Form DEF 14A Investcorp Credit Manage For: Nov 03

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Investcorp Credit Management BDC, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

Table of Contents

Investcorp Credit Management BDC, Inc.

280 Park Avenue, 39th Floor

New York, NY 10017

(212) 257-5199

September 24, 2021

Dear Stockholder:

You are cordially invited to attend the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Investcorp Credit Management BDC, Inc. to be held on November 3, 2021 at 9:30 a.m., Eastern Time, at the offices of the Company, 280 Park Avenue, 39th Floor, New York, NY 10017. Only stockholders of record at the close of business on September 15, 2021 are entitled to the notice of, and to vote at, the Annual Meeting, including any postponement or adjournment thereof.

Details regarding the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

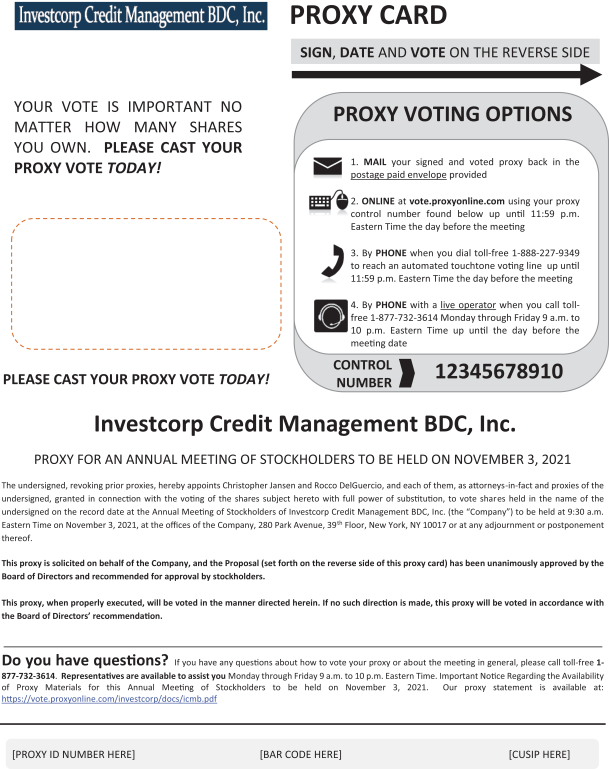

It is important that your shares be represented at the Annual Meeting, and you are encouraged to vote your shares as soon as possible. The enclosed proxy card contains instructions for voting over the Internet, by telephone or by returning your proxy card via mail in the envelope provided. Your vote is important.

As part of our precautions regarding the coronavirus, or COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate in the meeting will be issued by press release and filed with the Securities and Exchange Commission as additional proxy material. We urge you to retain your control or proxy voting number after you vote in case changes are made to the meeting format and such information is again required.

We look forward to seeing you at the Annual Meeting.

Sincerely yours,

Michael C. Mauer

Chairman of the Board

and Chief Executive Officer

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on November 3, 2021.

Our proxy statement and annual report on Form 10-K for the year ended June 30, 2021 (“Annual Report”) are available at the following cookies-free website that can be accessed anonymously: https://vote.proxyonline.com/investcorp/docs/icmb.pdf.

Table of Contents

Investcorp Credit Management BDC, Inc.

280 Park Avenue, 39th Floor

New York, NY 10017

(212) 257-5199

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD November 3, 2021

To the Stockholders of Investcorp Credit Management BDC, Inc.:

The 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Investcorp Credit Management BDC, Inc., a Maryland corporation (the “Company”), will be held at the offices of the Company, 280 Park Avenue, 39th Floor, New York, NY 10017 on November 3, 2021, at 9:30 a.m., Eastern Time, for the following purposes:

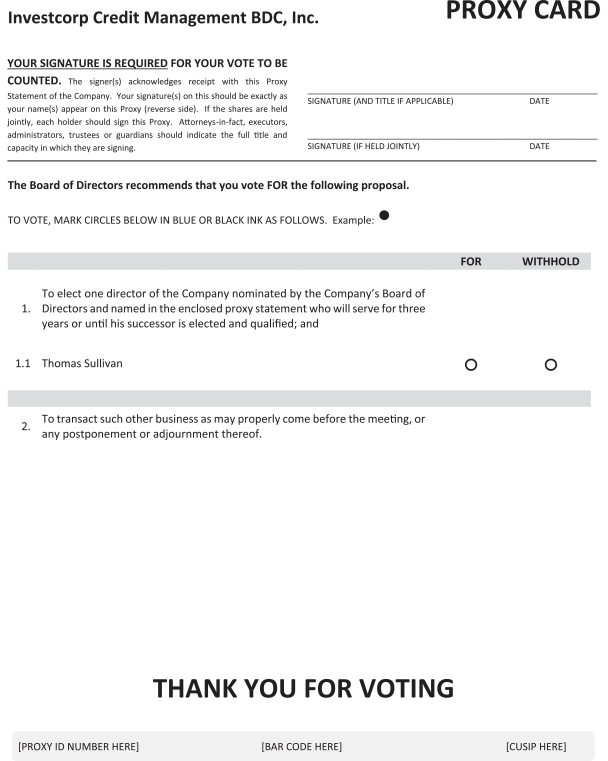

| 1. | To elect one director of the Company nominated by the Company’s Board of Directors (the “Board”) and named in this proxy statement who will serve for three years or until his successor is elected and qualified; and |

| 2. | To transact such other business as may properly come before the meeting, or any postponement or adjournment thereof. |

THE BOARD, INCLUDING THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE NOMINEE NAMED IN PROPOSAL 1 IN THIS PROXY STATEMENT.

You have the right to receive notice of and to vote at the Annual Meeting if you were a stockholder of record at the close of business on September 15, 2021. Whether or not you expect to be present at the Annual Meeting, please sign the enclosed proxy and return it promptly in the self-addressed envelope provided. As a registered stockholder, you may also vote your proxy electronically by telephone or over the Internet by following the instructions included with your proxy card. Instructions are shown on the proxy card. In the event there are not sufficient votes for a quorum or to approve any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of the proxies by the Company.

As part of our precautions regarding the coronavirus, or COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate in the meeting will be issued by press release and filed with the Securities and Exchange Commission as additional proxy material. We urge you to retain your control or proxy voting number after you vote in case changes are made to the meeting format and such information is again required.

If you have questions about the proposals or would like additional copies of the proxy statement, please contact our proxy solicitor, AST Fund Solutions, LLC, at (877) 732-3614.

By Order of the Board,

Christopher E. Jansen

President and Secretary

New York, New York

September 24, 2021

This is an important meeting. To ensure proper representation at the Annual Meeting, please complete, sign, date and return the proxy card in the enclosed, self-addressed envelope. You may also vote your proxy electronically by telephone or over the Internet by following the instructions included with your proxy card Even if you vote your shares prior to the Annual Meeting, you still may attend the Annual Meeting and vote your shares in person.

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

4 | |||

| 6 | ||||

| CONFLICTS OF INTEREST AND CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

16 | |||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

Table of Contents

Investcorp Credit Management BDC, Inc.

280 Park Avenue, 39th Floor

New York, NY 10017

(212) 257-5199

PROXY STATEMENT

2021 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Investcorp Credit Management BDC, Inc., a Maryland corporation (the “Company,” “we,” “us” or “our”), for use at the Company’s 2021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on November 3, 2021, at 9:30 a.m. Eastern Time, at the offices of the Company, 280 Park Avenue, 39th Floor, New York, NY 10017 and at any postponements or adjournments thereof. This proxy statement, the accompanying proxy card and the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2021 are first being sent to stockholders on or about September 29, 2021.

