how to vote, you should follow the directions provided with the voting instruction card.

| 2 |

If I am a beneficial owner of shares, can my brokerage firm vote my shares? What is a broker non-vote?

If you are a beneficial owner and do not vote via the instructions provided by your nominee, under stock exchange rules applicable to brokerage firms, your broker or other nominee is permitted to vote any shares it holds for your account in its discretion with respect to “routine” proposals, but it is not allowed to vote your shares with respect to non-routine proposals. Broker non-votes occur when shares are held indirectly through a broker, bank, or other intermediary on behalf of a beneficial or “street name” holder and the broker or other nominee submits a proxy but does not vote for a matter because the broker or other nominee has not received voting instructions from the beneficial owner and the broker or other nominee does not have discretionary voting authority on the matter. The Reverse Stock Split Proposal and the Adjournment Proposal are “routine” matters. As a result, we do not expect broker non-votes on those proposals, because your broker or other nominee will have discretion to vote your shares on such matters, in the absence of timely direction from you. However, we understand that certain brokerage firms have elected not to vote on “routine” matters without your voting instructions. If your broker or other nominee has made this decision and you do not provide voting instructions, your vote will not be cast and will have the effect of votes against the Reverse Stock Split Proposal and the Adjournment Proposal. Accordingly, we urge you to direct your broker or other nominee how to vote by returning your voting materials as instructed or by obtaining a proxy from your broker or other nominee in order to vote your shares in person at the EGM.

YOUR VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT. Our Board approved the Reverse Stock Split Proposal in order to help ensure that the share price of our common stock meets the continued listing requirements of the Nasdaq Capital Market. The delisting of our common stock from Nasdaq would likely have very serious consequences for the Company and our shareholders.

If I am a record holder, how do I vote my shares? Can I revoke my vote?

If you are the “record holder” of your shares, meaning that you own your shares in your own name and not through a bank, broker or other nominee, you may vote in one of four ways.

| 1. | You may vote over the Internet. You may vote your shares by following the “Vote by Internet” instructions on the enclosed proxy card. If you vote by Internet, your use of that system, and specifically the entry of your control number/other unique identifier, will be deemed to constitute your appointment, in writing and under hand, and for all purposes of the Irish Companies Act of 2014, of Curtis McWilliams, and/or each of its duly appointed substitutes if applicable, as your proxy to vote your shares on your behalf in accordance with your Internet instructions. The internet voting facilities for eligible shareholders of record will close at 4:59 a.m., Irish time, on the day of the EGM (11:59 p.m., Eastern Time, on the day prior to the EGM). | |

| 2. | You may vote by telephone. You may vote your shares by following the “Vote by Phone” instructions on the enclosed proxy card. If you vote by telephone, you do not need to vote over the Internet or complete and mail your proxy card. If you vote by telephone, your use of that telephone system, and specifically the entry of your pin number/other unique identifier, will be deemed to constitute your appointment, in writing and under hand, and for all purposes of the Irish Companies Act of 2014, of Curtis McWilliams, and/or each of its duly appointed substitutes if applicable, as your proxy to vote your shares on your behalf in accordance with your telephone instructions. The telephone voting facilities for eligible shareholders of record will close at 4:59 a.m., Irish time, on the day of the EGM (11:59 p.m., Eastern Time, on the day prior to the EGM). | |

| 3. | You may vote by mail. You may vote by completing, dating and signing the proxy card delivered with this Proxy Statement and promptly mailing it in the enclosed postage-paid envelope. If you vote by mail, you do not need to vote over the Internet or by telephone. We must receive the completed proxy card by 4:59 a.m., Irish time, on the day of the EGM (11:59 p.m., Eastern Time, on the day prior to the EGM) to be counted. | |

| 4. | You may vote in person. If you attend the EGM, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot at the EGM. Ballots will be available at the EGM. |

All proxies that are executed and delivered by mail or in person, or are otherwise submitted over the Internet or by telephone will be voted on the matters set forth in the accompanying Notice in accordance with the shareholders’ instructions. However, if no choice is specified on a proxy as to one or more of the proposals, the proxy will be voted in accordance with the Board’s recommendations on such proposals as set forth in this proxy statement. All proxies will be forwarded to the Company’s registered office electronically.

| 3 |

After you have submitted a proxy, you may still change your vote and revoke your proxy prior to the EGM by doing any one of the following things:

| ● | submitting a new proxy by following the “Vote by Internet” or “Vote by Phone” instructions on the enclosed proxy card at a date later than your previous vote but prior to the voting deadline (which is 4:59 a.m., Irish time, on the day of the EGM (11:59 p.m., Eastern Time, on the day prior to the EGM); | |

| ● | signing another proxy card and either arranging for delivery of that proxy card by mail by 4:59 a.m., Irish time, on the day of the EGM (11:59 p.m., Eastern Time, on the day prior to the EGM), or by delivering that signed proxy card in person at the EGM; | |

| ● | sending written notice that you are revoking your proxy at c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, United States; or | |

| ● | voting in person at the EGM. |

Your attendance at the EGM alone will not revoke your proxy.

Even if you currently plan to vote at the EGM, we recommend that you vote by telephone or internet or return your proxy card as described above so that your votes will be counted if you later decide not to attend the EGM or are unable to attend.