We encourage you to vote your shares, either by voting in person at the Annual Meeting or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card, and the Company receives it in time for the Annual Meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. This proxy statement is also available via the Internet at www.icmbdc.com (under the Investor Relations section). The website also includes electronic copies of the form of proxy and the Company’s Annual Report on Form 10-K. If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically via the Internet or by telephone. This program provides eligible stockholders who receive a copy of the Company’s Annual Report on Form 10-K and proxy statement, either by paper or electronically, the opportunity to vote via the Internet or by telephone. If your voting form does not reference Internet or telephone voting information, please complete and return the paper proxy card in the pre-addressed, postage-paid envelope provided.

Date and Location

We will hold the Annual Meeting on November 3, 2021 at 9:30 a.m. Eastern Time, at the offices of the Company, 280 Park Avenue, 39th Floor, New York, NY 10017.

As part of our precautions regarding the coronavirus, or COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate in the meeting will be issued by press release and filed with the Securities and Exchange Commission (“SEC”) as additional proxy material. We urge you to retain your control or proxy voting number after you vote in case changes are made to the meeting format and such information is again required.

Admission

Only record or beneficial owners of the Company’s common stock as of the close of business on September 15, 2021 or their proxies may attend the Annual Meeting. Beneficial owners must also provide evidence of stock holdings, such as a recent brokerage account or bank statement.

1

Table of Contents

Purpose of the Annual Meeting

At the Annual Meeting, you will be asked to vote on the following proposals:

| 1. | To elect one director of the Company nominated by the Board and named in this proxy statement who will serve for three years or until his successor is elected and qualified; and |

| 2. | To transact such other business as may properly come before the meeting, or any postponement or adjournment thereof. |

Record Date and Quorum Required

The record date of the Annual Meeting is the close of business on September 15, 2021 (the “Record Date”). You may cast one vote for each share of common stock that you own as of the Record Date.

A quorum of stockholders must be present for any business to be conducted at the Annual Meeting. The presence at the Annual Meeting, in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast as of the Record Date will constitute a quorum. Abstentions will be treated as shares present for quorum purposes. On the Record Date, there were 14,383,340 shares outstanding and entitled to vote. Thus, 7,191,671 must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

If a quorum is not present at the Annual Meeting, the stockholders who are represented may adjourn the Annual Meeting until a quorum is present. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal for which an adjournment is sought, to permit further solicitation of proxies.

Submitting Voting Instructions for Shares Held Through a Broker

If you hold shares of common stock through a broker, bank or other nominee, you must follow the voting instructions you receive from your broker, bank or nominee. If you hold shares of common stock through a broker, bank or other nominee and you want to vote in person at the meeting, you must obtain a legal proxy from the record holder of your shares. If you do not submit voting instructions to your broker, bank or other nominee, your broker, bank or other nominee will not be permitted to vote your shares on any proposal considered at the meeting.

Authorizing a Proxy for Shares Held in Your Name

If you are a record holder of shares of common stock, you may authorize a proxy to vote on your behalf by mail, as described on the enclosed proxy card. Authorizing a proxy will not limit your right to vote in person at the meeting. A properly completed, executed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke the proxy. If you authorize a proxy without indicating your voting instructions, the proxyholder will vote your shares according to the Board’s recommendations.

Revoking Your Proxy

If you are a stockholder of record, you can revoke your proxy by (1) delivering a written revocation notice prior to the Annual Meeting to our Secretary, Christopher E. Jansen, at 280 Park Avenue, 39th Floor, New York, NY 10017; (2) delivering a later-dated proxy that we receive no later than the opening of the polls at the meeting; or (3) voting in person at the meeting. If you hold shares of common stock through a broker, bank or other nominee, you must follow the instructions you receive from your nominee in order to revoke your voting instructions. Attending the Annual Meeting does not revoke your proxy unless you also vote in person at the meeting. Stockholders have no appraisal or dissenters’ rights in connection with any of the proposals described herein.

2

Table of Contents

Vote Required

| Proposal | Vote Required | Broker Discretionary Voting Allowed |

Effect of Abstentions and Broker Non-Votes | |||

| Proposal 1 — To elect one director of the Company nominated by the Board and named in this proxy statement who will serve for three years or until his successor is elected and qualified. | Affirmative vote of the holders of a plurality of the shares of stock outstanding and entitled to vote thereon at the Annual Meeting. | No | Because directors are elected by a plurality of the votes, an abstention will have no effect on the outcome of the vote. | |||

INFORMATION REGARDING THIS SOLICITATION

The Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing, and mailing this proxy statement, the accompanying Notice of Annual Meeting of Stockholders, and the proxy card. We have requested that brokers, nominees, fiduciaries and other persons holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners. We will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mail, proxies may be solicited in person and by telephone or facsimile transmission by directors, officers or regular employees of the Company or CM Investment Partners LLC (our “Adviser” and administrator) (for which no director, officer or regular employee will receive any additional or special compensation). The address of our Adviser is 280 Park Avenue, 39th Floor, New York, NY 10017.

The Company has engaged the services of AST Fund Solutions, LLC for the purpose of assisting in the solicitation of proxies at an anticipated cost of approximately $30,000 plus reimbursement of certain expenses and fees for additional services requested. Please note that AST Fund Solutions, LLC may solicit stockholder proxies by telephone on behalf of the Company. They will not attempt to influence how you vote your shares, but only ask that you take the time to authorize your proxy. You may also be asked if you would like to authorize your proxy over the telephone and to have your voting instructions transmitted to the Company’s proxy tabulation firm.

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokerages and other institutional holders of record have implemented householding. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. If you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, please notify your broker. Stockholders who currently receive multiple copies of the proxy statement at their addresses and would like to request information about householding of their communications should contact their brokers or other intermediary holder of record. You can notify us by sending a written request to: Christopher E. Jansen, Secretary, Investcorp Credit Management BDC, Inc., 280 Park Avenue, 39th Floor, New York, NY 10017.

3

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of September 15, 2021, the beneficial ownership of each current director, each nominee for director, the Company’s executive officers, each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of September 15, 2021 are deemed to be outstanding and beneficially owned by the person holding such options or warrants. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Percentage of ownership is based on 14,383,340 shares of common stock outstanding as of September 15, 2021.

Unless otherwise indicated, to our knowledge, each stockholder listed below has sole voting and investment power with respect to the shares beneficially owned by the stockholder, except to the extent authority is shared by their spouses under applicable law. Unless otherwise indicated, the address of all executive officers and directors is c/o Investcorp Credit Management BDC, Inc., 280 Park Avenue, 39th Floor, New York, NY 10017.

The Company’s directors are divided into two groups — interested directors and independent directors. Interested directors are “interested persons” as defined in Section 2(a)(19) of the 1940 Act.

| Name and Address of Beneficial Owner |

Number of Shares Owned Beneficially(1) |

Percentage of Class |

||||||

| Interested Director |

||||||||

| Michael C. Mauer |

114,612 | (2) | * | |||||

| Independent Directors |

||||||||

| Julie Persily |

18,511 | * | ||||||

| Thomas Sullivan |

10,000 | * | ||||||

| Lee Shaiman |

1,000 | * | ||||||

| Executive Officers |

||||||||

| Christopher E. Jansen |

77,667 | * | ||||||

| Rocco DelGuercio |

12,141 | * | ||||||

| Executive officers and directors as a group |

233,931 | 1.63 | % | |||||

| 5% Holders |

||||||||

| Cyrus Opportunities Master Fund II, Ltd. |

||||||||

| Crescent 1, L.P. |

||||||||

| CRS Master Fund, L.P. |

||||||||

| Cyrus Select Opportunities Master Fund, Ltd. |

3,418,976 | (3) | 23.77 | % | ||||

| Kennedy Capital Management, Inc. |

957,230 | (4) | 6.66 | % | ||||

| Stifel Venture Corp. |

2,181,818 | (5) | 15.17 | % | ||||

| Investcorp BDC Holdings Limited |

1,417,354 | (6) | 9.85 | % | ||||

| * | Less than 1% |

| (1) | Beneficial ownership has been determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| (2) | Includes one share held by Mr. Mauer’s wife. |

| (3) | Based on information obtained in a Schedule 13D as filed on August 30, 2021. Includes 217,170 shares held by Cyrus Opportunities Master Fund II, Ltd., 75,051 shares held by Crescent 1, L.P., 67,467 shares held by CRS Master Fund, L.P., and 39,522 shares held by Cyrus Select Opportunities Master Fund, Ltd. The principal business address of the Crescent 1, L.P., CRS Master Fund, L.P., Cyrus Select Opportunities Master Fund, Ltd. and Cyrus Opportunities Master Fund II, Ltd. (collectively, the “Cyrus Funds”), is 65 East 55th Street, 35th Floor, New York, New York 10022. |

4

Table of Contents

| (4) | Based on information obtained in a Schedule 13G filed on February 16, 2021. The principal business address of Kennedy Capital Management Inc. is 10829 Olive Blvd., St. Louis, MO 63141. |

| (5) | Based on information obtained in an amended Schedule 13D filed jointly by Stifel Financial Corp. and Stifel Venture Corp. (“Stifel”) on October 4, 2019. The principal business address of Stifel is One Financial Plaza, 501 North Broadway, St. Louis, Missouri 63102. |

| (6) | Based on information obtained in a Schedule 13D/A as filed jointly on September 23, 2021 by Investcorp Credit Management US LLC (“Investcorp Credit Management US”), Investcorp BDC Holdings Limited, SIPCO Holdings Limited, and Investcorp S.A. Includes 1,417,354 shares directly owned by Investcorp BDC Holdings Limited, which includes 680,935 shares purchased in transactions exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) thereof and Regulation D thereunder, as reported in Current Reports on Form 8-K filed by the Company on December 5, 2019, March 6, 2020 and September 7, 2021. |

The following table sets forth as of September 15, 2021, the dollar range of our securities owned by our directors and executive officers.

| Name |

Dollar Range of Equity Securities Beneficially Owned(1)(2) | |

| Interested Director: |

||

| Michael C. Mauer |

Over $100,000 | |

| Independent Directors: |

||

| Julie Persily |

Over $100,000 | |

| Thomas Sullivan |

$50,001-$100,000 | |

| Lee Shaiman |

$1–$10,000 | |

| Executive Officers: |

||

| Christopher E. Jansen |

Over $100,000 | |

| Rocco DelGuercio |

$50,001–$100,000 | |

| (1) | The dollar range of equity securities beneficially owned is based on the closing price for our common stock of $5.55 on September 15, 2021 on the NASDAQ Global Select Market. Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Exchange Act. |

| (2) | Dollar ranges are as follows: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or Over $100,000. |

5

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTOR

Our business and affairs are managed under the direction of our Board. Pursuant to our articles of amendment and restatement and bylaws, the number of directors on our Board is currently fixed at four directors and is divided into three classes. Each director holds office for the term to which he or she is elected and until his or her successor is duly elected and qualified. At each Annual Meeting, the successors to the class of directors whose terms expire at such meeting will be elected to hold office for a term expiring at the Annual Meeting of Stockholders held in the third year following the year of their election and until their successors have been duly elected and qualified or any director’s earlier resignation, death or removal.

Thomas Sullivan has been nominated for re-election for a three-year term expiring in 2024. Mr. Sullivan is not being nominated to serve as a director pursuant to any agreement or understanding between him and the Company.

A stockholder can vote for or withhold his or her vote for the nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of the nominees named in this proxy statement. If the nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of such person as is nominated by the Board as a replacement. The Board has no reason to believe that the nominee will be unable or unwilling to serve.

Required Vote

This proposal requires the affirmative vote of the holders of a plurality of the shares of stock outstanding and entitled to vote thereon. Stockholders may not cumulate their votes. If you vote “withhold authority” with respect to each nominee, your shares will not be voted with respect to such person. Because directors are elected by a plurality of the votes, an abstention will have no effect on the outcome of the vote and, therefore, is not offered as a voting option for this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED IN THIS PROXY STATEMENT.

Information about Directors and Executive Officers

Board of Directors

We have adopted provisions in our articles of amendment and restatement that divide our Board into three classes. At each annual meeting, directors will be elected for staggered terms of three years (other than the initial terms, which extend for up to three years), with the term of office of only one of these three classes of directors expiring each year. Each director will hold office for the term to which he or she is elected and until his or her successor is duly elected and qualifies.

Information regarding Mr. Sullivan, who is being nominated for election as a director of the Company by the stockholders at the Annual Meeting, as well as information about our current directors whose terms of office will continue after the Annual Meeting, is below. There were no legal proceedings of the type described in

6

Table of Contents

Item 401(f) of Regulation S-K in the past 10 years against any of the directors, director nominees, or officers of the Company and none are currently pending.

| Name |

Year of |

Position(s) |

Terms of |

Principal Occupation(s) |

Other | |||||

| Interested Director |

||||||||||

| Michael C. Mauer, | 1961 | Chief Executive Officer and Chairman of the Board | Director since 2013; Term expires 2022 | Chief Executive Officer and Chairman of the Board of the Company since 2017; Co-Chief Investment Officer of our CM Investment Partners LLC since 2013; Co-head of Investcorp Credit Management US since 2019; and Managing Partner and Co-Chief Investment Officer of CM Investment Partners, LP from 2012 to 2014. | — | |||||

| Independent Directors |

||||||||||

| Julie Persily | 1965 | Director | Director since 2013; Term expires 2023 | Co-Head of Leveraged Finance and Capital Markets of Nomura Securities North America (2010-2011); Co-Head of the Leveraged Finance Group at Citigroup Inc. from December 2006 to November 2008; Head of Acquisition Finance Group at Citigroup Inc. from December 2001 to November 2006; and Managing Director of Citigroup Inc. from July 1999 to November 2001. | Runway Growth Credit Fund Inc. since 2017; SEACOR Marine Holdings Inc. since 2018. | |||||

| Lee Shaiman | 1956 | Director | Director since 2020; Term expires 2023 | Executive Director of the Loan Syndications and Trading Association since January 2018; Chief Investment Officer and Portfolio Manager ArrowMark Colorado Holdings, LLC from 2015-2017. | — | |||||

| Thomas Sullivan | 1962 | Director | Director since 2019; Term expires 2021 | Partner at Standard General L.P. since June 2016; Managing Partner of Smallwood Partners, LLC from 2009 to 2015. | Spirit Realty Capital, Inc. since 2021; SMTA Liquidating Trust since 2020; Totes Isotoner Corporation since 2020; NewHold Investment Corp. from 2020-2021; Media General Inc. from 2013-2017; American Apparel Inc. from 2014-2016. | |||||

7

Table of Contents

The address for each of our directors is c/o Investcorp Credit Management BDC, Inc., 280 Park Avenue, 39th Floor, New York, NY 10017.