YOUR VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT. Our approved the Reverse Stock Split Proposal in order to help ensure that the share price of our common stock meets the continued listing requirements of the Nasdaq Capital Market. The delisting of our common stock from Nasdaq would likely have very serious consequences for the Company and our shareholders.

How do I attend the EGM?

The EGM will be held on December 15, 2022, beginning at 5:00 p.m., Irish time (12:00 p.m., Eastern Time), at Arthur Cox LLP, 10 Earlsfort Terrace Dublin 2, D02 T380, Ireland.

You may obtain admission to the EGM by identifying yourself at the EGM as a shareholder as of the Record Date. If you are a record owner, possession of a copy of a proxy card will be adequate identification. If you are a beneficial (but not record) owner, a copy of an account statement from your bank, broker or other nominee showing shares held for your benefit on November 8, 2022 will be adequate identification.

What are my choices when voting?

As to each of the proposals, shareholders may vote for the proposal, against the proposal, or abstain from voting on the proposal. If you vote to “abstain”, your shares will be counted as present at the EGM, and your abstention will have the effect of a vote against the proposal.

What are the Board’s recommendations on how I should vote my shares?

The Board of Directors recommends that you vote your shares as follows:

| ● | Proposal 1 – FOR the Reverse Stock Split Proposal. | |

| ● | Proposal 2 – FOR the Adjournment Proposal. |

YOUR VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT. Our Board of Directors approved the Reverse Stock Split Proposal in order to help ensure that the share price of our common stock meets the continued listing requirements of the Nasdaq Global Select Market. The delisting of our common stock from Nasdaq would likely have very serious consequences for the Company and our shareholders.

| 4 |

What if I am a record holder and I do not specify how I want my shares voted?

If you are a record holder who returns a completed proxy card that does not specify how you want to vote your shares on one or more proposals, the designated proxies will vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted in the following manner:

| ● | Proposal 1 – FOR the Reverse Stock Split Proposal. | |

| ● | Proposal 2 – FOR the Adjournment Proposal. |

If you are a street name holder and do not provide voting instructions on one or more proposals, your bank, broker, or other nominee may be able to vote those shares. See “If I am a beneficial owner of shares, can my brokerage firm vote my shares? What is a broker non-vote?”

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the EGM?

No. None of our shareholders has any dissenters’ or appraisal rights with respect to the matters to be voted on at the EGM.

What are the solicitation expenses and who pays the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. We have retained Georgeson LLC (“Georgeson”) to assist in the solicitation of proxies on our behalf (which they may conduct by personal interview, mail, telephone, facsimile, email, other electronic channels or communication or otherwise) and provide related advice and informational support, for which Georgeson will receive a base services fee of $13,500 plus reimbursement of reasonable and documented costs and expenses associated with this solicitation and the preparation of Proxy Materials. In addition, certain of our directors, officers, and employees may solicit proxies in person, by telephone, personal contact or by other means of communication. They will not receive any additional compensation for these activities.

If shareholders need assistance with casting or changing their vote, they may contact Georgeson for assistance at +1-800-261-1052.

Who counts the votes?

All votes will be tabulated by the inspector of election appointed by the Board for the EGM. Each proposal will be tabulated separately.

Where can I find voting results?

The Company expects to publish the voting results in a Current Report on Form 8-K, which it expects to file with the SEC within four business days following the EGM.

| 5 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to the Company regarding the beneficial ownership of its outstanding common equity as of November 8, 2022:

| ● | each person known by the Company to be the beneficial owner of more than 5% of its outstanding ordinary shares; | |

| ● | each of the Company’s named executive officers and directors; and | |

| ● | all the Company’s executive officers and director as a group. |

In the table below, percentage of beneficial ownership is based on 91,877,828 ordinary shares outstanding as of the November 8, 2022. Beneficial ownership includes shares for which a person, directly or indirectly, has or shares voting or investment power, or both, and also includes shares that each such person has the right to acquire within 60 days following November 8, 2022, including upon the exercise of options. Where applicable, we calculate the beneficial ownership percentage of a person by including the number of shares deemed to be beneficially owned by that person (by reason of the right to acquire such shares within 60 days following November 8, 2022) in both the numerator and the denominator that are used for such calculation. All the Company’s warrants trading on Nasdaq under the symbol “KALWW” (the “Kalera Warrants”) beneficially owned as indicated below are immediately exercisable for ordinary shares and the ordinary shares underlying such Kalera Warrants are deemed outstanding for purposes of computing the ownership percentage of the holder thereof (but not any other person). Unless otherwise indicated, the Company believes that all persons named in the table have sole voting and investment power with respect to all the ordinary shares beneficially owned by them. Unless otherwise indicated in the footnotes, the address for each listed person is Kalera Public Limited Company, 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland.

| Name and Address of Beneficial Owner | Number of Shares beneficially owned | Percentage of Outstanding Shares beneficially owned | ||||||

| Directors and Named Executive Officers: | ||||||||

| Daniel Malechuk(1) | 271,500 | * | ||||||

| Curtis McWilliams(2) | 29,240 | * | ||||||

| Fernando Cornejo(3) | 50,050 | * | ||||||

| Austin Martin(4) | 72,800 | * | ||||||

| Umur Hursever(5) | 24,435 | * | ||||||

| Maria Sastre(6) | 7,360 | * | ||||||

| Sonny Perdue(7) | 5,688 | * | ||||||

| Cristian Toma | 485,613 | * | ||||||

| Faisal AlMeshal | — | * | ||||||

| Brent de Jong(8) | 11,808,750 | 12 | % | |||||

| Jim Leighton | — | * | ||||||

| Robert Arnall | — | * | ||||||

| All Directors and Executive Officers as a group (fifteen (15) persons) | 12,483,936 | 12.7 | % | |||||

| 5% Holders: | ||||||||

| DJCAAC, LLC(8) | 11,808,750 | 12 | % | |||||

| * | Represents beneficial ownership of less than 1% |

| (1) | Mr. Malechuk is Kalera SA’s former President and Chief Executive Officer. The amount of shares beneficially owned includes 271,500 stock options issued in connection with the business combination consummated on June 28, 2022 (the “Business Combination”) between the Company, Kalera SA and, inter alios, Agrico Acquisition Corp. (“Agrico”) in exchange for Kalera SA stock options. |

| (2) | The amount of shares beneficially owned includes 12,512 stock options issued pursuant to the 2022 Long-Term Stock Incentive Plan (the “2022 Plan”) adopted by the Company in connection with the Business Combination between the Company, Kalera SA and, inter alios, Agrico. |

| (3) | The amount of shares beneficially owned includes 50,050 stock options issued pursuant to the 2022 Plan. |

| (4) | The amount of shares beneficially owned includes 72,800 stock options issued pursuant to the 2022 Plan. |

| (5) | The amount of shares beneficially owned are shares held by LGT Bank AG as custodian. |

| (6) | The amount of shares beneficially owned includes 5,688 stock options issued pursuant to the 2022 Plan. |

| (7) | The amount of shares beneficially owned includes 5,688 stock options issued pursuant to the 2022 Plan. |

| (8) | The amount of shares beneficially owned includes 6,171,875 shares underlying Kalera Warrants beneficially owned by such holder. The address for DJCAAC, LLC is 777 Post Oak Blvd., Suite 430, Houston, TX, 77056. |

| 6 |

THE

Reverse Stock Split Proposal

(Proposal 1)

General

The Board has unanimously adopted and is recommending for shareholder approval a reverse stock split (i.e., a consolidation of share capital under Irish law) at a ratio of 1-for-100. Accordingly, if our shareholders vote in favor of this proposal, and the reverse stock split is effected, then every one hundred ordinary shares of $0.0001 nominal value each in the authorized and issued share capital of the Company will be consolidated into 1 ordinary share of $0.01 nominal value each. Immediately following the reverse stock split, the nominal value of the ordinary shares in the authorized and issued share capital of the Company will be reduced from the aforementioned nominal value to $0.0001 each.

At the close of business on November 8, 2022 we had 91,877,828 ordinary shares issued. Based on the number of ordinary shares currently issued, immediately following the completion of the reverse stock split, and, for illustrative purposes only, we would have approximately 918,778 ordinary shares issued, without giving effect to the treatment of fractional shares. We do not expect the reverse stock split itself to have any economic effect on our shareholders, debt holders or holders of options or restricted stock, except to the extent the reverse stock split will result in fractional shares as discussed below.

Reasons for the Reverse Stock Split

Our primary objective in proposing the reverse stock split is to attempt to increase the per share trading price of our ordinary shares in order to remain in compliance with the listing requirements of Nasdaq Capital Market (“Nasdaq”). The Board believes that the reverse stock split is a potentially effective means for increasing the per share trading price of our ordinary shares to a sufficient level to allow us to maintain compliance with Nasdaq listing requirements and to avoid, or at least mitigate, the likely adverse consequences of our non-compliance with the Nasdaq listing requirements and the related sanctions.

Nasdaq has the discretion to delist our ordinary shares due to non-compliance with the Nasdaq listing requirements. As such, the Board has considered the potential harm to the Company and its shareholders should our ordinary shares be delisted from Nasdaq. Delisting our ordinary shares could adversely affect the liquidity of our ordinary shares because alternatives, such as the OTC Bulletin Board and the pink sheets, are generally considered to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations in seeking to buy our ordinary shares on an over-the-counter market. Many investors likely would not buy or sell our ordinary shares due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or other reasons. In addition, if the ordinary shares are delisted from Nasdaq and not relisted on an appropriately recognized stock exchange in the US or Canada, our ordinary shares would become ineligible for holding through the Depository Trust Company (DTC) and any subsequent transfers of our ordinary shares would come within the charge to Irish stamp duty at a rate of 1% on the higher of the consideration paid for the ordinary shares or the market value of the shares on the date of transfer, which may impact the price a purchaser would pay for our ordinary shares.