Executive Officers Who Are Not Directors

Information regarding our executive officers who are not directors is as follows:

| Name |

Year of Birth |

Position |

Officer Since | Principal Occupation(s) During Past 5 Years | ||||

| Christopher E. Jansen | 1959 | President and Secretary | 2013 | President, Secretary and Co-Chief Investment Officer of CM Investment Partners LLC since 2013. | ||||

| Rocco DelGuercio | 1963 | Chief Financial Officer and Chief Compliance Officer | 2016 | Chief Financial Officer and Chief Compliance Officer of the Company and CM Investment Partners LLC since 2016; Chief Financial Officer and Treasurer of Credit Suisse Park View BDC, Inc., Credit Suisse Asset Management Income Fund Inc. and Credit Suisse High Yield Bond Fund from 2013-2016. | ||||

The address for each of our executive officers is c/o Investcorp Credit Management BDC, Inc., 280 Park Avenue, 39th Floor, New York, NY 10017.

Biographical Information

The Board considered whether each of the directors is qualified to serve as a director, based on a review of the experience, qualifications, attributes and skills of each director, including those described below. The Board considered whether each director has significant experience in the investment or financial services industries and has held management, board or oversight positions in other companies and organizations. For the purposes of this presentation, our directors have been divided into two groups — independent directors and interested directors. Interested directors are “interested persons” as defined in the 1940 Act.

Independent Directors

Julie Persily has served as a member of the Board and chair of the Compensation Committee of the Board since 2013. Since September 2019, Ms. Persily has served as chair of the Valuation Committee of the Board. Ms. Persily has also served as a director of Runway Growth Credit Fund Inc., a private closed-end management investment company that has elected to be regulated as a BDC, since 2016; and SEACOR Marine Holdings Inc. (NYSE: SMHI), a global marine and support transportation services company, since April 2018. Ms. Persily retired in 2011 after serving as the Co-Head of Leveraged Finance and Capital Markets of Nomura Securities North America, a unit of Nomura Holdings Inc. (NYSE: NMR), a securities and investment banking company, since July 2010. Ms. Persily previously served in various capacities at Citigroup Inc. (NYSE: C), a financial services company, including as the Co-Head of the Leveraged Finance Group from December 2006 to November 2008, the Head of Acquisition Finance Group from December 2001 to November 2006 and as Managing Director from July 1999 to November 2001. From 1990 to 1999, Ms. Persily served in various capacities including as a Managing Director, Leveraged Finance at BT Securities Corp., a financial services company and a subsidiary of Bankers Trust Corp., which was acquired by Deutsche Bank in April 1999. From 1987 to 1989, Ms. Persily served as an analyst at Drexel Burnham Lambert, a securities and investment banking company. Ms. Persily

8

Table of Contents

received a B.A. in psychology and economics from Columbia College and a M.B.A in financing and accounting from Columbia Business School. We believe Ms. Persily’s extensive experience with structuring, negotiating and marketing senior loans, high yield and mezzanine financings brings important and valuable skills to the Board.

Lee Shaiman has served as a member of the Board and chair of the Audit Committee of the Board since May 7, 2020. Mr. Shaiman has served as Executive Director of the Loan Syndications and Trading Association (“LSTA”) since January 2018. Prior to joining the LSTA, Mr. Shaiman was the Chief Investment Officer and Portfolio Manager for the liquid-credit business at ArrowMark Colorado Holdings, LLC, where he lead an investment team focused on investing in senior secured loans, held primarily in collateralized loan obligation vehicles. Prior to joining ArrowMark, Mr. Shaiman was a Managing Director and Senior Portfolio Manager and Chairman of the Debt Funds investment committee at GSO Capital Partners, a division of Blackstone. He was directly involved in all aspects of managing, structuring and raising funds primarily invested in senior secured loans. Mr. Shaiman received a Bachelor of Science in Economics from Rutgers University and a Master of Science in Accounting and Taxation from The Wharton School, University of Pennsylvania. We believe Mr. Shaiman’s extensive experience with financial institutions and his knowledge of capital markets, accounting and public company regulatory issues brings important and valuable skills to our board of directors.

Thomas Sullivan has served as a member of the Board since September 15, 2019. Since November 2019, Mr. Sullivan has served as chair of the Nominating and Corporate Governance Committee of the Board. Mr. Sullivan has served as a partner of SG Special Situations Fund L.P., whose investment manager is Standard General L.P., a New York-based investment firm that manages event-driven opportunity funds, since June 2016 where he is responsible for portfolio management. Prior to joining Standard General L.P., Mr. Sullivan was the managing partner of Smallwood Partners, LLC, a financial advisory services firm from 2009 to 2015 and a managing director of Investcorp International, Inc., a global middle market private equity firm from 1996 to 2008. Mr. Sullivan has served on numerous boards and committees over the prior twenty-five years. Mr. Sullivan currently serves on the board of directors and as a member of the compensation committee of Spirit Realty Capital, Inc., a Maryland corporation. Mr. Sullivan also serves on the board of trustees of SMTA Liquidating Trust (successor to Spirit MTA REIT), a Maryland common law trust. Mr. Sullivan served as a member of the board of directors of NewHold Investment Corp., and as a member of its nominating committee, from July 2020 to July 2021. Prior to its dissolution on January 1, 2020 and the establishment of SMTA Liquidating Trust, Mr. Sullivan served on the board of trustees of Spirit MTA REIT, an externally managed, publicly traded REIT, and was chair of its compensation committee and a member of its audit committee and related party transactions committee. Mr. Sullivan also serves as the chairman of the board of directors of Totes Isotoner Corporation, a private company, and is chairman of its compensation committee. Mr. Sullivan served as a member of the board of directors, including as a member of the audit committee, finance committee and budget advisory committee, of Media General Inc. from November 2013 to February 2017. Additionally, Mr. Sullivan served as a member of the board of directors, lead director of the suitability committee and chairperson of the nominating and governance committee of American Apparel Inc. from August 2014 to March 2016. Mr. Sullivan received a Bachelor of Science in Accountancy from Villanova University. We believe Mr. Sullivan’s extensive experience with financial institutions and his knowledge of capital markets and structured financing brings important and valuable skills to our board of directors.