In addition, the Company believes that the reverse stock split may make the ordinary shares more attractive to a broader range of institutional and other investors, as the current market price of the ordinary shares may affect their acceptability to certain institutional investors, professional investors, and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share can result in individual shareholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. The Company believes that the reverse stock split will make the ordinary shares a more attractive and cost effective investment for many investors, which may enhance the liquidity of the ordinary shares.

| 7 |

Risk Factors Associated with the Reverse Stock Split

In deciding whether to recommend approval of the reverse stock split to the Company’s shareholders, the Board also took into account potential negative factors associated with the reverse stock split. These factors include the negative perception of reverse stock splits held by some investors, analysts and other stock market participants, the fact that the stock prices of some companies that have effected reverse stock splits have subsequently declined back to pre-split levels, the adverse effect on liquidity that might be caused by a reduced number of shares issued and outstanding, and the costs associated with implementing a reverse stock split.

Although the Board expects the reverse stock split will result in an increase in the market price of the ordinary shares, the reverse stock split may not increase the market price of the ordinary shares in proportion to the reduction in the number of ordinary shares issued and outstanding or result in a long-term increase in the market price, which is dependent upon many factors, including the Company’s performance, prospects and other factors detailed from time to time in the Company’s reports filed with the Securities and Exchange Commission (the “SEC”), as well as variables outside of the Company’s control (such as market volatility, investor response to the news of a proposed reverse stock split and the general economic environment). The history of similar reverse stock splits for companies in like circumstances is varied. If the reverse stock split is effected and the market price of the ordinary shares declines, the percentage decline as an absolute number and as a percentage of the Company’s overall market capitalization may be greater than would occur in the absence of the reverse stock split. The trading liquidity of the ordinary shares may also decline due to the fewer number of ordinary shares that are publicly traded. In addition, the reverse stock split will likely increase the number of shareholders who own “odd lots” of fewer than 100 ordinary shares. Shareholders who hold odd lots typically experience an increase in the cost of selling their shares, as well as possible greater difficulty in effecting such sales. Accordingly, the reverse stock split may not achieve the desired results that have been outlined above.

In addition, there can be no assurance that our ordinary shares will not be delisted due to a failure to meet other continued listing requirements even if the per share market price of our ordinary shares after the reverse stock split remains in excess of $1.00.

Principal Effects of the Reverse Stock Split

Immediately following the reverse stock split, each shareholder would own a reduced number of ordinary shares. However, the reverse stock split would be effected simultaneously for all of our issued and outstanding ordinary shares. The reverse stock split would affect all of our shareholders uniformly and would not change any shareholder’s percentage ownership interest in our company, except to the extent that the reverse stock split results in any of our shareholders owning fractional shares. We will not issue any fractional shares as a result of the reverse stock split and in lieu thereof, to the extent that we have the ability to aggregate and sell such shares on the market (see further below under “—Treatment of Fractional Shares”), any shareholders that would otherwise be entitled to receive a fractional share will be entitled to receive a cash payment in an amount equal to the net cash proceeds attributable to the sale of such fractional entitlement following the aggregation and sale by us on behalf of each of the relevant shareholders of all of our ordinary shares that they would otherwise be entitled to receive, on the basis of prevailing market prices at such time.

The reverse stock split will not change the rights attaching to our ordinary shares. Following the Reverse Stock Split, our ordinary shares and the Kalera Warrants would continue to be reported on Nasdaq under the symbols “KAL” and “KALWW”, respectively, and we would continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”). After the effective time of the reverse stock split, our ordinary shares will have a new Committee on Uniform Securities Identification Procedures (“CUSIP”) number, which is a number used to identify our equity securities.

| 8 |

The following table sets forth the range of (i) the number of our ordinary shares that would be authorized and issued and (ii) the number of our ordinary shares that would be issued upon exercise, settlement or conversion, as applicable, of outstanding options, restricted stock units, warrants, secured convertible loan and contingent value rights, in each case assuming that the reverse stock split was implemented as of November 8, 2022 at a reverse stock split ratio of 1-for-100, which our shareholders are being asked to approve.

| Before Reverse Stock Split | After Reverse Stock Split | |||||||

| Number of ordinary shares outstanding | 91,877,828 | 918,778 | ||||||

| Number of ordinary shares issuable upon exercise of outstanding options as set out in the 2022 Plan | 904,505 | 9,045 | ||||||

| Number of ordinary shares issuable upon exercise of options assumed from Agrico in connection with the Business Combination | 364,000 | 3,640 | ||||||

| Number of ordinary shares issuable upon settlement of outstanding restricted share units granted under the 2022 Plan | 926,446 | 9,264 | ||||||

| Number of ordinary shares issuable upon exercise of the Kalera Warrants | 14,437,500 | 144,375 | ||||||

| Number of ordinary shares issuable upon exercise of the warrants issued to Armistice Capital Master Fund Ltd. pursuant to a securities purchase agreement dated July 7, 2022 | 5,000,000 | 50,000 | ||||||

| Number of ordinary shares issuable upon exercise of the warrants issued in connection with a public offering described in the Company’s registration statement on Form S-1 first filed with the SEC on October 7, 2022 and declared effective on October 26, 2022 | 136,000,000 | 1,360,000 | ||||||

| Number of ordinary shares issuable upon conversion of the secured convertible loan established under a secured convertible loan agreement dated March 4, 2022 between the Company and, inter alios, certain of its shareholders (as amended)(1) | 107,692,307 | 1,076,923 | ||||||

| Number of ordinary shares issuable upon exercise of the contingent value rights granted to certain shareholders in connection with the Business Combination | 3,717,932 | 37,179 | ||||||

| (1) | Pursuant to the terms of this agreement, such shares will only become issuable upon conversion starting on January 23, 2023. |

For outstanding stock options, warrants and the shares underlying the secured convertible loan, the applicable exercise or conversion price per ordinary share, as applicable, will also be adjusted based on the reverse stock split ratio of 1-for-100 in order to preserve their intrinsic value.