Interested Director

Michael C. Mauer has served as our Chief Executive Officer and Chairman of the Board and as Co-Chief Investment Officer of our Adviser since 2013. Mr. Mauer has also served as co-head of Investcorp Credit Management US since August 2019. From January 2012 to February 2014, Mr. Mauer served as the Managing Partner and Co-Chief Investment Officer of CM Investment Partners, LP. Mr. Mauer is also a member of our Adviser’s investment committee and board of managers. Mr. Mauer served as a Senior Managing Director and head of the leveraged loan effort at Cyrus Capital Partners, L.P. (“Cyrus Capital”) from September 2011 to February 2014. Mr. Mauer resigned from Cyrus Capital upon our election to be regulated as a BDC. From July 2009 to September 2010, Mr. Mauer worked for Icahn Capital where he was a Senior Managing Director and a

9

Table of Contents

member of the investment team. In addition, he was in charge of the firm’s Marketing and Investor Relations. Prior to that, Mr. Mauer was a Managing Director at Citigroup Inc. (NYSE: C), a financial services company, from 2001 to 2009. During that time, he led several businesses including Global Co-Head of Leveraged Finance and Global Co-Head of Fixed Income Currency and Commodity Distribution. In addition, during this period he was a senior member of Citigroup Inc.’s credit committee responsible for all underwriting and principal commitments of leveraged finance capital worldwide. From 1988 to 2001, Mr. Mauer held several positions at JPMorgan including Head of North American Investment Grade and Leverage Loan Syndicate, Sales and Trading businesses. Mr. Mauer began his career in 1982 at Price Waterhouse & Co., where he was a Senior Accountant and a C.P.A. Mr. Mauer received a B.S. from the University of Scranton and an M.B.A. from Columbia University. We believe Mr. Mauer’s extensive investing, finance, and restructuring experience bring important and valuable skills to the Board.

Executive Officers Who Are Not Directors

Christopher E. Jansen has served as our President, Secretary and as Co-Chief Investment Officer of our Adviser since 2013. Mr. Jansen served as a member of the Board from 2013 until August 2019. From June 2012 to February 2014, Mr. Jansen served as a Partner and Co-Chief Investment Officer of CM Investment Partners, LP. Mr. Jansen is also a member of our Adviser’s investment committee and board of managers. Mr. Jansen also served as a Senior Managing Director at Cyrus Capital from April 2012 to February 2014. Mr. Jansen resigned from Cyrus Capital upon our election to be regulated as a BDC. Formerly, Mr. Jansen was a senior advisor at Sound Harbor Partners from April 2011 to March 2012. Prior to that, Mr. Jansen was a founding Managing Partner and Senior Portfolio Manager for Stanfield Capital Partners from inception in 1998 until the sale of the company in 2010. As a member of Stanfield Capital Partners’ Management Committee, Mr. Jansen was involved in planning the strategic direction of the firm. Additional responsibilities included the oversight and administration of the investment process and the implementation of portfolio management procedures of the company’s Collateralized Loan Obligation and bank loan businesses. During his tenure at Stanfield, Jansen was responsible for the management of 15 different portfolios aggregating in excess of $7 billion in assets. These portfolios were comprised of large corporate loans, middle-market loans, second lien loans, high yield bonds and structured finance securities. Prior to Stanfield Capital Partners, Mr. Jansen was Managing Director and Portfolio Manager at Chancellor Senior Secured Management from 1990 to 1998. While at Chancellor, Jansen was responsible for the management of 11 different portfolios aggregating in excess of $4 billion in assets. These portfolios were comprised of large corporate loans, middle-market loans and second lien loans. From 1983 to 1990, Mr. Jansen held various positions at Manufacturers Hanover Trust Company, including as Vice President in the Bank’s Acquisition Finance Group and LBO Management Group. Mr. Jansen received a B.A. from Rutgers College and a M.M. from the Kellogg School of Management at Northwestern University.

Rocco DelGuercio has served as our Chief Financial Officer since June 2016 and as our Chief Compliance Officer since September 2016. Mr. DelGuercio has also served as Chief Financial Officer of our Adviser since June 2016 and as Chief Compliance Officer of our Adviser since September 2016. Mr. DelGuercio spent over 10 years at Credit Suisse Asset Management and served in various capacities, including as Chief Financial Officer and Treasurer of Credit Suisse Park View BDC, Inc., a BDC, and Credit Suisse Asset Management Income Fund Inc. and Credit Suisse High Yield Bond Fund, each a closed-end management investment company. Mr. DelGuercio also served as the Chief Financial Officer and Treasurer of ten open-end management investment companies managed by Credit Suisse Asset Management. From February 2012 to April 2013, Mr. DelGuercio was an independent contractor consulting for a 12 billion dollar money manager and a large global service provider. Prior to that, Mr. DelGuercio served as Director of Legg Mason & Co., LLC from March 2004 to January 2012. Mr. DelGuercio earned a B.A. in Liberal Arts from The College of Staten Island, a B.A. in Business from Chadwick University and an M.B.A. in Finance from New York Institute of Technology.

Board of Directors and Its Leadership Structure

Our business and affairs are managed under the direction of our Board. Pursuant to our articles of amendment and restatement, the number of directors on our Board is currently fixed at four directors and divided into three

10

Table of Contents

classes. Three of the members of our Board are not “interested persons” of the Company, or its affiliates as defined in Section 2(a)(19) of the 1940 Act. We refer to these individuals as our “independent directors.” The Board elects our officers, who serve at the discretion of the Board. The responsibilities of the Board include quarterly valuation of our assets, corporate governance activities, oversight of our financing arrangements and oversight of our investment activities.

Oversight of our investment activities extends to oversight of the risk management processes employed by our Adviser as part of its day-to-day management of our investment activities. The Board anticipates reviewing risk management processes at both regular and special board meetings throughout the year, consulting with appropriate representatives of our Adviser as necessary and periodically requesting the production of risk management reports or presentations. The goal of the Board’s risk oversight function is to ensure that the risks associated with our investment activities are accurately identified, thoroughly investigated and responsibly addressed. Stockholders should note, however, that the Board’s oversight function cannot eliminate all risks or ensure that particular events do not adversely affect the value of investments.

The Board has established an audit committee, a compensation committee, a nominating and corporate governance committee and a valuation committee and may establish additional committees from time to time as necessary. While our Board is ultimately responsible for risk oversight, the committees assist our Board in fulfilling its responsibility with respect to risk oversight. As discussed in greater detail below, committees assist our Board in the following ways:

| • | the audit committee of the Board (“Audit Committee”) assists with respect to risk management in the areas of financial reporting, internal controls, and compliance with legal and regulatory requirements; |

| • | the nominating and governance committee of the Board (the “Nominating and Corporate Governance Committee”) assists with respect to management of risks associated with Board organization and membership, and other corporate governance matters, as well as company culture and ethical compliance; |

| • | the valuation committee of the Board (the “Valuation Committee”) assists with respect to management risks related to the valuation of our investment portfolio; and |

| • | the compensation committee of the Board (the “Compensation Committee”) assists with respect to management of risks related to executive succession. |

The scope of the responsibilities assigned to each of these committees is discussed in greater detail below. Mr. Mauer serves as our Chief Executive Officer and Chairman of the Board and the Managing Member and Co-Chief Investment Officer of our Adviser and Mr. Jansen serves as our President and Secretary and is a member of and the Co-Chief Investment Officer of our Adviser. We believe that Mr. Mauer’s history with our Adviser and its predecessor, CM Investment Partners, LP, his familiarity with its investment platform, and his extensive knowledge of and experience in the financial services industry qualify him to serve as the Chairman of our Board.

The Board does not have a lead independent director. We are aware of the potential conflicts that may arise when a non-independent director is Chairman of the Board, but believe these potential conflicts are offset by our strong corporate governance practices. Our corporate governance practices include regular meetings of the independent directors in executive session without the presence of interested directors and management, the establishment of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Valuation Committee, each of which is comprised solely of independent directors, and the appointment of a Chief Compliance Officer, with whom the independent directors meet without the presence of interested directors and other members of management, who is responsible for administering our compliance policies and procedures.

The Board believes that its leadership structure is appropriate in light of our characteristics and circumstances because the structure allocates areas of responsibility among the individual directors and the committees in a

11

Table of Contents

manner that affords effective oversight. Specifically, the Board believes that the relationship of Mr. Mauer with our Adviser provides an effective bridge between the Board and management and encourages an open dialogue between management and our Board, ensuring that these groups act with a common purpose. The Board also believes that its small size creates a highly efficient governance structure that provides ample opportunity for direct communication and interaction between our management, our Adviser and the Board.

Board Meetings

The Board met four times during the fiscal year ended June 30, 2021. Each director attended at least 75% of the total number of meetings of the Board and committees on which the director served that were held while the director was a member. The Board’s standing committees are set forth below. We require each director to make a diligent effort to attend all Board and committee meetings, as well as each Annual Meeting of Stockholders. Our 2020 Annual Meeting of Stockholders was attended by each member of the Board.

Audit Committee

The members of the Audit Committee are Ms. Persily, Mr. Shaiman and Mr. Sullivan, each of whom is independent for purposes of the 1940 Act and NASDAQ corporate governance regulations. Mr. Shaiman serves as the chairperson of the Audit Committee. Our Board has determined that Mr. Shaiman is an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K of the Securities Act. The Board has adopted a charter of the Audit Committee, which is available in print to any stockholder who requests it and it is also available on the Company’s website at www.icmbdc.com.

The Audit Committee is responsible for approving our independent accountants, reviewing with our independent accountants the plans and results of the audit engagement, approving professional services provided by our independent accountants, reviewing the independence of our independent accountants and reviewing the adequacy of our internal accounting controls.

The Audit Committee met five times during the fiscal year ended June 30, 2021.

Compensation Committee

The members of the Compensation Committee are Ms. Persily, Mr. Shaiman and Mr. Sullivan, each of whom is independent for purposes of the 1940 Act and the NASDAQ corporate governance regulations. Ms. Persily serves as chairperson of the Compensation Committee. The Compensation Committee is responsible for overseeing our compensation policies generally, evaluating executive officer performance, overseeing and setting compensation for our directors and, as applicable, our executive officers and, as applicable, preparing the report on executive officer compensation that SEC rules require to be included in our annual proxy statement. Currently, none of our executive officers are compensated by us, and as such, the compensation committee is not required to produce a report on executive officer compensation for inclusion in our annual proxy statement.

The Compensation Committee has the sole authority to retain and terminate any compensation consultant assisting the Compensation Committee, including sole authority to approve all such compensation consultants’ fees and other retention terms. The Compensation Committee may delegate its authority to subcommittees or the chairperson of the Compensation Committee when it deems appropriate and in our best interests.

The Compensation Committee met one time during the fiscal year ended June 30, 2021.

Nominating and Corporate Governance Committee

The members of the Nominating and Corporate Governance Committee are Ms. Persily, Mr. Shaiman and Mr. Sullivan, each of whom is independent for purposes of the 1940 Act and NASDAQ corporate governance

12

Table of Contents

regulations. Mr. Sullivan serves as chairperson of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for selecting, researching and nominating directors for election by our stockholders, selecting nominees to fill vacancies on the Board or a committee of the Board, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and our management.

The Nominating and Corporate Governance Committee will consider nominees to the Board recommended by a stockholder if such stockholder complies with the advance notice provisions of our bylaws. Our bylaws provide that a stockholder who wishes to nominate a person for election as a director at a meeting of stockholders must deliver written notice to our corporate secretary. This notice must contain, as to each nominee, all of the information relating to such person as would be required to be disclosed in a proxy statement meeting the requirements of Regulation 14A under the Exchange Act, and certain other information set forth in the bylaws. In order to be eligible to be a nominee for election as a director by a stockholder, such potential nominee must deliver to our corporate secretary a written questionnaire providing the requested information about the background and qualifications of such person and would be in compliance with all of our publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines.

The Nominating and Corporate Governance Committee has not adopted a formal policy with regard to the consideration of diversity in identifying individuals for election as members of the Board, but the committee will consider such factors as it may deem are in our best interests and those of our stockholders. Those factors may include a person’s differences of viewpoint, professional experience, education and skills, as well as his or her race, gender and national origin. In addition, as part of the Board’s annual self-assessment, the members of the Nominating and Corporate Governance Committee will evaluate the membership of the Board and whether the Board maintains satisfactory policies regarding membership selection.

A charter of the Nominating and Corporate Governance Committee is available in print to any stockholder who requests it, and it is also available on the Company’s website at www.icmbdc.com.

The Nominating and Corporate Governance Committee met one time during the fiscal year ended June 30, 2021.

Valuation Committee

The members of the Valuation Committee are Ms. Persily, Mr. Shaiman and Mr. Sullivan, each of whom is not an interested person for purposes of the 1940 Act and NASDAQ corporate governance regulations. Ms. Persily serves as the chairperson of the Valuation Committee. The Valuation Committee is responsible for aiding the Board in fair value pricing of our debt and equity investments that are not publicly traded or for which current market values are not readily available. The Board and the Valuation Committee utilize the services of an independent valuation firm to help them determine the fair value of these securities. The Board has engaged an independent valuation firm to review, on a periodic basis, at least once annually, the valuation for each of our Level 3 investments. We invest primarily in investments classified as Level 3. The Board, including the members of the Valuation Committee, also meet with the independent valuation firm periodically review the methodology of the independent valuation firm. The Valuation Committee reviews subsequent transactions to test the accuracy of the independent valuation firm’s valuations.

The Valuation Committee met four times during the fiscal year ended June 30, 2021.

13

Table of Contents

Compensation of Directors

The following table shows information regarding the compensation received by our independent directors in office for the fiscal year ended June 30, 2021. No compensation is paid to directors who are “interested persons” for their service as directors.

| Name |

Aggregate Cash Compensation from Investcorp Credit Management BDC, Inc.(1) |

Total Compensation from Investcorp Credit Management BDC, Inc. Paid to Director(1) |

||||||

| Independent Directors |

||||||||

| Julie Persily |

$ | 103,000 | $ | 103,000 | ||||

| Lee Shaiman |

$ | 105,500 | $ | 105,500 | ||||

| Thomas Sullivan |

$ | 99,500 | $ | 99,500 | ||||

| (1) | For a discussion of the independent directors’ compensation, see below. We do not have a profit-sharing or retirement plan, and directors do not receive any pension or retirement benefits. |

The independent directors receive an annual fee of $75,000. They also receive $2,500 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending in person or telephonically each regular Board meeting and each special telephonic Board meeting. They also receive $1,000 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with each committee meeting attended in person and each telephonic committee meeting. The chair of the Audit Committee receives an annual fee of $7,500. The chairs of the Valuation Committee, the Nominating and Corporate Governance Committee and the Compensation Committee receive an annual fee of $2,500, $2,500 and $2,500, respectively. We have obtained directors’ and officers’ liability insurance on behalf of our directors and officers. No compensation is paid to directors who are “interested persons” for their service as directors.

Corporate Governance

Corporate Governance Documents

We maintain a corporate governance webpage at the “Corporate Governance” link at www.icmbdc.com.