In addition, the number of shares available for issuance pursuant to the 2022 Plan or upon exercise of the warrants would be adjusted proportionately based on the reverse stock split ratio of 1-for-100 resulting in a reduction in the number of shares available for issuance under such plan or warrants, as applicable, following the effectuation of the reverse stock split.

Treatment of Fractional Shares

We will not issue fractional shares in connection with the reverse stock split. Instead, we will aggregate the fractional entitlements of shareholders who otherwise would be entitled to receive fractional shares because they hold a number of ordinary shares not evenly divisible by the number of ordinary shares which our board of directors ultimately determines should be consolidated into one ordinary share pursuant to the reverse stock split or they hold less than the number of ordinary shares which our board of directors ultimately determines should be consolidated into one ordinary share pursuant to the reverse stock split and, to the extent possible, sell such ordinary shares on the basis of prevailing market prices at such time. We will subsequently remit the proceeds of such sales, after deducting any applicable costs, to the shareholders who otherwise would be entitled to receive fractional shares and such shareholders will be entitled to receive a cash payment in lieu of such fractional entitlement in an amount equal to the net cash proceeds attributable to the sale of such fractional entitlement. Should the cash consideration for the fractional shares be less than $5.00 for each shareholder, the sale proceeds will be aggregated and donated to a charity organization at the discretion of the directors. Each (if any) of the authorized and issued ordinary shares of nominal value $0.01 that cannot be consolidated into one ordinary share pursuant to the reverse stock split shall, immediately following the effective time of the reverse stock split, be acquired by us from the shareholders otherwise entitled thereto for no consideration and be cancelled. For the avoidance of doubt, shareholders would not be entitled to receive interest for their fractional shares.

| 9 |

If pre-reverse stock split, you do not hold sufficient ordinary shares to receive at least one ordinary share after the reverse stock split, and you want to hold our ordinary shares after the reverse stock split, you may do so by taking either of the following actions far enough in advance so that it is completed before the reverse stock split is effected:

| ● | purchase a sufficient number of our ordinary shares so that you would hold at least that number of ordinary shares in your account prior to the implementation of the reverse stock split that would entitle you to receive at least one ordinary share on a post-reverse stock split basis; or | |

| ● | if applicable, consolidate your accounts so that you hold at least that number of our ordinary shares in one account prior to the reverse stock split that would entitle you to at least one ordinary share on a post-reverse stock split basis. Ordinary shares held in registered form (that is, shares held by you in your own name on our company’s share register maintained by our transfer agent) and ordinary shares held in “street name” (that is, shares held by you through a bank, broker or other nominee) for the same investor would be considered held in separate accounts and would not be aggregated when implementing the reverse stock split. Also, ordinary shares held in registered form but in separate accounts by the same investor would not be aggregated when implementing the reverse stock split. |

After the reverse stock split, then-current shareholders would have no further interest in our company with respect to their fractional shares. A person otherwise entitled to a fractional share would not have any voting, dividend or other rights in respect of his or her fractional share except to receive the cash payment as described above. Such cash payments would reduce the number of post-reverse stock split shareholders to the extent that there are shareholders holding fewer than that number of pre- reverse stock split shares within the 1-for-100 ratio described above. Reducing the number of post-reverse stock split shareholders, however, is not the purpose of this proposal.

Shareholders should be aware that, under the escheat laws of the various jurisdictions where shareholders reside, where we are domiciled and where the funds for fractional shares would be deposited, sums due to shareholders in payment for fractional shares that are not timely claimed after the effective date may be required to be paid to the designated agent for each such jurisdiction. Thereafter, shareholders otherwise entitled to receive such funds may have to seek to obtain them directly from the designated agent for each such jurisdiction to which they were paid.

Book-Entry Shares and Payment for Fractional Shares

All our registered shareholders hold their shares electronically in book-entry form with our transfer agent. Therefore, shareholders do not hold physical certificates evidencing their ownership of our ordinary shares. However, they are provided with a statement reflecting the number of our ordinary shares registered in their accounts. If our shareholders vote in favor of the consolidation and the consolidation is effected, immediately following the reverse stock split, the reduction in the number of our authorized and issued ordinary shares will occur without any further action on the part of the shareholders. No action needs to be taken to receive post-reverse stock split shares or payment in lieu of fractional shares, if applicable. If a shareholder is entitled to post-reverse stock split shares, a transaction statement will automatically be sent to the shareholder’s address of record indicating the number of our ordinary shares held following the reverse stock split. A check will also be mailed to such shareholders’ registered address as soon as practicable after the reverse stock split, if applicable. By signing and cashing this check, such shareholders will warrant that they owned the ordinary shares for which they received the cash payment.