Our Corporate Governance Procedures, Code of Ethics and Business Conduct, Code of Ethics and Board committee charters are available at our corporate governance webpage at www.icmbdc.com and are also available to any stockholder who requests them by writing to our Secretary, Christopher E. Jansen, at Investcorp Credit Management BDC, Inc., 280 Park Avenue, 39th Floor, New York, NY 10017.

Director Independence

In accordance with rules of NASDAQ, the Board annually determines the independence of each director. No director is considered independent unless the Board has determined that he or she has no material relationship with the Company. The Company monitors the status of its directors and officers through the activities of the Nominating and Corporate Governance Committee and through a questionnaire to be completed by each director no less frequently than annually, with updates periodically if information provided in the most recent questionnaire has changed.

In order to evaluate the materiality of any such relationship, the Board uses the definition of director independence set forth in the NASDAQ listing rules. Section 5605 provides that a director of a BDC shall be considered to be independent if he or she is not an “interested person” of the Company, as defined in Section 2(a)(19) of the 1940 Act. Section 2(a)(19) of the 1940 Act defines an “interested person” to include, among other things, any person who has, or within the last two years had, a material business or professional relationship with the Company or our Adviser.

14

Table of Contents

The Board has determined that each of the directors is independent and has no relationship with the Company, except as a director and stockholder of the Company, with the exception of Mr. Mauer, who is an interested person of the Company due to his positions as an officer of the Company and as an officer of our Adviser.

Annual Evaluation

Our directors perform an evaluation, at least annually, of the effectiveness of the Board and its committees. This evaluation includes discussion among the Board and committees of the Board.

Communication with the Board

We believe that communications between our Board, our stockholders and other interested parties are an important part of our corporate governance process. Stockholders with questions about the Company are encouraged to contact the Company’s Investor Relations department at (212) 257-5199. However, if stockholders believe that their questions have not been addressed, they may communicate with the Company’s Board by sending their communications to Investcorp Credit Management BDC, Inc., 280 Park Avenue, 39th Floor, New York, NY 10017, Attn.: Board of Directors or to [email protected]. All stockholder communications received in this manner will be delivered to one or more members of the Board.

All communications involving accounting, internal accounting controls and auditing matters, possible violations of, or non-compliance with, applicable legal and regulatory requirements or policies, or retaliatory acts against anyone who makes such a complaint or assists in the investigation of such a complaint, will be referred to our Audit Committee.

The acceptance and forwarding of a communication to any director does not imply that the director owes or assumes any fiduciary duty to the person submitting the communication, all such duties being only as prescribed by applicable law.

Code of Business Conduct and Ethics

Our code of ethics, which is signed by directors and executive officers of the Company, requires that directors and executive officers avoid any conflict, or the appearance of a conflict, between an individual’s personal interests and the interests of the Company. Pursuant to the code of ethics, which is available on our website under the “Corporate Governance” link at www.icmbdc.com, each director and executive officer must disclose any conflicts of interest, or actions or relationships that might give rise to a conflict, to the Audit Committee. Certain actions or relationships that might give rise to a conflict of interest are reviewed and approved by the Board.

Compensation Committee Interlocks and Insider Participation

All members of the Compensation Committee are independent directors and none of the members is a present or past employee of the Company. No member of the Compensation Committee: (i) has had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Securities Exchange Act of 1934, as amended; or (ii) is an executive officer of another entity, at which one of our executive officers serves on the Board.

Hedging Transactions

Our Statement of Policy on Insider Trading (the “Insider Trading Policy”) does not expressly prohibit Covered Persons (as defined in the Insider Trading Policy) from engaging in certain forms of hedging or monetization transactions (e.g., zero-cost collars and forward sale contracts), but such transactions are strongly discouraged. In this regard, any person wishing to enter into such an arrangement must first pre-clear the proposed transaction with the Company’s Chief Compliance Officer. Such request for pre-clearance of a hedging or similar arrangement must be received at least two weeks before the Covered Person intends to execute the documents in connection with the proposed transaction and must set forth the reason for the proposed transaction.

15

Table of Contents

CONFLICTS OF INTEREST AND CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company has procedures in place for the review, approval and monitoring of transactions involving the Company and certain persons related to the Company. As a BDC, the 1940 Act restricts the Company from participating in certain transactions with certain persons affiliated with the Company, including our officers, directors, and employees and any person controlling or under common control with us.

In order to ensure that we do not engage in any prohibited transactions with any persons affiliated with the Company, our officers screen each of our transactions for any possible affiliations, close or remote, between the proposed portfolio investment, the Company, companies controlled by us and our employees and directors. The Company will not enter into any transactions unless and until we are satisfied that the transaction is not prohibited by the 1940 Act or, if such prohibitions exist, the Company has taken appropriate actions to seek Board review and approval or exemptive relief from the SEC for such transaction.

Investment Advisory Agreement

The Company entered into an investment advisory agreement with the Adviser on August 30, 2019 (the “Advisory Agreement”), in which certain of the Company’s directors and executive officers have ownership and financial interests. Messrs. Mauer and Jansen, together, hold an approximate 24% interest in our Adviser. Investcorp Credit Management US holds an approximate 76% ownership interest in the Adviser. Pursuant to the Advisory Agreement, the Company has agreed to pay to the Adviser a base management fee and an incentive fee. Mr. Mauer, an interested member of the Board, has a direct or indirect pecuniary interest in the Adviser. The incentive fee will be computed and paid on income that we may not have yet received in cash at the time of payment. This fee structure may create an incentive for the Adviser to invest in certain types of speculative securities. Additionally, we will rely on investment professionals from the Adviser to assist the Board with the valuation of our portfolio investments. The Adviser’s management fee and incentive fee is based on the value of our investments and, therefore, there may be a conflict of interest when personnel of the Adviser are involved in the valuation process for our portfolio investments.

Administration Agreement

The Company entered into an administration agreement with the Adviser on August 30, 2019 (the “Administration Agreement”) pursuant to which the Adviser furnishes the Company with office facilities and equipment and provides it with the clerical, bookkeeping, recordkeeping and other administrative services necessary to conduct day-to-day operations. Under this Administration Agreement, the Adviser performs, or oversees the performance of, the Company’s required administrative services, which include, among other things, being responsible for the financial records which the Company is required to maintain and preparing reports to its stockholders and reports filed with the SEC. The Company reimburses the Adviser for the allocable portion (subject to the review of the Board) of overhead and other expenses incurred by it in performing its obligations under the Administration Agreement, including rent, the fees and expenses associated with performing compliance functions, and the Company’s allocable portion of the cost of its chief financial officer and chief compliance officer and his respective staff. In addition, the Adviser may satisfy certain of its obligations to the Company under the Administration Agreement through the services agreement with Investcorp International Inc., an affiliate of Investcorp, including supplying the Company with accounting and back-office professionals upon the request of the Adviser.

Co-investment Exemptive Relief

On July 20, 2021, the SEC issued an exemptive order (the “Exemptive Order”), which superseded a prior order issued on March 19, 2019, which permits the Company to co-invest, subject to the satisfaction of certain conditions, in certain private placement transactions with other funds managed by the Adviser or its affiliates and any future funds that are advised by the Adviser or its affiliated investment advisers. Under the terms of the

16

Table of Contents

exemptive order, in order for the Company to participate in a co-investment transaction a “required majority” (as defined in Section 57(o) of the 1940 Act) of the Company’s independent directors must conclude that (i) the terms of the proposed transaction, including the consideration to be paid, are reasonable and fair to the Company and its stockholders and do not involve overreaching in respect of the Company or its stockholders on the part of any person concerned, and (ii) the proposed transaction is consistent with the interests of the Company’s stockholders and is consistent with the Company’s investment objectives and strategies.