Effect on Non-Registered Shareholders

We intend to treat shareholders holding our ordinary shares in “street name,” through a broker, bank or other nominee, in the same manner as registered shareholders whose shares are registered in their names. Brokers, banks or other nominees will be instructed to effect a reverse stock split for their beneficial holders holding our ordinary shares in “street name.” However, non-registered shareholders holding our ordinary shares through a bank, broker or other nominee should note that such banks, brokers or other nominees may have different procedures for processing the consolidation than those that would be put in place by us for registered shareholders, and their procedures may result, for example, in differences in the precise cash amounts being paid by such nominees in lieu of a fractional share. If you hold your shares with such a bank, broker or other nominee.

| 10 |

Reduction in the Nominal Value of the Ordinary Shares and Accounting Consequences

The nominal value per share of our ordinary shares will be consolidated from $0.0001 to $0.01 and subsequently immediately reduced to $0.0001 nominal value per share. Subject to non-material adjustments to cater for the cancellation of remaining fractional entitlements, the consolidation will not affect the total ordinary shareholders’ equity on the balance sheet, although it will result in the share capital attributable to ordinary shares decreasing and the undenominated capital increasing. The per share net income or loss and net book value will be higher because there would be fewer ordinary shares issued and outstanding. All historic share and per share amounts in the consolidated financial statements and related footnotes that the Company files with the SEC in the future will be adjusted accordingly. We do not anticipate that any other accounting consequences would arise as a result of the consolidation.

No Appraisal Rights

No action is proposed herein for which the laws of Ireland, or our constitution, provide a right to our shareholders to dissent and obtain appraisal of, or payment for, such shareholder’s ordinary shares.

No Going Private Transaction

Notwithstanding the decrease in the number of issued ordinary shares following the reverse stock split, the Board does not intend for this transaction to be the first step in a series of plans or proposals of a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Interests of Certain Persons in the Proposal

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in the Reverse Stock Split Proposal, except to the extent of their ownership of our ordinary shares and securities convertible or exercisable for our ordinary shares, as set forth in the section entitled “Security Ownership of Certain Beneficial Owners and Management” above. However, the Company does not believe that its officers or directors have interests in this proposal that are different from or greater than those of any other of its shareholders due to their shares and securities being subject to the same proportionate adjustment in accordance with the terms of the Reverse Stock Split Proposal as all of our other outstanding ordinary shares and securities convertible into or exercisable for our ordinary shares.

Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following discussion is a summary of the material U.S. federal income tax consequences of the proposed reverse stock split to U.S. Holders (as defined below) that hold our ordinary shares as capital assets for U.S. federal income tax purposes (generally, property held for investment). This discussion is based on the Internal Revenue Code of 1986, as amended, which we refer to as the Code, U.S. Treasury Regulations promulgated thereunder, judicial decisions, and published rulings and administrative pronouncements of the U.S. Internal Revenue Service, which we refer to as the IRS, in each case in effect as of the date of this proxy statement. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely affect a U.S. Holder. We have not sought and will not seek any rulings from the IRS regarding the matters discussed below and there can be no assurance the IRS or a court will not take a contrary position to that discussed below regarding the tax consequences of the proposed reverse stock split. This discussion assumes that we are a foreign corporation that is not a “passive foreign investment company” within the meaning of Section 1297(a) of the Code.

For purposes of this discussion, a “U.S. Holder” is a beneficial owner of our ordinary shares that, for U.S. federal income tax purposes, is or is treated as (i) an individual who is a citizen or resident of the United States; (ii) a corporation (or any other entity or arrangement treated as a corporation) created or organized under the laws of the United States, any state thereof, or the District of Columbia; (iii) an estate, the income of which is subject to U.S. federal income tax regardless of its source; or (iv) a trust if (1) its administration is subject to the primary supervision of a court within the United States and all of its substantial decisions are subject to the control of one or more “United States persons” (within the meaning of Section 7701(a)(30) of the Code ), or (2) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a United States person.

| 11 |

This discussion does not address all U.S. federal income tax consequences relevant to the particular circumstances of a U.S. Holder, including the impact of the Medicare contribution tax on net investment income.

In addition, it does not address consequences relevant to U.S. Holders that are subject to special rules, including, without limitation, banks or financial institutions, insurance companies, real estate investment trusts, regulated investment companies, “controlled foreign corporations,” grantor trusts, tax-exempt organizations, dealers or traders in securities, commodities or currencies, traders in securities that elect to mark-to-market their securities holdings, shareholders who hold our ordinary shares as part of a position in a straddle or as part of a hedging, conversion or integrated transaction for U.S. federal income tax purposes, persons whose functional currency is not the U.S. dollar, U.S. expatriates, or U.S. Holders who actually or constructively own 5% or more of our stock.

If a partnership (or other entity treated as a partnership for U.S. federal income tax purposes) is the beneficial owner of our ordinary shares, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Accordingly, partnerships (and other entities treated as partnerships for U.S. federal income tax purposes) holding our ordinary shares and the partners in such entities should consult their own tax advisors regarding the U.S. federal income tax consequences of the proposed reverse stock split to them.

In addition, the following discussion does not address the U.S. federal estate and gift tax, alternative minimum tax, or state, local and non-U.S. tax law consequences of the proposed reverse stock split. Furthermore, the following discussion does not address any tax consequences of transactions effectuated before, after or at the same time as the proposed reverse stock split, whether or not they are in connection with the proposed reverse stock split. This discussion should not be considered as tax or investment advice, and the tax consequences of the proposed reverse stock split may not be the same for all shareholders.

Each shareholder should consult his, her or its own tax advisors concerning the particular U.S. federal tax consequences of the proposed Reverse Stock Split, as well as the consequences arising under the laws of any other taxing jurisdiction, including any state, local or foreign tax consequences.

Tax Consequences to U.S. Holders

The proposed reverse stock split is expected to be treated as a “recapitalization” pursuant to Section 368(a)(1)(E) of the Code. As a result, a U.S. Holder generally should not recognize gain or loss upon the proposed reverse stock split for U.S. federal income tax purposes, except with respect to cash received in lieu of a fractional ordinary share, as discussed below. A U.S. Holder’s aggregate adjusted tax basis in our ordinary shares received pursuant to the proposed reverse stock split should equal the aggregate adjusted tax basis of our ordinary shares surrendered (excluding the amount of such basis that is allocated to any fractional ordinary share for which the U.S. Holder receives cash). The U.S. Holder’s holding period in our ordinary shares received pursuant to the proposed reverse stock split should include the holding period in our ordinary shares exchanged therefor. U.S. Treasury Regulations provide detailed rules for allocating the tax basis and holding period of ordinary shares surrendered in a recapitalization to shares received in the recapitalization. U.S. Holders that acquired our ordinary shares on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

A U.S. Holder that, pursuant to the proposed reverse stock split, receives cash in lieu of a fractional ordinary share should recognize capital gain or loss in an amount equal to the difference, if any, between the amount of cash received and the portion of the U.S. Holder’s aggregate adjusted tax basis in the ordinary shares surrendered that is allocated to such fractional share. Such capital gain or loss will be short term if the pre-reverse stock split shares were held for one year or less at the effective time of the reverse stock split and long term if held for more than one year.

A U.S. Holder of our ordinary shares may be subject to information reporting and backup withholding on cash paid in lieu of a fractional share in connection with the proposed reverse stock split. A U.S. Holder of our ordinary shares will be subject to backup withholding if such U.S. Holder is not otherwise exempt and such U.S. Holder does not provide its taxpayer identification number in the manner required or otherwise fails to comply with applicable backup withholding tax rules. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded or allowed as a credit against a U.S. Holder’s federal income tax liability, if any, provided the required information is timely furnished to the IRS.

| 12 |

The U.S. federal income tax discussion set forth above does not discuss all aspects of U.S. federal income taxation that may be relevant to a particular shareholder in light of such shareholder’s circumstances and income tax situation.

Accordingly, we urge you to consult with your own tax advisor with respect to all of the potential U.S. federal, state, local and foreign tax consequences to you of the proposed Reverse Stock Split.

Material Irish Tax Consequences of the Reverse Stock Split

The following is a summary of the material Irish tax consequences of the proposed reverse stock split for beneficial holders of our ordinary shares. The summary does not purport to be a comprehensive description of all of the tax considerations that may be relevant to each shareholder. The summary is based upon Irish tax laws and the practice of the Irish Revenue Commissioners in effect on the date of this proxy statement. Changes in law and/or administrative practice may result in alteration of the tax considerations described below, possibly with retrospective effect.

The summary does not constitute legal or tax advice and is intended only as a general guide. The summary is not exhaustive and shareholders should consult their own tax advisors about the Irish tax consequences (and tax consequences under the laws of other relevant jurisdictions) of the proposed reverse stock split. The summary applies only to shareholders who hold their ordinary shares as capital assets and does not apply to other categories of shareholders, such as dealers in securities, trustees, insurance companies, collective investment schemes and shareholders who acquired their ordinary shares, or who have, or who are deemed to have, acquired their ordinary shares by virtue of an Irish office or employment (performed or carried on in Ireland). Such persons may be subject to special rules.

Irish Tax on Chargeable Gains

The current rate of tax on chargeable gains (where applicable) in Ireland is 33%.

Non-Irish Resident Shareholders

Shareholders that are not resident or ordinarily resident in Ireland and who do not hold our ordinary shares in connection with a trade or business carried on by them through a branch or agency in Ireland will not be subject to Irish tax on chargeable gains as a result of the proposed reverse stock split.

Irish Resident Shareholders

Shareholders that are resident or ordinarily resident in Ireland for tax purposes or shareholders that hold their ordinary shares in connection with a trade or business carried on through a branch or agency in Ireland will, subject to the availability of any exemptions or reliefs, be within the charge to Irish tax on chargeable gains on the consolidation of their existing ordinary shares pursuant to the proposed reverse stock split. Such shareholders should consult their own tax advisors on the Irish tax consequences of the proposed reverse stock split.