License Agreement

The Company has entered into a license agreement with the Adviser pursuant to which the Adviser has granted the Company a non-exclusive, royalty-free license to use the name “Investcorp”.

Other Conflicts of Interest

The Company may also have conflicts of interest arising out of the investment advisory activities of the Adviser. The Adviser may in the future manage other investment funds, accounts or investment vehicles that invest or may invest in assets eligible for purchase by the Company. To the extent that the Company competes with entities managed by the Adviser or any of its affiliates for a particular investment opportunity, the Adviser will allocate investment opportunities across the entities for which such opportunities are appropriate, consistent with (a) its internal investment allocation policies, (b) the requirements of the Investment Advisers Act of 1940, as amended, and (c) certain restrictions under the 1940 Act regarding co-investments with affiliates.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act and the disclosure requirements of Item 405 of SEC Regulation S-K require that our directors and executive officers, and any persons holding more than 10% of any class of our equity securities report their ownership of such equity securities and any subsequent changes in that ownership to the SEC and to us. Based solely on a review of the written statements and copies of such reports furnished to us by our executive officers, directors and greater than 10% beneficial owners, we believe that, during the fiscal year ended June 30, 2021, all Section 16(a) filing requirements applicable to the executive officers, directors and stockholders were timely satisfied.

Currently, none of our executive officers are compensated by us. We currently have no employees, and each of our executive officers is also an employee of our Adviser. Each of Messrs. Mauer and Jansen has a direct ownership and financial interest in and may receive compensation and/or profit distributions from, the Adviser. None of Mr. Mauer, Mr. Jansen or Mr. Muns receives any direct compensation from us. See “Conflicts of Interest and Certain Relationships and Related Transactions.” Services necessary for our business are provided by individuals who are employees of our Adviser, pursuant to the terms of the Advisory Agreement and the Administration Agreement. Rocco DelGuercio, our Chief Financial Officer and Chief Compliance Officer, is paid by the Adviser, as our administrator, subject to reimbursement by us of an allocable portion of such compensation for services rendered by Mr. DelGuercio to us. To the extent that the Adviser outsources any of its functions, we will pay the fees associated with such functions on a direct basis without profit to the Adviser.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The Board, including the Audit Committee and independent directors thereof, have selected RSM US LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2022.

17

Table of Contents

RSM US LLP has advised the Company that neither the firm nor any present member or associate of it has any material financial interest, direct or indirect, in the Company or its affiliates. It is expected that a representative of RSM US LLP will be present at the Annual Meeting and will have an opportunity to make a statement if he or she chooses and will be available to answer questions.

The following table presents fees for professional services rendered by RSM US LLP for the fiscal years ended June 30, 2021 and 2020. Aggregate audit and tax fees in the table below consist of fees billed and/or accrued:

| Fiscal Year Ended June 30, 2021 |

Fiscal Year Ended June 30, 2020 |

|||||||

| Audit Fees |

$ | 416,137 | $ | 389,087 | ||||

| Audit-Related Fees |

— | — | ||||||

| Tax Fees |

17,900 | 19,650 | ||||||

| All Other Fees |

— | — | ||||||

|

|

|

|

|

|||||

| TOTAL FEES: |

$ | 434,037 | $ | 408,737 | ||||

|

|

|

|

|

|||||

Services rendered by RSM US LLP in connection with fees presented above were as follows:

Audit Fees. Audit fees include fees for services that normally would be provided by the accountant in connection with statutory and regulatory filings or engagements and that generally only the independent accountant can provide. In addition to fees for the audit of our annual financial statements and the review of our quarterly financial statements in accordance with generally accepted auditing standards, this category contains fees for comfort letters, consents, and assistance with and review of documents filed with the SEC.

Audit-Related Fees. Audit related fees are assurance related services that traditionally are performed by the independent accountant, such as attest services that are not required by statute or regulation.

Tax Fees. Tax fees include professional fees for tax compliance and tax advice.

All Other Fees. Fees for other services would include fees for products and services other than the services reported above.

Pre-Approval Policy

The Audit Committee has established a pre-approval policy that describes the permitted audit, audit-related, tax and other services to be provided by RSM US LLP, the Company’s independent registered public accounting firm. The policy requires that the Audit Committee pre-approve all audit and non-audit services performed by the independent auditor in order to assure that the provision of such service does not impair the auditor’s independence. In accordance with the pre-approval policy, the Audit Committee includes every year a discussion and pre-approval of such services and the expected costs of such services for the year.

Any requests for audit, audit-related, tax and other services that have not received general pre-approval at the first Audit Committee meeting of the year must be submitted to the Audit Committee for specific pre-approval, irrespective of the amount, and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings of the Audit Committee. However, the Audit Committee may delegate pre-approval authority to one or more of its members. The member or members to whom such authority is delegated shall report any pre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent registered public accounting firm to management. The Audit Committee pre-approved 100% of services described in this policy.

18

Table of Contents

Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s financial statements in accordance with auditing standards generally accepted in the United States and expressing an opinion on the conformity of those audited financial statements in accordance with accounting principles generally accepted in the United States. The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee is also directly responsible for the appointment, compensation and oversight of the Company’s independent registered public accounting firm.

Review with Management

The Audit Committee has reviewed the audited financial statements and met and held discussions with management regarding the audited financial statements. Management has represented to the Audit Committee that the Company’s financial statements were prepared in accordance with the United States generally accepted accounting principles.

Review and Discussion with Independent Registered Public Accounting Firm

The Audit Committee has discussed with RSM US LLP, the Company’s independent registered public accounting firm during the year ended June 30, 2021, matters required to be discussed by Statement of Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. SAS No. 61, as amended, requires our independent registered public accounting firm to discuss with our Audit Committee, among other things, the following:

| • | methods used to account for significant unusual transactions; |

| • | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| • | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| • | disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the consolidated financial statements. |

The Audit Committee received and reviewed the written disclosures and the letter from the independent registered public accounting firm required by the applicable Public Company Accounting Oversight Board rule regarding the independent accountant’s communications with audit committees concerning independence and has discussed with the auditors the auditors’ independence. The Audit Committee has also considered the compatibility of non-audit services with the auditors’ independence.

Conclusion

Based on the Audit Committee’s discussion with management and the independent registered public accounting firm, the Audit Committee’s review of the audited financial statements, the representations of management and the report of the independent registered public accounting firm to the Audit Committee, the Audit Committee recommended that the Board include the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended June 30, 2021 for filing with the SEC. The Audit Committee also recommended the selection of RSM US LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2022 and the Board approved such recommendation.

The Audit Committee

Lee Shaiman, Chairman

Julie Persily

Thomas Sullivan

19

Table of Contents

The Board knows of no other business to be presented for action at the Annual Meeting. If any matters do come before the Annual Meeting on which action can properly be taken, it is intended that the proxies shall vote in accordance with the judgment of the person or persons exercising the authority conferred by the proxy at the Annual Meeting. The submission of a proposal does not guarantee its inclusion in the Company’s proxy statement or presentation at the Annual Meeting unless certain securities law requirements are met.

SUBMISSION OF STOCKHOLDER PROPOSALS