The proposed reverse stock split will be intended to be treated as a “reorganization” of our share capital and, accordingly, should not result in a disposal by any such shareholder of any of our ordinary shares, except with respect to cash received in lieu of a fractional ordinary share, as discussed below. Instead the ordinary shares held after the proposed reverse stock split should be treated as the same asset and as having been acquired at the same time and for the same consideration as the ordinary shares held before the reverse stock split (adjusted for any part of the consideration attributable to the part disposal in respect of the receipt of cash in lieu of a fractional ordinary share).

The receipt by such a shareholder of any cash in lieu of a fractional ordinary share should be treated as a part disposal of his or her ordinary shares for Irish tax on chargeable gains in respect of the cash consideration received.

| 13 |

Stamp Duty

The rate of stamp duty (where applicable) on transfers of shares of Irish incorporated companies is 1% of the price paid or the market value of the shares acquired, whichever is greater. Irish stamp duty should not arise as a result of the reverse stock split.

THE IRISH TAX CONSIDERATIONS SUMMARIZED ABOVE ARE FOR GENERAL INFORMATION ONLY. HOLDERS OF OUR ORDINARY SHARES SHOULD CONSULT WITH THEIR TAX ADVISORS REGARDING THE TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN IRELAND.

Proposed Resolution

The Board recommends that the shareholders approve the following resolutions as an ordinary resolution:

“That:

| (a) | every one hundred authorized and issued shares (nominal value of $0.0001 each) in the capital of the Company will be consolidated with effect from December 16, 2022 (the “Effective Time”) into one ordinary share of nominal value $0.01 each, provided that, where such consolidation would otherwise result in a shareholder being entitled to a fraction of an ordinary share of $0.01 (nominal value) each, (1) such fraction shall, so far as possible, be aggregated and consolidated with the fractions of a consolidated ordinary share of $0.01 (nominal value) each to which other shareholders would otherwise be entitled and the board of directors of the Company be authorized to sell (or appoint any other person to sell) to any person, on behalf of the relevant shareholders, all the consolidated ordinary shares representing such fractions at the best price reasonably obtainable, (2) the net proceeds of any such sale shall be remitted in due proportion to the shareholders who would have been entitled to the fractions, (3) any director of the Company (or any person appointed by the board of directors of the Company) be authorized to execute an instrument of transfer in respect of such shares on behalf of the relevant shareholders and to do all acts and things the directors consider necessary or desirable to effect the transfer of such shares to, or in accordance with the directions of, any buyer of any such share; and (4) should the net proceeds of any such sale be less than $5.00, the sale proceeds will be aggregated and donated to a charity organisation at the discretion of the directors; and | |

| (b) | the nominal value of each of the authorized and issued shares ordinary shares of $0.01 each resulting from the foregoing resolution, be reduced, with effect from the Effective Time, from $0.01 to $0.0001, pursuant to section 83(1)(d) of the Irish Companies Act 2014.” |

Vote Required and Recommendation of the Board of Directors

The Reverse Stock Split Proposal will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against the proposal. If you vote to “abstain”, your shares will be counted as present at the EGM, and your abstention will have the effect of a vote against the proposal. Broker non-votes will not count as votes in favor of or against the proposal and will have no effect on the vote total for the proposal.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF THE REVERSE STOCK SPLIT PROPOSAL.

| 14 |

THE

ADJOURNMENT PROPOSAL

(Proposal 2)

The Company is asking its shareholders to approve an adjournment of the EGM to a later date or dates, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposal.

Proposed Resolution

The Board recommends that the shareholders approve the following resolution as an ordinary resolution:

“That the EGM is adjourned to a later date or dates, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals.”

Vote Required and Recommendation of the Board of Directors

The Adjournment Proposal will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against the proposal. If you vote to “abstain”, your shares will be counted as present at the EGM, and your abstention will have the effect of a vote against the proposal. Broker non-votes will not count as votes in favor of or against the proposal and will have no effect on the vote total for the proposal.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF THE ADJOURNMENT PROPOSAL.

| 15 |

Other than the business set forth in the Notice, management is not aware of any other business to come before the EGM. Should any other business be properly brought before the EGM, it is the intention of the persons named in the form of proxy to vote the ordinary shares represented thereby in accordance with their discretion and best judgment on such matter.

Shareholders that have additional questions about the information contained in this Proxy Statement or that wish to obtain further directions to access the EGM, should contact Fernando Cornejo at +1 407 559 5536, or send a request to Kalera Public Limited Company at 7455 Emerald Dunes Dr., Suite 2100, Orlando, FL, 32822.

YOUR VOTE IS IMPORTANT

PLEASE SIGN, DATE AND RETURN YOUR PROXY CARD

OR VOTE BY TELEPHONE OR VOTE THROUGH THE INTERNET

AS SOON AS POSSIBLE

| By order of the Board of Directors, | ||

| By: | /s/ Curtis McWilliams | |

| Name: | Curtis McWilliams | |

| Title: | Chairman of the Board | |

| 16 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Aston Bay Signs Definitive Agreement to Option the Epworth Sediment Hosted Copper-Silver-Zinc-Cobalt Project, Nunavut, Canada; Dr. Elizabeth Turner Joins Advisory Board

- Central Pacific Financial Reports First Quarter 2024 Earnings of $12.9 Million

- Kennametal to Attend BofA Securities Transportation, Airlines and Industrial Conference 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share